End User Computing Market by Solution (Virtual Desktop Infrastructure, Device Management, Unified Communication, and Software Asset Management), Service (Consulting, Support and Maintenance, Training and Education, and Managed Services), Industry Vertical, and Region - Global Forecast to 2023

[123 Pages Report] The end user computing market size is expected to grow USD 5.51 billion in 2017 to USD 11.17 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 12.8% during the forecast period. With the proliferation of mobile devices and BYOD trend, enterprises are looking for technologies and methods to tap digital opportunities for their business purpose and growth. Moreover, With the advent of new technologies, such as virtualization, cloud computing, and software-defined architectures, organizations are changing the way how their IT teams and business processes function through end user computing solutions and services; this drastic change is fueled by the increasing focus of organizations on digital technologies. The base year for the study is 2017, and the forecast period is 2018–2023.

Market Dynamics

Drivers

- Increasing BYOD trend in organizations

- Need to increase the productivity of employees

- Savings on IT spending to reduce the economic pressure faced by organizations

Restraints

- Government and compliance issues

- Issues related to transformation and integration of processes by organizations

Opportunities

- Organizations’ increasing focus toward digitalization

Challenges

- Difficulties in auditing and improper utilization of resources by employees

Increasing BYOD trend in organizations will increase the popularity and demand of the global end user computing market

Rapid advancements in mobile computing have led to the growing popularity of the BYOD trend in corporate environments. Enterprise mobility has changed the way how traditional business processes operate. It enables the employees to access business applications and services on enterprise-owned or personal devices, anywhere and anytime, with the highest level of security and improved user experience (UX). Hence, it is necessary to ensure the confidentiality and integrity of the organizational data by safeguarding it from potential risks. With the increasing trend of BYOD, organizations need to streamline device management and operations by improving the overall UX. Moreover, this trend has given rise to end user computing solutions, wherein employees of the organizations can widely utilize and develop these solutions without robust IT general controls.

The following are the major objectives of the study.

- To define, describe, and forecast the end user computing market by solution, service, industry vertical, and region

- To provide detailed information about the major factors influencing the growth of the end user computing market (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the end user computing market

- To forecast the market size of the market segments with respect to 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players of the end user computing market and comprehensively analyze their market size and core competencies in the market

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations, in the global end user computing market

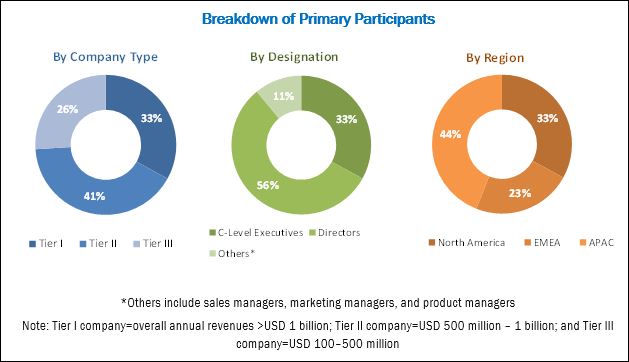

The research methodology used to estimate and forecast the end user computing market began with the collection and analysis of the data on key vendors’ revenues through secondary sources, such as company websites, press releases, annual reports, TechTarget reports, Cloud Security Alliance reports, SC magazine, and SANS Institute studies. Vendor offerings were taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the total market size of the global end user computing market from revenues of the key players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with the key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process, and to arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of the primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The end user computing market comprises key vendors, such as IGEL (Europe), Genpact (US), Tech Mahindra (India), Mindtree (India), Nucleus Software (India), Patriot Technologies (US), NetApp (US), Connection (US), HCL Infosystems (India), Synapse360 (UK), Hitachi Systems Micro Clinic (India), IDS (US), CSS Corp (India), SITA (Switzerland), Infosys (India), Data Integrity (Canada), Fujitsu (Japan), Focus Technology Solutions (US), SMP-Corp (US), Emerio (Singapore), Fortem Information Technology (UK), Serole Technologies (Australia), The Ergonomic Group (US), Coreio (Canada), and Emtec (US). These vendors provide end user computing solutions and services to end users for catering to their unique business requirements, productivity, compliances, and security needs.

Major Market Developments

- In March 2018, IGEL launched the virtual community feature in its end user computing offering to provide the enhanced user experience to its customers

- In October 2017, NetApp launched new solutions, Elio, and a virtual support assistant, NetApp Active IQ which would enhance digital transformation with the help of predictive analytics, proactive support, and cognitive computing.

- In August 2016, Fujitsu acquired a leading US-based network service provider, TrueNet Communications to extend Fujitsu Network Communications' range of offerings and also to enhance the company's ability to deliver complete, end-to-end solutions

Key Target Audience for End User Computing Market

- End User Computing service vendors

- End User Computing solution providers

- Content Information Service Providers (CISPs)

- Internet Service Providers (ISPs)

- Mobility solution providers

- Mobility service providers

- Cloud solution providers

- Service professionals

- Investors and venture capitalists

- Mobile application consumers

- Enterprises/Small and Medium-sized Enterprises (SMEs)

- Device manufacturers

- System integrators

- Bring Your Own Device (BYOD) service users

- Wireless network operators

- Application and software developers

- Government/non-profit associations

- Business organizations

Scope of the End User Computing Market Research Report

The research report segments the end user computing market into the following subsegments:

By solution:

- Virtual Desktop Infrastructure

- Unified communication

- Device management

- Software asset management

- Others (workplace transformation services, application delivery, user experience, and profile management)

By service:

- Consulting

- Support and maintenance

- Training and education

- System integration

- Managed services

By industry vertical:

- IT and telecom

- Banking, Financial Services, and Insurance (BFSI)

- Education

- Healthcare

- Government

- Retail

- Media and entertainment

- Manufacturing

- Others (automotive, travel and hospitality, and energy and utilities)

By region:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Critical questions which the report answers

- What are new market segments to focus over the next 2–5 years for prioritizing the efforts and investments?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives the detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of geographies into respective countries

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets forecasts the global End User Computing (EUC) market size to grow from USD 6.11 billion in 2018 to USD 11.17 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 12.8% during the forecast period. The increasing demand for mobility solutions by organizations and the shift of organizations toward desktop virtualization infrastructures to increase the productivity and efficiency of employees by streamlining all these technologies through EUC solutions are expected to drive the adoption of EUC solutions and services. With the adoption of EUC solutions, organizations can effectively maintain, monitor, streamline, and manage all end user devices and computing platforms, along with virtual infrastructures, of the organizations.

EUC solutions include Virtual Desktop Infrastructure (VDI), device management, unified communication, software asset management, and others (workplace transformation services, application delivery, user experience, and profile management). The VDI segment is expected to play a key role in the EUC market and projected to grow at the highest CAGR during the forecast period. Moreover, this segment is expected to hold the largest market size during the forecast period due to the increasing adoption of desktop virtualization solutions and the need of organizations to increase the productivity and efficiency of the employees by streamlining these technologies.

The Banking, Financial Services, and Insurance (BFSI) industry vertical is the fastest-growing industry vertical in the EUC market, as there is high adoption of desktop virtualization solutions by BFSI organizations to support the transfer of their infrastructures to the cloud. However, the healthcare industry vertical is expected to grow at a decent rate due to the overall cost reduction, low turnaround time, and remote application access. The managed services segment is expected to grow at the highest CAGR, owing to the growing demand for maintaining and updating the EUC solutions periodically.

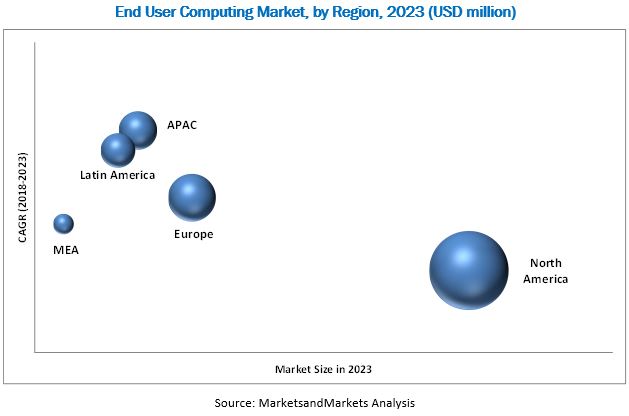

North America is expected to hold the largest market size during the forecast period. Due to the proliferation of mobile devices and Bring Your Own Device (BYOD) trend, enterprises are looking for technologies and methods that can tap digital opportunities; EUC solutions are proving to be a viable option to achieve this purpose in the APAC and North American regions. In Latin America, there is an increasing demand for virtualization solutions, as the enterprises are slowly moving away from legacy desktop infrastructures. This, in turn, is expected to boost the growth of the market in this region. However, the lack of proper government regulations, varied compliance issues across several geographical regions, and issues related to transformation and integration of processes by organizations would hinder the growth of the market.

The demand for Virtual Desktop Infrastructure, Unified Communication, and Device Management will drive the growth of the overall End User Computing market.

Virtual Desktop Infrastructure

VDI is a desktop virtualization approach that hosts desktop operating systems, system applications, and data on a centralized server in a data center. VDI separates end-users’ systems from physical infrastructures and provides virtual access to systems, applications, and data using the client-server computing model. All-sized enterprises are adopting VDI solutions to centralize their end-user data and applications, and to meet the increasing need for fast and reliable computing solutions. This centralization helps organizations reduce data security threats and reduce the high maintenance and hardware costs. VDI solutions also offer significant security benefits, such as mitigating data leakage or thieving risks. The increasing adoption of the BYOD policy across enterprises, which prefers centralized management of desktop, is one of the major factors in driving the high adoption of VDI solutions.

Unified Communication

Unified communication is a flexible and effective collaboration and communication tool that can be delivered on-premises and over-the-cloud, and facilitates the sharing of important information within an organization. It offers unified voice, video, and internet-based integrated solutions that can be deployed to readily connect people within an organization. Unified communication combines multiple IT or IT capabilities, which improve the communication among individuals, groups, and an organization’s operations. The unified communication platform is a single-user interface that helps access all unified communication capabilities, including desktop, web, and mobile phone with features that include softphone capabilities, instant messaging, and presence management.

Device Management

The device management solution assists organizations in managing, tracking, and sustaining all the devices in an ecosystem. The device management process includes configuration, provisioning, monitoring, and enrollment of all devices using a single console. It also ensures that the device complies with data security-related government regulations and policies. Moreover, vendors offer a range of add-on features, such as automatic device recognition, camera restriction, execute remote functions, location tracking, self-enrollment, and multi-user management. The device management solution manages all the devices, including Choose Your Own Device (CYOD); Corporate-Owned, Personally Enabled (COPE); Corporate‐Owned, Single‐Use (COSE); remote devices; and BYOD

Critical questions which the report answers

- What are new market segments to focus over the next 2–5 years for prioritizing the efforts and investments?

- Which are the key players in the market and how intense is the competition?

The high penetration of mobile devices in workplaces, propelled by digital transformation, and the need to streamline these devices and technologies are expected to spur the growth of the EUC solutions. Moreover, organizations shifting from legacy desktop infrastructures to virtualization, due to the benefits virtualization offers such as high reliability, low cost of maintenance, and high efficiency, are expected to add to the demand for EUC solutions. However, lack of proper government regulations and issues related to the transformation and integration of processes by organizations may restrain the adoption of EUC solutions and services. There are several established players, such as IGEL (Europe), Genpact (US), Tech Mahindra (India), Mindtree (India), Nucleus Software (India), Patriot Technologies (US), NetApp (US), Connection (US), HCL Infosystems (India), Synapse360 (UK), Hitachi Systems Micro Clinic (India), IDS (US), CSS Corp (India), SITA (Switzerland), Infosys (India), Data Integrity (Canada), Fujitsu (Japan), Focus Technology Solutions (US), SMP-Corp (US), Emerio (Singapore), Fortem Information Technology (UK), Serole Technologies (Australia), The Ergonomic Group (US), Coreio (Canada), and Emtec (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the End User Computing Market

4.2 Market Share of Top 3 Industry Verticals and Regions

4.3 Market By Solution, 2018

4.4 Market Investment Scenario

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Byod Trend in Organizations

5.2.1.2 Need to Increase the Productivity of Employees

5.2.1.3 Savings on IT Spending to Reduce the Economic Pressure Faced By Organizations

5.2.2 Restraints

5.2.2.1 Government and Compliance Issues

5.2.2.2 Issues Related to Transformation and Integration of Processes By Organizations

5.2.3 Opportunities

5.2.3.1 Organizations’ Increasing Focus Toward Digitalization

5.2.4 Challenges

5.2.4.1 Difficulties in Auditing and Improper Utilization of Resources By Employees

5.3 Use Cases

5.3.1 Adoption of End User Computing Solutions By A Leading Automobile Firm in Australia

5.3.2 Dependence of A Leading Gaming Software Developing Firm on Virtualized End User Computing Solution

5.3.3 A Leading Energy Firm’s Need for A Next-Generation End User Computing Solution

5.3.4 Banking Firm Identified the Need to Control Spreadsheet Following Audit

5.4 Innovation Spotlight

6 End User Computing Market, By Solution (Page No. - 36)

6.1 Introduction

6.2 Virtual Desktop Infrastructure

6.3 Unified Communication

6.4 Device Management

6.5 Software Asset Management

6.6 Others

7 Market By Service (Page No. - 42)

7.1 Introduction

7.2 Consulting

7.3 Support and Maintenance

7.4 Training and Education

7.5 System Integration

7.6 Managed Services

8 End User Computing Market, By Industry Vertical (Page No. - 48)

8.1 Introduction

8.2 IT and Telecom

8.3 Banking, Financial Services, and Insurance

8.4 Education

8.5 Healthcare

8.6 Government

8.7 Retail

8.8 Media and Entertainment

8.9 Manufacturing

8.10 Others

9 End User Computing Market, By Region (Page No. - 58)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.2 Canada

9.3 Europe

9.3.1 United Kingdom

9.3.2 France

9.3.3 Rest of Europe

9.4 Asia Pacific

9.4.1 Japan

9.4.2 Australia

9.4.3 Rest of Asia Pacific

9.5 Middle East and Africa

9.5.1 Middle East

9.5.2 Africa

9.6 Latin America

9.6.1 Brazil

9.6.2 Mexico

9.6.3 Rest of Latin America

10 Competitive Landscape (Page No. - 76)

10.1 Overview

10.2 Competitive Scenario

10.2.1 Partnerships, Agreements, and Collaborations

10.2.2 New Product Launches/Product Enhancements

10.2.3 Mergers and Acquisitions

10.2.4 Business Expansions

11 Company Profiles (Page No. - 80)

(Business Overview, Products and Services/ Solutions Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Igel

11.2 Genpact

11.3 Tech Mahindra

11.4 Mindtree

11.5 HCL Infosystems

11.6 Infosys

11.7 Fujitsu

11.8 Netapp

11.9 EMTEC

11.10 Hitachi Systems Micro Clinic

11.11 CSS Corp

11.12 Focus Technology Solutions

11.13 Emerio

11.14 Fortem Information Technology

11.15 Nucleus Software

11.16 Connection

11.17 Coreio

11.18 Patriot Technologies

11.19 Data Integrity Inc.

11.20 IDS

11.21 Sita

11.22 Serole Technologies

11.23 Smp-Corp

11.24 Synapse 360

11.25 The Ergonomic Group

*Details on Business Overview, Products and Services/ Solutions Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 117)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (49 Tables)

Table 1 Global End User Computing Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y %)

Table 2 Latest End User Computing Innovations

Table 3 Market Size By Solution, 2016–2023 (USD Million)

Table 4 Virtual Desktop Infrastructure: Market Size By Region, 2016–2023 (USD Million)

Table 5 Unified Communication: Market Size By Region, 2016–2023 (USD Million)

Table 6 Device Management: Market Size By Region, 2016–2023 (USD Million)

Table 7 Software Asset Management: Market Size By Region, 2016–2023 (USD Million)

Table 8 Others: Market Size By Region, 2016–2023 (USD Million)

Table 9 End User Computing Market Size, By Service, 2016–2023 (USD Million)

Table 10 Consulting: Market Size By Region, 2016–2023 (USD Million)

Table 11 Support and Maintenance: Market Size By Region, 2016–2023 (USD Million)

Table 12 Training and Education: Market Size By Region, 2016–2023 (USD Million)

Table 13 System Integration: Market Size By Region, 2016–2023 (USD Million)

Table 14 Managed Services: Market Size By Region, 2016–2023 (USD Million)

Table 15 End User Computing Market Size, By Industry Vertical, 2016–2023 (USD Million)

Table 16 IT and Telecom: Market Size By Region, 2016–2023 (USD Million)

Table 17 Banking, Financial Services, and Insurance: Market Size By Region, 2016–2023 (USD Million)

Table 18 Education: Market Size By Region, 2016–2023 (USD Million)

Table 19 Healthcare: Market Size By Region, 2016–2023 (USD Million)

Table 20 Government: Market Size By Region, 2016–2023 (USD Million)

Table 21 Retail: Market Size By Region, 2016–2023 (USD Million)

Table 22 Media and Entertainment: Market Size By Region, 2016–2023 (USD Million)

Table 23 Manufacturing: Market Size By Region, 2016–2023 (USD Million)

Table 24 Others: Market Size By Region, 2016–2023 (USD Million)

Table 25 End User Computing Market Size, By Region, 2016–2023 (USD Million)

Table 26 North America: Market Size By Country, 2016–2023 (USD Million)

Table 27 North America: Market Size By Solution, 2016–2023 (USD Million)

Table 28 North America: Market Size By Service, 2016–2023 (USD Million)

Table 29 North America: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 30 Europe: End User Computing Market Size, By Country, 2016–2023 (USD Million)

Table 31 Europe: Market Size By Solution, 2016–2023 (USD Million)

Table 32 Europe: Market Size By Service, 2016–2023 (USD Million)

Table 33 Europe: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 34 Asia Pacific: Market Size By Country, 2016–2023 (USD Million)

Table 35 Asia Pacific: Market Size By Solution, 2016–2023 (USD Million)

Table 36 Asia Pacific: Market Size By Service, 2016–2023 (USD Million)

Table 37 Asia Pacific: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 38 Middle East and Africa: End User Computing Market Size, By Country, 2016–2023 (USD Million)

Table 39 Middle East and Africa: Market Size By Solution, 2016–2023 (USD Million)

Table 40 Middle East and Africa: Market Size By Service, 2016–2023 (USD Million)

Table 41 Middle East and Africa: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 42 Latin America: End User Computing Market Size, By Country, 2016–2023 (USD Million)

Table 43 Latin America: Market Size By Solution, 2016–2023 (USD Million)

Table 44 Latin America: Market Size By Service, 2016–2023 (USD Million)

Table 45 Latin America: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 46 Partnerships, Agreements, and Collaborations, 2017–2018

Table 47 New Product Launches/Product Enhancements, 2017–2018

Table 48 Mergers and Acquisitions, 2017–2018

Table 49 Business Expansions, 2017–2018

List of Figures (40 Figures)

Figure 1 End User Computing Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company Size, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 End User Computing Market: Assumptions

Figure 8 Market Size By Solution

Figure 9 Market Size By Service

Figure 10 Global Market Share: North America is Estimated to Hold the Largest Market Share in 2018

Figure 11 Global Market By Industry Vertical: Banking, Financial Services, and Insurance Industry Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Increasing Adoption of Virtual Desktop Infrastructure and Byod Solutions is Expected to Drive the Demand for End User Computing Solutions and Services

Figure 13 Banking, Financial Services, and Insurance Industry Vertical, and North America are Estimated to Hold the Largest Market Shares in 2018

Figure 14 Virtual Desktop Infrastructure Segment is Estimated to Have the Largest Market Share in 2018

Figure 15 Asia Pacific is Expected to Emerge as the Best Market for Investments in the Next 5 Years

Figure 16 End User Computing Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Virtual Desktop Infrastructure Segment is Estimated to Have the Largest Market Size in 2018

Figure 18 Managed Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 19 Banking, Financial Services, and Insurance Industry Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 20 North America is Estimated to Account for the Largest Market Size in 2018

Figure 21 Asia Pacific is Expected to Register the Highest CAGR During the Forecast Period

Figure 22 Computing Devices Market End User Spending Worldwide From 2014 to 2017 (In Billion USD)

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Key Developments By the Leading Players in the End User Computing Market for 2016–2018

Figure 26 Key Market Evaluation Framework

Figure 27 Igel: SWOT Analysis

Figure 28 Genpact: Company Snapshot

Figure 29 Genpact: SWOT Analysis

Figure 30 Tech Mahindra: Company Snapshot

Figure 31 Tech Mahindra: SWOT Analysis

Figure 32 Mindtree: Company Snapshot

Figure 33 Mindtree: SWOT Analysis

Figure 34 HCL Infosystems: Company Snapshot

Figure 35 HCL Infosystems: SWOT Analysis

Figure 36 Infosys: Company Snapshot

Figure 37 Fujitsu: Company Snapshot

Figure 38 Netapp: Company Snapshot

Figure 39 Nucleus Software: Company Snapshot

Figure 40 Connection: Company Snapshot

Growth opportunities and latent adjacency in End User Computing Market

Market of EUC and their purchasing models.

End user computing vendors in USA for IT transformation