Enterprise Metadata Management Market by Component (Tools, Services), Application (Governance and Compliance Management, Risk Management, Incident Management), Deployment Model, Metadata Type, Business Function, Industry Vertical - Global Forecast to 2022

[149 Pages Report] The enterprise metadata management market size is expected to grow from USD 2.21 Billion in 2016 to USD 7.85 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 24.1%. The major growth drivers of the market include centralized data management, governance, risk and compliance management, increasing business data volume, and operational excellence and data quality management. The base year considered for this report is 2016 and the market forecast period is 20172022.

Objectives of the Study

The main objective of the report is to define, describe, and forecast the global enterprise metadata management market on the basis of components (tools and services), applications (governance and compliance management, risk management, product and process management, incident management, and others), metadata types (business metadata, technical metadata, and operational metadata), deployment models, industry verticals, and regions. The report provides detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges). The report aims to strategically analyze the micromarkets with respect to the individual growth trends, prospects, and contributions to the total market. The report attempts to forecast the market size with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The report strategically profiles key players and comprehensively analyzes their core competencies. It also tracks and analyzes competitive developments, such as partnerships, collaborations, and agreements; mergers and acquisitions; new product launches and new product developments; and R&D activities in the market.

Research Methodology

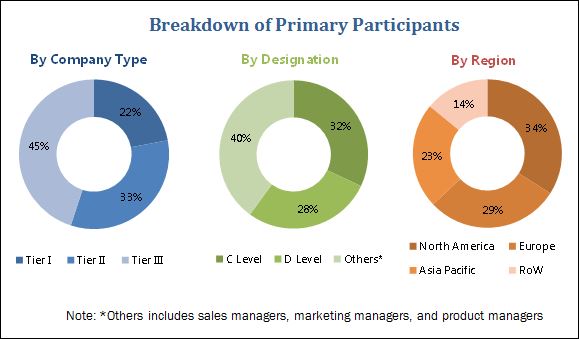

The research methodology used to estimate and forecast the market began with capturing data on key vendor revenues through secondary research, which included directories and databases (D&B Hoovers, Bloomberg Businessweek, and Factiva). The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global enterprise metadata management market that was derived from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The enterprise metadata management market ecosystem comprises vendors, such as Adaptive (US), ASG Technologies (US), Cambridge Semantics (US), CentricMinds (VIC), Collibra (US), Data Advantage Group (US), IBM (US), Informatica (US), Oracle (US), SAP (Germany), Talend (US), TopQuadrant (North Carolina), Alation (US), AWS (US), Datum LLC (US), Infogix (US), Mulesoft (US), Global IDs (US), Smartlogic (US), Idera (US), erwin Inc. (US), Information Builders (US), Orchestra Networks (France), Trillium Software (US), and Varonics Systems (US). The other stakeholders of the EDM market include network and system integrators, EDM managed service providers, cloud providers, marketing analytics executives, third-party providers, and technology providers.These Enterprise Metadata Management Software Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy. Please visit 360Quadrants to see the vendor listing of Enterprise Metadata Management Software.

Key Target Audience for Enterprise Metadata Management Market Research Report

- Service providers and distributors

- enterprise metadata management application builders

- Independent Software Vendors (ISVs)

- Analytics consulting companies

- Enterprises

- End-users

The study answers several questions for the stakeholders, primarily which market segments to focus on in the next 25 years for prioritizing efforts and investments.

Scope of the Enterprise Metadata Management Market Research Report

|

Report Metrics |

Details |

|

Market size available for years |

20162022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component (Tools, Services), Application (Governance and Compliance Management, Risk Management, Incident Management), Deployment Model, Metadata Type, Business Function, Industry Vertical |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America |

|

Companies covered |

Adaptive (US), ASG Technologies (US), Cambridge Semantics (US), CentricMinds (VIC), Collibra (US), Data Advantage Group (US), IBM (US), Informatica (US), Oracle (US), and SAP (Germany). |

The research report categorizes the Enterprise Metadata Management Market to forecast the revenues and analyze trends in each of the following subsegments:

By Component

- Tools

- Services

- Managed services

- Professional services

- Support and maintenance

- Consulting services

- Education and training

By Application

- Governance and compliance management

- Risk management

- Product and process management

- Incident management

- Others (operations management and employee performance data management)

By Metadata Type

- Business metadata

- Technical metadata

- Operational metadata

By Deployment Model

- On-premises

- Cloud

By Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunication and IT

- Retail and eCommerce

- Healthcare and life sciences

- Manufacturing

- Government and defense

- Energy and utilities

- Media and entertainment

- Others (transportation and logistics, travel and hospitality, and education)

By Region

- North America

- US

- Canada

- Europe

- UK

- Germany

- Rest of Europe

- APAC

- China

- India

- Rest of APAC

- Latin America

- Brazil

- Mexico

- MEA

- Kingdom of Saudi Arabia

- Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the North American enterprise metadata management market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the Latin American market

- Further breakdown of the MEA market

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Centralized data management, increasing business data volume, operational excellence and data quality management, governance, and risk and compliance management are expected to be the driving factors for the overall growth of the market.

The Enterprise Metadata Management market report provides detailed insights into the global market, which is segmented on basis of components, applications, metadata type, deployment models, industry verticals, and regions. Each of these markets are further subsegmented and analyzed based on the current adoption trends and future market scenarios. In the component segment, the tools segment is estimated to hold the largest market share throughout the forecast period, as a variety of enterprise metadata management solutions serve a variety of purposes, such as resource discovery and stringent non-compliance penalties on the breach of any confidential data that might be internal or external to the company in the developed countries of North America and Europe.

The cloud deployment model is expected to have a higher adoption rate than the on-premises deployment model and this trend is expected to continue throughout the forecast period. Cloud-based solutions are majorly deployed by large enterprises owing to various factors, including the reduced operational costs, simple deployments, and higher scalability. Cloud-based enterprise metadata management solutions are expected to grow at the highest CAGR during the forecast period. Among organization sizes, the increasing adoption can be observed among large enterprises, and the segment is expected to continue its dominating market position during the forecast period. The Small and Medium-sized Enterprises (SMEs) segment with the increasing focus on improving the customer experience is likely to have the highest growth rate during the forecast period.

The Banking, Financial Services, and Insurance (BFSI) industry vertical is expected to have a dominant market share throughout the forecast period, owing to the increasing corporate data and customer critical information in this sector. In addition, the increasing customer transactions outside the branch through multiple channels, such as web, chat, mobile, and social media, are expected to lead to the higher adoption of enterprise metadata management market solutions.

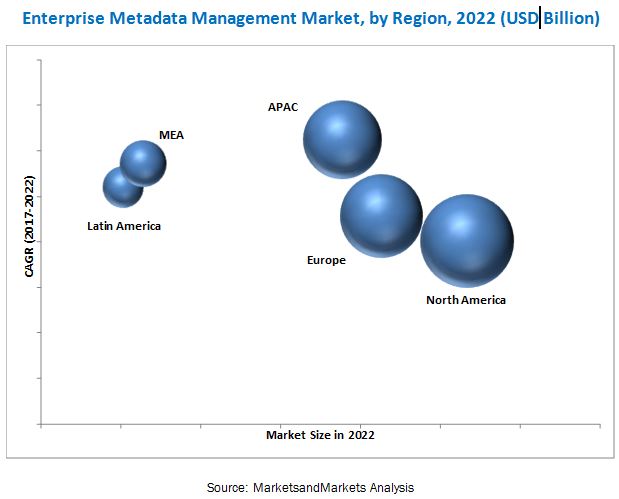

The report provides in-depth analysis of different geographic regions and covers all the major aspects across North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. Countries in North America, such as the US and Canada are the forerunners in the adoption of advanced security solutions. North America is the home to most vendors and organizations with a large operation base and customers. Having developed economies and being the early adopters of the technology, the region has witnessed a significant adoption of cloud-based security solutions, especially among the large enterprises. North America is expected to dominate the market throughout the forecast period in terms of revenue generation. However, APAC is projected to provide significant growth opportunities for the vendors and expected to grow at the highest CAGR during the forecast period.

Uncertainty regarding the Return on Investment (RoI) is believed to be restraining the growth of the enterprise metadata management market. Inconsistent business semantics and data integration affecting data insights timeliness are said to be the major challenges affecting the growth of global market, especially in the developing regions.

The enterprise metadata management market ecosystem comprises vendors, such as Adaptive (US), ASG Technologies (US), Cambridge Semantics (US), CentricMinds (VIC), Collibra (US), Data Advantage Group (US), IBM (US), Informatica (US), Oracle (US), and SAP (Germany). Vendors operating in the global market have adopted several organic and inorganic strategies, such as acquisitions, collaborations and partnerships, new product launches, and product developments to enhance their client base and customer experience. The partnership strategy has also been adopted widely by the topnotch players to enhance their market reach and provide innovative security solutions. For example, in July 2016, Oracle and Fujitsu partnered to deliver enterprise-grade, world-class cloud services to global customers, especially in Japan.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Enterprise Metadata Management Market

4.2 Market Share, By Region

4.3 Lifecycle Analysis, By Region, 2017

5 Market Overview and Industry Trends (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Centralized Data Management

5.2.1.2 Operational Excellence and Data Quality Management

5.2.1.3 Increasing Business Data Volume

5.2.1.4 Regulations, and Risk and Compliance Management

5.2.2 Restraints

5.2.2.1 Uncertain RoI

5.2.3 Opportunities

5.2.3.1 Rise of AI for Better Data Quality and Management

5.2.3.2 Risk Management and Incident Adjustment Management Applications Enhance the Overall Metadata Governance

5.2.4 Challenges

5.2.4.1 Inconsistent Business Semantics

5.2.4.2 Data Integration Affecting Data Insights Timeliness

5.3 Technology Overview/Architecture Modules

5.4 Use Cases

5.4.1 Use Case # 1: Central Governance of Enterprise Metadata Model and Granular Mapping of Legacy Data Estate

5.4.2 Use Case # 2: A Renowned Fmcg Company in India Opted for Data Management Tools for Governance of Huge Data Volumes Across Different Countries

5.4.3 Use Case # 3: Financial Firm Adopted Metadata Management Tool to Maximize Data Governance and Sourcing Advantage

5.4.4 Use Case # 4: Business Metadata and Data Relationships Made it Easier for End-Users to Access Data in A Consistent Manner

6 Market Analysis, By Application (Page No. - 40)

6.1 Introduction

6.2 Governance and Compliance Management

6.3 Risk Management

6.4 Product and Process Management

6.5 Incident Management

6.6 Others

7 Market Analysis, By Metadata Type (Page No. - 47)

7.1 Introduction

7.2 Business Metadata

7.3 Technical Metadata

7.4 Operational Metadata

8 Enterprise Metadata Management Market Analysis, By Component (Page No. - 51)

8.1 Introduction

8.2 Tools

8.3 Services

8.3.1 Managed Services

8.3.2 Professional Services

8.3.2.1 Support and Maintenance

8.3.2.2 Consulting

8.3.2.3 Education and Training

9 Market Analysis, By Business Function (Page No. - 61)

9.1 Introduction

9.2 Human Resource

9.3 Marketing and Sales

9.4 Finance

9.5 Operations

9.6 Legal

10 Market Analysis, By Deployment Model (Page No. - 66)

10.1 Introduction

10.2 On-Premises

10.3 Cloud

11 Market, By Industry Vertical (Page No. - 70)

11.1 Introduction

11.2 Banking, Financial Services, and Insurance

11.3 Telecommunication and IT

11.4 Retail and Ecommerce

11.5 Healthcare and Lifesciences

11.6 Manufacturing

11.7 Government and Defense

11.8 Energy and Utilities

11.9 Media and Entertainment

11.10 Others

12 Geographic Analysis (Page No. - 80)

12.1 Introduction

12.2 North America

12.2.1 By Component

12.2.2 By Application

12.2.3 By Metadata Type

12.2.4 By Deployment Model

12.2.5 By Business Function

12.2.6 By Industry Vertical

12.2.7 By Country

12.2.7.1 United States

12.2.7.2 Canada

12.3 Europe

12.3.1 By Component

12.3.2 By Application

12.3.3 By Metadata Type

12.3.4 By Deployment Model

12.3.5 By Business Function

12.3.6 By Industry Vertical

12.3.7 By Country

12.3.7.1 Germany

12.3.7.2 United Kingdom

12.3.7.3 Rest of Europe

12.4 Asia Pacific

12.4.1 By Component

12.4.2 By Application

12.4.3 By Metadata Type

12.4.4 By Deployment Model

12.4.5 By Business Function

12.4.6 By Industry Vertical

12.4.7 By Country

12.4.7.1 China

12.4.7.2 India

12.4.7.3 Rest of APAC

12.5 Middle East and Africa

12.5.1 By Component

12.5.2 By Application

12.5.3 By Metadata Type

12.5.4 By Deployment Model

12.5.5 By Business Function

12.5.6 By Industry Vertical

12.5.7 By Country

12.5.7.1 Kingdom of Saudi Arabia

12.5.7.2 Africa

12.6 Latin America

12.6.1 By Component

12.6.2 By Application

12.6.3 By Metadata Type

12.6.4 By Deployment Model

12.6.5 By Business Function

12.6.6 By Industry Vertical

12.6.7 By Country

12.6.7.1 Brazil

12.6.7.2 Mexico

13 Company Profiles (Page No. - 107)

(Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments)*

13.1 Adaptive

13.2 ASG Technologies

13.3 Cambridge Semantics

13.4 Centricminds

13.5 Collibra

13.6 Data Advantage Group

13.7 IBM

13.8 Informatica

13.9 Oracle

13.10 SAP

13.11 Talend

13.12 Topquadrant

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 140)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customization

14.6 Related Reports

14.7 Author Details

List of Tables (81 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Enterprise Metadata Management Market Size, By Application, 20152022 (USD Million)

Table 3 Governance and Compliance Management: Market Size, By Region, 20152022 (USD Million)

Table 4 Risk Management: Market Size, By Region, 20152022 (USD Million)

Table 5 Product and Process Management: Market Size, By Region, 20152022 (USD Million)

Table 6 Incident Management: Market Size, By Region, 20152022 (USD Million)

Table 7 Others: Market Size, By Region, 20152022 (USD Million)

Table 8 Market Size, By Metadata Type, 20152022 (USD Million)

Table 9 Business Metadata: Market Size, By Region, 20152022 (USD Million)

Table 10 Technical Metadata: Market Size, By Region, 20152022 (USD Million)

Table 11 Operational Metadata: Market Size, By Region, 20152022 (USD Million)

Table 12 Enterprise Metadata Management Market Size, By Component, 20152022 (USD Million)

Table 13 Tools: Market Size, By Region, 20152022 (USD Million)

Table 14 Services: Market Size, By Region, 20152022 (USD Million)

Table 15 Services: Market Size, By Type, 20152022 (USD Million)

Table 16 Managed Services Market Size, By Region, 20152022 (USD Million)

Table 17 Professional Services Market Size, By Region, 20152022 (USD Million)

Table 18 Professional Services Market Size, By Type, 20152022 (USD Million)

Table 19 Support and Maintenance Market Size, By Region, 20152022 (USD Million)

Table 20 Consulting Market Size, By Region, 20152022 (USD Million)

Table 21 Education and Training Market Size, By Region, 20152022 (USD Million)

Table 22 Enterprise Metadata Management Market Size, By Business Function, 20152022 (USD Million)

Table 23 Human Resource: Market Size, By Region, 20152022 (USD Million)

Table 24 Marketing and Sales: Market Size, By Region, 20152022 (USD Million)

Table 25 Finance: Market Size, By Region, 20152022 (USD Million)

Table 26 Operations: Market Size, By Region, 20152022 (USD Million)

Table 27 Legal: Market Size, By Region, 20152022 (USD Million)

Table 28 Market Size, By Deployment Model, 20152022 (USD Million)

Table 29 On-Premises: Market Size, By Region, 20152022 (USD Million)

Table 30 Cloud: Market Size, By Region, 20152022 (USD Million)

Table 31 Enterprise Metadata Management Market Size, By Industry Vertical, 20152022 (USD Million)

Table 32 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 33 Telecommunication and IT: Market Size, By Region, 20152022 (USD Million)

Table 34 Retail and Ecommerce: Market Size, By Region, 20152022 (USD Million)

Table 35 Healthcare and Lifesciences: Market Size, By Region, 20152022 (USD Million)

Table 36 Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 37 Government and Defense: Market Size, By Region, 20152022 (USD Million)

Table 38 Energy and Utilities: Market Size, By Region, 20152022 (USD Million)

Table 39 Media and Entertainment: Market Size, By Region, 20152022 (USD Million)

Table 40 Others: Market Size, By Region, 20152022 (USD Million)

Table 41 Enterprise Metadata Management Market Size, By Region, 20152022 (USD Million)

Table 42 North America: Market Size, By Component, 20152022 (USD Million)

Table 43 North America: Market Size, By Service, 20152022 (USD Million)

Table 44 North America: Market Size, By Professional Service, 20152022 (USD Million)

Table 45 North America: Market Size, By Application, 20152022 (USD Million)

Table 46 North America: Market Size, By Metadata Type, 20152022 (USD Million)

Table 47 North America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 48 North America: Market Size, By Business Function, 20152022 (USD Million)

Table 49 North America: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 50 Europe: Enterprise Metadata Management Market Size, By Component, 20152022 (USD Million)

Table 51 Europe: Market Size, By Service, 20152022 (USD Million)

Table 52 Europe: Market Size, By Professional Service, 20152022 (USD Million)

Table 53 Europe: Market Size, By Application, 20152022 (USD Million)

Table 54 Europe: Market Size, By Metadata Type, 20152022 (USD Million)

Table 55 Europe: Market Size, By Deployment Model, 20152022 (USD Million)

Table 56 Europe: Market Size, By Business Function, 20152022 (USD Million)

Table 57 Europe: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 58 Asia Pacific: Enterprise Metadata Management Market Size, By Component, 20152022 (USD Million)

Table 59 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 60 Asia Pacific: Market Size, By Professional Service, 20152022 (USD Million)

Table 61 Asia Pacific: Management Market Size, By Application, 20152022 (USD Million)

Table 62 Asia Pacific: Market Size, By Metadata Type, 20152022 (USD Million)

Table 63 Asia Pacific: Market Size, By Deployment Model, 20152022 (USD Million)

Table 64 Asia Pacific: Market Size, By Business Function, 20152022 (USD Million)

Table 65 Asia Pacific: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 66 Middle East and Africa: Enterprise Metadata Management Market Size, By Component, 20152022 (USD Million)

Table 67 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 68 Middle East and Africa: Market Size, By Professional Service, 20152022 (USD Million)

Table 69 Middle East and Africa: Market Size, By Application, 20152022 (USD Million)

Table 70 Middle East and Africa: Market Size, By Metadata Type, 20152022 (USD Million)

Table 71 Middle East and Africa: Market Size, By Deployment Model, 20152022 (USD Million)

Table 72 Middle East and Africa: Market Size, By Business Function, 20152022 (USD Million)

Table 73 Middle East and Africa: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 74 Latin America: Enterprise Metadata Management Market Size, By Component, 20152022 (USD Million)

Table 75 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 76 Latin America: Market Size, By Professional Service, 20152022 (USD Million)

Table 77 Latin America: Market Size, By Application, 20152022 (USD Million)

Table 78 Latin America: Market Size, By Metadata Type, 20152022 (USD Million)

Table 79 Latin America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 80 Latin America: Market Size, By Business Function, 20152022 (USD Million)

Table 81 Latin America: Market Size, By Industry Vertical, 20152022 (USD Million)

List of Figures (35 Figures)

Figure 1 Enterprise Metadata Management Market Segmentation

Figure 2 Regional Scope

Figure 3 Market Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Market Assumptions

Figure 9 Market is Expected to Witness Growth in the Global Market for the Period 20172022

Figure 10 Market Snapshot, By Component (2017 vs 2022)

Figure 11 Market Snapshot, By Service (2017 vs 2022)

Figure 12 Market Snapshot, By Application (2017 vs 2022)

Figure 13 Market Snapshot, By Deployment Model (2017 vs 2022)

Figure 14 Market Snapshot, By Industry Vertical (20172022)

Figure 15 Enterprise Metadata Management Market Growth is Driven By the Need for Advance Analytics By Businesses for Future Estimation

Figure 16 North America is Estimated to Have the Largest Market Share in 2017

Figure 17 Asia Pacific is Expected to Have an Exponential Growth During the Forecast Period

Figure 18 Enterprise Metadata Management Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Centralized Data Storage and Management Features

Figure 20 Governance and Compliance Management Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 Business Metadata Type is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 Services Component is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 23 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 24 Consulting Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 25 Operations Business Function is Expected to Have the Highest Market Growth During the Forecast Period

Figure 26 Cloud Deployment Model is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 27 Manufacturing Industry Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 29 North America: Market Snapshot

Figure 30 Asia Pacific: Market Snapshot

Figure 31 IBM: Company Snapshot

Figure 32 Informatica: Company Snapshot

Figure 33 Oracle: Company Snapshot

Figure 34 SAP: Company Snapshot

Figure 35 Talend: Company Snapshot

Growth opportunities and latent adjacency in Enterprise Metadata Management Market