Platform as a Service (PaaS) Market by Type (APaaS, IPaaS, DBPaaS), Deployment (Public and Private), Organization Size (Large Enterprises and SMEs), Vertical (Consumer Goods and Retail, BFSI, Manufacturing), and Region (2022 - 2026)

Platform as a Service Market - Analysis, Industry Size & Forecast

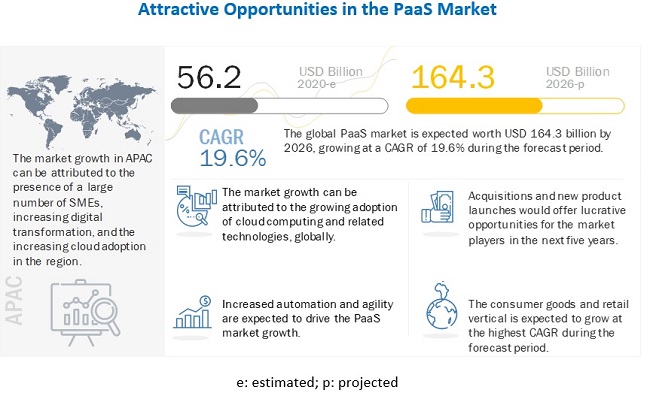

The global Platform as a Service Market size was valued at USD 56.2 billion in 2020 and is expected to grow at a CAGR of 19.6% from 2020 to 2026. The revenue forecast for 2026 is projected to reach $164.3 billion. The base year for estimation is 2019, and the historical data spans from 2021 to 2026. Key factors that are expected to drive the growth of the market are the increasing need to reduce time to market and cost of application development and focus on streamlining application management. However, cloud washing hindering the growth of PaaS, and security concerns related to the adoption of public cloud are expected to limit the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Platform as a Service Market Dynamics

Driver: Increasing need to reduce TTM and cost of application development

The technological landscape in companies is changing at an alarming rate, including the way the infrastructure is built and maintained and software applications are being developed and deployed. Time to Market (TTM) is the time taken by an organization to introduce a product or a feature; it is a crucial factor to determine the success of an organization along with the development cost of its products. Better control over the development process makes it easier to introduce a product. Almost all companies give importance to TTM and aim to improve the same, but a majority of companies fail to attain the desired TTM due to inefficiencies in the overall digital landscape.

Digital transformation is the key to empower developers and enhance customer engagement and experiences. Companies aim at introducing the product as soon as possible because it is estimated that the first software product to enter the market can get up to 70% of the market share. Companies face financial losses if they fail to meet the TTM targets. It has been observed that there would be 33% less profit over five years if a product is introduced six months later to the market. On the other hand, if a product is launched on time, but it is 50% over budget, then the profit will be reduced by around 4%.

Less TTM and lower cost of application development would polish internal processes, fine-tune the approach to software product development, avoid development wastes, and ensure good cooperation. Hence, companies are focused on reducing the TTM and application development cost as it is important for them to introduce major version releases or small updates on time to be competitive in the market.

Restraint: Cloud washing hinders the PaaS market growth

The term cloud washing is used when marketing teams label their software to make their software more appealing. Cloud-washed PaaS solutions differ from cloud-native offerings. Cloud-washed platform as a service solutions deliver similar architecture and programming models. These solutions offer limited cloud characteristics and deliver only incremental improvement. However, cloud-native solutions that inject behavior into the application decouple application code from run-time infrastructure details, increase application density, and facilitate distributed interactions. There are many instances where end users are unable to determine whether a PaaS is cloud-washed or cloud-native. Cloud-washed solutions consume large amounts of machine resources (e.g. CPU, memory) and increased administration effort. Hence, the use of cloud-washed solutions is expected to hinder the market growth.

Opportunity: Rapid development of mobile app ecosystem

The mobile ecosystem is growing at a high pace, and app development emerges as a crucial component fueling its growth. Due to the growth of digital enterprises, the development of enterprise mobile apps is also becoming a top priority for organizations. As per the report by 451 Research, 50% of IT organizations plan to deploy a minimum of ten mobile apps over the next two years. Due to the COVID-19 pandemic, there has been a sudden spike in demand for some mobile applications. Technologies such as 5G and cloud computing have increased the development of these mobile applications. PaaS providers offer a certain set of tools for tablet, mobile, and web platforms, including a variety of functions right from data recovery, data backups, data security to licensing formalities, support, and maintenance, as well as server-based scalability. Developers can boost the application development, while platform as a service providers take care of the rest.

Challenge: Vendor lock-in issues

In the case of vendor lock-in, the switching cost is high, so that the customer is stuck with the original vendor. Due to financial pressure and a limited workforce, customers are unable to switch to other vendors. Lack of standardization is also another major factor for the vendor lock-in process in the platform as a service market. Furthermore, many customers are not aware of the standards that cause interoperability and portability of applications when taking services from vendors. To overcome this challenge, PaaS vendors maintain good business relationships with customers to ensure they continue to use their services.

Application PaaS (aPaaS) segment to hold a larger market size during the forecast period

Various government organizations are adopting aPaaS as it provides modernization efforts while meeting all security requirements. For instance, in May 2019, Appian formed a partnership with Smartronix Inc., which is AWS’s premier partner, to deliver the speed and impact of low-code Appian platform to the Federal Government and the Department of Defense (DoD) through AWS or Microsoft Azure government cloud platform. The PaaS segment is gaining traction among enterprises, due to the various benefits it offers, such as reduced coding time, additional development capabilities without involving more staff, developing applications for multiple platforms, accessibility to support tools, support for geographically distributed teams, and efficient management of application development lifecycle.

Public cloud deployment to hold a larger market size in 2020

The public cloud segment is growing as various SMEs have embraced public PaaS. It offers a wide scope for data recovery and offers infrastructure, including hardware, OS, software, and middleware servers to run applications across different platforms. Moreover, enterprises are adopting public cloud services as they are easy to implement. Furthermore, with the adoption of public cloud solutions, it becomes easy to access platform solutions, such as big data, data analytics, and the Internet of Things (IoT). To cater to the growing demand for public cloud solutions, various organizations are shifting toward public cloud offerings. For instance, Red Hat OpenShift is an open-source enterprise PaaS. The company is providing its public PaaS version of OpenShift on its Red Hat Enterprise Linux (RHEL).

Large enterprises to hold a majority of the market share during the forecast period

The trend of digitalization has been increasing extensively among large enterprises. The growing connectivity of bandwidths and mobility trends can be seen more among large enterprises, due to the presence of a huge workforce. Large enterprises have a large corporate network and many revenue streams. These organizations are also keen to invest in new and latest technologies to effectively run their business. The platform as a service market has a stronghold in large enterprises, as the IT infrastructure becomes more complex in large enterprises as compared to SMEs. The increasing demand for employees to access computing resources and applications from a mobile location and at any time has made it complex for enterprises to store their data properly, maintain and manage their data centers, and focus on their core business operations.

Manufacturing industry vertical to hold a significant market share during the forecast period

The demand for faster delivery and heightened production is rapidly increasing. Cloud technology assists manufacturing companies in meeting these increasing demands. It is mandatory for the manufacturing vertical to adapt to global changes in connectivity and computing. It is estimated that by 2023 about 50% of software used by manufacturers will be cloud-based. The cloud has made it easier to adopt emerging technologies, such as Machine-to-Machine (M2M) communication and IoT, which have led the manufacturing vertical to transform and digitalize processes on a large scale. These factors are accelerating the demand for cloud computing, leading to improved customer service and easier sustenance in the highly competitive market. Many manufacturers are using platform as a service services for many of their mission-critical deployments. Along with software and web-based apps, PaaS provides third-party hardware as well as software for connection and data retrieval within the factory. PaaS services help the vertical in improving operational efficiencies within their factories.

To know about the assumptions considered for the study, download the pdf brochure

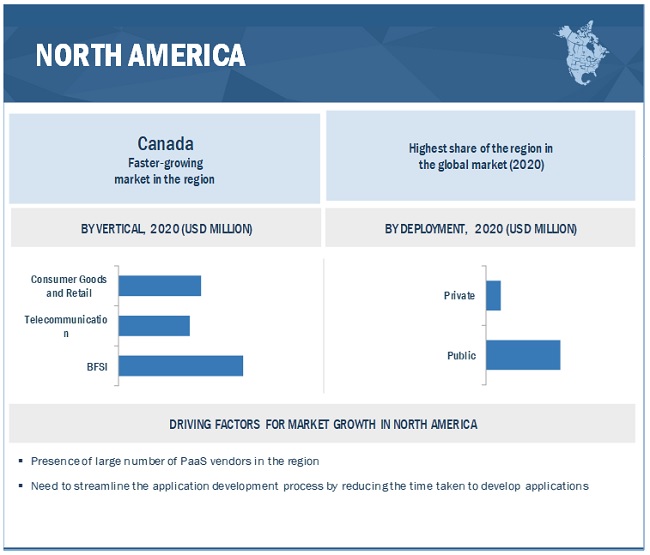

North America to account for the largest market size during the forecast period

The global platform as a service market by region covers five major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East & Africa (MEA), and Latin America. North America is expected to be the most promising region for major verticals, such as IT, BFSI, and telecommunications. The increasing budget allocation for cloud services among enterprises is further expected to drive the market in North America. North America is expected to be the most promising region for major verticals, such as telecommunications, IT and ITeS, BFSI, and the government and public sector. The PaaS market size in North America is expected to grow steadily during the forecast period, as enterprises are adopting advanced application development technologies at various levels as a part of their strategy to sustain in the competitive market.

Platform as a Service Market Companies

The PaaS vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering PaaS solutions and services globally are AWS (US), Microsoft (US), Alibaba Cloud (China), IBM (US), Salesforce (US), Google (US), Oracle (US), SAP (Germany), Mendix (US), Zoho Corporation (India), Engine Yard (US), Apprenda (US), VMware (US), ServiceNow (US), Plesk (Switzerland), Render (US), CircleCI (US), Tray.io (US), Cloud 66 (UK), AppHarbor (US), Jelastic (US), Platform.sh (France), Scalingo (France), PythonAnywhere (US), and Blazedpath (US).

The study includes an in-depth competitive analysis of key players in the PaaS market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Scope of the report

|

Report Metric |

Details |

|

Market Size value in 2020 |

US $56.2 billion |

|

Market Size value 2026 |

US $164.3 billion |

|

Market size available for years |

2016–2026 |

|

Base year considered |

2019 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Type, Deployment, Organization Size, Vertical, and Region |

|

Platform as a Service Market Drivers |

|

|

Platform as a Service Market Opportunities |

|

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

List of Companies in Platform as a Service |

AWS (US), Microsoft (US), Alibaba Cloud (China), IBM (US), Salesforce (US), Google (US), Oracle (US), SAP (Germany), Mendix (US), Zoho Corporation (India), Engine Yard (US), Apprenda (US), VMware (US), ServiceNow (US), Plesk (Switzerland), Render (US), CircleCI (US), Tray.io (US), Cloud 66 (UK), AppHarbor (US), Jelastic (US), Platform.sh (France), Scalingo (France), PythonAnywhere (US), and Blazedpath (US). |

This research report categorizes the PaaS market based on component, deployment type, organization size, vertical, and region.

Platform as a Service Market Based on the type:

- Application PaaS (aPaaS)

- Integration PaaS (iPaaS)

- Database PaaS (dbPaaS)

- Others

Based on the deployment:

- Public

- Private

Based on the organization size:

- Large Enterprises

- SMEs

Platform as a Service Market Based on the vertical

- BFSI

- Consumer goods and retail

- Telecommunication

- IT and ITeS

- Manufacturing

- Healthcare and life sciences

- Energy and utility

- Others

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Western Europe

- Central and Eastern Europe

-

APAC

- China

- Japan

- Rest of APAC

-

MEA

- KSA

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In January 2021, Microsoft introduced a new Wisely blockchain-enabled cPaaS offerings for enterprises, mobile carriers, OTT players, marketers, and industry regulators to improve their quality of service.

- In Septmber 2020, Oracle expanded its security portfolio with new cloud services designed to automatically help protect cloud workloads and data from risks posed by cyber threats. The three new cloud services, including Oracle data safe, Oracle cloud guard, and Oracle maximum security zones, provide centralized security configuration as well as automated enforcement of security practices.

- In June 2020, IBM collaborated with Wipro to accelerate the transformation to the cloud. Under this collaboration, Wipro will develop hybrid cloud offerings to help businesses migrate, manage, and transform across public or private clouds.

- In January 2019, AWS acquired CloudEndure, an Israeli-based company, which offers Disaster Recovery (DR) services. This acquisition would help AWS deliver enhanced and innovative migration, backup, and DR solutions to customers.

Frequently Asked Questions (FAQ):

How big is the platform as a service market?

What is the platform as a service market growth?

Who are the top vendors in the platform as a service market?

Which countries are considered in the European region?

What are the major platform as a service types considered in the study?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

1.3 COVID-19 ECONOMIC ASSESSMENT

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

1.4 OBJECTIVES OF THE STUDY

1.4.1 MARKET DEFINITION

1.4.2 INCLUSIONS AND EXCLUSIONS

1.5 MARKET SCOPE

1.5.1 MARKET SEGMENTATION

1.5.2 REGIONS COVERED

1.5.3 YEARS CONSIDERED FOR THE STUDY

1.6 CURRENCY CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakup of primary profiles

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.4 MARKET REVENUE ESTIMATION

2.5 GROWTH FORECAST ASSUMPTIONS

2.6 MARKET FORECAST

2.7 COMPANY EVALUATION MATRIX METHODOLOGY

2.8 RESEARCH ASSUMPTIONS

2.9 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 46)

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN THE PAAS MARKET

4.2 NORTH AMERICA: PAAS MARKET, BY VERTICAL AND COUNTRY

4.3 ASIA PACIFIC: PAAS MARKET, BY COMPONENT AND COUNTRY

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing need to reduce ttm and cost of application development

5.2.1.2 Focus on streamlining am

5.2.2 RESTRAINTS

5.2.2.1 Cloud washing hinders the paas market growth

5.2.2.2 Security concerns related to public cloud

5.2.3 OPPORTUNITIES

5.2.3.1 Rapid development of mobile app ecosystem

5.2.3.2 Emergence of video communication paas

5.2.4 CHALLENGES

5.2.4.1 Vendor lock-in issues

5.3 PATENT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 REGULATORY LANDSCAPE

5.5.1 GENERAL DATA PROTECTION REGULATION

5.5.2 PAYMENT CARD INDUSTRY-DATA SECURITY STANDARD

5.5.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.5.4 GRAMM-LEACH-BLILEY ACT

5.5.5 SARBANES-OXLEY ACT

5.5.6 SOC2

5.6 INDUSTRY TRENDS

5.6.1 CASE STUDY ANALYSIS

5.6.1.1 Use case 1: consumer goods and retail

5.6.1.2 Use case 2: media and entertainment

5.6.1.3 Use case 3: bfsi

5.6.1.4 Use case 4: information technology

5.6.1.5 Use case 5: healthcare

5.7 PRICING ANALYSIS

5.8 VALUE CHAIN ANALYSIS

5.9 TECHNOLOGY ANALYSIS

5.9.1 BLOCKCHAIN

5.9.2 MACHINE LEARNING

5.9.3 INTERNET OF THINGS

5.9.4 AUGMENTED REALITY

5.9.5 ARTIFICIAL INTELLIGENCE

5.1 PLATFORM AS A SERVICE MARKET: COVID-19 IMPACT

5.10.1.1 COVID-19 impact on PaaS market: Assumptions

5.10.2 DRIVERS AND OPPORTUNITIES

5.10.3 RESTRAINTS AND CHALLENGES

6 PAAS MARKET, BY TYPE (Page No. - 66)

6.1 INTRODUCTION

6.1.1 TYPE: PLATFORM AS A SERVICE MARKET DRIVERS

6.1.2 TYPE: COVID-19 IMPACT

6.2 APPLICATION PLATFORM AS A SERVICE

6.3 INFRASTRUCTURE PLATFORM AS A SERVICE

6.4 DATABASE PLATFORM AS A SERVICE

6.5 OTHERS

7 PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT (Page No. - 74)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT: PAAS MARKET DRIVERS

7.1.2 DEPLOYMENT: COVID-19 IMPACT

7.2 PUBLIC

7.3 PRIVATE

8 PLATFORM AS A SERVICE MARKET, BY ORGANIZATION SIZE (Page No. - 80)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: PAAS MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

8.2 LARGE ENTERPRISES

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

9 PLATFORM AS A SERVICE MARKET, BY VERTICAL (Page No. - 86)

9.1 INTRODUCTION

9.1.1 VERTICAL: PAAS MARKET DRIVERS

9.1.2 VERTICAL: COVID-19 IMPACT

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

9.3 CONSUMER GOODS AND RETAIL

9.4 INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY-ENABLED SERVICES

9.5 TELECOMMUNICATIONS

9.6 MANUFACTURING

9.7 HEALTHCARE AND LIFE SCIENCES

9.8 ENERGY AND UTILITY

9.9 OTHER VERTICALS

10 PLATFORM AS A SERVICE MARKET, BY REGION (Page No. - 98)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: PAAS MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

10.2.4 UNITED STATES

10.2.5 CANADA

10.3 EUROPE

10.3.1 EUROPE: PLATFORM AS A SERVICE MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: REGULATORY LANDSCAPE

10.3.4 UNITED KINGDOM

10.3.5 GERMANY

10.3.6 FRANCE

10.3.7 REST OF WESTERN EUROPE

10.3.8 CENTRAL AND EASTERN EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: PAAS MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

10.4.4 CHINA

10.4.5 JAPAN

10.4.6 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: PLATFORM AS A SERVICE MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.3 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

10.5.4 KINGDOM OF SAUDI ARABIA

10.5.5 REST OF MIDDLE EAST AND AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: PAAS MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

10.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

10.6.4 BRAZIL

10.6.5 MEXICO

10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 142)

11.1 MARKET EVALUATION FRAMEWORK

11.2 MARKET RANKING

11.3 MARKET SHARE ANALYSIS

11.4 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS

11.5 KEY MARKET DEVELOPMENTS

11.5.1 NEW PRODUCT LAUNCHES

11.5.2 DEALS

11.5.3 OTHERS

11.6 COMPANY EVALUATION MATRIX

11.6.1 STAR

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE

11.6.4 PARTICIPANTS

11.7 STARTUP/SME EVALUATION MATRIX, 2020

11.7.1 RESPONSIVE COMPANIES

11.7.2 PROGRESSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

12 COMPANY PROFILES (Page No. - 161)

12.1 INTRODUCTION

12.2 AWS

12.2.1 BUSINESS OVERVIEW

12.2.2 PRODUCTS OFFERED

12.2.3 RECENT DEVELOPMENTS

12.2.4 AWS: COVID-19 DEVELOPMENTS

12.2.5 MNM VIEW

12.2.5.1 Key strengths

12.2.5.2 Strategic choices made

12.2.5.3 Weaknesses and competitive threats

12.3 MICROSOFT

12.3.1 BUSINESS OVERVIEW

12.3.2 PLATFORMS OFFERED

12.3.3 RECENT DEVELOPMENTS

12.3.4 MICROSOFT: COVID-19 DEVELOPMENTS

12.3.5 MNM VIEW

12.3.5.1 Key strengths

12.3.5.2 Strategic choices made

12.3.5.3 Weaknesses and competitive threats

12.4 ALIBABA CLOUD

12.4.1 BUSINESS OVERVIEW

12.4.2 SERVICES OFFERED

12.4.3 RECENT DEVELOPMENTS

12.4.4 ALIBABA CLOUD: COVID-19 DEVELOPMENTS

12.4.5 MNM VIEW

12.4.5.1 Key strengths

12.4.5.2 Strategic choices made

12.4.5.3 Weaknesses and competitive threats

12.5 IBM

12.5.1 BUSINESS OVERVIEW

12.5.2 PRODUCTS OFFERED

12.5.3 RECENT DEVELOPMENTS

12.5.4 IBM: COVID-19 DEVELOPMENTS

12.5.5 MNM VIEW

12.5.5.1 Key strengths

12.5.5.2 Strategic choices made

12.5.5.3 Weaknesses and competitive threats

12.6 SALESFORCE

12.6.1 BUSINESS OVERVIEW

12.6.2 SERVICES OFFERED

12.6.3 RECENT DEVELOPMENTS

12.6.4 SALESFORCE: COVID-19 DEVELOPMENTS

12.6.5 MNM VIEW

12.6.5.1 Key strengths

12.6.5.2 Strategic choices made

12.6.5.3 Weaknesses and competitive threats

12.7 GOOGLE

12.7.1 BUSINESS OVERVIEW

12.7.2 PRODUCTS OFFERED

12.7.3 RECENT DEVELOPMENTS

12.7.4 GOOGLE: COVID-19 DEVELOPMENTS

12.7.5 MNM VIEW

12.7.5.1 Key strengths

12.7.5.2 Strategic choices made

12.7.5.3 Weaknesses and competitive threats

12.8 ORACLE

12.8.1 BUSINESS OVERVIEW

12.8.2 PRODUCTS OFFERED

12.8.3 RECENT DEVELOPMENTS

12.9 SAP

12.9.1 BUSINESS OVERVIEW

12.9.2 SERVICES OFFERED

12.9.3 RECENT DEVELOPMENTS

12.10 MENDIX

12.10.1 BUSINESS OVERVIEW

12.10.2 SERVICES OFFERED

12.10.3 RECENT DEVELOPMENTS

12.11 ZOHO CORPORATION

12.11.1 BUSINESS OVERVIEW

12.11.2 PRODUCTS OFFERED

12.11.3 RECENT DEVELOPMENTS

12.12 ENGINE YARD

12.12.1 BUSINESS OVERVIEW

12.12.2 PRODUCTS OFFERED

12.13 APPRENDA

12.14 VMWARE

12.15 SERVICENOW

12.16 PLESK

12.17 RENDER

12.18 CIRCLECI

12.19 TRAY.IO

12.20 CLOUD 66

12.21 APPHARBOR

12.22 JELASTIC

12.23 PLATFORM.SH

12.24 SCALINGO

12.25 PYTHONANYWHERE

13 ADJACENT AND RELATED MARKETS (Page No. - 202)

13.1 INTRODUCTION

13.1.1 RELATED MARKETS

13.1.2 LIMITATIONS

13.2 CLOUD COMPUTING MARKET

13.2.1 MARKET OVERVIEW

13.2.2 MARKET SIZE AND FORECAST BY SERVICE MODEL

13.2.3 GEOGRAPHIC ANALYSIS

14 APPENDIX (Page No. - 209)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

LIST OF TABLES (231 TABLE)

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2020

TABLE 2 FACTOR ANALYSIS

TABLE 3 ASSUMPTIONS FOR THE STUDY

TABLE 4 TOP TEN PATENT OWNERS (US)

TABLE 5 PORTER’S FIVE FORCES ANALYSIS: PLATFORM AS A SERVICE MARKET

TABLE 6 MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 7 MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 8 TYPE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 9 TYPE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 10 APAAS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 11 APAAS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 12 IPAAS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 IPAAS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 14 DBPAAS: PAAS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 DBPAAS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 16 OTHERS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 OTHERS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 18 MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 19 MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 20 DEPLOYMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 DEPLOYMENT: PLATFORM AS A SERVICE MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 22 PUBLIC: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 PUBLIC: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 24 PRIVATE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 PRIVATE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 26 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 27 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 28 ORGANIZATION SIZE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 ORGANIZATION SIZE: PAAS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 30 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 32 SMALL AND MEDIUM ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 SMALL AND MEDIUM ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 34 MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 35 MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 36 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 BANKING, FINANCIAL SERVICES, AND INSURANCE: PLATFORM AS A SERVICE MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 38 CONSUMER GOODS AND RETAIL: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 CONSUMER GOODS AND RETAIL: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 40 INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY ENABLED SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY ENABLED SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 42 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 TELECOMMUNICATIONS: PAAS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 44 MANUFACTURING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 MANUFACTURING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 46 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 48 ENERGY AND UTILITY: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 ENERGY AND UTILITY: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 50 OTHER VERTICALS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 OTHER VERTICALS: PLATFORM AS A SERVICE MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 52 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 53 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: PLATFORM AS A SERVICE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 61 NORTH AMERICA: PAAS MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 64 UNITED STATES: PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 65 UNITED STATES: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 66 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 67 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 68 CANADA: PAAS MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 69 CANADA: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 70 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 71 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 72 EUROPE: PLATFORM AS A SERVICE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 78 EUROPE: PAAS MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 80 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 82 UNITED KINGDOM: PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 83 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 84 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 85 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 86 GERMANY: PAAS MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 87 GERMANY: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 88 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 89 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 90 FRANCE: PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 91 FRANCE: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 92 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 93 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 94 REST OF WESTERN EUROPE: PAAS MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 95 REST OF WESTERN EUROPE: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 96 REST OF WESTERN EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 97 REST OF WESTERN EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 98 CENTRAL AND EASTERN EUROPE: PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 99 CENTRAL AND EASTERN EUROPE: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 100 CENTRAL AND EASTERN EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 101 CENTRAL AND EASTERN EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 102 ASIA PACIFIC: PAAS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 107 ASIA PACIFIC: PLATFORM AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 112 CHINA: PAAS MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 113 CHINA: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 114 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 115 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 116 JAPAN: PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 117 JAPAN: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 118 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 119 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 120 REST OF ASIA PACIFIC: PAAS MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 121 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 122 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 123 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 124 MIDDLE EAST AND AFRICA: PLATFORM AS A SERVICE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 128 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 129 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 130 MIDDLE EAST AND AFRICA: PAAS MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 131 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 132 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 133 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 134 KINGDOM OF SAUDI ARABIA: PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 135 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 136 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 137 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 138 REST OF MIDDLE EAST AND AFRICA: PAAS MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 139 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 140 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 141 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 142 LATIN AMERICA: PLATFORM AS A SERVICE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 143 LATIN AMERICA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 144 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 145 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 146 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 147 LATIN AMERICA: PAAS MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 148 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 151 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 152 BRAZIL: PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 153 BRAZIL: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 154 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 155 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 156 MEXICO: PAAS MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 157 MEXICO: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 158 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 159 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 160 REST OF LATIN AMERICA: PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 161 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 162 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 163 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 164 PLATFORM AS A SERVICE MARKET: DEGREE OF COMPETITION

TABLE 165 NEW PRODUCT LAUNCHES, 2018-2021

TABLE 166 DEALS, 2019-2020

TABLE 167 OTHERS, 2018-2020

TABLE 168 COMPANY PRODUCT FOOTPRINT

TABLE 169 COMPANY INDUSTRY FOOTPRINT

TABLE 170 COMPANY REGION FOOTPRINT

TABLE 171 COMPANY SOLUTION SCORE

TABLE 172 AWS: BUSINESS OVERVIEW

TABLE 173 AWS: PRODUCTS OFFERED

TABLE 174 AWS: PLATFORM AS A SERVICE: NEW LAUNCHES

TABLE 175 AWS: PLATFORM AS A SERVICE: DEALS

TABLE 176 AWS: PLATFORM AS A SERVICE: OTHERS

TABLE 177 MICROSOFT: BUSINESS OVERVIEW

TABLE 178 MICROSOFT: PRODUCTS OFFERED

TABLE 179 MICROSOFT: PLATFORM AS A SERVICE: NEW LAUNCHES

TABLE 180 MICROSOFT: PLATFORM AS A SERVICE: DEALS

TABLE 181 MICROSOFT: PLATFORM AS A SERVICE: OTHERS

TABLE 182 ALIBABA CLOUD: BUSINESS OVERVIEW

TABLE 183 ALIBABA CLOUD: PRODUCTS OFFERED

TABLE 184 ALIBABA CLOUD: PLATFORM AS A SERVICE: NEW LAUNCHES

TABLE 185 ALIBABA CLOUD: PLATFORM AS A SERVICE: DEALS

TABLE 186 ALIBABA CLOUD: PLATFORM AS A SERVICE: OTHERS

TABLE 187 IBM: BUSINESS OVERVIEW

TABLE 188 IBM: PRODUCTS OFFERED

TABLE 189 IBM: PLATFORM AS A SERVICE: NEW LAUNCHES

TABLE 190 IBM: PLATFORM AS A SERVICE: DEAL

TABLE 191 IBM: PLATFORM AS A SERVICE: OTHERS

TABLE 192 SALESFORCE: BUSINESS OVERVIEW

TABLE 193 SALESFORCE: SERVICES OFFERED

TABLE 194 SALESFORCE: PLATFORM AS A SERVICE: NEW LAUNCHES

TABLE 195 GOOGLE: BUSINESS OVERVIEW

TABLE 196 GOOGLE: PRODUCTS OFFERED

TABLE 197 GOOGLE: PLATFORM AS A SERVICE: DEALS

TABLE 198 ORACLE: BUSINESS OVERVIEW

TABLE 199 ORACLE: PRODUCT OFFERED

TABLE 200 ORACLE: PLATFORM AS A SERVICE: NEW LAUNCHES

TABLE 201 ORACLE: PLATFORM AS A SERVICE: DEALS

TABLE 202 ORACLE: PLATFORM AS A SERVICE: OTHERS

TABLE 203 SAP: BUSINESS OVERVIEW

TABLE 204 SAP: SERVICES OFFERED

TABLE 205 SAP: PLATFORM AS A SERVICE: NEW LAUNCHES

TABLE 206 ORACLE: PLATFORM AS A SERVICE: DEALS

TABLE 207 MENDIX: BUSINESS OVERVIEW

TABLE 208 MENDIX: PRODUCTS OFFERED

TABLE 209 MENDIX: PLATFORM AS A SERVICE: NEW LAUNCHES

TABLE 210 MENDIX: PLATFORM AS A SERVICE: DEALS

TABLE 211 ZOHO CORPORATION: BUSINESS OVERVIEW

TABLE 212 ZOHO CORPORATION: PRODUCTS OFFERED

TABLE 213 ZOHO CORPORATION: PLATFORM AS A SERVICE: NEW LAUNCHES

TABLE 214 ENGINE YARD: BUSINESS OVERVIEW

TABLE 215 ENGINE YARD: PRODUCT OFFERED

TABLE 216 CLOUD COMPUTING MARKET SIZE, BY SERVICE MODEL, 2016–2019 (USD BILLION)

TABLE 217 CLOUD COMPUTING MARKET SIZE, BY SERVICE MODEL, 2020–2025 (USD BILLION)

TABLE 218 INFRASTRUCTURE AS A SERVICE: CLOUD COMPUTING MARKET SIZE, BY REGION, 2016–2019 (USD BILLION)

TABLE 219 INFRASTRUCTURE AS A SERVICE: CLOUD COMPUTING MARKET SIZE, BY REGION, 2020–2025 (USD BILLION)

TABLE 220 PLATFORM AS A SERVICE: CLOUD COMPUTING MARKET SIZE, BY REGION, 2016–2019 (USD BILLION)

TABLE 221 PLATFORM AS A SERVICE: CLOUD COMPUTING MARKET SIZE, BY REGION, 2020–2025 (USD BILLION)

TABLE 222 SOFTWARE AS A SERVICE: CLOUD COMPUTING MARKET SIZE, BY REGION, 2016–2019 (USD BILLION)

TABLE 223 SOFTWARE AS A SERVICE: CLOUD COMPUTING MARKET SIZE, BY REGION, 2020–2025 (USD BILLION)

TABLE 224 CLOUD COMPUTING MARKET SIZE, BY REGION, 2016–2019 (USD BILLION)

TABLE 225 CLOUD COMPUTING MARKET SIZE, BY REGION, 2020–2025 (USD BILLION)

TABLE 226 NORTH AMERICA: CLOUD COMPUTING MARKET SIZE, BY SERVICE MODEL, 2016–2019 (USD BILLION)

TABLE 227 NORTH AMERICA: CLOUD COMPUTING MARKET SIZE, BY SERVICE MODEL, 2020–2025 (USD BILLION)

TABLE 228 NORTH AMERICA: CLOUD COMPUTING MARKET SIZE, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 229 NORTH AMERICA: CLOUD COMPUTING MARKET SIZE, BY VERTICAL, 2020–2025 (USD BILLION)

TABLE 230 NORTH AMERICA: CLOUD COMPUTING MARKET SIZE, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 231 NORTH AMERICA: CLOUD COMPUTING MARKET SIZE, BY COUNTRY, 2020–2025 (USD BILLION)

LIST OF FIGURES (47 FIGURES)

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

FIGURE 6 PLATFORM AS A SERVICE MARKET: RESEARCH DESIGN

FIGURE 7 PLATFORM AS A SERVICE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING PLATFORM AS A SERVICE SOLUTIONS AND SERVICES (1/2)

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING PLATFORM AS A SERVICE SOLUTIONS AND SERVICES (2/2)

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 (BOTTOM-UP): REVENUE OF VENDORS FROM SOLUTIONS AND SERVICES

FIGURE 12 ILLUSTRATION OF COMPANY PLATFORM AS A SERVICE REVENUE ESTIMATION

FIGURE 13 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

FIGURE 14 APAAS TYPE, PUBLIC DEPLOYMENT, AND LARGE ENTERPRISES TO HOLD HIGH MARKET SHARES IN 2020

FIGURE 15 NORTH AMERICA TO ACCOUNT FOR THE HIGHEST SHARE IN THE PLATFORM AS A SERVICE MARKET IN 2020

FIGURE 16 INCREASING DEMAND FOR PAAS TO TACKLE HIGH DEMAND FROM THE BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY TO DRIVE MARKET GROWTH

FIGURE 17 BANKING, FINANCIAL SERVICES AND INSURANCE SEGMENT AND UNITED STATES TO ACCOUNT FOR HIGH SHARES IN THE NORTH AMERICAN MARKET IN 2020

FIGURE 18 PUBLIC DEPLOYMENT AND CHINA TO ACCOUNT FOR HIGH SHARES IN THE ASIA PACIFIC PAAS MARKET IN 2020

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PLATFORM AS A SERVICE MARKET

FIGURE 20 NUMBER OF PATENTS PUBLISHED IN LAST 10 YEARS

FIGURE 21 TOP FIVE COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

FIGURE 22 PORTER’S FIVE FORCES ANALYSIS: PLATFORM AS A SERVICE MARKET

FIGURE 23 PRICING ANALYSIS: PLATFORM AS A SERVICE MARKET

FIGURE 24 PAAS MARKET: VALUE CHAIN ANALYSIS

FIGURE 25 PRE- AND POST-COVID-19 SCENARIOS DURING FORECAST PERIOD

FIGURE 26 DBPAAS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 27 PRIVATE SEGMENT TO GROW AT A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 28 LARGE ORGANIZATIONS SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 29 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD MAJORITY OF THE MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 30 NORTH AMERICA TO HOLD THE HIGHEST MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 33 MARKET EVALUATION FRAMEWORK

FIGURE 34 MARKET RANKING IN 2020

FIGURE 35 MARKET SHARE ANALYSIS OF COMPANIES IN THE PLATFORM AS A SERVICE MARKET

FIGURE 36 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS IN THE PAAS MARKET, 2016-2020

FIGURE 37 KEY DEVELOPMENTS IN PARTNER RELATIONSHIP MANAGEMENT MARKET DURING 2018–2021

FIGURE 38 MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

FIGURE 39 PLATFORM AS A SERVICE MARKET, STARTUP/SME EVALUATION MATRIX, 2020

FIGURE 40 AWS: COMPANY SNAPSHOT

FIGURE 41 MICROSOFT: COMPANY SNAPSHOT

FIGURE 42 ALIBABA CLOUD: COMPANY SNAPSHOT

FIGURE 43 IBM: COMPANY SNAPSHOT

FIGURE 44 SALESFORCE: COMPANY SNAPSHOT

FIGURE 45 GOOGLE: COMPANY SNAPSHOT

FIGURE 46 ORACLE: COMPANY SNAPSHOT

FIGURE 47 SAP: COMPANY SNAPSHOT

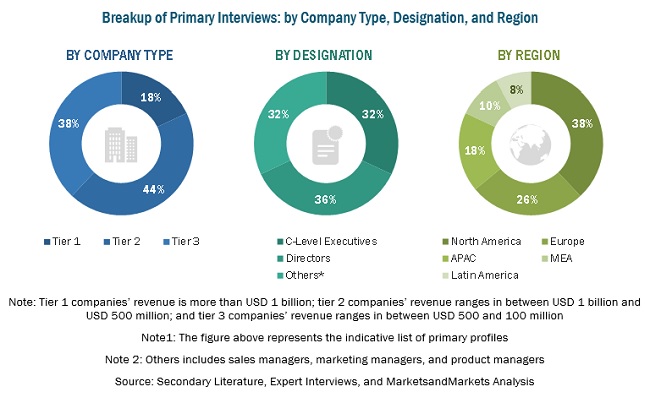

The study involved four major activities in estimating the current size of the global platform as a service market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total PaaS market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the PaaS market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the PaaS market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global PaaS market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the PaaS market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the Platform as a Service (PaaS) market based on type, vertical, organization size, deployment, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the PaaS market

- To analyze the impact of COVID-19 on type, verticals, organization size, deployment, and regions across the globe

- To analyze the market with respect to individual growth trends, prospects, and contributions to the PaaS market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the PaaS market

- To profile key players in the PaaS market and comprehensively analyze their core competencies in each microsegment.

- To analyze key players based on pricing models, technology analysis, and their market shares

- To analyze competitive developments, such as new product launches, product enhancements, partnerships, and Mergers and Acquisitions (M&As), in the PaaS market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Platform as a Service (PaaS) Market