Essential Oils Market by Product Type, Application (Food & beverages, Cosmetics & Toiletries, Aromatherapy, Home Care, and Health Care), Source (Fruits & Vegetables, Herbs & Spices, Flowers), Method of Extraction and Region - Global Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Essential Oils Market Dynamics

Drivers: The aromatherapy industry has overall displayed an upward trend

Aromatherapy is gaining traction globally, and its rising demand is attributed to the rising hospitality sector and consumer preference for natural aromatherapy products and premium fragrances, due to which essential oils world market is growing. The sedentary lifestyle has resulted in increased stress and anxiety levels globally. There is an increased demand for aromatherapy as it is clinically proven to cater to such conditions as it elevates cognitive performance, mood, and performance ability. The stakeholders are harnessing the functional benefits of essential oils and aromatherapy within the supply side. At the same time, the fragrance industry has transited from the classic perfume to the wellness and self-care industry. Besides, beauty and skin care products are integrating within the wellness industry, and aromatherapy is becoming an essential component of fragrance, beauty, and wellness.

Restraints: Side effects may be caused due to consumers being unaware of the appropriate dosage

Essential oils are highly concentrated compounds; using a small amount of these oils imparts numerous benefits. However, they are associated with certain side effects due to their highly concentrated and volatile nature of diffuser world market. Most essential oils have been found to be safe; however, they require proper care, and proper instructions should be followed before using them. Side effects of them mainly occur when consumers are unaware of the proper procedure of application to be followed, which is restraining the essential oils market growth.

Opportunities: Developing countries are expected to experience an increase in demand for essential oils over the coming years

Consumer preference for essential oils is rapidly increasing, and marketing campaigns are planned around highlighting their use and claimed health benefits. Developing countries such as China and India are expected to experience an increase in demand over the coming years. The growing demand is also driven by population growth, leading to higher production of food & beverage and cosmetics. The demand for them is expected to grow at a moderate rate in economically backward countries and at an exponential rate in new & emerging markets of Asia Pacific countries. High demand, along with the low cost of extraction, is a major factor that would aid suppliers.

Challenges: Synthetic and substandard products available in the market act as substitutes to natural plant extracts and pose a challenge for the essential oil manufacturers

Synthetic substitutes for essential oils market are easily available and are used in most synthetic cosmetics as cheaper substitutes. Several synthetic drugs are available in the market, including antibiotics and anti-inflammatory drugs. Hence, several synthetic and substandard products available in the market act as substitutes for natural plant extracts and pose a challenge for essential oil manufacturers.

Moreover, in most cases, it is highly difficult to recognize the synthetic additives, thus implying the significance of proper labeling. FDA has established labeling requirements for fragrances in cosmetics and aromatherapy. FDA requires the list of ingredients under the Fair Packaging and Labeling Act (FPLA). This law is not allowed to be used to force a company to tell “trade secrets.” Fragrance and flavor formulas are complex mixtures of many different naturals and synthetic chemical ingredients. They are the kinds of cosmetic components that are most likely to be “trade secrets.” Information required for cosmetic essential oils or essential oil products includes the declaration of ingredients and caution statements. The FDA provides a Cosmetic Labeling Guide with full regulations for cosmetic labels and a very useful compliance guide for labeling over-the-counter (OTC) drugs. Such transparency is expected to mitigate the challenge of adulteration and promote the growth of the market.

Key Highlights of Essential Oils Market

-

High demand: Essential oils have gained widespread popularity in recent years due to their numerous health benefits and uses in personal care products and aromatherapy.

-

Wide variety of oils: There is a wide range of essential oils available, each with its own unique properties and benefits, such as lavender, peppermint, eucalyptus, and lemon.

-

Natural origin: They are derived from natural sources, such as plants and flowers, making them appealing to consumers seeking natural and organic products.

- Versatile usage: They can be used for a variety of purposes, including aromatherapy, personal care, massage, and as ingredients in food and drinks.

- Growing market: The market is growing globally, driven by increased demand for natural and organic products, and the growing popularity of aromatherapy and natural health remedies.

- Regional differences: The demand for essential oils varies by region, with some markets, such as Asia-Pacific, showing particularly strong growth.

- Online sales: Online essential oils sales have become an important channel for the market, as consumers increasingly prefer to purchase products online due to convenience and access to a wider range of products.

Essential Oils Market Scope

|

Report Attribute |

Details |

|

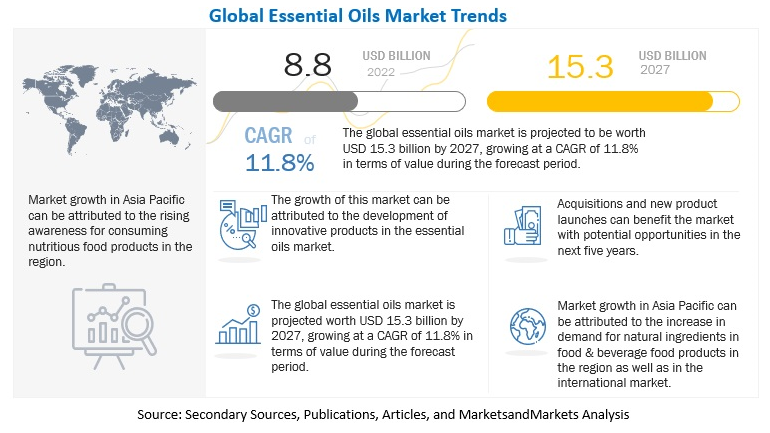

Market Valuation in 2022 |

USD 8.8 billion |

|

Revenue Forecast in 2027 |

USD 15.3 billion |

|

Progress Rate |

11.8% CAGR |

| Largest Growing Region |

North America |

|

Companies Profiled |

|

| Growth Opportunities |

Powdered essential oil to create new opportunities |

| Key Drivers |

|

| Largest Market Share Segment |

Lavender Oil Segment |

Essential Oils Market Synopsis

Lavender Oil is Gaining Traction for Its Multipurpose Role

Lavender Oil is an essential oil obtained from steam distillation from the spikes of certain species of lavender. Although lavender is native to France and the western Mediterranean regions, it is now cultivated worldwide. Lavender oil can benefit the skin in numerous ways. It could lessen acne, help even skin tone, and reduce wrinkles. It can even be used to treat other things, such as improving hair health and digestion.

Distillation is the Most Economical and Cost-Effective Method for Extraction of Essential Oil

Distillation is used for aromatic compounds. Distillation is the most economical method in essential oils world market, and the process can be carried out with simple equipment close to the plant production location. It could be attributed to its property of retaining the oil's benefits and its cost-effectiveness. Steam distillation is popular due to its simplicity and low investment requirements. Steam distillation is the most common method for extracting and isolating oleoresins and essential oils from plants for use in natural products. The amount of steam can be controlled because there is no thermal decomposition of the oil constituents.

Indian Aroma Exports, an Indian essential oil manufacturer, provides a diverse range of steam-distilled essential oils. Steam distillation primarily extracts essential oils for perfumery, food, and pharmaceutical applications. Herbs, spices, and flowers can also be distilled. In the process of steam distillation, vegetable material is mixed with water, and the system is brought to a boil, a process known as hydro-distillation. To separate the water from the oil fraction, the vapor is collected and condensed.

The North American Essential Oils Market is Primarily Driven by Growth in the US and Canadian Markets

The US market dominated the North American market in 2021. It is the largest country in terms of the import and export globally. The consumption of essential oil products in the US is considerably high. Products with all-natural ingredients are increasing in popularity because of increasing awareness about health, wellness, and sustainable lifestyle. Consumers are ready to spend extra on products that claim to be natural and organic. It is leading manufacturers of food and beverage and other industries like cosmetics to introduce essential oil in their formulations to satisfy consumer demand and capitalize on the trend. With their natural origin, help manufacturers claim their products to be natural and free from artificial chemicals.

To know about the assumptions considered for the study, download the pdf brochure

Consumers have realized the importance of essential oil products due to the growing prevalence of health issues and other lifestyle diseases. Essential oils of herbs and spices origin are rising in demand. Essential oils such as peppermint, spearmint, and orange are in high demand in Canada. This demand is rising because of globalization as consumers demand new, innovative, and international flavors. Moreover, a busy lifestyle and less time for cooking have increased the demand for processed foods as they are convenient, which further opens new possibilities for essential oil use. The increasing awareness about health & hygiene drives the demand for convenience food and consumer products manufactured using natural ingredients in the country. Similarly, the demand for premium consumer products among the high-income population is expected to drive the essential oils market.

Top Companies in the Essential Oils Market

Key players in this market include Cargill, Incorporated (US), DSM (Netherlands), Givaudan (Switzerland), International Flavors & Fragrances Inc. (US), Sensient Technologies Corporation (US), Symrise (Germany), Robertet SA (France), MANE (France), doTERRA (US), NOW Foods (US), Lebermuth, Inc. (US), BIOLANDES (France), Norex Flavours Private Limited (India) and India Essential Oils (India).

Target Audience:

- Supply side: Essential oil producers, suppliers, distributors, importers, and exporters

- Demand side: Food & beverage manufacturers, cosmetic manufacturers, home care product manufacturers, health care product manufacturers, feed and toiletries manufacturers

- Regulatory bodies: Government agencies and Non-Governmental Organization (NGO)

- Commercial R&D institutions and financial institutions

- Associations, regulatory bodies, and other industry-related bodies:

Essential Oils Market Segmentation

In this report, the market is segmented based on product type, application, source, method of extraction and region.

|

Aspect |

Details |

|

Market by Type |

|

|

Essential Oils Market by Application |

|

|

Market by Source |

|

|

Market by Method of Extraction |

|

|

Market by Region |

|

Recent Developments in Essential Oils Market

- In July 2022, doTERRA is growing rapidly with Expansion into India. doTERRA's essential oils are sourced from India, Asia, the Pacific, the Middle East, and Africa, so an operating presence in India makes strategic sense for doTERRA’s global growth.

- In February 2022, Givaudan acquired Myrissi (France). The acquisition of Myrissi would enable Givaudan’s long-term Fragrance & Beauty strategy; their expertise in AI would support Givaudan in proposing new organoleptic approaches to consumers.

- In September 2022, MANE KANCOR’s innovation Center was opened at Angamaly, focusing on innovations in natural shelf-life solutions, natural color solutions, culinary taste solutions, personal care ingredients, and nutraceutical products.

- In July 2022, the acquisition of Flavor Solutions, Inc. (US) grew Sensient’s flavor portfolio through the expansion of its traditional flavor offering as well as the addition of savory reaction flavors, natural shelf-life extender technologies, and additional sweetness enhancing and salt reduction taste-modulation technology platforms.

Frequently Asked Questions (FAQs):

How big is the market for essential oils?

The global essential oils market size is projected to reach USD 15.3 billion by 2027

What is the estimated growth rate (CAGR) of the global essential oils market?

The global essential oils market is expected to grow at a compound annual growth rate (CAGR) of 11.8% from 2022 to 2027

What are the major revenue pockets in the essential oils market currently?

In 2021, the North American essential oils market was dominated by the US, which is the largest country globally in terms of both import and export of essential oils. The consumption of essential oil products is high in the US, where all-natural products are increasingly popular due to rising awareness about health, wellness, and sustainable living.

Which region is projected to account for the largest share of the essential oils market?

The essential oils market is expected to grow in North America and is expected to dominate during the forecast period. Based on the consumption pattern for beverage items, North America is considered to witness significant demand for processed beverage products that contain essential oils such as lemon and orange.

Which players are involved in manufacturing of essential oils?

Key players in this market include Cargill, Incorporated (US), DSM (Netherlands), Givaudan (Switzerland), International Flavors & Fragrances Inc. (US), Sensient Technologies Corporation (US), Symrise (Germany), Robertet SA (France), MANE (France), doTERRA (US), NOW Foods (US), Lebermuth, Inc. (US), BIOLANDES (France), Norex Flavours Private Limited (India) and India Essential Oils (India).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 46)

1.1 STUDY OBJECTIVES

1.2 ESSENTIAL OILS MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2021

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 52)

2.1 RESEARCH DATA

FIGURE 2 ESSENTIAL OILS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

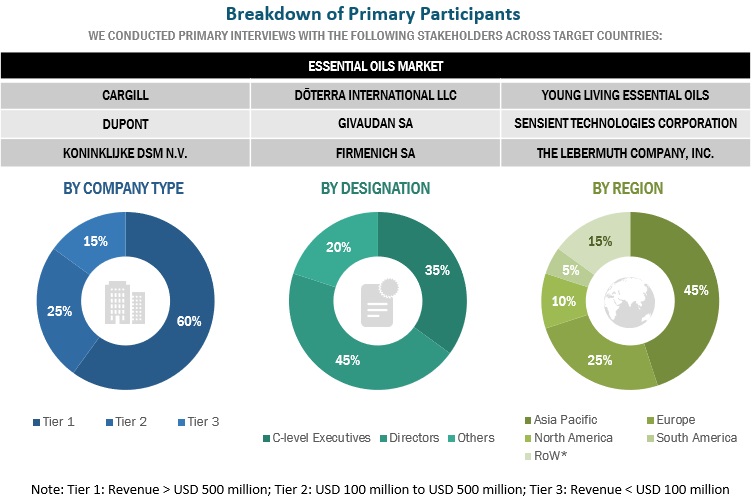

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

FIGURE 5 MARKET SIZE ESTIMATION (DEMAND SIDE)

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 ESSENTIAL OIL WORLD MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 RESEARCH LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 63)

TABLE 2 ESSENTIAL OILS MARKET SHARE SNAPSHOT, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET SIZE, BY METHOD OF EXTRACTION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET SHARE AND GROWTH RATE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 68)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ESSENTIAL OIL MARKET

FIGURE 13 GROWING DEMAND FOR NATURAL AND ORGANIC INGREDIENTS TO CREATE MARKET GROWTH OPPORTUNITIES

4.2 MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 14 ASIA PACIFIC WAS LARGEST MARKET IN 2021

4.3 ASIA PACIFIC: MARKET, BY SOURCE & COUNTRY

FIGURE 15 CHINA TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC MARKET IN 2021

4.4 ASIA PACIFIC: MARKET, BY APPLICATION

FIGURE 16 FOOD & BEVERAGES TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

4.5 MARKET, BY METHODS OF EXTRACTION

FIGURE 17 DISTILLATION METHOD TO BE USED ON A LARGE-SCALE DURING FORECAST PERIOD

4.6 MARKET, BY APPLICATION & REGION

FIGURE 18 FOOD & BEVERAGES TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 73)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 RISE IN DEPRESSION AND ANXIETY DISORDERS

FIGURE 19 PREVALENCE OF DEPRESSION INCREASED SIGNIFICANTLY IN 2020

5.2.2 INCREASING DEMAND FOR ORGANIC FOOD

FIGURE 20 ORGANIC FRESH PRODUCE SALES, BY VOLUME, 2020–2021

5.3 MARKET DYNAMICS: ESSENTIAL OILS MARKET

FIGURE 21 ESSENTIAL OIL MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Increase in demand for aromatherapy

TABLE 3 ESSENTIAL OILS MOST COMMONLY PURCHASED BY AROMATHERAPISTS, 2016–2017

5.3.1.2 Increasing demand for natural ingredients and clean label products

5.3.1.3 Increased use in homecare products

5.3.1.4 Use of essential oils as an additive in feed

5.3.1.5 Demand in cosmetic & fragrance industry

5.3.2 RESTRAINTS

5.3.2.1 Depletion of natural resources

5.3.2.2 Side effects associated with specific essential oils

5.3.3 OPPORTUNITIES

5.3.3.1 Powdered essential oil to create new opportunities

5.3.4 CHALLENGES IN THE ESSENTIAL OILS MARKET

5.3.4.1 Prevalence of synthetic/adulterated products

6 INDUSTRY TRENDS (Page No. - 84)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING

6.2.3 PRODUCTION

6.2.4 PACKAGING, STORAGE, AND DISTRIBUTION

6.2.5 END USERS

FIGURE 22 WORLD MARKET ESSENTIAL OIL: VALUE CHAIN

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 23 MARKET: SUPPLY CHAIN

6.4 MARKET MAP AND ECOSYSTEM OF ESSENTIAL OILS MARKET

6.4.1 DEMAND SIDE

6.4.2 SUPPLY SIDE

FIGURE 24 ESSENTIAL OILS: ECOSYSTEM MAP

6.4.3 ECOSYSTEM MAP

TABLE 4 MARKET: ECOSYSTEM

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN MARKET FOR ESSENTIAL OIL

FIGURE 25 REVENUE SHIFT IMPACTING ESSENTIAL OIL MARKET

6.6 TECHNOLOGY ANALYSIS

6.6.1 ULTRASONIC HYDRO DISTILLATION

6.6.2 PRESSURIZED HOT WATER EXTRACTION

6.6.3 DRYING TECHNOLOGY

6.6.4 ENCAPSULATION

6.7 PRICING ANALYSIS

6.7.1 SELLING PRICES CHARGED BY KEY PLAYERS IN TERMS OF APPLICATION

FIGURE 26 SELLING PRICES OF KEY PLAYERS FOR ESSENTIAL OILS APPLICATIONS

TABLE 5 SELLING PRICE OF KEY PLAYERS FOR TOP APPLICATIONS (USD/KG))

FIGURE 27 AVERAGE SELLING PRICE IN KEY REGIONS, BY APPLICATION, 2017–2021 (USD/KG)

TABLE 6 FOOD & BEVERAGES: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

TABLE 7 COSMETICS: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

TABLE 8 AROMATHERAPY: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

TABLE 9 HOMECARE: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

TABLE 10 HOMECARE: AVERAGE SELLING PRICE, BY REGION, 2018–2021 (USD/KG)

TABLE 11 HEALTHCARE: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

TABLE 12 OTHER APPLICATIONS: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

6.8 ESSENTIAL OILS MARKET: PATENT ANALYSIS

FIGURE 28 NUMBER OF PATENTS GRANTED FOR ESSENTIAL OILS, 2011–2021

FIGURE 29 REGIONAL ANALYSIS OF PATENTS GRANTED , 2022

6.8.1 LIST OF MAJOR PATENTS

TABLE 13 PATENTS IN ESSENTIAL OIL MARKET, 2019–2022

6.9 TRADE ANALYSIS: ESSENTIAL OIL MARKET

6.9.1 EXPORT SCENARIO: ESSENTIAL OILS FOR CITRUS FRUITS

FIGURE 30 CITRUS FRUIT ESSENTIAL OILS EXPORT, BY KEY COUNTRIES, 2017–2021 (USD THOUSAND)

TABLE 14 EXPORT DATA FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.2 IMPORT SCENARIO: CITRUS FRUIT ESSENTIAL OILS

FIGURE 31 CITRUS FRUIT ESSENTIAL OILS IMPORT, BY KEY COUNTRIES, 2017–2021 (USD THOUSAND)

TABLE 15 IMPORT DATA FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.3 EXPORT SCENARIO:

FIGURE 32 ESSENTIAL OILS EXPORT, BY KEY COUNTRIES, 2017–2021 (USD THOUSAND)

TABLE 16 EXPORT DATA FOR KEY COUNTRIES, 2021 (VALUE)

6.9.4 IMPORT SCENARIO:

FIGURE 33 ESSENTIAL OILS IMPORT, BY KEY COUNTRIES, 2017–2021 (USD THOUSAND)

TABLE 17 IMPORT DATA FOR KEY COUNTRIES, 2021 (VALUE)

6.10 CASE STUDIES: ESSENTIAL OIL WORLD MARKET

6.10.1 ROCKY MOUNTAIN OILS: SUSTAINABLE PACKAGING

6.10.2 DOTERRA: INCREASE OPERATIONS EFFICIENCY

6.11 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 18 KEY CONFERENCES AND EVENTS IN ESSENTIAL OILS MARKET

6.12 TARIFF AND REGULATORY LANDSCAPE

6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 22 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.12.2 REGULATORY FRAMEWORK

6.12.2.1 North America

6.12.2.1.1 US

6.12.2.1.2 Canada

6.12.2.2 Europe

6.12.2.3 Asia Pacific

6.12.2.3.1 India

6.12.2.3.2 Japan

6.12.2.4 South America

6.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 23 ESSENTIAL OILS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.13.1 INTENSITY OF COMPETITIVE RIVALRY

6.13.2 BARGAINING POWER OF SUPPLIERS

6.13.3 BARGAINING POWER OF BUYERS

6.13.4 THREAT OF SUBSTITUTES

6.13.5 THREAT OF NEW ENTRANTS

6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

TABLE 24 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP APPLICATIONS (%)

6.14.2 BUYING CRITERIA

FIGURE 35 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

TABLE 25 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

7 ESSENTIAL OILS MARKET, BY TYPE (Page No. - 118)

7.1 INTRODUCTION

FIGURE 36 MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 26 MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 27 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 28 MARKET, BY TYPE, 2017–2021 (KT)

TABLE 29 MARKET, BY TYPE, 2022–2027 (KT)

7.2 ORANGE OIL

7.2.1 INCREASED USE IN AROMATHERAPY

TABLE 30 ORANGE OIL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 31 ORANGE OIL: ESSENTIAL OIL MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 32 ORANGE OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 33 ORANGE OIL: MARKET, BY REGION, 2022–2027 (KT)

7.3 PEPPERMINT OIL

7.3.1 EUROPE AND ASIA PACIFIC TO HAVE SIGNIFICANT IMPACT ON MARKET

TABLE 34 PEPPERMINT OIL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 35 PEPPERMINT OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 36 PEPPERMINT OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 37 PEPPERMINT OIL: MARKET, BY REGION, 2022–2027 (KT)

7.4 LEMON OIL

7.4.1 RISE IN DEMAND FOR NUTRACEUTICALS WITH NATURAL FLAVOR

TABLE 38 LEMON OIL: ESSENTIAL OILS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 39 LEMON OIL: ESSENTIAL OIL MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 40 LEMON OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 41 LEMON OIL: MARKET, BY REGION, 2022–2027 (KT)

7.5 LAVENDER OIL

7.5.1 IMPROVES SKIN HEALTH

TABLE 42 LAVENDER OIL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 43 LAVENDER OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 44 LAVENDER OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 45 LAVENDER OIL: MARKET, BY REGION, 2022–2027 (KT)

7.6 LIME OIL

7.6.1 EFFECTIVE FOR SKIN INFECTION TREATMENTS

TABLE 46 LIME OIL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 47 LIME OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 48 LIME OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 49 LIME OIL: ESSENTIAL OILS MARKET, BY REGION, 2022–2027 (KT)

7.7 ROSEMARY OIL

7.7.1 INCREASED USAGE IN HEALTHCARE PRODUCTS DUE TO ANTIOXIDANT PROPERTIES

TABLE 50 ROSEMARY OIL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 51 ROSEMARY OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 52 ROSEMARY OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 53 ROSEMARY OIL: MARKET, BY REGION, 2022–2027 (KT)

7.8 CORNMINT OIL

7.8.1 POWERFUL ANTIBACTERIAL AND ANTISEPTIC OIL

TABLE 54 CORNMINT OIL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 55 CORNMINT OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 56 CORNMINT OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 57 CORNMINT OIL: MARKET, BY REGION, 2022–2027 (KT)

7.9 SPEARMINT OIL

7.9.1 EXTENSIVELY USED IN FOOD & BEVERAGE INDUSTRY AS FLAVORING INGREDIENT

TABLE 58 SPEARMINT OIL: ESSENTIAL OILS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 59 SPEARMINT OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 60 SPEARMINT OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 61 SPEARMINT OIL: MARKET, BY REGION, 2022–2027 (KT)

7.10 GERANIUM OIL

7.10.1 PRIMARY FLORAL COMPONENT IN FRAGRANCE AND COSMETICS

TABLE 62 GERANIUM OIL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 63 GERANIUM OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 64 GERANIUM OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 65 GERANIUM OIL: MARKET, BY REGION, 2022–2027 (KT)

7.11 CLOVE LEAF OIL

7.11.1 USED FOR ORAL HEALTH DUE TO GERMICIDAL PROPERTIES

TABLE 66 CLOVE LEAF OIL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 67 CLOVE LEAF OIL: ESSENTIAL OIL MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 68 CLOVE LEAF OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 69 CLOVE LEAF OIL: MARKET, BY REGION, 2022–2027 (KT)

7.12 ROSE OIL

7.12.1 WIDELY USED IN AROMATHERAPY

TABLE 70 ROSE OIL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 71 ROSE OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 72 ROSE OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 73 ROSE OIL: MARKET, BY REGION, 2022–2027 (KT)

7.13 CORIANDER OIL

7.13.1 USE IN SEASONINGS DUE TO FLAVORING PROPERTIES

TABLE 74 CORIANDER OIL: ESSENTIAL OILS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 75 CORIANDER OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 76 CORIANDER OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 77 CORIANDER OIL: MARKET, BY REGION, 2022–2027 (KT)

7.14 TEA TREE OIL

7.14.1 THERAPEUTIC BENEFITS TO INCREASE DEMAND IN SKINCARE AND COSMETICS INDUSTRY

TABLE 78 TEA TREE OIL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 79 TEA TREE OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 80 TEA TREE OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 81 TEA TREE OIL: MARKET, BY REGION, 2022–2027 (KT)

7.15 CITRONELLA OIL

7.15.1 LARGE-SCALE USE IN AROMATHERAPY TO TREAT MIGRAINE AND HEADACHES

TABLE 82 CITRONELLA OIL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 83 CITRONELLA OIL: ESSENTIAL OIL MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 84 CITRONELLA OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 85 CITRONELLA OIL: MARKET, BY REGION, 2022–2027 (KT)

7.16 EUCALYPTUS OIL

7.16.1 HIGH DEMAND IN DENTAL CARE DUE TO GERMICIDAL PROPERTIES

TABLE 86 EUCALYPTUS OIL: ESSENTIAL OILS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 87 EUCALYPTUS OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 88 EUCALYPTUS OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 89 EUCALYPTUS OIL: MARKET, BY REGION, 2022–2027 (KT)

7.17 JASMINE OIL

7.17.1 EXTENSIVELY USED FOR HEALTH BENEFITS

TABLE 90 JASMINE OIL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 91 JASMINE OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 92 JASMINE OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 93 JASMINE OIL: MARKET, BY REGION, 2022–2027 (KT)

7.18 OTHER TYPES

TABLE 94 OTHER TYPES OF OIL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 95 OTHER TYPES OF OIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 96 OTHER TYPES OF OIL: MARKET, BY REGION, 2017–2021 (KT)

TABLE 97 OTHER TYPES OF OIL: MARKET, BY REGION, 2022–2027 (KT)

8 ESSENTIAL OILS MARKET, BY METHOD OF EXTRACTION (Page No. - 154)

8.1 INTRODUCTION

FIGURE 37 MARKET SHARE (VALUE), BY METHOD OF EXTRACTION, 2022 VS. 2027

TABLE 98 ESSENTIAL OIL MARKET, BY METHOD OF EXTRACTION, 2017–2021 (USD MILLION)

TABLE 99 MARKET, BY METHOD OF EXTRACTION, 2022–2027 (USD MILLION)

TABLE 100 MARKET, BY METHOD OF EXTRACTION, 2017–2021 (KT)

TABLE 101 MARKET, BY METHOD OF EXTRACTION, 2022–2027 (KT)

8.2 DISTILLATION

8.2.1 STEAM DISTILLATION METHOD USED EXTENSIVELY TO OBTAIN ESSENTIAL OILS ECONOMICALLY

TABLE 102 DISTILLATION: ESSENTIAL OILS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 103 DISTILLATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 104 DISTILLATION: OIL MARKET, BY REGION, 2017–2021 (KT)

TABLE 105 DISTILLATION: MARKET, BY REGION, 2022–2027 (KT)

8.3 COLD PRESS EXTRACTION

8.3.1 CITRUS FRUITS EXTRACTED VIA COLD PRESS

TABLE 106 COLD PRESS EXTRACTION: ESSENTIAL OIL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 107 COLD PRESS EXTRACTION: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 108 COLD PRESS EXTRACTION: MARKET, BY REGION, 2017–2021 (KT)

TABLE 109 COLD PRESS EXTRACTION: MARKET, BY REGION, 2022–2027 (KT)

8.4 CARBON DIOXIDE EXTRACTION

8.4.1 AROMA AND BIOACTIVE COMPONENTS OF ESSENTIAL OILS EFFECTIVELY RETAINED

TABLE 110 CARBON DIOXIDE EXTRACTION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 111 CARBON DIOXIDE EXTRACTION: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 112 CARBON DIOXIDE EXTRACTION: MARKET, BY REGION, 2017–2021 (KT)

TABLE 113 CARBON DIOXIDE EXTRACTION: MARKET, BY REGION, 2022–2027 (KT)

8.5 OTHER EXTRACTIONS

TABLE 114 OTHER EXTRACTIONS: ESSENTIAL OILS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 115 OTHER EXTRACTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 116 OTHER EXTRACTIONS: MARKET, BY REGION, 2017–2021 (KT)

TABLE 117 OTHER EXTRACTIONS: MARKET, BY REGION, 2022–2027 (KT)

9 ESSENTIAL OILS MARKET, BY SOURCE (Page No. - 164)

9.1 INTRODUCTION

FIGURE 38 ESSENTIAL OIL MARKET SIZE, BY SOURCE, 2022 VS. 2027 (USD MILLION)

TABLE 118 MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 119 MARKET, BY SOURCE, 2022–2027 (USD MILLION)

9.2 FRUITS & VEGETABLES

9.2.1 COLD PRESS METHOD PREFERRED FOR ESSENTIAL OIL EXTRACTION FROM FRUITS AND VEGETABLE

TABLE 120 FRUITS & VEGETABLES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 121 FRUITS & VEGETABLES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 FLOWERS

9.3.1 ESSENTIAL OILS REPRESENT AN UPSTREAM BUSINESS OPPORTUNITY FOR FLORICULTURE MARKET

TABLE 122 FLOWERS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 123 FLOWERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 HERBS & SPICES

9.4.1 HERB-DERIVED ESSENTIAL OILS AS NATURAL REPLACERS OF COMPOUNDS OF SYNTHETIC ORIGIN

TABLE 124 HERBS & SPICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 125 HERBS & SPICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 ESSENTIAL OILS MARKET, BY APPLICATION (Page No. - 170)

10.1 INTRODUCTION

FIGURE 39 MARKET SHARE (VALUE), BY APPLICATION, 2022 VS. 2027

TABLE 126 ESSENTIAL OIL MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 127 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 128 MARKET, BY APPLICATION, 2017–2021 (KT)

TABLE 129 MARKET, BY APPLICATION, 2022–2027 (KT)

10.2 FOOD & BEVERAGES

10.2.1 EXTENSIVE USE OF CITRUS ESSENTIAL OILS IN FOOD & BEVERAGE INDUSTRY

TABLE 130 FOOD & BEVERAGES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 131 FOOD & BEVERAGES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 132 FOOD & BEVERAGES: MARKET, BY REGION, 2017–2021 (KT)

TABLE 133 FOOD & BEVERAGES: MARKET, BY REGION, 2022–2027 (KT)

10.3 COSMETICS & TOILETRIES

10.3.1 EXTENSIVE USE DUE TO FRAGRANCE AND FUNCTIONAL PROPERTIES

TABLE 134 COSMETICS & TOILETRIES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 135 COSMETICS & TOILETRIES: ESSENTIAL OIL MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 136 COSMETICS & TOILETRIES: MARKET, BY REGION, 2017–2021 (KT)

TABLE 137 COSMETICS & TOILETRIES: MARKET, BY REGION, 2022–2027 (KT)

10.4 AROMATHERAPY

10.4.1 THERAPEUTIC POTENTIAL OF ESSENTIAL OILS

TABLE 138 AROMATHERAPY: ESSENTIAL OILS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 139 AROMATHERAPY: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 140 AROMATHERAPY: MARKET, BY REGION, 2017–2021 (KT)

TABLE 141 AROMATHERAPY: MARKET, BY REGION, 2022–2027 (KT)

10.5 HOMECARE

10.5.1 DEMAND FOR NATURAL INGREDIENTS TO BOOST DEMAND

TABLE 142 HOMECARE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 143 HOMECARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 144 HOMECARE: MARKET, BY REGION, 2017–2021 (KT)

TABLE 145 HOMECARE: MARKET, BY REGION, 2022–2027 (KT)

10.6 HEALTHCARE

10.6.1 MENTAL WELL-BEING TO DRIVE HEALTHCARE INDUSTRY

TABLE 146 HEALTHCARE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 147 HEALTHCARE: ESSENTIAL OIL MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 148 HEALTHCARE: MARKET, BY REGION, 2017–2021 (KT)

TABLE 149 HEALTHCARE: MARKET, BY REGION, 2022–2027 (KT)

10.7 OTHER APPLICATIONS

TABLE 150 OTHER APPLICATIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 151 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 152 OTHER APPLICATIONS: MARKET, BY REGION, 2017–2021 (KT)

TABLE 153 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (KT)

11 ESSENTIAL OILS MARKET, BY REGION (Page No. - 184)

11.1 INTRODUCTION

FIGURE 40 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

FIGURE 41 GEOGRAPHIC SNAPSHOT OF MARKET IN TERMS OF CAGR, BY VALUE, 2022–2027

TABLE 154 MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 155 ESSENTIAL OIL MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 156 MARKET SIZE, BY REGION, 2017–2021 (KT)

TABLE 157 MARKET SIZE, BY REGION, 2022–2027 (KT)

11.2 NORTH AMERICA

TABLE 158 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 159 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 160 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (KT)

TABLE 161 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KT)

TABLE 162 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 163 NORTH AMERICA: OIL MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 164 NORTH AMERICA: ESSENTIAL OILS MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 165 NORTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 166 NORTH AMERICA: MARKET SIZE, BY METHOD OF EXTRACTION, 2017–2021 (USD MILLION)

TABLE 167 NORTH AMERICA: MARKET SIZE, BY METHOD OF EXTRACTION, 2022–2027 (USD MILLION)

TABLE 168 NORTH AMERICA: MARKET SIZE, BY METHOD OF EXTRACTION, 2017–2021 (KT)

TABLE 169 NORTH AMERICA: MARKET SIZE, BY METHOD OF EXTRACTION, 2022–2027 (KT)

TABLE 170 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 171 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 172 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 173 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

TABLE 174 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 175 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Multifold end-use applications driving market

TABLE 176 US: ESSENTIAL OILS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 177 US: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 178 US: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 179 US: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.2.2 CANADA

11.2.2.1 High demand from herbs & spices

TABLE 180 CANADA: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 181 CANADA: ESSENTIAL OIL MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 182 CANADA: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 183 CANADA: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.2.3 MEXICO

11.2.3.1 Economic growth and increase in population driving end-use industries

TABLE 184 MEXICO: ESSENTIAL OILS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 185 MEXICO: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 186 MEXICO: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 187 MEXICO: MARKET SIZE, BY APPLICATION, 2022–2027 (KT )

11.3 EUROPE

TABLE 188 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 189 EUROPE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 190 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2021 (KT)

TABLE 191 EUROPE: MARKET SIZE, BY REGION, 2022–2027 (KT)

TABLE 192 EUROPE: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 193 EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 194 EUROPE: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 195 EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 196 EUROPE: MARKET SIZE, BY METHOD OF EXTRACTION, 2017–2021 (USD MILLION)

TABLE 197 EUROPE: MARKET SIZE, BY METHOD OF EXTRACTION, 2022–2027 (USD MILLION)

TABLE 198 EUROPE: MARKET SIZE, BY METHOD OF EXTRACTION, 2017–2021(KT)

TABLE 199 EUROPE: MARKET SIZE, BY METHOD OF EXTRACTION, 2022–2027 (KT)

TABLE 200 EUROPE: ESSENTIAL OILS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 201 EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 202 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 203 EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

TABLE 204 EUROPE: MARKET SIZE, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 205 EUROPE: MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Use of essential oils for aromatherapy to meet consumers’ demand for natural scents

TABLE 206 GERMANY: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 207 GERMANY: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 208 GERMANY: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 209 GERMANY: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.3.2 FRANCE

11.3.2.1 Fragrance and flavor companies extensively using essential oils

TABLE 210 FRANCE: ESSENTIAL OILS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 211 FRANCE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 212 FRANCE: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 213 FRANCE: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.3.3 UK

11.3.3.1 Personal care and cosmetics companies focus on aromatherapy

TABLE 214 UK: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 215 UK: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION )

TABLE 216 UK: ESSENTIAL OIL MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 217 UK: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.3.4 ITALY

11.3.4.1 Major producer of lemon and other citrus essential oils

TABLE 218 ITALY: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 219 ITALY: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 220 ITALY: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 221 ITALY: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.3.5 SPAIN

11.3.5.1 Expansion of fragrance and perfumery industry

TABLE 222 SPAIN: ESSENTIAL OILS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 223 SPAIN: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 224 SPAIN: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 225 SPAIN: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.3.6 REST OF EUROPE

11.3.6.1 Development of food & beverages, homecare, and flavoring industry

TABLE 226 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 227 REST OF EUROPE: ESSENTIAL OIL MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 228 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 229 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.4 ASIA PACIFIC

FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 230 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 231 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 232 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2021 (KT)

TABLE 233 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (KT)

TABLE 234 ASIA PACIFIC: ESSENTIAL OILS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 235 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 236 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 237 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 238 ASIA PACIFIC: MARKET SIZE, BY METHOD OF EXTRACTION, 2017–2021 (USD MILLION)

TABLE 239 ASIA PACIFIC: MARKET SIZE, BY METHOD OF EXTRACTION, 2022–2027 (USD MILLION)

TABLE 240 ASIA PACIFIC: MARKET SIZE, BY METHOD OF EXTRACTION, 2017–2021(KT)

TABLE 241 ASIA PACIFIC: MARKET SIZE, BY METHOD OF EXTRACTION, 2022–2027 (KT)

TABLE 242 ASIA PACIFIC: MARKET SIZE, APPLICATION, 2017–2021 (USD MILLION)

TABLE 243 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 244 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 245 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

TABLE 246 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 247 ASIA PACIFIC MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Demand for essential oils for aromatherapy

TABLE 248 CHINA: ESSENTIAL OILS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 249 CHINA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 250 CHINA: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 251 CHINA: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.4.2 JAPAN

11.4.2.1 Increasing use of essential oil-infused skincare products

TABLE 252 JAPAN: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 253 JAPAN: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 254 JAPAN: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 255 JAPAN: MARKET SIZE, BY APPLICATION, 2022–2027 (KT )

11.4.3 INDIA

11.4.3.1 Increased demand for natural and organic products in food & beverage industry

TABLE 256 INDIA: ESSENTIAL OILS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION )

TABLE 257 INDIA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 258 INDIA: ESSENTIAL OIL MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 259 INDIA: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.4.4 AUSTRALIA & NEW ZEALAND

11.4.4.1 Increase in consumer preferences for high-quality products with natural ingredients

TABLE 260 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 261 AUSTRALIA & NEW ZEALAND: ESSENTIAL OIL MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 262 AUSTRALIA & NEW ZEALAND: SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 263 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.4.5 REST OF ASIA PACIFIC

TABLE 264 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 265 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 266 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 267 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.5 SOUTH AMERICA

FIGURE 43 SOUTH AMERICA: MARKET SNAPSHOT

TABLE 268 SOUTH AMERICA: ESSENTIAL OILS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 269 SOUTH AMERICA: SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 270 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (KT)

TABLE 271 SOUTH AMERICA: OIL MARKET SIZE, BY COUNTRY, 2022–2027 (KT))

TABLE 272 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 273 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 274 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 275 SOUTH AMERICA: ESSENTIAL OIL MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 276 SOUTH AMERICA: MARKET SIZE, BY METHOD OF EXTRACTION, 2017–2021 (USD MILLION)

TABLE 277 SOUTH AMERICA: MARKET SIZE, BY METHOD OF EXTRACTION, 2022–2027 (USD MILLION)

TABLE 278 SOUTH AMERICA: MARKET SIZE, BY METHOD OF EXTRACTION, 2017–2021(KT)

TABLE 279 SOUTH AMERICA: MARKET SIZE, BY METHOD OF EXTRACTION, 2022–2027 (KT)

TABLE 280 SOUTH AMERICA: MARKET SIZE, APPLICATION, 2017–2021 (USD MILLION)

TABLE 281 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 282 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 283 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

TABLE 284 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 285 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Leading producer of orange OIL

TABLE 286 BRAZIL: ESSENTIAL OILS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 287 BRAZIL: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 288 BRAZIL: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 289 BRAZIL: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.5.2 ARGENTINA

11.5.2.1 Growing demand for aromatherapy

TABLE 290 ARGENTINA: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 291 ARGENTINA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 292 ARGENTINA: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 293 ARGENTINA: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.5.2.2 Rest of South America

TABLE 294 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 295 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 296 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 297 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.6 REST OF THE WORLD

TABLE 298 ROW: ESSENTIAL OILS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 299 ROW: ESSENTIAL OIL MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 300 ROW: MARKET SIZE, BY REGION, 2017–2021 (KT)

TABLE 301 ROW: MARKET SIZE, BY REGION, 2022–2027 (KT)

TABLE 302 ROW: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 303 ROW: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 304 ROW: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 305 ROW: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 306 ROW: ESSENTIAL OIL MARKET SIZE, BY METHOD OF EXTRACTION, 2017–2021 (USD MILLION)

TABLE 307 ROW: MARKET SIZE, BY METHOD OF EXTRACTION, 2022–2027 (USD MILLION)

TABLE 308 ROW: MARKET SIZE, APPLICATION, 2017–2021 (USD MILLION)

TABLE 309 ROW: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 310 ROW: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 311 ROW: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

TABLE 312 ROW: MARKET SIZE, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 313 ROW: MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

11.6.1 MIDDLE EAST

11.6.1.1 Extensive use in food industry

TABLE 314 MIDDLE EAST: ESSENTIAL OILS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 315 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 316 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 317 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

11.6.2 AFRICA

11.6.2.1 Increase in demand for essential oil-infused cosmetic products

TABLE 318 AFRICA: MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 319 AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 320 AFRICA: MARKET SIZE, BY APPLICATION, 2017–2021 (KT)

TABLE 321 AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (KT)

12 COMPETITIVE LANDSCAPE (Page No. - 264)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2021

TABLE 322 ESSENTIAL OILS MARKET: DEGREE OF COMPETITION (COMPETITIVE)

12.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 44 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD BILLION)

12.4 KEY PLAYER STRATEGIES

TABLE 323 STRATEGIES ADOPTED BY KEY MANUFACTURERS

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 45 MARKET SIZE FOR ESSENTIAL OILS: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

12.5.5 PRODUCT FOOTPRINT

TABLE 324 COMPANY FOOTPRINT, BY TYPE

TABLE 325 COMPANY FOOTPRINT, BY APPLICATION

TABLE 326 COMPANY FOOTPRINT, BY REGION

TABLE 327 OVERALL COMPANY FOOTPRINT

12.6 ESSENTIAL OILS MARKET, EVALUATION QUADRANT FOR START-UPS/SMES, 2021

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

FIGURE 46 MARKET: COMPANY EVALUATION QUADRANT, 2021 (START-UP/SME)

12.6.5 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

TABLE 328 MARKET SIZE: DETAILED LIST OF KEY START-UPS/SMES

TABLE 329 MARKET SIZE: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

12.7 COMPETITIVE SCENARIO

12.7.1 NEW PRODUCT LAUNCHES

TABLE 330 ESSENTIAL OILS: NEW PRODUCT LAUNCHES, 2021–2022

12.7.2 DEALS

TABLE 331 DEALS, 2018–2021

12.7.3 OTHERS

TABLE 332 ESSENTIAL OILS: OTHERS, 2020–2022

13 COMPANY PROFILES (Page No. - 281)

13.1 INTRODUCTION: ESSENTIAL OILS MARKET

(Business overview, Products offered, Recent Developments, MNM view)*

13.2 KEY PLAYER

13.2.1 DSM

TABLE 333 DSM: COMPANY OVERVIEW

FIGURE 47 DSM: COMPANY SNAPSHOT

TABLE 334 DSM: PRODUCTS OFFERED

TABLE 335 DSM: DEALS

TABLE 336 DSM: OTHERS

13.2.2 GIVAUDAN

TABLE 337 GIVAUDAN: COMPANY OVERVIEW

FIGURE 48 GIVAUDAN: COMPANY SNAPSHOT

TABLE 338 GIVAUDAN: PRODUCTS OFFERED

TABLE 339 GIVAUDAN: NEW PRODUCT LAUNCHES

TABLE 340 GIVAUDAN: DEALS

TABLE 341 GIVAUDAN: OTHERS

13.2.3 INTERNATIONAL FLAVORS & FRAGRANCES INC. (IFF)

TABLE 342 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY OVERVIEW

FIGURE 49 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

TABLE 343 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS OFFERED

TABLE 344 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

13.2.4 SENSIENT TECHNOLOGIES CORPORATION : ESSENTIAL OILS MARKET

TABLE 345 SENSIENT TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

FIGURE 50 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 346 SENSIENT TECHNOLOGIES CORPORATION: PRODUCTS OFFERED

TABLE 347 SENSIENT TECHNOLOGIES CORPORATION: DEALS

13.2.5 CARGILL, INCORPORATED

TABLE 348 CARGILL, INCORPORATED: COMPANY OVERVIEW

FIGURE 51 CARGILL, INCORPORATED: COMPANY SNAPSHOT

TABLE 349 CARGILL, INCORPORATED: PRODUCTS OFFERED

TABLE 350 CARGILL, INCORPORATED: NEW PRODUCT LAUNCHES

13.2.6 SYMRISE

TABLE 351 SYMRISE: COMPANY OVERVIEW

FIGURE 52 SYMRISE: COMPANY SNAPSHOT

TABLE 352 SYMRISE: PRODUCTS OFFERED

TABLE 353 SYMRISE: DEALS

TABLE 354 SYMRISE: OTHERS

13.2.7 ROBERTET, SA

TABLE 355 ROBERTET SA: COMPANY OVERVIEW

FIGURE 53 ROBERTET SA: COMPANY SNAPSHOT

TABLE 356 ROBERTET SA: PRODUCTS OFFERED

TABLE 357 ROBERTET SA.: DEALS

13.2.8 MANE

TABLE 358 MANE: COMPANY OVERVIEW

TABLE 359 MANE: PRODUCTS OFFERED

TABLE 360 MANE: DEALS

TABLE 361 MANE: OTHERS

13.2.9 DÔTERRA

TABLE 362 DÔTERRA: COMPANY OVERVIEW: ESSENTIAL OILS MARKET

TABLE 363 DÔTERRA: NEW PRODUCTS OFFERED

TABLE 364 DÔTERRA: OTHERS

13.2.10 NOW FOODS

TABLE 365 NOW FOODS: COMPANY OVERVIEW

TABLE 366 NOW FOODS: PRODUCTS OFFERED

13.2.11 SYNTHITE INDUSTRIES LTD.

TABLE 367 SYNTHITE INDUSTRIES LTD.: COMPANY OVERVIEW

TABLE 368 SYNTHITE INDUSTRIES LTD.: PRODUCTS OFFERED

13.2.12 LEBERMUTH, INC.

TABLE 369 LEBERMUTH, INC.: COMPANY OVERVIEW

TABLE 370 LEBERMUTH, INC.: PRODUCTS OFFERED

13.2.13 BIOLANDES

TABLE 371 BIOLANDES: COMPANY OVERVIEW

TABLE 372 BIOLANDES.: PRODUCTS OFFERED

13.2.14 NOREX FLAVOURS PRIVATE LIMITED

TABLE 373 NOREX FLAVOURS PRIVATE LIMITED: COMPANY OVERVIEW

TABLE 374 NOREX FLAVOURS PRIVATE LIMITED: PRODUCTS OFFERED

13.2.15 INDIA ESSENTIAL OILS

TABLE 375 INDIA ESSENTIAL OILS: COMPANY OVERVIEW

TABLE 376 INDIA: PRODUCTS OFFERED

13.3 OTHER PLAYERS (SMES/START-UPS)

13.3.1 FALCON

TABLE 377 FALCON: COMPANY OVERVIEW

TABLE 378 FALCON: PRODUCTS OFFERED

13.3.2 FAROTTI S.R.L.

TABLE 379 FAROTTI: COMPANY OVERVIEW: ESSENTIAL OILS MARKET

TABLE 380 FAROTTI S.R.L: PRODUCTS OFFERED

13.3.3 VIDYA HERBS

TABLE 381 VIDYA HERBS.: COMPANY OVERVIEW

TABLE 382 VIDYA HERBS: PRODUCTS OFFERED

13.3.4 YOUNG LIVING ESSENTIAL OILS, LC.

TABLE 383 YOUNG LIVING ESSENTIAL OILS, LC.: COMPANY OVERVIEW

TABLE 384 PRODUCTS OFFERED

TABLE 385 NEW PRODUCT LAUNCHES

TABLE 386 DEALS

13.3.5 ESSENTIAL OILS OF NEW ZEALAND LTD.

TABLE 387 ESSENTIAL OILS OF NEW ZEALAND LTD.: BUSINESS OVERVIEW

TABLE 388 PRODUCTS OFFERED

13.3.6 VEDA OILS

13.3.7 HCP WELLNESS

13.3.8 VITAL HERBS

13.3.9 CV RASAYANA WANGI

13.3.10 ALCHEMY CHEMICALS

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS: ESSENTIAL OILS MARKET(Page No. - 337)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 PLANT EXTRACTS MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.3 PLANT EXTRACTS MARKET, BY TYPE

TABLE 389 PLANT EXTRACTS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 390 PLANT EXTRACTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 391 PLANT EXTRACTS MARKET, BY TYPE, 2016–2021 (KT)

TABLE 392 PLANT EXTRACTS MARKET, BY TYPE, 2022–2027 (KT)

14.3.4 PLANT EXTRACTS MARKET, BY REGION

14.3.4.1 North America

TABLE 393 NORTH AMERICA: PLANT EXTRACTS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 394 NORTH AMERICA: PLANT EXTRACTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 395 NORTH AMERICA: PLANT EXTRACTS MARKET, BY TYPE, 2016–2021 (KT)

TABLE 396 NORTH AMERICA: PLANT EXTRACTS MARKET, BY TYPE, 2022–2027 (KT)

14.3.4.2 Europe

TABLE 397 EUROPE: PLANT EXTRACTS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 398 EUROPE: PLANT EXTRACTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 399 EUROPE: PLANT EXTRACTS MARKET, BY TYPE, 2016–2021 (KT)

TABLE 400 EUROPE: PLANT EXTRACTS MARKET, BY TYPE, 2022–2027 (KT)

14.3.4.3 Asia Pacific: ESSENTIAL OILS MARKET

TABLE 401 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 402 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 403 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY TYPE, 2016–2021 (KT)

TABLE 404 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY TYPE, 2022–2027 (KT)

14.3.4.4 Rest of the World (RoW)

TABLE 405 REST OF THE WORLD: PLANT EXTRACTS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 406 REST OF THE WORLD: PLANT EXTRACTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 407 REST OF THE WORLD: PLANT EXTRACTS MARKET, BY TYPE, 2016–2021 (KT)

TABLE 408 REST OF THE WORLD: PLANT EXTRACTS MARKET, BY TYPE, 2022–2027 (KT)

14.3.5 PHYTOGENIC FEED ADDITIVES MARKET

14.3.5.1 Market definition

14.3.5.2 Market overview

14.3.5.3 Phytogenic feed additives market, by type

14.3.5.3.1 Introduction

TABLE 409 PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 410 PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 411 PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (TONS)

TABLE 412 PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (TONS)

14.3.5.4 Phytogenic feed additives market, by region

14.3.5.4.1 North America

TABLE 413 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 414 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 415 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE 2018–2021 (TONS)

TABLE 416 NORTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (TONS)

14.3.5.4.2 Europe

TABLE 417 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 418 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 419 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE 2018–2021 (TONS)

TABLE 420 EUROPE: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (TONS)

14.3.5.4.3 Asia Pacific

TABLE 421 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 422 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 423 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE 2018–2021 (TONS)

TABLE 424 ASIA PACIFIC: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (TONS)

14.3.5.4.4 South America: ESSENTIAL OILS MARKET

TABLE 425 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 426 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 427 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE 2018–2021 (TONS)

TABLE 428 SOUTH AMERICA: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (TONS)

14.3.5.4.5 Rest of the World (RoW)

TABLE 429 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 430 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 431 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE 2018–2021 (TONS)

TABLE 432 ROW: PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2022–2027 (TONS)

15 APPENDIX (Page No. - 359)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

This research involves the extensive use of secondary sources; directories; and databases, such as the Food and Drug Administration (FDA), Herb Society of America, American Herbal Products Association, American Spice Trade Association, Essential Oils Association of India, Bloomberg, and Factiva, to identify and collect information useful for a technical, market-oriented, and commercial study of the essential oils market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Drug Administration (FDA), European Spices Association, Spices Board, European Flavors & Fragrances Association, The International Federation of Essential Oils and Aroma Trades, were referred to identify and collect information for this study. The secondary sources also include medical journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The essential oils market comprises several stakeholders, including fruits & vegetables, and spices & herbs suppliers, ingredient suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply-side include research institutions involved in R&D to introduce technology, distributors, wholesalers, importers & exporters of spices and herbs, essential oils manufacturers and technology providers. Primary sources from the demand-side include key opinion leaders, executives, vice presidents, and CEOs of food & beverage product, aromatherapy product manufacturers, cosmetics, home care and health care products manufacturing companies, through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Essential Oils Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the essential oil market. These approaches were extensively used to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry's supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The peer market—the plant extracts and botanical extracts market—was considered to validate further the market details of essential oils.

Bottom-up approach:

- The market sizes were analyzed based on the share of each type of essential oils at regional and country levels. Thus, the global market was estimated with a bottom-up approach of the type at the country level.

- Other factors include the penetration rate in distinguished application sectors, such as food & beverages, home care, health care, aromatherapy, and cosmetics; consumer awareness; and function trends; essential olis pricing trends; the adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the essential oil market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall essential oils market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Essential Oils Market Report Objectives

- To define, segment, and project the global market on the basis of product type, application, method of extraction, source, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the essential oil market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of European essential oils market, by key country

- Further breakdown of the Rest of South America essential oil market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Essential Oils Market