Plant Extracts Market

Plant Extracts Market by Type (Oleoresins, Essential Oils, Flavonoids, Alkaloids, Carotenoids), Application (Food & Beverages, Cosmetics, Pharmaceuticals, Dietary Supplements), Form, Source, Extraction Process, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

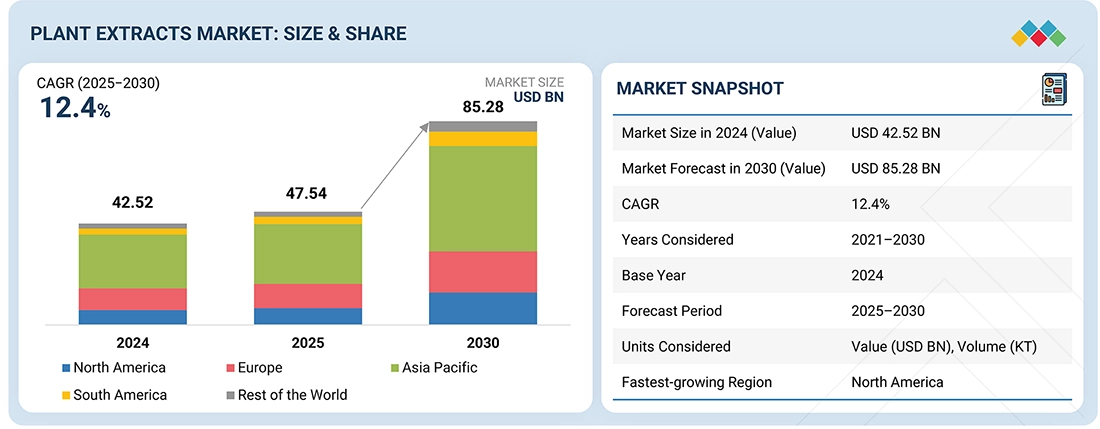

The plant extracts market is projected to reach USD 85.28 billion by 2030 from USD 47.54 billion in 2025, at a CAGR of 12.4% from 2025 to 2030. The growth of this market is driven by increasing demand for natural ingredients and clean-label products, and the growing market for nutraceuticals and herbal supplements.

KEY TAKEAWAYS

-

BY REGIONEurope is estimated to account for a 21.3% share of the plant extracts market in 2025

-

BY TYPEBy type, the essential oil segment is expected to register the highest CAGR of 11.2%.

-

BY APPLICATIONBy application, the cosmetics & personal care segment is projected to grow at the fastest rate from 2025 to 2030.

-

BY SOURCEBy source, the herbs & spices segment is expected to dominate the market.

-

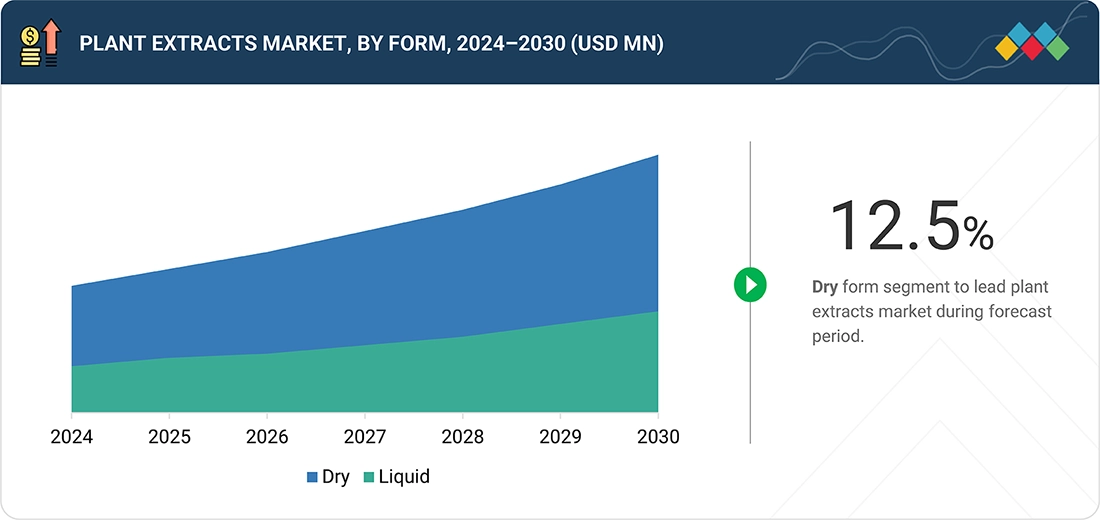

BY FORMBy form, the dry segment is estimated to hold a 72% share of the market in 2025.

-

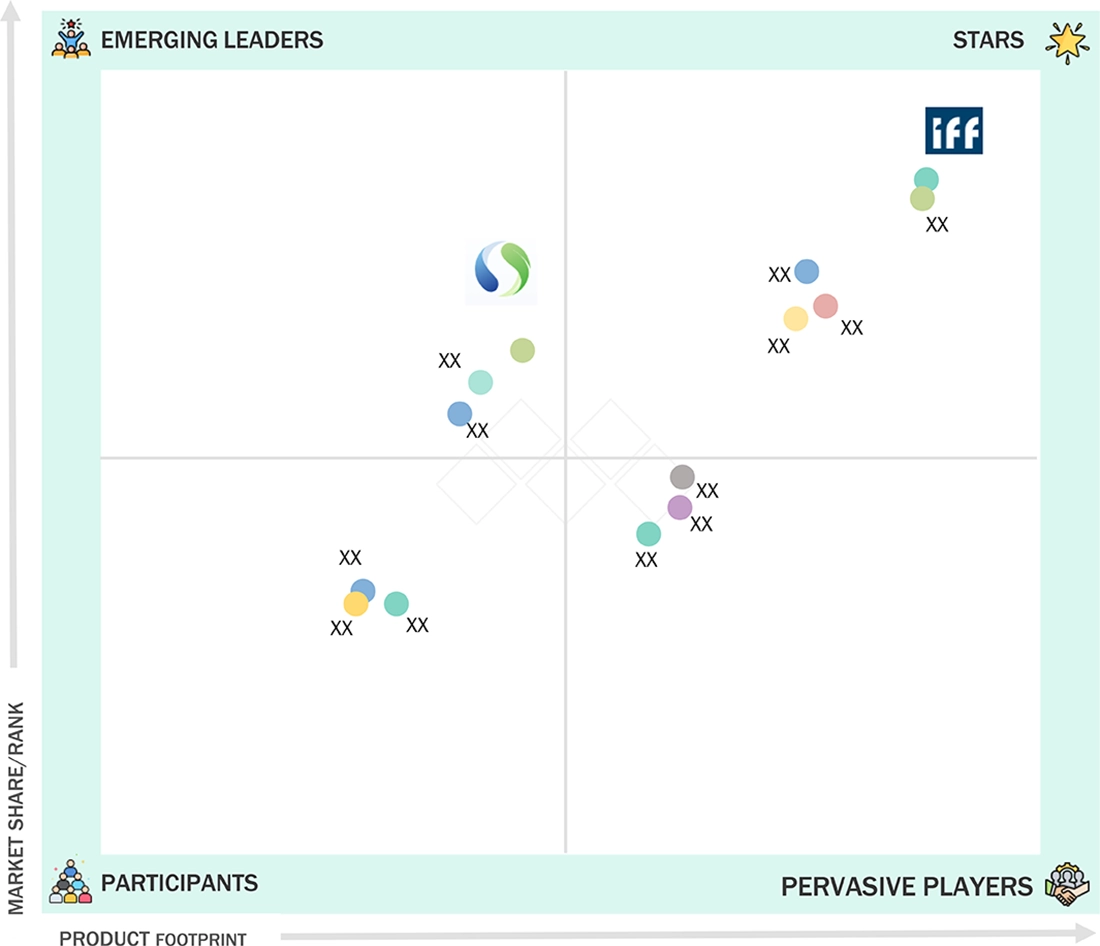

COMPETITIVE LANDSCAPE - KEY PLAYERSIFF, Givaudan, and Symrise were among the companies identified as star players in the plant extracts market (global), given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPSArjuna Natural, Blue Sky Botanics, and Prinova Group LLC, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The plant extracts market is expected to grow at a significant rate due to a shift in consumer preferences from synthetic products to natural products in various applications, as well as rising investments by major market players.

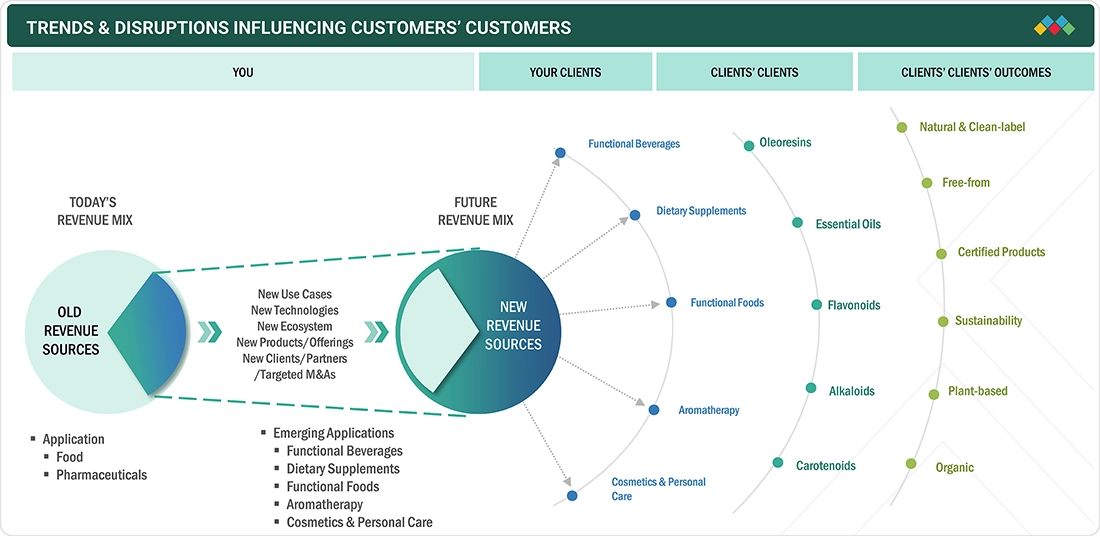

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are new emerging applications of plant extracts, and the target end users are clients of plant extract manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users, thus affecting the revenue of hotbets and further the revenues of plant extract manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for natural ingredients and clean-label products

-

Demand for essential oils from cosmetics industry

Level

-

Lack of standardization, and varying regulations and quality standards

-

Price fluctuations and inadequacy of raw materials

Level

-

Technological intervention in production process

-

Government initiatives to promote natural ingredients

Level

-

Lack of downstream processing facilities and resultant microbial contamination

-

Adulteration and cost margin for natural additives compared to synthetic counterparts

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for natural ingredients and clean-label products

Natural and organic products have high demand across a variety of consumer products, especially within the food & beverage industry. Consumer demand for healthy, natural ingredients is in tandem with the rise in demand for health-consciousness among consumers and sustainability quotient.

Restraint: Lack of standardization, and varying regulations and quality standards

Plant extracts are a concoction of several plant compounds and are subjected to rigorous health and safety checks based on government regulations in different countries. Several studies have been conducted by regulatory bodies to assess the impact of these products on human health.

Opportunity: Technological intervention in production process

Technological intervention across the supply chain helps the plant extracts business to propel. Bioactive extraction is witnessing high technology adoption. Besides, “Green technologies” are being adopted to result in significant sustainable measures.

Challenge: Lack of downstream processing facilities and resultant microbial contamination

Increasing incidences of microbial contamination in spices and seasonings imported from developing countries is a major challenge, especially because of raw material shortages.

Plant Extracts Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Symrise entered into a strategic partnership with Evoxx Technologies. | The partners plan to create biotechnological procedures for ingredients used in cosmetics. Evoxx provides expertise in R&D, and Symrise extends its expertise and capabilities in developing novel and long-lasting cosmetic components. |

|

Givaudan Active Beauty uses advanced vegetal extraction and biomimetic NaDES technology to develop authentically natural, sustainable botanical actives. Its expertise in phytochemistry and innovative platforms like Eutectys enables the creation of unique plant-derived skincare ingredients. | These technologies deliver high-performance actives that support hydration, anti-ageing, and skin balance while meeting consumer demand for clean, green formulations. The approach also promotes sustainability through efficient extraction and upcycling of botanical resources. |

|

Kerry acquired US-based Natreon, Inc., a leading supplier of branded Ayurvedic botanical ingredients. | The acquisition is expected to deliver health benefits substantiated by clinical research to a greater number of consumers, ultimately supporting its ambition to reach over two billion people with sustainable nutrition solutions by 2030. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The plant extracts ecosystem is categorized into manufacturers, regulatory bodies, and end-use companies. The plant extracts market is a dynamic and rapidly expanding ecosystem characterized by diverse stakeholders and innovative products. Established companies and agile startups are central to this market, and they develop plant extract products.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Plant Extracts Market, By Type

Among types, essential oils accounted for a significant market share in 2024. The importance of essential oils is increasing because they are mostly used in the food & beverage, cosmetics, and fragrance industries.

Plant Extracts Market, By Application

Plant extracts are becoming increasingly important food additives due to their high concentrations of bioactive compounds. Plant and herbal extracts have long been used to enhance healthfulness, color, taste, and even the flavor of food, beverages, and supplements

Plant Extracts Market, By Source

The herbs & spices segment is estimated to dominate the plant extracts market. The consumption of herbs & spices has been linked with several health benefits due to their medicinal properties.

Plant Extracts Market, By Form

Dry extracts have numerous advantages, including less storage space, stability, and ease of standardization for plant active ingredients, leading to increased demand

REGION

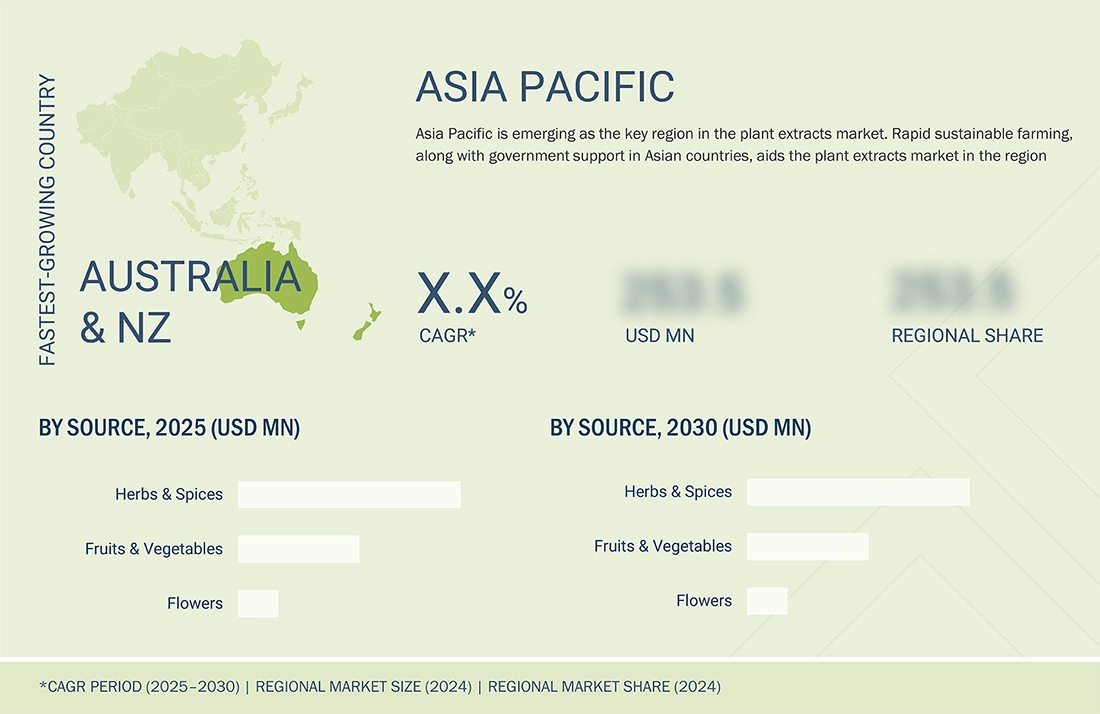

Asia Pacific to be dominant region in global plant extracts market during forecast period

Asia Pacific accounted for the largest market share. This dominance is attributed to factors such as a surge in the consumption rate of vegan food & beverage products, the rise in demand for functional food products, and an increase in awareness of the health benefits associated with the consumption of clean-label food products among consumers.

Plant Extracts Market: COMPANY EVALUATION MATRIX

In the plant extract market matrix, IFF and Symrise (Stars) lead with a strong market share and extensive product footprint for various applications, driven by their strong geographical presence, significant formulation and distribution capabilities, and strong ties with end-use manufacturers. Carbery Group (Emerging Leader) is gaining visibility with its specialized plant extract offerings for key applications, strengthening its position through strong product offerings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Givaudan (Switzerland)

- International Flavors & Fragrances Inc. (US)

- Sensient Technologies Corporation (US)

- Symrise AG (Germany)

- dsm-firmenich (Netherlands)

- Synthite Industries Ltd (India)

- Indesso (Indonesia)

- Cargill Incorporated (US)

- ADM (US)

- Kerry Group (Ireland)

- Döhler (Germany)

- Kangcare Bioindustry Co. Ltd. (China)

- Vidya Herbs (India)

- Carbery Group (Ireland)

- Martin Bauer Group (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 42.52 Billion |

| Market Forecast in 2030 (Value) | USD 85.28 Billion |

| Growth Rate | CAGR of 12.4% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (KT) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, Rest of the World |

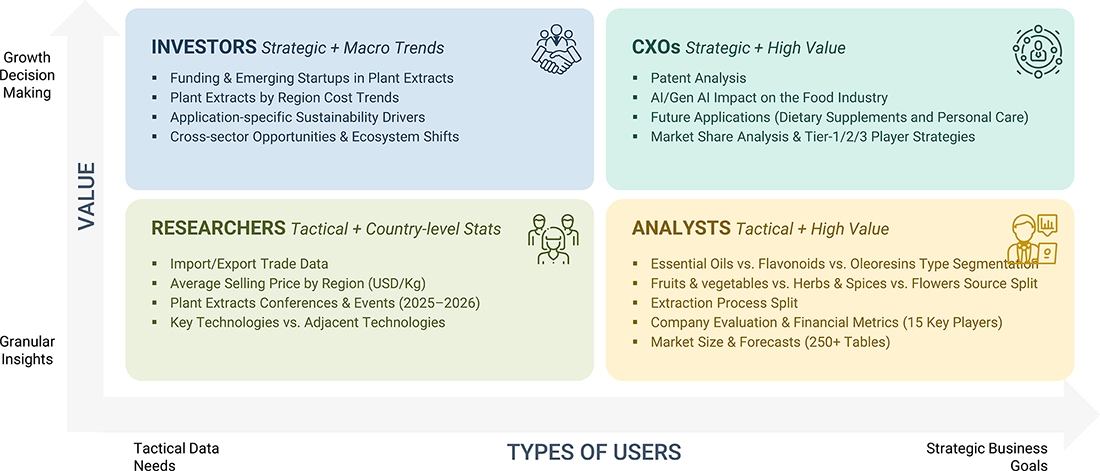

WHAT IS IN IT FOR YOU: Plant Extracts Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based Health Food Ingredients Manufacturers |

|

|

| Supplement Segment Assessment |

|

|

RECENT DEVELOPMENTS

- October 2025 : Symrise partnered with Canadian biotech Aplantex to secure sustainable, biotech-derived plant molecules like apigenin, orientin, vitexin, and luteolin—known for antioxidant and anti-aging benefits. Using Aplantex’s photosynthetic biomass technology, the collaboration addresses climate-related supply challenges and strengthens Symrise’s position in resilient, traceable plant-extract innovation.

- October 2025 : Symrise launched a new generation of Actipone botanical extracts featuring two innovative, 100% natural-origin ingredients—Pure Balance CC (rosemary extract for sebum control) and AHA Renew (upcycled cranberry powder acids for gentle skin renewal) backed by in vitro and ex vivo efficacy data and aligned with circular-beauty principles. These supplements strengthen its sustainable, high-performance positioning, supported by ethical sourcing, advanced green extraction technologies like SymFrequency, and tailored skin- and hair-care solutions.

- September 2024 : Givaudan Active Beauty launched its [N.A.S.] Vibrant Collection, a range of five 100% natural-origin, vegan powder botanical extracts designed for hybrid make-up, combining skincare benefits with color cosmetics.

- June 2024 : Döhler significantly expanded its Paarl, South Africa facility, investing over R400 million (USD 21 million) to add state-of-the-art production lines (compounds, emulsions, powdered and liquid flavors), bulk juice concentrate processing, refrigerated storage, packaging, and new R&D labs—aimed at enhancing local market access across Southern Africa. This upgrade empowers Southern African customers with direct access to Döhler’s full ingredient portfolio, supports localized product innovation, including African botanical extracts like aloe ferox, baobab, and rooibos, and strengthens its position to capitalize on the “African cool” export trend.

Table of Contents

- 4.1 INTRODUCTION

-

4.2 MARKET DYNAMICSDRIVERSRESTRAINTSOPPORTUNITIESCHALLENGES

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

-

5.1 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERS

- 5.2 MACROECONOMICS INDICATORS

-

5.3 VALUE CHAIN ANALYSISRESEARCH & PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGPROCESSING AND MANUFACTURING OPERATIONSPACKAGING, STORAGE, AND DISTRIBUTIONEND-USER SEGMENTS AND CONSUMPTION PATTERNSVALUE ADDED ACROSS THE VALUE CHAIN

-

5.4 ECOSYSTEM ANALYSISDEMAND SIDESUPPLY SIDE

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF TYPE, BY KEY PLAYERS (2024)AVERAGE SELLING PRICE TREND, BY REGION (2021-2024)

-

5.6 TRADE ANALYSISEXPORT SCENARIO (HS CODE 1302) – MAJOR EXPORTING COUNTRIES & REGIONSIMPORT SCENARIO (HS CODE 1302) – MAJOR IMPORTING COUNTRIES & REGIONS

- 5.7 KEY CONFERENCES & EVENTS IN 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

-

5.11 IMPACT OF 2025 US TARIFF – PLANT EXTRACT MARKETINTRODUCTIONKEY TARIFF RATESPRICE IMPACT ANALYSISIMPACT ON COUNTRY/REGION*- US- Europe- Asia PacificIMPACT ON END-USE INDUSTRIES

-

6.1 KEY TECHNOLOGIESSOLVENT EXTRACTION TECHNOLOGIESSUPERCRITICAL FLUID TECHNOLOGYULTRASOUND-BASED TECHNOLOGIESENZYME-AIDED EXTRACTION TECHNOLOGIES

-

6.2 COMPLEMENTARY TECHNOLOGIESMEMBRANE SEPARATIONENCAPSULATION & STABILIZATIONDRYING TECHNOLOGIES

-

6.3 ADJACENT TECHNOLOGIESPLC-DRIVEN AUTOMATED EXTRACTION LINESBIOTECHNOLOGY PLATFORMSNANO-FORMULATION TECHNOLOGY

-

6.4 PATENT ANALYSISLIST OF MAJOR PATENTS PERTAINING TO THE MARKET

- 6.5 FUTURE & EMERGING EXTRACTS OF PLANTS

-

6.6 IMPACT OF GEN AI ON FOOD & BEVERAGE INDUSTRYINTRODUCTIONUSE OF GEN AI IN FOOD & BEVERAGE INDUSTRYCASE STUDY ANALYSISIMPACT ON PLANT EXTRACT MARKETADJACENT ECOSYSTEM WORKING ON GEN AI

- 6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

-

7.1 REGIONAL REGULATIONSREGULATORY BODIES AND FRAMEWORKSCERTIFICATION AND ACCREDITATION BODIESLABELLING REQUIREMENTS AND CLAIMSANTICIPATED REGULATORY CHANGES OVER THE NEXT 5-10 YEARS

-

7.2 SUSTAINABILITY INITIATIVESSUSTAINABLE SOURCINGCARBON FOOTPRINT REDUCTION INITIATIVESCIRCULAR ECONOMY APPROACHESCERTIFICATION, TRACEABILITY & TRANSPARENCY

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 BIODEGRADABLE PACKAGING, CERTIFICATIONS, LABELING, ECO-STANDARDS

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 9.1 INTRODUCTION

- 9.2 OLEORESINS

- 9.3 ESSENTIAL OILS

- 9.4 FLAVONOIDS

- 9.5 ALKALOIDS

- 9.6 CAROTENOIDS

- 9.7 OTHER TYPES

- 10.1 INTRODUCTION

- 10.2 FOOD & BEVERAGES

- 10.3 PHARMACEUTICALS

- 10.4 DIETARY SUPPLEMENTS

- 10.5 COSMETICS & PERSONAL CARE

- 10.6 OTHER APPLICATION

- 11.1 INTRODUCTION

- 11.2 FRUITS & VEGETABLES

- 11.3 HERBS & SPICES

- 11.4 FLOWERS

- 12.1 INTRODUCTION

- 12.2 DRY

- 12.3 LIQUID

- 13.1 INTRODUCTION

- 13.2 SOLVENT EXTRACTION

- 13.3 STEAM DISTILLATION

- 13.4 COLD PRESSING/MECHANICAL EXPRESSION

- 13.5 SUPERCRITICAL FLUID EXTRACTION

- 13.6 OTHER EXTRACTION PROCESS

-

14.1 NORTH AMERICAUSCANADAMEXICO

-

14.2 EUROPEGERMANYUKFRANCESPAINITALYREST OF EUROPE

-

14.3 ASIA PACIFICCHINAJAPANINDIAAUSTRALIA & NEW ZEALANDREST OF ASIA PACIFIC

-

14.4 SOUTH AMERICABRAZILARGENTINAREST OF SOUTH AMERICA

-

14.5 REST OF THE WORLDMIDDLE EASTAFRICA

- 15.1 OVERVIEW

- 15.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN, 2022 - 2025

- 15.3 REVENUE ANALYSIS, 2022 – 2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 BRAND/PRODUCT COMPARISON

- 15.6 COMPANY VALUATION AND FINANCIAL METRICS

-

15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2024- Company Footprint- Region Footprint- Type Footprint- Source Footprint

-

15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024- Detailed list of key start-up/SMEs- Competitive benchmarking of key start-ups/SMEs

-

15.9 COMPETITIVE SCENARIONEW PRODUCT LAUNCHESDEALSEXPANSIONSOTHERS

-

16.1 KEY PLAYERSDSM-FIRMENICHINTERNATIONAL FLAVORS & FRAGRANCES INC.KERRY GROUP PLCADMCARGILL, INCORPORATED.GIVAUDANSYMRISESENSIENT TECHNOLOGIES CORPORATIONKALSEC INCKANGCARE BIOINDUSTRY CO. LTDMARTINBAUERCARBERY GROUPDÖHLERSYNTHITE INDUSTRIES LTDINDESSO

-

16.2 STARTUPS/SMESARJUNA NATURALBLUE SKY BOTANICSPRINOVA GROUP LLCSYDLER INDIA PVT. LTDALCHEMY CHEMICALSSHAANXI JIAHE PHYTOCHEM CO., LTD .VITAL HERBSTOKIWA PHYTOCHEMICAL CO., LTDNATIVE EXTRACTS PTY LTDPLANTNAT

-

17.1 RESEARCH DATASECONDARY DATA- Key data from secondary sourcesPRIMARY DATA- Key data from primary sources- Key Industry Insights- Breakdown of Primaries

-

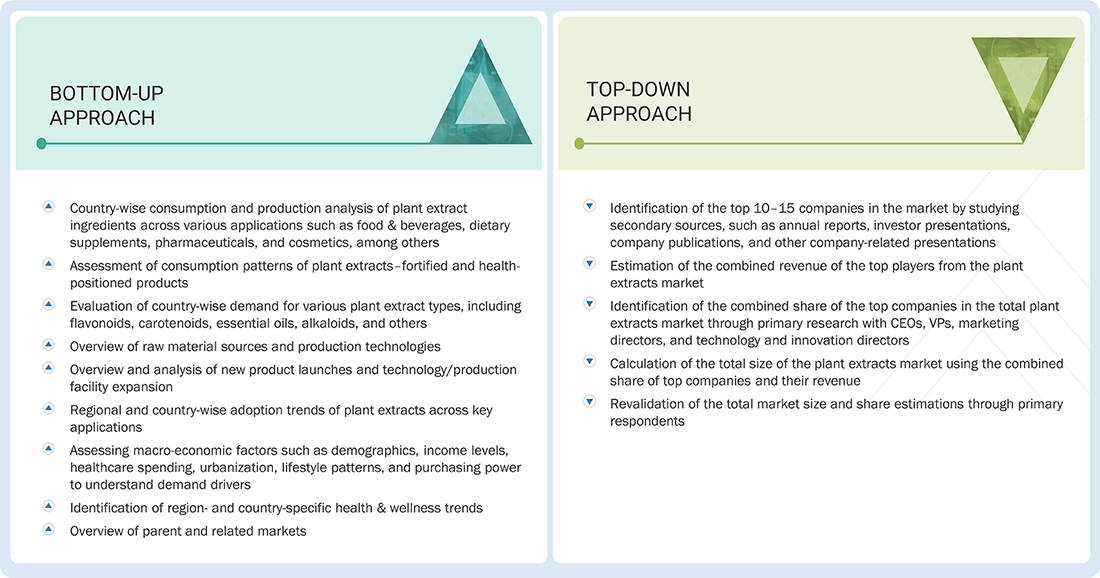

17.2 MARKET SIZE ESTIMATIONBOTTOM-UP APPROACH- Approach For Capturing Market Share By Bottom-Up AnalysisTOP-DOWN APPROACH- Approach For Capturing Market Share By Top-Up Analysis

- 17.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 17.4 RESEARCH ASSUMPTIONS

- 17.5 RISK ASSESSMENT

- 17.6 LIMITATIONS

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 19.3 AVAILABLE CUSTOMIZATIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS

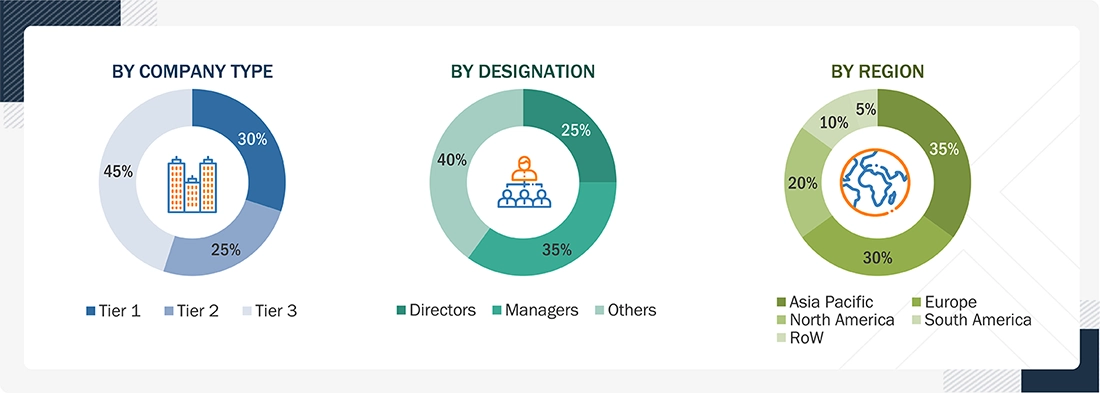

Methodology

This study employed two primary approaches to estimate the current size of the plant extracts market. Exhaustive secondary research was conducted to gather information on the market segments, including type, application, source, form, and extraction process. The next step involved validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

This research study used extensive secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information for a technical, market-oriented, and commercial market study. In the secondary research process, sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information. Secondary research was mainly used to obtain key information about the industry’s supply chain, the pool of key players, and market classification and segmentation based on the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the plant extracts market scenario through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), directors from business development, marketing, research, and development teams, as well as key executives from distributors and key opinion leaders.

Primary interviews were conducted to gather insights, including market statistics, revenue data from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped to understand the various trends related to type, application, source, form, extraction process, and region. Stakeholders from the demand side, including distributors, importers, exporters, and end-use sectors such as food & beverages, dietary supplements, cosmetics & personal care, and pharmaceutical product manufacturers, were interviewed to understand the buyers’ perspective on suppliers, products, and the outlook for their business, which will impact the overall market.

Breakdown Of Primary Interviews

Note: The three tiers of companies are defined based on their total revenues in 2023 or 2024, as available financial data permits: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million ≤ revenue ≤ USD 1 billion; Tier 3: Revenue < USD 100 million. RoW includes Africa and the Middle East.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Givaudan | Product Development Manager | |

| Flora & Fragrances International | Sales Manager | |

| RS Fragrances International Pvt. Ltd | Marketing Head | |

| Bell Flavors & Fragrances | Marketing Head | |

| Synthite Technologies | Senior Sales Manager | |

| Indesso Aroma | Business Development Manager | |

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the plant extracts market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Plant Extracts Market: Bottom-up and Top-down Approaches

Data Triangulation

After determining the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation procedure was employed, wherever applicable, to estimate the overall plant extracts market and obtain precise statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

A plant extract is a substance or an active ingredient with desirable properties; this extract is removed from the tissue of a plant, usually by treating it with a solvent, to be used for a particular purpose. Extracts may be used in various sectors of activity, including pharmaceuticals for their therapeutic properties, food & beverage products for their functional properties, and cosmetics with functional properties for beauty and well-being.

As defined by Alfa Chemistry, a plant extract is a substance or active substance of a desired property extracted from plant tissue by treatment for a specific purpose. Plant extracts can be used in a variety of areas, including health foods, therapeutic drugs, cosmetics, processing aids, additives, chemical alternatives, and so on.

Stakeholders

- Supply side: Plant extract producers, suppliers, distributors, importers, and exporters

- Demand side: Food & beverage manufacturers, cosmetics manufacturers, nutraceutical manufacturers, pharmaceutical industries, and dietary supplement manufacturers

- Regulatory bodies: Government agencies and Non-governmental Organizations (NGO)

- Commercial R&D institutions and financial institutions

-

Associations, regulatory bodies, and other industry-related bodies:

- Food and Drug Administration (FDA)

- United States Department of Agriculture (USDA)

- Herb Society of America

- American Herbal Products Association

- International Herb Association

- American Spice Trade Association

- European Spices Association

- Spices Board

- Essential Oil Association of India

- International Federation of Essential Oils and Aroma Trades

- European Flavors & Fragrances Association

Report Objectives

- To determine and project the size of the plant extracts market based on type, application, source, form, extraction process, and region, over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Plant Extracts Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Plant Extracts Market