Eubiotics Market by Type (Probiotics, Prebiotics, Organic Acids, Essential Oils), Livestock (Swine, Poultry, Ruminant, Aquaculture), Form (Dry and Liquid), Function (Nutrition & Gut Health, Yield, Immunity, Production) - Global Forecast to 2022

[182 Pages Report] The global eubiotics market is projected to grow from USD 4.84 billion in 2016 and reach USD 7.48 billion by 2022, at a CAGR of 7.51% from 2016 to 2022. Consumption of eubiotics-based feed provides basic nutritional components as well as health and medicinal benefits to livestock, such as preclusion and cure of diseases. Eubiotics enhances microflora in the gut of the host and increasing lactose tolerance level, which helps in healthy growth of the livestock.

The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2022.

Market Dynamics

Drivers

- Increasing awareness about feed quality and safety

- Replacing antibiotic growth promoters (AGPs) with eubiotics

- Rising demand for manufactured feed

- Growth in demand for animal protein

Restraints

- Trade complexities due to impositions of regulations

- Increasing complexities in the food production chain

Opportunities

- Increasing investments and opportunities in animal nutrition

- Growing consumer awareness

- Increasing investment in the pet industry

Challenges

- Rise in raw material prices

- Increasing disease outbreaks in livestock

Increasing awareness about feed quality and safety to drive the global eubiotics market

The growth of the eubiotics market is driven by the rising customer awareness towards superior quality feed grades, which are nutritive and have an accurate composition of ingredients to maintain the balance during consumption. Manufacturers are focusing on maintaining a balance in the ingredients used in the production of eubiotics to optimize nutrient absorption. In addition, the imposition of bans on antibiotics in North America and Europe, rise in prices of natural feed grades, and the use of feed enzymes for cost reduction of feed grades further contribute to the growth of the market. The high-growth potential in emerging markets provides new growth opportunities to the market players.

The following are the major objectives of the study.

- To understand the eubiotics market by identifying its various subsegments

- To define, segment, and project the size of the eubiotics market with respect to type, livestock, form, and region

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contribution to the total market

- To project the size of the market, in terms of value, in the four main regions, namely, North America, Europe, Asia-Pacific, and the Rest of the World (RoW)

- To analyze opportunities in the eubiotics market for stakeholders and provide the details of the competitive landscape for key market leaders

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze the competitive developments—such as new product launches, mergers & acquisitions, expansions & investments, agreements, partnerships, joint ventures, collaborations, and product approvals—in the eubiotics market

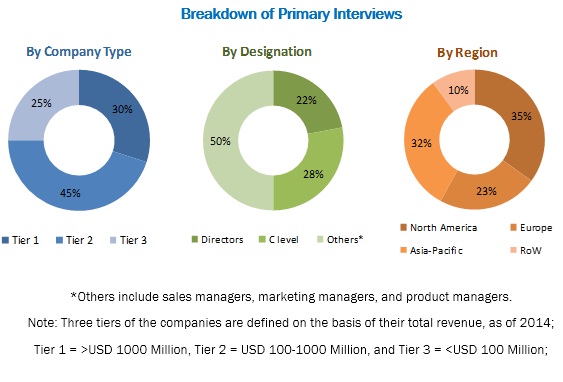

During this research study, major players operating in the eubiotics market across regions were identified, and their offerings, regional presence, and distribution channels were analyzed through in-depth discussions. Top-down and bottom-up approaches were used to determine the overall market size. The market size of the other individual markets was estimated using the percentage splits obtained through secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Leading players in the eubiotics market focused on research and product development, raw material supply, component manufacturing, distribution and sale, and post-sales services. Key players identified in the eubiotics market are Cargill (US), BASF SE (Germany), E. I. du Pont de Nemours and Company (US), Koninklijke DSM N. V. (Netherlands), Chr. Hansen A/S (Denmark), Novozymes (Denmark), Calpis Co., Ltd. (Japan), Lesaffre Group (France), Kemin Industries, Inc. (US), Lallemand Inc. (Canada), ADDCON (Germany), Behn Meyer (Malaysia), Novus International Inc. (US), and Advanced BioNutrition Corporation (US).

Major Market Developments

- In September 2016, Cargill invested USD 146 million in a feed plant at Bathinda, Punjab, India. The plant offers nutritious and safe feed to dairy farmers in Punjab, Haryana, Uttar Pradesh, and Rajasthan. It produces 120,000 metric tons of feed per month and feeds 75,000 cows per day.

- In May 2016, Kemin set up a new advanced quality control lab and 14.600 square meters of warehouse and logistics office space at the Kemin campus in Belgium to expand and develop its business.

- In May 2016, Lallemand NZ Ltd (trading as Vitec Nutrition) (New Zealand) merged with Nutritech International (New Zealand). With this merger, the company became New Zealand’s largest supplier of animal nutrition and forage additive technologies. This strengthened its position in the eubiotics market.

- In January 2016, Chr. Hansen acquired Nutritional Physiology Company, a leading supplier of probiotic products for beef cattle. This acquisition created attractive opportunities for synergies within sales, including cross-selling, supply chain improvements, and innovation. This helped the company to broaden its microbial platform and expand its presence in the beef cattle segment.

- In January 2016, Kemin announced a new product for the swine and poultry market— ButiPEARL Z— that offers key nutrients required for optimal gut health. This would help the company to strengthen its product portfolio in the animal nutrition market.

Target Audience:

- Eubiotic manufacturers

- Feed manufacturers

- Animal pharmaceutical companies

- Eubiotics raw material suppliers

- Eubiotics product exporters & importers

- Educational institutions

- Regulatory authorities

- Consulting firms

Report Scope

By Type

- Probiotics

- Prebiotics

- Organic acids

- Essential oils

By Livestock:

- Poultry

- Swine

- Ruminants

- Aquatic animals

- Others (horses, sheep, and birds)

By Function:

- Nutrition and gut health

- Yield

- Immunity

- Production

By Form:

- Dry

- Liquid

By Geography

- North America

- Europe

- Asia–Pacific

- Rest of the World (RoW)

Critical questions which the report answers

- What are types in which the eubiotics manufacturers are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

- Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

The global eubiotics market is projected to grow from USD 4.84 billion in 2016 and reach USD 7.48 billion by 2022, at a CAGR of 7.51% from 2016 to 2022. The growth of the eubiotics market is primarily attributed to the increasing awareness about feed quality and safety, rise in demand for manufactured feed, growth in demand for animal high protein, change in farming practices and technology, and replacing antibiotic growth promoters (AGPs) with eubiotics. In addition, the rise in the population leads to an increase in the demand for food such as milk and meat, which in turn, contributes to the growth of the eubiotics market.

The eubiotics market is segmented on the basis of type, which is further segmented as probiotics, prebiotics, organic acids, and essential oils. Among all the types of eubiotics, the probiotics segment accounted for the largest market share, followed by organic acids and prebiotics. The consumption of eubiotics is increasing significantly with the imposition of various government regulations pertaining to the animal health. In addition, the imposition of ban on the use of antibiotics as growth promoters for livestock by the European Union (EU) has created a massive demand for eubiotics.

On the basis of livestock type, the eubiotics market is segmented into swine, poultry, ruminants, aquatic animals, and others, which include horses, sheep, and birds. The market for poultry is projected to witness the fastest growth, as it provides poultry birds with protein and improves their health. The demand for poultry chicken remains high in the food industry due to its high nutrient value.

On the basis of functions, the global market is segmented into nutrition & gut health, yield, immunity, and productivity. The aim of using eubiotics is to restore the deficiencies in the microflora and prevent diseases in livestock. Besides from health benefits, researchers are focusing on using eubiotics in feed for other functions.

On the basis of form, the eubiotics are available in two basic forms, namely, dry and liquid. The dry form has a long shelf-life as compared to liquid form. Dry forms of eubiotics have various advantages and are used in various feed additive products. However, the liquid eubiotics are useful and preferred by farmers for use in feed as they are easy to mix and do not affect the texture of the feed.

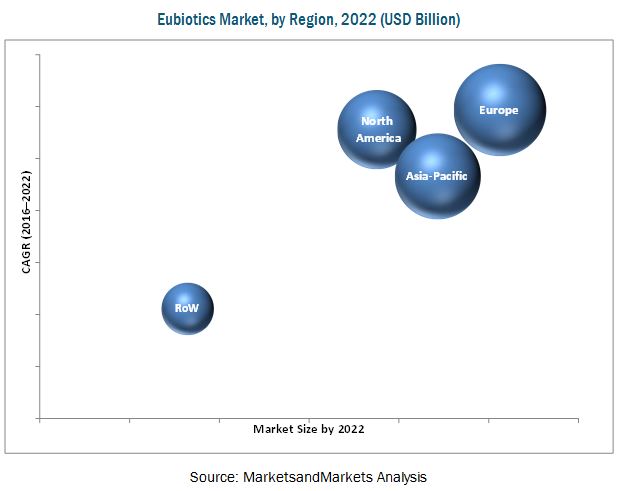

Europe accounted for the largest market share in the eubiotics market, followed by Asia-Pacific, and North America. France and Germany constituted the largest country-level markets in Europe in 2015. Increasing awareness about the benefits of eubiotics among the cultivators and rising population across regions are driving the growth of the market in this region. The eubiotics market in the Asia-Pacific is projected to grow due to the increased investments from several multinational manufacturers, advancements in agricultural technologies, and exports of key products in feed. Moreover, extensive R&D initiatives were undertaken for exploring the new varieties of eubiotics for use in the feed industry.

Imposition of government regulations across countries to improve animal health increases the consumption of eubiotics.

Probiotics

Probiotics are living microorganisms that impart health benefits besides basic nutrition. Imposition of the ban on the use of antibiotics as feed additives, supplement for enhancing growth, and prevent diseases in Europe is projected to reflect positively on the market growth. Due to this, the farmers are using probiotic bacteria as an effective alternative in the feed. The probiotic products may have one single strain or a combination of numerous strains of bacteria. However, manufacturers prefer probiotic products with more number of strains for enhanced response of the digestive systems to the stressors.

Prebiotics

Prebiotics in animal feed is important constituents in the eubiotics market, as they protect animal health and increase the efficiency of nutrient utilization. Due to its health-promoting properties, prebiotics are increasingly used as an alternative to antimicrobials. The key driver for the growth of the feed prebiotics market is the ban on antibiotic growth promoters in Europe. The imposition of this ban has encouraged research and product development, resulting in the production of alternative feed additives to work against pathogenic gut microfloral colonization.

Organic acids

Organic acids have gained global acceptance as an alternative for antibiotic growth promoters (AGPs) in livestock feed. This is attributed to their ability to kill pathogenic microorganisms and improve the growth and performance of livestock. A study by the USDA, conducted on the use of organic acids as feed additives, indicated that blends of organic acids containing various organic and inorganic acids have synergistic effects on the overall performance of animals. Antibiotics, now banned by the EU as standard feed additives, is substituted by synergetic formulations of such acids without losing on animal production yields.

Essential oils

Essential oils are liquid preparations extracted from aromatic plants that have unique beneficial effects on animal performance. Infeed additives, their inclusion level is usually low, but is beneficial due to their stabilizing effect, which optimizes gut microflora, increases daily weight gain and feed conversion efficiency, and prevents digestive dysfunctions in livestock.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming trends for the eubiotics market?

Stringent international quality standards and regulations for eubiotic products pose significant challenges for the use of eubiotics in the feed market.

Key players in the market are Cargill (US), BASF SE (Germany), E. I. du Pont de Nemours and Company (US), Koninklijke DSM N. V. (Netherlands), Chr. Hansen A/S (Denmark), Novozymes (Denmark), Calpis Co., Ltd. (Japan), Lesaffre Group (France), Kemin Industries, Inc. (US), Lallemand Inc. (Canada), ADDCON (Germany), Behn Meyer (Malaysia), Novus International Inc. (US), and Advanced BioNutrition Corporation (US). These players are focusing on undertaking expansions & investments, mergers & acquisitions, new product launches, and agreements, partnerships, collaborations, and joint ventures to pace ahead in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Market Covered

1.3.2 Periodization Considered

1.4 Currency Considered

1.5 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Introduction

2.2 Research Data

2.2.1 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Industry Insights

2.2.2.3 Breakdown of Primary Interviews

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Eubiotics Market

4.2 Eubiotics Markets: Key Countries

4.3 Life Cycle Analysis: Eubiotics Market, By Region

4.4 Eubiotics Market, By Type

4.5 Developed vs Emerging Eubiotics Markets, 2016 vs 2022

4.6 Eubiotics Market, By Form & Region, 2015

5 Market Overview (Page No. - 34)

5.1 Introduction

5.1.1 Types of Eubiotics

5.1.1.1 Probiotics

5.1.1.2 Prebiotics

5.1.1.3 Essential Oils

5.1.1.4 Organic Acids

5.2 Macroindicators

5.2.1 Introduction

5.2.1.1 Growing Population and Rising Demand for Diversified Food

5.2.1.2 Increase in Meat Production/Consumption

5.2.1.3 Parent Market Analysis: Animal Feed Industry

5.3 Market Segmentation

5.3.1 By Type

5.3.2 By Function

5.3.3 By Form

5.3.4 By Livestock

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Awareness About Feed Quality and Safety

5.4.1.2 Replacing Antibiotic Growth Promoters (AGPS) With Eubiotics

5.4.1.3 Rising Demand for Manufactured Animal Feed

5.4.1.4 Growth in Demand for Animal Protein

5.4.2 Restraints

5.4.2.1 Trade Complexities Due to Regulatory Structure

5.4.2.2 Food Production Chain Increasingly Complex

5.4.3 Opportunities

5.4.3.1 Increasing Investments and Opportunities in Animal Nutrition

5.4.3.2 Heightened Consumer Awareness

5.4.3.3 Rise in the Pet Industry Spending

5.4.4 Challenges

5.4.4.1 Rise in Raw Material Prices

5.4.4.2 Increasing Disease Outbreaks in Livestock

5.5 Regulatory Framework

5.5.1 Antibiotics as Feed Additives

5.5.2 Ban on Antibiotics

5.5.2.1 Europe

5.5.2.2 South Korea

5.5.2.3 U.S.

6 Industry Trends (Page No. - 53)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Prominent Companies

6.3.2 Small & Medium Enterprises

6.3.3 End Users

6.4 Porter’s Five Forces Analysis

6.4.1 Intensity of Competitive Rivalry

6.4.2 Bargaining Power of Suppliers

6.4.3 Bargaining Power of Buyers

6.4.4 Threat of New Entrants

6.4.5 Threat of Substitutes

6.5 Patent Analysis

7 Eubiotics Market, By Type (Page No. - 64)

7.1 Introduction

7.2 Probiotics

7.2.1 Lactobacilli

7.2.1.1 Research on Lactobacilli

7.2.2 Bifidobacteria

7.2.2.1 Research on Bifidobacteria

7.2.3 Streptococcus Thermophilus

7.2.4 Other Bacteria

7.3 Prebiotics

7.3.1 Inulin

7.3.2 Fructo-Oligosaccharides (FOS)

7.3.3 Galacto-Oligosaccharides (GOS)

7.3.4 Mannan-Oligosaccharide (MOS)

7.4 Organic Acids

7.4.1 Formic Acid

7.4.2 Lactic Acid

7.4.3 Fumaric Acid

7.4.4 Propionic Acid

7.4.5 Acetic Acid

7.5 Essential Oils

8 Eubiotics Market, By Livestock (Page No. - 74)

8.1 Introduction

8.1.1 Key Features

8.1.1.1 Modulation of Microflora

8.1.1.2 Stimulation of Immune Response

8.1.1.3 Metabolite Excretion

8.2 Swine

8.2.1 Key Features

8.2.1.1 Stimulate and Neutralize

8.2.1.2 Protection Against Infection

8.3 Poultry

8.3.1 Key Features

8.3.1.1 Growth and Improved Feed Conversion Rate

8.4 Ruminants

8.5 Aquatic Animals

8.6 Other Livestock

9 Eubiotics Market, By Form (Page No. - 81)

9.1 Introduction

9.1.1 Dry Form

9.1.2 Liquid Form

10 Eubiotics Market, By Function (Page No. - 85)

10.1 Introduction

10.2 Nutrition & Gut Health

10.3 Yield

10.4 Immunity

10.5 Productivity

11 Eubiotics Market, By Region (Page No. - 89)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 U.K.

11.3.2 Germany

11.3.3 France

11.3.4 Italy

11.3.5 Spain

11.3.6 Russia

11.3.7 Switzerland

11.3.8 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 India

11.4.3 Japan

11.4.4 Australia

11.4.5 Rest of Asia-Pacific

11.5 Rest of the World (RoW)

11.5.1 Brazil

11.5.2 Argentina

11.5.3 South Africa

11.5.4 Others in RoW

12 Competitive Landscape (Page No. - 127)

12.1 Overview

12.2 Eubiotics Market: Company Ranking

12.3 Competitive Situation & Trends

12.4 Expansions & Investments: the Key Strategy, 2010–2016

12.4.1 Expansions & Investments

12.4.2 Mergers & Acquisitions

12.4.3 New Product Launches

12.4.4 Agreements, Partnerships, Collaborations, and Joint Ventures

13 Company Profiles (Page No. - 135)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Cargill

13.2 BASF SE

13.3 E.I. Dupont De Nemours and Company

13.4 Koninklijke DSM N.V.

13.5 Chr. Hansen Holding A/S

13.6 Novozymes

13.7 Calpis Co., Ltd.

13.8 Lesaffre Group

13.9 Kemin Industries, Inc.

13.10 Lallemand, Inc.

13.11 Addcon

13.12 Behn Meyer Group

13.13 Novus International, Inc.

13.14 Advanced Bio Nutrition Corp

13.15 Beneo Group

“ * The companies listed are a representative sample of the market’s ecosystem and in no particular order”

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 170)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.2.1 Expansions & Investments

14.2.2 Mergers & Acquisitions

14.2.3 New Product Launches

14.2.4 Agreements, Partnerships, Collaborations, and Joint Ventures

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (86 Tables)

Table 1 Per Capita Consumption of Meat Through 2030

Table 2 Typical Broiler Performance With Eubiotic Nutrition in the Netherlands, 2015

Table 3 Protein Supply Per Capita for Key Countries, 2006-2009 (Grams/Day)

Table 4 List of Major Patents in Probiotics in Animal Feed, 2012–2016

Table 5 List of Major Patents in Prebiotics in Animal Feed, 2012–2016

Table 6 List of Major Patents in Essential Oils in Animal Feed, 2012-2016

Table 7 Eubiotics Market Size, By Type, 2014–2022 (USD Million)

Table 8 Eubiotics Market Size, By Type, 2014–2022 (Kt)

Table 9 Probiotics Market Size, By Region, 2014–2022 (USD Million)

Table 10 Prebiotics Market Size, By Region, 2014–2022 (USD Million)

Table 11 Organic Acids Market Size, By Region, 2014–2022 (USD Million)

Table 12 Essential Oils Market Size, By Region, 2014–2022 (USD Million)

Table 13 Eubiotics Market Size, By Livestock, 2014–2022 (USD Million)

Table 14 Swine: Eubiotics Market Size, By Region, 2014–2022 (USD Million)

Table 15 Poultry: Eubiotics Market Size, By Region, 2014–2022 (USD Million)

Table 16 Ruminants: Eubiotics Market Size, By Region, 2014–2022 (USD Million)

Table 17 Aquatic Animals: Eubiotics Market Size, By Region, 2014–2022 (USD Million)

Table 18 Other Livestock: Eubiotics Market Size, By Region, 2014–2022 (USD Million)

Table 19 Eubiotics Market Size, By Form, 2014-2022 (USD Million)

Table 20 Dry Eubiotics Market Size, By Region, 2014-2022 (USD Million)

Table 21 Liquid Eubiotics Market Size, By Region, 2014-2022 (USD Million)

Table 22 Eubiotics Market Size, By Region, 2014-2022 (USD Million)

Table 23 North America: Eubiotics Market Size, By Country, 2014-2022 (USD Million)

Table 24 North America: Market Size, By Type, 2014–2022 (USD Million)

Table 25 North America: Market Size, By Livestock, 2014–2022 (USD Million)

Table 26 North America: Market Size, By Form, 2014–2022 (USD Million)

Table 27 U.S.: Eubiotics Market Size, By Type, 2014–2022 (USD Million)

Table 28 U.S.: Market Size, By Livestock, 2014-2022 (USD Million)

Table 29 Canada: Eubiotics Market Size, By Type, 2014-2022 (USD Million)

Table 30 Canada: Market Size, By Livestock, 2014-2022 (USD Million)

Table 31 Mexico: Eubiotics Market Size, By Type, 2014-2022 (USD Million)

Table 32 Mexico: Market Size, By Livestock, 2014-2022 (USD Million)

Table 33 Europe: Eubiotics Market Size, By Country, 2014–2022 (USD Million)

Table 34 Europe: Market Size, By Type, 2014–2022 (USD Million)

Table 35 Europe: Market Size, By Livestock, 2014–2022 (USD Million)

Table 36 Europe: Market Size, By Form, 2014–2022 (USD Million)

Table 37 U.K.: Eubiotics Market Size, By Type, 2014–2022 (USD Million)

Table 38 U.K.: Market Size, By Livestock, 2014–2022 (USD Million)

Table 39 Germany: Eubiotics Market Size, By Type, 2014–2022 (USD Million)

Table 40 Germany: Market Size, By Livestock, 2014–2022 (USD Million)

Table 41 France: Eubiotics Market Size, By Type, 2014–2022 (USD Million)

Table 42 France: Market Size, By Livestock, 2014–2022 (USD Million)

Table 43 Italy: Eubiotics Market Size, By Type, 2014–2022 (USD Million)

Table 44 Italy: Market Size, By Livestock, 2014–2022 (USD Million)

Table 45 Spain: Eubiotics Market Size, By Type, 2014–2022 (USD Million)

Table 46 Spain: Market Size, By Livestock, 2014–2022 (USD Million)

Table 47 Russia: Eubiotics Market Size, By Type, 2014–2022 (USD Million)

Table 48 Russia: Market Size, By Livestock, 2014–2022 (USD Million)

Table 49 Switzerland: Eubiotics Market Size, By Type, 2014–2022 (USD Million)

Table 50 Switzerland: Market Size, By Livestock, 2014–2022 (USD Million)

Table 51 Rest of Europe: Eubiotics Market Size, By Type, 2014–2022 (USD Million)

Table 52 Rest of Europe: Market Size, By Livestock, 2014–2022 (USD Million)

Table 53 Asia-Pacific: Eubiotics Market Size, By Country, 2014–2022 (USD Million)

Table 54 Asia-Pacific: Market Size, By Type, 2014–2022 (USD Million)

Table 55 Asia-Pacific: Market Size, By Livestock, 2014–2022 (USD Million)

Table 56 Asia-Pacific: Market Size, By Form, 2014–2022 (USD Million)

Table 57 China: Eubiotics Market Size, By Type, 2014–2022 (USD Million)

Table 58 China: Market Size, By Livestock, 2014–2022 (USD Million)

Table 59 India: Eubiotics Market Size, By Type, 2014–2022 (USD Million)

Table 60 India: Market Size, By Livestock, 2014–2022 (USD Million)

Table 61 Japan: Eubiotics Market Size, By Type, 2014–2022 (USD Million)

Table 62 Japan: Market Size, By Livestock, 2014–2022 (USD Million)

Table 63 Australia: Eubiotics Market Size, By Type, 2014–2022 (USD Million)

Table 64 Australia: Market Size, By Livestock, 2014–2022 (USD Million)

Table 65 Rest of Asia-Pacific: Eubiotics Market Size, By Type, 2014–2022 (USD Million)

Table 66 Rest of Asia-Pacific: Market Size, By Livestock, 2014–2022 (USD Million)

Table 67 RoW: Eubiotics Market Size, By Country, 2014-2022 (USD Million)

Table 68 RoW: Market Size, By Type, 2014-2022 (USD Million)

Table 69 RoW: Market Size, By Livestock, 2014-2022 (USD Million)

Table 70 RoW: Market Size, By Form, 2014-2022 (USD Million)

Table 71 Brazil: Eubiotics Market Size, By Type, 2014-2022 (USD Million)

Table 72 Brazil: Market Size, By Livestock, 2014-2022 (USD Million)

Table 73 Argentina: Eubiotics Market Size, By Type, 2014-2022 (USD Million)

Table 74 Argentina: Market Size, By Livestock, 2014-2022 (USD Million)

Table 75 South Africa: Eubiotics Market Size, By Type, 2014-2022 (USD Million)

Table 76 South Africa: Market Size, By Livestock, 2014-2022 (USD Million)

Table 77 Others in RoW: Eubiotics Market Size, By Type, 2014-2022 (USD Million)

Table 78 Others in RoW: Market Size, By Livestock, 2014-2022 (USD Million)

Table 79 Expansions & Investments, 2010–2016

Table 80 Mergers & Acquisitions, 2010–2016

Table 81 New Product Launches, 2010–2016

Table 82 Agreements, Partnerships, Collaborations, and Joint Ventures, 2010–2016

Table 83 Expansions & Investments, 2010–2016

Table 84 Mergers & Acquisitions, 2010–2016

Table 85 New Product Launches, 2010–2016

Table 86 Agreements, Partnerships, Collaborations, and Joint Ventures, 2010–2016

List of Figures (53 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Eubiotics Market Size, By Livestock, 2016 vs 2022

Figure 7 Probiotics Projected to Account for the Largest Share of the Eubiotics Market From 2016 to 2022

Figure 8 Dry Form Projected to Dominate the Eubiotics Market, 2016–2022

Figure 9 European Region Accounted for Largest Market Share for Eubiotics in 2015

Figure 10 Eubiotics: an Emerging Market With Promising Growth Potential, 2016-2022

Figure 11 Germany Was the Fastest-Growing Market for Eubiotics, 2015

Figure 12 European Eubiotics Market is Experiencing High Growth

Figure 13 Probiotics Expected to Dominate the Market Throughout the Forecast Period

Figure 14 India & Brazil are Projected to Be the Most Attractive Markets for Eubiotics During the Forecast Period

Figure 15 Europe Accounted for the Largest Share in the Form Segment in 2015

Figure 16 Population Growth Trend, 1961-2050

Figure 17 Eubiotics Market, By Type

Figure 18 Market, By Function

Figure 19 Market, By Form

Figure 20 Market, By Livestock

Figure 21 Market Dynamics Snapshot

Figure 22 Number of GMP+ FSA Certified* Companies, 2009-2015

Figure 23 Food Chain Approach

Figure 24 Feed Additives Growth Outlook Estimated Through 2022

Figure 25 Change in Consumer Meat Preferences, 2009 vs 2014

Figure 26 Annual Spending Per Pet in the U.S., 2011-1016

Figure 27 Manufacturing Contributes Major Value to Overall Price of Eubiotics Market

Figure 28 Research Organizations & Technologists: Integral Part of Supply Chain of the Eubiotics Market

Figure 29 Porter’s Five Forces Analysis: Eubiotics Market

Figure 30 Number of Patents Approved for Probiotics & Prebiotics in Animal Feed, 2012–2016

Figure 31 Geographical Analysis: Prebiotics and Probiotics Patent Approval, 2012–2016

Figure 32 Prebiotics Segment to Be the Fastest-Growing in the Eubiotics Market

Figure 33 Eubiotics Market Size, By Livestock, 2016-2022

Figure 34 Dry Segment to Dominate the Eubiotics Market From 2016 to 2022

Figure 35 Classification of Animal Feed Additives

Figure 36 Effect of Probiotics on Animal Health

Figure 37 Europe: Eubiotics Market Snapshot

Figure 38 China Was the Market Leader in the Asia-Pacific Region in 2015

Figure 39 Expansions & Investments: Leading Approach of Key Players (2010–2016)

Figure 40 Global Eubiotics Company Rankings (2015)

Figure 41 Battle for Market Share: Expansions and Investments Was the Most Popular Growth Strategy

Figure 42 Expansions & Investments Fueled Growth and Innovation (2014–2016)

Figure 43 Cargill: Company Snapshot

Figure 44 Cargill: SWOT Analysis

Figure 45 BASF SE: Company Snapshot

Figure 46 BASF SE: SWOT Analysis

Figure 47 E.I. Dupont De Nemours and Company: Company Snapshot

Figure 48 E. I. Du Pont De Nemours and Company: SWOT Analysis

Figure 49 Koninklijke DSM N.V. : Company Snapshot

Figure 50 Koninklijke DSM N. V.: SWOT Analysis

Figure 51 Chr. Hansen A/S: Company Snapshot

Figure 52 Chr. Hansen A/S: SWOT Analysis

Figure 53 Novozymes: Company Snapshot

Growth opportunities and latent adjacency in Eubiotics Market