EV Charging Cable Market by Power Supply (AC and DC), Application (Private Charging & Public Charging), Length (2-5 Meters, 6-10 Meters, and >10 Meters), Shape, Mode, Charging Level, Connector Type, Cable Type Diameter & Region - Global Forecast to 2030

EV Charging Cables Market Size, Growth Report & Forecast

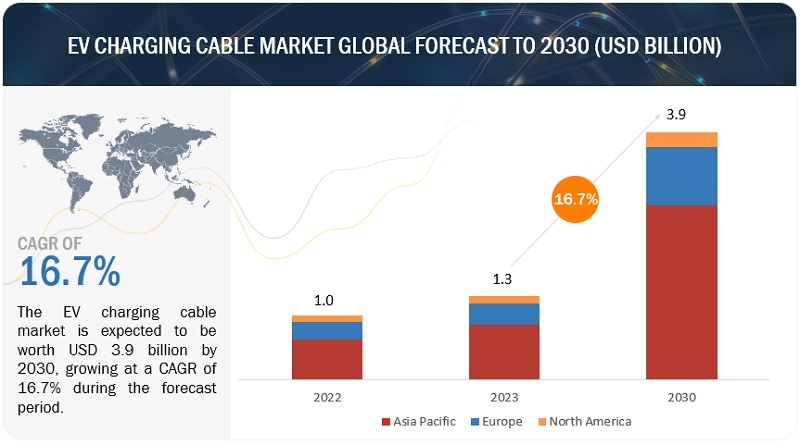

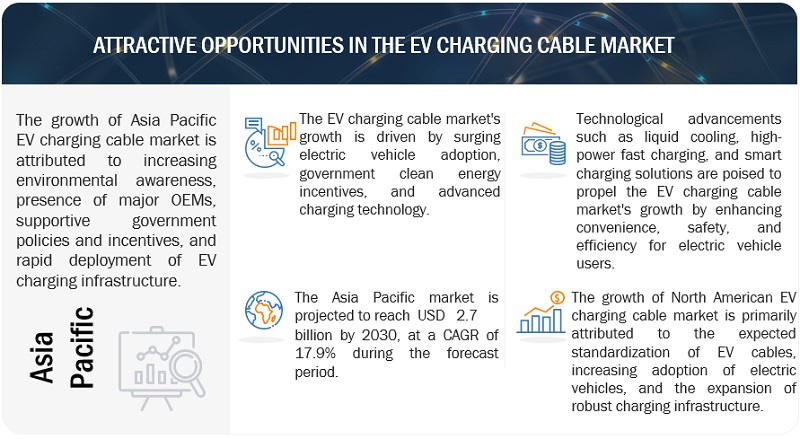

[310 Pages Report] The global EV charging cable market worldwide size was valued at USD 1.3 billion in 2023 and is expected to reach USD 3.9 billion by 2030, registering a CAGR of 16.7%. With environmental concerns at the forefront of collective consciousness and the increasing popularity of electric vehicles, the demand for cutting-edge charging solutions has never been more pronounced. In this dynamic landscape, various innovative technologies are reshaping the EV Landscape, transforming the EV charging cable market into a hotbed of innovation, efficiency, and user-friendly advancements.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

EV Charging Cables Market Growth Dynamics:

Driver: Government policies & subsidies to accelerate setup of EV charging stations

The increasing pace of charging station deployment is expected to accelerate further the demand for related components such as EV charging cables. Various governments are funding the development of charging station infrastructure and subsidizing EV charging infrastructure. In addition to subsidies, governments are also introducing favorable policies for installing EV charging infrastructure. Several governments provide various kinds of incentives such as low or zero registration fees and exemptions from import, purchase, and road taxes. Europe was the first region to introduce plans to shift fully to EVs by 2050, which was later changed to 2035. Other countries have also set up plans to increase EV charging infrastructure along with their EV shift by 2030 and beyond. Various countries thus set up policies for EV charging stations around the world. Furthermore, countries such as Norway and Germany are investing significantly in promoting the sales of EVs. Thus, due to the significant incentives and subsidies offered in Europe, there is high growth in the sale of electric vehicles. This has increased the demand for components and equipment associated with EV charging operations, such as charging cables, connectors, adapters, and portable chargers. Government initiatives and subsidies promoting electric vehicle (EV) adoption are gaining momentum, particularly evident in the US Inflation Reduction Act (IRA) of August 2022. Allocated from a USD 369 billion climate investment fund, the IRA outlines measures to expedite the EV transition. The Clean Vehicle Tax Credit is a cornerstone of the IRA, introducing stringent criteria for EV incentives starting in 2023. Eligible EVs must be assembled in North America, possess a 7 kWh+ battery, weigh under 6.35 t, and fit price caps. Major US automakers are aligning with IRA provisions, with incentives of up to USD 7,500 per vehicle. The IRA also fosters battery production through Advanced Manufacturing Production Tax Credits. Further, in February 2023, the European Union introduced the Green Deal Industrial Plan, prioritizing expedited permitting, financial support, skill enhancement, and open trade to advance net-zero projects.

Restraint: High initial investments in EV fast-charging infrastructure

The initial investment in setting up a fast-charging system is much higher compared to petrol, CNG, or LPG fuel stations. This has been a major restraint that has kept countries around the world from shifting to EVs on a larger scale. The cost for EV fast charging is high due to the higher equipment costs and the additional requirement for the fast charger to install a transformer to connect the grid and charging system. This has led to the slower development of charging networks around the world, which have gained traction in the past few years due to concerns related to vehicle emissions. The cost of DC fast-charging cables is notably higher, with a fast-charging cable priced around USD 126, significantly more than slower charging cables. This elevated expense, coupled with the costly installation of slow charging stations at approximately USD 1,700 in the UK, could hinder the widespread adoption of this technology. DC Fast Chargers, which power electric vehicles using direct current, offer rapid and efficient charging. These chargers can charge an average EV to 80% in about 30 minutes, making them particularly appealing for commercial applications. Despite their advantages, the higher cost of DC Fast Chargers is mainly due to the more expensive equipment involved. To make EVs successful, it is necessary to develop infrastructure to support them. The initial investment for installations of charging stations is very high compared to other types of fuel stations.

Opportunity: Technological advancements for EV charging cables

The rising demand for high-speed charging stations has compelled manufacturers of EV charging cables to develop advanced technology cables. Most of the DC charging stations operate on 400 V to 480 V and can charge up to about 50 kW. Leading EV charging cable manufacturers have launched various new products to ease charging. For instance, Phoenix Contact, a leading EV charging cables market player, has developed high-power charging cables that can charge electric vehicles rapidly. These cables do not overheat during charging as they are cooled efficiently with an environment-friendly water-glycol mixture. Technological advancements have also led to changes in the charging interface. For instance, LEONI AG developed a new charging cable concept involving a status-indicating light function. This advanced feature illuminates the charging cable, which enhances safety and prevents tripping over the cable in dark areas. Further, in May 2023, Volvo Cars announced to invest in the bidirectional EV charging startup dcbel. The firm introduced its "r16" Home Energy Station, a comprehensive sustainable energy system that includes solar energy, two-way charging for backup power, and an intelligent home energy management system. Moreover, In May 2023, Scania achieved a significant milestone by successfully implementing and testing a pilot megawatt charging system developed by ABB E-mobility. This achievement marks a crucial advancement in the creation of a high-power charging solution for heavy-duty vehicles, promising to cut charging times in half. The joint effort aims to facilitate rapid charging for commercial electric vehicles, offering substantial range improvements and bolstering the market for fossil-free heavy-duty vehicles. Further advancements in EV charging cables are expected to act as an opportunity for market growth.

Challenge: Mechanical and corrosive damages lowering the reliability of EV charging cables

The reliability of EV charging cables can be compromised by various factors, including mechanical and corrosive damages and the impacts of weathering and temperature fluctuations resulting from cyclic use. The charging cable, a crucial link between the charging station and the vehicle, is susceptible to wear and tear over time. Fraying or physical damage to the cable can lead to charging failures, while issues like loose connections, cable breaks, or faulty plugs can result in slow or unreliable charging. Mechanical problems, such as damaged components within the charging port or the use of incompatible cables, can further exacerbate these issues. Moreover, weathering impacts and temperature rises due to cyclic use can also contribute to the deterioration of EV charging cables. Exposure to varying weather conditions, such as extreme heat, cold, and moisture, can degrade the cable's insulation and protective layers over time. This can weaken the overall structural integrity of the cable and increase the risk of performance issues. Additionally, frequent and repetitive plugging and unplugging, coupled with the associated temperature changes during charging and discharging cycles, can lead to thermal stress and gradual degradation of the cable's materials. Addressing these multifaceted challenges is essential to ensure the long-term reliability and durability of EV charging cables. As the demand for electric vehicles and charging solutions continues to rise, industry stakeholders are actively working on innovative designs and materials to enhance the cable's resistance to mechanical wear, corrosive elements, weathering, and temperature fluctuations. The EV charging ecosystem aims to deliver a seamless and dependable charging experience for electric vehicle users worldwide by advancing these aspects.

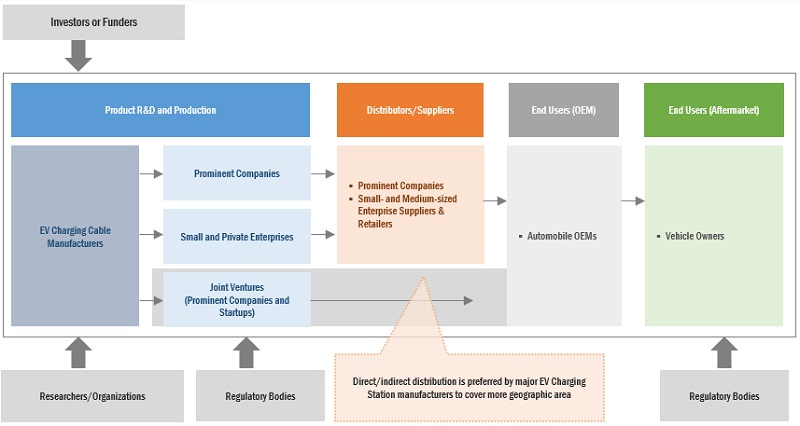

Market Ecosystem

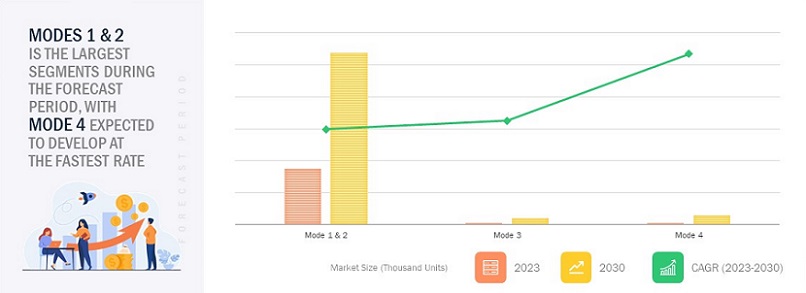

Mode 4 EV charging cables to be the fastest growing segment during forecast period

The mode 4 segment is expected to register the fastest rate during the forecast period, driven by the demand for swift DC charging solutions, particularly in dedicated charging stations for long-distance travel. Mode 4 includes DC fast charging. It works with varying charging rates, starting with portable 5 kW units to 50 kW and 150 kW, as well as upcoming 350- & 400-kW standards. This type of charging now provides DC (direct current) up to 200 amperes and is recommended for rapid charging of EVs. It consists of high charging capacity; thus, charging cables are required to handle the high current capacity of fast charging. Mode 4 charging cables are specifically used for DC charging, and the power is converted before being transferred to the vehicle. However, since this type of charging transfers a large amount of power directly to the battery, the cables need to be permanently connected to the charging station and are often liquid-cooled to handle the heat. In the United States, the deployment of Mode 4 EV charging stations has been supported by federal and state government incentives, such as tax credits and grants. China is currently the largest market for electric vehicles, and the government is investing heavily in charging infrastructure to support this growth. In Europe, there has been a push towards deploying ultra-fast charging stations, with many countries setting ambitious targets for the number of stations to be deployed in the coming years. For example, Germany has set a goal of having 1 million public charging stations by 2030, with 10,000 of them being ultra-fast charging stations. Overall, the deployment of Mode 4 EV charging stations is crucial to the growth and adoption of electric vehicles worldwide, and there have been significant developments and investments in this area in recent years.

Level 1 EV charging cable segment to hold largest market share during the forecast period

By charging level, the Level 1 segment is estimated to lead the market during the forecast period as the infrastructure required for Level 1 charging is less expensive than Level 2 and Level 3. Additionally, electric vehicles are typically sold with Level 1 chargers, which results in exponentially high sales of Level 1 charging cables. Considering the rapid sales of electric vehicles worldwide, the Level 1 segment is estimated to remain dominant in the market throughout the forecast period. 1 charging for most vehicles in the market requires 8 to 16 hours for complete charging, depending upon the size of the battery. Level 1 charging is used when the EV needs to be used for short distances. Such type of charging infrastructure costs the lowest among all charging types and is often subsidized by governments with various incentive schemes. Most EVs are equipped with Level 1 charging, which is easily accessible and cost-effective. For instance, in July 2023, Lectron, a prominent supplier of electric vehicle (EV) charging solutions, has unveiled its latest innovation – The Lectron Level 1 EV Charger to the needs of daily commuters by delivering convenient and straightforward charging solutions. Operating at a charging speed of up to 1.65 kW and drawing 15 Amps of current guarantees a dependable and consistent charging experience. Engineered with a NEMA 5-15 plug, it seamlessly connects to standard 110V outlets. Its portable and user-centric design renders it an ideal choice for those seeking on-the-move charging capabilities.

Asia Pacific to be the largest market for EV Charging Cables by value during the forecast period

The Asia Pacific region is expected to be the largest market for EV charging cables during the forecast period. The increasing adoption of electric vehicles in China and Japan is expected to drive the market. Major EV OEMs like BYD, NIO, and Hyundai, coupled with government subsidies and incentives in countries such as China, Japan, and South Korea, foster robust EV adoption and necessitate extensive charging infrastructure. Particularly in growing economies like India, where EV adoption is in its early stages but rapidly gaining traction, government initiatives like FAME-II and proactive measures from companies like Tata Motors and Mahindra Electric drive the demand for charging cables. Similarly, in June 2023, China has prolonged its tax exemption initiative for new energy vehicles (NEVs) until 2027, reaffirming its dedication to fostering the electric vehicle (EV) sector. This decision is anticipated to enhance domestic sales and sustain China's role as a prominent player in the global EV market. The extension offers stability and assistance to both consumers and manufacturers while also fostering potential foreign investment opportunities in the realm of electric mobility. These factors collectively position the Asia Pacific region as the epicenter of the burgeoning electric vehicle charging cables market.

Key Market Players

The EV charging cable market is dominated by Leoni AG (Germany), Aptiv (Ireland), TE Connectivity (Switzerland), BESEN International Group (China), Dyden Corporation (Japan), among others. These companies manufacturers EV charging cables. These companies have set up R&D facilities and offer best-in-class products to their customers.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2030 |

|

Forecast units |

Volume (Thousand Units) and Value (USD Million/Billion) |

|

Segments covered |

Diameter, Power Supply, Application, Cable Type, Charging Level, Shape, Jacket Material, Mode, Cable Length, Connector Type |

|

Geographies covered |

Asia Pacific, Europe, North America |

|

Companies Covered |

Leoni AG (Germany), Aptiv (Ireland), TE Connectivity (Switzerland), BESEN International Group (China), Dyden Corporation (Japan). |

This research report categorizes the electric vehicle charging cable market based on Diameter, Power Supply, Application, Cable Type, Charging Level, Shape, Jacket Material, Mode, Cable Length and Connector Type and Region.

Based on Diameter:

- <10 mm

- 10-20 mm

- >20 mm

Based on Power Supply:

- AC

- DC

Based on Application:

- Private

- Public

Based on Cable Type:

- Normal Charging Cable

- High-Power Charging Cable (HPC)

- Liquid-Cooled High-Power Charging Cable

Based on Charging Level:

- Level 1

- Level 2

- Level 3

Based on Shape:

- Straight

- Coiled

Based on Jacket Material:

- All Rubber

- Thermoplastic Elastomer (TPE)

- Polyvinyl Chloride (PVC)

Based on Mode:

- Mode 1 & 2

- Mode 3

- Mode 4

Based on Cable Length:

- 2-5 Meters

- 6-10 Meters

- >10 Meters

Based on Connector Type:

- Type1

- Type2

- CCS 1

- CCS 2

- CHADEMO

- GB/T

- NACS/Tesla

Based on the region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

North America

- US

- Canada

-

Europe

- Austria

- Denmark

- France

- Germany

- Netherlands

- Norway

- Spain

- Sweden

- Switzerland

- Italy

- UK

Recent Developments

- In April 2023, Leoni AG announced that it has changed its Business Group AM to the Automotive Cable Solutions (ACS) Division, underscoring the vital role of automotive cables within the company's cables segment. With a global network of ten facilities across seven countries and around 3,300 employees, ACS is a prominent supplier of standard automotive, special, and charging cables.

- In September 2022, Ravicab Cables Private Limited announced acquisition of Leoni Cable Solution India Private Limited (LCSI), Pune, a wholly-owned subsidiary of Leoni AG. This strategic move by Ravicab not only broadens its market presence but also extends its product offerings, establishing a seamless synergy with Ravicab's ambitious growth plans. The acquisition opens up exciting opportunities for investment and growth in the acquired business, setting the stage for a promising future in terms of development and expansion.

- In August 2022, Huber+Suhner partnered with South Korean EV charging system producer, SK Signet. Both companies will work together as part of this cooperation to further advance and encourage EV charging infrastructure innovation.

- In May 2022, Aptiv Plc announced its plan to acquire 85% of Intercable Automotive Solutions, a unit of Italy's Intercable. The deal, valued at USD 605.71 million, will grant Aptiv access to cutting-edge technology used in EVs. Intercable Automotive Solutions specializes in manufacturing high-voltage busbars capable of carrying substantially more electrical power than conventional cables. The unit operates manufacturing facilities in both Europe and Asia.

- In May 2022, Aptiv Plc announced its plan to acquire 85% of Intercable Automotive Solutions, a unit of Italy's Intercable. The deal, valued at USD 605.71 million, will grant Aptiv access to cutting-edge technology used in EVs. Intercable Automotive Solutions specializes in manufacturing high-voltage busbars capable of carrying substantially more electrical power than conventional cables. The unit operates manufacturing facilities in both Europe and Asia.

Frequently Asked Questions (FAQ):

What is the current size of the EV charging cable market by volume?

The current size of the EV charging cable market is estimated at 18,520 thousand units in 2023.

Who are the winners in the EV charging cable market?

The EV charging cable market is dominated by Leoni AG (Germany), Aptiv (Ireland), TE Connectivity (Switzerland), BESEN International Group (China), Dyden Corporation (Japan), among others. These companies manufacture EV charging cables, and offer best-in-class products to their customers.

Which region will have the fastest-growing market for EV charging cable market?

Asia Pacific will be the fastest-growing EV charging cable market region due to the increasing awareness of environmental sustainability, supportive government initiatives, and advancements in charging infrastructure.

What are the key technologies affecting the EV charging cable market?

The key technologies affecting the EV charging cable market are liquid cooling, smart charging, V2X integration, and automated charging robots.

Which companies provide EV charging cable for ultra-fast charging?

Companies such as Hubher+Sunher, Staubli, Phoenix Contact, among others, provide EV charging cables with ultra-fast charging capabilities.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rapidly growing EV sales- Government subsidies for installation of EV charging stations- Advancements in EV charging technologies to reduce charging time- Rising prices of gasoline- High charging efficiency of wired EV chargersRESTRAINTS- Emergence of wireless EV charging- High initial investments in EV fast-charging systemsOPPORTUNITIES- Development of advanced cables- Rapid integration of megawatt charging systemsCHALLENGES- Safety issues related to charging cables- Implications of mechanical and corrosive damages

-

5.3 ECOSYSTEM MAPPINGOEMSTIER I SUPPLIERSSOFTWARE PROVIDERSEV CHARGING PROVIDERSBATTERY MANUFACTURERS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 EV OFFERINGS BY LEADING OEMS

-

5.6 KEY STAKEHOLDERS AND BUYING CRITERIANORMAL CHARGING CABLESHIGH-POWER CHARGING CABLESKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.7 PRICING ANALYSIS

-

5.8 TECHNOLOGY ANALYSISLIQUID-COOLED EV CHARGING CABLESOPEN CHARGE POINT PROTOCOLV2X CHARGERSBIDIRECTIONAL CHARGERSSMART EV CHARGING SYSTEMSHANDSFREE EV CHARGING

-

5.9 PATENT ANALYSISINTRODUCTION

-

5.10 CASE STUDY ANALYSISWEIGHT REDUCTION FOR HIGH-VOLTAGE COMPONENTSDC FAST CHARGERS TO SUPPORT EXPANSION OF RIDE-HAILING FLEETOXGUL-E PROJECT — INNOVATIVE ON-STREET EV CHARGING SOLUTIONULTRA-FAST HIGH-POWER CHARGING WITH 3M’S LIQUID COOLING TECHNOLOGYDONCASTER CABLES — CERTIFICATE OF ASSESSED DESIGN FOR EV-ULTRA

-

5.11 TARIFF AND REGULATORY LANDSCAPENETHERLANDSGERMANYFRANCEUKCHINAUSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

- 5.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

-

5.14 EV CHARGING CABLE MARKET SCENARIOS, 2023–2030MOST LIKELY SCENARIOOPTIMISTIC SCENARIOPESSIMISTIC SCENARIO

-

6.1 INTRODUCTIONOPERATIONAL DATA

-

6.2 PRIVATE CHARGINGGROWING ADOPTION OF SUSTAINABLE VEHICLES TO DRIVE MARKET

-

6.3 PUBLIC CHARGINGSHIFT TO SUSTAINABLE TRANSPORTATION TO DRIVE MARKET

- 6.4 KEY PRIMARY INSIGHTS

- 7.1 INTRODUCTION

-

7.2 NORMAL CHARGING CABLEWIDESPREAD COMPATIBILITY AND ACCESSIBILITY OF NORMAL CHARGING CABLES FOR EVERYDAY EV CHARGING NEEDS TO DRIVE MARKET

-

7.3 HIGH-POWER CHARGING CABLEINCREASING DEMAND FOR FASTER CHARGING TIMES AND EXTENDED EV RANGE TO DRIVE MARKET

-

7.4 LIQUID-COOLED HIGH-POWER CHARGING CABLENEED FOR EFFICIENT HEAT MANAGEMENT AND REDUCED CABLE WEIGHT TO DRIVE MARKET

- 7.5 KEY PRIMARY INSIGHTS

- 8.1 INTRODUCTION

-

8.2 LEVEL 1CONVENIENCE FOR DAILY CHARGING NEEDS, COMPATIBILITY WITH STANDARD OUTLETS, AND SUITABILITY FOR ON-THE-GO CHARGING TO DRIVE MARKET

-

8.3 LEVEL 2RAPID CHARGING SPEED, CONVENIENCE FOR HOME USE, AND COMPATIBILITY WITH COMMON RESIDENTIAL ELECTRICAL OUTLETS TO DRIVE MARKET

-

8.4 LEVEL 3ULTRA-FAST CHARGING SPEED FOR QUICK AND CONVENIENT EV RECHARGING TO DRIVE MARKET

- 8.5 KEY PRIMARY INSIGHTS

-

9.1 INTRODUCTIONOPERATIONAL DATA

-

9.2 TYPE 1WIDE ACCEPTANCE ACROSS NORTH AMERICA AND JAPAN TO DRIVE MARKET

-

9.3 TYPE 2COMPATIBILITY WITH SEVERAL EV MODELS AND OFFICIAL CHARGING PLUGS IN EUROPE TO DRIVE MARKET

-

9.4 CCS1REDUCED DEMAND FOR CHADEMO IN NORTH AMERICA TO DRIVE MARKET

-

9.5 CCS2WIDESPREAD ACCEPTANCE BY MAJOR OEMS TO DRIVE MARKET

-

9.6 CHADEMOMARKET CONSOLIDATION IN EUROPE AND NORTH AMERICA FOR EV CHARGER PLUG TYPES TO DRIVE MARKET

-

9.7 GB/TADOPTION OF GB/T CONNECTORS AS NATIONAL STANDARD FOR EV CHARGING IN CHINA TO DRIVE MARKET

-

9.8 NACS/TESLA CONNECTORSCOMPATIBILITY WITH TESLA EVS AND LEADING OEMS PLANNING TO INCORPORATE NACS CONNECTORS IN NORTH AMERICA TO DRIVE MARKET

- 9.9 KEY PRIMARY INSIGHTS

-

10.1 INTRODUCTIONOPERATIONAL DATA

-

10.2 <10 MMABILITY TO PROVIDE HASSLE-FREE CHARGING TO DRIVE MARKET

-

10.3 10-20 MMABILITY TO CATER TO WIDE RANGE OF EVS TO DRIVE MARKET

-

10.4 >20 MMABILITY TO OFFER SWIFT RECHARGING TO DRIVE MARKET

- 10.5 KEY PRIMARY INSIGHTS

- 11.1 INTRODUCTION

- 11.2 ALL RUBBER JACKET

- 11.3 THERMOPLASTIC ELASTOMER (TPE) JACKET

- 11.4 POLYVINYL CHLORIDE (PVC) JACKET

-

12.1 INTRODUCTIONOPERATIONAL DATA

-

12.2 2-5 METERSCONVENIENT HOME CHARGING NEEDS AND COMPATIBILITY WITH SMALL SPACES TO DRIVE MARKET

-

12.3 6-10 METERSVERSATILITY AND CONVENIENCE FOR CHARGING AND ACCOMMODATING VARIOUS PARKING AND STATION SETUPS TO DRIVE MARKET

-

12.4 >10 METERSNEED FOR FLEXIBLE AND CONVENIENT CHARGING OPTIONS IN VARIOUS PARKING LAYOUTS TO DRIVE MARKET

- 12.5 KEY PRIMARY INSIGHTS

-

13.1 INTRODUCTIONOPERATIONAL DATA

-

13.2 MODE 1 & 2GROWING EV DEMAND AND EASE OF HOME CHARGING TO DRIVE MARKET

-

13.3 MODE 3DEMAND FOR DESTINATION AC PUBLIC AND SEMI-PUBLIC CHARGING TO DRIVE MARKET

-

13.4 MODE 4GROWING NEED FOR DC FAST CHARGING TO DRIVE MARKET

- 13.5 KEY PRIMARY INSIGHTS

-

14.1 INTRODUCTIONOPERATIONAL DATA

-

14.2 AC CHARGINGWIDESPREAD ADOPTION AND COMPATIBILITY WITH EXISTING ELECTRICAL INFRASTRUCTURE TO DRIVE MARKET

-

14.3 DC CHARGINGGROWING DEMAND FOR HIGH-POWER CHARGING TO DRIVE MARKET

- 14.4 KEY PRIMARY INSIGHTS

-

15.1 INTRODUCTIONOPERATIONAL DATA

-

15.2 STRAIGHTSIMPLE DESIGN AND LOWER COST TO DRIVE MARKET

-

15.3 COILEDSPACE-SAVING DESIGN TO DRIVE MARKET

- 15.4 KEY PRIMARY INSIGHTS

- 16.1 INTRODUCTION

-

16.2 ASIA PACIFICCHINA- Extensive charging infrastructure expansion to drive marketINDIA- Increasing demand for EVs and rising consumer awareness of sustainable transportation to drive marketJAPAN- Collaborative efforts between industry leaders and major OEMs for widespread charging station deployment to drive marketSOUTH KOREA- Government initiative on EV infrastructure development to drive market

-

16.3 EUROPEFRANCE- Government support to boost EV industry to drive marketGERMANY- Electrification plans by Leading German OEMs to drive marketNETHERLANDS- Rapid EV charging infrastructure deployment to drive marketNORWAY- Expansion of EV charging infrastructure to drive marketSWEDEN- Government’s focus on EV infrastructure for sustainable future to drive marketUK- Favorable government policies and new EV infrastructure commitments from charging providers to drive marketDENMARK- Increasing consumer awareness and collaboration between EV service providers to drive marketAUSTRIA- Rapid increase in EV adoption to drive marketSPAIN- Collaborations between OEMs and EV charging station providers to drive marketSWITZERLAND- Rapid expansion of EV infrastructure to drive marketITALY- Moderate shift to EVs to drive market

-

16.4 NORTH AMERICAUS- Presence of leading OEMs and charging station providers to drive marketCANADA- Government support to nurture EV charging infrastructure to drive market

- 17.1 OVERVIEW

- 17.2 MARKET RANKING ANALYSIS

- 17.3 REVENUE ANALYSIS

-

17.4 COMPETITIVE SCENARIOPRODUCT LAUNCHES/DEVELOPMENTSDEALSEXPANSIONSOTHER DEVELOPMENTS

-

17.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 17.6 SME EVALUATION MATRIX

- 17.7 COMPETITIVE BENCHMARKING

- 17.8 RIGHT TO WIN

-

18.1 KEY PLAYERSLEONI AG- Business overview- Products offered- Recent developments- MnM viewAPTIV PLC- Business overview- Products offered- Recent developments- MnM viewBESEN INTERNATIONAL GROUP- Business overview- Products offered- MnM viewDYDEN CORPORATION- Business overview- Products offered- MnM viewTE CONNECTIVITY- Business overview- Products offered- Recent developments- MnM viewBRUGG GROUP- Business overview- Products offeredSINBON ELECTRONICS- Business overview- Products offered- Recent developmentsCOROPLAST- Business overview- Products offered- Recent developmentsHUBER+SUHNER- Business overview- Products offered- Recent developmentsPHOENIX CONTACT- Business overview- Products offeredTEISON ENERGY TECHNOLOGY CO., LTD.- Business overview- Products offeredSYSTEMS WIRE AND CABLE- Business overview- Products offeredELAND CABLES- Business overview- Products offered- Recent developments

-

18.2 OTHER PLAYERSGENERAL CABLE TECHNOLOGIES CORPORATION (PRYSMIAN GROUP)EV CABLES LTD.MANLON POLYMERSCHENGDU KHONS TECHNOLOGY CO., LTD.ELKEM ASAALLWYN CABLESHWATEK WIRES AND CABLE CO., LTD.SHANGHAI MIDA EV POWER CO., LTD.

- 19.1 EVOLUTION OF EV CHARGING CABLE TECHNOLOGIES

- 19.2 ASIA PACIFIC TO BE KEY FOCUS AREA FOR EV CHARGING CABLE PROVIDERS

- 19.3 UPCOMING MEGAWATT CHARGING STATION DEMAND TO CREATE NEW OPPORTUNITIES FOR SPECIALIZED LIQUID-COOLED EV CHARGING CABLES

- 19.4 CONCLUSION

- 20.1 KEY INSIGHTS OF INDUSTRY EXPERTS

- 20.2 DISCUSSION GUIDE

- 20.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 20.4 CUSTOMIZATION OPTIONS

- 20.5 RELATED REPORTS

- 20.6 AUTHOR DETAILS

- TABLE 1 EV CHARGING CABLE MARKET DEFINITION, BY APPLICATION

- TABLE 2 MARKET DEFINITION, BY CHARGING LEVEL

- TABLE 3 MARKET DEFINITION, BY POWER SUPPLY

- TABLE 4 MARKET DEFINITION, BY SHAPE

- TABLE 5 MARKET DEFINITION, BY MODE

- TABLE 6 MARKET DEFINITION, BY DIAMETER

- TABLE 7 MARKET DEFINITION, BY CONNECTOR TYPE

- TABLE 8 MARKET DEFINITION, BY CABLE TYPE

- TABLE 9 MARKET DEFINITION, BY LENGTH

- TABLE 10 MARKET DEFINITION, BY JACKET MATERIAL

- TABLE 11 MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 12 CURRENCY EXCHANGE RATES

- TABLE 13 EV CHARGING STATION PLANS, BY COUNTRY

- TABLE 14 WIRELESS CHARGING VS. PLUG-IN CHARGING

- TABLE 15 EQUIPMENT AND INSTALLATION COSTS OF DC FAST CHARGERS

- TABLE 16 ROHS RESTRICTED SUBSTANCES IN GOODS

- TABLE 17 IMPACT OF MARKET DYNAMICS

- TABLE 18 MARKET: ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

- TABLE 20 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- TABLE 21 PATENT REGISTRATIONS

- TABLE 22 NETHERLANDS: EV INCENTIVES

- TABLE 23 NETHERLANDS: EV CHARGING STATION INCENTIVES

- TABLE 24 GERMANY: EV INCENTIVES

- TABLE 25 GERMANY: EV CHARGING STATION INCENTIVES

- TABLE 26 FRANCE: EV INCENTIVES

- TABLE 27 FRANCE: EV CHARGING STATION INCENTIVES

- TABLE 28 UK: EV INCENTIVES

- TABLE 29 UK: EV CHARGING STATION INCENTIVES

- TABLE 30 CHINA: EV INCENTIVES

- TABLE 31 CHINA: EV CHARGING STATION INCENTIVES

- TABLE 32 US: EV INCENTIVES

- TABLE 33 US: EV CHARGING STATION INCENTIVES

- TABLE 34 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 35 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 36 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 37 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 38 MARKET (MOST LIKELY), BY REGION, 2023–2030 (USD MILLION)

- TABLE 39 MARKET (OPTIMISTIC), BY REGION, 2023–2030 (USD MILLION)

- TABLE 40 MARKET (PESSIMISTIC), BY REGION, 2023–2030 (USD MILLION)

- TABLE 41 MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 42 MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 43 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 44 MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 45 LEADING EV PUBLIC AND PRIVATE CHARGING PROVIDERS WORLDWIDE

- TABLE 46 PRIVATE MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 47 PRIVATE MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 48 PRIVATE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 PRIVATE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 50 PUBLIC MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 51 PUBLIC MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 52 PUBLIC MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 PUBLIC MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 54 MARKET, BY CABLE TYPE, 2019–2022 (THOUSAND UNITS)

- TABLE 55 MARKET, BY CABLE TYPE, 2023–2030 (THOUSAND UNITS)

- TABLE 56 NORMAL MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 57 NORMAL MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 58 HIGH-POWER MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 59 HIGH-POWER MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 60 LIQUID-COOLED HIGH-POWER MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 61 LIQUID-COOLED HIGH-POWER MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 62 CHARGING CABLES BY LEVEL OF CHARGING

- TABLE 63 MARKET, BY CHARGING LEVEL, 2019–2022 (THOUSAND UNITS)

- TABLE 64 MARKET, BY CHARGING LEVEL, 2023–2030 (THOUSAND UNITS)

- TABLE 65 LEVEL 1: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 66 LEVEL 1: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 67 LEVEL 2: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 68 LEVEL 2: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 69 TIME TAKEN BY DC FAST CHARGER TO CHARGE VEHICLES

- TABLE 70 LEVEL 3: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 71 LEVEL 3: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 72 MARKET, BY CONNECTOR TYPE, 2019–2022 (THOUSAND UNITS)

- TABLE 73 MARKET, BY CONNECTOR TYPE, 2023–2030 (THOUSAND UNITS)

- TABLE 74 GLOBAL ACCEPTANCE OF EV CHARGING CONNECTORS

- TABLE 75 TYPE 1: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 76 TYPE 1: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 77 TYPE 2: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 78 TYPE 2: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 79 CCS1: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 80 CCS1: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 81 CCS2: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 82 CCS2: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 83 CHADEMO: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 84 CHADEMO: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 85 GB/T: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 86 GB/T: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 87 NACS/TESLA CONNECTORS: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 88 NACS/TESLA CONNECTORS: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 89 MARKET, BY DIAMETER, 2019–2022 (THOUSAND UNITS)

- TABLE 90 MARKET, BY DIAMETER, 2023–2030 (THOUSAND UNITS)

- TABLE 91 EV CHARGING CABLE USAGE, BY DIAMETER, OFFERED BY LEONI AG

- TABLE 92 <10 MM: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 93 <10 MM: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 94 10-20 MM: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 95 10-20 MM: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 96 >20 MM: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 97 >20 MM: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 98 CHARACTERISTICS AND BENEFITS OF CABLE JACKET

- TABLE 99 COMPARISON OF EV CHARGING CABLE JACKET MATERIALS

- TABLE 100 MARKET, BY LENGTH, 2019–2022 (THOUSAND UNITS)

- TABLE 101 MARKET, BY LENGTH, 2023–2030 (THOUSAND UNITS)

- TABLE 102 LENGTH OF CHARGING CABLES PROVIDED WITH NEW ELECTRIC CARS

- TABLE 103 2-5 METERS: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 104 2-5 METERS: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 105 6-10 METERS: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 106 6-10 METERS: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 107 >10 METERS: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 108 >10 METERS: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 109 MARKET, BY MODE, 2019–2022 (THOUSAND UNITS)

- TABLE 110 MARKET, BY MODE, 2023–2030 (THOUSAND UNITS)

- TABLE 111 CHARGING CABLE SPECIFICATIONS

- TABLE 112 MODE 1 & 2: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 113 MODE 1 & 2: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 114 MODE 3: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 115 MODE 3: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 116 MODE 4: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 117 MODE 4: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 118 MARKET, BY POWER SUPPLY, 2019–2022 (THOUSAND UNITS)

- TABLE 119 MARKET, BY POWER SUPPLY, 2023–2030 (THOUSAND UNITS)

- TABLE 120 GLOBAL PROVIDERS OF EV CHARGING CABLES

- TABLE 121 AC: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 122 AC: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 123 DC: MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 124 DC: MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 125 MARKET, BY SHAPE, 2019–2022 (THOUSAND UNITS)

- TABLE 126 MARKET, BY SHAPE, 2023–2030 (THOUSAND UNITS)

- TABLE 127 PRODUCERS OF EV CABLES WORLDWIDE

- TABLE 128 STRAIGHT MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 129 STRAIGHT MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 130 COILED MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 131 COILED MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 132 MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 133 MARKET, BY REGION, 2023–2030 (THOUSAND UNITS)

- TABLE 134 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 135 MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (THOUSAND UNITS)

- TABLE 137 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2030 (THOUSAND UNITS)

- TABLE 138 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 140 CHINA: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 141 CHINA: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 142 CHINA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 143 CHINA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 144 INDIA: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 145 INDIA: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 146 INDIA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 147 INDIA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 148 JAPAN: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 149 JAPAN: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 150 JAPAN: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 151 JAPAN: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 152 SOUTH KOREA: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 153 SOUTH KOREA: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 154 SOUTH KOREA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 155 SOUTH KOREA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 156 EUROPE: MARKET, BY COUNTRY, 2019–2022 (THOUSAND UNITS)

- TABLE 157 EUROPE: MARKET, BY COUNTRY, 2023–2030 (THOUSAND UNITS)

- TABLE 158 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 159 EUROPE: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 160 FRANCE: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 161 FRANCE: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 162 FRANCE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 163 FRANCE: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 164 GERMANY: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 165 GERMANY: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 166 GERMANY: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 167 GERMANY: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 168 NETHERLANDS: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 169 NETHERLANDS: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 170 NETHERLANDS: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 171 NETHERLANDS: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 172 NORWAY: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 173 NORWAY: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 174 NORWAY: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 175 NORWAY: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 176 SWEDEN: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 177 SWEDEN: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 178 SWEDEN: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 179 SWEDEN: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 180 RAPID CHARGING DEPLOYMENT PLANS IN UK

- TABLE 181 DESTINATION AND ON-STREET CHARGING IN UK

- TABLE 182 UK: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 183 UK: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 184 UK: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 185 UK: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 186 DENMARK: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 187 DENMARK: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 188 DENMARK: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 189 DENMARK: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 190 AUSTRIA: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 191 AUSTRIA: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 192 AUSTRIA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 193 AUSTRIA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 194 SPAIN: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 195 SPAIN: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 196 SPAIN: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 197 SPAIN: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 198 SWITZERLAND: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 199 SWITZERLAND: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 200 SWITZERLAND: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 201 SWITZERLAND: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 202 ITALY: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 203 ITALY: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 204 ITALY: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 205 ITALY: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 206 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (THOUSAND UNITS)

- TABLE 207 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (THOUSAND UNITS)

- TABLE 208 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 209 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 210 US: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 211 US: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 212 US: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 213 US: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 214 CANADA: MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 215 CANADA: MARKET, BY APPLICATION, 2023–2030 (THOUSAND UNITS)

- TABLE 216 CANADA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 217 CANADA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 218 PRODUCT LAUNCHES/DEVELOPMENTS, 2020–2023

- TABLE 219 DEALS, 2020–2023

- TABLE 220 EXPANSIONS, 2020–2023

- TABLE 221 OTHER DEVELOPMENTS, 2020–2023

- TABLE 222 MARKET: COMPANY FOOTPRINT, 2023

- TABLE 223 MARKET: APPLICATION FOOTPRINT, 2023

- TABLE 224 MARKET: REGIONAL FOOTPRINT, 2023

- TABLE 225 MARKET: LIST OF KEY PLAYERS

- TABLE 226 RIGHT TO WIN, 2020–2023

- TABLE 227 LEONI AG: COMPANY OVERVIEW

- TABLE 228 LEONI AG: CABLES OFFERED WITH DIFFERENT GLOBAL STANDARDS

- TABLE 229 LEONI AG: CHARGING CABLE SOLUTIONS OFFERED (STRAIGHT VERSIONS)

- TABLE 230 LEONI AG: PRODUCTS OFFERED

- TABLE 231 LEONI AG: PRODUCT DEVELOPMENTS

- TABLE 232 LEONI AG: DEALS

- TABLE 233 LEONI AG: OTHERS

- TABLE 234 APTIV PLC: COMPANY OVERVIEW

- TABLE 235 APTIV PLC: PRODUCTS OFFERED

- TABLE 236 APTIV PLC: DEALS

- TABLE 237 APTIV PLC: OTHERS

- TABLE 238 BESEN INTERNATIONAL GROUP: COMPANY OVERVIEW

- TABLE 239 BESEN INTERNATIONAL GROUP: EV CHARGING CABLE COMPARISON

- TABLE 240 BESEN INTERNATIONAL GROUP: PRODUCTS OFFERED

- TABLE 241 DYDEN CORPORATION: COMPANY OVERVIEW

- TABLE 242 DYDEN CORPORATION: MAJOR CUSTOMERS

- TABLE 243 DYDEN CORPORATION: REGIONAL EV CHARGING CABLE SPECIFICATIONS

- TABLE 244 DYDEN CORPORATION: PRODUCTS OFFERED

- TABLE 245 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 246 TE CONNECTIVITY: MAJOR CUSTOMERS

- TABLE 247 TE CONNECTIVITY: EV CHARGING CABLE COMPARISON

- TABLE 248 TE CONNECTIVITY: PRODUCTS OFFERED

- TABLE 249 TE CONNECTIVITY: OTHERS

- TABLE 250 BRUGG GROUP: COMPANY OVERVIEW

- TABLE 251 BRUGG GROUP: EV CHARGING CABLE COMPARISON

- TABLE 252 BRUGG GROUP: PRODUCTS OFFERED

- TABLE 253 SINBON ELECTRONICS: COMPANY OVERVIEW

- TABLE 254 SINBON ELECTRONICS: EV CHARGING CABLE COMPARISON

- TABLE 255 SINBON ELECTRONICS: PRODUCTS OFFERED

- TABLE 256 SINBON ELECTRONICS: OTHERS

- TABLE 257 COROPLAST: COMPANY OVERVIEW

- TABLE 258 COROPLAST: EV CHARGING CABLE COMPARISON

- TABLE 259 COROPLAST: PRODUCTS OFFERED

- TABLE 260 COROPLAST: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 261 COROPLAST: DEALS

- TABLE 262 COROPLAST: OTHERS

- TABLE 263 HUBER+SUHNER: COMPANY OVERVIEW

- TABLE 264 HUBER+SUHNER: EV CHARGING CABLE COMPARISON

- TABLE 265 HUBER+SUHNER: PRODUCTS OFFERED

- TABLE 266 HUBER+SUHNER: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 267 HUBER+SUHNER: DEALS

- TABLE 268 PHOENIX CONTACT: COMPANY OVERVIEW

- TABLE 269 PHOENIX CONTACT: EV CHARGING CABLE COMPARISON

- TABLE 270 PHOENIX CONTACT: PRODUCTS OFFERED

- TABLE 271 TEISON ENERGY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 272 TEISON ENERGY TECHNOLOGY CO., LTD.: CERTIFICATIONS

- TABLE 273 TEISON ENERGY TECHNOLOGY CO., LTD.: EV CHARGING CABLE COMPARISON

- TABLE 274 TEISON ENERGY TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 275 SYSTEMS WIRE AND CABLE: COMPANY OVERVIEW

- TABLE 276 SYSTEMS WIRE AND CABLE: PRODUCTS OFFERED

- TABLE 277 ELAND CABLES: COMPANY OVERVIEW

- TABLE 278 ELAND CABLES: PRODUCTS OFFERED

- TABLE 279 ELAND CABLES: PRODUCT DEVELOPMENTS

- TABLE 280 GENERAL CABLE TECHNOLOGIES CORPORATION (PRYSMIAN GROUP): COMPANY OVERVIEW

- TABLE 281 EV CABLES LTD.: COMPANY OVERVIEW

- TABLE 282 MANLON POLYMERS: COMPANY OVERVIEW

- TABLE 283 CHENGDU KHONS TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 284 ELKEM ASA: COMPANY OVERVIEW

- TABLE 285 ALLWYN CABLES: COMPANY OVERVIEW

- TABLE 286 HWATEK WIRES AND CABLE CO., LTD.: COMPANY OVERVIEW

- TABLE 287 SHANGHAI MIDA EV POWER CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 EV CHARGING CABLE MARKET SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- FIGURE 4 KEY INDUSTRY INSIGHTS

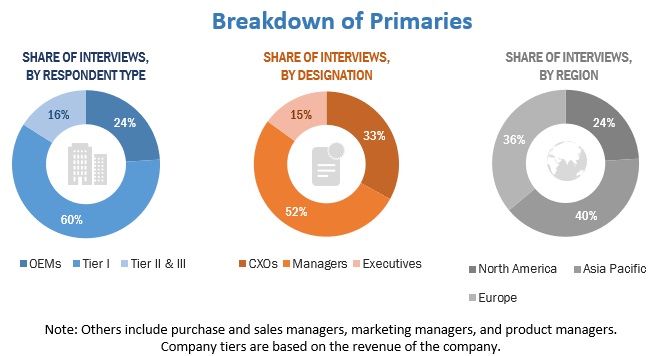

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

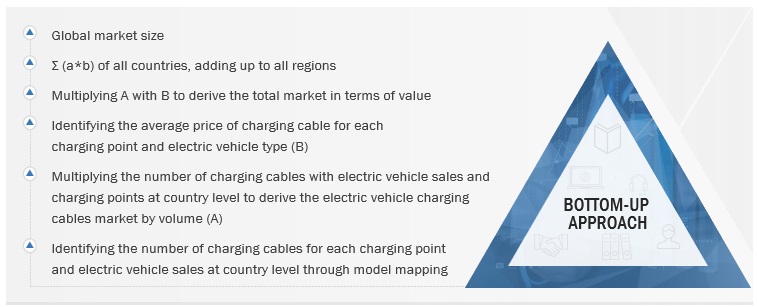

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

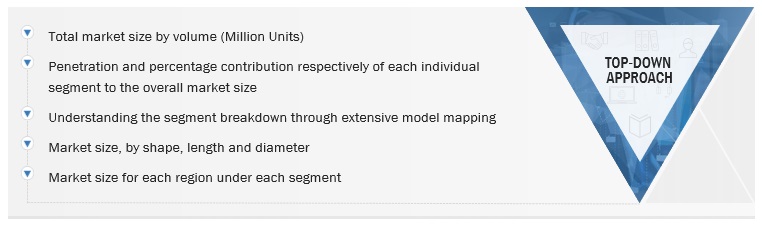

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 MARKET ESTIMATION NOTES

- FIGURE 10 MARKET: DATA TRIANGULATION

- FIGURE 11 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 12 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- FIGURE 13 MARKET OVERVIEW

- FIGURE 14 MARKET, BY REGION, 2023 VS. 2030

- FIGURE 15 MARKET PERFORMANCE IN 2023

- FIGURE 16 MODE 4 SEGMENT TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 LEVEL 1 TO BE LARGEST CHARGING SEGMENT OF MARKET

- FIGURE 18 GROWING EV ADOPTION AND RAPID EV CHARGING STATION DEPLOYMENT TO DRIVE MARKET

- FIGURE 19 PUBLIC SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 20 LEVEL 1 TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 21 DC SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 22 MODE 1 & 2 SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 23 COILED SEGMENT TO REGISTER FASTER GROWTH DURING FORECAST PERIOD

- FIGURE 24 2-5 METERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 25 LESS THAN 20 MM SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 26 EV CHARGING CABLES WITH GB/T CONNECTOR COMPATIBILITY TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 27 NORMAL CHARGING CABLE TO BE LARGEST CABLE TYPE DURING FORECAST PERIOD

- FIGURE 28 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 MARKET DYNAMICS

- FIGURE 30 CURRENT STATE OF ZEV SALE TARGETS

- FIGURE 31 GLOBAL EV SHIFT TARGETS

- FIGURE 32 TYPES OF EV CHARGING STATIONS

- FIGURE 33 AVERAGE PETROL PRICES, BY COUNTRY, 2021–2023

- FIGURE 34 OPERATING COST OF EVS VS. ICE VEHICLES

- FIGURE 35 CHARGING EFFICIENCY OF WIRED AND WIRELESS CHARGERS

- FIGURE 36 MEGAWATT CHARGING CABLE PROVIDERS

- FIGURE 37 CAUSES OF EV CHARGING CABLE FAILURE

- FIGURE 38 MARKET: ECOSYSTEM MAPPING

- FIGURE 39 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- FIGURE 41 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- FIGURE 42 AVERAGE SELLING PRICE OF EV CHARGING CABLES, BY APPLICATION, 2023

- FIGURE 43 AVERAGE SELLING PRICE OF EV CHARGING CABLES, BY APPLICATION, 2030

- FIGURE 44 AVERAGE SELLING PRICE OF EV CHARGING CABLES, 2022

- FIGURE 45 LIQUID-COOLED EV CHARGING CONNECTOR

- FIGURE 46 OPEN CHARGE POINT PROTOCOL

- FIGURE 47 PARTS OF V2X (VEHICLE TO EVERYTHING)

- FIGURE 48 BIDIRECTIONAL EV CHARGING ENERGY FLOW

- FIGURE 49 SMART EV CHARGING SYSTEMS

- FIGURE 50 PUBLICATION TRENDS, 2013–2023

- FIGURE 51 TOP PATENT APPLICANTS

- FIGURE 52 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- FIGURE 53 FUTURE TRENDS AND SCENARIO, 2023–2030 (USD MILLION)

- FIGURE 54 MARKET, BY APPLICATION, 2023 VS. 2030

- FIGURE 55 COMPARISON OF DIFFERENT TYPES OF DC FAST CHARGING

- FIGURE 56 LIQUID-COOLED HIGH-POWER CHARGING CABLE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 57 LEVEL 3 SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 58 TYPES OF EV CHARGER CONNECTORS

- FIGURE 59 CCS1 TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 60 MARKET, BY DIAMETER, 2023–2030

- FIGURE 61 MARKET, BY CABLE LENGTH, 2023–2030

- FIGURE 62 MODE 4 SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 63 DC SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 64 COILED CHARGING CABLE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 65 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 66 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 67 EV POLICIES IN INDIAN STATES

- FIGURE 68 EV SUBSIDIES IN SOUTH KOREA

- FIGURE 69 EUROPE: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- FIGURE 70 GERMANY EV ROADMAP

- FIGURE 71 UK EV ROADMAP

- FIGURE 72 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 73 MARKET RANKING ANALYSIS, 2023

- FIGURE 74 TOP PUBLIC/LISTED PLAYERS DOMINATING MARKET DURING LAST 5 YEARS (2018–2022)

- FIGURE 75 MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 76 MARKET: SME EVALUATION MATRIX, 2023

- FIGURE 77 LEONI AG: COMPANY SNAPSHOT

- FIGURE 78 APTIV PLC: COMPANY SNAPSHOT

- FIGURE 79 APTIV PLC: COMPANY 2030 VISION

- FIGURE 80 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 81 TE CONNECTIVITY: TYPES OF CHARGING

- FIGURE 82 BRUGG GROUP: COMPANY SNAPSHOT

- FIGURE 83 BRUGG GROUP: SUBSIDIARIES

- FIGURE 84 SINBON ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 85 SINBON ELECTRONICS: GLOBAL FOOTPRINT

- FIGURE 86 SINBON ELECTRONICS: SOLUTIONS FOR VEHICLES

- FIGURE 87 HUBER+SUHNER: COMPANY SNAPSHOT

- FIGURE 88 HUBER+SUHNER: COMPANY PERFORMANCE

The study involved four major activities in estimating the current size of the EV charging cable market. Exhaustive secondary research was done to collect information on the market, the peer market, and the child markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of electric vehicle manufacturers, International Energy Agency (IEA), Alternative Fuel Data Center (AFDC), European Alternate Fuels Observatory (EAFO), Federal Transit Administration (FTA), Regional Transportation Authority (RTA), country-level vehicle associations and trade organizations, and the US Department of Transportation (DOT)], EV related magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, government organizations websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global EV charging cable market.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across four major regions, namely, Asia Pacific, Europe, North America. Approximately 25% and 75% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total market size. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of volume, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

EV charging cable are an essential component of the EV charging infrastructure and are used to connect electric vehicles to charging stations or power sources for recharging the vehicle's battery. The market for EV charging cables revolves around the production and distribution of essential components that facilitate the charging of electric vehicles. It is closely tied to the broader EV ecosystem and is influenced by technological advancements, regulatory requirements, and market trends.

List of Key Stakeholders

- Distributors and Retailers

- EV Charging Equipment Providers

- Electric Vehicle Manufacturers

- EV Charging Network Operators

- Governments and Regulatory Bodies

- Utilities and Energy Providers

- Fleet Operators

- EV Owners and Consumers

- Standards Organizations

- Research and Development Institutions

- Maintenance and Service Providers

- Automotive Dealerships

- Real Estate Developers and Property Managers

- Environmental Organizations

Report Objectives

- To segment and forecast the EV charging cable market size in terms of volume (thousand units) and value (USD Million).

- To define, describe, and forecast the market based on Diameter, Power Supply, Application, Cable Type, Charging Level, Shape, Jacket Material, Mode, Cable Length and Connector Type and Region.

- To segment the market and forecast its size, by volume, based on region (Asia Pacific, Europe, North America)

- To segment and forecast the market size by application (public and private)

- To segment and forecast the market size by charging level (level 1, level 2, and level 3)

- To segment and forecast the market size by shape (straight and coiled)

- To segment and forecast the market size by power supply (AC and DC)

- To segment and forecast the market size by jacket material (all rubber, thermoplastic elastomer (TPE), and polyvinyl chloride (PVC))

- To segment and forecast the market size by mode (mode 1 & 2, mode 3, and mode 4)

- To segment and forecast the market size by cable length (2-5 meters, 6-10 meters, and

- >10 meters)

- To segment and forecast the market size by diameter (less than 10 mm, 10 to 20 mm, and above 20 mm)

- To segment and forecast the market size by cable type (Normal Charging Cable. High-Power Charging Cable, Liquid-Cooled High-Power Charging Cable)

- To segment and forecast the market size by connector type (Type1, Type2, CCS 1, CCS 2, CHADEMO, GB/T, NACS/Tesla)

- To analyze the technological developments impacting the EV charging cable market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as deals, new product developments, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- EV charging cables market, by charging level, at the country level (for countries covered in the report)

- EV charging cables market, by mode, at the country level (for countries covered in the report)

Company Information

- Profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in EV Charging Cable Market