Face Mask Market by Nature (Disposable, Reusable), Material Type, Type (Surgical, Respirator), End-Use, Distribution Channel (Pharmacy & Drug Stores, Supermarket & Hypermarket, Specialty Stores, E-commerce) and Region - Global Forecast to 2027

Updated on : September 02, 2025

Face Mask Market

The global face mask market was valued at USD 25.1 billion in 2022 and is projected to reach USD 3.0 billion by 2027, growing at -34.5% cagr from 2022 to 2027. The market is witnessing immense growth in demand primarily due to the COVID-19 pandemic. This has led to a rise in consumer awareness pertaining to importance of use of face masks. Moreover, the surge in social media marketing encouraging consumers to adopt wearing personal protective equipment such as face masks is helping market growth.

Face Mask Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Face mask Market

The COVID-19 pandemic has had a positive effect on the face mask market. Face masks are primarily used as a personal protective equipment to prevent or slow down the transmission of viruses such as SARS-CoV-2. Hence, these face masks have been employed as a public and personal health control measure. The COVID-19 pandemic has had a debilitating effect on overall manufacturing, supply chain and logistics across the world. The various impacts of COVID-19 are as follows:

- The World Health Organization estimates that overall face mask production needs to be increased by 40% to meet the global shortage. The pandemic has already spread to over 213 countries which has caused many governments to ban exports of personal protective equipment including face masks. As a result, many companies are making additional efforts to bridge the gap between supply and demand of these face masks.

- In May 2020, over 75 countries had mandated the use of face masks and approximately 88% of the world population lived in countries that recommended use of face masks in public settings.

Face Mask Market Dynamics

Driver: Surge in social media marketing

Many social meda platforms and smartphone applications have tried to create a positive environment towards wearing face masks in public and community settings to help prevent the transmission of the SARS-CoV-2 virus. Social media giant, Facebook, is already working in tandem with the World Health Organization and is providing free advertising space to help create awareness about the COVID-19 pandemic. The company has modified the user interface of social media platforms such as Facebook and Instagram by placing alerts on top of the feeds section, reminding users to wear face masks and also providing additional tips to stem the transmission of COVID-19. These tips are recommendations of the US CDC and thus are extremely helpful for users.

Restraint: Volatility in raw material prices

Volatile raw material prices are one of the major restraints stemming the full growth of the face mask market. Face masks are made from nonwoven materials, metal strips and ear loops which are in turn derived from the oil & gas sector and the mining industry. Disruptions in supply chain, and low manufacturing output affected the flow of raw materials in the early part of 2020 however, such disruptions have continued to plague market prices even in 2021. Such fluctuating prices of raw materials have had a detrimental impact on cash flows, profitability and earnings of companies present in the face mask market.

Opportunity: Growing healthcare industry in emerging economies

Developing nations and economies such as China, Brazil, India, and South Africa are expected to provide massive growth opportunities for companies of the face mask market. Increasing aging population, high patient volumes, rising per capita income, and awareness to maintain health & hygiene are some of the variables that are helping the face mask market to grow in these countries. Companies are expected to capitalize on these developments and improve their geographic reach to gain additional revenue.

Challenge: Volatility in production

One of the commonly used nonwoven materials used for fabricating face masks is polypropylene (PP). A specialized version of the material known as electric melt-blown polypropylene is produced by only a handful of companies across the globe. To produce this material, companies have a high initial investment along with capital expenditure as specialized machineries such as hoppers, extruders and melt spinning systems are needed. Such specialized equipment and high capital expenditure pose as challenges to new entrants in the face mask market.

Face Mask Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

The other face masks, in by type segment of the face mask market is projected to grow at a significant CAGR during the forecast period.

Other face masks include dust, fashion and pitta masks. Countries such as Japan, China, India and the US extensively use pitta masks as a preventive measure against dust and pollution. However, the COVID-19 pandemic related shortages in face masks has compelled users to adopt using dust, fashion and pitta masks as a means of personal protection against transmission of SARS-CoV-2 virus.

Reusable face masks are projected to witness robust growth in by nature segment of the face mask market type in terms of value during the forecast period.

The reusable face mask segment is projected to witness the maximum growth in the market during the forecast period. Shortage of disposable face masks, affordability and ease of use has resulted in massive adoption of resuable face masks in 2020 and 2021. This demand is projected to continue during the forecast period as people are expected to shift to reusable masks as the pandemic subsides.

The Hospitals & Clinics end-use industry segment is estimated to witness promising growth in the face mask market.

Hospitals & clinics are the primary users of respirators, and surgical masks as these personal protective equipment help to prevent the inhalation of bacteria and viruses. Mandatory use of face masks in hospitals & clinics are part of the infection control strategy and help in elimination of cross-contamination between patients and the nursing staff. Moreover, with increase in spread of the pandemic there is likelihood of additional demand for face masks for use in hospital & clinics.

Asia Pacific accounted for the largest share of the face mask market in 2021.

Asia Pacific region accounts for the maximum population of the world. Developing economies such as India and developed countries like China are continuously improving their healthcare infrastructure to support the aging population. Moreover countries like Japan have rising geriatric population which directly stems for the need of superior healthcare infrastructure. Countries present in this region have also been expanding their economies in recent years leading to growing per capital income, and increased disposable income. All these factors are expected to boost the face mask market during the forecast period.

Face Mask Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 25.1 Billion |

|

Revenue Forecast in 2027 |

USD 3.0 Billion |

|

CAGR |

-34.5% |

|

Market Size Availability for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million and USD Billion) |

|

Segments Covered |

Material Type, Type, Nature, End-Use,Distribution Channel and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include 3M Company (US), Honeywell International Inc. (US), Kimberly-Clark Corporation (US), Cardinal Health, Inc. (US), Owens & Minor, Inc. (US), Alpha Pro Tech, Ltd. (Canada), Ambu A/S (Denmark), Cantel Medical Corp. (US), Shanghai Dasheng Health Products Manufacture Co., Ltd (China), Foss Performance Materials, LLC (US) and Medline Industries, Inc. (US). |

This research report categorizes the Face Mask Market based on material type, type, nature, end-use, distribution channel and region.

Based on Material Type, the face mask market has been segmented as follows:

- Polypropylene (PP)

- Polyurethane

- Polyester

- Cotton

-

Others

- Flexible PVC

- PET

- Rubber

- Silicon

Based on Type, the face mask market has been segmented as follows:

-

Surgical

- ASTM 1

- ASTM 2

- ASTM 3

-

Respirator

- N-Series

- R-Series

- P-Series

- Procedure

-

Others

- Dust mask

- Fashion mask

- PITTA mask

Based on Nature' the face mask market has been segmented as follows:

- Disposable

- Reusable

Based on End Use, the face mask market has been segmented as follows:

- Hospitals & Clinics

- Industrial & Institutional

- Personal/Individual Protection

Based on Distribution Channel, the face mask market has been segmented as follows:

- Pharmacy & Drug Stores

- Supermarket & Hypermarket

- Specialty Stores

- E-commerce

Based on Region, the face mask market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Face Mask Market Players

3M Company (US), Honeywell International Inc. (US), Kimberly-Clark Corporation (US), Cardinal Health, Inc. (US), Owens & Minor, Inc. (US), Alpha Pro Tech, Ltd. (Canada), Ambu A/S (Denmark), Cantel Medical Corp. (US), Shanghai Dasheng Health Products Manufacture Co., Ltd (China), Medline Industries, Inc. (US), Mölnlycke Health Care AB (Sweden), Prestige Ameritech (US), Makrite (Taiwan), CNTUS-SUNGJIN Co., Ltd. (South Korea), Foss Performance Materials, LLC (US), and Irema Ireland (Ireland) are some of the leading players operating in the market.

Recent Developments

- In April 2021, Cardinal Health Inc. increased the production of gowns, surgical and procedural masks for the North America region by expanding their production line. As a result, the company will now be able to produce additional surgical and procedural masks by 150 million units. The company has also increased its safety needle production capacity by 15 million units.

- sIn February 2020, Alpha Pro Tech Ltd. announced an increase in production of their N-95 respirator masks in response to immense market demand. The company as a result has expanded its production facilities at Salt Lake City, Utah and will now be able to make additional N-95 respirator masks.

Frequently Asked Questions (FAQ):

How big is the Face Mask Market?

Face Mask Market worth $3.0 billion by 2027.

What is the growth rate of Face Mask Market?

Face Mask Market grows at a CAGR of -34.5% during the forecast period.

What is a face mask?

According to the Centers for Disease Control and Prevention (CDC) (US), a face mask is a product covering the wearer’s nose and mouth. It is affixed to the head with straps that go around the ears, head or both. The prime objective of a face mask is to protect the wearer from particles or from liquid contaminating the face.

Which are the key companies operating in the market?

Companies such as 3M Company (US), Honeywell International Inc. (US), Kimberly-Clark Corporation (US), Cardinal Health, Inc. (US), Owens & Minor, Inc. (US), Alpha Pro Tech, Ltd. (Canada), Ambu A/S (Denmark), and Cantel Medical Corp. (US) are key companies operating in this market.

What is a key strategy adopted by the market players?

One of the most important differentiating factors providing a competitive edge to companies in the market is the extensive adoption of strategies such as expansions, acquisitions, and partnerships, which gives them a head start in enhancing their presence in the evolving market.

What is the COVID-19 impact on face mask market?

COVID-19 outbreak is expected to have a major positive impact on the global demand for face mask. The outbreak and the spread of the COVID-19 has led to tremendous increase in the production of face masks across the world, as these masks are used as prevention equipment against the spread of the COVID-19 virus. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 FACE MASK MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

TABLE 2 MARKET, BY END-USE INDUSTRY: INCLUSIONS & EXCLUSIONS

TABLE 3 MARKET, BY NATURE: INCLUSIONS & EXCLUSIONS

TABLE 4 MARKET, BY DISTRIBUTION CHANNEL: INCLUSIONS & EXCLUSIONS

TABLE 5 MARKET, BY MATERIAL TYPE: INCLUSIONS & EXCLUSIONS

TABLE 6 MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 FACE MASK MARKET SEGMENTATION

FIGURE 2 MARKET: REGIONS COVERED

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 3 FACE MASK MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 List of participating companies for primary research

2.1.2.3 Key industry insights

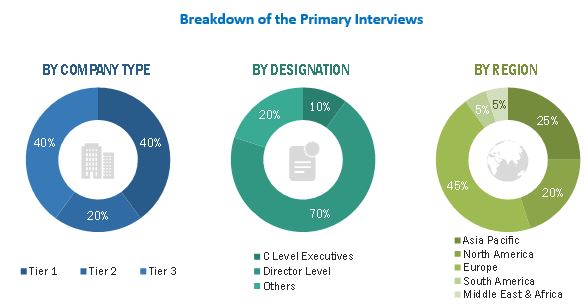

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 BASE NUMBER CALCULATION

FIGURE 6 MARKET SIZE ESTIMATION (DEMAND-SIDE): FACE MASK MARKET

FIGURE 7 CHINA & INDIA - FACE MASK MARKET, BY RESPIRATOR TYPE (2021)

2.4 DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 48)

TABLE 7 FACE MASK MARKET SNAPSHOT, 2022 & 2027

FIGURE 8 SURGICAL SEGMENT ACCOUNTED FOR LARGEST SHARE OF OVERALL FACE MASK MARKET IN 2021

FIGURE 9 DISPOSABLE NATURE SEGMENT ACCOUNTED FOR LARGER SHARE OF MARKET IN 2021

FIGURE 10 PERSONAL/INDIVIDUAL PROTECTION END-USE INDUSTRY ACCOUNTED FOR LARGEST SHARE OF FACE MASK MARKET IN 2021

FIGURE 11 PHARMACY & DRUG STORES SEGMENT ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2021

FIGURE 12 ASIA PACIFIC EXPECTED TO LEAD MARKET FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN FACE MASK MARKET

FIGURE 13 OUTBREAK OF COVID-19 DRIVING FACE MASK MARKET

4.2 FACE MASK MARKET, BY REGION

FIGURE 14 MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4.3 ASIA PACIFIC MARKET, BY TYPE & COUNTRY

FIGURE 15 RESPIRATOR SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF ASIA PACIFIC FACE MASK MARKET IN 2022

4.4 FACE MASK MARKET, BY MAJOR COUNTRIES

FIGURE 16 FACE MASK MARKET IN INDIA PROJECTED TO WITNESS HIGHEST CAGR FROM 2019 TO 2022

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 FACE MASK MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Outbreak of COVID-19 pandemic

TABLE 8 FACE MASK MANDATES, BY COUNTRY

FIGURE 18 ESTIMATED GROWTH IN PRODUCTION OF MEDICAL PERSONAL PROTECTION EQUIPMENT DUE TO COVID-19 PANDEMIC

5.2.1.2 Surge in social media marketing

FIGURE 19 FACE MASK KEYWORD COUNT ON GOOGLE, 2018–2021

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

FIGURE 20 CRUDE OIL BRENT WITNESSED SHARPEST DIP IN PRICES IN 2020

5.2.2.2 Restricted future growth

5.2.3 OPPORTUNITIES

5.2.3.1 Growing healthcare industry in emerging economies like India

FIGURE 21 HEALTHCARE INDUSTRY GROWTH IN INDIA (2016-2022)

5.2.4 CHALLENGES

5.2.4.1 Volatility in production

5.2.4.2 Adverse effect of face masks on the environment

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 22 PORTER'S FIVE FORCES ANALYSIS: FACE MASK MARKET

TABLE 9 FACE MASK MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF RIVALRY

6 INDUSTRY TRENDS (Page No. - 65)

6.1 VALUE CHAIN ANALYSIS

FIGURE 23 FACE MASK VALUE CHAIN

6.2 ECOSYSTEM MAP

FIGURE 24 ECOSYSTEM MAP FOR FACE MASK MARKET

6.3 AVERAGE SELLING PRICE TREND

FIGURE 25 AVERAGE PRICE OF FACE MASKS IN DIFFERENT REGIONS (2021)

TABLE 10 AVERAGE PRICE OF FACE MASKS, BY REGION (2021)

6.4 REGULATORY LANDSCAPE

6.4.1 CDC GUIDELINES & STANDARDS FOR FACE MASKS

TABLE 11 PERFORMANCE STANDARDS APPROVED BY CDC FOR RESPIRATORS

TABLE 12 PERFORMANCE STANDARDS FOR DISPOSABLE & SURGICAL MASKS

6.5 TRENDS/ DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

6.6 TECHNOLOGY ANALYSIS

6.6.1 PRIMARY PRODUCTION TECHNOLOGY OF N95 RESPIRATOR

6.6.2 PRODUCTION PROCESS OF N95 RESPIRATOR

6.7 CASE STUDY ANALYSIS

6.7.1 USE OF FACE MASK (RESPIRATOR) IN FOUNDRIES FOR RESPIRATORY PROTECTION

6.7.2 FACE MASKS PLAYED PROMINENT ROLE TO MITIGATE SPREAD OF COVID-19

6.7.3 SURGICAL FACE MASKS WIDELY USED IN MEDICAL INDUSTRY FOR PREVENTION AGAINST CONTAMINATION

6.7.4 A SMART FACE MASK THAT TRANSLATES SPEECH INTO EIGHT DIFFERENT LANGUAGES

6.8 KEY CONFERENCES AND EVENTS, 2022-2024

TABLE 13 FACE MASK MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.9 PATENT ANALYSIS

6.9.1 INTRODUCTION

6.9.2 DOCUMENT TYPE

FIGURE 27 PATENT ANALYSIS

FIGURE 28 PATENT PUBLICATION FILING TREND (2010–2021)

6.9.3 INSIGHT

6.9.4 JURISDICTION ANALYSIS

FIGURE 29 PATENT JURISDICTION ANALYSIS – TOP 10 COUNTRIES

6.9.5 TOP APPLICANTS AND OWNERS

TABLE 14 TOP 10 PATENT OWNERS IN LAST 10 YEARS

FIGURE 30 TOP APPLICANTS IN PATENT FILING – NONWOVEN FABRIC MASK

6.10 COVID-19 IMPACT ANALYSIS

6.10.1 COVID-19 HEALTH ASSESSMENT

FIGURE 31 COUNTRY-WISE SPREAD OF COVID-19

FIGURE 32 ECONOMIC OUTPUT OF DIFFERENT COUNTRIES, 2020 VS 2021

TABLE 15 THREE SCENARIO-BASED ANALYSES OF COVID-19 IMPACT ON GLOBAL ECONOMY

6.10.2 COVID-19 IMPACT ON FACE MASK MARKET

6.10.2.1 COVID-19 pandemic created a surge in demand for face masks

6.10.2.2 Response to COVID-19 pandemic by the 3M Company

6.10.2.3 Growth of face mask market post-COVID-19 pandemic

7 FACE MASK MARKET, BY MATERIAL TYPE (Page No. - 82)

7.1 INTRODUCTION

TABLE 16 RAW MATERIALS REQUIRED FOR FACE MASKS

7.2 POLYPROPYLENE (PP)

7.3 POLYURETHANE

7.4 POLYESTER

7.5 COTTON

8 FACE MASK MARKET, BY NATURE (Page No. - 85)

8.1 INTRODUCTION

FIGURE 33 FACE MASK MARKET, BY NATURE, 2022 & 2027 (USD MILLION)

TABLE 17 MARKET SIZE, BY NATURE, 2018–2021 (USD MILLION)

TABLE 18 MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

8.2 DISPOSABLE

8.2.1 INCREASED USE OF RESPIRATORS IN HOSPITALS TO DRIVE DEMAND

8.3 REUSABLE

8.3.1 LOW COST TO SPUR DEMAND

9 FACE MASK MARKET, BY DISTRIBUTION CHANNEL (Page No. - 89)

9.1 INTRODUCTION

FIGURE 34 FACE MASK MARKET, BY DISTRIBUTION CHANNEL, 2022 & 2027 (USD MILLION)

TABLE 19 MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2021 (USD MILLION)

TABLE 20 MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

9.2 PHARMACY & DRUG STORES

9.2.1 PHARMACY & DRUG STORES SEGMENT IS LARGEST DISTRIBUTION CHANNEL FOR FACE MASK

9.3 SPECIALITY STORE

9.3.1 DEMAND FOR FACE MASKS IN SPECIALTY STORES INCREASED DUE TO COVID-19

9.4 SUPERMARKET & HYPERMARKET

9.4.1 SUPERMARKET & HYPERMARKET ACCOUNTED FOR SECOND-LARGEST MARKET SHARE

9.5 E-COMMERCE

9.5.1 ONGOING PANDEMIC DRIVING DEMAND FOR FACE MASK IN E-COMMERCE SEGMENT

10 FACE MASK MARKET, BY TYPE (Page No. - 94)

10.1 INTRODUCTION

FIGURE 35 FACE MASK MARKET, BY TYPE, 2021, 2022 & 2027 (USD MILLION)

TABLE 21 MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 22 MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.2 SURGICAL

10.2.1 INCREASED DEMAND FOR SURGICAL MASK DUE TO COVID-19

TABLE 23 SURGICAL MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 SURGICAL MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.2.2 ASTM LEVEL 1

10.2.3 ASTM LEVEL 2

10.2.4 ASTM LEVEL 3

TABLE 25 SURGICAL MARKET SIZE, BY ASTM LEVEL, 2018–2021 (USD MILLION)

TABLE 26 SURGICAL MARKET SIZE, BY ASTM LEVEL, 2022–2027 (USD MILLION)

10.3 PROCEDURE

10.3.1 INCREASED DEMAND FROM MEDICAL INDUSTRY EXPECTED TO DRIVE PROCEDURE MASKS MARKET

TABLE 27 PROCEDURE FACE MASK MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 PROCEDURE MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.4 RESPIRATOR

10.4.1 RESPIRATOR SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2021

10.4.2 N-SERIES (N95, N99, AND N100)

10.4.3 R-SERIES (R95)

10.4.4 P-SERIES (P95 & P100)

TABLE 29 RESPIRATOR FACE MASK MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 RESPIRATOR MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.5 OTHERS

10.5.1 FASHION MASKS TO FUEL DEMAND FOR OTHERS SEGMENT

TABLE 31 OTHER FACE MASKS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 OTHER FACE MASKS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11 FACE MASK MARKET, BY END-USE INDUSTRY (Page No. - 104)

11.1 INTRODUCTION

FIGURE 36 FACE MASK MARKET, BY END-USE INDUSTRY, 2022 & 2027 (USD MILLION)

TABLE 33 MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 34 MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11.2 HOSPITALS & CLINICS

11.2.1 INCREASING HEALTHCARE INFRASTRUCTURE TO BOOST DEMAND

TABLE 35 MARKET SIZE IN HOSPITALS & CLINICS, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 MARKET SIZE IN HOSPITALS & CLINICS, BY REGION, 2022–2027 (USD MILLION)

11.3 INDUSTRIAL & INSTITUTIONAL

11.3.1 NEED TO PREVENT DUST INHALATION IN INDUSTRIAL SETTINGS TO DRIVE DEMAND

TABLE 37 MARKET SIZE IN INDUSTRIAL & INSTITUTIONAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 MARKET SIZE IN INDUSTRIAL & INSTITUTIONAL, BY REGION, 2022–2027 (USD MILLION)

11.4 PERSONAL/INDIVIDUAL PROTECTION

11.4.1 ONGOING COVID-19 PANDEMIC TO DRIVE MARKET IN THIS SEGMENT

TABLE 39 FACE MASK MARKET SIZE IN PERSONAL/INDIVIDUAL PROTECTION, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 MARKET SIZE IN PERSONAL/INDIVIDUAL PROTECTION, BY REGION, 2022–2027 (USD MILLION)

12 FACE MASK MARKET, BY REGION (Page No. - 110)

12.1 INTRODUCTION

FIGURE 37 FACE MASK MARKET, BY MAJOR COUNTRIES, 2022–2027

TABLE 41 MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC FACE MASK MARKET SNAPSHOT

TABLE 43 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 44 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 45 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 46 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 47 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 48 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 49 ASIA PACIFIC: SURGICAL FACE MASK MARKET SIZE, BY ASTM LEVEL, 2018–2021 (USD MILLION)

TABLE 50 ASIA PACIFIC: SURGICAL MARKET SIZE, BY ASTM LEVEL, 2022–2027 (USD MILLION)

12.2.1 CHINA

12.2.1.1 China accounted for largest share of Asia Pacific face mask market in 2021

TABLE 51 CHINA: MACROECONOMIC INDICATORS FOR FACE MASK MARKET

12.2.1.2 China: COVID-19 impact analysis

TABLE 52 CHINA: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 53 CHINA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 54 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 55 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.2.2 INDIA

12.2.2.1 India is fastest-growing market in the region

12.2.2.2 India: COVID-19 impact analysis

TABLE 56 INDIA: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 57 INDIA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 58 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 59 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.2.3 JAPAN

12.2.3.1 Large geriatric population in Japan to support market growth

TABLE 60 JAPAN: MACROECONOMIC INDICATORS FOR MARKET

TABLE 61 JAPAN: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 62 JAPAN: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 63 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 64 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.2.4 SOUTH KOREA

12.2.4.1 Well-developed healthcare system expected to drive market growth

TABLE 65 SOUTH KOREA: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 66 SOUTH KOREA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 67 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 68 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.2.5 INDONESIA

12.2.5.1 Outbreak of COVID-19 to spur demand for face masks in Indonesia

TABLE 69 INDONESIA: MACROECONOMIC INDICATORS FOR FACE MASK MARKET

TABLE 70 INDONESIA: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 71 INDONESIA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 72 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 73 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.2.6 PHILIPPINES

12.2.6.1 Increased demand for face masks in Philippines due to COVID-19 outbreak

TABLE 74 PHILIPPINES: MACROECONOMIC INDICATORS FOR FACE MASK MARKET

TABLE 75 PHILIPPINES: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 76 PHILIPPINES: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 77 PHILIPPINES: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 78 PHILIPPINES: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.2.7 REST OF ASIA PACIFIC

TABLE 79 REST OF ASIA PACIFIC: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 80 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 81 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 82 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.3 EUROPE

FIGURE 39 EUROPE FACE MASK MARKET SNAPSHOT

TABLE 83 EUROPE: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 89 EUROPE: SURGICAL MARKET SIZE, BY ASTM LEVEL, 2018–2021 (USD MILLION)

TABLE 90 EUROPE: SURGICAL MARKET SIZE, BY ASTM LEVEL, 2022–2027 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Increasing patient volumes in hospitals driving market growth

TABLE 91 GERMANY: MACROECONOMIC INDICATORS FOR FACE MASK MARKET

12.3.1.2 COVID-19 impact analysis

TABLE 92 GERMANY: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 93 GERMANY: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 94 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 95 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.3.2 UK

12.3.2.1 Increase in hospitalization rates driving demand for face masks

12.3.2.2 COVID-19 impact analysis

TABLE 96 UK: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 97 UK: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 98 UK: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 99 UK: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Favorable government initiatives to support market growth

TABLE 100 FRANCE: MACROECONOMIC INDICATORS FOR FACE MASK MARKET

TABLE 101 FRANCE: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 102 FRANCE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 103 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 104 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.3.4 ITALY

12.3.4.1 Large geriatric population to support market growth

12.3.4.2 COVID-19 impact analysis

TABLE 105 ITALY: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 106 ITALY: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 107 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 108 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.3.5 SPAIN

12.3.5.1 Large number of healthcare service programs driving use of face masks

TABLE 109 SPAIN: MACROECONOMIC INDICATORS FOR FACE MASK MARKET

TABLE 110 SPAIN: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 111 SPAIN: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 112 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 113 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.3.6 RUSSIA

12.3.6.1 Increased demand for face masks due to COVID-19 outbreak

TABLE 114 RUSSIA: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 115 RUSSIA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 116 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 117 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.3.7 REST OF EUROPE

TABLE 118 REST OF EUROPE: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 119 REST OF EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 120 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 121 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.4 NORTH AMERICA

FIGURE 40 NORTH AMERICA FACE MASK MARKET SNAPSHOT

TABLE 122 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 123 NORTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 124 NORTH AMERICA: SURGICAL MARKET SIZE, BY ASTM LEVEL, 2018–2021 (USD MILLION)

TABLE 125 NORTH AMERICA: SURGICAL MARKET SIZE, BY ASTM LEVEL, 2022–2027 (USD MILLION)

TABLE 126 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 127 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 128 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 129 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.1 US

12.4.1.1 US accounted for largest share of the regional market

12.4.1.2 COVID-19 Impact Analysis

TABLE 130 US: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 131 US: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 132 US: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 133 US: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.4.2 CANADA

12.4.2.1 Increase in number of surgeries performed to drive market growth

12.4.2.2 COVID-19 impact analysis

TABLE 134 CANADA: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 135 CANADA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 136 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 137 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.4.3 MEXICO

12.4.3.1 Increased demand for face masks due to COVID-19 outbreak

TABLE 138 MEXICO: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 139 MEXICO: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 140 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 141 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.5 MIDDLE EAST & AFRICA

TABLE 142 MIDDLE EAST & AFRICA: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 144 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.1 SAUDI ARABIA

12.5.1.1 Increased demand for face masks due to COVID-19

TABLE 148 SAUDI ARABIA: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 149 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 150 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 151 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.5.2 UAE

12.5.2.1 Increase in number of surgeries performed to drive market growth

TABLE 152 UAE: MACROECONOMIC INDICATORS FOR FACE MASK MARKET

TABLE 153 UAE: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 154 UAE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 155 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 156 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.5.3 IRAN

12.5.3.1 Iran accounted for largest share of market in Middle East & Africa

TABLE 157 IRAN: MACROECONOMIC INDICATORS FOR FACE MASK MARKET

TABLE 158 IRAN: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 159 IRAN: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 160 IRAN: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 161 IRAN: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 162 REST OF MIDDLE EAST & AFRICA: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 163 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 164 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 165 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.6 SOUTH AMERICA

TABLE 166 SOUTH AMERICA: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 167 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 168 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 169 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 170 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 171 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.1 BRAZIL

12.6.1.1 Brazil accounted for largest share of South America market in 2021

TABLE 172 BRAZIL: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 173 BRAZIL: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 174 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 175 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.6.2 ARGENTINA

12.6.2.1 Argentina is fastest-growing market for face masks in South America

TABLE 176 ARGENTINA: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 177 ARGENTINA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 178 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 179 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12.6.3 REST OF SOUTH AMERICA

TABLE 180 REST OF SOUTH AMERICA: FACE MASK MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 181 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 182 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 183 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 171)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES

TABLE 184 OVERVIEW OF STRATEGIES ADOPTED BY FACE MASK MANUFACTURERS

13.3 REVENUE ANALYSIS

13.3.1 REVENUE ANALYSIS OF TOP PLAYERS IN FACE MASK MARKET

FIGURE 41 TOP FIVE PLAYERS – REVENUE ANALYSIS (2016-2020)

13.4 COMPETITIVE LANDSCAPE MAPPING, 2020

13.4.1 STAR

13.4.2 EMERGING LEADER

13.4.3 PERVASIVE

13.4.4 PARTICIPANT

FIGURE 42 FACE MASK MARKET: COMPETITIVE LEADERSHIP MAPPING OF MAJOR COMPANIES, 2020

13.5 COMPETITIVE BENCHMARKING

13.5.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 43 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN FACE MASK MARKET

13.5.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 44 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

13.6 SME MATRIX, 2020

13.6.1 PROGRESSIVE COMPANIES

13.6.2 DYNAMIC COMPANIES

13.6.3 RESPONSIVE COMPANIES

13.6.4 STARTING BLOCKS

FIGURE 45 FACE MASK MARKET: COMPETITIVE LEADERSHIP MAPPING OF EMERGING COMPANIES, 2020

TABLE 185 COMPANY INDUSTRY FOOTPRINT, 2020

TABLE 186 COMPANY TYPE FOOTPRINT, 2020

TABLE 187 COMPANY REGION FOOTPRINT, 2020

TABLE 188 COMPANY FOOTPRINT, 2020

FIGURE 46 FACE MASK: DETAILED LIST OF KEY STARTUP/SMES

FIGURE 47 FACE MASK: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

13.7 KEY MARKET DEVELOPMENTS

TABLE 189 MARKET: DEALS, 2016–2021

TABLE 190 FACE MASK MARKET: OTHERS, 2016–2021

14 COMPANY PROFILES (Page No. - 193)

14.1 MAJOR COMPANIES

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

14.1.1 3M COMPANY

TABLE 191 3M COMPANY: COMPANY OVERVIEW

FIGURE 48 3M COMPANY: COMPANY SNAPSHOT

14.1.2 HONEYWELL INTERNATIONAL INC.

TABLE 192 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

FIGURE 49 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

14.1.3 KIMBERLY-CLARK CORPORATION

TABLE 193 KIMBERLY-CLARK CORPORATION: COMPANY OVERVIEW

FIGURE 50 KIMBERLY-CLARK CORPORATION: COMPANY SNAPSHOT

14.1.4 ALPHA PRO TECH, LTD.

TABLE 194 ALPHA PRO TECH, LTD.: COMPANY OVERVIEW

FIGURE 51 ALPHA PRO TECH, LTD.: COMPANY SNAPSHOT

14.1.5 OWENS & MINOR, INC.

TABLE 195 OWENS & MINOR, INC.: COMPANY OVERVIEW

FIGURE 52 OWENS & MINOR, INC.: COMPANY SNAPSHOT

14.1.6 AMBU A/S

TABLE 196 AMBU A/S: COMPANY OVERVIEW

FIGURE 53 AMBU A/S: COMPANY SNAPSHOT

14.1.7 MÖLNLYCKE HEALTH CARE AB

TABLE 197 MÖLNLYCKE HEALTH CARE AB: COMPANY OVERVIEW

FIGURE 54 MÖLNLYCKE HEALTH CARE AB: COMPANY SNAPSHOT

14.1.8 CARDINAL HEALTH, INC.

TABLE 198 CARDINAL HEALTH, INC.: COMPANY OVERVIEW

FIGURE 55 CARDINAL HEALTH, INC.: COMPANY SNAPSHOT

14.1.9 CANTEL MEDICAL CORP.

TABLE 199 CANTEL MEDICAL CORP.: COMPANY OVERVIEW

FIGURE 56 CANTEL MEDICAL CORP.: COMPANY SNAPSHOT

14.1.10 CNTUS-SUNGJIN CO., LTD.

TABLE 200 CNTUS-SUNGJIN CO., LTD.: COMPANY OVERVIEW

FIGURE 57 CNTUS-SUNGJIN CO., LTD.: COMPANY SNAPSHOT

14.1.11 IREMA IRELAND

TABLE 201 IREMA IRELAND: COMPANY OVERVIEW

14.1.12 MAKRITE

TABLE 202 MAKRITE: COMPANY OVERVIEW

14.1.13 MEDLINE INDUSTRIES, INC.

TABLE 203 MEDLINE INDUSTRIES, INC.: COMPANY OVERVIEW

14.1.14 SHANGHAI DASHENG HEALTH PRODUCTS MANUFACTURE CO., LTD.

TABLE 204 SHANGHAI DASHENG HEALTH PRODUCTS MANUFACTURE CO., LTD.: COMPANY OVERVIEW

14.1.15 PRESTIGE AMERITECH

TABLE 205 PRESTIGE AMERITECH: COMPANY OVERVIEW

14.1.16 FOSS PERFORMANCE MATERIALS, LLC

TABLE 206 FOSS PERFORMANCE MATERIALS, LLC: COMPANY OVERVIEW

14.2 OTHER COMPANIES

14.2.1 HAKUGEN EARTH CO., LTD.

TABLE 207 HAKUGEN EARTH CO., LTD.: COMPANY OVERVIEW

14.2.2 KOWA COMPANY, LTD.

TABLE 208 KOWA COMPANY, LTD.: COMPANY OVERVIEW

14.2.3 WINNER MEDICAL GROUP INC.

TABLE 209 WINNER MEDICAL GROUP INC.: COMPANY OVERVIEW

14.2.4 VENUS SAFETY & HEALTH PVT. LTD.

TABLE 210 VENUS SAFETY & HEALTH PVT. LTD.: COMPANY OVERVIEW

14.2.5 MOLDEX-METRIC, INC.

TABLE 211 MOLDEX-METRIC, INC.: COMPANY OVERVIEW

14.2.6 DACH SCHUTZBEKLEIDUNG GMBH & CO. KG

TABLE 212 DACH SCHUTZBEKLEIDUNG GMBH & CO. KG: COMPANY OVERVIEW

14.2.7 JIANGSU TEYIN IMP. & EXP. CO., LTD.

TABLE 213 JIANGSU TEYIN IMP. & EXP. CO., LTD.: COMPANY OVERVIEW

14.2.8 LOUIS M. GERSON CO., INC.

TABLE 214 LOUIS M. GERSON CO., INC.: COMPANY OVERVIEW

14.2.9 AERO PRO CO., LTD.

TABLE 215 AERO PRO CO., LTD.: COMPANY OVERVIEW

14.2.10 CAMBRIDGE MASK CO.

TABLE 216 CAMBRIDGE MASK CO.: COMPANY OVERVIEW

14.2.11 STERIMED MEDICAL DEVICES PVT. LTD.

TABLE 217 STERIMED MEDICAL DEVICES PVT. LTD.: COMPANY OVERVIEW

14.2.12 TELEFLEX INCORPORATED

TABLE 218 TELEFLEX INCORPORATED: COMPANY OVERVIEW

14.2.13 BYD CO. LTD.

TABLE 219 BYD CO. LTD.: COMPANY OVERVIEW

14.2.14 SRI VISHNU DISPOSABLES PRIVATE LIMITED

TABLE 220 SRI VISHNU DISPOSABLES PRIVATE LIMITED: COMPANY OVERVIEW

14.2.15 BD

TABLE 221 BD: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 252)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

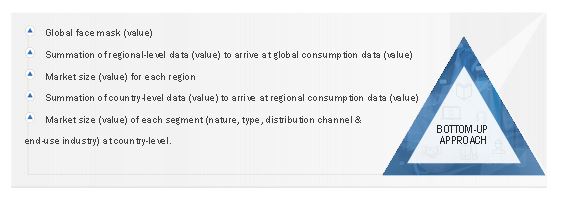

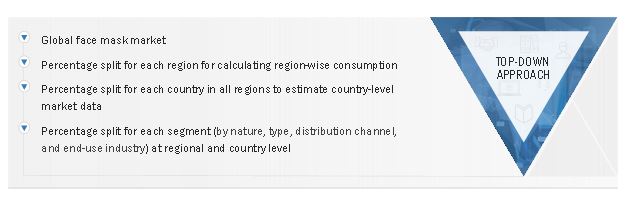

The study involved four major activities in estimating the current size of the face mask market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the face mask value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

The face mask market comprises several stakeholders, such as raw material suppliers, manufacturers, raw material manufacturers, distributors, traders, suppliers, healthcare institutions, contract manufacturing organizations, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the face mask market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, and related key executives from various key companies and organizations operating in the face mask market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the face mask market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the face mask market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the size of the market based on type, material type, nature, distribution channel, end-use, and region

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To forecast the size of the various segments of the market based on five regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa—along with key countries in each of these regions

- To analyze the opportunities in the market for stakeholders and present a competitive landscape for the market leaders

- To analyze recent developments, such as expansions, agreements, contracts, partnerships, acquisitions, collaborations, and divestments in the face mask market

- To strategically profile the key players in the market and comprehensively analyze their core competencies*

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- A further breakdown of product portfolio of each company in the market

- A further breakdown of a region of the face mask market with respect to a particular country

- Details and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Face Mask Market