To determine the current size of the medical radiation detection, monitoring & safety market, this study engaged in four main activities. A comprehensive study was conducted using secondary research methods to gather data about the market, its parent market, and its peer markets. The next stage involved conducting primary research to confirm these conclusions, assumptions, and sizing with industry experts throughout the value chain. A combination of top-down and bottom-up methods was used to assess the overall market size. The market sizes of segments and subsegments were then estimated using data triangulation techniques and market breakdown.

The four steps involved in estimating the market size are

Secondary Research

Within the secondary data collection process, a range of secondary sources were reviewed so as to identify and gather data for this study, including regulatory bodies, databases (like D&B Hoovers, Bloomberg Business, and Factiva), white papers, certified publications, articles by well-known authors, annual reports, press releases, and investor presentations of companies.

Primary Research

A thorough method was used in the primary research phase, which involved interviewing a wide range of sources from the supply and demand sides. The purpose of these interviews was to collect the qualitative and quantitative information needed to put together this report. The primary sources were mostly industry professionals from both core and related sectors; they also included preferred suppliers, manufacturers, distributors, service providers, and technology inventors, as well as entities connected to all aspects of the value chain in this business. We carefully conducted in-depth interviews with a variety of main respondents, including advisers from the industry, subject-matter experts, C-level executives from important market companies, and important sector stakeholders. A full assessment of future potentialities was the goal, along with the acquisition and validation of important qualitative and quantitative findings.

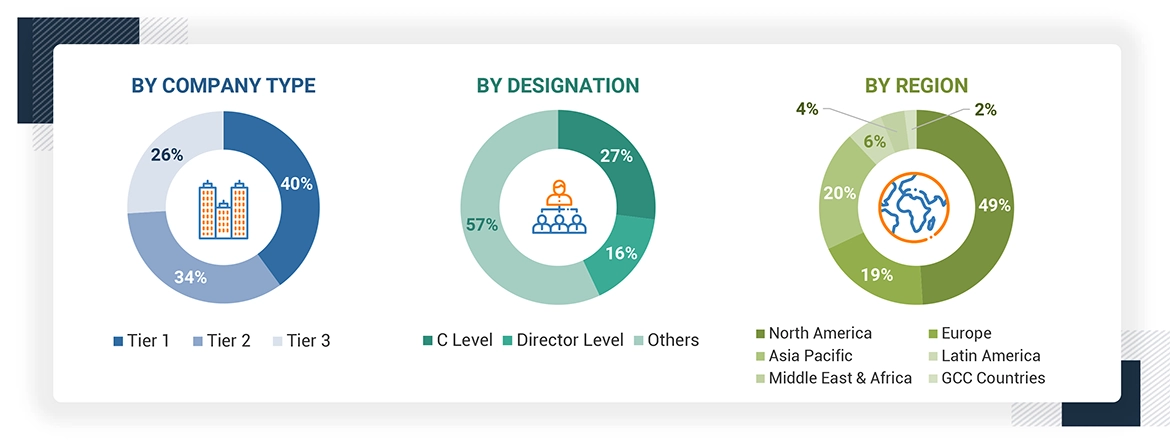

A breakdown of the primary respondents is provided below:

Note 1: Others include sales, marketing, and product managers.

Note 2: Tiers of companies are defined based on their total revenue. As of 2023, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = < USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Mirion Technologies, Inc. |

Advisor |

|

Fortive |

Strategic manager |

|

Thermo Fisher Scientific Inc. |

Senior Director |

|

IBA Worldwide |

VP Marketing |

Market Size Estimation

All major providers offering various medical radiation detection, monitoring & safety products were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value medical radiation detection, monitoring & safety products market was also split into various segments and subsegments at the region and country level based on:

-

Product mapping of various providers for each type in medical radiation detection, monitoring & safety products at the regional and country level

-

Relative adoption pattern of each medical radiation detection, monitoring & safety products among key application segments at the regional and/or country level

-

Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

-

Detailed secondary research to gauge the prevailing market trends at the regional and/or country level

Data Triangulation

After arriving at the overall market size using the process explained above, the overall market was split into several segments and subsegments. To do the overall market engineering and get the exact statistics for all segments and subsegments, data triangulation and market breakup procedures were used wherever applicable. The data was triangulated by studying various factors and trends from both the demand- and supply-side of the application and technology segment as well.

Market Definition

Medical radiation detection and monitoring products measure and detect radiation emissions or the levels of radiation produced by a source in a healthcare setting. Medical radiation safety products protect the environment and people against harmful radiation in the healthcare industry.

Stakeholders

-

Manufacturers and Vendors of Medical radiation detection, monitoring & safety products

-

Pharmaceutical and Biopharmaceutical Companies

-

Diagnostic Associations

-

Various Research and Consulting Firms

-

Distributors and Suppliers of of Medical radiation detection, monitoring & safety products

-

Healthcare Institutes

-

Research Institutes

Report Objectives

-

The study aims to define, describe, segment, and forecast the Medical radiation detection, monitoring & safety market by product, detector, safety product, end user, and by region.

-

To provide detailed information about the factors influencing the market growth (such as drivers, trends, opportunities, and challenges)

-

To perform an assessment of the Medical radiation detection, monitoring & safety market, with a view to Porter's Five Forces, regulatory scenario, value chain, supply chain, ecosystem analysis, patent protection, pricing assessment, key stakeholders, and buying criteria.

-

To analyze the individual growth trends, prospects, and contributions of micromarkets1 of the total Medical radiation detection, monitoring & safety market. To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

-

To predict the size of the market segments concerning six regions including North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries.

-

To profile the key players and comprehensively analyze their respective product portfolios, market positions, and core competencies. To track and analyze company developments such as product launches & approvals, acquisitions, collaborations, expansions, and other developments

Growth opportunities and latent adjacency in Medical Radiation Detection, Monitoring & Safety Market