Far-Field Speech and Voice Recognition Market Size, Share, Statistics and Industry Growth Analysis Report by Component (Microphones, Digital Signal Processors, Software), Microphone Solutions (Single Microphone, Linear Arrays, Circular Arrays), Application and Geography - Global Forecast to 2028

Updated on : Sep 12, 2024

Far-Field Speech and Voice Recognition Market Size, Share & Growth

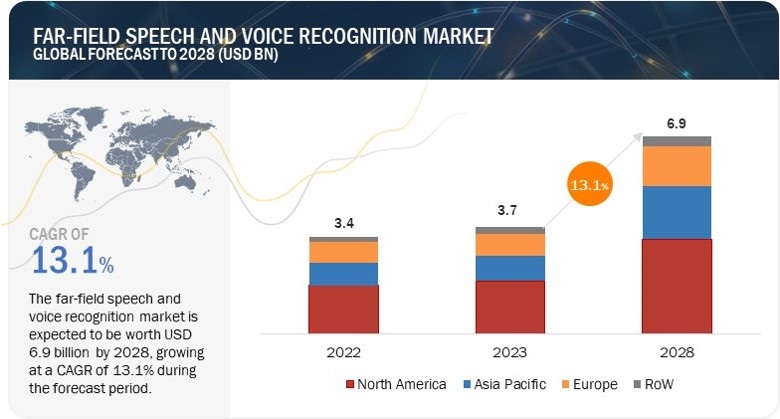

[250 Pages Report] The Far-Field Speech and Voice Recognition Market was valued at USD 3.7 Billion in 2023 and is estimated to reach USD 6.9 Billion by 2028, registering a CAGR of 13.1% during the forecast period.

The growth of the far-field speech and voice recognition market is governed by the enhanced accuracy through advanced front-end hardware, increasing adoption of voice control-based smart speakers, and technological advancement of deep-learning-based far-field microphones.

Far-Field Speech and Voice Recognition Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Far-Field Speech and Voice Recognition Market Trends & Dynamics:

Drivers: Enhanced accuracy through advanced front-end hardware

The continual advancement and integration of front-end hardware components are serving as major growth drivers for the far-field speech and voice recognition market. The accuracy of far-field speech recognition systems heavily relies on the quality and capabilities of front-end hardware, such as microphone arrays and digital signal processors (DSP). These components are essential for minimizing the impact of environmental noise and reverberation, ensuring optimal accuracy and performance. Manufacturers of microphones and processors are actively developing advanced noise cancellation and wind reduction algorithms utilizing beamforming technology. By leveraging these innovations, they aim to enhance the robustness and accuracy of far-field speech and voice recognition systems. Companies like Apple and Amazon are incorporating multiple microphones and beamforming technology in smart speaker devices like Home Pod and Echo, enabling accurate voice recognition even from a distance.

The demand for highly accurate far-field speech recognition is increasing, particularly in mission-critical applications such as aerospace, autonomous cars, industrial automation, and service robots. Both businesses and consumers rely on the accuracy of speech recognition technology to ensure effective human-machine interaction. To enable the market’s growth, far-field speech recognition technology needs to match the accuracy levels achieved in near-field speech recognition, which has an estimated error rate of 5.1%, according to IBM. As the accuracy of far-field speech and voice recognition technology continues to improve through advancements in front-end hardware components, the market is poised for expansion. The ability to deliver accurate and reliable performance in noisy environments and over long distances will drive the adoption of far-field speech and voice recognition systems in various industries and consumer applications.

Restraint: Privacy threat

The growing privacy threats from voice-enabled smart home devices pose a restraint on the far-field speech and voice recognition market. Data privacy concerns have become a major barrier to consumers’ adoption of these devices. Users are increasingly wary of the collection and potential misuse of their personal data, creating a sense of distrust. This lack of trust hinders the market’s growth potential as consumers hesitate to embrace far-field speech and voice recognition technologies. Security vulnerabilities in voice-enabled smart home devices also contribute to privacy threats. As these devices are connected to the internet, they become potential targets for cyberattacks. The fear of unauthorized access to personal information or control over connected devices within the home amplifies privacy concerns. Governments and regulatory bodies are also stepping in to address these issues by implementing stricter regulations, such as the GDPR, which adds compliance complexities and costs for companies operating in the far-field speech and voice recognition market.

To overcome this restraint and drive market growth, companies in the far-field speech and voice recognition market must prioritize user privacy and security. They need to implement robust data protection measures, such as strong encryption and secure data storage, to assure users of their data’s safety. Transparent data practices and clear communication regarding data collection and usage can help build trust with consumers. Compliance with relevant privacy regulations is crucial to demonstrate commitment to user privacy. By addressing these privacy concerns head-on, companies can mitigate the restraint posed by the growing privacy threats and foster wider adoption of far-field speech and voice recognition technologies.

Opportunities: Expanding into multilingual and global markets

Global businesses are increasingly expanding their operations across multiple countries, creating a need for voice recognition systems that can accurately comprehend and interact in various languages and dialects. This demand spans industries such as customer service, call centers, e-commerce, and hospitality, where multilingual voice recognition enables businesses to offer personalized user experiences, enhancing customer satisfaction and engagement. In the travel and tourism industry, voice-enabled technologies play a vital role in serving international travelers. Multilingual voice recognition systems assist travelers with tasks like language translation, navigation, and local recommendations, improving the convenience and accessibility of their travel experiences. Airports, hotels, and tourist attractions leverage multilingual voice recognition for services like informational assistance, ticketing, and guest support, leading to improved efficiency and customer service quality.

Furthermore, in households with members who speak different languages, multilingual voice recognition systems provide seamless interactions with smart home devices. These systems understand and respond to voice commands in various languages, allowing each household member to communicate with the devices in their preferred language. This feature enhances the user experience and convenience, driving the adoption of far-field voice-controlled smart home devices. Leading voice assistants like Amazon’s Alexa and Google Assistant have already recognized the importance of multilingual capabilities. For example, Alexa supports multiple languages, including English, Spanish, French, German, Italian, Japanese, and more, while Google Assistant offers support for over 30 languages. By enabling users to interact with these voice assistants in their native languages, these companies have expanded their user base in the fields of the voice recognition solutions industry. As the global market increasingly embraces voice-controlled technologies, the demand for accurate and versatile multilingual voice recognition systems will continue to rise. Companies that invest in research and development to enhance language understanding and accent recognition will be well-positioned to seize this market opportunity. By offering seamless and personalized voice interactions in multiple languages, far-field speech and voice recognition systems can tap into new customer segments and expand their market presence in diverse regions worldwide.

Challenge: Power issues and lack of standardization

The widespread adoption of far-field voice recognition in mobile devices faces obstacles due to the high power consumption of sophisticated microphones, powerful processors, and constant connection and listening capabilities. As a result, most voice-activated devices need to remain plugged in at all times. This limitation hinders the broader acceptance of this technology. Additionally, smart speaker manufacturers lack a common standardization in implementing measures to address legal and encryption concerns related to voice recognition, particularly in preventing intruder hacking.

There are speculations that many smart device manufacturers are hesitant to adopt speech recognition platforms from third-party vendors as using trigger phrases like “Ok Google” or “Alexa” could diminish their brand power. Another significant challenge in the speech and voice recognition industry is the absence of a standardized platform for developing customized products in this field. This poses a major issue for small companies that lack both a standard platform and the necessary capital. Consequently, it becomes challenging for these companies to create and market products, applications, and solutions in the far-field speech and voice recognition market.

Far-Field Speech and Voice Recognition Market Ecosystem

Digital Signal Processors segment to hold larger market share during the forecast period.

In 2022, the digital signal processors segment accounted for the larger share of the far-field speech and voice recognition market. The market growth for digital signal processors in the far-field speech and voice recognition market is attributed to the increasing demand for low-power and energy-efficient processors. With the rising adoption of battery-powered devices such as wearable devices, smart speakers, and smart home devices, there is a growing need for processors that can operate on low power while still providing high performance. This has led to the development of digital signal processors with specialized architectures optimized for low-power operation, which in turn has driven the growth of the digital signal processors segment.

Circular arrays segment account for the largest share of the far-field speech and voice recognition market for during the forecast period.

In 2022, the Circular arrays segment held the largest share of the far-field speech and voice recognition market. The demand for circular array microphones is expected to rise in the coming years, owing to their ability to capture audio from a full 360-degree range. This makes them an ideal solution for large conference rooms, event spaces, and other settings where participants may be situated across a wide area. Advancements in microphone technology and manufacturing processes are expected to reduce the cost of circular array microphones, making them more affordable and accessible to a wider range of industries and applications. With the growing adoption of video conferencing and other remote communication technologies in businesses and organizations, the need for high-quality far-field speech recognition technology that can capture audio from multiple directions is expected to increase, thereby boosting the demand for circular array microphones.

Robotics application to exhibit highest growth in terms of far-field speech and voice recognition market during the forecast period.

The robotics application segment is expected to account for the highest growth of the far-field speech and voice recognition market. Far-field speech and voice recognition technology have become essential in the development of household robotics. Household robots are becoming more popular as consumers seek ways to automate routine tasks and improve their quality of life. Far-field speech and voice recognition technology can significantly enhance the capabilities of household robots, making them more intuitive and user-friendly. With advancements in AI and natural language processing (NLP), the accuracy and efficiency of far-field speech and voice recognition technology have improved significantly, thus fueling market growth. In September 2022, iRobot Corporation (US) launched the Roomba Combo j7+, an advanced robotic vacuum and mop. iRobot has also released the iRobot OS 5.0 updates, which enhance the voice and personalization control of the j7 Series robots throughout the entire product range. With the new iRobot OS 5.0, the Roomba Combo j7+ can recognize and respond to around 600 voice commands. Such proactive product launches will fuel the segment growth of the robotics application.

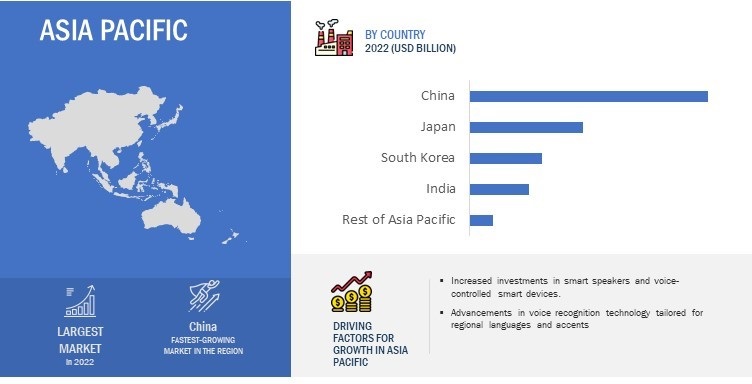

Far-field speech and voice recognition market in Asia Pacific estimated to grow at the fastest rate during the forecast period.

The far-field speech and voice recognition market,in Asia Pacific is expected to grow at the highest CAGR during the forecast period. The market is driven by its large population and high adoption of smart devices, leading to rapid market expansion. Countries such as China, India, Japan, and South Korea are leading the way, subject to language diversity, increased penetration of smart home technology products, and booming e-commerce. The market is witnessing several investments in AI and natural language processing (NLP) technologies to enable accurate multilingual voice recognition and localization. Key players are focusing on developing voice-enabled applications, smart home devices, and voice-based customer service solutions to cater to the diverse needs of the region. With its thriving technology ecosystem and fast-paced digital transformation, Asia Pacific is poised to be a major market for far-field speech and voice recognition technologies.

Far-Field Speech and Voice Recognition Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Companies Of Far-Field Speech and Voice Recognition Market

Major vendors in the far-field speech and voice recognition companies include Qualcomm Incorporated (US), HARMAN International (US), Synaptics Incorporated (US), NXP Semiconductors (Netherlands), STMicroelectronics (Switzerland), Andrea Electronics (US), Cirrus Logic (US), Microchip Technology Inc. (US), Infineon Technologies AG (Germany) and Knowles Corporation (US). Apart from this, Analog Devices, Inc. (US), Sensory, Inc. (US), Meeami Technologies (India), TDK Corporation (Japan), Vocal Technologies (US), Vesper Technologies (US), Alango Technologies Ltd. (Israel), MediaTek Inc. (Taiwan), CEVA, Inc. (US), Fortemedia, Inc. (US), XMOS (UK) are among a few emerging companies in the far-field speech and voice recognition market.

Far-Field Speech and Voice Recognition Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size in 2023 |

USD 3.7 Billion |

|

Projected Market Size in 2028 |

USD 6.9 Billion |

|

Growth Rate |

CAGR of 13.1% |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Segments covered |

Component, Microphone Solution, Application and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major players include Qualcomm Incorporated (US), HARMAN International (US), STMicroelectronics (Switzerland), Synaptics Incorporated (US), NXP Semiconductors (Netherlands), Knowles Corporation (US), Andrea Electronics (US), Cirrus Logic (US), Microchip Technology Inc. (US), Infineon Technologies AG (Germany) and Others- total 25 players have been covered. |

Far-Field Speech and Voice Recognition Market Highlights

This research report categorizes the far-field speech and voice recognition market based on component, microphone solution, application, and Region.

|

Segment |

Subsegment |

|

By Component: |

|

|

By Microphone Solution: |

|

|

By Application: |

|

|

By Region: |

|

Recent Developments

- In February 2023, Infineon Technologies AG (Germany) launched the PDM microphone with low power consumption. Owing to its ultra-low power consumption, it is used in applications such as wireless earbuds, over-ear headsets, and hearing enhancement devices.

- In January 2023, HARMAN International (US) launched Sound and Vibration Sensor and External Microphone products at CES 2023. These advanced solutions enhance in-vehicle and exterior audio experiences, offering safety and communication improvements, including far-field speech and voice recognition capabilities.

- In May 2022, Infineon Technologies AG (Germany) launched XENSIV MEMS microphones which are used for consumer electronics headphones with active noise cancellation (ANC), TWS earbuds, conference devices with beamforming capability, laptops, tablets, or smart speakers with voice user interfaces.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the far-field speech and voice recognition market during 2023-2028?

The global far-field speech and voice recognition market is expected to record the CAGR of 13.1% from 2023-2028.

Which regions are expected to pose significant demand for far-field speech and voice recognition market from 2023-2028?

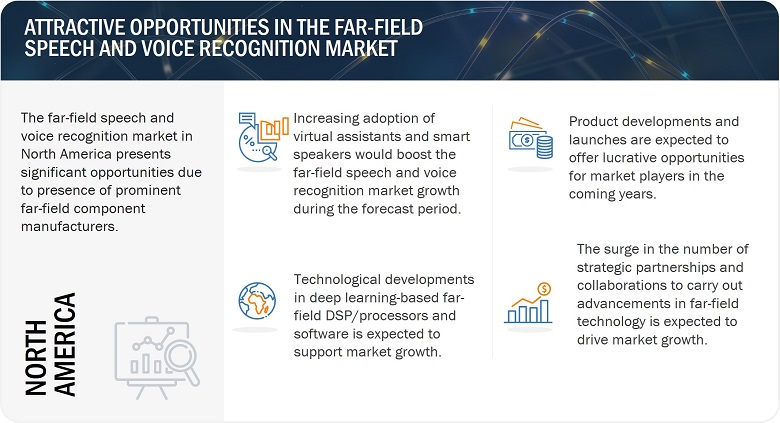

North America, and Asia Pacific is expected to pose significant demand from 2023 to 2028. Major economies such as US, Canada, China, India, Japan and South Korea are expected to have a high potential for the future growth of the market.

What are the major market opportunities in the far-field speech and voice recognition market?

Expanding into multilingual and global markets, deployment of far-field speech and voice recognition in smart home devices, and application of speech and voice recognition in service robotics re projected to create lucrative opportunities for the players operating in the far-field speech and voice recognition market during the forecast period.

Which are the significant players operating in far-field speech and voice recognition market?

Key players operating in the far-field speech and voice recognition market are Qualcomm Incorporated (US), Harman International (A Samsung Company) (US), Synaptics Incorporated (US), NXP Semiconductors (Netherlands), STMicroelectronics (Switzerland), and Knowles Corporation (US).

What are the major applications of the far-field speech and voice recognition market?

Smart TV/STB, smart speakers, automotive, and robotics are the major applications of the far-field speech and voice recognition market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Enhanced accuracy through advanced front-end hardware- Increasing adoption of voice control-based smart speakers- Technological advancement of deep learning-based far-field microphonesRESTRAINTS- Privacy threats- Lack of accuracy in noisy and harsh environmentsOPPORTUNITIES- Expansion into multilingual and global markets- Deployment in smart home devices- Increasing application in service roboticsCHALLENGES- Power issues and lack of standardization

-

5.3 TECHNOLOGY ANALYSISNEURAL NETWORK-BASED SPEECH RECOGNITIONACOUSTIC ECHO CANCELLATION (AEC)BEAMFORMING AND MICROPHONE ARRAYS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

- 5.8 AVERAGE SELLING PRICE ANALYSIS

-

5.9 CASE STUDY ANALYSISUSE CASE 1: ARKX LABORATORIES ENABLED ROBUST FAR-FIELD VOICE CONTROL IN CHALLENGING ENVIRONMENTSUSE CASE 2: ARKX AFE ENHANCED VOICE INTERACTION IN SELF-SERVICE KIOSKSUSE CASE 3: ALEXA HELPED HAWAII PACIFIC HEALTH TO ENHANCE PATIENT EXPERIENCE THROUGH QUERY RESOLUTION

- 5.10 TRADE ANALYSIS

-

5.11 PATENT ANALYSISLIST OF MAJOR PATENTS

- 5.12 KEY CONFERENCES AND EVENTS IN 2023–2024

- 5.13 TARIFF ANALYSIS

-

5.14 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY STANDARDS- ISO/IEC 19794-2- ISO/IEC 30107- Federal Information Processing Standards- European Telecommunications Standards Institute- ANSI/CTA-2082- EU RED DirectiveGOVERNMENT REGULATIONS- US- European Union- China- Japan

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 MICROPHONESRISING DEMAND FOR VOICE-CONTROLLED DEVICES TO FUEL MARKET

-

6.3 DIGITAL SIGNAL PROCESSORSDEMAND FOR IMPROVED ACCURACY AND RELIABILITY IN DIGITAL COMMUNICATION TO DRIVE MARKET

-

6.4 SOFTWARECONTINUOUS ADVANCEMENTS IN AI, ML, AND SIGNAL PROCESSING TO ACCELERATE MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 SINGLE MICROPHONEMAJOR APPLICATIONS IN IOT DEVICES TO DRIVE MARKET

-

7.3 LINEAR ARRAYSDEMAND FOR SOUND LOCALIZATION AND IMPROVED VOICE RECOGNITION TO DRIVE MARKET

-

7.4 CIRCULAR ARRAYS360-DEGREE COVERAGE TO BOOST DEMAND

- 8.1 INTRODUCTION

-

8.2 SMART TV/STBINCREASING DEMAND FOR HANDS-FREE AND INTUITIVE CONTROL TO FUEL MARKET

-

8.3 SMART SPEAKERSRISING DEMAND FOR VOICE-ENABLED SMART HOME DEVICES TO DRIVE MARKET

-

8.4 AUTOMOTIVERISING DEMAND FOR CONNECTED CARS TO BOOST MARKET

-

8.5 ROBOTICSADOPTION OF HOUSEHOLD ROBOTS TO DRIVE DEMAND

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Improved focus on voice-enabled applications for automotive, healthcare, and retail sectors to fuel demandCANADA- Technological advancements in AI and ML to drive marketMEXICO- Development of voice recognition systems tailored to local language, accents, and cultural preferences to propel market

-

9.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- High demand for voice-controlled devices to propel marketUK- Rising penetration of voice-controlled smart TV in domestic households to augment market growthFRANCE- Increasing adoption of voice-enabled devices to boost marketITALY- Integration of voice recognition in vehicles by luxury auto brands to drive marketREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Robust presence of key market players to support marketINDIA- Increased prevalence of mobile and Internet users to expand market growthJAPAN- Rapid deployment of AI into innovative robotic devices to fuel marketSOUTH KOREA- Technological innovations and tax incentives to provide impetus to market growthREST OF ASIA PACIFIC

-

9.5 ROWROW: RECESSION IMPACTSOUTH AMERICA- Smart home and consumer applications to spur market growthMIDDLE EAST & AFRICA- Strong focus on digital transformation to contribute to market growth

-

10.1 OVERVIEWKEY GROWTH STRATEGIES ADOPTED BY LEADING PLAYERS IN MARKET

- 10.2 REVENUE ANALYSIS

- 10.3 MARKET SHARE ANALYSIS (2022)

-

10.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.5 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.6 COMPETITIVE BENCHMARKING

- 10.7 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET: COMPANY FOOTPRINT

-

10.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

-

11.1 KEY PLAYERSQUALCOMM INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHARMAN INTERNATIONAL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSTMICROELECTRONICS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSYNAPTICS INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNXP SEMICONDUCTORS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKNOWLES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewANDREA ELECTRONICS- Business overview- Products/Solutions/Services offered- Recent developmentsCIRRUS LOGIC- Business overview- Products/Solutions/Services offered- Recent developmentsMICROCHIP TECHNOLOGY INC.- Business overview- Products/Solutions/Services offered- Recent developmentsINFINEON TECHNOLOGIES AG- Business overview- Products/Solutions/Services offered- Recent developments

-

11.2 OTHER PLAYERSANALOG DEVICES, INC.SENSORY INC.MEEAMI TECHNOLOGIESTDK CORPORATIONVOCAL TECHNOLOGIESVESPER TECHNOLOGIES, INC.ALANGO TECHNOLOGIES LTD.MEDIATEK INC.CEVA, INC.FORTEMEDIA, INC.XMOSMATRIXADAPTIVE DIGITAL TECHNOLOGIESGOERTEKSENSIBEL

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET: RISK ASSESSMENT

- TABLE 2 FAR-FILED SPEECH AND VOICE RECOGNITION MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 3 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE ANALYSIS OF FAR-FIELD MICROPHONES BY MARKET PLAYERS FOR TOP THREE APPLICATIONS

- TABLE 5 AVERAGE SELLING PRICE ANALYSIS OF FAR-FIELD DSP/PROCESSORS BY MARKET PLAYERS FOR TOP THREE APPLICATIONS

- TABLE 6 LIST OF TOP PATENT OWNERS IN LAST 10 YEARS

- TABLE 7 LIST OF MAJOR PATENTS

- TABLE 8 MARKET: KEY CONFERENCES AND EVENTS

- TABLE 9 MFN TARIFF FOR HS CODE 851810 EXPORTED BY US

- TABLE 10 MFN TARIFF FOR HS CODE 851810 EXPORTED BY CHINA

- TABLE 11 MFN TARIFF FOR HS CODE 854231 EXPORTED BY US

- TABLE 12 MFN TARIFF FOR HS CODE 854231 EXPORTED BY CHINA

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 19 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 20 MARKET, BY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 21 MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 22 MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 23 MICROPHONES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 MICROPHONES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 MICROPHONES: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 26 MICROPHONES: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 DIGITAL SIGNAL PROCESSORS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 DIGITAL SIGNAL PROCESSORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 DIGITAL SIGNAL PROCESSORS: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 30 DIGITAL SIGNAL PROCESSORS: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 31 SOFTWARE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 SOFTWARE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 34 SOFTWARE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 35 MARKET, BY MICROPHONE SOLUTION, 2019–2022 (MILLION UNITS)

- TABLE 36 MARKET, BY MICROPHONE SOLUTION, 2023–2028 (MILLION UNITS)

- TABLE 37 MARKET, BY MICROPHONE SOLUTION, 2019–2022 (USD MILLION)

- TABLE 38 MARKET, BY MICROPHONE SOLUTION, 2023–2028 (USD MILLION)

- TABLE 39 MARKET, BY APPLICATION, 2019–2022 (MILLION UNITS)

- TABLE 40 MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 41 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 42 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 43 SMART TV/STB: MARKET, BY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 44 SMART TV/STB: MARKET, BY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 45 SMART TV/STB: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 46 SMART TV/STB: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 47 SMART TV/STB: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 48 SMART TV/STB: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 49 SMART TV/STB: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 SMART TV/STB: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 SMART SPEAKERS: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 52 SMART SPEAKERS: MARKET, BY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 53 SMART SPEAKERS: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 54 SMART SPEAKERS: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 55 SMART SPEAKERS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 56 SMART SPEAKERS: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 57 SMART SPEAKERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 SMART SPEAKERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 AUTOMOTIVE: MARKET, BY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 60 AUTOMOTIVE: MARKET, BY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 61 AUTOMOTIVE: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 62 AUTOMOTIVE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 63 AUTOMOTIVE: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 64 AUTOMOTIVE: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 65 AUTOMOTIVE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 AUTOMOTIVE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 ROBOTICS: MARKET, BY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 68 ROBOTICS: MARKET, BY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 69 ROBOTICS: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 70 ROBOTICS: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 71 ROBOTICS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 72 ROBOTICS: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 73 ROBOTICS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 74 ROBOTICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 OTHERS: MARKET, BY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 76 OTHERS: MARKET, BY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 77 OTHERS: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 78 OTHERS: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 79 OTHERS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 80 OTHERS: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 81 OTHERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 82 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 84 MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 85 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 86 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 94 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 96 EUROPE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 97 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 105 ROW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 106 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 107 ROW: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 108 ROW: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 109 ROW: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 110 ROW: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 KEY GROWTH STRATEGIES ADOPTED BY LEADING PLAYERS IN MARKET

- TABLE 112 MARKET: DEGREE OF COMPETITION

- TABLE 113 STARTUPS IN MARKET

- TABLE 114 MARKET: LIST OF KEY STARTUPS

- TABLE 115 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME

- TABLE 116 COMPANY FOOTPRINT

- TABLE 117 COMPANY COMPONENT FOOTPRINT

- TABLE 118 COMPANY MICROPHONE SOLUTION FOOTPRINT

- TABLE 119 COMPANY APPLICATION FOOTPRINT

- TABLE 120 COMPANY REGIONAL FOOTPRINT

- TABLE 121 PRODUCT LAUNCHES, 2019–2023

- TABLE 122 DEALS, 2020–2023

- TABLE 123 QUALCOMM INCORPORATED: COMPANY OVERVIEW

- TABLE 124 QUALCOMM INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 125 QUALCOMM INCORPORATED: PRODUCT LAUNCHES

- TABLE 126 QUALCOMM INCORPORATED: DEALS

- TABLE 127 HARMAN INTERNATIONAL: COMPANY OVERVIEW

- TABLE 128 HARMAN INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 HARMAN INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 130 HARMAN INTERNATIONAL: DEALS

- TABLE 131 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 132 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 134 STMICROELECTRONICS: DEALS

- TABLE 135 SYNAPTICS INCORPORATED: COMPANY OVERVIEW

- TABLE 136 SYNAPTICS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 SYNAPTICS INCORPORATED: DEALS

- TABLE 138 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 139 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 NXP SEMICONDUCTORS: PRODUCT LAUNCHES

- TABLE 141 NXP SEMICONDUCTORS: DEALS

- TABLE 142 KNOWLES CORPORATION: COMPANY OVERVIEW

- TABLE 143 KNOWLES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 KNOWLES CORPORATION: PRODUCT LAUNCHES

- TABLE 145 KNOWLES CORPORATION: DEALS

- TABLE 146 ANDREA ELECTRONICS: COMPANY OVERVIEW

- TABLE 147 ANDREA ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 ANDREA ELECTRONICS: PRODUCT LAUNCHES

- TABLE 149 ANDREA ELECTRONICS: DEALS

- TABLE 150 CIRRUS LOGIC: COMPANY OVERVIEW

- TABLE 151 CIRRUS LOGIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 CIRRUS LOGIC: PRODUCT LAUNCHES

- TABLE 153 CIRRUS LOGIC: DEALS

- TABLE 154 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 155 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES

- TABLE 157 MICROCHIP TECHNOLOGY INC.: DEALS

- TABLE 158 MICROCHIP TECHNOLOGY INC.: OTHERS

- TABLE 159 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 160 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 162 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 163 INFINEON TECHNOLOGIES AG: OTHERS

- FIGURE 1 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE OF MARKET PLAYERS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 RESEARCH ASSUMPTIONS

- FIGURE 9 GDP GROWTH PROJECTIONS TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 10 RECESSION IMPACT ON MARKET, 2019–2028 (USD MILLION)

- FIGURE 11 DIGITAL SIGNAL PROCESSORS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 CIRCULAR ARRAYS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 SMART SPEAKERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 INCREASING ADOPTION OF VIRTUAL ASSISTANTS AND SMART SPEAKERS TO BOOST MARKET DURING FORECAST PERIOD

- FIGURE 16 DIGITAL SIGNAL PROCESSORS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 CIRCULAR ARRAYS AND SMART SPEAKERS TO HOLD LARGEST MARKET SHARES IN 2023

- FIGURE 18 NORTH AMERICA TO HAVE LARGEST SHARE OF MARKET IN 2023

- FIGURE 19 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 20 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 DRIVERS FOR MARKET AND THEIR IMPACT

- FIGURE 22 RESTRAINTS FOR MARKET AND THEIR IMPACT

- FIGURE 23 OPPORTUNITIES FOR GLOBAL MARKET AND THEIR IMPACT

- FIGURE 24 CHALLENGES FOR MARKET AND THEIR IMPACT

- FIGURE 25 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 TRENDS/DISRUPTIONS IN MARKET

- FIGURE 28 AVERAGE SELLING PRICE ANALYSIS OF FAR-FIELD MICROPHONES OFFERED BY MARKET PLAYERS FOR TOP THREE APPLICATIONS

- FIGURE 29 AVERAGE SELLING PRICE ANALYSIS OF FAR-FIELD DSP/PROCESSORS OFFERED BY MARKET PLAYERS FOR TOP THREE APPLICATIONS

- FIGURE 30 IMPORT DATA FOR HS CODE 851810, BY COUNTRY, 2018–2022

- FIGURE 31 EXPORT DATA FOR HS CODE 851810, BY COUNTRY, 2018–2022

- FIGURE 32 IMPORT DATA FOR HS CODE 854231, BY COUNTRY, 2018–2022

- FIGURE 33 EXPORT DATA FOR HS CODE 854231, BY COUNTRY, 2018–2022

- FIGURE 34 NUMBER OF PATENTS GRANTED PER YEAR FROM 2013 TO 2022

- FIGURE 35 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 38 DIGITAL SIGNAL PROCESSORS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET FOR MICROPHONES DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA TO LEAD MARKET FOR DIGITAL SIGNAL PROCESSORS DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA TO DOMINATE MARKET IN SOFTWARE SEGMENT DURING FORECAST PERIOD

- FIGURE 42 CIRCULAR ARRAYS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 43 SMART SPEAKERS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 44 FAR-FIELD SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 46 US TO DOMINATE NORTH AMERICAN MARKET DURING FORECAST PERIOD

- FIGURE 47 EUROPE: MARKET SNAPSHOT

- FIGURE 48 GERMANY TO DOMINATE EUROPEAN MARKET DURING FORECAST PERIOD

- FIGURE 49 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 50 CHINA TO DOMINATE ASIA PACIFIC MARKET DURING FORECAST PERIOD

- FIGURE 51 REVENUE ANALYSIS OF TOP 5 COMPANIES IN MARKET, 2020–2022

- FIGURE 52 MARKET, COMPANY EVALUATION MATRIX, 2022

- FIGURE 53 STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 54 QUALCOMM INCORPORATED: COMPANY SNAPSHOT

- FIGURE 55 HARMAN INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 56 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 57 SYNAPTICS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 58 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 59 KNOWLES CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 ANDREA ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 61 CIRRUS LOGIC: COMPANY SNAPSHOT

- FIGURE 62 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- FIGURE 63 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

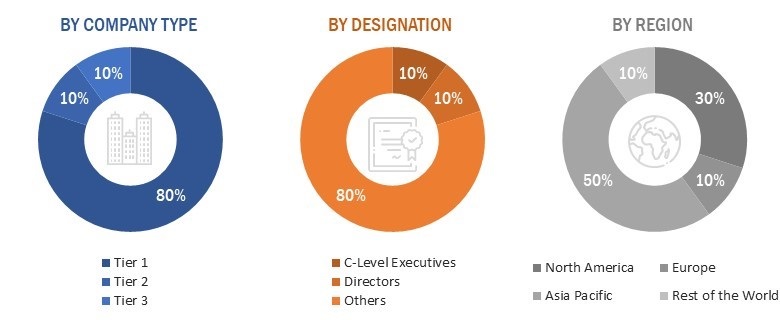

The study involved four major activities in estimating the size for far-field speech and voice recognition market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies, white papers, and articles by recognized authors were referred to. Secondary research was conducted to obtain key information about the market’s supply chain, the market’s value chain, the pool of key market players, and market segmentation according to industry trends, regions, and developments from both market and technology perspectives.

Primary Research

Extensive primary research was conducted after understanding and analyzing the far-field speech and voice recognition market scenario through secondary research. Several primary interviews were conducted with key opinion leaders from both demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW). Approximately 25% of primary interviews were conducted with the demand side and 75% with the supply side. These primary data were collected through telephonic interviews, questionnaires, and emails.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, both top-down and bottom-up approaches were implemented to estimate and validate the size of the far-field speech and voice recognition market and various other dependent submarkets. The key players in the far-field speech and voice recognition market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of top players and interviews with experts (such as CEOs, COOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Far-field Speech and Voice Recognition Market: Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the far-field speech and voice recognition market from the revenue of key players and their market share. The overall market size was calculated based on the revenues of key players identified in the market. In this approach, the market was split in terms of value at the application level. The application segment was further segmented into regional levels (North America, Europe, Asia Pacific, Rest of the World). The bottom-up process was implemented for the data extracted from the secondary research to validate the market size of the concerned segments. Then the market share of each company was estimated to verify the revenue shares used earlier in the bottom-up procedure. With the data triangulation procedure and the validation of data through primaries, exact values of the overall market size were determined and confirmed in the study.

Far-field Speech and Voice Recognition Market: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research. To calculate specific market segments, the most appropriate parent market size was considered to implement the top-down approach. Data from interviews were consolidated, checked for consistency and accuracy, and inserted into the data model to arrive at the market numbers following the top-down approach. Market sizes in different geographies were identified and analyzed through secondary research. Upon the estimation and validation of the main market size, further segmentation was done based on consolidated inputs from key players with respect to regional adoption trends, along with different far-field speech and voice recognition components, microphone solutions, applications, and regions.

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Definition

Far-field speech and voice recognition is a technology that enables accurate detection, interpretation, and processing of spoken language and voice commands from a distance, typically in scenarios where the speaker is several meters away from the microphone or in environments with high levels of ambient noise. It involves the use of advanced signal processing techniques, such as beamforming, noise cancellation, and echo suppression, to capture and isolate the desired sound source while filtering out background noise and reverberations.

Key Stakeholders

- Component and technology suppliers

- System integration and solution providers

- Original equipment manufacturers

- Application developers

- Suppliers and distributors

- Technology standards organizations, forums, alliances, and associations

- Government agencies, financial institutions, and investment communities

- Research organizations

- Analysts and strategic business planners

- Venture capitalists, private equity firms, and startups

- End-users including individual consumers, business professionals, automotive users, healthcare facilities, educational institutions, smart homeowners, retail businesses, among others

Report Objectives

- To define, describe, and forecast the size of the far-field speech and voice recognition market in terms of value and volume based on component, microphone solution, application, and region

- To forecast the market size for various segments with respect to four regions, namely North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information about factors (drivers, restraints, opportunities, and challenges) influencing the growth of the far-field speech and voice recognition market

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s Five Forces analysis, and regulations pertaining to the market

- To provide a detailed overview of the value chain of the far-field speech and voice recognition ecosystem

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the far-field speech and voice recognition market

- To strategically profile key players, comprehensively analyze their market positions in terms of ranking and core competencies2, and provide a competitive landscape of the far-field speech and voice recognition market

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the far-field speech and voice recognition market

- To study the impact of the recession on the far-field speech and voice recognition market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Growth opportunities and latent adjacency in Far-Field Speech and Voice Recognition Market

Interested on finding out market potential per technology is present in the robotics market.

Software play a significant role in ensuring the interoperability and compatibility, I would like to understand whether this report include different types of software used in far field voce recognition and the market sizing for the same?

I would like to understand the market trends in far field voice recognition market

I would like to understand the automotive application market for innovative technologies in this space

Does this report provide application wise product analysis for Indian market