Text-to-Speech Market Size, Share & Industry Growth Analysis Report by Offering (Software, Service, SaaS), Deployment (On-premises, Cloud-based), Voice (Neural & Custom, Non-Neural), Solution (Accessibility, Voice-based AI), Organization Size, Language, Vertical & Region – Global Forecast to 2029

Updated on : September 10, 2025

Text-to-Speech Market Size & Growth

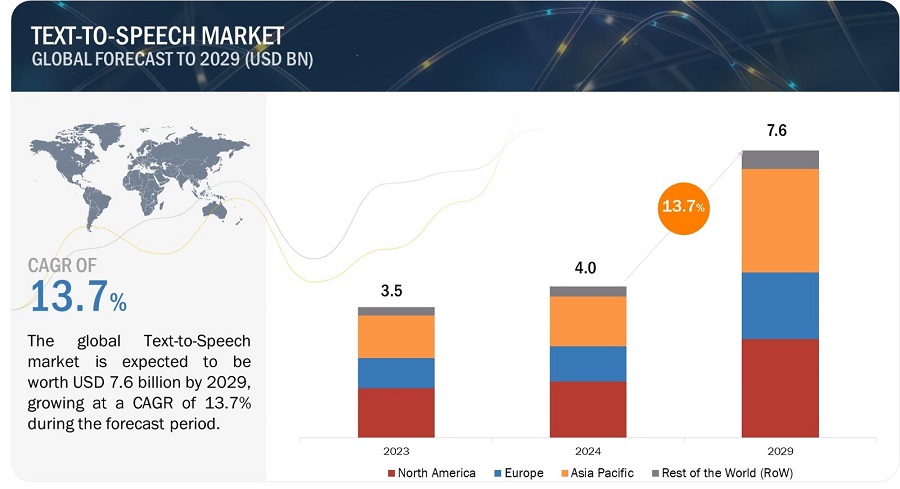

The global Text-to-Speech Market was valued at USD 4.0 billion in 2024 and is projected to grow from USD 4.66 billion in 2025 to USD 7.6 billion by 2029, at a CAGR of 13.7% during the forecast period. This robust growth is propelled by advancements in AI-driven text-to-speech software, increasing government initiatives for accessible education, and the proliferation of smart devices. Challenges persist in ensuring natural prosody and addressing privacy concerns, yet the market is poised to capitalize on opportunities in cloud-based deployments and autonomous vehicles.

Key Takeaways:

• Market Growth: The global Text-to-Speech Market was valued at USD 4.0 billion in 2024 and is projected to grow from USD 4.66 billion in 2025 to USD 7.6 billion by 2029, at a CAGR of 13.7% during the forecast period.

• By Product: AI-driven text-to-speech software and neural text-to-speech technology are at the forefront, enhancing user experience with lifelike voice synthesis.

• By Application: Educational settings are a significant application area, as institutions adopt TTS solutions to support inclusive learning for differently-abled students.

• By Technology: Multilingual capabilities and advancements in natural language processing are key technological drivers, facilitating broader adoption across diverse markets.

• By End User: The elderly population and individuals with learning disabilities are increasingly dependent on TTS technology, driving demand for accessible digital content.

• By Region: ASIA-PACIFIC is expected to grow fastest at 15.8% CAGR, driven by technological adoption and government-led educational initiatives.

• Competitive Landscape: The market is characterized by intense competitive rivalry, with key players focusing on enhancing security measures to mitigate privacy concerns associated with cloud-based TTS applications.

In conclusion, the text-to-speech market is on a dynamic growth trajectory, driven by technological innovations and increasing demand for accessibility solutions. Long-term opportunities are plentiful, particularly with the integration of TTS technology into autonomous vehicles and the continued expansion of cloud-based services. As technology evolves, the market is expected to further transform, creating a more inclusive digital environment for users globally.

The text-to-speech market is experiencing growth driven by the rising need for AI-based tools, natural language processing, and the widespread adoption of advanced electronic devices. However, challenges surrounding clear pronunciation and voice modification are impeding market advancement. Despite these hurdles, opportunities emerge from the increasing demand for mobile devices, augmented government spending on education for differently-abled students, and the growing population facing diverse learning difficulties. A significant trend in the text-to-speech market involves the expected upsurge in demand fueled by progress in digital content development, the prevalent use of handheld devices, and the expanding reach of internet connectivity.

Text-to-Speech Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Text-to-Speech Market Trends and Dynamics:

Driver: Increased government spending on education of differently-abled students

The growth of the Text-to-Speech market is fueled by a notable driver: the augmented government expenditure on the education of differently-abled students. This trend is contributing to an escalating demand for Text-to-Speech solutions within educational settings. As educational institutions strive to create more inclusive learning environments, Text-to-Speech technology is playing a pivotal role by providing accessible tools for individuals with visual or learning impairments. This facilitates the dissemination of information through spoken text, ultimately enhancing the educational experience for a diverse range of students.

Restraint: Growing privacy, security, and ethical concerns in cloud-based Text-to-Speech

Despite the optimistic growth trajectory of the Text-to-Speech market, a noteworthy restraint is arising due to heightened concerns in the realms of privacy, security, and ethics associated with cloud-based TTS applications. As TTS solutions rely increasingly on cloud infrastructure, users and organizations are becoming more cautious about potential risks and vulnerabilities. The concerns span a range of issues, including the fear of data breaches, where unauthorized access to sensitive information could occur, and apprehensions about the potential misuse of personal or confidential data processed by these cloud-based systems. To mitigate these concerns, it is imperative for developers and providers of cloud-based TTS applications to implement robust security measures.

This includes encryption protocols to safeguard data during transmission and storage, rigorous access controls to limit unauthorized entry, and adherence to ethical standards in data usage and handling. Proactive transparency about data practices, compliance with privacy regulations, and continuous improvement of security protocols are essential to reassure users and organizations, fostering trust and ensuring the sustained adoption of cloud-based Text-to-Speech solutions in the market.

Opportunity: Integration of Text-to-Speech in autonomous vehicles

An exciting prospect for the Text-to-Speech market lies in the increasing integration of TTS technology into autonomous vehicles. With the automotive industry progressing towards autonomous and connected vehicles, there is a growing demand for sophisticated voice interfaces that can enhance user experience and safety. Text-to-speech systems are becoming integral in providing natural and contextually relevant voice communication within the vehicle environment. This includes delivering navigation prompts, enabling hands-free calling, and facilitating other interactive features. The integration of TTS in autonomous vehicles not only responds to the demand for advanced in-car communication but also positions Text-to-Speech providers at the forefront of contributing to the evolution of smart and user-friendly automotive technologies.

Challenge: Creating a comprehensive acoustic database for Text-to-Speech

A substantial hurdle confronted by the Text-to-Speech market is the intricate task of developing a generic acoustic database that can effectively cover the extensive array of language variations. The quest for achieving natural-sounding speech synthesis across diverse linguistic contexts necessitates the creation of comprehensive databases that encompass not only different languages but also various accents, dialects, and regional nuances. This poses a formidable challenge as it demands ongoing efforts to update databases continuously, accommodating the dynamic evolution of language patterns and the ever-expanding global linguistic diversity. The significance of overcoming this challenge cannot be overstated.

The authenticity and naturalness of synthesized speech are directly contingent on the richness and accuracy of the underlying acoustic database. Text-to-speech providers must grapple with the complexities of capturing the subtleties inherent in diverse linguistic expressions to deliver solutions that resonate authentically with users across a spectrum of cultural and linguistic backgrounds. Successfully addressing this challenge not only enhances the quality of Text-to-Speech offerings but also ensures their relevance and effectiveness in a global context, where linguistic diversity is a fundamental aspect of human communication.

Rf-Over-Fiber Market Ecosystem

The Text-to-Speech market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the text-to-speech market include Microsoft Corporation (US), Google (US), Amazon.com, Inc. (US), IBM (US), and Baidu Inc. (China).

Services by offering is expected to hold the highest market share during the forecast period.

Services holds the largest share in the Text-to-Speech market offering category due to the heightened demand for cloud-based TTS solutions and the shift toward service-oriented models. The versatility and scalability of TTS services enable businesses to access advanced voice synthesis capabilities without the need for substantial infrastructure investments. Cloud-based offerings, in particular, provide a cost-effective and efficient way for organizations to integrate TTS into their applications and products.

The subscription-based nature of TTS services ensures continuous updates, improved customization options, and simplified maintenance, appealing to businesses seeking hassle-free and up-to-date solutions. As the market emphasizes accessibility, flexibility, and seamless integration, TTS services emerge as a pivotal and dominant offering, catering to the evolving needs of a wide range of industries.

Based on deployment, Cloud-based to hold the highest CAGR during the forecast period

Cloud-based deployment is experiencing a high CAGR in the Text-to-Speech market due to its inherent advantages aligning with contemporary business demands. Cloud solutions offer unparalleled scalability, allowing organizations to dynamically manage resources based on fluctuating demands without hefty upfront investments in infrastructure.

The cost-effectiveness of cloud deployment is particularly attractive to businesses seeking efficient and budget-friendly solutions, especially smaller enterprises. Additionally, cloud-based Text-to-Speech services facilitate seamless updates and maintenance, ensuring users consistently access the latest advancements in voice synthesis technology. As the business landscape increasingly prioritizes flexibility, rapid implementation, and resource efficiency, the growth of cloud-based deployment in the text-to-speech market reflects its ability to meet these evolving demands and drive widespread adoption.

Large enterprises in Text-to-Speech market to hold the highest market share.

Large enterprises dominate the Text-to-Speech market based on organization size due to their substantial resources, comprehensive infrastructure, and sophisticated technological needs. These organizations often require scalable and feature-rich solutions to meet diverse and complex requirements across various sectors. Large enterprises can invest in and deploy robust Text-to-Speech systems seamlessly, integrating them into their extensive networks and applications.

The need for advanced communication tools, customer engagement platforms, and interactive applications in sectors such as customer service, e-learning, and entertainment drives the demand for high-quality Text-to-Speech solutions. The financial capacity and expansive operational scale of large enterprises position them as key contributors to the adoption of sophisticated and tailored Text-to-Speech technologies, securing their prominence in this market segment.

Based on verticals, the education sector in Text-to-Speech market accounts for highest CAGR

The education sector is experiencing a high CAGR in the Text-to-Speech market due to the increasing recognition of its transformative impact on learning experiences. Text-to-speech technology has become instrumental in addressing diverse learning needs, catering to students with visual impairments, reading difficulties, or those who benefit from auditory reinforcement. The implementation of TTS in educational materials and e-learning platforms enhances accessibility, making content more inclusive for all students. As digital learning gains prominence, educational institutions are leveraging TTS for providing interactive and personalized content delivery. Additionally, the growing awareness of diverse learning styles and the emphasis on inclusive education contribute to the rising adoption of Text-to-Speech solutions, position.

Text-to-Speech Industry Regional Analysis

Text-to-Speech market in Asia Pacific region to exhibit highest CAGR during the forecast period

The Asia Pacific region is witnessing the highest CAGR in the Text-to-Speech industry, propelled by several factors. The region is undergoing rapid technological advancements and digital transformation, with a burgeoning population of tech-savvy consumers. The increasing adoption of smartphones, rising internet penetration, and a growing demand for voice-enabled applications in diverse industries contribute to the heightened growth. Additionally, the linguistic diversity across Asia Pacific necessitates versatile Text-to-Speech solutions, catering to a wide array of languages and dialects. As businesses and consumers alike in the region recognize the value of voice technology, coupled with the expanding need for accessibility features, the Text-to-Speech market in Asia Pacific is experiencing robust growth, making it a pivotal player in the global landscape.

Text-to-Speech Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Text-to-Speech Companies - Key Market Players

The Text-to-Speech companies is dominated by players such as

- Microsoft Corporation (US),

- Google (US),

- Amazon.com, Inc. (US),

- IBM (US),

- Baidu Inc. (China) and others.

Text-to-Speech Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 4.0 billion in 2024 |

|

Expected Market Size |

USD 7.6 billion by 2029 |

|

Growth Rate |

CAGR of 13.7% |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Offering, By Deployment Mode, By Voice Type, By Organization Size, By Language, and By Vertical. |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the world (RoW) |

|

Companies covered |

The major market players include Microsoft Corporation (US), Google (US), Amazon.com, Inc. (US), IBM (US), and Baidu Inc. (China). (A total of 25 players are profiled) |

Text-to-Speech Market Highlights

|

Segment |

Subsegment |

|

By Offering |

|

|

By Deployment Mode |

|

|

By Voice Type |

|

|

By Organization Size |

|

|

By Language |

|

|

By Region |

|

Recent Developments in Text-to-Speech Industry

- In November 2023, Microsoft has introduced the public preview of Azure AI Speech, a technology enabling users to generate talking avatar videos through text input and develop real-time interactive bots utilizing human images.

- In January 2023, Microsoft has unveiled VALL-E, an innovative language model approach for text-to-speech synthesis (TTS). This method utilizes audio codec codes as intermediate representations and has the capability to replicate an individual's voice after analyzing a mere three seconds of audio recording.

- In January 2023, Amazon Polly introduces two additional voices for US English support: Ruth, a new neural female voice, and Stephen, a new neural male voice. This expands the portfolio for this locale to include a total of six female voices and four male voices.

- In October 2023, IBM has announced the acquisition of Manta Software Inc, a data lineage platform. This strategic move enhances IBM's capabilities across watsonx.ai, watsonx.data, and watsonx. governance, empowering businesses to create products grounded in principles of trust and transparency

- In March 2022, Microsoft Corp declared the successful finalization of its acquisition of Nuance Communications Inc. a frontrunner in conversational AI and ambient intelligence spanning various industries, including healthcare, financial services, retail, and telecommunications

- In December 2020, Watson Discovery is an AI-powered intelligent search and text analytics technology that breaks down data silos and finds information hidden deep within corporate databases. The platform employs cutting-edge, market-leading natural language processing solutions to extract relevant business insights from documents, webpages, and large data, reducing research time by up to 75%.

Frequently Asked Questions (FAQs):

What are the Text-to-Speech market's major driving factors and opportunities?

The Text-to-Speech market is driven by increasing demand for AI-based tools and natural language processing, widespread adoption of advanced electronic devices, and growing applications across industries. The rising need for accessibility features, particularly for differently-abled individuals, fuels market growth. Technological advancements, such as enhanced pronunciation and voice modification capabilities, contribute to the expanding use of Text-to-Speech solutions. Furthermore, the surge in demand for mobile devices, coupled with increased government spending on education, presents additional opportunities for market expansion.

Which region is expected to hold the highest market share?

North America commands a larger share of the Text-to-Speech market due to its highly developed technological landscape, including major players in the IT and software industry. The region's early adoption of artificial intelligence (AI) and natural language processing (NLP) technologies contributes to the robust ecosystem for voice synthesis. The prevalence of English as a primary language further solidifies North America's dominance, with a vast market for English language models. Additionally, the region's focus on technological innovation, coupled with a tech-savvy consumer base, positions North America at the forefront of Text-to-Speech market leadership.

Who are the leading players in the global Text-to-Speech market?

Companies such as Microsoft Corporation (US), Google (US), Amazon.com, Inc. (US), IBM (US), and Baidu Inc. (China) are the leading players in the market. Moreover, these companies rely on several strategies, including new product launches and developments, collaborations and partnerships, and acquisitions. Such strategies give these companies an edge over other players in the market.

What are some of the technological advancements in the Text-to-Speech market?

Technological advancements in the Text-to-Speech market are marked by the evolution of AI-driven tools, fostering more natural language processing capabilities. Continuous improvements in voice synthesis enhance the lifelike quality of generated speech. Pronunciation clarity and voice modification technologies are advancing, addressing previous challenges. Moreover, the integration of TTS in various applications, from navigation devices to virtual assistants, reflects the ongoing innovation driving the market forward.

What is the size of the global Text-to-Speech market?

The global Text-to-Speech market was valued at USD 4.0 billion in 2024 and is anticipated to reach USD 7.6 billion in 2029 at a CAGR of 13.7% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for Interactive Voice Response (IVR) systems- Increasing government initiatives pertaining to education of differently abled students- Growing dependence of elderly population on technology- Increasing number of people with different learning disabilitiesRESTRAINTS- Complexity of generating correct prosody and pronunciation of naturally occurring speech- Privacy and security concerns associated with cloud-based text-to-speech technologyOPPORTUNITIES- Integration of speech recognition technology with robotics- Growing inclination toward cloud-based deployment mode- Integration of text-to-speech technology into autonomous vehiclesCHALLENGES- Creation of generic acoustic database to cover language variations- Growing cybercrime, data privacy, and ethical considerations

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM/MARKET MAP

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF TEXT-TO-SPEECH SERVICES OFFERED BY KEY PLAYERSAVERAGE SELLING PRICE TREND OF TEXT-TO-SPEECH SERVICES, BY VERTICALAVERAGE SELLING PRICE TREND OF TEXT-TO-SPEECH SERVICES, BY REGION

-

5.7 TECHNOLOGY ANALYSISCOMPLIMENTARY TECHNOLOGIES- AI-driven text-to-speech software- Multilingual text-to-speech systems- Neural text-to-speech technology

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISYAPI KREDI INTRODUCED VOICE-ENABLED ATMS FOR PEOPLE WITH DISABILITIES UTILIZING SESTEK’S TECHNOLOGYNEW MEXICO STATE TRANSFORMED TRAINING MODULES WITH COLOSSYAN’S AI-POWERED PLATFORMCYBER INC. USED SYNTHESIA TO SCALE TRAINING VIDEOS AND EXPAND PRESENCE TO NEW MARKETSGATWICK AIRPORT ENHANCED CUSTOMER SERVICE WITH CEREPROC'S TTS SYSTEMBRACKEN IMPROVED E-LEARNING PLATFORM BY DEPLOYING NEOSPEECH'S TEXT-TO-SPEECH SOLUTION

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS

-

5.14 TARIFF, STANDARDS, AND REGULATORY LANDSCAPETARIFFREGULATIONS- Regulatory bodies, government agencies, and other organizations- RegulationsSTANDARDS

- 6.1 INTRODUCTION

- 6.2 ACCESSIBILITY SOLUTIONS

- 6.3 VOICE-BASED AI

- 7.1 INTRODUCTION

-

7.2 SOFTWAREADVANCEMENTS IN NLP ALGORITHMS AND MULTILINGUAL CAPABILITIES OF TEXT-TO-SPEECH PRODUCTS TO FUEL MARKET GROWTH

-

7.3 SERVICESSOFTWARE-AS-A-SERVICE (SAAS)- Scalability and adaptability benefits offered by SaaS to drive marketSUPPORT, IMPLEMENTATION & CONSULTING- Technicalities involved in implementing text-to-speech to boost demand

- 8.1 INTRODUCTION

-

8.2 ON-PREMISESINCREASING DEMAND FOR DATA PRIVACY AND SECURITY IN DATA-SENSITIVE ORGANIZATIONS TO FOSTER SEGMENTAL GROWTH

-

8.3 CLOUD-BASEDRISING USE OF CLOUD-BASED AND AI-DRIVEN APPLICATIONS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.1 INTRODUCTION

-

9.2 NEURAL & CUSTOMABILITY TO OFFER UNIQUE CUSTOM VOICE PERSONAS AND LIFELIKE SPEECH SYNTHESIS TO DRIVE MARKET

-

9.3 NON-NEURALSWIFT RESPONSES AND REAL-TIME TEXT-TO-SPEECH CONVERSIONS TO PROPEL SEGMENTAL GROWTH

- 10.1 INTRODUCTION

-

10.2 SMESNEED TO BOOST ONLINE PRESENCE BY CREATING ENGAGING CONTENT FOR DIGITAL PLATFORMS TO DRIVE DEMAND

-

10.3 LARGE ENTERPRISESNEED FOR MULTILINGUAL SUPPORT FOR CONSISTENT COMMUNICATION BETWEEN EMPLOYEES FROM DIVERSE BACKGROUNDS TO FUEL MARKET GROWTH

- 11.1 INTRODUCTION

-

11.2 ENGLISHEASE OF LEARNING ENGLISH AND GLOBAL APPLICATIONS TO DRIVE SEGMENTAL GROWTH

-

11.3 MANDARIN CHINESEINCREASING DEMAND FOR ADVANCED TECHNOLOGIES AND NATURAL LANGUAGE PROCESSING IN CHINA TO FUEL SEGMENTAL GROWTH

-

11.4 HINDIRISING USE OF SMARTPHONES AND INTERNET PENETRATION IN INDIA TO BOOST SEGMENTAL GROWTH

-

11.5 ARABICRAPID DIGITAL TRANSFORMATION ACROSS ARABIC-SPEAKING REGIONS TO PROPEL SEGMENTAL GROWTH

-

11.6 SPANISHINCREASING POPULATION AND ECONOMIC SUCCESS IN SPANISH-SPEAKING COUNTRIES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.7 OTHER LANGUAGES

- 12.1 INTRODUCTION

-

12.2 CONSUMER ELECTRONICSNEED FOR MORE INTUITIVE AND USER-FRIENDLY INTERFACES TO DRIVE MARKET

-

12.3 AUTOMOTIVE & TRANSPORTATIONNEED FOR SMARTER, VOICE-ACTIVATED VEHICLES TO ENHANCE DRIVER SAFETY AND OVERALL EXPERIENCE TO FUEL MARKET GROWTH

-

12.4 HEALTHCAREFOCUS ON PROVIDING PATIENT-CENTRIC HEALTHCARE EXPERIENCE AND STREAMLINING WORKFLOW AT HOSPITALS TO BOOST MARKET GROWTH

-

12.5 EDUCATIONSUBSTANTIAL BENEFITS FOR LEARNERS WITH VISUAL IMPAIRMENT AND LANGUAGE CHALLENGES TO DRIVE MARKET

-

12.6 BFSIPERSONALIZED AND HANDS-FREE CUSTOMER EXPERIENCE AND FRAUD DETECTION FEATURES TO CONTRIBUTE TO MARKET GROWTH

-

12.7 RETAILPERSONALIZED ONLINE SHOPPING EXPERIENCE LEADING TO INCREASED CUSTOMER SATISFACTION TO AUGMENT MARKET GROWTH

-

12.8 ENTERPRISESIMPROVED BUSINESS PERFORMANCE AND EFFECTIVENESS IN EMERGENCY ALERT SYSTEMS TO PROPEL MARKET

-

12.9 HOSPITALITYRISING IMPLEMENTATION OF VOICE-BASED SEARCH IN ONLINE PORTALS TO ENHANCE TRAVEL MARKETING TO DRIVE MARKET

- 12.10 OTHER VERTICALS

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICAUS- Increasing adoption of text-to-speech and voice recognition technologies by major corporations to fuel market growthCANADA- Commitment to providing accessible multilingual services across different sectors to drive marketMEXICO- Integration of text-to-speech technology into navigation and in-car entertainment systems to propel marketIMPACT OF RECESSION ON TTS MARKET IN NORTH AMERICA

-

13.3 EUROPEGERMANY- Growing demand for natural and context-aware voice interactions to fuel market growthUK- Embracing digital economy and innovative technologies backed by government initiatives to drive marketITALY- Rising popularity of virtual assistants and navigation systems to foster market growthFRANCE- Surge in initiatives promoting digital transformation to boost market growthSPAIN- Rising integration of text-to-speech solutions with smart devices and virtual assistants to fuel market growthREST OF EUROPEIMPACT OF RECESSION ON TEXT-TO-SPEECH MARKET IN EUROPE

-

13.4 ASIA PACIFICCHINA- Booming digital landscape and population growth to drive marketJAPAN- Rising adoption of text-to-speech technology to enhance user interfaces and create immersive experiences to contribute to market growthSOUTH KOREA- Integration of text-to-speech technology with consumer electronics to foster market growthINDIA- Higher linguistic diversity and rapid digital transformation to boost market growthREST OF ASIA PACIFICIMPACT OF RECESSION ON TTS MARKET IN ASIA PACIFIC

-

13.5 ROWSOUTH AMERICA- Growing demand from consumer electronics industry and enterprises to support market growthMIDDLE EAST & AFRICA- Rising demand for digital accessibility and Arabic language support in text-to-speech solutions to drive marketIMPACT OF RECESSION ON MARKET IN ROW

- 14.1 OVERVIEW

-

14.2 STRATEGIES ADOPTED BY KEY PLAYERSPRODUCT/SERVICE PORTFOLIOREGIONAL FOCUSORGANIC/INORGANIC GROWTH STRATEGIES

- 14.3 MARKET SHARE ANALYSIS

- 14.4 FIVE-YEAR COMPANY REVENUE ANALYSIS

-

14.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

14.6 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

14.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

- 15.1 INTRODUCTION

-

15.2 KEY PLAYERSIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAMAZON.COM, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBAIDU, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCEREPROC LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSENSORY INC.- Business overview- Products/Solutions/Services offered- Recent developmentsIFLYTEK CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsREADSPEAKER B.V.- Business overview- Products/Solutions/Services offered- Recent developmentsSESTEK- Business overview- Products/Solutions/Services offered- Recent developments

-

15.3 OTHER PLAYERSLUMENVOXACAPELA GROUPNEXTUP TECHNOLOGIES, LLCTEXTSPEAK CORPORATIONVONAGE AMERICA, LLCELEVENLABSRESEMBLE AILOVO, INC.DEEPBRAIN AISYNTHESIA LIMITEDHEYGENCOLOSSYAN INC.MURF.AINUANCE COMMUNICATIONS, INC.ISPEECH, INC.

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 AVERAGE SELLING PRICE TREND OF TEXT-TO-SPEECH SERVICES OFFERED BY KEY PLAYERS (USD/MONTH)

- TABLE 2 TEXT-TO-SPEECH MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 4 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 5 TTS MARKET: LIST OF PATENTS, 2019–2023

- TABLE 6 TOP 20 PATENT OWNERS IN MARKET, 2013–2023

- TABLE 7 TTS MARKET: LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 8 MFN TARIFF FOR HS CODE 851989-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 9 MFN TARIFF FOR HS CODE 851989-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 TEXT-TO-SPEECH: CODES AND STANDARDS

- TABLE 15 TEXT-TO-SPEECH MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 16 MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 17 SERVICES: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 18 SERVICES: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 19 TTS MARKET, BY DEPLOYMENT MODE, 2020–2023 (USD MILLION)

- TABLE 20 TTS MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 21 ON-PREMISES: MARKET, BY ORGANIZATION SIZE, 2020–2023 (USD MILLION)

- TABLE 22 ON-PREMISES: MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

- TABLE 23 ON-PREMISES: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 24 ON-PREMISES: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 25 ON-PREMISES: MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 26 ON-PREMISES: MARKET IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 27 ON-PREMISES: MARKET IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 28 ON-PREMISES: MARKET IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 29 ON-PREMISES: MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 30 ON-PREMISES: MARKET IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 31 ON-PREMISES: MARKET IN ROW, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 32 ON-PREMISES: MARKET IN ROW, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 33 CLOUD-BASED: MARKET, BY ORGANIZATION SIZE, 2020–2023 (USD MILLION)

- TABLE 34 CLOUD-BASED: MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

- TABLE 35 CLOUD-BASED: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 36 CLOUD-BASED: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 37 CLOUD-BASED: MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 38 CLOUD-BASED: MARKET IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 39 CLOUD-BASED: MARKET IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 40 CLOUD-BASED: MARKET IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 41 CLOUD-BASED: MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 42 CLOUD-BASED: MARKET IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 43 CLOUD-BASED: MARKET IN ROW, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 44 CLOUD-BASED: MARKET IN ROW, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 45 TEXT-TO-SPEECH MARKET, BY VOICE TYPE, 2020–2023 (USD MILLION)

- TABLE 46 MARKET, BY VOICE TYPE, 2024–2029 (USD MILLION)

- TABLE 47 NEURAL & CUSTOM: MARKET, BY LANGUAGE, 2020–2023 (USD MILLION)

- TABLE 48 NEURAL & CUSTOM: MARKET, BY LANGUAGE, 2024–2029 (USD MILLION)

- TABLE 49 NON-NEURAL: MARKET, BY LANGUAGE, 2020–2023 (USD MILLION)

- TABLE 50 NON-NEURAL: MARKET, BY LANGUAGE, 2024–2029 (USD MILLION)

- TABLE 51 MARKET, BY ORGANIZATION SIZE, 2020–2023 (USD MILLION)

- TABLE 52 MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

- TABLE 53 SMES: MARKET, BY DEPLOYMENT MODE, 2020–2023 (USD MILLION)

- TABLE 54 SMES: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 55 LARGE ENTERPRISES: MARKET, BY DEPLOYMENT MODE, 2020–2023 (USD MILLION)

- TABLE 56 LARGE ENTERPRISES: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 57 TEXT-TO-SPEECH MARKET, BY LANGUAGE, 2020–2023 (USD MILLION)

- TABLE 58 MARKET, BY LANGUAGE, 2024–2029 (USD MILLION)

- TABLE 59 ENGLISH: MARKET, BY VOICE TYPE, 2020–2023 (USD MILLION)

- TABLE 60 ENGLISH: MARKET, BY VOICE TYPE, 2024–2029 (USD MILLION)

- TABLE 61 MANDARIN CHINESE: MARKET, BY VOICE TYPE, 2020–2023 (USD MILLION)

- TABLE 62 MANDARIN CHINESE: TTS MARKET, BY VOICE TYPE, 2024–2029 (USD MILLION)

- TABLE 63 HINDI: MARKET, BY VOICE TYPE, 2020–2023 (USD MILLION)

- TABLE 64 HINDI: MARKET, BY VOICE TYPE, 2024–2029 (USD MILLION)

- TABLE 65 ARABIC: MARKET, BY VOICE TYPE, 2020–2023 (USD MILLION)

- TABLE 66 ARABIC: MARKET, BY VOICE TYPE, 2024–2029 (USD MILLION)

- TABLE 67 SPANISH: MARKET, BY VOICE TYPE, 2020–2023 (USD MILLION)

- TABLE 68 SPANISH: MARKET, BY VOICE TYPE, 2024–2029 (USD MILLION)

- TABLE 69 OTHER LANGUAGES: MARKET, BY VOICE TYPE, 2020–2023 (USD MILLION)

- TABLE 70 OTHER LANGUAGES: MARKET, BY VOICE TYPE, 2024–2029 (USD MILLION)

- TABLE 71 TEXT-TO-SPEECH MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 72 MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 73 CONSUMER ELECTRONICS: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 74 CONSUMER ELECTRONICS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 75 AUTOMOTIVE & TRANSPORTATION: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 76 AUTOMOTIVE & TRANSPORTATION: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 77 HEALTHCARE: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 78 HEALTHCARE: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 79 EDUCATION: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 80 EDUCATION: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 81 BFSI: TTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 82 BFSI: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 83 RETAIL: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 84 RETAIL: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 85 ENTERPRISES: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 86 ENTERPRISES: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 87 HOSPITALITY: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 88 HOSPITALITY: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 89 OTHER VERTICALS: TTS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 90 OTHER VERTICALS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 91 MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 92 MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 93 NORTH AMERICA: TEXT-TO-SPEECH MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 94 NORTH AMERICA: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 95 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2020–2023 (USD MILLION)

- TABLE 96 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 97 NORTH AMERICA: MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 98 NORTH AMERICA: MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 100 EUROPE: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY DEPLOYMENT MODE, 2020–2023 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 105 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 106 ASIA PACIFIC: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2020–2023 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 111 ROW: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 112 ROW: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 113 ROW: MARKET, BY DEPLOYMENT MODE, 2020–2023 (USD MILLION)

- TABLE 114 ROW: MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 115 ROW: MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 116 ROW: TTS MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 117 TTS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020–2023

- TABLE 118 TEXT-TO-SPEECH MARKET SHARE ANALYSIS, 2023

- TABLE 119 COMPANY FOOTPRINT, BY OFFERING

- TABLE 120 COMPANY FOOTPRINT, BY DEPLOYMENT MODE

- TABLE 121 COMPANY FOOTPRINT, BY VERTICAL

- TABLE 122 COMPANY FOOTPRINT, BY REGION

- TABLE 123 OVERALL COMPANY FOOTPRINT

- TABLE 124 MARKET: LIST OF KEY START-UPS/SMES

- TABLE 125 START-UPS/SMES FOOTPRINT, BY OFFERING

- TABLE 126 START-UPS/SMES FOOTPRINT, BY DEPLOYMENT MODE

- TABLE 127 START-UPS/SMES FOOTPRINT, BY VERTICAL

- TABLE 128 START-UPS/SMES FOOTPRINT, BY REGION

- TABLE 129 TTS MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 130 TEXT-TO-SPEECH MARKET: DEALS, 2020–2023

- TABLE 131 IBM: BUSINESS OVERVIEW

- TABLE 132 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 IBM: PRODUCT LAUNCHES

- TABLE 134 IBM: DEALS

- TABLE 135 MICROSOFT: BUSINESS OVERVIEW

- TABLE 136 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 MICROSOFT: PRODUCT LAUNCHES

- TABLE 138 MICROSOFT: DEALS

- TABLE 139 AMAZON.COM, INC.: BUSINESS OVERVIEW

- TABLE 140 AMAZON.COM, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 AMAZON.COM, INC.: PRODUCT LAUNCHES

- TABLE 142 GOOGLE: BUSINESS OVERVIEW

- TABLE 143 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 GOOGLE: PRODUCT LAUNCHES

- TABLE 145 BAIDU, INC.: BUSINESS OVERVIEW

- TABLE 146 BAIDU, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 BAIDU, INC.: PRODUCT LAUNCHES

- TABLE 148 CEREPROC LTD.: BUSINESS OVERVIEW

- TABLE 149 CEREPROC LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 CEREPROC LTD.: PRODUCT LAUNCHES

- TABLE 151 CEREPROC LTD.: DEALS

- TABLE 152 SENSORY INC.: BUSINESS OVERVIEW

- TABLE 153 SENSORY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 SENSORY INC.: PRODUCT LAUNCHES

- TABLE 155 SENSORY INC.: DEALS

- TABLE 156 IFLYTEK CORPORATION: BUSINESS OVERVIEW

- TABLE 157 IFLYTEK CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 IFLYTEK CORPORATION: PRODUCT LAUNCHES

- TABLE 159 READSPEAKER B.V.: BUSINESS OVERVIEW

- TABLE 160 READSPEAKER B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 READSPEAKER B.V.: PRODUCT LAUNCHES

- TABLE 162 READSPEAKER B.V.: DEALS

- TABLE 163 SESTEK: BUSINESS OVERVIEW

- TABLE 164 SESTEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 SESTEK: PRODUCT LAUNCHES

- FIGURE 1 TEXT-TO-SPEECH MARKET: SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: RESEARCH FLOW

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

- FIGURE 5 MARKET: BOTTOM-UP APPROACH

- FIGURE 6 MARKET: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 SERVICES TO ACCOUNT FOR LARGER SHARE OF MARKET IN 2029

- FIGURE 9 CLOUD-BASED DEPLOYMENT MODE TO DOMINATE TTS MARKET IN 2029

- FIGURE 10 NEURAL & CUSTOM VOICE TYPE TO HOLD MAJOR SHARE OF TTS MARKET IN 2029

- FIGURE 11 LARGE ENTERPRISES TO LEAD TEXT-TO-SPEECH MARKET IN 2029

- FIGURE 12 ENGLISH LANGUAGE TO HOLD LARGEST SHARE OF MARKET IN 2029

- FIGURE 13 CONSUMER ELECTRONICS VERTICAL TO LEAD MARKET IN 2029

- FIGURE 14 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 15 INCREASING ADOPTION OF AI AND ML SOLUTIONS IN DIFFERENT VERTICALS TO PROVIDE LUCRATIVE OPPORTUNITIES FOR MARKET BETWEEN 2024 AND 2029

- FIGURE 16 ENGLISH LANGUAGE TO LEAD IN TECT-TO-SPEECH MARKET DURING FORECAST PERIOD

- FIGURE 17 CONSUMER ELECTRONICS VERTICAL TO HOLD LARGEST SHARE IN MARKET IN 2029

- FIGURE 18 CONSUMER ELECTRONICS AND CHINA TO HOLD LARGEST SHARES OF TTS MARKET IN ASIA PACIFIC IN 2024

- FIGURE 19 INDIA TO RECORD HIGHEST CAGR IN GLOBAL TTS MARKET DURING FORECAST PERIOD

- FIGURE 20 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 TTS MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 22 POPULATION AGED 60 YEARS OR ABOVE, 1980–2050

- FIGURE 23 TTS MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 24 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 25 MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 26 TEXT-TO-SPEECH MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 ECOSYSTEM ANALYSIS

- FIGURE 28 ROLE OF PARTICIPANTS IN ECOSYSTEM

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 30 AVERAGE SELLING PRICE TREND OF TEXT-TO-SPEECH SERVICES OFFERED BY KEY PLAYERS, 2023

- FIGURE 31 AVERAGE SELLING PRICE TREND OF TEXT-TO-SPEECH SERVICES, BY VERTICAL, 2020–2023 (USD/MILLION CHARACTERS)

- FIGURE 32 AVERAGE SELLING PRICE TREND OF TEXT-TO-SPEECH SERVICES, BY REGION (USD/MILLION CHARACTERS)

- FIGURE 33 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 36 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 37 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 38 NUMBER OF PATENTS GRANTED WORLDWIDE PERTAINING TO TEXT-TO-SPEECH TECHNOLOGY, 2013–2023

- FIGURE 39 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS RELATED TO TEXT-TO-SPEECH TECHNOLOGY, 2013–2023

- FIGURE 40 SERVICES TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 41 CLOUD-BASED DEPLOYMENT MODE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 42 NEURAL & CUSTOM VOICE TYPE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 43 SMES TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 44 SPANISH LANGUAGE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 CONSUMER ELECTRONICS VERTICAL TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 46 ASIA PACIFIC TO RECORD HIGHEST CAGR IN TEXT-TO-SPEECH MARKET DURING FORECAST PERIOD

- FIGURE 47 NORTH AMERICA: TTS MARKET SNAPSHOT

- FIGURE 48 EUROPE: TTS MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 50 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 51 REVENUE ANALYSIS OF KEY PLAYERS, 2018–2022

- FIGURE 52 MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 53 TEXT-TO-SPEECH MARKET: START-UPS/SMES EVALUATION MATRIX, 2023

- FIGURE 54 IBM: COMPANY SNAPSHOT

- FIGURE 55 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 56 AMAZON.COM, INC.: COMPANY SNAPSHOT

- FIGURE 57 GOOGLE: COMPANY SNAPSHOT

- FIGURE 58 BAIDU, INC.: COMPANY SNAPSHOT

- FIGURE 59 IFLYTEK CORPORATION: COMPANY SNAPSHOT

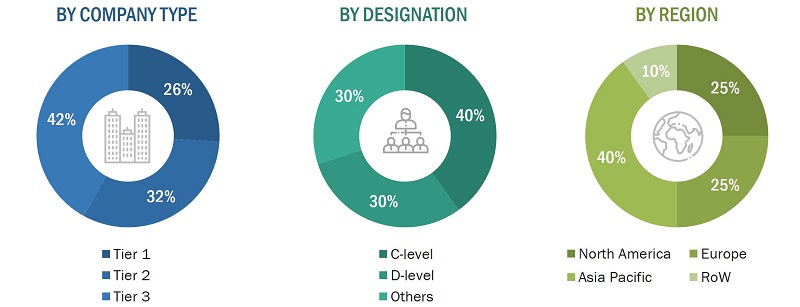

The study involved four major activities in estimating the current size of the Text-to-Speech market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

|

Sources |

Web Link |

|

ResponsiveVoice Text to Speech |

https://responsivevoice.org/ |

|

National Institute of Health |

https://www.nih.gov/ |

|

eLearning Industry |

https://elearningindustry.com/top-10-text-to-speech-tts-software-elearning |

|

Talk Business UK |

https://www.talk-business.co.uk/2019/11/18/the-numerous-benefits-of-using-text-to-speech-for-your-business/ |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the Text-to-Speech market through secondary research. Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods, to perform market estimation and forecasting for the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

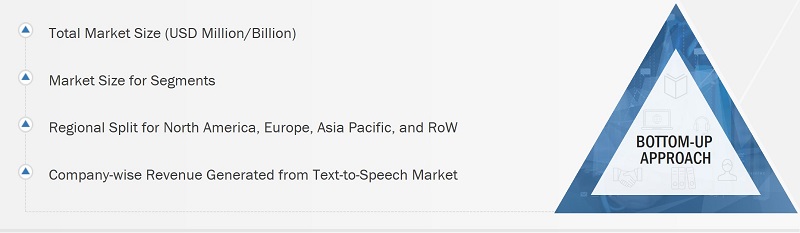

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the Text-to-Speech market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying entities in the Text-to-Speech value chain influencing the entire Text-to-Speech industry

- Analyzing each entity along with related major companies identifying technology providers for the implementation of offerings and services

- Estimating the market for these Text-to-Speech end users

- Tracking ongoing and upcoming implementation of Text-to-Speech developments by various companies and forecasting the market based on these developments and other critical parameters

- Arriving at the market size by analyzing Text-to-Speech companies based on their countries and then combining it to get the market estimate by region

- Verifying estimates and crosschecking them by a discussion with key opinion leaders, which include CXOs, directors, and operation managers

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

The most appropriate immediate parent market size has been used to implement the top-down approach to calculate the market size of specific segments. The top-down approach has been implemented for the data extracted from the secondary research to validate the market size obtained.

Each company’s market share has been estimated to verify the revenue shares used earlier in the top-down approach. This study has determined and confirmed the overall parent market and individual market sizes by the data triangulation method and data validation through primaries. The data triangulation method in this study is explained in the next section.

- Focusing initially on topline investments by market players in the Text-to-Speech ecosystem

- Calculating the market size based on the revenue generated by market players through the sales of Text-to-Speech components

- Mapping the use of Text-to-Speech in different offerings.

- Building and developing the information related to the revenue generated by market players through key products

- Estimating the geographic split using secondary sources considering factors, such as the number of players in a specific country and region, the role of major players in the development of innovative products, and adoption and penetration rates in a particular country for various offerings, deployment modes, voice types, organization sizes, languages, and verticals.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The data triangulation procedure has been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Speech recognition involves a machine or program's capability to interpret dictation or recognize and execute spoken commands. Text-to-speech (TTS) technology, on the other hand, converts digital text into spoken language. Initially developed to aid the visually impaired, TTS systems find application in various scenarios, assisting those who read slowly, face concentration challenges, need writing feedback, experience visual stress, and more. Over time, technological progress has expanded the use of TTS across diverse applications, including providing directions on navigation devices, facilitating public announcements, and serving as voices for virtual assistants.

Key Stakeholders

- Software providers

- Defense controlling system manufacturers

- Smart car manufacturers

- Mobile handset manufacturers

- Healthcare industry players

- Industry experts

Report Objectives

- To describe and forecast the Text-to-Speech market, in terms of value, based on offering, deployment mode, voice type, organization size, language, and vertical.

- To forecast the market size, in terms of value, for various segments with regard to 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the Text-to-Speech market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments, and perform a value chain analysis of the Text-to-Speech landscape

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments, such as partnerships and joint ventures, mergers and acquisitions, new product developments, expansions, and research and development, in the Text-to-Speech market

- To track and analyze competitive developments, such as partnerships, collaborations, agreements, joint ventures, mergers and acquisitions, expansions, product/service launches, and other developments in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the Text-to-Speech market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Text-to-Speech market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Text-to-Speech Market

Hi, I would like to download a report which contains text to speech (TTS) market size, main players, trend forecast etc.