Farm Equipment Rental Market by Equipment Type (Tractors, Harvesters, Sprayers, Balers & Other Equipment Types), Power Output (<30HP, 31-70HP, 71-130HP, 131-250HP, >250HP), Drive (Two-wheel Drive and Four-wheel Drive), Region Global Forecast to 2025

Farm Equipment Rental Market

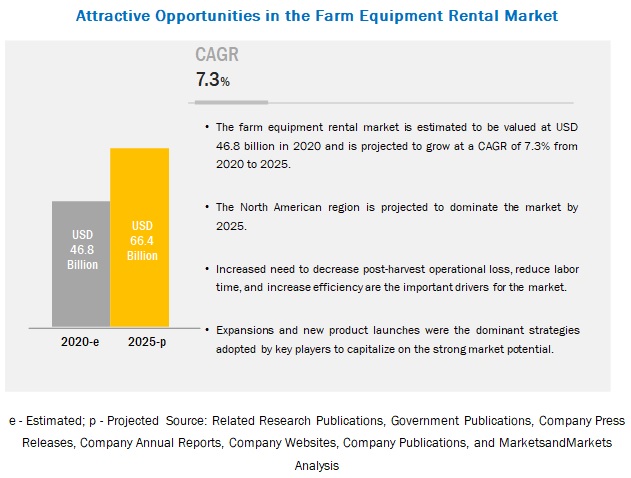

Global Farm Equipment Rental Market is expected to grow at a CAGR of 7.3%.

Drivers and Restraints:

Market dynamics for farm equipment rental continue to evolve on the basis key drivers and restraints. The rising demand for operational efficiency and increasing mechanization of farm processes in developing countries increases the demand for farm equipment rental. The key drivers and restraints in farm equipment rental market are enlisted below.

Key drivers for farm equipment rental include:

- Shortage of skilled labor and an increase in mechanization in developing countries

- Rising demand for productivity and operational efficiency

- High cost of agriculture equipment

- Limited availability of arable land

- Growing government subsidies for farming equipment

Restraints impeding the market include:

- Low level of awareness among farmers

The growth of the rental farm equipment market is driven by the growing need to reduce the financial burden on farmers. Farm equipment such as large farm tractors, harvesters, mowers, balers, conditioners, threshing equipment, and tillage equipment are quite expensive for the farmers. However, the farm equipment rental companies ease up the financial burden by offering the equipment at affordable leasing rates. Farm equipment rental services offer cost benefits to farmers and help them transform agriculture through mechanization.

Top equipment types of farm equipment rental:

- Tractors

- Harvesters

- Sprayers

- Balers

The farm equipment rental market has been classified, based on their power output as <30 HP, 3170 HP, 71130 HP, 131250 HP, and >250 HP. The rentals business of farm equipment operates in an environment with varied consumption patterns across the globe, and also varied demographics and geographies. The demand for farm equipment based on their power output from the developed nations is higher due to factors such as high consumption rates, higher food production necessity, greater power requirements in the farms, and the large land size of the farm holdings. Also, in the developing regions, the factors that drive the growth of sales for these tractors are the increasing farm mechanization, growing shift toward commercial farming practices, and greater subsidy support from the governments to enhance current mechanization levels.

Top power outputs used in farm equipment rental:

- <30 HP

- 31-70 HP

- 71-130 HP

- 131-250 HP

- > 250 HP

With advancement in new technological platforms required to manufacture farm equipment, increasing awareness of mechanization and adoption rate by the farmers and focus on sustainable agriculture, several farm equipment manufacturers have opted for giving their equipment on rent to the farmers at a lower cost. The leading players in farm equipment rental market are listed below.

Top 10 players in farm equipment rental include:

- John Deere

- CNH Industrial

- Kubota Corporation

- AGCO Corporation

- Mahindra & Mahindra

- JCB

- Escorts Ltd.

- Tractors & Farm Equipment Ltd.

- Pape Group, Inc.

- Premier Equipment Rentals

Top 5 Start-ups in farm equipment rental include:

- Flaman Group of Companies Ltd.

- Pacific Ag Rentals LLC

- Pacific Tractor & Implement Ltd.

- Farmease

- KWIPPED, Inc

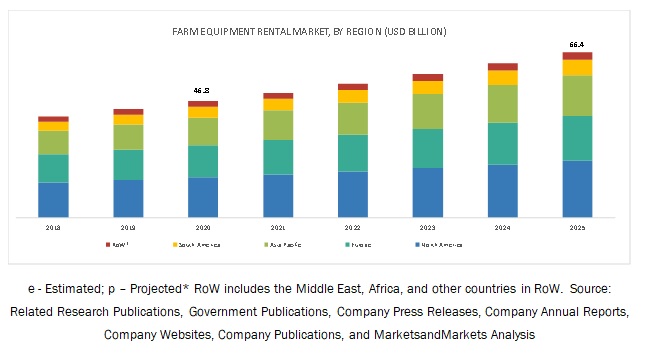

[181 Pages Report] The farm equipment rental market is estimated to account for a value of USD 46.8 billion in 2020 and is projected to grow at a CAGR of 7.3% from 2020, to reach a value of USD 66.4 billion by 2025. The global market is projected to witness significant growth due to factors such as the rise in the global population, shortage of skilled labor, increasing mechanization trends and rising demand for food grain products have fueled technological advancements across the globe are some of the major factors fueling the demand for farm equipment rental.

By drive, the four-wheel-drive segment is projected to be a faster-growing segment in the global market during the forecast period.

Four-wheel-drive tractors are robust machines used mainly for large scale commercial farming practices of 1002,000 ha. They have a very high pulling capacity and have high wheel-slip and wheel-power capacities. The body of the tractor is resistant to maximum wear and tear, and it also reduces the overall cultivation time required. The demand for 4WD tractors is seen maximum from the developed nations such as the US and those in Europe, which have the majority of the commercial and large-scale farmers. They also witness 95%99% of mechanization adoption rates in farming.

By equipment type, the harvesters segment is projected to grow at the highest CAGR in the farm equipment rental market during the forecast period.

The harvesters are versatile, self-propelled machines that are designed to harvest an assortment of grain crops efficiently. Reaping, threshing, and winnowing are the three separate harvesting operations combined into a single process using a harvester. Therefore, high labor costs and an insufficient workforce in the harvesting category are the main driving factors for the increase in demand for harvesters in the market for farm equipment rental.

By power output, the 71-130 HP segment is projected to dominate the global farm equipment rental market during the forecast period.

The 71130 HP segment majorly consists of 4WD tractors and some 2WD tractor models as well. Countries in the Asia Pacific region are striving to increase the farm mechanization rates are experiencing a growth in demand for such tractors. The demand for these tractors from the developed nations is higher due to factors such as high consumption rates, higher food production necessity, greater power requirements in the farms, and the large land size of the farm holdings.

The increasing demand for renting tractors and harvesters in the Asia Pacific region is projected to drive the growth of the market

According to the FAO, Asia Pacific accounted for nearly 40% of the global arable land in 2016. Farmers in the Asia Pacific region are increasingly producing rice and crops such as palm and cotton. Further, a shift from the adoption of labor-intensive farming techniques to advanced technological equipment in the agricultural sector across the Asia Pacific countries has led to increasing demand for tractor and various farming equipment such as harvester and spraying and threshing equipment for the renting purpose. Investments in various agriculture machinery have also led to increased crop production, particularly in developing countries such as India, China, Vietnam, and Thailand.

Key Market Players

Key players in this market include John Deere (US), CNH Industrial (UK), Kubota Corporation (Japan), AGCO Corporation (US), Mahindra & Mahindra (India), JCB (UK), Escorts Ltd (India), Tractors and farm equipments ltd. (India). These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities and strong distribution networks across these regions.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20182025 |

|

Base year considered |

2018 |

|

Forecast period |

20202025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Equipment type, Power Output, and Drive |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and Rest of the World |

|

Companies covered |

John Deere (US), CNH Industrial (UK), Kubota Corporation (Japan), AGCO Corporation (US), Mahindra & Mahindra (India), JCB (UK), and Escorts Ltd (India), Tractors and Farm Equipments Ltd. (India), Pape Group (US), Premier Equipment Rentals (US), Flaman Group of Companies (Canada), Pacific Ag Rentals (US), Pacific Tractors & implements Ltd (US), Kwipped Inc. (US), Cedar street sales & rentals (US), Farmease (US), EM3 Agri Services (India), German Bliss Equipment Inc. (US), and Friesen Sales & Rentals (US). |

This research report categorizes the farm equipment rentals market based on equipment type, power output, and drive.

The global market has been segmented as follows:

On the basis of equipment type:

- Tractors

- Harvesters

- Balers

- Sprayers

- Other equipment types

On the basis of power output:

- <30 HP

- 31-70 HP

- 71-130 HP

- 131-250 HP

- >250 HP

On the basis of drive:

- Two-wheel drive

- Four-wheel drive

Recent Developments:

- In November 2019, John Deere launched a new series of 8R wheel tractors, 8RT two-track tractors, and the very first four-track tractors. These have enhanced ride quality and can be driven with the ease of any other wheel tractor.

- In December 2019, CNH Industrial N.V acquired K Line Ag, an Australian agricultural tillage and farm management equipment manufacturer.

- In January 2020, Kubota launched its "X Tractor- cross tractor," which is a highly versatile, completely unmanned equipment operated via AI.

- In January 2020, AGCO Corporation launched its new Fendt momentum planter in North America so as to provide better accuracy and proper positioning of seeds while sowing activities. It has raised the standards for seed placement.

- In January 2020, Mahindra and Mahindra inaugurated its newly established manufacturing facility in Telangana (India), with INR 250 crore investment. This initiative was taken to increase the overall production output of the business by 92,000 units on an average per annum.

Key questions addressed by the report:

- What are the new application areas for the farm equipment rental market that companies are exploring?

- Who are some of the key players operating in the market for farm equipment rental, and how intense is the competition?

- What kind of competitors and stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

- How are the current R&D activities and M&As in the market for farm equipment rental projected to create a disrupting environment in the coming years?

- What will be the level of impact of new product launches on the revenues of stakeholders due to the benefits, such as increasing revenue, environmental regulatory compliance, and sustainable profits for the suppliers, offered by the farm equipment rental market?

Frequently Asked Questions (FAQ):

Which region is expected to witness significant demand for farm equipment rental in the coming years?

Which is the most widely rented farm equipment in various regions?

What is the major driver in farm equipment rental market?

What are the major opportunity areas for Farm Equipment Rental market?

2. Rise in the adoption of new and advanced technological applications in farm machineries

What is the percentage of key strategies adopted by leading players of Farm Equipment Rental Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 32)

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 OPPORTUNITIES IN THE GLOBAL MARKET

4.2 MARKET, BY DRIVE

4.3 ASIA PACIFIC: MARKET FOR FARM EQUIPMENT RENTAL , BY KEY COUNTRY AND EQUIPMENT TYPE

4.4 MARKET, BY EQUIPMENT TYPE AND REGION

4.5 MARKET: MAJOR REGIONAL SUBMARKETS

5 MARKET OVERVIEW (Page No. - 39)

5.1 INTRODUCTION

5.2 MACROINDICATORS

5.2.1 GROWING DEMAND FOR AGRICULTURAL MECHANIZATION TO MEET GLOBAL FOOD SECURITY

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Shortage of skilled labor and an increase in mechanization in developing countries

5.3.1.2 Rising demand for productivity and operational efficiency

5.3.1.3 High cost of agriculture equipment

5.3.1.4 Limited availability of arable land

5.3.1.5 Growing government subsidies for farming equipment

5.3.2 RESTRAINTS

5.3.2.1 Low level of awareness among farmers

5.3.3 OPPORTUNITIES

5.3.3.1 Strong growth in emerging economies

5.3.3.2 Rise in the adoption of new and advanced technological applications in farm machinery

5.3.4 CHALLENGES

5.3.4.1 Lack of safety-related regulations in developing regions

6 INDUSTRY TRENDS (Page No. - 47)

6.1 INTRODUCTION

6.2 KEY INFLUENCERS

6.3 INDUSTRY TRENDS

6.3.1 GLOBAL FARM EQUIPMENT MARKET TRENDING PROGRESSIVELY TOWARD RENTING OF EQUIPMENT AS COMPARED TO PURCHASING

6.4 PORTERS FIVE FORCES ANALYSIS

6.4.1 BARGAINING POWER OF SUPPLIERS

6.4.1.1 Intense competition among key regional players

6.4.2 BARGAINING POWER OF BUYERS

6.4.3 THREAT OF NEW ENTRANTS

6.4.4 THREAT OF SUBSTITUTES

6.4.5 INTENSITY OF RIVALRY

6.4.5.1 Local farm equipment manufacturers Vs. OEMs

7 FARM EQUIPMENT RENTAL MARKET, BY EQUIPMENT TYPE (Page No. - 53)

7.1 INTRODUCTION

7.2 TRACTORS

7.2.1 THE TRACTORS SEGMENT IS PROJECTED TO DOMINATE THE ASIA PACIFIC REGION IN TERMS OF GROWTH

7.3 HARVESTERS

7.3.1 ASIA PACIFIC IS PROJECTED TO LEAD THE HARVESTERS MARKET DURING THE FORECAST PERIOD

7.4 SPRAYERS

7.4.1 SPRAYERS WOULD WITNESS LARGE-SCALE DEMAND IN THE DEVELOPED COUNTRIES

7.5 BALERS

7.5.1 NORTH AMERICA IS ESTIMATED TO LEAD THE BALERS SEGMENT IN THIS MARKET

7.6 OTHER EQUIPMENT TYPES

7.6.1 EQUIPMENT TYPES SUCH AS POWER TILLERS, THRESHING EQUIPMENT, AND PLANTING EQUIPMENT ARE PREFERRED IN THE RENTAL MARKET

8 FARM EQUIPMENT RENTAL MARKET, BY POWER OUTPUT (Page No. - 60)

8.1 INTRODUCTION

8.2 < 30 HP

8.2.1 UTILITY/COMPACT TRACTORS HOLDS STRONG RENTAL MARKET IN THE DEVELOPING COUNTRIES

8.3 3170 HP

8.3.1 ASIA PACIFIC ACCOUNTED FOR THE HIGHEST SHARE IN THE MARKET FOR 3170 HP TRACTORS

8.4 71130 HP

8.4.1 HIGH DEMAND FOR EQUIPMENT WITH POWER OUTPUT 71130 HP COMMON IN ALL GLOBAL MARKETS

8.5 131250 HP

8.5.1 US AND EUROPE ARE THE LARGEST MARKETS FOR LARGE TRACTORS

8.6 >250 HP

8.6.1 HIGH POWER TRACTORS ACCOUNTS FOR HIGH DEMAND FROM LARGE FARMLANDS OF MORE THAN 100 HECTARES

9 FARM EQUIPMENT RENTAL MARKET, BY DRIVE (Page No. - 68)

9.1 INTRODUCTION

9.2 TWO-WHEEL-DRIVE

9.2.1 EXTENSIVE BENEFITS RAISE THE DEMAND FOR TWO-WHEEL-DRIVE TRACTORS IN DEVELOPING NATIONS

9.3 FOUR-WHEEL-DRIVE

9.3.1 FARMERS WORKING WITH TOUGH SOILS AND LAND CONDITIONS DRIVE THE MARKET FOR 4WD TRACTORS

10 FARM EQUIPMENT RENTAL MARKET, BY REGION (Page No. - 73)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.1.1 The US market for farm equipment rental is progressing slowly due to trends more inclined toward the purchase of equipment

10.2.2 CANADA

10.2.2.1 Rental services can acquire better market share as farmers are dealing with difficult climatic conditions and rising equipment prices

10.2.3 MEXICO

10.2.3.1 Affordability and shortage of farm equipment driving the market for rental equipment

10.3 EUROPE

10.3.1 FRANCE

10.3.1.1 Slower rate of growth for the rentals market due to high mechanization levels in farmlands

10.3.2 GERMANY

10.3.2.1 Sustenance of small farm outputs through the equipment hiring model

10.3.3 SPAIN

10.3.3.1 Market for farm equipment rental developing steadily in the country

10.3.4 ITALY

10.3.4.1 Increased pressure for improving the production of smallholding farmers increases the scope for rental businesses

10.3.5 UK

10.3.5.1 Increasing scope of the rental business in the market due to large farm sizes and unstable financial system

10.3.6 POLAND

10.3.6.1 Large concentration of small farmers and supportive government subsidies increase the scope for rental businesses

10.3.7 REST OF EUROPE

10.3.7.1 Growing need to increase the level of mechanization in smallholding farms driving the equipment rental market

10.4 ASIA PACIFIC

10.4.1 INDIA

10.4.1.1 India is estimated to have the highest growth potential for the equipment rental market

10.4.2 CHINA

10.4.2.1 Tractors market declining but niche equipment market showing promising growth

10.4.3 JAPAN

10.4.3.1 Rising shortage of young labour and an increase in machine costs driving the market for equipment rental

10.4.4 AUSTRALIA

10.4.4.1 Slow growth of the farm industry showing promising potential for choosing rental-based farm equipment

10.4.5 THAILAND

10.4.5.1 Growth in market potential for equipment renting observed due to better adoption of mechanization by farmers in Thailand

10.4.6 REST OF ASIA PACIFIC

10.5 SOUTH AMERICA

10.5.1 BRAZIL

10.5.1.1 Huge untapped market for rental businesses, with farmers ready to rent with reduced rental rates

10.5.2 ARGENTINA

10.5.2.1 Moderate market for renting businesses, with large farms, better rates of mechanization, and high automotive businesses already established in the market

10.5.3 CHILE

10.5.3.1 Dependence on imported equipment for cultivation raises scope for the equipment renting business in Chile

10.5.4 REST OF SOUTH AMERICA

10.5.4.1 Growing rates of mechanization and also growing trends toward renting systems in the market

10.6 REST OF THE WORLD

10.6.1 AFRICA

10.6.1.1 South Africa adopting alternatives for enhancing productivity with lower capital costs

10.6.2 MIDDLE EAST

10.6.2.1 Access to better farming machinery driving the market for equipment renting

10.6.3 TURKEY

10.6.3.1 Slowly developing mechanization sector showing better scope for rental farm equipment due to unstable economic scenarios

11 COMPETITIVE LANDSCAPE (Page No. - 126)

11.1 OVERVIEW

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 VISIONARY LEADERS

11.2.2 DYNAMIC DIFFERENTIATORS

11.2.3 INNOVATORS

11.2.4 EMERGING COMPANIES

11.3 MARKET SHARE ANALYSIS, 2019

11.4 COMPETITIVE SCENARIO

11.4.1 ACQUISITIONS

11.4.2 EXPANSIONS & INVESTMENTS

11.4.3 NEW PRODUCT LAUNCHES

11.4.4 AGREEMENTS & COLLABORATIONS

12 COMPANY PROFILES (Page No. - 135)

(Business overview, Products offered, Recent developments, SWOT analysis & Right to win)*

12.1 JOHN DEERE

12.2 CNH INDUSTRIAL

12.3 KUBOTA CORPORATION

12.4 AGCO CORPORATION

12.5 MAHINDRA & MAHINDRA

12.6 JCB

12.7 ESCORTS LTD.

12.8 TRACTORS & FARM EQUIPMENTS LTD.

12.9 PAPE GROUP INC.

12.10 PREMIER EQUIPMENT RENTALS

12.11 FLAMAN GROUP OF COMPANIES LTD.

12.12 PACIFIC AG RENTALS LLC

12.13 PACIFIC TRACTOR & IMPLEMENT LTD

12.14 FARMEASE

12.15 KWIPPED, INC

12.16 CEDAR STREETS SALES & RENTALS INC.

12.17 EM3 AGRI-SERVICES LTD.

12.18 GERMAN BLISS EQUIPMENT INC.

12.19 FRIESEN SALES & RENTALS

*Details on Business overview, Products offered, Recent developments, SWOT analysis & Right to win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 174)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (111 Tables)

TABLE 1 USD EXCHANGE RATES, 20152018

TABLE 2 MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 3 FARM EQUIPMENT RENTAL MARKET SIZE FOR TRACTORS, BY REGION, 20182025 (USD MILLION)

TABLE 4 MARKET SIZE FOR HARVESTERS, BY REGION, 20182025 (USD MILLION)

TABLE 5 MARKET SIZE FOR SPRAYERS, BY REGION, 20182025 (USD MILLION)

TABLE 6 MARKET SIZE FOR BALERS, BY REGION, 20182025 (USD MILLION)

TABLE 7 MARKET SIZE FOR OTHER EQUIPMENT TYPES, BY REGION, 20182025 (USD MILLION)

TABLE 8 MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 9 <30 HP FARM EQUIPMENT RENTAL MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 10 3170 HP FARM EQUIPMENT RENTAL MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 11 71130 HP FARM EQUIPMENT RENTAL MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 12 131250 HP FARM EQUIPMENT RENTAL MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 13 > 250 HP FARM EQUIPMENT RENTAL MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 14 MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 15 TWO-WHEEL-DRIVE MARKET for FARM EQUIPMENT RENTAL, SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 16 FOUR-WHEEL-DRIVE MARKET for FARM EQUIPMENT RENTAL, SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 17 MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 18 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 19 NORTH AMERICA: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 20 NORTH AMERICA: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 21 NORTH AMERICA: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 22 US: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 23 US: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 24 US: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 25 FARM EQUIPMENT RENTAL RATE IN CANADA, 2018-2019

TABLE 26 CANADA: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 27 CANADA: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 28 CANADA: FARM EQUIPMENT RENTAL MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 29 MEXICO: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 30 MEXICO: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 31 MEXICO: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 32 EUROPE: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 33 EUROPE: FARM EQUIPMENT RENTAL SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 34 EUROPE: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 35 EUROPE: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 36 FRANCE: FARM EQUIPMENT RENTAL SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 37 FRANCE: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 38 FRANCE: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 39 GERMANY: FARM EQUIPMENT RENTAL SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 40 GERMANY: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 41 GERMANY: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 42 SPAIN: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 43 SPAIN: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 44 SPAIN: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 45 ITALY: FARM EQUIPMENT RENTAL SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 46 ITALY: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 47 ITALY: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 48 UK: MARKET SIZE FOR FARM EQUIPMENT RENTAL, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 49 UK: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 50 UK: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 51 POLAND: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 52 POLAND: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 53 POLAND: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 54 REST OF EUROPE: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 55 REST OF EUROPE: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 56 REST OF EUROPE: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 61 INDIA: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 62 INDIA: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 63 INDIA: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 64 CHINA: MARKET SIZE, BY EQUIPMENT TYPE, 20182026 (USD MILLION)

TABLE 65 CHINA: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 66 CHINA: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 67 JAPAN: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 68 JAPAN: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 69 JAPAN: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 70 AUSTRALIA: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 71 AUSTRALIA: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 72 AUSTRALIA: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 73 THAILAND: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 74 THAILAND: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 75 THAILAND: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 76 REST OF ASIA PACIFIC: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 77 REST OF ASIA PACIFIC: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 78 REST OF ASIA PACIFIC: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 79 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 80 SOUTH AMERICA: Market SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 81 SOUTH AMERICA: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 82 SOUTH AMERICA: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 83 BRAZIL: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 84 BRAZIL: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 85 BRAZIL: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 86 ARGENTINA: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 87 ARGENTINA: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 88 ARGENTINA: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 89 CHILE: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 90 CHILE: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 91 CHILE: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 92 REST OF SOUTH AMERICA: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 93 REST OF SOUTH AMERICA: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 94 REST OF SOUTH AMERICA: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 95 ROW: FARM EQUIPMENT RENTAL MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 96 ROW: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 97 ROW: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 98 ROW: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 99 AFRICA: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 100 AFRICA: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 101 AFRICA: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 102 MIDDLE EAST: MARKET SIZE, BY EQUIPMENT TYPE, 20182025 (USD MILLION)

TABLE 103 MIDDLE EAST: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 104 MIDDLE EAST: MARKET SIZE, BY DRIVE, 20182025 (USD MILLION)

TABLE 105 TURKEY: MARKET SIZE, BY EQUIPMENT TYPE, 20172025 (USD MILLION)

TABLE 106 TURKEY: MARKET SIZE, BY POWER OUTPUT, 20182025 (USD MILLION)

TABLE 107 TURKEY: MARKET SIZE FOR FARM EQUIPMENT RENTAL, BY DRIVE, 20182025 (USD MILLION)

TABLE 108 ACQUISITIONS, 20172020

TABLE 109 EXPANSIONS & INVESTMENTS, 20172020

TABLE 110 NEW PRODUCT LAUNCHES, 20172020

TABLE 111 AGREEMENTS & COLLABORATIONS, 20172020

LIST OF FIGURES (45 Figures)

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

FIGURE 3 RESEARCH DESIGN

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 DATA TRIANGULATION METHODOLOGY

FIGURE 7 FARM EQUIPMENT RENTAL MARKET SIZE, BY EQUIPMENT TYPE, 2020 VS. 2025

FIGURE 8 THE TWO-WHEEL DRIVE SEGMENT, BY DRIVE, IS PROJECTED TO DOMINATE BY 2025

FIGURE 9 71-130 HP SEGMENT ESTIMATED TO DOMINATE THE MARKET IN 2020

FIGURE 10 ASIA PACIFIC WAS THE LARGEST MARKET IN TERMS OF GROWTH RATE IN 2019

FIGURE 11 HIGH DEMAND FOR TRACTORS AND HARVESTERS TO DRIVE THE GROWTH OF THE MARKET

FIGURE 12 FOUR-WHEEL DRIVE WAS THE MOST PREFERRED SEGMENT IN THE MARKET IN 2019

FIGURE 13 ASIA PACIFIC: INDIA WAS A MAJOR CONSUMER OF MARKET IN THE ASIA PACIFIC REGION IN 2019

FIGURE 14 NORTH AMERICA ACCOUNTED FOR THE LARGEST MARKET SHARE FOR BALERS IN 2019

FIGURE 15 THE US ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

FIGURE 16 GLOBAL POPULATION PROJECTED TO REACH ~9.7 BILLION BY 2050

FIGURE 17 FARM EQUIPMENT RENTAL: MARKET DYNAMICS

FIGURE 18 WORLD EMPLOYMENT IN THE AGRICULTURE SECTOR, 20102019 (% OF TOTAL EMPLOYMENT)

FIGURE 19 ANNUAL AVAILABLE ARABLE LAND, 19502020 (HECTARES/PERSON)

FIGURE 20 OPERATION-WISE MECHANIZATION RATES IN INDIA

FIGURE 21 PORTERS FIVE FORCES ANALYSIS: INVOLVEMENT OF ESTABLISHED PLAYERS IN R&D IS INCREASING COMPETITION IN THE INDUSTRY

FIGURE 22 TRACTORS SEGMENT PROJECTED TO DOMINATE THE FARM EQUIPMENT RENTAL MARKET DURING THE FORECAST PERIOD

FIGURE 23 COUNTRY-WISE EXISTING VEGETARIAN POPULATION SHARE, 2019

FIGURE 24 71130 HP SEGMENT PROJECTED TO DOMINATE THE FARM EQUIPMENT RENTAL MARKET DURING THE FORECAST PERIOD

FIGURE 25 ADOPTION RATES OF FARM MECHANIZATION, BY COUNTRY, 2018

FIGURE 26 FOUR-WHEEL-DRIVE SEGMENT PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 27 INDIA PROJECTED TO WITNESS HIGH GROWTH RATE IN THE MARKET BETWEEN 2020 AND 2025

FIGURE 28 NORTH AMERICA: REGIONAL SNAPSHOT

FIGURE 29 TOTAL AGRICULTURAL MACHINERY EXPORTS FROM EUROPE (USD BILLION)

FIGURE 30 ASIA PACIFIC: REGIONAL SNAPSHOT

FIGURE 31 MARKET, COMPETITIVE LEADERSHIP MAPPING, 2018

FIGURE 32 MARKET, BY COMPANY, 2019

FIGURE 33 KEY DEVELOPMENTS OF THE LEADING PLAYERS IN THE FARM EQUIPMENT RENTAL MARKET, 20172020

FIGURE 34 JOHN DEERE: COMPANY SNAPSHOT

FIGURE 35 JOHN DEERE: SWOT ANALYSIS

FIGURE 36 CNH INDUSTRIAL: COMPANY SNAPSHOT

FIGURE 37 CNH INDUSTRIAL: SWOT ANALYSIS

FIGURE 38 KUBOTA CORPORATION: COMPANY SNAPSHOT

FIGURE 39 KUBOTA CORPORATION: SWOT ANALYSIS

FIGURE 40 AGCO CORPORATION: COMPANY SNAPSHOT

FIGURE 41 AGCO CORPORATION: SWOT ANALYSIS

FIGURE 42 MAHINDRA & MAHINDRA : COMPANY SNAPSHOT

FIGURE 43 MAHINDRA & MAHINDRA: SWOT ANALYSIS

FIGURE 44 JCB: COMPANY SNAPSHOT

FIGURE 45 ESCORTS LTD: COMPANY SNAPSHOT

The farm equipment rental market is projected to grow at a CAGR of 7.3% over the next five years. The growth of the market is attributed to a shortage of skilled labor and an increase in mechanization in developing countries, rising demand for productivity and operational efficiency, limited availability of arable land and increasing government subsidies for farming equipment.

The global market is segmented on the basis of equipment type, power output, and drive. It was further segmented on the basis of region into North America, Europe, Asia Pacific, South America, and the Rest of the World (RoW). The main objectives of the report are to define, segment, and project the market size of the global farm equipment rentals market for segmentation and provide a detailed study of key factors influencing the growth of the market and profiling the key players in the market and their core competencies.

Years considered for this report are as follows:

- 2018 Base Year

2020 Estimated Year

2025 Projected Year

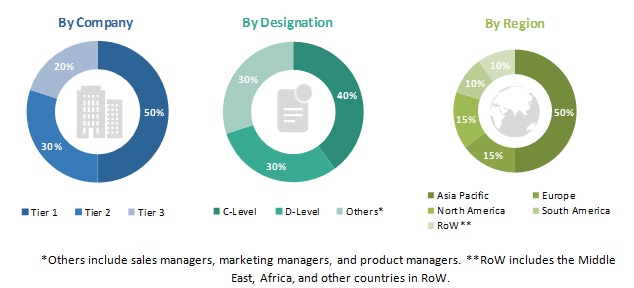

Research Methodology

This report includes estimations of the market sizes, in terms of value (USD million), with the base year as 2018, and forecast period from 2020 to 2025. The top-down and bottom-up approaches were used to estimate and validate the size of the farm equipment rentals market and to estimate the size of various other dependent submarkets. Key players in the market were identified through secondary sources, such as the US Department of Agriculture (USDA), Association of Equipment Manufacturers (AEM), Verband Deutscher Maschinen-und Anlagenbau e.V. (VDMA), and their market shares in respective regions were determined through primary and secondary research. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. Both the top-down and bottom-up approaches were used to estimate and validate the total size of the farm equipment rentals market. These approaches were also used extensively to estimate the size of various dependent submarkets. With the data triangulation procedure and validation of data through primaries, the overall size of the parent market size and size of each individual market were determined.

Secondary Research

The secondary sources referred for this research study include government sources, such as the Food and Agriculture Organization (FAO), the US Department of Agriculture (USDA), US Department of Agriculture (USDA), Association of Equipment Manufacturers (AEM), Verband Deutscher Maschinen-und Anlagenbau e.V. (VDMA) , Comitι Europιen des groupements de constructeurs dumachinisme agricole (CEMA)the ministries of the agricultural department in various countries, corporate filings (such as annual reports, press releases, investor presentations, and financial statements), and trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

Extensive primary research was conducted after acquiring information about the global market scenario through secondary research. Several primary interviews were conducted with the market experts from the demand (farm associations, dealers, and distributors) and supply (manufacturers, technology & service providers, and raw material suppliers) sides across countries of the studied regions. Nearly 20% and 80% of the primary interviews were conducted with the demand and supply sides, respectively. This primary data was collected through questionnaires, e-mails, and telephonic interviews:

To know about the assumptions considered for the study, download the pdf brochure

Target Audience

The stakeholders for the report include:

- Farm equipment (tractors, harvesters, balers, sprayers, implements) manufacturers

- Farm equipment and component manufacturing associations

- Farm equipment component suppliers

- Farm equipment dealers and distributors

- Government and regulatory authorities

- Research professionals

- Tier 1 system dealers and farm equipment rental suppliers

The objectives of the study are:

- Determining and projecting the size of the farm equipment rental market, based on equipment type, power output, drive, and regional markets, over a five-year period, ranging from 2020 to 2025

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shift in demand patterns across different subsegments and regions

The study answers several questions for stakeholders, primarily, which market segments to focus on in the next two to five years for prioritizing efforts and investments

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Farm Equipment Rental Market