Farm Equipment Market Size, Share & Analysis

Farm Equipment Market by Power (<30, 31-70, 71-130, 131-250, >250HP), Type (Tractors, Balers, Sprayers, Harvesters), Function, Tractor Drive Type, Forestry Machinery, Electric Tractor, Type & Propulsion, Rental, & Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The farm equipment market is projected to grow from USD 115.58 Billion in 2025 to USD 152.79 billion by 2032, registering a CAGR of 4.1%. The farm tractor market is expected to see sluggish growth over the next 2–3 years due to a combination of tight farm economics and policy pressures. Persistently high interest rates are discouraging equipment financing, while softening global crop prices are eroding farmers’ cash flow and delaying fleet replacements. In parallel, dealer margins are under strain from elevated inventory costs and discounting pressures, reducing channel appetite for restocking. Additionally, US tariffs on Chinese and imported components are inflating input costs, limiting affordability even as OEMs attempt to localize production.

KEY TAKEAWAYS

-

BY POWER OUTPUTThe 31–70?HP tractor segment leads the market as it balances affordability with regulatory compliance. Stricter emission standards (US EPA Tier?IV Final, EU Stage?V) make high-HP tractors costly due to complex after-treatment systems, while lower-HP models remain simpler and cost-competitive. Farmers favor 31–70?HP units for adequate field power without the high cost and maintenance of advanced emission technologies.

-

BY EQUIPMENT TYPECereal combines boost efficiency by reducing labor and crop losses. North America (US-led) and China are key markets for these combines, with manufacturers like Deere, CLAAS, Wuhan Wubota, and Shandong Jianghua integrating AI and precision farming to enhance yields. Rising interest rates have temporarily suppressed North American sales, with recovery expected post-2026.

-

ELECTRIC TRACTOR MARKET, BY PROPULSIONElectric tractors are gaining traction for crop and livestock operations. Europe leads adoption, driven by the Farm to Fork strategy and strict emissions targets, with 51–100 kWh batteries for small farms and >100 kWh for large farms. Key players include Kubota, Solectrac, CNH Industrial, AGCO, and Monarch. North America follows, supported by state regulations and incentives like California’s CORE program for diesel-to-electric transition.

-

FARM EQUIPMENT MARKET, BY FUNCTIONAsia Oceania is the fastest-growing market for sowing and planting equipment, driven by high food demand and large farming populations in India and China, with expected growth of ~50% during the forecast period. Key offerings include tractor-mounted seed drills, rice transplanters, power-tiller machines, and specialized planters, with models from Deere (GreenSystem), KUHN (MAXIMA, PLANTER 3), and New Holland (PP400). North America is the second-largest market, supported by vast farmland and the adoption of precision farming technologies, such as WINTERSTEIGER GPS GeoLink and Fendt Xaver robotic sowing, enhancing efficiency and accuracy in large-scale operations.

-

BY REGIONAsia Pacific is the largest brake friction market, led by China, India, and South Korea. Rising demand for compact SUVs, projected to grow from USD 53.92 billion in 2024 to USD 70.61 billion in 2027, is boosting the adoption of disc brakes. SUVs and premium vehicles require high-performance carbon composite friction products to meet safety and braking efficiency needs for heavier, high-speed vehicles.

-

COMPETITIVE LANDSCAPEKey players such as Deere & Company (US), AGCO Corporation (US), CNH Industrial N.V. (Netherlands), Kubota Corporation (Japan), and CLAAS KGaA mbH (Germany) are focusing on innovations in autonomous technologies in farm equipment. Key players in the farm equipment market are investing in new production lines in the Asia Oceania region to cater to the increase in demand and export tractors to Europe and North American markets due to lower manufacturing costs for compact and mid-range tractors.

Farm mechanization is expected to remain soft for the next 2–3 years due to various factors such as low crop prices, high operating costs, tighter profit margins for farmers, and higher interest rates in the US, with a stronger US dollar, which has impacted the farmers' spending on farm equipment and their financing options for equipment purchases. According to the Association of Equipment Manufacturers (AEM) and the European Agricultural Machinery (CEMA), the farm equipment market is experiencing a decline due to several interrelated factors, such as a rise in logistics costs, geopolitical uncertainties, high interest rates, and EU CAP Policy, and Farmers' Protests.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in demand and trends in the farm equipment market directly impact OEMs and suppliers. Rising emphasis on efficiency, sustainability, and precision agriculture is reshaping equipment requirements. The shift toward autonomous and electric-powered machinery drives demand for advanced sensors, telematics, and low-emission powertrains. Increasing focus on soil health, crop yield optimization, and operator safety influences equipment design, connectivity, and technology integration. These shifts cascade to component suppliers, Tier-I equipment manufacturers, and OEMs, ultimately transforming revenue models across the value chain and unlocking growth opportunities for smart, sustainable, and performance-optimized farm machinery solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Government support with farm loan waivers/ credit finance

-

OEM/sales incentives to support dealer services and rental operations

Level

-

High equipment cost in emerging economies

-

Growth in rental market

Level

-

Increasing R&D and adoption of electric tractors

-

Growing adoption of precision farming

Level

-

Rapidly changing emission norms and mandates

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Government support with farm loan waivers/ credit finance

Government-backed loan waivers and credit reforms are directly accelerating farm mechanization adoption. The OECD’s 2024 data highlight a 12.6% surge in global agricultural support, reflecting intensified public funding and price interventions that enable equipment purchases. In India, the RBI’s 2025 collateral-free loan expansion (to USD 2,303) reduces financing barriers, boosting tractor and implement sales among smallholders. Such fiscal interventions are shifting latent demand into equipment investments, strengthening medium-term growth for farm machinery manufacturers across emerging markets.

Restraint: High equipment cost in emerging economies

High equipment and lifecycle costs remain a structural barrier to mechanization in emerging markets. Advanced mechatronic systems demand capital-intensive production and frequent upgrades to meet emission norms, inflating prices. Beyond purchase cost, maintenance, parts, and financing gaps deter smallholders from adoption. Conversely, in developed markets, labor shortages justify higher equipment investments, widening the adoption gap. This cost asymmetry continues to restrain global farm equipment penetration, especially in price-sensitive economies.

Opportunity: Increasing R&D and adoption of electric tractors

Rapid advancements in electrification and automation are unlocking new growth avenues in the farm equipment market. Substantial R&D investments such as China’s USD 3.5 billion allocation in 2024 for agricultural machinery subsidies and Deere & Company’s ongoing innovation in autonomous and electric tractors underline a global push toward sustainable mechanization. Emerging models like New Holland’s T4.70e, Case IH EVX 110, and India’s Tiger Electric and X45H2 demonstrate industry momentum toward low-emission, high-efficiency solutions. Although challenges such as battery limitations and insufficient charging infrastructure persist, these developments are set to enhance productivity, reduce operating costs, and create strong opportunities for technology-driven manufacturers and suppliers.

Challenge: Rapidly changing emission norms and mandates

Frequent updates to emission standards worldwide are pressuring farm equipment manufacturers to invest continuously in R&D for compliant engines and exhaust technologies. Regional transitions such as India’s shift from TREM IIIA to TREM IV/V and Europe’s stringent Stage V regulations require market-specific adaptations, increasing engineering complexity, certification costs, and production challenges. OEMs face the ongoing task of balancing regulatory compliance, cost-efficiency, and performance across diverse global markets.

Farm Equipment Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supply of key farm equipment parts such as engines, transmissions, hydraulics, tires, and precision sensors to OEMs. Integration of advanced components for electric, autonomous, and high-HP tractors. | • Enables OEMs to deliver reliable, high-performance equipment. • Supports adoption of advanced technologies (autonomous, electric, precision farming). • Reduces downtime and maintenance costs for end-users. |

|

Manufacturing tractors, combines, 4WD and 2WD models, sowing & planting machinery, electric and autonomous farm equipment. Customization for regional emission norms and farm sizes. | • Provides complete mechanized solutions to farmers. • Enhances productivity and operational efficiency. • Complies with regional regulations and sustainability standards |

|

Distribution, after-sales service, and equipment rental for farmers, enabling access to high-value machinery without large capital expenditure. | • Increases equipment accessibility to small and medium farmers. • Reduces upfront investment and financial risk. • Provides maintenance support and ensures operational uptime. |

|

Provision of agricultural loans, leasing, subsidies, and incentives for purchasing farm machinery. Support for electrification and modernization programs. | • Improves affordability and adoption of farm equipment. • Facilitates investment in advanced, high-efficiency machinery. • Encourages mechanization and productivity improvements across farms. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem mapping highlights various farm equipment market players, including component suppliers, OEMs, dealers & rental services, and financial institutions. The leading players in the farm equipment market are Deere & Company (US), AGCO Corporation (US), CNH Industrial N.V. (Netherlands), Kubota Corporation (Japan), CLAAS KGaA mbH (Germany), among others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Farm Tractor Market, By Power Output

The 31–70 HP tractor segment is poised to dominate the market, accounting for over 50% of global sales by 2025, driven primarily by small and medium-sized farms in emerging markets, with India leading adoption at over 80% market share in 2024. Regulatory changes, such as India’s TREM Stage IV norms, increased tractor prices due to mandatory CRDI installation, prompting a consumer shift toward 45–50 HP models offering 4WD at lower cost. Government subsidy schemes, including the Macro-Management Scheme, are further stimulating mid-range tractor adoption. In contrast, declining farming activity in Japan has led OEMs, such as ISEKI, to relocate production to Indonesia, targeting higher-growth overseas markets by 2030.

Farm Tractor Market, by Drive Type

The 4WD tractor segment is dominated by Europe, with over 80% market share in 2024, driven by large farmlands and labor shortages that demand high-performance, mechanized equipment. Key OEMs include Deere & Company (9R, 6R, 7R), CNH Industrial (Case IH Magnum, New Holland T9), and AGCO (Massey Ferguson 8700, Fendt 1000 Vario), all investing in R&D and precision agriculture features. Asia Oceania, led by India, is the second-largest market, with 4WD tractors used in contract farming regions. Upcoming TREM V regulations in India (2026) are expected to boost exports of compliant tractors to Europe, supporting international trade growth and future demand.

Farm Equipment Market, by Equipment Type

Cereal combines enhance harvesting efficiency by integrating cutting, threshing, and grain separation, reducing labor and crop losses while enabling large-area coverage. North America, led by the US, dominates exports and market share, with key manufacturers including Deere & Company, CLAAS, and Massey Ferguson. Recent sales declines (2022–2024) were driven by rising interest rates, with recovery expected post-2026. China, producing 52.29 million tons of cereals in 2024, represents the largest demand market in Asia Oceania. Leading manufacturers such as Wuhan Wubota, Shandong Jianghua, and Jiangxi Yongji are integrating AI, sensors, and precision farming features to boost yield and reduce labor dependence, supporting market growth.

Forestry Machinery Market, By Product Type

Skidders are critical for efficient timber transport in large-scale logging, with North America (US and Canada) leading demand due to extensive forestry operations. Top-selling models include Deere 640L–948L series and Komatsu 855.1–X370E. Demand is comparatively lower in Europe, where forwarders and harvesters dominate, and in Oceania, where grapple skidders or adapted machinery are preferred. Robust performance in challenging terrains underpins market growth during the forecast period.

REGION

During the forecast period, Asia Oceania is expected to be the fastest-growing region in the global farm equipment market.

The Asia Oceania region is the fastest-growing region with a CAGR of 5.2% during the forecast period. Factors such as lack of farm labor, increasing farm wages, and government incentives drive the farm equipment market. The major countries holding the highest market share for farm equipment are India, followed by China. India holds the largest market for tractors, whose sales declined by ~5.0% whereas the other equipment’s sales declined by 6–8%. In China, the combined market has the highest market share in terms of revenue, which is more than 70% in the year 2024. The sales for combines and self-propelled sprinkler equipment have observed a decline over the past 2 years and are expected to remain low till 2026. This decline in demand for food products is due to a decrease in commodity pricing, which has lowered the farmers’ spending on new equipment. Hence, it is estimated that by 2027, commodity pricing might increase by 2026-2027, after which the farmers’ spending might increase for all the equipment, and will drive the market.

Farm Equipment Market: COMPANY EVALUATION MATRIX

In the farm equipment market matrix, John Deere (Star) leads with a strong global presence, a comprehensive product portfolio, and advanced precision farming solutions across machinery types. JCB (Emerging Leader) is gaining traction with innovative, connected, and autonomous equipment offerings, showing strong growth potential to move toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | 115.58 BN |

| Market Size Forecast in 2032 | 152.79 BN |

| Growth Rate | CAGR of 4.1% from 2025 to 2032 |

| Actual data | 2021-2032 |

| Base year | 2024 |

| Forecast period | 2025-2032 |

| Units considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | • Farm tractor market, By power output - <30 HP, 31–70 HP, 71–130 HP, 131–250 HP, and >250 HP • Farm tractor market, by drive type – two-wheel drives and four-wheel drives • Farm equipment market rental market, by equipment type – tractors, combines, sprayers, balers, and others • By Function – plowing & cultivation, sowing & planting, harvesting & threshing, and others • By equipment type - cereal combines, non-cereal combines, balers, self-propelled sprayers, tractor-mounted sprayers, and tillers • Farm tractor rental market, by power output - <30 HP, 31–70 HP, 71–130 HP, 131–250 HP, and >250 HP • Electric tractor market, by propulsion - battery electric, hybrid electric, and hydrogen • Forestry machinery market, by product type - skidders, forwarders, bunchers, swing machines, harvesters, loaders, and other forestry machinery |

| Regional Scope | Asia Pacific, Europe, North America, Rest of the World |

WHAT IS IN IT FOR YOU: Farm Equipment Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Insights on electric and autonomous tractors adoption across key regions. | • Mapping of battery capacities, HP ranges, and autonomous features. • Regional adoption trends in Europe, North America, and Asia Oceania. • Benchmarking of OEMs: Kubota, Monarch, Deere, CNH Industrial. | • Identification of high-growth markets for electric/autonomous tractors. • Technology roadmap for OEMs to target sustainable mechanization solutions. • Competitive positioning for EV and autonomous tractor portfolios. |

| Market analysis for precision sowing & planting equipment. | • Regional demand assessment in Asia, Oceania, and North America. • Segmental insights for tractor-mounted, robotic, and semi-automatic planters. • OEM benchmarking: Deere, KUHN, New Holland, WINTERSTEIGER, Fendt. | • Strategic guidance on high-potential segments (robotic and precision planters). • Identification of technology adoption opportunities. • Insights for investment and product development planning. |

| Analysis of the combine harvesters and skidders market by region. | • Regional demand and revenue assessment for combines and skidders. • OEM benchmarking: Deere, CLAAS, Massey Ferguson, Komatsu, Wuhan Wubota. • Mapping of technological advancements like AI, sensors, and precision farming. | • Identification of high-growth regional markets for combines and skidders. • Insights on technology adoption to improve efficiency and yield. • Competitive positioning for OEMs in mechanized harvesting solutions. |

RECENT DEVELOPMENTS

- January 2025 : John Deere launched autonomous tractor prototypes for large-scale row crop operations, featuring AI-driven navigation and advanced GPS integration. The tractors aim to reduce labor dependency and improve field efficiency while maintaining high productivity.

- February 2025 : AGCO launched upgrades to the Fendt e100 Vario electric tractor, increasing battery capacity and runtime to enable longer field operations. Designed to support sustainable farming with minimal emissions.

- August 2024 : AGCO Corporation launched tractors and combines from different sub-brands named “Fendt 600 Vario”, “Massey Ferguson 9S tractors”, and “the Gleaner T Series combines.” The Fendit 600 Vario was available in 140 to 240-horsepower engines. Massey Ferguson 9S tractors were available with 28 to 400-hp power engines. The Gleaner T-Series was made of Dura-Drive Technology and had engine power up to 322 HP in the T61 to 430 HP in the T81 model.

- June 2024 : John Deere launched a new technology called “MACHINE SYNC,” which allows walker combine operators to control the attached tractors' speed, direction, and position.

Table of Contents

Methodology

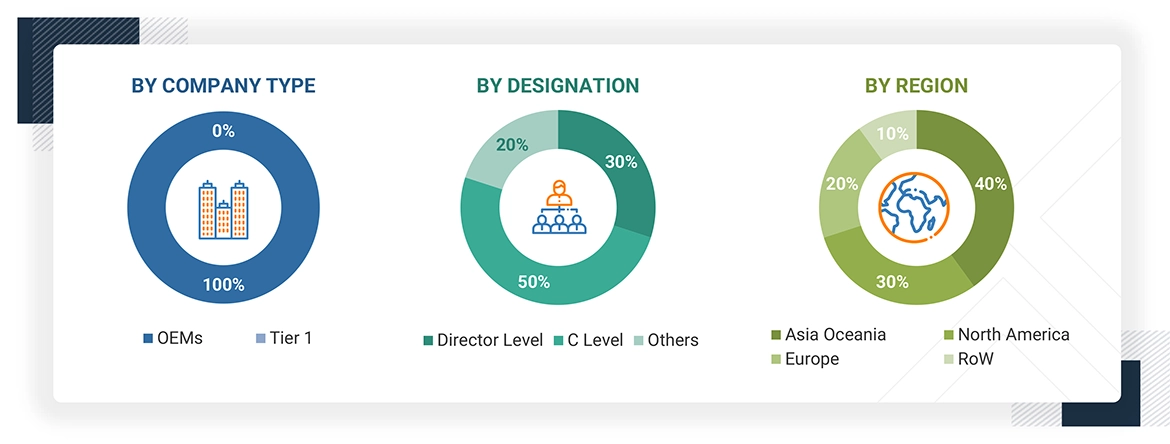

This research study involved extensive secondary sources, such as company annual reports/presentations, industry association publications, industry magazine articles, directories, technical handbooks, World Economic Outlook, technical articles, and databases, to identify and collect information on the farm equipment market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players (farm equipment component/system providers, farm equipment OEMs, and technology suppliers), and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess market prospects.

Secondary Research

Secondary sources for this research study included farm equipment associations and organizations, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and industry associations. Secondary data was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

Extensive primary research was conducted after understanding the farm equipment market scenario through secondary research. Several primary interviews were conducted with market experts from demand (OEMs) and supply (farm equipment suppliers and component manufacturers) across major regions, namely, North America, Europe, and Asia Pacific. Approximately 100% primary interviews were conducted from the demand sides. Primary data was collected through questionnaires, emails, and telephonic interviews.

The canvassing of primaries covered various departments within organizations, such as sales, operations, and marketing, to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from primaries. This and the opinions of in-house subject matter experts led to the conclusions described in the remainder of this report.

Note: Tier of companies are based on the value chain of the farm equipment market; revenues of companies were not considered. Tier I companies are farm equipment .

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

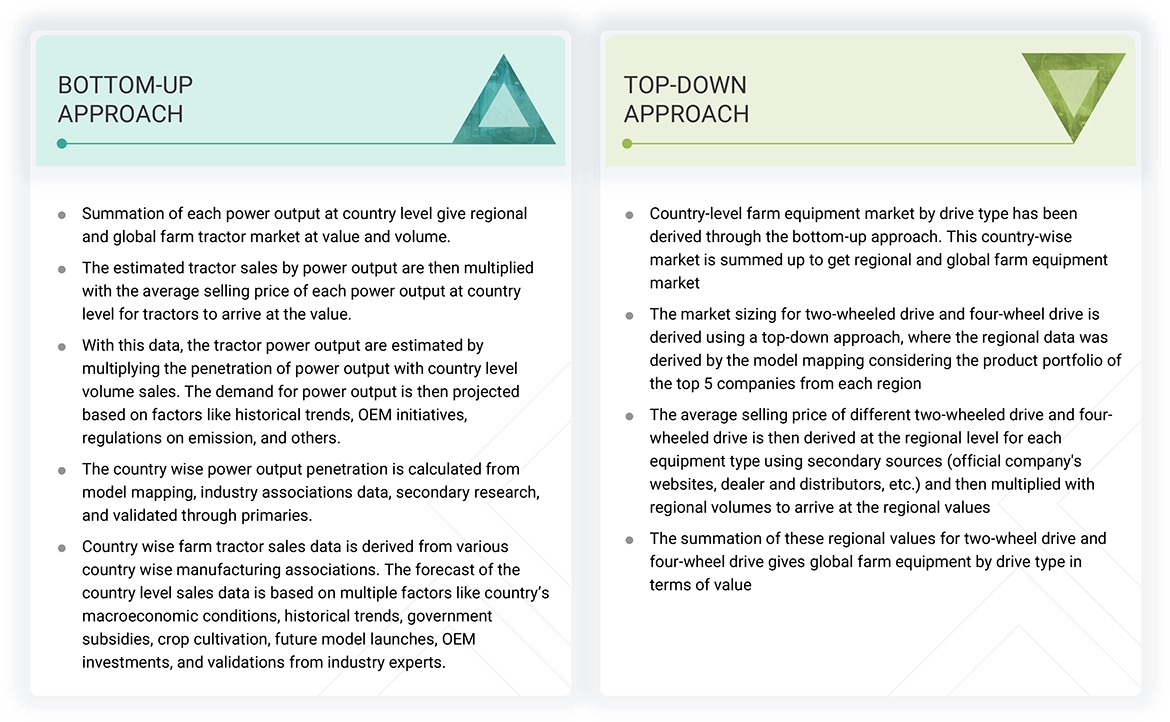

A detailed market estimation approach was followed to estimate and validate the value and volume of the farm equipment market and other dependent submarkets, as mentioned below:

- The bottom-up approach was used to estimate and validate the size of the farm tractor market. The market size by power output, in terms of volume, was derived by multiplying the country-level breakup for each power output category (<30 HP, 31–70 HP, 71–130 HP, 131–250 HP, and >250 HP) with regional-level farm equipment sales.

- The country-level market, by power output by volume, was multiplied by the country-level average selling price (ASP) for each application to get the market for each application by value.

- The summation of the regional-level market would give the global market by power output category (<30 HP, 31–70 HP, 71–130 HP, 131–250 HP, and >250 HP). The total value of each region was then summed up to derive the total value of the market by power output.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

The market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Farm Equipment Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments using the market size estimation processes explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Farm equipment is machines used on farmlands to perform various agricultural activities. These machines help enhance efficiency and productivity. Tractors, combines, sprayers, balers, and implements are the key farm equipment categories used in several farming activities, such as plowing, planting and seeding, harvesting, crop care, and threshing.

Stakeholders

- Farm Equipment Manufacturers

- Farm Equipment and Component Manufacturing Associations

- Farm Equipment Component Suppliers

- Farm Equipment Dealers and Distributors

- Government and Regulatory Authorities

- Research Professionals

- Farm Equipment Importers, Retailers, and Dealers

- Tier 1 System Suppliers

Report Objectives

- To segment and forecast the size of the farm equipment market in terms of volume (units) and value (USD million) from 2021 to 2032

-

To define, describe, and forecast the farm tractor market by value and volume based on

- Power output (<30 HP, 31–70 HP, 71–130 HP, 131–250 HP, and >250 HP) at country and regional levels

- Drive type (two-wheel drive and four-wheel drive) at the regional level

- Region [Asia Oceania, Europe, North America, and the Rest of the World (RoW)], along with key countries in each of these regions

- To define, describe, and forecast the farm equipment market by value based on equipment type (cereal combines, non-cereal combines, balers, self-propelled sprayers, and tractor-mounted sprayers)

- To define, describe, and forecast the farm implements market by value, based on function (plowing & cultivating, sowing & planting, plant protection & fertilizing, harvesting & threshing, and others) at the regional level

- To define, describe, and forecast the farm equipment rental market by value based on equipment type (tractors, combines, sprayers, balers, and others) at the regional level

-

To define, describe, and forecast the farm tractor rental market by value based on

- Power output (<30 HP, 31–70 HP, 71–130 HP, 131–250 HP, and >250 HP) at the regional level

- To define, describe, and forecast the electric tractor market, by value and volume, based on propulsion (battery electric, hybrid electric, hydrogen) at the regional level

- To define, describe, and forecast the forestry equipment market by value based on equipment type (Feller Buncher, Harvester, Forwarder, Skidder, Swing Machines, Knuckleboom Loader, Others)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the farm equipment market

- To strategically analyze markets concerning individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities for stakeholders and details of the competitive landscape for market leaders

- To analyze the market share of the key players in the farm equipment market

- To strategically analyze the market with supply chain analysis, market ecosystem, trade analysis, case studies, ASP analysis, conferences and events, OEM analysis, OEM wise sales data for key countries, OEM wise sales data for combine harvester in key countries, patent analysis, Tractor models from top OEMs with price range, farm equipment market outlook by country, OEM strategy for future investment by the key players, total cost of ownership for electric and diesel tractor, total cost of ownership, investment and funding scenario, trends/disruptions impacting buyers, technology trends, and regulatory analysis

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), new product developments, and other activities carried out by key industry participants.

-

To study the following concerning the market:

- Supply Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Conferences and Events

- Average Selling Price Analysis

- Buying Criteria

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To track and analyze competitive developments such as product developments, deals, and others undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s needs.

- Farm Equipment Market, by Drive Type, at Country level (for countries covered in the scope of the report)

- Agriculture Sprayer Market, by Type (for countries covered in the scope of the report)

- Profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Farm Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Farm Equipment Market

David

May, 2022

What are the Farm Equipment Market government efforts in emerging countries to increase farm mechanization? .

Farooq

Jul, 2022

MarketsandMarkets report in Farm Equipment was updated in Jan 2022, and it covers the market trends and growth factors with respect to Farm Equipment Market. It also covered the Market estimations of Farm Equipment’s in terms of Value (USD Million)and Volume (‘000 Units) by Tractor Power Output/ Tractor Drive Type/ Autonomous Tractor/ Electric Tractor/ Farm Equipment/ Implement/ Rental at regional and country level for the period 2016-2027. The report also covers the detail competitive landscape with key players Market Share Analysis, Developments of Key Market Players Like There Contracts & Agreements, Investments & Expansions, Joint Venture, Partnerships, And Collaborations and their Business Overview, Products/solutions/services Offered, Recent Developments, SWOT Analysis. Our report is primarily a demand-based coverage that states the Historic, Current and Future revenues at a regional and country level for which we had contacted several primary respondents from supply and demand side of the business to obtain the qualitative and quantitative information. We have forecasted the market size both in terms of Volume (Units) and Value (USD Million) till year 2027, which is broken down by Farm tractor market by Power Output, Farm tractor market by Drive Type, Farm equipment market, by equipment type, Implements market, by function, Farm equipment Rental market, Farm equipment market by region, Farm equipment Rental market by region.Farm Equipment Market report for your kind evaluation. Based on our conversation, I understood your company Quality Tractor Parts Ltd. being the Ireland's leading national and international tractor parts supplier and the importer & distributor for new and replacement parts for agricultural tractors you are currently looking to understand available total addressable market for these equipment’s globally, which is precisely covered in our report with profiles of the top leading Farm Equipment Manufacturer and Component Manufacturers..

Daniel

Jun, 2022

How emerging markets offering revenue expansion opportunities in Farm Equipment Market?.

apoorv

Jul, 2019

I want to understand the current and future Global market/business potential of Farm Equipments - Tractor attachments .

Nilesh

Jun, 2019

we are looking for No. of Tractor Engines manufactured /forecasted in the coming years for the Tractor segment in India. We are supplying some components for Engine Assly..