Federated Learning Market by Application (Drug Discovery, Industrial IoT, Risk Management), Vertical (Healthcare and Life Sciences, BFSI, Manufacturing, Automotive and Transportation, Energy and Utilities) and Region - Global Forecast to 2028

According to the AS-IS scenario, the global Federated Learning Market size is estimated to grow from USD 127 million in 2023 to USD 210 million by 2028, at a CAGR of 10.6% during the forecast period. The major growth factor of the federated learning market is that it allows numerous players to develop shared, strong & deep training models while sharing important information, permitting crucial concerns such as data protection, confidentiality, information-privileged access, and accessibility to large datasets to be addressed. Federated learning enables several institutions to perform collaborative research without sharing sensitive patient data in the healthcare sector. This accelerates the drug discovery process by allowing models to be trained on diverse data sets, and it leads to precise predictions. Federated learning in IIoT advances the development of predictive models for maintenance & optimization from the data aggregated from various sources without sharing raw data between them. It ensures data security and improves operational efficiency in diverse industrial scenarios.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Rising demand for personalized AI models across verticals

Federated learning is key to enabling companies to develop AI applications with data coming from a variety of different and decentralized sources while still enabling privacy. For example, AI can learn to offer personalized treatment recommendations for patients based on models trained across patient data from multiple hospitals without sharing sensitive information. Similarly, in the financial sector, customized credit rating systems can be improved by using information from various organizations while safeguarding user confidentiality. Federated learning in the retail industry makes it possible to create highly personalized shopping experiences by examining customer behavior on various platforms. The ability to create personalized, privacy-preserving AI models is driving the increased use of federated learning technology for industries wanting to provide customized services while protecting data in line with the most stringent data protection regimes.

Restraint: High computational requirements for complex federated models

Federated learning requires the training of AI models across many decentralized devices or servers, a process that could be computationally intensive, fundamentally in large complex datasets. Federated learning requires synchronization and aggregation of updates from different sources in real-time, which can pressure existing hardware and resources within a network. This is particularly an issue in industries where the computational infrastructure is limited or for applications such as drug discovery or autonomous systems, which require highly intricate models. The demand for secure and effective communication among nodes increases the computational workload even more. Therefore, the expensive upgrade of infrastructure for federated learning may discourage smaller organizations from embracing this technology, restricting its broad implementation and impeding the market's growth.

Opportunity: Integration of federated learning with blockchain for enhanced security

Blockchain's decentralized and immutable ledger can improve federated learning by securely recording model updates. Federated learning ensures that the data and model parameters exchanged among the participants are tamper-proof. It particularly benefits applications requiring integrity and security of data in industries like finance, healthcare, and retail. In the case of healthcare, the means of blockchain guarantees secure tracking of contributions from different hospitals during federated model training and prevents unauthorized data manipulation. In finance, blockchain ensures that the risk management models, shared across multiple institutions, are transparently and securely updated. Organizations can promote the use of federated learning in security-sensitive applications by integrating blockchain technology, which helps foster trust in collaborative AI models, minimizing data breach risks, and adhering to strict regulatory mandates.

Challenge: Developing robust federated learning algorithms for non-independently and identically distributed (non-IID) data

Non-IID data, where the data distribution varies significantly across different clients or devices, is common in real-world scenarios, such as in healthcare or IoT environments. This variability is often complex for traditional federated learning algorithms to handle, which lowers model efficiency and accuracy. Advancements in algorithms specifically designed to handle non-IID data can unlock the full potential of federated learning. For instance, creating algorithms that efficiently handle heterogeneous patient data from multiple sources can result in more precise diagnosis instruments and treatment suggestions in personalized healthcare. Similarly, in IoT networks, robust algorithms can improve predictive maintenance by accurately analyzing diverse data from different devices and sources. These developments can increase the application of federated learning across industries spurring market expansion and enabling more customized and efficient AI solutions by tackling the problems associated with non-IID data.

Federated Learning Market Ecosystem

As per optimistic scenario, among verticals, the automotive and transportation segment to grow at a the highest CAGR during the forecast period

As per optimistic scenario, the automotive and transportation vertical is likely to witness the fastest growth rate in the federated learning market due to the increasing demand for advanced, real-time data processing and decision-making capabilities in autonomous vehicles. Federated learning enables the improvement of these systems through distributed data learning from different vehicles and infrastructures, avoiding the centralization of sensitive information. For instance, self-driving cars can exchange and acquire knowledge from driving data in various locations, improving their skills in handling challenging situations while still protecting privacy. Furthermore, federated learning in smart transportation networks can enhance traffic management by examining data from various sources, enhancing effectiveness and safety. The automotive sector will increasingly utilize federated learning to ensure secure, scalable, and privacy-preserving AI models as it moves towards fully autonomous and connected vehicles, driving market growth in this vertical.

As per optimistic scenario, among regions, Europe to hold the largest market size during the forecast period

Europe is expected to hold the largest market share in the federated learning market due to its stringent data privacy regulations, such as the General Data Protection Regulation (GDPR), which drives demand for decentralized data processing solutions. The region's commitment to safeguarding personal information aligns well with the core principles of federated learning, which keep data close by and lower the chance of security breaches. Europe's advanced healthcare and automotive industries are continuously adopting federated learning for applications such as personalized medicine, drug discovery, and autonomous vehicles. The presence of leading tech firms and research institutions further accelerates innovation and adoption of federated learning across various verticals. In addition, European governments are investing in AI research and development, hence creating a favorable environment for the development of federated learning.

Key Market Players

The federated learning solutions vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global federated learning solutions market include NVIDIA (US), Cloudera (US), IBM (US), Microsoft (US), Google (US), along with SMEs and startups such as Owkin (US), Intellegens (UK), Edge Delta (US), Secure AI Labs (US), and Sherpa.AI (Spain).

Scope of the Report

|

Report Metrics |

Details |

|

Market Size value in 2023 |

USD 127 million |

|

Market Size value for 2028 |

USD 210 million |

|

CAGR Growth Rate |

10.6% |

|

Largest Market |

Europe |

|

Market size available for years |

2023–2028 |

|

Base year considered |

2023 |

|

Forecast period |

2023–2028 |

|

Segments covered |

Application, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

NVIDIA (US), Cloudera (US), IBM (US), Microsoft (US), Google (US), Intel(US), Owkin(US), Intellegens(UK), Edge Delta(US), Enveil(US), Lifebit(UK), DataFleets(US), Secure AI Labs(US), Sherpa.AI(Spain), Decentralized Machine Learning(Singapore), Consilient(US), Apheris(Germany), Acuratio(US), FEDML(US). |

This research report categorizes the Federated Learning Market based on application, vertical, and region.

Market By Application:

- Drug Discovery

- Shopping Experience Personalization

- Data Privacy and Security Management

- Risk Management

- Industrial Internet of Things

- Online Visual Object Detection

- Augmented Reality/Virtual Reality

- Other Applications

Market By Verticals:

- Banking, Financial Services, and Insurance

- Healthcare and Life Sciences

- Retail and Ecommerce

- Manufacturing

- Energy and Utilities

- Automotive and Transportaion

- IT and Telecommunication

- Other Verticals

Market By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments:

- In June 2024, Rhino Health announced a partnership with Google Cloud to scale their groundbreaking Federated Computing Solution. Rhino’s Federated Computing Platform (Rhino FCP) unlocks data silos across hyperscalers, data centers, geographies, and organizations.

- In March 2024, Google Research created a new software library called FAX, which enables large-scale computations for machine learning across various devices, including computers and smartphones. Built on top of JAX, a high-performance ML tool, FAX is specifically designed to simplify the implementation of federated learning.

- In July 2023, Microsoft announced the release of a system architecture and software development kit (SDK), called the Project Florida. Project Florida aims to simplify the task of deploying cross-device FL solutions by providing cloud-hosted infrastructure and accompanying task management interfaces, as well as multi-platform SDK support.

- In March 2022, NVIDIA launched Communications Intelligence Platform, a Clara Holoscan, solution which was designed for its healthcare sciences business has been updated to MGX, as a one-of-a-kind end-to-end system for both AI technologies and intelligent healthcare manufacturing and deployment in implantable augmentations.

- In January 2022, Intel launched OpenVINO integration with TensorFlow, the OpenVINO toolkit is used for online improvements and execution required for increased TensorFlow interoperability. It was created for programmers who want to try out the OpenVINO toolset and see how it might assist them in boosting the effectiveness of existing inferential apps with little code changes.

- In November 2021, NVIDIA launched NVIDIA FLARE, NVIDIA FLARE stands for Federated Learning Application Runtime Environment is an open-source platform, which is based on the foundation of NVIDIA Clara Train's federated learning software, and was employed for biomedical imagery, functional genomics, cancer, and COVID-19 research. Investigators and data scientists could use this SDK to convert their current ML techniques processes to a decentralized network. NVIDIA FLARE supports a variety of networked topologies, spanning peer-to-peer, asynchronous, and server-client techniques, among others.

Frequently Asked Questions (FAQ):

What is federated learning?

Federated learning is a type of machine learning where models are trained across multiple decentralized devices or servers, such as smartphones, computers, or edge devices, while keeping the data localized on those devices. Instead of gathering data in a central location, federated learning allows each device to process its data and share only the model updates (like gradients or weights) with a central server. This approach enhances data privacy and security since the raw data never leaves the user's device, making it particularly useful in sensitive domains like healthcare, finance, and personalized services. Federated learning is designed to work efficiently across distributed networks and can handle large-scale, diverse data while minimizing the risk of data breaches and maintaining compliance with data protection regulations.

Which region is estimated to hold the highest share in the streaming analytics market?

Europe and North America are early adopters of federated learning due to their strong focus on data privacy and security, driven by stringent regulations like GDPR in Europe and CCPA in North America. These regions have advanced technological infrastructures, with a high concentration of leading tech companies, research institutions, and AI-driven industries, such as healthcare, finance, and automotive, which are keen on leveraging federated learning to improve data-driven insights while maintaining compliance with privacy laws.

Which are key verticals adopting federated learning solutions?

Key verticals adopting federated learning solutions include healthcare and life sciences, BFSI, retail and e-commerce, manufacturing, automotive and transportation, IT and telecommunication, and energy and utilities.

Which are the key vendors exploring federated learning space?

The key vendors exploring federated learning include NVIDIA, IBM, Cloudera, Microsoft, Google, Owkin, Intellegens, Secure AI Labs, Lifebit, Edge Delta, and many others offering federated learning solutions or focused on various research project initiatives.

What are the key applications of federated learning?

Drug discovery, data privacy and security management, risk management, shopping experience personalization, industrial IoT, online visual object detection, Augmented Reality/Virtual Reality, and other applications such as video analytics, corporate IT, genomics, and anomaly detection may be the key applications end-users will look for federated learning. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The research study for the federated learning market involved the use of extensive secondary sources, directories, and several journals, including Elsevier B.V., IEEE Xplore, and Journal of Medical Internet Research (JMIR), and blogs, such as Google AI, OpenMined, NVIDIA, and IBM, to identify and collect information useful for this comprehensive market research study. Primary sources were industry experts from the core and related industries, preferred federated learning providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as Elsevier B.V., IEEE Xplore, and Journal of Medical Internet Research (JMIR), and blogs, such as Google AI, OpenMined, NVIDIA, and IBM, magazines such as Analytics India Magazine, HealthTech magazine, and other magazines.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from federated learning solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation.

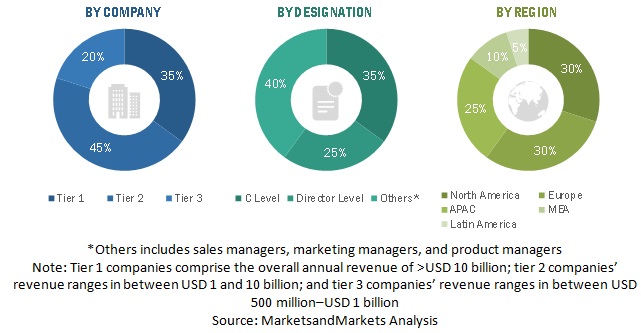

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The federated learning market is in an initial stage, with a very limited number of available deployments, and a limited number of vendors. Available secondary data as well as primary information was analyzed to identify use cases, research projects, initiatives, and consortiums specific to the market. An exhaustive list of all vendors offering solutions or having initiatives/research projects in the market was prepared. All players do not have solution offerings, whereas some key players such as Cloudera, IBM, and Google are working on research projects to further explore the potential of the federated learning market. The revenue contribution of the market vendors who have direct offerings was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated on the basis of breadth of applications and verticals. On the other hand, the vendors working on research projects were studied in detail to identify their progress and understand the future scope of federated learning solutions. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation. The list of vendors considered for estimating the market size is not limited to the vendors profiled in the report.

The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, . The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation. The list of vendors considered for estimating the market size is not limited to the vendors profiled in the report. However, MarketsandMarkets prepared a laundry list of vendors offering edge AI software and ML solutions, and mapped their products related to the federated learning market to identify major vendors operating in the market. The likelihood of these vendors venturing into market is high as they already have ML and edge AI software-specific offerings and federated learning solutions can enable further efficiencies.

Report Objectives

- To define, describe, and predict the federated learning market by region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details related to the different vendors operating and working on research projects in the federated learning market

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the federated learning market

- To analyze different applications of federated learning across verticals

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Federated Learning Market