Feed Mycotoxin Binders and Modifiers Market by Type (feed mycotoxin binders, feed mycotoxin modifiers), Livestock (poultry, swine, ruminants, aquatic animals and others), Source (inorganic, organic), Form (dry, liquid) and Region - Global Forecast 2025

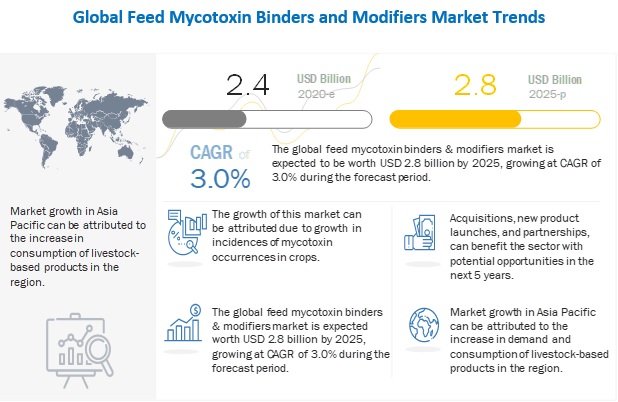

[277 Pages Report] The feed mycotoxin binders and modifiers market is estimated to account for a value of USD 2.4 billion in 2020 and is projected to grow at a CAGR of 3.0% from 2020, to reach a value of USD 2.8 billion by 2025. Increasing need of green adjuvants, improving efficiency and effectiveness of agrochemicals are some of the factors driving the growth of the feed mycotoxin binders and modifiers market.

COVID-19 Impact on the Global Feed mycotoxin binders and modifiers Market

Amid the spread of Covid-19 pandemic the demand for meat products fell sharply, due to health concerns in the countries. Thus the production levels and prices of the products fell simultaneously. Regions such as Europe and North America, recorded losses of their feed businesses. China suspended the operation of 5 of its Brazilian swine meat processing units, as confirmed by the US National Pork Producers Council (NPPC). It also carried out similar operations in the European region and US, inorder to prevent the second wave of Coronavirus in China. Such scenarios have created a situation of instability in the markets and further the logistics and supply chain briers are acting as barriers to smooth flow of operations. However with global efforts are taken to support the feed sector, as meat is an important food source providing an array of nutritions to the humans. Which will help return the feed mycotoxin binders and modifiers market scenarios to normalcy in the future.

Feed mycotoxin binders and modifiers Market Dynamics

Driver: Rise in incidences of mycotoxin occurrence in crops

There are over 500 identified mycotoxin strains in the world, including aflatoxins (B1, B2, G1, G2, and M1), ochratoxin A, deoxynivalenol, and fumonisins that are the major mycotoxins found in livestock feed. The incidences of disease outbreaks, owing to them are on the rise. All the regions in the world, developed or developing, are susceptible to the harmful impact of these mycotoxins. According to the FAO study, about 25% of the crops produced across the globe contain mycotoxins. Thus, to improve the health and wealth of livestock and to produce maximum livestock performance, mycotoxin binders & modifiers are expected to be used by the livestock growers.

Restraint: Prominent usage of mold inhibitors, acidifiers, and other feed preservatives as feed additives and lack in awareness among the small-scale livestock growers

Most of the livestock growers do not consider mycotoxin binders & modifiers as necessary feed additives and prefer using other feed additives such as mold inhibitors, acidifiers, and other feed preservatives to improve the livestock feed to extend the shelf life of feed and to improve the health and wealth of the livestock. This is due to the reason that mycotoxin binders & modifiers are perceived to contribute to the additional cost, thus acting as a restraint to market growth. In order to overcome these barriers, proper information related to risk associated with mycotoxin should be marketed with the livestock growers, educating them about the benefits of mycotoxin binders & modifiers.

Opportunity: Strong growth opportunities in poultry and aquafeed sectors in emerging markets of Asia Pacific and South America even through the minor set-backs of Covid- 19.

The growth in demand for feed mycotoxin binders & modifiers offers an opportunity for market development, especially in developing countries such as China, India, Brazil, and Argentina. Poultry and aquaculture rearing in feedlots can be considered as the significant growth sector for usage of the feed mycotoxin binders & modifiers market in South America and the Asia Pacific region, owing to their large-scale farming. The growth opportunities for the usage of feed mycotoxin binders & modifiers are furthered by factors such as a significant focus on feed safety and livestock health in order to meet the rising meat consumption and strengthened feed demand. Increased importance laid on the quality of feed products in these emerging markets is another factor offering significant opportunity for growth. Furthermore, constant disease outbreaks among livestock can also influence the usage and market development opportunity for feed mycotoxin binders & modifiers, as regulatory bodies globally focus on adopting control measures on feeding practices to address feed and consequently food safety

Challenge: Unintended consequences of using mycotoxin binders & modifiers

Mycotoxin binders & modifiers are used in such cases to combat mycotoxin contamination in livestock. Mycotoxin binders reduce the negative effects of mycotoxins in feed. However, not all mycotoxin binders have the same characteristics and thus work differently when added to feed. Every binder has its own specific binding capacity, which differs according to its source; even two clay products from the same family of bentonites may have different efficiency levels. In some regions such as the EU allows a maximum inclusion level of 2% clay in feed to bind aflatoxin B1; however, the risk of binding with the existing nutrients exists in feed even at lower inclusion levels. These undesirable binding results reduce the efficiency against mycotoxins, and there may be a reduction in the availability of essential nutrients for growth and production in the livestock. Such cases might be unknown to the farmers who use mycotoxin detoxifiers in feed.

By type, the clay subtype is projected to account for the largest market share in the feed mycotoxin binders and modifiers market during the forecast period.

The clay subtype dominated the feed mycotoxin binders & modifiers market. Clay is the most widely used mycotoxin binder in the feed industry. Clay mineral of aluminates and silicates are highly commercialized binders due to the increased awareness of consumers about their benefits, which is driving their market growth. Clay is highly effective against aflatoxins. There are many different silicates, and they all differ in mycotoxin binding. Chemically modified clay can bind multiple mycotoxins, including fumonisins, zearalenone, and trichothecenes. This has resulted in increased consumption of clay as a mycotoxin binder.

By livestock, the poultry subtype is projected to dominate the feed mycotoxin binders and modifiers market during the forecast period.

The poultry segment is projected to be the largest and fastest-growing segment, in terms of livestock production. Broilers, layers, and breeders are domesticated to produce eggs and meat for commercial consumption. Growing concerns about livestock health such as improved body mass, concern about the number and quality of egg production, and enhanced feed efficiency have led to an increasing demand for the use of mycotoxin binders & modifiers in poultry feed.

By source, the inorganic segment is projected to dominate the feed mycotoxin binders and modifiers market during the forecast period.

The inorganic segment dominated the feed mycotoxin binders & modifiers market. Feed mycotoxin binders are mostly obtained from inorganic sources such as silicates of aluminum, sodium, potassium, and calcium. The effectiveness of inorganic mycotoxin binders depends on the chemical structure and binding properties of mycotoxin binders such as polarity and solubility. Clay products including bentonite, zeolite, montmorillonites, and HSCAS (hydrated sodium calcium aluminosilicate), activated charcoal, and synthetic polymers such as polyvinylpyrrolidone and cholestyramine are used in the feed industry to bind aflatoxins.

By form, the dry form segment is projected to dominate the feed mycotoxin binders and modifiers market during the forecast period.

Feed mycotoxin binders & modifiers are most widely used in the dry form. Mycotoxin binders and modifiers are used in the dry form, as they mix readily with the feed ingredients and are easy to store. Moreover, in the dry form, dosage can be more accurately measured by livestock growers in comparison with the liquid form. Such factors are driving the market for the dry form of feed mycotoxin binders & modifiers.

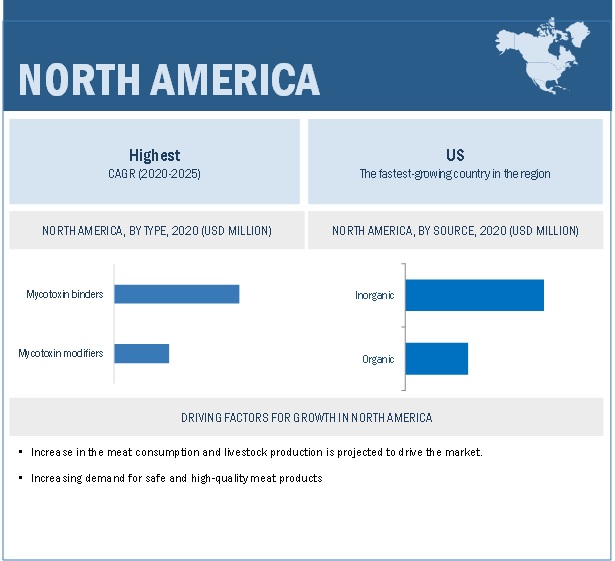

The increasing adoption of mycotxin binders and modifiers in the North American region is driving the growth of the feed mycotoxin binders and modifiers market.

The global feed mycotoxin binders & modifiers market was dominated by the North American region. The large market size of the region is attributed to the high adoption of mycotoxin binders & modifiers. This is mainly due to the increase in demand for safe and high-quality livestock-based products, food safety awareness, stringent quality regulations, and aim to reduce, prevent and eliminate the growth and presence of mycotoxin contaminant in the food chain. In the North American region, corn, wheat, and barley are the major crops used in feed production. These crops are highly susceptible to fungal growth and mycotoxin contamination. Adverse climatic conditions such as prolonged drought and flood result in increased incidences of mycotoxin contamination in crops. This also increases the contamination risk in feed, which is projected to result in economic losses. Such factors have led to an increase in demand for feed mycotoxin binders & modifiers in the region.

Key Market Players

Key players in this market include include major players such as Cargill (US), BASF (Germany), ADM (US), Bayer (Germany), Perstorp (Sweden), Chr. Hansen (Denmark). These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

20162025 |

|

Base year considered |

2019 |

|

Forecast period considered |

20202025 |

|

Units considered |

Value (USD) & Volume (KT) |

|

Segments covered |

Type, Livestock, Source, Form and Region |

|

Regions covered |

North America, Asia Pacific, Europe, South America, and RoW |

|

Companies studied |

The major market players include Cargill (US), BASF (Germany), ADM (US), Bayer (Germany), Perstorp (Sweden), Chr. Hansen (Denmark), Kemin (US), Nutreco (Netherlands), Adisseo (France), Alltech (US), Novus International (US), Biomin (Austria), Impextraco (Belgium), Norel (Spain), and Global Nutritech (Turkey). (Total 25 companies) |

This research report categorizes the feed mycotoxin binders and modifiers market based on Type, Livestock, Source, Form and Region.

On the basis of type, the feed mycotoxin binders and modifiers market has been segmented as follows:

- Feed mycotoxin binders

- Clay

- Bentonite

- Others

- Feed mycotoxin modifiers

- Enzymes

- Yeast

- Bacteria

- Others

On the basis of livestock, the feed mycotoxin binders and modifiers market has been segmented as follows:

- Poultry

- Swine

- Ruminants

- Aquatic animals

- Others

On the basis of source, the feed mycotoxin binders and modifiers market has been segmented as follows:

- Inorganic

- Organic

On the basis of form, the feed mycotoxin binders and modifiers market has been segmented as follows:

- Dry

- Liquid

On the basis of region, the feed mycotoxin binders and modifiers market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- Rest of World (RoW)*

*Rest of the World (RoW) includes Middle East, South Africa and Other countries in RoW.

Recent Developments

- March 2020 Olmix group partnered with the INRAE (National Research Institute for Agriculture, Food and Environment) which is aimed at strengthening their position at both environment and animal nutrition and health by developing sustainable and economically viable agricultural food systems.

- December 2019 Olmix Group continued its global expansion activities and has now initiated a new facility at Serbia, inorder to help its customers tackle challenges faced by livestock concerning animal immunity, digestive welfare and mycotoxin risk management.

- In January 2019, ADM acquired Neovia (France), to increase its product profile for both livestock and companion animal health products. With the acquisition, it would offer premixes, feed ingredients, aquaculture, mycotoxin, and other additives.

- In December 2018, BioVet, S.A (Spain), subsidiary of Provimi launched its product Alquerfeed Antitox in India to target the Indian market.

- In July 2018, Bayer Animal Health signed an agreement with Mitsui Chemicals Agro, Inc. (Japan) for the development of the innovative product to treat parasites, such as fungi and bacteria.

- In February 2018 Adisseo acquired global feed additives producer Nutriad (Belgium). This transaction was part of Adisseos strategy to become one of the worldwide leaders of specialty additives in animal nutrition.

Frequently Asked Questions (FAQ):

Who are some of the key players operating in the feed mycotoxin binders and modifiers market and how intense is the competition?

The key players in the feed mycotoxin binders and modifiers market are Cargill (US), BASF (Germany), ADM (US), Bayer (Germany), Perstorp (Sweden), Novus International (US), BIOMIN (Austria), Impextraco (Belgium), Norel Animal Nutrition (Spain), and Chr. Hansen (Denmark). Competitive markets exisit in the North American and European regions, with major players located in these regions. The businesses are strongly developing newer innovative produts in the market for capturing greater markets shares in the international markets.

What kind of competitors and stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

The industry includes global animla nutrition busniesses such as Cargill (US), BASF (Germany), ADM (US), Bayer (Germany), Perstorp (Sweden), Novus International (US) as competitors and key stakeholders for the market are feed manufacturers and traders, dairy, poultry farms, and other livestock farms, manufacturers of feed mycotoxin binders & modifiers, Intermediary suppliers such as traders, and distributors of feed mycotoxin binders & modifiers, Government and research organizations, associations and industry bodies sucha as: Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), European Food Safety Authority (EFSA), International Society for Mycotoxicology (ISM), World Health Organization (WHO), European Association of Specialty Feed Ingredients and their Mixtures (FEFANA), International Feed Industry Federation (IFIF), Organization for Economic Co-operation and Development (OECD), World Organization for Animal Health (OIE), Animal Feed Manufacturers Association (AFMA), The Compound Feed Manufacturers Association (CLFMA), Animal Nutrition Association of Canada (ANAC) and National Grain and Feed Association (NGFA).

How are the current R&D activities and M&As in the feed mycotoxin binders and modifiers market projected to create a disrupting environment in the coming years?

The recent R&D activities undertaken by the major players in the market are in March 2020 Olmix group partnered with the INRAE (National Research Institute for Agriculture, Food and Environment) which is aimed at strengthening their position at both environment and animal nutrition and health; and in August 2018 Alltech opened a biocentreAlltech Coppens Aqua Centre, it would be the 4th biocentre of Alltech to conduct research and product innovation for aquatic animals. The recent M&A undertaken can be given as in January 2019 ADM acquired Neovia (France), to increase its product profile for both livestock and companion animal health products. With the acquisition, it would offer premixes, feed ingredients, aquaculture, mycotoxin, and other additives; and in February 2018 Adisseo acquired global feed additives producer Nutriad (Belgium). This transaction was part of Adisseos strategy to become one of the worldwide leaders of specialty additives in animal nutrition. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SEGMENTATION

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED FOR THE STUDY

1.6 CURRENCY CONSIDERED

1.7 VOLUME UNIT CONSIDERED

TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED, 20142019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 1 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 50)

TABLE 2 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SNAPSHOT, 2020 VS. 2025

FIGURE 5 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 6 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY LIVESTOCK, 2020 VS. 2025 (USD MILLION)

FIGURE 7 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SOURCE, 2020 VS. 2025 (USD MILLION)

FIGURE 8 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY FORM, 2020 VS. 2025 (USD MILLION)

FIGURE 9 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SHARE (VALUE), BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 OPPORTUNITIES IN THE FEED MYCOTOXIN BINDERS & MODIFIERS MARKET

FIGURE 10 GLOBAL INCREASE IN THE RISK OF MYCOTOXIN CONTAMINATION IN LIVESTOCK FEED TO DRIVE THE MARKET FOR FEED MYCOTOXIN BINDERS & MODIFIERS

4.2 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 11 JAPAN IS PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 ASIA PACIFIC: FEED MYCOTOXIN BINDERS MARKET, BY KEY SUBTYPE & COUNTRY

FIGURE 12 CHINA IS ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE IN THE ASIA PACIFIC MARKET WHILE CLAY IS SET TO DOMINATE IN TERMS OF SUBTYPE IN 2020

4.4 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET, BY LIVESTOCK & REGION

FIGURE 13 NORTH AMERICA & ASIA PACIFIC ARE PROJECTED TO ACCOUNT FOR MAJOR SHARES IN THE FEED MYCOTOXIN BINDERS & MODIFIERS MARKET ACROSS ALL TYPES OF LIVESTOCK THROUGH 2025

4.5 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET, BY TYPE & REGION

FIGURE 14 NORTH AMERICA TO DOMINATE IN 2020, ESPECIALLY IN THE BINDERS SEGMENT

4.6 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET, BY SOURCE

FIGURE 15 INORGANIC FEED MYCOTOXIN BINDERS & MODIFIERS PROJECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rise in incidences of mycotoxin occurrence in crops

FIGURE 17 MYCOTOXIN CONTAMINATION IN FEED INGREDIENTS, 2016

5.2.1.2 Stringent regulations limiting the presence of mycotoxins in feed products

TABLE 3 REGULATED CONTENT LEVELS FOR AFLATOXIN, COUNTRY & REGION

5.2.1.3 Global Increase in risk of mycotoxin contamination in livestock feed

FIGURE 18 RISKS ASSOCIATED WITH MYCOTOXIN IN DIFFERENT REGIONS, 2018

5.2.2 RESTRAINTS

5.2.2.1 Prominent usage of mold inhibitors, acidifiers, and other feed preservatives as feed additives and lack in awareness among the small-scale livestock growers

5.2.2.2 COVID-19 pandemic temporarily poses a negative impact on the overall growing consumption of livestock-based products

FIGURE 19 LIVESTOCK-BASED PRODUCT CONSUMPTION, BY COMMODITY, 19672030 (MILLION TON)

5.2.3 OPPORTUNITIES

5.2.3.1 Strong growth opportunities in poultry and aquafeed sectors in emerging markets of Asia Pacific and South America despite the COVID-19 crisis

5.2.4 CHALLENGES

5.2.4.1 Unintended consequences of using mycotoxin binders & modifiers

5.2.5 PRE- & POST-COVID-19 IMPACT ON THE MYCOTOXIN BINDERS & FEED ADDITIVES MARKET

5.3 VALUE CHAIN

FIGURE 20 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET: VALUE CHAIN

6 REGULATORY FRAMEWORK (Page No. - 70)

6.1 REGULATIONS FOR MYCOTOXIN BINDERS & MODIFIERS

6.1.1 REGULATION IN THE US FOR ANTI-MYCOTOXIN ADDITIVES

6.1.2 REGULATIONS IN EUROPE

6.1.2.1 Regulations on products for mycotoxin absorption

6.2 REGULATIONS FOR BENTONITE AS BINDER

6.3 REGULATIONS FOR CLAY AS BINDER

6.4 REGULATIONS ON MYCOTOXIN

TABLE 4 MYCOTOXIN REGULATIONS FOR FEED IN EUROPE

TABLE 5 MYCOTOXIN REGULATIONS FOR FEED IN THE US

TABLE 6 MYCOTOXIN REGULATIONS FOR FEED IN JAPAN

TABLE 7 MYCOTOXIN REGULATIONS FOR FEED IN CHINA

TABLE 8 MYCOTOXIN REGULATIONS FOR FEED IN INDONESIA

7 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET, BY TYPE (Page No. - 79)

7.1 INTRODUCTION

FIGURE 21 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 9 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 10 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 11 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (KT)

TABLE 12 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (KT)

TABLE 13 FEED MYCOTOXIN BINDERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 14 FEED MYCOTOXIN BINDERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

TABLE 15 FEED MYCOTOXIN BINDERS MARKET SIZE, BY SUBTYPE, 20162019 (KT)

TABLE 16 FEED MYCOTOXIN BINDERS MARKET SIZE, BY SUBTYPE, 20202025 (KT)

7.2 MYCOTOXINS BINDERS

7.2.1 CLAY

7.2.1.1 High effectiveness against aflatoxins is driving the market for clay

TABLE 17 CLAY: FEED MYCOTOXIN BINDERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 18 CLAY: FEED MYCOTOXIN BINDERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.2.2 BENTONITE

7.2.2.1 Ability to bind toxins as well as other harmful compounds

TABLE 19 BENTONITE: FEED MYCOTOXIN BINDERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 20 BENTONITE: FEED MYCOTOXIN BINDERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.2.3 OTHERS

7.2.3.1 Increased awareness about activated carbon as a mycotoxin binder

TABLE 21 OTHERS: FEED MYCOTOXIN BINDERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 22 OTHERS: FEED MYCOTOXIN BINDERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.3 MYCOTOXIN MODIFIERS

7.3.1 ENZYMES

7.3.1.1 Environmental-friendliness of enzymes is expected to drive their market share

TABLE 23 ENZYMES: FEED MYCOTOXIN BINDERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 24 ENZYMES: FEED MYCOTOXIN BINDERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.3.2 YEAST

7.3.2.1 Commercialization of yeast on a large scale

TABLE 25 YEAST: FEED MYCOTOXIN BINDERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 26 YEAST: FEED MYCOTOXIN BINDERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.3.3 BACTERIA

7.3.3.1 Increased R&D on bacteria is projected to drive the demand for bacteria as mycotoxin modifiers

TABLE 27 BACTERIA: FEED MYCOTOXIN BINDERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 28 BACTERIA: FEED MYCOTOXIN BINDERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.3.4 OTHERS

7.3.4.1 Rising awareness about the use of fungi and algae as mycotoxin modifiers

TABLE 29 OTHER MODIFIERS: FEED MYCOTOXIN BINDERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 30 OTHER MODIFIERS: FEED MYCOTOXIN BINDERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.3.5 COVID-19 IMPACT ON THE FEED MYCOTOXIN BINDERS & MODIFIERS MARKET, BY TYPE

8 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET, BY LIVESTOCK (Page No. - 93)

8.1 INTRODUCTION

FIGURE 22 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET, BY LIVESTOCK, 2020 VS. 2025 (USD MILLION)

TABLE 31 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY LIVESTOCK, 20162019 (USD MILLION)

TABLE 32 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY LIVESTOCK, 20202025 (USD MILLION)

8.2 POULTRY

8.2.1 BROILERS

8.2.1.1 Feed mycotoxin binders & modifiers are used in the feed for broilers to enhance their overall development

8.2.2 LAYERS

8.2.2.1 Feed mycotoxin binders & modifiers enhance the laying capacity of the chickens

8.2.3 BREEDERS

8.2.3.1 Improves egg production and enhancement in the shell quality of the eggs

TABLE 33 POULTRY: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 34 POULTRY: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 35 POULTRY: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 36 POULTRY: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

8.3 SWINE

8.3.1 STARTERS

8.3.1.1 Protect swine from the negative effects of mycotoxins

8.3.2 GROWERS

8.3.2.1 Improves the health of growers

8.3.3 SOWS

8.3.3.1 Better growth and survival of starter pigs, as it is less costly for the farmers

TABLE 37 SWINE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 38 SWINE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 39 SWINE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 40 SWINE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

8.4 RUMINANTS

8.4.1 CALVES

8.4.1.1 Mycotoxin binders & modifiers are used in the feed of calves to ensure their health and growth

8.4.2 DAIRY CATTLE

8.4.2.1 The mycotoxin present in dairy cattle feed can cause various disorders in cows

8.4.3 BEEF CATTLE

8.4.3.1 Feed mycotoxin binders & modifiers are essential for improving feed efficiency and maximizing the muscle growth of beef cattle

8.4.4 OTHERS

8.4.4.1 Mycotoxin binders & modifiers boost health and prevent health problems

TABLE 41 RUMINANTS: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 42 RUMINANTS: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 43 RUMINANTS: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 44 RUMINANTS: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

8.5 AQUATIC ANIMALS

8.5.1 GROWING USAGE OF CEREALS AND THEIR BY-PRODUCTS IN FISH FEED INCREASES THE RISK OF CONTAMINATION BY MYCOTOXINS

TABLE 45 AQUATIC ANIMALS: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 46 AQUATIC ANIMALS: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

8.6 OTHERS

TABLE 47 OTHERS: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 48 OTHERS: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

8.7 COVID-19 IMPACT ON THE FEED MYCOTOXINS & MODIFIERS MARKET, BY LIVESTOCK

9 FEED MYCOTOXIN BINDERS & MODIFIERS, BY SOURCE (Page No. - 105)

9.1 INTRODUCTION

FIGURE 23 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SOURCE, 2020 VS. 2025 (USD MILLION)

TABLE 49 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SOURCE, 2016-2019 (USD MILLION)

TABLE 50 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SOURCE, 2020-2025 (USD MILLION)

9.2 INORGANIC

9.2.1 LOWER PRICES AND EASE OF HANDLING ARE FACTORS PROJECTED TO DRIVE THE GROWTH OF THE INORGANIC FEED MYCOTOXIN BINDERS & MODIFIERS MARKET

TABLE 51 INORGANIC FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 52 INORGANIC FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9.3 ORGANIC

9.3.1 EFFECTIVENESS OF ORGANIC BINDERS & MODIFIERS ON A WIDE RANGE OF TOXINS IS DRIVING THE MARKET FOR ORGANICALLY SOURCED FEED MYCOTOXIN BINDERS & MODIFIERS

TABLE 53 ORGANIC FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 54 ORGANIC FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

10 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET, BY FORM (Page No. - 110)

10.1 INTRODUCTION

FIGURE 24 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY FORM, 2020 VS. 2025 (USD MILLION)

TABLE 55 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY FORM, 20162019 (USD MILLION)

TABLE 56 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY FORM, 20202025 (USD MILLION)

10.2 DRY

10.2.1 EASE OF STORAGE AND HANDLING IS DRIVING THE MARKET FOR THE DRY FORM OF FEED MYCOTOXIN BINDERS & MODIFIERS

TABLE 57 DRY FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 58 DRY FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

10.3 LIQUID

10.3.1 ENHANCED UNIFORMITY OF THE FINAL FEED PRODUCT

TABLE 59 LIQUID FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 60 LIQUID FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

11 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET, BY REGION (Page No. - 115)

11.1 INTRODUCTION

FIGURE 25 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SHARE (BY VALUE), BY KEY COUNTRY, 2020

TABLE 61 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 62 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

TABLE 63 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20162019 (KT)

TABLE 64 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20202025 (KT)

11.2 NORTH AMERICA

FIGURE 26 NORTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SNAPSHOT, 2020

TABLE 65 MYCOTOXIN OCCURRENCE AND RISK LEVEL IN NORTH AMERICA

TABLE 66 MYCOTOXIN OCCURRENCE AND RISK LEVEL IN CENTRAL AMERICA (MEXICO & OTHERS)

TABLE 67 NORTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 68 NORTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

TABLE 69 NORTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20162019 (KT)

TABLE 70 NORTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20202025 (KT)

TABLE 71 NORTH AMERICA: FEED MYCOTOXIN BINDERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 72 NORTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 73 NORTH AMERICA: FEED MYCOTOXIN BINDERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 74 NORTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

TABLE 75 NORTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY LIVESTOCK, 20162019 (USD MILLION)

TABLE 76 NORTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY LIVESTOCK, 20202025 (USD MILLION)

TABLE 77 NORTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY FORM, 20162019 (USD MILLION)

TABLE 78 NORTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY FORM, 20202025 (USD MILLION)

TABLE 79 NORTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS SIZE, BY SOURCE, 20162019 (USD MILLION)

TABLE 80 NORTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS SIZE, BY SOURCE, 20202025 (USD MILLION)

11.2.1 US

11.2.1.1 Increasing incidences of mycotoxins have driven the demand for mycotoxin binders & modifiers

TABLE 81 US: FEED MYCOTOXIN BINDERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 82 US: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 83 US: FEED MYCOTOXIN BINDERS& MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 84 US: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.2.2 CANADA

11.2.2.1 High mycotoxin contamination risk in crops

TABLE 85 CANADA: FEED MYCOTOXIN BINDERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 86 CANADA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 87 CANADA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 88 CANADA: FEED MYCOTOXIN MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Support from government programs and the increasing livestock production to drive the consumption of livestock feed

TABLE 89 MEXICO: FEED MYCOTOXIN BINDERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 90 MEXICO: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 91 MEXICO: FEED MYCOTOXIN BINDERS& MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 92 MEXICO: FEED MYCOTOXIN MODIFIERS & BINDERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.2.4 COVID-19 IMPACT ON THE NORTH AMERICAN MYCOTOXIN BINDERS & MODIFIERS MARKET

FIGURE 27 GLOBAL GROWTH IN MEAT PRODUCTION STATISTICS

11.3 EUROPE

TABLE 93 MYCOTOXIN OCCURRENCE AND RISK LEVEL IN NORTHERN EUROPE

TABLE 94 MYCOTOXIN OCCURRENCE AND RISK LEVEL IN CENTRAL EUROPE

TABLE 95 MYCOTOXIN OCCURRENCE AND RISK LEVEL IN EASTERN EUROPE

TABLE 96 MYCOTOXIN OCCURRENCE AND RISK LEVEL IN SOUTHERN EUROPE

TABLE 97 EUROPE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 98 EUROPE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

TABLE 99 EUROPE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20162019 (KT)

TABLE 100 EUROPE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20202025 (KT)

TABLE 101 EUROPE: FEED MYCOTOXIN BINDERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 102 EUROPE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 103 EUROPE: FEED MYCOTOXIN BINDERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 104 EUROPE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

TABLE 105 EUROPE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY LIVESTOCK, 20162019 (USD MILLION)

TABLE 106 EUROPE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY LIVESTOCK, 20202025 (USD MILLION)

TABLE 107 EUROPE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY FORM, 20162019 (USD MILLION)

TABLE 108 EUROPE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY FORM, 20202025 (USD MILLION)

TABLE 109 EUROPE: FEED MYCOTOXIN BINDERS & MODIFIERS SIZE, BY SOURCE, 20162019 (USD MILLION)

TABLE 110 EUROPE: FEED MYCOTOXIN BINDERS & MODIFIERS SIZE, BY SOURCE, 20202025 (USD MILLION)

11.3.1 SPAIN

11.3.1.1 High occurrence of toxins in feed crops

TABLE 111 SPAIN: FEED MYCOTOXIN BINDERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 112 SPAIN: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 113 SPAIN: FEED MYCOTOXIN BINDERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 114 SPAIN: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.3.2 RUSSIA

11.3.2.1 Russian pork production has witnessed significant growth in recent years

TABLE 115 RUSSIA: FEED MYCOTOXIN BINDERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 116 RUSSIA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 117 RUSSIA: FEED MYCOTOXIN BINDERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 118 RUSSIA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 High-quality standards for meat products and the presence of mycotoxins in cereal crops

TABLE 119 GERMANY: FEED MYCOTOXIN BINDERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 120 GERMANY: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 121 GERMANY: FEED MYCOTOXIN BINDERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 122 GERMANY: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.3.4 FRANCE

11.3.4.1 Demand for meat products and focus on increasing export

TABLE 123 FRANCE: FEED MYCOTOXIN BINDERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 124 FRANCE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 125 FRANCE: FEED MYCOTOXIN BINDERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 126 FRANCE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.3.5 ITALY

11.3.5.1 Increase in meat production to drive the demand for feed mycotoxins

TABLE 127 ITALY: FEED MYCOTOXIN BINDERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 128 ITALY: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 129 ITALY: FEED MYCOTOXIN BINDERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 130 ITALY: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.3.6 UK

11.3.6.1 Stringent food safety regulations and health awareness among consumers

TABLE 131 UK: FEED MYCOTOXIN BINDERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 132 UK: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 133 UK: FEED MYCOTOXIN BINDERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 134 UK: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.3.7 REST OF EUROPE

11.3.7.1 Increasing awareness about the benefits of mycotoxin binders & modifiers among livestock producers

TABLE 135 REST OF EUROPE: FEED MYCOTOXIN BINDERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 136 REST OF EUROPE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 137 REST OF EUROPE: FEED MYCOTOXIN BINDERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 138 REST OF EUROPE: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.3.8 COVID-19 IMPACT ON THE MYCOTOXIN BINDERS & MODIFIERS MARKET IN EUROPE

FIGURE 28 COUNTRY-WISE MEAT PRODUCTION LEVELS IN THE EUROPEAN REGION, 2019

11.4 ASIA PACIFIC

TABLE 139 MYCOTOXIN OCCURRENCE IN THE ASIA PACIFIC REGION

FIGURE 29 ASIA PACIFIC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SNAPSHOT, 2020

TABLE 140 ASIA PACIFIC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 141 ASIA PACIFIC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

TABLE 142 ASIA PACIFIC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20162019 (KT)

TABLE 143 ASIA PACIFIC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20202025 (KT)

TABLE 144 ASIA PACIFIC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 145 ASIA PACIFIC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 146 ASIA PACIFIC: FEED MYCOTOXIN BINDERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 147 ASIA PACIFIC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

TABLE 148 ASIA PACIFIC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY LIVESTOCK, 20162019 (USD MILLION)

TABLE 149 ASIA PACIFIC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY LIVESTOCK, 20202025 (USD MILLION)

TABLE 150 ASIA PACIFIC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY FORM, 20162019 (USD MILLION)

TABLE 151 ASIA PACIFIC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY FORM, 20202025 (USD MILLION)

TABLE 152 ASIA PACIFIC: FEED MYCOTOXIN BINDERS & MODIFIERS SIZE, BY SOURCE, 20162019 (USD MILLION)

TABLE 153 ASIA PACIFIC: FEED MYCOTOXIN BINDERS & MODIFIERS SIZE, BY SOURCE, 20202025 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Increasing consumer awareness about mycotoxin contamination in the feed industry

TABLE 154 CHINA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 155 CHINA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 156 CHINA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 157 CHINA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.4.2 INDIA

11.4.2.1 Animal husbandry is a dominant occupation in the country

TABLE 158 INDIA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 159 INDIA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 160 INDIA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 161 INDIA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 The rise in pork and beef consumption

TABLE 162 JAPAN: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 163 JAPAN: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 164 JAPAN: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 165 JAPAN: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.4.4 THAILAND

11.4.4.1 Increasing domestic consumption and export of poultry meat

TABLE 166 THAILAND: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 167 THAILAND: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 168 THAILAND: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 169 THAILAND: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.4.5 VIETNAM

11.4.5.1 Increasing feed production to have a proportional impact on the consumption of feed mycotoxin

TABLE 170 VIETNAM: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 171 VIETNAM: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 172 VIETNAM: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 173 VIETNAM: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

11.4.6.1 Rising awareness regarding the importance of livestock nutrition for good-quality meat and other animal-based by-products

TABLE 174 REST OF APAC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 175 REST OF APAC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 176 REST OF APAC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 177 REST OF APAC: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.4.7 COVID-19 IMPACT ON THE MYCOTOXIN BINDERS & MODIFIERS MARKET IN THE ASIA PACIFIC REGION

FIGURE 30 RISING MEAT PRODUCTIONS IN INDIA AND CHINA IN MILLION TONNES, 2008-2018

11.5 SOUTH AMERICA

TABLE 178 MYCOTOXIN OCCURRENCE AND RISK LEVEL IN SOUTH AMERICA

TABLE 179 SOUTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 180 SOUTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

TABLE 181 SOUTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20162019 (KT)

TABLE 182 SOUTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY COUNTRY, 20202025 (KT)

TABLE 183 SOUTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 184 SOUTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 185 SOUTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 186 SOUTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

TABLE 187 SOUTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY LIVESTOCK, 20162019 (USD MILLION)

TABLE 188 SOUTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY LIVESTOCK, 20202025 (USD MILLION)

TABLE 189 SOUTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY FORM, 20162019 (USD MILLION)

TABLE 190 SOUTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY FORM, 20202025 (USD MILLION)

TABLE 191 SOUTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS SIZE, BY SOURCE, 20162019 (USD MILLION)

TABLE 192 SOUTH AMERICA: FEED MYCOTOXIN BINDERS & MODIFIERS SIZE, BY SOURCE, 20202025 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Increased demand for meat and meat products in both the domestic and international markets despite the spread of the coronavirus pandemic

TABLE 193 BRAZIL: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 194 BRAZIL: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 195 BRAZIL: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 196 BRAZIL: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Increase in the domestic demand for meat and egg products in Argentina and investments in the poultry segment due to their health and nutrition benefits

TABLE 197 ARGENTINA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 198 ARGENTINA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 199 ARGENTINA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 200 ARGENTINA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.5.3 REST OF SOUTH AMERICA

11.5.3.1 The rise in demand and supply of livestock-based products and steady industrialization in livestock rearing to drive the market growth

TABLE 201 REST OF SA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 202 REST OF SA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 203 REST OF SA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 204 REST OF SA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.6 REST OF THE WORLD (ROW)

TABLE 205 MYCOTOXIN OCCURRENCE AND RISK LEVEL IN THE MIDDLE EAST

TABLE 206 MYCOTOXIN OCCURRENCE AND RISK LEVEL IN AFRICA

TABLE 207 ROW: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 208 ROW: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

TABLE 209 ROW: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20162019 (KT)

TABLE 210 ROW: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY REGION, 20202025 (KT)

TABLE 211 ROW: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 212 ROW: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 213 ROW: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 214 ROW: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

TABLE 215 ROW: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY LIVESTOCK, 20162019 (USD MILLION)

TABLE 216 ROW: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY LIVESTOCK, 20202025 (USD MILLION)

TABLE 217 ROW: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY FORM, 20162019 (USD MILLION)

TABLE 218 ROW: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY FORM, 20202025 (USD MILLION)

TABLE 219 ROW: FEED MYCOTOXIN BINDERS & MODIFIERS SIZE, BY SOURCE, 20162019 (USD MILLION)

TABLE 220 ROW: FEED MYCOTOXIN BINDERS & MODIFIERS SIZE, BY SOURCE, 20202025 (USD MILLION)

11.6.1 MIDDLE EAST

11.6.1.1 Increase in meat consumption and production, and rise in livestock disease outbreaks further affected by the spread of COVID-19 project slower growth in the region

TABLE 221 MIDDLE EAST: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 222 MIDDLE EAST: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 223 MIDDLE EAST: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 224 MIDDLE EAST: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

11.6.2 AFRICA

11.6.2.1 Presence of substantial livestock population

TABLE 225 AFRICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20162019 (USD MILLION)

TABLE 226 AFRICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 227 AFRICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20162019 (USD MILLION)

TABLE 228 AFRICA: FEED MYCOTOXIN BINDERS & MODIFIERS MARKET SIZE, BY SUBTYPE, 20202025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 198)

12.1 INTRODUCTION

12.2 COMPETITIVE LEADERSHIP MAPPING

12.2.1 VISIONARY LEADERS

12.2.2 DYNAMIC DIFFERENTIATORS

12.2.3 INNOVATORS

12.2.4 EMERGING COMPANIES

FIGURE 31 FEED MYCOTOXIN BINDERS & MODIFIERS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

12.3 START-UP MICROQUADRANTS

12.3.1 EMERGING LEADERS

12.3.2 STARTING BLOCKS

12.3.3 PROGRESSIVE COMPANIES

12.3.4 DYNAMIC CAPITALIZERS

FIGURE 32 FEED MYCOTOXIN BINDERS & MODIFIERS STARTUP MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

12.4 MARKET SHARE ANALYSIS

FIGURE 33 MARKET SHARE OF KEY PLAYERS IN THE FEED MYCOTOXIN BINDERS & MODIFIERS MARKET

12.5 COMPETITIVE SCENARIO

12.5.1 EXPANSIONS

TABLE 229 EXPANSIONS, 20142019

12.5.2 NEW PRODUCT LAUNCHES

TABLE 230 NEW PRODUCT LAUNCHES, 20142019

12.5.3 ACQUISITIONS

TABLE 231 ACQUISITIONS, 20142019

12.5.4 AGREEMENTS

TABLE 232 AGREEMENTS 20142019

13 COMPANY PROFILES (Page No. - 207)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

13.1 CARGILL

FIGURE 34 CARGILL: COMPANY SNAPSHOT

FIGURE 35 CARGILL: SWOT ANALYSIS

13.2 BASF

FIGURE 36 BASF: COMPANY SNAPSHOT

FIGURE 37 BASF: SWOT ANALYSIS

13.3 ARCHER DANIELS MIDLAND COMPANY (ADM)

FIGURE 38 ADM: COMPANY SNAPSHOT

FIGURE 39 ADM: SWOT ANALYSIS

13.4 BAYER

FIGURE 40 BAYER: COMPANY SNAPSHOT

FIGURE 41 BAYER: SWOT ANALYSIS

13.5 PERSTORP

FIGURE 42 PERSTORP: COMPANY SNAPSHOT

FIGURE 43 PERSTORP: SWOT ANALYSIS

13.6 CHR. HANSEN

FIGURE 44 CHR. HANSEN: COMPANY SNAPSHOT

13.7 KEMIN

13.8 NUTRECO

13.9 ADISSEO

13.10 ALLTECH

13.11 NOVUS INTERNATIONAL

13.12 BIOMIN

13.13 IMPEXTRACO

13.14 NOREL ANIMAL NUTRITION

13.15 GLOBAL NUTRITECH

13.16 AMLAN INTERNATIONAL

13.17 OLMIX GROUP

13.18 MICRON BIO SYSTEMS

13.19 SIBBIOPHARM

13.20 SELKO B.V

13.21 FF CHEMICALS B.V

13.22 ANFOTAL NUTRITIONS

13.23 BENTOLI INC

13.24 VISSCHER HOLLAND

13.25 BONA VENTURE ANIMAL NUTRITION

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS (Page No. - 244)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 FEED BINDERS MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

FIGURE 45 FEED BINDERS MARKET IS ESTIMATED TO HAVE A HIGH GROWTH DURING THE FORECAST PERIOD.

14.4 FEED BINDERS MARKET, BY TYPE

14.4.1 INTRODUCTION

TABLE 233 FEED BINDERS MARKET SIZE, BY TYPE, 20172025 (USD MILLION)

TABLE 234 FEED BINDERS MARKET SIZE, BY TYPE, 20172025 (KT

14.5 FEED BINDERS MARKET, BY REGION

14.5.1 NORTH AMERICA

TABLE 235 NORTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 20172025 (KT)

TABLE 236 NORTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 20172025 (USD MILLION)

14.5.2 EUROPE

TABLE 237 EUROPE: FEED BINDERS MARKET SIZE, BY TYPE, 20172025 (KT

TABLE 238 EUROPE: FEED BINDERS MARKET SIZE, BY TYPE, 20172025 (USD MILLION)

14.5.3 ASIA PACIFIC

TABLE 239 ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY TYPE, 20172025 (KT

TABLE 240 ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY TYPE, 20172025 (USD MILLION)

14.5.4 SOUTH AMERICA

TABLE 241 SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 20172025 (KT

TABLE 242 SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 20172025 (USD MILLION)

14.5.5 REST OF THE WORLD

TABLE 243 ROW: FEED BINDERS MARKET SIZE, BY TYPE, 20172025 (KT

TABLE 244 ROW: FEED BINDERS MARKET SIZE, BY TYPE, 20172025 (USD MILLION)

14.6 FEED ADDITIVES MARKET

14.7 LIMITATIONS

14.8 MARKET DEFINITION

14.9 MARKET OVERVIEW

FIGURE 46 FEED PRODUCTION TREND, 20112016 (MILLION TONS)

FIGURE 47 FEED ADDITIVES MARKET IS ESTIMATED TO HAVE FAST GROWTH DURING THE FORECAST PERIOD

14.1 FEED ADDITIVES MARKET, BY TYPE

14.10.1 INTRODUCTION

TABLE 245 FEED ADDITIVES MARKET SIZE, BY TYPE, 20152022 (USD MILLION)

TABLE 246 FEED ADDITIVES MARKET SIZE, BY TYPE, 20152022 (KT)

14.11 FEED ADDITIVES MARKET, BY LIVESTOCK

14.11.1 INTRODUCTION

TABLE 247 FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 20152022 (USD MILLION)

TABLE 248 FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 20152022 (KT)

14.12 FEED ADDITIVES MARKET BY REGION

14.12.1 INTRODUCTION

TABLE 249 FEED ADDITIVES MARKET SIZE, BY REGION, 20152022 (USD MILLION)

TABLE 250 FEED ADDITIVES MARKET SIZE, BY REGION, 20152022 (KT)

14.12.2 NORTH AMERICA

TABLE 251 NORTH AMERICA: FEED ADDITIVES MARKET SIZE, BY TYPE, 20152022 (USD MILLION)

14.12.3 EUROPE

TABLE 252 EUROPE: FEED ADDITIVES MARKET SIZE, BY TYPE, 20152022 (USD MILLION)

14.12.4 ASIA PACIFIC

TABLE 253 ASIA PACIFIC: FEED ADDITIVES MARKET SIZE, BY TYPE, 20152022 (USD MILLION)

14.13 SOUTH AMERICA

TABLE 254 SOUTH AMERICA: FEED ADDITIVES MARKET SIZE, BY TYPE, 20152022 (USD MILLION)

14.13.1 ROW

TABLE 255 ROW: FEED ADDITIVES MARKET SIZE, BY TYPE, 20152022 (USD MILLION)

15 APPENDIX (Page No. - 267)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

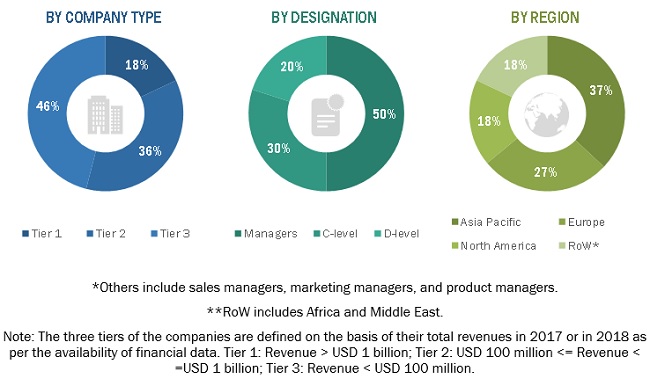

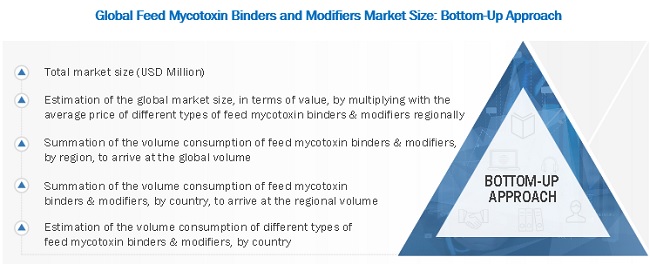

The study involves four major activities to estimate the current market size of the feed mycotoxin binders and modifiers market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation approaches were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, in order to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The feed mycotoxin binders and modifiers market comprises feed manufacturers and traders, dairy, poultry farms, and other livestock farms, manufacturers of feed mycotoxin binders & modifiers, Intermediary suppliers such as traders, and distributors of feed mycotoxin binders & modifiers, Government and research organizations, associations and industry bodies. The demand-side of this market is characterized by the rising demand for mycotoxin binder products in the animal feed industries. The supply-side is characterized by the supply of raw material providers in feed mycotoxin binders and modifiers from various suppliers in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the feed mycotoxin binders and modifiers market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- Major regions were identified, along with countries contributing the maximum share.

- The industrys supply chain and market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary respondents

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the feed mycotoxin binders and modifiers market.

Report Objectives

- To define, segment, and project the global market size of the feed mycotoxin binders and modifiers market.

- To understand the feed mycotoxin binders and modifiers market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, collaborations, divestments, disinvestments, and agreements

Core competencies of companies include their key developments and strategies adopted by them to sustain their position in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe feed mycotoxin binders and modifiers market into Poland, Russia, and Portugal

- Further breakdown of the Rest of Asia Pacific feed mycotoxin binders and modifiers market into Thailand, Vietnam, and South Korea

- Further breakdown of the others RoW feed mycotoxin binders and modifiers market into the Middle Eastern and African countries

Company Information

- · Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Feed Mycotoxin Binders and Modifiers Market