Feed Processing Market by Type (Cleaning & Sorting, Grinding, Mixing, Conditioning & Expanding, Dosing & Batching, Pelleting, Extrusion), Mode of Operation, Livestock, Form of Feed, and Region - Global Forecast to 2023

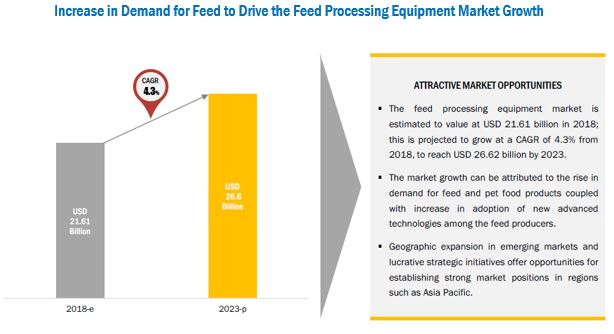

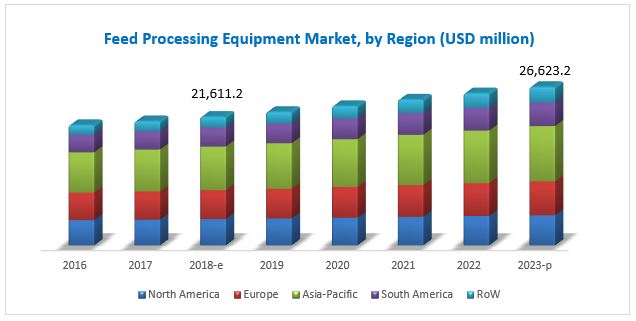

[135 Pages Report] The feed processing market was valued at USD 20.86 Billion in 2017, and is projected to grow at a CAGR of 4.3% from 2018, to reach USD 26.62 Billion by 2023. The base year considered for the study is 2017, while the forecast period spans from 2018 to 2023. The basic objective of the report is to define, segment, and project the global market size of the feed processing market on the basis of type, form of feed, mode of operation, livestock, and region. It also helps to understand the structure of the feed processing market by identifying its various segments. The other objectives include analyzing the opportunities in the market for the stakeholders, providing the competitive landscape of the market trends, and projecting the size of the feed processing market and its submarkets, in terms of value.

For More details on this research, Request Free Sample Report

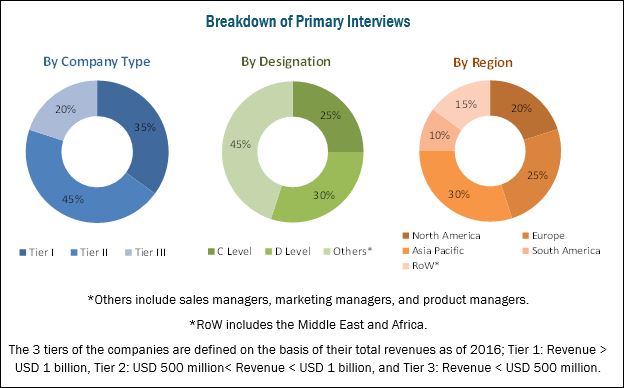

This research study involved the extensive use of secondary sources (which included directories and databases) such as Hoovers, Forbes, Bloomberg Businessweek, and Factiva to identify and collect information useful for this technical, market-oriented, and commercial study of the feed processing market. The primary sources that have been involved include industry experts from core and related industries and preferred suppliers, dealers, manufacturers, alliances, standards & certification organizations from companies, and organizations related to all segments of this industry’s value chain. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess future prospects. The following figure depicts the market research methodology applied in drafting this report on the feed processing market.

To know about the assumptions considered for the study, download the pdf brochure

Key participants in the feed processing market are the feed equipment manufacturers, suppliers, and regulatory bodies. The key players that are profiled in the report include Andritz (Austria), Buhler (Switzerland), Pavan (Italy), Clextral (France), Muyang (China), Bratney (US), Dinnissen (Netherlands), Henan Longchang Machinery (China), BK Allied (India), and Het Feed Machinery (China).

This report is targeted at the existing players in the industry, which include the following:

- Raw material suppliers

- Feed processing manufacturers

- Regulatory bodies

- Intermediary suppliers

- Feed manufacturers

- Trade associations and industry bodies

- Government and research organizations

“The study answers several questions for the stakeholders; primarily, which market segments to focus on in the next two to five years, for prioritizing efforts and investments.”

Scope of the Report

On the basis of Type, the feed processing market has been segmented as follows:

- Cleaning & sorting

- Grinding

- Mixing

- Conditioning & expanding

- Dosing & batching

- Pelleting

- Extrusion

- Cooling & drying

- Testing & analysis

- Others (bagging & warehousing, and bulk storage equipment)

On the basis of Form of feed, the feed processing market has been segmented as follows:

- Pellets

- Mash

- Crumbles

- Others (cubes, cakes, and liquid)

On the basis of Mode of Operation, the feed processing market has been segmented as follows:

- Automatic

- Semi-automatic

- Manual

On the basis of Livestock, the feed processing market has been segmented as follows:

- Poultry

- Ruminant

- Swine

- Others (aquatic animals, pets, and equine)

On the basis of Region, the feed processing market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (Middle East and Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Segment Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Asia Pacific feed processing market, by country

- Further breakdown of the Rest of European feed processing market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The feed processing market is estimated at USD 21.61 Billion in 2018 and is projected to reach USD 26.62 Billion by 2023, growing at a CAGR of 4.3% during the forecast period. The market size of feed processing includes both the valuation of existing feed processing and incremental revenue year-on-year. The global demand for feed processing is increasing significantly due to in the rising awareness regarding feed nutrition and health, technological advancements in the equipment industry, customized services, and an increase in the demand for feed around the world.

Based on type, the testing & analysis segment is projected to grow at the highest CAGR from 2018 to 2023. The need to understand the composition of feed was driven by the demand for balanced feed and improved additives from the stakeholders in the feed industry. Several advanced rapid analytical methods and technologies have been developed to conduct a wide range of tests and analyses of animal feed, which include pathogen testing, fat & oil analysis, mycotoxin analysis, nutritional labeling, and pesticide testing.

The pellets segment, by form of feed, accounted for the largest share of the global feed processing market in 2017. Pelleting is subsegmented into pellet mills, pellet crumblers, and others (block presses and feeders). Pellet feed is made from the mash, which is heated and compressed into a pellet, whereas crumbles are mostly made from whole pellets, which are cracked or rolled into a smaller size.

The poultry segment, by livestock, accounted for the largest share of the global feed processing market in 2017. Manufacturers are making significant investments in developing innovative feed equipment technologies for the production of various forms of the highest quality animal feed.

The Rest of the World (RoW) is projected to be the fastest-growing market for feed processing during the forecast period. The major countries with growth potential in this market include the Middle East and Africa. Africa is estimated to account for a larger share of the RoW feed processing market through 2023. This is an emerging market and hence provides opportunities for the growth of the feed processing market.

For More details on this research, Request Free Sample Report

One of the major restraining factors for the growth of the feed processing market is market consolidation. For instance, in December 2017, Pavan Group was acquired by GEA Group AG (Germany) in Italy. This acquisition enabled GEA in extending its technological portfolio by adopting extrusion and milling technologies for processed food and feed products.

Companies such as Andritz (Austria), Buhler (Switzerland), Pavan (Italy), Clextral (France), and Muyang (China) collectively account for a share of more than half of the feed processing market. These companies have a strong presence in Europe and the Rest of the world (RoW). They also have manufacturing facilities across these regions and a strong distribution network.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Feed Processing Market

4.2 Feed Processing Market Size, By Type, 2018 vs 2023

4.3 Feed Processing Market Size, By Mode of Operation, 2018 vs 2023

4.4 Feed Processing Market Share, By Livestock, 2018 vs 2023

4.5 Feed Processing Market, By Form of Feed

4.6 North American Feed Market, By Type & Country

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Demand for Feed Around the World

5.2.1.2 Growth in Awareness Regarding Feed Nutrition and Health

5.2.1.3 Technological Advancements in the Equipment Industry and Customized Services

5.2.2 Restraints

5.2.2.1 Market Consolidation

5.2.3 Opportunities

5.2.3.1 Growth in Demand for Feed Processing Equipment From Developing Economies

5.2.4 Challenges

5.2.4.1 High Capital Investment in Equipment

6 Feed Processing Market, By Type (Page No. - 41)

6.1 Introduction

6.2 Cleaning & Sorting

6.3 Grinding

6.4 Mixing

6.5 Conditioning & Expanding

6.6 Dosing & Batching

6.7 Pelleting

6.8 Extrusion

6.9 Cooling & Drying

6.10 Testing & Analysis

6.11 Others

7 Feed Processing Market, By Form of Feed (Page No. - 47)

7.1 Introduction

7.2 Pellets

7.3 Mash

7.4 Crumbles

7.5 Others

8 Feed Processing Market, By Mode of Operation (Page No. - 51)

8.1 Introduction

8.2 Automatic

8.3 Semi-Automatic

8.4 Manual

9 Feed Processing Market, By Livestock (Page No. - 54)

9.1 Introduction

9.2 Poultry

9.3 Ruminants

9.4 Swine

9.5 Others

10 Feed Processing Market, By Region (Page No. - 58)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Asia Pacific

10.3.1 China

10.3.2 India

10.3.3 Japan

10.3.3 Rest of Asia Pacific

10.4 Europe

10.4.1 Spain

10.4.2 Russia

10.4.3 Germany

10.4.4 France

10.4.5 Rest of Europe

10.5 South America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South America

10.6 Rest of the World (RoW)

10.6.1 Africa

10.6.2 Middle East

11 Competitive Landscape (Page No. - 96)

11.1 Overview

11.2 Company Ranking

11.2.1 Key Market Strategies

11.3 Competitive Scenario

11.3.1 Expansions

11.3.2 Acquisitions

11.3.3 New Product Launches

11.3.4 Collaborations & Partnerships

12 Company Profiles (Page No. - 103)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Andritz

12.2 Bühler

12.3 Pavan

12.4 Clextral

12.5 Muyang

12.6 Bratney

12.7 Dinnissen

12.8 Henan Longchang Machinery

12.9 BK Allied

12.10 Het Feed Machinery

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 127)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (71 Tables)

Table 1 US Dollar Exchange Rates Considered for the Study, 2014–2017

Table 2 Per Capita Consumption of Livestock Products Across Regions, 1964–2030

Table 3 Feed Processing Market Size, By Type, 2016–2023 (USD Million)

Table 4 Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 5 Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 6 Feed Processing Market Size, By Livestock, 2016–2023 (USD Million)

Table 7 Feed Processing Market Size, By Region, 2016–2023 (USD Million)

Table 8 North America: Feed Processing Market Size, By Type, 2016–2023 (USD Million)

Table 9 North America: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 10 North America: Feed Processing Market Size, By Livestock, 2016–2023 (USD Million)

Table 11 North America: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 12 North America: Feed Processing Market Size, By Country, 2016–2023 (USD Million)

Table 13 US: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 14 US: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 15 Canada: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 16 Canada: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 17 Mexico: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 18 Mexico: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 19 Asia Pacific: Feed Processing Market Size, By Type, 2016–2023 (USD Million)

Table 20 Asia Pacific: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 21 Asia Pacific: Feed Processing Market Size, By Livestock, 2016–2023 (USD Million)

Table 22 Asia Pacific: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 23 Asia Pacific: Feed Processing Market Size, By Country, 2016–2023 (USD Million)

Table 24 China: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 25 China: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 26 India: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 27 India: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 28 Japan: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 29 Japan: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 30 Rest of Asia Pacific: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 31 Rest of Asia Pacific: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 32 Europe: Feed Processing Market Size, By Type, 2016–2023 (USD Million)

Table 33 Europe: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 34 Europe: Feed Processing Market Size, By Livestock, 2016–2023 (USD Million)

Table 35 Europe: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 36 Europe: Feed Processing Market Size, By Country, 2016–2023 (USD Million)

Table 37 Spain: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 38 Spain: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 39 Russia: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 40 Russia: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 41 Germany: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 42 Germany: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 43 France: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 44 France: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 45 Rest of Europe: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 46 Rest of Europe: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 47 South America: Feed Processing Market Size, By Type, 2016–2023 (USD Million)

Table 48 South America: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 49 South America: Feed Processing Market Size, By Livestock, 2016–2023 (USD Million)

Table 50 South America: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 51 South America: Feed Processing Market Size, By Country, 2016–2023 (USD Million)

Table 52 Brazil: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 53 Brazil: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 54 Argentina: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 55 Argentina: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 56 Rest of South America: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 57 Rest of South America: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 58 RoW: Feed Processing Market Size, By Type, 2016–2023 (USD Million)

Table 59 RoW: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 60 RoW: Feed Processing Market Size, By Livestock, 2016–2023 (USD Million)

Table 61 RoW: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 62 RoW: Feed Processing Market Size, By Region, 2016–2023 (USD Million)

Table 63 Africa: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 64 Africa: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 65 Middle East: Feed Processing Market Size, By Mode of Operation, 2016–2023 (USD Million)

Table 66 Middle East: Feed Processing Market Size, By Form of Feed, 2016–2023 (USD Million)

Table 67 Top Five Companies in the Feed Processing Market, 2016

Table 68 Expansions, 2013–2017

Table 69 Acquisitions, 2013–2017

Table 70 New Product Launches, 2013–2017

Table 71 Collaborations & Partnerships, 2013–2017

List of Figures (38 Figures)

Figure 1 Market Segmentation

Figure 2 Geographic Scope

Figure 3 Feed Processing Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation & Methodology

Figure 7 Feed Processing Market Size, By Region, 2017

Figure 8 Feed Processing Market Snapshot, By Type, 2018 vs 2023

Figure 9 Feed Processing Market Snapshot, By Mode of Operation, 2018 vs 2023

Figure 10 Feed Processing Market Size, By Livestock, 2018 vs 2023

Figure 11 Feed Processing Market Size, By Form of Feed, 2018 vs 2023

Figure 12 Increase in Demand for Feed to Drive the Feed Processing Market Growth

Figure 13 Pelleting Segment is Projected to Dominate the Market By 2023

Figure 14 Automatic Segment is Estimated to Dominate the Market in 2018

Figure 15 Poultry Segment is Projected to Remain the Largest Market Through 2023

Figure 16 Pellets Segment Accounted for the Largest Share Across All Regions in 2017

Figure 17 US Accounted for the Largest Share in 2017

Figure 18 Feed Processing Market: Key Drivers, Restraints, Opportunities, and Challenges

Figure 19 Global Feed Production Trend, 2011–2016 (Million Tons)

Figure 20 Regional Feed Production Status, 2016 (Million Tons)

Figure 21 Leading Feed Producers, 2016 (Million Tons)

Figure 22 Feed Processing Market Size, By Type, 2018 vs 2023 (USD Million)

Figure 23 Feed Processing Market Size, By Form of Feed, 2016 vs 2023 (USD Million)

Figure 24 Feed Processing Market Size, By Mode of Operation, 2016 vs 2023 (USD Million)

Figure 25 Feed Processing Market Size, By Livestock, 2018 vs 2023 (USD Million)

Figure 26 North America: Feed Processing Market Snapshot

Figure 27 Asia Pacific: Feed Processing Market Snapshot

Figure 28 Key Developments of the Leading Players in the Feed Processing Market, 2013–2017

Figure 29 Feed Processing Market Developments, By Growth Strategy, 2013–2017

Figure 30 Feed Processing Market Developments, in Percentage, 2013–2017

Figure 31 Andritz: Company Snapshot

Figure 32 Andritz: SWOT Analysis

Figure 33 Bühler: Company Snapshot

Figure 34 Bühler: SWOT Analysis

Figure 35 Pavan: Company Snapshot

Figure 36 Pavan: SWOT Analysis

Figure 37 Clextral: SWOT Analysis

Figure 38 Muyang: SWOT Analysis

Growth opportunities and latent adjacency in Feed Processing Market