Flat Glass Coatings Market by Resin Type (Polyurethane, Epoxy, Acrylic), Technology (Solvent and Water-Based, Nano Coatings), Application (Mirror, Solar Power, Architectural, Automotive & Transportation, Decorative), and Region - Global Forecast to 2022

Flat Glass Coatings Market Size And Forecast

The flat glass coatings market is projected to reach USD 2,789.6 Million by 2022, at a CAGR of 20.99%. In this study, 2016 has been considered as the base year to estimate the size of the flat glass coating market. The report provides the forecast from 2017 to 2022. It aims at estimating the size and growth potential of the flat glass coatings market across different segments, such as resin type, technology, application, and region. Factors such as drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the flat glass coating market have also been studied in this report. The report analyzes the opportunities in the flat glass coatings market for stakeholders and presents a competitive landscape of the market.

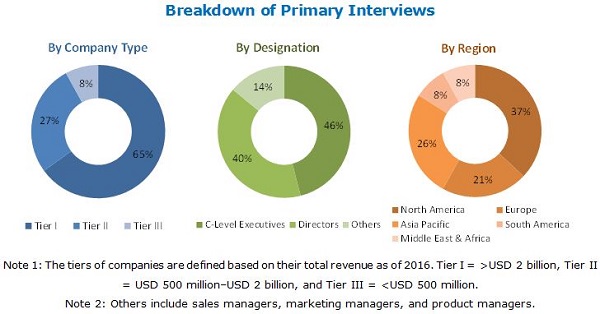

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the flat glass coatings market and to estimate the sizes of various other dependent submarkets. This research study involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government associations. Moreover, private websites and company websites have also been used to identify and collect information useful for this technical, market-oriented, and commercial study of the flat glass coating market. After arriving at the total market size, the overall market has been split into several segments and subsegments. The figure given below provides a breakdown of the primaries conducted during the research study, based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Key Players in Flat Glass Coatings Market

Arkema (France), FENZI (Italy), Ferro Corporation (US), Sherwin-Williams Company (US), Vitro Architectural Glass (Mexico), NIPPONPAINT (Japan), SunGuard (Guardian Glass) (US), Hesse (Germany), DIAMON-FUSION INTERNATIONAL (US), and Tribos Coatings (International) Ltd. (UK) are some of the key players operating in the flat glass coatings market.

Key Target Audience in Flat Glass Coatings Market

- Flat Glass Manufacturers

- Flat Glass Raw Material Suppliers

- Coatings Raw Material Suppliers

- Coating Formulation Technology Providers

- Industry Associations

- Nano Coating Technology Companies

- Automotive Companies

- Solar Panel Manufacturers

- Decorative Mirror Manufacturers

- Chemical Companies

- NGOs, Government, and Regional Agencies

- Research Organizations and Associations

Flat Glass Coatings Market Report Scope

This research report categorizes the flat glass coatings market based on resin type, technology, application, and region.

Flat Glass Coatings Market, By Resin Type:

- Polyurethane

- Epoxy

- Acrylic

- Others (Silicone and Alkyd)

Flat Glass Coatings Market, By Technology:

- Solvent-Based

- Water-Based

- Nano Coatings

Flat Glass Coating Market, By Application:

- Mirror Coatings

- Solar Power

- Architectural

- Automotive & Application

- Decorative

- Others

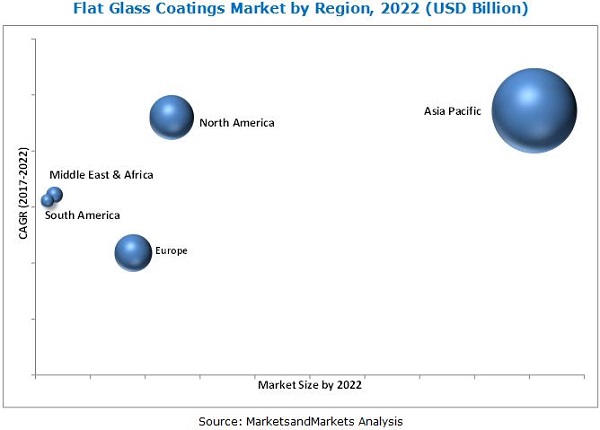

Flat Glass Coatings Market, By Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

The market is further analyzed for key countries in each of these regions.

Flat Glass Coatings Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the report:

Flat Glass Coatings Market Regional Analysis

- Country-level analysis of the flat glass coatings market, by resin type, technology, and application

Flat Glass Coatings Market Company Information

- Detailed analysis and profiles of additional market players

The global flat glass coatings market size is expected to reach 334.13 kilotons by 2022. In terms of value, the market is estimated to be USD 1,075.8 Million in 2017 and is likely to reach USD 2,789.6 Million by 2022, at a CAGR of 20.99% from 2017 to 2022. The high consumption of mirror coatings in beauty & cosmetics, architecture, decoration/kitchen is driving the market of flat glass coatings in the Asia Pacific region. Improvement in living standards and lifestyles has increased the demand for decorative mirrors, which are generally more expensive than the normal mirrors. The surging demand for solar energy in emerging economies and the preference for solar energy in residential applications have contributed to the growth of the solar PV glass market across the globe, which, in turn, drives the demand for flat glass coatings.

The flat glass coatings market is segmented on the basis of resin type into polyurethane, epoxy, acrylic, and others. The polyurethane resin segment is expected to grow at the highest CAGR during the forecast period of 2017 to 2022. Polyurethane resin-based coatings are used where high performance is required, such as in greenhouse buildings, solar panels, and space shuttles. Polyurethane resins are used in industrial and architectural coating systems as finish coats and are generally applied over the primer and intermediate coats to achieve a long-term protective coating.

Based on technology, the flat glass coating market is segmented into solvent-based, water-based, and nano coatings. The nano coatings segment is expected to grow at the highest CAGR during the forecast period. The growing automotive and electronics industries are expected to contribute to the growth of the nano coatings market during the forecast period. Growth in the coatings sector coupled with rising demand and urbanization in BRIC countries has been driving the global nano coatings market in the past few years. The growing preference for advanced materials in the automotive industry has led to a surge in nanotechnology R&D, which will, in turn, boost the nano coatings market growth.

Based on application, the flat glass coatings market is segmented into mirror, solar power, architecture, automotive & application, decorative, and electronics & application. Mirrors are used across all the major applications, such beauty & cosmetics, architectural, decorative, and automotive & transportation. Though the consumption of flat glass is more in the architectural application, the penetration of coatings in the mirror application is also very high.

The Asia Pacific flat glass coatings market is expected to grow at the highest CAGR during the forecast period due to the rising demand for flat glass coatings from countries such as India, China, South Korea, Vietnam, Taiwan, and Singapore. The robust demand in Asia Pacific is the major driving factor for the global flat glass coatings market. China will lead the demand for flat glass coatings in the region due to its increased industrial production. The country is also among the largest consumers of flat glass coatings at the global level.

The restraining factors in the market include high prices and limited knowledge, among others. The water-based coatings require more drying and curing time as compared to solvent-based coatings. During high humidity, water will not easily evaporate, resulting in poor cure and decrease in performance. This factor acts as a restraint for many water-based coating formulators. The nano coatings technology is expected to witness the highest growth during the forecast period. However, due to the high cost of nano coatings as compared to solvent- and water-based coatings, they are less popular as of now in the flat glass coatings market.

Key players operating in the flat glass coatings markets include Arkema (France), FENZI (Italy), Ferro Corporation (US), Sherwin-Williams Company (US), Vitro Architectural Glass (Mexico), NIPPONPAINT (Japan), SunGuard (Guardian Glass) (US), Hesse (Germany), DIAMON-FUSION INTERNATIONAL (US), and Tribos Coatings (International) Ltd. (UK).

Frequently Asked Questions (FAQ):

How big is the Flat Glass Coatings Market industry?

Flat Glass Coatings Market is estimated to be USD 1,075.8 Million in 2017 and is projected to grow at a CAGR of 20.99% between 2017 and 2022 to reach USD 2,789.6 Million by 2022, in terms of value.

Who leading market players in Flat Glass Coatings industry?

Arkema (France), FENZI (Italy), Ferro Corporation (US), Sherwin-Williams Company (US), Vitro Architectural Glass (Mexico), NIPPONPAINT (Japan), SunGuard (Guardian Glass) (US), Hesse (Germany), DIAMON-FUSION INTERNATIONAL (US), and Tribos Coatings (International) Ltd. (UK) are some of the key players operating in the flat glass coatings market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities for Flat Glass Coating

4.2 Flat Glass Coatings Market, By Resin Type

4.3 Flat Glass Coating Market, By Technology

4.4 Flat Glass Coatings Market, Developed vs Developing Countries

4.5 APAC Flat Glass Coating Market, By Country and Application

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Demand for Architectural Glass & Mirror in Residential and Commercial Buildings

5.2.1.2 Increased Demand From APAC

5.2.1.3 High Demand From Automotive & Transportation Application

5.2.1.4 High Growth in Solar Power Application

5.2.1.5 Growing Need for Energy-Efficient Buildings

5.2.2 Restraints

5.2.2.1 Need for More Drying Time in Water-Based Coating Technology

5.2.3 Opportunities

5.2.3.1 Demand for Green Buildings

5.2.4 Challenges

5.2.4.1 Stringent Regulatory Policies and Environmental Challenges

5.3 Porter’s Five Forces Analysis

5.3.1 Intensity of Competitive Rivalry

5.3.2 Bargaining Power of Buyers

5.3.3 Bargaining Power of Suppliers

5.3.4 Threat of Substitutes

5.3.5 Threat of New Entrants

5.4 Macroeconomic Overview and Key Drivers

5.4.1 Introduction

5.4.2 Trends and Forecast of GDP

5.4.3 Trends and Forecast of Construction Industry

5.4.4 Trends in Automotive Industry

5.4.5 Trends in Solar Power Industry

6 Flat Glass Coatings Market, By Resin Type (Page No. - 50)

6.1 Introduction

6.2 Polyurethane Resin

6.3 Epoxy

6.4 Acrylic

6.5 Others

6.5.1 Alkyd Resin

6.5.2 Silicone Resin

7 Flat Glass Coatings Market, By Technology (Page No. - 58)

7.1 Introduction

7.2 Solvent-Based Coatings

7.3 Water-Based Coatings

7.4 Nano Coatings Technology

8 Flat Glass Coating Market, By Application (Page No. - 64)

8.1 Introduction

8.2 Mirror

8.2.1 Silver

8.2.2 Aluminium

8.3 Solar Power

8.3.1 Photovoltaic Solar Power System

8.3.2 Concentrated Solar Power System

8.4 Architectural

8.5 Automotive & Transportation

8.6 Decorative

8.7 Others

9 Flat Glass Coatings Market, By Region (Page No. - 82)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 Malaysia

9.2.5 South Korea

9.2.6 Taiwan

9.2.7 Vietnam

9.2.8 Rest of APAC

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 UK

9.3.4 Turkey

9.3.5 Italy

9.3.6 Netherlands

9.3.7 Belgium

9.3.8 Spain

9.3.9 Rest of Europe

9.4 North America

9.4.1 US

9.4.2 Canada

9.4.3 Mexico

9.5 Middle East & Africa

9.5.1 South Africa

9.5.2 Iran

9.5.3 Saudi Arabia

9.5.4 UAE

9.5.5 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Chile

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 129)

10.1 Overview

10.2 Market Ranking

10.3 Competitive Scenario

10.3.1 Acquisition

10.3.2 New Product Launch

11 Company Profiles (Page No. - 132)

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

11.1 Fenzi

11.2 Arkema

11.3 Ferro

11.4 Vitro

11.5 Sherwin-Williams

11.6 Nippon Paint

11.7 Nano-Care Deutschland

11.8 Hesse

11.9 Tribos Coatings

11.10 Apogee Enterprises (Viracon)

11.11 CCM GmbH

11.12 Glas Trösch

11.13 Nanoshine

11.14 Diamon-Fusion

11.15 Casix

11.16 Warren Paint & Color

11.17 Nanonix Japan

11.18 Anhui Sinograce Chemical

11.19 Yantai Jialong Nano Industry

11.20 Sunguard (Guardian Glass)

11.21 Advanced Nanotech Lab

11.22 Pearl Nano

11.23 Nanotech Coatings

11.24 Bee Cool Glass Coatings

11.25 DOW Corning

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 165)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Authors Details

List of Tables (133 Tables)

Table 1 Flat Glass Coatings Market Snapshot (2017 vs 2022)

Table 2 Major Players Profiled in This Report

Table 3 Trends and Forecast of GDP, USD Billion (2016–2022)

Table 4 Trends and Forecast on Construction Spending’s Industry in North America, USD Billion (2015–2022)

Table 5 Trends and Forecast of Construction Industry in Europe, USD Billion (2015–2022)

Table 6 Trends and Forecast of Construction Industry in APAC, USD Billion (2015–2022)

Table 7 Trends and Forecast of Construction Industry in Middle East & Africa, USD Billion (2015–2022)

Table 8 Trends and Forecast of Construction Industry in Latin America, USD Billion (2015–2022)

Table 9 Automotive Production, Million Units (2011–2016)

Table 10 Global Solar Generation Capacity (2016)

Table 11 Market Size, By Type, 2015–2022 (Kiloton)

Table 12 Market Size, By Type, 2015–2022 (USD Million)

Table 13 Polyurethane-Market Size, By Region, 2015–2022 (Kiloton)

Table 14 Polyurethane Market Size, By Region, 2015–2022 (USD Million)

Table 15 Epoxy Market Size, By Region, 2015–2022 (Ton)

Table 16 Epoxy Market Size, By Region, 2015–2022 (USD Million)

Table 17 Acrylic Market Size, By Region, 2015–2022 (Ton)

Table 18 Acrylic Market Size, By Region, 2015–2022 (USD Million)

Table 19 Other Market Size, By Region, 2015–2022 (Ton)

Table 20 Other Market Size, By Region, 2015–2022 (USD Million)

Table 21 Market Size, By Technology, 2015–2022 (Kiloton)

Table 22 Market Size, By Technology, 2015–2022 (USD Million)

Table 23 Solvent-Based Market Size, By Region, 2015–2022 (Kiloton)

Table 24 Solvent-Based Market Size, By Region, 2015–2022 (USD Million)

Table 25 Water-Based Market Size, By Region, 2015–2022 (Kiloton)

Table 26 Water-Based Market Size, By Region, 2015–2022 (USD Million)

Table 27 Nano Coatings-Based Market Size, By Region, 2015–2022 (Ton)

Table 28 Nano Coatings-Based Market Size, By Region, 2015–2022 (USD Million)

Table 29 Market Size, By Application, 2015–2022 (Kiloton)

Table 30 Market Size, By Application, 2015–2022 (USD Million)

Table 31 Coatings Penetration in Flat Glass By Applications in Microns and Grams/M2

Table 32 Market Size in Mirror, By Region, 2015–2022 (Kiloton)

Table 33 Market Size in Mirror, By Region, 2015–2022 (USD Million)

Table 34 Market Size in Mirror, By Sub-Application, 2015–2022 (Kiloton)

Table 35 Market Size in Mirror, By Sub-Application, 2015–2022 (USD Million)

Table 36 Market Size in Solar Power, By Region, 2015–2022 (Ton)

Table 37 Market Size in Solar Power, By Region, 2015–2022 (USD Million)

Table 38 Market Size in Solar Power, By Sub-Application, 2015–2022 (Kiloton)

Table 39 Market Size in Solar Power, By Sub-Application, 2015–2022 (USD Million)

Table 40 Cumulative Installed Pv Glass in 2016

Table 41 Key Solar Power CSP Projects

Table 42 Key Solar Power CSP Stakeholders

Table 43 CSP Global Capacity and Additions, 2016

Table 44 CSP vs Pv Technology

Table 45 Market Size in Architectural, By Region, 2015–2022 (Ton)

Table 46 Market Size in Architectural, By Region, 2015–2022 (USD Million)

Table 47 Market Size in Automotive & Transportation, By Region, 2015–2022 (Ton)

Table 48 Market Size in Automotive & Transportation, By Region, 2015–2022 (USD Thousand)

Table 49 Market Size in Decorative, By Region, 2015–2022 (Ton)

Table 50 Market Size in Decorative, By Region, 2015–2022 (USD Million)

Table 51 Market Size in Other Applications, By Region, 2015–2022 (Ton)

Table 52 Market Size in Other Applications, By Region, 2015–2022 (USD Thousand)

Table 53 Market Size, By Region, 2015–2022 (Kiloton)

Table 54 Market Size, By Region, 2015–2022 (USD Million)

Table 55 APAC: Flat Glass Coatings Market Size, By Country, 2015–2022 (Kiloton)

Table 56 APAC: Market Size, By Country, 2015–2022 (USD Million)

Table 57 APAC: Market Size, By Technology, 2015–2022 (Kiloton)

Table 58 APAC: Market Size, By Technology, 2015–2022 (USD Million)

Table 59 APAC: Market Size, By Resin Type, 2015–2022 (Kiloton)

Table 60 APAC: Market Size, By Resin Type, 2015–2022 (USD Million)

Table 61 APAC: Market Size, By Application, 2015–2022 (Ton)

Table 62 APAC Market Size, By Application, 2015–2022 (USD Million)

Table 63 China: Flat Glass Coating Market Size, By Application, 2015–2022 (Ton)

Table 64 China: Market Size, By Application, 2015–2022 (USD Million)

Table 65 China: Market Size, By Technology, 2015–2022 (Kiloton)

Table 66 China Market Size, By Technology, 2015–2022 (USD Million)

Table 67 India: Flat Glass Coatings Market Size, By Application, 2015–2022 (Ton)

Table 68 India: Market Size, By Application, 2015–2022 (USD Thousand)

Table 69 India: Market Size, By Technology, 2015–2022 (Kiloton)

Table 70 India: Market Size, By Technology, 2015–2022 (USD Million)

Table 71 Japan: Flat Glass Coating Market Size, By Application, 2015–2022 (Ton)

Table 72 Japan Market Size, By Application, 2015–2022 (USD Thousand)

Table 73 Japan: Market Size, By Technology, 2015–2022 (Kiloton)

Table 74 Japan: Market Size, By Technology, 2015–2022 (USD Million)

Table 75 Europe: Flat Glass Coatings Market Size, By Country, 2015–2022 (Kiloton)

Table 76 Europe: Market Size, By Country, 2015–2022 (USD Million)

Table 77 Europe: Market Size, By Technology, 2015–2022 (Kiloton)

Table 78 Europe: Market Size, By Technology, 2015–2022 (USD Million)

Table 79 Europe: Market Size, By Resin Type, 2015–2022 (Kiloton)

Table 80 Europe: Market Size, By Resin Type, 2015–2022 (USD Million)

Table 81 Europe: Market Size, By Application, 2015–2022 (Ton)

Table 82 Europe Market Size, By Application, 2015–2022 (USD Million)

Table 83 Germany: Flat Glass Coating Market Size, By Application, 2015–2022 (Ton)

Table 84 Germany: Market Size, By Application, 2015–2022 (USD Thousand)

Table 85 Germany: Market Size, By Technology, 2015–2022 (Kiloton)

Table 86 Germany Market Size, By Technology, 2015–2022 (USD Million)

Table 87 France: Flat Glass Coatings Market Size, By Application, 2015–2022 (Ton)

Table 88 France: Market Size, By Application, 2015–2022 (USD Thousand)

Table 89 France: Market Size, By Technology, 2015–2022 (Ton)

Table 90 France Market Size, By Technology, 2015–2022 (USD Million)

Table 91 UK: Flat Glass Coating Market Size, By Application, 2015–2022 (Ton)

Table 92 UK: Market Size, By Application, 2015–2022 (USD Thousand)

Table 93 UK: Market Size, By Technology, 2015–2022 (Kiloton)

Table 94 UK: Market Size, By Technology, 2015–2022 (USD Million)

Table 95 Turkey: Flat Glass Coatings Market Size, By Application, 2015–2022 (Ton)

Table 96 Turkey: Market Size, By Application, 2015–2022 (USD Thousand)

Table 97 Turkey: Market Size, By Technology, 2015–2022 (Kiloton)

Table 98 Turkey: Market Size, By Technology, 2015–2022 (USD Million)

Table 99 North America: Flat Glass Coating Market Size, By Country, 2015–2022 (Kiloton)

Table 100 North America Market Size, By Country, 2015–2022 (USD Million)

Table 101 North America: Market Size, By Technology, 2015–2022 (Kiloton)

Table 102 North America: Market Size, By Technology, 2015–2022 (USD Million)

Table 103 North America: Market Size, By Resin Type, 2015–2022 (Kiloton)

Table 104 North America: Market Size, By Resin Type, 2015–2022 (USD Million)

Table 105 North America: Market Size, By Application, 2015–2022 (Ton)

Table 106 North America: Market Size, By Application, 2015–2022 (USD Million)

Table 107 US: Flat Glass Coatings Market Size, By Application, 2015–2022 (Ton)

Table 108 US: Market Size, By Application, 2015–2022 (USD Million)

Table 109 US: Market Size, By Technology, 2015–2022 (Kiloton)

Table 110 US: Market Size, By Technology, 2015–2022 (USD Million)

Table 111 Middle East & Africa: Flat Glass Coating Market Size, By Country, 2015–2022 (Ton)

Table 112 Middle East & Africa: Market Size, By Country, 2015–2022 (USD Million)

Table 113 Middle East & Africa: Market Size, By Technology, 2015–2022 (Kiloton)

Table 114 Middle East & Africa: Market Size, By Technology, 2015–2022 (USD Million)

Table 115 Middle East & Africa: Market Size, By Resin Type, 2015–2022 (Ton)

Table 116 Middle East & Africa: Market Size, By Resin Type, 2015–2022 (USD Million)

Table 117 Middle East & Africa: Market Size, By Application, 2015–2022 (Ton)

Table 118 Middle East & Africa: Market Size, By Application, 2015–2022 (USD Thousand)

Table 119 South America: Flat Glass Coatings Market Size, By Country, 2015–2022 (Ton)

Table 120 South America: Market Size, By Country, 2015–2022 (USD Million)

Table 121 South America: Market Size, By Technology, 2015–2022 (Kiloton)

Table 122 South America: Market Size, By Technology, 2015–2022 (USD Million)

Table 123 South America: Market Size, By Resin Type, 2015–2022 (Ton)

Table 124 South America: Market Size, By Resin Type, 2015–2022 (USD Million)

Table 125 South America: Market Size, By Application, 2015–2022 (Ton)

Table 126 South America: Market Size, By Application, 2015–2022 (USD Thousand)

Table 127 Brazil: Flat Glass Coating Market Size, By Technology, 2015–2022 (Ton)

Table 128 Brazil: Market Size, By Technology, 2015–2022 (USD Million)

Table 129 Brazil: Market Size, By Application, 2015–2022 (Ton)

Table 130 Brazil: Market Size, By Application, 2015–2022 (USD Thousand)

Table 131 Market Ranking of Key Players (2016)

Table 132 Acquisitions, 2014–2017

Table 133 New Product Launches, 2014–2017

List of Figures (33 Figures)

Figure 1 Flat Glass Coatings Market Segmentation

Figure 2 Flat Glass Coating Market: Research Design

Figure 3 Flat Glass Coatings Market: Data Triangulation

Figure 4 Polyurethane Segment to Register the Highest CAGR

Figure 5 Nano Coatings Technology to Register the Highest CAGR

Figure 6 Solar Power Application to Lead the Market

Figure 7 APAC to Be the Largest and Fastest-Growing Flat Glass Coating Market

Figure 8 Emerging Economies to Offer Lucrative Growth Opportunities to Market Players

Figure 9 Polyurethane Segment to Dominate the Flat Glass Coating Market

Figure 10 Nano Coatings Segment to Register the Highest CAGR

Figure 11 Developing Countries to Register A Higher CAGR Than Developed Countries

Figure 12 Mirror Application Accounted for the Largest Share in APAC Flat Glass Coating Market in 2016

Figure 13 India to Register the Highest CAGR During Forecast Period

Figure 14 China Dominated Flat Glass Coating Market in 2016

Figure 15 Flat Glass Coating Market: Porter’s Five Forces Analysis

Figure 16 Polyurethane Flat Glass Coatings Accounted for the Largest Share Across All Regions in 2016

Figure 17 Water-Based Technology Accounted for the Largest Share Across All Regions in 2016

Figure 18 Flat Glass Coatings in Solar Power to Account for the Maximum Share

Figure 19 Mirror Coatings Structure

Figure 20 Global CSP Market Situation, 2016

Figure 21 China is Emerging as A Strategic Location in Flat Glass Coating Market

Figure 22 APAC Flat Glass Coatings Market Snapshot

Figure 23 Europe: Flat Glass Coating Market Snapshot

Figure 24 North American Flat Glass Coatings Market Snapshot

Figure 25 Middle East & Africa: Flat Glass Coatings Market Snapshot

Figure 26 South America: Application Flat Glass Coating Market Snapshot

Figure 27 Companies Adopted Acquisition as the Key Growth Strategy Between 2014 and 2017

Figure 28 Arkema: Company Snapshot

Figure 29 Ferro: Company Snapshot

Figure 30 Vitro: Company Snapshot

Figure 31 Sherwin-Williams: Company Snapshot

Figure 32 Nippon Paint: Company Snapshot

Figure 33 DOW Corning: Company Snapshot

Growth opportunities and latent adjacency in Flat Glass Coatings Market