Flexible Battery Market by Type (Thin-film, Printed), Voltage, Capacity, Rechargeability (Primary Batteries, Secondary Batteries), Application (Medical Devices, Smart Packaging), Region - Global Forecast to 2025

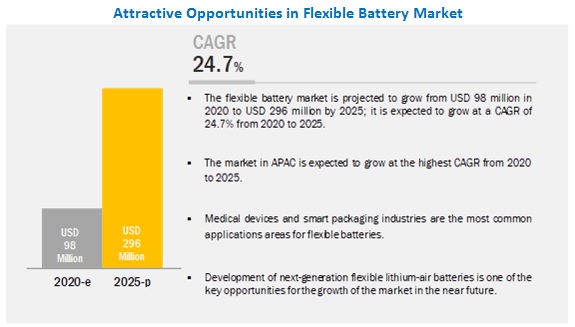

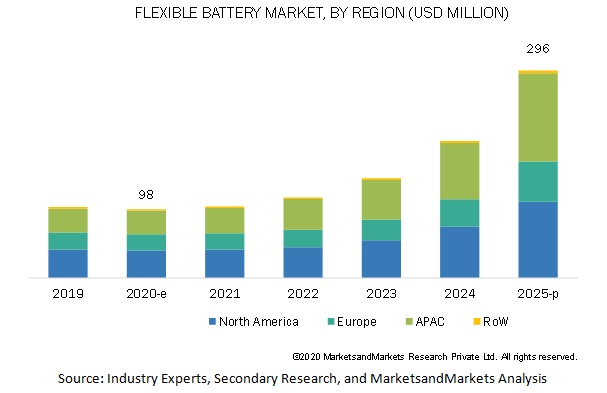

The Flexible Battery Market is projected to reach USD 296 million by 2025 from USD 142 million in 2022 at a CAGR of 24.7% during the forecast period. It was observed that the growth rate was 9% from 2021 to 2022. Smart Packaging is expected to account high market share of 31%.

The growth of this market is likely to be driven by rising number of research and development activities for developing flexible batteries for wearable devices, increasing use of thin and flexible batteries in flexible electronic devices, ongoing miniaturization of electronic devices, surging demand for flexible batteries in IoT applications, and increasing use of flexible batteries in medical devices to treat COVID-19 patients. The report covers the flexible battery market segmented into type, voltage, capacity, rerchargeability, application, and region.

Flexible Battery Market Segment Overview

The above 3V segment of the flexible battery market is projected to grow at the highest CAGR during the forecast period.

The demand for flexible batteries with a voltage of above 3V is expected to increase during the forecast period. Flexible batteries with a voltage above 3V offer higher power, longer life, and more safety than other flexible batteries.

The applications of these batteries are increasing owing to the development of a number of compact electronic devices, which are generally bulky if conventional batteries are used. These batteries are used in consumer electronics and wearables. They are free from toxic materials such as noxious liquids or gases.

The use of portable medical devices during the COVID-19 pandemic led to significant demand for flexible batteries.

Currently, flexible batteries are increasingly being used in the medical devices industry, as several manufacturers are designing and offering flexible batteries to power temperature sensors, pacemakers, and smart patches.

Technological advancements and penetration of IoT in the medical sector have generated opportunities for new battery-powered medical devices. Implantable medical devices, such as neural stimulators, pacemakers, and defibrillators, require batteries that can deliver steady, reliable power for a long duration of time. Flexible batteries meet such requirements owing to their excellent reliability and high performance.

New versions of pacemakers, drug delivery systems, medical patches, medical diagnosis sensors, disposable medical devices, and biosensors use flexible and thin power sources. The size and the flexibility of flexible batteries perfectly comply with these requirements. Thus, the medical devices segment holds a significant share of the flexible battery market.

The thin-film batteries segment held the largest share of the flexible battery market in 2019.

Thin-film batteries are widely used in smart packaging, smart cards, wearable devices, and medical devices. These batteries offer superior performance and higher average output voltage, as well as have lower chances of electrolyte leakages than bulky solid-state batteries.

The increased demand for miniaturized products used in these applications has led to a rise in the adoption of thin-film lithium-ion flexible batteries, thus driving the growth of the thin-film batteries segment significantly. The increasing demand for smart cards in telecommunication, banking, and transportation sectors for payment applications has also fueled the growth of the thin-film batteries segment of the flexible battery market.

The flexible battery market in APAC is projected to grow at the highest CAGR during the forecast period.

Continuously increasing demand for IoT-enabled devices and portable consumer electronics in countries such as China, Japan, and South Korea is driving the growth of the flexible battery market in APAC.

South Korea is home to companies such as LG Chem and Samsung SDI who have developed curved and flexible batteries to power their products such as smartphones, smart glasses, and wearable devices. In APAC, the popularity of smart packaging is continuously increasing, thereby driving the requirement of integrating flexible batteries with smart packaging.

The consumer electronics industry in China is also witnessing a decline in its production owing to the outbreak of COVID-19. The global prices of consumer electronics could rise in the coming months owing to the partial clamp down on manufacturing facilities in China. This, in turn, is expected to result in a shortage in the supply of components such as batteries required for consumer electronics, thereby negatively impacting the growth of the flexible battery market in 2020.

Key Market Players in Flexible Battery Industry

Samsung SDI (South Korea), LG Chem (South Korea), Enfucell Oy Ltd. (Finland), Blue Spark Technologies (US), Apple, Inc. (US), Panasonic (Japan), Ultralife Corporation (US), BrightVolt (US), Imprint Energy (US), Energy Diagnostics (UK), and Jenax (South Korea) are key players operating in the flexible battery market.

Samsung SDI (US) is one of the global leaders in flexible battery technology. It seeks to expand its market presence and create a progressive future through technological developments. The company has launched 2 innovative series of small-sized lithium-ion batteries—band batteries and strip batteries— for use in wearable devices. These batteries bend like fiber. The band batteries are designed to add as much as 50% to the original battery life of devices. The strip batteries are designed with a depth of 0.3mm and can be used in wearable devices such as smart necklaces and interactive clothing designs. Samsung SDI has operations in countries such as South Korea, Malaysia, China, Mexico, Vietnam, Austria, Russia, the US, India, Taiwan, and Japan.

Flexible Battery Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 98 Million |

| Projected Market Size | USD 296 Million |

| Growth Rate | CAGR of 24.7% |

|

Market size available for years |

2020–2025 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Largest Growing Region | Asia Pacific (APAC) |

| Largest Market Share Segment | Thin-Film batteries Segment |

| Highest CAGR Segment | 3V Segment |

In this report, the flexible battery market has been segmented into the following categories:

By Type:

- Thin-film Batteries

- Printed Batteries

By Voltage:

- Below 1.5V

- Between 1.5V and 3V

- Above 3V

By Capacity:

- Below 10 mAh

- Between 10 mAh and 100 mAh

- Above 100 mAh

By Rechargeability:

- Primary Batteries

- Secondary Batteries

By Application

- Consumer Electronics

- Smart Packaging

- Smart Cards

- Medical Devices

- Wireless Sensors

- Others (Drones, Displays, Energy Harvesting, and Smart Textiles)

By Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

RoW

- South America

- Middle East and Africa

Recent Developments in Flexible Battery

- In May 2017, Enfucell and Central Midori signed a license agreement for printing SoftBattery power sources of Enfucell. Under this agreement, Enfucell is widening the geographical coverage of its partner network to be able to serve the rapidly growing markets for IoT-enabled and wearable devices that are powered by printable batteries.

- In May 2019, Ultralife Corporation acquired Southwest Electronic Energy (SWE), an advanced battery solutions provider, in a deal worth USD 25 million. This acquisition enhanced the extensive portfolio of batteries and charger technologies of Ultralife Corporation and expanded its technical expertise to new industry segments.

Critical questions would be:

- Which flexible battery type is expected to have the highest demand in the near future?

- Which are the most preferred end-use applications of flexible batteries?

- What are the opportunities and challenges for the flexible battery market?

- What are the key industry trends in the market?

- Which specific region has the highest adoption of flexible batteries?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Break down of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up approach (demand side)

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down analysis (supply side)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 31)

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 FLEXIBLE BATTERY MARKET OPPORTUNITIES

4.2 MARKET, BY RECHARGEABILITY

4.3 MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY, 2025

4.4 MARKET, BY APPLICATION, 2020 & 2025

4.5 MARKET, BY COUNTRY

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 EVOLUTION

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Growing demand for flexible batteries for use in wearables

5.3.1.2 Increasing use of thin, flexible batteries for use in flexible electronic devices

5.3.1.3 Ongoing miniaturization of electronic devices

5.3.1.4 Surging demand for flexible batteries in IoT applications

5.3.1.5 Increasing use of flexible batteries in medical devices to treat COVID-19 patients

5.3.2 RESTRAINTS

5.3.2.1 High initial investments for developing flexible batteries

5.3.2.2 Lack of standardization for development of flexible batteries

5.3.3 OPPORTUNITIES

5.3.3.1 Development of next-generation flexible lithium-air batteries

5.3.3.2 Rise in adoption of wireless sensors equipped with flexible batteries

5.3.4 CHALLENGES

5.3.4.1 Fabrication complexity of flexible lithium-ion batteries

5.3.4.2 Costs and selection of raw materials for developing flexible batteries

5.3.4.3 Shutdown of flexible battery manufacturing plants in various countries owing to COVID-19

5.4 VALUE CHAIN ANALYSIS

5.5 IMPACT OF COVID-19 ON FLEXIBLE BATTERY MARKET

5.6 PATENTS RELATED TO FLEXIBLE BATTERIES

6 COMPONENTS USED IN FLEXIBLE BATTERIES (Page No. - 51)

6.1 INTRODUCTION

6.2 ELECTRODES

6.2.1 CATHODES

6.2.2 ANODES

6.3 SUBSTRATES

6.4 ELECTROLYTES

6.5 OTHERS

7 MATERIALS USED IN FLEXIBLE BATTERIES (Page No. - 54)

7.1 INTRODUCTION

7.2 LITHIUM ION

7.2.1 RISE IN USE OF LITHIUM-ION FLEXIBLE BATTERIES IN WEARABLE ELECTRONICS

7.3 LITHIUM POLYMER

7.3.1 INCREASE IN ADOPTION OF FLEXIBLE LITHIUM POLYMER-BASED BATTERIES OWING TO THEIR DURABILITY AND LOW SELF-DISCHARGE RATE

7.4 ZINC

7.4.1 ADVENT OF ZINC-BASED FLEXIBLE BATTERIES FOR USE IN NEXT-GENERATION FLEXIBLE ELECTRONICS

8 FLEXIBLE BATTERY MARKET, BY TYPE (Page No. - 57)

8.1 INTRODUCTION

8.2 THIN-FILM BATTERIES

8.2.1 THIN-FILM BATTERIES SEGMENT TO LEAD FLEXIBLE BATTERY MARKET FROM 2020 TO 2025

8.3 PRINTED BATTERIES

8.3.1 ECO-FRIENDLY AND BIO-FRIENDLY COMPOSITION OF PRINTED BATTERIES LEADING TO THEIR INCREASED GLOBAL ADOPTION

9 FLEXIBLE BATTERY MARKET, BY VOLTAGE (Page No. - 63)

9.1 INTRODUCTION

9.2 BELOW 1.5V

9.2.1 INCREASED ADOPTION OF BELOW 1.5V FLEXIBLE BATTERIES IN WEARABLE ELECTRONICS

9.3 BETWEEN 1.5V AND 3V

9.3.1 SURGED DEMAND FOR FLEXIBLE BATTERIES WITH VOLTAGE RANGING BETWEEN 1.5V AND 3V OWING TO EASE OF THEIR SAFE AND COMPLETE DISPOSABLE

9.4 ABOVE 3V

9.4.1 INCREASED USE OF FLEXIBLE BATTERIES WITH VOLTAGE ABOVE 3V OWING TO THEIR HIGH POWER OUTPUT AND LONG LIFE

10 FLEXIBLE BATTERY MARKET, BY CAPACITY (Page No. - 68)

10.1 INTRODUCTION

10.2 10 MAH FLEXIBLE BATTERIES

10.2.1 RISE IN USE OF BELOW 10 MAH FLEXIBLE BATTERIES IN MEDICAL DEVICES, SMART CARDS, AND RFID TAGS

10.3 BETWEEN 10 MAH AND 100 MAH FLEXIBLE BATTERIES

10.3.1 SURGE IN USE OF FLEXIBLE BATTERIES WITH CAPACITY RANGING BETWEEN 10 MAH AND 100 MAH IN ENERGY HARVESTING AND CONSUMER ELECTRONICS APPLICATIONS

10.4 ABOVE 100 MAH FLEXIBLE BATTERIES

10.4.1 INCREASE IN USE OF ABOVE 100 MAH FLEXIBLE BATTERIES IN HIGH-POWER APPLICATIONS

11 FLEXIBLE BATTERY MARKET, BY RECHARGEABILITY (Page No. - 73)

11.1 INTRODUCTION

11.2 PRIMARY BATTERIES

11.2.1 LOW COST AND ECO-FRIENDLY NATURE OF PRIMARY BATTERIES LEADING TO THEIR INCREASED USE IN VARIOUS APPLICATIONS

11.3 SECONDARY BATTERIES

11.3.1 INCREASED DEMAND FOR RECHARGEABLE SECONDARY BATTERIES OWING TO THEIR LONG LIFESPAN, HIGH-ENERGY DENSITY, AND LOW ENVIRONMENTAL IMPACT

12 FLEXIBLE BATTERY MARKET, BY APPLICATION (Page No. - 78)

12.1 INTRODUCTION

12.2 IMPACT OF COVID-19 ON APPLICATIONS OF FLEXIBLE BATTERIES

12.3 CONSUMER ELECTRONICS

12.3.1 RISE IN DEMAND FOR FLEXIBLE AND MINIATURIZED ELECTRONIC PRODUCTS LEADING TO DEVELOPMENT OF FLEXIBLE BATTERIES

12.3.2 SMARTPHONES

12.3.3 WEARABLE DEVICES

12.4 MEDICAL DEVICES

12.4.1 USE OF PORTABLE MEDICAL DEVICES DURING COVID-19 PANDEMIC LED TO SIGNIFICANT DEMAND FOR FLEXIBLE BATTERIES

12.4.2 COSMETIC AND MEDICAL PATCHES

12.4.3 PACEMAKERS

12.4.4 HEARING AIDS

12.4.5 OTHERS

12.5 SMART PACKAGING

12.5.1 THIN-FILM FLEXIBLE BATTERIES IMPROVE RANGE OF COMMUNICATION OF SMART PACKAGING

12.5.2 SMART LABELS

12.6 SMART CARDS

12.6.1 DESIGN AND FLEXIBILITY OF FLEXIBLE THIN-FILM BATTERIES ENABLES SMART CARDS TO SUSTAIN HARSH PRODUCTION CONDITIONS

12.7 WIRELESS SENSORS

12.7.1 LIGHTWEIGHT AND FLEXIBILITY OF FLEXIBLE BATTERIES MAKE THEM IDEAL CHOICE FOR WIRELESS SENSORS

12.8 OTHERS

13 GEOGRAPHIC ANALYSIS (Page No. - 106)

13.1 INTRODUCTION

13.2 NORTH AMERICA

13.2.1 US

13.2.1.1 Researchers in US developing flexible lithium-ion batteries for use in extreme conditions

13.2.2 CANADA

13.2.2.1 Adoption of IoT in medical devices and wireless sensors to create growth opportunities for flexible battery market in Canada

13.2.3 MEXICO

13.2.3.1 Increased research and development activities related to flexible batteries and surged sales of consumer electronics encourage companies to set up their production facilities in Mexico

13.3 EUROPE

13.3.1 GERMANY

13.3.1.1 Government support to promote production of flexible batteries to contribute to growth of market in Germany

13.3.2 UK

13.3.2.1 Surged demand for wearable devices and IoT-based medical devices to fuel growth of market in UK

13.3.3 FRANCE

13.3.3.1 Increased adoption of smart cards in France to lead to growth opportunities for market in country

13.3.4 REST OF EUROPE

13.4 APAC

13.4.1 CHINA

13.4.1.1 Increased production haul in China due to COVID-19 to adversely affect market in country

13.4.2 JAPAN

13.4.2.1 Presence of key companies manufacturing consumer electronics to contribute to growth of market in Japan

13.4.3 INDIA

13.4.3.1 Growth of medical sector in India to fuel demand for flexible batteries

13.4.4 REST OF APAC

13.5 ROW

13.5.1 SOUTH AMERICA

13.5.1.1 Chile being the world’s largest producer of lithium offers opportunities for battery manufacturers to establish their flexible battery manufacturing facilities in country

13.5.2 MIDDLE EAST AND AFRICA

13.5.2.1 Adoption of smart card technology in banks of Middle East for secure transaction to fuel growth of flexible printed battery market in region

14 COMPETITIVE LANDSCAPE (Page No. - 129)

14.1 INTRODUCTION

14.2 MARKET RANKING ANALYSIS

14.3 COMPETITIVE LEADERSHIP MAPPING

14.3.1 VISIONARY LEADERS

14.3.2 DYNAMIC DIFFERENTIATORS

14.3.3 INNOVATORS

14.3.4 EMERGING COMPANIES

14.4 COMPETITIVE SITUATIONS AND TRENDS

14.4.1 ACQUISITIONS AND AGREEMENTS, 2017–2019

15 COMPANY PROFILES (Page No. - 134)

15.1 INTRODUCTION

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

15.2 KEY PLAYERS

15.2.1 SAMSUNG SDI

15.2.2 LG CHEM

15.2.3 ENFUCELL OY LTD.

15.2.4 BLUE SPARK TECHNOLOGIES

15.2.5 APPLE INC.

15.2.6 PANASONIC CORPORATION

15.2.7 ULTRALIFE CORPORATION

15.2.8 BRIGHTVOLT

15.3 RIGHT TO WIN

15.4 OTHER PROMINENT PLAYERS

15.4.1 IMPRINT ENERGY

15.4.2 ENERGY DIAGNOSTICS

15.4.3 PROLOGIUM TECHNOLOGY CO., LTD.

15.4.4 MOLEX

15.4.5 POLYPLUS BATTERY COMPANY

15.4.6 ITEN SA

15.4.7 JENAX

15.4.8 GUANGZHOU FULLRIVER BATTERY NEW TECHNOLOGY CO., LTD.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 155)

16.1 INSIGHTS OF INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

LIST OF TABLES (102 Tables)

TABLE 1 FLEXIBLE BATTERY MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 2 THIN-FILM FLEXIBLE BATTERY, BY RECHARGEABILITY, 2017–2025 (USD MILLION)

TABLE 3 THIN-FILM FLEXIBLE BATTERY, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 4 THIN-FILM FLEXIBLE BATTERY, BY REGION, 2017–2025 (USD MILLION)

TABLE 5 PRINTED FLEXIBLE BATTERY, BY RECHARGEABILITY, 2017–2025 (USD MILLION)

TABLE 6 PRINTED FLEXIBLE BATTERY, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 7 PRINTED FLEXIBLE BATTERY, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 8 FLEXIBLE BATTERY MARKET, BY VOLTAGE, 2017–2025 (USD MILLION)

TABLE 9 ARKET FOR BELOW 1.5V, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 10 MARKET FOR BETWEEN 1.5V AND 3V, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 11 MARKET FOR ABOVE 3V, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 12 FLEXIBLE BATTERY MARKET, BY CAPACITY, 2017–2025 (USD MILLION)

TABLE 13 FLEXIBLE BATTERY MARKET FOR BELOW 10 MAH CAPACITY, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 14 FLEXIBLE BATTERY MARKET FOR BETWEEN 10 MAH AND 100 MAH CAPACITY, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 15 FLEXIBLE BATTERY MARKET FOR ABOVE 100 MAH CAPACITY, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 16 FLEXIBLE BATTERY MARKET, BY RECHARGEABILITY, 2017–2025 (USD MILLION)

TABLE 17 MARKET FOR PRIMARY BATTERIES, BY TYPE, 2017–2025 (USD MILLION)

TABLE 18 MARKET FOR PRIMARY BATTERIES, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 19 MARKET FOR SECONDARY BATTERIES, BY TYPE, 2017–2025 (USD MILLION)

TABLE 20 MARKET FOR SECONDARY BATTERIES, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 21 MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 22 MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 23 MARKET FOR CONSUMER ELECTRONICS, BY RECHARGEABILITY, 2017–2025 (USD MILLION)

TABLE 24 MARKET FOR CONSUMER ELECTRONICS, BY VOLTAGE, 2017–2025 (USD MILLION)

TABLE 25 MARKET FOR CONSUMER ELECTRONICS, BY CAPACITY, 2017–2025 (USD MILLION)

TABLE 26 MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 27 MARKET IN NORTH AMERICA FOR CONSUMER ELECTRONICS, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 28 MARKET IN EUROPE FOR CONSUMER ELECTRONICS, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 29 MARKET IN APAC FOR CONSUMER ELECTRONICS, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 30 MARKET IN ROW FOR CONSUMER ELECTRONICS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 31 MARKET FOR MEDICAL DEVICES, BY TYPE, 2017–2025 (USD MILLION)

TABLE 32 MARKET FOR MEDICAL DEVICES, BY RECHARGEABILITY, 2017–2025 (USD MILLION)

TABLE 33 MARKET FOR MEDICAL DEVICES, BY VOLTAGE, 2017–2025 (USD MILLION)

TABLE 34 MARKET FOR MEDICAL DEVICES, BY CAPACITY, 2017–2025 (USD MILLION)

TABLE 35 MARKET FOR MEDICAL DEVICES, BY REGION, 2017–2025 (USD MILLION)

TABLE 36 MARKET IN NORTH AMERICA FOR MEDICAL DEVICES, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 37 MARKET IN EUROPE FOR MEDICAL DEVICES, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 38 MARKET IN APAC FOR MEDICAL DEVICES, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 39 MARKET IN ROW FOR MEDICAL DEVICES, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 40 MARKET FOR SMART PACKAGING, BY TYPE, 2017–2025 (USD MILLION)

TABLE 41 MARKET FOR SMART PACKAGING, BY RECHARGEABILITY, 2017–2025 (USD MILLION)

TABLE 42 MARKET FOR SMART PACKAGING, BY VOLTAGE, 2017–2025 (USD MILLION)

TABLE 43 MARKET FOR SMART PACKAGING, BY CAPACITY, 2017–2025 (USD MILLION)

TABLE 44 MARKET FOR SMART PACKAGING, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 45 MARKET IN NORTH AMERICA FOR SMART PACKAGING, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 46 MARKET IN EUROPE FOR SMART PACKAGING, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 47 MARKET IN APAC FOR SMART PACKAGING, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 48 MARKET IN ROW FOR SMART PACKAGING, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 49 MARKET FOR SMART CARDS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 50 MARKET FOR SMART CARDS, BY RECHARGEABILITY, 2017–2025 (USD MILLION)

TABLE 51 MARKET FOR SMART CARDS, BY VOLTAGE, 2017–2025 (USD MILLION)

TABLE 52 MARKET FOR SMART CARDS, BY CAPACITY, 2017–2025 (USD MILLION)

TABLE 53 MARKET FOR SMART CARDS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 54 MARKET IN NORTH AMERICA FOR SMART CARDS, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 55 MARKET IN EUROPE FOR SMART CARDS, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 56 MARKET IN APAC FOR SMART CARDS, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 57 MARKET IN ROW FOR SMART CARDS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 58 MARKET FOR WIRELESS SENSORS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 59 MARKET FOR WIRELESS SENSORS, BY RECHARGEABILITY, 2017–2025 (USD MILLION)

TABLE 60 MARKET FOR WIRELESS SENSORS, BY VOLTAGE, 2017–2025 (USD MILLION)

TABLE 61 MARKET FOR WIRELESS SENSORS, BY CAPACITY, 2017–2025 (USD MILLION)

TABLE 62 MARKET FOR WIRELESS SENSORS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 63 MARKET IN NORTH AMERICA FOR WIRELESS SENSORS, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 64 MARKET IN EUROPE FOR WIRELESS SENSORS, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 65 MARKET IN APAC FOR WIRELESS SENSORS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 66 MARKET IN ROW FOR WIRELESS SENSORS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 67 MARKET FOR OTHER APPLICATIONS, BY TYPE, 2017–2025 (USD THOUSAND)

TABLE 68 MARKET FOR OTHER APPLICATIONS, BY RECHARGEABILITY, 2017–2025 (USD THOUSAND)

TABLE 69 MARKET FOR OTHER APPLICATIONS, BY VOLTAGE, 2017–2025 (USD THOUSAND)

TABLE 70 MARKET FOR OTHER APPLICATIONS, BY CAPACITY, 2017–2025 (USD MILLION)

TABLE 71 MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 72 MARKET IN NORTH AMERICA FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 73 MARKET IN EUROPE FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 74 MARKET IN APAC FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 75 MARKET IN ROW FOR OTHER APPLICATIONS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 76 MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 77 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 78 MARKET IN NORTH AMERICA, BY TYPE, 2017–2025 (USD MILLION)

TABLE 79 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 80 MARKET IN US, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 81 MARKET IN CANADA, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 82 MARKET IN MEXICO, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 83 MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 84 MARKET IN EUROPE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 85 MARKET IN EUROPE, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 86 MARKET IN GERMANY, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 87 MARKET IN UK, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 88 MARKET IN FRANCE, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 89 MARKET IN REST OF EUROPE, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 90 MARKET IN APAC, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 91 MARKET IN APAC, BY TYPE, 2017–2025 (USD MILLION)

TABLE 92 MARKET IN APAC, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 93 MARKET IN CHINA, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 94 MARKET IN JAPAN, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 95 MARKET IN INDIA, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 96 MARKET IN REST OF APAC, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 97 MARKET IN ROW, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 98 MARKET IN ROW, BY TYPE, 2017–2025 (USD THOUSAND)

TABLE 99 MARKET IN ROW, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 100 MARKET IN SOUTH AMERICA, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 101 FLEXIBLE BATTERY MARKET IN MIDDLE EAST AND AFRICA, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 102 RANKING OF TOP 3 MARKET PLAYERS, 2019

LIST OF FIGURES (47 Figures)

FIGURE 1 FLEXIBLE BATTERY MARKET

FIGURE 2 MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET THROUGH SUPPLY-SIDE ANALYSIS

FIGURE 6 DATA TRIANGULATION

FIGURE 7 MARKET WITH COVID-19 UPDATE

FIGURE 8 THIN-FILM BATTERIES SEGMENT TO LEAD MARKET FROM 2020 TO 2025

FIGURE 9 BELOW 10 MAH SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2025

FIGURE 10 CONSUMER ELECTRONICS SEGMENT OF MARKET TO GROW AT HIGHEST CAGR FROM 2022 TO 2025

FIGURE 11 MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 12 ATTRACTIVE OPPORTUNITIES IN MARKET FROM 2020 TO 2025

FIGURE 13 PRIMARY BATTERIES SEGMENT HELD LARGE SHARE OF MARKET IN 2019

FIGURE 14 MEDICAL DEVICES SEGMENT AND US TO HOLD LARGEST SHARES OF MARKET IN NORTH AMERICA IN 2025

FIGURE 15 SMART PACKAGING SEGMENT EXPECTED TO HOLD LARGEST SIZE OF MARKET IN 2025

FIGURE 16 MARKET IN INDIA EXPECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 17 EVOLUTION OF FLEXIBLE BATTERIES

FIGURE 18 MARKET DYNAMICS

FIGURE 19 WEARABLE TECHNOLOGY MARKET, 2013–2020

FIGURE 20 IMPACT OF DRIVERS ON MARKET

FIGURE 21 IMPACT OF RESTRAINTS AND OPPORTUNITIES ON MARKET

FIGURE 22 IMPACT OF CHALLENGES ON MARKET

FIGURE 23 MARKET: MAJOR VALUE ADDED BY RAW MATERIAL SUPPLIERS, MANUFACTURERS, AND ASSEMBLERS

FIGURE 24 COMPONENTS USED IN FLEXIBLE BATTERIES

FIGURE 25 MATERIALS USED IN FLEXIBLE BATTERIES

FIGURE 26 MARKET, BY TYPE

FIGURE 27 THIN-FILM BATTERIES SEGMENT OF MARKET TO GROW AT HIGH CAGR FROM 2020 TO 2025

FIGURE 28 MARKET, BY VOLTAGE

FIGURE 29 ABOVE 3V SEGMENT OF MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 30 MARKET, BY CAPACITY

FIGURE 31 MARKET, BY RECHARGEABILITY

FIGURE 32 SECONDARY BATTERIES SEGMENT OF MARKET TO GROW AT HIGH CAGR FROM 2020 TO 2025

FIGURE 33 FLEXIBLE BATTERY MARKET, BY APPLICATION

FIGURE 34 THIN-FILM BATTERIES SEGMEN

S FROM 2020 TO 2025

FIGURE 35 BELOW 10 MAH SEGMENT IS PROJECTED TO HOLD LARGE SIZE OF MARKET FOR MEDICAL DEVICES IN 2025

FIGURE 36 APAC TO LEAD MARKET FOR SMART PACKAGING FROM 2020 TO 2025

FIGURE 37 FLEXIBLE BATTERY MARKET IN INDIA FOR SMART CARDS TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 38 APAC TO LEAD MARKET FOR WIRELESS SENSORS FROM 2020 TO 2025

FIGURE 39 MARKET IN INDIA AND CHINA TO WITNESS SIGNIFICANT GROWTH FROM 2020 TO 2025

FIGURE 40 NORTH AMERICA: FLEXIBLE BATTERY MARKET SNAPSHOT

FIGURE 41 APAC: MARKET SNAPSHOT

FIGURE 42 MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 43 SAMSUNG SDI: COMPANY SNAPSHOT

FIGURE 44 LG CHEM: COMPANY SNAPSHOT

FIGURE 45 APPLE INC.: COMPANY SNAPSHOT

FIGURE 46 PANASONIC: COMPANY SNAPSHOT

FIGURE 47 ULTRALIFE CORPORATION: COMPANY SNAPSHOT

The study involves 4 major activities for estimating the size of the flexible battery market. Exhaustive secondary research has been conducted to collect information related to the flexible battery market, its peer markets, and its parent market. The validation of these findings and assumptions with the industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete size of the market. It has been followed by the market breakdown and data triangulation procedures to estimate the market size of each segment and subsegment.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. Secondary sources include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. The secondary data has been collected and analyzed to arrive at the overall market size, which has been validated further through primary research.

Primary Research

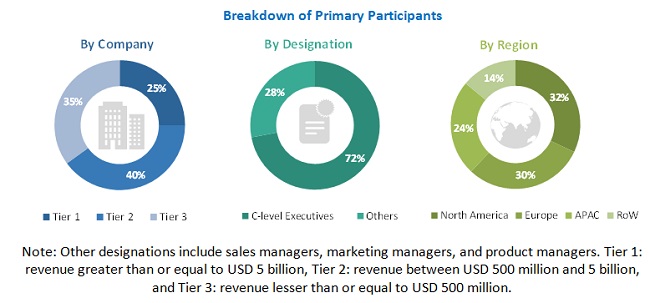

The flexible battery market comprises several stakeholders, such as associations and industrial bodies, flexible battery manufacturers, research organizations and consulting companies, and technology investors. Extensive primary research has been conducted after understanding and analyzing the flexible battery market through secondary research. Several primary interviews have been conducted with the market experts from both demand and supply sides across 4 regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). Approximately 20% of the primary interviews have been conducted with the demand side and approximately 80% with the supply side. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the flexible battery market. These methods have also been used extensively to estimate the size of various segments and subsegments of the market. The following method has been used to estimate the market size:

Bottom-Up:

- More than 25 companies offering flexible batteries have been identified and their offerings have been mapped based on type, rechargeability, capacity, and application

- Flexible batteries are at their initial stage of commercialization, as only a few companies have commercialized their flexible batteries

- Based on the data gathered from primary and secondary sources, the flexible batteries have been categorized into different types

- The size of the flexible battery market has been verified through the data sanity method; the revenues of the respective flexible battery providers have been analyzed through their annual reports and press releases; these revenues have been added to derive the overall market size

- A percentage has been assigned to the overall revenue of each company, or in some cases, segmental revenues, to derive their revenues from flexible batteries; these percentages have been assigned based on the product portfolio of each company and the range of flexible batteries offered

- Year-on-year (Y-o-Y) projections have shown a slow or a steady growth till 2019; however, due to the unfolding impact of COVID-19, the market has been witnessing a downfall in 2020 and is expected to recover by 2021 considering the commercialization of these batteries by various manufacturers for use in different applications

- Market trend analysis of flexible batteries has been carried out to understand the industry penetration rate and the demand and supply of flexible batteries for use in different industries to arrive at the CAGR of the market

- Estimates at every level have been verified and crosschecked by discussing them with key opinion leaders, including CXOs, directors, operation managers, and domain experts in MarketsandMarkets

- Various paid and unpaid information sources, such as annual reports, press releases, white papers, and databases have also been studied

Top-Down:

- Size of the flexible battery market has been estimated through data sanity of over 25 key companies

- It has been expected that the flexible battery market will observe a steep growth during the period under study as it is currently in the initial stage of the product cycle, with a few players beginning to commercialize their products

- Types of flexible batteries and their features and properties, as well as the geographical presence and key applications served by all players operating in the flexible battery market have been studied to estimate and arrive at the percentage split of different segments

- Different types of flexible batteries and the end-use applications that are expected to implement flexible batteries in the near future have been identified

- The split of the flexible battery market based on capacity (below 10 mAh, between 10 mAh and 100 mAh, and above 100 mAh) and voltage (below 1.5V, between 1.5V and 3V, and above 3V) has been estimated through secondary research

- The split of the flexible battery market based on rechargeability (primary batteries and secondary batteries) has been estimated by assuming the penetration and commercialization of each type of flexible battery

- The ongoing and the upcoming projects pertaining to the implementation of flexible batteries in various end-use applications have been identified, and the market size has been forecast based on these developments and other critical parameters

- The key opinion leaders from the key companies involved in the development of flexible batteries and related components have been approached for discussions to validate the split of the flexible battery market based on capacity, voltage, rechargeability, and application

- The geographical splits have been estimated using secondary sources, based on factors such as the number of players in a specific country and region and on the adoption and use cases of each type of battery with respect to applications in each region

Data Triangulation

After arriving at the overall market size through the process explained above, the total market has been split into several segments. The data triangulation and market breakdown procedure have been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the flexible battery market, in terms of value, based on voltage, capacity, rechargeability, type and application

- To provide quality information regarding materials and components used in flexible batteries

- To describe and forecast the flexible battery market, in terms of value, for North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the flexible battery market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the flexible battery market

- To provide a detailed impact of the COVID-19 on the flexible battery market

- To provide the impact of the COVID-19 on the application segments of the flexible battery market and players operating in it

- To strategically profile key players and comprehensively analyze their market shares and core competencies, along with a detailed competitive landscape of the market

- To analyze various strategies such as agreements and acquisitions undertaken in the flexible battery market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of the companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 16)

Growth opportunities and latent adjacency in Flexible Battery Market