Flexible Paper Packaging Market by Packaging Type (Pouches, Roll Stock, Shrink Sleeves, Wraps), Printing Technology (Rotogravure, Flexography, Digital Printing), embellishing type (Hot Coil, Cold Coil), Application, and Region - Global Forecast to 2026

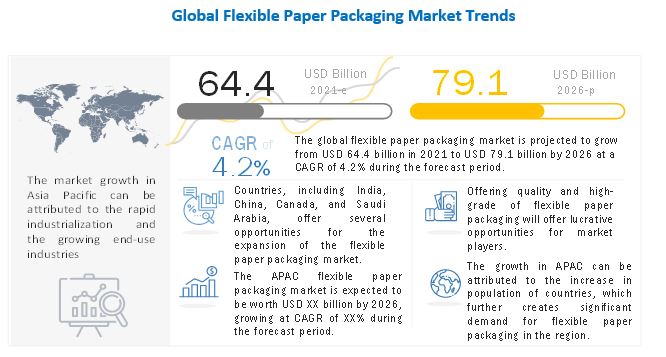

[190 Pages Report] The global flexible paper packaging market size is projected to grow from USD 64.4 billion in 2021 to USD 79.1 billion by 2026, at a CAGR of 4.2%. The flexible paper packaging market is expected to witness significant growth in the future as flexible paper packaging is lighter in weight, cost-efficient, and uses less material as compared to other forms of packaging. The growth of the flexible paper packaging market is attributed to its high efficiency and cost-effective nature. Flexible packaging is particularly useful in industries that require versatile packaging, such as food & beverage, personal care, homecare, and healthcare. However, factors such as high production cost and capital investment of flexible paper packaging may inhibit the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global flexible paper packaging market

As COVID-19 began closing non-essential businesses and shutting down borders in late March 2020, several companies in the packaging market created industry surveys to offer some indicating metrics about the impact of Covid-19 on packaging manufacturers, material suppliers, and machinery manufacturers. Industries deemed essential were working with capacity levels approaching 95%. Food, beverage, and healthcare industries are some of the sectors seeing increasing demand, as they are among the essential businesses.

Flexible paper packaging Market Dynamics

Driver: Cost-effectiveness and increased product shelf life

Flexible packaging requires fewer resources and energy for packaging; hence, flexible packs are available at low costs and occupy 35% less retail shelf space, rendering them cost-effective compared to other forms of packaging. Flexible paper packaging uses fewer natural resources, less energy in manufacturing, and creates fewer greenhouse gas emissions. Flexible paper packaging reduces product waste and increases product shelf life; for instance, mushrooms, potatoes, and onions packaged in flexible paper packaging ripen at a slower pace by absorbing excess moisture and keeping them dry. Flexible paper packaging can be done in the least packaging possible, thereby lowering product warehousing and shipping expenses while maintaining or improving product protection.

Restraint: Multi-layer packaging to pose challenges for recyclability

Paper is far more biodegradable than plastic and can be recycled very easily. However, it often ends up in landfills, where its degradation rate slows down while it takes up more space than the same weight of plastic. Further, paper-based flexible packaging is often laminated with various materials such as plastic/aluminum or coated with resin, thus becoming non-recyclable. Multi-layer packaging in a combination of layers such as paper-plastic-metal results in challenges for material separation.

Opportunity: Branding opportunities to boost the demand for flexible paper packaging

Flexible paper packaging allows for high-quality and high-impact graphics so that a brand can do 360-degree branding instead of being limited to the size of a label. Further, a printing partner that specializes in digitally printed flexible packaging can help achieve precise, photo-quality graphics and images. With flexible paper packaging, a manufacturer can attain all regulation-required information and have plenty of space for product features and benefits along with eye-catching graphics.

Challenge: Deforestation

Forest practices associated with some pulp and paper operations have caused devastation for the world’s most ecologically important species. Unsustainable pulp and paper operations have led to the conversion of high conservation value forests and illegal harvesting. This remains a challenge for the flexible paper packaging market, where there are constant efforts to achieve sustainability goals.

Pouches widely preferred type of flexible paper packaging

Pouches are projected to dominate the market for flexible paper packaging by 2026, in terms of value. The increased use of pouches is subjected to pouches being versatile, lightweight, and easy to transport. There is an increasing demand for pouches from the food packaging and e-commerce industries.

Significant increase in the demand for flexible paper packaging with flexography

On the basis of printing technology, flexography is projected to be the largest segment in the flexible paper packaging market during the forecast period. The growth of this segment is mainly attributed to the fact that inks used in flexography are low viscosity, which enables the print to dry quickly and speeds up the printing process, thus saving the cost of production.

Food most preferred application of flexible paper packaging

Based on application, the food segment is projected to be the largest segment in the flexible paper packaging market. The growth of this segment is mainly attributed to the high demand for flexible paper packaging as changing lifestyles and busy schedules of the working population. Flexible paper packaging also reduces leakage and extends the shelf-life of products. Food products are the largest consumers flexible plastic packaging owing to their convenience and portability. The primary functions of food & beverage packaging are the reduction of food loss and increasing the shelf-life of food products.

Hot Coil most favored for flexible paper packaging

By embellishing type, hot coil is projected to be the largest segment in the flexible paper packaging market. Hot foil embellishment is utilized across a wide range of industry sectors, but account for the highest share in the food and beverages (particularly confectionary such as premium chocolate, wine and liquor bottles, and other premium foods), cosmetics, electronics, banknotes, business cards, and greeting cards and artwork.

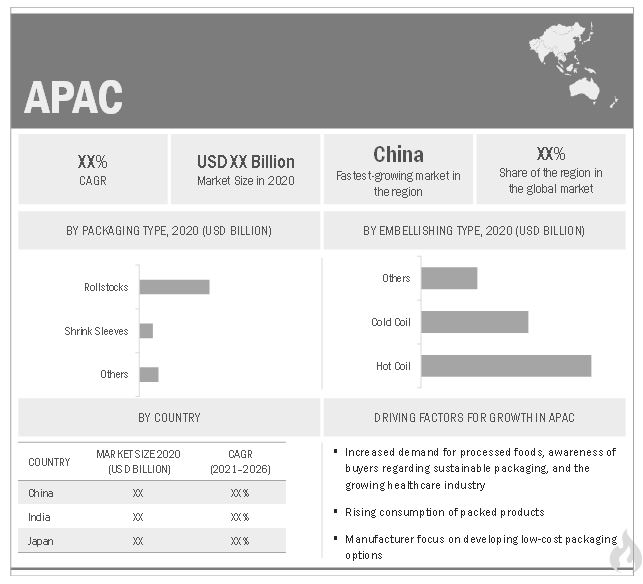

APAC region to lead the global flexible paper packaging market by 2026

The APAC region accounted for the largest market share in 2020. The demand for flexible paper packaging in APAC is mainly driven by China, India, and ASEAN countries, which are experiencing substantial growth in the construction industries. The growth of these industries is backed by the increasing public and private sector investments, increasing population, growing economy, and high disposable income.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The flexible paper packaging market is dominated by a few globally established players, such as Amcor Limited (Australia), Mondi Group (UK), Sonoco Products Company (US), Sealed Air Corporation (US), Huhtamaki OYJ (Finland), Sappi Global (South Africa), DS Smith (UK), Coveris Holding SA (UK), Sabert (US), Wihuri (Finland), amongst others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Billion) and Volume (Million Square Meter) |

|

Segments covered |

Packaging Type, Printing Technology, Embellishing Type, Application, and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies covered |

Amcor Limited (Australia), Mondi Group (UK), Sonoco Products Company (US), Sealed Air Corporation (US), Huhtamaki OYJ (Finland), Sappi Global (South Africa), DS Smith (UK), Coveris Holding SA (UK), Sabert (US), Wihuri (Finland) |

This research report categorizes the flexible paper packaging market based on type, end-use industry, and region.

On the basis of packaging type:

- Pouches

- Rollstock

- Shrink Sleeves

- Wraps

- Others

On the basis of printing technology:

- Rotogravure

- Flexography

- Digital Printing

- Others

On the basis of embellishing type:

- Hot Coil

- Cold Coil

- Others

On the basis of application:

- Food

- Spirits

- Other Beverages

- Healthcare

- Beauty & Personal Care

- Others

On the basis of region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

What is the current size of global flexible paper packaging market?

The global flexible paper packaging market size is projected to grow from USD 64.4 billion in 2021 to USD 79.1 billion by 2026, at a CAGR of 4.2% from 2021 to 2026.

How is the flexible paper packaging market aligned?

The flexible paper packaging market is highly fragmented, and have number of manufacturers operating at the regional, and domestic level. The market will continue to be fragmented and this fragmentation will increase over the forecast period.

Who are the key players in the global flexible paper packaging market?

The key players operating in the flexible paper packaging market are Amcor Limited (Australia), Mondi Group (UK), Sonoco Products Company (US), Sealed Air Corporation (US), Huhtamaki OYJ (Finland), Sappi Global (South Africa), DS Smith (UK), Coveris Holding SA (UK), Sabert (US), Wihuri (Finland), amongst others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSION AND EXCLUSION

1.4 MARKET SCOPE

1.4.1 FLEXIBLE PAPER PACKAGING MARKET SEGMENTATION

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.4.3 REGIONS COVERED

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 34)

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 ASIA PACIFIC TO SHOW HIGH GROWTH RATE DUE TO RAPID INDUSTRIALIZATION AND GROWING END-USE INDUSTRIES

4.2 FLEXIBLE PAPER PACKAGING MARKET, BY EMBELLISHMENT TYPE

4.3 GLOBAL FLEXIBLE PAPER PACKAGING MARKET, BY REGION AND APPLICATION, 2020

5 MARKET OVERVIEW (Page No. - 39)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Cost-effectiveness and increased product shelf life

5.2.1.2 Downsizing packaging material usage

5.2.1.3 Rising demand from end-use industries and increasing e-commerce sales

5.2.2 RESTRAINTS

5.2.2.1 Multi-layer packaging to pose challenges for recyclability

5.2.3 OPPORTUNITIES

5.2.3.1 Branding opportunities to boost the demand for flexible paper packaging

5.2.3.2 Consumers’ preference for sustainable packaging

5.2.4 CHALLENGES

5.2.4.1 Deforestation

6 INDUSTRY TRENDS (Page No. - 43)

6.1 VALUE CHAIN ANALYSIS

6.1.1 PROMINENT COMPANIES

6.1.2 SMALL & MEDIUM ENTERPRISES

6.2 PORTER’S FIVE FORCES ANALYSIS

6.2.1 THREAT OF NEW ENTRANTS

6.2.2 THREAT OF SUBSTITUTES

6.2.3 BARGAINING POWER OF SUPPLIERS

6.2.4 BARGAINING POWER OF BUYERS

6.2.5 INTENSITY OF COMPETITIVE RIVALRY

6.3 YC-YCC DRIVERS

6.4 MARKET MAPPING/ ECOSYSTEM MAP

6.5 TECHNOLOGY ANALYSIS

6.5.1 VARIOUS PRINTING METHODS FOR PAPER BAGS

6.5.1.1 Screen printing

6.5.1.2 Foil printing

6.5.1.3 Litho printing

6.5.1.4 Flexo printing

6.5.1.5 Digital printing

6.5.2 FORM-FILL-SEAL MACHINE FOR FLEXIBLE PAPER PACKAGING

6.5.3 STRETCHABLE PAPER FOR NOVEL PAPER APPLICATIONS

6.6 REGULATORY ANALYSIS

6.6.1 PAPER STANDARDS AND PACKAGING STANDARDS

6.6.2 PAPER STANDARDS AND PACKAGING STANDARDS DEVELOPED BY ASTM

6.6.2.1 Standard practice for conditioning paper and paper products for testing, ASTM D685-17

6.6.2.1.1 Scope

6.6.2.2 Standard guide for validating recycled content in packaging paper and paperboard, ASTM D5663-15(2020)

6.6.2.2.1 Scope

6.7 PRICING ANALYSIS

6.7.1 CHANGES IN PAPER AND PACKAGING PRICING IN 2021

6.8 TRADE ANALYSIS

6.9 CASE STUDY ANALYSIS

6.10 COVID-19 IMPACT ON FLEXIBLE PAPER PACKAGING MARKET

6.10.1 IMPACT OF COVID-19 ON END-USE SECTORS OF FLEXIBLE PAPER PACKAGING

6.10.1.1 Impact of COVID-19 on the food & beverage industry

6.10.1.2 Impact of COVID-19 on the pharmaceutical industry

6.10.1.3 Impact of COVID-19 on the personal & homecare industry

6.10.2 NEW OPPORTUNITIES AMID COVID-19

7 FLEXIBLE PAPER PACKAGING MARKET, BY PACKAGING TYPE (Page No. - 57)

7.1 INTRODUCTION

7.2 POUCHES

7.2.1 ECONOMICAL AND EFFICIENT PACKAGING

7.3 ROLLSTOCKS

7.3.1 DESIGNED TO INCREASE SHELF-LIFE

7.4 SHRINK SLEEVES

7.4.1 PROVIDE ESTHETIC IMPACT AND MARKETING EXPOSURE

7.5 WRAPS

7.5.1 RISING DEMAND DUE TO INCREASING ONLINE SALES AND E-COMMERCE

7.6 OTHERS

7.6.1 CONVENIENT, EASY TO HANDLE, AND ENVIRONMENT-FRIENDLY

8 FLEXIBLE PAPER PACKAGING MARKET, BY PRINTING TECHNOLOGY (Page No. - 61)

8.1 INTRODUCTION

8.2 FLEXOGRAPHY

8.3 ROTOGRAVURE

8.4 DIGITAL PRINTING

8.5 OTHERS

9 FLEXIBLE PAPER PACKAGING MARKET, BY EMBELLISHING TYPE (Page No. - 65)

9.1 INTRODUCTION

9.2 HOT FOIL

9.2.1 HELPS ATTRACT CONSUMER ATTENTION DUE TO ITS ESTHETIC PROPERTIES

9.3 COLD FOIL

9.3.1 PROVIDES HIGHER LEVEL OF ACCURACY AND CONSISTENCY IN THE EMBELLISHING

9.4 OTHERS

9.4.1 PROVIDE ESTHETIC IMPACT AND MARKETING EXPOSURE

10 FLEXIBLE PAPER PACKAGING MARKET, BY APPLICATION (Page No. - 69)

10.1 INTRODUCTION

10.2 FOOD

10.2.1 INCREASING CONSUMPTION OF CONVIENCE FOODS TO BOOST MARKET

10.3 OTHER BEVERAGES

10.3.1 SHIFT IN CONSUMER PREFERENCE TO BOOST MARKET GROWTH

10.4 WINES & SPIRITS

10.4.1 RAPID URBANIZATION, CHANGING LIFESTYLES TO BOOST GROWTH

10.5 HEALTHCARE

10.5.1 RISE IN DEMAND FOR PHARMACEUTICAL PRODUCTS DUE TO PANDEMIC TO BOOST MARKET

10.6 BEAUTY & PERSONAL CARE

10.6.1 AFFORDABLE SMALL SIZE PACKAGING TO BOOST MARKET

10.7 OTHERS

11 FLEXIBLE PAPER PACKAGING MARKET, BY REGION (Page No. - 73)

11.1 INTRODUCTION

11.2 ASIA PACIFIC

11.2.1 CHINA

11.2.1.1 Increasing demand for consumer goods to drive demand for flexible paper packaging in China

11.2.2 JAPAN

11.2.2.1 Rising disposable income and high urban population to drive market

11.2.3 INDIA

11.2.3.1 India witnesses high demand from organized retail and e-commerce sectors

11.2.4 SOUTH KOREA

11.2.4.1 Market in South Korea is driven by rising demand for ready-to-eat and processed food

11.2.5 REST OF ASIA PACIFIC

11.3 EUROPE

11.3.1 GERMANY

11.3.1.1 Market in Germany growing due to high demand for pharmaceutical packaging

11.3.2 UK

11.3.2.1 Growth in the healthcare industry to offer lucrative market opportunities

11.3.3 FRANCE

11.3.3.1 Growing pharmaceutical industry to boost market

11.3.4 RUSSIA

11.3.4.1 Increase in demand for flexible paper packaging in various end-use industries to drive market

11.3.5 ITALY

11.3.5.1 Increasing demand from retail, food, and healthcare industries to drive market

11.3.6 SPAIN

11.3.6.1 Increase in demand from retail, home & personal care, pharmaceutical, and food & beverage industries to drive market

11.3.7 REST OF EUROPE

11.4 NORTH AMERICA

11.4.1 US

11.4.1.1 US to lead market in North America by 2026

11.4.2 CANADA

11.4.2.1 Rising demand from food & beverage and home & personal care industries drives market growth

11.4.3 MEXICO

11.4.3.1 Rising investments in consumer-packaged goods (CPGs) companies boosts market in Mexico

11.5 MIDDLE EAST & AFRICA

11.5.1 UAE

11.5.1.1 UAE to be the fastest-growing market in region

11.5.2 SOUTH AFRICA

11.5.2.1 Growth of packaging industry to drive market

11.5.3 REST OF MIDDLE EAST & AFRICA

11.6 SOUTH AMERICA

11.6.1 BRAZIL

11.6.1.1 Brazil to dominate the flexible paper packaging market in South America

11.6.2 ARGENTINA

11.6.2.1 Rising demand for flexible paper packaging in food packaging to drive market

11.6.3 REST OF SOUTH AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 147)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

12.3 MARKET RANKING

12.3.1 AMCOR LIMITED

12.3.2 MONDI GROUP

12.3.3 SONOCO PRODUCT COMPANY

12.3.4 SEALED AIR CORPORATION

12.3.5 HUHTAMAKI OYJ

12.4 COMPANY EVALUATION QUADRANT

12.4.1 STAR

12.4.2 PERVASIVE

12.4.3 EMERGING LEADER

12.4.4 PARTICIPANT

12.5 COMPETITIVE SCENARIO AND TRENDS

12.5.1 DEALS

13 COMPANY PROFILES (Page No. - 154)

13.1 KEY COMPANIES

13.1.1 AMCOR LIMITED

13.1.1.1 Business overview

13.1.1.2 Products offered

13.1.1.3 Recent developments

13.1.1.4 MnM view

13.1.1.4.1 Key strengths/right to win

13.1.1.4.2 Strategic choices made

13.1.1.4.3 Weaknesses and competitive threats

13.1.2 MONDI GROUP

13.1.2.1 Business overview

13.1.2.2 Products and solutions

13.1.2.3 MnM view

13.1.2.3.1 Key strengths/right to win

13.1.2.3.2 Strategic choices made

13.1.2.3.3 Weaknesses and competitive threats

13.1.3 SONOCO PRODUCTS COMPANY

13.1.3.1 Business overview

13.1.3.2 Products and solutions

13.1.3.3 MnM view

13.1.3.3.1 Key strengths/right to win

13.1.3.3.2 Strategic choices made

13.1.3.3.3 Weaknesses and competitive threats

13.1.4 SEALED AIR CORPORATION

13.1.4.1 Business overview

13.1.4.2 Products and solutions

13.1.4.3 Recent developments

13.1.4.4 MnM view

13.1.4.4.1 Key strengths/right to win

13.1.4.4.2 Strategic choices made

13.1.4.4.3 Weaknesses and competitive threats

13.1.5 HUHTAMAKI OYJ

13.1.5.1 Business overview

13.1.5.2 Products and solutions

13.1.5.3 Recent developments

13.1.5.4 MnM view

13.1.5.4.1 Key strengths/right to win

13.1.5.4.2 Strategic choices made

13.1.5.4.3 Weaknesses and competitive threats

13.1.6 SAPPI GLOBAL

13.1.6.1 Business overview

13.1.6.2 Products and solutions

13.1.6.3 MnM view

13.1.7 DS SMITH

13.1.7.1 Business overview

13.1.7.2 Products and Solutions

13.1.7.3 MnM view

13.1.8 COVERIS HOLDINGS SA

13.1.8.1 Business overview

13.1.8.2 Products and solutions

13.1.8.3 Recent developments

13.1.8.4 MnM view

13.1.9 SABERT

13.1.9.1 Business overview

13.1.9.2 Products and solutions

13.1.9.3 Recent developments

13.1.9.4 MnM view

13.1.10 WIHURI

13.1.10.1 Business overview

13.1.10.2 Products and solutions

13.1.10.3 MnM view

13.2 OTHER PLAYERS

13.2.1 VISY PROPRIETARY LIMITED

13.2.2 TUPPERWARE BRANDS

13.2.3 SILGAN

13.2.4 REYNOLDS PACKAGING

13.2.5 JUJO THERMAL

13.2.6 LINPAC PACKAGING

13.2.7 DART CONTAINER CORPORATION

13.2.8 D&W FINE PACK

13.2.9 GENPAK

14 APPENDIX (Page No. - 184)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

LIST OF TABLES (236 Tables)

TABLE 1 INCLUSION AND EXCLUSION

TABLE 2 FLEXIBLE PAPER PACKAGING MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 3 LIST OF EXPORTERS FOR PRODUCT: 48 PAPER AND PAPERBOARD; ARTICLES OF PAPER PULP, OF PAPER OR OF PAPERBOARD, 2016-2020 (IN USD THOUSAND)

TABLE 4 LIST OF IMPORTERS FOR PRODUCT: 48 PAPER AND PAPERBOARD; ARTICLES OF PAPER PULP, OF PAPER OR OF PAPERBOARD, 2016-2020 (IN USD THOUSAND)

TABLE 5 PAPERPAK CASE STUDY FOR KATHMANDU

TABLE 6 PAPERPAK CASE STUDY FOR HARPER, INC.

TABLE 7 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 8 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 9 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 10 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 11 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY EMBELLISHING TYPE, 2019–2026 (USD BILLION)

TABLE 12 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY EMBELLISHING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 13 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 14 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 15 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY REGION, 2019–2026 (USD BILLION)

TABLE 16 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY REGION, 2019–2026 (MILLION METRIC TON)

TABLE 17 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 18 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 19 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 20 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 21 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 22 FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 23 FLEXIBLE PAPER PACKAGING MARKET SIZE, EMBELLISHING TYPE, 2019–2026 (USD BILLION)

TABLE 24 FLEXIBLE PAPER PACKAGING MARKET SIZE, EMBELLISHING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 25 ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 26 ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METRIC TON)

TABLE 27 ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 28 ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 29 ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 30 ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 31 ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 32 ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 33 ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY EMBELLISHING TYPE, 2019–2026 (USD BILLION)

TABLE 34 ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY EMBELLISHING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 35 CHINA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 36 CHINA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 37 CHINA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 38 CHINA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 39 CHINA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 40 CHINA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 41 JAPAN: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 42 JAPAN: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 43 JAPAN: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 44 JAPAN: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 45 JAPAN: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 46 JAPAN: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 47 INDIA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 48 INDIA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 49 INDIA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 50 INDIA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 51 INDIA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 52 INDIA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 53 SOUTH KOREA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 54 SOUTH KOREA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 55 SOUTH KOREA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 56 SOUTH KOREA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 57 SOUTH KOREA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 58 SOUTH KOREA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 59 REST OF ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 60 REST OF ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 61 REST OF ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 62 REST OF ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 63 REST OF ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 64 REST OF ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 65 EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 66 EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METRIC TON)

TABLE 67 EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 68 EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 69 EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 70 EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 71 EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 72 EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 73 EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY EMBELLISHING TYPE, 2019–2026 (USD BILLION)

TABLE 74 EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY EMBELLISHING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 75 GERMANY: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 76 GERMANY: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 77 GERMANY: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 78 GERMANY: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 79 GERMANY: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 80 GERMANY: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 81 UK: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 82 UK: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 83 UK: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 84 UK: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 85 UK: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 86 UK: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 87 FRANCE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 88 FRANCE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 89 FRANCE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 90 FRANCE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 91 FRANCE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 92 FRANCE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 93 RUSSIA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 94 RUSSIA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 95 RUSSIA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 96 RUSSIA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 97 RUSSIA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 98 RUSSIA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 99 ITALY: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 100 ITALY: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 101 ITALY: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 102 ITALY: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 103 ITALY: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 104 ITALY: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 105 SPAIN: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 106 SPAIN: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 107 SPAIN: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 108 SPAIN: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 109 SPAIN: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 110 SPAIN: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 111 REST OF EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 112 REST OF EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 113 REST OF EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 114 REST OF EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 115 REST OF EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 116 REST OF EUROPE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 117 NORTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 118 NORTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METRIC TON)

TABLE 119 NORTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 120 NORTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 121 NORTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 122 NORTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 123 NORTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 124 NORTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 125 NORTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY EMBELLISHING TYPE, 2019–2026 (USD BILLION)

TABLE 126 NORTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY EMBELLISHING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 127 US: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 128 US: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 129 US: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 130 US: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 131 US: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 132 US: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 133 CANADA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 134 CANADA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 135 CANADA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 136 CANADA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 137 CANADA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 138 CANADA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 139 MEXICO: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 140 MEXICO: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 141 MEXICO: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 142 MEXICO: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 143 MEXICO: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 144 MEXICO: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 145 MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 146 MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METRIC TON)

TABLE 147 MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 148 MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 149 MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 150 MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 151 MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 152 MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 153 MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY EMBELLISHING TYPE, 2019–2026 (USD BILLION)

TABLE 154 MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY EMBELLISHING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 155 UAE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 156 UAE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 157 UAE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 158 UAE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 159 UAE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 160 UAE: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 161 SOUTH AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 162 SOUTH AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 163 SOUTH AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 164 SOUTH AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 165 SOUTH AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 166 SOUTH AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 167 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 168 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 169 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 170 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 171 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 172 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 173 SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 174 SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METRIC TON)

TABLE 175 SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 176 SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 177 SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 178 SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 179 SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 180 SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 181 SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY EMBELLISHING TYPE, 2019–2026 (USD BILLION)

TABLE 182 SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY EMBELLISHING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 183 BRAZIL: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 184 BRAZIL: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 185 BRAZIL: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 186 BRAZIL: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 187 BRAZIL: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 188 BRAZIL: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 189 ARGENTINA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 190 ARGENTINA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 191 ARGENTINA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 192 ARGENTINA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 193 ARGENTINA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 194 ARGENTINA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 195 REST OF SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (USD BILLION)

TABLE 196 REST OF SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2019–2026 (MILLION METRIC TON)

TABLE 197 REST OF SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 198 REST OF SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METRIC TON)

TABLE 199 REST OF SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD BILLION)

TABLE 200 REST OF SOUTH AMERICA: FLEXIBLE PAPER PACKAGING MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION METRIC TON)

TABLE 201 FLEXIBLE PAPER PACKAGING MARKET: DEALS, JANUARY 2016–NOVEMBER 2020

TABLE 202 AMCOR LIMITED: COMPANY OVERVIEW

TABLE 203 AMCOR LIMITED: PRODUCTS OFFERED

TABLE 204 AMCOR LIMITED: DEALS

TABLE 205 MONDI GROUP: COMPANY OVERVIEW

TABLE 206 MONDI GROUP: PRODUCTS OFFERED

TABLE 207 SONOCO PRODUCTS COMPANY: COMPANY OVERVIEW

TABLE 208 SONOCO PRODUCTS COMPANY: PRODUCTS OFFERED

TABLE 209 SEALED AIR CORPORATION: COMPANY OVERVIEW

TABLE 210 SEALED AIR CORPORATION: PRODUCTS OFFERED

TABLE 211 SEALED AIR CORPORATION: DEALS

TABLE 212 HUHTAMAKI OYJ: COMPANY OVERVIEW

TABLE 213 HUHTAMAKI OYJ: PRODUCTS OFFERED

TABLE 214 HUHTAMAKI OYJ: DEALS

TABLE 215 SAPPI GLOBAL: COMPANY OVERVIEW

TABLE 216 SAPPI GLOBAL: PRODUCTS OFFERED

TABLE 217 DS SMITH: COMPANY OVERVIEW

TABLE 218 DS SMITH: PRODUCTS OFFERED

TABLE 219 COVERIS HOLDINGS SA: COMPANY OVERVIEW

TABLE 220 COVERIS HOLDINGS SA: PRODUCTS OFFERED

TABLE 221 COVERIS HOLDINGS SA: DEALS

TABLE 222 SABERT: COMPANY OVERVIEW

TABLE 223 SABERT: PRODUCTS OFFERED

TABLE 224 SABERT: DEALS

TABLE 225 WIHURI: COMPANY OVERVIEW

TABLE 226 WIHURI: PRODUCTS OFFERED

TABLE 227 VISY PROPRIETARY LIMITED: COMPANY OVERVIEW

TABLE 228 TUPPERWARE BRANDS: COMPANY OVERVIEW

TABLE 229 SILGAN: COMPANY OVERVIEW

TABLE 230 REYNOLDS PACKAGING: COMPANY OVERVIEW

TABLE 231 JUJO THERMAL: COMPANY OVERVIEW

TABLE 232 LINPAC PACKAGING: COMPANY OVERVIEW

TABLE 233 DART CONTAINER CORPORATION: COMPANY OVERVIEW

TABLE 234 D&W FINE PACK: COMPANY OVERVIEW

TABLE 235 ETIQUETTE LABELS: COMPANY OVERVIEW

TABLE 236 PAKPLAST: COMPANY OVERVIEW

LIST OF FIGURES (34 Figures)

FIGURE 1 FLEXIBLE PAPER PACKAGING MARKET: RESEARCH DESIGN

FIGURE 2 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY-SIDE

FIGURE 6 FLEXIBLE PAPER PACKAGING MARKET: DATA TRIANGULATION

FIGURE 7 POUCHES SEGMENT TO LEAD THE FLEXIBLE PAPER PACKAGING MARKET BY 2026

FIGURE 8 FLEXOGRAPHY PRINTING TECHNOLOGY TO LEAD THE MARKET IN 2020

FIGURE 9 FOOD TO BE THE LARGEST APPLICATION OF FLEXIBLE PAPER PACKAGING MARKET DURING THE FORECAST PERIOD

FIGURE 10 ASIA PACIFIC ACCOUNTED FOR THE LARGEST SHARE OF THE FLEXIBLE PAPER PACKAGING MARKET IN 2020

FIGURE 11 INCREASING DRIVE TOWARD SUSTAINABILITY IS PROPELLING THE FLEXIBLE PAPER PACKAGING MARKET

FIGURE 12 COLD FOIL TO BE THE FASTEST-GROWING SEGMENT

FIGURE 13 FOOD SEGMENT AND ASIA PACIFIC ACCOUNTED FOR THE LARGEST SHARES

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE FLEXIBLE PAPER PACKAGING MARKET

FIGURE 15 FLEXIBLE PAPER PACKAGING MARKET: VALUE CHAIN

FIGURE 16 PORTER’S FIVE FORCES ANALYSIS OF FLEXIBLE PAPER PACKAGING MARKET

FIGURE 17 YC-YCC DRIVERS

FIGURE 18 ECOSYSTEM MAP

FIGURE 19 POUCHES SEGMENT TO LEAD FLEXIBLE PAPER PACKAGING MARKET DURING FORECAST PERIOD

FIGURE 20 FLEXOGRAPHY SEGMENT TO LEAD FLEXIBLE PAPER PACKAGING MARKET DURING FORECAST PERIOD

FIGURE 21 COLD FOIL EMBELLISHING TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

FIGURE 22 FOOD SEGMENT TO LEAD FLEXIBLE PAPER PACKAGING MARKET DURING FORECAST PERIOD

FIGURE 23 CHINA TO BE FASTEST-GROWING MARKET FROM 2021 TO 2026

FIGURE 24 ASIA PACIFIC: FLEXIBLE PAPER PACKAGING MARKET SNAPSHOT

FIGURE 25 COMPANIES ADOPTED EXPANSION AS THE KEY GROWTH STRATEGY, 2016–2021

FIGURE 26 MARKET RANKING OF KEY PLAYERS, 2020

FIGURE 27 FLEXIBLE PAPER PACKAGING MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

FIGURE 28 AMCOR LIMITED: COMPANY SNAPSHOT

FIGURE 29 MONDI GROUP: COMPANY SNAPSHOT

FIGURE 30 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

FIGURE 31 SEALED AIR CORPORATION: COMPANY SNAPSHOT

FIGURE 32 HUHTAMAKI OYJ: COMPANY SNAPSHOT

FIGURE 33 SAPPI GLOBAL: COMPANY SNAPSHOT

FIGURE 34 DS SMITH: COMPANY SNAPSHOT

The study involved four major activities for estimating the current global size of the flexible paper packaging market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of precast concrete through primary research. The supply-side approach was employed to estimate the overall size of the flexible paper packaging market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the flexible paper packaging market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

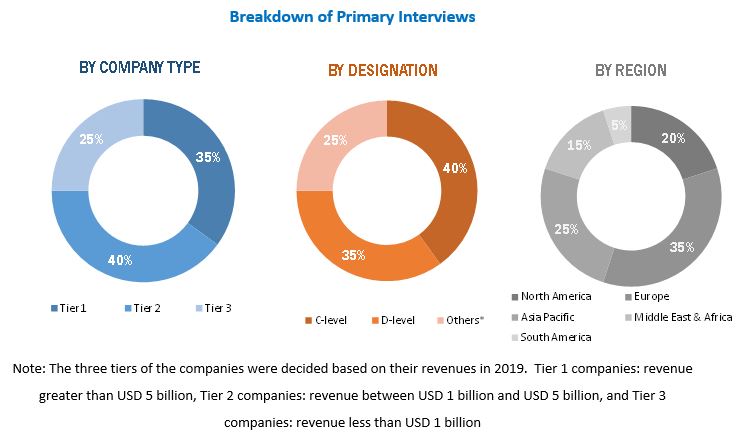

Primary Research

Various primary sources from both the supply and demand sides of the flexible paper packaging market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the flexible paper packaging industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

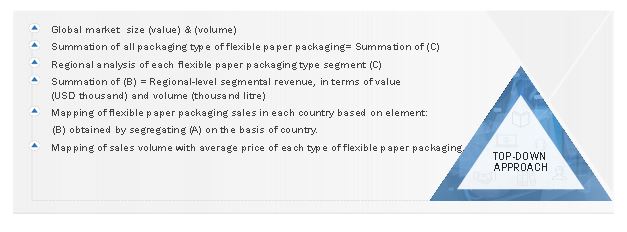

The top-down approach was used to estimate and validate the global size of the flexible paper packaging market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the flexible paper packaging market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the flexible paper packaging market in terms of value and volume based on packaging type, printing technology, embellishing type, application, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, APAC, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as investments & expansions, partnerships & collaborations, new product developments, and merger & acquisitions, in the flexible paper packaging market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the flexible paper packaging report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the flexible paper packaging market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Flexible Paper Packaging Market