Packaging Printing Market by Printing Ink (Aqueous, UV-based), Printing Technology (Flexography, Gravure, Digital), Packaging Type (Labels & Tags, Flexible), Application (Food & Beverages, Cosmetics, Pharmaceuticals), & Region - Global Forecast to 2025

Updated on : August 25, 2025

Packaging Printing Market

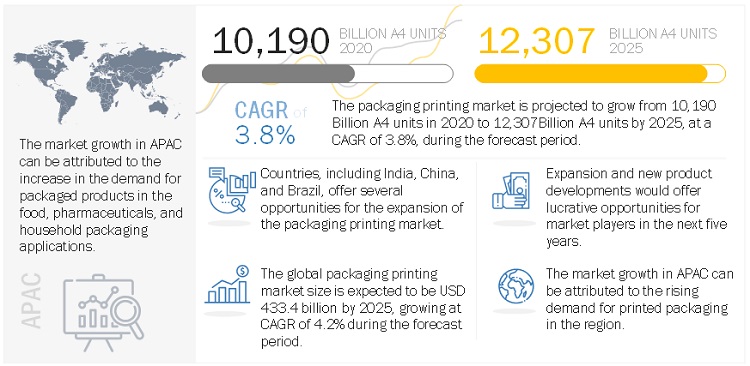

The global packaging printing market was valued at USD 352.1 billion in 2020 and is projected to reach USD 433.4 billion by 2025, growing at 4.2% cagr from 2020 to 2025. The market will be driven by growth in the packaging industry, demand for products with an aesthetic appeal, product differentiation, and technological advancements. In terms of packaging technology, an increase in demand for digital printing is an opportunity for packaging printing, as the market for digital printing is growing at a high rate. Also, in terms of application, growth in the food & beverage and personal care & cosmetics industries is expected to propel the market for packaging printing in the coming years.

Global Packaging Printing Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Packaging Printing Market Dynamics

DRIVERS: Growing demand for innovative printing

The demand for innovation in printing is also driving the market for packaging printing. Innovation in printing has resulted in the use of printing processes, such as digital printing and three-dimensional printing. The use of digital printing eliminates the steps required in conventional printing technology. It also helps to achieve consistent printing, reduce wastage, shorter turnaround, and make printing cheaper for lower volumes.

Three-dimensional printing helps to reproduce realistic illustrations. Three-dimensional printing processes are faster as compared to traditional printing processes. They help to reduce wastes by utilizing most of the materials and help to attain sustainability in printing processes. The image quality produced by three-dimensional printing processes is better than that of traditional methods.

RESTRAINT: Initial capital investment required

High initial capital investment is required for establishing manufacturing and printing facilities. Investment is required for setting up plants and for buying printing equipment. For instance, a rotogravure press costs around USD 1 million compared to a lithographic press. A single rotogravure cylinder cost around USD 5,000, as compared to an affordable lithographic plate. However, lithographic printing is being phased out by technologies that are required to cater to the demands of companies in a progressively competitive market. The offset printing process also requires a fairly large amount of investment in equipment and setup. These include investments in printing equipment, such as flexography press, offset printer, and rotogravure press; other types of presses and raw materials include printing inks, energy, and paper. Hence, this acts as a restraint for new entrants or those aiming at changing or upgrading their printing technologies.

OPPORTUNITIES: Increasing demand for sustainable printing

Sustainable printing makes use of recycled and renewable resources and helps reduce the impact of printing on the environment. Process-free plates, such as cold press plates, are used, which helps to eliminate volatile compounds. The use of cold presses in printers reduces the elimination of volatile compounds in the atmosphere. The use of a digital printer prevents the replacement of plates and eventually saves time and resources. The use of water-based and UV-curable inks lowers the impact of printing on the environment by eliminating the emissions of volatile organic compounds. The rise in demand for sustainable printing is providing opportunities for growth in the packaging printing market.

CHALLENGES: Packaging and printing regulations

Packaging and printing regulations ensure that the printing practices undertaken have a low impact on the environment. Stringent printing regulations in Europe include the European environmental legislative framework, which ensures that the emissions of volatile organic compounds are under control. The regulations also ensure the control of chemicals in printing. The European printing industry is also committed to reduce carbon dioxide emissions and help in reducing the carbon footprint. The European Timber regulation that came into existence in 2013 ensures that the paper products used in printing are not due to illegal logging.

The US Food and Drug Administration, including the Federal Food and Drug Cosmetics Act, which ensures that the ink used for printing on food packages is manufactured using good manufacturing practices and is safe to use.

Corrugated segment to dominate the market in 2020

Corrugated box printing is based on the type of packaging where the corrugated box is used for primary, secondary, and tertiary packaging. Direct print and pre-print are the two widely accepted ways to print on corrugated boxes. Direct print is also known as a post-print, on which the printing is directly done on the corrugated box. This is the most common method used in the industry to print on corrugated boxes. It is usually done with flexography and digital printing. However, pre-printing offers extremely high-quality print offers stunning point-of-purchases displays on the corrugated boxes

Flexography to hold largest share of the packaging printing market in 2020

Flexography is a widely used technology in packaging printing due to the wide range of benefits it offers. It is used to print corrugated containers, folding cartons, multiwall sacks, paper sacks, plastic bags, milk and beverage cartons, disposable cups and containers, labels, adhesive tapes, and wrappers (candy and food). Flexography printing process involves image preparation, plate making, printing, and finishing. The major difference between flexography and other printing technologies is that it uses plates made of flexible materials, such as plastics, rubbers, and UV-sensitive polymers

Solvent-based ink segment is expected to have largest CAGR during the forecast period

Solvent inks are inks that contain pigments besides dyes. Unlike aqueous inks, where the carrier is water, solvent-based inks contain volatile organic compounds. These inks are comparatively inexpensive than UV-curable and aqueous inks and enable printing on various surfaces, such as corrugated boards, paper, flexible packaging materials, metal foils, and plastic materials. Solvent inks offer vibrant colors, although not as strong as aqueous dye inks. Prints made using these inks are generally waterproof and UV-safe without special over-coatings..

Food & beverage application is expected to have largest market share during the forecast period

The food & beverage industry is the largest end-user industry for packaging printing, which accounts for a share of 36.6% in 2019 in terms of value. The food & beverage industry requires packaging solutions for storage, handling, and transportation of products. An increase in demand for product differentiation and labeling to authenticate the products is a major factor that is projected to drive the growth of the food & beverage packaging segment in the market for packaging printing. To enhance the aesthetic appeal and salability of the product, the demand for packaging printing is projected to increase. As packaging printing offers high print quality, color assortment, and print on demand facility, its demand in the packaging industry is projected to increase.

Asia Pacific is expected to be the fastest growing region during the forecast period.

The rise in the economy and the rapid growth in the manufacturing sector in the APAC region have positively impacted the growth of printed packaging mediums. The rise in awareness has pushed consumers to call for product-related information before actual consumption, thereby increasing the demand for packaging printing. Also, companies are using aesthetically enhanced printing on their packaging to promote their brands in an intensely competitive market.

To know about the assumptions considered for the study, download the pdf brochure

Packaging Printing Market Players

The packaging printing market is dominated by a few globally established players such as Mondi PLC (UK) , Sonoco Products Company (US), Graphics Packaging Holding Company (US), among others.

Read More: Packaging Printing Companies

Packaging Printing Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Billion) and Volume (Billion A4 Unit) |

|

Segments covered |

Type, Printing Technology, Printing Ink, Application, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies covered |

Mondi plc (Austria), Sonoco Products Company (US), Graphics Packaging Holding Company (US), Quad/Graphics (US), Amcor Limited (Australia), Constantia flexibles (Austria), Quantum Print and Packaging Limited (UK), WS Packaging Group(US),Toppan Printing Company (Japan), and Duncan Printing group (UK) |

This research report categorizes the packaging printing market based on type, printing technology, printing ink, application, and region.

On the basis of type:

- Corrugated

- Flexible

- Folding cartons

- Label & Tags

- Others (includes Wood & Textile)

On the basis of printing technology:

- Flexography

- Gravure

- Offset

- Screen Printing

- Digital

On the basis of printing ink:

- Solvant-based

- UV-based

- Aqueous

- Others (Latex inks, dye sublimation ink, and eco-solvent & solvent UV)

On the basis of application:

- Food & beverage

- Household & cosmetics

- Pharmaceutical

- Others (includes automotive and electronics industries)

On the basis of region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In August 2019, Mondi Plc. Launched web platforms, namely, myMondi.net, for outstanding print and designs to mark their uncoated fine paper (UFP) brands. It assists professionals from the printing and design industries to know about high-quality paper brands, as well as paper recommendations, local distributor’s details, and multimedia content that educate on packaging printing.

- In July 2019, Graphics Packaging acquired Artistic Carton Mill and converted facilities that have divisions in Auburn, Indiana, and Elgin, Illinois, and is the leading producer of folding cartons and coated recycled paperboard. This acquisition has increased its product portfolio and production capacity and expanded its geographical footprint to cater to the increasing demand.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the packaging printing market during 2020-2025?

The global packaging printing market is expected to record a CAGR of 4.2% from 2020–2025.

What are the driving factors for the packaging printing?

The packaging printing market is primarily driven by the packaging industry. The need for better communicability, shelf appeal, and product differentiation compels the cosmetic & toiletry, healthcare, consumer goods, and food & beverage industries to rely on packaging printing.

Which are the significant players operating in the packaging printing market?

Mondi PLC (UK) , Sonoco Products Company (US), Graphics Packaging Holding Company (US), among others. are some of the major companies operating in the packaging printing market.

Which region will lead the packaging printing market in the future?

Asia Pacific is expected to lead the packaging printing market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 PACKAGING PRINTING MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.3.2 REGIONS COVERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Key industry insights

2.2 MARKET ENGINEERING PROCESS

2.2.1 TOP-DOWN APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 BASE NUMBER CALCULATION

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.4 FORECAST NUMBER CALCULATION

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 4 CORRUGATED PACKAGING TYPE TO ACCOUNT FOR THE LARGEST SHARE

FIGURE 5 MARKET FOR DIGITAL PRINTING TECHNOLOGY TO GROW AT THE HIGHEST RATE FROM 2020 TO 2025

FIGURE 6 SOLVENT-BASED SEGMENT TO BE THE LARGEST SEGMENT

FIGURE 7 FOOD & BEVERAGE TO BE THE LARGEST APPLICATION OF PACKAGING PRINTING

FIGURE 8 APAC DOMINATED THE PACKAGING PRINTING MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 EMERGING ECONOMIES TO WITNESS HIGHER DEMAND FOR PACKAGING PRINTING

FIGURE 9 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES IN THE PACKAGING PRINTING MARKET

4.2 APAC: PACKAGING PRINTING MARKET, BY APPLICATION AND COUNTRY, 2019

FIGURE 10 CHINA AND FOOD & BEVERAGE SEGMENT ACCOUNTED FOR LARGEST SHARES

4.3 PACKAGING PRINTING MARKET, BY TYPE

FIGURE 11 CORRUGATED SEGMENT TO LEAD THE PACKAGING PRINTING MARKET

4.4 PACKAGING PRINTING MARKET, BY TECHNOLOGY

FIGURE 12 FLEXOGRAPHY SEGMENT TO LEAD THE PACKAGING PRINTING MARKET

4.5 PACKAGING PRINTING MARKET, BY PRINTING INK

FIGURE 13 SOLVENT-BASED PRINTING INK FIND LARGEST APPLICATIONS

4.6 PACKAGING PRINTING MARKET, BY APPLICATION

FIGURE 14 FOOD & BEVERAGE TO BE THE LARGEST APPLICATION OF PACKAGING PRINTING

4.7 PACKAGING PRINTING MARKET, BY KEY COUNTRIES

FIGURE 15 PACKAGING PRINTING MARKET IN INDIA TO GROW AT THE HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PACKAGING PRINTING MARKET

5.2.1 DRIVERS

5.2.1.1 Growth in the packaging industry

5.2.1.2 Growing need for creative packaging medium due to intense competition and brand awareness

5.2.1.3 Growing demand for innovative printing

5.2.1.4 Increasing supply chain management

TABLE 1 BENEFITS OF USING PACKAGE PRINTING

5.2.2 RESTRAINTS

5.2.2.1 Initial capital investment required

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for digital printing and usage of RFIDs in packaging

5.2.3.2 Increasing demand for sustainable printing

5.2.3.3 Technological advancements in the printing industry

5.2.4 CHALLENGES

5.2.4.1 High-quality printing at low cost

5.2.4.2 Packaging and printing regulations

6 INDUSTRY TRENDS (Page No. - 52)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 17 PACKAGING PRINTING VALUE CHAIN ANALYSIS

6.2.1 PROMINENT COMPANIES

6.2.2 SMALL & MEDIUM ENTERPRISES

6.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 PACKAGING PRINTING MARKET: PORTER’S FIVE FORCES ANALYSIS

6.3.1 THREAT OF NEW ENTRANTS

6.3.2 THREAT OF SUBSTITUTES

6.3.3 BARGAINING POWER OF SUPPLIERS

6.3.4 BARGAINING POWER OF BUYERS

6.4 PACKAGING PRINTING PATENT ANALYSIS

TABLE 2 LIST OF PATENTS BY DIVINE DAVID A, THOMPSON DAVID S, AND COLSON SHAY C

TABLE 3 LIST OF PATENTS BY ANHUI FUYANG GUOTAI COLOR PRINTING PACKAGE CO. LTD.

TABLE 4 LIST OF PATENTS BY ANHUI XUANYANG PACKAGING TECH CO LTD.

TABLE 5 LIST OF PATENTS BY ZHONGZHENG PACKAGING PRINTING CO, LTD.

TABLE 6 LIST OF PATENTS BY INTERNATIONAL PAPER COMPANY

7 IMPACT OF COVID-19 ON PACKAGING INDUSTRY (Page No. - 61)

7.1 INTRODUCTION

7.2 GAINERS, BY TOP END-USE INDUSTRIES

7.2.1 HEALTHCARE

7.2.2 FOOD & BEVERAGE

7.2.3 PERSONAL CARE

7.3 LOSERS, BY TOP END-USE INDUSTRIES

7.3.1 LUXURY GOODS

7.3.2 ELECTRICAL & ELECTRONICS

7.4 GAINERS, BY TOP TECHNOLOGIES

7.4.1 ASEPTIC PACKAGING

7.4.2 INTELLIGENT/SMART PACKAGING

7.5 LOSERS, BY TOP TECHNOLOGIES

7.5.1 NON-AUTOMATED TECHNOLOGY

7.5.2 PACKAGING ROBOTS AND EQUIPMENT FOR BULK PACKAGING

8 PACKAGING PRINTING MARKET, BY PACKAGING TYPE (Page No. - 66)

8.1 INTRODUCTION

FIGURE 19 CORRUGATED SEGMENT DOMINATED THE PACKAGING PRINTING MARKET, IN 2019

TABLE 7 PRINTING PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD BILLION)

TABLE 8 DIGITAL PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

8.2 LABELS & TAGS

8.3 FLEXIBLES

8.3.1 PLASTIC

8.4 CORRUGATED

8.5 FOLDING CARTONS

8.5.1 PAPER & PAPERBOARD

8.6 OTHERS

9 PACKAGING PRINTING MARKET, BY PRINTING TECHNOLOGY (Page No. - 71)

9.1 INTRODUCTION

FIGURE 20 PACKAGING PRINTING MARKET, BY PRINTING TECHNOLOGY, 2020 VS. 2025 (USD BILLION)

TABLE 9 PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 10 PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

9.2 FLEXOGRAPHY PRINTING TECHNOLOGY

9.3 ROTOGRAVURE PRINTING TECHNOLOGY

9.4 OFFSET PRINTING TECHNOLOGY

9.5 DIGITAL PRINTING TECHNOLOGY

9.6 SCREEN PRINTING

10 PACKAGING PRINTING MARKET, BY PRINTING INK (Page No. - 75)

10.1 INTRODUCTION

FIGURE 21 SOLVENT-BASED INK SEGMENT TO DOMINATE THE PACKAGING PRINTING MARKET BY 2025

TABLE 11 PACKAGING PRINTING MARKET SIZE, BY PRINTING INK, 2018–2025 (USD BILLION)

TABLE 12 PACKAGING PRINTING MARKET SIZE, BY PRINTING INK, 2018–2025 (BILLION A4 UNIT)

10.2 SOLVENT-BASED INK

10.3 UV-BASED

10.4 AQUEOUS INK

10.5 OTHERS

11 PACKAGING PRINTING MARKET, BY APPLICATION (Page No. - 79)

11.1 INTRODUCTION

FIGURE 22 PACKAGING PRINTING MARKET SHARE, BY APPLICATION, 2020 VS. 2025

11.2 PACKAGING PRINTING MARKET, BY APPLICATION

TABLE 13 PACKAGING PRINTING MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 14 PACKAGING PRINTING MARKET SIZE, BY APPLICATION, 2018–2025 (BILLION A4 UNIT)

11.3 FOOD & BEVERAGE

11.4 HOUSEHOLD & COSMETIC PRODUCTS

11.5 PHARMACEUTICALS

11.6 OTHERS

12 PACKAGING PRINTING MARKET, BY REGION (Page No. - 83)

12.1 INTRODUCTION

TABLE 15 PACKAGING PRINTING MARKET SIZE, BY REGION, 2018–2025 (USD BILLION)

TABLE 16 PACKAGING PRINTING MARKET SIZE, BY REGION, 2018–2025 (BILLION A4 UNIT)

FIGURE 23 REGIONAL SNAPSHOT: INDIA TO BE THE FASTEST-GROWING MARKET FROM 2020 TO 2025

12.2 EUROPE

TABLE 17 EUROPE: PACKAGING PRINTING MARKET SIZE, BY COUNTRY, 2018–2025 (USD BILLION)

TABLE 18 EUROPE: PACKAGING PRINTING MARKET SIZE, BY COUNTRY, 2018–2025 (BILLION A4 UNIT)

TABLE 19 EUROPE: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 20 EUROPE: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 21 EUROPE: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 22 EUROPE: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

TABLE 23 EUROPE: PACKAGING PRINTING MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 24 EUROPE: PACKAGING PRINTING MARKET SIZE, BY APPLICATION, 2018–2025 (BILLION A4 UNIT)

12.2.1 GERMANY

12.2.1.1 Rise in domestic and international demand for printed packaging

TABLE 25 GERMANY: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 26 GERMANY: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 27 GERMANY: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 28 GERMANY: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.2.2 FRANCE

12.2.2.1 Increase in purchasing power and growth of the manufacturing industry to drive the market

TABLE 29 FRANCE: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 30 FRANCE: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 31 FRANCE: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 32 FRANCE: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.2.3 UK

12.2.3.1 Increased spending on healthcare products packaging is driving the market

TABLE 33 UK: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 34 UK: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 35 UK: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 36 UK: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.2.4 ITALY

12.2.4.1 Significant boost in the pharmaceutical industry to increase demand for packaging printing

TABLE 37 ITALY: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 38 ITALY: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 39 ITALY: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 40 ITALY: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.2.5 RUSSIA

12.2.5.1 Russia to grow at the second-highest CAGR in Europe

TABLE 41 RUSSIA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 42 RUSSIA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 43 RUSSIA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 44 RUSSIA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.2.6 SPAIN

12.2.6.1 Largest market for the manufacturing of industrial vehicles

TABLE 45 SPAIN: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 46 SPAIN: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 47 SPAIN: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 48 SPAIN: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.2.7 REST OF EUROPE

TABLE 49 REST OF EUROPE: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 50 REST OF EUROPE: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 51 REST OF EUROPE: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 52 REST OF EUROPE: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.3 NORTH AMERICA

TABLE 53 NORTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY COUNTRY, 2018–2025 (USD BILLION)

TABLE 54 NORTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY COUNTRY, 2018–2025 (BILLION A4 UNIT)

TABLE 55 NORTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 56 NORTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 57 NORTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 58 NORTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

TABLE 59 NORTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 60 NORTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY APPLICATION, 2018–2025 (BILLION A4 UNIT)

12.3.1 US

12.3.1.1 Increasing trend of retail shopping is expected to drive the market

TABLE 61 US: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 62 US: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 63 US: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 64 US: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.3.2 CANADA

12.3.2.1 Rising income level and changing lifestyle are accelerating the packaging printing demand in the country

TABLE 65 CANADA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 66 CANADA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 67 CANADA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 68 CANADA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.3.3 MEXICO

12.3.3.1 Increasing demand from the manufacturing industry to accelerate demand for packaging printing

TABLE 69 MEXICO: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 70 MEXICO: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 71 MEXICO: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 72 MEXICO: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.4 APAC

FIGURE 24 APAC: MARKET SNAPSHOT

TABLE 73 APAC: PACKAGING PRINTING MARKET SIZE, BY COUNTRY, 2018–2025 (USD BILLION)

TABLE 74 APAC: PACKAGING PRINTING MARKET SIZE, BY COUNTRY, 2018–2025 (BILLION A4 UNIT)

TABLE 75 APAC: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 76 APAC: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 77 APAC: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 78 APAC: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

TABLE 79 APAC: PACKAGING PRINTING MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 80 APAC: PACKAGING PRINTING MARKET SIZE, BY APPLICATION, 2018–2025 (BILLION A4 UNIT)

12.4.1 CHINA

12.4.1.1 Easy availability of raw materials and cheap labor to fuel market growth

TABLE 81 CHINA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 82 CHINA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 83 CHINA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 84 CHINA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.4.2 INDIA

12.4.2.1 Government investments in the food processing industry to propel market growth

TABLE 85 INDIA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 86 INDIA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 87 INDIA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 88 INDIA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.4.3 JAPAN

12.4.3.1 Increase in demand for packaged food authenticity to increase the need for packaging printing

TABLE 89 JAPAN: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 90 JAPAN: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 91 JAPAN: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 92 JAPAN: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.4.4 SOUTH KOREA

12.4.4.1 Urbanization and demand for packaged food items to boost the market

TABLE 93 SOUTH KOREA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 94 SOUTH KOREA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 95 SOUTH KOREA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 96 SOUTH KOREA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.4.5 AUSTRALIA

12.4.5.1 High acceptance of innovative & new technologies and the need for appealing packaging designs in the country

TABLE 97 AUSTRALIA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 98 AUSTRALIA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 99 AUSTRALIA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 100 AUSTRALIA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.4.6 VIETNAM

12.4.6.1 Vietnam is engaged in the import and export of food products

TABLE 101 VIETNAM: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 102 VIETNAM: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 103 VIETNAM: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 104 VIETNAM: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.4.7 REST OF APAC

TABLE 105 REST OF APAC: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 106 REST OF APAC: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 107 REST OF APAC: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 108 REST OF APAC: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.5 MIDDLE EAST & AFRICA (MEA)

TABLE 109 MEA: PACKAGING PRINTING MARKET SIZE, BY COUNTRY, 2018–2025 (USD BILLION)

TABLE 110 MEA: PACKAGING PRINTING MARKET SIZE, BY COUNTRY, 2018–2025 (BILLION A4 UNIT)

TABLE 111 MEA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 112 MEA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 113 MEA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 114 MEA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

TABLE 115 MEA: PACKAGING PRINTING MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 116 MEA: PACKAGING PRINTING MARKET SIZE, BY APPLICATION, 2018–2025 (BILLION A4 UNIT)

12.5.1 SOUTH AFRICA

12.5.1.1 Growth in the flexible packaging industry to drive demand

TABLE 117 SOUTH AFRICA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 118 SOUTH AFRICA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 119 SOUTH AFRICA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 120 SOUTH AFRICA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.5.2 UAE

12.5.2.1 Growth in the food & beverage industry to drive packaging printing demand

TABLE 121 UAE: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 122 UAE: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 123 UAE: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 124 UAE: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.5.3 SAUDI ARABIA

12.5.3.1 Growing demand for informative packaging to fuel market growth

TABLE 125 SAUDI ARABIA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 126 SAUDI ARABIA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 127 SAUDI ARABIA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 128 SAUDI ARABIA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.5.4 TURKEY

12.5.4.1 Increasing trends in the packaging industry to boost the market

TABLE 129 TURKEY: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 130 TURKEY: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 131 TURKEY: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 132 TURKEY: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.5.5 REST OF MEA

TABLE 133 REST OF MEA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 134 REST OF MEA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 135 REST OF MEA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 136 REST OF MEA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.6 SOUTH AMERICA

TABLE 137 SOUTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY COUNTRY, 2018–2025 (USD BILLION)

TABLE 138 SOUTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY COUNTRY, 2018–2025 (BILLION A4 UNIT)

TABLE 139 SOUTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 140 SOUTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 141 SOUTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 142 SOUTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

TABLE 143 SOUTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY APPLICATION, 2018–2025 (USD BILLION)

TABLE 144 SOUTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY APPLICATION, 2018–2025 (BILLION A4 UNIT)

12.6.1 BRAZIL

12.6.1.1 Government initiatives to attract investments in the packaging sector

TABLE 145 BRAZIL: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 146 BRAZIL: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 147 BRAZIL: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 148 BRAZIL: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.6.2 ARGENTINA

12.6.2.1 Expansion in the end-use industries to spur market growth

TABLE 149 ARGENTINA: PACKAGING PRINTING MARKET, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 150 ARGENTINA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 151 ARGENTINA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 152 ARGENTINA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

12.6.3 REST OF SOUTH AMERICA

TABLE 153 REST OF SOUTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (USD BILLION)

TABLE 154 REST OF SOUTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY PRINTING TECHNOLOGY, 2018–2025 (BILLION A4 UNIT)

TABLE 155 REST OF SOUTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD BILLION)

TABLE 156 REST OF SOUTH AMERICA: PACKAGING PRINTING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (BILLION A4 UNIT)

13 COMPETITIVE LANDSCAPE (Page No. - 150)

13.1 OVERVIEW

FIGURE 25 COMPANIES UNDERTOOK ACQUISITION AS A KEY GROWTH STRATEGY IN THE PACKAGING PRINTING MARKET

13.2 COMPETITIVE SCENARIO

13.2.1 ACQUISITIONS

TABLE 157 ACQUISITIONS

13.2.2 EXPANSIONS AND INVESTMENTS

TABLE 158 EXPANSIONS AND INVESTMENTS

13.2.3 NEW PRODUCT DEVELOPMENTS & TECHNOLOGICAL ADVANCEMENTS

TABLE 159 NEW PRODUCT DEVELOPMENTS & TECHNOLOGICAL ADVANCEMENTS

13.2.4 PARTNERSHIPS

TABLE 160 PARTNERSHIPS

13.3 SHARE OF KEY PLAYERS IN THE PACKAGING PRINTING MARKET

FIGURE 26 MONDI GROUP LED THE PACKAGING PRINTING MARKET IN 2019

13.4 MICROQUADRANT FOR PACKAGING PRINTING MANUFACTURERS

13.4.1 STAR

13.4.2 EMERGING LEADERS

13.4.3 PERVASIVE

13.4.4 EMERGING COMPANIES

FIGURE 27 PACKAGING PRINTING MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2019

13.5 COMPETITIVE BENCHMARKING

13.5.1 STRENGTH OF PRODUCT PORTFOLIO

13.5.2 BUSINESS STRATEGY EXCELLENCE

14 COMPANY PROFILES (Page No. - 159)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

14.1 MONDI PLC

TABLE 161 MONDI PLC: MAJOR MANUFACTURING SITES LOCATION

FIGURE 28 MONDI PLC: COMPANY SNAPSHOT

FIGURE 29 MONDI PLC: SWOT ANALYSIS

FIGURE 30 WINNING IMPERATIVES: MONDI PLC

14.2 SONOCO PRODUCTS COMPANY

TABLE 162 NET SALES OF THE BUSINESS SEGMENTS FOR YEAR ENDED DECEMBER 31, 2019 (USD BILLION)

TABLE 163 SONOCO PRODUCT COMPANY: MAJOR MANUFACTURING SITES

FIGURE 31 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

FIGURE 32 SONOCO PRODUCTS COMPANY: SWOT ANALYSIS

FIGURE 33 SONOCO PRODUCT COMPANY: WINNING IMPERATIVES

14.3 GRAPHICS PACKAGING HOLDING COMPANY

FIGURE 34 GRAPHICS PACKAGING HOLDINGS COMPANY: COMPANY SNAPSHOT

FIGURE 35 GRAPHICS PACKAGING HOLDING COMPANY: SWOT ANALYSIS

FIGURE 36 GRAPHICS PACKAGING HOLDINGS COMPANY: WINNING IMPERATIVES

14.4 QUAD/GRAPHICS, INC.

FIGURE 37 QUAD/GRAPHICS, INC.: COMPANY SNAPSHOT

FIGURE 38 QUAD/GRAPHICS, INC.: SWOT ANALYSIS

FIGURE 39 QUAD/GRAPHICS, INC.: WINNING IMPERATIVES

14.5 AMCOR LIMITED

FIGURE 40 AMCOR LIMITED: COMPANY SNAPSHOT

FIGURE 41 AMCOR LIMITED.: SWOT ANALYSIS

FIGURE 42 AMCOR LIMITED: WINNING IMPERATIVES

14.6 CONSTANTIA FLEXIBLES GMBH

TABLE 164 CONSTANTIA FLEXIBLES GMBH: MAJOR MANUFACTURING SITES

FIGURE 43 CONSTANTIA FLEXIBLES GMBH: COMPANY SNAPSHOT

TABLE 165 PRODUCT-BASED PRINTING TECHNOLOGIES

FIGURE 44 CONSTANTIA FLEXIBLES: SWOT ANALYSIS

14.7 QUANTUM PRINT AND PACKAGING LTD.

14.8 WS PACKAGING GROUP, INC.

14.9 KIDO PACKAGING CORPORATION

14.10 TOPPAN PRINTING CO., LTD.

FIGURE 45 TOPPAN PRINTING CO., LTD.: COMPANY SNAPSHOT

FIGURE 46 TOPPAN PRINTING CO., LTD.: SWOT ANALYSIS

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

14.11 OTHER COMPANIES

14.11.1 DUNCAN PRINTING GROUP

14.11.2 BELMONT PACKAGING

14.11.3 SHREE ARUN PACKAGING CO. (SAPCO)

14.11.4 THE SAINT PETERSBURG EXEMPLARY PRINTING HOUSE

14.11.5 FLEXO PRINT GMBH

14.11.6 COVERIS

14.11.7 ROTOSTAMPA S.R.L.

14.11.8 QUANTUM PACKAGING

14.11.9 SALMAN GROUP

15 APPENDIX (Page No. - 199)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

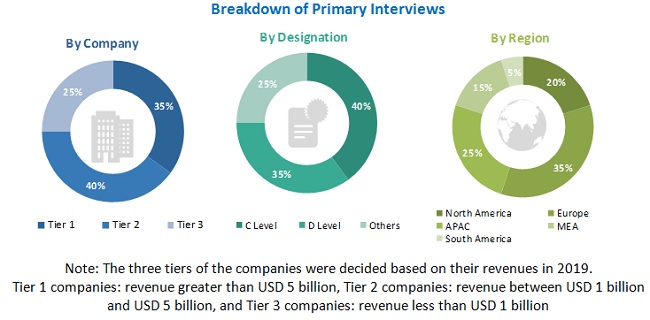

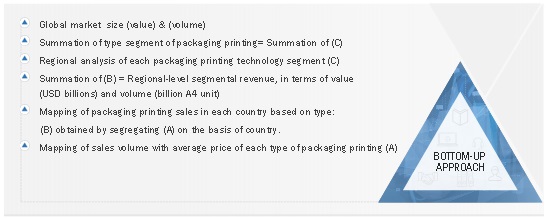

The study involved four major activities for estimating the current global size of the packaging printing market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of packaging printing through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the packaging printing market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the packaging printing market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the packaging printing market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the packaging printing industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the packaging printing market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the packaging printing market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the packaging printing market in terms of value and volume based on type, technology, ink, application, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product developments, expansions & investments, acquisitions, and agreements in the packaging printing market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the packaging printing report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the packaging printing market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Packaging Printing Market