Food Diagnostics Market by Type (Systems, Test Kits, and Consumables), Testing Type (Safety and Quality), Site (Outsourcing Facility and Inhouse), Food Tested (Meat, Poultry & Seafood, Dairy Products, Processed Food) and Region - Global Forecast to 2028

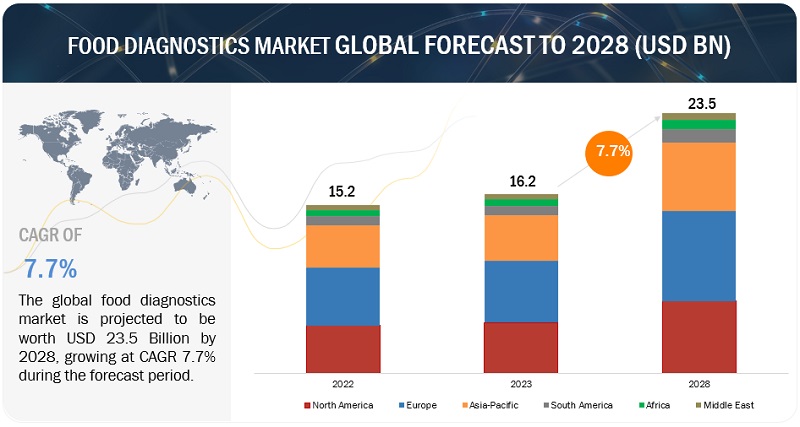

[423 Pages Report] The global food diagnostics market is estimated to be valued at USD 16.2 billion in 2023 and is projected to reach USD 23.5 billion by 2028, at a CAGR of 7.7% from 2023 to 2028.

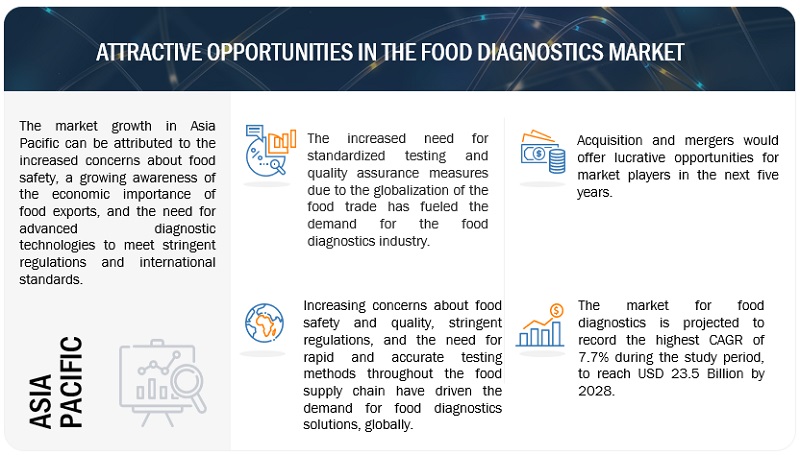

The demand for food diagnostic solutions has surged as consumers and regulatory bodies become more vigilant about food safety and quality. This market is characterized by a wide range of products, including systems, test kits, and consumables, each contributing significantly to its expansion. The growth can be attributed to the need for rapid and accurate detection of allergens, contaminants, pathogens, and adulterants in food products. One of the major factors driving the food diagnostics market is the globalization of the food trade. As the food supply chain extends across international borders, the need for robust diagnostic systems has grown exponentially. Food producers and exporters must comply with various food safety regulations and quality standards in different countries. This has led to increased adoption of advanced diagnostic tools to ensure that products meet diverse and often stringent requirements, fostering market growth.

However, alongside these opportunities, the food diagnostics market also faces challenges due to the differences in food safety and quality laws across countries. Navigating the complex regulatory landscape can be daunting for businesses, and harmonizing global food safety standards remains a significant challenge.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Increasing cases of food recalls

The rise in food recalls has been a major driver for the food diagnostics industry, spurred by concerns about food safety and consumer health. When contaminated or unsafe food products enter the market, the consequences can be severe, leading to illnesses, hospitalizations, and even fatalities. This heightened awareness of food safety issues has prompted both regulatory bodies and food manufacturers to invest in advanced diagnostic technologies. These technologies enable rapid and accurate detection of contaminants, pathogens, allergens, and adulterants, reducing the risk of tainted food reaching consumers. Furthermore, the financial and reputational costs associated with food recalls have incentivized companies to adopt cutting-edge diagnostic solutions to minimize the chances of such incidents, thereby fostering the growth of the food diagnostics market.

Restraints: Lack of basic supporting infrastructure in developing countries

In many developing countries of the world, the absence of adequate facilities, such as well-equipped laboratories and skilled personnel, poses a substantial hurdle to effective food diagnostics. The limited access to state-of-the-art testing equipment, diagnostic kits, and a reliable cold chain for sample transportation can impede the accurate and timely assessment of food safety, thereby increasing the risk of foodborne illnesses and outbreaks. Additionally, poor data collection and management systems hinder the surveillance and monitoring of foodborne pathogens. To address these challenges, investment in infrastructure, capacity building, and technology transfer is imperative, ensuring that the benefits of advanced food diagnostics reach even the most resource-constrained regions, ultimately safeguarding public health and global food supply chains.

Opportunities: Increased budget allocation and expenditure on food safety

Governments, regulatory bodies, and food industry stakeholders across the globe have recognized the critical importance of ensuring the safety and quality of the food supply chain. This recognition has resulted in a substantial upswing in investments in food safety measures, creating a fertile ground for innovation and growth within the food diagnostics market. The development and adoption of advanced technologies, such as DNA-based testing and rapid pathogen detection, have gained significant traction, enabling more precise and efficient monitoring of food products from farm to fork. Additionally, the growing c awareness regarding foodborne illnesses and demand for transparency by consumers in the food supply chain has further fueled the need for robust food diagnostics solutions, presenting a myriad of opportunities for companies to develop cutting-edge diagnostic tools and services. In this evolving landscape, the food diagnostics market is poised for substantial expansion, offering promising prospects for improved food safety and quality.

Challenges: Complexity in the quantification of test results

The demand for accurate and reliable food safety testing has surged, driven by increasing consumer awareness and stricter regulatory requirements. However, achieving precise quantification of contaminants, pathogens, and allergens in food products has proven to be a formidable task. Complex food matrices, such as dairy, meat, and processed foods, can interfere with traditional testing methods, leading to false positives or negatives. Moreover, the diversity of food samples, from raw ingredients to finished products, requires adaptable testing approaches. The dynamic nature of foodborne pathogens and emerging contaminants further exacerbates the challenge. Analytical techniques have had to evolve to keep pace with these complexities, leading to increased research and development costs and the need for highly skilled personnel. These challenges not only hinder the efficiency of food diagnostics but also have significant implications for public health and the global food industry's integrity. Addressing the quantification complexities in food diagnostics remains a top priority for researchers and industry professionals alike.

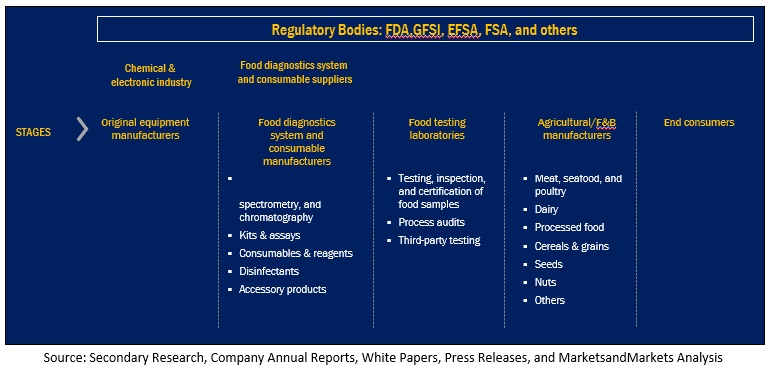

Food Diagnostics Market: Value Chain Analysis

Ecosystem Analysis

The market ecosystem for food diagnostics encompasses various stakeholders and components involved in the production, distribution, and end users of food diagnostics products. Various regulatory bodies are also involved in this market, and they are one of the significant stakeholders.

Ecosystem Map

Based on food tested, the meat, poultry, and seafood segment is estimated to account for the largest market share of the food diagnostics market.

Foodborne illnesses and contamination outbreaks are a recurring global concern, which often find their origin in these protein-rich categories. Ensuring the safety and quality of meat, poultry, and seafood is crucial to prevent widespread health hazards and maintain consumer confidence. Furthermore, meat, poultry, and seafood play a pivotal role in the food industry, contributing significantly to the market's revenue. As staples in diets worldwide, they command a substantial portion of consumer expenditure, making their quality and safety of utmost importance. Thus, monitoring these items for pathogens, allergens, chemical residues, and other contaminants is crucial for both consumer safety and the industry's economic stability.

Globalization of the food supply chain has made it necessary to address international regulations and standards. Compliance with stringent regulations, such as Hazard Analysis and Critical Control Points (HACCP), ISO standards, and national food safety guidelines, is mandatory for manufacturers and exporters. This has driven the need for advanced food diagnostics techniques in meat, poultry, and seafood.

Based on the testing type, the safety segment is anticipated to dominate as well as grow at the highest CAGR in the food diagnostics market.

The safety sub-segment is poised to dominate and experience the highest growth within the testing type segment of the food diagnostics market. Food safety testing is a critical component of the global food industry, ensuring that the products we consume are safe for human consumption. In recent times, it has become even more prioritized than food quality testing, given the increasing concerns over foodborne illnesses and outbreaks. Food safety testing involves various techniques to detect contaminants, pathogens, and chemical residues in food products, protecting consumers from potential health hazards. Contaminants, such as pathogens like Salmonella and E. coli, as well as chemical residues and allergens, can pose severe health risks. Hence, stringent regulatory requirements and increased awareness have propelled the demand for robust testing methods. Moreover, in the era of globalization and complex supply chains, food safety testing has gained prominence to prevent outbreaks, safeguard public health, and maintain the reputation of food manufacturers.

By site, the outsourcing facility segment is estimated to dominate as well as grow at the highest CAGR in the food diagnostics market.

Outsourcing facilities refer to third-party laboratories and testing centers that food manufacturers and distributors contract to conduct food safety and quality assessments, instead of relying on in-house testing. Outsourcing facility offers cost-effective solutions for businesses. Establishing and maintaining an in-house testing facility demands significant capital investment, technical expertise, and ongoing operational costs. Outsourcing allows companies to save on these expenditures and allocate resources more efficiently. Additionally, the complexity of food safety regulations and standards has grown significantly in recent years. Outsourcing facilities specialize in staying up-to-date with these evolving regulations and can provide expertise that is often challenging to maintain inhouse. This ensures that food products are compliant with stringent requirements.

Moreover, outsourcing enhances flexibility and scalability. Food manufacturers can adapt to fluctuations in demand by adjusting the scope of testing services as needed, without the constraints of in-house capabilities. As food safety remains a paramount concern for consumers and regulatory bodies, the convenience, cost-efficiency, and specialized expertise offered by outsourcing facilities make them a preferred choice, thus fueling their substantial growth within the food diagnostics market.

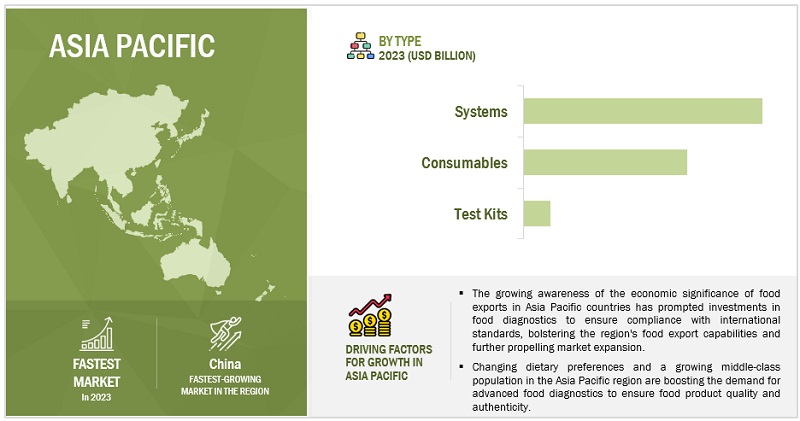

Asia Pacific is estimated to grow at the highest CAGR in the global food diagnostics market.

Asia Pacific region is experiencing a significant population expansion, urbanization, and a rise in disposable income. The region's rapidly growing population, particularly in countries like China and India, has led to increased food consumption. With this upsurge in demand, the need for effective food safety and quality testing has become paramount. As more people migrate to urban centers, the demand for processed and packaged foods is increasing. This burgeoning demand for food products necessitates stringent quality control and safety measures, which are driving the growth of the food diagnostics market.

Furthermore, the food supply chain in the Asia Pacific is becoming increasingly complex, with globalization and the expansion of international trade. This complexity necessitates comprehensive testing and monitoring throughout the supply chain, from farm to fork. As a result, food diagnostics solutions are gaining importance in ensuring the safety and quality of products.

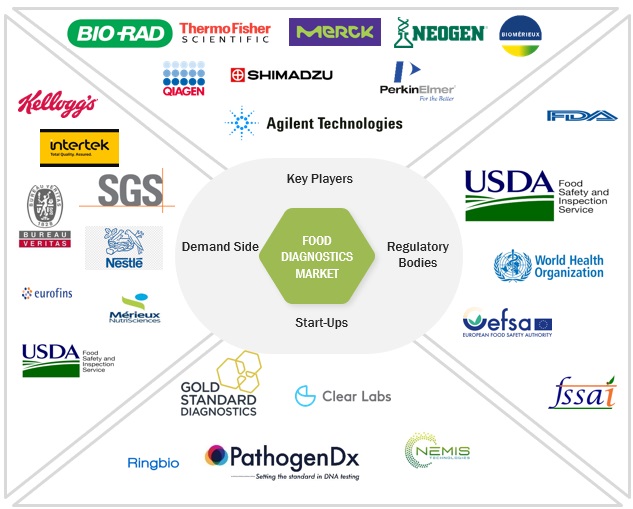

Key Market Players

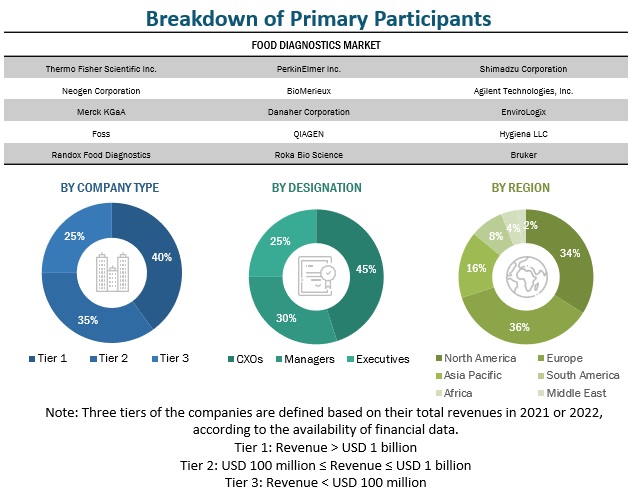

Bio-Rad Laboratories Inc. (US), Thermo Fisher Scientific Inc. (US), Shimadzu Corporation (Japan), Neogen Corporation (US), BioMerieux (France), Agilent Technologies Inc. (US), Merck KGaA (Germany), QIAGEN (Germany), Bruker (US), and Danaher (US) are among the key players in the global food diagnostics market. To increase their company's revenues and market shares, companies are focusing on launching new products, developing partnerships, and acquiring other companies. The key strategies used by companies in the food diagnostics market include geographical expansion to tap the potential of emerging economies, strategic acquisitions to gain a foothold over the extensive supply chain, and new product launches as a result of extensive research and development (R&D) initiatives.

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments Covered |

By Type, By Testing Type, By Site, By Food Tested, and By Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, Africa, and Middle East |

|

Companies studied |

|

Food Diagnostics Market:

By Type

- Systems

- Test Kits

- Consumables

By Testing Type

- Safety

- Quality

By Site

- Outsourcing Facility

- Inhouse

By Food Tested

- Meat, poultry, and seafood

- Dairy products

- Processed food

- Fruits & vegetables

- Cereals, grains, and pulses

- Nuts, seeds, and spices

- Other food tested

By Region

- North America

- Europe

- Asia Pacific

- South America

- Africa

- Middle East

Recent Developments

- In June 2023, Agilent Technologies, Inc. (US) introduced the 6495 triple quadrupole LC/MS system, designed specifically to cater to the needs of research and testing laboratories dealing with high-volume sample processing. Utilizing state-of-the-art iFunnel technology, this system achieves exceptional sensitivity with remarkably low detection limits, even when dealing with challenging analytes in complex sample matrices like omics, food, and environmental samples. Importantly, it maintains precision by utilizing sub-millisecond dwell times. This system effectively addresses the increasing demand for precise food safety and quality control measures, positioning Agilent as a prominent player in the market and reinforcing its reputation as a reliable provider of cutting-edge analytical instruments for food analysis and diagnostics.

- In September 2022, Neogen Corporation (US) successfully completed its merger with 3M's (US) Food Safety business, marking a significant step in creating a pioneering presence in the food safety industry. The merger's primary objective is to leverage the prevailing trends in sustainability, food safety, and supply chain integrity. This strategic union has empowered Neogen Corporation with an expanded geographical reach, an array of innovative product offerings, enhanced digital capabilities, and greater financial flexibility within the realm of food diagnostics.

- In May 2022, Thermo Fisher Scientific Inc. (US) formed a strategic partnership with LabShares Newton (US) to bolster the Boston biotech ecosystem. This collaboration aims to supply cutting-edge instruments, laboratory equipment, and essential consumables to support emerging life sciences companies in their pursuit of advancing drug discovery. Thermo Fisher Scientific Inc. will furnish fully equipped laboratory spaces, offer comprehensive services, and provide necessary equipment to more than 25 biotech firms, streamlining the process of bringing innovative therapeutics to market. The shared laboratory space will be outfitted with crucial tools, such as microscopes and PC instruments. This cooperation not only offers biotech companies access to state-of-the-art equipment but also allows Thermo Fisher Scientific Inc. to gain valuable insights into the changing requirements and challenges of the food diagnostics market. By establishing closer relationships with early-stage life sciences firms involved in food safety research and development, Thermo Fisher Scientific Inc. can further enhance its understanding of this field.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share of the food diagnostics market?

The Europe region accounted for the largest share, in terms of value, of USD 5.2 billion, of the global food diagnostics market in 2022 and is expected to grow.

What is the current size of the global food diagnostics market?

The food diagnostics market is estimated at USD 16.2 billion in 2023 and is projected to reach USD 23.5 billion by 2028, at a CAGR of 7.7% from 2023 to 2028.

What are the key players in the market?

The key players in this market include Bio-Rad Laboratories Inc. (US), Thermo Fisher Scientific Inc. (US), Shimadzu Corporation (Japan), Neogen Corporation (US), BioMerieux (France), Agilent Technologies Inc. (US), Merck KGaA (Germany), QIAGEN (Germany), Bruker (US), and Danaher (US).

What are the factors driving the food diagnostics market?

Increasing cases of food recalls and increasing instances of foodborne illnesses.

Which segment by food tested accounted for the largest food diagnostics market share?

The meat, poultry, and seafood segment dominated the market for food diagnostics market and was valued at USD 4.8 billion in 2022. This is due to the perishable nature of these products.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSGLOBALIZATION OF FOOD TRADERISE IN CONSUMER HEALTH AWARENESS

-

5.3 MARKET DYNAMICSDRIVERS- Increase in incidences of foodborne illnesses- Initiatives by regulatory bodies and governments to improve food safety across regions- Increase in cases of food recallsRESTRAINTS- Lack of basic supporting infrastructure in emerging economiesOPPORTUNITIES- Technological innovations in testing- Increase in budget allocation and expenditure on food safety- Growth in food trade and regulations to combat outbreaks in emerging economiesCHALLENGES- High cost of rapid technologies (hybridization-based, spectrometry-based)- Complexity in quantification of test results- Standardization of testing protocols

- 6.1 INTRODUCTION

-

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

-

6.3 VALUE CHAIN ANALYSISRAW MATERIALSFOOD MILLSDISTRIBUTION

- 6.4 SUPPLY CHAIN ANALYSIS

-

6.5 TECHNOLOGY ANALYSISUPCOMING TECHNOLOGIES IN FOOD DIAGNOSTICS MARKET- Microarray- Phages- Biochip- Biosensors- Flow Cytometry- NMR- NIRS- ICP

- 6.6 MARKET MAPPING

- 6.7 TRADE ANALYSIS

-

6.8 PATENT ANALYSIS

-

6.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.10 CASE STUDY ANALYSIS

-

6.11 PRICING ANALYSISAVERAGE SELLING PRICE, BY KEY PLAYERAVERAGE SELLING PRICE, BY TYPEAVERAGE SELLING PRICE, BY REGION

-

6.12 REGULATORY FRAMEWORKREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.13 NORTH AMERICA: REGULATIONSUS REGULATIONS- Federal legislationCANADAMEXICO

-

6.14 EUROPEEUROPEAN UNION REGULATIONS- Microbiological Criteria Regulation- Melamine Legislation- General Food Law for Food Safety- GMOs Regulation- Regulations on ToxinsGERMANYUK- Mycotoxin Regulations in UKFRANCEITALYPOLAND

-

6.15 ASIA PACIFICCHINA- Regulating Bodies for Food Safety in China- Major Efforts of China to Standardize its Food Safety SystemJAPANINDIA- Food Safety Standards Amendment Regulations, 2012- Food Safety and Standards Amendment Regulations, 2011- Food Safety and Standards Act, 2006AUSTRALIA- Food Standards Australia and New ZealandNEW ZEALAND- GMO Labeling Regulation in Asia PacificINDONESIA- General Law for Food SafetyREGULATIONS ON PESTICIDESREGULATIONS ON MYCOTOXINS IN FOODCHEMICAL CONTAMINANTSGENETICALLY ENGINEERED FOODSREGULATIONS ON ALLERGEN LABELING IN FOOD

-

6.16 REST OF THE WORLDSOUTH AFRICA- International vs. Local Standards & Legislations- Private Standards in South Africa & Requirements for Product TestingBRAZIL- Ministry of Agriculture, Livestock, and Food Supply (MAPA)- Ministry of Health (MS)ARGENTINA

-

6.17 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.18 KEY CONFERENCES AND EVENTS, 2023–2024

- 7.1 INTRODUCTION

-

7.2 INHOUSEIMPROVED QUALITY AND FASTER TURNAROUND TIMES OF TESTING TO DRIVE GROWTH OF INHOUSE FOOD DIAGNOSTICS LABORATORIES

-

7.3 OUTSOURCING FACILITYREDUCED OPERATIONAL EXPENSES AND OVERHEAD COSTS TO FUEL DEMAND FOR OUTSOURCING FACILITIES

- 8.1 INTRODUCTION

-

8.2 SYSTEMSDEMAND FOR HIGHER FOOD SAFETY STANDARDS AND RAPID TECHNOLOGIES TO DRIVE MARKETHYBRIDIZATION-BASED- High level of accuracy and reliability of hybridization-based systems to drive its demand- Polymerase Chain Reaction (PCR)- Microarrays- Gene amplifiers- SequencersCHROMATOGRAPHY-BASED- Chromatography-based systems to detect broad range of analytes, including contaminants, pesticides, mycotoxins, and flavor compounds- High-Performance Liquid Chromatography (HPLC)- Liquid Chromatography (LC)- Gas Chromatography (GC)- Other Chromatography-based TechnologiesSPECTROMETRY-BASED- Spectrometry-based systems to provide non-destructive testing, minimal sample preparation, and reduce wasteIMMUNOASSAY-BASED- Growing demand for ELISA for food safety analysis to drive immunoassay-based systemsBIOSENSORS- Ease of application and simple methodology for performing safety tests to drive growthOTHER SYSTEMS

-

8.3 TEST KITSACCESSIBILITY, COST-EFFICIENCY, AND EASE OF USE IN TESTING KITS TO DRIVE MARKET

-

8.4 CONSUMABLESNEED TO MAINTAIN STERILITY AND PROVIDE PRECISION & EFFICIENCY IN FOOD DIAGNOSTICS PROCESS TO DRIVE MARKETREAGENTS- Rise in use of reagents alongside diagnostic systems to drive demand for testing food samplesTEST ACCESSORIES- Need for precision and efficiency in testing processes to drive growth for test accessoriesDISINFECTANTS- Need to maintain sterile and hygienic environments during food safety tests to drive demand for disinfectantsOTHER CONSUMABLES

- 9.1 INTRODUCTION

-

9.2 MEAT, POULTRY, AND SEAFOODRISING GLOBAL CONSUMPTION OF MEAT, POULTRY, AND SEAFOOD AND INCREASING CONTAMINATION TO DRIVE MARKET

-

9.3 DAIRY PRODUCTSRISING FOODBORNE ILLNESSES AND NEED TO FILTER ADDITIVES TO FUEL DEMAND FOR FOOD DIAGNOSTICS IN DAIRY PRODUCTS

-

9.4 PROCESSED FOODMICROBIAL CONTAMINATION AND NEED TO PREVENT ILLNESSES AND CHEMICAL HAZARDS TO DRIVE MARKET

-

9.5 FRUITS & VEGETABLESNEED TO PREVENT RECALLS DUE TO CONTAMINATION AND HARMFUL PESTICIDES TO FUEL DEMAND IN FRUITS AND VEGETABLES

-

9.6 CEREALS, GRAINS, AND PULSESHIGH RISK OF CONTAMINATION RELATED TO PESTICIDES AND MYCOTOXINS TO DRIVE DEMAND FOR FOOD DIAGNOSTICS

-

9.7 NUTS, SEEDS, AND SPICESNEED TO FILTER HARMFUL SUBSTANCES AND CONTAMINANTS FROM NUTS, SEEDS, AND SPICES TO DRIVE MARKET

- 9.8 OTHER FOOD TESTED

- 10.1 INTRODUCTION

-

10.2 QUALITYINCREASED EMPHASIS ON PRODUCT LABELING AND TRANSPARENCY TO DRIVE MARKET FOR FOOD QUALITY TESTING SOLUTIONSSHELF-LIFE TESTING- Need to prevent food spoilage, reduce waste, and safeguard consumer health to drive demand for shelf-life testingNUTRITIONAL ANALYSIS- Consumer health awareness and regulatory compliance to propel growth of food diagnostics solutions for nutritional analysisFLAVOR AND AROMA ANALYSIS- Flavor and aroma analysis to ensure quality of food productsTEXTURE AND VISCOSITY TESTING- Ability to enhance sensory satisfaction to drive demand for food diagnostics solutions for texture and viscosity testing

-

10.3 SAFETYGROWING PREVALENCE OF FOODBORNE ILLNESSES TO DRIVE MARKET FOR FOOD SAFETY TESTING SOLUTIONSPATHOGEN TESTING- Need to identify harmful microorganisms and prevent foodborne illnesses to drive demand for pathogen testingALLERGEN TESTING- Growth in awareness of food allergies to drive demand for food diagnostics solutionsTOXIN TESTING- Consumer awareness and demand for toxin-free products to spur demand for food diagnostics solutions for toxin testingPESTICIDE RESIDUE TESTING- Global trade and export compliance to drive demand for food diagnostics solutions for pesticide residue testing

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Stringent food safety regulations and technological advancements in US to drive marketCANADA- Growing food industry and government initiatives to prevent potential food risks in Canada to propel market growthMEXICO- Strong agricultural trade partnership with US to lead to increased demand for better food diagnostics systems in Mexico

-

11.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Multiple foodborne illness outbreaks and environmental factors to fuel market growth in GermanyUK- Government commitment to food safety and combating food crime to drive UK’s food diagnostics marketFRANCE- Food recall incidents and consumer awareness to drive surge in French food diagnostics marketITALY- Substantial investments and stringent regulations to propel growth of food diagnostics market in ItalySPAIN- Rise in Salmonella and Yersinia outbreaks in Spain to drive food diagnostics marketPOLAND- Rise in poultry production and exports to drive Poland’s food diagnostics marketREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Shift from wet markets to supermarkets or eCommerce channels to cause food diagnostics to play major role in ChinaINDIA- Export rejections and government initiatives to drive growth of food diagnostics market in IndiaJAPAN- Safety concerns in seafood industry to propel adoption of food diagnosticsAUSTRALIA & NEW ZEALAND- Allergen mitigation and proactive initiatives to drive food diagnostics market in Australia and New ZealandSOUTH KOREA- Heavy reliance on food imports to augment South Korea’s food diagnostics adoptionREST OF ASIA PACIFIC

-

11.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- International trade disputes and global food safety standards to drive growth of food diagnostics market in BrazilARGENTINA- Rise in foodborne illnesses to lead to increase in food testing practices and diagnostics in ArgentinaREST OF SOUTH AMERICA

-

11.6 MIDDLE EASTRELIANCE IN FOOD IMPORTS AND GROWTH IN EXPORTS TO FUEL FOOD DIAGNOSTICS MARKET IN MIDDLE EAST

-

11.7 AFRICAAFRICA: RECESSION IMPACT ANALYSISSOUTH AFRICA- History of listeriosis outbreak to drive surge of South African food diagnostics marketREST OF AFRICA

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS

- 12.3 SEGMENTAL REVENUE ANALYSIS FOR KEY PLAYERS

- 12.4 KEY PLAYER ANNUAL REVENUE VS. GROWTH

- 12.5 KEY PLAYERS EBIT/EBITDA

- 12.6 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

12.8 KEY COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

12.9 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

-

12.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERSTHERMO FISHER SCIENTIFIC INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBIO-RAD LABORATORIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNEOGEN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHIMADZU CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBIOMÉRIEUX- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAGILENT TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewQIAGEN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBRUKER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDANAHER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPERKINELMER INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFOSS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHYGIENA LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewR-BIOPHARM AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROMER LABS DIVISION HOLDING- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

13.2 STARTUPS/SMESENVIROLOGIX- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRANDOX FOOD DIAGNOSTICS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPROMEGA CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPATHOGENDX CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROKA BIO SCIENCE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOLD STANDARD DIAGNOSTICSCLEAR LABS, INC.RING BIOTECHNOLOGY CO LTD.NEMIS TECHNOLOGIES AGBIOREX FOOD DIAGNOSTICS

- 14.1 INTRODUCTION

- 14.2 RESEARCH LIMITATIONS

-

14.3 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKETMARKET DEFINITIONMARKET OVERVIEWFOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITEFOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION

-

14.4 FOOD SAFETY TESTING MARKETMARKET DEFINITIONMARKET OVERVIEWFOOD SAFETY TESTING MARKET, BY TECHNOLOGYFOOD SAFETY TESTING MARKET, BY REGION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 FOOD DIAGNOSTICS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 US: FOODBORNE OUTBREAKS, 2021–2023

- TABLE 4 FOOD DIAGNOSTICS MARKET: ECOSYSTEM

- TABLE 5 TOP 10 EXPORTERS OF DIAGNOSTIC OR LABORATORY REAGENTS, 2022 (USD THOUSAND)

- TABLE 6 TOP 10 IMPORTERS OF DIAGNOSTIC OR LABORATORY REAGENTS, 2022 (USD THOUSAND)

- TABLE 7 KEY PATENTS ABOUT FOOD DIAGNOSTICS MARKET, 2021–2023

- TABLE 8 PORTER’S FIVE FORCES IMPACT ON FOOD DIAGNOSTICS MARKET

- TABLE 9 BCN RESEARCH LABORATORIES IMPROVED PATHOGEN DETECTION WITH BIOMÉRIEUX’S GENE-UP

- TABLE 10 EUROFINS MICROBIOLOGY LABORATORY NETWORK IMPLEMENTED RHEONIX LISTERIA PATTERNALERT

- TABLE 11 AVERAGE SELLING PRICES OF FOOD DIAGNOSTIC UNITS, BY TYPE, 2019–2023 (USD/UNIT)

- TABLE 12 AVERAGE SELLING PRICES OF FOOD DIAGNOSTIC SYSTEMS, BY REGION, 2019–2023 (USD/UNIT)

- TABLE 13 AVERAGE SELLING PRICES OF FOOD DIAGNOSTIC TEST KITS, BY REGION, 2019–2023 (USD/UNIT)

- TABLE 14 AVERAGE SELLING PRICES OF FOOD DIAGNOSTIC CONSUMABLES, BY REGION, 2019–2023 (USD/UNIT)

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 FEDERAL FOOD, DRUG, AND COSMETIC ACT, BY TOLERANCE OF RAW & PROCESSED FOOD

- TABLE 19 MAXIMUM ACCEPTED LEVELS OF AFLATOXIN, BY PRODUCT

- TABLE 20 NORTH AMERICA: REGULATORY COMPLIANCE DATES

- TABLE 21 MAXIMUM LEVEL FOR MELAMINE & ITS STRUCTURAL ANALOGS

- TABLE 22 GMOS: LABELING REQUIREMENT

- TABLE 23 COMMISSION REGULATION FOR OCHRATOXIN A

- TABLE 24 MAXIMUM LEVELS OF MYCOTOXINS, BY FOODSTUFF

- TABLE 25 GMOS LABELING IN ASIA PACIFIC COUNTRIES

- TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FOOD DIAGNOSTICS TYPES

- TABLE 27 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 28 FOOD DIAGNOSTICS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 29 FOOD DIAGNOSTICS MARKET, BY SITE, 2019–2022 (USD MILLION)

- TABLE 30 FOOD DIAGNOSTICS MARKET, BY SITE, 2023–2028 (USD MILLION)

- TABLE 31 INHOUSE FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 INHOUSE FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 OUTSOURCING FACILITY-BASED FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 OUTSOURCING FACILITY-BASED FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 36 FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 38 FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 39 FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 40 FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 41 FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 44 FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 45 HYBRIDIZATION-BASED FOOD DIAGNOSTICS SYSTEMS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 HYBRIDIZATION-BASED FOOD DIAGNOSTICS SYSTEMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 HYBRIDIZATION-BASED FOOD DIAGNOSTICS SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 48 HYBRIDIZATION-BASED FOOD DIAGNOSTICS SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 49 CHROMATOGRAPHY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 CHROMATOGRAPHY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 CHROMATOGRAPHY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 52 CHROMATOGRAPHY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 53 SPECTROMETRY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 SPECTROMETRY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 IMMUNOASSAY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 IMMUNOASSAY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 FOOD DIAGNOSTIC BIOSENSORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 FOOD DIAGNOSTIC BIOSENSORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 OTHER FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 OTHER FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 FOOD DIAGNOSTIC TEST KITS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 FOOD DIAGNOSTIC TEST KITS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 FOOD DIAGNOSTIC TEST KITS MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 64 FOOD DIAGNOSTIC TEST KITS MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 65 FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 66 FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 67 FOOD DIAGNOSTIC CONSUMABLES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 FOOD DIAGNOSTIC CONSUMABLES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 FOOD DIAGNOSTIC CONSUMABLES MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 70 FOOD DIAGNOSTIC CONSUMABLES MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 71 FOOD DIAGNOSTIC REAGENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 FOOD DIAGNOSTIC REAGENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 FOOD DIAGNOSTIC TEST ACCESSORIES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 74 FOOD DIAGNOSTIC TEST ACCESSORIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 FOOD DIAGNOSTIC DISINFECTANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 FOOD DIAGNOSTIC DISINFECTANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 OTHER FOOD DIAGNOSTIC CONSUMABLES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 OTHER FOOD DIAGNOSTIC CONSUMABLES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2019–2022 (USD MILLION)

- TABLE 80 FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 81 PRODUCTION OF MEAT, BY REGION, 2000–2020 (THOUSAND TONS)

- TABLE 82 MEAT, POULTRY, AND SEAFOOD: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 83 MEAT, POULTRY, AND SEAFOOD: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 DAIRY PRODUCTS: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 85 DAIRY PRODUCTS: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 PROCESSED FOOD: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 87 PROCESSED FOOD: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 FRUITS & VEGETABLES: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 FRUITS & VEGETABLES: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 CEREALS, GRAINS, AND PULSES: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 91 CEREALS, GRAINS, AND PULSES: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 92 NUTS, SEEDS, AND SPICES: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 NUTS, SEEDS, AND SPICES: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 OTHER FOOD TESTED: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 95 OTHER FOOD TESTED: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 96 FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 97 FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 98 QUALITY: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 99 QUALITY: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 100 QUALITY: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 101 QUALITY: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 102 SHELF-LIFE TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 103 SHELF-LIFE TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 104 NUTRITIONAL ANALYSIS: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 105 NUTRITIONAL ANALYSIS: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 106 FLAVOR & AROMA ANALYSIS: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 107 FLAVOR & AROMA ANALYSIS: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 108 TEXTURE & VISCOSITY TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 109 TEXTURE & VISCOSITY TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 110 SAFETY: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 111 SAFETY: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 112 SAFETY: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 113 SAFETY: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 114 PATHOGEN TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 115 PATHOGEN TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 116 ALLERGEN TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 117 ALLERGEN TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 118 TOXIN TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 119 TOXIN TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 120 PESTICIDE RESIDUE TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 121 PESTICIDE RESIDUE TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 122 FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 123 FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 124 FOOD DIAGNOSTICS MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 125 FOOD DIAGNOSTICS MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 126 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 127 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 128 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019–2022 (MILLION UNITS)

- TABLE 129 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 130 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 131 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 133 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 134 NORTH AMERICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 135 NORTH AMERICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SITE, 2019–2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SITE, 2023–2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2019–2022 (USD MILLION)

- TABLE 147 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 148 US: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 149 US: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 150 US: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 151 US: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 152 CANADA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 153 CANADA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 154 CANADA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 155 CANADA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 156 MEXICO: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 157 MEXICO: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 158 MEXICO: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 159 MEXICO: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 160 EUROPE: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 161 EUROPE: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 162 EUROPE: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019–2022 (MILLION UNITS)

- TABLE 163 EUROPE: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 164 EUROPE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 165 EUROPE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 166 EUROPE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 167 EUROPE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 168 EUROPE: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 169 EUROPE: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 170 EUROPE: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 171 EUROPE: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 172 EUROPE: FOOD DIAGNOSTICS MARKET, BY SITE, 2019–2022 (USD MILLION)

- TABLE 173 EUROPE: FOOD DIAGNOSTICS MARKET, BY SITE, 2023–2028 (USD MILLION)

- TABLE 174 EUROPE: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 175 EUROPE: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 176 EUROPE: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 177 EUROPE: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 178 EUROPE: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 179 EUROPE: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 180 EUROPE: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2019–2022 (USD MILLION)

- TABLE 181 EUROPE: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 182 GERMANY: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 183 GERMANY: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 184 GERMANY: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 185 GERMANY: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 186 UK: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 187 UK: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 188 UK: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 189 UK: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 190 FRANCE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 191 FRANCE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 192 FRANCE: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 193 FRANCE: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 194 ITALY: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 195 ITALY: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 196 ITALY: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 197 ITALY: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 198 SPAIN: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 199 SPAIN: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 200 SPAIN: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 201 SPAIN: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 202 POLAND: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 203 POLAND: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 204 POLAND: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 205 POLAND: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 206 REST OF EUROPE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 207 REST OF EUROPE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 208 REST OF EUROPE: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 209 REST OF EUROPE: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 210 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 211 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 212 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019–2022 (MILLION UNITS)

- TABLE 213 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 214 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 215 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 216 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 217 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 218 ASIA PACIFIC: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 219 ASIA PACIFIC: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 220 ASIA PACIFIC: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 221 ASIA PACIFIC: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 222 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY SITE, 2019–2022 (USD MILLION)

- TABLE 223 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY SITE, 2023–2028 (USD MILLION)

- TABLE 224 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 225 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 226 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 227 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 228 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 229 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 230 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2019–2022 (USD MILLION)

- TABLE 231 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 232 CHINA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 233 CHINA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 234 CHINA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 235 CHINA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 236 INDIA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 237 INDIA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 238 INDIA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 239 INDIA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 240 JAPAN: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 241 JAPAN: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 242 JAPAN: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 243 JAPAN: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 244 AUSTRALIA & NEW ZEALAND: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 245 AUSTRALIA & NEW ZEALAND: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 246 AUSTRALIA & NEW ZEALAND: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 247 AUSTRALIA & NEW ZEALAND: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 248 SOUTH KOREA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 249 SOUTH KOREA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 250 SOUTH KOREA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 251 SOUTH KOREA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 252 REST OF ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 253 REST OF ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 254 REST OF ASIA PACIFIC: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 255 REST OF ASIA PACIFIC: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 256 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 257 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 258 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019–2022 (MILLION UNITS)

- TABLE 259 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 260 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 261 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 262 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 263 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 264 SOUTH AMERICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 265 SOUTH AMERICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 266 SOUTH AMERICA: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 267 SOUTH AMERICA: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 268 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SITE, 2019–2022 (USD MILLION)

- TABLE 269 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SITE, 2023–2028 (USD MILLION)

- TABLE 270 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 271 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 272 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 273 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 274 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 275 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 276 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2019–2022 (USD MILLION)

- TABLE 277 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 278 BRAZIL: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 279 BRAZIL: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 280 BRAZIL: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 281 BRAZIL: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 282 ARGENTINA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 283 ARGENTINA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 284 ARGENTINA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 285 ARGENTINA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 286 REST OF SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 287 REST OF SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 288 REST OF SOUTH AMERICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 289 REST OF SOUTH AMERICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 290 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 291 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 292 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 293 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 294 MIDDLE EAST: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 295 MIDDLE EAST: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 296 MIDDLE EAST: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 297 MIDDLE EAST: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 298 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY SITE, 2019–2022 (USD MILLION)

- TABLE 299 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY SITE, 2023–2028 (USD MILLION)

- TABLE 300 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 301 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 302 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 303 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 304 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 305 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 306 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2019–2022 (USD MILLION)

- TABLE 307 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 308 AFRICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 309 AFRICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 310 AFRICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019–2022 (MILLION UNITS)

- TABLE 311 AFRICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 312 AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 313 AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 314 AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 315 AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 316 AFRICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 317 AFRICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 318 AFRICA: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 319 AFRICA: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 320 AFRICA: FOOD DIAGNOSTICS MARKET, BY SITE, 2019–2022 (USD MILLION)

- TABLE 321 AFRICA: FOOD DIAGNOSTICS MARKET, BY SITE, 2023–2028 (USD MILLION)

- TABLE 322 AFRICA: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 323 AFRICA: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 324 AFRICA: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 325 AFRICA: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 326 AFRICA: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2019–2022 (USD MILLION)

- TABLE 327 AFRICA: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2023–2028 (USD MILLION)

- TABLE 328 AFRICA: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2019–2022 (USD MILLION)

- TABLE 329 AFRICA: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 330 SOUTH AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 331 SOUTH AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 332 SOUTH AFRICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 333 SOUTH AFRICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 334 REST OF AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 335 REST OF AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 336 REST OF AFRICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 337 REST OF AFRICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 338 FOOD DIAGNOSTICS MARKET: DEGREE OF COMPETITION, 2022

- TABLE 339 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 340 COMPANY FOOTPRINT, BY TYPE

- TABLE 341 COMPANY FOOTPRINT, BY TESTING TYPE

- TABLE 342 COMPANY FOOTPRINT, BY REGION

- TABLE 343 OVERALL COMPANY FOOTPRINT

- TABLE 344 FOOD DIAGNOSTICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 345 FOOD DIAGNOSTICS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 346 PRODUCT LAUNCHES, 2020–2022

- TABLE 347 DEALS, 2019–2022

- TABLE 348 OTHERS, 2022

- TABLE 349 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

- TABLE 350 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES

- TABLE 351 THERMO FISHER SCIENTIFIC INC.: DEALS

- TABLE 352 THERMO FISHER SCIENTIFIC INC.: OTHERS

- TABLE 353 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

- TABLE 354 BIO-RAD LABORATORIES, INC.: PRODUCT LAUNCHES

- TABLE 355 MERCK KGAA: BUSINESS OVERVIEW

- TABLE 356 MERCK KGAA: DEALS

- TABLE 357 NEOGEN CORPORATION: BUSINESS OVERVIEW

- TABLE 358 NEOGEN CORPORATION: PRODUCT LAUNCHES

- TABLE 359 NEOGEN CORPORATION: DEALS

- TABLE 360 SHIMADZU CORPORATION: BUSINESS OVERVIEW

- TABLE 361 BIOMÉRIEUX: BUSINESS OVERVIEW

- TABLE 362 BIOMÉRIEUX: PRODUCT LAUNCHES

- TABLE 363 BIOMÉRIEUX: DEALS

- TABLE 364 BIOMÉRIEUX: OTHERS

- TABLE 365 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 366 AGILENT TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 367 AGILENT TECHNOLOGIES, INC.: OTHERS

- TABLE 368 QIAGEN: BUSINESS OVERVIEW

- TABLE 369 BRUKER: BUSINESS OVERVIEW

- TABLE 370 BRUKER: PRODUCT LAUNCHES

- TABLE 371 DANAHER: BUSINESS OVERVIEW

- TABLE 372 PERKINELMER INC.: BUSINESS OVERVIEW

- TABLE 373 PERKINELMER INC.: PRODUCT LAUNCHES

- TABLE 374 PERKINELMER INC.: DEALS

- TABLE 375 FOSS: BUSINESS OVERVIEW

- TABLE 376 HYGIENA LLC: BUSINESS OVERVIEW

- TABLE 377 R-BIOPHARM AG: BUSINESS OVERVIEW

- TABLE 378 R-BIOPHARM AG: DEALS

- TABLE 379 ROMER LABS DIVISION HOLDING: BUSINESS OVERVIEW

- TABLE 380 ENVIROLOGIX: BUSINESS OVERVIEW

- TABLE 381 RANDOX FOOD DIAGNOSTICS: BUSINESS OVERVIEW

- TABLE 382 PROMEGA CORPORATION: BUSINESS OVERVIEW

- TABLE 383 PATHOGENDX CORPORATION: BUSINESS OVERVIEW

- TABLE 384 ROKA BIO SCIENCE: BUSINESS OVERVIEW

- TABLE 385 GOLD STANDARD DIAGNOSTICS: BUSINESS OVERVIEW

- TABLE 386 CLEAR LABS, INC.: BUSINESS OVERVIEW

- TABLE 387 RING BIOTECHNOLOGY CO LTD.: BUSINESS OVERVIEW

- TABLE 388 NEMIS TECHNOLOGIES AG: BUSINESS OVERVIEW

- TABLE 389 BIOREX FOOD DIAGNOSTICS: BUSINESS OVERVIEW

- TABLE 390 ADJACENT MARKETS

- TABLE 391 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2018–2022 (USD MILLION)

- TABLE 392 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023–2028 (USD MILLION)

- TABLE 393 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 394 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 395 FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2017–2021 (USD MILLION)

- TABLE 396 FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 397 FOOD SAFETY TESTING MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 398 FOOD SAFETY TESTING MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 REGIONAL SEGMENTATION

- FIGURE 3 YEARS CONSIDERED

- FIGURE 4 FOOD DIAGNOSTICS MARKET: RESEARCH DESIGN

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 FOOD DIAGNOSTICS MARKET: BOTTOM-UP APPROACH

- FIGURE 7 FOOD DIAGNOSTICS MARKET: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 GLOBAL INFLATION RATE, 2012–2022

- FIGURE 11 GLOBAL GROSS DOMESTIC PRODUCT, 2012–2022 (USD TRILLION)

- FIGURE 12 RECESSION INDICATORS AND THEIR IMPACT ON FOOD DIAGNOSTICS MARKET

- FIGURE 13 GLOBAL FOOD DIAGNOSTICS MARKET: CURRENT FORECAST VS. RECESSION IMPACT FORECAST

- FIGURE 14 FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 FOOD DIAGNOSTICS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 FOOD DIAGNOSTICS MARKET, BY SITE, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 FOOD DIAGNOSTICS MARKET, BY REGION, 2022

- FIGURE 19 INCREASING INSTANCES OF FOODBORNE OUTBREAKS AND GLOBALIZATION OF FOOD TRADE TO DRIVE FOOD DIAGNOSTICS MARKET

- FIGURE 20 SYSTEMS SEGMENT AND GERMANY TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2022

- FIGURE 21 SAFETY SEGMENT TO LEAD MARKET BY 2028

- FIGURE 22 MEAT, POULTRY, AND SEAFOOD SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 23 OUTSOURCING FACILITY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 24 SYSTEMS SEGMENT AND EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 25 US TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 26 CHANGE IN EXPORT VALUE, BY PRODUCT [AVERAGE BASE PERIOD (2000–2002) VS. AVERAGE CURRENT PERIOD (2019–2021)]

- FIGURE 27 CONSUMER CHECKS FOR LABEL AND NUTRITIONAL INFORMATION PANEL (NIP) OF FOOD PRODUCTS (PERCENTAGE OF CONSUMERS), 2019

- FIGURE 28 FOOD DIAGNOSTICS MARKET DYNAMICS

- FIGURE 29 AUSTRALIA: FOOD RECALLS COORDINATED BY FSANZ, 2013–2023

- FIGURE 30 US: FOOD RECALLS, 2013–2023

- FIGURE 31 USDA’S FSIS FEDERAL BUDGET FOR FOOD SAFETY, 2021–2023 (USD MILLION)

- FIGURE 32 REVENUE SHIFT FOR FOOD DIAGNOSTICS MARKET

- FIGURE 33 FOOD DIAGNOSTICS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 34 FOOD DIAGNOSTICS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 35 FOOD DIAGNOSTICS MARKET: ECOSYSTEM MAP

- FIGURE 36 FOOD DIAGNOSTICS MARKET: MARKET MAP

- FIGURE 37 PATENTS GRANTED FOR FOOD DIAGNOSTICS MARKET, 2013–2022

- FIGURE 38 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 39 AVERAGE SELLING PRICE OF KEY PLAYERS FOR FOOD DIAGNOSTIC TYPES

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FOOD DIAGNOSTIC TYPES

- FIGURE 41 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 42 FOOD DIAGNOSTICS MARKET, BY SITE, 2023 VS. 2028 (USD MILLION)

- FIGURE 43 FOOD DIAGNOSTICS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 44 FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023 VS. 2028 (USD MILLION)

- FIGURE 45 FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 46 FOOD DIAGNOSTICS MARKET: GEOGRAPHIC SNAPSHOT, 2023–2028 (USD MILLION)

- FIGURE 47 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 48 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 49 TOP 10 COMMODITIES IMPORTED BY MEXICO FROM US, 2022 (USD BILLION)

- FIGURE 50 EUROPE: FOOD DIAGNOSTICS MARKET SNAPSHOT

- FIGURE 51 EUROPE: COUNTRY-LEVEL INFLATION DATA, 2017–2022

- FIGURE 52 EUROPE: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 53 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET SNAPSHOT

- FIGURE 54 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 55 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 56 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 57 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 58 AFRICA: INFLATION RATES, BY KEY COUNTRY, 2018–2022

- FIGURE 59 AFRICA: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 60 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2018–2022 (USD BILLION)

- FIGURE 61 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020–2022

- FIGURE 62 EBITDA, 2022 (USD BILLION)

- FIGURE 63 FOOD DIAGNOSTICS MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 64 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 65 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 66 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 67 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT

- FIGURE 68 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 69 NEOGEN CORPORATION: COMPANY SNAPSHOT

- FIGURE 70 SHIMADZU CORPORATION: COMPANY SNAPSHOT

- FIGURE 71 BIOMÉRIEUX: COMPANY SNAPSHOT

- FIGURE 72 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 73 QIAGEN: COMPANY SNAPSHOT

- FIGURE 74 BRUKER: COMPANY SNAPSHOT

- FIGURE 75 DANAHER: COMPANY SNAPSHOT

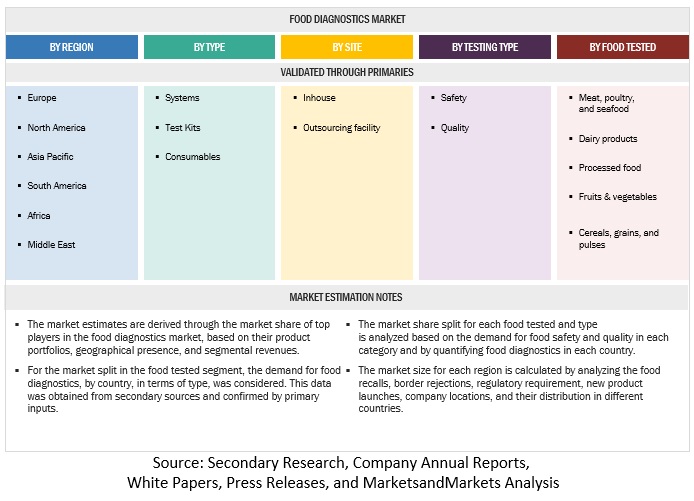

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the food diagnostics market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

The secondary sources referred for this research study include government sources, the EU Commission, the European Food Safety Authority, the German Federal Institute of Risk Assessment, the Food Safety and Standards Authority of India (FSSAI the Food and Agricultural Organization (FAO), United States Department of Agriculture (USDA), Food Standards Australia New Zealand (FSANZ), and others were referred to, to identify and collect information for this study. The secondary sources also included food diagnostics manufacturers' annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and paid databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The food diagnostics market comprises multiple stakeholders, including raw material suppliers, processed food suppliers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce to the manufacturers, and importers & exporters of food diagnostics from the demand side include distributors, wholesalers, and key opinion leaders through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

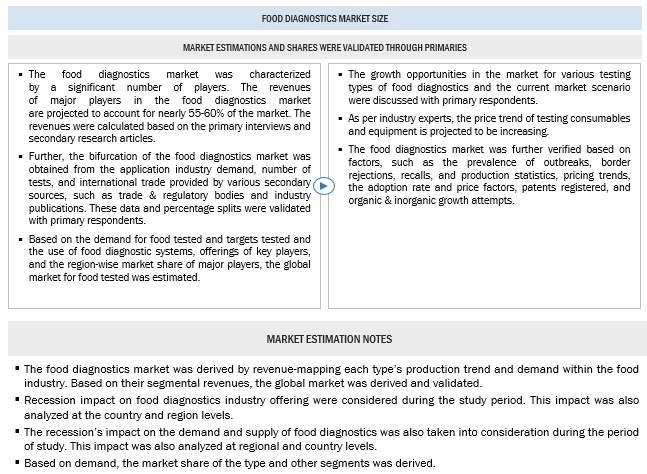

The following approaches represent the overall market size estimation process employed for the purpose of this study.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key customers in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market customers, along with extensive interviews for opinions from leaders such as CEOs, directors, and marketing executives.

Top-down Approach:

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom-up Approach:

- The bottom-up procedure was employed to determine the overall size of the food diagnostics market from the production and demand of each type of product.

- Calculations for the market size were based on the production and consumption demand of each type of product identified in the market, which led to the overall market size. This overall market size was used in the top-down procedure to estimate the sizes of other individual markets (mentioned in the market segmentation) via percentage splits derived using secondary and primary sources.

- For the calculation of each type of specific market segment, the size of the most appropriate immediate parent market was considered for implementing the top-down procedure. The bottom-up procedure was also implemented for data extracted from secondary research to validate the market sizes obtained for each segment.

- The market share for the demand-side analysis was then estimated for each company to verify the revenue share used earlier in the bottom-up procedure. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent and each market were determined and confirmed in this study. The data triangulation procedure implemented for this study is explained in the next section

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the global market size from the estimation process explained above, the total market was split into various segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the food diagnostics market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying a range of factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Food diagnostics systems are designed to identify food contamination and quality parameters at various stages of a supply chain, such as storage, manufacturing, processing, and packaging. Food diagnostics include systems that detect the presence of contaminants and analyze the nutritional content of the food sample to help monitor the safety and quality of food samples. It also includes consumables such as reagents, disinfectants, and test accessories essential to perform food safety and quality tests and obtain accurate and specific results. Different organizations, including government agencies and research institutions, may have their own specific methods and guidelines for conducting food diagnostics. These methods can encompass various analytical techniques, such as spectroscopy, chromatography, immunoassays, DNA analysis, and more, depending on the specific parameters being measured.

Stakeholders

- Raw material suppliers

- Food diagnostics systems, kits, and consumables manufacturers

- Food manufacturers

- Importers and exporters of food diagnostics systems, kits, and consumables

- Traders, distributors, and suppliers

- Government and research organizations

- Trade associations

-

Associations, regulatory bodies, food safety agencies, and other industry-related bodies:

- Food and Drug Administration (FDA)

- European Food Safety Authority (EFSA)

- United States Department of Agriculture (USDA)

- Food Standards Australia New Zealand (FSANZ)

- Food Safety and Standards Authority of India (FSSAI)

Report Objectives

Market Intelligence

- Determining and projecting the size of the food diagnostics market, with respect to type, food tested, site, testing type, and region, over five years, ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

- Identifying and profiling the key players in the food diagnostics market

-

Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies players adopt across the key regions.

- Analyzing the value chain and products across key regions and their impact on prominent market players

- Providing insights on key product innovations and investments in the food diagnostics market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the rest of Asia Pacific food diagnostics market into the Thailand, Malaysia, Singapore, and other ASEAN countries.