Gantry Robot Market by Axis, Payload, Support (End Effector and Robot), Application (Handling, Assembling & Disassembling, Dispensing), Industry (Automotive, Metals & Machinery, Pharmaceuticals & Cosmetics), and Region - Global Forecast to 2025

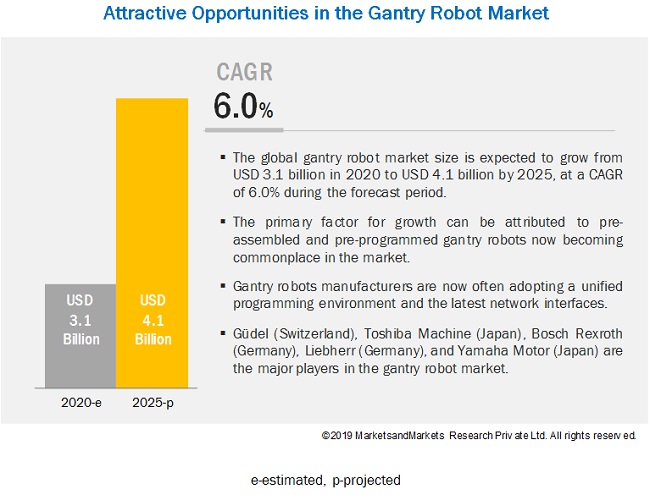

[206 Pages Repoert] According to MarketsandMarkets, the global gantry robot market size is projected to grow from USD 3.1 billion in 2020 to USD 4.1 billion by 2025; it is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.0% from 2020 to 2025. Computerized gantry design and configuration through software has given rise to pre-engineered gantry robots, drastically reducing design and setup time while also facilitating easy maintenance for the end user.

Programing standards, such as the IEC-61131-3 and ANSI 15.06, as well as modern networking interfaces, has unified the programming environment and enabled better communication protocols between robots as well as robotic peripherals. The objective of the report is to define, describe, and forecast the gantry robot market based on the number of axes, payload, application, industry, support, and region.

3-axis gantry robots estimated to hold the largest share of the gantry robot market in 2020.

The 3-axis segment is estimated to hold the largest share of the global gantry robot market in 2020. 3-axes robots offer enhanced accuracy and payload capacity due to the increased rigidity of their design compared to 1-axis or 2-axis robots. As such, many of the table-top gantry robots used for high accuracy applications, such as gluing and laser cutting, are often of 3-axis design. For large gantry systems, due to the load support on both sides, 3-axis can handle very heavy payloads, sometimes even exceeding 3000 Kg. The wide range of applications of 3-axis gantry robots for various sizes has led to widespread adoption by the manufacturing industry.

Gantry robots with a payload capacity greater than 350 Kg is projected to be the fastest-growing segment during the forecast period.

The more than 350 Kg segment of the gantry robot market is projected to grow at the highest CAGR from 2020 to 2024. For high payload applications that involve long travel distances, gantry robots are still the ideal solution. Such tasks include moving heavy engine blocks or a semi-finished vehicle assembly. Such tasks cannot be replaced by other industrial robots, even by the largest articulated robot. These type of robots also performs other heavy-duty applications such as automation of conventional mechanical press lines and servo press lines.

For payloads below 50 Kg, articulated and SCARA robots may be slowly replacing gantry robots in many instances, but heavy-duty tasks often do not have other alternatives besides using gantry robots. Hence, this segment expected to have the fastest growth rate.

The assembling and disassembling application segment of the gantry robot market to grow at the fastest rate during the forecast period.

One of the primary advantages of a gantry robot is that it is capable of reaching every single point within its workspace while maintaining its accuracy and repeatability. Hence, gantry robots are expected to have a growing use for assembling and disassembling applications for both small and large objects.

For electronics manufacturing, table-top robots are often used for PCB assembly. Other applications include the screwdriving of electronic components such as hard drives. Such components often require accurate placement of screws and the robots also provide consistency in regards to torque when compared to manual screwdriving. For larger applications, gantry robots are used for wheel and tire, engine, and transmission assembly.

The metals and machinery industry segment of the gantry robot market is projected to grow at the highest CAGR from 2020 to 2025.

The metals and machinery segment of the gantry robot market is projected to grow at the highest CAGR during the forecast period. Gantry robots are ideal for machining various sizes of workpieces.

CNC style gantry robots are often used where parts need to be machined with tight tolerance. Large workpieces greater than 50 Kg often exceed the capabilities of a SCARA robot. For even larger workpieces, articulated robots may lose their accuracy over longer distances. For small parts, gantry robots can have accuracy as low as 1 ΅m. Due to its advantage in many areas over other industrial robots, gantry robots are expected to grow at the fastest rate for this industry.

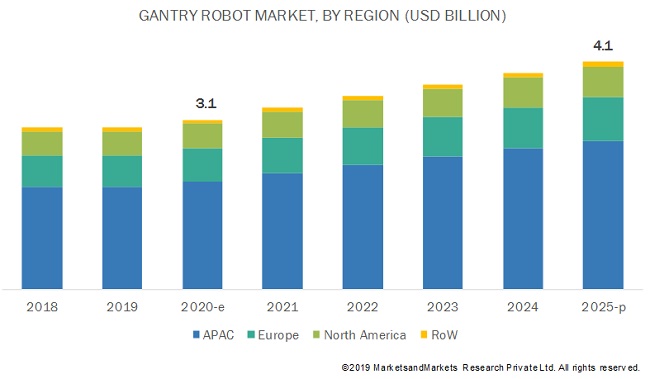

APAC is projected to account for the largest share of the gantry robot market during the forecast period.

APAC is projected to account for the largest share of the gantry robot market during the forecast period owing to the largest size and scale of the manufacturing industry in the region when compared to other regions such as North America and Europe. In APAC, the automotive and electrical and electronics industries are the primary markets for the deployment of gantry robots.

China is the largest automotive manufacturer in the world and the largest in Asia. China, alongside Japan and South Korea, accounts for most of the automotive vehicles produced within Asia. China, Taiwan and South Korea also account for the largest electrical and electronics industry in the world. Hence, gantry robots are expected to have the largest share in the APAC region.

Key Market Players

Major companies in the gantry robot market are Toshiba Machine (Japan), Liebherr (Germany), Gόdel (Switzerland), Bosch Rexroth (Germany), Yamaha Motor (Japan), Macron Dynamics (US), IAI (Japan), Cimcorp (Finland), OMRON (Japan), Nordson (US). Apart from these, STON ROBOT (China) and ALIO Industries (US) are among a few emerging companies in the gantry robot market.

Initially established in 1949 as Shibaura Machine, the company was later renamed as Toshiba Machine (Japan) in 1961. It offers various machines for injection molding, die-casting, and nano-processing. Additionally, the company manufactures and markets semiconductor manufacturing equipment, machine tools, servo motors, controllers, and industrial robots. Cartesian/gantry robots are offered under the lineup of industrial robots. The company has three business segments: Molding Machinery, Machine Tools, and Other Products. Cartesian robots are offered under the Other Products segment. The series of Cartesian robots are offered as a single-axis specification (1-axis) or orthogonal axis specification (2-axis to 4-axis). More than 130 variants of Cartesian/gantry robots are offered, with a payload-carrying capacity ranging from 3 Kg to 250 Kg. Belt, gear, ball screw, and harmonic drives are utilized in these robots.

Dedicated controllers and teach pendants are offered for use with its Cartesian robots. Automotive, electrical & electronics, food & beverages, glass, and pharmaceuticals are among a few of the industries that use Cartesian robots offered by the company. Other than Cartesian robots, the company also supplies machinery and electronic controls to automotive, aerospace, heavy equipment, construction, plastics, transportation, semiconductor, and communication markets worldwide. Toshiba Machine has a strong network of subsidiaries across the world; a few of them are Toshiba Machine Co. America, Toshiba Machine S.E. Asia PTE. Ltd., Toshiba Machine Co. Canada Ltd., Toshiba Machine G.m.b.H (Germany), and various others are located in Thailand, Taiwan, China, Vietnam, India, Indonesia, Mexico, and Brazil. The company has six production plants, of which three are in Japan, and the remaining are located in China, India, and Thailand.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

20172025 |

|

Base year |

2019 |

|

Forecast period |

20202025 |

|

Units |

Value (USD million/billion) and Volume (Units) |

|

Segments covered |

Number of axes, payload, support, application, industry, and geography |

|

Geographic regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Toshiba Machine (Japan), Liebherr (Germany), Gόdel (Switzerland), Bosch Rexroth (Germany), Yamaha Motor (Japan), Macron Dynamics (US), IAI (Japan), Cimcorp (Finland), OMRON (Japan), Nordson (US), SAGE Automation (US), LPR Global (Canada), Aerotech (US), Hirata (Japan), Yaskawa (Japan), Fisnar (US), Parker Hannifin (US), ABB (Switzerland), KUKA (Germany), DENSO (Japan), STON ROBOT (China), ALIO Industries (US), CK Manufacturing/Industrial Concepts (Canada), Transman (Sweden), and IntelLiDrives (US) |

This report categorizes the gantry robot market based on the number of axes, payload, support, application, industry, and geography.

By Number of Axes:

- 1-axis (X)

- 2-axis (X-Y)

- 3-axis (X-Y-Z)

- 4-axis (X-Y-Z-R)

By Payload:

- Less than 50 Kg

- 51350 Kg

- More than 350 Kg

By Support:

- End Effector

- Robot (Articulated and SCARA)

By Application:

- Handling

- Assembling and Disassembling

- Welding and Soldering

- Dispensing (Gluing and Painting)

- Processing (Milling and Cutting)

- Others (Inspection and Molding)

By Industry:

- Automotive

- Electrical and Electronics

- Metals and Machinery

- Plastics, Rubber, and Chemicals

- Food and Beverages

- Precision Engineering and Optics

- Pharmaceuticals and Cosmetics

- Others

By Geography:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Italy

- Spain

- France

- UK

- Rest of Europe

- APAC

- China

- South Korea

- Japan

- Taiwan

- Thailand

- India

- Rest of APAC

- RoW

- Middle East and Africa

- South America

Key Questions Addressed in the Report

- What will be the dynamics for the adoption of gantry robots based on the number of axes?

- How will different regions (North America, Europe, APAC, and Row) contribute to the overall market growth by 2025?

- Which countries are expected to adopt various gantry robots at a fast rate?

- What are the different end-effectors and industrial robots that are being mounted to gantry robots?

- What are the key market dynamics influencing gantry robot market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

Frequently Asked Questions (FAQ):

Which are the major applications of gantry robots? How huge is the opportunity for their growth in the next five years?

Handling is one of the major applications for gantry robots. Gantry robots can be built to handle a wide range of payloads, even exceeding 3,000 kg. Gantry robots can also have a very long reach which enables goods to be moved over long distances. The inherent accuracy of the gantry robots also makes them ideal for assembling and disassembling applications. They can assemble heavy items like engine blocks as well as light items such as PCBs and integrated circuits. With growing assembling and disassembling operations in manufacturing, the market for gantry robots for this application is expected to grow at the fastest rate in the next 5 years.

Which are the major companies in the gantry robot market? What are their major strategies to strengthen their market presence?

Major companies in the gantry robot market include Gόdel (Switerland), Bosch Rexroth (Germany), Toshiba Machine (Japan), Liebherr (Germany), and Yamaha Motor (Japan). The major strategies adopted by these companies to strangthen their presence in the marketspace are new product launches and expansions.

What are the opportunities for new market entrants?

Opportunities for new market players include focusing on small- and medium-scale manufacturers who are facing increasing competition. Gantry robots must also be reconfigureble to suit changing needs in manufacturing operations. Mounting brackets, actuators, drives, and controls should b reconfigurable or changed depending on the application which makes it possible to rebuild systems rather than purchasing new robots. This is highly beneficial for smaller companies with fewer resources and limited funds

What are the drivers and opportunities for the gantry robot market?

Factors such as the prevalence of pre-assembled and pre-programmed gantry systems and the integration of latest communication interfaces such as EtherCAT, Sercos III, and Etherner/IP are expected to the main driving forces for the gantry robot market. Moreover, the increasing support for ANSI 15.06 programming environment and greater acceptance of IEC-61131-3 standard for PLC programming is also expected to drive the market growth.

Which end-user industries are expected to drive the growth of the market in the next 5 years?

The market for metals and machinery industry is expected to drive the market for gantry robots in the next 5 years. Gantry robots are used to transfer and stack sheet metal processing units. These robots also perform 3D cutting and welding of sheet metal and pipes. Overhead gantry robots are being used for deburring. As the industry often poses health hazard risk to factory workers, the increasing adoption of automation in this sector will drive the growth of the gantry robot market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Study Objectives

1.2 Definition and Scope

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.3.1 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 25)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.3 Market Projections

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 37)

4 Premium Insights (Page No. - 42)

4.1 Attractive Market Opportunities in Gantry Robot Market

4.2 Gantry Robot Market, By Payload

4.3 Gantry Robot Market, By Number of Axes

4.4 Gantry Robot Market, By Application

4.5 Gantry Robot Market in APAC, By Industry vs By Country/Region

4.6 Gantry Robot Market, By Country

5 Market Overview (Page No. - 46)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Prevalence of Pre-Assembled and Pre-Programmed Gantry and Cartesian Systems

5.1.1.2 Acceptance of Gantry and Cartesian Systems Owing to Their Enhanced Programming and Communication Interfaces

5.1.2 Restraints

5.1.2.1 Non-Applicability of Cartesian and Gantry Systems for Several Applications Due to Their Design Constraints

5.1.2.2 Limited Acceptance of Cartesian and Gantry Systems in Developing Countries

5.1.3 Opportunities

5.1.3.1 Rising Adoption of Cartesian and Gantry Systems Owing to Their Cost-Effectiveness, Flexibility, and Easy Reconfiguration

5.1.3.2 Growing Demand for Medium- and Large-Sized Gantry Robots for Industrial Applications

5.1.3.3 Growing Deployment of Cartesian Systems That Can Be Programmed for Collaborative Applications

5.1.4 Challenges

5.1.4.1 Complexities Associated With Designing and Testing Large Gantry Systems

5.2 Value Chain Analysis

6 Gantry Robot Market, By Number of Axes (Page No. - 55)

6.1 Introduction

6.2 1-Axis (X)

6.2.1 Single Axis Robots are Easy to Maintain and are Used for General Purpose Applications

6.3 2-Axis (X-Y)

6.3.1 2-Axis Robots are Being Used in Plastics Industry for Injection Molding Applications

6.4 3-Axis (X-Y-Z)

6.4.1 3-Axis Robots Offer High Rigidity for Enhanced Accuracy and Payload Capacity

6.5 4-Axis (X-Y-Z-R)

6.5.1 4th Axis of A Gantry Robot Provides Rotational Movement for Added Flexibility

7 Gantry Robot Market, By Payload (Page No. - 61)

7.1 Introduction

7.2 Less Than 50 Kg

7.2.1 Low Payload Gantry Robots are Designed for High Accuracy and Repeatability

7.3 51350 Kg

7.3.1 51-350 Kg Payload Gantry Robots Can Be Designed and Built in Multiple Configurations

7.4 More Than 350 Kg

7.4.1 More Than 350 Kg Payload Gantry Robots Can Handle Items Weighing as Much as 3,600 Kg

8 Gantry Robot Market, By Support (Page No. - 68)

8.1 Introduction

8.2 End Effector

8.3 Robot

8.3.1 Articulated

8.3.2 Scara

9 Gantry Robot Market, By Application (Page No. - 72)

9.1 Introduction

9.2 Handling

9.2.1 Handling Application to Dominate Gantry Robot Market in 2020

9.3 Assembling and Disassembling

9.3.1 Assembly Application Using Gantry Robots Deliver Excellent Speed and Precision

9.4 Welding and Soldering

9.4.1 Soldering Applications are Performed Using Specialized Table-Top Robots

9.5 Dispensing

9.5.1 Gluing

9.5.1.1 Electrical & Electronics Industries Require Precise Adhesive Dispensers

9.5.2 Painting

9.5.2.1 Gantry Robots Attached to Articulated Robots are Used for Painting Applications

9.6 Processing

9.6.1 Milling

9.6.1.1 Robotic Milling is Ideal for Large Workpieces

9.6.2 Cutting

9.6.2.1 Robotic Cutting is Employed in Varieties of Industries

9.7 Others

9.7.1 Inspection

9.7.1.1 Gantry Robot Inspection Enhances Repeatability of Inspection Procedures

9.7.2 Molding

9.7.2.1 Foundry and Forging Robots are Used in Die-Casting and Molding Applications

10 Gantry Robot Market, By Industry (Page No. - 83)

10.1 Introduction

10.2 Automotive

10.2.1 Gantry Robots are Used for Handling Heavy Objects in Automotive Industry

10.3 Electrical and Electronics

10.3.1 Small Payload Gantry Robots With High Accuracy are Used in Electronics Industry

10.4 Metals and Machinery

10.4.1 Gantry Robots are Ideal Large Workpieces

10.5 Plastics, Rubber, and Chemicals

10.5.1 Gantry Robots are Preferred Over Other Industrial Robots for Injection Molding

10.6 Food & Beverages

10.6.1 Gantry Robots are Used in Food Industry for Both Primary and Secondary Operations

10.7 Precision Engineering and Optics

10.7.1 Gantry Robots are Ideal for Laser Cutting Small and Large Workpieces

10.8 Pharmaceuticals and Cosmetics

10.8.1 Gantry Robots Last for Long Duration With Minimal Degradation in Pharmaceutical Applications.

10.9 Others

11 Geographic Analysis (Page No. - 118)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 US has Largest Manufacturing Industry in North America and Also Houses Several Gantry Robot Manufacturers

11.2.2 Canada

11.2.2.1 Ontario Canada Expected to have Highest Concentration in Gantry Robots

11.2.3 Mexico

11.2.3.1 Strong Fdi Presence and Growing Market for Automation is Expected to the Primary Growth Driver for Gantry Robots in Mexico

11.3 Europe

11.3.1 Germany

11.3.1.1 Germany Houses Several Gantry Robot Manufacturers

11.3.2 Italy

11.3.2.1 Gantry Robots are Utilized in Pharmaceutical and Food Apart From the Automotive Industry in Italy

11.3.3 Spain

11.3.3.1 Spain to have Fastest Growth for Gantry Robots in Europe Due to Adoption of Automation in Manufacturing Industries

11.3.4 France

11.3.4.1 Increasing Deployment of Industrial Robots to Increase Global Competitiveness is Expected to Drive Market in France

11.3.5 UK

11.3.5.1 Investments in R&D for Reviving Automotive Industry in UK Offers High Growth Potential

11.3.6 Rest of Europe

11.4 APAC

11.4.1 China

11.4.1.1 China Represents Largest Market for Gantry Robots in the World Along With Automotive Industry

11.4.2 South Korea

11.4.2.1 South Korea Houses Prominent Regional Gantry Robot Manufacturers

11.4.3 Japan

11.4.3.1 Japan Holds Second-Largest Market for Gantry Robots Due to Its Sizable Automotive and Electronics Industry

11.4.4 Taiwan

11.4.4.1 Taiwan has Been Keen on Developing Its Own Gantry Robots Due to Its Large Electronics Industry

11.4.5 Thailand

11.4.5.1 Gantry Robots in Thailand are Mainly Available Through Authorized Distributors

11.4.6 India

11.4.6.1 India to Be Growing Market for Industrial Robots With Several Gantry Robot Manufacturers Building Their Market Presence

11.4.7 Rest of APAC

11.5 RoW

11.5.1 Middle East & Africa

11.5.1.1 Middle East has A Growing Number of Complete Knockdown as Well as Spare Parts Manufacturing Facilities for Automotive Industry

11.5.2 South America

11.5.2.1 Argentina and Brazil are Steadily Increasing the Use of Gantry Robots With an Improving Economic Scenario

12 Components of A Gantry Robotic System (Qualitative) (Page No. - 146)

12.1 Introduction

12.2 Drives

12.2.1 Rack/Belt

12.2.2 Ball Screw

12.2.3 Harmonic Drive

12.2.4 Non-Contact Linear Motor

12.2.5 Stepper Motor

12.2.6 Servo Motor

12.3 End Effector

12.4 Robots

12.5 Vision Systems

12.6 Controller

13 Competitive Landscape (Page No. - 150)

13.1 Overview

13.2 Market Ranking Analysis

13.3 Competitive Leadership Mapping

13.3.1 Visionary Leaders

13.3.2 Dynamic Differentiators

13.3.3 Innovators

13.3.4 Emerging Companies

13.4 Strength of Product Portfolio (25 Players)

13.5 Business Strategy Excellence (25 Players)

13.6 Competitive Situations and Trends

13.6.1 Product Launches

13.6.2 Partnerships and Collaborations

13.6.3 Expansions

13.6.4 Acquisitions

13.6.5 Contracts and Agreements

14 Company Profiles (Page No. - 161)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

14.1 Key Players

14.1.1 Toshiba Machine

14.1.2 Liebherr

14.1.3 Gόdel

14.1.4 Bosch Rexroth

14.1.5 Yamaha Motor

14.1.6 Macron Dynamics

14.1.7 IAI

14.1.8 Cimcorp

14.1.9 Omron

14.1.10 Nordson

14.2 Right to Win

14.2.1 Toshiba Machine

14.2.2 Bosch Rexroth

14.2.3 Gόdel

14.2.4 Liebherr

14.2.5 Yamaha Motor

14.3 Other Key Players

14.3.1 Sage Automation

14.3.2 Lpr Global

14.3.3 Aerotech

14.3.4 Hirata

14.3.5 Yaskawa

14.3.6 Fisnar

14.3.7 Parker Hannifin

14.3.8 ABB

14.3.9 Kuka

14.3.10 Denso

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 199)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets Subscription Portal

15.3 Available Customizations

15.4 Related Reports

15.5 Author Details

List of Tables (117 Tables)

Table 1 Gantry Robot Market, in Terms of Value and Volume, 20172025

Table 2 Gantry Robot Market, By Axis, 20172025 (USD Million)

Table 3 Gantry Robot Market for 1-Axis Robot, By Payload, 20172025 (USD Million)

Table 4 Gantry Robot Market for 2-Axis Robot, By Payload, 20172025 (USD Million)

Table 5 Gantry Robot Market for 3-Axis Robot, By Payload, 20172025 (USD Million)

Table 6 Gantry Robot Market for 4-Axis Robot, By Payload, 20172025 (USD Million)

Table 7 Gantry Robot Market, By Payload, 20172025 (USD Million)

Table 8 Companies Offering Gantry Robots With Payload Capacity Below 50 Kg

Table 9 Gantry Robot Market for Robots With Payload Capacity Less Than 50 Kg, By Application, 20172025 (USD Million)

Table 10 Gantry Robot Market for Robots With Payload Capacity Less Than 50 Kg, By Application, 20172025 (USD Million)

Table 11 Companies Offering Gantry Robots With Payload Capacity Between 51350 Kg

Table 12 Gantry Robot Market for Robots With Payload Capacity 51350 Kg, By Axis, 20172025 (USD Million)

Table 13 Gantry Robot Market for Robots With Payload Capacity 51350 Kg, By Application, 20172025 (USD Million)

Table 14 Companies Offering Gantry Robots With Payload Capacity More Than 350 Kg

Table 15 Gantry Robot Market for Robots With Payload Capacity More Than 350 Kg, By Axis, 20172025 (USD Million)

Table 16 Gantry Robot Market for Robots With Payload Capacity More Than 350 Kg, By Application, 20172025 (USD Million)

Table 17 Gantry Robot Market, By Support, 20172025 (USD Million)

Table 18 Example of Gantry Robot Manufacturers Offering In-House End Effectors

Table 19 Gantry Robots That Can Be Attached With Articulated Or Scara Robots

Table 20 Gantry Robot Market, By Application, 20172025 (USD Million)

Table 21 Gantry Robot Market for Handling Application, By Industry, 20172025 (USD Million)

Table 22 Gantry Robot Market for Handling Application, By Payload, 20172025 (USD Million)

Table 23 Gantry Robot Market for Assembling & Disassembling Application, By Industry, 20172025 (USD Million)

Table 24 Gantry Robot Market for Assembling & Disassembling Application, By Payload, 20172025 (USD Million)

Table 25 Gantry Robot Market for Welding & Soldering Application, By Industry, 20172025 (USD Thousand)

Table 26 Gantry Robot Market for Welding & Soldering Application, By Payload, 20172025 (USD Million)

Table 27 Gantry Robot Market for Dispensing Application, By Industry, 20172025 (USD Thousand)

Table 28 Gantry Robot Market for Dispensing Application, By Payload, 20172025 (USD Million)

Table 29 Gantry Robot Market for Processing Application, By Industry, 20172025 (USD Thousand)

Table 30 Gantry Robot Market for Processing Application, By Payload, 20172025 (USD Thousand)

Table 31 Gantry Robot Market for Other Applications, By Industry, 20172025 (USD Thousand)

Table 32 Gantry Robot Market for Other Applications, By Payload, 20172025 (USD Thousand)

Table 33 Gantry Robot Market (Including Prices of Peripherals, Software, and System Engineering), By Industry, 20172025 (USD Million)

Table 34 Gantry Robot Market, By Industry, 20172025 (USD Million)

Table 35 Gantry Robot Market for Automotive Industry, By Region, 20172025 (USD Million)

Table 36 Gantry Robot Market for Automotive Industry in North America, By Country, 20172025 (USD Million)

Table 37 Gantry Robot Market for Automotive Industry in Europe, By Country, 20172025 (USD Million)

Table 38 Gantry Robot Market for Automotive Industry in APAC, By Country, 20172025 (USD Million)

Table 39 Gantry Robot Market for Automotive Industry in RoW, By Region, 20172025 (USD Thousand)

Table 40 Gantry Robot Market for Automotive Industry, By Application, 20172025 (USD Million)

Table 41 Gantry Robot Market for Electrical and Electronics Industry, By Region, 20172025 (USD Million)

Table 42 Gantry Robot Market for Electrical and Electronics Industry in North America, By Country, 20172025 (USD Thousand)

Table 43 Gantry Robot Market for Electrical and Electronics Industry in Europe, By Country, 20172025 (USD Thousand)

Table 44 Gantry Robot Market for Electrical and Electronics Industry in APAC, By Country, 20172025 (USD Million)

Table 45 Gantry Robot Market for Electrical and Electronics Industry in RoW, By Region, 20172025 (USD Thousand)

Table 46 Gantry Robot Market for Electrical and Electronics Industry, By Application, 20172025 (USD Million)

Table 47 Gantry Robot Market for Metals and Machinery Industry, By Region, 20172025 (USD Thousand)

Table 48 Gantry Robot Market for Metals and Machinery Industry in North America, By Country, 20172025 (USD Thousand)

Table 49 Gantry Robot Market for Metals and Machinery Industry in Europe, By Country, 20172025 (USD Thousand)

Table 50 Gantry Robot Market for Metals and Machinery Industry in APAC, By Country, 20172025 (USD Thousand)

Table 51 Gantry Robot Market for Metals and Machinery Industry in RoW, By Region, 20172025 (USD Thousand)

Table 52 Gantry Robot Market for Metals and Machinery Industry, By Application, 20172025 (USD Thousand)

Table 53 Gantry Robot Market for Plastics, Rubber, and Chemicals Industry, By Region, 20172025 (USD Thousand)

Table 54 Gantry Robot Market for Plastics, Rubber, and Chemicals Industry in North America, By Country, 20172025 (USD Thousand)

Table 55 Gantry Robot Market for Plastics, Rubber, and Chemicals Industry in Europe, By Country, 20172025 (USD Thousand)

Table 56 Gantry Robot Market for Plastics, Rubber, and Chemicals Industry in APAC, By Country, 20172025 (USD Thousand)

Table 57 Gantry Robot Market for Plastics, Rubber, and Chemicals Industry in RoW, By Region, 20172025 (USD Thousand)

Table 58 Gantry Robot Market for Plastics, Rubber, and Chemicals Industry, By Application, 20172025 (USD Thousand)

Table 59 Gantry Robot Market for Food & Beverages Industry, By Region, 20172025 (USD Thousand)

Table 60 Gantry Robot Market for Food & Beverages Industry in North America, By Country, 20172025 (USD Thousand)

Table 61 Gantry Robot Market for Food & Beverages Industry in Europe, By Country, 20172025 (USD Thousand)

Table 62 Gantry Robot Market for Food & Beverages Industry in APAC, By Country, 20172025 (USD Thousand)

Table 63 Gantry Robot Market for Food & Beverages Industry in RoW, By Region, 20172025 (USD Thousand)

Table 64 Gantry Robot Market for Food & Beverages Industry, By Application, 20172025 (USD Thousand)

Table 65 Gantry Robot Market for Precision Engineering and Optics Industry, By Region, 20172025 (USD Thousand)

Table 66 Gantry Robot Market for Precision Engineering and Optics Industry in North America, By Country, 20172025 (USD Thousand)

Table 67 Gantry Robots Market for Precision Engineering and Optics Industry in Europe, By Country, 20172025 (USD Thousand)

Table 68 Gantry Robot Market for Precision Engineering and Optics Industry in APAC, By Country, 20172025 (USD Thousand)

Table 69 Gantry Robot Market for Precision Engineering and Optics Industry in RoW, By Region, 20172025 (USD Thousand)

Table 70 Gantry Robot Market for Precision Engineering and Optics Industry, By Application, 20172025 (USD Thousand)

Table 71 Gantry Robot Market for Pharmaceuticals and Cosmetics Industry, By Region, 20172025 (USD Thousand)

Table 72 Gantry Robot Market for Pharmaceuticals and Cosmetics Industry in North America, By Country, 20172025 (USD Thousand)

Table 73 Gantry Robot Market for Pharmaceuticals and Cosmetics Industry in Europe, By Country, 20172025 (USD Thousand)

Table 74 Gantry Robot Market for Pharmaceuticals and Cosmetics Industry in APAC, By Country, 20172025 (USD Thousand)

Table 75 Gantry Robot Market for Pharmaceuticals and Cosmetics Industry in RoW, By Region, 20172025 (USD Thousand)

Table 76 Gantry Robot Market for Pharmaceuticals and Cosmetics Industry, By Application, 20172025 (USD Thousand)

Table 77 Gantry Robot Market for Other Industries, By Region, 20172025 (USD Thousand)

Table 78 Gantry Robot Market for Other Industries in North America, By Country, 20172025 (USD Thousand)

Table 79 Gantry Robot Market for Other Industries in Europe, By Country, 20172025 (USD Thousand)

Table 80 Gantry Robot Market for Other Industries in APAC, By Country, 20172025 (USD Thousand)

Table 81 Gantry Robot Market for Other Industries in RoW, By Region, 20172025 (USD Thousand)

Table 82 Gantry Robot Market for Other Industries, By Application, 20172025 (USD Thousand)

Table 83 Gantry Robot Market, By Region, 20172025 (USD Million)

Table 84 Gantry Robot Market, By Region, 20172025 (Units)

Table 85 Gantry Robot Market in North America, By Country, 20172025 (USD Million)

Table 86 Gantry Robot Market in North America, By Industry, 20172025 (USD Thousand)

Table 87 Gantry Robot Market in US, By Industry, 20172025 (USD Thousand)

Table 88 Gantry Robot Market in Canada, By Industry, 20172025 (USD Thousand)

Table 89 Gantry Robot Market in Mexico, By Industry, 20172025 (USD Thousand)

Table 90 Gantry Robot Market in Europe, By Country, 20172025 (USD Million)

Table 91 Gantry Robot Marker in Europe, By Industry, 20172025 (USD Thousand)

Table 92 Gantry Robot Market in Germany, By Industry, 20172025 (USD Thousand)

Table 93 Gantry Robot Market in Italy, By Industry, 20172025 (USD Thousand)

Table 94 Gantry Robot Market in Spain, By Industry, 20172025 (USD Thousand)

Table 95 Gantry Robot Market in France, By Industry, 20172025 (USD Thousand)

Table 96 Gantry Robot Market in UK, By Industry, 20172025 (USD Thousand)

Table 97 Gantry Robot Market in Rest of Europe, By Industry, 20172025 (USD Thousand)

Table 98 Gantry Robot Market in APAC, By Country, 20172025 (USD Million)

Table 99 Gantry Robot Market in APAC, By Industry, 20172025 (USD Million)

Table 100 Gantry Robot Market in China, By Industry, 20172025 (USD Thousand)

Table 101 Gantry Robots Market in South Korea, By Industry, 20172025 (USD Thousand)

Table 102 Gantry Robot Market in Japan, By Industry, 20172025 (USD Thousand)

Table 103 Gantry Robot Market in Taiwan, By Industry, 20172025 (USD Thousand)

Table 104 Gantry Robot Market in Thailand, By Industry, 20172025 (USD Thousand)

Table 105 Gantry Robot Market in India, By Industry, 20172025 (USD Thousand)

Table 106 Gantry Robot Market in Rest of APAC, By Industry, 20172025 (USD Thousand)

Table 107 Gantry Robot Market in RoW, By Country, 20172025 (USD Thousand)

Table 108 Gantry Robot Market in RoW, By Industry, 20172025 (USD Thousand)

Table 109 Gantry Robot Market in Middle East & Africa, By Industry, 20172025 (USD Thousand)

Table 110 Gantry Robot Market in South America, By Industry, 20172025 (USD Thousand)

Table 111 Comparison Between Rack & Pinion and Belt Drives

Table 112 Gantry Robot Market Ranking, 2019

Table 113 Product Launches, 20172019

Table 114 Partnerships and Collaborations, 20172019

Table 115 Expansions, 20172019

Table 116 Acquisitions, 20172019

Table 117 Contracts and Agreements, 20172019

List of Figures (53 Figures)

Figure 1 Segmentation of Gantry Robot Market

Figure 2 Gantry Robot Market: Research Design

Figure 3 Market Size Estimation Methodology: Approach 1 Bottom-Up (Demand Side): Demand for Gantry Robots in US

Figure 4 Gantry Robot Market: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Approach 2 (Supply Side): Revenue Generated From Products in Gantry Robot Market

Figure 6 Market Size Estimation Methodology: Approach 2 (Supply Side): Illustration of Revenue Estimation for One Company in Gantry Robot Market

Figure 7 Gantry Robot Market: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 Gantry Robots With Payload Capacity More Than 350 Kg Held Largest Market Share in 2019

Figure 10 3-Axis Gantry Robots Held Largest Share of Market in 2019

Figure 11 Robots Mounted on Gantry Systems to Record Higher CAGR During Forecast Period

Figure 12 Gantry Robots Will Be Primarily Used for Handling Applications in 2020

Figure 13 Automotive Industry to Hold Largest Share of Gantry Robot Market During Forecast Period

Figure 14 APAC to Account for Largest Share of Gantry Robot Market in 2020

Figure 15 Growing Demand for Gantry Robots With Payload Capacity of More Than 350 Kg to Drive Growth of Gantry Robot Market During Forecast Period

Figure 16 Gantry Robots With Payload Capacity of More Than 350 Kg to Gain Largest Market Share During Forecast Period

Figure 17 3-Axis Gantry Robots Account for Largest Market Share in 2020

Figure 18 Handling Application to Hold Largest Share of Gantry Robot Market in 2020

Figure 19 Automotive Industry and China to Hold Largest Share of Gantry Robot Market in APAC, By Industry and Country, Respectively, in 2020

Figure 20 Market in Taiwan, Thailand, and India to Grow at Significant CAGR During Forecast Period

Figure 21 Impact of Drivers on Gantry Robots Market

Figure 22 Impact of Restraints on Gantry Robots Market

Figure 23 Impact of Opportunities on Gantry Robots Market

Figure 24 Impact of Challenges on Gantry Robots Market

Figure 25 Value Chain Analysis of Ecosystem of Gantry Robots: R&D and Manufacturing Phases Add Maximum Value

Figure 26 3-Axis Gantry Robots to Hold Largest Share of Market During Forecast Period

Figure 27 Market for Gantry Robots With Payload Capacity More Than 350 Kg to Grow at Highest CAGR During Forecast Period

Figure 28 Market for Gantry Robots With Robot Support are Expected to Grow at Higher CAGR During Forecast Period

Figure 29 Handling Application to Hold Largest Share of Gantry Robot Market Throughout Forecast Period

Figure 30 Automotive Industry to Hold Largest Share Throughout Forecast Period

Figure 31 Market for Automotive Industry in APAC to Grow at Highest CAGR During Forecast Period

Figure 32 APAC to Hold Largest Share of Market for Electrical and Electronics Industry During Forecast Period

Figure 33 Market for Metals and Machinery Industry in APAC to Grow at Highest CAGR During Forecast Period

Figure 34 Gantry Robot Market for Plastics, Rubber, and Chemicals Industry in APAC to Hold Largest Share in 2020

Figure 35 Gantry Robot Market for Food & Beverages Industry in APAC to Grow at Highest CAGR During Forecast Period

Figure 36 Gantry Robot Market for Precision Engineering and Optics Industry in Europe to Grow at Highest CAGR During Forecast Period

Figure 37 Gantry Robot Market for Pharmaceuticals and Cosmetics Industry in Europe to Grow at Highest CAGR During Forecast Period

Figure 38 APAC to Hold Largest Share of Gantry Robot Market for Other Industries Throughout Forecast Period

Figure 39 Thailand to Grow at Fastest Rate During Forecast Period

Figure 40 North America: Gantry Robot Market Snapshot

Figure 41 Europe: Gantry Robot Market Snapshot

Figure 42 APAC: Gantry Robot Market Snapshot

Figure 43 Middle East and Africa to Hold Largest Share of Gantry Robots Market Throughout Forecast Period

Figure 44 Players in Gantry Robot Market Adopted Product Launches as Their Key Strategy for Business Expansion From 2017 to 2019

Figure 45 Gόdel LED Gantry Robot Market in 2019

Figure 46 Gantry Robot Market (Global) Competitive Leadership Mapping, 2019

Figure 47 Gantry Robot Market Witnessed Moderate Growth From 2017 to 2019

Figure 48 Toshiba Machine: Company Snapshot

Figure 49 Liebherr: Company Snapshot

Figure 50 Bosch Rexroth: Company Snapshot

Figure 51 Yamaha Motor: Company Snapshot

Figure 52 Omron: Company Snapshot

Figure 53 Nordson: Company Snapshot

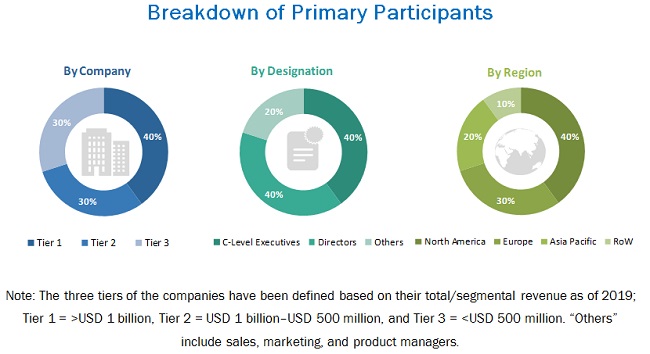

The study involved the estimation of the current size of the global gantry robot market. Exhaustive secondary research was carried out to collect information about the market, its peer markets, and its parent market. It was followed by the validation of findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete size of the market. It was followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information pertinent to this study on the gantry robot market. Secondary sources included annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles by recognized authors, directories, and databases. Secondary research was conducted to obtain key information about the supply chain of the industry, value chain of the market, the total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology oriented perspectives.

After the complete market engineering (which included calculations for the market statistics, market breakdown, data triangulation, market size estimations, and market forecasting), extensive primary research was carried out to gather information, as well as to verify and validate the critical numbers obtained.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the gantry robot market through secondary research. Several primary interviews were conducted with the market experts from both demand (commercial application providers) and supply (equipment manufacturers and distributors) sides across four major regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). Approximately 20% and 80% of primary interviews were conducted with parties from the demand side and supply side, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, were used to estimate and validate the size of the gantry robot market and other dependent submarkets. Key players in the market were determined through primary and secondary research. This entire research methodology involved the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives for key insights (both qualitative and quantitative) about the gantry robot market. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market segments covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analyses from MarketsandMarkets and presented in the report.

Data Triangulation

After arriving at the overall gantry robot market size using the estimation processes explained above, the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides for gantry robots.

Report Objectives

- To describe and forecast the gantry robot market, in terms of value, based on the number of axes, payload, support, application, and industry

- To describe and forecast the market size, in terms of value and volume, for four main regions: North America, Europe, APAC, and RoW

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the gantry robot market

- To provide an overview of the value chain pertaining to the gantry robot ecosystem

- To strategically analyze micromarkets with respect to individual growth trends, business prospects, and contribution to the total gantry robot market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the gantry robot market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the gantry robot market report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Gantry Robot Market