Genetic Toxicology Testing Market by Product (Assays, Reagents & Consumables, Services), By Application (Healthcare Industry, Food Industry, Cosmetics Industry, Agriculture Industry) & Region - Global Forecast to 2025

Market Growth Outlook Summary

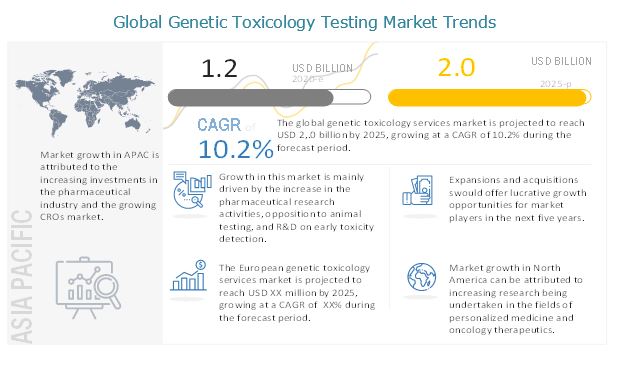

The global genetic toxicology testing market growth forecasted to transform from $1.2 billion in 2020 to $2.0 billion by 2025, driven by a CAGR of 10.2%. Growth in this market is primarily driven by increased pharmaceutical research activities, opposition to animal testing, and R&D on early toxicity detection. The increasing focus on drug discovery and personalized medicine using in vitro methods, and the rising demand for humanized animal models, are expected to offer significant growth opportunities for the players operating in the global genetic toxicology testing market. On the other hand, the failure to establish the intricacies of in vivo conditions, lack of in vitro models to study complex endpoints, and the reluctance of regulatory authorities to consider alternative methods for proving safety and efficacy are expected to restrain the growth of this market to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

Genetic Toxicology Testing Market Dynamics

Driver: Increased number of pharmaceutical R&D activities

The primary goal of R&D activities is to increase the overall chances of approval of Phase I drug candidates by increasing the acceptance of compounds in the preclinical stages. To achieve this, intensive R&D activities are conducted in the early stages of drug development. This, in turn, drives the demand for genetic toxicology services. Increased R&D investments in the initial stages of drug development are also expected to increase the use of in vivo toxicology methods before the drug reaches the expensive clinical stages. This also leads to a rise in demand for genetic toxicology services, thereby fueling the growth of the market.

Restraint: Lack of validated in vitro models to study complex endpoints

Autoimmunity and immune-stimulation are important endpoints for drug development, considering the fact that half of the new drugs developed are human proteins and antibodies. Currently, these therapeutic molecules can be tested only in animal models. The evaluation of the memory response triggered inside a body post a secondary infection is not allowed by in vitro genetic testing methods. These methods lack the ability to evaluate the recovery response of a body with respect to acute versus long-term immunosuppression. They are also incapable of evaluating the toxic effects of the therapeutic molecules on lymphoid architecture, such as on lymph nodes, which could lead to defects in cellular interactions necessary for immune response. Currently, there are no effective systems that use human cells for in vitro antibody production, unlike T-dependent antibody sheep red blood cells (SRBC) in animals. Due to the lack of effective in vitro models for humans, researchers still depend on animal tests to detect autoimmunity and immune-stimulation triggered by newly developed drugs.

Opportunity: Risen global demand for humanized animal models

Humanized mice are increasingly being used as models for various biomedical research applications. In September 2017, professors at the Jackson Laboratory and the Yale University (US) received a 3-year grant worth USD 1.5 million to conduct advanced research on humanized MISTRG models for gaining biological insights into human melanoma and identifying therapeutic targets. In November 2018, the Jackson Laboratory, with the Yale University (US), received a grant worth USD 700,000 from the US-based Connecticut Bioscience Innovation Fund (CBIF). This grant aimed at supporting the collaboration among scientists to develop humanized mice models that accurately represent human responses to cancer and cancer therapies.

The requirement of identifying the actual effect of drugs on humans and studying human-specific infections, therapies, and immune responses augment the use and the development of humanized animal models, thereby aiding the growth of the genetic toxicology services market during the forecast period.

Challenge: Regulations and laws to ensure ethical use of animals in research activities

Government regulations in a number of countries require geno toxicology testing on animals as a condition for imports or sales of pesticides, industrial chemicals, drugs, medical devices, vaccines, genetically modified food, and some consumer products. Every year, millions of animals, including mice, rats, frogs, dogs, cats, rabbits, hamsters, guinea pigs, monkeys, fish, and birds, are used for drug development. This has led to the establishment of several animal ethical review committees in different countries. These committees comprise animal care committees, institutional animal care and use committees, and animal ethics committees. One such committee is People for the Ethical Treatment of Animals (PETA).

The services segment accounts for the largest share of the market, by product

Based on product, the genetic toxicology testing market is segmented into reagents & consumables, assays, and services. The services segment accounted for the larger market share in 2019. The growing R&D activities in the pharmaceutical industry, growing government investments in the field of life sciences research, and the increasing research being undertaken with integrated omics studies, which is leading to increased outsourcing of services to contract research organizations (CROs), are factors attributing to the larger share of the segment.

The cosmetics industry segment is expected to grow at the highest CAGR during the forecast period

Based on application, the genetic toxicology testing market is segmented into the healthcare industry (pharmaceutical & biotechnology), food industry, cosmetic industry, and others (agriculture and chemical industries). The cosmetics industry segment is expected to witness the highest growth during the forecast period. The increasing use of cosmetics owing to the rising disposable incomes and their easy availability to the public has driven the industry to invest in the research of breakthrough products and develop safe products.

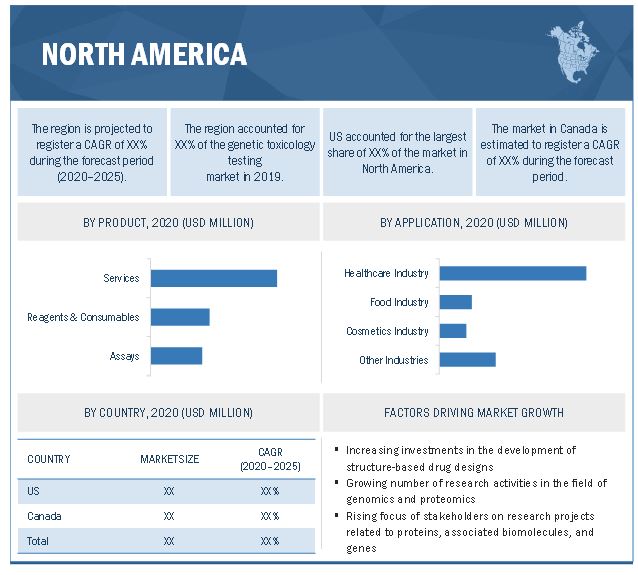

North America is expected to account for the largest share of the genetic toxicology testing market

In 2019, North America accounted for the largest share of the genetic toxicology testing market, followed by Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The large share of this market segment can be attributed to the increasing development of structure-based drug designs, growing academic and government investments in genomics and proteomics research, rising life sciences research funding, high biopharmaceutical R&D expenditure, and the emerging adoption of advanced technologies in North America. The presence of a large number of global players in this region is another key factor contributing to the large share of this market segment.

The prominent players in this market are Thermo Fisher Scientific, Inc. (US), Charles River Laboratories International, Inc. (US), Laboratory Corp Of America Holdings (US), Eurofins Scientific (Germany), Jubilant Life Sciences Limited (India), Merck KGaA (Germany), Toxikon Corporation (US), and Gentronix Limited (UK)

Scope of the Genetic Toxicology Testing Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$1.2 billion |

|

Projected Revenue Size by 2025 |

$2.0 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 10.2% |

|

Market Driver |

Increased number of pharmaceutical R&D activities |

|

Market Opportunity |

Risen global demand for humanized animal models |

The study categorizes the Genetic Toxicology Testing Market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Reagents & Consumables

- Assays

- Services

By Application

- Healthcare Industry (pharmaceutical & biotechnology)

- Food Industry

- Cosmetics Industry

- Other Industries (agriculture and chemical industries)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In 2020, Evotec established a dedicated site for the R&D of gene therapy-based projects.

- In 2020, Merck KGaA invested USD 21.32 million in a new Life Science Laboratory in Switzerland.

- In 2019, LabCorp opened a new R&D center in Shanghai (China).

- In 2019, Charles River entered an agreement with Toxys to offer the latter’s ToxTracker in North America.

Frequently Asked Questions (FAQs):

What is the size of Genetic Toxicology Testing Market ?

The global genetic toxicology testing market is projected to reach USD 2.0 billion by 2025, growing at a CAGR of 10.2%.

What are the major growth factors of Genetic Toxicology Testing Market ?

Growth in this market is primarily driven by increased pharmaceutical research activities, opposition to animal testing, and R&D on early toxicity detection.

Who all are the prominent players of Genetic Toxicology Testing Market ?

The prominent players in this market are Thermo Fisher Scientific, Inc. (US), Charles River Laboratories International, Inc. (US), Laboratory Corp Of America Holdings (US), Eurofins Scientific (Germany), Jubilant Life Sciences Limited (India), Merck KGaA (Germany), Toxikon Corporation (US), and Gentronix Limited (UK) .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION & SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 GENETIC TOXICOLOGY TESTING MARKET

1.2.3 YEARS CONSIDERED FOR STUDY

1.3 CURRENCY

1.4 STAKEHOLDERS

1.5 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 19)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.2 KEY DATA FROM SECONDARY SOURCES

2.2 PRIMARY RESEARCH

2.2.1 PRIMARY SOURCES

2.2.1.1 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 5 MARKET ANALYSIS APPROACH

FIGURE 6 TOP-DOWN APPROACH

2.4 DATA TRIANGULATION APPROACH

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.5 MARKET SHARE ESTIMATION

2.6 ASSUMPTIONS FOR STUDY

3 EXECUTIVE SUMMARY (Page No. - 29)

FIGURE 8 GENETIC TOXICOLOGY TESTING MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 9 GENETIC TOXICOLOGY TESTING MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 10 GEOGRAPHIC ANALYSIS: GENETIC TOXICOLOGY TESTING MARKET

4 PREMIUM INSIGHTS (Page No. - 33)

4.1 GENETIC TOXICOLOGY TESTING MARKET OVERVIEW

FIGURE 11 INCREASING RESEARCH BEING CONDUCTED USING GENE-BASED TECHNOLOGIES TO DRIVE MARKET GROWTH

4.2 EUROPE: GENETIC TOXICOLOGY TESTING MARKET, BY PRODUCT

FIGURE 12 SERVICES SEGMENT ACCOUNTED FOR LARGEST SHARE OF EUROPEAN GENETIC TOXICOLOGY TESTING MARKET IN 2019

4.3 GENETIC TOXICOLOGY TESTING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 13 MARKET IN ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

4.4 GENETIC TOXICOLOGY TESTING MARKET, BY REGION (2018–2025)

FIGURE 14 NORTH AMERICA TO CONTINUE DOMINATING GENETIC TOXICOLOGY TESTING MARKET UNTIL 2025

5 MARKET OVERVIEW (Page No. - 37)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

TABLE 1 GENETIC TOXICOLOGY SERVICES MARKET: IMPACT ANALYSIS

5.2.1 MARKET DRIVERS

5.2.1.1 Increased number of pharmaceutical R&D activities

FIGURE 15 R&D INVESTMENTS, BY COUNTRY, 2017 VS. 2018 (USD BILLION)

5.2.1.2 Opposition to animal testing of drugs and cosmetics

5.2.1.3 R&D activities for early toxicity detection in drugs

5.2.2 MARKET RESTRAINTS

5.2.2.1 Lack of validated in vitro models to study complex endpoints

5.2.2.2 Reluctance of countries toward replacement of in vivo methods with alternative testing

5.2.2.3 Failure of in vitro methods to achieve intricacies similar to in vivo methods

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 Increased focus on drug discovery and personalized medicines using in vitro methods

5.2.3.2 Risen global demand for humanized animal models

5.2.4 MARKET CHALLENGES

5.2.4.1 Regulations and laws to ensure ethical use of animals in research activities

TABLE 2 REGULATORY AUTHORITIES OVERSEEING USE OF ANIMAL MODELS IN RESEARCH ACTIVITIES

5.2.4.2 Dearth of skilled professionals

5.3 INDUSTRY TRENDS

5.3.1 INCREASING FOCUS ON PREDICTIVE TOXICOLOGY

5.4 PARENT MARKET (IN VITRO TOXICOLOGY TESTING): SUPPLY CHAIN ANALYSIS

FIGURE 16 SUPPLY CHAIN ANALYSIS: IN VITRO TOXICOLOGY TESTING MARKET

5.5 COVID- 19 HEALTH ASSESSMENT

FIGURE 17 GLOBAL PROPAGATION OF COVID-19

FIGURE 18 COVID-19 PROPAGATION: SELECT COUNTRIES

5.6 COVID-19 IMPACT ON GENETIC TOXICOLOGY SERVICES MARKET

6 GENETIC TOXICOLOGY TESTING MARKET, BY PRODUCT (Page No. - 50)

6.1 INTRODUCTION

FIGURE 19 SERVICES SEGMENT TO LEAD GENETIC TOXICOLOGY TESTING MARKET DURING FORECAST PERIOD

TABLE 3 GENETIC TOXICOLOGY TESTING MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

6.2 SERVICES

6.2.1 INCREASED TREND OF OUTSOURCING TOXICITY TESTING SERVICES BY KEY INDUSTRIES SUCH AS PHARMACEUTICALS AND CHEMICALS TO FOSTER MARKET GROWTH

TABLE 4 GENETIC TOXICOLOGY SERVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.3 REAGENTS AND CONSUMABLES

6.3.1 REPETITIVE USE OF CONSUMABLES IN TESTING ACTIVITIES SUPPORTS MARKET GROWTH

TABLE 5 GENETIC TOXICOLOGY REAGENTS AND CONSUMABLES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.4 ASSAYS

6.4.1 INCREASED NEED FOR ACCURATE ANALYSIS DRIVES ADOPTION OF DIFFERENT TYPES OF ASSAYS

TABLE 6 GENETIC TOXICOLOGY ASSAYS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7 GENETIC TOXICOLOGY TESTING MARKET, BY APPLICATION (Page No. - 56)

7.1 INTRODUCTION

7.2 COVID-19 IMPACT, BY APPLICATION

FIGURE 20 HEALTHCARE INDUSTRY TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 7 GENETIC TOXICOLOGY TESTING MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

7.3 HEALTHCARE INDUSTRY

7.3.1 INCREASING R&D INVESTMENTS IN ONCOLOGY FIELD TO BOOST DEMAND FOR GENOTOXICOLOGY TESTING

TABLE 8 GENETIC TOXICOLOGY TESTING MARKET FOR HEALTHCARE INDUSTRY, BY COUNTRY, 2018–2025 (USD MILLION)

7.4 FOOD INDUSTRY

7.4.1 GROWING FOCUS ON FOOD SAFETY TO PROPEL MARKET GROWTH

TABLE 9 GENETIC TOXICOLOGY TESTING MARKET FOR FOOD INDUSTRY, BY COUNTRY, 2018–2025 (USD MILLION)

7.5 COSMETICS INDUSTRY

7.5.1 RISING ADOPTION OF IN VITRO GENOTOXICOLOGY ASSAYS DUE TO BAN ON ANIMAL TESTING FOR COSMETIC PRODUCTS AND INGREDIENTS TO SPUR MARKET GROWTH

TABLE 10 GENETIC TOXICOLOGY TESTING MARKET FOR COSMETICS INDUSTRY, BY COUNTRY, 2018–2025 (USD MILLION)

7.6 OTHER INDUSTRIES

TABLE 11 GENETIC TOXICOLOGY TESTING MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2018–2025 (USD MILLION)

8 GENETIC TOXICOLOGY TESTING MARKET, BY REGION (Page No. - 65)

8.1 INTRODUCTION

8.2 COVID-19 IMPACT, BY REGION

TABLE 12 GENETIC TOXICOLOGY TESTING MARKET, BY REGION, 2018–2025 (USD MILLION)

8.3 NORTH AMERICA

FIGURE 21 TOTAL NUMBER OF CLINICAL TRIALS: GLOBAL VS. NORTH AMERICA, 2017

FIGURE 22 NORTH AMERICA: GENETIC TOXICOLOGY TESTING MARKET SNAPSHOT

TABLE 13 NORTH AMERICA: GENETIC TOXICOLOGY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 NORTH AMERICA: GENETIC TOXICOLOGY TESTING MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 15 NORTH AMERICA: GENETIC TOXICOLOGY TESTING MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8.3.1 US

8.3.1.1 US dominates North American market

TABLE 16 US: NIH BUDGET FOR VARIOUS DISCIPLINES, FY 2019 VS. FY 2020 (USD BILLION)

TABLE 17 US: GENETIC TOXICOLOGY TESTING MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 18 US: GENETIC TOXICOLOGY TESTING MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8.3.2 CANADA

8.3.2.1 Increasing funding and improved infrastructure for gene-based research supporting market growth

TABLE 19 CANADA: GENETIC TOXICOLOGY TESTING MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 20 CANADA: GENETIC TOXICOLOGY TESTING MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8.4 EUROPE

FIGURE 23 EUROPE: GENETIC TOXICOLOGY TESTING MARKET SNAPSHOT

TABLE 21 EUROPE: GENETIC TOXICOLOGY TESTING MARKET, BY COUNTRY,2018–2025 (USD MILLION)

TABLE 22 EUROPE: GENETIC TOXICOLOGY TESTING MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 23 EUROPE: GENETIC TOXICOLOGY TESTING MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.1 GERMANY

8.4.1.1 Growing R&D activities in genomics to propel market growth

TABLE 24 GERMANY: GENETIC TOXICOLOGY TESTING MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 25 GERMANY: GENETIC TOXICOLOGY TESTING MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.2 FRANCE

8.4.2.1 Increasing government support for gene-based research to support market growth

TABLE 26 FRANCE: GENETIC TOXICOLOGY TESTING MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 27 FRANCE: GENETIC TOXICOLOGY TESTING MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.3 UK

8.4.3.1 Rising public and private funding for research to drive market growth

TABLE 28 UK: GENETIC TOXICOLOGY TESTING MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 29 UK: GENETIC TOXICOLOGY TESTING MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.4 REST OF EUROPE

TABLE 30 ROE: GENETIC TOXICOLOGY TESTING MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 31 ROE: GENETIC TOXICOLOGY TESTING MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8.5 ASIA PACIFIC

8.5.1 INCREASING RESEARCH FUNDING AND GROWING AWARENESS ABOUT PERSONALIZED THERAPEUTICS TO SUPPORT MARKET GROWTH

TABLE 32 ASIA PACIFIC: GENETIC TOXICOLOGY TESTING MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 33 ASIA PACIFIC: GENETIC TOXICOLOGY TESTING MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8.6 LATIN AMERICA

8.6.1 GROWTH IN PHARMACEUTICAL INDUSTRY IN MEXICO TO SUPPORT MARKET GROWTH

TABLE 34 LATIN AMERICA: GENETIC TOXICOLOGY TESTING MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 35 LATIN AMERICA: GENETIC TOXICOLOGY TESTING MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8.7 MIDDLE EAST & AFRICA

8.7.1 IMPROVING FOCUS ON PRECISION MEDICINE AND DISEASE GENETICS DRIVING MARKET GROWTH

TABLE 36 MIDDLE EAST & AFRICA: GENETIC TOXICOLOGY TESTING MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA: GENETIC TOXICOLOGY TESTING MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 89)

9.1 OVERVIEW

FIGURE 24 PRODUCT LAUNCHES—KEY GROWTH STRATEGY ADOPTED BY MARKET PLAYERS FROM 2017 TO NOVEMBER 2020

9.2 MARKET SHARE ANALYSIS

FIGURE 25 GENETIC TOXICOLOGY SERVICES MARKET SHARE, BY KEY PLAYER, 2019

9.3 COMPANY EVALUATION MATRIX

9.3.1 STAR

9.3.2 EMERGING LEADER

9.3.3 PERVASIVE

9.3.4 EMERGING COMPANIES

FIGURE 26 GENETIC TOXICOLOGY SERVICES MARKET: COMPETITIVE LEADERSHIP MAPPING (2019)

9.4 COMPETITIVE SITUATION AND TRENDS

9.4.1 EXPANSIONS

TABLE 38 EXPANSIONS, 2017–2020

9.4.2 ACQUISITIONS

TABLE 39 ACQUISITIONS, 2017–2020

9.4.3 OTHER STRATEGIES

TABLE 40 OTHER STRATEGIES, 2017–2020

10 COMPANY PROFILES (Page No. - 97)

10.1 THERMO FISHER SCIENTIFIC INC.

FIGURE 27 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2019)

10.2 CHARLES RIVER LABORATORIES INTERNATIONAL, INC.

FIGURE 28 CHARLES RIVER LABORATORIES INTERNATIONAL, INC.: COMPANY SNAPSHOT (2019)

10.3 CREATIVE BIOARRAY

10.4 CYPROTEX PLC

FIGURE 29 EVOTEC AG: COMPANY SNAPSHOT (2019)

10.5 LABORATORY CORP OF AMERICA HOLDINGS

FIGURE 30 LABORATORY CORP OF AMERICA HOLDINGS: COMPANY SNAPSHOT (2019)

10.6 JUBILANT LIFE SCIENCES LIMITED

FIGURE 31 JUBILANT LIFE SCIENCES LIMITED: COMPANY SNAPSHOT (2020)

10.7 MERCK KGAA (MILLIPORE SIGMA )

FIGURE 32 MERCK KGAA: COMPANY SNAPSHOT (2019)

10.8 SHANGHAI MEDICILON INC.

10.9 EUROFINS SCIENTIFIC

FIGURE 33 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT (2019)

10.10 CREATIVE BIOLABS

10.11 TOXIKON CORPORATION

10.12 ENVIRONMENTAL BIO-DETECTION PRODUCTS INC. (EBPI)

10.13 GENTRONIX LIMITED

10.14 MB RESEARCH LABORATORIES

10.15 SOTERA HEALTH LLC

11 APPENDIX (Page No. - 124)

11.1 INSIGHTS OF INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

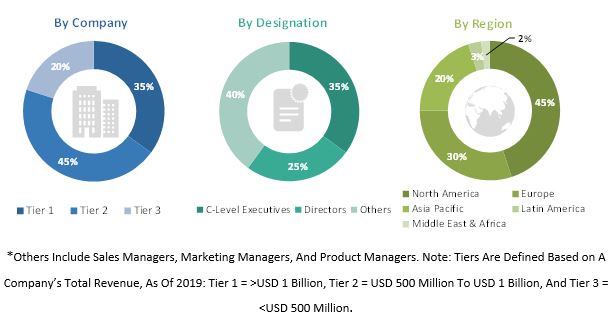

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories and databases such as D&B, Bloomberg Business, and Factiva; and white papers, annual reports, and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global genetic toxicology testing market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, manufacturing managers, and related key executives from various key companies and organizations operating in the global genetic toxicology testing market. The primary sources from the demand side include purchase and sales managers, research organizations, and pharmaceutical and biotechnology companies.

Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by product, application, and region).

Data Triangulation

After arriving at the market size, the total genetic toxicology testing market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the genetic toxicology testing market by product, application, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall genetic toxicology services market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the genetic toxicology testing market in five main regions (along with their respective key countries), namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the genetic toxicology testing market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments such as acquisitions; product launches; expansions; collaborations, and partnerships; and R&D activities of the leading players in the genetic toxicology testing market

- To benchmark players within the genetic toxicology testing market using the "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

The study categorizes the Genetic Toxicology Testing Market based on product, application, regional and global level.

By Product

- Reagents & Consumables

- Assays

- Services

By Application

- Healthcare Industry (pharmaceutical & biotechnology)

- Food Industry

- Cosmetics Industry

- Other Industries (agriculture and chemical industries)

By Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Rest of Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Asia Pacific genetic toxicology testing market into China, Japan, India, and others

- Further breakdown of Latin American genetic toxicology testing market into the Brazil, Mexico, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Genetic Toxicology Testing Market