Geomembranes Market by Type (HDPE, LDPE & LLDPE, PVC, EPDM, PP), Manufacturing Process (Extrusion, Calendering), Application (Mining, Waste Management, Water Management, Civil Construction), and Geography - Global Forecast to 2027

Updated on : August 28, 2025

Geomembranes Market

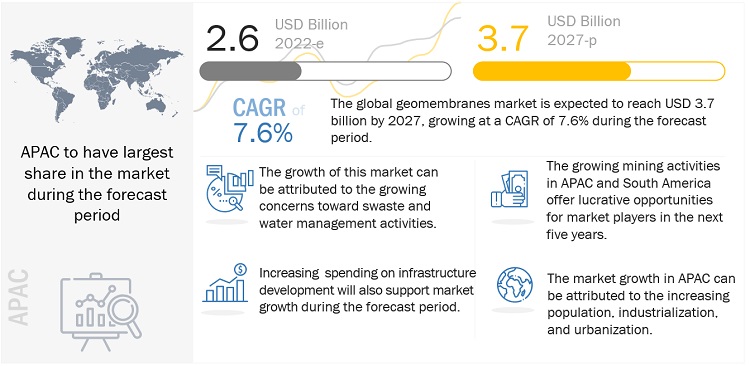

The global geomembranes market was valued at USD 2.6 billion in 2022 and is projected to reach USD 3.7 billion by 2027, growing at 7.6% cagr from 2022 to 2027. This growth is attributed to the increased mining activities in APAC and South America, the growing concerns towards waste and water management activities, and the increasing spending on infrastructure development.

Global Geomembranes Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Geomembrane Market Dynamics

Driver: Increased mining activities in APAC and South America

Growing industrialization and urbanization in major countries such as China and India have spurred the demand for metals and minerals in the last few years. Moreover other countries in APAC that have attracted significant mining investments are Australia, New Zealand, Japan, South Korea, Singapore, Mongolia, and Indonesia. South America is also one of the growing region for the mining industry. It has become a preferred destination for mining investments by major global mining companies. Major countries such as Brazil, Peru, and Chile have large mining capacities and have witnessed increased investments from foreign companies over the past five years. The mining industry is one of the major consumers of geomembranes. Geomembranes are used to help recapture and recycle the harmful chemicals being used in solution to treat ponds and secondary containment applications. This is expected to drive the geomembranes market during the forecast period.

Restrain: Fluctuating raw material prices on account of volatility in crude oil prices

Volatility in crude oil prices is one of the major restraining factor for geomembranes manufacturers. Most raw materials which is use in manufacturing of geomembranes are petroleum-based and are vulnerable to rapid fluctuations in crude oil prices. The rise or fall in crude oil prices directly affects the price of the raw materials required for geomembranes. Leading anufacturers have to cope with high and volatile raw material costs, which in return reduces their profit margins. This has lead tp to a scenario in which market players to enhance the efficiency and productivity of their operations to sustain growth and retain market share.

Opportunity: Increasing spending on infrastructure development

Growing infrastructural development such as water supply and treatment plants, roads, tunnels, dams, railways, airports, bridges, telecommunication networks, schools, and hospitals. As per as Confederation of International Contractors' Associations (CICA), the output for residential and non-residential (including commercial, industrial, and others) infrastructures will grow by 85%, in terms of volume, to reach USD 15.5 trillion by 2030. There are a multitude of applications for geomembranes within construction sector. The long shelf-life along with good physical & mechanical properties of geomembranes will work in favor of the market. Thus, growing infrastructural developments, are expected to create growth opportunities for the geomembranes market during the forecast period.

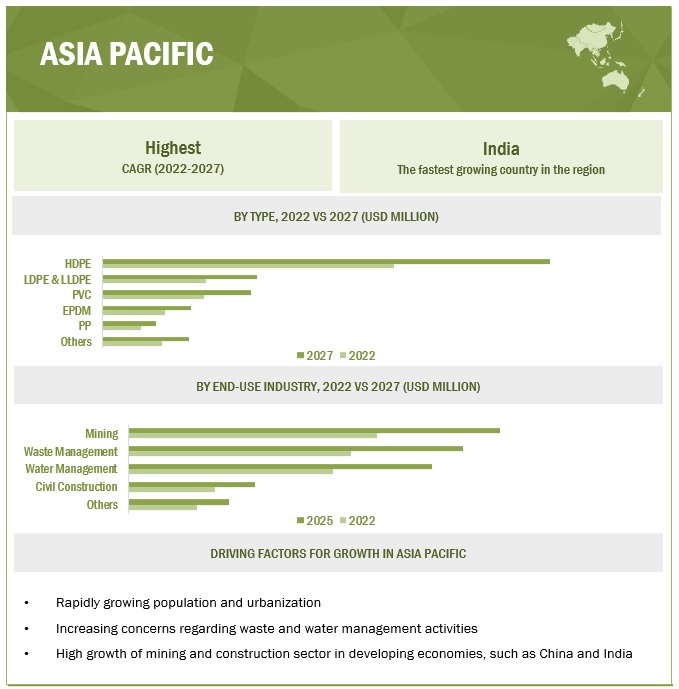

HDPE is the fastest-growing type during the forecast period

HDPE, LDPE & LLDPE, PVC, EPDM, and PP are the major types of geomembranes available in the market. HDPE geomembranes are the largest and fastest-growing segment in terms of value in 2021. These membranes possess excellent properties such as chemical resistance, high durability, high stability, ultraviolet protection, inherent flexibility, and aging resistance from powerful stresses of weather. These geomembranes are commonly used for applications that demand excellent chemical & UV resistance and overall endurance properties at an affordable cost.

By application mining is expected to account for the largest market size during the forecast period

Mining, waste management, water management, and civil construction are the major applications of geomembranes. \, Mining is estimated to be the largest application during the forecast period. Owing to the durability of geomembranes, in harsh climates, its application is significantly increasing in the mining sector including metal mining, non-metallic mineral mining, and energy mining. The most common applications of geomembranes in the mining industry include heap leach pads, wastewater runoff ponds, tailing ponds, processed water containment, floating covers, soil remediation, secondary containment, and tailings cap enclosures.

By region APAC is projected to have the fastest growth during the forecast period

APAC is projected to be the fastest-growing market during the forecast period. It is projected to grow at a CAGR of 7.0% between 2022 and 2027. The growth in this region is primarily attributed to its rapidly growing population and increasing urbanization and industrialization. These factors are rapidly driving the demand for waste and water management projects in the region. Developing economies, such as India, China, South Korea, and Australia, are investing in various mining and infrastructural development projects that are also driving the market.

To know about the assumptions considered for the study, download the pdf brochure

Geomembranes Market Players

The major players present in the geomembranes market is Solmax (Canada), Raven Industries (US), AGRU (Austria), Carlisle Construction Materials LLC (US), Atarfil (Spain), PLASTIKA KRITIS (Greece), JUTA (Czech Republic), and Maccaferri (Italy) among others.

Geomembranes Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/USD Billion) and Volume (Million Square Meters) |

|

Segments covered |

Type, Manufacturing Process, Application, and Region |

|

Geographies covered |

North America, APAC, Europe, South America, and Middle East & Africa |

|

Companies covered |

Solmax (Canada), Raven Industries (US), AGRU (Austria), Carlisle Construction Materials LLC (US), and Atarfil (Spain). |

This research report categorizes the geomembranes market based on type, manufacturing process, application, and region.

Geomembranes Market based on Type:

- High-density polyethylene (HDPE)

- Low-density polyethylene (LDPE) & Linear low-density polyethylene (LLDPE)

- Polyvinyl chloride (PVC)

- Ethylene propylene diene monomer (EPDM)

- Polypropylene (PP)

- Others (polyethylene, chlorosulfonated polyethylene, ethylene interpolymer alloy, thermoplastic polyolefin, polyurethane, XR reinforced geomembrane, and bituminous geomembrane)

Geomembranes Market based on Manufacturing Process:

- Extrusion

- Calendering

- Others (spread coating, co-extrusion, and lamination)

Geomembranes Market based on Application:

- Mining

- Waste Management

- Water Management

- Civil Construction

- Others (environmental containment, soil erosion control, energy, and oil & gas)

Geomembranes Market based on Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In February 2018, Atarfil acquired Garden City Geotech (Australia), the largest manufacturer of HDPE geomembranes in Australia. This acquisition enabled the company to strengthen their its expertise and presence in the Australian market.

- In December 2017, Solmax acquired the US-based GSE Environmental, a top player in the geosynthetic industry. This acquisition gave Solmax a broader manufacturing footprint and an expanded world-wide commercial network. This has also helped the company to work more closely and cohesively with customers, including local service companies and specialized installers, who require customized attention.

- In September 2017, Raven Industries acquired Colorado Lining International, a full service geosynthetics contractor for around USD 14 million. This acquisition added new design-build and installation service components, which enhanced Raven’s geomembrane business through extended service and product offerings.

Frequently Asked Questions (FAQ):

Which is the largest regional market for geomembranes?

Asia-Pacific is the largest regional market for geomembranes.

What is the current market size of the global geomembranes market?

The global geomembranes market size is expected to grow from USD 2.6 billion in 2022 to USD 3.7 billion by 2027, at a CAGR) of 7.6% during the forecast period.

Which type of geomembranes has a high demand in the market?

The HDPE type of geomembranes is the fastest-growing type in the coming five years. They are the most affordable type of geomembranes. They are known for their dense configuration (>0.94 g/cm3) in comparison to all other polyethylene types. They also have long-term durability with excellent chemical & UV resistance. These properties are driving their market at the highest pace.

Are there any regulations for geomembranes?

Several countries in Europe and North America have introduced regulations to use environmentally friendly products that do not harm the environment. Hence, various research is being conducted to use environmentally friendly products.

Who are the major manufacturers of geomembranes?

Companies such as Solmax ( Canada), Raven Industries (US), AGRU ( Austria), Carlisle Construction Materials LLC (US), and Atarfil ( Spain) are the major manufacturers of geomembranes. These companies have a strong global distribution network and effective supply chain strategies. Such advantages give these companies an edge over other companies.

What is the COVID-19 impact on the geomembranes market?

Industry experts said that COVID-19 have badly affected manufacturing as well as construction activities globally. Global GDP is expected to shrink by 3.0%, as per the International Monetary Fund (IMF). However, the demand is expected to rise post-pandemic, owing to measures including flexibilization, resizing, operational excellence, digitization, and investments in R&D. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 1 GEOMEMBRANES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

FIGURE 2 GEOMEMBRANES MARKET ANALYSIS THROUGH SECONDARY RESEARCH

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 GEOMEMBRANES MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 GEOMEMBRANES MARKET: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 GEOMEMBRANES MARKET: DATA TRIANGULATION

2.4 LIMITATIONS

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 6 HDPE GEOMEMBRANES TO DOMINATE MARKET IN 2022

FIGURE 7 MINING APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 8 APAC TO BE FASTEST-GROWING GEOMEMBRANES MARKET

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 ATTRACTIVE OPPORTUNITIES IN GEOMEMBRANES MARKET

FIGURE 9 HIGH GROWTH PROJECTED DURING FORECAST PERIOD

4.2 GEOMEMBRANES MARKET, BY TYPE

FIGURE 10 HDPE TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

4.3 GEOMEMBRANES MARKET, BY APPLICATION

FIGURE 11 MINING TO DOMINATE GEOMEMBRANES APPLICATIONS MARKET

4.4 GLOBAL GEOMEMBRANES MARKET, BY COUNTRY

FIGURE 12 INDIA TO REGISTER HIGHEST CAGR

4.5 APAC: GEOMEMBRANES MARKET, BY APPLICATION AND COUNTRY, 2022

FIGURE 13 MINING SEGMENT AND CHINA TO HOLD LARGEST SHARES

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, AND OPPORTUNITIES IN GEOMEMBRANES MARKET

5.2.1 DRIVERS

5.2.1.1 Increased mining activities in APAC and South America

FIGURE 15 APAC TO LEAD GLOBAL MINING INDUSTRY

5.2.1.2 Growing concerns for waste and water management activities

5.2.2 RESTRAINTS

5.2.2.1 Fluctuating raw material prices on account of volatility in crude oil prices

FIGURE 16 CRUDE OIL PRICE FLUCTUATIONS, 2001–2020

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing spending on infrastructural developments

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT FROM SUBSTITUTES

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT FROM NEW ENTRANTS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS

5.4.1 RESEARCH & DEVELOPMENT

5.4.2 MANUFACTURING, COMPOUNDING, AND FORMULATION

5.4.3 DISTRIBUTION, MARKETING, AND SALES

5.5 ECOSYSTEM

FIGURE 19 GEOMEMBRANES MARKET ECOSYSTEM

5.6 AVERAGE SELLING PRICE ANALYSIS

FIGURE 20 PRICE ANALYSIS FOR GEOMEMBRANES MARKET

5.7 TARIFF AND REGULATORY LANDSCAPE

TABLE 1 REGULATORY LANDSCAPE, BY REGION/COUNTRY

5.8 TECHNOLOGY ANALYSIS

5.9 PATENT ANALYSIS

5.9.1 OVERVIEW

5.9.1.1 Methodology

TABLE 2 PATENT ANALYSIS

FIGURE 21 PATENT APPLICATIONS FOR GEOMEMBRANES MARKET

FIGURE 22 GLOBAL PACE OF PATENT PROPAGATION

FIGURE 23 PATENT JURISDICTION ANALYSIS

FIGURE 24 TOP APPLICANTS

TABLE 3 LIST OF PATENTS: UNIVERSITY OF HOHAI

TABLE 4 LIST OF PATENTS: BEIJING GEO ENVIRON ENGINEERING & TECHNOLOGY

TABLE 5 LIST OF PATENTS: POWERCHINA HUADONG ENGINEERING CORP LTD.

TABLE 6 LIST OF PATENTS: WATERSHED GEOSYNTHETICS LLC

5.10 CASE STUDY ANALYSIS

5.10.1 EXTREME SLOPE WITH AGRU HDPE GEOMEMBRANE

5.10.2 SINGAPORE LANDFILL

5.11 MACROECONOMIC INDICATORS

5.11.1 GDP TRENDS AND FORECASTS

TABLE 7 PROJECTED GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2018–2021

5.11.2 TRENDS IN MINING INDUSTRY

TABLE 8 MINERAL PRODUCTION STATISTICS, BY REGION, 2014–2018 (BILLION METRIC TONS)

5.11.3 CONSTRUCTION STATISTICS

TABLE 9 VALUE-ADDED STATISTICS IN INDUSTRIES (INCLUDING CONSTRUCTION), BY COUNTRY, 2018 (USD MILLION)

6 GEOMEMBRANES MARKET, BY TYPE (Page No. - 60)

6.1 INTRODUCTION

FIGURE 25 HDPE GEOMEMBRANES TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 10 POTENTIAL ADVANTAGES AND DISADVANTAGES OF SOME TYPES

TABLE 11 APPROXIMATE WEIGHT PERCENTAGE FORMULATIONS OF SOME TYPES

TABLE 12 GEOMEMBRANES MARKET SIZE, BY TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 13 GEOMEMBRANES MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 14 GEOMEMBRANES MARKET SIZE, BY TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 15 GEOMEMBRANES MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

6.2 HDPE

6.2.1 HDPE TO ACCOUNT FOR LARGEST MARKET SHARE

6.3 LDPE & LLDPE

6.3.1 LOW DENSITY ALONG WITH HIGH ELASTICITY AND FLEXIBILITY TO BOOST DEMAND

6.4 PVC

6.4.1 BETTER QUALITY OF PVC GEOMEMBRANES TO SUPPORT USAGE

6.5 EPDM

6.5.1 SUPERIOR PROPERTIES OF EPDM GEOMEMBRANES TO BOOST DEMAND

6.6 PP

6.6.1 LOW LEVELS OF CRYSTALLINITY IN PP TO DRIVE END-USER PREFERENCE

6.7 OTHERS

7 GEOMEMBRANES MARKET, BY APPLICATION (Page No. - 66)

7.1 INTRODUCTION

FIGURE 26 MINING TO HOLD LARGEST SHARE OF APPLICATIONS MARKET

TABLE 16 GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 17 GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 18 GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 19 GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 MINING

7.2.1 MINING TO DOMINATE APPLICATIONS MARKET

TABLE 20 GEOMEMBRANES MARKET SIZE FOR MINING, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 21 GEOMEMBRANE MARKET SIZE FOR MINING, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 GEOMEMBRANES MARKET SIZE FOR MINING, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 23 GEOMEMBRANE MARKET SIZE FOR MINING, BY REGION, 2022–2027 (USD MILLION)

7.3 WASTE MANAGEMENT

7.3.1 POPULATION GROWTH TO DRIVE WASTE MANAGEMENT ACTIVITIES

TABLE 24 GEOMEMBRANES MARKET SIZE FOR WASTE MANAGEMENT, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 25 GEOMEMBRANE MARKET SIZE FOR WASTE MANAGEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 GEOMEMBRANES MARKET SIZE FOR WASTE MANAGEMENT, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 27 GEOMEMBRANE MARKET SIZE FOR WASTE MANAGEMENT, BY REGION, 2022–2027 (USD MILLION)

7.4 WATER MANAGEMENT

7.4.1 GEOMEMBRANES USAGE TO PREVENT CONTAMINATION OF GROUNDWATER TO DRIVE MARKET

TABLE 28 GEOMEMBRANES MARKET SIZE FOR WATER MANAGEMENT, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 29 GEOMEMBRANE MARKET SIZE FOR WATER MANAGEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 GEOMEMBRANES MARKET SIZE FOR WATER MANAGEMENT, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 31 GEOMEMBRANE MARKET SIZE FOR WATER MANAGEMENT, BY REGION, 2022–2027 (USD MILLION)

7.5 CIVIL CONSTRUCTION

7.5.1 POTENTIAL TO PREVENT WATER SEEPAGE TO DRIVE USE OF GEOMEMBRANES IN CIVIL CONSTRUCTION

TABLE 32 GEOMEMBRANES MARKET SIZE FOR CIVIL CONSTRUCTION, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 33 GEOMEMBRANE MARKET SIZE FOR CIVIL CONSTRUCTION, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 GEOMEMBRANES MARKET SIZE FOR CIVIL CONSTRUCTION, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 35 GEOMEMBRANE MARKET SIZE FOR CIVIL CONSTRUCTION, BY REGION, 2022–2027 (USD MILLION)

7.6 OTHERS

TABLE 36 GEOMEMBRANES MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 37 GEOMEMBRANE MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 GEOMEMBRANES MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 39 GEOMEMBRANE MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

8 GEOMEMBRANES MARKET, BY MANUFACTURING PROCESS (Page No. - 79)

8.1 INTRODUCTION

8.2 EXTRUSION

8.2.1 WIDE USAGE OF BLOWN-FILM EXTRUSION TO DRIVE MARKET GROWTH

8.3 CALENDERING

8.3.1 HIGH PRODUCTION RATE AND ACCURACY TO SPECIFICATIONS DRIVING GROWTH OF CALENDERING

8.4 OTHERS

9 GEOMEMBRANES MARKET, BY REGION (Page No. - 81)

9.1 INTRODUCTION

FIGURE 27 APAC TO REGISTER HIGHEST GROWTH

TABLE 40 GEOMEMBRANES MARKET SIZE, BY REGION, 2018–2021 (MILLION SQUARE METER)

TABLE 41 GEOMEMBRANE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 GEOMEMBRANES MARKET SIZE, BY REGION, 2022–2027 (MILLION SQUARE METER)

TABLE 43 GEOMEMBRANE MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.2 APAC

FIGURE 28 APAC: GEOMEMBRANES MARKET SNAPSHOT

TABLE 44 APAC: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 45 APAC: GEOMEMBRANE MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 46 APAC: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 47 APAC: GEOMEMBRANE MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 48 APAC: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 49 APAC: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 50 APAC: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 51 APAC: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 52 APAC: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 53 APAC: GEOMEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 54 APAC: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 55 APAC: GEOMEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

9.2.1 CHINA

9.2.1.1 China to dominate APAC geomembranes market

TABLE 56 CHINA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 57 CHINA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 58 CHINA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 59 CHINA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.2.2 INDIA

9.2.2.1 Industrialization and urbanization to drive market growth

TABLE 60 INDIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 61 INDIA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 62 INDIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 63 INDIA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.2.3 JAPAN

9.2.3.1 Government investments in construction industry to drive market

TABLE 64 JAPAN: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 65 JAPAN: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 66 JAPAN: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 67 JAPAN: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.2.4 AUSTRALIA

9.2.4.1 Ongoing projects for improving infrastructure to boost market

TABLE 68 AUSTRALIA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 69 AUSTRALIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 70 AUSTRALIA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 71 AUSTRALIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.2.5 INDONESIA

9.2.5.1 Civil construction projects to drive demand for geomembranes

TABLE 72 INDONESIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 73 INDONESIA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 74 INDONESIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 75 INDONESIA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.2.6 SOUTH KOREA

9.2.6.1 Government initiatives to support construction industry and end-user demand

TABLE 76 SOUTH KOREA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 77 SOUTH KOREA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 78 SOUTH KOREA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 79 SOUTH KOREA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.2.7 REST OF APAC

TABLE 80 REST OF APAC: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 81 REST OF APAC: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 82 REST OF APAC: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 83 REST OF APAC: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.3 EUROPE

FIGURE 29 EUROPE: GEOMEMBRANES MARKET SNAPSHOT

TABLE 84 EUROPE: GEOMEMBRANE MARKET SIZE, BY COUNTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 85 EUROPE: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 86 EUROPE: GEOMEMBRANE MARKET SIZE, BY COUNTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 87 EUROPE: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 88 EUROPE: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 89 EUROPE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 90 EUROPE: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 91 EUROPE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 92 EUROPE: GEOMEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 93 EUROPE: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 94 EUROPE: GEOMEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 95 EUROPE: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Residential infrastructure to drive demand for geomembranes

TABLE 96 GERMANY: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 97 GERMANY: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 98 GERMANY: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 99 GERMANY: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Upcoming projects in construction to boost market

TABLE 100 UK: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 101 UK: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 102 UK: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 103 UK: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Growing construction industry and foreign investments to drive market

TABLE 104 FRANCE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 105 FRANCE: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 106 FRANCE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 107 FRANCE: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Waste management and civil constructions to influence geomembranes market

TABLE 108 ITALY: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 109 ITALY: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 110 ITALY: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 111 ITALY: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Huge investments in construction projects to influence market

TABLE 112 SPAIN: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 113 SPAIN: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 114 SPAIN: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 115 SPAIN: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.6 RUSSIA

9.3.6.1 Government investments to support construction industry

TABLE 116 RUSSIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 117 RUSSIA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 118 RUSSIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 119 RUSSIA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.7 REST OF EUROPE

TABLE 120 REST OF EUROPE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 121 REST OF EUROPE: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 122 REST OF EUROPE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 123 REST OF EUROPE: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.4 NORTH AMERICA

FIGURE 30 NORTH AMERICA: GEOMEMBRANES MARKET SNAPSHOT

TABLE 124 NORTH AMERICA: GEOMEMBRANE MARKET SIZE, BY COUNTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 125 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 126 NORTH AMERICA: GEOMEMBRANE MARKET SIZE, BY COUNTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 127 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 128 NORTH AMERICA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 129 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 130 NORTH AMERICA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 131 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 132 NORTH AMERICA: GEOMEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 133 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 134 NORTH AMERICA: GEOMEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 135 NORTH AMERICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

9.4.1 US

9.4.1.1 US to dominate North American market

TABLE 136 US: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 137 US: GEOMEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 138 US: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 139 US: GEOMEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

9.4.2 CANADA

9.4.2.1 Government initiatives for construction sector to drive market

TABLE 140 CANADA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 141 CANADA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 142 CANADA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 143 CANADA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.4.3 MEXICO

9.4.3.1 Government policies and trade relationships to drive construction industry

TABLE 144 MEXICO: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 145 MEXICO: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 146 MEXICO: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 147 MEXICO: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

TABLE 148 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 149 MIDDLE EAST & AFRICA: GEOMEMBRANE MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 151 MIDDLE EAST & AFRICA: GEOMEMBRANE MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 153 MIDDLE EAST & AFRICA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 154 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 155 MIDDLE EAST & AFRICA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 157 MIDDLE EAST & AFRICA: GEOMEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 158 MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 159 MIDDLE EAST & AFRICA: GEOMEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

9.5.1 SAUDI ARABIA

9.5.1.1 Support for residential construction sector to drive growth

TABLE 160 SAUDI ARABIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 161 SAUDI ARABIA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 162 SAUDI ARABIA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 163 SAUDI ARABIA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.5.2 SOUTH AFRICA

9.5.2.1 Rising government focus on construction to drive geomembrane demand

TABLE 164 SOUTH AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND SQUARE METER)

TABLE 165 SOUTH AFRICA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 166 SOUTH AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 167 SOUTH AFRICA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.5.3 UAE

9.5.3.1 Political and economic stability to drive investments in construction industry

TABLE 168 UAE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 169 UAE: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 170 UAE: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 171 UAE: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 172 REST OF MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 173 REST OF MIDDLE EAST & AFRICA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 174 REST OF MIDDLE EAST & AFRICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 175 REST OF MIDDLE EAST & AFRICA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.6 SOUTH AMERICA

TABLE 176 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2018–2021 (MILLION SQUARE METER)

TABLE 177 SOUTH AMERICA: GEOMEMBRANE MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION )

TABLE 178 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY COUNTRY, 2022–2027 (MILLION SQUARE METER)

TABLE 179 SOUTH AMERICA: GEOMEMBRANE MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 180 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 181 SOUTH AMERICA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 182 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 183 SOUTH AMERICA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 184 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2018–2021 (MILLION SQUARE METER)

TABLE 185 SOUTH AMERICA: GEOMEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 186 SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY TYPE, 2022–2027 (MILLION SQUARE METER)

TABLE 187 SOUTH AMERICA: GEOMEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

9.6.1 BRAZIL

9.6.1.1 High population to drive demand for infrastructure and geomembranes

TABLE 188 BRAZIL: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 189 BRAZIL: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 190 BRAZIL: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 191 BRAZIL: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.6.2 ARGENTINA

9.6.2.1 Growing opportunities in mining to drive market

TABLE 192 ARGENTINA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 193 ARGENTINA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 194 ARGENTINA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 195 ARGENTINA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.6.3 REST OF SOUTH AMERICA

TABLE 196 REST OF SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

TABLE 197 REST OF SOUTH AMERICA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 198 REST OF SOUTH AMERICA: GEOMEMBRANES MARKET SIZE, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

TABLE 199 REST OF SOUTH AMERICA: GEOMEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 150)

10.1 OVERVIEW

FIGURE 31 KEY GROWTH STRATEGIES ADOPTED BETWEEN 2017 AND 2022

10.2 MARKET EVALUATION FRAMEWORK

10.3 MARKET SHARE, 2021

FIGURE 32 TOP FIVE COMPANIES ACCOUNTED FOR DOMINANT MARKET SHARE IN 2021

10.4 MARKET RANKING

FIGURE 33 SOLMAX DOMINATED MARKET IN 2021

10.5 COMPANY EVALUATION MATRIX DEFINITIONS

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 34 COMPANY EVALUATION MATRIX, 2021

FIGURE 35 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN GEOMEMBRANES MARKET

FIGURE 36 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN GEOMEMBRANES MARKET

10.6 COMPETITIVE LEADERSHIP MAPPING FOR SMES

10.6.1 PROGRESSIVE COMPANIES

10.6.2 RESPONSIVE COMPANIES

10.6.3 DYNAMIC COMPANIES

10.6.4 STARTING BLOCKS

FIGURE 37 GEOMEMBRANES MARKET COMPETITIVE LEADERSHIP MAPPING FOR SMES, 2021

10.7 PRODUCT FOOTPRINT (SMES)

FIGURE 38 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS IN GEOMEMBRANES (SMES) MARKET

10.8 STRATEGY FOOTPRINT (SMES)

FIGURE 39 STRATEGY FOOTPRINT ANALYSIS OF TOP PLAYERS IN GEOMEMBRANES (SMES) MARKET

10.8.1 SOLMAX

10.8.2 RAVEN INDUSTRIES

10.8.3 AGRU

10.8.4 CARLISLE CONSTRUCTION MATERIALS LLC

10.8.5 ATARFIL

10.9 KEY MARKET DEVELOPMENTS

10.9.1 ACQUISITIONS

TABLE 200 ACQUISITIONS, 2017–2022

10.9.2 EXPANSIONS

TABLE 201 EXPANSIONS, 2017–2022

11 COMPANY PROFILES (Page No. - 161)

11.1 MAJOR PLAYERS

(Business Overview, Solutions, Products & Services, Recent Developments, MnM View)*

11.1.1 SOLMAX

TABLE 202 SOLMAX: BUSINESS OVERVIEW

11.1.2 RAVEN INDUSTRIES

TABLE 203 RAVEN INDUSTRIES: BUSINESS OVERVIEW

FIGURE 40 RAVEN INDUSTRIES: COMPANY SNAPSHOT

11.1.3 AGRU

TABLE 204 AGRU: BUSINESS OVERVIEW

11.1.4 CARLISLE CONSTRUCTION MATERIALS LLC

TABLE 205 CARLISLE CONSTRUCTION MATERIALS LLC: BUSINESS OVERVIEW

11.1.5 ATARFIL

TABLE 206 ATARFIL: BUSINESS OVERVIEW

11.1.6 FIRESTONE BUILDING PRODUCTS

TABLE 207 FIRESTONE BUILDING PRODUCTS: BUSINESS OVERVIEW

11.1.7 JUTA

TABLE 208 JUTA: BUSINESS OVERVIEW

11.1.8 MACCAFERRI

TABLE 209 MACCAFERRI: BUSINESS OVERVIEW

11.1.9 PLASTIKA KRITIS

TABLE 210 PLASTIKA KURTIS: BUSINESS OVERVIEW

11.1.10 NAUE GROUP

TABLE 211 NAUE GROUP: BUSINESS OVERVIEW

*Details on Business Overview, Solutions, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

11.2 ADDITIONAL PLAYERS

11.2.1 ANHUI HUIFENG NEW SYNTHETIC MATERIALS

11.2.2 CARTHAGE MILLS

11.2.3 ENVIRONMENTAL PROTECTION

11.2.4 GEOFABRICS

11.2.5 GEOSYNTHETICS LIMITED

11.2.6 GINEGAR PLASTIC PRODUCTS

11.2.7 GLOBAL SYNTHETICS

11.2.8 LAYFIELD GROUP

11.2.9 CETCO

11.2.10 NILEX

11.2.11 SOTRAFA

11.2.12 SOPREMA

11.2.13 TEXEL INDUSTRIES LIMITED

11.2.14 TITAN ENVIRONMENTAL CONTAINMENT

11.2.15 US FABRICS

12 APPENDIX (Page No. - 186)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

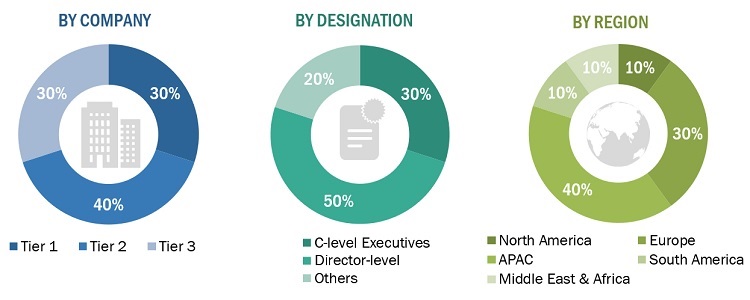

The study involved four major activities in estimating the current market size of geomembranes. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg Business Week, Factiva, World Bank, and Industry Journals have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, and databases.

Primary Research

The geomembranes market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mining, waste management, water management, and civil construction activities. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following the breakdown of primary respondents –

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the geomembranes market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of geomembranes.

Report Objectives

- To define, describe, and forecast the geomembranes market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, and opportunities) influencing the market growth

- To analyze and forecast the market size by type and application

- To forecast the market size with respect to five regions, namely, Asia Pacific (APAC), Europe, North America, South America, and the Middle East and Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, COVID-19 impact, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments in the market, such as acquisitions, investments, and expansions

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of the APAC geomembranes market.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Geomembranes Market

Specific information about Brazilian market, such as production by types (PVC,PEAD, etc), by application, by players, market share, etc

Specific information on new product development for Pond, Reservoir and Canal lining market

Research methodology- Geomembrane market. Scope - such as bituminous geomembrane market dynamic and competition

Incomplete

Market size and growth analysis on geomembranes in GCC region and names of key companies, their capacity, along with imports & exports data and regulations.

Information on design and installation of geo-textiles in cyclone affected rural roads, due to coastal erosion