Geosynthetics Market by Type (Geotextile, Geomembranes, Geogrids, Geofoams, Geonets), Application (Waste Management, Water Management, Transportation Infrastructure, Civil Construction), and Region - Global Forecast to 2026

Geosynthetics Market

The global geosynthetics market was valued at USD 9.9 billion in 2021 and is projected to reach USD 13.2 billion by 2026, growing at a cagr 6.0% from 2021 to 2026. The rising demand for geosynthetics is majorly due to increasing investments on infrastructural developments, and rising concerns over waste and water management globally. Market growth is largely driven by the increasing population and urbanization, coupled with increasing industrial activities in the APAC and South America which is expected to offer opportunities for manufacturers during the forecast period. Developments in the field of technology, and growing demand for sustainable products are presenting opportunities for the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global geosynthetics market

Geosynthetics are largely used in waste management, and infrastructure development applications such as railroads, roadways, soil reinforcement and stabilization, heap leach pads, landfills, and containment sites. The basic functions of geosynthetics materials are separation, reinforcement, filtration, drainage, and barrier. The increasing spending on infrastructural development and demand for waste management is expected to offer opportunities for manufacturers during the forecast period.

COVID-19 pandemic has significantly disrupted the global construction sector in 2020, with projects being halted due to lockdown restrictions owing to the non-availability of workforces, supply chain disruptions, country-wide lockdowns, temporary closures of infrastructure projects, and limited availability of raw materials. Companies have witnessed lower demand for new office spaces, shops, and others which resulted in a decline in revenue. However, due to the easing of the norms by the government with preventive measures such as social distancing and relief funds, the end-use industries are recovering. Moreover, the construction sector was exempted from the lockdown restrictions in few countries such as Australia as it falls under essential services. In Indonesia, preventive lockdown measures, hampered supply chains, and delays in infrastructure projects are major reasons for the decline in the construction industry in the country. The US construction industry was affected majorly due to the limited availability of raw material as the imports from various other countries such as China was restricted due to the pandemic. However, stimulus package by various government globally has helped the countries to support the declining economy, which is also expected to support the construction industry and lead to economic recovery post the COVID-19 crisis by boosting infrastructural growth.

Geosynthetics Market Dynamics

Driver: Growth of the geosynthetics market can be attributed to increasing investments in waste management in emerging economies

Rapidly increasing population and urbanization is contributing in increasing levels of solid and liquid wastes across the globe. Rising environmental awareness is leading to an increase in the demand for appropriate waste and water management projects. Geosynthetics are used as landfill caps to prevent the migration of fluids into landfills by reducing or eliminating the post-closure generation of leachate and associated treatment costs. Geosynthetics are widely used in various water management activities owing to the increasing public concerns in serious and widespread water pollution. Geosynthetics liner systems are used in waste treatment lagoons at wastewater treatment plants to protect water resources including lakes, rivers, ponds, aquifers, and reservoirs which is expected to boost the demand for geosynthetics during the forecast period.

Restrain: Fluctuating raw material prices due to the volatility in the prices of crude oil

The prices and availability of raw materials are the major factors that affect the prices of end-products. Most raw materials required for geosynthetics (polyethylene, polypropylene, polyvinyl chloride, and ethylene propylene diene monomer) are vulnerable to fluctuations in the prices of crude oil. The rise or fall in crude oil prices directly impacts the prices of the raw materials required for the manufacture of geosynthetics. However, due to the current pandemic, almost all countries have banned both, domestic and international travel. This has resulted in a significant reduction in the demand for fuel for transportation, which has further affected the prices of crude oil.

Opportunity: Rising demand from the mining and oil & gas industries

The mining industry is one of the major consumers of geosynthetics. The demand for metals and minerals from Asia is expected to drive the mining industry. China is a leading producer of rare-earth metals, gold, copper, coal, limestone, and iron & steel, while India has witnessed significant investments in the iron & steel industry. Moreover, South America has become a preferred destination for investments in mining by major global mining companies. Key countries such as Brazil, Peru, and Chile have large mining capacities and witnessed increased investments from foreign companies over the past five years. The increasing adoption of advanced extraction processes in mining activities is expected to drive the geosynthetics market during the forecast period.

Geotextiles is estimated to be the largest market in the overall geosynthetics market in 2021.

Geotextiles are non-biodegradable, permeable, durable, and engineered fabrics made from fibers. Geotextiles are used in geotechnical engineering applications such as heavy construction, buildings, pavement construction, hydrogeology, and environmental engineering. They are also used for drainage and erosion control, pavement and repairs, soil reinforcements & stabilization, embankments, asphalt overlays, and others.

Waste management is expected to be the largest geosynthetics-consuming application in 2021.

Waste management accounts for the largest share of the market. Geosynthetics are used in waste management for performing a various function such as filtration, separation, drainage, barrier, and reinforcement. It includes the proper collection, transport, treatment, recycling, and disposal of residential, industrial, and commercial waste. Geosynthetics are essential for controlling the leakage of contaminated gas and liquid into groundwater, rivers, aquifers, and other freshwater sources. Due to the increase in population, urbanization, and industrialization, the need for waste management activities is expected to increase during the forecast period.

Based on region, APAC is projected to grow the fastest in the geosynthetics market during the forecast period.

The geosynthetics market is dominated by APAC in 2020. The region is growing at a faster rate which contributes for the high growth of the geosynthetics market. The emerging market of India, China, and other countries of the APAC are growing and boosting the regional market growth. The market growth in the region is driven by rapidly increasing population, urbanization, and industrialization. Growing investment for the development of public infrastructure and demand for solid waste management system are the major factors driving the geosynthetics demand in the region.

Geosynthetics Market Players

The key players in the geosynthetics market include SOLMAX (Canada), NAUE GmbH & Co. KG (Germany), Officine Maccaferri Spa( Italy), Berry Global Inc ( US), and Agru America, Inc ( US) are the major players in the market. These players have established a strong foothold in the market by adopting strategies, such as new product launches, expansions, joint ventures, agreements, partnerships, and mergers & acquisitions.

Geosynthetics Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 9.9 billion |

|

Revenue Forecast in 2026 |

USD 13.2 billion |

|

CAGR |

6.0% |

|

Years considered for the study |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Volume (Million Square Meter) and Value (USD) |

|

Segments |

Type, Application, and Region |

|

Regions |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies |

SOLMAX (Canada), NAUE GmbH & Co. KG (Germany), Officine Maccaferri Spa ( Italy), Berry Global Inc ( US), and AGRU America, Inc ( US) are the major players in the market. 25 major players covered. |

This research report categorizes the geosynthetics market based on type, application, and region.

By Type:

- Geotextiles

- Geomembranes

- Geogrids

- Geofoam

- Geonets

- Others

By Application

- Waste Management

- Water Management

- Transportation Infrastructure

- Civil Construction

- Others

By Region

- North America

- APAC

- Europe

- Middle East & Africa

- South America

The geosynthetics market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In June 2021, SOLMAX acquired TenCate Geosynthetics, the Netherlands-based provider of geosynthetics and industrial fabrics. The acquisition is expected to increase the innovation capabilities and global reach of the company. The acquisition is expected to bring additional business opportunities for the company in containment and infrastructure applications in mining, transportation, energy, waste management, and civil engineering.

- In June 2019, SOLMAX is expanding its operations by establishing a new geosynthetics facility in Nevada, US. The expansion is expected to bring competitive advantage to the company through the development of innovative and more reliable products to cater various end-use industries.

- In July 2020, NAUE developed its first biodegradable nonwoven geotextile product under the brand, Secutex Green. The product is developed from organic and renewable materials for civil engineering applications.

- In June 2017, Tensar International Corporation has newly developed an enhanced variant of its TriAx geogrid utilized in the transportation industry. TriAx geogrid provides significant performance improvement in road uniformity & soil stabilization.

- In February 2019, Strata System established a new production facility in Gujarat, India. The company is expected to manufacture StrataGrid geogrid and HDPE geocells to cater the rising demand for geosynthetics materials. The new facility is expected to have sufficient production capacity to cater the Indian geosynthetics market along with international exports.

- In March 2021, Fibertex Nonwovens has USD 48 million to expand its production capacity of the manufacturing facility in the US. The new facility is expected to have a spunlace operation line to focus on sustainable product development to cater the rising demand from the North American market.

- In May 2019, NAUE expanded its geogrid production capacity with a new manufacturing line at its Adorf, Germany facility.

Frequently Asked Questions (FAQ):

What is the current size of the global geosynthetics market?

The global geosynthetics market is projected to reach USD 13.2 billion by 2026 from USD 9.9 billion in 2021, at a CAGR of 6.0% between 2021 and 2026

Are there any regulations for the geosynthetics market?

Several countries in Europe and North America have introduced regulations for this market. For e.g., in the European Union, agencies such as the European Environment Agency (EEA), the European Council for an Energy-Efficient Economy, the Council of European Energy Regulators (CEER), and others are involved in mandating adopting regulations, updating policies, and implementation efforts of these regulations in the respective sectors.

Who are the winners in the global geosynthetics market?

Companies such as SOLMAX (Canada), NAUE GmbH & Co. KG (Germany), Officine Maccaferri Spa ( Italy), Berry Global Inc ( US), and Agru America, Inc ( US) fall under the winner’s category. They have the potential to broaden their product portfolio and compete with other key market players. Such advantages give these companies an edge over other companies.

What is the COVID-19 impact on geosynthetics manufacturers?

Industry experts believe that COVID-19 could affect the end-use industries globally. The manufactures has faced production being halted due to lockdown restrictions owing to the non-availability of workforces, supply chain disruptions, country-wide lockdowns, temporary closures of facilities, and limited availability of raw materials which has affected the production and sales of various manufacturers

What are some of the drivers in the market?

The increasing requirement of geosynthetics in waste management applications is expected to drive the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Market Size Estimation

2.2 Market Share Estimation

2.2.1 Key Data Points Taken From Secondary Sources

2.2.2 Key Data Points From Primary Sources

2.2.3 Assumptions

3 Executive Summary (Page No. - 21)

4 Premium Insights (Page No. - 25)

4.1 Attractive Market Opportunity for Geosynthetics

4.2 Life Cycle Analysis, By Geography

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Segmentation

5.2.1 Geosynthetics Market By Product Type

5.2.2 Geosynthetics Market By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Government Policies Boosting Infrastructure Growth Across the Globe

5.3.1.2 Evolving Environmental Protection Regulations and Standards to Boost Future Growth of Geosynthetics

5.3.1.3 Cost Effectiveness

5.3.2 Restrains

5.3.2.1 Volatile Raw Material Prices

5.3.2.2 Lack of Quality Control Across Developing Countries

5.3.3 Opportunities

5.3.3.1 Developing Countries Will Boost the Future Growth

5.3.3.2 Rising Regulatory Standard Fueling Growth

5.3.3.3 Opportunities Associated With Oil & Gas and Mining Industries

6 Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five forces Analysis

6.3.1 Threat From New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Supplier

6.3.5 Degree of Competition

6.4 Raw Material Analysis

6.5 Market Life Cycle Analysis

7 Market, By Type (Page No. - 45)

7.1 Introduction

7.2 Geotextiles Market

7.3 Geomembranes Market

7.4 Geogrids Market

7.5 Geofoam Market

7.6 Geonets Market

7.7 Others Market

8 Geographic Analysis (Page No. - 60)

8.1 Introduction

8.2 Geotextile Market

8.2.1 Geotextile Market, By Region

8.2.1.1 Market Size in Terms of Value, By Region

8.2.1.2 Market Size, By Region

8.2.2 North America

8.2.2.1 Market Size in Terms of Value, By Country

8.2.2.2 Market Size, By Country

8.2.3 Asia-Pacific

8.2.3.1 Market Size in Terms of Value, By Country

8.2.3.2 Market Size, By Country

8.2.4 Europe

8.2.4.1 Market Size in Terms of Value, By Country

8.2.4.2 Market Size, By Country

8.3 Geomembranes Market

8.3.1 Geomembranes Market, By Region

8.3.1.1 Market Size in Terms of Value, By Region

8.3.1.2 Market Size, By Region

8.3.2 North America

8.3.2.1 Market Size in Terms of Value, By Country

8.3.2.2 Market Size, By Country

8.3.3 Asia-Pacific

8.3.3.1 Market Size in Terms of Value, By Country

8.3.3.2 Market Size, By Country

8.3.4 Europe

8.3.4.1 Market Size in Terms of Value, By Country

8.3.4.2 Market Size, By Country

8.4 Geogrids Market

8.4.1 Geogrids Market, By Region

8.4.1.1 Market Size in Terms of Value, By Region

8.4.1.2 Market Size, By Region

8.4.2 North America

8.4.2.1 Market Size in Terms of Value, By Country

8.4.2.2 Market Size, By Country

8.4.3 Asia-Pacific

8.4.3.1 Market Size in Terms of Value, By Country

8.4.3.2 Market Size, By Country

8.4.4 Europe

8.4.4.1 Market Size in Terms of Value, By Country

8.4.4.2 Market Size, By Country

8.5 Geofoams Market

8.5.1 Geofoams Market, By Region

8.5.1.1 Market Size in Terms of Value, By Region

8.5.1.2 Market Size, By Region

8.5.2 North America

8.5.2.1 Market Size in Terms of Value, By Country

8.5.2.2 Market Size, By Country

8.5.3 Asia-Pacific

8.5.3.1 Market Size in Terms of Value, By Country

8.5.3.2 Market Size, By Country

8.5.4 Europe

8.5.4.1 Market Size in Terms of Value, By Country

8.5.4.2 Market Size, By Country

8.6 Geonets Market

8.6.1 Geonets Market, By Region

8.6.1.1 Market Size in Terms of Value, By Region

8.6.1.2 Market Size, By Region

8.6.2 North America

8.6.2.1 Market Size in Terms of Value, By Country

8.6.2.2 Market Size, By Country

8.6.3 Asia-Pacific

8.6.3.1 Market Size in Terms of Value, By Country

8.6.3.2 Market Size, By Country

8.6.4 Europe

8.6.4.1 Market Size in Terms of Value, By Country

8.6.4.2 Market Size, By Country

8.7 Others Market

8.7.1 Others Market, By Region

8.7.1.1 Market Size in Terms of Value, By Region

8.7.1.2 Market Size, By Region

8.8 Global Locations of Key Market Players

9 Competitive Landscape (Page No. - 87)

9.1 Overview

9.1.1 Market Share Analysis for Geosynthetics Market

9.1.2 Competitive Situation & Trends

9.2 Agreement, Collaboration and Partnerships

9.3 Mergers and Acqusitions

9.4 Expanions & Investments

9.5 New Product Launches

10 Company Profiles (Page No. - 94)

10.1 Introduction

10.2 ACE Geosynthetics

10.2.1 Business Overview

10.2.2 Products & Services

10.2.3 Key Strategy

10.3 ACH Foam Technologies

10.3.1 Business Overview

10.3.2 Products & Services

10.3.3 Key Strategy

10.3.4 Recent Developments

10.4 AGRU America Inc.

10.4.1 Business Overview

10.4.2 Products & Services

10.4.3 Key Strategy

10.4.4 Recent Developments

10.5 Asahi Geotechnologies Co. Ltd.

10.5.1 Business Overview

10.5.2 Products & Services

10.5.3 Key Strategy

10.6 Belton Industries Inc.

10.6.1 Business Overview

10.6.2 Products & Services

10.6.3 Key Strategy

10.7 Carthage Mills

10.7.1 Business Overview

10.7.2 Products & Services

10.7.3 Key Strategy

10.8 Cetco Lining Technologies

10.8.1 Business Overview

10.8.2 Products & Services

10.8.3 Key Strategy

10.8.4 Recent Developments

10.9 Contech Engineered Solutions LLC

10.9.1 Business Overview

10.9.2 Products & Services

10.9.3 Key Strategy

10.10 Gundle/Slt Environmental Inc. (GSE)

10.10.1 Business Overview

10.10.2 Products & Services

10.10.3 Key Strategy

10.10.4 Recent Developments

10.10.5 SWOT Analysis

10.10.6 MNM View

10.11 Hanes GEO Components

10.11.1 Business Overview

10.11.2 Products & Services

10.11.3 Key Strategy

10.11.4 Recent Developments

10.12 Huesker Synthetic GMBH

10.12.1 Business Overview

10.12.2 Products & Services

10.12.3 Key Strategy

10.12.4 Recent Developments

10.13 Kaytech Engineered Products

10.13.1 Business Overview

10.13.2 Products & Services

10.13.3 Key Strategy

10.13.4 Recent Developments

10.14 Low & Bonar PLC

10.14.1 Business Overview

10.14.2 Products & Services

10.14.3 Key Strategy

10.14.4 Recent Developments

10.14.5 SWOT Analysis

10.14.6 MNM View

10.15 NAUE GMBH & Co. KG

10.15.1 Business Overview

10.15.2 Products & Services

10.15.3 Key Strategy

10.15.4 SWOT Analysis

10.15.5 MNM View

10.16 officine Maccaferri

10.16.1 Business Overview

10.16.2 Products & Services

10.16.3 Key Strategy

10.16.4 Recent Developments

10.17 Propex

10.17.1 Business Overview

10.17.2 Products & Services

10.17.3 Key Strategy

10.17.4 Recent Developments

10.18 Royal Tencate Nv

10.18.1 Business Overview

10.18.2 Products & Services

10.18.3 Key Strategy

10.18.4 Recent Developments

10.18.5 SWOT Analysis

10.18.6 MNM View

10.19 Strata Systems Inc.

10.19.1 Business Overview

10.19.2 Products & Services

10.19.3 Key Strategy

10.19.4 Recent Developments

10.20 Tenax Group

10.20.1 Business Overview

10.20.2 Products & Services

10.20.3 Key Strategy

10.20.4 Recent Developments

10.21 Tensar Corporation

10.21.1 Business Overview

10.21.2 Products & Services

10.21.3 Key Strategy

10.21.4 Recent Developments

List of Tables (71 Tables)

Table 1 Geosyntheticss: Impact of Major Drivers, 2014–2019

Table 2 Geosynthetics: Impact of Major Restraints, 2014–2019

Table 3 Geosynthetics: Impact of Major Opportunities, 2013–2018

Table 4 Geosythetics : Types and Their Raw Materials

Table 5 Properties of Polymers

Table 6 Global Geosynthetics Market Size, By Type, 2012–2019 ($Million)

Table 7 Global Geosynthetics Market Size, By Type, 2012–2019 (Million Meter Square)

Table 8 Geosynthetics Market Application Trend, By Type

Table 9 Geosynthetics: Classification of Properties

Table 10 Geotextiles Market Size, By Applications, 2012–2019 ($Million)

Table 11 Geotextiles Market Size, By Applications, 2012–2019 (Million Meter Square)

Table 12 Geomembranes Market Size, By Applications, 2012–2019 ($Million)

Table 13 Geomembranes Market Size, By Applications, 2012–2019 (Million Meter Square)

Table 14 Geogrids Market Size, By Applications, 2012–2019 ($Million)

Table 15 Geogrids Market Size, By Applications, 2012–2019 (Million Meter Square)

Table 16 Geofoam Market Size, By Applications, 2012–2019 ($Million)

Table 17 Geofoam Market Size, By Applications, 2012–2019 (Million Meter Cube)

Table 18 Geonets Market Size, By Applications, 2012–2019 ($Million)

Table 19 Geonets Market Size, By Applications, 2012–2019 (Million Meter Square)

Table 20 Others Market Size, By Applications, 2012–2019 ($Million)

Table 21 Others Market Size, By Applications, 2012–2019 (Million Meter Square)

Table 22 Geosynthetics: European Standards for Applications

Table 23 Geosynthetics Market Size , By Region , 2012-2019 ($Million)

Table 24 Geosynthetics Market Size , By Region , 2012-2019 (Million Meter Square)

Table 25 Geotextiles Market Size , By Region , 2012-2019 ($Million)

Table 26 Geotextiles Market Size, By Region, 2012–2019 (Million Meter Square)

Table 27 North America: Geotextiles Market Size, By Country, 2012–2019 ($Million)

Table 28 North America: Geotextiles Market Size, By Country, 2012–2019, (Million Meter Square)

Table 29 Asia-Pacific: Geotextiles Market Size, By Country, 2012–2019 ($Million)

Table 30 Asia-Pacific: Geotextiles Market, By Country, 2012–2019 (Million Meters Square)

Table 31 Europe: Geotextile Market, By Country, 2012–2019 ($Million)

Table 32 Europe: Geotextiles Market, By Country, 2012–2019 (Million Meters Square)

Table 33 Geomembranes Market Size, By Region, 2012–2019 ($Million)

Table 34 Geomembranes Market Size, By Region, 2012–2019 (Million Meter Square)

Table 35 North America: Geomembranes Market Size, By Country, 2012–2019 ($Million)

Table 36 North America: Geomembranes Market Size, By Country, 2012–2019, (Million Meter Square)

Table 37 Asia-Pacifc: Geomembranes Market Size, By Country, 2012–2019 ($Million)

Table 38 Asia-Pacifc: Geomembranes Market Size, By Country, 2012–2019 (Million Meter Square)

Table 39 Europe: Geomembranes Market Size, By Country, 2012–2019 ($Million)

Table 40 Europe: Geomembranes Market Size, By Country, 2012–2019 (Million Meter Square)

Table 41 Geogrids Market Size, By Region, 2012–2019 ($Million)

Table 42 Geogrids Market Size, By Region, 2012–2019 (Million Meter Square)

Table 43 North America: Geogrids Market Size, By Country, 2012–2019 ($Million)

Table 44 North America: Geogrids Market Size, By Country, 2012–2019, (Million Meter Square)

Table 45 Asia-Pacific: Geogrids Market Size, By Country, 2012–2019 ($Million)

Table 46 Asia-Pacifc: Geogrids Market Size, By Country, 2012–2019 (Million Meter Square)

Table 47 Europe: Geogrid Market Size, By Country, 2012–2019 ($Million)

Table 48 Europe: Geogrids Market Size, By Country, 2012–2019 (Million Meter Square)

Table 49 Geofoams Market Size, By Region, 2012–2019 ($Million)

Table 50 Geofoams Market Size, By Region, 2012–2019 (Million Meter Cube)

Table 51 North America: Geofoams Market Size, By Country, 2012–2019 ($Million)

Table 52 North America: Geofoams Market Size, By Country, 2012–2019, (Million Meter Cube)

Table 53 Asia-Pacifc: Geofoams Market Size, By Country, 2012–2019 ($Million)

Table 54 Asia-Pacifc: Geofoams Market Size, By Country, 2012–2019 (Million Meter Cube)

Table 55 Europe: Geofoams Market Size, By Country, 2012–2019 ($Million)

Table 56 Europe: Geofoams Market Size, By Country, 2012–2019 (Million Meter Cube)

Table 57 Geonets Market Size, By Region, 2012–2019 ($Million)

Table 58 Geonets Market Size, By Region, 2012–2019 (Million Meter Square)

Table 59 North America: Geonets Market Size, By Country, 2012–2019 ($Million)

Table 60 North America: Geonets Market Size, By Country, 2012–2019, (Million Meter Square)

Table 61 Asia-Pacifc: Geonets Market Size, By Country, 2012–2019 ($Million)

Table 62 Asia-Pacifc: Geonets Market Size, By Country, 2012–2019 (Million Meter Square)

Table 63 Europe: Geonets Market Size, By Country, 2012–2019 ($Million)

Table 64 Europe: Geonets Market Size, By Country, 2012–2019 (Million Meter Square)

Table 65 Others Market Size, By Region, 2012–2019 ($Million)

Table 66 Others Market Size, By Region, 2012–2019 (Million Meter Square)

Table 67 Geosynthetics: Key Market Players, By Geography

Table 68 Agreement, Collaboration, Consolidation and Partnership, 2011-2014

Table 69 Mergers and Acqusitions, 2011-2014

Table 70 Expansions and Investments 2011-2014

Table 71 New Product Launches, 2011–2014

List of Figures (54 Figures)

Figure 1 Global Geosynthetics Market : Research Methodology

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

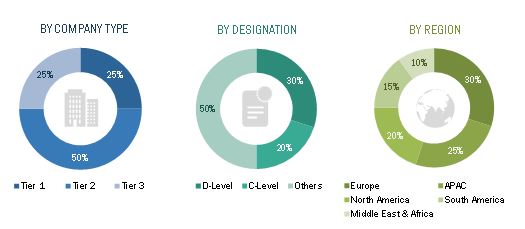

Figure 4 Break Down of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Geosynthetics Market Snapshot (2014-2019) : Geogrids is Projected to Be the Fastest Growing Application in Next Five Years

Figure 6 Global Geosynthetics Market, By Type, 2013

Figure 7 Global Geosynthetics Market Share, 2013

Figure 8 Global Geosynthetics Market, By Value

Figure 9 Fastest Growing Product Types and Regions

Figure 10 Most of the Asia-Pacific Countries Register High-Growth Rates

Figure 11 Geogrids is the Fastest-Growing Product Type Followed By Geonets

Figure 12 North America Would Dominate the Geosynthetics Type for the Next Five Years

Figure 13 Geogrids Unravel New Revenue Pockets for Market Players

Figure 14 ROW Soon to Enter Exponential Growth Phase in Coming Years

Figure 15 Market Segmentation: By Product Type

Figure 16 Geosynthetics Market By Application

Figure 17 Geosynthetics Market: Market Dynamics

Figure 18 Geosynthetics: Value Chain Analysis

Figure 19 Geosynthetics: Porter’s Five forces Analysis

Figure 20 Geosynthetics : Market Life Cycle Analysis By Region

Figure 21 Geotextiles Witness Significant Market Shares

Figure 22 Innovations in Geosynthetics Market

Figure 23 Key Elements Driving the Geosynthetics Market

Figure 24 Key Drivers of the Geosynthetics Market

Figure 25 Geographic Snapshot (2013)

Figure 26 Major Companies Adopted Product Innovation As the Key Growth Strategy Over the Last Three Years

Figure 27 GSE Environmental Grew At the Fastest Rate Between 2009-2013

Figure 28 Battle for Market Share: Partnership, Agreement, Joint Venture and Collaborations Were the Key Strategy

Figure 29 Competitive Developments, 2010-2014

Figure 30 Geographic Revenue Mix of top Three Players

Figure 31 ACE Geosynthetics: Business Overview

Figure 32 ACH Foam Technologies: Business Overview

Figure 33 AGRU America Inc.: Business Overview

Figure 34 Asahi Geotechnologies Co. Ltd.: Business Overview

Figure 35 Belton Industries Inc.: Business Overview

Figure 36 Carthage Mills: Business Overview

Figure 37 Cetco Lining Technologies: Business Overview

Figure 38 Contech Engineered Solutions LLC: Business Overview

Figure 39 Gundle/Slt Environmental Inc. (GSE): Business Overview

Figure 40 SWOT Analysis

Figure 41 Hanes GEO Components: Business Overview

Figure 42 Huesker Synthetic GMBH: Business Overview

Figure 43 Kaytech Engineered Products: Business Overview

Figure 44 Low & Bonar PLC: Business Overview

Figure 45 SWOT Analysis

Figure 46 NAUE GMBH & Co. KG: Business Overview

Figure 47 SWOT Analysis

Figure 48 Officine Maccaferri: Business Overview

Figure 49 Propex: Business Overview

Figure 50 Royal Tencate: Business Overview

Figure 51 SWOT Analysis

Figure 52 Strata Systems Inc.: Business Overview

Figure 53 Tenax Group: Business Overview

Figure 54 Tensar Corporation: Business Overview

Overview of Geonets Market

Geonets are a type of geosynthetic material that are widely used in various civil engineering applications such as road construction, landfills, mining, and erosion control. Geonets are made of high-density polyethylene (HDPE) or polypropylene (PP) and have a unique three-dimensional structure that provides superior drainage, filtration, and reinforcement properties. The global Geonets market is expected to grow at a significant rate in the coming years due to the increasing demand for geosynthetic materials in the construction industry, particularly in emerging economies. The growing awareness about the benefits of geosynthetics such as cost-effectiveness, durability, and high performance is also driving the growth of the Geonets market.

Geonets are a type of geosynthetic material, which includes geotextiles, geogrids, geomembranes, and other products. Geonets are used in combination with other geosynthetic products to provide additional reinforcement and support.

The Geonets market is expected to have a positive impact on the Geosynthetics market as a whole, as the demand for geosynthetics continues to grow globally. As the construction industry expands, the demand for geosynthetic materials such as geonets, geotextiles, and geomembranes is likely to increase, driving the growth of the Geosynthetics market.

Futuristic growth use-cases of Geonets Market

The Geonets market is expected to see growth in applications such as mining, oil and gas, and infrastructure development. In the mining industry, geonets are used for tailings management and leach pad lining systems. In the oil and gas industry, they are used for erosion control and slope stabilization. In infrastructure development, geonets are used for road construction, drainage systems, and retaining walls.

Top players in Geonets Market

Some of the top players in the Geonets market include TenCate Geosynthetics, Huesker, Tensar Corporation, Strata Systems, and Thrace Group.

Other industries impacted by Geonets Market

The Geonets market is expected to impact several other industries in the future, including the construction industry, mining industry, oil and gas industry, and agriculture industry. The use of geonets in these industries can lead to improved safety, cost-effectiveness, and environmental protection.

Speak to our Analyst today to know more about Geonets Market!

The study involved four major activities in estimating the current market size for the geosynthetics market. The exhaustive secondary research was conducted to collect information on the market, peer market, and child market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Factiva, Zauba, Hoovers, and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulations form agencies such as the International Geosynthetics Society (IGS), the US Environmental Protection Agency (EPA), the Industrial Waste Management Association (IWMA), the Asian Infrastructure Investment Bank (AIIB), regulatory bodies, and databases.

Primary Research

The geosynthetics market comprises several stakeholders such as raw material suppliers, distributors of geosynthetics, end-users, and regulatory organizations in the supply chain. The demand side of this market consists of transportation infrastructure developers, civil construction developers, waste management solution providers, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the geosynthetics market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players, materials, in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of geosynthetics and their applications.

Objectives of the Study:

- To analyze and forecast the size of the geosynthetics market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market

- To analyze and forecast the market by type/material, application, and region

- To forecast the size of the market with respect to five regions: Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as investment & expansion, joint venture, partnership, and merger & acquisition

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

- Notes: Micromarkets1 are the sub-segments of the geosynthetics market included in the report.

-

Core competencies2 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the geosynthetics market

Company Information:

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Geosynthetics Market