Frozen Foods Market by Product (Fruits & Vegetables, Dairy Products, Bakery Products, Meat and seafood Products, Plant-Based Protein, Convenience Food and ready Meals, Pet Food), Consumption, Type, Distribution Channel Region - Global Forecast to 2028

Frozen Foods Market Overview (2023-2028)

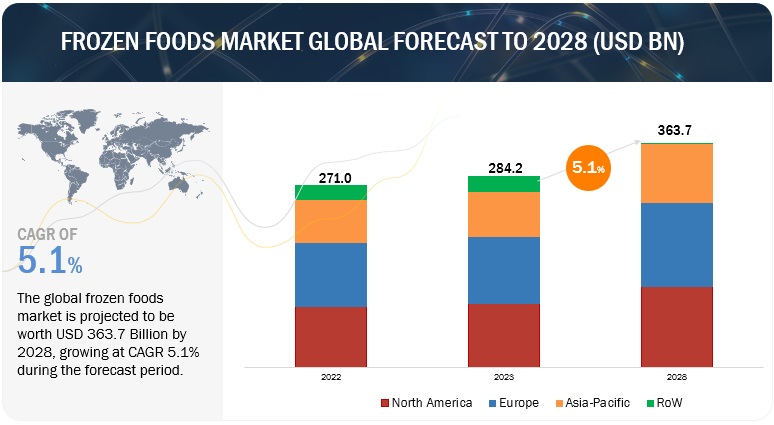

The global frozen foods market size was USD 284.2 billion in 2023 and is projected to grow from USD 363.7 billion in 2028, at a CAGR of 5.1%. One of the primary advantages is their longer shelf life compared to fresh alternatives. This quality significantly reduces food waste, a growing concern globally. Consumers can confidently stock up on frozen foods, knowing they won't spoil quickly, aligning with sustainability goals.

The proliferation of e-commerce has further propelled the frozen foods market. Online shopping platforms offer unparalleled convenience, allowing consumers to access and order frozen foods with ease. This digital accessibility has broadened the market's reach and made it simpler for individuals to incorporate frozen food products into their meal plans.

Globalization plays a pivotal role as well, with an extensive range of international cuisines available in frozen form. Consumers can now enjoy a diverse culinary experience from the comfort of their homes, adding excitement and variety to their diets.

Lastly, the perception of frozen foods as a safer option due to reduced contamination risk bolsters their demand. In an era where food safety is paramount, the frozen foods market benefits from this perceived advantage, further driving its growth and expansion.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Drivers: Rapid Growth in the Packaged Food & Beverage Drives Growth in the Frozen Foods Market

The rapid growth in the packaged food and beverage industry is significantly fueling the expansion of the frozen foods market. This synergy can be attributed to several key factors. Firstly, the packaged food and beverage sector is experiencing increasing demand due to changing consumer lifestyles and preferences. Convenience, portability, and longer shelf life are all characteristics that appeal to today's busy consumers.

Frozen foods align seamlessly with these trends, providing convenient, ready-to-eat or easy-to-prepare meal options. They offer a practical solution for individuals and families seeking quick, hassle-free dining choices in the packaged food realm.

Furthermore, the packaged food industry's robust distribution networks and marketing strategies make it easier for frozen food products to reach a broader consumer base. This collaborative growth strengthens both sectors, as they cater to evolving consumer needs for convenience and variety in their food choices.

Restraints: Rising Preference for Fresh and Natural Food Products

The escalating preference for fresh and natural food products is exerting a constraining effect on the growth of the frozen foods market. Consumers today are increasingly health-conscious and inclined towards choices perceived as less processed and more wholesome. This shift in preference is driven by the desire for higher nutritional value and fewer additives in their diets.

As a result, the frozen foods market faces the challenge of convincing health-conscious consumers that their products offer comparable nutritional benefits to fresh alternatives. Additionally, the perception that fresh foods are inherently healthier can deter potential consumers from exploring frozen options.

Moreover, the rising trend of farm-to-table and locally sourced produce further reinforces the preference for fresh foods, as consumers seek to connect with the source of their food and support local agriculture.

Opportunities: Rising disposable incomes in emerging economies, driving frozen foods segment

The expanding trade of processed foods presents a significant opportunity within the frozen foods market. As global trade networks continue to grow, the frozen foods industry stands to benefit in several ways. Firstly, increased international trade facilitates the exchange of a wide variety of processed foods, including frozen options. This enables consumers to access a diverse range of products from around the world, expanding their culinary horizons. Secondly, globalization supports the import and export of frozen food ingredients, allowing for cost-effective sourcing of raw materials. This can lead to more competitive pricing and increased profitability for frozen food manufacturers. Moreover, international trade encourages innovation and the development of new frozen food products to meet the tastes and preferences of different regions. This diversity in offerings can attract a broader consumer base and drive market growth.

Challenges: Lack of Cold Chain Infrastructure in Developing Countries

The lack of adequate cold chain infrastructure in developing countries poses a formidable challenge to the frozen foods market. Cold chain infrastructure, which includes temperature-controlled storage, transportation, and distribution facilities, is essential for maintaining the quality and safety of frozen food products. In many developing nations such as South Africa, and Kenya these critical components of the supply chain are underdeveloped or insufficient.

This deficiency hampers the frozen foods market in multiple ways. It can lead to temperature fluctuations during transportation and storage, resulting in quality degradation and potential food safety risks. Moreover, the limited cold chain infrastructure restricts the availability of frozen products in remote and underserved areas, limiting market penetration and growth potential.

Additionally, the cost of establishing and maintaining cold chain infrastructure is often high, posing financial challenges for both producers and distributors. Overall, addressing the cold chain infrastructure gap in developing countries is crucial to unlock the full growth potential of the frozen foods market in these regions.

Market Ecosystem

Based on type, the raw material segment is estimated to hold the largest market share during the forecast period of the frozen foods market.

Raw frozen food is poised to dominate the frozen food market due to its versatility and appeal to a wide range of consumers. This category encompasses an array of products, including fruits, vegetables, seafood, and meats, offering consumers the flexibility to create diverse and customized meals. Raw frozen foods retain their inherent nutritional value and flavor, often outperforming their cooked or processed counterparts. Furthermore, they cater to various dietary preferences, such as vegan, paleo, and gluten-free diets, making them inclusive and adaptable. In an era where health consciousness and convenience intersect, raw frozen foods align perfectly, allowing consumers to prepare fresh, wholesome meals with minimal effort. This appeal is driving their popularity, ensuring that raw frozen food remains the largest share of the frozen food market.

Based on consumption, the retail segment is anticipated to witness the highest growth in the frozen foods market.

The COVID-19 pandemic has accelerated the trend of consumers stocking up on frozen essentials due to their longer shelf life, providing a boost to the retail frozen food segment. Additionally, as consumers become more health-conscious, frozen foods are evolving to offer a wider range of healthier options, including organic and low-calorie choices, further appealing to a health-focused demographic.

Furthermore, retail channels provide a convenient and accessible distribution network, making it easier for consumers to purchase frozen foods. With the ongoing expansion of e-commerce and online grocery shopping, retail frozen foods are well-positioned to capture a significant share of the market as they cater to the evolving preferences and needs of today's consumers.

Based on the distribution channel, the online segment is projected to experience the highest growth during the forecast period of the frozen foods market.

The online distribution channel is poised to experience the fastest growth in the frozen food market due to a confluence of factors. Firstly, the digital transformation of the retail landscape has seen an exponential increase in e-commerce and online grocery shopping, driven by changing consumer preferences and convenience. This shift has been further accelerated by the COVID-19 pandemic, which prompted many consumers to turn to online platforms for their shopping needs, including frozen foods.

Secondly, online channels offer a wider variety and selection of frozen food products compared to brick-and-mortar stores, catering to diverse dietary preferences, including vegan, gluten-free, and organic options. This variety attracts a broader customer base, appealing to health-conscious and adventurous consumers.

Moreover, the ease of doorstep delivery and the ability to compare prices and products online makes it an attractive option for time-pressed consumers. As technology continues to advance and online platforms become more user-friendly, the online distribution channel is primed for rapid growth in the frozen food market, providing unparalleled convenience and accessibility for consumers.

Frozen Foods Market Trends

- Health and Wellness: Consumers are increasingly seeking healthier frozen food options, including those with organic ingredients, fewer additives, and lower sodium content. There's a growing demand for frozen fruits, vegetables, and lean protein options as people become more health-conscious.

- Plant-Based Alternatives: With the rise in vegetarianism, veganism, and flexitarian diets, there's a surge in demand for plant-based frozen foods. This includes plant-based meat substitutes, dairy-free ice creams, and vegetable-based frozen meals, catering to the needs of diverse dietary preferences.

- Convenience and Time-Saving: Busy lifestyles and hectic schedules have fueled the demand for convenient meal solutions. Frozen foods offer quick and easy meal options without compromising on taste or nutrition. Single-serve frozen meals, microwaveable snacks, and pre-cut frozen produce are gaining popularity among consumers seeking hassle-free meal solutions.

- Premiumization: Consumers are willing to pay more for higher-quality frozen food products. Brands are focusing on premium ingredients, innovative packaging, and gourmet flavors to differentiate themselves in the market. Premium frozen pizzas, artisanal ice creams, and specialty frozen appetizers are witnessing increased demand among discerning consumers.

- Ethnic and Global Flavors: There's a growing interest in ethnic and global cuisines, driving the demand for frozen foods featuring authentic flavors from around the world. Frozen ethnic meals, such as Indian curries, Asian stir-fries, and Mediterranean dishes, are becoming increasingly popular as consumers seek diverse culinary experiences at home.

- Sustainability: Environmental concerns are influencing consumer purchasing decisions, prompting companies to adopt more sustainable practices in packaging and sourcing. Eco-friendly packaging materials, recyclable packaging, and responsibly sourced ingredients are becoming important considerations for environmentally conscious consumers.

- Online Retailing: The rise of e-commerce has transformed the frozen foods market, making it more accessible to consumers through online grocery platforms and meal delivery services. Brands are investing in e-commerce strategies, including direct-to-consumer sales and partnerships with online retailers, to reach a wider audience and offer greater convenience to consumers.

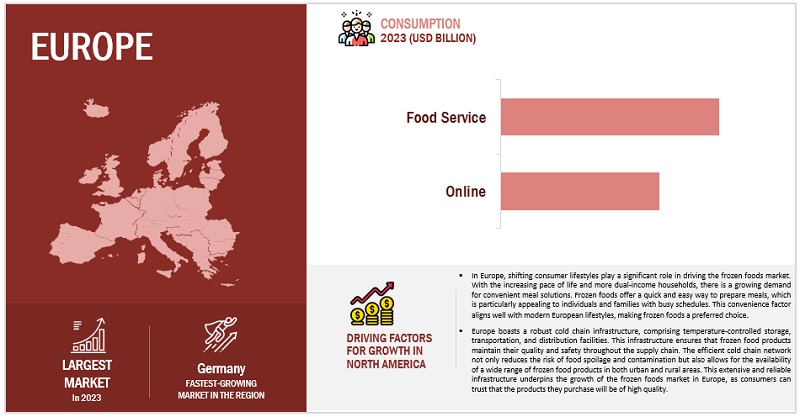

Europe Holds the Largest Share of the Frozen Foods Market

Europe is a major hub for frozen vegetable consumption, driven by busy lifestyles and a growing demand for affordable, nutritious, and convenient food options. Rising incomes and changing dietary preferences are propelling this market, with consumers shifting towards plant-based diets. Key opportunities for vegetable suppliers are found in countries like Germany, France, Belgium, Italy, and the Netherlands. Public awareness of the superior nutritional value of frozen vegetables over fresh and refrigerated ones is boosting demand, especially among younger generations.

According to the European Ministry of Foreign affairs, in 2021, Europe imported €3 billion worth of frozen vegetables, totaling 2.8 million tonnes, with 91% coming from within Europe and only 9% from developing nations. Europe's status as a major global frozen vegetable producer drives this predominantly internal trade. Germany, with a 20% market share, leads European imports, followed by France (18%) and Belgium (14%). These countries, particularly Germany and France, are crucial focus markets. Belgium, while a major producer and exporter, sources certain vegetable varieties from other nations. Italy, the Netherlands, Spain, and Sweden also rank among the top European markets.

Germany, ranked as the world's third-largest frozen vegetable importer (after the United States and Japan), holds the top spot in Europe. In 2021, 90% of Germany's frozen vegetable imports came from fellow European nations, with 10% originating from developing countries. This robust import activity within Europe contributes significantly to the growth of the European frozen foods market.

Contract catering, in which an external organization outsources catering services to a specialized company through a contractual arrangement, is becoming increasingly popular among businesses, public authorities, childcare centers, educational institutions, healthcare facilities, and correctional facilities in Europe. According to Food Service Europe, the contract catering industry boasts an annual turnover exceeding USD 26.59 billion, with substantial growth potential since, on average, only 35% of European firms or collective organizations providing social food services have contracts with catering companies.

The growing trend of dining outside the home is driving the expansion of contract catering to encompass a broader range of venues and events than ever before. This includes services at sporting events, museums, train stations, airports, and more. These organizations often rely on their contracted caterers not only to provide food but also to establish a unique style, atmosphere, and image for their customers.

This trend in contract catering is anticipated to have a positive impact on the European frozen foods market. With more venues and events seeking catering services, there is an increased demand for a diverse range of food options, including frozen foods. Contract caterers opt for frozen food solutions to efficiently meet this demand, as frozen foods offer convenience, longer shelf life, and the ability to cater to a wide range of tastes and preferences. As a result, the European frozen foods market stands to benefit from the growth of the contract catering sector as it continues to expand its reach and services.

Frozen Foods Market Share

The key players in this market include General Mills Inc. (US), Nestlé (Switzerland), Unilever (Netherlands), McCain Foods Limited (Canada), Conagra Brands, Inc. (US), Kellogg's Company (US), Grupo Bimbo (Mexico), and The Kraft Heinz Company (US)

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2023 |

USD 284.2 billion |

|

Revenue forecast in 2028 |

USD 363.7 billion |

|

Growth Rate |

CAGR of 5.1% from 2023 to 2028 |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments Covered |

By Product, Type, Consumption, Distribution Channel, Freezing technique, and Region |

|

Growth Drivers |

|

|

Regions covered |

North America, Europe, Asia Pacific, Central & South America, and RoW |

|

Key Companies Profiled |

|

Frozen Foods Market Segmentation:

This research report categorizes the frozen foods market based on Product, Type, Consumption, Distribution Channel, Freezing technique, and Region.

By Product

-

Fruits & Vegetables

- Frozen Fruits

- Berries

- Mango Chunks

- Others

- Vegetables

- Cauliflower

- Broccoli

- Bell Pepper

- Carrot

- Beans

- Mushroom

- Avocado

- Corn

- Others

- Frozen Potatoes

- French Fries

- Other processed potato products such as Hash Brown, Etc

- Dairy Products

-

Bakery Products

- Proofed

- Fully Baked

-

Meat & Seafood Products

-

Poultry

- Raw (Secondary Processing)

- Pre/Half Cooked (Further Processing)

- Fully Cooked/Ready to Eat (Further Processing)

-

Red Meat

- Raw (Secondary Processing)

- Pre/Half cooked (Further Processing)

- Fully Cooked/Ready to Eat (Further Processing)

-

Fish/Seafood

- Raw (Secondary Processing)

- Pre/Half Cooked (Further Processing)

- Fully Cooked/Ready to Eat (Further Processing)

-

Poultry

-

Plant-based protein

-

- Pre/Half Cooked (Further Processing)

- Fully Cooked/Ready to Eat (Further Processing)

-

- Convenience Food & Ready Meals

- Pet Food

- Other Products

By Consumption

- Food Service

- Retail

By Type

- Raw Material

- Half-cooked

- Ready-to-Eat

By Distribution Channel

- Online

- Offline

By Freezing Technique

- Individual Quick Freezing (IQF)

- Blast Freezing

- Belt Freezing

By Region:

- North America

- Europe

- Asia Pacific

- Central & South America

- Rest of the World (RoW)

Target Audience

- Frozen food producers, suppliers, distributors, importers, and exporters

- Large-scale frozen food manufacturers and research organizations

- Related government authorities, commercial research & development (R&D) institutions, FDA, EFSA, USDA, FSANZ, EUFIC government agencies & NGOs, and other regulatory bodies

- Food product consumers

- Regulatory bodies, including government agencies and NGOs.

- Commercial research & development (R&D) institutions and financial institutions

- Government and research organizations

Frozen Foods Market Industry News

- In April 2023, Nestlé and the private equity firm PAI Partners came to an agreement to establish a joint venture focused on Nestlé's frozen pizza business in Europe. This move aimed to create a specialized player in a highly competitive and constantly evolving market segment. In this joint venture, Nestlé would maintain a minority stake, ensuring equal voting rights in partnership with PAI Partners.

- In March 2023, McCain Foods, the global leader in frozen potato products manufacturing, made a significant announcement of a substantial investment totaling USD 438.4 million. This investment is directed towards the expansion and doubling in size of its potato processing plant located in Coaldale, Alberta. This strategic move is expected to foster continued growth for the company, strengthening its ability to cater to key markets.

- In January 2022, Unilever, the largest ice cream company globally, introduced its new portfolio offerings for the year 2022. These offerings spanned across four of its prominent packaged ice cream and frozen novelty brands, namely Breyers, Klondike, Magnum ice cream, and Talenti Gelato & Sorbetto. This strategic move reflected Unilever's commitment to innovation and meeting consumer preferences by continuously refreshing its product lines and expanding its portfolio.

Frequently Asked Questions (FAQ):

What is the current size of the Frozen foods market?

The frozen foods market is estimated at USD 284.2 Billion in 2023 and is projected to reach USD 363.7 Billion by 2028, at a CAGR of 5.1% from 2023 to 2028.

Which are the key players in the market?

The key players in this market include General Mills Inc. (US), Nestlé (Switzerland), Unilever (Netherlands), McCain Foods Limited (Canada), Conagra Brands, Inc (US), Kellogg's Company (US), Grupo Bimbo (Mexico), and The Kraft Heinz Company (US).

Which region is projected to account for the largest share of the frozen foods market?

Europe holds the distinction of being the largest market in the frozen foods sector due to a combination of factors. Firstly, the region boasts a well-established and affluent consumer base that values convenience without compromising on quality. Secondly, changing lifestyles and an increase in dual-income households have driven demand for time-saving meal solutions, making frozen foods an attractive choice. Additionally, Europe's strong cold chain infrastructure ensures the preservation of frozen products' quality during distribution. Lastly, the market benefits from a wide array of innovative and culturally diverse frozen food offerings, catering to the varied tastes and preferences of European consumers, further fueling its dominance in the industry.

Which frozen product is projected to grow at the highest rate during the forecast period?

Convenience foods and ready meals are poised for the highest growth within the frozen foods market due to changing consumer lifestyles and the demand for quick, easy-to-prepare options. Factors like urbanization, busy schedules, and a desire for convenience drive this trend, making these products increasingly popular choices among consumers seeking efficient meal solutions.

Which distribution channel is projected to account for the fastest growth of the frozen foods market?

Online distribution channel is expected to experience rapid growth in the frozen foods market due to the increasing prevalence of e-commerce and shifting consumer preferences. Convenience, a wide product selection, and the ease of home delivery have made online platforms a preferred choice for purchasing frozen foods. This trend is further accelerated by digital advancements and changing shopping habits, driving the swift expansion of online distribution.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSCHANGING CONSUMER LIFESTYLES AND DIETARY PREFERENCESGLOBALIZATION AND INTERNATIONAL TRADE POLICIESINFLATION RATE

-

5.3 MARKET DYNAMICSDRIVERS- Developments in retail landscape- Rising demand for convenience food- Technological advancements in cold chain marketRESTRAINTS- Rising preference for fresh and natural food products- Need for maintaining temperature requirementsOPPORTUNITIES- Digitalization of retail industry- Increasing trade of processed foodCHALLENGES- Lack of cold chain infrastructure in developing economies

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGPRODUCTION AND PROCESSINGPACKAGINGDISTRIBUTIONMARKETING & SALES

-

6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

6.4 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.5 REGULATORY FRAMEWORKNORTH AMERICA- US- Canada- MexicoEUROPEAN UNION (EU)- Germany- France- UK- Italy- SpainASIA PACIFIC- China- India- Australia & New ZealandCENTRAL & SOUTH AMERICA- Brazil- Argentina

-

6.6 PATENT ANALYSIS

- 6.7 TRADE ANALYSIS

-

6.8 PRICING ANALYSISAVERAGE SELLING PRICE TREND ANALYSIS

-

6.9 ECOSYSTEM ANALYSISDEMAND SIDESUPPLY SIDE

-

6.10 TECHNOLOGY ANALYSISROBOTICS FREEZER PALLETIZING SYSTEMFROZEN BAKERY PRODUCTS AND ARTIFICIAL INTELLIGENCE

-

6.11 CASE STUDIESCOLES QUALITY FOODS INSTALLED CRYOGENIC FLOUR CHILLING SYSTEM TO ACHIEVE CONSISTENT DOUGH MIXING PERFORMANCEMMCI ROBOTICS INCORPORATED SPECIALLY DESIGNED MMCI FD-1500 AUTOMATED PALLET DISPENSER INTO ROBOTIC SETUP TO ACHIEVE SEAMLESS PALLETIZING AT LOW TEMPERATURES

-

6.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSKEY STAKEHOLDERS AND BUYING CRITERIABUYING CRITERIA

- 6.14 KEY CONFERENCES & EVENTS

- 7.1 INTRODUCTION

-

7.2 FRUITS & VEGETABLESFROZEN FRUITS- Berries- Mango chunks- Other frozen fruitsFROZEN VEGETABLES- Frozen peas- Cauliflower- Broccoli- Bell pepper- Carrot- Beans- Mushroom- Avocado- Corn- Other frozen vegetablesFROZEN POTATOES- Cost-effectiveness of potatoes to drive their use in frozen food industry- French fries- Other frozen processed potato products

-

7.3 MEAT & SEAFOOD PRODUCTSPOULTRY- Growing health awareness and demand for quality protein products to drive consumption of frozen poultry- Raw- Half-cooked- Fully cooked/Ready-to-eatRED MEAT- High nutritional value of frozen red meat to boost its consumption- Raw- Half-cooked- Frozen fully cooked/ready-to-eatFISH/SEAFOOD- Year-round availability of frozen fish and seafood to drive consumption and market growth- Raw- Half-cooked- Frozen fully cooked/ready-to-eat

-

7.4 PLANT-BASED PROTEINCONSUMER DEMAND FOR VALUE-ADDED MEAT ALTERNATIVES TO EXPAND FROZEN PLANT-BASED PROTEIN MARKETPRE/HALF-COOKED- Rising demand for convenient meat alternatives to drive growth of half-cooked frozen plant-based proteinFULLY COOKED/READY-TO-EAT- Taste, ethics, and dietary preferences of consumers to shape market expansion

-

7.5 CONVENIENCE FOODS & READY MEALSCHANGING LIFESTYLES AND INCREASING GLOBALIZATION TO PROPEL DEMAND FOR CONVENIENCE FOOD & READY MEALS

-

7.6 DAIRY PRODUCTSINCREASING ICE CREAM CONSUMPTION AND HIGH MARKET PENETRATION TO DOMINATE MARKET

-

7.7 BAKERY PRODUCTSPROOFED- Rising demand for convenience and high-quality foods to drive market growthFULLY BAKED- Rising consumer preference for fully baked foods to fuel market

- 7.8 OTHER PRODUCTS

- 8.1 INTRODUCTION

-

8.2 RAW MATERIALEXTENDED SHELF LIFE OF FROZEN RAW MATERIAL TO DRIVE MARKET GROWTH

-

8.3 HALF-COOKEDBUSY LIFESTYLES AND LIMITED COOKING TIME TO DRIVE POPULARITY OF HALF-COOKED FOOD PRODUCTS

-

8.4 READY-TO-EATCHANGING LIFESTYLES AND URBANIZATION TO DRIVE GROWTH OF READY-TO-EAT FROZEN FOODS MARKET

- 9.1 INTRODUCTION

-

9.2 FOOD SERVICEEVOLVING CONSUMER DEMAND FOR DIVERSE FOOD FLAVORS TO DRIVE MARKET GROWTH

-

9.3 RETAILINCREASING PURCHASING POWER AND DEMAND FOR CONVENIENCE FOODS TO DRIVE GROWTH

- 10.1 INTRODUCTION

-

10.2 OFFLINECHANGING CONSUMPTION PATTERNS AND CUSTOMER WILLINGNESS TO TRY NEW PRODUCTS TO BOOST GROWTH

-

10.3 ONLINEGROWTH IN ONLINE DISTRIBUTION CHANNELS DRIVEN BY BURGEONING E-COMMERCE CULTURE TO BOOST MARKET EXPANSION

- 11.1 INTRODUCTION

-

11.2 INDIVIDUAL QUICK FREEZING (IQF)RISING NEED FOR USE OF ADVANCED TECHNOLOGY TO PRESERVE QUALITY AND TASTE OF PRODUCTS TO DRIVE GROWTH

-

11.3 BLAST FREEZINGFOCUS ON OVERCOMING LIMITATIONS OF CONVENTIONAL FREEZING TECHNIQUES TO BOOST GROWTH

-

11.4 BELT FREEZINGRISING EMPHASIS ON ELEVATING QUALITY OF FROZEN FOOD PRODUCTS TO SPUR DEMAND FOR BELT FREEZING TECHNIQUE

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Rising consumer demand for nutritious food products to drive market growthCANADA- Rapid growth in food processing industry to boost marketMEXICO- Increasing demand for convenience food to propel market growth

-

12.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- High purchasing power of consumers and preference for convenience food over conventional food to spur growthFRANCE- Increasing inclination of consumers towards ready meals to drive growthUK- Growing consumer recognition of frozen food products to drive their popularityITALY- High demand for ice cream and increasing market penetration to encourage market expansionSPAIN- Focus of retailers on providing quality, convenience, and value to customers to spur market growthRUSSIA- Russian frozen foods market to face crisis amidst exodus of Western companies and Ukraine’s conflict-driven supply chain disruptionsREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISAUSTRALIA & NEW ZEALAND- Increasing acceptance among consumers for half-cooked frozen foods to drive growthCHINA- Rising acceptance of western cuisines and food habits to drive marketINDIA- Growing processed food industry to fuel market growthJAPAN- Advancements in refrigeration technology and rising demand for at-home dining options to propel marketREST OF ASIA PACIFIC

-

12.5 CENTRAL & SOUTH AMERICACENTRAL & SOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Rapid urbanization and increasing purchasing power of people to accelerate growth of frozen foods marketREST OF CENTRAL & SOUTH AMERICA

-

12.6 REST OF THE WORLD (ROW)ROW: RECESSION IMPACT ANALYSISMIDDLE EAST- Surging demand for readily available food options to encourage frozen foods market expansionAFRICA- Expanding retail sector to drive frozen foods market

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS, 2022

- 13.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.4 REVENUE ANALYSIS

- 13.5 KEY PLAYERS’ ANNUAL REVENUE VS. GROWTH

- 13.6 EBITDA OF KEY PLAYERS

- 13.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

13.8 COMPANY EVALUATION MATRIX (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

13.9 COMPANY EVALUATION MATRIX (STARTUPS/SMES)PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

13.10 COMPETITIVE SCENARIOOTHERS

-

14.1 KEY PLAYERSGENERAL MILLS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCONAGRA BRANDS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGRUPO BIMBO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNESTLÉ- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewUNILEVER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKELLOGG CO.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMCCAIN FOODS LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE KRAFT HEINZ COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewASSOCIATED BRITISH FOODS PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAJINOMOTO CO., INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVANDEMOORTELE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLANTMANNEN UNIBAKE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCARGILL, INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEUROPASTRY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJBS FOODS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKIDFRESH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARYZTA AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHISHI HE DEMING SEAFOOD CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOOB ORGANIC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOMAR INTERNATIONAL PVT. LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKUPPIESBUBBA FOODS, LLCSMART PRICE SALES & MARKETING, INC.CHEVON AGROTECH PRIVATE LIMITEDM/S INDIA FROZEN FOODS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

-

15.3 FRUIT & VEGETABLE PROCESSING MARKETMARKET DEFINITIONMARKET OVERVIEW

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2019–2022

- TABLE 2 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 LIST OF MAJOR PATENTS PERTAINING TO FROZEN FOODS MARKET, 2013–2022

- TABLE 8 IMPORT VALUE OF FROZEN FRUITS FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 9 EXPORT VALUE OF FROZEN FRUITS FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 10 IMPORT VALUE OF FROZEN MEAT FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 11 EXPORT VALUE OF FROZEN MEAT FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 12 IMPORT VALUE OF FROZEN POULTRY MEAT FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 13 EXPORT VALUE OF FROZEN POULTRY MEAT FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 14 IMPORT VALUE OF FROZEN VEGETABLES FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 15 EXPORT VALUE OF FROZEN VEGETABLES FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 16 IMPORT VALUE OF FROZEN DAIRY PRODUCTS FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 17 EXPORT VALUE OF FROZEN DAIRY PRODUCTS FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 18 AVERAGE SELLING PRICE OF FROZEN FOODS, BY REGION, 2018–2023 (USD/KG)

- TABLE 19 AVERAGE SELLING PRICE OF FROZEN FOODS, BY TYPE, 2018–2023 (USD/KG)

- TABLE 20 FROZEN FOODS MARKET ECOSYSTEM

- TABLE 21 IMPACT OF PORTER’S FIVE FORCES

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FROZEN FOODS, BY TYPE

- TABLE 23 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- TABLE 24 KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 25 FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 26 FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 27 FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (KT)

- TABLE 28 FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (KT)

- TABLE 29 FRUITS & VEGETABLES: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 FRUITS & VEGETABLES: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 FRUITS & VEGETABLES: FROZEN FOODS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 32 FRUITS & VEGETABLES: FROZEN FOODS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 33 FROZEN FRUITS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 FROZEN FRUITS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 FROZEN FRUITS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 36 FROZEN FRUITS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 37 BERRIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 BERRIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 BERRIES MARKET, BY REGION, 2018–2022 (KT)

- TABLE 40 BERRIES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 41 MANGO CHUNKS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 MANGO CHUNKS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 MANGO CHUNKS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 44 MANGO CHUNKS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 45 OTHER FROZEN FRUITS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 OTHER FROZEN FRUITS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 OTHER FROZEN FRUITS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 48 OTHER FROZEN FRUITS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 49 FROZEN VEGETABLES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 FROZEN VEGETABLES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 FROZEN VEGETABLES MARKET, BY REGION, 2018–2022 (KT)

- TABLE 52 FROZEN VEGETABLES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 53 FROZEN PEAS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 FROZEN PEAS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 FROZEN PEAS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 56 FROZEN PEAS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 57 CAULIFLOWER MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 CAULIFLOWER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 CAULIFLOWER MARKET, BY REGION, 2018–2022 (KT)

- TABLE 60 CAULIFLOWER MARKET, BY REGION, 2023–2028 (KT)

- TABLE 61 BROCCOLI MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 BROCCOLI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 BROCCOLI MARKET, BY REGION, 2018–2022 (KT)

- TABLE 64 BROCCOLI MARKET, BY REGION, 2023–2028 (KT)

- TABLE 65 BELL PEPPER MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 BELL PEPPER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 BELL PEPPER MARKET, BY REGION, 2018–2022 (KT)

- TABLE 68 BELL PEPPER MARKET, BY REGION, 2023–2028 (KT)

- TABLE 69 CARROT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 70 CARROT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 CARROT MARKET, BY REGION, 2018–2022 (KT)

- TABLE 72 CARROT MARKET, BY REGION, 2023–2028 (KT)

- TABLE 73 BEANS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 74 BEANS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 BEANS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 76 BEANS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 77 MUSHROOM MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 MUSHROOM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 MUSHROOM MARKET, BY REGION, 2018–2022 (KT)

- TABLE 80 MUSHROOM MARKET, BY REGION, 2023–2028 (KT)

- TABLE 81 AVOCADO MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 82 AVOCADO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 AVOCADO MARKET, BY REGION, 2018–2022 (KT)

- TABLE 84 AVOCADO MARKET, BY REGION, 2023–2028 (KT)

- TABLE 85 CORN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 86 CORN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 CORN MARKET, BY REGION, 2018–2022 (KT)

- TABLE 88 CORN MARKET, BY REGION, 2023–2028 (KT)

- TABLE 89 OTHER FROZEN VEGETABLES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 90 OTHER FROZEN VEGETABLES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 OTHER FROZEN VEGETABLES MARKET, BY REGION, 2018–2022 (KT)

- TABLE 92 OTHER FROZEN VEGETABLES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 93 FROZEN POTATOES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 94 FROZEN POTATOES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 FROZEN POTATOES MARKET, BY REGION, 2018–2022 (KT)

- TABLE 96 FROZEN POTATOES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 97 FRENCH FRIES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 98 FRENCH FRIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 99 FRENCH FRIES MARKET, BY REGION, 2018–2022 (KT)

- TABLE 100 FRENCH FRIES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 101 OTHER FROZEN PROCESSED POTATO PRODUCTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 102 OTHER FROZEN PROCESSED POTATO PRODUCTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 OTHER FROZEN PROCESSED POTATO PRODUCTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 104 OTHER FROZEN PROCESSED POTATO PRODUCTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 105 MEAT & SEAFOOD PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 106 MEAT & SEAFOOD PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 107 MEAT & SEAFOOD PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 108 MEAT & SEAFOOD PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 109 POULTRY: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 110 POULTRY: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 111 POULTRY: FROZEN FOODS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 112 POULTRY: FROZEN FOODS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 113 RAW POULTRY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 114 RAW POULTRY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 115 RAW POULTRY MARKET, BY REGION, 2018–2022 (KT)

- TABLE 116 RAW POULTRY MARKET, BY REGION, 2023–2028 (KT)

- TABLE 117 HALF-COOKED POULTRY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 118 HALF-COOKED POULTRY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 119 HALF-COOKED POULTRY MARKET, BY REGION, 2018–2022 (KT)

- TABLE 120 HALF-COOKED POULTRY MARKET, BY REGION, 2023–2028 (KT)

- TABLE 121 FULLY COOKED/READY-TO-EAT POULTRY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 122 FULLY COOKED/READY-TO-EAT POULTRY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 123 FULLY COOKED/READY-TO-EAT POULTRY MARKET, BY REGION, 2018–2022 (KT)

- TABLE 124 FULLY COOKED/READY-TO-EAT POULTRY MARKET, BY REGION, 2023–2028 (KT)

- TABLE 125 RED MEAT: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 126 RED MEAT: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 127 RED MEAT: FROZEN FOODS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 128 RED MEAT: FROZEN FOODS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 129 RAW RED MEAT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 130 RAW RED MEAT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 131 RAW RED MEAT MARKET, BY REGION, 2018–2022 (KT)

- TABLE 132 RAW RED MEAT MARKET, BY REGION, 2023–2028 (KT)

- TABLE 133 HALF-COOKED RED MEAT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 134 HALF-COOKED RED MEAT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 135 HALF-COOKED RED MEAT MARKET, BY REGION, 2018–2022 (KT)

- TABLE 136 HALF-COOKED RED MEAT MARKET, BY REGION, 2023–2028 (KT)

- TABLE 137 FULLY COOKED/READY-TO-EAT RED MEAT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 138 FULLY COOKED/READY-TO-EAT RED MEAT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 139 FULLY COOKED/READY-TO-EAT RED MEAT MARKET, BY REGION, 2018–2022 (KT)

- TABLE 140 FULLY COOKED/READY-TO-EAT RED MEAT MARKET, BY REGION, 2023–2028 (KT)

- TABLE 141 FISH/SEAFOOD: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 142 FISH/SEAFOOD: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 143 FISH/SEAFOOD: FROZEN FOODS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 144 FISH/SEAFOOD: FROZEN FOODS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 145 RAW FISH/SEAFOOD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 146 RAW FISH/SEAFOOD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 147 RAW FISH/SEAFOOD MARKET, BY REGION, 2018–2022 (KT)

- TABLE 148 RAW FISH/SEAFOOD MARKET, BY REGION, 2023–2028 (KT)

- TABLE 149 HALF-COOKED FISH/SEAFOOD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 150 HALF-COOKED FISH/SEAFOOD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 151 HALF-COOKED FISH/SEAFOOD MARKET, BY REGION, 2018–2022 (KT)

- TABLE 152 HALF-COOKED FISH/SEAFOOD MARKET, BY REGION, 2023–2028 (KT)

- TABLE 153 FULLY COOKED/READY-TO-EAT FISH/SEAFOOD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 154 FULLY COOKED/READY-TO-EAT FISH/SEAFOOD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 155 FULLY COOKED/READY-TO-EAT FISH/SEAFOOD MARKET, BY REGION, 2018–2022 (KT)

- TABLE 156 FULLY COOKED/READY-TO-EAT FISH/SEAFOOD MARKET, BY REGION, 2023–2028 (KT)

- TABLE 157 PLANT-BASED PROTEIN: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 158 PLANT-BASED PROTEIN: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 159 PLANT-BASED PROTEIN: FROZEN FOODS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 160 PLANT-BASED PROTEIN: FROZEN FOODS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 161 PRE/HALF-COOKED: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 162 PRE/HALF-COOKED: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 163 PRE/HALF-COOKED: FROZEN FOODS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 164 PRE/HALF-COOKED: FROZEN FOODS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 165 FULLY COOKED/READY-TO-EAT: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 166 FULLY COOKED/READY-TO-EAT: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 167 FULLY COOKED/READY-TO-EAT: FROZEN FOODS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 168 FULLY COOKED/READY-TO-EAT: FROZEN FOODS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 169 CONVENIENCE FOODS & READY MEALS: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 170 CONVENIENCE FOODS & READY MEALS: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 171 CONVENIENCE FOODS & READY MEALS: FROZEN FOODS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 172 CONVENIENCE FOODS & READY MEALS: FROZEN FOODS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 173 DAIRY PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 174 DAIRY PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 175 DAIRY PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 176 DAIRY PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 177 BAKERY PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 178 BAKERY PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 179 BAKERY PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 180 BAKERY PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 181 PROOFED: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 182 PROOFED: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 183 PROOFED: FROZEN FOODS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 184 PROOFED: FROZEN FOODS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 185 FULLY BAKED: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 186 FULLY BAKED: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 187 FULLY BAKED: FROZEN FOODS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 188 FULLY BAKED: FROZEN FOODS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 189 OTHER PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 190 OTHER PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 191 OTHER PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 192 OTHER PRODUCTS: FROZEN FOODS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 193 FROZEN FOODS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 194 FROZEN FOODS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 195 RAW MATERIAL: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 196 RAW MATERIAL: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 197 HALF-COOKED: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 198 HALF-COOKED: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 199 READY-TO-EAT: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 200 READY-TO-EAT: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 201 FROZEN FOODS MARKET, BY CONSUMPTION, 2018–2022 (USD MILLION)

- TABLE 202 FROZEN FOODS MARKET, BY CONSUMPTION, 2023–2028 (USD MILLION)

- TABLE 203 FOOD SERVICE: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 204 FOOD SERVICE: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 205 RETAIL: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 206 RETAIL: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 207 FROZEN FOODS MARKET, BY DISTRIBUTION CHANNEL, 2018–2022 (USD MILLION)

- TABLE 208 FROZEN FOODS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 209 OFFLINE: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 210 OFFLINE: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 211 ONLINE: FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 212 ONLINE: FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 213 FROZEN FOODS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 214 FROZEN FOODS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 215 FROZEN FOODS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 216 FROZEN FOODS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 217 NORTH AMERICA: FROZEN FOODS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 218 NORTH AMERICA: FROZEN FOODS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 219 NORTH AMERICA: FROZEN FOODS MARKET, BY COUNTRY, 2018–2022 (KT)

- TABLE 220 NORTH AMERICA: FROZEN FOODS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 221 NORTH AMERICA: FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 222 NORTH AMERICA: FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 223 NORTH AMERICA: FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (KT)

- TABLE 224 NORTH AMERICA: FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (KT)

- TABLE 225 NORTH AMERICA: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 226 NORTH AMERICA: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 227 NORTH AMERICA: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2018–2022 (KT)

- TABLE 228 NORTH AMERICA: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2023–2028 (KT)

- TABLE 229 NORTH AMERICA: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 230 NORTH AMERICA: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 231 NORTH AMERICA: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2018–2022 (KT)

- TABLE 232 NORTH AMERICA: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2023–2028 (KT)

- TABLE 233 NORTH AMERICA: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 234 NORTH AMERICA: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 235 NORTH AMERICA: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2018–2022 (KT)

- TABLE 236 NORTH AMERICA: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2023–2028 (KT)

- TABLE 237 NORTH AMERICA: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 238 NORTH AMERICA: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 239 NORTH AMERICA: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2018–2022 (KT)

- TABLE 240 NORTH AMERICA: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2023–2028 (KT)

- TABLE 241 NORTH AMERICA: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2018–2022 (USD MILLION )

- TABLE 242 NORTH AMERICA: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 243 NORTH AMERICA: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2018–2022 (KT)

- TABLE 244 NORTH AMERICA: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2023–2028 (KT)

- TABLE 245 NORTH AMERICA: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 246 NORTH AMERICA: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 247 NORTH AMERICA: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2018–2022 (KT)

- TABLE 248 NORTH AMERICA: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2023–2028 (KT)

- TABLE 249 NORTH AMERICA: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 250 NORTH AMERICA: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 251 NORTH AMERICA: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2018–2022 (KT)

- TABLE 252 NORTH AMERICA: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2023–2028 (KT)

- TABLE 253 NORTH AMERICA: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 254 NORTH AMERICA: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 255 NORTH AMERICA: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2018–2022 (KT)

- TABLE 256 NORTH AMERICA: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2023–2028 (KT)

- TABLE 257 NORTH AMERICA: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 258 NORTH AMERICA: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 259 NORTH AMERICA: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2018–2022 (KT)

- TABLE 260 NORTH AMERICA: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2023–2028 (KT)

- TABLE 261 NORTH AMERICA: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 262 NORTH AMERICA: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 263 NORTH AMERICA: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2018–2022 (KT)

- TABLE 264 NORTH AMERICA: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2023–2028 (KT)

- TABLE 265 NORTH AMERICA: FROZEN FOODS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 266 NORTH AMERICA: FROZEN FOODS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 267 NORTH AMERICA: FROZEN FOODS MARKET, BY CONSUMPTION, 2018–2022 (USD MILLION)

- TABLE 268 NORTH AMERICA: FROZEN FOODS MARKET, BY CONSUMPTION, 2023–2028 (USD MILLION)

- TABLE 269 NORTH AMERICA: FROZEN FOODS MARKET, BY DISTRIBUTION CHANNEL, 2018–2022 (USD MILLION)

- TABLE 270 NORTH AMERICA: FROZEN FOODS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 271 US: FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 272 US: FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 273 US: FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (KT)

- TABLE 274 US: FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (KT)

- TABLE 275 US: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 276 US: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 277 US: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2018–2022 (KT)

- TABLE 278 US: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2023–2028 (KT)

- TABLE 279 US: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 280 US: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 281 US: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2018–2022 (KT)

- TABLE 282 US: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2023–2028 (KT)

- TABLE 283 US: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 284 US: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 285 US: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2018–2022 (KT)

- TABLE 286 US: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2023–2028 (KT)

- TABLE 287 US: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 288 US: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 289 US: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2018–2022 (KT)

- TABLE 290 US: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2023–2028 (KT)

- TABLE 291 US: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 292 US: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 293 US: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2018–2022 (KT)

- TABLE 294 US: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2023–2028 (KT)

- TABLE 295 US: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 296 US: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 297 US: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2018–2022 (KT)

- TABLE 298 US: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2023–2028 (KT)

- TABLE 299 US: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 300 US: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 301 US: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2018–2022 (KT)

- TABLE 302 US: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2023–2028 (KT)

- TABLE 303 US: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 304 US: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 305 US: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2018–2022 (KT)

- TABLE 306 US: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2023–2028 (KT)

- TABLE 307 US: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 308 US: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 309 US: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2018–2022 (KT)

- TABLE 310 US: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2023–2028 (KT)

- TABLE 311 US: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 312 US: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 313 US: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2018–2022 (KT)

- TABLE 314 US: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2023–2028 (KT)

- TABLE 315 CANADA: FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 316 CANADA: FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 317 CANADA: FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (KT)

- TABLE 318 CANADA: FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (KT)

- TABLE 319 CANADA: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 320 CANADA: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 321 CANADA: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2018–2022 (KT)

- TABLE 322 CANADA: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2023–2028 (KT)

- TABLE 323 CANADA: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 324 CANADA: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 325 CANADA: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2018–2022 (KT)

- TABLE 326 CANADA: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2023–2028 (KT)

- TABLE 327 CANADA: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 328 CANADA: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 329 CANADA: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2018–2022 (KT)

- TABLE 330 CANADA: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2023–2028 (KT)

- TABLE 331 CANADA: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 332 CANADA: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 333 CANADA: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2018–2022 (KT)

- TABLE 334 CANADA: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2023–2028 (KT)

- TABLE 335 CANADA: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 336 CANADA: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 337 CANADA: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2018–2022 (KT)

- TABLE 338 CANADA: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2023–2028 (KT)

- TABLE 339 CANADA: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 340 CANADA: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 341 CANADA: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2018–2022 (KT)

- TABLE 342 CANADA: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2023–2028 (KT)

- TABLE 343 CANADA: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 344 CANADA: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 345 CANADA: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2018–2022 (KT)

- TABLE 346 CANADA: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2023–2028 (KT)

- TABLE 347 CANADA: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 348 CANADA: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 349 CANADA: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2018–2022 (KT)

- TABLE 350 CANADA: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2023–2028 (KT)

- TABLE 351 CANADA: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 352 CANADA: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 353 CANADA: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2018–2022 (KT)

- TABLE 354 CANADA: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2023–2028 (KT)

- TABLE 355 CANADA: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 356 CANADA: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 357 CANADA: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2018–2022 (KT)

- TABLE 358 CANADA: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2023–2028 (KT)

- TABLE 359 MEXICO: FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 360 MEXICO: FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 361 MEXICO: FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (KT)

- TABLE 362 MEXICO: FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (KT)

- TABLE 363 MEXICO: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 364 MEXICO: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 365 MEXICO: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2018–2022 (KT)

- TABLE 366 MEXICO: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2023–2028 (KT)

- TABLE 367 MEXICO: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 368 MEXICO: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 369 MEXICO: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2018–2022 (KT)

- TABLE 370 MEXICO: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2023–2028 (KT)

- TABLE 371 MEXICO: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 372 MEXICO: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 373 MEXICO: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2018–2022 (KT)

- TABLE 374 MEXICO: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2023–2028 (KT)

- TABLE 375 MEXICO: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 376 MEXICO: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 377 MEXICO: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2018–2022 (KT)

- TABLE 378 MEXICO: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2023–2028 (KT)

- TABLE 379 MEXICO: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 380 MEXICO: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 381 MEXICO: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2018–2022 (KT)

- TABLE 382 MEXICO: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2023–2028 (KT)

- TABLE 383 MEXICO: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 384 MEXICO: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 385 MEXICO: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2018–2022 (KT)

- TABLE 386 MEXICO: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2023–2028 (KT)

- TABLE 387 MEXICO: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 388 MEXICO: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 389 MEXICO: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2018–2022 (KT)

- TABLE 390 MEXICO: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2023–2028 (KT)

- TABLE 391 MEXICO: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 392 MEXICO: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 393 MEXICO: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2018–2022 (KT)

- TABLE 394 MEXICO: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2023–2028 (KT)

- TABLE 395 MEXICO: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 396 MEXICO: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 397 MEXICO: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2018–2022 (KT)

- TABLE 398 MEXICO: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2023–2028 (KT)

- TABLE 399 MEXICO: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 400 MEXICO: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 401 MEXICO: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2018–2022 (KT)

- TABLE 402 MEXICO: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2023–2028 (KT)

- TABLE 403 EUROPE: FROZEN FOODS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 404 EUROPE: FROZEN FOODS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 405 EUROPE: FROZEN FOODS MARKET, BY COUNTRY, 2018–2022 (KT)

- TABLE 406 EUROPE: FROZEN FOODS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 407 EUROPE: FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 408 EUROPE: FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 409 EUROPE: FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (KT)

- TABLE 410 EUROPE: FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (KT)

- TABLE 411 EUROPE: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 412 EUROPE: FROZEN FOODS MARKET FRUITS & VEGETABLES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 413 EUROPE: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2018–2022 (KT)

- TABLE 414 EUROPE: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2023–2028 (KT)

- TABLE 415 EUROPE: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 416 EUROPE: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 417 EUROPE: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2018–2022 (KT)

- TABLE 418 EUROPE: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2023–2028 (KT)

- TABLE 419 EUROPE: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 420 EUROPE: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 421 EUROPE: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2018–2022 (KT)

- TABLE 422 EUROPE: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2023–2028 (KT)

- TABLE 423 EUROPE: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 424 EUROPE: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 425 EUROPE: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2018–2022 (KT)

- TABLE 426 EUROPE: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2023–2028 (KT)

- TABLE 427 EUROPE: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 428 EUROPE: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 429 EUROPE: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2018–2022 (KT)

- TABLE 430 EUROPE: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2023–2028 (KT)

- TABLE 431 EUROPE: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 432 EUROPE: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 433 EUROPE: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2018–2022 (KT)

- TABLE 434 EUROPE: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2023–2028 (KT)

- TABLE 435 EUROPE: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 436 EUROPE: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 437 EUROPE: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2018–2022 (KT)

- TABLE 438 EUROPE: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2023–2028 (KT)

- TABLE 439 EUROPE: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 440 EUROPE: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 441 EUROPE: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2018–2022 (KT)

- TABLE 442 EUROPE: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2023–2028 (KT)

- TABLE 443 EUROPE: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 444 EUROPE: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 445 EUROPE: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2018–2022 (KT)

- TABLE 446 EUROPE: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2023–2028 (KT)

- TABLE 447 EUROPE: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 448 EUROPE: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 449 EUROPE: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2018–2022 (KT)

- TABLE 450 EUROPE: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2023–2028 (KT)

- TABLE 451 EUROPE: FROZEN FOODS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 452 EUROPE: FROZEN FOODS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 453 EUROPE: FROZEN FOODS MARKET, BY CONSUMPTION, 2018–2022 (USD MILLION)

- TABLE 454 EUROPE: FROZEN FOODS MARKET, BY CONSUMPTION, 2023–2028 (USD MILLION)

- TABLE 455 EUROPE: FROZEN FOODS MARKET, BY DISTRIBUTION CHANNEL, 2018–2022 (USD MILLION)

- TABLE 456 EUROPE: FROZEN FOODS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 457 GERMANY: FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 458 GERMANY: FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 459 GERMANY: FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (KT)

- TABLE 460 GERMANY: FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (KT)

- TABLE 461 GERMANY: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 462 GERMANY: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 463 GERMANY: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2018–2022 (KT)

- TABLE 464 GERMANY: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2023–2028 (KT)

- TABLE 465 GERMANY: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 466 GERMANY: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 467 GERMANY: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2018–2022 (KT)

- TABLE 468 GERMANY: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2023–2028 (KT)

- TABLE 469 GERMANY: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 470 GERMANY: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 471 GERMANY: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2018–2022 (KT)

- TABLE 472 GERMANY: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2023–2028 (KT)

- TABLE 473 GERMANY: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 474 GERMANY: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 475 GERMANY: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2018–2022 (KT)

- TABLE 476 GERMANY: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2023–2028 (KT)

- TABLE 477 GERMANY: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 478 GERMANY: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 479 GERMANY: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2018–2022 (KT)

- TABLE 480 GERMANY: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2023–2028 (KT)

- TABLE 481 GERMANY: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 482 GERMANY: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 483 GERMANY: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2018–2022 (KT)

- TABLE 484 GERMANY: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2023–2028 (KT)

- TABLE 485 GERMANY: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 486 GERMANY: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 487 GERMANY: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2018–2022 (KT)

- TABLE 488 GERMANY: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2023–2028 (KT)

- TABLE 489 GERMANY: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 490 GERMANY: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 491 GERMANY: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2018–2022 (KT)

- TABLE 492 GERMANY: FROZEN FOODS MARKET FOR RED MEAT, BY PRODUCT, 2023–2028 (KT)

- TABLE 493 GERMANY: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 494 GERMANY: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 495 GERMANY: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2018–2022 (KT)

- TABLE 496 GERMANY: FROZEN FOODS MARKET FOR SEAFOOD, BY PRODUCT, 2023–2028 (KT)

- TABLE 497 GERMANY: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 498 GERMANY: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 499 GERMANY: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2018–2022 (KT)

- TABLE 500 GERMANY: FROZEN FOODS MARKET FOR PLANT-BASED PROTEIN, BY PRODUCT, 2023–2028 (KT)

- TABLE 501 FRANCE: FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 502 FRANCE: FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 503 FRANCE: FROZEN FOODS MARKET, BY PRODUCT, 2018–2022 (KT)

- TABLE 504 FRANCE: FROZEN FOODS MARKET, BY PRODUCT, 2023–2028 (KT)

- TABLE 505 FRANCE: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 506 FRANCE: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 507 FRANCE: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2018–2022 (KT)

- TABLE 508 FRANCE: FROZEN FOODS MARKET FOR FRUITS & VEGETABLES, BY PRODUCT, 2023–2028 (KT)

- TABLE 509 FRANCE: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 510 FRANCE: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 511 FRANCE: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2018–2022 (KT)

- TABLE 512 FRANCE: FROZEN FOODS MARKET FOR FRUITS, BY PRODUCT, 2023–2028 (KT)

- TABLE 513 FRANCE: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 514 FRANCE: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 515 FRANCE: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2018–2022 (KT)

- TABLE 516 FRANCE: FROZEN FOODS MARKET FOR VEGETABLES, BY PRODUCT, 2023–2028 (KT)

- TABLE 517 FRANCE: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 518 FRANCE: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 519 FRANCE: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2018–2022 (KT)

- TABLE 520 FRANCE: FROZEN FOODS MARKET FOR FROZEN POTATOES, BY PRODUCT, 2023–2028 (KT)

- TABLE 521 FRANCE: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 522 FRANCE: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 523 FRANCE: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2018–2022 (KT)

- TABLE 524 FRANCE: FROZEN FOODS MARKET FOR BAKERY PRODUCTS, BY PRODUCT, 2023–2028 (KT)

- TABLE 525 FRANCE: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 526 FRANCE: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 527 FRANCE: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2018–2022 (KT)

- TABLE 528 FRANCE: FROZEN FOODS MARKET FOR MEAT & SEAFOOD PRODUCTS, BY PRODUCT, 2023–2028 (KT)

- TABLE 529 FRANCE: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 530 FRANCE: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 531 FRANCE: FROZEN FOODS MARKET FOR POULTRY, BY PRODUCT, 2018–2022 (KT)