Refrigerated Transport Market by Mode of Transport (Road, Sea, Rail & Air), Application (Chilled food & Frozen food), Vehicle Type (LCV, MHCV & HCV), Temperature (Single & Multi-temperature), Technology and Region - Global Forecast to 2027

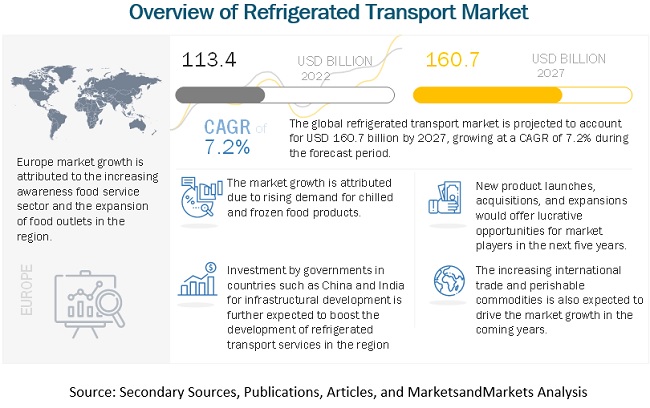

The refrigerated transport market is a rapidly growing industry, with a valuation of $113.4 billion in 2022, and a projected CAGR of 7.2% from 2022 to 2027, reaching $160.7 billion. This growth presents a unique opportunity for stakeholders to leverage the latest advancements in cold chain logistics and expand their business horizons, while also contributing to the growth and development of the global economy. The market is poised to make a significant impact on the global economy, thanks to its vital role in ensuring the safe and efficient transportation of perishable goods. As this demand for temperature-controlled logistics continues to rise, the refrigerated transport industry is evolving at a breakneck pace, driven by an insatiable appetite for innovation and sustainability.

From cutting-edge technologies that promote food safety and reduce waste to eco-friendly solutions that minimize environmental impact, the refrigerated transport sector is at the forefront of a new era of responsible and responsive logistics. By creating value for customers, driving growth for businesses, and contributing to a more sustainable future for all, the refrigerated transport market is a testament to the power of technology, innovation, and entrepreneurship to drive positive change in the world.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19

With the starting of year 2022, it has witnessed that governments of various nations have taken number of measures to relax covid restrictions which is resulting a positive impact on the for refrigerated transport and is anticipated to witness a significant increment in the upcoming years till 2027. In addition, the demand for several perishable products, including dairy (especially the plant-based) products, confectionery, and bakery products, fresh fruits and vegetables, and ready-to-eat food (including cook & eat and heat & eat) has witnessed significant growth in recent few years. These market trends are anticipated to boost the demand for the refrigerated transport market over the forecast period. However, it has been witnessed that during 2021-2022, several variants of COVID-19 have hit the market, which has negatively impacted the global market. These market scenarios are anticipated to negatively impact the demand for the market over the forecast period.

Market Dynamics

Drivers: Increasing demand for frozen perishable commodities

Several factors such as increasing women employment across the world, sudden impact of pandemic and increasing hectic life coupled with work-from-home culture is shifting the consumption pattern and consumer perception of frozen foods. The projected growth of frozen foods is promising, with growth opportunities from emerging markets such as the countries of the Asia Pacific, South America, and Eastern Europe.

As frozen foods have a longer shelf life, they are preferred when climatic conditions affect crop productivity. Food manufacturers strive to provide frozen as well as processed and packaged foods to consumers at affordable prices. Freezing techniques provide the perfect solution to move food from the farmer’s market to the supermarket by improving affordability & accessibility and preventing loss of food. The growth of service sectors such as fast-food chains, quick service restaurants, and hypermarkets accelerates the demand for frozen foods.

Restraints: High energy costs and the requirement for significant capital investments

A major focus for manufacturers, retailers, and consumers in the food industry is to ensure food quality and safety by preventing premature expiry, decay, and spoilage. It has become necessary for service providers to invest in modern cold storage facilities, advanced vehicles, and system technologies. However, high energy costs are a growing concern for cold chain providers (energy costs are particularly high in North America and Europe). Refrigerated storage facilities use traditional fluorescent light fixtures, which are switched on throughout the year as mandatory under regulations. Rising fuel costs and efficient fuel consumption management are some of the other major concerns for cold chain providers, as the requirement for refrigerated vehicles in cold chains, especially in North America and Europe, has increased over the last few years.

Opportunities: Intermodal transport to save fuel costs

Service providers are looking for new strategies to select transport modes to cut costs and increase supply chain efficiency. Currently, intermodal transport is used with increasing frequency in the food & beverage industry. Intermodal transport relies primarily on rail shipments and transports perishable commodities using multiple modes of transportation (trucks, ships, and air). Reefer containers are also utilized in intermodal transport. Refrigerated rail transport is widely used due to the rising fuel costs. According to the Association of American Railroads (AAR), Washington, companies have invested heavily in rail infrastructure and associated technology. For instance, Union Pacific Corporation, one of North America's leading transportation companies, has invested more than USD 30 billion in its rail network since 2000, enabling the construction or modernization of intermodal facilities and the creation of a route structure that offers truck-competitive delivery services.

Challenges: Lack of transport infrastructure support in emerging markets and skilled resources in developed markets

The developing markets such as the Asia Pacific and Latin American countries lack efficient transport infrastructure and are not well connected. In developed markets such as the US and the UK, the transport infrastructure is efficient; however, the major challenging factor for refrigerated transport is the lack of skilled labor. There is a need for skilled technicians and mechanics to maintain refrigerated transport equipment. Efficient technicians can help control maintenance costs in the overall operating costs and save the lead time of transporting perishable commodities to retail. The shortage of skilled labor affects the productivity and profitability of the refrigerated road transport market.

By application, Chilled food was the largest application segment in the global market.

Chilled food products are substantially growing and are expected to witness high-growth prospects in the emerging economies of Asia Pacific, South America, and the Middle East amidst the growing consumption of convenience foods in these regions. Apart from this, the expansion of fast-food chains and supermarkets is expected to create lucrative opportunities for chilled food product manufacturers and refrigerated transport service providers in the coming years.

By mode of transport, MHCV is the second fastest growing segment in the global market.

Refrigerated MHCV are used for medium-distance transportation from one city to another. These semi-trucks are also used when the delivery of perishable goods is time sensitive. Perishable goods such as fish, meat, and milk, and dairy products are mostly transported with the help of trucks. The increase in the use of multi-temperature refrigerated systems provides an option to transport more than one perishable item at a time, improving transportation efficiency via trucks.

By temperature, multi-temperature was the fastest growing segment in the global refrigerated transport market.

With the growth of the foodservice industry, the fleet of multi-temperature refrigerated trailers has continued to increase in size and significance. Multi-temperature refrigerated trailers are equipped with evaporators and host unit controls that provide different temperatures in one trailer. These units now feature microprocessors that control, monitor, pre-trip, and trouble-shoot each temperature zone within the complete multi-temperature system.

By technology, fully electrified segement is anticipated to be the fastest growing segment in the market over the foreseeable future.

A full-electric vehicle virtually have zero pollution and green house gas (GHG) emission. These features are promoting the major players to introduce fully electric vehicles in the global market. For instance, in March 2022, ThermoKing, one of the leading and innovative players in the refrigerated vehicle manufacturers, announced to expand its portfolio with the launch of new vehicle refrigeration systems, ‘e200’.

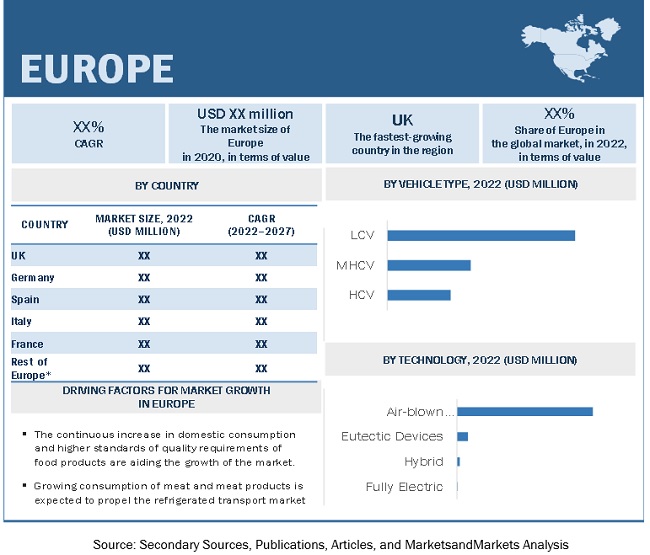

By region, Europe was the largest regional market for the refrigerated transport industry

To know about the assumptions considered for the study, download the pdf brochure

Europe accounted for 25.7% of the refrigerated transport market in 2021. The general trend in the market in Europe is that food product manufacturers and retailers move from local service providers to larger pan-European service providers due to the development of network-focused technological solutions, technological up-gradation in refrigerated systems & transport, and the focus on the implementation of quality standards set by the public and private sector.

Key Market Players:

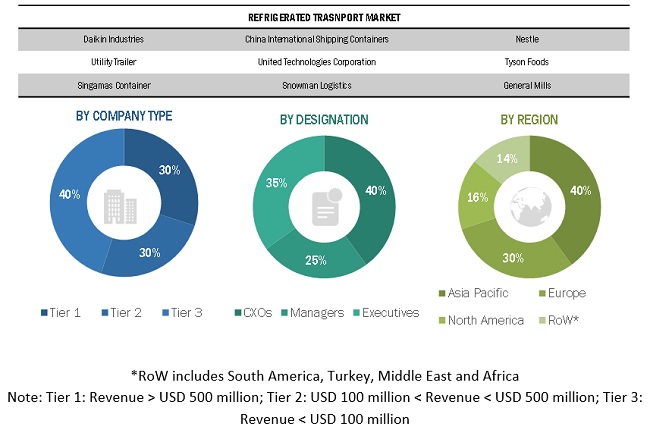

Key players in this market include United Technologies Corporation (Carrier Corporation) (US), DAIKIN INDUSTRIES Ltd.(Japan), Ingersoll Rand (Ireland), China International Shipping Containers (Group) Co., Ltd (China), Utility Trailer Manufacturing Company (US), Singamas Container Holdings Limited (China), Hyundai (Korea), Schmitz Cargobull (Germany), KRONE (Germany), LAMBERET SAS (France), Tata Motors (India), VE Commercial Vehicles Limited (India), Shaanxi Tianhui Inlong Trading Co. Ltd (China), Wabash National Corporation (US) and Great Dane LLC (US).

Scope of the Refrigerated Transport Market Report

|

Report Metric |

Details |

|

Market magnitude in 2022 |

USD 113.4 billion |

|

Revenue projection in 2027 |

USD 160.7 billion |

|

Progress rate |

CAGR of 7.2% |

|

Market size available for years |

2019-2027 |

|

Base year for estimation |

2021 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Temperature, Region, Technology |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Prominent organizations profiled |

Cargill, Incorporated (US), Kerry Group plc. (Ireland), DSM (Netherlands), Kemin Industries Inc. (US), and ADM (US) |

|

Report Highlights |

This version includes refinement of the market size with respect to mode of transport, temperature, technology, application, and regional markets, provided based on the COVID-19 impact at the global level. |

Target Audience:

- Food & beverage manufacturers

- Importer, exporter, and trader of agricultural commodities

- Government and research organizations

- Retail market players

- Cold chian players

- Marketing directors

- Key executives from various key companies and organizations in refrigerated transport market

This research report categorizes refrigerated transport market based on application, mode of transport, temperature, technology, and region.

By Application

-

Chilled food

- Milk

- Bakery & confectionery products

- Dairy products

- Beverages

- Fresh fruits & vegetables

-

Frozen food

- Ice cream

- Frozen dairy products

- Meat-processed

- Fish & sea food

- Bakery products

By Mode of Transport (Road)

- LCV

- MHCV

- HCV

By Temperature

- Single temperature

- Multi-temperature

By Technology

- Air-blown Evaporators

- Eutectic Devices

- Hybrid

- Fully Electrified

By Region

- North America

- Europe

- Asia Pacific

- South America

-

Rest of the World (RoW)

- Middle East

- Africa

Refrigerated Transport Market Recent Developments

- In March 2022, United Technologies Corporation partnered with Phillips Connect with the launch of Utility Connect. The Utility Connect system stems from Utility’s proprietary wiring harness that has been re-engineered to work with the Phillips Connect Smart7 nosebox. Utility recognized early on the advantages of providing the highest quality, corrosion-free harnesses that would seamlessly and reliably connect to multiple sensors for the trailer's life.

- In January 2022, Carrier Corporation expanded its electrification capabilities through a new alliance with ConMet adding wheel-based power generation that captures energy that otherwise would be wasted during braking events. The alliance also advances Carrier’s broader zero-emission transport refrigeration solutions, with the availability of electric options for the trailer, truck, and light commercial vehicle customers before the end of 2022, helping address upcoming emissions regulations.

- In October 2021, Trailer Dynamics GmbH and trailer manufacturer Krone have announced a strategic partnership. The common goal is the production-ready development of an electrified trailer that significantly reduces the diesel and CO2 emissions of diesel semitrailer tractors and increases the range of BEV semitrailer tractors..

- In February 2021, Ingersoll Rand manufactured fully electric refrigeration units for small to medium-sized vans and trucks. With a unique mix of control, convenience, utilization, and reliability, the e200 is the ideal all-electric solution for electric and engine-powered trucks. The e200 provides a unique mix of control and convenience, paired with low noise and reduced weight, and offers an attractive solution across urban settings and final mile deliveries.

Frequently Asked Questions (FAQ):

What is the expected market size for the global refrigerated transport market in the coming years?

The refrigerated transport market is expected to surge to a valuation of $160.7 billion by 2027, representing an unprecedented era of growth for this dynamic industry.

What is the estimated growth rate (CAGR) of the global refrigerated transport market for the next five years?

The global refrigerated transport market is set to grow at a moderate rate, representing a CAGR of 7.2% during the forecast period.

What are the major revenue pockets in the refrigerated transport market currently?

Europe accounted for 25.7% of the refrigerated transport market in 2021. The general trend in the market in Europe is that food product manufacturers and retailers move from local service providers to larger pan-European service providers due to the development of network-focused technological solutions, technological up-gradation in refrigerated systems & transport, and the focus on the implementation of quality standards set by the public and private sector.

What was the size of the global refrigerated transport market in 2022?

In 2022, the refrigerated transport market achieved a global value of $113.4 billion.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, detailed explanation of research methodology can be provided over a scheduled call, it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market including:

- Bottom up approach

- Top down approach (Based on global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of below mentioned players, company profiles provide insights such as business overview covering information on the company’s business segments, financials, geographic presence and revenue mix and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis and MnM view to elaborate analyst view on the company. Some of the key players in the market include United Technologies Corporation (Carrier Corporation) (US), DAIKIN INDUSTRIES Ltd.(Japan), Ingersoll Rand (Ireland), China International Shipping Containers (Group) Co., Ltd (China), Utility Trailer Manufacturing Company (US), Singamas Container Holdings Limited (China), Hyundai (Korea), Schmitz Cargobull (Germany), KRONE (Germany), LAMBERET SAS (France), Tata Motors (India), VE Commercial Vehicles Limited (India), Shaanxi Tianhui Inlong Trading Co. Ltd (China), Wabash National Corporation (US) and Great Dane LLC (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 54)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 REGIONS COVERED

1.4.1 INCLUSIONS AND EXCLUSIONS

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 VOLUME UNIT CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2021

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 60)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE – BOTTOM-UP (BASED ON REFRIGERATED TRANSPORT MARKET, BY REGION)

2.2.2 APPROACH TWO – TOP DOWN (BASED ON THE GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS AND RISK ASSESSMENT OF THE STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 OPTIMISTIC SCENARIO

2.6.2 REALISTIC & PESSIMISTIC SCENARIO

2.6.3 SCENARIO-BASED MODELLING

2.7 INTRODUCTION TO COVID–19

2.8 COVID–19 HEALTH ASSESSMENT

FIGURE 4 COVID–19: GLOBAL PROPAGATION

FIGURE 5 COVID–19 PROPAGATION: SELECT COUNTRIES

2.9 COVID–19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.9.1 COVID–19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 75)

TABLE 2 GLOBAL: MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 9 REFRIGERATED TRANSPORT MARKET SIZE FOR CHILLED FOOD PRODUCTS, BY PRODUCT TYPE, 2022 VS 2027 (KILO TON)

FIGURE 10 MARKET SIZE FOR REFRIGERATED TRANSPORT, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET SIZE FOR REFRIGERATED TRANSPORT, BY TEMPERATURE, 2022 VS. 2027 (UNIT)

FIGURE 12 MARKET SIZE FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

FIGURE 13 REFRIGERATED TRANSPORT MARKET, BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 80)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 14 GROWING DEMAND FOR CHILLED & FROZEN FOOD PRODUCTS TO DRIVE THE MARKET

4.2 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY APPLICATION AND COUNTRY

FIGURE 15 CHINA TO ACCOUNT FOR THE LARGEST SHARE IN THE FROZEN PRODUCTS SEGMENT IN THE ASIA PACIFIC MARKET IN 2022

4.3 REFRIGERATED TRANSPORT MARKET, BY VEHICLE TYPE

FIGURE 16 LCV SEGMENT ESTIMATED TO HOLD THE LARGEST SHARE OF THE REFRIGERATED TRANSPORT MARKET IN 2022

4.4 REFRIGERATED TRANSPORT MARKET, BY TEMPERATURE

FIGURE 17 MULTI-TEMPERATURE SEGMENT IS ESTIMATED TO DOMINATE THE MARKET IN 2022

4.5 REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY

FIGURE 18 CONVENTIONAL TECHNOLOGY ESTIMATED TO HOLD A LARGER SHARE OF THE REFRIGERATED TRANSPORT MARKET IN 2022

4.6 REFRIGERATED TRANSPORT MARKET, BY APPLICATION AND REGION

FIGURE 19 ASIA PACIFIC TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 20 COVID-19 IMPACT ON THE REFRIGERATED TRANSPORT MARKET: COMPARISON OF PRE-AND POST-COVID-19 SCENARIOS

5 MARKET OVERVIEW (Page No. - 85)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing need for temperature control to prevent food loss and potential health hazards

FIGURE 22 INDIA: ANNUAL FOOD WASTAGE AS PERCENTAGE OF PRODUCTION, 2020

5.2.1.2 Increasing international trade of perishable commodities

5.2.1.3 Technological innovations in refrigerated systems and equipment

5.2.1.4 Increased demand for frozen perishable commodities

FIGURE 23 CHINA: BEEF & VEAL PRODUCTION AND CONSUMPTION, 2016–2021 (THOUSAND METRIC TON)

5.2.1.5 Increase in the use of advanced cold rooms

5.2.1.6 Growing demand for fresh fruits and vegetables in Europe

FIGURE 24 SHARE OF FRESH FRUIT AND VEGETABLES IMPORT VALUE IN 2020

5.2.2 RESTRAINTS

5.2.2.1 High energy costs and the requirement for significant capital investments

5.2.2.2 Climate change affecting transportation infrastructure

5.2.2.3 Environmental concerns regarding greenhouse gas emissions

FIGURE 25 ENVIRONMENTAL IMPACT OF THE FOOD SUPPLY CHAIN

5.2.3 OPPORTUNITIES

5.2.3.1 Intermodal transport to save fuel costs

5.2.3.2 Integration of multi-temperature systems in trucks and trailers

5.2.3.3 Increasing foreign direct investments in emerging markets

5.2.4 CHALLENGES

5.2.4.1 Lack of transport infrastructure support in emerging markets and skilled resources in developed markets

5.2.4.2 Maintaining product integrity during the transportation of perishable commodities

5.2.4.3 Rising fuel costs and high capital investment requirement

6 MARKET DISRUPTIONS (Page No. - 96)

6.1 BREXIT

6.1.1 IMPACT OF BREXIT ON GLOBAL TRADE

6.1.1.1 Free internal market

6.1.1.2 Most impacted countries include Belgium, the Netherlands, and Germany

TABLE 3 ESTIMATED MOST FAVOURED NATION (MFN) TARIFF LEVELS, BY KEY SECTOR, 2016

FIGURE 26 TOP FIVE COMMODITIES EXPORTED BY THE UK TO THE UN, “NOVEMBER” 2021

FIGURE 27 TOP 5 COMMODITIES IMPORTED BY THE UK FROM THE EU, “NOVEMBER” 2021

6.1.2 IMPLICATIONS OF BREXIT ON ROAD TRANSPORT OPERATORS

6.1.2.1 Professional competence in road transport

6.1.2.2 Permits for road transport

6.1.3 APPROVALS FOR VEHICLES

6.1.4 INSPECTION AND CUSTOMS CHECKS

6.1.5 THE CUMULATIVE EFFECT OF BORDER CONTROL ON JOURNEY TIMES

6.2 SILK ROAD

6.2.1 THREE MAIN ROUTES

6.2.1.1 The Eurasian Land-Bridge with new opportunities

6.2.1.2 Volumes are still low, but trade value is higher

6.2.1.3 Chinese and European hinterlands more accessible

6.3 U.S.- UK TRADE AND INVESTMENT TIES

FIGURE 28 SHARE OF U.S. AND UK TOTAL TRADE (TOTAL 2020 GOODS AND SERVICES TRADE (EXPORTS AND IMPORTS) WITH SELECTED TRADING PARTNERS)

6.4 SUBSTITUTES IN REFRIGERATED TRANSPORT

TABLE 4 REFRIGERANT SUBSTITUTE WITH THEIR GWP, SNAP LISTING DATE, AND LISTING STATUS

6.5 MACROECONOMIC INDICATORS

6.5.1 GROWTH OF THE ORGANIZED RETAIL INDUSTRY

FIGURE 29 GROWING ORGANIZED RETAIL INDUSTRY IS FUELING THE DEMAND FOR REFRIGERATED TRANSPORT

6.5.2 INCREASING NEED FOR REFRIGERATED TRANSPORT

7 INDUSTRY TRENDS (Page No. - 105)

7.1 INTRODUCTION

7.2 VALUE CHAIN

7.2.1 SUPPLY PROCUREMENT

7.2.2 TRANSPORT

7.2.3 STORAGE & DISTRIBUTION

7.2.4 END-PRODUCT MANUFACTURERS

FIGURE 30 VALUE CHAIN ANALYSIS OF THE REFRIGERATED TRANSPORT MARKET

7.3 TECHNOLOGY ANALYSIS

7.4 PRICING ANALYSIS: REFRIGERATED TRANSPORT MARKET

TABLE 5 GLOBAL REFRIGERATED TRANSPORT AVERAGE SELLING PRICE (ASP), BY TECHNOLOGY, 2019-2021 (USD/UNITS)

TABLE 6 GLOBAL REFRIGERATED TRANSPORT AVERAGE SELLING PRICE (ASP), BY REGION, 2019-2021 (USD/UNITS)

7.5 MARKET MAP AND ECOSYSTEM REFRIGERATED TRANSPORT MARKET

7.5.1 DEMAND-SIDE

7.5.2 SUPPLY-SIDE

FIGURE 31 REFRIGERATED TRANSPORT MARKET: MARKET MAP

TABLE 7 REFRIGERATED TRANSPORT MARKET: SUPPLY CHAIN (ECOSYSTEM)

7.6 TRENDS IMPACTING BUYERS

FIGURE 32 REFRIGERATED TRANSPORT MARKET: TRENDS IMPACTING BUYERS

7.7 PATENT ANALYSIS

FIGURE 33 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2021

FIGURE 34 TOP 10 INVESTORS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 35 TOP 10 APPLICANTS WITH THE HIGHEST NO. OF PATENT DOCUMENTS

TABLE 8 SOME OF THE PATENTS PERTAINING TO REFRIGERATION TRANSPORT, 2019–2021

7.8 TRADE DATA: REFRIGERATED TRANSPORT MARKET

7.8.1 TROPICAL FRUITS (AVOCADO, PINEAPPLE, GUAVA, MANGOES, AND FIGS)

TABLE 9 TOP 10 IMPORTERS AND EXPORTERS OF TROPICAL FRUITS (AVOCADOS, PINEAPPLES, GUAVA, MANGOES, FIGS) (USD MN)

7.8.2 POULTRY

TABLE 10 TOP 10 IMPORTERS AND EXPORTERS OF POULTRY, (USD MN)

7.9 REGULATORY BODIES/GOVERNMENT AGENCIES/OTHER ORGANIZATIONS

7.10 KEY CONFERENCES & EVENTS IN 2022-2023

7.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 11 REFRIGERATED TRANSPORT MARKET: PORTER’S FIVE FORCES ANALYSIS

7.11.1 DEGREE OF COMPETITION

7.11.2 BARGAINING POWER OF SUPPLIERS

7.11.3 BARGAINING POWER OF BUYERS

7.11.4 THREAT OF SUBSTITUTES

7.11.5 THREAT OF NEW ENTRANTS

7.12 CASE STUDIES

7.12.1 RISING COLD CHAIN LOGISTICS DEMAND FOR TRANSPORT OF PERISHABLE PRODUCTS

7.12.2 EURO FOOD GROUP SIGNED AN AGREEMENT WITH CARRIER CORPORATION FOR REFRIGERATED EQUIPMENT SUPPLY

7.13 KEY STAKEHOLDERS IN VALUE CHAIN AND BUYING CRITERIA

7.13.1 KEY STAKEHOLDERS IN THE VALUE CHAIN

7.13.2 BUYING CRITERIA

8 REGULATIONS FOR THE REFRIGERATED TRANSPORT MARKET (Page No. - 121)

8.1 INTRODUCTION

8.2 FDA FOOD SAFETY MODERNIZATION ACT (FSMA)

8.3 AGREEMENT ON THE INTERNATIONAL CARRIAGE OF PERISHABLE FOODSTUFFS AND THE SPECIAL EQUIPMENT TO BE USED FOR SUCH CARRIAGE (ATP)

8.3.1 SELECTION OF EQUIPMENT AND TEMPERATURE CONDITIONS TO BE OBSERVED FOR THE CARRIAGE OF QUICK (DEEP)-FROZEN AND FROZEN FOODSTUFFS

TABLE 12 TEMPERATURE CONDITIONS FOR FROZEN FOODS

8.3.2 MONITORING THE AIR TEMPERATURE FOR TRANSPORT OF QUICK-FROZEN PERISHABLE FOODSTUFFS

TABLE 13 TEMPERATURE CONDITIONS FOR CHILLED FOODS

8.4 OTHER COUNTRY-WISE REGULATIONS

8.4.1 EUROPE

8.4.1.1 Temperature control and legislation requirements for refrigerated transport

8.4.2 INDIA

8.4.2.1 cop approval requirements for refrigerated transport

8.4.3 US

8.4.3.1 ELECTROLYTE SPILLAGE AND ELECTRICAL SHOCK PROTECTION for refrigerated transport

8.4.4 AUSTRALIA & NEW ZEALAND

8.4.4.1 Food Standards Australia New Zealand (FSANZ)

8.5 COUNTRY-WISE LEGISLATIONS FOR THE USE OF REFRIGERANTS

8.5.1 EUROPEAN UNION: F-GAS

TABLE 14 HFC REFRIGERANTS WITH THEIR GWP AND PHASE OUT DATES IN EUROPE

FIGURE 36 ALLOCATED QUOTAS FOR PLACING F-GASES ON THE EUROPEAN MARKET

8.5.2 UNITED STATES: SNAP REGULATIONS

8.5.3 JAPAN: "ACT ON RATIONAL USE & PROPER MANAGEMENT OF FLUOROCARBONS"

TABLE 15 HFC REFRIGERANTS WITH THEIR APPLICATION AND RESPECTIVE GWP AND PHASE OUT DATES IN JAPAN

8.5.4 CHINA: "FIRST CATALOGUE OF RECOMMENDED SUBSTITUTES FOR HCFCS"

TABLE 16 RECOMMENDED REFRIGERANTS THAT CAN SUBSTITUTE R-22 FOR DIFFERENT APPLICATIONS ACCORDING TO CHINESE AUTHORITIES

8.5.5 CANADA: "REGULATIONS AMENDING THE OZONE-DEPLETING SUBSTANCES AND HALOCARBON ALTERNATIVES REGULATIONS (PROPOSAL)"

TABLE 17 REFRIGERANTS AND THEIR PHASEOUT IN CANADA

8.5.6 AUSTRALIA: "OZONE PROTECTION AND SYNTHETIC GREENHOUSE GAS MANAGEMENT AMENDMENT BILL 2017"

8.6 ASIA PACIFIC

8.6.1 EURO-ASIAN TRANSPORT LINKS (EATL)

8.6.2 SILK ROAD

9 REFRIGERATED TRANSPORT MARKET, BY APPLICATION (Page No. - 131)

9.1 INTRODUCTION

FIGURE 37 CHILLED FOOD PRODUCTS TO DOMINATE THE MARKET FROM 2022 TO 2027 (KT)

TABLE 18 MARKET SIZE FOR REFRIGERATED TRANSPORT, BY APPLICATION, 2019–2022 (KT)

TABLE 19 REFRIGERATED TRANSPORT MARKET, BY APPLICATION, 2023–2027 (KT)

9.2 CHILLED FOOD PRODUCTS

TABLE 20 REFRIGERATED TRANSPORT MARKET SIZE FOR CHILLED FOOD PRODUCTS, BY REGION, 2019–2022 (KT)

TABLE 21 MARKET SIZE FOR CHILLED FOOD PRODUCTS, BY REGION, 2023–2027 (KT)

FIGURE 38 MARKET SIZE FOR CHILLED FOOD PRODUCTS, BY TYPE, 2022 VS. 2027 (KT)

9.2.1 MILK

TABLE 22 REFRIGERATED MILK MARKET SIZE, BY REGION, 2019–2022 (KT)

TABLE 23 REFRIGERATED MILK MARKET SIZE, BY REGION, 2023–2027 (KT)

9.2.2 BAKERY & CONFECTIONERY PRODUCTS

TABLE 24 REFRIGERATED BAKERY & CONFECTIONERY PRODUCTS MARKET SIZE, BY REGION, 2019–2022 (KT)

TABLE 25 REFRIGERATED BAKERY & CONFECTIONERY PRODUCTS MARKET SIZE, BY REGION, 2023–2027 (KT)

9.2.3 DAIRY PRODUCTS

TABLE 26 REFRIGERATED DAIRY PRODUCTS MARKET SIZE, BY REGION, 2019–2022 (KT)

TABLE 27 REFRIGERATED DAIRY PRODUCTS MARKET SIZE, BY REGION, 2023–2027 (KT)

9.2.4 BEVERAGES

TABLE 28 REFRIGERATED BEVERAGES MARKET SIZE, BY REGION, 2019–2022 (KT)

TABLE 29 REFRIGERATED BEVERAGES MARKET SIZE, BY REGION, 2023–2027 (KT)

9.2.5 FRESH FRUITS & VEGETABLES

TABLE 30 REFRIGERATED FRESH FRUITS & VEGETABLE MARKET SIZE, BY REGION, 2019–2022 (KT)

TABLE 31 REFRIGERATED FRESH FRUITS & VEGETABLE MARKET SIZE, BY REGION, 2023–2027 (KT)

9.3 FROZEN FOOD PRODUCTS

TABLE 32 REFRIGERATED TRANSPORT MARKET SIZE FOR FROZEN FOOD PRODUCTS, BY REGION, 2019–2022 (KT)

TABLE 33 MARKET SIZE FOR FROZEN FOOD PRODUCTS, BY REGION, 2023–2027 (KT)

FIGURE 39 MARKET SIZE FOR FROZEN FOOD PRODUCTS, BY TYPE, 2022 VS. 2027 (KT)

9.3.1 ICE CREAM

TABLE 34 REFRIGERATED ICECREAM MARKET SIZE, BY REGION, 2019–2022 (KT)

TABLE 35 REFRIGERATED ICECREAM MARKET SIZE, BY REGION, 2023–2027 (KT)

9.3.2 FROZEN DAIRY PRODUCTS

TABLE 36 REFRIGERATED FROZEN DAIRY PRODUCTS MARKET SIZE, BY REGION, 2019–2022 (KT)

TABLE 37 REFRIGERATED FROZEN DAIRY PRODUCTS MARKET SIZE, BY REGION, 2023–2027 (KT)

9.3.3 PROCESSED MEAT

FIGURE 40 CATEGORIES OF PROCESSED MEAT PRODUCTS AND TYPICAL EXAMPLES

TABLE 38 REFRIGERATED PROCESSED MEAT MARKET SIZE, BY REGION, 2019–2022 (KT)

TABLE 39 REFRIGERATED PROCESSED MEAT MARKET SIZE, BY REGION, 2023–2027 (KT)

9.3.4 FISH & SEAFOOD

TABLE 40 REFRIGERATED FISH & SEAFOOD MARKET SIZE, BY REGION, 2019–2022 (KT)

TABLE 41 REFRIGERATED FISH & SEAFOOD MARKET SIZE, BY REGION, 2023–2027 (KT)

9.3.5 BAKERY PRODUCTS

TABLE 42 REFRIGERATED BAKERY PRODUCTS MARKET SIZE, BY REGION, 2019–2022 (KT)

TABLE 43 REFRIGERATED BAKERY PRODUCTS MARKET SIZE, BY REGION, 2023–2027 (KT)

10 REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT (Page No. - 147)

10.1 INTRODUCTION

FIGURE 41 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY MODE OF TRANSPORT, 2022 VS. 2027 (UNITS)

10.2 REFRIGERATED ROAD TRANSPORT

TABLE 44 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

TABLE 45 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY VEHICLE TYPE, 2023–2027 (USD MILLION)

TABLE 46 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY VEHICLE TYPE, 2019–2022 (UNITS)

TABLE 47 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY VEHICLE TYPE, 2023–2027 (UNITS)

10.3 COVID-19 IMPACT ON THE REFRIGERATED TRANSPORT MARKET BY VEHICLE TYPE

10.3.1 OPTIMISTIC SCENARIO

TABLE 48 OPTIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE REFRIGERATED TRANSPORT MARKET, BY VEHICLE TYPE, 2020–2023 (USD MILLION)

10.3.2 REALISTIC SCENARIO

TABLE 49 REALISTIC SCENARIO: IMPACT OF COVID–19 ON THE MARKET, BY VEHICLE TYPE, 2020–2023 (USD MILLION)

10.3.3 PESSIMISTIC SCENARIO

TABLE 50 PESSIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE MARKET, BY VEHICLE TYPE, 2020–2023 (USD MILLION)

10.3.4 REFRIGERATED LCV (VAN)

TABLE 51 REFRIGERATED LCV MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

TABLE 52 REFRIGERATED LCV MARKET SIZE, BY REGION, 2023–2027 (USD MILLION)

TABLE 53 REFRIGERATED LCV MARKET SIZE, BY REGION, 2019–2022 (UNITS)

TABLE 54 REFRIGERATED LCV MARKET SIZE, BY REGION, 2023–2027 (UNITS)

10.3.5 REFRIGERATED MHCV (TRUCK)

TABLE 55 REFRIGERATED MHCV MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

TABLE 56 REFRIGERATED MHCV MARKET SIZE, BY REGION, 2023–2027 (USD MILLION)

TABLE 57 REFRIGERATED MHCV MARKET SIZE, BY REGION, 2019–2022 (UNITS)

TABLE 58 REFRIGERATED MHCV MARKET SIZE, BY REGION, 2023–2027 (UNITS)

10.3.6 REFRIGERATED HCV (TRAILERS & SEMI-TRAILERS)

TABLE 59 REFRIGERATED HCV MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

TABLE 60 REFRIGERATED HCV MARKET SIZE, BY REGION, 2023–2027 (USD MILLION)

TABLE 61 REFRIGERATED HCV MARKET SIZE, BY REGION, 2019–2022 (UNITS)

TABLE 62 REFRIGERATED HCV MARKET SIZE, BY REGION, 2023–2027 (UNITS)

10.4 REFRIGERATED SEA TRANSPORT

10.5 REFRIGERATED RAIL TRANSPORT

10.6 REFRIGERATED AIR TRANSPORT

11 REFRIGERATED TRANSPORT MARKET, BY TEMPERATURE (Page No. - 160)

11.1 INTRODUCTION

FIGURE 42 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY TEMPERATURE, 2022 VS. 2027 (UNITS)

TABLE 63 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY TEMPERATURE, 2019–2022 (UNITS)

TABLE 64 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY TEMPERATURE, 2023–2027 (UNITS)

11.2 SINGLE-TEMPERATURE

TABLE 65 SINGLE-TEMPERATURE REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY REGION, 2019–2022 (UNITS)

TABLE 66 SINGLE-TEMPERATURE REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY REGION, 2023–2027 (UNIT)

11.3 MULTI-TEMPERATURE

TABLE 67 MULTI-TEMPERATURE REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY REGION, 2019–2022 (UNITS)

TABLE 68 MULTI-TEMPERATURE REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY REGION, 2023–2027 (UNITS)

12 REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY (Page No. - 165)

12.1 INTRODUCTION

FIGURE 43 REFRIGERATED ROAD TRANSPORT MARKET SIZE, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

TABLE 69 REFRIGERATED TRANSPORT MARKET SIZE, BY TECHNOLOGY, 2019–2022 (USD MILLION)

TABLE 70 MARKET SIZE FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2023–2027 (USD MILLION)

TABLE 71 MARKET SIZE FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2019–2022 (UNITS)

TABLE 72 MARKET SIZE FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2023–2027 (UNITS)

12.2 COVID-19 IMPACT ON THE REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY

12.2.1 OPTIMISTIC SCENARIO

TABLE 73 OPTIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

12.2.2 REALISTIC SCENARIO

TABLE 74 REALISTIC SCENARIO: IMPACT OF COVID–19 ON THE REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

12.2.3 PESSIMISTIC SCENARIO

TABLE 75 PESSIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE REFRIGERATED TRANSPORT MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

12.3 VAPOR COMPRESSION SYSTEMS

12.3.1 CONVENTIONAL

TABLE 76 CONVENTIONAL: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

TABLE 77 CONVENTIONAL: MARKET SIZE FOR REFRIGERATED TRANSPORT, BY REGION, 2023–2027 (USD MILLION)

TABLE 78 CONVENTIONAL: MARKET SIZE FOR REFRIGERATED TRANSPORT, BY REGION, 2019–2022 (UNITS)

TABLE 79 CONVENTIONAL: MARKET SIZE FOR REFRIGERATED TRANSPORT, BY REGION, 2023–2027 (UNITS)

12.3.2 HYBRID

TABLE 80 HYBRID: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

TABLE 81 HYBRID: MARKET SIZE FOR REFRIGERATED TRANSPORT, BY REGION, 2023–2027 (USD MILLION)

TABLE 82 HYBRID: MARKET SIZE FOR REFRIGERATED TRANSPORT, BY REGION, 2019–2022 (UNITS)

TABLE 83 HYBRID: MARKET SIZE FOR REFRIGERATED TRANSPORT, BY REGION, 2023–2027 (UNITS)

12.3.3 FULLY ELECTRIC

TABLE 84 FULLY ELECTRIC: REFRIGERATED TRANSPORT MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

TABLE 85 FULLY ELECTRIC: MARKET SIZE FOR REFRIGERATED TRANSPORT, BY REGION, 2023–2027 (USD MILLION)

TABLE 86 FULLY ELECTRIC: MARKET SIZE FOR REFRIGERATED TRANSPORT, BY REGION, 2019–2022 (UNITS)

TABLE 87 FULLY ELECTRIC: MARKET SIZE FOR REFRIGERATED TRANSPORT, BY REGION, 2023–2027 (UNITS)

12.4 COMPRESSOR TECHNOLOGY

12.4.1 SCROLL

12.4.2 OPEN-RECIP

12.4.3 OTHERS

13 REFRIGERATED TRANSPORT MARKET, BY REGION (Page No. - 176)

13.1 INTRODUCTION

FIGURE 44 INDIA TO RECORD THE FASTEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 88 REFRIGERATED TRANSPORT MARKET, BY REGION, 2019–2022 (USD MILLION)

TABLE 89 MARKET FOR REFRIGERATED TRANSPORT, BY REGION, 2023–2027 (USD MILLION)

TABLE 90 MARKET FOR REFRIGERATED TRANSPORT, BY REGION, 2019–2022 (UNITS)

TABLE 91 MARKET FOR REFRIGERATED TRANSPORT, BY REGION, 2023–2027 (UNITS)

13.2 COVID-19 IMPACT ON THE REFRIGERATED TRANSPORT MARKET BY REGION

13.2.1 OPTIMISTIC SCENARIO

TABLE 92 OPTIMISTIC SCENARIO: MARKET FOR REFRIGERATED TRANSPORT, BY REGION, 2020–2023 (USD MILLION)

13.2.2 REALISTIC SCENARIO

TABLE 93 REALISTIC SCENARIO: MARKET FOR REFRIGERATED TRANSPORT, BY REGION, 2020–2023 (USD MILLION)

13.2.3 PESSIMISTIC SCENARIO

TABLE 94 PESSIMISTIC SCENARIO: REFRIGERATED TRANSPORT MARKET, BY REGION, 2020–2023 (USD MILLION)

13.3 NORTH AMERICA

TABLE 95 NORTH AMERICA VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

TABLE 96 NORTH AMERICA VEHICLE TYPE: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (USD MILLION)

TABLE 97 NORTH AMERICA VEHICLE TYPE: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2019–2022 (UNITS)

TABLE 98 NORTH AMERICA VEHICLE TYPE: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (UNITS)

TABLE 99 NORTH AMERICA CHILLED PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019–2022 (KT)

TABLE 100 NORTH AMERICA CHILLED PRODUCTS: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (KT)

TABLE 101 NORTH AMERICA FROZEN PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019–2022 (KT)

TABLE 102 NORTH AMERICA FROZEN PRODUCTS: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (KT)

TABLE 103 NORTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 106 NORTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 107 NORTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY TEMPERATURE, 2019–2022 (UNITS)

TABLE 108 NORTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY TEMPERATURE, 2023–2027 (UNITS)

TABLE 109 NORTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2019–2022 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2023–2027 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2019–2022 (UNITS)

TABLE 112 NORTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2023–2027 (UNITS)

TABLE 113 NORTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 114 NORTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 115 NORTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 116 NORTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.3.1 US

13.3.1.1 Temperature-sensitive dairy, beverages, and meat products make up a significant market for the industry

TABLE 117 US: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 118 US: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 119 US: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 120 US: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 121 US: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 122 US: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 123 US: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 124 US: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.3.2 CANADA

13.3.2.1 The country is a major importer and exporter of agricultural products

TABLE 125 CANADA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 126 CANADA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 127 CANADA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 128 CANADA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 129 CANADA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 130 CANADA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 131 CANADA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 132 CANADA: REFRIGERATED TRANSPORT MARKET, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.3.3 MEXICO

13.3.3.1 Increasing consumption of packaged food products has led to the increased demand for retail distribution

TABLE 133 MEXICO: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 134 MEXICO: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 135 MEXICO: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 136 MEXICO: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 137 MEXICO: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 138 MEXICO: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 139 MEXICO: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 140 MEXICO: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.4 EUROPE

FIGURE 45 EUROPE: REFRIGERATED TRANSPORT MARKET SNAPSHOT

TABLE 141 EUROPE VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

TABLE 142 EUROPE VEHICLE TYPE: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (USD MILLION)

TABLE 143 EUROPE VEHICLE TYPE: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2019–2022 (UNITS)

TABLE 144 EUROPE VEHICLE TYPE: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (UNITS)

TABLE 145 EUROPE CHILLED PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019–2022 (KT)

TABLE 146 EUROPE CHILLED PRODUCTS: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (KT)

TABLE 147 EUROPE FROZEN PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019–2022 (KT)

TABLE 148 EUROPE FROZEN PRODUCTS: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (KT)

TABLE 149 EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 150 EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 151 EUROPE: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 152 EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 153 EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY TEMPERATURE, 2019–2022 (UNITS)

TABLE 154 EUROPE:MARKET FOR REFRIGERATED TRANSPORT, BY TEMPERATURE, 2023–2027 (UNITS)

TABLE 155 EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2019–2022 (USD MILLION)

TABLE 156 EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2023–2027 (USD MILLION)

TABLE 157 EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2019–2022 (UNITS)

TABLE 158 EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2023–2027 (UNITS)

TABLE 159 EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 160 EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 161 EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 162 EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.4.1 UK

13.4.1.1 The continuous increase in domestic consumption and higher standards of quality requirements of food products are aiding the growth of the market

TABLE 163 UK: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 164 UK: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 165 UK: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 166 UK: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 167 UK: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 168 UK: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 169 UK: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 170 UK: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.4.2 GERMANY

13.4.2.1 The country is a major importer and exporter of agricultural products

TABLE 171 GERMANY: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 172 GERMANY: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 173 GERMANY: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 174 GERMANY: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 175 GERMANY: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 176 GERMANY: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 177 GERMANY: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 178 GERMANY: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.4.3 FRANCE

13.4.3.1 Growing consumption of meat and meat products is expected to propel the refrigerated transport market

TABLE 179 FRANCE: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 180 FRANCE: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 181 FRANCE: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 182 FRANCE: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 183 FRANCE: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 184 FRANCE: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 185 FRANCE: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 186 FRANCE: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.4.4 ITALY

13.4.4.1 Increasing consumer inclination towards healthy food products and ready-to-eat meals

TABLE 187 ITALY: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 188 ITALY: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 189 ITALY: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 190 ITALY: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 191 ITALY: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 192 ITALY: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 193 ITALY: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 194 ITALY: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.4.5 SPAIN

13.4.5.1 Technological development has contributed to the refrigerated transport market in Spain

TABLE 195 SPAIN: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 196 SPAIN: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 197 SPAIN: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 198 SPAIN: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 199 SPAIN: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 200 SPAIN: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 201 SPAIN: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 202 SPAIN: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.4.6 REST OF EUROPE

13.4.6.1 Development of the refrigerated transport market is dependent on the growing food & beverage industry

TABLE 203 REST OF EUROPE: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 204 REST OF EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 205 REST OF EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 206 REST OF EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 207 REST OF EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 208 REST OF EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 209 REST OF EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 210 REST OF EUROPE: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.5 ASIA PACIFIC

FIGURE 46 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET SNAPSHOT

TABLE 211 ASIA PACIFIC VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

TABLE 212 ASIA PACIFIC VEHICLE TYPE: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (USD MILLION)

TABLE 213 ASIA PACIFIC VEHICLE TYPE: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2019–2022 (UNITS)

TABLE 214 ASIA PACIFIC VEHICLE TYPE: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (UNITS)

TABLE 215 ASIA PACIFIC CHILLED PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019–2022 (KT)

TABLE 216 ASIA PACIFIC CHILLED PRODUCTS: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (KT)

TABLE 217 ASIA PACIFIC FROZEN PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019–2022 (KT)

TABLE 218 ASIA PACIFIC FROZEN PRODUCTS: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (KT)

TABLE 219 ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 220 ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 221 ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 222 ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 223 ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY TEMPERATURE, 2019–2022 (UNITS)

TABLE 224 ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY TEMPERATURE, 2023–2027 (UNITS)

TABLE 225 ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2019–2022 (USD MILLION)

TABLE 226 ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2023–2027 (USD MILLION)

TABLE 227 ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2019–2022 (UNITS)

TABLE 228 ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2023–2027 (UNITS)

TABLE 229 ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 230 ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 231 ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 232 ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.5.1 CHINA

13.5.1.1 Rising demand for high-quality fresh food products

TABLE 233 CHINA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 234 CHINA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 235 CHINA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 236 CHINA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 237 CHINA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 238 CHINA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 239 CHINA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 240 CHINA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.5.2 JAPAN

13.5.2.1 Growing consumer preference for processed food & beverage products

TABLE 241 JAPAN: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 242 JAPAN: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 243 JAPAN: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 244 JAPAN: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 245 JAPAN: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 246 JAPAN: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 247 JAPAN: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 248 JAPAN: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.5.3 INDIA

13.5.3.1 Change in consumption patterns increase demand for packaged food products

TABLE 249 INDIA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 250 INDIA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 251 INDIA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 252 INDIA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 253 INDIA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 254 INDIA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 255 INDIA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 256 INDIA:MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.5.4 SOUTH KOREA

13.5.4.1 Increasing trading of perishables attributed to the growth of the refrigerated transport market

TABLE 257 SOUTH KOREA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 258 SOUTH KOREA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 259 SOUTH KOREA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 260 SOUTH KOREA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 261 SOUTH KOREA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 262 SOUTH KOREA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 263 SOUTH KOREA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 264 SOUTH KOREA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.5.5 REST OF ASIA PACIFIC

TABLE 265 REST OF ASIA PACIFIC: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 266 REST OF ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 267 REST OF ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 268 REST OF ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 269 REST OF ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 270 REST OF ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 271 REST OF ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 272 REST OF ASIA PACIFIC: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.6 SOUTH AMERICA

TABLE 273 SOUTH AMERICA VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

TABLE 274 SOUTH AMERICA VEHICLE TYPE: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (USD MILLION)

TABLE 275 SOUTH AMERICA VEHICLE TYPE: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2019–2022 (UNITS)

TABLE 276 SOUTH AMERICA VEHICLE TYPE: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (UNITS)

TABLE 277 SOUTH AMERICA CHILLED PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019–2022 (KT)

TABLE 278 SOUTH AMERICA CHILLED PRODUCTS: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (KT)

TABLE 279 SOUTH AMERICA FROZEN PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019–2022 (KT)

TABLE 280 SOUTH AMERICA FROZEN PRODUCTS: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (KT)

TABLE 281 SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 282 SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 283 SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 284 SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 285 SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY TEMPERATURE, 2019–2022 (UNITS)

TABLE 286 SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY TEMPERATURE, 2023–2027 (UNITS)

TABLE 287 SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2019–2022 (USD MILLION)

TABLE 288 SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2023–2027 (USD MILLION)

TABLE 289 SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2019–2022 (UNITS)

TABLE 290 SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2023–2027 (UNITS)

TABLE 291 SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 292 SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 293 SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 294 SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.6.1 BRAZIL

13.6.1.1 Growing organized retail sector enhances the refrigerated transport market growth

TABLE 295 BRAZIL: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 296 BRAZIL: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 297 BRAZIL: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 298 BRAZIL: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 299 BRAZIL: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 300 BRAZIL: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 301 BRAZIL: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 302 BRAZIL: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.6.2 ARGENTINA

13.6.2.1 Increasing consumption of convenience food products resulted in the rise in demand for refrigerated transport

TABLE 303 ARGENTINA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 304 ARGENTINA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 305 ARGENTINA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 306 ARGENTINA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 307 ARGENTINA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 308 ARGENTINA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 309 ARGENTINA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 310 ARGENTINA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.6.3 REST OF SOUTH AMERICA

TABLE 311 REST OF SOUTH AMERICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 312 REST OF SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 313 REST OF SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 314 REST OF SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 315 REST OF SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 316 REST OF SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 317 REST OF SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 318 REST OF SOUTH AMERICA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.7 REST OF THE WORLD

TABLE 319 REST OF THE WORLD VEHICLE TYPE: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

TABLE 320 REST OF THE WORLD VEHICLE TYPE: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (USD MILLION)

TABLE 321 REST OF THE WORLD VEHICLE TYPE: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2019–2022 (UNITS)

TABLE 322 REST OF THE WORLD VEHICLE TYPE: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (UNITS)

TABLE 323 REST OF THE WORLD CHILLED PRODUCTS: REFRIGERATED TRANSPORT MARKET, BY COUNTRY, 2019–2022 (KT)

TABLE 324 REST OF THE WORLD CHILLED PRODUCTS: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (KT)

TABLE 325 REST OF THE WORLD FROZEN PRODUCTS: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2019–2022 (KT)

TABLE 326 REST OF THE WORLD FROZEN PRODUCTS: MARKET FOR REFRIGERATED TRANSPORT, BY COUNTRY, 2023–2027 (KT)

TABLE 327 REST OF THE WORLD: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 328 REST OF THE WORLD: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 329 REST OF THE WORLD: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 330 REST OF THE WORLD: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 331 REST OF THE WORLD: MARKET FOR REFRIGERATED TRANSPORT, BY TEMPERATURE, 2019–2022 (UNITS)

TABLE 332 REST OF THE WORLD: MARKET FOR REFRIGERATED TRANSPORT, BY TEMPERATURE, 2023–2027 (UNITS)

TABLE 333 REST OF THE WORLD: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2019–2022 (USD MILLION)

TABLE 334 REST OF THE WORLD: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2023–2027 (USD MILLION)

TABLE 335 REST OF THE WORLD: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2019–2022 (UNITS)

TABLE 336 REST OF THE WORLD: MARKET FOR REFRIGERATED TRANSPORT, BY TECHNOLOGY, 2023–2027 (UNITS)

TABLE 337 REST OF THE WORLD: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 338 REST OF THE WORLD: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 339 REST OF THE WORLD: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 340 REST OF THE WORLD: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.7.1 AFRICA

13.7.1.1 Increase in the export of perishable foods such as fruits & vegetables is the key driver for African refrigerated transport

TABLE 341 AFRICA: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 342 AFRICA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 343 AFRICA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 344 AFRICA: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 345 AFRICA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 346 AFRICA: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 347 AFRICA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 348 AFRICA: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

13.7.2 MIDDLE EAST

13.7.2.1 Significant reliance on food imports to drive the growth of the market

TABLE 349 MIDDLE EAST: REFRIGERATED TRANSPORT MARKET, BY MODE OF TRANSPORT, 2019–2022 (USD MILLION)

TABLE 350 MIDDLE EAST: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (USD MILLION)

TABLE 351 MIDDLE EAST: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2019–2022 (UNITS)

TABLE 352 MIDDLE EAST: MARKET FOR REFRIGERATED TRANSPORT, BY MODE OF TRANSPORT, 2023–2027 (UNITS)

TABLE 353 MIDDLE EAST: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2019–2022 (KT)

TABLE 354 MIDDLE EAST: MARKET FOR REFRIGERATED TRANSPORT, BY CHILLED PRODUCTS, 2023–2027 (KT)

TABLE 355 MIDDLE EAST: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2019–2022 (KT)

TABLE 356 MIDDLE EAST: MARKET FOR REFRIGERATED TRANSPORT, BY FROZEN PRODUCTS, 2023–2027 (KT)

14 COMPETITIVE LANDSCAPE (Page No. - 276)

14.1 OVERVIEW

14.2 MARKET SHARE ANALYSIS, 2021

TABLE 357 FROZEN AND CHILLED FOOD MANUFACTURERS SHARE ANALYSIS, 2021

14.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 47 FIVE-YEAR TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2016–2020 (USD BILLION)

14.4 COVID-19-SPECIFIC COMPANY RESPONSE

14.4.1 KELLOGG CO

14.4.2 GENERAL MILLS INC.

14.4.3 NESTLE SA

14.4.4 CONAGRA BRANDS

14.4.5 TYSON FOODS, INC.

14.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

14.5.1 STARS

14.5.2 PERVASIVE PLAYERS

14.5.3 EMERGING LEADERS

14.5.4 PARTICIPANTS

FIGURE 48 FROZEN AND CHILLED FOOD MANUFACTURERS, COMPANY EVALUATION QUADRANT, 2021

14.5.5 FROZEN AND CHILLED FOOD FOOTPRINT (KEY PLAYERS)

TABLE 358 COMPANY FOOTPRINT, BY CHILLED FOOD PRODUCTS

TABLE 359 COMPANY FOOTPRINT, BY FROZEN FOOD PRODUCTS

TABLE 360 COMPANY REGIONAL, BY REGIONAL FOOTPRINT

TABLE 361 OVERALL, COMPANY FOOTPRINT

TABLE 362 FROZEN AND CHILLED FOOD: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

14.6 COMPETITIVE SCENARIO

14.6.1 NEW PRODUCT LAUNCHES

TABLE 363 FROZEN AND CHILLED FOOD: NEW PRODUCT LAUNCHES, 2018-2021

14.6.2 DEALS

TABLE 364 FROZEN AND CHILLED FOOD: DEALS, 2018-2022

14.6.3 OTHERS

TABLE 365 FROZEN AND CHILLED FOOD: OTHERS, 2019-2021

15 COMPANY PROFILES (Page No. - 288)

15.1 KEY PLAYERS

(Business overview Products/solutions/services offered, Recent Developments, MNM view)*

15.1.1 NESTLE SA

TABLE 366 NESTLE SA: BUSINESS OVERVIEW

FIGURE 49 NESTLE SA: COMPANY SNAPSHOT

TABLE 367 NESTLE SA: PRODUCTS OFFERED

TABLE 368 NESTLE SA: NEW PRODUCT LAUNCHES

TABLE 369 NESTLE SA: OTHERS

15.1.2 TYSON FOODS, INC.

TABLE 370 TYSON FOODS, INC.: BUSINESS OVERVIEW

FIGURE 50 TYSON FOODS, INC.: COMPANY SNAPSHOT

TABLE 371 TYSON FOODS, INC.: PRODUCTS OFFERED

TABLE 372 TYSON FOODS, INC.: DEALS

15.1.3 THE KRAFT HEINZ COMPANY

TABLE 373 THE KRAFT HEINZ COMPANY: BUSINESS OVERVIEW

FIGURE 51 THE KRAFT HEINZ COMPANY: COMPANY SNAPSHOT

TABLE 374 THE KRAFT HEINZ COMPANY: PRODUCTS OFFERED

TABLE 375 THE KRAFT HEINZ COMPANY: DEALS

15.1.4 GENERAL MILLS INC.

TABLE 376 GENERAL MILLS INC.: BUSINESS OVERVIEW

FIGURE 52 GENERAL MILLS INC.: COMPANY SNAPSHOT

TABLE 377 GENERAL MILLS INC.: PRODUCTS OFFERED

TABLE 378 GENERAL MILLS INC.: DEALS

TABLE 379 GENERAL MILLS INC.: OTHERS

15.1.5 SMITHFIELD FOODS, INC

TABLE 380 SMITHFIELD FOODS, INC: BUSINESS OVERVIEW

TABLE 381 SMITHFIELD FOODS, INC: PRODUCTS OFFERED

15.1.6 KELLOGG CO.

TABLE 382 KELLOGG CO.: BUSINESS OVERVIEW

FIGURE 53 KELLOGG CO.: COMPANY SNAPSHOT

TABLE 383 KELLOGG CO.: PRODUCTS OFFERED

TABLE 384 KELLOGG CO.: NEW PRODUCT LAUNCHES

15.1.7 CONAGRA BRANDS, INC.

TABLE 385 CONAGRA BRANDS, INC.: BUSINESS OVERVIEW

FIGURE 54 CONAGRA BRANDS, INC.: COMPANY SNAPSHOT

TABLE 386 CONAGRA BRANDS, INC.: PRODUCTS OFFERED

15.1.8 KERRY GROUP PLC

TABLE 387 KERRY GROUP PLC: BUSINESS OVERVIEW

FIGURE 55 KERRY GROUP PLC: COMPANY SNAPSHOT

TABLE 388 KERRY GROUP PLC: PRODUCTS OFFERED

15.1.9 DEL MONTE PACIFIC LIMITED

TABLE 389 DEL MONTE PACIFIC LIMITED: BUSINESS OVERVIEW

FIGURE 56 DEL MONTE PACIFIC LIMITED: COMPANY SNAPSHOT

TABLE 390 DEL MONTE PACIFIC LIMITED: PRODUCTS OFFERED

15.1.10 ARYZTA AG

TABLE 391 ARYZTA AG: BUSINESS OVERVIEW

FIGURE 57 ARYZTA AG: COMPANY SNAPSHOT

TABLE 392 ARYZTA AG: PRODUCTS OFFERED

*Details on Business overview Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

16 COMPETITIVE LANDSCAPE (Page No. - 319)

16.1 OVERVIEW

16.2 MARKET SHARE ANALYSIS, 2021

TABLE 393 REFRIGERATED AND TRANSPORT SERVICE PROVIDERS MANUFACTURERS SHARE ANALYSIS, 2021

16.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 58 FIVE-YEAR TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2016–2020 (USD BILLION)

16.4 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

16.4.1 STARS

16.4.2 PERVASIVE PLAYERS

16.4.3 EMERGING LEADERS

16.4.4 PARTICIPANTS

FIGURE 59 REFRIGERATED TRANSPORT SERVICE PROVIDERS AND MANUFACTURERS, COMPANY EVALUATION QUADRANT, 2021

16.5 REFRIGERATED TRANSPORT MARKET, SMES EVALUATION QUADRANT, 2021

16.5.1 PROGRESSIVE COMPANIES

16.5.2 STARTING BLOCKS

16.5.3 RESPONSIVE COMPANIES

16.5.4 DYNAMIC COMPANIES

FIGURE 60 MARKET FOR REFRIGERATED TRANSPORT: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

16.5.5 REFRIGERATED TRANSPORT SERVICE PROVIDER'S PRODUCT FOOTPRINT (KEY PLAYERS)

TABLE 394 COMPANY FOOTPRINT, BY MODE OF TRANSPORT

TABLE 395 COMPANY FOOTPRINT, BY TEMPERATURE

TABLE 396 REFRIGERATED AND TRANSPORT SERVICE PROVIDERS: COMPETITIVE BENCHMARKING OF MARKET PLAYERS

16.6 COMPETITIVE SCENARIO

16.6.1 NEW PRODUCT LAUNCHES

TABLE 397 REFRIGERATED TRANSPORT SERVICE PROVIDERS: NEW PRODUCT LAUNCHES, 2018-2021

16.6.2 DEALS

TABLE 398 REFRIGERATED TRANSPORT SERVICE PROVIDERS: DEALS, 2018-2022

16.6.3 OTHERS

TABLE 399 REFRIGERATED TRANSPORT SERVICE PROVIDERS: OTHERS, 2019-2021

17 COMPANY PROFILES (Page No. - 332)

17.1 KEY PLAYERS

(Business overview Products/solutions/services offered, Recent Developments, MNM view)*

17.1.1 UNITED TECHNOLOGIES CORPORATION (CARRIER CORPORATION)

TABLE 400 UNITED TECHNOLOGIES CORPORATION (CARRIER CORPORATION): BUSINESS OVERVIEW

FIGURE 61 UNITED TECHNOLOGIES CORPORATION (CARRIER CORPORATION): COMPANY SNAPSHOT

TABLE 401 UNITED TECHNOLOGIES CORPORATION (CARRIER CORPORATION): PRODUCTS OFFERED

TABLE 402 UNITED TECHNOLOGIES CORPORATION (CARRIER CORPORATION): NEW PRODUCT LAUNCHES

TABLE 403 UNITED TECHNOLOGIES CORPORATION (CARRIER CORPORATION): DEALS

TABLE 404 UNITED TECHNOLOGIES CORPORATION (CARRIER CORPORATION): OTHERS

17.1.2 DAIKIN INDUSTRIES, LTD.,

TABLE 405 DAIKIN INDUSTRIES, LTD.: BUSINESS OVERVIEW

FIGURE 62 DAIKIN INDUSTRIES, LTD.: COMPANY SNAPSHOT

TABLE 406 DAIKIN INDUSTRIES, LTD.: PRODUCTS OFFERED

TABLE 407 DAIKIN INDUSTRIES, LTD.: DEALS

17.1.3 INGERSOLL RAND

TABLE 408 INGERSOLL RAND: BUSINESS OVERVIEW

FIGURE 63 INGERSOLL RAND: COMPANY SNAPSHOT

TABLE 409 INGERSOLL RAND: PRODUCTS OFFERED

TABLE 410 INGERSOLL RAND: NEW PRODUCT LAUNCHES

TABLE 411 INGERSOLL RAND: DEALS

TABLE 412 INGERSOLL RAND: OTHERS

17.1.4 CHINA INTERNATIONAL SHIPPING CONTAINERS (GROUP) CO., LTD.

TABLE 413 CHINA INTERNATIONAL SHIPPING CONTAINERS (GROUP) CO., LTD.: BUSINESS OVERVIEW

TABLE 414 CHINA INTERNATIONAL SHIPPING CONTAINERS (GROUP) CO., LTD.: PRODUCTS OFFERED

TABLE 415 CHINA INTERNATIONAL SHIPPING CONTAINERS (GROUP) CO., LTD.: NEW PRODUCT LAUNCHES

17.1.5 UTILITY TRAILER MANUFACTURING COMPANY

TABLE 416 UTILITY TRAILER MANUFACTURING COMPANY: BUSINESS OVERVIEW

TABLE 417 UTILITY TRAILER MANUFACTURING COMPANY: PRODUCTS/ OFFERED

TABLE 418 UTILITY TRAILER MANUFACTURING COMPANY: NEW PRODUCT LAUNCHES

TABLE 419 UTILITY TRAILER MANUFACTURING COMPANY: DEALS

TABLE 420 UTILITY TRAILER MANUFACTURING COMPANY: OTHERS

17.1.6 SINGAMAS CONTAINER HOLDINGS LIMITED

TABLE 421 SINGAMAS CONTAINER HOLDINGS LIMITED: BUSINESS OVERVIEW

FIGURE 64 SINGAMAS CONTAINER HOLDINGS LIMITED: COMPANY SNAPSHOT

TABLE 422 SINGAMAS CONTAINER HOLDINGS LIMITED: PRODUCTS OFFERED

TABLE 423 SINGAMAS CONTAINER HOLDINGS LIMITED: DEALS

17.1.7 HYUNDAI

TABLE 424 HYUNDAI: BUSINESS OVERVIEW

FIGURE 65 HYUNDAI: COMPANY SNAPSHOT

TABLE 425 HYUNDAI: PRODUCTS OFFERED

TABLE 426 HYUNDAI: NEW PRODUCT LAUNCHES

TABLE 427 HYUNDAI: OTHERS

17.1.8 SCHMITZ CARGOBULL

TABLE 428 SCHMITZ CARGOBULL: BUSINESS OVERVIEW

TABLE 429 SCHMITZ CARGOBULL: PRODUCTS OFFERED

TABLE 430 SCHMITZ CARGOBULL: NEW PRODUCT LAUNCHES

TABLE 431 SCHMITZ CARGOBULL: OTHERS

17.1.9 KRONE

TABLE 432 KRONE: BUSINESS OVERVIEW

TABLE 433 KRONE: PRODUCTS OFFERED

TABLE 434 KRONE: DEALS

17.1.10 MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD.

TABLE 435 MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD.: BUSINESS OVERVIEW

TABLE 436 MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD.: PRODUCTS OFFERED

17.1.11 RIVACOLD SRL

TABLE 437 RIVACOLD SRL: BUSINESS OVERVIEW

TABLE 438 RIVACOLD SRL: PRODUCTS OFFERED

17.1.12 SAFKAR

TABLE 439 SAFKAR: BUSINESS OVERVIEW

TABLE 440 SAFKAR: PRODUCTS OFFERED

17.1.13 KINGTEC USA

TABLE 441 KINGTEC USA: BUSINESS OVERVIEW

TABLE 442 KINGTEC USA: PRODUCTS OFFERED

17.1.14 FRIGOBLOCK

TABLE 443 FRIGOBLOCK: BUSINESS OVERVIEW

TABLE 444 FRIGOBLOCK: PRODUCTS OFFERED

17.1.15 GAH (REFRIGERATION) LTD

TABLE 445 GAH (REFRIGERATION) LTD: BUSINESS OVERVIEW

TABLE 446 GAH (REFRIGERATION) LTD: PRODUCTS OFFERED

17.1.16 LAMBERET SAS

TABLE 447 LAMBERET SAS: BUSINESS OVERVIEW

TABLE 448 LAMBERET SAS: PRODUCTS OFFERED

17.1.17 TATA MOTORS

TABLE 449 TATA MOTORS: BUSINESS OVERVIEW

TABLE 450 TATA MOTORS: PRODUCTS OFFERED

17.1.18 VE COMMERCIAL VEHICLES LIMITED

TABLE 451 VE COMMERCIAL VEHICLES LIMITED: BUSINESS OVERVIEW

TABLE 452 VE COMMERCIAL VEHICLES LIMITED: PRODUCTS OFFERED

17.1.19 SHAANXI TIANHUI INLONG TRADING CO. LTD

TABLE 453 SHAANXI TIANHUI INLONG TRADING CO. LTD: BUSINESS OVERVIEW

TABLE 454 SHAANXI TIANHUI INLONG TRADING CO. LTD: PRODUCTS OFFERED

17.1.20 WABASH NATIONAL CORPORATION

TABLE 455 WABASH NATIONAL CORPORATION: BUSINESS OVERVIEW

TABLE 456 WABASH NATIONAL CORPORATION: PRODUCTS OFFERED

17.1.21 GREAT DANE LLC

TABLE 457 GREAT DANE LLC: BUSINESS OVERVIEW

TABLE 458 GREAT DANE LLC: PRODUCTS OFFERED

*Details on Business overview Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

18 ADJACENT AND RELATED MARKETS (Page No. - 373)

18.1 INTRODUCTION

TABLE 459 ADJACENT MARKETS

18.2 LIMITATIONS

18.3 COLD CHAIN MARKET

18.3.1 MARKET DEFINITION

18.3.2 MARKET OVERVIEW

TABLE 460 COLD CHAIN MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

18.4 FROZEN FOOD MARKET

18.4.1 MARKET DEFINITION

18.4.2 MARKET OVERVIEW

TABLE 461 FROZEN FOOD MARKET SIZE, BY PRODUCT, 2020–2025 (USD BILLION)

19 APPENDIX (Page No. - 376)

19.1 DISCUSSION GUIDE

19.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

19.3 AVAILABLE CUSTOMIZATIONS

19.4 RELATED REPORTS

19.5 AUTHOR DETAILS

The study involved four major activities in estimating refrigerated transport market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the demand-side and supply-side approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Refrigerated Transport Market Primary Research