Global Ophthalmology Devices Market (2009 - 2014)

Please click here to get the updated version of Ophthalmology Devices and Drugs Market (Contact Lens, OCT Scanner, IOL, Dry Eye, AMD, Glaucoma) Competitive Landscape & Global Forecasts To 2017

Global ophthalmology devices and drugs market is witnessing a significant growth due to the increasing incidence and prevalence of eye related disorders such as presbyopia, macular degeneration, and diabetic retinopathy among the aging population. With the introduction of ophthalmic devices equipped with sophisticated technologies, people are increasingly opting for ophthalmic surgeries to correct their eye related disorders.

This report on ophthalmology devices covers major eye problems such as cataract, refractiveerror and other retinal disorders. The cataract devices market includes intraocular lenses andphacoemulsification devices, the refractive error devices include excimer lasers and contactlenses, and devices for other retinal disorders are vitrectomy systems. The report analyzesfuture potential for all these markets and also technology trends seen in these markets inthe recent past.

The report forecasts, identifies and analyses market trends, drivers, restraints and opportunities, competitive landscape and strategic developments.

Market Estimates and Forecasts

The report categorizes global ophthalmology devices market based on major eye disorders such as cataract, refractive error and other retinal disorders. In addition to market sizes and forecasts, the report identifies and analyzes trends and opportunities for each submarket; providing fifteen market tables for submarkets in the U.S., Europe, Asia Pacific, and Rest of the World (ROW), with the latter comprising of Russia, CIS, Australia, New Zealand, Canada, Mexico, and Africa.

What makes our reports unique?

- We provide 10% customization. Normally it is seen that clients do not find specific market intelligence that they are looking for. Our customization will ensure that you necessarily get the market intelligence you are looking for and we get a loyal customer.

- We conduct detailed market positioning, product positioning and competitive positioning. Entry strategies, gaps and opportunities are identified for all the stakeholders.

- Comprehensive market analysis for the following sectors: cataract devices, refractive error devices and other retinal disorders.

Key questions answered

- Which are the high-growth segments/cash cows and how is the market segmented in terms of ophthalmology devices market?

- What are market estimates and forecasts; which markets are doing well and which are not?

- Where are the gaps and opportunities; what is driving the market?

- Which are the key playing fields? Which are the winning edge imperatives?

- How is the competitive outlook; who are the main players in each of the segments; what are the key selling products; what are their strategic directives, operational strengths and product pipelines? Who is doing what?

Powerful Research and analysis

MarketsandMarkets (M&M) is a global market research and consulting company based in the U.S. We publish strategically analyzed market research reports and serve as a business intelligence partner to Fortune 500 companies across the world. MarketsandMarkets also provides multi-client reports, company profiles, databases, and custom research services.

M&M covers thirteen industry verticals, including advanced materials, automotive and transportation, banking and financial services, biotechnology, chemicals, consumer goods energy and power, food and beverages, industrial automation, medical devices, pharmaceuticals, semiconductor and electronics, and telecommunications and IT.

We at MarketsandMarkets are inspired to help our clients grow by providing apt business insight with our huge market intelligence repository.

Global Ophthalmology Devices Market Set to Grow at 7.3% CAGR

The ophthalmology devices studied and segmented in this report are as per their usage in the diagnosis and treatment of eye related diseases and that are cataract, refractive error and other retinal disorders. The devices analyzed are Intra Ocular Lens (Cataract), Phacoemulsification Systems (Cataract), Laser-Assisted In Situ Keratomileusis (LASIK) (Refractive Error), Contact Lens (Refractive Error) and Vitrectomy Systems (Other Retinal Disorders). The total market for the above mentioned devices/equipments is estimated to be ~ $11.3 billion in 2009, growing at a CAGR of 7.3%. Alcon, (U.S.), Bausch & Lomb, (U.S.), Abbott Medical Optics (U.S.), Johnson & Johnson (U.S), are the leading players in the global ophthalmology devices market.

The cataract surgery devices market is estimated at ~ $4.4 billion in 2009 with intraocular lens market comprising ~ 77% of the entire cataract surgery market and growing the fastest with a CAGR of ~ 8.5%. The phacoemulsification market is relatively steady and growing at a rate of 6.8% and is valued at ~ $1 billion in 2009. The refractive error market is estimated at ~ $ 6.7 billion in 2009, with the contact lens market valued at ~ 85% of the total refractive error market and growing at a CAGR of 7.5%.

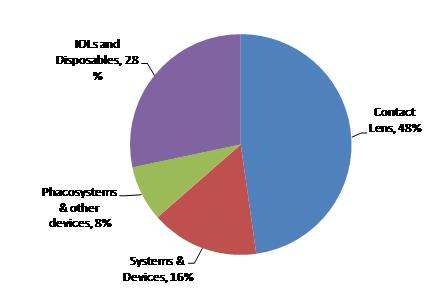

Global Ophthalmology devices market, by products

Source: MarketsandMarkets

The contact lens market contributes the highest amongst the ophthalmology devices market with a share of ~ 48%, followed by IOLs (Intraocular lens) with 28%.

The U.S. commands the largest share of the global ophthalmology devices market, primarily due to high patient awareness, quality of healthcare services, and systemized reimbursement structure. Technological developments such as femtosecond lasers are also gaining popularity due to the greater patient comfort they facilitate over conventional lasers; and because they enable customized treatment based on the individual eye dimensions of each patient.

The ophthalmology devices market witnessed an increase in new product launches in the year 2009. The total number of ophthalmology device patents filed globally dipped in the year 2008, and rose again in 2009 due to increased R&D activity in the market.

Table of contents

Executive summary

Market overview

Cataract market

Refractive error market

Other retinal disorders

Geographic analysis

Competitive landscape

Patent analysis

definitions

1 introduction

1.1 Key take-aways

1.2 Report description

1.3 Markets covered

1.4 Research methodology

1.5 stakeholders

2 Summary

3 Market overview

3.1 Market Overview

3.2 Market Analysis

3.3 Market challenges

3.4 Market opportunities

3.5 Competitive landscape

3.6 Patent trends

4 Cataract market

4.1 Introduction

4.2 Cataract solutions

4.3 Market potential

4.4 Future outlook

4.5 Drivers, restraints, & opportunities

4.5.1 Cataract backlog shows huge potential

4.5.2 High surgery cost

4.5.3 Low penetration in developing countries

4.6 TECHNOLOGY TRENDS

4.6.1 Femtosecond lasers

4.6.2 Use of Multifocal implant

4.6.3 Other technology developments

4.7 Intraocular Lens Market

4.7.1 Introduction

4.7.2 Drivers, restraints, & opportunities

4.7.2.1 Advancements in technologies

4.7.2.2 High cost of IOLs

4.7.2.3 Phakic IOLs

4.7.3 TECHNOLOGY TRENDS

4.7.3.1 Implant edge design

4.7.3.2 Accommodating implants

4.7.3.3 Implants that correct optical aberrations

4.8 Phacoemulsification devices

4.8.1 Introduction

4.8.2 Drivers & Restraints

4.8.2.1 Increased consumer preference due to reduced risk

4.8.2.2 High cost of phacoemulsification systems

4.8.2.3 Lack of trained ophthalmologists

4.8.3 Opportunities

4.8.3.1 Bimanual phacoemulsification systems

4.8.3.2 Reduced intraocular pressure

4.8.4 TECHNOLOGY TRENDS

5 Refractive Error

5.1 Introduction

5.2 Refractive error solutions

5.3 Market Potential

5.4 Future outlook

5.5 Drivers, restraints, & opportunities

5.5.1 Shift in consumer preference

5.5.2 Lack of insurance

5.5.3 Initiatives by Refractive Error Committee

5.6 TECHNOLOGY TRENDS

5.6.1 Easy diagnosis of refractive error

5.6.2 Other TECHNOLOGY TRENDS

5.7 Excimer LASer

5.7.1 Introduction

5.7.2 Drivers, restraints, & opportunities

5.7.2.1 Expansion of applications

5.7.2.2 Long term effects of LASIK cannot be determined

5.7.2.3 High Initial Investment in LASIK Equipment

5.7.2.4 Potential among Generation Y

5.7.3 TECHNOLOGY TRENDS

5.7.3.1 Wavefront LASIK eye surgery

5.7.3.2 Laser Assisted Sub-Epithelial Keratomileusis

5.8 Contact lens

5.8.1 Introduction

5.8.2 Drivers & restraints

5.8.2.1 Increased comfort

5.8.2.2 High cost of maintenance while using contact lens

5.8.2.3 Risks associated with the usage of contact lens

5.8.3 Opportunities

5.8.3.1 Bionic contact lens

5.8.3.2 Use of lenses while sleeping

5.8.4 TECHNOLOGY TRENDS

5.8.4.1 Gas permeable contact lenses

6 Other retinal disorders

6.1 Introduction

6.2 Drivers & opportunities

6.2.1 Increase in diabetic retinopathy

6.2.2 Shift from 25 g to 23 g

7 Geographic analysis

7.1 Introduction

7.2 U.S. Ophthalmology devices market

7.3 Europe ophthalmology devices market

7.4 Asia ophthalmology devices market

7.5 ROW ophthalmology devices market

8 Competitive Landscape

8.1 Introduction

8.2 New products analysis

9 Patent Analysis

9.1 Patent growth analysis

9.2 patent analysis by Geography

9.3 Patent analysis by assignees

10 Company Profiles

10.1 Abbott Medical Optics, Inc.

10.2 Alcon Inc.

10.3 Appasamy Associates

10.4 Aurolab

10.5 Bausch & Lomb Inc.

10.6 Carl-Zeiss AG

10.7 CIBA Vision Corp.

10.8 Ellex Medical Lasers Ltd

10.9 Essilor International S.A.

10.10 Haag-Streit AG

10.11 Hoya Corp.

10.12 Johnson & Johnson Vision Care, Inc.

10.13 Menicon Co., Ltd.

10.14 NIDEK CO., LTD.

10.15 Oertli Instrument AG

10.16 Rayner Intraocular Lenses Ltd

10.17 Santen Pharmaceutical Co., Ltd

10.18 STAAR Surgical Company

10.19 Technolas Perfect Vision GmbH

10.20 Ziemer Ophthalmic Systems AG

Appendix

U.S. Patents

Europe Patents

Japan Patents

List of TableS

Table 1 Global ophthalmology devices market, by products 2009 2014 ($Millions)

Table 2 Cataract devices market, by products 2007 2009 ($Millions)

Table 3 Cataract devices market, by geography 2007 2009 ($Millions)

Table 4 Intraocular lens market, by geography 2007 2009 ($Millions)

Table 5 Phacoemulsification device market, by geography 2007 2009 ($Millions)

Table 6 refractive error devices market, by products 2007 2009 ($Millions)

Table 7 refractive error devices market, by geography 2007 2009 ($Millions)

Table 8 Excimer laser market, by geography 2007 2009 ($Millions)

Table 9 Contact lens market, by geography 2007 2009 ($Millions)

Table 10 vitrectomy systems market, by geography 2007 2009 ($Millions)

Table 11 Global ophthalmology devices market, by geography 2007 2014 ($Millions)

Table 12 U.s. ophthalmology devices market, by products 2007 2014 ($Millions)

Table 13 Europe ophthalmology devices market, by products 2007 2014 ($Millions)

Table 14 asia ophthalmology devices market, by products 2007 2014 ($Millions)

Table 15 row ophthalmology devices market, by products 2007 2014 ($Millions)

TABLE 16 Agreements & Collaborations (January 2007 March 2010)

TABLE 17 Mergers & Acquisitions (January 2007 March 2010)

TABLE 18 New Product Development and R&D (January 2007 March 2010)

List of FIGURES

Figure 1 Global ophthalmology market (2009)

Figure 2 ophthalmology devices: market segments

Figure 3 Ophthalmology devices: Market Dynamics

Figure 4 Ophthalmology devices: market challenges

Figure 5 Ophthalmology devices: market opportunities

Figure 6 Global ophthalmology market: competitive landscape

Figure 7 Ophthalmology devices: Patent trends (2004 - 2009)

Figure 8 Major causes of blindness

Figure 9 Market shares of IOL players (2007)

Figure 10 Market shares of phacoemulsification device players (2007)

Figure 11 Market Shares of excimer laser players (2007)

Figure 12 Market shares of contact lens players (2007)

Figure 13 Markets shares of vitrectomy system players (2007)

Figure 14 ophthalmology market: growth strategies (January 2007 March 2010)

Figure 15 Segmentation of new product launches (January 2007 March 2010)

Figure 16 Year-on-year patent analysis (2007 - 2009)

Figure 17 Patent analysis, by geography (2004 - 2009)

Figure 18 Patents by assignees (2004 - 2009)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Global Ophthalmology Devices Market