Transplant Diagnostics Market Size, Share & Trends by Technology (PCR, NGS, Sanger Sequencing), Product (Instrument, Reagent, Software), Application (HLA, Blood Profile, Pathogen Detection), Type (Heart, Kidney, Liver, Bone Marrow), End User & Region - Global Forecast to 2028

Transplant Diagnostics Market Size, Share & Trends

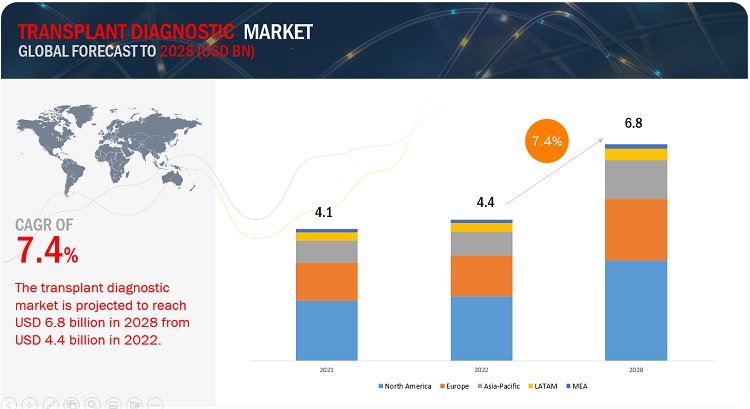

The global transplant diagnostics market, valued at US$4.1 billion in 2021, stood at US$4.4 billion in 2022 and is projected to advance at a resilient CAGR of 7.4% from 2023 to 2028, culminating in a forecasted valuation of US$6.8 billion by the end of the period. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

Increased impact of infectious diseases. The number of people with end-stage organ failure has been rising, and due to advancements in transplantation, a larger percentage of people are now eligible for organ transplantation. This growing need is a result of these two factors. Increasing public and private funding for transplantation and various organ transplant awareness campaigns.

Transplant Diagnostics Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

e- Estimated; p- Projected

Transplant Diagnostics Market Dynamics

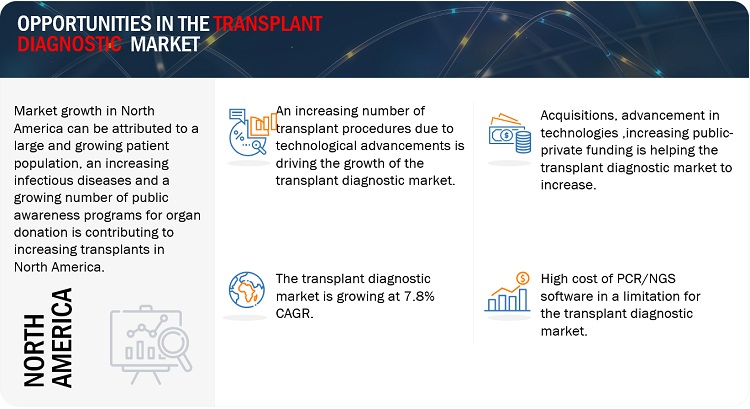

Driver: Increasing number of transplant procedures.

The rising adoption of several technologies and screening tests, genomic profiling and cross-matching are making transplants a suitable way of giving life or rebirth of the individual. The rising number of transplant procedures across major countries can be attributed to the rising CAGR of the transplant market. For instance, in the U.S 41,354 organ transplants were carried out in 2021, France 5,273 organ transplants in 2021. Diseases such as TB, end-stage renal diseases and liver cirrhosis are common among geriatric individuals and it makes it a compulsion for the individual to undergo transplant surgery.

Opportunity: Growing public awareness about organ donation and transplantation.

In 2022, the American Transplant foundation organized a fundraising event namely DLA Awards to support programs that promote public awareness related to organ donations and transplantations In 2021, the Organ receiving and giving awareness network (India) conducted an awareness program that aimed to strengthen public willingness to donate organs for transplantation procedures in India.In US long runs of 3kms,5kms and 10kms are organized to promote organ transplants within the public and make them aware of the necessity of giving life to others.

Challenge: Significant gap between number of organs donors and organs required.

There is a significant gap between number of organs donated annually and number of organs donations required. The limited number of organs donated annually across the globe is primarily due to strict government enforcement and limited medical reimbursements for living organ donors and lack of awareness about organ donations.

Restraint: High procedural cost of NGS and PCR-based diagnostic assays

Transplant diagnostic procedures for Histocompatibility tests,blood profiling,genomic profiling are conducted through specialized molecular diagnostic platforms that consists of several advanced technologies. These technologies are integrated with conventional PCR/NGS instruments and thus the cost of these advanced products is on the higher edge.

Market Ecosystem

By technology, the molecular assay technologies segment accounted for the largest share of the transplant diagnostics market during the forecast period.

In 2022, molecular assay technologies accounted for the largest share of in the market. This segment is projected to reach USD 6,156.9 million in 2028 from USD 4,166.0 in 2022, at a CAGR of 8.0% during the forecast period. Molecular assays are used in transplant diagnostic procedures for donor-recipient compatibility testing. The growing demand for molecular assays during transplant diagnostic procedures is mainly attributed to the technological benefits offered by these assays as compared to non-molecular assays, such as high procedural efficacy, the study of multiple samples and real time analysis.

By End User, Independent reference laboratories is expected to grow at the fastest rate in the transplant diagnostics market during the forecast period.

In 2022, Independent reference laboratories hold a larger share In the market with a share of 58.65%. This end-user segment is projected to reach USD 4,233.9 in 2028 from USD 2,668.8 in 2022. This end-user segment is also expected to grow at the highest CAGR of 8.0% during the forecast period. The large share of this segment can be attributed to the rapid modernization and automation of diagnostic laboratories and growing number of research and developmental activities.

By Product & Services, the Reagents & Consumables segment holds the largest share of the transplant diagnostics market.

In 2022, Reagents & Consumables holds the largest around 72.2% in the market. This Product & Service segment is projected to reach USD 5,131.0 million in 2028 from USD 3,265.2 million in 2022. Reagents & consumables account for the largest share of transplant diagnostics. Expansion in the application horizons of molecular assay techniques in transplant diagnostics, increasing patient emphasis on effective and early patient profiling during organ transplantation.

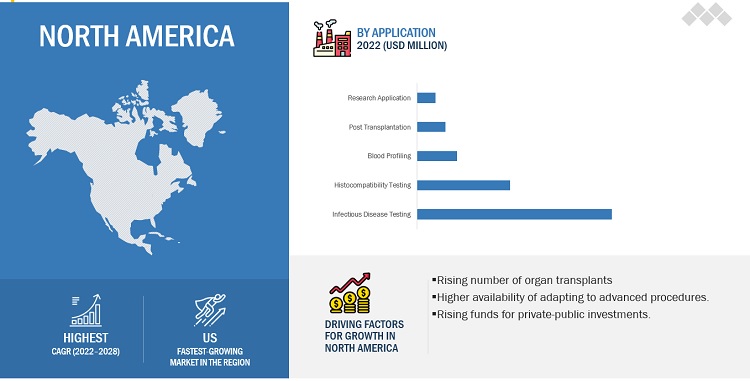

By Application, Infectious disease testing accounted for the largest share of the transplant diagnostics market during the forecast period.

In 2022, Infectious disease testing is projected to reach USD 3,764.3 million in 2028 from USD 2,344.0 million in 2022.A number of factors, such as ongoing technological advancements in the field of molecular assay techniques, the increasing adoption of these techniques for pathogen detection and histocompatibility testing and the rising incidence of infectious chronic diseases is helping this segment to grow at a high CAGR.

North America is expected to be the largest region in the transplant diagnostics market during the forecast period.

North America, comprising the US and Canada, accounted for the largest share of 45.4% of the market in 2022. Factors such as the high prevalence of diseases, the rising geriatric population, emergence of infectious diseases is contributing to the large share of North America.

APAC region is growing at the highest CAGR of 8.3% due to increasing organ donations and various public and private reimbursements policies.

To know about the assumptions considered for the study, download the pdf brochure

As of 2021, prominent players in the market are include bioMérieux SA (France), Becton, Dickinson, and Company (US), Thermo Fisher Scientific (US), Bio-Rad Laboratories, Inc. (US) among others.

Transplant Diagnostics Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2020–2028 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2028 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Technology, Product & Service, Application, Transplant type, End User & Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Companies covered |

include bioMérieux SA (France), Becton, Dickinson and Company (US), Thermo Fisher Scientific (US), Bio-Rad Laboratories, Inc. (US), Bruker (US), RMerck KGaA (US), |

This report categorizes the global transplant diagnostics market into following segments & sub-segments:

By Technology

-

Molecular assay technologies

- PCR-based molecular assays

- Real-time PCR

- Sequence-specific primer-PCR

- Sequence-specific Oligonucleotide-PCR

- Other PCR-based molecular assays

-

Sequencing based molecular assays

- Sanger sequencing

- Next generation sequencing

- Other sequencing based molecular assays

- Non molecular assays technologies

By Product & Service

- Reagents & Consumables

- Instruments

- Software & Services

By Application

-

Diagnostic application

-

Pre-transplantation Diagnostics

- Infectious Disease testing

- Histocompatibility testing

- Blood profiling

- Post -transplantation Diagnostics

-

Pre-transplantation Diagnostics

- Research applications

By transplant type

-

Solid Organ Transplantation

- Kidney transplantation

- Liver transplantation

- Heart transplantation

- Lung transplantation

- Pancrease transplantation

- Other Organs transplantation

- Stem Cell transplantation

- Soft tissue transplantation

- Bone marrow transplantation

By End User

- Hospitals and Transplant centers

- Research &Academic Institutes

- Independent reference laboratories

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments

- In February 2023, BD received FDA approval for BD Onclarity HPV assay in the serology testing segment

- In March 2023 BioRad received AQAC International and AFNOR approval for its iQ-Check kits.

- Hoffmann-La Roche Ltd. unveiled Cobas Infinity edge, a cloud-based point-of-care platform that is available everywhere, in January 2022. Practitioners in the healthcare industry can manage patient data thanks to advanced technology. This has aided the business in diversifying its product offering.

Frequently Asked Questions (FAQ):

What is the projected market value of the global transplant diagnostics market?

The global market of transplant diagnostics is projected to reach USD 6.8 billion.

What is the estimated growth rate (CAGR) of the global transplant diagnostics market for the next five years?

The global transplant diagnostics market in terms of revenue was estimated to be worth $4.4 billion in 2022 and is poised to grow at a CAGR of 7.4%.

What does the current study of the transplant diagnostics market consist of?

The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing number of transplant procedures- Technological advancements in transplant diagnostic procedures- Increasing public-private funding for target research activities- Rising prevalence of infectious diseasesRESTRAINTS- High procedural cost of NGS- and PCR-based diagnostic assays- Limited reimbursement for target proceduresOPPORTUNITIES- Rising adoption of cross-matching and chimerism testing during pre- & post-transplantation- Growing public awareness about organ donation and transplantationCHALLENGES- Significant gap between number of organ donors and organs required annually- Procedural and technical limitations associated with donor-recipient screening

- 5.3 IMPACT OF RECESSION ON TRANSPLANT DIAGNOSTICS MARKET

-

6.1 INTRODUCTIONMOLECULAR ASSAY TECHNOLOGIES- PCR-BASED MOLECULAR ASSAYS- SEQUENCING-BASED MOLECULAR ASSAYSNON-MOLECULAR ASSAY TECHNOLOGIES- Replacement of non-molecular assay techniques with DNA-based techniques to hamper growth

-

7.1 INTRODUCTIONREAGENTS & CONSUMABLES- Largest and fastest-growing segment of transplant diagnostics marketINSTRUMENTS- Increasing public-private investments to drive marketSOFTWARE & SERVICES- Growing automation & digitalization of diagnostic laboratory procedures to support market growth

-

8.1 INTRODUCTIONDIAGNOSTIC APPLICATIONS- Pre-transplantation diagnostics- Post-transplantation diagnosticsRESEARCH APPLICATIONS- Growing funding for research to drive market

-

9.1 INTRODUCTIONINDEPENDENT REFERENCE LABORATORIES- Rising consolidation of diagnostic laboratories to drive marketHOSPITALS & TRANSPLANT CENTERS- Growing purchasing power of hospitals & transplant centers to support market growthRESEARCH LABORATORIES & ACADEMIC INSTITUTES- Increasing industry-academia collaborations in genomics-based transplant diagnostic research to drive market

-

10.1 INTRODUCTIONSOLID ORGAN TRANSPLANTATION- Kidney transplantation- Liver transplantation- Lung transplantation- Heart transplantation- Pancreas transplantation- Other organ transplantationSTEM CELL TRANSPLANTATION- Rising procedural volume and growing research activities to drive marketSOFT TISSUE TRANSPLANTATION- Technological advancements and rising prevalence of target diseases to drive marketBONE MARROW TRANSPLANTATION- Dearth of well-trained surgeons to perform bone marrow transplantation to hinder growth

-

11.1 INTRODUCTIONNORTH AMERICA- US- CanadaEUROPE- GERMANY- UK- France- Spain- Italy- Rest of EuropeASIA PACIFIC- China- India- Japan- Australia- South Korea- Rest of Asia PacificLATIN AMERICA- Brazil- Mexico- Rest of Latin AmericaMIDDLE EAST & AFRICA- Developing healthcare infrastructure to favor market growth

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 MARKET SHARE ANALYSIS

-

12.4 COMPETITIVE SCENARIOPRODUCT LAUNCHES AND APPROVALSDEALS

-

12.5 COMPETITIVE LEADERSHIP MAPPINGSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.1 KEY PLAYERSBIO-RAD LABORATORIES- Business overview- Products offered- Recent developments- MnM viewF. HOFFMANN-LA ROCHE LTD.- Business overview- Products offered- Recent developments- MnM viewQIAGEN NV- Business overview- Products offered- Recent developments- MnM viewBECTON, DICKINSON AND COMPANY- Business overview- Products offered- Recent developmentsBIOFORTUNA- Business overview- Products offered- Recent developmentsBIOMÉRIEUX SA- Business overview- Products offered- Recent developmentsCAREDX- Business overview- Products offered- Recent developmentsGENDX- Business overview- Products offered- Recent developmentsHOLOGIC, INC.- Business overview- Products offered- Recent developmentsILLUMINA, INC.- Business overview- Products offered- Recent developmentsIMMUCOR, INC.- Products offered- Recent developmentsLUMINEX CORPORATION- Business overview- Products offered- Recent developmentsMERCK KGAA- Business overview- Products offered- Recent developmentsOMIXON- Business overview- Products offered- Recent developmentsTHERMO FISHER SCIENTIFIC- Business overview- Products offered- Recent developments

-

13.2 OTHER PLAYERSALPHABIOTECH LIMITEDBAG DIAGNOSTICS GMBHHANSA BIOPHARMA ABHISTOGENETICS LLCPACIFIC BIOSCIENCES OF CALIFORNIA, INC.TBG DIAGNOSTICS LIMITEDTAKARA BIO INC.INNO-TRAIN DIAGNOSTIK GMBH

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 2 PUBLIC-PRIVATE INVESTMENTS AND RESEARCH GRANTS FOR DEVELOPMENT OF TRANSPLANT DIAGNOSTIC PRODUCTS, 2018–2022

- TABLE 3 EUROPE: COST OF ASSAYS FOR MAJOR NGS/PCR-BASED GENOMIC TESTS (2021)

- TABLE 4 US: MEDICAL REIMBURSEMENTS FOR TRANSPLANTATION PROCEDURES (2021)

- TABLE 5 TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 6 TRANSPLANT DIAGNOSTICS MARKET FOR MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 7 TRANSPLANT DIAGNOSTICS MARKET FOR MOLECULAR ASSAY TECHNOLOGIES, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 8 TRANSPLANT DIAGNOSTICS MARKET FOR MOLECULAR ASSAY TECHNOLOGIES, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 9 TRANSPLANT DIAGNOSTICS MARKET FOR MOLECULAR ASSAY TECHNOLOGIES, BY END USER, 2020–2028 (USD MILLION)

- TABLE 10 TRANSPLANT DIAGNOSTICS MARKET FOR MOLECULAR ASSAY TECHNOLOGIES, BY REGION, 2020–2028 (USD MILLION)

- TABLE 11 TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 12 TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 13 TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 14 TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY END USER, 2020–2028 (USD MILLION)

- TABLE 15 TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 16 TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCE-SPECIFIC OLIGONUCLEOTIDE-PCR, BY REGION, 2020–2028 (USD MILLION)

- TABLE 17 TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCE-SPECIFIC PRIMER-PCR, BY REGION, 2020–2028 (USD MILLION)

- TABLE 18 TRANSPLANT DIAGNOSTICS MARKET FOR REAL-TIME PCR, BY REGION, 2020–2028 (USD MILLION)

- TABLE 19 TRANSPLANT DIAGNOSTICS MARKET FOR OTHER PCR-BASED MOLECULAR ASSAYS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 20 TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 21 TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 22 TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 23 TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY END USER, 2020–2028 (USD MILLION)

- TABLE 24 TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 25 TRANSPLANT DIAGNOSTICS MARKET FOR SANGER SEQUENCING, BY REGION, 2020–2028 (USD MILLION)

- TABLE 26 TRANSPLANT DIAGNOSTICS MARKET FOR NEXT-GENERATION SEQUENCING, BY REGION, 2020–2028 (USD MILLION)

- TABLE 27 TRANSPLANT DIAGNOSTICS MARKET FOR OTHER SEQUENCING-BASED MOLECULAR ASSAYS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 28 TRANSPLANT DIAGNOSTICS MARKET FOR NON-MOLECULAR ASSAY TECHNOLOGIES, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 29 TRANSPLANT DIAGNOSTICS MARKET FOR NON-MOLECULAR ASSAY TECHNOLOGIES, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 30 TRANSPLANT DIAGNOSTICS MARKET FOR NON-MOLECULAR ASSAY TECHNOLOGIES, BY END USER, 2020–2028 (USD MILLION)

- TABLE 31 TRANSPLANT DIAGNOSTICS MARKET FOR NON-MOLECULAR ASSAY TECHNOLOGIES, BY REGION, 2020–2028 (USD MILLION)

- TABLE 32 TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 33 TRANSPLANT DIAGNOSTICS MARKET FOR REAGENTS & CONSUMABLES, BY REGION, 2020–2028 (USD MILLION)

- TABLE 34 TRANSPLANT DIAGNOSTICS MARKET FOR INSTRUMENTS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 35 TRANSPLANT DIAGNOSTICS MARKET FOR SOFTWARE & SERVICES, BY REGION, 2020–2028 (USD MILLION)

- TABLE 36 TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 37 TRANSPLANT DIAGNOSTICS MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 38 TRANSPLANT DIAGNOSTICS MARKET FOR DIAGNOSTIC APPLICATIONS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 39 PRE-TRANSPLANTATION DIAGNOSTICS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 40 PRE-TRANSPLANTATION DIAGNOSTICS MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 41 INFECTIOUS DISEASE TESTING MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 42 HISTOCOMPATIBILITY TESTING MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 43 BLOOD PROFILING MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 44 POST-TRANSPLANTATION DIAGNOSTICS MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 45 TRANSPLANT DIAGNOSTICS MARKET FOR RESEARCH APPLICATIONS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 46 TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 47 TRANSPLANT DIAGNOSTICS MARKET FOR INDEPENDENT REFERENCE LABORATORIES, BY REGION, 2020–2028 (USD MILLION)

- TABLE 48 TRANSPLANT DIAGNOSTICS MARKET FOR HOSPITALS & TRANSPLANT CENTERS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 49 TRANSPLANT DIAGNOSTICS MARKET FOR RESEARCH LABORATORIES & ACADEMIC INSTITUTES, BY REGION, 2020–2028 (USD MILLION)

- TABLE 50 TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020–2028 (USD MILLION)

- TABLE 51 SOLID ORGAN TRANSPLANTATION MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 52 SOLID ORGAN TRANSPLANTATION MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 53 KIDNEY TRANSPLANTATION MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 54 LIVER TRANSPLANTATION MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 55 LUNG TRANSPLANTATION MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 56 HEART TRANSPLANTATION MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 57 PANCREAS TRANSPLANTATION MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 58 OTHER ORGAN TRANSPLANTATION MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 59 STEM CELL TRANSPLANTATION MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 60 SOFT TISSUE TRANSPLANTATION MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 61 BONE MARROW TRANSPLANTATION MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 62 TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: TRANSPLANT DIAGNOSTICS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 71 US: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 72 US: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 73 US: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 74 CANADA: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 75 CANADA: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 76 CANADA: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 77 EUROPE: TRANSPLANT DIAGNOSTICS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 78 EUROPE: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 79 EUROPE: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 80 EUROPE: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 81 EUROPE: TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 82 EUROPE: TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 83 EUROPE: TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020–2028 (USD MILLION)

- TABLE 84 EUROPE: TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 85 GERMANY: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 86 GERMANY: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 87 GERMANY: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 88 UK: ORGAN TRANSPLANTATION PROCEDURES, 2019 VS. 2021

- TABLE 89 UK: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 90 UK: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 91 UK: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 92 FRANCE: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 93 FRANCE: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 94 FRANCE: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 95 SPAIN: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 96 SPAIN: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 97 SPAIN: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 98 ITALY: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 99 ITALY: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 100 ITALY: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 101 REST OF EUROPE: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 102 REST OF EUROPE: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 103 REST OF EUROPE: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: TRANSPLANT DIAGNOSTICS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 112 CHINA: ORGAN TRANSPLANTATION PROCEDURES, 2019 VS. 2021

- TABLE 113 CHINA: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 114 CHINA: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 115 CHINA: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 116 INDIA: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 117 INDIA: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 118 INDIA: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 119 JAPAN: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 120 JAPAN: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 121 JAPAN: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 122 AUSTRALIA: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 123 AUSTRALIA: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 124 AUSTRALIA: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 125 SOUTH KOREA: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 126 SOUTH KOREA: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 127 SOUTH KOREA: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 131 LATIN AMERICA: TRANSPLANT DIAGNOSTICS MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 132 LATIN AMERICA: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 133 LATIN AMERICA: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 134 LATIN AMERICA: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 135 LATIN AMERICA: TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 136 LATIN AMERICA: TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 137 LATIN AMERICA: TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020–2028 (USD MILLION)

- TABLE 138 LATIN AMERICA: TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 139 BRAZIL: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 140 BRAZIL: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 141 BRAZIL: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 142 MEXICO: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 143 MEXICO: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 144 MEXICO: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 145 REST OF LATIN AMERICA: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 146 REST OF LATIN AMERICA: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 147 REST OF LATIN AMERICA: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: TRANSPLANT DIAGNOSTICS MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: TRANSPLANT DIAGNOSTICS MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020–2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 155 BIO-RAD LABORATORIES: COMPANY OVERVIEW (2021)

- TABLE 156 F. HOFFMANN-LA ROCHE LTD.: COMPANY OVERVIEW (2021)

- TABLE 157 QIAGEN NV: COMPANY OVERVIEW (2021)

- TABLE 158 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW (2021)

- TABLE 159 BIOMÉRIEUX SA: COMPANY OVERVIEW (2021)

- TABLE 160 CAREDX: COMPANY OVERVIEW (2021)

- TABLE 161 GENDX: COMPANY OVERVIEW (2021)

- TABLE 162 HOLOGIC, INC.: COMPANY OVERVIEW (2021)

- TABLE 163 ILLUMINA, INC.: COMPANY OVERVIEW (2021)

- TABLE 164 IMMUCOR, INC.: COMPANY OVERVIEW (2021)

- TABLE 165 LUMINEX CORPORATION: COMPANY OVERVIEW (2021)

- TABLE 166 MERCK KGAA: COMPANY OVERVIEW (2021)

- TABLE 167 OMIXON: COMPANY OVERVIEW (2021)

- TABLE 168 THERMO FISHER SCIENTIFIC: COMPANY OVERVIEW (2021)

- FIGURE 1 RESEARCH DESIGN: TRANSPLANT DIAGNOSTICS MARKET

- FIGURE 2 KEY DATA FROM SECONDARY SOURCES

- FIGURE 3 PRIMARY SOURCES

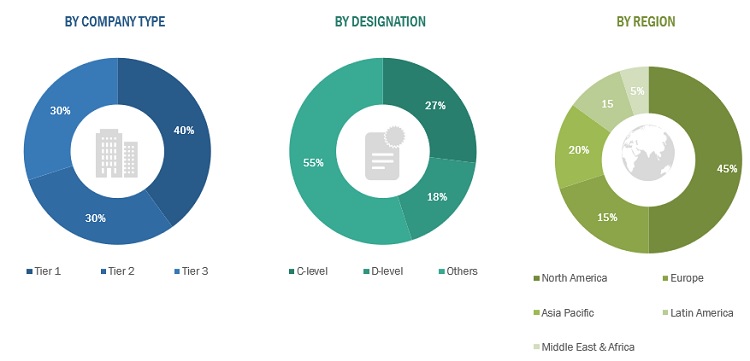

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 REAGENTS & CONSUMABLES TO CONTINUE TO DOMINATE TRANSPLANT DIAGNOSTICS MARKET UNTIL 2028

- FIGURE 9 SEQUENCE-SPECIFIC OLIGONUCLEOTIDE-PCR SEGMENT DOMINATED TRANSPLANT DIAGNOSTICS MARKET IN 2022

- FIGURE 10 KIDNEY TRANSPLANTATION SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 11 INFECTIOUS DISEASE TESTING SEGMENT TO DOMINATE TRANSPLANT DIAGNOSTIC APPLICATIONS MARKET BY 2028

- FIGURE 12 INDEPENDENT REFERENCE LABORATORIES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 REGIONAL SNAPSHOT OF TRANSPLANT DIAGNOSTICS MARKET

- FIGURE 14 RISING NUMBER OF TRANSPLANTATION PROCEDURES TO DRIVE MARKET

- FIGURE 15 PCR-BASED MOLECULAR ASSAYS TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 INDEPENDENT REFERENCE LABORATORIES ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 17 HEART TRANSPLANTATION SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 18 CHINA TO WITNESS HIGHEST GROWTH RATE IN TRANSPLANT DIAGNOSTICS MARKET DURING FORECAST PERIOD

- FIGURE 19 TRANSPLANT DIAGNOSTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 NUMBER OF KIDNEY TRANSPLANTATION PROCEDURES IN MAJOR MARKETS, 2022 VS. 2028

- FIGURE 21 NUMBER OF LIVER TRANSPLANTATION PROCEDURES IN MAJOR MARKETS, 2022 VS. 2028

- FIGURE 22 NUMBER OF LUNG TRANSPLANTATION PROCEDURES IN MAJOR MARKETS, 2022 VS. 2028

- FIGURE 23 NUMBER OF HEART TRANSPLANTATION PROCEDURES IN MAJOR MARKETS, 2022 VS. 2028

- FIGURE 24 NUMBER OF PANCREAS TRANSPLANTATION PROCEDURES IN MAJOR MARKETS, 2022 VS. 2028

- FIGURE 25 NORTH AMERICA: TRANSPLANT DIAGNOSTICS MARKET SNAPSHOT

- FIGURE 26 US: SOLID ORGAN TRANSPLANTATION PROCEDURES, 2019–2021

- FIGURE 27 CANADA: SOLID ORGAN TRANSPLANTATION PROCEDURES, 2019–2021

- FIGURE 28 ASIA PACIFIC: TRANSPLANT DIAGNOSTICS MARKET SNAPSHOT

- FIGURE 29 JAPAN: SOLID ORGAN TRANSPLANTATION PROCEDURES, 2019–2021

- FIGURE 30 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN TRANSPLANT DIAGNOSTICS MARKET

- FIGURE 31 TRANSPLANT DIAGNOSTICS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

- FIGURE 32 TRANSPLANT DIAGNOSTICS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 33 BIO-RAD LABORATORIES: COMPANY SNAPSHOT (2021)

- FIGURE 34 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2021)

- FIGURE 35 QIAGEN NV: COMPANY SNAPSHOT (2021)

- FIGURE 36 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2021)

- FIGURE 37 BIOMÉRIEUX SA: COMPANY SNAPSHOT (2021)

- FIGURE 38 CAREDX: COMPANY SNAPSHOT (2021)

- FIGURE 39 HOLOGIC, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 40 ILLUMINA, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 41 IMMUCOR, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 42 LUMINEX CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 43 MERCK KGAA: COMPANY SNAPSHOT (2021)

- FIGURE 44 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2021)

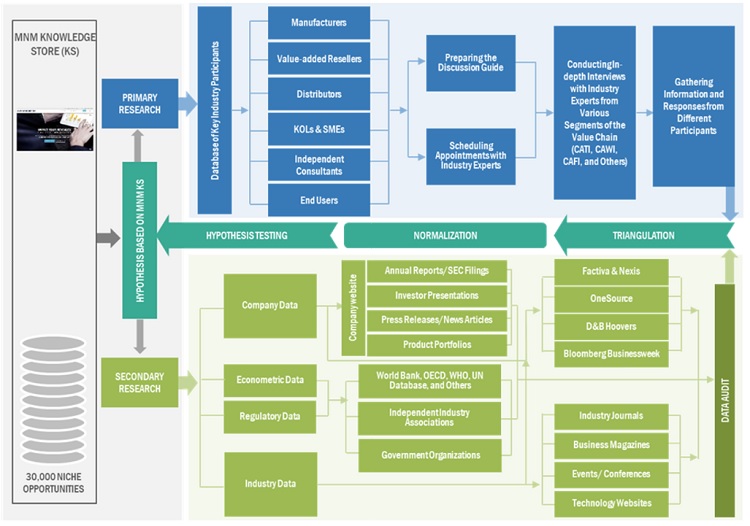

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the microcatheter market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the medical aesthetic market. The primary sources from the demand side include medical OEMs, Oncologists, CDMOs and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2021, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

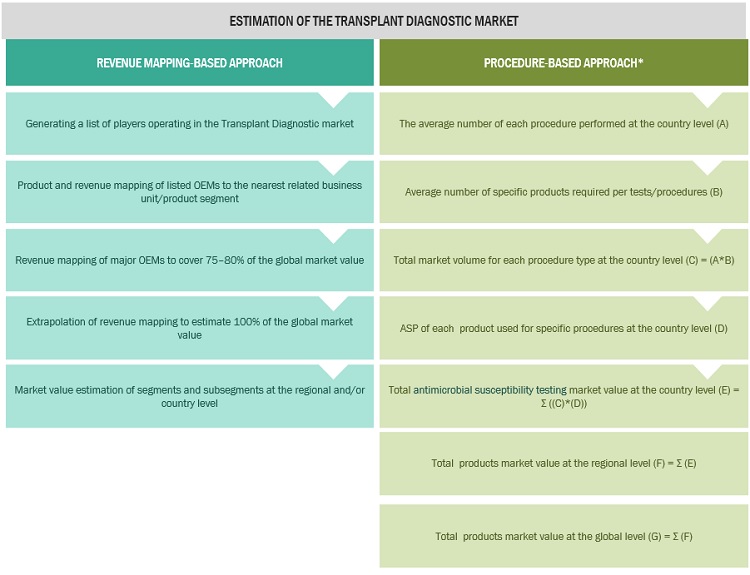

Market Estimation Methodology

In this report, the transplant diagnostic market size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the transplant diagnostic business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the transplant diagnostic market

- Mapping annual revenues generated by major global players from the product segment (or nearest reported business unit/product category)

- Revenue mapping of major players to cover major share of the global market share, as of 2021

- Extrapolating the global value of the transplant diagnostic market

To know about the assumptions considered for the study, Request for Free Sample Report

Approaches

Bottom-up Approach

- For estimating the size of the transplant Diagnostics market, the country-level market revenues were obtained from secondary sources and through extensive primary interviews

- Country-level markets for the US and Canada were added to arrive at the market size for North America. Similarly, country-level markets for other countries were added to arrive at the market size of Europe and Asia Pacific.

- The total market derived through the bottom up approach was again validated through secondary sources and primaries.

Top-down approach

- The overall market size derived from the bottom-up approach was used in the top-down procedure to estimate the size of the subsegment.

- Percentage splits were applied to the total market size (splits were obtained from secondary and primary research) to obtain the market size for each subsegment.

- The top-down approach was used to reach the regional and country-level market size for these subsegments.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the Transplant Diagnostic market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the transplant diagnostic market was validated using both top-down and bottom-up approaches.

Market definition

Transplant diagnostic procedures are used to determine donor-recipient compatibility to avoid immune rejection in a recipient. These procedures are adopted for donor-recipient cross-matching, subject profiling, genotyping and other related diagnostic tests. Advanced genomic techniques(such as PCR and NGS) are increasingly being used during transplant diagnostic procedures, apart from serological and other conventional techniques for immune-compatibility testing.

Key stakeholders

- Transplant Diagnostic product manufacturing companies.

- Healthcare service providers (Including hospitals, transplant centers and blood transfusion centers)

- Blood, tissue and stem cell banks

- Government Organizations

- Independent association and regulatory authorities

- R&D companies

- Independent reference laboratories

- Diagnostic Laboratories

- Clinical Research organizations

Objectives of the Study

- To define, describe, and forecast the Transplant diagnostic marketon the basis of Technology, Product & Service, Application,End User & Region.

- To provide detailed information regarding the major factors influencing the growth potential of the transplant diagnostic market(drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the Transplant diagnostic market

- To analyze key growth opportunities in the Transplant diagnostic market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, Thailand, Indonesia and the RoAPAC), Latin America (Brazil, Mexico, and RoLATAM), and the Middle East & Africa

- To profile the key players in the Transplant diagnostic market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the transplant diagnostic market, such as product launches; agreements; expansions; and mergers & acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present transplant diagnostic market;

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe Transplant diagnostic marketinto Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

- Further breakdown of the Rest of the Asia Pacific Transplant diagnostic marketinto Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Latin American Transplant diagnostic market into Colombia, Chile, Argentina, and Peru, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Transplant Diagnostics Market