HLA Typing for Transplant Market: Growth, Size, Share, and Trends

HLA Typing for Transplant Market by Technology (PCR (SSO, SSP, Real-time), NGS, Sanger), Product (Instrument, Reagent, Software), Application (Chimerism, Antibody Screening), Type (Organ, Soft Tissue), End User (Hospital, Clinic) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global human leukocyte antigen (HLA) typing for transplant market is projected to reach USD 1.4 billion by 2030 from USD 1.1 billion in 2025, at a CAGR of 6.0% during the forecast period. The escalating demand for organ transplants, which is a prime market driver, is closely associated with lifestyle and occupational risk factors. Sedentary behavior, poor dietary habits, obesity, diabetes mellitus, and hypertension significantly contribute to the prevalence of chronic kidney and liver diseases. The detrimental effects of alcohol consumption and tobacco use lead to liver cirrhosis and exacerbate COPD, thereby increasing the necessity for liver and lung transplants.

KEY TAKEAWAYS

-

By RegionThe North America HLA typing for transplant market accounted for a 45.7% revenue share in 2024.

-

By Product & ServicesThe HLA typing segment within the transplant market is categorized into reagents & consumables, instruments, and software & services. In 2024, reagents & consumables commanded the largest market share of 71.7%.

-

By TechnologyThe HLA typing landscape in the transplant market is delineated by two primary categories: molecular and non-molecular assay technologies. In 2024, the molecular assay technologies segment dominated the market with a share of 92.7%.

-

By ApplicationBy application, the antibody screening is expected to dominate the market.

-

By End-userBy end-use application, the independent reference laboratories segment will grow the fastest during the forecast period with a CAGR of 7.4%.

-

By Transplant TypeBy Transplant Type, the solid organ transplant segment is expected to dominate the market, growing at the highest CAGR of 6.4%.

The HLA typing for transplant market is witnessing steady growth, driven by the escalating demand for organ transplants, which is a prime market driver, is closely associated with lifestyle and occupational risk factors. Sedentary behavior, poor dietary habits, obesity, diabetes mellitus, and hypertension significantly contribute to the prevalence of chronic kidney and liver diseases. The detrimental effects of alcohol consumption and tobacco use lead to liver cirrhosis and exacerbate COPD, thereby increasing the necessity for liver and lung transplants. Furthermore, occupational exposure to industrial toxins, particularly seen in mining and manufacturing sectors, can result in significant hepatic and pulmonary damage. An aging workforce, coupled with an uptick in cardiovascular morbidity, further intensifies the demand for heart transplants. These trends highlight the critical role of HLA typing in facilitating donor-recipient compatibility, which is essential for improving transplant success rates.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on stakeholders’ business in the HLA Typing for Transplant market arises from increasing transplant volumes, advancements in molecular diagnostics, and evolving regulatory frameworks. Hospitals, transplant centers, independent reference laboratories, and research institutions are the primary users of HLA typing solutions, with precision compatibility and post-transplant monitoring as key focus areas. Shifts toward next-generation sequencing (NGS)-based platforms, automation of workflows, and stringent organ matching regulations are improving the efficiency, accuracy, and outcomes of transplant procedures. These advancements, in turn, fuel the demand for high-throughput and reliable HLA typing systems and services, shaping the market’s expansion trajectory.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising number of organ donors and transplant procedures

-

Surge in organ failure cases due to increased prevalence of chronic diseases

Level

-

High costs of HLA typing products

-

Shortage of healthy organs for transplants

Level

-

Adoption of NGS and automation for high throughput needs

-

Use of AI and ML in HLA typing for better accuracy and broader clinical utility

Level

-

Regulatory complexities across regions

-

Lack of standardization across HLA typing laboratories

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Rising number of organ donors and transplant procedures

HLA typing plays a crucial role in testing donor-recipient compatibility before transplantation, helping to prevent graft rejection caused by mismatches in blood components. This testing also reduces the risk of complications such as graft-versus-host disease (GVHD) and post-transplant lymphoproliferative disorders. Kidney transplants rose to 27,759 in 2024, reflecting a 1.6% rise from 2023. In Australia in 2023, 1,088 kidney transplants were performed, up from 938 in 2022. Despite this progress, approximately 1,800 Australians remained on the transplant waiting list as of May 2023.A key factor behind this growth is the increasing number of organ donors, with 16,988 deceased donors and 7,030 living donors contributing to these life-saving procedures. Deceased donor transplants reached 41,119 in 2024, surpassing the 40,000 mark for the first time and continuing a 12-year annual growth streak. The consistent increase in organ transplantation procedures globally accentuates the critical role of HLA typing in pre-transplant evaluations. Accurate HLA matching between donors and recipients is essential to minimize transplant rejection risk and enhance long-term graft survival. As transplantation activities expand, the demand for comprehensive HLA typing services is expected to rise correspondingly. Significantly, transplant rates among racial and ethnic minority groups also continued to rise. Hispanic/Latino recipients saw a 6.5% increase, totaling 9,097 transplants, while Black non-Hispanic recipients experienced a 1.5% rise, with 10,990 transplants performed in 2024. These trends highlight ongoing efforts to enhance outreach and improve transplant access in communities disproportionately affected by organ failure, particularly kidney disease. The ongoing increase in organ transplantation procedures underscores the critical need for accurate HLA typing to guarantee the best transplant results. With the rising global demand for organ transplants, the significance of strong HLA typing protocols is more vital than ever in facilitating successful transplantation efforts.

Restraint: High cost of HLA typing products

The high cost of HLA typing products continues to be a significant barrier to the growth of the HLA typing for transplant market. Cutting-edge HLA typing technologies—such as next-generation sequencing (NGS), real-time PCR, and sequence-specific oligonucleotide (SSO) methods—require significant upfront investment in specialized equipment, reagents, and trained personnel. These expenses are especially challenging for smaller laboratories, research institutions, and healthcare facilities in low- and middle-income countries, where financial resources are often limited. In emerging economies, limited healthcare infrastructure further compounds the cost barrier, slowing the adoption of HLA typing technologies. Even in high-income countries, the high price point of advanced sequencing platforms presents challenges. For example, in the US, Illumina’s NovaSeq X device has a list price nearing USD 1 million, compared to the more affordable MiSeq i100, priced at USD 49,000. The i100 Plus, designed for higher sample throughput, is listed at USD 109,000. Such pricing disparities illustrate the financial hurdle faced by institutions looking to scale or upgrade their HLA typing capabilities. For example, Illumina's Trusight HLA V2, an amplicon-based NGS HLA typing kit, costs approximately USD 5,000 for 11 HLA genes and 24 samples, or about USD 208 per sample. In India, the cost of HLA typing for the Molecular B51 locus ranges from INR 3,000 to INR 34,000, while the High-Resolution HLA Typing Test (A, B, C, DP, DQ, DR) costs around INR 14,980 in Mumbai. The substantial costs associated with equipment, reagents, and specialized personnel create financial barriers that can limit the widespread adoption of advanced HLA typing technologies, especially in emerging economies where healthcare budgets are constrained.

Opportunity: Adoption of NGS and automation for high throughput needs

Continuous improvements in sequencing technologies are creating a favorable landscape for the adoption of HLA typing in transplantation. In particular, the increasing use of next-generation sequencing (NGS) has significantly enhanced the resolution, throughput, and accuracy of HLA typing, crucial factors for reducing graft rejection risk and improving long-term transplant success. In recent years, low-cost, scalable NGS platforms have been developed that enable high-resolution typing across multiple loci, minimizing ambiguities associated with conventional methods such as Sanger sequencing or PCR-SSP. Moreover, the introduction of fully automated HLA typing workflows has reduced manual error, turnaround times, and operational burdens on laboratories. As of 2024, transplant centers and reference labs are increasingly adopting platforms such as Illumina's Nextera Flex for Enrichment and Thermo Fisher Scientific’s Ion Torrent Genexus System to support high-throughput, cost-effective donor-recipient matching. These developments are expanding the utility of HLA typing in both routine and complex transplant cases. The increasing affordability and accessibility of NGS technologies also present an opportunity to extend advanced HLA testing capabilities to emerging markets and resource-constrained regions, thereby widening the global footprint of transplant-ready facilities.

Challenge: Regulatory complexities across regions

The market for HLA typing is still struggling since different regions have different and changing regulatory frameworks. A variety of national and regional approval procedures, such as adherence to strict clinical performance standards, labeling guidelines, and post-market surveillance duties, must be negotiated by manufacturers. Agencies such as the FDA and EMA have increased monitoring of molecular diagnostic tests, particularly those that impact transplant choices, in essential markets such as the US and the EU. Demands for compliance have increased since the introduction of the IVDR (In Vitro Diagnostic Regulation) in Europe, which, even for tests that were previously self-certified, now requires third-party certification and substantial clinical evidence. These complex requirements pose notable barriers to entry for smaller manufacturers and may delay the commercialization of next-generation HLA typing solutions despite their potential to improve transplant outcomes. Furthermore, divergent regulatory expectations between regions increase the cost and time associated with multinational product rollouts, constraining broader market access. Such delays and limitations in bringing innovative HLA typing platforms to clinical use may inadvertently restrict test availability, especially in settings with time-sensitive transplant workflows. The regulatory environment, while critical for patient safety, thus remains a constraining factor for scaling up adoption and expanding access to HLA typing technologies in transplant care.

transplant diagnostics market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployed as a turnkey NGS HLA typing kit + Ion Torrent workflow for high-resolution typing across class I & II loci, replacing SSO/SSP in several academic centers. | It enabled faster matching and reduced downstream confirmatory testing in Hospital histocompatibility labs, transplant labs. Higher allele resolution, consolidated workflow (single-run typing), reduced ambiguous calls vs Sanger were achived. |

|

Roche deployed LightMix Kit HLA-B27 which is compatible with Roche LightCycler. The assay is designed for the detection of the HLA-B27 allele from human genomic DNA extracts. | The end results come with enhanced diagnostic accuracy while detecting the HLA-B27 allele. |

|

Illumina’s TruSight HLA / MiSeq system workflow delivers high-throughput, high-resolution HLA typing for donor registries and large hospital networks. | Increased throughput and automation; enabled registry scale typing and reduced per-sample cost at high volumes; improved match rates for unrelated donor searches. |

|

Bio-Rad's HLA SSP Typing Kits are designed for the determination of HLA Class I alleles using sequence-specific primers in a real-time PCR format. | The kits, when integrated with Bio-Rad CFX96 Touch Real-Time PCR System, gave an increase in High-Throughput Capability and increased accuracy. |

|

Development of AlloSeq Tx17 NGS HLA typing kit for pre-transplant matching. | High-resolution typing improves donor–recipient compatibility, reduces graft rejection risk. Facilitates precision-matched organ allocation in clinical transplantation workflows. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem for HLA typing for transplant market consists of product categories such as instruments, software, reagents, and consumables. Instruments include PCR and sequencers that are used in HLA typing for pre-transplant evaluation. The clinical workflow also depends on the type of transplant, i.e., soft tissue, stem cell, or solid organ transplant. The products for HLA typing for transplant are mainly used in diagnostic applications such as chimerism monitoring, antibody screening, and research applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

HLA Typing for Transplant Market, By Product and Service

The HLA typing segment within the transplant market is categorized into reagents & consumables, instruments, and software & services. In 2024, reagents & consumables commanded the largest market share due to the frequent utilization and repeated applications of reagents and kits in HLA typing by diagnostic laboratories and transplant centers. The growing need for precise identification of HLA alleles is likely to propel the expansion of this segment. Contributing factors include an increasing patient focus on effective and timely HLA profiling during organ transplantation, heightened adoption of HLA typing methodologies in research settings, and a rise in organ transplant procedures. Nevertheless, market growth is anticipated to face challenges from the accelerating integration of laboratory automation and limited reimbursement options for transplantation procedures in developed markets. These factors may hinder the overall advancement of the reagents & consumables sector within the HLA typing domain.

HLA Typing for Transplant Market, By Technology

The HLA typing landscape in the transplant market is delineated by two primary categories: molecular and non-molecular assay technologies. In 2024, the molecular assay technologies segment dominated the HLA typing market for transplants. Techniques such as Polymerase Chain Reaction (PCR) and Next-Generation Sequencing (NGS) facilitate high-resolution HLA typing, significantly improving turnaround times for analyzing and detecting multiple alleles at specific HLA loci. The superior capabilities of molecular methods over traditional serological approaches are anticipated to propel the growth of this segment. The substantial market share enjoyed by molecular assay technologies is largely due to the swift adoption of DNA-based HLA typing, which offers advantages such as reduced turnaround times, enhanced procedural efficiency, the capacity to analyze multiple samples concurrently, and the feasibility of real-time analysis.

HLA Typing for Transplant Market, By Application

Antibody screening holds the largest share in the HLA typing for transplant market because it plays a crucial role in ensuring donor–recipient compatibility and preventing transplant rejection. Detecting pre-existing and donor-specific antibodies helps clinicians assess the immunological risk before transplantation, significantly improving graft survival rates. With the rise in organ and stem cell transplants, antibody screening has become a standard pre-transplant procedure across hospitals and transplant centers. Moreover, advancements in flow cytometry and Luminex-based assays have enhanced detection sensitivity, enabling faster and more accurate identification of antibodies. These clinical benefits, combined with the growing emphasis on personalized matching and post-transplant monitoring, have made antibody screening the most widely adopted and essential application in HLA typing.

HLA Typing for Transplant Market, By End-user

Independent reference laboratories hold the largest share in the HLA typing for transplant market due to their advanced testing capabilities, specialized expertise, and ability to handle high testing volumes with precision and speed. These labs are equipped with state-of-the-art molecular platforms such as next-generation sequencing (NGS) and Luminex-based systems, enabling them to deliver highly accurate and standardized results for donor–recipient matching. Their centralized operations allow hospitals, transplant centers, and organ procurement organizations to outsource complex HLA testing cost-effectively while ensuring regulatory compliance and quick turnaround times. Additionally, the growing demand for cross-matching, antibody screening, and post-transplant monitoring has further strengthened the reliance on independent reference labs, positioning them as the preferred and dominant end-user segment in the market.

HLA Typing for Transplant Market, By Transplant Type

Solid organ transplant accounts for the largest share in the HLA typing for transplant market because HLA compatibility plays a critical role in determining graft acceptance and long-term transplant success. Procedures such as kidney, liver, heart, and lung transplants rely heavily on precise HLA matching to minimize the risk of rejection and post-transplant complications. The global rise in chronic organ failure, expanding transplant programs, and improved donor registries have significantly increased the volume of solid organ transplants performed each year. Moreover, advancements in molecular typing and antibody screening technologies have enhanced matching accuracy and accelerated decision-making in organ allocation. These factors collectively make solid organ transplantation the dominant segment driving demand for HLA typing solutions.

REGION

By region, the Asia Pacific is projected to grow with a significant CAGR during the forecast period.

The market for HLA typing in the context of transplantation is categorized into several regions, including North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Among these, the Asia Pacific region is notably making substantial investments to enhance its healthcare infrastructure, which is critical for improving transplant services. This region is also witnessing a significant expansion in transplant capacity, indicating a growing demand for organ transplants and related technologies. In contrast, North America represents a mature market characterized by a high adoption rate of next-generation sequencing (NGS)-based HLA typing technologies, which are essential for matching donors with recipients. Additionally, the presence of well-established transplant registries in this region facilitates a streamlined process for organ allocation and enhances patient outcomes. While North America enjoys these advantages, the Asia-Pacific region remains underpenetrated in terms of advanced HLA typing technologies, presenting substantial opportunities for market growth and innovation. As the landscape of the HLA typing market evolves, major players are increasingly aligning their strategies to capitalize on these opportunities. They are likely to focus on expanding their operations in underdeveloped regions, investing in technological advancements, and forming partnerships to enhance their service offerings in the transplantation sector. This approach is geared towards addressing the unmet needs in regions such as the Asia Pacific while consolidating their positions in more developed markets such as North America.

transplant diagnostics market: COMPANY EVALUATION MATRIX

In the HLA typing for transplant market, Thermo Fisher Scientific stands out as a clear leader with its broad range of molecular diagnostics and NGS-based solutions trusted for donor–recipient compatibility testing. CareDx, an emerging player, is gaining momentum through its strong focus on transplant-specific diagnostics and advanced antibody monitoring tools. While Thermo Fisher continues to lead with scale, technology depth, and global reach, CareDx is rapidly closing the gap as personalized and non-invasive HLA testing solutions become more widely adopted across hospitals and reference labs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 1.1 BN |

| Market Forecast in 2030 (Value) | USD 1.4 BN |

| Growth Rate | CAGR of 6.0% from 2025-2030 |

| Years Considered | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Procedure) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Products & Services (Reagents and Consumables, Instruments, Software and Services), Technology (Molecular assays, Sequencing-based molecular assays and non-molecular assays), Application (Diagnostic, research) , Transplant Type (solid organ transplants, soft-tissue transplants and stem cell transplants), and End-user (Independent reference labs, hospitals and transplant centers and research labs and academic institutes). |

| Regions Covered | North America, Europe, Asia Pacific, Latin America and Middle East and Africa |

WHAT IS IN IT FOR YOU: transplant diagnostics market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Hospital & Transplant Center |

|

|

| Independent Reference Lab |

|

|

RECENT DEVELOPMENTS

- 2/1/2025 12:00:00 AM : CareDx, Inc. (US) expanded its lab automation infrastructure in Brisbane, CA, and announced investments in AI-driven bioinformatics for HLA typing and longitudinal transplant monitoring.

- 11/1/2024 12:00:00 AM : DiaSorin S.p.A. (Italy) updated xMAP-based typing panels and expanded Class II allele libraries, enhancing mid-throughput HLA typing for small to medium transplant centers.

- 5/1/2024 12:00:00 AM : Thermo Fisher Scientific, Inc. (US) launched Ion AmpliSeq HLA Panels v3, optimized for the Genexus Integrated Sequencer, providing improved Class I & II coverage with lower turnaround times

- 10/1/2024 12:00:00 AM : CareDx, Inc. (US) launched AlloSeq cfDNA v2, a cell-free DNA assay that integrates HLA typing with transplant surveillance to support early rejection risk detection.

- 3/1/2024 12:00:00 AM : llumina, Inc. (US) and GenDx (US) partnered to co-develop NGS HLA typing software, combining GenDx’s NGSengine with Illumina’s sequencing platforms, aimed at labs in the US and EU.

Table of Contents

Methodology

This study analyzed market variables related to small and medium-sized businesses and major corporations to balance primary and secondary research for the human leukocyte antigen (HLA) typing for transplant market. The next phase involved conducting primary research with industry experts along the value chain to validate the findings, assumptions, and market sizing. Several methodologies were employed to estimate the overall market size, including both top-down and bottom-up approaches. This study focuses on key market segments, emerging trends, regulatory frameworks, and competitive environments. It also examines leading market players and their strategies within this sector. In conclusion, the total market size was determined using top-down and bottom-up approaches and data triangulation to arrive at the final figure. Ongoing primary research was conducted throughout the study to validate and test each hypothesis.

Secondary Research

During the study, secondary research utilized a variety of sources, including directories and databases such as Bloomberg Businessweek, D&B Hoovers, and Factiva. Additional materials included white papers, annual reports, SEC filings, and investor presentations. This research approach collects and generates data that offers comprehensive, technical, and market-focused insights into the HLA typing for transplant market. The data provides information on key players and market segmentation based on recent industry trends and significant market developments. Additionally, a database of leading industry figures was created through this secondary research.

Primary Research

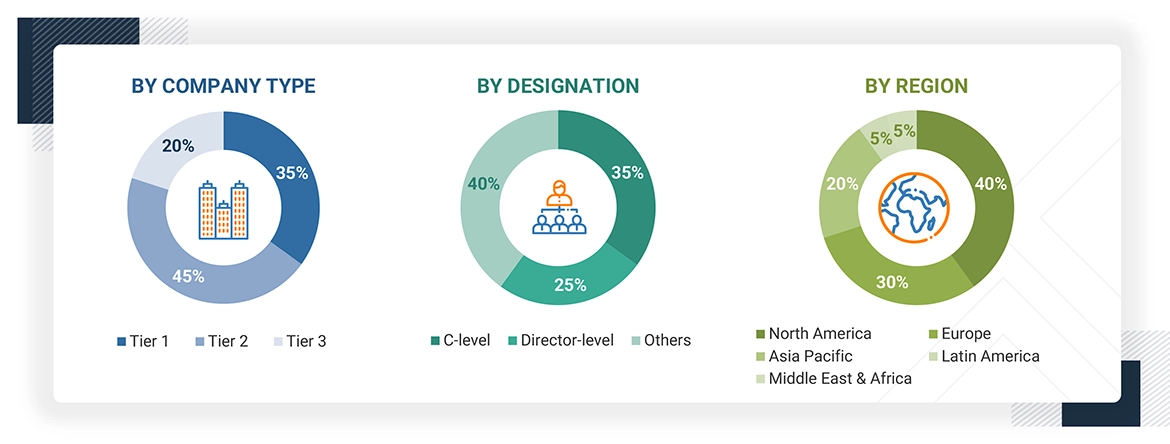

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the HLA typing for transplant market. The primary sources from the demand side include medical OEMs, CDMOs, and service providers. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include distributors, suppliers, product managers, business development managers, marketing managers, and sales managers.

Note: Companies are categorized into tiers based on their total revenue. As of 2024, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, the global HLA typing for transplant market size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the HLA typing for transplants business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and marketing executives.

Segmental revenues were calculated based on the revenue mapping of major solution/service providers to calculate the global market value. This process involved the following steps:

- Generating a list of major global players/OEMs operating in the HLA typing for transplant market

- Mapping the annual revenue generated by major global players from the HLA typing segment (or the nearest reported business unit/product category)

- Revenue mapping of top players to cover at least ~75% of the global market share as of 2024

- Extrapolation of the revenue mapping of major players to derive the global value of the market

- Extrapolating the global value of the HLA typing for transplant market.

- Summation of market value for all segments and subsegments to achieve the actual value of the global HLA typing for transplant market

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global HLA typing for transplant market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, top-down and bottom-up approaches validated the HLA typing for transplant market.

Market Definition

HLA typing assays are critical in transplant immunology, as they facilitate the identification of HLA antigens essential for assessing donor-recipient compatibility and mitigating the risk of alloimmune rejection. These assays are pivotal in donor-recipient cross-matching, subject profiling, genotyping, and various diagnostic applications. Recent advancements in HLA typing technology, which enable high-resolution typing, afford precise delineation of HLA allele variations. This increased accuracy significantly enhances the predictive capability for transplant outcomes, thereby minimizing rejection and graft-versus-host disease incidence. As a result, these innovations are instrumental in making transplantation a more feasible and successful therapeutic option for patients.

Stakeholders

- Manufacturers of HLA typing products for transplant

- Distributors & suppliers of HLA typing products for transplant

- Hospitals, Transplant Centers, reference laboratories, Cord Blood Banks

- Research Laboratories and Academic Institutes

- Organ Procurement Organizations (OPOs)

- Non-government organizations

- Government regulatory authorities

- Contract manufacturers and third-party suppliers

- Clinical research organizations (CROs)

- Government and non-governmental regulatory authorities

- Market research and consulting firms

Report Objectives

- To define, describe, and forecast the HLA typing for transplant market based on product & service, technology, application, transplant type, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global HLA typing for transplant market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the global HLA typing for transplant market

- To provide an average selling price trend for the target product categories in HLA typing for transplant market

- To analyze key growth opportunities in the global HLA typing for transplant market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), the Asia Pacific (Japan, China, India, Australia, South Korea, and the Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa

- To profile the key players in the global HLA typing for transplant market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global HLA typing for transplant market, such as product launches, agreements, expansions, and acquisitions

Frequently Asked Questions(FAQ)

What is the projected market value of the HLA typing for transplant market?

The global market of HLA typing for transplant market is projected to reach USD 1.4 billion by 2030.

What is the estimated CAGR of the HLA typing for transplant market for the next five years?

The HLA typing for transplant market is projected to grow at a CAGR of 6.0% from 2025 to 2030.

Which product and service segment of the HLA typing for transplant market witnesses the highest market share?

The reagents & consumables are projected to observe the highest market share due to their wider adoption.

What are the major revenue pockets in the HLA typing for transplant market currently?

The Asia Pacific is expected to grow at the highest pace during the forecast period, primarily due to growing opportunities in China and India.

Who are the key players operating in the HLA typing for transplant market, and what are the key growth strategies applied?

In 2024, the diagnostic HLA typing for transplant market was dominated by Thermo Fisher Scientific (US), Illumina, Inc. (US), QIAGEN (Germany), CareDx (US), F. Hoffmann-La Roche Ltd. (Switzerland), and Bio-Rad Laboratories, Inc. (US). The players adopted key strategies, such as collaborations, partnerships, acquisitions, expansions, and product launches, to increase their market penetration.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the HLA Typing for Transplant Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in HLA Typing for Transplant Market