The research report includes four major activities, estimating the size of the grow lights market. Secondary research has been done to gather important information about the market and peer markets. To validate the findings, assumptions, and sizing with the primary research with industry experts across the supply chain is the next step. Both bottom-up and top-down approaches have been used to estimate the market size. After this, the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments

Secondary Research

During the secondary research phase, a diverse array of secondary sources was consulted to gather pertinent information for this study. These sources included corporate filings such as annual reports, press releases, investor presentations, and financial statements, as well as data from trade, business, and professional associations. Additionally, white papers, location-based marketing journals, accredited publications, articles authored by recognized experts, directories, and databases were utilized.

The primary objective of the secondary research was to obtain crucial insights into the industry's supply chain, market monetary flow, and the comprehensive landscape of key players. It also facilitated the segmentation of the market according to prevailing industry trends, reaching down to granular levels. Moreover, it involved the analysis of geographic markets and significant developments from both market and technology perspectives. The secondary data underwent meticulous collection and analysis to ascertain the overall market size, which was subsequently validated through primary research.

Primary Research

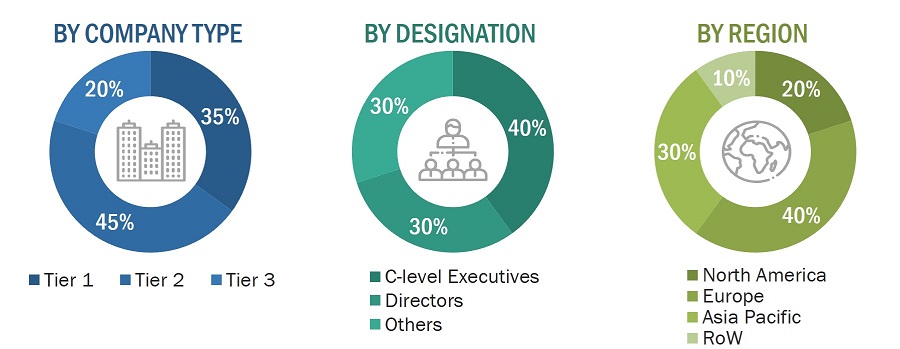

During the primary research phase, a variety of primary sources were utilized to gather qualitative and quantitative insights for this report, encompassing both the supply and demand sides. On the supply side, primary sources included industry experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, subject-matter experts (SMEs), consultants, and other key executives from prominent companies and organizations operating within the grow lights market.

Following a rigorous market engineering process, which entailed calculations for market statistics, breakdowns, size estimations, forecasting, and data triangulation, extensive primary research was conducted to collect, verify, and validate critical numerical data. This primary research aimed to identify segmentation types, industry trends, key players, competitive landscapes, and key market dynamics such as drivers, restraints, opportunities, and challenges. Additionally, it sought to understand the key strategies adopted by market players.

Drawing upon insights garnered from secondary research on the grow lights market, a thorough primary research effort was undertaken. Multiple primary interviews were conducted with experts from both the demand and supply sides across four key regions: North America, Europe, Asia Pacific, and ROW (Middle East, South America, and Africa). Approximately 25% of the primary interviews were conducted with representatives from the demand side, while 75% was with those from the supply side. Primary data collection was executed through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

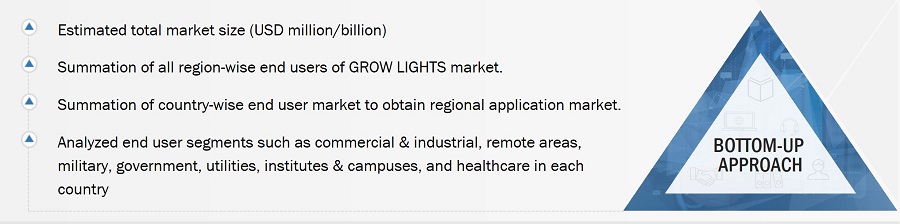

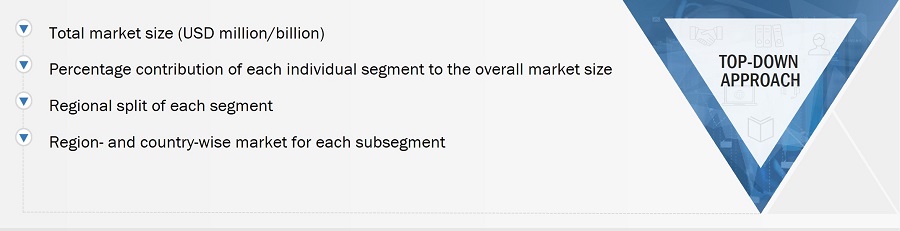

This report employed both top-down and bottom-up methodologies to evaluate and validate the size of the grow lights market and its related submarkets. Key players in the grow lights sector were identified through secondary research, while their market share in specific regions was determined through a blend of primary and secondary research. The comprehensive research approach included reviewing annual and financial reports of industry leaders and conducting interviews with key stakeholders, such as CEOs, VPs, directors, and marketing executives, to gather both quantitative and qualitative insights. Percentage shares, divisions, and breakdowns were sourced from secondary references and cross-checked with primary sources. All potential market influencers were examined through primary research and analyzed to compile the final quantitative and qualitative dataset. This data was consolidated and enriched with extensive analysis from MarketsandMarkets. The following figures illustrate the methodology utilized to estimate the overall market size for this study.

Market Size Estimation Methodology-Bottom-Up Approach

The overall size of the grow lights market was determined using a bottom-up approach, which involved calculating the market size based on the revenue generated by key players and their market share. A thorough analysis of key players in the grow lights market was conducted, and market size estimations were derived by considering the size of their grow lights offerings.

Market Size Estimation Methodology-Top-Down Approach

The top-down methodology utilized the overall market size as the foundation for determining individual market sizes, following the market segmentation with percentage allocations derived from primary and secondary research. To calculate specific market segment sizes, the immediate parent market size was utilized in applying the top-down approach. Additionally, the bottom-up approach was employed to validate segment sizes using data obtained from secondary research sources. Company market share estimates were utilized to confirm revenue distributions previously used in the bottom-up approach. Through a data triangulation process and validation via primary research sources, this study conclusively determined and confirmed both the overall parent market size and the size of each individual market segment.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation was employed to complete the market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using the top-down and bottom-up approaches.

Market Definition

Grow lights are artificial lights designed to support indoor plant growth throughout the year. These lights, often LED and electric, stimulate plant growth by emitting light suitable for photosynthesis. Essentially, grow lights (also known as horticultural lights) provide a spectrum similar to sunlight, enabling indoor plants to undergo photosynthesis. They are crucial gardening tools that ensure houseplants receive sufficient light, even in rooms lacking natural sunlight.

Grow lights play a vital role in urban agriculture practices. They can deliver a customized light spectrum tailored to the needs of specific plants or supplement natural light, particularly in regions with limited daylight hours, such as colder countries. By extending the hours of natural daylight, grow lights enhance the health, growth rate, and yield of plants.

Key Stakeholders

-

Raw Material Suppliers

-

Original Equipment Manufacturers (OEMs)

-

Original Design Manufacturers (ODMs)

-

Research Institutes

-

Grow Lights Providers

-

Forums, Alliances, and Associations

-

Governments and Financial Institutions

-

Analysts and Strategic Business Planners

The main objectives of this study are as follows:

-

To describe and forecast the size of the grow lights market, in terms of value, by wattage, spectrum, cultivated plant, lighting type, application, installation type, and sales channel

-

To describe and forecast the market size of various segments across four key regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

-

To describe and forecast the grow lights market, in terms of value and volume, by offering

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the grow lights market

-

To provide an overview of the supply chain pertaining to the grow lights ecosystem, along with the average selling prices of grow light solutions

-

To strategically analyze the ecosystem, tariffs and regulations, patent landscape, Porter’s five forces, import and export scenarios, trade landscape, and case studies pertaining to the market under study

-

To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments

-

To provide details of the competitive landscape for market leaders

-

To analyze competitive developments such as product launches & developments, partnerships, agreements, and acquisitions in the grow lights market

-

To profile key players in the grow lights market and comprehensively analyze their market ranking based on their revenues, market shares, and core competencies2

-

To provide updated market developments of profiled players. The current report includes the market developments from January 2023 to May 2024

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Country-wise Information for Asia Pacific

-

Detailed analysis and profiling of additional market players (up to five)

Eli

Aug, 2017

What would be the price for all the tables related to Europe? Europe if the only region I am interested in..

Richard

Apr, 2016

Could you please let us know if the report includes the information at these detailed levels by country?.

Eli

Feb, 2017

The price is outside my budget, I would buy this immediately if I have a discount. .

Amy

Aug, 2016

I am interested in the residential/household consumer segment of the market - is that clearly broken out in this report?.

alan

Jan, 2019

We are a grow lighting manufacture, including, ballasts, HID and LED fixtures. We are planing a new product line but it is hard to decide to which will be better, HID or LED?.

chris

Mar, 2017

Is there any discount on the single license price? I am interested in forecast from 2019-2025, by geographic region, by application, by top industry players?.

Fred

Aug, 2016

We are the LED grow light manufacturers,supplying quality products with best price. we serve our growers from all over the world. We want to keep pace with technological advancements and opportunities in the LED grow light market and find the valuable clients from overseas. Thanks!.