Healthcare Data Storage Market by Delivery (Remote, Hybrid, On-premise), Architecture (File, Block, Object), Type (Tape, Flash, Solid), Systems (Direct, Network), End User (Pharma, Biotech, CRO, Hospital, Clinic, Research Center) - Global Forecasts to 2024

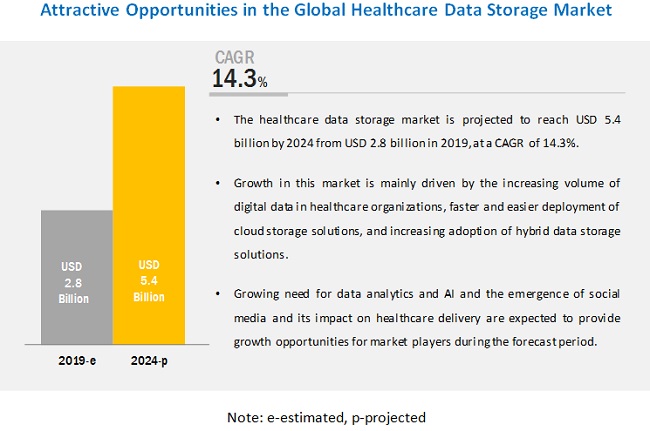

The global healthcare data storage market size is projected to reach USD 5.4 billion in 2024, at a CAGR of 14.3%. The growth in this market is driven mainly by the increasing volume of digital data generated in healthcare organizations, the rapid and easy deployment of cloud storage solutions, and the growing adoption of hybrid data storage solutions.

The flash & solid-state storage segment is expected to grow at the highest CAGR during the forecast period

Based on type, the market is segmented into magnetic storage and flash & solid-state storage. The flash & solid-state storage segment accounted for the largest share of the market in 2018 and is expected to register the highest CAGR during the forecast period. The high capacities of flash & solid-state drives as compared to magnetic disks and their declining costs have resulted in their increased adoption by end users.

The on-premise model segment accounted for the largest share of the healthcare data storage market in 2018

Based on the deployment model, the market is segmented into on-premise, remote, and hybrid solutions. The on-premise segment is expected to account for the largest share of the market. On-premise solutions are the most-widely adopted storage solutions in the market. This deployment model can make use of multi-vendor architecture and minimize risks associated with data breach and external attacks. Also, users own on-premise storage and have control over their deployment, backup, and data recovery systems. These advantages are driving the growth of the on-premise solutions market.

The pharmaceutical & biotechnology companies segment accounted for the largest share in 2018

Based on the end user, the medical market is segmented into pharmaceutical & biotechnology companies, CROs, and CMOs; research centers, academic & government institutes, and clinical research labs; hospitals, clinics, and ASCs; diagnostic & clinical laboratories; and other end users. The pharmaceutical & biotechnology companies, CROs, and CMOs segment accounted for the largest share of the market in 2018. This can be attributed to the fact that extensive research on drug discovery is done in pharmaceutical & biotechnology companies, which generates a massive amount of data.

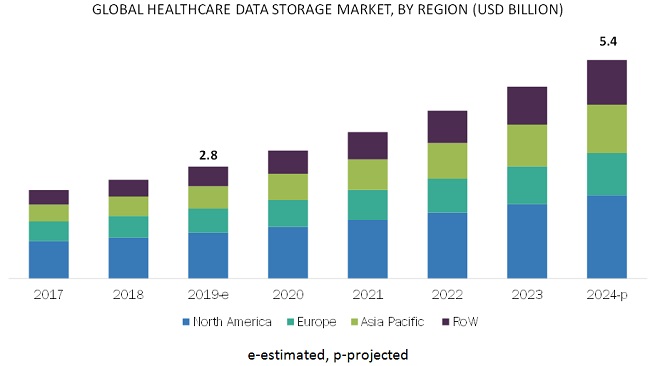

North America dominated the market in 2018

In 2018, North America commanded the largest share of the market. The increasing volume of unstructured healthcare data across and rapid technological advancements have led to an increased demand for secure, reliable, and cost-efficient storage infrastructure in North America. However, the RoW is expected to grow at the highest CAGR during the forecast period.

Key Players in the Healthcare Data Storage Market

Dell (US), IBM Corporation (US), NetApp (US), Hewlett Packard Enterprise Development LP (US), Pure Storage, Inc. (US), Hitachi, Ltd. (Japan), Toshiba Corporation (Japan), Western Digital Corporation (US), Scality (US), Huawei Technologies Co., Ltd. (China), Fujitsu (Japan), Samsung (South Korea), Drobo (US), Tintri (US), and Cloudian (US) are the prominent players in the market.

Dell (US)

Dell is one of the leading providers of healthcare data storage solutions across the globe. The company has primarily focused on enabling its customers to use additional technologies, alongside maintaining existing platforms. Dell overcomes challenges related to popular storage technologies by launching new products or upgrading existing ones. The company aspires to be a leading player in this market with its innovative technologies and leverages its economic stability by investing in flash, hyper-converged, and software-defined storage (SDS) approaches.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Deployment, Storage system, Architecture, End User, and Region |

|

Geographies covered |

North America (US, Canada, and Mexico), Europe (Germany, UK, France, and Rest of Europe), Asia, and the Rest of the World (RoW) |

|

Companies covered |

Dell (US), IBM Corporation (US), NetApp (US), Hewlett Packard Enterprise (US), Pure Storage, Inc. (US), Hitachi, Ltd. (Japan), Toshiba Corporation (Japan), Western Digital Corporation (US), Scality (US), Huawei Technologies Co., Ltd. (China), Fujitsu (Japan), Samsung (South Korea), Drobo (US), Tintri (US), and Cloudian (US). |

The research report categorizes the market into the following segments and subsegments:

By Deployment

- On-premise

- Remote

- Hybrid

By Architecture

- Object Storage

- File Storage

- Block Storage

By Type

- Magnetic Storage

- Magnetic Disks

- Magnetic Tapes

- Flash & Solid-state Storage

By Storage System

- Direct-attached Storage

- Network-attached Storage

- Storage Area Network

By End User

- Pharmaceutical & Biotechnology Companies, CROs, and CMOS

- Research Centers, Academic & Government Institutes, and Clinical Research Labs

- Hospitals, Clinics, and ASCs

- Diagnostic & Clinical Laboratories

- Other End Users

By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Rest of Europe (RoE)

- Asia

- RoW

Key Questions Addressed by the Report

- Where will all these developments take the industry in the mid to long-term?

- What types of annual and multi-year partnerships are healthcare data storage companies exploring?

- Which are the key players in the market, and how intense is the competition?

- Which are the recent contracts and agreements key players have signed?

- What are the recent trends affecting healthcare data storage solutions providers?

Frequently Asked Questions (FAQ):

Which is the leading type of healthcare data storage?

Based on type, the healthcare data storage market is segmented into magnetic storage and flash & solid-state storage. The flash & solid-state storage segment accounted for the largest share of the market in 2018 and is expected to register the highest CAGR during the forecast period. The high capacities of flash & solid-state drives as compared to magnetic disks and their declining costs have resulted in their increased adoption by end users.

Which is the leading end user for of healthcare data storage?

Based on the end user, the healthcare data storage market is segmented into pharmaceutical & biotechnology companies, CROs, and CMOs; research centers, academic & government institutes, and clinical research labs; hospitals, clinics, and ASCs; diagnostic & clinical laboratories; and other end users. The pharmaceutical & biotechnology companies, CROs, and CMOs segment accounted for the largest share of the market in 2018. This can be attributed to the fact that extensive research on drug discovery is done in pharmaceutical & biotechnology companies, which generates a massive amount of data.

Which is the leading deployment model of healthcare data storage?

Based on the deployment model, the healthcare data storage market is segmented into on-premise, remote, and hybrid solutions. The on-premise segment is expected to account for the largest share of the market. On-premise solutions are the most-widely adopted storage solutions in the market. This deployment model can make use of multi-vendor architecture and minimize risks associated with data breach and external attacks. Also, users own on-premise storage and have control over their deployment, backup, and data recovery systems. These advantages are driving the growth of the on-premise solutions market.

Who are the key players operating in the healthcare data storage market?

Prominent players in healthcare data storage market include Dell (US), IBM Corporation (US), NetApp (US), Hewlett Packard Enterprise Development LP (US), Pure Storage, Inc. (US), Hitachi, Ltd. (Japan), Toshiba Corporation (Japan), Western Digital Corporation (US), Scality (US), Huawei Technologies Co., Ltd. (China), Fujitsu (Japan), Samsung (South Korea), Drobo (US), Tintri (US), and Cloudian (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Sources

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Sources

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 35)

4.1 Healthcare Data Storage: Market Overview

4.2 Healthcare Data Storage Market, By Storage System, 20192024 (USD Million)

4.3 Healthcare Data Storage Market Share, By End User & Region, 2018

4.4 Healthcare Data Storage Market: Geographic Growth Opportunities

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Massive Growth in Digital Data Volume in Healthcare Organizations

5.2.1.2 Faster and Easier Deployment of Cloud Storage Solutions

5.2.1.3 Increasing Adoption of Hybrid Data Storage Solutions

5.2.2 Opportunities

5.2.2.1 Increased Need for Data Analytics and Artificial Intelligence

5.2.3 Challenges

5.2.3.1 Rising Security Concerns Related to Cloud-Based Image Processing and Analytics

5.2.3.2 Lack of Structured Data

6 Healthcare Data Storage Market, By Deployment (Page No. - 46)

6.1 Introduction

6.2 On-Premise

6.2.1 On-Premise Deployment Minimizes Risks Associated With Data Breach and External Attacks

6.3 Hybrid

6.3.1 Hybrid Deployment Segment to Witness the Highest Growth During the Forecast Period

6.4 Remote

6.4.1 Low Total Cost of Ownership & High Returns on Investment are Expected to Drive the Growth of This Deployment Segment

7 Healthcare Data Storage Market, By Architecture (Page No. - 52)

7.1 Introduction

7.2 File Storage

7.2.1 File-Based Storage Offers Simplicity When There is A Common Platform to Place Raw FilesA Key Factor Driving Market Growth

7.3 Object Storage

7.3.1 Object-Based Storage is A Preferred Option for Cloud Storage Providers Due to Its Scalability and Shared Tenancy

7.4 Block Storage

7.4.1 Each Block is Controlled and Formatted on an Individual Basis, as Per the Need of Server-Based Operating Systems an Advantage That Will Drive Growth

8 Healthcare Data Storage Market, By Type (Page No. - 58)

8.1 Introduction

8.2 Flash & Solid-State Storage

8.2.1 Flash & Solid-State Storage to Register the Highest CAGR During the Forecast Period

8.3 Magnetic Storage

8.3.1 Magnetic Disks

8.3.1.1 Magnetic Disks Provide High Storage Capacities at Affordable Prices

8.3.2 Magnetic Tapes

8.3.2.1 Magnetic Tapes Offer Long-Term Data Retention

9 Healthcare Data Storage Market, By Storage System (Page No. - 65)

9.1 Introduction

9.2 Storage Area Network

9.2.1 Storage Area Network Held the Largest Share of the Healthcare Data Storage Market in 2018

9.3 Direct-Attached Storage

9.3.1 Direct-Attached Storage is the Oldest and Most Convenient Data Storage System in Use

9.4 Network-Attached Storage

9.4.1 Network-Attached Storage Segment is Expected to Grow at the Highest Rate During the Forecast Period

10 Healthcare Data Storage Market, By End User (Page No. - 71)

10.1 Introduction

10.2 Pharmaceutical & Biotechnology Companies, CROS, and CMOS

10.2.1 A Large Amount of Data Generated By This End-User Segment is Driving the Adoption of Healthcare Data Storage Systems

10.3 Hospitals, Clinics, and Ascs

10.3.1 Increasing Use of Diagnostic Imaging to Drive Market Growth

10.4 Research Centers, Academic & Government Institutes, and Clinical Research Labs

10.4.1 This Segment is Expected to Grow at the Highest CAGR During the Forecast Period

10.5 Diagnostic & Clinical Laboratories

10.5.1 Increased Use of Hospital Information Systems & Medical Imaging Solutions to Support Market Growth

10.6 Other End Users

11 Healthcare Data Storage Market, By Region (Page No. - 82)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Strong Economy and Increasing R&D Expenditure are Expected to Drive the Healthcare Data Storage Market in the US

11.2.2 Canada

11.2.2.1 Canadas Healthcare System is Shifting From Infrastructure-Based Data Storage to Advanced Storage Devices

11.2.3 Mexico

11.2.3.1 Mexico is Expected to Witness the Highest Growth in the North American Healthcare Data Storage Market

11.3 Europe

11.3.1 UK

11.3.1.1 Move to Paperless Environments and Digitization Will Drive the Demand for Data Storage Solutions in the UK

11.3.2 Germany

11.3.2.1 High Adoption of Ehr Systems Among Primary Care Physicians is A Major Driver in Germany

11.3.3 France

11.3.3.1 France Registered High Adoption of IoT Services and Big Data, Which Points to High Growth in the Demand for Effective Healthcare Data Storage Solutions in the Coming Years

11.3.4 RoE

11.4 Asia

11.4.1 Big Data, Iot, and Other Digital and Virtualized Platforms in Asia are Driving the Demand for Healthcare Data Storage Solutions

11.5 Rest of the World

12 Competitive Landscape (Page No. - 112)

12.1 Overview

12.2 Market Player Ranking

12.3 Competitive Leadership Mapping

12.3.1 Visionary Leaders

12.3.2 Dynamic Differentiators

12.3.3 Innovators

12.3.4 Emerging Players

12.4 Competitive Situation and Trends

12.4.1 Product Launches & Upgrades

12.4.2 Acquisitions

12.4.3 Other Strategies

13 Company Profiles (Page No. - 119)

(Business Overview, Products Offered, Recent Developments, MnM View)*

13.1 Dell

13.2 IBM Corporation

13.3 NetApp

13.4 Hewlett Packard Enterprise (HPE)

13.5 Pure Storage

13.6 Hitachi

13.7 Toshiba

13.8 Western Digital

13.9 Scality

13.10 Huawei

13.11 Other Key Players

13.11.1 Fujitsu

13.11.2 Samsung

13.11.3 Drobo

13.11.4 Tintri

13.11.5 Cloudian

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 156)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (137 Table)

Table 1 Increase of Data Volume and Complexity Relative to Computational Power

Table 2 Office-Based Physician Electronic Health Record Adoption in the US (20042017)

Table 3 Largest Healthcare Data Breaches in the US (20102018)

Table 4 Healthcare Data Storage Market, By Deployment, 20172024 (USD Million)

Table 5 Healthcare Data Storage Market for On-Premise Deployment, By Region, 20172024 (USD Million)

Table 6 North America: Healthcare Data Storage Market for On-Premise Deployment, By Country, 20172024 (USD Million)

Table 7 Europe: Healthcare Data Storage Market for On-Premise Deployment, By Country, 20172024 (USD Million)

Table 8 Healthcare Data Storage Market for Hybrid Deployment, By Region, 20172024 (USD Million)

Table 9 North America: Healthcare Data Storage Market for Hybrid Deployment, By Country, 20172024 (USD Million)

Table 10 Europe: Healthcare Data Storage Market for Hybrid Deployment, By Country, 20172024 (USD Million)

Table 11 Healthcare Data Storage Market for Remote Deployment, By Region, 20172024 (USD Million)

Table 12 North America: Healthcare Data Storage Market for Remote Deployment, By Country, 20172024 (USD Million)

Table 13 Europe: Healthcare Data Storage Market for Remote Deployment, By Country, 20172024 (USD Million)

Table 14 Healthcare Data Storage Market, By Architecture, 20172024 (USD Million)

Table 15 File Storage Market, By Region, 20172024 (USD Million)

Table 16 North America: File Storage Market, By Country, 20172024 (USD Million)

Table 17 Europe: File Storage Market, By Country, 20172024 (USD Million)

Table 18 Object Storage Market, By Region, 20172024 (USD Million)

Table 19 North America: Object Storage Market, By Country, 20172024 (USD Million)

Table 20 Europe: Object Storage Market, By Country, 20172024 (USD Million)

Table 21 Block Storage Market, By Region, 20172024 (USD Million)

Table 22 North America: Block Storage Market, By Country, 20172024 (USD Million)

Table 23 Europe: Block Storage Market, By Country, 20172024 (USD Million)

Table 24 Healthcare Data Storage Market, By Type, 20172024 (USD Million)

Table 25 Flash & Solid-State Storage Market, By Region, 20172024 (USD Million)

Table 26 North America: Flash & Solid-State Storage Market, By Country, 20172024 (USD Million)

Table 27 Europe: Flash & Solid-State Storage Market, By Country, 20172024 (USD Million)

Table 28 Magnetic Storage Market, By Type, 20172024 (USD Million)

Table 29 Magnetic Storage Market, By Region, 20172024 (USD Million)

Table 30 North America: Magnetic Storage Market, By Country, 20172024 (USD Million)

Table 31 Europe: Magnetic Storage Market, By Country, 20172024 (USD Million)

Table 32 Magnetic Disks Market, By Region, 20172024 (USD Million)

Table 33 North America: Magnetic Disks Market, By Country, 20172024 (USD Million)

Table 34 Europe: Magnetic Disks Market, By Country, 20172024 (USD Million)

Table 35 Magnetic Tapes Market, By Region, 20172024 (USD Million)

Table 36 North America: Magnetic Tapes Market, By Country, 20172024 (USD Million)

Table 37 Europe: Magnetic Tapes Market, By Country, 20172024 (USD Million)

Table 38 Healthcare Data Storage Market, By Storage System, 20172024 (USD Million)

Table 39 Storage Area Network Market, By Region, 20172024 (USD Million)

Table 40 North America: Storage Area Network Market, By Country, 20172024 (USD Million)

Table 41 Europe: Storage Area Network Market, By Country, 20172024 (USD Million)

Table 42 Direct-Attached Storage Market, By Region, 20172024 (USD Million)

Table 43 North America: Direct-Attached Storage Market, By Country, 20172024 (USD Million)

Table 44 Europe: Direct-Attached Storage Market, By Country, 20172024 (USD Million)

Table 45 Network-Attached Storage Market, By Region, 20172024 (USD Million)

Table 46 North America: Network-Attached Storage Market, By Country, 20172024 (USD Million)

Table 47 Europe: Network-Attached Storage Market, By Country, 20172024 (USD Million)

Table 48 Healthcare Data Storage Market, By End User, 20172024 (USD Million)

Table 49 Registered Clinical Trial Studies, 20102019

Table 50 Healthcare Data Storage Market for Pharmaceutical & Biotechnology Companies, CROS, and CMOS, By Region, 20172024 (USD Million)

Table 51 North America: Healthcare Data Storage Market for Pharmaceutical & Biotechnology Companies, CROS, and CMOS, By Country, 20172024 (USD Million)

Table 52 Europe: Healthcare Data Storage Market for Pharmaceutical & Biotechnology Companies, CROS, and CMOS, By Country, 20172024 (USD Million)

Table 53 Number of Diagnostic Imaging Procedures Performed in Hospitals and Ambulatory Surgery Centers in the Us

Table 54 Healthcare Data Storage Market for Hospitals, Clinics, and Ascs, By Region, 20172024 (USD Million)

Table 55 North America: Healthcare Data Storage Market for Hospitals, Clinics, and Ascs, By Country, 20172024 (USD Million)

Table 56 Europe: Healthcare Data Storage Market for Hospitals, Clinics, and Ascs, By Country, 20172024 (USD Million)

Table 57 Healthcare Data Storage Market for Research Centers, Academic & Government Institutes, and Clinical Research Labs, By Region, 20172024 (USD Million)

Table 58 North America: Healthcare Data Storage Market for Research Centers, Academic & Government Institutes, and Clinical Research Labs, 20172024 (USD Million)

Table 59 Europe: Healthcare Data Storage Market for Research Centers, Academic & Government Institutes, and Clinical Research Labs, 20172024 (USD Million)

Table 60 Healthcare Data Storage Market for Diagnostic & Clinical Laboratories, By Region, 20172024 (USD Million)

Table 61 North America: Healthcare Data Storage Market for Diagnostic & Clinical Laboratories, By Country, 20172024 (USD Million)

Table 62 Europe: Healthcare Data Storage Market for Diagnostic & Clinical Laboratories, By Country, 20172024 (USD Million)

Table 63 Healthcare Data Storage Market for Other End Users, By Region, 20172024 (USD Million)

Table 64 North America: Healthcare Data Storage Market for Other End Users, By Country, 20172024 (USD Million)

Table 65 Europe: Healthcare Data Storage Market for Other End Users, By Country, 20172024 (USD Million)

Table 66 Healthcare Data Storage Market, By Region, 20172024 (USD Million)

Table 67 North America: Healthcare Data Storage Market, By Country, 20172024 (USD Million)

Table 68 North America: Healthcare Data Storage Market, By Deployment, 20172024 (USD Million)

Table 69 North America: Healthcare Data Storage Market, By Architecture, 20172024 (USD Million)

Table 70 North America: Healthcare Data Storage Market, By Type, 20172024 (USD Million)

Table 71 North America: Magnetic Storage Market, By Type, 20172024 (USD Million)

Table 72 North America: Healthcare Data Storage Market, By Storage System, 20172024 (USD Million)

Table 73 North America: Healthcare Data Storage Market, By End User, 20172024 (USD Million)

Table 74 US: Healthcare Data Storage Market, By Deployment, 20172024 (USD Million)

Table 75 US: Healthcare Data Storage Market, By Architecture, 20172024 (USD Million)

Table 76 US: Healthcare Data Storage Market, By Type, 20172024 (USD Million)

Table 77 US: Magnetic Storage Market, By Type, 20172024 (USD Million)

Table 78 US: Healthcare Data Storage Market, By Storage System, 20172024 (USD Million)

Table 79 US: Healthcare Data Storage Market, By End User, 20172024 (USD Million)

Table 80 Canada: Healthcare Data Storage Market, By Deployment, 20172024 (USD Million)

Table 81 Canada: Healthcare Data Storage Market, By Architecture, 20172024 (USD Million)

Table 82 Canada: Healthcare Data Storage Market, By Type, 20172024 (USD Million)

Table 83 Canada: Magnetic Storage Market, By Type, 20172024 (USD Million)

Table 84 Canada: Healthcare Data Storage Market, By Storage System, 20172024 (USD Million)

Table 85 Canada: Healthcare Data Storage Market, By End User, 20172024 (USD Million)

Table 86 Mexico: Healthcare Data Storage Market, By Deployment, 20172024 (USD Million)

Table 87 Mexico: Healthcare Data Storage Market, By Architecture, 20172024 (USD Million)

Table 88 Mexico: Healthcare Data Storage Market, By Type, 20172024 (USD Million)

Table 89 Mexico: Magnetic Storage Market, By Type, 20172024 (USD Million)

Table 90 Mexico: Healthcare Data Storage Market, By Storage System, 20172024 (USD Million)

Table 91 Mexico: Healthcare Data Storage Market, By End User, 20172024 (USD Million)

Table 92 Europe: Healthcare Data Storage Market, By Country, 20172024 (USD Million)

Table 93 Europe: Healthcare Data Storage Market, By Deployment, 20172024 (USD Million)

Table 94 Europe: Healthcare Data Storage Market, By Architecture, 20172024 (USD Million)

Table 95 Europe: Healthcare Data Storage Market, By Type, 20172024 (USD Million)

Table 96 Europe: Magnetic Storage Market, By Type, 20172024 (USD Million)

Table 97 Europe: Healthcare Data Storage Market, By Storage System, 20172024 (USD Million)

Table 98 Europe: Healthcare Data Storage Market, By End User, 20172024 (USD Million)

Table 99 UK: Healthcare Data Storage Market, By Deployment, 20172024 (USD Million)

Table 100 UK: Healthcare Data Storage Market, By Architecture, 20172024 (USD Million)

Table 101 UK: Healthcare Data Storage Market, By Type, 20172024 (USD Million)

Table 102 UK: Magnetic Storage Market, By Type, 20172024 (USD Million)

Table 103 UK: Healthcare Data Storage Market, By Storage System, 20172024 (USD Million)

Table 104 UK: Healthcare Data Storage Market, By End User, 20172024 (USD Million)

Table 105 Germany: Healthcare Data Storage Market, By Deployment, 20172024 (USD Million)

Table 106 Germany: Healthcare Data Storage Market, By Architecture, 20172024 (USD Million)

Table 107 Germany: Healthcare Data Storage Market, By Type, 20172024 (USD Million)

Table 108 Germany: Magnetic Storage Market, By Type, 20172024 (USD Million)

Table 109 Germany: Healthcare Data Storage Market, By Storage System, 20172024 (USD Million)

Table 110 Germany: Healthcare Data Storage Market, By End User, 20172024 (USD Million)

Table 111 France: Healthcare Data Storage Market, By Deployment, 20172024 (USD Million)

Table 112 France: Healthcare Data Storage Market, By Architecture, 20172024 (USD Million)

Table 113 France: Healthcare Data Storage Market, By Type, 20172024 (USD Million)

Table 114 France: Magnetic Storage Market, By Type, 20172024 (USD Million)

Table 115 France: Healthcare Data Storage Market, By Storage System, 20172024 (USD Million)

Table 116 France: Healthcare Data Storage Market, By End User, 20172024 (USD Million)

Table 117 RoE: Healthcare Data Storage Market, By Deployment, 20172024 (USD Million)

Table 118 RoE: Healthcare Data Storage Market, By Architecture, 20172024 (USD Million)

Table 119 RoE: Healthcare Data Storage Market, By Type, 20172024 (USD Million)

Table 120 RoE: Magnetic Storage Market, By Type, 20172024 (USD Million)

Table 121 RoE: Healthcare Data Storage Market, By Storage System, 20172024 (USD Million)

Table 122 RoE: Healthcare Data Storage Market, By End User, 20172024 (USD Million)

Table 123 Asia: Healthcare Data Storage Market, By Deployment, 20172024 (USD Million)

Table 124 Asia: Healthcare Data Storage Market, By Architecture, 20172024 (USD Million)

Table 125 Asia: Healthcare Data Storage Market, By Type, 20172024 (USD Million)

Table 126 Asia: Magnetic Storage Market, By Type, 20172024 (USD Million)

Table 127 Asia: Healthcare Data Storage Market, By Storage System, 20172024 (USD Million)

Table 128 Asia: Healthcare Data Storage Market, By End User, 20172024 (USD Million)

Table 129 RoW: Healthcare Data Storage Market, By Deployment, 20172024 (USD Million)

Table 130 RoW: Healthcare Data Storage Market, By Architecture, 20172024 (USD Million)

Table 131 RoW: Healthcare Data Storage Market, By Type, 20172024 (USD Million)

Table 132 RoW: Magnetic Storage Market, By Type, 20172024 (USD Million)

Table 133 RoW: Healthcare Data Storage Market, By Storage System, 20172024 (USD Million)

Table 134 RoW: Healthcare Data Storage Market, By End User, 20172024 (USD Million)

Table 135 Product Launches & Upgrades, 20162019

Table 136 Acquisitions, 20162019

Table 137 Other Strategies, 20162019

List of Figures (33 Figures)

Figure 1 Healthcare Data Storage: Market Segmentation

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Healthcare Data Storage Market, By Deployment, 2019 vs 2024 (USD Million)

Figure 8 Healthcare Data Storage Market, By Architecture, 2019 vs 2014 (USD Million)

Figure 9 Healthcare Data Storage Market, By Type, 2019 vs 2014 (USD Million)

Figure 10 Healthcare Data Storage Market, By Storage System, 2019 vs 2024 (USD Million)

Figure 11 Healthcare Data Storage Market, By End User, 2019 vs 2024 (USD Million)

Figure 12 Geographical Snapshot: Healthcare Data Storage Market

Figure 13 Massive Growth in Digital Data Volume in Healthcare Organizations is A Major Factor Driving the Adoption of Healthcare Data Storage Solutions

Figure 14 Storage Area Network Accounted for the Largest Market Share in 2018

Figure 15 North America Accounted for the Largest Share of the Market in 2018

Figure 16 The RoW is Expected to Grow at the Highest Rate During the Forecast Period

Figure 17 Healthcare Data Storage Market: Drivers, Opportunities, and Challenges

Figure 18 Number of Healthcare Data Breaches in the US (20092018)

Figure 19 North America: Healthcare Data Storage Market Snapshot

Figure 20 Europe: Healthcare Data Storage Market Snapshot

Figure 21 Product Launches & UpgradesKey Growth Strategy Adopted By Market Players From 2016 to 2019

Figure 22 Market Evolution Framework

Figure 23 Healthcare Data Storage Market Player Ranking, 2018

Figure 24 Competitive Leadership Mapping of the Healthcare Data Storage Market

Figure 25 Company Snapshot: Dell

Figure 26 Company Snapshot: IBM Corporation

Figure 27 Company Snapshot: NetApp

Figure 28 Company Snapshot: Hewlett Packard Enterprise (HPE)

Figure 29 Company Snapshot: Pure Storage

Figure 30 Company Snapshot: Hitachi

Figure 31 Company Snapshot: Toshiba

Figure 32 Company Snapshot: Western Digital

Figure 33 Company Snapshot: Huawei

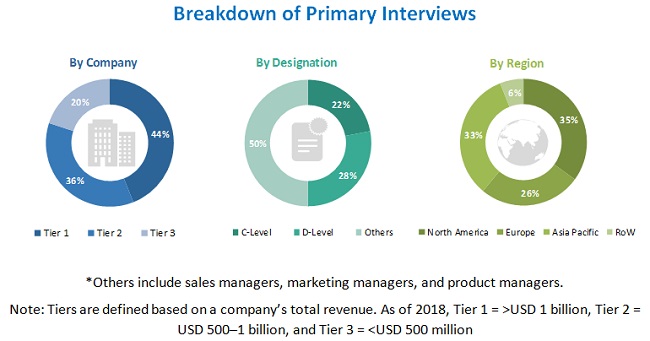

This research study involved four major activities in estimating the current size of the global healthcare data storage market. Exhaustive secondary research was done to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing values with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was mainly used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global healthcare data storage market. Secondary sources such as directories; databases such as Bloomberg Businessweek, Factiva, and the Wall Street Journal; white papers; and annual reports were also used to obtain vital information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess the prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global healthcare data storage market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The revenue generated from the sales of healthcare data storage products by leading players has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global market based on type, deployment, storage system, architecture, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, challenges, and opportunities)

- To strategically analyze micromarkets for individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments for six main regionsNorth America, Europe, Asia, and the Rest of the World (RoW)

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as agreements, collaborations, & partnerships; product launches & upgrades; and acquisitions in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs.

The following customization options are available for this report.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Data Storage Market