Healthcare Facility Management Market Size, Share & Trends by Service, (Hard Services (Fire Protection), Construction Services (Building, Repair), Energy Services (Energy Management)), Location (On Site, Off site), Settings (Acute, Post-acute, Non-acute) - US Forecast to 2026

Healthcare Facility Management Market Size, Share & Trends

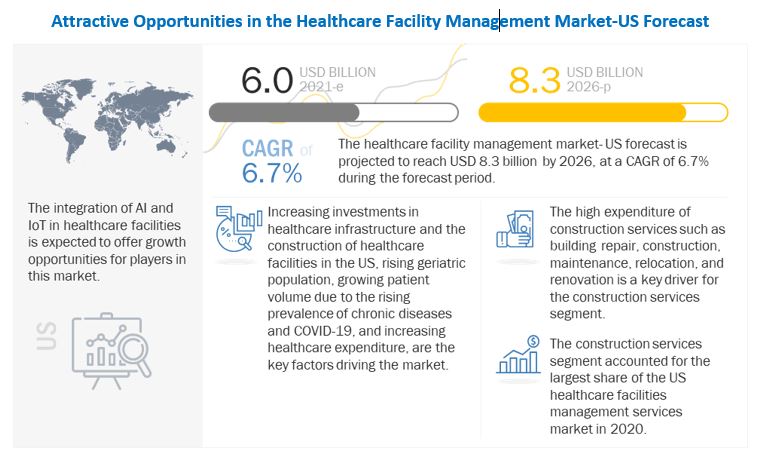

The size of global healthcare facility management market in terms of revenue was estimated to be worth $6.0 billion in 2021 and is poised to reach $8.3 billion by 2026, growing at a CAGR of 6.7% from 2021 to 2026. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

The market is growing with the increasing investments into the healthcare infrastructure and healthcare facility construction projects in the US, the rising geriatric population base, increasing patient volume along with the rising prevalence of chronic diseases and infections (COVID-19), and their increasing healthcare expenditure. The market growth is restrained by the maintenance related challenges of the healthcare facilities during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Healthcare Facility Management Market Dynamics

Driver: Increasing investments in healthcare infrastructure and the construction of healthcare facilities, rising geriatric population, Growing patient volume due to the rising prevalence of chronic diseases and COVID-19 and the Increasing healthcare expenditure

The chronic diseases such as diabetes, cardiovascular diseases and cancer are on rise across the country. The prevalence of infectious disease is also increasing at an alarming rate. The investments into the healthcare infrastructure to meet the increasing demand of the patients would push the growth of the market.

Restraint: Maintenance issues of healthcare facilities

The maintenance of the healthcare facilities incurs immense cost. It also compels to follow struct regulatory rules and compliances. The facility also remains under the constant threat of vandalism and theft.

Opportunity: Integration of AI and IoT in healthcare facilities

The use of automation in healthcare energy management solutions is on the rise. Power quality is a critical need for hospitals and healthcare facilities. The AI and IoT would help in the energy optimization and the energy flow of the healthcare building.

Challenge: The highly competitive nature of the market

The highly competitive nature of the market can pose major challenges. The market is highly competitive as there are numerous small and medium-sized enterprises that offer services having specialization in either energy, hard, or construction, or in combination. The presence of many players in the market has increased competition.

The on-site facility management segment accounted for the largest market share in the Healthcare Facility Management Industry-US Forecast and is expected to grow at the highest CAGR during the forecast period.

Based on the location, the Healthcare Facility Management Market-US Forecast is segmented into on site and off site facility management. The on-site facility management segment accounted for the largest market share and is projected to register the highest growth of during the forecast period. The growth of the on-site segment is driven by the rising demand for effective health facilities and the more adoption of outsourcing facility management services. Most of the healthcare facilities management services are efficiently performed on-site.

Construction service segment account for the largest share of the Healthcare Facility Management Industry-US Forecast. The hard services are expected to grow with the highest CAGR during the forecast period

Based on services, the Healthcare Facility Management Market-US Forecast is segmented into construction services, hard services, and energy services. The construction services segment accounted for the largest market share, owing to the massive expenditure related to the construction services for the healthcare buildings. It further includes building repair, construction, maintenance, relocation, and renovation services for the healthcare faculties. The hard services segment is projected to grow at the highest CAGR during the forecast period which is supported by the increasing focus on effective healthcare HVAC, ventilation, and mechanical and electrical services. The integration of advanced technologies such as IoT and artificial intelligence boost the performance of these services.

Acute setting account for the largest share of the Healthcare Facility Management Industry-US Forecast. The post-acute setting is expected to grow at the fastest CAGR.

Based on settings, the Healthcare Facility Management Market-US Forecast is segmented into acute, post-acute, and non-acute settings. The acute settings segment accounted for the largest market share. The largest share is attributed to the highest sophistication of the acute facilities and its massive expenditure of the facility management services.

The Healthcare Facility Management Market-US Forecast is fragmented, with a few leading market players and numerous small players. Some of the major companies operating in this market are Jones Lang LaSalle IP, Inc. (US), CBRE (US), Sodexo (France), ABM (US), and ISS (Denmark).

Scope of the Healthcare Facility Management Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$6.0 billion |

|

Projected Revenue Size by 2026 |

$8.3 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 6.7% |

|

Market Driver |

Increasing investments in healthcare infrastructure and the construction of healthcare facilities, rising geriatric population, Growing patient volume due to the rising prevalence of chronic diseases and COVID-19 and the Increasing healthcare expenditure |

|

Market Opportunity |

Integration of AI and IoT in healthcare facilities |

This report categorizes the Healthcare Facility Management Market-US Forecast to forecast revenue and analyze trends in each of the following submarkets

By Location

- On-site Facility Management

- Off-site Facility Management

By Service

-

Hard Services

- Plumbing, Air Conditioning, and Maintenance

- Fire Protection

- Mechanical and Electrical Maintenance

- Other Hard Services

-

Construction Services

- Building Construction

- Building Repair and Maintenance, Testing, and Inspection

- Other Construction Services

-

Energy Services

- Energy Management

- Other Energy Services

By Setting

-

Acute

- Short-term Acute and Critical Access Hospitals

- Children’s Hospitals

- Academic Medical Centers

- Military Treatment Facilities

- Ambulatory Surgery Centers

-

Post-acute

- Long-term Acute Facilities

- Skilled Nursing Facilities

- Other Post-acute Settings

-

Non-acute

- Physicians’ Offices & Clinics

- Other Non-acute Settings

Recent Developments of Healthcare Facility Management Industry

- In January 2022, CBRE acquired Building, a leading provider of occupancy planning and technology services, to meet the growing occupier demand for holistic occupancy management services.

- In November 2021, JLL acquired Building Engines, a building operations platform.

- In September 2021, ABM acquired Crown Building Maintenance Co. and Crown Energy Services, Inc. (collectively, Able), a leading facilities service.

- In April 2021, Sodexo acquired MTS Health Limited, the UK’s leading provider of medical equipment asset management, to expand its business in the healthcare sector.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the healthcare facility management market?

The healthcare facility management market boasts a total revenue value of $8.3 billion by 2026.

What is the estimated growth rate (CAGR) of the healthcare facility management market?

The global healthcare facility management market has an estimated compound annual growth rate (CAGR) of 6.7% and a revenue size in the region of $6.0 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 13)

1.1 OBJECTIVES OF THE STUDY

1.2 HEALTHCARE FACILITY MANAGEMENT INDUSTRY DEFINITION

TABLE 1 DEFINITIONS OF THE SEGMENTS COVERED IN THE REPORT

TABLE 2 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.3.3 CURRENCY

1.3.4 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

TABLE 3 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

FIGURE 1 US HEALTHCARE FACILITIES MANAGEMENT SERVICES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE AND DESIGNATION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 US HEALTHCARE FACILITIES MANAGEMENT SERVICES MARKET – REVENUE SHARE ANALYSIS ILLUSTRATION: ISS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF US HEALTHCARE FACILITIES MANAGEMENT SERVICES

FIGURE 6 CAGR PROJECTIONS

FIGURE 7 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 INDICATORS AND ASSUMPTIONS AND THEIR IMPACT ON THE STUDY

2.6.1 COVID-19-SPECIFIC ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 4 RISK ASSESSMENT

2.9 COVID-19 ECONOMIC ASSESSMENT

2.10 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 9 CRITERIA IMPACTING THE US ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 10 US HEALTHCARE FACILITY MANAGEMENT MARKET, BY LOCATION, 2021 VS. 2026 (USD BILLION)

FIGURE 11 US HEALTHCARE FACILITIES MANAGEMENT SERVICES MARKET, BY SERVICE, 2021 VS. 2026 (USD BILLION)

FIGURE 12 US HEALTHCARE FACILITIES MANAGEMENT SERVICES MARKET, BY SETTING, 2021 VS. 2026 (USD BILLION)

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 US HEALTHCARE FACILITIES MANAGEMENT SERVICES MARKET OVERVIEW

FIGURE 13 CONSTRUCTION OF HEALTHCARE FACILITIES AND THE GROWING PATIENT VOLUME ARE DRIVING THE DEMAND FOR HEALTHCARE FACILITIES MANAGEMENT SERVICES IN THE US

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

TABLE 5 MARKET DYNAMICS: IMPACT ANALYSIS

FIGURE 14 US HEALTHCARE FACILITY MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 MARKET DRIVERS

5.2.1.1 Increasing investments in healthcare infrastructure and the construction of healthcare facilities in the US

5.2.1.2 Rising geriatric population

FIGURE 15 NUMBER OF PERSONS AGED 65 AND OLDER, 1900-2060 (MILLION)

5.2.1.3 Increasing patient volume due to the rising prevalence of chronic diseases and COVID-19

5.2.1.4 Increasing healthcare expenditure

FIGURE 16 UNITED STATES: HEALTHCARE EXPENDITURE, 2019

5.2.2 MARKET RESTRAINTS

5.2.2.1 Maintenance issues of healthcare facilities

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 Integration of AI and IoT in healthcare facilities

5.2.4 MARKET CHALLENGES

5.2.4.1 High competition in the market

5.3 COVID-19 IMPACT ON THE US HEALTHCARE FACILITIES MANAGEMENT SERVICES MARKET

5.3.1 COVID-19 IMPACT ON CERTAIN COMPANIES AND THE INCREASING POTENTIAL OF MARKET PLAYERS IN THE COMING YEARS

5.3.2 COVID-19 IMPACT ON HEALTHCARE FACILITIES SUCH AS HEALTHCARE INFRASTRUCTURE AND THEIR CONSTRUCTION

5.3.2.1 Rising funding for the construction of hospitals in the US

5.3.2.2 Initiatives taken by healthcare facilities in the US

5.4 ECOSYSTEM ANALYSIS

FIGURE 17 ECOSYSTEM ANALYSIS: US HEALTHCARE FACILITIES MANAGEMENT SERVICES MARKET

5.5 PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 BARGAINING POWER OF SUPPLIERS

5.5.3 BARGAINING POWER OF BUYERS

5.5.4 INTENSITY OF COMPETITIVE RIVALRY

5.5.5 THREAT OF SUBSTITUTES

5.6 REGULATORY SCENARIO

5.7 PATENT ANALYSIS

FIGURE 18 LIST OF MAJOR PATENTS FOR US HEALTHCARE FACILITIES MANAGEMENT SERVICES

TABLE 6 INDICATIVE LIST OF US HEALTHCARE FACILITIES MANAGEMENT PATENTS

6 US HEALTHCARE FACILITY MANAGEMENT MARKET, BY LOCATION (Page No. - 57)

6.1 INTRODUCTION

TABLE 7 US HEALTHCARE FACILITIES MANAGEMENT SERVICES MARKET, BY LOCATION, 2019–2026 (USD MILLION)

6.2 ON-SITE FACILITY MANAGEMENT

6.2.1 INCREASING DEMAND FOR BETTER HEALTH FACILITIES TO DRIVE MARKET GROWTH

6.3 OFF-SITE FACILITY MANAGEMENT

6.3.1 OFF-SITE FACILITY MANAGEMENT SERVICES ARE PERFORMED AWAY FROM THE HEALTHCARE FACILITY

7 US HEALTHCARE FACILITY MANAGEMENT MARKET, BY SERVICE (Page No. - 60)

7.1 INTRODUCTION

TABLE 8 US HEALTHCARE FACILITIES MANAGEMENT SERVICES MARKET, BY SERVICE, 2019–2026 (USD MILLION)

7.2 CONSTRUCTION SERVICES

7.2.1 CONSTRUCTION SERVICES TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 9 US HEALTHCARE FACILITIES MANAGEMENT CONSTRUCTION SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

7.2.2 BUILDING CONSTRUCTION

7.2.3 BUILDING REPAIR AND MAINTENANCE, TESTING, AND INSPECTION

7.2.4 OTHER CONSTRUCTION SERVICES

7.3 HARD SERVICES

7.3.1 HARD SERVICES SEGMENT TO REGISTER THE HIGHEST GROWTH IN THE FORECAST PERIOD

TABLE 10 US HEALTHCARE FACILITIES MANAGEMENT HARD SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

7.3.2 PLUMBING, AIR CONDITIONING, AND MAINTENANCE

7.3.3 FIRE PROTECTION

7.3.4 OTHER HARD SERVICES

7.4 ENERGY SERVICES

7.4.1 ENERGY SERVICES AID IN ENERGY OPTIMIZATION

TABLE 11 US HEALTHCARE FACILITIES MANAGEMENT ENERGY SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

7.4.2 ENERGY MANAGEMENT

7.4.3 OTHER ENERGY SERVICES

8 US HEALTHCARE FACILITY MANAGEMENT MARKET, BY SETTING (Page No. - 67)

8.1 INTRODUCTION

TABLE 12 US HEALTHCARE FACILITY MANAGEMENT INDUSTRY, BY SETTING, 2019–2026 (USD MILLION)

8.2 ACUTE SETTINGS

8.2.1 ACUTE SETTINGS REQUIRE HIGH-END SERVICES FOR FACILITY MANAGEMENT

TABLE 13 US ACUTE HEALTHCARE FACILITY MANAGEMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.2.2 SHORT-TERM ACUTE & CRITICAL ACCESS HOSPITALS

8.2.3 CHILDREN’S HOSPITALS

8.2.4 ACADEMIC MEDICAL CENTERS

8.2.5 MILITARY TREATMENT FACILITIES

8.2.6 AMBULATORY SURGERY CENTERS

8.3 POST-ACUTE SETTINGS

8.3.1 POST-ACUTE SETTINGS SEGMENT TO REGISTER THE HIGHEST GROWTH IN THE MARKET

TABLE 14 US POST-ACUTE HEALTHCARE FACILITY MANAGEMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.3.2 SKILLED NURSING FACILITIES

8.3.3 LONG-TERM ACUTE FACILITIES

8.3.4 OTHER POST-ACUTE SETTINGS

8.4 NON-ACUTE SETTINGS

8.4.1 NON-ACUTE SETTINGS SERVE PATIENTS FOR LONG-TERM HEALTH TREATMENT

TABLE 15 US NON-ACUTE HEALTHCARE FACILITY MANAGEMENT INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

8.4.2 PHYSICIANS’ OFFICES & CLINICS

8.4.3 OTHER NON-ACUTE SETTINGS

9 COMPETITIVE LANDSCAPE (Page No. - 74)

9.1 OVERVIEW

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

9.2.1 OVERVIEW OF THE STRATEGIES ADOPTED BY THE KEY PLAYERS IN THE US HEALTHCARE FACILITY MANAGEMENT MARKET

9.3 REVENUE ANALYSIS

FIGURE 19 REVENUE ANALYSIS OF KEY PLAYERS IN THE US HEALTHCARE FACILITY MANAGEMENT MARKET

9.4 MARKET SHARE ANALYSIS

FIGURE 20 US HEALTHCARE FACILITY MANAGEMENT INDUSTRY SHARE ANALYSIS, 2020

TABLE 16 US HEALTHCARE FACILITY MANAGEMENT MARKET: DEGREE OF COMPETITION

9.5 COMPANY EVALUATION QUADRANT

9.5.1 STARS

9.5.2 EMERGING LEADERS

9.5.3 PARTICIPANTS

9.5.4 PERVASIVE PLAYERS

FIGURE 21 US HEALTHCARE FACILITY MANAGEMENT MARKET: COMPANY EVALUATION QUADRANT, 2020

9.6 COMPETITIVE BENCHMARKING

9.6.1 COMPANY SERVICES FOOTPRINT

9.6.2 COMPANY REGIONAL FOOTPRINT

9.6.3 COMPANY FOOTPRINT

9.7 COMPETITIVE SCENARIO AND TRENDS

9.7.1 DEALS

TABLE 17 DEALS, JANUARY 2018–FEBRUARY 2022

9.7.2 SERVICE LAUNCHES

TABLE 18 SERVICE LAUNCHES, JANUARY 2018–FEBRUARY 2022

9.7.3 OTHER DEVELOPMENTS

TABLE 19 OTHER DEVELOPMENTS, JANUARY 2018–FEBRUARY 2022

10 COMPANY PROFILES (Page No. - 86)

(Business Overview, Services, Key Insights, Recent Developments, MnM View)*

10.1 JONES LANG LASALLE IP, INC.

TABLE 20 JONES LANG LASALLE, IP, INC.: BUSINESS OVERVIEW

FIGURE 22 JONES LANG LASALLE IP, INC.: COMPANY SNAPSHOT (2020)

10.2 CBRE

TABLE 21 CBRE: BUSINESS OVERVIEW

FIGURE 23 CBRE: COMPANY SNAPSHOT (2020)

10.3 SODEXO

TABLE 22 SODEXO: BUSINESS OVERVIEW

FIGURE 24 SODEXO: COMPANY SNAPSHOT (2021)

10.4 ABM

TABLE 23 ABM: BUSINESS OVERVIEW

FIGURE 25 ABM: COMPANY SNAPSHOT (2021)

10.5 ISS

TABLE 24 ISS: BUSINESS OVERVIEW

FIGURE 26 ISS: COMPANY SNAPSHOT (2020)

10.6 JOHNSON CONTROLS

TABLE 25 JOHNSON CONTROLS: BUSINESS OVERVIEW

FIGURE 27 JOHNSON CONTROLS: COMPANY SNAPSHOT (2021)

10.7 ACCRUENT

TABLE 26 ACCRUENT: BUSINESS OVERVIEW

10.8 MEDXCEL

TABLE 27 MEDXCEL: BUSINESS OVERVIEW

10.9 GSH GROUP

TABLE 28 GSH GROUP: BUSINESS OVERVIEW

10.10 OTHER PLAYERS

10.10.1 3M

TABLE 29 3M: COMPANY OVERVIEW

10.10.2 HOSPITAL ENERGY

TABLE 30 HOSPITAL ENERGY: COMPANY OVERVIEW

10.10.3 ELECTRO INDUSTRIES/GAUGETECH INC.

TABLE 31 ELECTRO INDUSTRIES/GAUGETECH INC.: COMPANY OVERVIEW

10.10.4 BUILDINGLOGIX

TABLE 32 BUILDINGLOGIX: COMPANY OVERVIEW

10.10.5 ENERGY MANAGEMENT CONSULTANTS, INC.

TABLE 33 ENERGY MANAGEMENT CONSULTANTS, INC.: COMPANY OVERVIEW

10.10.6 NEVA CORPORATION

TABLE 34 NEVA CORPORATION: COMPANY OVERVIEW

10.10.7 MONROE MECHANICAL, INC.

TABLE 35 MONROE MECHANICAL, INC.: COMPANY OVERVIEW

10.10.8 TORCON

TABLE 36 TORCON: COMPANY OVERVIEW

10.10.9 U.S. ENGINEERING COMPANY HOLDINGS

TABLE 37 U.S. ENGINEERING COMPANY HOLDINGS: COMPANY OVERVIEW

*Details on Business Overview, Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 121)

11.1 INSIGHTS OF INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the Healthcare Facility Management Industry-US Forecast. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the Healthcare Facility Management Industry-US Forecast. The secondary sources used for this study include such as the Journal of Facilities Management, Journal of Hospital Management and Health Policy, American Hospital Association, International Journal of Healthcare Management, Journal of Facility Management Education and Research, International Journal of Strategic Property Management, Organisation for Economic Co-operation and Development (OECD), American Medical Group Association (AMGA), American Hospital Association (AHA), US Department of Health and Human Services (HHS), World Health Organization (WHO), Institute for Health Technology Transformation (IHT2), Office of the National Coordinator for Health Information Technology (ONC), Healthcare Information and Management Systems Society (HIMSS), Ambulatory Surgery Center Association, American Health Care Association and the ?National Center for Assisted Living (AHCA/NCAL), and American Medical Group Association (AMGA).

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Healthcare Facility Management Industry-US Forecast. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the US Healthcare Facilities Management Services business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the Healthcare Facility Management Industry-US Forecast by location, service, and setting

- To provide detailed information about the factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To profile the key players and their core competencies2

- To track and analyze competitive developments such as partnerships, agreements, joint ventures, mergers and acquisitions, service development, and research and development (R&D) activities in the Healthcare Facility Management Industry-US Forecast

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following

Company Information

- Over 18 companies profiled

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Facility Management Market