AI in Virtual Medical Assistants Market Size, Growth, Share & Trends Analysis

AI in Virtual Medical Assistants Market by Offering (Apps, EHR/EMR, IoT), Mode (Text, Multimodal, Avatar), Application (Workflow, Triage, RPM, Scheduling, Billing), End User, Use Case (Patient Access, Mental Health) & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

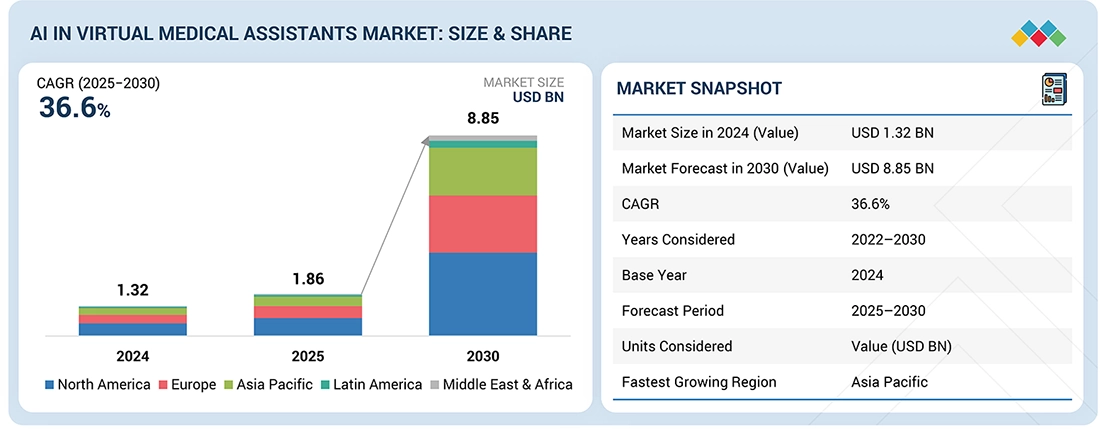

The AI in Virtual Medical Assistants market, valued at US$1.32 billion in 2024, stood at US$1.86 billion in 2025 and is projected to advance at a resilient CAGR of 36.6% from 2025 to 2030, culminating in a forecasted valuation of US$8.85billion by the end of the period. The growth of this market is primarily driven by advancements in data security and compliance, increasing healthcare workforce shortages, and the need to reduce administrative burden on clinicians.

KEY TAKEAWAYS

-

By RegionNorth America to dominate the market with a share of 42.8% in 2024.

-

By OfferingBy offering, the EHR/EMR-integrated systems segment is expected to register the highest CAGR of 38.3%

-

By Mode of InteractionBy mode of interaction, multimodal interaction segment is expected to register the highest CAGR of 38.1%

-

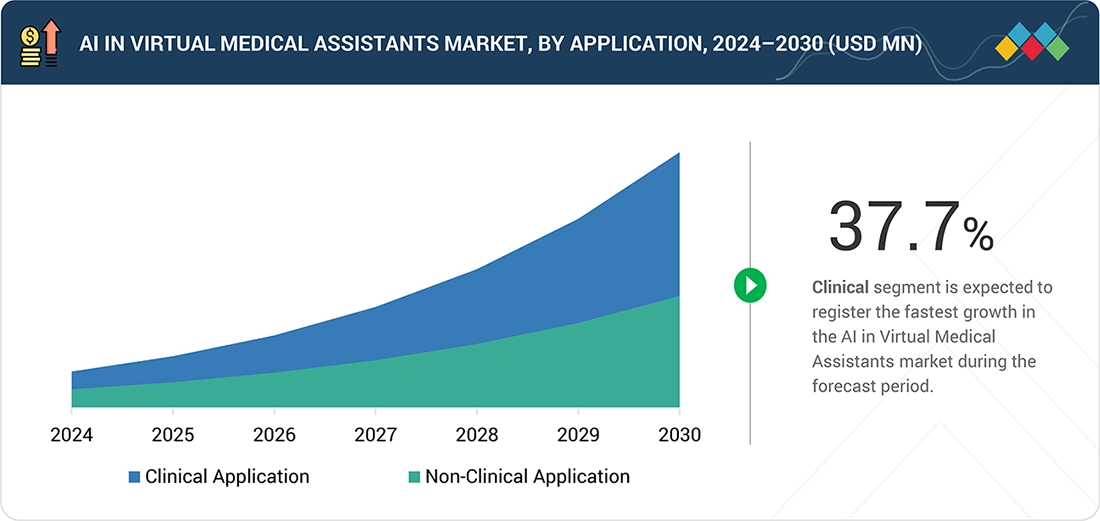

By ApplicationBy application, clinical segment to dominate the market during the forecast period

-

By End UserBy end user, the healthcare providers segment held the largest market share

-

Competitive LandscapeTeladoc Health, Microsoft and Infermedica were identified as some of the star players in the AI in virtual medical assistants market, given their strong market share and product footprint.

-

Competitive LandscapeSully AI, Medva, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The growth of this market is primarily driven by advancements in data security and compliance, which foster trust among providers for sensitive patient interactions. Advances in natural language processing, speech recognition, and machine learning are enabling AI assistants to handle tasks like appointment scheduling, symptom triage, medication reminders, and patient engagement more accurately

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

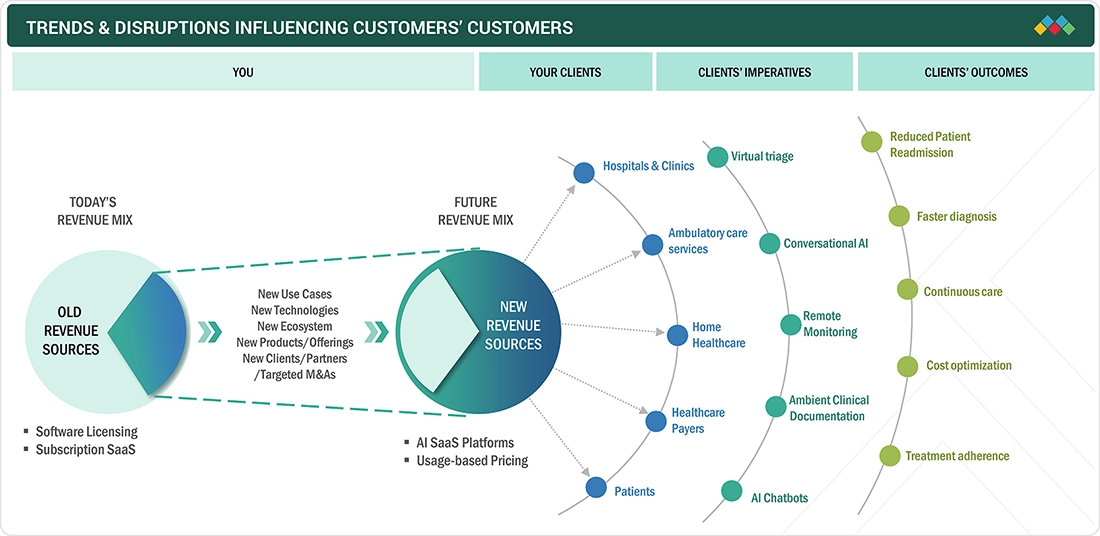

The AI in Virtual Medical Assistants market is being disrupted by advanced conversational AI, virtual triage, and remote monitoring, with growing adoption across hospitals & clinics, ambulatory care centers, home healthcare providers, healthcare payers, and patients. Advancements in AI platforms, integration with patient portals and telehealth platforms is streamlining workflows, improving clinical decision-making, reducing readmissions, and driving cost optimization across end users.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Advancements in AI-powered virtual medical assistants platform

-

Increasing use of smartphones and digital platforms

Level

-

Data privacy and security concerns

-

Bias in inaccuracy in AI models

Level

-

Emerging markets and underserved populations

-

Growing pressure in healthcare system to adopt virtual health platforms

Level

-

Accountability and legal liability

-

Regulatory complexity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advancements in AI-powered virtual medical assistants platform

Advancements in AI-powered virtual medical assistant platforms are a key driver of market growth, as improvements in natural language processing, generative AI, voice recognition, and clinical decision support enable more human-like, accurate, and context-aware interactions. These platforms can now handle complex tasks such as symptom assessment, patient triage, clinical documentation, and personalized care guidance, reducing clinician workload and improving patient experience. For example, Ada Health uses advanced AI algorithms to guide patients through symptom checks and recommend next steps, while Babylon Health integrates AI virtual assistants with teleconsultations to support scalable, on-demand primary care delivery.

Restraint: Data privacy and security concerns

Concerns about data privacy, security, and compliance are major obstacles to the widespread adoption of AI-driven virtual health assistants. These tools often handle sensitive patient information, such as medical records, mental health details, and real-time health monitoring data. Unauthorized access or misuse of this information can cause serious legal and ethical problems. The World Health Organization emphasizes that data security remains a key challenge in digital health systems. More than 60% of countries lack comprehensive legal frameworks to protect electronic health data. Additionally, cyberattacks targeting healthcare organizations are increasing. A 2023 IBM Security report states that the healthcare sector has had the highest average costs for data breaches over the past 13 years, with each breach costing around USD 10.93 million.

Opportunity: Emerging markets and underserved populations

Emerging markets and underserved populations offer strong growth opportunities for AI-powered virtual medical assistants, as these solutions can scale healthcare access at low cost in regions with limited clinicians and infrastructure. Smartphone- and messaging-based AI assistants enable basic triage, health education, maternal care guidance, and disease awareness in local languages, improving reach in rural and low-income settings. For example, companies such as Amazon in January 2026, launched an AI health chatbot for One Medical members that uses medical records to answer health questions, guide care decisions, schedule appointments, and renew prescriptions

Challenge: Accountability and legal liability

A major challenge in the AI virtual medical assistants market is accountability and legal liability related to clinical decisions and patient interactions made by automated systems. Unlike traditional healthcare, where responsibility clearly lies with licensed professionals, using AI in patient-facing roles creates uncertainty in pinpointing fault if there is misdiagnosis, misinformation, or adverse outcomes. For example, if a virtual medical assistants offers an incorrect symptom assessment or delays escalation to a human clinician, it becomes difficult to determine whether liability falls on the software maker, healthcare facility, or provider.

AI IN VIRTUAL MEDICAL ASSISTANTS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

AI chatbots for patient queries, scheduling, reminders, voice-based clinical documentation | Reduces clinician admin burden; scalable, integrates with EHRs |

|

AI-powered virtual assistants for symptom triage, appointment scheduling, patient support, and care navigation, delivered via cloud and conversational AI | Lower operational costs, and seamless integration with digital health and telehealth workflows |

|

AI virtual assistants for patient support, follow-ups, and agent-assist during live interactions | Omnichannel engagement, consistent responses, faster issue resolution |

|

Conversational AI for booking, care coordination, prescription status, and reminders | Enhances digital patient engagement; reduces staff workload |

|

AI-powered symptom intake, virtual triage, scheduling, and telehealth visit support | Improves access to care, automates pre-visit workflows, clinician efficiency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI in Virtual Medical Assistants market ecosystem comprises established technology and healthcare leaders, innovative startups, major cloud service providers, and a broad base of healthcare end users. Key players (Microsoft, Verint Systems, Teladoc Health) and emerging startups (Sully AI, Medva) are driving innovation in conversational AI, virtual triage, and remote patient engagement, while cloud providers enable scalable, secure, and compliant deployment. Adoption by hospitals, clinics, and healthcare networks is accelerating, creating a collaborative ecosystem that supports end-to-end digital care delivery and continuous market expansion.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI in Virtual Medical Assistants Market, By Offering

In 2024, web-based platforms segment held the largest share for the AI in virtual medical assistants market, due to its easy deployment, cross-device accessibility, and smooth integration with EHR and hospital IT systems. Web-based solutions enable rapid scaling without complex installations, making them ideal for large healthcare networks. For example, Microsoft offers web-based AI healthcare assistants through its cloud platform, allowing providers to deliver patient support, scheduling, and clinical workflow automation via browsers and web portals.

AI in Virtual Medical Assistants Market, By Mode of Interaction

In 2024, text-based interaction held the largest share of the AI in virtual medical assistants market, driven by its simplicity, low cost, and widespread use across messaging apps and patient portals. Text-based assistants are widely used for symptom checking, appointment scheduling, medication reminders, and follow-ups. For example, Ada Health offers a text-based AI assistant that guides users through symptom assessment and care recommendations, making it highly scalable and accessible across regions.

AI in Virtual Medical Assistants Market, By Application

In 2024, clinical segment held the largest share for the AI in virtual medical assistants market. This growth is driven by rising demand for AI-powered virtual health assistants that improve patient management and clinical efficiency. These tools support symptom assessment, chronic care tracking, medication adherence, and post-treatment monitoring, helping clinicians make better decisions while reducing workload. When integrated with electronic health records, they enable more personalized care and efficient documentation. For example, Teladoc Health uses AI virtual assistants to support symptom intake and follow-up care within its telehealth platform.

AI in Virtual Medical Assistants Market, By End User

In 2024, healthcare providers held the largest share for the AI in virtual medical assistants market, driven by the growing adoption of advanced healthcare technologies to improve patient outcomes and operational efficiency. Hospitals and clinics are increasingly using electronic health records, AI-powered diagnostic tools, and virtual health assistants to streamline workflows, support clinical decision-making, and deliver personalized care. For example, Mayo Clinic leverages AI-enabled digital health solutions and integrated EHR systems to enhance patient engagement and optimize clinical operations across its hospital network.

REGION

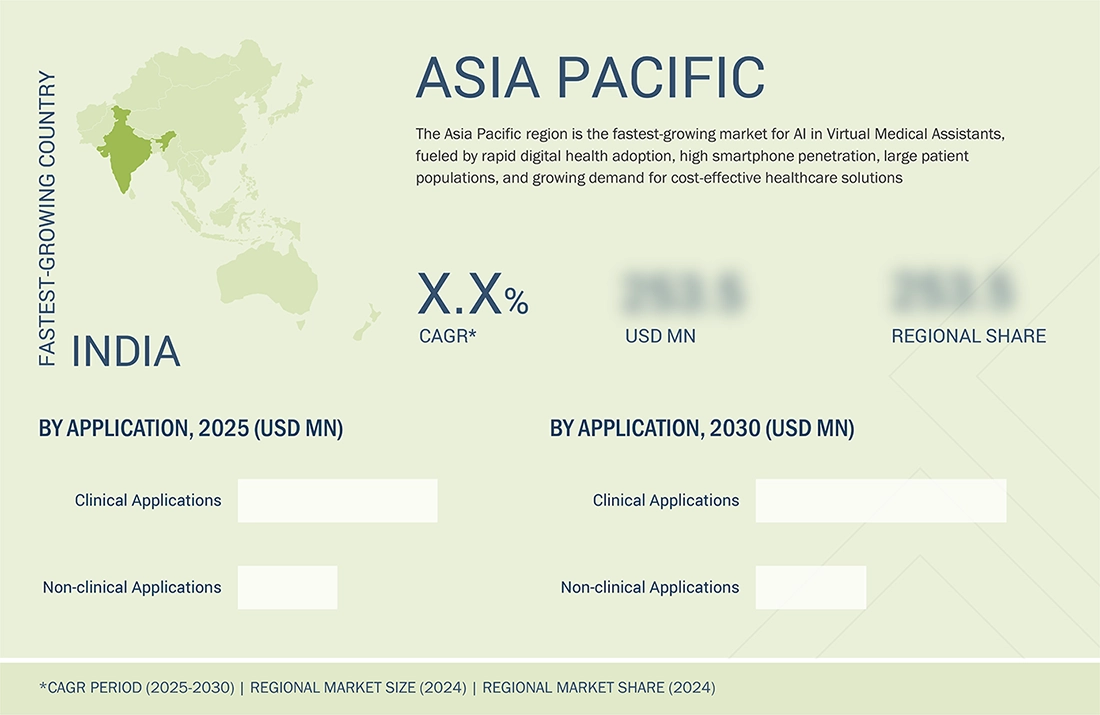

The Asia Pacific region is expected to be the fastest-growing region in the AI in Virtual Medical Assistants market in 2024.

Asia Pacific region is the fastest-growing region for AI in Virtual Medical Assistants market, driven by rapid digital health adoption, expanding smartphone penetration, large patient populations, and increasing government initiatives to improve healthcare access. Countries in the region are leveraging AI to address clinician shortages and rising healthcare demand. For example, Apollo Hospitals has adopted AI-driven virtual assistants and digital health platforms to support patient engagement, appointment management, and remote care across its hospital network.

AI IN VIRTUAL MEDICAL ASSISTANTS MARKET: COMPANY EVALUATION MATRIX

In the AI in Virtual Medical Assistants Market matrix, Teladoc Health (Star) leads with a strong market share and an extensive product footprint, driven by AI-driven virtual assistants for symptom intake, virtual triage, patient engagement, and post-visit follow-ups, improving care accessibility. Ada Health (Emerging Leader) driven by personalized, text-based interactions that help users understand symptoms, assess risk, and determine next steps in care.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Microsoft (US)

- Teladoc Health, Inc. (US)

- Amazon.com, Inc. (US)

- eGain Corporation (US)

- LivePerson (US)

- Infermedica (Poland)

- Teckel Medical (Spain)

- Fabric Labs (US)

- Movate (US)

- Feebris (UK)

- Healthtap, Inc. (US)

- ADA health (Germany)

- Buoy Health (US)

- Woebot Health (US)

- Wysa Ltd. (US)

- Well Health Technologies Corp. (Canada)

- Healthily (UK)

- Orbita, Inc. (US)

- Hyro AI Inc (US)

- Empower Health (US)

- Veradigm LLC (US)

- K Health (US)

- Salesforce, Inc. (US)

- Verint Systems (US)

- NiCE (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.32 Billion |

| Market Forecast in 2030 (value) | USD 8.85 Billion |

| Growth Rate | CAGR of 36.6% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

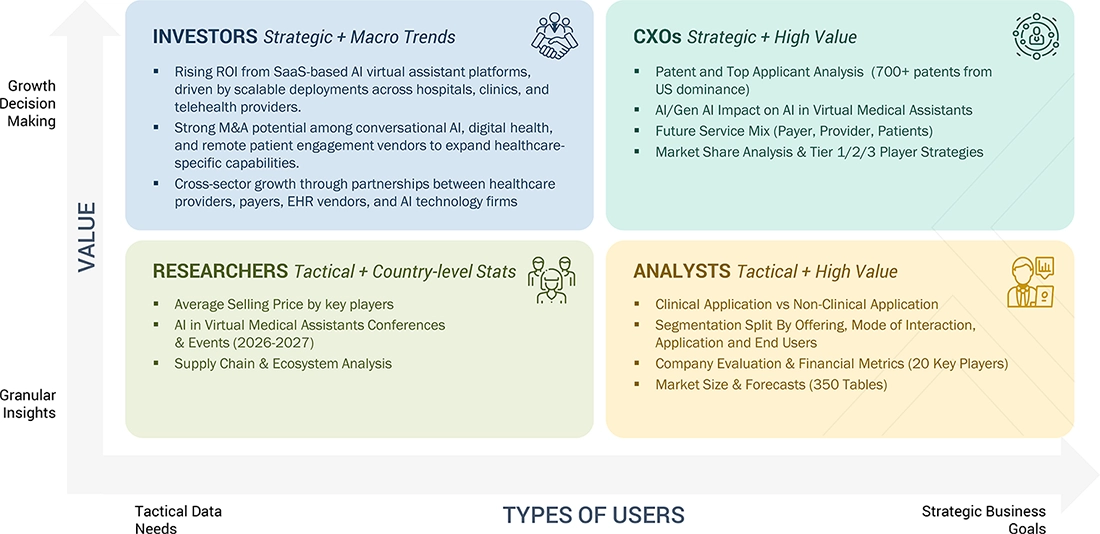

WHAT IS IN IT FOR YOU: AI IN VIRTUAL MEDICAL ASSISTANTS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Benchmarking of AI virtual assistant vendors by capabilities, use cases, deployment, and pricing. | Supports competitive benchmarking, vendor selection, partnership evaluation, and market positioning. |

| Regional Market Entry Strategy | Analysis of regulations, digital health readiness, and provider adoption by region. | Enables faster market entry, optimized go-to-market strategy, and regulatory alignment. |

RECENT DEVELOPMENTS

- May 2025 : Microsoft officially launched Dragon Copilot for US partners, integrating ambient clinical documentation, voice recognition, and generative AI to automate medical notetaking and streamline administrative workflows

- April 2025 : Fabric Labs launched concierge virtual care, a subscription-based, AI-powered virtual care platform featuring integrated lab testing, EMR connectivity, and asynchronous care support

- May 2024 : Microsoft collaborated with Wipro to launch a suite of generative AI-powered virtual assistants tailored for financial services. The virtual agents aim to enhance customer experience, automate complex service interactions, and support operational efficiency.

Table of Contents

Methodology

This market research study relied heavily on secondary sources, directories, and databases to gather information relevant to the technical, market-oriented, and financial analysis of the AI in virtual medical assistants market. In-depth interviews were carried out with key industry participants, subject-matter experts (SMEs), C-level executives of major market players, and industry consultants, among other specialists, to obtain and validate critical qualitative and quantitative data and to evaluate market prospects. The market size of AI in virtual medical assistants was estimated using various secondary research methods and cross-verified with primary research inputs to determine the final market size.

Secondary Research

The secondary research process involved extensive use of secondary sources, including directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some additional non-exclusive sources include the World Health Organization (WHO), the Organisation for Economic Co-operation and Development (OECD), Healthcare Information and Management Systems Society (HIMSS), Centers for Disease Control and Prevention (CDC), ClinicalTrials.gov, expert interviews, and MarketsandMarkets analysis. Secondary research was used to gather information suitable for the detailed, technical, market-focused, and commercial analysis of the AI in virtual medical assistants market. It was also employed to gather essential data about key players, market classification, and segmentation based on industry trends, down to the most granular level, as well as significant developments related to market and technology insights. A database of key industry leaders was also created using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. Primary sources mainly include industry experts from core and related industries, preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations involved in all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, such as key industry players, subject-matter experts (SMEs), C-level executives of major market companies, and industry consultants, among others, to obtain and verify critical qualitative and quantitative data as well as assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics, including drivers, restraints, opportunities, challenges, and strategies adopted by key players.

After completing the market engineering process, which included calculations for market statistics, market breakdowns, size estimates, forecasting, and data triangulation, extensive primary research was conducted. This research aimed to gather information and verify the key figures obtained during the market analysis. Furthermore, primary research was conducted to identify different types of market segmentation, analyze industry trends, evaluate the competitive landscape of AI in virtual medical assistants offered by various players, and understand key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies employed by leading market participants.

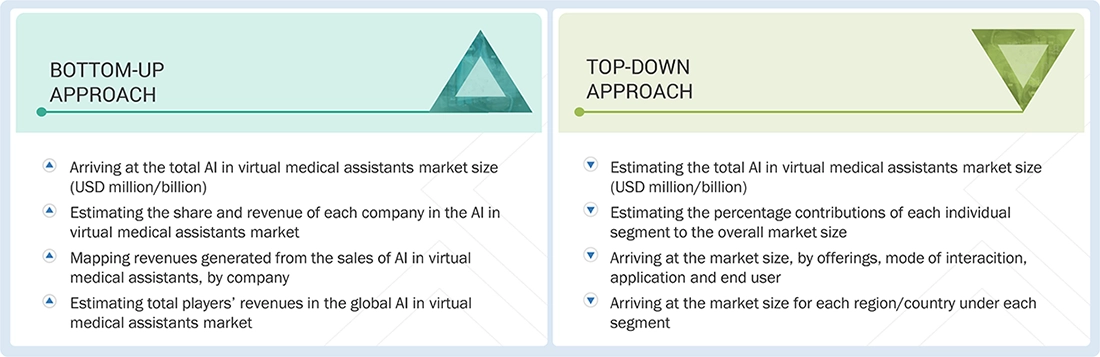

In the comprehensive market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to estimate and forecast the market for the overall segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was conducted on the entire market engineering process to identify key information and insights throughout the report.

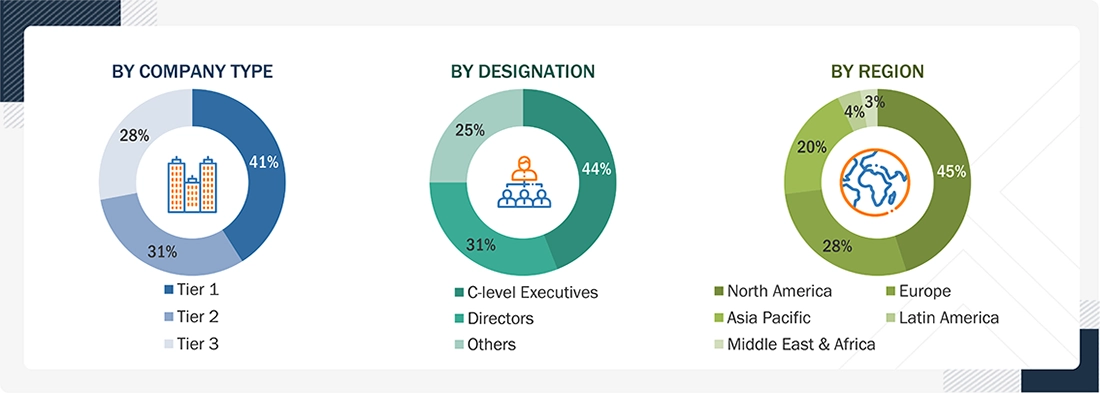

Breakdown of Primary Interviews

Note 1: Other designations include sales, marketing, and product managers.

Note 2: Tiers are defined based on a company’s total revenue, as of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and the top-down approach (assessment of utilization/adoption/penetration trends, by offering, mode of interaction, application, end user, and region).

Data Triangulation

After determining the overall market size using the process described above, the AI in virtual medical assistants market was segmented and subsegmented. Data triangulation and market breakdown methods were used whenever applicable to complete the entire market engineering process and obtain precise statistics for all segments and subsegments. The data was triangulated by analyzing various factors and trends from both the demand and supply sides in AI in virtual medical assistants market.

Market Definition

The AI in the virtual medical assistant market includes software solutions that use artificial intelligence to communicate with patients and healthcare providers via conversational interfaces. These assistants are designed to support a variety of healthcare tasks, including appointment scheduling, symptom assessment, medication reminders, chronic disease management, mental health support, and patient education. By integrating natural language processing (NLP), machine learning (ML), and predictive analytics, AI-powered VHAs improve patient engagement, streamline administrative processes, and increase access to care, especially for remote and underserved populations. These solutions can be implemented across multiple platforms, including mobile apps, websites, and smart devices, and are increasingly playing an important role in delivering digital, personalized healthcare services.

Key Stakeholders

- AI & VHA Technology Developers

- Healthcare Providers (Hospitals, Outpatient Settings, Telehealth Providers, Primary Care Centers, Mental Health Clinics, Long-term & Elder Care Facilities, Other Healthcare Providers)

- Payers & Insurers

- Patients & Caregivers

- Research & Development (R&D) Companies

- Business Research & Consulting Service Providers

- Medical Research Laboratories

- Academic Medical Centers/Universities/Hospitals/Research Institutes

- Regulatory Bodies (FDA, EMA, IAEA, etc.)

- AI & Algorithm Developers

- Technology Infrastructure Providers

- Venture Capitalists & Private Equity Firms

- Advocacy Groups & Professional Associations

- Investors & Financial Institutions

Report Objectives

- To define, describe, and forecast the AI in virtual medical assistants market by offering, mode of interaction, application, end user, and region

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall AI in virtual medical assistants market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the AI in virtual medical assistants market in five main regions (and their respective countries): North America, Europe, the Asia Pacific, the Middle East & Africa, and Latin America

- To provide key industry insights, such as ecosystem, value chain, technology, regulatory, patent, and the impact of the US tariff analysis

- To profile the key players in the market and comprehensively analyze their core competencies

- To track and analyze competitive developments, such as product launches & upgrades, collaborations, partnerships, acquisitions, investments, contracts, agreements, alliances, mergers, funding, and expansions of the leading players in the market

- To benchmark players within the market using the company evaluation matrix, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available customizations:

With the given market data, MarketsandMarkets offers customizations the company’s specific needs. The following customization options are available for the report:

GEOGRAPHIC ANALYSIS

- Further breakdown of the Rest of Europe AI in virtual medical assistants market into Sweden, Denmark, Norway, and others

- Further breakdown of the Rest of Asia Pacific AI in virtual medical assistants market into Australia, South Korea, Vietnam, Pakistan, New Zealand, Australia, South Korea, and others

- Further breakdown of the Rest of Latin America AI in virtual medical assistants market into Argentina, Chile, Colombia, and others

- Further breakdown of the Rest of Middle East & Africa AI in virtual medical assistants market into Egypt, Nigeria, Israel, and others.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI in Virtual Medical Assistants Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI in Virtual Medical Assistants Market