Hepatitis Testing Market / Diagnosis Market by Disease Type (Hepatitis B, Hepatitis C, Other Hepatitis), Technology (ELISA, RDT, PCR, INAAT), End User (Hospitals, Diagnostic Laboratories, Blood Banks), and Region - Global Forecast to 2026

Market Growth Outlook Summary

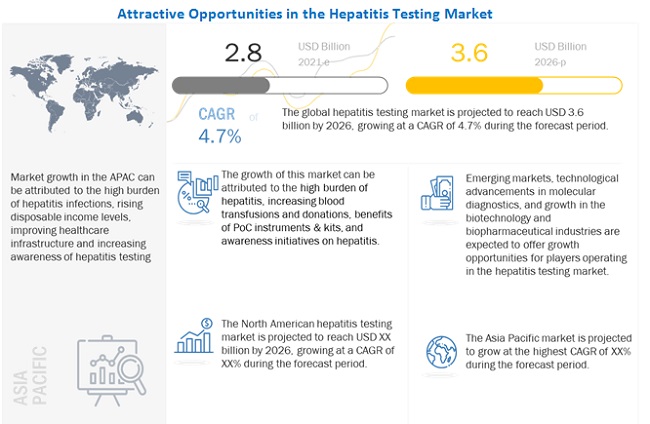

The global hepatitis testing market growth forecasted to transform from $2.8 billion in 2021 to $3.6 billion by 2026, driven by a CAGR of 4.7%. The growth of the global market is being driven by factors such as the high burden of hepatitis, increasing blood transfusion and donations, benefits of POC instruments and kits, and awareness initiatives on hepatitis. High cost of nucleic acid tests, lack of mandates for nucleic acid tests in developing countries and unfavorable reimbursement scenarios are expected to restrain hepatitis market growth. Emerging markets, rising technological advancements in molecular diagnostics, and growth in the biotechnology and biopharmaceutical industries are expected to offer strong growth opportunities for players in the market. In contrast, changing regulatory landscape, opertationsla barriers and shortage of skilled professionals may challenge market growth to a certain extent. The market is segmented based on disease type, technology, end user, and region.

Hepatitis Testing Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Upcoming Changes in the Hepatitis Testing Market Report

- Changes in the market scope: The current report includes the historical data for the market.

- New and improved representation of financial information: The new edition of the report provides updated financial information till 2020 (depending on availability) for each listed company in a graphical representation in a single diagram (instead of multiple tables). This will allow for the easy analysis of the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating country/region, and business segment focus in terms of the highest revenue-generating segment.

- Recent market developments: Recent developments help understand market trends and growth strategies adopted by players in the market. For instance, the number of product launches in this market has increased in the last three years (2018 to 2021).

- Latest product portfolio: The new edition of the report provides an updated product portfolio of the companies profiled in the report.

- Company profiles: Nine additional company profiles have been added (a total of 20 companies are profiled).

- Competitive leadership mapping: This edition of the report includes a comprehensive study of companies’ rankings and capabilities. The top vendors in the market have been evaluated in this section. A similar analysis has been conducted for start-ups/SMEs.

- COVID-19 impact: The current edition of the report covers the COVID-19 impact on the market. Additional points in the market overview section have been added, keeping in mind the impact of COVID-19 on the market.

Hepatitis Testing Market Dynamics

DRIVER: High burden of hepatitis

Hepatitis is a major public health concern with a high prevalence rate worldwide, despite significant improvements in treatment options, vaccination coverage, and public awareness. Of all the hepatitis types, B and C are the most prevalent and contribute toward higher mortality rates. In 2019, an estimated 296 million and 58 million people were living with chronic HBV and chronic HCV infection, respectively. In underdeveloped countries, the prevalence of hepatitis is high as compared to developed countries

RESTRAINT: Lack of mandates for nucleic acid tests in developing countries

In developing and low-resource countries, NAT is not mandatory due to the expensive nature of this test and the requirement of skilled personnel. In India, by 2016, only 58 out of a total of 2,550 (~2%) blood banks performed NAT for hepatitis diagnosis. In many developing countries such as India and China, ELISA is the only mandatory test, which acts as a major inhibitor for the adoption of NAT. In India, blood screening involves serological testing for hepatitis surface antigens; however, there are no mandates for using NAT. As a result, there is a lack of clarity about results among people undergoing hepatitis diagnostic tests, which acts as a restraint for market growth.

OPPORTUNITY: Growth in biotechnology and biopharmaceutical industries

The demand for immunoassay instruments and consumables is high in the biotechnology and biopharmaceutical industries. As a result, the growth of these industries is expected to support the growth of the market during the forecast period. In these industries, the growth of the end-user base has compelled many companies to launch new products and invest in developing advanced products. This is considered a positive indicator for market growth as immunoassays are applied at many stages— from product development and manufacturing to quality control—in production.

CHALLENGE: Operational barriers

Clinical laboratories across major markets are still evolving; technicians face operational challenges in ensuring effective sample procurement, storage, and transportation, especially while adopting novel technologies such as NGS and lab-on-a-chip PCR devices. Laboratory space also needs to be reconfigured to meet the requirements of conducting specific molecular diagnostic tests used for pathogen detection as a means of avoiding cross-contamination and ensuring efficient time management. This results in considerable cost escalation to maintain and operate advanced molecular diagnostic instruments, particularly those capable of handling a single sample type. Furthermore, due to the rapid mutation of microbes and the increasing outbreak of epidemics, clinical laboratories need to adopt innovative technologies capable of rapid sample diagnosis. However, the shortage of skilled and technically knowledgeable laboratory technicians to operate advanced hepatitis testing products has hindered their overall adoption, particularly in emerging markets.

Hepatitis B segment dominated the Hepatitis testing industry in 2020.

Based on disease type, the hepatitis testing market is segmented into hepatitis B, hepatitis C, and other hepatitis diseases (hepatitis A, D, and E). The hepatitis B segment accounted for the largest share of the market in 2020. Factors such as the rising prevalence of hepatitis B, availability of a large number of hepatitis B diagnostic tests, and the increasing adoption of nucleic acid tests for HBV diagnosis are driving the growth of this market segment.

The ELISA segment of hepatitis testing industry, to witness the highest market share during the forecast period.

Based on technology, the hepatitis testing market is segmented into enzyme-linked immunosorbent assay (ELISA), rapid diagnostic tests, polymerase chain reaction (PCR), isothermal nucleic acid amplification technology (INAAT), and other technologies (such as sequencing, mass spectrometry, and western blotting). The ELISA segment accounted for the largest share of the market in 2020. The large share of this segment can primarily be attributed to the wide acceptance of this test in clinical practices to diagnose hepatitis.

North America was the largest regional market for hepatitis testing industry in 2020.

The global hepatitis testing market is segmented into North America (the US and Canada), Europe (Germany, the UK, and the Rest of Europe), Asia Pacific, and Rest of the World. In 2020, North America dominates the global market, and this trend is expected to continue during the forecast period. The large share and high growth of this region can be attributed to the rising prevalence of hepatitis and increased research and clinical trials for hepatitis testing in the US.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players operating in this market include Abbott Laboratories (US), F. Hoffmann La Roche Ltd. (Switzerland), and Siemens Healthineers AG (Germany).

Scope of the Hepatitis Testing Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$2.8 billion |

|

Projected Revenue Size by 2026 |

$3.6 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 4.7% |

|

Market Driver |

High burden of hepatitis |

|

Market Opportunity |

Growth in biotechnology and biopharmaceutical industries |

This report categorizes the hepatitis testing market to forecast revenue and analyze trends in each of the following submarkets:

By Disease Type

- Hepatitis B (HBV)

- Hepatitis C (HCV)

- Other Hepatitis Diseases

By Technology

- Enzyme-linked Immunosorbent Assay (ELISA)

- Rapid Diagnostic Tests (RDT)

- Polymerase Chain Reaction (PCR)

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- Other Technologies

By End User

- Hospital & Diagnostic Laboratories

- Blood Banks

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- Rest of Europe

- Asia Pacific

- Rest of the World

Recent Developments of Hepatitis Testing Industry:

- In 2021, Abbott received FDA Emergency Use Authorization (EUA) for the Alinity m Resp-4-Plex assay.

- In 2021, F.Hoffmann-La Roche Ltd. acquired GenMark Diagnostics (US) which aimed at adding more products to Roche’s molecular diagnostics portfolio and the global distribution of products offered by GenMark Diagnostics.

- In 2021, Bio-Rad Laboratories, Inc. partnered with Seegene, Inc. (South Korea). The partnership aims at collaborative development and the commercialization of infectious disease diagnostic products.

- In 2020, Vela Diagnostics launched an NGS-based test used in the detection of HIV-1, HCV, HBV, and CMV.

Frequently Asked Questions (FAQ):

What is the projected market value of the global hepatitis testing market?

The global market of hepatitis testing is projected to reach USD 3.6 billion.

What is the estimated growth rate (CAGR) of the global hepatitis testing market for the next five years?

The global hepatitis testing market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.7% from 2021 to 2026.

What are the major revenue pockets in the hepatitis testing market currently?

The global market is segmented into North America (the US and Canada), Europe (Germany, the UK, and the Rest of Europe), Asia Pacific, and Rest of the World. In 2020, North America dominates the global market, and this trend is expected to continue during the forecast period. The large share and high growth of this region can be attributed to the rising prevalence of hepatitis and increased research and clinical trials for hepatitis testing in the US.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

FIGURE 1 HEPATITIS TESTING MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key industry insights

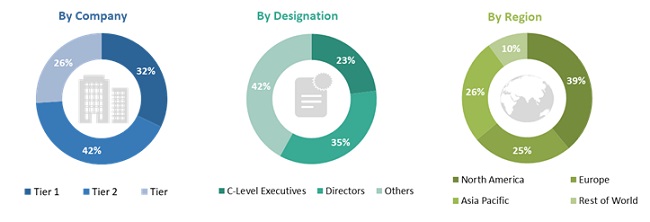

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.1 GROWTH FORECAST

FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 7 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.5.1 COVID-19-SPECIFIC ASSUMPTIONS

2.6 LIMITATIONS

2.7 RISK ASSESSMENT

2.8 COVID-19 ECONOMIC ASSESSMENT

2.9 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 9 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 10 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 11 HEPATITIS TESTING MARKET, BY DISEASE TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 12 HEPATITIS TESTING INDUSTRY, BY TECHNOLOGY, 2021 VS. 2026 (USD MILLION)

FIGURE 13 HEPATITIS TESTING INDUSTRY, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 14 HEPATITIS TESTING INDUSTRY, BY REGION, 2021 VS. 2026 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 HEPATITIS TESTING MARKET OVERVIEW

FIGURE 15 HIGH BURDEN OF HEPATITIS TO DRIVE MARKET GROWTH

4.2 MARKET, BY TECHNOLOGY (2021–2026)

FIGURE 16 RAPID DIAGNOSTIC TESTS SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 NORTH AMERICA: MARKET, BY DISEASE TYPE AND COUNTRY (2020)

FIGURE 17 THE US ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2020

4.4 HEPATITIS TESTING INDUSTRY: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 ASIA PACIFIC TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

FIGURE 19 HEPATITIS TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 High burden of hepatitis

TABLE 1 HEPATITIS PREVALENCE, BY REGION, 2019 (MILLION)

5.2.1.2 Increasing blood transfusion and donations

TABLE 2 AVERAGE PREVALENCE OF HEPATITIS INFECTION IN BLOOD DONATIONS, BY INCOME GROUP

5.2.1.3 Benefits of POC instruments and kits

5.2.1.4 Awareness initiatives on hepatitis

5.2.2 RESTRAINTS

5.2.2.1 High cost of nucleic acid tests

5.2.2.2 Lack of mandates for nucleic acid tests in developing countries

5.2.2.3 Unfavorable reimbursement scenario

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets

5.2.3.2 Rising technological advancements in molecular diagnostics

5.2.3.3 Growth in the biotechnology and biopharmaceutical industries

5.2.4 CHALLENGES

5.2.4.1 Changing regulatory landscape

5.2.4.2 Operational barriers

5.2.4.3 Shortage of skilled professionals

5.3 COVID-19 IMPACT ON THE MARKET

6 HEPATITIS TESTING MARKET, BY DISEASE TYPE (Page No. - 55)

6.1 INTRODUCTION

TABLE 3 HEPATITIS TESTING INDUSTRY, BY DISEASE TYPE, 2018–2020 (USD MILLION)

TABLE 4 MARKET, BY DISEASE TYPE, 2021–2026 (USD MILLION)

6.2 HEPATITIS B (HBV)

6.2.1 HEPATITIS B SEGMENT TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

TABLE 5 HEPATITIS B CHRONIC INFECTIONS IN THE WESTERN PACIFIC REGION, 2019

TABLE 6 HEPATITIS B TESTING MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 7 HEPATITIS B TESTING MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 8 NORTH AMERICA: HEPATITIS B TESTING MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 9 NORTH AMERICA: HEPATITIS B TESTING MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 10 EUROPE: HEPATITIS B TESTING MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 11 EUROPE: HEPATITIS B TESTING MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

6.3 HEPATITIS C (HCV)

6.3.1 GOVERNMENT INITIATIVES FOR SUPPORTING HCV DIAGNOSIS TO DRIVE MARKET GROWTH

TABLE 12 HEPATITIS C CHRONIC INFECTIONS IN THE WESTERN PACIFIC REGION, 2019

TABLE 13 HEPATITIS C TESTING MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 14 HEPATITIS C TESTING MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 15 NORTH AMERICA: HEPATITIS C TESTING MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 16 NORTH AMERICA: HEPATITIS C TESTING MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 17 EUROPE: HEPATITIS C TESTING MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 18 EUROPE: HEPATITIS C TESTING MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

6.4 OTHER HEPATITIS DISEASES

TABLE 19 REP0RTED HEPATITIS A CASES IN THE US SINCE 2016

TABLE 20 OTHER HEPATITIS DISEASE TESTING MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 21 OTHER HEPATITIS DISEASE TESTING MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 22 NORTH AMERICA: OTHER HEPATITIS DISEASE TESTING MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 23 NORTH AMERICA: OTHER HEPATITIS DISEASE TESTING MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 24 EUROPE: OTHER HEPATITIS DISEASE TESTING MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 25 EUROPE: OTHER HEPATITIS DISEASE TESTING MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

7 HEPATITIS TESTING MARKET, BY TECHNOLOGY (Page No. - 65)

7.1 INTRODUCTION

TABLE 26 HEPATITIS TESTING INDUSTRY, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 27 MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

7.2 ENZYME-LINKED IMMUNOSORBENT ASSAY (ELISA)

7.2.1 ELISA IS WIDELY USED FOR THE DETECTION OF HEPATITIS

TABLE 28 MARKET FOR ELISA, BY REGION, 2018–2020 (USD MILLION)

TABLE 29 MARKET FOR ELISA, BY REGION, 2021–2026 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET FOR ELISA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET FOR ELISA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 32 EUROPE: MARKET FOR ELISA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 33 EUROPE: MARKET FOR ELISA, BY COUNTRY, 2021–2026 (USD MILLION)

7.3 RAPID DIAGNOSTIC TESTS (RDT)

7.3.1 RAPID TESTS ARE HIGHLY USEFUL IN COUNTRIES WITH LIMITED ACCESSIBILITY TO SOPHISTICATED TECHNOLOGIES

TABLE 34 MARKET FOR RAPID DIAGNOSTIC TESTS, BY REGION, 2018–2020 (USD MILLION)

TABLE 35 MARKET FOR RAPID DIAGNOSTIC TESTS, BY REGION, 2021–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET FOR RAPID DIAGNOSTIC TESTS, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET FOR RAPID DIAGNOSTIC TESTS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 38 EUROPE: MARKET FOR RAPID DIAGNOSTIC TESTS, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 39 EUROPE: MARKET FOR RAPID DIAGNOSTIC TESTS, BY COUNTRY, 2021–2026 (USD MILLION)

7.4 POLYMERASE CHAIN REACTION (PCR)

7.4.1 PCR TECHNOLOGY IS USED IN CONFIRMATORY TESTS FOR HEPATITIS DIAGNOSIS

TABLE 40 MARKET FOR POLYMERASE CHAIN REACTION, BY REGION, 2018–2020 (USD MILLION)

TABLE 41 MARKET FOR POLYMERASE CHAIN REACTION, BY REGION, 2021–2026 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET FOR POLYMERASE CHAIN REACTION, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET FOR POLYMERASE CHAIN REACTION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 44 EUROPE: MARKET FOR POLYMERASE CHAIN REACTION, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 45 EUROPE: MARKET FOR POLYMERASE CHAIN REACTION, BY COUNTRY, 2021–2026 (USD MILLION)

7.5 ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGY (INAAT)

7.5.1 COST-BENEFITS OF INAAT ARE DRIVING THE GROWTH OF THIS MARKET SEGMENT

TABLE 46 MARKET FOR INAAT, BY REGION, 2018–2020 (USD MILLION)

TABLE 47 MARKET FOR INAAT, BY REGION, 2021–2026 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET FOR INAAT, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET FOR INAAT, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 50 EUROPE: MARKET FOR INAAT, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 51 EUROPE: MARKET FOR INAAT, BY COUNTRY, 2021–2026 (USD MILLION)

7.6 OTHER TECHNOLOGIES

TABLE 52 MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2018–2020 (USD MILLION)

TABLE 53 MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2021–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 56 EUROPE: MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 57 EUROPE: MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021–2026 (USD MILLION)

8 HEPATITIS TESTING MARKET, BY END USER (Page No. - 80)

8.1 INTRODUCTION

TABLE 58 HEPATITIS TESTING INDUSTRY, BY END USER, 2018–2020 (USD MILLION)

TABLE 59 MARKET, BY END USER, 2021–2026 (USD MILLION)

8.2 HOSPITAL & DIAGNOSTIC LABORATORIES

8.2.1 HOSPITAL & DIAGNOSTIC LABORATORIES ARE THE LARGEST END USERS OF HEPATITIS TESTING PRODUCTS

TABLE 60 MARKET FOR HOSPITAL & DIAGNOSTIC LABORATORIES, BY REGION, 2018–2020 (USD MILLION)

TABLE 61 MARKET FOR HOSPITAL & DIAGNOSTIC LABORATORIES, BY REGION, 2021–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET FOR HOSPITAL & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET FOR HOSPITAL & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 64 EUROPE: MARKET FOR HOSPITAL & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 65 EUROPE: MARKET FOR HOSPITAL & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2021–2026 (USD MILLION)

8.3 BLOOD BANKS

8.3.1 INCREASING NUMBER OF BLOOD DONATIONS TO DRIVE THE GROWTH OF THIS MARKET SEGMENT

TABLE 66 MARKET FOR BLOOD BANKS, BY REGION, 2018–2020 (USD MILLION)

TABLE 67 MARKET FOR BLOOD BANKS, BY REGION, 2021–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET FOR BLOOD BANKS, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET FOR BLOOD BANKS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 70 EUROPE: MARKET FOR BLOOD BANKS, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 71 EUROPE: MARKET FOR BLOOD BANKS, BY COUNTRY, 2021–2026 (USD MILLION)

8.4 OTHER END USERS

TABLE 72 MARKET FOR OTHER END USERS, BY REGION, 2018–2020 (USD MILLION)

TABLE 73 MARKET FOR OTHER END USERS, BY REGION, 2021–2026 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET FOR OTHER END USERS, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 76 EUROPE: MARKET FOR OTHER END USERS, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 77 EUROPE: MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2026 (USD MILLION)

9 HEPATITIS TESTING MARKET, BY REGION (Page No. - 89)

9.1 INTRODUCTION

TABLE 78 GLOBAL: HEPATITIS TESTING INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 79 GLOBAL: HEPATITIS TESTING INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 20 NORTH AMERICA: HEPATITIS TESTING MARKET SNAPSHOT

TABLE 80 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY DISEASE TYPE, 2018–2020 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY DISEASE TYPE, 2021–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 87 NORTH AMERICA: HEPATITIS TESTING MARKET, BY END USER, 2021–2026 (USD MILLION)

9.2.1 US

9.2.1.1 High healthcare expenditure to drive market growth in the US

TABLE 88 US: NUMBER OF HEPATITIS A CASES REPORTED, 2015 VS. 2019

TABLE 89 HEPATITIS A PREVALENCE RATE PER 100,000 POPULATION IN THE US, 2013–2017

TABLE 90 US: KEY MACROINDICATORS

TABLE 91 US: HEPATITIS TESTING MARKET, BY DISEASE TYPE, 2018–2020 (USD MILLION)

TABLE 92 US: MARKET, BY DISEASE TYPE, 2021–2026 (USD MILLION)

TABLE 93 US: MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 94 US: MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 95 US: HEPATITIS TESTING INDUSTRY, BY END USER, 2018–2020 (USD MILLION)

TABLE 96 US: HEPATITIS TESTING MARKET, BY END USER, 2021–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Favorable government initiatives are expected to boost market growth in Canada

TABLE 97 CANADA: KEY MACROINDICATORS

TABLE 98 CANADA: HEPATITIS TESTING MARKET, BY DISEASE TYPE, 2018–2020 (USD MILLION)

TABLE 99 CANADA: MARKET, BY DISEASE TYPE, 2021–2026 (USD MILLION)

TABLE 100 CANADA: MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 101 CANADA: MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 102 CANADA: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 103 CANADA: HEPATITIS TESTING MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3 EUROPE

TABLE 104 NUMBER OF HEPATITIS B CASES IN EUROPE, BY COUNTRY, 2014–2018

TABLE 105 EUROPE: HEPATITIS TESTING MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY DISEASE TYPE, 2018–2020 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY DISEASE TYPE, 2021–2026 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 111 EUROPE: HEPATITIS TESTING INDUSTRY, BY END USER, 2018–2020 (USD MILLION)

TABLE 112 EUROPE: HEPATITIS TESTING MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Increasing demand for advanced diagnostic technologies to drive market growth in Germany

TABLE 113 GERMANY: KEY MACROINDICATORS

TABLE 114 GERMANY: HEPATITIS TESTING MARKET, BY DISEASE TYPE, 2018–2020 (USD MILLION)

TABLE 115 GERMANY: MARKET, BY DISEASE TYPE, 2021–2026 (USD MILLION)

TABLE 116 GERMANY: MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 117 GERMANY: MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 118 GERMANY: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 119 GERMANY: HEPATITIS TESTING MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3.2 UK

9.3.2.1 Increasing number of clinical laboratories to drive market growth in the UK

TABLE 120 NUMBER OF HEPATITIS C CASES REPORTED IN ENGLAND AND WALES, 2008–2018

TABLE 121 UK: KEY MACROINDICATORS

TABLE 122 UK: HEPATITIS TESTING MARKET, BY DISEASE TYPE, 2018–2020 (USD MILLION)

TABLE 123 UK: MARKET, BY DISEASE TYPE, 2021–2026 (USD MILLION)

TABLE 124 UK: MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 125 UK: MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 126 UK: HEPATITIS TESTING INDUSTRY, BY END USER, 2018–2020 (USD MILLION)

TABLE 127 UK: HEPATITIS TESTING MARKET, BY END USER, 2021–2026 (USD MILLION)

9.3.3 REST OF EUROPE

TABLE 128 ROE: HEALTHCARE EXPENDITURE, BY COUNTRY, 2010 VS. 2018 (% OF GDP)

TABLE 129 ROE: HEPATITIS TESTING MARKET, BY DISEASE TYPE, 2018–2020 (USD MILLION)

TABLE 130 ROE: MARKET, BY DISEASE TYPE, 2021–2026 (USD MILLION)

TABLE 131 ROE: MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 132 ROE: MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 133 ROE: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 134 ROE: HEPATITIS TESTING MARKET, BY END USER, 2021–2026 (USD MILLION)

9.4 ASIA PACIFIC

9.4.1 HIGH PREVALENCE OF HEPATITIS TO BOOST MARKET GROWTH

TABLE 135 ASIA PACIFIC: ESTIMATED PREVALENCE OF CHRONIC HBV AND HCV

TABLE 136 ASIA PACIFIC: COST COVERAGE FOR THE DIAGNOSIS OF CHRONIC VIRAL HEPATITIS

FIGURE 21 ASIA PACIFIC: HEPATITIS TESTING MARKET SNAPSHOT

TABLE 137 CHINA: KEY MACROINDICATORS

TABLE 138 JAPAN: KEY MACROINDICATORS

TABLE 139 INDIA: KEY MACROINDICATORS

TABLE 140 ASIA PACIFIC: HEPATITIS TESTING MARKET, BY DISEASE TYPE, 2018–2020 (USD MILLION)

TABLE 141 ASIA PACIFIC: HEPATITIS TESTING INDUSTRY, BY DISEASE TYPE, 2021–2026 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 145 ASIA PACIFIC: HEPATITIS TESTING MARKET, BY END USER, 2021–2026 (USD MILLION)

9.5 REST OF THE WORLD

9.5.1 LESS-STRINGENT REGULATIONS FOR DIAGNOSTIC PRODUCTS TO DRIVE MARKET GROWTH

TABLE 146 REST OF THE WORLD: HEPATITIS TESTING MARKET, BY DISEASE TYPE, 2018–2020 (USD MILLION)

TABLE 147 REST OF THE WORLD: MARKET, BY DISEASE TYPE, 2021–2026 (USD MILLION)

TABLE 148 REST OF THE WORLD: MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 149 REST OF THE WORLD: MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 150 REST OF THE WORLD: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 151 REST OF THE WORLD: HEPATITIS TESTING MARKET, BY END USER, 2021–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 123)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 152 OVERVIEW OF STRATEGIES ADOPTED BY KEY HEPATITIS TESTING MARKET PLAYERS

10.3 MARKET SHARE ANALYSIS

FIGURE 22 MARKET SHARE ANALYSIS, 2020

TABLE 153 HEPATITIS TESTING INDUSTRY: DEGREE OF COMPETITION (2020)

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 23 HEPATITIS TESTING INDUSTRY: COMPANY EVALUATION QUADRANT (2020)

10.5 COMPANY EVALUATION QUADRANT: SMES/START-UPS

10.5.1 PROGRESSIVE COMPANIES

10.5.2 STARTING BLOCKS

10.5.3 RESPONSIVE COMPANIES

10.5.4 DYNAMIC COMPANIES

FIGURE 24 HEPATITIS TESTING INDUSTRY: COMPANY EVALUATION QUADRANT FOR SMES & START-UPS (2020)

10.6 COMPETITIVE SCENARIO

10.6.1 PRODUCT LAUNCHES & APPROVALS

TABLE 154 PRODUCT LAUNCHES & APPROVALS

10.6.2 DEALS

TABLE 155 DEALS

10.6.3 OTHER DEVELOPMENTS

TABLE 156 OTHER DEVELOPMENTS

10.7 COMPANY FOOTPRINT ANALYSIS

TABLE 157 TECHNOLOGY, DISEASE TYPE, AND REGIONAL FOOTPRINT OF COMPANIES

TABLE 158 TECHNOLOGY FOOTPRINT OF COMPANIES

TABLE 159 DISEASE TYPE FOOTPRINT OF COMPANIES

TABLE 160 REGIONAL FOOTPRINT OF COMPANIES

11 COMPANY PROFILE (Page No. - 135)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

11.1.1 ABBOTT LABORATORIES

TABLE 161 ABBOTT LABORATORIES: BUSINESS OVERVIEW

FIGURE 25 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2020)

11.1.2 F. HOFFMANN-LA ROCHE LTD.

TABLE 162 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

FIGURE 26 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2020)

11.1.3 BIO-RAD LABORATORIES, INC.

TABLE 163 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

FIGURE 27 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2020)

11.1.4 SIEMENS HEALTHINEERS AG

TABLE 164 SIEMENS HEALTHINEERS AG: BUSINESS OVERVIEW

FIGURE 28 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2020)

11.1.5 DIASORIN S.P.A

TABLE 165 DIASORIN S.P.A: BUSINESS OVERVIEW

FIGURE 29 DIASORIN S.P.A.: COMPANY SNAPSHOT (2020)

11.1.6 QIAGEN

TABLE 166 QIAGEN: BUSINESS OVERVIEW

FIGURE 30 QIAGEN: COMPANY SNAPSHOT (2020)

11.1.7 DANAHER CORPORATION

TABLE 167 DANAHER CORPORATION: BUSINESS OVERVIEW

FIGURE 31 DANAHER CORPORATION: COMPANY SNAPSHOT (2020)

11.1.8 GRIFOLS, S.A.

TABLE 168 GRIFOLS, S.A.: BUSINESS OVERVIEW

FIGURE 32 GRIFOLS, S.A.: COMPANY SNAPSHOT (2020)

11.1.9 BIOMÉRIEUX SA

TABLE 169 BIOMÉRIEUX SA: BUSINESS OVERVIEW

FIGURE 33 BIOMÉRIEUX SA: COMPANY SNAPSHOT (2020)

11.1.10 ORTHO CLINICAL DIAGNOSTICS

TABLE 170 ORTHO CLINICAL DIAGNOSTICS: BUSINESS OVERVIEW

FIGURE 34 ORTHO CLINICAL DIAGNOSTICS: COMPANY SNAPSHOT (2020)

11.2 OTHER PLAYERS

11.2.1 FUJIREBIO US, INC.

11.2.2 ORASURE TECHNOLOGIES

11.2.3 EPITOPE DIAGNOSTICS

11.2.4 TRIVITRON HEALTHCARE

11.2.5 MERIL LIFE SCIENCES PVT. LTD.

11.2.6 GENMARK DIAGNOSTICS INC.

11.2.7 VELA DIAGNOSTICS

11.2.8 MOLBIO DIAGNOSTICS PVT. LTD.

11.2.9 GENEOMBIO TECHNOLOGIES PVT. LTD.

11.2.10 MEDMIRA INC.

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 174)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the hepatitis testing market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the hepatitis testing market. The secondary sources used for this study include World Health Organization, World Bank, Centers for Disease Control and Prevention, National Institutes of Health, National Center for Biotechnology Information, United States Department of Health & Human Services (HHS), Association of State and Territorial Health Officials, Association of Asian Pacific Community Health Organizations (AAPCHO), European Diagnostic Manufacturers Association (EDMA), Food and Drug Administration (FDA), Annual Reports, SEC Filings, Expert Interviews, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the hepatitis testing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the hepatitis testing business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the hepatitis testing market by disease type, technology, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions, namely, North America, Europe, the Asia Pacific (APAC), and the Rest of the World (RoW)

- To profile the key market players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions; product developments; partnerships, agreements, and collaborations; and expansions in the hepatitis testing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hepatitis Testing Market