Herbicides Safener Market by Type (Benoxacor, Furilazole, Dichlormid, Isoxadifen), Crop (Corn, Soybean, Wheat, Sorghum, Barley, Rice), Herbicide Selectivity, Herbicide Application Stage (Post-emergence, Pre-emergence) & Region - Global Forecast to 2027

[276 Pages Report] The market for Herbicides safener is estimated at USD 1.1 billion in 2022; it is projected to grow at a CAGR of 7.5% to reach USD 1.6 billion by 2027.The effects of herbicide-treated crops on human health and the environment form a major factor expected to affect the growth of the herbicides and herbicide safeners market across the globe during the forecast period. Many countries, particularly the European Union and North America, are developing stringent regulatory frameworks to keep herbicide usage in check. Thus, there is a growing need to develop sustainable herbicide and safener combinations to address the issue of toxicity of herbicides, which could serve as a new product development opportunity in the herbicide safeners market.

To know about the assumptions considered for the study, Request for Free Sample Report

Herbicides safener Market Dynamics

Driver: Increase in instances of herbicide-induced crop damage

Herbicide safeners can selectively protect crop plants from herbicide damage, while not reducing herbicide activity on unwanted and ubiquitous weed species. Certain safeners are used commercially to improve the herbicide selectivity between crop and weed species, which can either be applied along with the herbicide as a mixture or as a seed treatment to the crop seed. Research conducted by IACR-Long Ashton Research Station in the UK inferred that the plants treated with a seed-dressing of the herbicide safener, naphthalic anhydride (NA), before applying herbicide suffered less damage as compared to the plants grown from untreated seed.

Herbicide safeners are essentially applied in the pre/post-emergence treatment of crops to obtain better results in terms of yield and quality. Thus, the increasing instances and rising awareness of herbicide damage to the crop are likely to fuel the demand for herbicide safener-based formulations..

Restraint: Issues related to herbicide residue

Herbicide breakdown requires sufficient time, moisture, and temperature in the soil to support the growth of microbes that degrade herbicide compounds. Some herbicides break down fast or are firmly bound to the soil, preventing them from causing problems for crops grown the following season. Other herbicides take longer to decompose, and as a result, they can last for seasons after they have been applied. These residues can injure sensitive crops grown in subsequent seasons. Herbicides with restricted recropping options are referred to as residual herbicides.

Herbicide residues can cause serious damage to the plants if not carefully monitored and controlled. Each country or region specifies the Maximum Residue Limit (MRL) that the plant protection product can have on the final food crop. Farmers regularly spray herbicides such as glyphosate on oat, wheat, and barley crops as a desiccant to dry out crops, so as to speed up the harvesting process. A lawsuit was filed against Quaker Oats, a brand owned by PepsiCo, over glyphosate traces. The company stated that herbicides were not used during the milling process. Farmers use herbicides for certain grains before harvesting, causing the food items to contain residues; hence, the residue issue was present when the crop was harvested. This restricts the use of herbicides, in turn, their safeners.

Opportunity: Development of safener combinations for biologically derived herbicides

Formulated bioherbicides typically contain the active ingredient, which is the living biotic agent, a carrier, and adjuvants that may contain nutrients and other substances to nurture the agent, act as a protectant during exposure to adverse environmental conditions, aid in host infection, and support optimum weed control efficacy, Natural herbicides have several advantages over chemical herbicides, such as high selectivity and low side effects in non-target organisms. They normally do not leave residues and present a low number of cases that show signs of resistance.

Biological weed control utilizes natural enemies, natural substances, or biotic agents to suppress the germination and growth of weed populations to an economical threshold level. Many new environmentally friendly products for controlling pests, including weeds, have become available as a result of the growing public demand for safe green products. Bioherbicides developed from plant extracts, phytopathogenic microorganisms, or microbial phytotoxins (i.e., mycoherbicides) are a useful approach to weed control. They usually do not possess persistent characteristics, which means they do not stay active in the environment for long periods of time, are less likely to contaminate soil and water, and have no adverse effects on non-target organisms.

Challenge: Lack of awareness and technical expertise, and low adoption rate

There have been several pieces of evidence that prove the efficacy and selectivity of safeners in herbicide formulations. Stakeholders such as crop protectant companies, the research fraternity, and plant breeders have taken leverage on the importance of these herbicide safener compositions at the farm level. However, the production of herbicide-safener combinations is expensive for manufacturers at the factory level as the cost of production increases, which becomes unaffordable for farmers. It is estimated that about 10% of the herbicides produced have herbicide safener composition for an effective application.

Additionally, there is a lack of awareness among growers, especially farmers, regarding the use of herbicide safeners, who spend a lot on crop protection products and other materials. Despite spending so much, they face the damages/losses incurred due to herbicide injury in the form of quality and yield losses.

The Benoxacor segment is projected to account for the highest CAGR growth in the Herbicides safener market.

Benoxacor herbicide safeners are used in the majority of herbicides available on the market. Furthermore, benoxacor is primarily used on corn, soybeans, and sorghum crops. Benoxacor is a safener mostly compatible with selective herbicides and extensively used for both pre- and post-emergent application methods. Benoxacor is an herbicide safener used with metolachlor.

The Pre-emergence segment, by herbicide application is projected to account for the fastest growth during the forecast period.

Pre-emergence herbicides prevent germinated weed seedlings from establishing themselves by inhibiting root, shoot, or both growths. To be effective, the herbicide must be integrated into the soil via rainfall or irrigation, and it must be present when the weed seeds germinate. Pre-emergence herbicides have no effect on weed seeds.. As a result, the Pre-emergence segment is expected to witness a fastest growth during the forecast period.

The soybean segment is estimated to account for the largest market share in the Herbicides safener market during the forecast period.

Soybean is an important global crop, providing protein and oil; ~88% of the soybean crop was crushed and processed for industrial purposes, especially for feed production, in 2017, according to the USDA. China is rapidly becoming a major importer of soybean from many countries, especially in South America, to cater to the increasing domestic demand. Benoxacor is the most used herbicide safener in combination with the herbicide active ingredient, S-metolachlor, and atrazine in herbicides. Companies such as Tenkoz, Syngenta, Corteva Agriscience, and ADAMA provide herbicide safeners premixed with herbicides.

The Selective herbicides, by herbicide selectivity is estimated to account for the fastest market growth in the Herbicides safenermarket during the forecast period.

Selective herbicides are mainly used due to their selective action in protecting weeds and crops from excessive use of herbicides. A selective herbicide kills some plants while leaving others alone. Herbicides labeled for weed control in lawns, for example, kill broadleaf weeds such as dandelions and thistles but not grasses. Herbicide safeners effectively improve herbicide selectivity, allowing grass-weed herbicides to be developed for use in grass crops, including cereals, corn, and rice.

To know about the assumptions considered for the study, download the pdf brochure

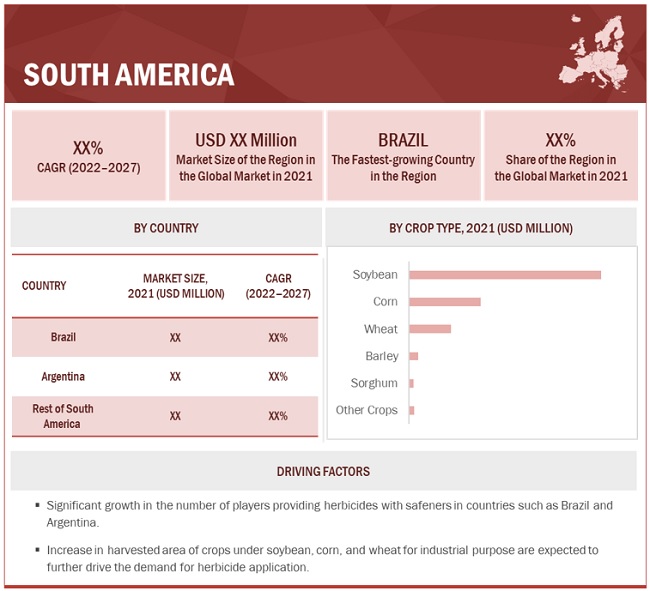

South America is projected to account for the largest share in the Herbicides safener market during the forecast period.

Land and water are abundant in South America. The region accounts for 13% of the global agricultural and fish commodities production and 17% of the net export value of such products. This share is set to increase over the coming decade, according to the OECD-FAO Agricultural Outlook 20212030. Export demand is a critical growth factor for agriculture in this region which is evident because the region is dominated by large export-oriented commercial farms, especially in Argentina and Brazil. Latin America has about 9% of the global population and will add another 58 million people by 2030. It is also one of the regions prone to food insecurity. Thus, crop production expansion by agricultural intensification is crucial. The total agricultural land use is expected to expand by nearly 11 million hectares by 2027, further increasing the demand for crop protection chemicals such as insecticides, herbicides, and nematicides. Subsequently, this can lead to increased demand for safeners added with herbicides to protect crops against herbicide injuries.

Key Market Players

The key players in this market include Corteva Agriscience (US), BASF (Germany), Bayer (Germany), and Syngenta (Switzerland). Some emerging players in the global market include Nufarm (Australia), ADAMA (Israel), Arysta LifeScience (US), Drexel Chemical Company (US), Winfield United (US), Sipcam-Oxon (Italy), Helm AG (Germany), Tenkoz (US), Rainbow Agro (China), and Helena Agri Enterprise (US). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

20222027 |

|

Base year considered |

2021 |

|

Forecast period considered |

20222027 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments covered |

By type, By Crop, By Herbicide Selectivity, By Herbicide Application Stage, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

Corteva Agriscience (US), BASF (Germany), Bayer (Germany), and Syngenta (Switzerland). |

This research report categorizes the Herbicides safener market based on type, application, form, source, and region.

Based on type, the market has been segmented as follows:

- Benoxacor

- Furilazole

- Dichlormid

- Isoxadifen

- Other types

Based on crop, the market has been segmented as follows:

- Corn

- Soybean

- Wheat

- Sorghum

- Barley

- Rice

- Other crops

Based on the Herbicide Selectivity, the market has been segmented as follows:

- Selective herbicides

- Non-selective herbicides

Based on the Herbicide application stage, the market has been segmented as follows:

- Pre-emergence

- Post-emergence

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (the Middle East & Africa)

Recent Developments

- In July 2021, Syngenta Crop Protection announced the signing of a contract to acquire Dipagro, a distributor of agricultural inputs in the Brazilian state of Mato Grosso. This move would increase farmers access to Syngentas technologies and services in a region experiencing rapid agricultural growth.

- In May 2021, Corteva Agriscience and BASF Canada Agricultural Solutions (BASF) announced a collaboration and a joint approach to weed control by recommending the use of Liberty 200 SN and Enlist herbicides in combination on Enlist E3TM soybean acres.

- In April 2020, Sumitomo Chemical Company, Limited completed the acquisition of four South American subsidiaries owned by Nufarm Limited group companies in Brazil, Argentina, Chile, and Colombia. With this acquisition, Sumitomo Chemical would be able to establish its own solid crop protection product development and sales network in South America, including Brazil, the worlds largest crop protection market.

- In Feb 2019, UPL Ltd completed the acquisition of Arysta LifeScience Inc. from Platform Specialty Products. The completion of the transaction, which was signed in July 2018, marked a major step in the history of UPL. The acquisition further strengthened UPLs position as a global leader in agricultural solutions.

Frequently Asked Questions (FAQ):

Who are some of the key players operating in the Herbicides safenermarket and how intense is the competition?

The key players in this market include Corteva Agriscience (US), BASF (Germany), Bayer (Germany), and Syngenta (Switzerland). Some emerging players in the global market include Nufarm (Australia), ADAMA (Israel), Arysta LifeScience (US), Drexel Chemical Company (US), Winfield United (US), Sipcam-Oxon (Italy), Helm AG (Germany), Tenkoz (US), Rainbow Agro (China), and Helena Agri Enterprise (US). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

What kind of stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

The key stakeholders to Herbicides safenermarket would be

- Herbicide, herbicide safener, and other pesticide manufacturers/formulators

- Herbicide, herbicide safener, and other chemical importers/exporters

- Intermediary suppliers, including wholesalers and traders

- Research institutes and organizations

- Government pesticide authorities and regulatory bodies such as the World Health Organization (WHO), US Environmental Protection Agency (EPA), and Pest Management Regulatory Agency (PMRA)

- Farm cooperative societies and agrochemical industry associations

What are the potential challenges to the Herbicides safener market?

The crop protection market is controlled by regulations imposed by the EU and FAO on the usage of crop protection chemicals. Manufacturers in countries such as Germany and France face challenges in developing, registering, producing, and distributing their crop protection products. The increasing number of R&D mandates is also expected to have an adverse impact on the crop protection industry, which would, in turn, affect the herbicide safeners market.

What are the key market trends in the food Herbicides safener market?

Major factors affecting overall herbicide use trends have been changes in crop acreage, influenced by economic and policy factors, the replacement of older compounds with newer ones applied at lower per-acre rates, influenced by pesticide regulation, contributing to reduced pesticide quantities, and the adoption of genetically-engineered crops since the mid-1990s.

The cost of herbicides is relatively cheap compared to the cost of labor assigned for manual weeding. Thus, the increasing need for the application of herbicides is likely to propel the demand for herbicide safeners as well. There is an increasing need to meet the challenges of feeding the ever-growing population, for which an increase in crop yield is inevitable.

What are the key development strategies undertaken by companies in the Herbicides safener market?

Strategies such as new product launches, investments into expansion and development, research initiatives are the key strategies being used by large players in order to achieve differential positioning in the global market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 20172021

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 HERBICIDE SAFENERS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 36)

TABLE 2 HERBICIDES SAFENER MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 4 HERBICIDES SAFENER MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 5 HERBICIDES SAFENER MARKET, BY HERBICIDE APPLICATION STAGE, 2022 VS. 2027 (USD MILLION)

FIGURE 6 HERBICIDE SAFENERS MARKET, BY HERBICIDE SELECTIVITY, 2022 VS. 2027 (USD MILLION)

FIGURE 7 HERBICIDE SAFENERS MARKET, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 8 HERBICIDES SAFENER MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE MARKET

FIGURE 9 INCREASED FOCUS ON CROP PROTECTION OFFERS OPPORTUNITIES FOR MARKET GROWTH

4.2 SOUTH AMERICA: HERBICIDE SAFENERS MARKET, BY COUNTRY & TYPE

FIGURE 10 BENOXACOR WAS THE DOMINANT TYPE IN THE SOUTH AMERICAN HERBICIDE SAFENERS MARKET

4.3 MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE SELECTIVITY

FIGURE 11 SELECTIVE HERBICIDE SAFENERS TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.4 MARKET FOR HERBICIDE SAFENERS, BY CROP & REGION

FIGURE 12 SOUTH AMERICA LED THE HERBICIDE SAFENERS MARKET IN 2021

4.5 MARKET FOR HERBICIDE SAFENERS, BY REGION

FIGURE 13 US ACCOUNTED FOR THE LARGEST SHARE OF THE GLOBAL HERBICIDE SAFENERS MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 MARKET FOR HERBICIDE SAFENERS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increase in instances of herbicide-induced crop damage

5.2.1.2 Higher demand for herbicides

5.2.1.3 Rise in the production of cereals & grains in developing countries

FIGURE 15 GLOBAL CEREAL PRODUCTION, 2O212030 (MILLION TONS)

FIGURE 16 ECONOMIC LOSSES DUE TO WEEDS, 2018 (USD MILLION)

FIGURE 17 YIELD LOSSES (%) DUE TO WEEDS, 2018

5.2.1.4 Rise in trend of post-emergence application of herbicide safeners

5.2.1.5 Potential as better solutions to combat herbicide-resistant weeds

FIGURE 18 NUMBER OF HERBICIDE-RESISTANT SPECIES BY CROP, 2019

FIGURE 19 NUMBER OF HERBICIDE-RESISTANT WEED SPECIES, BY WEED FAMILY, 2019

5.2.2 RESTRAINTS

5.2.2.1 Regulatory ban on herbicides

5.2.2.2 Issues Related to Herbicide Residue

TABLE 3 RELATIVE PERSISTENCE OF SOME HERBICIDES IN SOIL

5.2.3 OPPORTUNITIES

5.2.3.1 New registrations of active herbicidal ingredients

5.2.3.2 Development of safener combinations for biologically derived herbicides

FIGURE 20 US: GROWTH OF TOTAL ORGANIC SALES VS. GROSS DOMESTIC PRODUCT, 2007-2020

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness and technical expertise, and low adoption rate

5.2.4.2 Concerns regarding the impact of pesticides on human health and environment

TABLE 4 SIGNS AND SYMPTOMS OF ACUTE EXPOSURE TO SEVERAL HERBICIDE-ACTIVE INGREDIENTS

6 INDUSTRY TRENDS (Page No. - 60)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 21 HERBICIDE SAFENERS MARKET: VALUE CHAIN ANALYSIS

6.2.1 RESEARCH & DEVELOPMENT

6.2.2 REGISTRATION

6.2.3 FORMULATION/MANUFACTURING

6.2.4 LOGISTICS & DISTRIBUTION

6.2.5 MARKETING & SALES

6.2.6 POST-SALE SERVICES

6.3 SUPPLY CHAIN

6.3.1 MARKET FOR HERBICIDE SAFENERS: ECOSYSTEM VIEW

6.4 PRICING ANALYSIS: MARKET FOR HERBICIDE SAFENERS

FIGURE 22 PRICING TREND OF THE REGION OF HERBICIDE SAFENERS, 20162020 (USD/KG)

6.5 TECHNOLOGY ANALYSIS

6.5.1 USE OF NANOTECHNOLOGY TO ASSIST HERBICIDE SAFENER AND FOLIAR FERTILIZER ADHESIVE

6.6 PATENT ANALYSIS

FIGURE 23 PATENTS GRANTED FOR HERBICIDE SAFENERS MARKET, 20112021

FIGURE 24 REGIONAL ANALYSIS OF PATENT GRANTED FOR HERBICIDE SAFENERS MARKET, 20112021

TABLE 5 KEY PATENTS PERTAINING TO HERBICIDES SAFENERS MARKET, 2020

6.7 ECOSYSTEM

6.7.1 MARKET ECOSYSTEM

FIGURE 25 MARKET FOR HERBICIDES SAFENER: ECOSYSTEM

FIGURE 26 KEY PLAYERS IN HERBICIDE SAFENERS MARKET ECOSYSTEM

6.7.1.1 Supply Side

6.7.1.1.1 Ingredient and raw material providers

6.7.1.2 Demand Side

6.7.1.2.1 Regulatory bodies & certification providers

TABLE 6 HERBICIDES SAFENERS MARKET: ECOSYSTEM

6.8 PORTERS FIVE FORCES ANALYSIS

TABLE 7 HERBICIDES SAFENER MARKET: PORTERS FIVE FORCES ANALYSIS

6.8.1 DEGREE OF COMPETITION

6.8.2 BARGAINING POWER OF SUPPLIERS

6.8.3 BARGAINING POWER OF BUYERS

6.8.4 THREAT OF SUBSTITUTES

6.8.5 THREAT OF NEW ENTRANTS

6.9 TRADE ANALYSIS

FIGURE 27 HERBICIDE IMPORT VALUE, 20162020 (USD MILLION)

FIGURE 28 HERBICIDE EXPORT VALUE, 20162020 (USD MILLION)

6.10 KEY CONFERENCES & EVENTS IN 20222023

TABLE 8 HERBICIDES SAFENER MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 20222023

6.11 TARIFF AND REGULATORY LANDSCAPE

6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS BUSINESS

FIGURE 29 REVENUE SHIFT FOR HERBICIDE SAFENERS MARKET

6.13 KEY STAKEHOLDERS & BUYING CRITERIA

FIGURE 30 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 TYPE

6.13.1 KEY STAKEHOLDERS IN THE BUYING PROCESS

TABLE 13 INFLUENCE OF STAKEHOLDERS ON THE BUYING PROCESS FOR THE TOP 3 TYPES

6.13.2 BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA FOR THE TOP 3 PRODUCT TYPES

TABLE 14 KEY BUYING CRITERIA FOR THE TOP 3 PRODUCT TYPES

6.14 CASE STUDY ANALYSIS

6.14.1 BAYER CROP SCIENCE AVAILS HERBICIDES SAFENERS PRODUCTS

6.14.1.1 Problem statement

6.14.1.2 Solution offered

6.14.1.3 Outcome

6.14.2 THE SYNGENTA HERBICIDE RESISTANCE QUICK-TESTTM (QT) PRODUCT

6.14.2.1 Problem statement

6.14.2.2 Solution offered

6.14.2.3 Outcome and analysis

7 HERBICIDE SAFENERS MARKET, BY TYPE (Page No. - 82)

7.1 INTRODUCTION

FIGURE 32 HERBICIDE SAFENERS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 15 HERBICIDE SAFENERS MARKET, BY TYPE, 20162021 (USD MILLION)

TABLE 16 HERBICIDE SAFENERS MARKET, BY TYPE, 20222027 (USD MILLION)

7.2 BENOXACOR

TABLE 17 BENOXACOR MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 18 BENOXACOR MARKET, BY REGION, 20222027 (USD MILLION)

7.3 FURILAZOLE

TABLE 19 FURILAZOLE MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 20 FURILAZOLE MARKET, BY REGION, 20222027 (USD MILLION)

7.4 DICHLORMID

TABLE 21 DICHLORMID MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 22 DICHLORMID MARKET, BY REGION, 20222027 (USD MILLION)

7.5 ISOXADIFEN

TABLE 23 ISOXADIFEN MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 24 ISOXADIFEN MARKET, BY REGION, 20222027 (USD MILLION)

7.6 OTHER SAFENERS

TABLE 25 OTHER SAFENERS MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 26 OTHER SAFENERS MARKET, BY REGION, 20222027 (USD MILLION)

8 HERBICIDE SAFENERS MARKET, BY HERBICIDE APPLICATION STAGE (Page No. - 91)

8.1 INTRODUCTION

FIGURE 33 HERBICIDE SAFENERS MARKET, BY HERBICIDE APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 27 MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE APPLICATION STAGE, 20162021 (USD MILLION)

TABLE 28 HERBICIDE SAFENERS MARKET, BY HERBICIDE APPLICATION STAGE, 20222027 (USD MILLION)

8.2 POST-EMERGENCE

TABLE 29 POST-EMERGENT HERBICIDE SAFENERS MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 30 POST-EMERGENT HERBICIDE SAFENERS MARKET, BY REGION, 20222027 (USD MILLION)

8.3 PRE-EMERGENCE

TABLE 31 PRE-EMERGENT HERBICIDE SAFENERS MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 32 PRE-EMERGENT HERBICIDE SAFENERS MARKET, BY REGION, 20222027 (USD MILLION)

9 HERBICIDE SAFENERS MARKET, BY CROP (Page No. - 96)

9.1 INTRODUCTION

FIGURE 34 HERBICIDE SAFENERS MARKET, BY CROP, 2022 VS. 2027 (USD MILLION)

TABLE 33 MARKET SIZE FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD MILLION)

TABLE 34 MARKET SIZE FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD MILLION)

9.2 SOYBEAN

TABLE 35 HERBICIDE SAFENERS MARKET FOR SOYBEAN, BY REGION, 20162021 (USD MILLION)

TABLE 36 MARKET SIZE FOR SOYBEAN, BY REGION, 20222027 (USD MILLION)

9.3 WHEAT

TABLE 37 MARKET FOR WHEAT, BY REGION, 20162021 (USD MILLION)

TABLE 38 MARKET FOR WHEAT, BY REGION, 20222027 (USD MILLION)

9.4 CORN

TABLE 39 MARKET FOR CORN, BY REGION, 20162021 (USD MILLION)

TABLE 40 MARKET FOR CORN, BY REGION, 20222027 (USD MILLION)

9.5 SORGHUM

TABLE 41 HERBICIDE SAFENERS MARKET FOR SORGHUM, BY REGION, 20162021 (USD MILLION)

TABLE 42 MARKET FOR SORGHUM, BY REGION, 20222027 (USD MILLION)

9.6 RICE

TABLE 43 HERBICIDE SAFENERS MARKET FOR RICE, BY REGION, 20162021 (USD MILLION)

TABLE 44 MARKET FOR RICE, BY REGION, 20222027 (USD MILLION)

9.7 BARLEY

TABLE 45 HERBICIDE SAFENERS MARKET FOR BARLEY, BY REGION, 20162021 (USD MILLION)

TABLE 46 MARKET FOR BARLEY, BY REGION, 20222027 (USD MILLION)

9.8 OTHER CROPS

TABLE 47 HERBICIDE SAFENERS MARKET FOR OTHER CROPS, BY REGION, 20162021 (USD MILLION)

TABLE 48 MARKET FOR OTHER CROPS, BY REGION, 20222027 (USD MILLION)

TABLE 49 COMMERCIALLY AVAILABLE HERBICIDE SAFENERS

TABLE 50 EFFECTS OF SAFENERS ON PHYSIOLOGICAL OR BIOCHEMICAL SYSTEMS

TABLE 51 AGRICULTURE USES, FORMULATIONS, AND APPLICATION METHODS OF COMMERCIAL HERBICIDE SAFENERS

10 HERBICIDE SAFENERS MARKET, BY HERBICIDE SELECTIVITY (Page No. - 111)

10.1 INTRODUCTION

FIGURE 35 MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE SELECTIVITY, 2022 VS. 2027 (USD MILLION)

TABLE 52 HERBICIDE SAFENERS MARKET, BY HERBICIDE SELECTIVITY, 20162021 (USD MILLION)

TABLE 53 MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE SELECTIVITY, 20222027 (USD MILLION)

10.2 SELECTIVE HERBICIDES

TABLE 54 HERBICIDE SAFENERS MARKET IN SELECTIVE HERBICIDES, BY REGION, 20162021 (USD MILLION)

TABLE 55 MARKET IN SELECTIVE HERBICIDES, BY REGION, 20222027 (USD MILLION)

10.3 NON-SELECTIVE HERBICIDES

TABLE 56 HERBICIDE SAFENERS MARKET IN NON-SELECTIVE HERBICIDES, BY REGION, 20162021 (USD MILLION)

TABLE 57 MARKET IN NON-SELECTIVE HERBICIDES, BY REGION, 20222027 (USD MILLION)

11 HERBICIDE SAFENERS MARKET, BY REGION (Page No. - 116)

11.1 INTRODUCTION

FIGURE 36 SOUTH AMERICA AND ASIA PACIFIC TO WITNESS SIGNIFICANT MARKET GROWTH (20222027)

TABLE 58 MARKET FOR HERBICIDE SAFENERS, BY REGION, 20162021 (USD MILLION)

TABLE 59 MARKET FOR HERBICIDE SAFENERS, BY REGION, 20222027 (USD MILLION)

TABLE 60 MARKET FOR HERBICIDE SAFENERS, BY REGION, 20162021 (TONS)

TABLE 61 MARKET FOR HERBICIDE SAFENERS, BY REGION, 20222027 (TONS)

11.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

TABLE 62 NORTH AMERICA: HERBICIDE SAFENERS MARKET, BY COUNTRY, 20162021 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY COUNTRY, 20222027 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY TYPE, 20162021 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY TYPE, 20222027 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE APPLICATION STAGE, 20162021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE APPLICATION STAGE, 20222027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE SELECTIVITY, 20162021 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE SELECTIVITY, 20222027 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET FOR SOYBEAN, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 73 NORTH AMERICA: SOYBEAN HERBICIDE SAFENERS MARKET, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 74 NORTH AMERICA: HERBICIDE SAFENERS MARKET FOR SORGHUM, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 75 NORTH AMERICA: MARKET FOR SORGHUM, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 76 NORTH AMERICA: MARKET FOR WHEAT, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 77 NORTH AMERICA: MARKET FOR WHEAT, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 78 NORTH AMERICA: MARKET FOR BARLEY, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 79 NORTH AMERICA: MARKET FOR BARLEY, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 80 NORTH AMERICA: MARKET FOR RICE, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 81 NORTH AMERICA: MARKET FOR RICE, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 82 NORTH AMERICA: MARKET FOR CORN, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 83 NORTH AMERICA: MARKET FOR CORN, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 84 NORTH AMERICA: MARKET FOR OTHER CROPS, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 85 NORTH AMERICA: MARKET FOR OTHER CROPS, BY COUNTRY, 20222027 (USD THOUSAND)

11.2.1 US

TABLE 86 US: HERBICIDE SAFENERS MARKET, BY CROP, 20162021 (USD THOUSAND)

TABLE 87 US: MARKET, BY CROP, 20222027 (USD THOUSAND)

11.2.2 CANADA

TABLE 88 CANADA: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD THOUSAND)

TABLE 89 CANADA: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD THOUSAND)

11.2.3 MEXICO

TABLE 90 MEXICO: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD THOUSAND)

TABLE 91 MEXICO: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD THOUSAND)

11.3 EUROPE

TABLE 92 EUROPE: HERBICIDE SAFENERS MARKET, BY COUNTRY, 20162021 (USD MILLION)

TABLE 93 EUROPE: MARKET FOR HERBICIDE SAFENERS, BY COUNTRY, 20222027 (USD MILLION)

TABLE 94 EUROPE: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD MILLION)

TABLE 95 EUROPE: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD MILLION)

TABLE 96 EUROPE: MARKET FOR HERBICIDE SAFENERS, BY TYPE, 20162021 (USD MILLION)

TABLE 97 EUROPE: MARKET FOR HERBICIDE SAFENERS, BY TYPE, 20222027 (USD MILLION)

TABLE 98 EUROPE: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE APPLICATION STAGE, 20162021 (USD MILLION)

TABLE 99 EUROPE: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE APPLICATION STAGE, 20222027 (USD MILLION)

TABLE 100 EUROPE: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE SELECTIVITY, 20162021 (USD MILLION)

TABLE 101 EUROPE: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE SELECTIVITY, 20222027 (USD MILLION)

TABLE 102 EUROPE: SOYBEAN HERBICIDE SAFENERS MARKET, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 103 EUROPE: SOYBEAN HERBICIDE SAFENERS MARKET, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 104 EUROPE: HERBICIDE SAFENERS MARKET FOR WHEAT, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 105 EUROPE: MARKET FOR WHEAT, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 106 EUROPE: MARKET FOR SORGHUM, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 107 EUROPE: MARKET FOR SORGHUM, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 108 EUROPE: MARKET FOR BARLEY, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 109 EUROPE: MARKET FOR BARLEY, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 110 EUROPE: MARKET FOR RICE, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 111 EUROPE: MARKET FOR RICE, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 112 EUROPE: MARKET FOR CORN, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 113 EUROPE: MARKET FOR CORN, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 114 EUROPE: MARKET FOR OTHER CROPS, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 115 EUROPE: HERBICIDE SAFENERS MARKET FOR OTHER CROPS, BY COUNTRY, 20222027 (USD THOUSAND)

11.3.1 GERMANY

TABLE 116 GERMANY: HERBICIDE SAFENERS MARKET, BY CROP, 20162021 (USD THOUSAND)

TABLE 117 GERMANY: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD THOUSAND)

11.3.2 FRANCE

TABLE 118 FRANCE: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD THOUSAND)

TABLE 119 FRANCE: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD THOUSAND)

11.3.3 UK

TABLE 120 UK: HERBICIDE SAFENERS MARKET, BY CROP, 20162021 (USD THOUSAND)

TABLE 121 UK: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD THOUSAND)

11.3.4 SPAIN

TABLE 122 SPAIN: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD THOUSAND)

TABLE 123 SPAIN: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD THOUSAND)

11.3.5 REST OF EUROPE

TABLE 124 REST OF EUROPE: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD THOUSAND)

TABLE 125 REST OF EUROPE: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD THOUSAND)

11.4 ASIA PACIFIC

TABLE 126 ASIA PACIFIC: HERBICIDE SAFENERS MARKET, BY COUNTRY, 20162021 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET FOR HERBICIDE SAFENERS, BY COUNTRY, 20222027 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET FOR HERBICIDE SAFENERS, BY TYPE, 20162021 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET FOR HERBICIDE SAFENERS, BY TYPE, 20222027 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE APPLICATION STAGE, 20162021 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE APPLICATION STAGE, 20222027 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE SELECTIVITY, 20162021 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE SELECTIVITY, 20222027 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET FOR CORN, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 137 ASIA PACIFIC:MARKET FOR CORN, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 138 ASIA PACIFIC: SOYBEAN HERBICIDE SAFENERS MARKET, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 139 ASIA PACIFIC: SOYBEAN HERBICIDE SAFENERS MARKET, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 140 ASIA PACIFIC: HERBICIDE SAFENERS MARKET FOR WHEAT, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 141 ASIA PACIFIC: MARKET FOR WHEAT, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 142 ASIA PACIFIC: MARKET FOR SORGHUM, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 143 ASIA PACIFIC: MARKET FOR SORGHUM, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 144 ASIA PACIFIC: MARKET FOR BARLEY, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 145 ASIA PACIFIC: MARKET FOR BARLEY, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 146 ASIA PACIFIC: MARKET FOR RICE, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 147 ASIA PACIFIC: MARKET FOR RICE, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 148 ASIA PACIFIC: MARKET FOR OTHER CROPS, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 149 ASIA PACIFIC: MARKET FOR OTHER CROPS, BY COUNTRY, 20222027 (USD THOUSAND)

11.4.1 AUSTRALIA

TABLE 150 AUSTRALIA: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD THOUSAND)

TABLE 151 AUSTRALIA: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD THOUSAND)

11.4.2 CHINA

TABLE 152 CHINA: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD THOUSAND)

TABLE 153 CHINA: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD THOUSAND)

11.4.3 JAPAN

TABLE 154 JAPAN: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD THOUSAND)

TABLE 155 JAPAN: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD THOUSAND)

11.4.4 REST OF ASIA PACIFIC

TABLE 156 REST OF ASIA PACIFIC: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD THOUSAND)

TABLE 157 REST OF ASIA PACIFIC: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD THOUSAND)

11.5 SOUTH AMERICA

TABLE 158 SOUTH AMERICA: HERBICIDE SAFENERS MARKET, BY COUNTRY, 20162021 (USD MILLION)

TABLE 159 SOUTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY COUNTRY, 20222027 (USD MILLION)

FIGURE 38 SOUTH AMERICA: MARKET SNAPSHOT

TABLE 160 SOUTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY TYPE, 20162021 (USD MILLION)

TABLE 161 SOUTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY TYPE, 20222027 (USD MILLION)

TABLE 162 SOUTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD MILLION)

TABLE 163 SOUTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD MILLION)

TABLE 164 SOUTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE APPLICATION STAGE, 20162021 (USD MILLION)

TABLE 165 SOUTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE APPLICATION STAGE, 20222027 (USD MILLION)

TABLE 166 SOUTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE SELECTIVITY, 20162021(USD MILLION)

TABLE 167 SOUTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE SELECTIVITY, 20222027 (USD MILLION)

TABLE 168 SOUTH AMERICA: MARKET FOR SOYBEAN, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 169 SOUTH AMERICA: MARKET FOR SOYBEAN, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 170 SOUTH AMERICA: MARKET FOR WHEAT, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 171 SOUTH AMERICA: MARKET FOR WHEAT, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 172 SOUTH AMERICA: MARKET FOR SORGHUM, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 173 SOUTH AMERICA: MARKET FOR SORGHUM, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 174 SOUTH AMERICA: MARKET FOR BARLEY, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 175 SOUTH AMERICA: MARKET FOR BARLEY, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 176 SOUTH AMERICA: MARKET FOR RICE, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 177 SOUTH AMERICA: MARKET FOR RICE, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 178 SOUTH AMERICA: MARKET FOR CORN, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 179 SOUTH AMERICA: MARKET FOR CORN, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 180 SOUTH AMERICA: MARKET FOR OTHER CROPS, BY COUNTRY, 20162021 (USD THOUSAND)

TABLE 181 SOUTH AMERICA: MARKET FOR OTHER CROPS, BY COUNTRY, 20222027 (USD THOUSAND)

11.5.1 BRAZIL

TABLE 182 BRAZIL: HERBICIDE SAFENERS MARKET, BY CROP, 20162021 (USD THOUSAND)

TABLE 183 BRAZIL: MARKET, BY CROP, 20222027 (USD THOUSAND)

11.5.2 ARGENTINA

TABLE 184 ARGENTINA: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD THOUSAND)

TABLE 185 ARGENTINA: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD THOUSAND)

11.5.3 REST OF SOUTH AMERICA

TABLE 186 REST OF SOUTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD THOUSAND)

TABLE 187 REST OF SOUTH AMERICA: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD THOUSAND)

11.6 REST OF THE WORLD

TABLE 188 ROW: HERBICIDE SAFENERS MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 189 ROW: MARKET FOR HERBICIDE SAFENERS, BY REGION, 20222027 (USD MILLION)

TABLE 190 ROW: MARKET FOR HERBICIDE SAFENERS, BY TYPE, 20162021 (USD MILLION)

TABLE 191 ROW: MARKET FOR HERBICIDE SAFENERS, BY TYPE, 20222027 (USD MILLION)

TABLE 192 ROW: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20162021 (USD MILLION)

TABLE 193 ROW: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD MILLION)

TABLE 194 ROW: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE SELECTIVITY, 20162021 (USD MILLION)

TABLE 195 ROW: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE SELECTIVITY, 20222027 (USD MILLION)

TABLE 196 ROW: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE APPLICATION STAGE, 20162021 (USD MILLION)

TABLE 197 ROW: MARKET FOR HERBICIDE SAFENERS, BY HERBICIDE APPLICATION STAGE, 20222027 (USD MILLION)

TABLE 198 ROW: MARKET FOR SOYBEAN, BY REGION, 20162021 (USD THOUSAND)

TABLE 199 ROW: MARKET FOR SOYBEAN, BY REGION, 20222027 (USD THOUSAND)

TABLE 200 ROW: MARKET FOR WHEAT, BY REGION, 20162021 (USD THOUSAND)

TABLE 201 ROW: MARKET FOR WHEAT, BY REGION, 20222027 (USD THOUSAND)

TABLE 202 ROW: MARKET FOR CORN, BY REGION, 20162021 (USD THOUSAND)

TABLE 203 ROW: MARKET FOR CORN, BY REGION, 20222027 (USD THOUSAND)

TABLE 204 ROW: MARKET FOR SORGHUM, BY REGION, 20162021 (USD THOUSAND)

TABLE 205 ROW: MARKET FOR SORGHUM, BY REGION, 20222027 (USD THOUSAND)

TABLE 206 ROW: MARKET FOR BARLEY, BY REGION, 20162021 (USD THOUSAND)

TABLE 207 ROW: MARKET FOR BARLEY, BY REGION, 20222027 (USD THOUSAND)

TABLE 208 ROW: MARKET FOR RICE, BY REGION, 20162021 (USD THOUSAND)

TABLE 209 ROW: MARKET FOR RICE, BY REGION, 20222027 (USD THOUSAND)

TABLE 210 ROW: MARKET FOR OTHER CROPS, BY REGION, 20162021 (USD THOUSAND)

TABLE 211 ROW: MARKET FOR OTHER CROPS, BY REGION, 20222027 (USD THOUSAND)

11.6.1 AFRICA

TABLE 212 AFRICA: HERBICIDE SAFENERS MARKET, BY CROP, 20162021 (USD THOUSAND)

TABLE 213 AFRICA: HERBICIDE SAFENERS MARKET, BY CROP, 20222027 (USD THOUSAND)

11.6.2 MIDDLE EAST

TABLE 214 MIDDLE EAST: HERBICIDE SAFENERS MARKET, BY CROP, 20162021 (USD THOUSAND)

TABLE 215 MIDDLE EAST: MARKET FOR HERBICIDE SAFENERS, BY CROP, 20222027 (USD THOUSAND)

12 COMPETITIVE LANDSCAPE (Page No. - 186)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS

TABLE 216 HERBICIDE SAFENERS SHARE (CONSOLIDATED)

12.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 39 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 20192021 (USD BILLION)

12.4 KEY PLAYER STRATEGIES

FIGURE 40 OVERVIEW OF STRATEGIES DEPLOYED BY KEY HERBICIDE SAFENERS PRODUCERS

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 41 HERBICIDE SAFENERS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

12.6 PRODUCT FOOTPRINT

TABLE 217 COMPANY FOOTPRINT, BY TYPE

TABLE 218 COMPANY FOOTPRINT, BY HERBICIDE APPLICATION STAGE

TABLE 219 COMPANY REGIONAL FOOTPRINT

TABLE 220 OVERALL COMPANY FOOTPRINT

12.7 HERBICIDE SAFENERS MARKET, START-UP/SME EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANIES

12.7.2 STARTING BLOCKS

12.7.3 RESPONSIVE COMPANIES

12.7.4 DYNAMIC COMPANIES

FIGURE 42 HERBICIDE SAFENERS MARKET: COMPANY EVALUATION QUADRANT, 2022 (START-UP/SME)

TABLE 221 HERBICIDE SAFENERS MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 222 HERBICIDE SAFENERS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

12.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

12.8.1 PRODUCT LAUNCHES

TABLE 223 PRODUCT LAUNCHES, OCTOBER 2020MARCH 2022

12.8.2 DEALS

TABLE 224 DEALS, FEBRUARY 2019JULY 2021

12.8.3 OTHERS

TABLE 225 OTHERS, JUNE 2020APRIL 2021

13 COMPANY PROFILES (Page No. - 202)

(Business overview, Products offered, Recent developments & MnM View)*

13.1 KEY PLAYERS

13.1.1 CORTEVA AGRISCIENCE

TABLE 226 CORTEVA AGRISCIENCE: BUSINESS OVERVIEW

FIGURE 43 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

TABLE 227 CORTEVA AGRISCIENCE: PRODUCT LAUNCHES

TABLE 228 CORTEVA AGRISCIENCE: OTHERS

13.1.2 SYNGENTA

TABLE 229 SYNGENTA: BUSINESS OVERVIEW

FIGURE 44 SYNGENTA: COMPANY SNAPSHOT

TABLE 230 SYNGENTA: DEALS

TABLE 231 SYNGENTA: PRODUCT LAUNCHES

13.1.3 BAYER AG

TABLE 232 BAYER AG: BUSINESS OVERVIEW

FIGURE 45 BAYER AG: COMPANY SNAPSHOT

TABLE 233 BAYER AG: PRODUCT LAUNCHES

13.1.4 BASF

TABLE 234 BASF: BUSINESS OVERVIEW

FIGURE 46 BASF: COMPANY SNAPSHOT

TABLE 235 BASF: PRODUCT LAUNCHES

TABLE 236 BASF: DEALS

13.1.5 UPL

TABLE 237 UPL: BUSINESS OVERVIEW

FIGURE 47 UPL: COMPANY SNAPSHOT

TABLE 238 UPL LTD: DEALS

13.1.6 NUFARM LIMITED

TABLE 239 NUFARM LIMITED: BUSINESS OVERVIEW

FIGURE 48 NUFARM LIMITED: COMPANY SNAPSHOT

TABLE 240 NUFARM LIMITED: DEALS

13.1.7 ADAMA AGRICULTURAL SOLUTIONS

TABLE 241 ADAMA AGRICULTURAL SOLUTIONS: BUSINESS OVERVIEW

FIGURE 49 ADAMA AGRICULTURAL SOLUTIONS: COMPANY SNAPSHOT

13.1.8 HELM AG

TABLE 242 HELM AG: BUSINESS OVERVIEW

FIGURE 50 HELM AG: COMPANY SNAPSHOT

TABLE 243 HELM AG: PRODUCT LAUNCHES

TABLE 244 HELM AG: DEALS

TABLE 245 HELM AG: OTHERS

13.1.9 SIPCAM-OXON GROUP

TABLE 246 SIPCAM-OXON GROUP: BUSINESS OVERVIEW

FIGURE 51 SIPCAM OXON GROUP: COMPANY SNAPSHOT

TABLE 247 SIPCAM OXON GROUP: OTHERS

13.1.10 RAINBOW AGRO

TABLE 248 RAINBOW AGRO: BUSINESS OVERVIEW

13.1.11 BHARAT RASAYAN LIMITED

TABLE 249 BHARAT RASAYAN LIMITED: BUSINESS OVERVIEW

FIGURE 52 BHARAT RASAYAN LIMITED: COMPANY SNAPSHOT

13.1.12 BHAGIRADHA CHEMICALS & INDUSTRIES LIMITED

TABLE 250 BHAGIRADHA CHEMICALS & INDUSTRIES LIMITED: BUSINESS OVERVIEW

FIGURE 53 BHAGIRADHA CHEMICALS & INDUSTRIES LIMITED: COMPANY SNAPSHOT

13.1.13 HELENA AGRI ENTERPRISE

TABLE 251 HELENA AGRI ENTERPRISE: BUSINESS OVERVIEW

13.1.14 TENKOZ

TABLE 252 TENKOZ: BUSINESS OVERVIEW

13.1.15 DREXEL CHEMICAL COMPANY

TABLE 253 DREXEL CHEMICAL COMPANY: BUSINESS OVERVIEW

13.1.16 WINFIELD UNITED

TABLE 254 WINFIELD UNITED: BUSINESS OVERVIEW

13.1.17 HPM

TABLE 255 HPM: BUSINESS OVERVIEW

13.1.18 SHIVA PHARMACHEM

TABLE 256 SHIVA PHARMACHEM: BUSINESS OVERVIEW

13.1.19 SIMSON PHARMA LIMITED

TABLE 257 SIMSON PHARMA LIMITED: BUSINESS OVERVIEW

13.1.20 MATRIX CERAMICS AND CHEMICALS

TABLE 258 MATRIX CERAMICS AND CHEMICALS: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 TORONTO RESEARCH CHEMICALS

13.2.2 JIGS CHEMICAL

13.2.3 MEDCHEMEXPRESS

13.2.4 NATIONAL ANALYTICAL CORPORATION

13.2.5 MERCK (SIGMA ALDRICH)

14 ADJACENT AND RELATED MARKETS (Page No. - 257)

14.1 INTRODUCTION

TABLE 259 ADJACENT MARKETS TO THE HERBICIDE SAFENERS MARKET

14.2 LIMITATIONS

14.3 HERBICIDES MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 260 HERBICIDES MARKET SIZE, BY TYPE, 20142022 (USD BILLION)

15 ADDITIONAL CUSTOMIZATION (Page No. - 259)

15.1 KEY ASPECTS

TABLE 261 KEY ASPECTS OF HERBICIDE SAFENERS

TABLE 262 LIST OF HERBICIDE ACTIVE INGREDIENTS MIXED WITH ACTIVE SAFENERS: VOLUME

16 APPENDIX (Page No. - 267)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

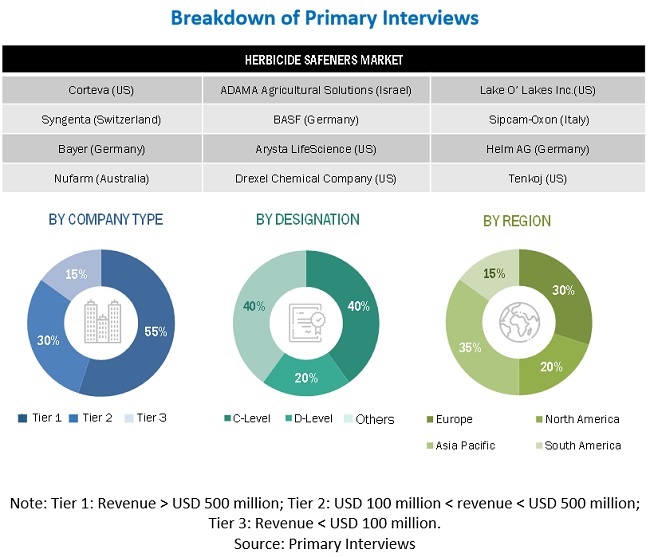

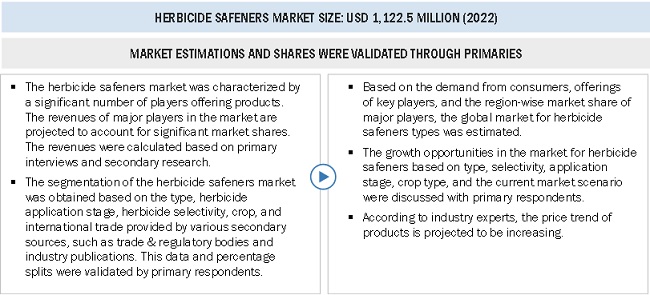

The study involved four major steps in estimating the size of the Herbicides safener market. Exhaustive secondary research was done to collect information on the market, as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Secondary research was mainly conducted to obtain critical information about the industrys supply chain, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, which include raw material suppliers, technology suppliers, and herbicide safener manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include herbicide safener manufacturers. The primary sources from the demand side include distributors, importers, exporters, and end consumers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the market. These approaches have also been used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- Approach 1:

- The key players in the industry and the market were identified through extensive secondary research.

- The revenues of major herbicide safeners market players were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- Based on the market share analysis of key industry players from all regions, we arrived at the final market size of the herbicide safeners market.

- Approach 2:

- Based on the demand for the type of herbicide safeners, selectivity, application stage, crop, offerings of key players, and the region-wise market share of major players, the global market, by type, was estimated.

- The demand analysis was conducted for each type, selectivity, application stage, crop type, and regional segment.

- The pricing analysis was conducted across regions at a global level.

- From this, we derived the market sizes for each region.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the herbicides safeners market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global Herbicides safener Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into various segments and subsegments. To estimate the overall market and arrive at the exact statistics for all subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- Determining and projecting the herbicide safeners market size with respect to its type, herbicide application stage, herbicide selectivity, crop, and regional markets, over a five-year-period ranging from 2022 to 2027

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling key market players and service providers in the herbicide safeners market based on the following:

- Product offering

- Business strategies

- Strengths, weaknesses, opportunities, and threats

- Key financials

- Understanding the competitive landscape for a comparative analysis of market leaders and identifying the key market shareholders across the industry.

- Analyzing regulatory frameworks across regions and their impact on prominent market players

- Providing insights on key investments in product innovations and technology

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific scientific needs.

The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of European market for herbicide safeners into Poland and Ukraine.

- Further breakdown of the Rest of Asia Pacific market for herbicide safeners into India, Vietnam, Malaysia, Indonesia, and Thailand.

- Further breakdown of the Rest of South American market for herbicide safeners into Colombia, Paraguay, Uruguay, and Chile.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Herbicides Safener Market