Wireless Audio Device Market Size, Share & Growth

Wireless Audio Device Market by Product (Headphones, Earphones, Speakers, True Wireless Hearables/Earbuds, Soundbars), Functionality (Smart Devices, Non-smart Devices), Technology (Bluetooth, Wi-Fi, Radio Frequency), and Application - Forecast to 2032

OVERVIEW

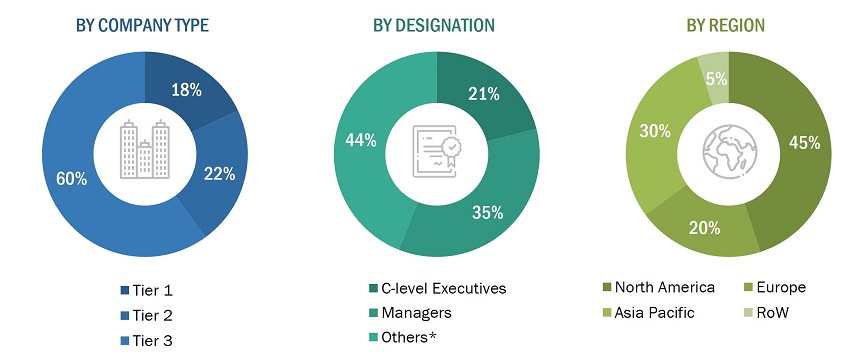

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The wireless audio device market size is projected to reach USD 81.39 billion by 2032 from USD 60.01 billion in 2025, at a CAGR of 4.4%. The growth of the wireless audio device market is driven by rising smartphone adoption, increasing consumer preference for cable-free and portable audio solutions, and expanding use cases across entertainment, gaming, fitness, and remote work.The wireless audio device market is rapidly growing as consumers increasingly prefer portable, cord-free devices such as earbuds, headphones, and speakers for seamless connectivity with smartphones and smart devices. Advancements in Bluetooth technology, longer battery life, and high-quality audio streaming are driving widespread adoption across residential, commercial, and entertainment applications.

KEY TAKEAWAYS

-

By RegionAsia Pacific accounted for a 39.8% share of the global wireless audio device market in 2024.

-

By ProductBy product, the True Wireless Hearables/Earbuds segment is expected to register the highest CAGR of 5.6%.

-

By TechnologyBy technology, the Bluetooth segment is projected to grow at the fastest rate of 4.9% from 2025 to 2032.

-

By FunctionalityBy functionality, the smart devices segment is expected to dominate the market.

-

By ApplicationBy application, the automotive segment is projected to grow at the highest rate during the forecast period.

-

Competitive LandscapeCompany Apple Inc. (US), HARMAN International (US), and Xiaomi(China) were identified as some of the star players in the wireless audio device market (global), given their strong market share and product footprint.

-

Competitive LandscapeCompanies Anker Innovations (China) and Edifier (China), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The wireless audio device market is experiencing strong growth, driven by increasing consumer demand for compact, cable-free, and high-performance audio products, such as true wireless earbuds, wireless headphones, and smart hearables, which enhance convenience, mobility, and sound quality. New deals and developments, including investments in advanced Bluetooth, battery, and noise-cancellation technologies, as well as innovations in AI-enabled audio processing and sustainable product design, are reshaping the competitive landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The wireless audio device market share has evolved significantly over time. While conventional wireless speakers are already widely used, ongoing advances in audio technology are driving a shift toward smart speakers due to their added functionality and user benefits. Smart speakers enhance the listening experience through features such as intelligent assistance and improved sound quality. Demand from consumer, home audio, automotive, entertainment, education, security, professional, and commercial applications is expected to create strong growth opportunities for market participants. The e adoption of Bluetooth LE, high-fidelity audio systems, and integrated smart assistance features are expected to provide new revenue opportunities for market players.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Elevating demand for true wireless earbuds and headphones

-

Rising adoption of wireless audio devices in commercial sector

Level

-

Restrictive radio frequency spectrum in audio equipment

-

Hearing impairment from prolonged

Level

-

Popularity of wireless audio devices in health and fitness sector

-

Advent of Bluetooth LE Audio

Level

-

Compromised audio quality due to bandwidth constraints, coding delays, and errors

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Elevating demand for true wireless earbuds and headphones

The wireless audio device market is driven by the growing popularity of truly wireless earbuds offering portability, long battery life, and advanced features such as ANC and voice assistants, along with rising smartphone adoption and seamless wireless technologies like Bluetooth, Wi-Fi, and AirPlay, enabling easy, multi-device audio streaming.

Restraint: Restrictive radio frequency spectrum in audio equipment

Radio frequency devices operating between 3 kHz and 300 GHz are regulated by the FCC to prevent interference with radio services. Manufacturers must comply with FCC equipment authorization rules, which can act as a restraint due to compliance complexity, cost, and regulatory requirements, despite growing adoption across sectors such as healthcare.

Opportunity: Popularity of wireless audio devices in health and fitness sector

The health & fitness sector presents strong opportunities for wireless audio devices, driven by rising fitness adoption and demand for smart, cord-free solutions. Devices with immersive sound, customizable audio, and built-in health sensors for tracking vitals and workouts, along with real-time and voice-enabled feedback, are enhancing user engagement and driving market growth.

Challenge: Compromised audio quality due to bandwidth constraints, coding delays, and errors

Designing wireless audio devices is challenging due to bandwidth limitations, coding delays, and bit errors that affect real-time audio quality. Although Bluetooth and Wi-Fi have advanced, limited available bandwidth, such as Bluetooth A2DP caps and audio-video convergence in consumer devices, continues to restrict performance and complicate product development.

WIRELESS AUDIO DEVICE MARKET SIZE, SHARE AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of AirPods and AirPods Pro across consumer electronics and enterprise mobility ecosystems, integrated with iOS, macOS, and spatial audio technologies | Seamless device interoperability, enhanced user experience, strong ecosystem lock-in, and premium sound quality with active noise cancellation |

|

Use of wireless noise-canceling headphones (WH-1000XM series) in consumer, travel, and professional audio segments | Industry-leading noise cancellation, superior audio processing, improved user comfort, and strong brand differentiation |

|

Adoption of wireless earbuds and headphones in aviation, corporate offices, and premium consumer markets | Advanced acoustic engineering, reduced ambient noise, improved productivity, and high customer loyalty |

|

Integration of Galaxy Buds within the Galaxy smartphone and wearable ecosystem, targeting mass-market consumers | Optimized device connectivity, scalable manufacturing, competitive pricing, and enhanced user convenience |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The wireless audio device market ecosystem comprises R&D engineers, raw material suppliers, device manufacturers, technology providers, system integrators, distributors, and service providers collaborating to deliver end-to-end audio solutions. This interconnected ecosystem enables innovation in sound quality, connectivity, manufacturing efficiency, distribution reach, and content integration across consumer and enterprise applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Wireless Audio Device Market, By Product

As of 2024, the true wireless hearables/earbuds segment held the largest share of the wireless audio device market and is expected to maintain its lead during the forecast period due to strong consumer demand for compact, cable-free designs, improved battery life, advanced features such as ANC and voice assistants, and seamless integration with smartphones and wearable ecosystems.

Wireless Audio Device Market, By Technology

In 2024, Bluetooth technology dominated the wireless audio device market due to its wide compatibility with smartphones and consumer electronics, low power consumption, cost-effectiveness, stable connectivity, and continuous advancements such as Bluetooth Low Energy and improved audio codecs that enhance sound quality and user experience.

Wireless Audio Device Market, By Application

The consumer application is expected to dominate the wireless audio device market in 2032 because of widespread smartphone usage, growing adoption of true wireless earbuds and headphones, rising demand for entertainment and gaming, and increasing preference for convenient, portable, and feature-rich audio solutions among end users.

REGION

Asia Pacific to be fastest-growing region in wireless audio device market during forecast period

The Asia Pacific wireless audio device market trends is expected to register the highest CAGR during the forecast period, driven by rapid smartphone adoption, a large and tech-savvy youth population, rising disposable incomes, expanding e-commerce penetration, and the strong presence of cost-competitive local and regional manufacturers

The North America wireless audio device market is projected to reach USD 22.11 billion by 2030 from USD 18.39 billion in 2025, at a CAGR of 3.8%. Its growth is driven by increasing demand for cordless convenience, widespread adoption of smartphones and smart devices, the rise of remote work and fitness-focused lifestyles, and ongoing advances in wireless audio and connectivity technologies.

The Europe wireless audio device market is projected to reach USD 17.74 billion by 2032 from USD 13.28 billion in 2025, at a CAGR of 4.2%. It is growing due to rising demand for cordless use, widespread adoption of smartphones and smart devices, expanding remote work and fitness lifestyles, and ongoing advances in wireless audio and connectivity technologies.

WIRELESS AUDIO DEVICE MARKET SIZE, SHARE AND TRENDS: COMPANY EVALUATION MATRIX

In the wireless audio device market growth matrix, Apple Inc. (Star Player) leads with a strong market share and broad product ecosystem, driven by the widespread adoption of AirPods and seamless integration across its devices, supported by advanced features such as spatial audio and active noise cancellation. Masimo (Emerging Leader) is gaining traction through its differentiated audio offerings that integrate advanced health-monitoring and sensing technologies, strengthening its position via innovation and medically oriented use cases.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Apple Inc. (US)

- HARMAN International (US)

- Xiaomi (China)

- Sony Group Corporation (Japan)

- Imagine Marketing Limited (India)

- Bose Corporation (US)

- Sonos, Inc. (US)

- Masimo (US)

- Sennheiser electronic SE & Co. KG (Germany)

- VIZIO Inc.(US)

- VOXX International Corp. (US)

- Marshall Group AB (Sweden)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 56.93 BN |

| Market Forecast in 2032 (Value) | USD 81.39 BN |

| Growth Rate | CAGR of 4.4% from 2025-2030 |

| Years Considered | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Rest of the World |

WHAT IS IN IT FOR YOU: WIRELESS AUDIO DEVICE MARKET SIZE, SHARE AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Consumer Electronics OEM | Competitive benchmarking of wireless audio portfolios (earbuds, headphones, speakers) | Identify product gaps vs leading brands |

| True Wireless / Hearables Manufacturer | Product adoption and segment growth analysis (TWS/earbuds vs headsets vs speakers) | Insights on fastest-growing categories and subsegments |

| Bluetooth / Connectivity Chip Supplier | Technology adoption mapping (Bluetooth Classic, LE Audio, Wi-Fi) and future trends | Identify key opportunities in next-gen codecs and multi-stream support |

| Smart Home/IoT Platform Provider | Integration analysis of wireless audio ecosystem with voice assistants and smart home systems | Highlight adoption drivers for smart audio devices |

RECENT DEVELOPMENTS

- June 2024 : HARMAN International introduced the JBL Professional Pro SoundBar PSB-2, an enhancement to its PSB soundbar series, now featuring HDMI and Bluetooth digital source inputs. The PSB-2 is designed to provide focused audio output while reducing sound leakage to adjacent rooms. It is ideal for use in hotel rooms, cruise ship cabins, meeting rooms, classrooms, and other similar environments.

- September 2023 : Apple unveiled the AirPods Pro (2nd generation) with MagSafe Charging (USB-C), enhancing its popular headphones. These AirPods Pro deliver outstanding sound quality, up to twice the Active Noise Cancellation of the previous model, an advanced Transparency mode, a more immersive Spatial Audio experience, and a wider range of ear tip sizes for a better fit.

- June 2023 : Bose Corporation formed a partnership with Normani to showcase the sounds and stories of this new era, aiming to connect with music lovers around the globe. Bose believes in the ability of sound to connect and unite fans worldwide, and multi-platinum artist Normani is well-versed in using her chart-topping hits to achieve this.

FAQ

1. What are wireless audio devices and how do they work?

Wireless audio devices, including earbuds, headphones, speakers, and soundbars, transmit audio signals via Bluetooth or Wi-Fi, eliminating the need for cables while maintaining high-quality sound.

2. Which segments dominate the soundbar and wireless audio markets?

In soundbars, multi-channel setups (2.1, 5.1) and wireless-enabled models are most popular, while true wireless earbuds and portable Bluetooth speakers lead the broader wireless audio device market.

3. What drives the growth of the South Korea wireless audio market?

High smartphone penetration, tech-savvy urban consumers, smart home adoption, and preference for portable audio devices drive strong growth in South Korea’s wireless audio market.

4. How is the Bluetooth wireless audio market evolving?

The Bluetooth wireless audio market is growing due to advancements in Bluetooth standards, improved battery life, low-latency streaming, AI-based sound optimization, and increasing demand for portable audio solutions.

5. Who are the key players in these markets?

Major players include Samsung, LG, Sony, Bose, Apple, Sonos, and Vizio, offering products ranging from soundbars to true wireless earbuds and multi-room wireless speakers.

Table of Contents

Methodology

The study involved four major activities in estimating the size of the wireless audio device market. Exhaustive secondary research has been conducted to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering wireless audio devices have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases.

Secondary research has been conducted mainly to obtain critical information about the market’s value chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both demand- and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the wireless audio device market through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand and supply sides across 4 major regions: North America, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews. questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the wireless audio device market.

- Identifying end users that are either using or are expected to use wireless audio devices

- Analyzing major providers of wireless audio devices and original equipment manufacturers (OEMs), as well as studying their portfolios and understanding different technologies used

- Analyzing historical and current data pertaining to the market, in terms of volume, for each product segment of the wireless audio devices market

- Analyzing the average selling price of wireless audio devices based on different technologies used in different products

- Arriving at the market estimates by analyzing the revenue of companies and then combining these figures to arrive at the market size

- Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases, to gather the required information

- Tracking the ongoing developments and identifying the upcoming ones in the market that include investments, research and development activities, product launches, collaborations, and partnerships undertaken, as well as forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with the key opinion leaders to understand the wireless audio device technologies and related raw materials, as well as products designed and developed to analyze the break-up of the scope of work carried out by the key companies manufacturing panels

- Verifying and cross-checking the estimate at every level through discussions with key opinion leaders such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts in MarketsandMarkets

The top-down approach has been used to estimate and validate the total size of the wireless audio device market.

- Focusing on top-line investments and expenditures being made in the ecosystems of various end users

- Calculating the market size considering revenues generated by major players through the cost of wireless audio device systems

- Segmenting each application of wireless audio devices in each region and deriving the global market size based on region

- Acquiring and analyzing information related to revenues generated by players through their key product offerings

- Conducting multiple on-field discussions with key opinion leaders involved in the development of various wireless audio device offerings

- Estimating the geographic split using secondary sources based on various factors, such as the number of players in a specific country and region and the types of wireless audio device technology used in home audio, consumer, professional, and automotive applications

Data Triangulation

After arriving at the overall size of the wireless audio device market through the process explained, the total market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using the top-down and bottom-up approaches.

Market Definition

A wireless audio device refers to an instrument or a device that uses wireless technology to transmit or receive audio signals through wireless technologies such as Bluetooth, radiofrequency, and Wi-Fi. Wireless audio devices such as wireless speakers, soundbars, headphones, earphones, microphones, and headsets in the consumer electronics sector implement these technologies.

Key Stakeholders

- Brand Product Manufacturers/Original Equipment Manufacturers (OEMs)/Original Device Manufacturers (ODMs)

- Wireless Audio Device System Manufacturers

- Semiconductor Component Suppliers/Foundries

- Wireless Audio Device Material and Component Suppliers

- Manufacturing Equipment Suppliers

- System Integrators

- Technology/IP Developers

- Consulting and Market Research Service Providers

- Wireless Audio Device- and Material-related Associations, Organizations, Forums, and Alliances

- Venture Capitalists and Startups

- Research and Educational Institutes

- Distributors and Resellers

- End Users

Report Objectives

- To define, describe, and forecast the wireless audio device market, by technology, functionality, application, and region, in terms of value

- To describe and forecast the wireless audio device market, by product, in terms of value and volume

-

To forecast the market size, in terms of value for various segments with regard to

four main regions— North America, Europe, Asia Pacific, and Rest of the World (RoW) - To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the value chain pertaining to the wireless audio device ecosystem, along with the average selling prices of different types of wireless audio devices

- To provide information pertaining to the ecosystem, Porter’s five forces, technologies, tariffs and regulations, patents, trade landscape, key conferences and events, and case studies pertaining to the market under study

- To analyze the micromarkets with respect to industry trends, prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market and provide a detailed competitive landscape for market leaders

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies

- To analyze strategic developments such as product launches, collaborations, contracts, expansions, and partnerships undertaken by the leading players in the wireless audio device market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Wireless Audio Device Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Wireless Audio Device Market