Human Milk Oligosaccharides (HMO) Market by Type (2’ Fl, 3’ Fl, 3’ Sl, 6’ Sl), Application (Infant Formula, Functional Food & Beverages, Food Supplement), Concentration (Acidic, Neutral) & Region (North America, Europe, APAC, South America, RoW) - (2022 – 2027)

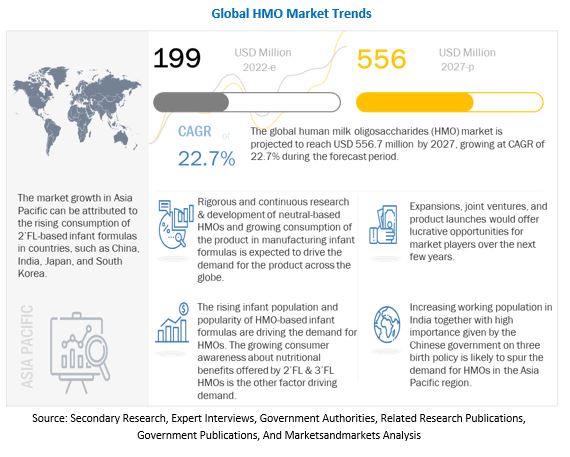

The global Human Milk Oligosaccharides Market size was valued at USD 199 million in 2022 and is projected to reach USD 556 million by 2027, growing at a CAGR of 22.7% from 2022 to 2027.

The human milk oligosaccharides market has grown due to their use as an ingredient in functional foods and infant formula, as they have properties that support inflammation and immune regulation, and aid in the neurological development of infants. The demand for such functional foods has risen as people become more health-conscious and seek to improve their diets. However, the growth of the market is hindered by the high cost of production.

To know about the assumptions considered for the study, Request for Free Sample Report

Human Milk Oligosaccharides Market Dynamics

Drivers: Rise in infant population

The UN data suggests that over 250 babies are born per minute globally. An average of 353,000 babies are born per day, making the total count of babies born in a year more than 130 million. This directly results in the rise in the consumption of infant formulas at a global level. Several other factors are also responsible for this increased consumption. Some of these include a rise in the number of working women post-giving birth, the inability of mothers to lactate, and better nutrition options for growing infants. According to the UN, the global population is projected to reach 9.6 billion by 2050. Human milk oligosaccharides are used as a major ingredient in the infant nutrition industry for manufacturing various infant formula and baby food. This constantly expanding population is expected to boost the sales of human milk oligosaccharides as an infant formula ingredient in the coming years. According to the National Bureau of Statistics of China, the country recorded 15.23 million births in 2018, creating a lucrative opportunity for manufacturers. Thus, China is expected to be a key revenue generator for the Human Milk Oligosaccharides market.

Restraints: High production cost associated with development of HMO-composed supplements and food products

The development and commercial aspects of HMO products are complex, expensive, and uncertain. Factors behind product development success are technological conditions, consumer demand, and legislative and regulatory background. Substantial investment is required for the R&D of a particular type of HMO to be used to produce dietary supplements or other functional food such as prebiotics. These products are developed and produced in accordance with international food regulations. Also, highly sterilized and technical equipment and processes are required to manufacture and extract various other functional ingredients. As a result of the high cost of production, the price of the final product is also high. Marketing and distribution further add to the product price. Although consumers are aware of the health benefits of these expensive functional food products, their high prices restrict them from buying the product. The intensity of the factor further increases in developing countries with a price-sensitive consumer base, especially in some Asian and African countries.

Opportunities: Emergence of alternative animal milk oligosaccharides

Bovine milk oligosaccharides are expected to play a key role in infant nutrition. A laboratory study by RMIT University (Australia), published in the British Journal of Nutrition, suggested that goat milk infant formula had similar prebiotic properties to breast milk and is expected to play a key role in the gut health of infants. Ausnutria Nutrition BV (Netherlands) offers goat milk-based infant formulas under its brand, Kabrita.

Another animal source is camel milk. In 2018, a UAE-based company, the Emirates Industry for Camel Milk and Products, also known as ‘Camelicious,’ launched a camel milk-based baby formula containing a high amount of iron for babies aged 1–3 years. Thus, these sources of animal milk oligosaccharides are expected to gain acceptance in the infant formula ingredients markets in the coming years. rigorous regulatory requirements in the environmental protection sector apply to the manufacturers’ production processes and their production environment

Challenges: Complex industrial process to extract oligosaccharides from milk

One of the biggest challenges associated with developing large-scale or industrial processes to recover oligosaccharides from mammalian milk is achieving a high degree of purity. More specifically, the challenge is to remove simple sugars such as lactose, glucose, and galactose that lack prebiotic activities and might have adverse effects while simultaneously maximizing product recovery. The use of lactose hydrolysis combined with membrane filtration to recover oligosaccharides from milk was successful; however, as the process remains tedious, there is a need to introduce much more advanced and convenient techniques through rigorous techniques research and development activities.

To know about the assumptions considered for the study, download the pdf brochure

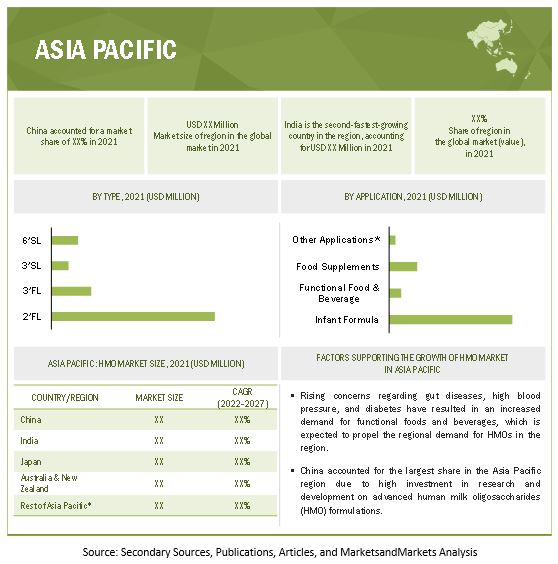

Asia Pacific dominated the Human Milk Oligosaccharides Market, with a value of USD 92.6 million in 2021; it is projected to reach USD 321.8 million by 2027, at a CAGR of 23.2% during the forecast period.

Asia Pacific consisting of countries like China, India, Japan, Australia & New Zealand and Others is found to dominate the HMO market with presence of large consumer base for Human Milk Oligosaccharides derivative products. The region is densely populated with countries like China and India, witnessing a rapid rise in infant population every year. This tendency of population rising is influencing the infant formula market where HMO is used as a vital ingredient for formulating infant foods and other supplements.

New Zealand is one of the major exporters of infant formulas to China, which generates high revenue for the country; hence, the market of HMO-based infant formulas in New Zealand is expected to witness substantial growth during the forecast period. Japan is expected to witness gradual growth in the HMO market, due to the decline in birth rates in recent years. According to an article published by the World Economic Forum in January 2022, the number of births recorded in Japan in 2020 stood at 840,832, which is 2.8% lower than in 2019 and the lowest since 1899.

Top Companies in the Human Milk Oligosaccharides Market

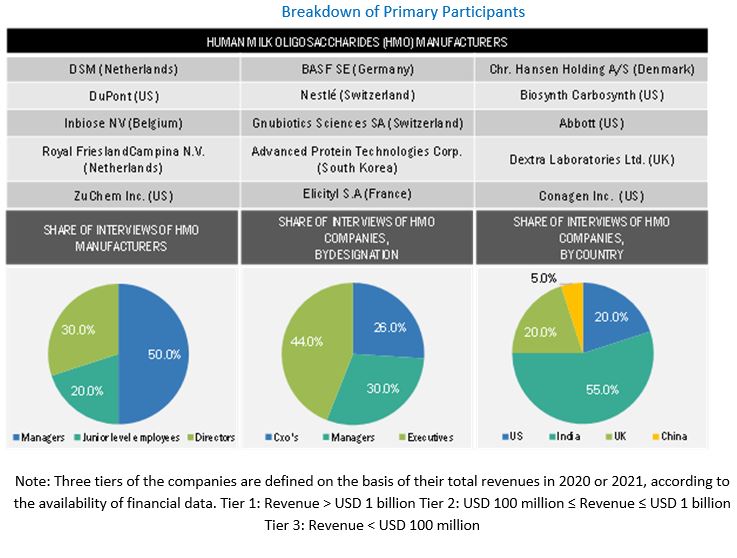

The key players in the Human Milk Oligosaccharides Market include DSM (Netherlands), BASF SE (Germany), Chr. Hansen Holding A/S (Denmark), DUPONT ( US), and Royal FrieslandCampina N.V. (Netherlands).

Scope of the report

The increase in the application of HMOs in functional foods and rising demand in infant formula have led to the growth of the HMOs market.

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 199 million |

|

Market Size Value in 2027 |

USD 556 million |

|

Market Growth Rate |

CAGR of 22.7% from 2022 to 2027 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments covered |

By Type, Application and Concentration |

|

Regions covered |

North America, Europe, Asia Pacific, South America and RoW |

|

Market Growth Drivers |

The increase in the application of HMOs in functional foods and rising demand in infant formula have led to the growth of the HMOs market |

|

Market Opportunities |

Emergence of alternative animal milk oligosaccharides to create opportunities in the HMO market. |

|

Largest Growing Region |

Asia Pacific consisting of countries like China, India, Japan, Australia and New Zealand |

|

Companies studied |

|

This research report categorizes the Human Milk Oligosaccharides Market, based on type, application, concentration and region

Target Audience

- HMO raw material suppliers

- HMO manufacturers

- Intermediate suppliers, such as traders and distributors of HMO

- Manufacturers of infant formula, functional food and beverages, dietary supplements etc.

- Government and research organizations

-

Associations, regulatory bodies, and other industry-related bodies:

- World Health Organization (WHO)

- European Food Safety Authority (EFSA)

- U.S. Food and Drug Administration

- Environmental Protection Agency

Human Milk Oligosaccharides Market Segmentation

|

By Type |

By Application |

By Concentration |

By Region |

|

|

|

|

Recent Developments

- In August 2021, Nestle launched the new NAN SUPREME PRO 3 formula products with five human milk oligosaccharides (2’-FL, DFL, LNT, 3’-SL, and 6’-SL), which it claims enhance children’s immunity systems.

- In September 2020, Chr. Hansen acquired Jennewein Biotechnologie GmbH and a strong patent portfolio relating to the production of human milk oligosaccharides (HMOs) and several litigations related hereto.

- In May 2019, BASF and Glycosyn signed a partnership agreement for the development and commercialization of human milk oligosaccharides (HMOs) for broad use in dietary supplements, functional nutrition, and medical food.

- In February 2019, DuPont Nutrition & Health and Lonza Specialty Ingredients announced an agreement under which Lonza will manufacture and supply CARE4U 2’-FL—a human milk oligosaccharide (HMOs). The development of HMOs is part of a larger microbiome investment strategy for DuPont, and central to this is developing scalable production

- In December 2018, Royal FrieslandCampina N.V. completed the acquisition of a Spain-based distributor, Millan Vicente, which would help it grow its presence in the infant formula ingredients market in Spain.

FAQs:

What is the projected market value of the global Human Milk Oligosaccharides Market?

What are the major revenue pockets in the Human Milk Oligosaccharides Market currently?

Asia Pacific dominated the Human Milk Oligosaccharides Market, with a value of USD 92.6 million in 2021; it is projected to reach USD 321.8 million by 2027, at a CAGR of 23.2% during the forecast period.

Which are the key players in the human milk oligosaccharides market, and how intense is the competition?

The key players in this market include DSM (Netherlands), BASF SE (Germany), CHR Hansen Holding A/S (Denmark), Dupont (US), and Others. The players, such as DSM (Netherlands), BASF (Germany), CHR Hansen Holding A/S (Denmark), Dupont (US), and Nestle (Switzerland), are expected to dominate the market due to their innovative products and usage of different distribution channels to meet consumer demand. These companies have been focusing on expanding their market presence, enhancing their solutions, and partnering with a large number of channel partners and technology companies to cater to consumers across the globe. The deep roots of these players in the market and their robust offerings are among the major factors that have helped the company achieve major sales and revenues in the global HMO market .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES CONSIDERED, 2017–2021

1.7 UNITS CONSIDERED

1.8 STAKEHOLDERS

1.9 INTRODUCTION TO COVID-19

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 HUMAN MILK OLIGOSACCHARIDES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 HUMAN MILK OLIGOSACCHARIDES MARKET SIZE ESTIMATION, BY TYPE (SUPPLY-SIDE)

FIGURE 5 MARKET SIZE ESTIMATION (DEMAND-SIDE)

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 9 COVID-19: GLOBAL PROPAGATION

FIGURE 10 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 11 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 12 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 13 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 46)

TABLE 3 HUMAN MILK OLIGOSACCHARIDES MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 14 HUMAN OLIGOSACCHARIDES MARKET, BY TYPE, 2022 VS. 2027

FIGURE 15 MARKET, BY APPLICATION, 2022 VS. 2027

FIGURE 16 MARKET, BY CONCENTRATION, 2022 VS. 2027

FIGURE 17 MARKET : REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 18 HUMAN MILK OLIGOSACCHARIDES IMPART MEMORY ENHANCEMENT, GUT HEALTH MAINTENANCE, AND BRAIN DEVELOPMENT TO INFANTS

4.2 HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION

FIGURE 19 ASIA PACIFIC EXPECTED TO DOMINATE THE GLOBAL MARKET BY 2027 IN TERMS OF VALUE

FIGURE 20 ASIA PACIFIC EXPECTED TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD, BY VOLUME TERMS

4.3 MARKET, BY TYPE

FIGURE 21 2’FL SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD BY VALUE TERMS

FIGURE 22 MARKET FOR 2’FL-BASED HMOS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE BY 2027 IN TERMS OF VOLUME

4.4 HMO MARKET, BY CONCENTRATION

FIGURE 23 NEUTRAL HUMAN MILK OLIGOSACCHARIDES SEGMENT EXPECTED TO ACCOUNT FOR A LARGER SIZE DURING THE FORECAST PERIOD

4.5 MARKET, BY APPLICATION

FIGURE 24 DEMAND FOR HMOS IN INFANT FORMULA APPLICATION EXPECTED TO BE THE HIGHEST DURING THE FORECAST PERIOD

4.6 ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET , BY TYPE & KEY COUNTRY

FIGURE 25 CHINA AND 2’FL MARKET SEGMENTS ACCOUNTED FOR A SIGNIFICANT SHARE IN THE MARKET

FIGURE 26 CANADA, THE US, MEXICO, AND CHINA EXPECTED TO GROW AT A SIGNIFICANT RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 DIGITALIZATION OF THE RETAIL INDUSTRY

FIGURE 27 EU: ONLINE PURCHASES OF GOODS & SERVICES, 2018

5.2.2 RISE IN THE NUMBER OF DUAL-INCOME HOUSEHOLDS

FIGURE 28 US: EMPLOYMENT STATUS OF PARENTS WITH CHILDREN UNDER 18 YEARS, 2020

5.2.3 RAPID URBANIZATION ACROSS REGIONS

FIGURE 29 URBAN AND RURAL POPULATIONS IN THE WORLD, 2016–2020

5.3 MARKET DYNAMICS

FIGURE 30 HUMAN MILK OLIGOSACCHARIDES MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Rise in the infant population

FIGURE 31 GROWTH IN INFANT POPULATION, 2010–2020 (THOUSAND)

5.3.1.2 Growth in health awareness leading to increased consumption of dietary supplements

FIGURE 32 US: DIETARY CONSUMPTION RATE, BY AGE GROUP, 2020

5.3.1.3 Extensive R&D initiatives by companies operating in the infant formula market

5.3.2 RESTRAINTS

5.3.2.1 Higher production costs associated with the development of HMO-composed supplements and food products

5.3.2.2 Stringent regulations and trade policies in the infant formula and dietary supplement industries

5.3.3 OPPORTUNITIES

5.3.3.1 Emergence of alternative animal milk oligosaccharides

5.3.3.2 Adoption of advanced technologies in the functional food industry

5.3.4 CHALLENGES

5.3.4.1 Complex industrial process to extract oligosaccharides from milk

5.3.4.2 Lack of consumer awareness regarding benefits associated with HMO-formulated products

5.4 KEY CONFERENCES & EVENTS

TABLE 4 HUMAN MILK OLIGOSACCHARIDES MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

5.5 KEY STAKEHOLDERS & BUYING CRITERIA

5.5.1 KEY STAKEHOLDERS IN THE BUYING PROCESS

TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 MODES OF APPLICATIONS

5.5.2 BUYING CRITERIA

FIGURE 33 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 6 KEY BUYING CRITERIA FOR TOP 3 MODES OF APPLICATION

6 INDUSTRY TRENDS (Page No. - 66)

6.1 OVERVIEW

6.2 REGULATORY FRAMEWORK

6.3 NORTH AMERICA

6.3.1 CANADA

6.3.2 US

6.3.3 MEXICO

6.4 EUROPEAN UNION (EU)

6.5 ASIA PACIFIC

6.5.1 JAPAN

6.5.2 CHINA

6.5.3 INDIA

6.5.4 AUSTRALIA & NEW ZEALAND

6.6 SOUTH AMERICA

6.6.1 BRAZIL

6.6.2 ARGENTINA

6.7 REST OF THE WORLD (ROW)

6.7.1 MIDDLE EAST

6.8 REGULATORY BODIES

6.9 PATENT ANALYSIS

FIGURE 34 HUMAN MILK OLIGOSACCHARIDES MARKET: PATENT ANALYSIS, BY APPLICANT, 2017–2021

FIGURE 35 MARKET: PATENT ANALYSIS, BY REGION, 2017–2021

FIGURE 36 MARKET: PATENT ANALYSIS, BY LEGAL STATUS, 2017–2021

TABLE 7 RECENT PATENTS GRANTED WITH RESPECT TO HMOS

6.10 VALUE CHAIN ANALYSIS

FIGURE 37 VALUE CHAIN ANALYSIS

6.11 COVID-19 IMPACT ON THE MARKET

6.12 TREND/DISRUPTION IMPACTING BUYERS IN THE HUMAN MILK OLIGOSACCHARIDES MARKET

FIGURE 38 REVENUE SHIFT FOR THE MARKET

6.13 MARKET ECOSYSTEM

TABLE 8 MARKET: ECOSYSTEM

6.14 TECHNOLOGY ANALYSIS

6.14.1 HIGH-PERFORMANCE ANION-EXCHANGE CHROMATOGRAPHY FOR HUMAN MILK OLIGOSACCHARIDES ANALYSIS

6.14.2 CAPILLARY ELECTROPHORESIS FOR HUMAN MILK OLIGOSACCHARIDES ANALYSIS

6.15 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 PORTER’S FIVE FORCES ANALYSIS

6.15.1 INTENSITY OF COMPETITIVE RIVALRY

6.15.2 BARGAINING POWER OF SUPPLIERS

6.15.3 BARGAINING POWER OF BUYERS

6.15.4 THREAT OF SUBSTITUTES

6.15.5 THREAT OF NEW ENTRANTS

6.16 CASE STUDY ANALYSIS

6.16.1 USE CASE 1: LAYER ORIGIN INTRODUCED EASY-TO-USE AND EFFICIENT-TO-HMO PREBIOTIC PILLS AND POWDER FOR ADULTS

6.17 PRICE ANALYSIS

6.17.1 INTRODUCTION

6.17.2 PRICE ANALYSIS: MARKET, BY TYPE, 2017-2021 (USD PER/KG)

6.17.3 PRICE ANALYSIS: HMO MARKET, BY REGION, 2017-2021 (USD PER/KG)

7 HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE (Page No. - 80)

7.1 INTRODUCTION

FIGURE 39 MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 10 HMO MARKET, BY TYPE, 2017–2021 (TONS)

TABLE 11 MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 12 HMO MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 13 MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.1.1 MARKET: COVID-19 IMPACT ANALYSIS, BY TYPE

TABLE 14 REALISITIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY TYPE, 2017–2022 (USD MILLION)

TABLE 15 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

TABLE 16 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

7.2 2’FL

7.2.1 AUTHORIZATION OF HMOS BY GOVERNMENT BODIES FOR CONSUMPTION

TABLE 17 2’FL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 18 2’FL: HMO MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 19 2’FL: MARKET , BY REGION, 2017–2021 (TONS)

TABLE 20 2’FL: MARKET , BY REGION, 2022–2027 (TONS)

7.3 3’FL

7.3.1 PREBIOTIC QUALITY OF 3’FL EXPECTED TO PROPEL THE GROWTH OF THE HUMAN MILK OLIGOSACCHARIDES MARKET IN THE UPCOMING YEARS

TABLE 21 3’FL: MARKET , BY REGION, 2017–2021 (USD MILLION)

TABLE 22 3’FL: MARKET , BY REGION, 2022–2027 (USD MILLION)

TABLE 23 3’FL: MARKET , BY REGION, 2017–2021 (TONS)

TABLE 24 3’FL: MARKET , BY REGION, 2022–2027 (TONS)

7.4 3’SL

7.4.1 SIGNIFICANCE OF 3’SL IN LANGUAGE DEVELOPMENT DURING EARLY CHILDHOOD

TABLE 25 3’SL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 26 3’SL: HMO MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 27 3’SL: HUMAN MILK OLIGOSACCHARIDES MARKET , BY REGION, 2017–2021 (TONS)

TABLE 28 3’SL: MARKET , BY REGION, 2022–2027 (TONS)

7.5 6’SL

7.5.1 WIDE USAGE OF HMOS ACROSS INDUSTRIES

TABLE 29 6’SL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 30 6’SL: MARKET , BY REGION, 2022–2027 (USD MILLION)

TABLE 31 6’SL: HMO MARKET, BY REGION, 2017–2021 (TONS)

TABLE 32 6’SL: MARKET , BY REGION, 2022–2027 (TONS)

8 HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION (Page No. - 93)

8.1 INTRODUCTION

FIGURE 40 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 33 MARKET , BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 34 MARKET , BY APPLICATION, 2022–2027 (USD MILLION)

8.1.1 EXTENSIVE R&D ACTIVITIES BY INFANT FORMULA MANUFACTURERS

TABLE 35 INFANT FORMULA: HMO MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 36 INFANT FORMULA: HUMAN MILK OLIGOSACCHARIDES MARKET , BY REGION, 2022–2027 (USD MILLION)

8.2 FUNCTIONAL FOOD & BEVERAGES

8.2.1 ROLE OF FAST-PACED LIFESTYLE AND GROWING ADOPTION OF CONVENIENCE FOOD PRODUCTS IN THE GROWTH OF FUNCTIONAL

TABLE 37 FUNCTIONAL FOOD & BEVERAGES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 38 FUNCTIONAL FOOD & BEVERAGES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 FOOD SUPPLEMENTS

8.3.1 GROWING HEALTH AWARENESS AND DEMAND FOR NUTRITION-RICH FOOD PRODUCTS

TABLE 39 FOOD SUPPLEMENTS: HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 40 FOOD SUPPLEMENTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 OTHER APPLICATIONS

8.4.1 WIDE USAGE OF HMOS ACROSS INDUSTRIES

TABLE 41 OTHER APPLICATIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 42 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 HUMAN MILK OLIGOSACCHARIDES MARKET, BY CONCENTRATION (Page No. - 101)

9.1 INTRODUCTION

FIGURE 41 MARKET, BY CONCENTRATION, 2022 VS. 2027 (USD MILLION)

TABLE 43 HMO MARKET, BY CONCENTRATION, 2017–2021 (USD MILLION)

TABLE 44 MARKET, BY CONCENTRATION, 2022–2027 (USD MILLION)

9.2 NEUTRAL

9.2.1 RISING CONSUMER CONCERNS REGARDING GUT HEALTH AND IMMUNITY IN INFANTS

TABLE 45 NEUTRAL: MARKET FOR HUMAN MILK OLIGOSACCHARIDES, BY REGION, 2017–2021 (USD MILLION)

TABLE 46 NEUTRAL: MARKET , BY REGION, 2022–2027 (USD MILLION)

9.3 ACIDIC

9.3.1 IMITATION OF HUMAN MILK IN PREMIUM INFANT FORMULAS

TABLE 47 ACIDIC: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 48 ACIDIC: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION (Page No. - 106)

10.1 INTRODUCTION

FIGURE 42 CHINA EXPECTED TO ACCOUNT FOR THE LARGEST SHARE IN THE MARKET IN 2022

FIGURE 43 MARKET FOR HUMAN MILK OLIGOSACCHARIDES, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 49 GLOBAL HUMAN MILK OLIGOSACCHARIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 50 GLOBAL MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 51 GLOBAL MARKET, BY REGION, 2017–2021 (TONS)

TABLE 52 GLOBAL MARKET, BY REGION, 2022–2027 (TONS)

TABLE 53 GLOBAL HMO MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 54 GLOBAL MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 55 GLOBAL HMO MARKET, BY TYPE, 2017–2021 (TONS)

TABLE 56 GLOBAL MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 57 GLOBAL HMO MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 58 GLOBAL MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 59 GLOBAL HMO MARKET, BY CONCENTRATION, 2017–2021(USD MILLION)

TABLE 60 GLOBAL MARKET, BY CONCENTRATION, 2022–2027 (USD MILLION)

10.2 HUMAN MILK OLIGOSACCHARIDES MARKET: COVID-19 IMPACT ANALYSIS - BY REGION

TABLE 61 REALISITIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 62 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 63 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY REGION, 2017–2022 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 44 NORTH AMERICA: MARKETSNAPSHOT, 2022

TABLE 64 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY TYPE, 2017–2021 (TONS)

TABLE 69 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 70 NORTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY CONCENTRATION, 2017–2021 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY CONCENTRATION, 2022–2027 (USD MILLION)

10.3.1 US

10.3.1.1 Increased demand from end-user companies, such as Nestlé S.A. (Switzerland) and Danone S.A. (France)

TABLE 74 US: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 75 US: MARKET , BY TYPE, 2022–2027 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Cronobacter Sakazakii or Salmonella Newport infection among infants hindering the Canadian market

TABLE 76 CANADA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 77 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.3 MEXICO

10.3.3.1 Rise in per capita expenditure on nutritious and healthy foods estimated to boost the market

TABLE 78 MEXICO: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 79 MEXICO: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4 EUROPE

TABLE 80 EUROPE: HUMAN MILK OLIGOSACCHARIDES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY TYPE, 2017–2021 (TONS)

TABLE 85 EUROPE: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 86 EUROPE: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY CONCENTRATION, 2017–2021 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY CONCENTRATION, 2022–2027 (USD MILLION)

10.4.1 GERMANY

10.4.1.1 Continuous research and development in the HMO segment

TABLE 90 GERMANY: MARKET FOR HUMAN MILK OLIGOSACCHARIDES, BY TYPE, 2017–2021 (USD MILLION)

TABLE 91 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.2 UK

10.4.2.1 Introduction of HMO-based infant formulas

TABLE 92 UK: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 93 UK: HMO MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.3 FRANCE

10.4.3.1 Strategic initiatives taken by local players

TABLE 94 FRANCE: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 95 FRANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.4 SPAIN

10.4.4.1 Consumer preference for clean-label ingredients paving the way for 2’FL dietary supplement products

TABLE 96 SPAIN: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 97 SPAIN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.5 ITALY

10.4.5.1 Increasing popularity of HMO-based adult supplements

TABLE 98 ITALY: MARKET FOR HUMAN MILK OLIGOSACCHARIDES, BY TYPE, 2017–2021 (USD MILLION)

TABLE 99 ITALY: HMO MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.4.6 REST OF EUROPE

10.4.6.1 Aggressive marketing around infant formulas and misleading health claims hindering the market growth

TABLE 100 REST OF EUROPE: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 101 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.5 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: HUMAN MILK OLIGOSACCHARIDES MARKET SNAPSHOT, 2022

TABLE 102 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 104 ASIA PACIFIC: HMO MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY TYPE, 2017–2021 (TONS)

TABLE 107 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 108 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY CONCENTRATION, 2017–2021 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY CONCENTRATION, 2022–2027 (USD MILLION)

10.5.1 CHINA

10.5.1.1 Continuous research & development in the field of HMO expected to expand the market

TABLE 112 CHINA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 113 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.5.2 INDIA

10.5.2.1 Millennial population playing an important role in driving the demand for HMO-based food products

TABLE 114 INDIA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 115 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.5.3 JAPAN

10.5.3.1 Stringent rules and regulations by the Japanese government bodies challenging human milk oligosaccharides market growth

TABLE 116 JAPAN: HMO MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 117 JAPAN: HMO MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.5.4 AUSTRALIA & NEW ZEALAND

10.5.4.1 Approval for the use of 2’FL HMOs in infant formula

TABLE 118 AUSTRALIA & NEW ZEALAND: MARKET FOR HUMAN MILK OLIGOSACCHARIDES, BY TYPE, 2017–2021 (USD MILLION)

TABLE 119 AUSTRALIA & NEW ZEALAND: HMO MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.5.5 REST OF ASIA PACIFIC

10.5.5.1 Strategic decisions undertaken

TABLE 120 REST OF ASIA PACIFIC: HMO MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 121 REST OF ASIA PACIFIC: HMO MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.6 SOUTH AMERICA

TABLE 122 SOUTH AMERICA: HUMAN MILK OLIGOSACCHARIDES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 123 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 124 SOUTH AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 125 SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 126 SOUTH AMERICA: MARKET, BY TYPE, 2017–2021 (TONS)

TABLE 127 SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 128 SOUTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 129 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 130 SOUTH AMERICA: MARKET, BY CONCENTRATION, 2017–2021 (USD MILLION)

TABLE 131 SOUTH AMERICA: MARKET, BY CONCENTRATION, 2022–2027 (USD MILLION)

10.6.1 BRAZIL

10.6.1.1 Infant formulas gaining popularity due to their ease of use

TABLE 132 BRAZIL: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 133 BRAZIL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.6.2 ARGENTINA

10.6.2.1 Growing inclination toward functional food

TABLE 134 ARGENTINA: MARKET , BY TYPE, 2017–2021 (USD MILLION)

TABLE 135 ARGENTINA: HMO MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.6.3 REST OF SOUTH AMERICA

10.6.3.1 Influence of health and wellness trends

TABLE 136 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 137 REST OF SOUTH AMERICA: HMO MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.7 REST OF THE WORLD (ROW)

TABLE 138 ROW: HUMAN MILK OLIGOSACCHARIDES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 139 ROW: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 140 ROW: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 141 ROW: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 142 ROW: MARKET, BY TYPE, 2017–2021 (TONS)

TABLE 143 ROW: MARKET, BY TYPE, 2022–2027 (TONS)

TABLE 144 ROW: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 145 ROW: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 146 ROW: MARKET, BY CONCENTRATION, 2017–2021 (USD MILLION)

TABLE 147 ROW: MARKET, BY CONCENTRATION, 2022–2027 (USD MILLION)

10.7.1 MIDDLE EAST

10.7.1.1 Complementary food feeding among infants

TABLE 148 MIDDLE EAST: HUMAN MILK OLIGOSACCHARIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 149 MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.7.2 AFRICA

10.7.2.1 Prevalence of vitamin deficiency among women and children

TABLE 150 AFRICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 151 AFRICA: HMO MARKET, BY TYPE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 156)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS, 2021

TABLE 152 HUMAN MILK OLIGOSACCHARIDES MARKET: DEGREE OF COMPETITION

11.3 KEY PLAYER STRATEGIES

11.4 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 46 THREE-YEAR TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2019–2021 (USD BILLION)

11.5 COVID-19-SPECIFIC COMPANY RESPONSE

11.5.1 DSM

11.5.2 BASF SE

11.5.3 DUPONT

11.5.4 CHR HANSEN HOLDING A/S

11.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 47 HUMAN MILK OLIGOSACCHARIDES MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

11.7 PRODUCT FOOTPRINT

TABLE 153 COMPANY, BY TYPE FOOTPRINT

TABLE 154 COMPANY, BY APPLICATION FOOTPRINT

TABLE 155 COMPANY, BY REGIONAL FOOTPRINT

TABLE 156 COMPANY, BY OVERALL FOOTPRINT

11.8 START-UP/SME EVALUATION QUADRANT (OTHER PLAYERS)

11.8.1 PROGRESSIVE COMPANIES

11.8.2 STARTING BLOCKS

11.8.3 RESPONSIVE COMPANIES

11.8.4 DYNAMIC COMPANIES

TABLE 157 DETAILED LIST OF KEY STARTUP/SMES

TABLE 158 HUMAN MILK OLIGOSACCHARIDES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

FIGURE 48 MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

11.9 COMPETITIVE SCENARIO

11.9.1 NEW PRODUCT LAUNCHES

TABLE 159 MARKET: NEW PRODUCT LAUNCHES, 2018–2021

11.9.2 DEALS

TABLE 160 MARKET: DEALS, 2018–2021

12 COMPANY PROFILES (Page No. - 172)

12.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

12.1.1 DSM

TABLE 161 DSM: BUSINESS OVERVIEW

FIGURE 49 DSM: COMPANY SNAPSHOT

TABLE 162 DSM: PRODUCTS OFFERED

TABLE 163 DSM: DEALS

12.1.2 BASF SE.

TABLE 164 BASF SE.: BUSINESS OVERVIEW

FIGURE 50 BASF SE.: COMPANY SNAPSHOT

TABLE 165 BASF SE.: PRODUCTS OFFERED

TABLE 166 BASF SE: NEW PRODUCT LAUNCHES

TABLE 167 BASF SE.: DEALS

12.1.3 CHR HANSENHOLDING A/S

TABLE 168 CHR HANSEN HOLDING A/S: BUSINESS OVERVIEW

FIGURE 51 CHR. HANSEN HOLDINGS A/S: COMPANY SNAPSHOT

TABLE 169 CHR. HANSEN HOLDINGS A/S: PRODUCTS OFFERED

TABLE 170 CHR. HANSEN HOLDING A/S: DEALS

12.1.4 DUPONT

TABLE 171 DUPONT: HUMAN MILK OLIGOSACCHARIDES MARKET BUSINESS OVERVIEW

FIGURE 52 DUPONT: COMPANY SNAPSHOT

TABLE 172 DUPONT: PRODUCTS OFFERED

TABLE 173 DUPONT: NEW PRODUCT LAUNCHES

TABLE 174 DUPONT: DEALS

12.1.5 NESTLE

TABLE 175 NESTLE: BUSINESS OVERVIEW

FIGURE 53 NESTLE: COMPANY SNAPSHOT

TABLE 176 NESTLE: PRODUCTS OFFERED

TABLE 177 NESTLE: NEW PRODUCT LAUNCHES

12.1.6 BIOSYNTH CARBOSYNTH

TABLE 178 BIOSYNTH CARBOSYNTH: BUSINESS OVERVIEW

TABLE 179 BIOSYNTH CARBOSYNTH: PRODUCTS OFFERED

TABLE 180 BIOSYNTH CARBOSYNTH: DEALS

12.1.7 INBIOSE NV.

TABLE 181 INBIOSE NV.: BUSINESS OVERVIEW

TABLE 182 INBIOSE NV: PRODUCTS OFFERED

12.1.8 GNUBIOTICS SCIENCES S.A.

TABLE 183 GNUBIOTICS SCIENCES S.A.: BUSINESS OVERVIEW

TABLE 184 GNUBIOTICS SCIENCES S.A.: PRODUCTS OFFERED

TABLE 185 GNUBIOTICS SCIENCES S.A.: NEW PRODUCT LAUNCHES

12.1.9 ABBOTT LABORATORIES

TABLE 186 ABBOTT LABORATORIES: HUMAN MILK OLIGOSACCHARIDES MARKET BUSINESS OVERVIEW

FIGURE 54 ABBOTT LABORATORIES: COMPANY SNAPSHOT

TABLE 187 ABBOTT LABORATORIES: PRODUCTS OFFERED

TABLE 188 ABBOTT LABORATORIES: NEW PRODUCT LAUNCHES

12.1.10 ROYAL FRIESLANDCAMPINA N.V

TABLE 189 ROYAL FRIESLANDCAMPINA N.V: BUSINESS OVERVIEW

FIGURE 55 ROYAL FRIESLANDCAMPINA N.V: COMPANY SNAPSHOT

TABLE 190 ROYAL FRIESLANDCAMPINA N.V: PRODUCTS OFFERED

TABLE 191 ROYAL FRIESLANDCAMPINA N.V: NEW PRODUCT LAUNCHES

TABLE 192 ROYAL FRIESLANDCAMPINA N.V: DEALS

12.1.11 ELICITYL S.A

TABLE 193 ELICITYL S.A.: BUSINESS OVERVIEW

TABLE 194 ELICITYL S.A: PRODUCTS OFFERED

12.1.12 DEXTRA LABORATORIES LTD.

TABLE 195 DEXTRA LABORATORIES LTD.: BUSINESS OVERVIEW

TABLE 196 DEXTRA LABORATORIES LTD.: PRODUCTS OFFERED

12.2 START-UPS/SME’S/OTHER PLAYERS

12.2.1 ZUCHEM INC.

TABLE 197 ZUCHEM INC.: COMPANY OVERVIEW

12.2.2 ADVANCED PROTEIN TECHNOLOGIES CORP.

TABLE 198 ADVANCED PROTEIN TECHNOLOGIES CORP.: COMPANY OVERVIEW

12.2.3 CONAGEN INC.

TABLE 199 CONAGEN INC.: COMPANY OVERVIEW

12.2.4 KYOWA HAKKO BIO CO. LTD.

TABLE 200 KYOWA HAKKA BIO CO. LTD.: COMPANY OVERVIEW

12.2.5 MEDOLAC LABORATORIES

TABLE 201 MEDOLAC LABORATORIES: COMPANY OVERVIEW

12.3 END USER COMPANY PROFILES

12.3.1 H & H GROUP

TABLE 202 H&H GROUP: BUSINESS OVERVIEW

TABLE 203 H&H GROUP: PRODUCTS OFFERED

12.3.2 LAYER ORIGIN NUTRITION

TABLE 204 LAYER ORIGIN NUTRITION: BUSINESS OVERVIEW

TABLE 205 LAYER ORIGIN NUTRITION: PRODUCTS OFFERED

12.3.3 STANDARD PROCESS INC.

TABLE 206 STANDARD PROCESS INC.: HUMAN MILK OLIGOSACCHARIDES MARKET BUSINESS OVERVIEW

TABLE 207 STANDARD PROCESS INC.: PRODUCTS OFFERED

12.3.4 RECKITT BENCKISER GROUP

TABLE 208 RECKITT BENCKISER GROUP: BUSINESS OVERVIEW

TABLE 209 RECKITT BENCKISER GROUP: PRODUCTS OFFERED

12.3.5 AMAZON

TABLE 210 AMAZON: BUSINESS OVERVIEW

TABLE 211 AMAZON: PRODUCTS OFFERED

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 210)

13.1 INTRODUCTION

13.2 INFANT FORMULA INGREDIENTS MARKET

13.2.1 LIMITATIONS

13.2.2 MARKET DEFINITION

13.2.3 MARKET OVERVIEW

13.2.4 INFANT FORMULA INGREDIENTS MARKET, BY INGREDIENT

TABLE 212 INFANT FORMULA INGREDIENTS MARKET SIZE, BY INGREDIENT, 2017–2025 (USD MILLION)

TABLE 213 INFANT FORMULA INGREDIENTS MARKET SIZE, BY INGREDIENT, 2017–2025 (KT)

13.2.5 INFANT FORMULA INGREDIENTS MARKET, BY REGION

TABLE 214 INFANT FORMULA INGREDIENTS MARKET SIZE, BY REGION, 2017–2025 (USD BILLION)

TABLE 215 INFANT FORMULA INGREDIENTS MARKET SIZE, BY REGION, 2017–2025 (KT)

13.3 FUNCTIONAL FOOD INGREDIENTS MARKET

13.3.1 LIMITATIONS

13.3.2 MARKET DEFINITION

13.3.3 MARKET OVERVIEW

13.3.4 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE

TABLE 216 FUNCTIONAL FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 217 FUNCTIONAL FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

13.3.5 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION

TABLE 218 FUNCTIONAL FOOD INGREDIENTS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 219 FUNCTIONAL FOOD INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

14 APPENDIX (Page No. - 220)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the Human Milk Oligosaccharides Market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure depicts the research design applied in drafting this report on the HMO market.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the HMO market.

To know about the assumptions considered for the study, download the pdf brochure

Human Milk Oligosaccharides Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the human milk oligosaccharides market. These approaches were extensively to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

-

Top-down approach:

- The key players in the industry and the market were identified through extensive secondary research.

- The industry's supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The parent market—infant formula ingredients market—was considered to validate the market details of human milk oligosaccharides (HMO) further.

-

Bottom-up approach:

- The market sizes were analyzed based on the share of each type of human milk oligosaccharides (HMO) at regional and country levels. Thus, the global market for HMO was estimated with a bottom-up approach of the type at the country level.

- Based on the demand from each application, offerings of key players, and the region-wise market share of major players, the global market for the application was estimated.

- Other factors include penetration rate of HMO in end-user applications, such as infant formulas, food supplements, and functional food & beverages; consumer awareness; and function trends; pricing trends; the adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the growth of the human milk oligosaccharides market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

The following sections (bottom-up & top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Food Supplement and Infant Nutrition connected with Human Milk Oligosaccharides Market

Human Milk Oligosaccharides (HMOs) are complex carbohydrates that are naturally present in human breast milk and play an important role in supporting a healthy gut microbiome and immune system in infants.

In recent years, HMOs have gained attention for their potential benefits in adult health and nutrition, as well as in infant formula and food supplements.

The infant nutrition market is closely connected to the HMO market, as several key players in the infant formula industry are now adding HMOs to their formulas as a way to mimic the benefits of breast milk.

Additionally, food supplements targeted towards infants and young children are now incorporating HMOs to promote gut health and support immune function.

Overall, the use of HMOs in both the infant nutrition and food supplement markets reflects a growing interest in natural, prebiotic ingredients that can support overall health and wellness.

Future growth opportunities, use cases, niche drivers, and threats for the Food Supplement and Infant Nutrition Business:

-

Increased Demand for Plant-Based Supplements: As consumers become more conscious of their environmental impact and animal welfare, there is a growing demand for plant-based supplements. Companies that offer high-quality, effective plant-based supplements are likely to see growth in the future.

-

Personalized Nutrition: With advances in technology and data analytics, companies are increasingly able to offer personalized nutrition recommendations and supplements. This trend is likely to continue as consumers seek customized solutions for their health needs.

-

Expansion into Emerging Markets: The infant nutrition market is expanding into emerging markets, particularly in Asia, where there is a growing middle class and increasing demand for premium products.

-

E-commerce: The COVID-19 pandemic has accelerated the shift to e-commerce, and companies that invest in their online presence and digital marketing are likely to see growth in the future.

-

Use Cases:

- Beauty and Personal Care: Food supplements that promote skin health, hair growth, and nail strength are becoming popular in the beauty and personal care market.

- Mental Health: There is a growing demand for food supplements that can improve cognitive function, reduce stress and anxiety, and promote relaxation.

- Digestive Health: Food supplements with prebiotics and probiotics that can improve gut health and support a healthy immune system are gaining popularity.

-

Immune Support: With the ongoing COVID-19 pandemic, there is a growing demand for food supplements that can support immune function and overall health.

-

Niche Drivers:

- Natural and Organic Ingredients: Consumers are increasingly seeking out natural and organic food supplements and infant nutrition products.

- Sustainable Packaging: Companies that offer sustainable packaging solutions are likely to see growth in the future, as consumers become more environmentally conscious.

- Transparency: Consumers are increasingly interested in knowing where their food supplements and infant nutrition products come from and how they are made.

-

Scientific Research and Development: Companies that invest in scientific research and development to create innovative products and ingredients are likely to see growth in the future.

-

Niche Threats:

- Regulatory Compliance: The food supplement and infant nutrition markets are highly regulated, and companies that fail to comply with regulations could face fines and reputational damage.

- Counterfeit Products: Counterfeit food supplements and infant nutrition products pose a risk to consumer safety and can damage the reputation of legitimate companies.

- Negative Publicity: Negative publicity, such as product recalls or safety concerns, can damage consumer trust and hurt sales.

- Competition from Large Corporations: Large corporations with significant resources and established brands can pose a threat to smaller food supplement and infant nutrition companies.

The Food Supplement and Infant Nutrition Market is likely to Impact Several Industries in the Future.

-

Pharmaceutical Industry: The food supplement and infant nutrition market is increasingly viewed as a complementary approach to traditional medicine. As a result, the pharmaceutical industry may face competition from food supplement and infant nutrition companies that offer natural and plant-based products.

-

Beauty and Personal Care Industry: As mentioned earlier, food supplements that promote skin health, hair growth, and nail strength are becoming popular in the beauty and personal care market. This trend is likely to continue, and the beauty and personal care industry may be impacted as consumers turn to food supplements for their beauty needs.

-

Agriculture Industry: Companies that produce ingredients for food supplements and infant nutrition products may impact the agriculture industry, as demand for specific crops or ingredients increases.

-

Retail Industry: The retail industry may be impacted as more food supplement and infant nutrition products are sold online and through e-commerce channels. Traditional brick-and-mortar retailers may need to adapt to changing consumer behavior and preferences.

- Healthcare Industry: The healthcare industry may also be impacted as consumers turn to food supplements and infant nutrition products for preventive health measures. Health care providers may need to adjust their approach to include recommendations for food supplements and nutrition products as part of their treatment plans.

Growth Drivers for Food Supplement and Infant Nutrition Business from Macro to Micro Level

-

Macro level:

- Increasing Health Awareness: The increasing awareness among consumers about the benefits of a healthy lifestyle, preventive health measures, and the importance of proper nutrition is a major growth driver for the food supplement and infant nutrition market.

- Rising Disposable Income: As disposable income rises globally, consumers are willing to spend more on health and wellness products, including food supplements and infant nutrition products.

- Changing Demographics: An aging population, rising birth rates, and changing family structures are contributing to the growth of the infant nutrition market.

-

Regulatory Support: Regulatory bodies around the world are supporting the food supplement and infant nutrition market by setting standards and regulations to ensure product safety and efficacy.

-

Micro level:

- Product Innovation: Companies that innovate and introduce new products to meet consumer needs and preferences are likely to experience growth in the food supplement and infant nutrition market.

- Strong Distribution Network: Having a strong distribution network, both online and offline, can help companies reach a wider customer base and increase sales.

- Marketing and Branding: Companies that invest in marketing and branding efforts to create strong brand awareness and promote the benefits of their products are more likely to succeed in the market.

- Quality Control and Assurance: Ensuring the safety, quality, and efficacy of products is essential for building trust and loyalty among consumers and maintaining a competitive edge in the market.

- Partnerships and Acquisitions: Partnerships and acquisitions can help companies expand their product offerings, reach new markets, and increase their competitive advantage in the market.

Human Milk oloigosaccharides Market Report Objectives

-

Market Intelligence

- Determining and projecting the size of the human milk oligosaccharides market based on type, application, concentration, and region, over a six-year period, ranging from 2022 to 2027

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

-

Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shift in demand patterns across different subsegments and regions

-

Competitive Intelligence

- Identifying and profiling the key market players in the HMO market

- Determining the share of key players operating in the HMO market

-

Providing a comparative analysis of the market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths, weaknesses, opportunities, and threats

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by the key companies

- Analyzing the patents registered and regulatory frameworks across regions and their impact on prominent market players

- Analyzing the market dynamics and competitive situations & trends across regions and their impact on prominent market players

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for HMO into the Greece

- Further breakdown of the Rest of South America market for HMO into Chile, Peru, and Ecuador

- Further breakdown of other countries in the RoW market for HMO into Egypt, Israel, and Turkey

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Human Milk Oligosaccharides (HMO) Market