Hybrid Vehicle Market by Electric Powertrain (Parallel, Series), Degree of Hybridization (Full, Micro, and Mild), Propulsion (HEV, PHEV, and NGV), Vehicle Type (PC, CV), Component (Battery, Electric Motor, and Transmission), and Region - Global Forecast to 2025

Hybrid Vehicle Market

Hybrid vehicles are more fuel efficient than gasoline and diesel vehicles. Hybrid vehicles such as PHEVs can reduce fuel costs dramatically because of high efficiency of electric motors. As per the IEA, PHEVs are expected to use about 40-60% less gasoline than conventional vehicles because the can run solely on electricity. The reducing price of batteries is expected to positively affect the demand for hybrid vehicles. With the reduction in battery prices, the market is set to become more cost competitive as compared to diesel and gasoline vehicles.

Market Drivers:

- Increasing emission norms

- Optimum fuel efficiency

- Continuous reduction in battery price

Market Restraints:

- Rising demand for BEVs and FCEVs

- High vehicle cost and insufficient infrastructure

Top 10 Players:

- Toyota: Founded in 1937 and headquartered in Aichi, Japan, Toyota operates in automotive and financial services. It manufactures and sells hybrid trucks and cars through its Automotive segment. Its product portfolio includes Camry Hybrid, Avalon Hybrid, Highlander Hybrid, Prius, etc.

- Ford: Established in 1903 and headquartered in Michigan, US, Ford operates under automotive and financial services. Under automotive segment the company manufactures passenger cars, SUVs, trucks, electric vehicles, and hybrid vehicles. Hybrid vehicle segment includes various models such as C-Max Hybrid, Fusion Hybrid SE, and Fusion Energi SE.

- Volvo: Established in 1927 and headquartered in Gothenburg, Sweden, Volvo offers hybrid cars, trucks, and buses besides manufacturing hybrid engines. Volvo’s hybrid cars portfolio includes Volvo XC 90, Volvo XC 60, Volvo V 90, Volvo V 60, and Volvo S 90. Volvo hybrid truck and bus product lines include Volvo FE, Volvo 7900 hybrid bus, and 8400 hybrid city bus.

- Daimler: Established in 1886 and headquartered in Stuttgart, Germany, Daimler is the world’s biggest manufacturer of commercial vehicles. It has 5 business units – Daimler Trucks, Mercedes-Benz Cars, Mercedes-Benz Vans, Daimler Buses, and Daimler Financial Services. The company offers hybrid passenger cars, truck, and buses. Some examples of passenger hybrid cars include C-class saloon C 350e and E class saloon E 350e.

- Honda: Established in 1948 and headquartered in Tokyo, Japan, Honda operates through 4 business segments, namely, automobile, financial service, motorcycle and power products, and Other. The company offers hybrid cars through automobile business segment. Various car models include Honda Accord Hybrid, Honda Clarity Plug-In Hybrid, Honda CR-Z Hybrid, and Honda Civic Hybrid.

- Hyundai

- General Motors

Top Suppliers:

- Bosch

- ZF

- Continental

- BorgWarner

- Schaeffler

- Alisson Transmission

- Eaton

- Magna International

- Mahle

- Denso

- Delphi

- Cummins

Technology Overview:

- Micro Hybrid

- Mild Hybrid

- 48V Li-Ion Battery of Mild Hybrid Technology Roadmap

- Full Hybrid

- Plug-in Hybrid

- Higher benefits of mild hybrid vehicles such as low cost, high fuel efficiency and less emission to drive the segment growth

- Governments in China and Japan are offering incentives and tax rebate on the purchase of mild hybrids

- Similarly, full hybrids offer robust fuel efficiency and reduced emission due to continual technology upgrade

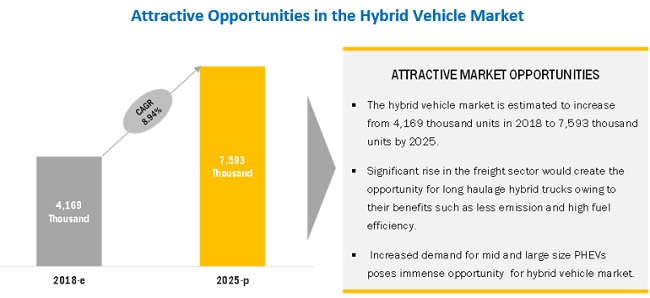

[154 Pages Report] The global hybrid vehicle market size was valued at 4,169 thousand units in 2018 and is projected to reach 7,593 million units by 2025, at a CAGR of 8.94%, during the forecast period. The demand for market is rising due to stringent emission regulation standards and the growing demand for low or zero-emission vehicles. Furthermore, governments of various countries provide purchase grants and tax rebates for hybrid vehicles, including HEVs and PHEVs. A hybrid vehicle uses more than one type of power source. The most common types of hybrid vehicles use a combination of an internal combustion engine (ICE) and an electric motor. Hybrid vehicles are designed for better fuel efficiency, more power, and minimum emissions. These vehicles capture electrical energy produced from different sources, such as regenerative braking systems. They can conserve energy by shutting down the engine when the car is parked, idle, or when the electric motor’s energy is sufficient to drive the vehicle without assistance from the ICE.

By propulsion, the HEV segment is estimated to hold the largest share of the hybrid vehicle market.

Vehicles that use both internal combustion engines as well as an electric drive to drive the vehicle are termed as Hybrid Electric Vehicles (HEV). The hybrid vehicle market for HEV is increasing due to high sales volume in the US, Japan, and China. Moreover, developing countries such as Mexico, India, and Brazil are also deploying hybrid vehicles to cope with the increasingly stringent emission standards as these vehicles are inexpensive compared to PHEVs(plug-in hybrid electric vehicle) and EVs. Additionally, HEV has a substantial market share compared to other eco-friendly vehicles such as NGV(natural gas vehicle) and PHEV, owing to the better fuel efficiency it offers.

By degree of hybridization, the full hybrid segment is estimated to hold the largest share of the hybrid vehicle market.

The full hybrid segment is estimated to hold the largest market share by volume during the forecast period. The market for the mild-hybrid sector is projected to grow at the highest CAGR during the forecast period. The growth of the full hybrid segment can be attributed to improving fuel efficiency and reduced emission due to continuous technology upgrades.

By electric powertrain type, the parallel hybrid segment is estimated to hold the largest share of the hybrid vehicle market during the forecast period.

The hybrid vehicle market has been segmented by electric powertrain type into parallel and series hybrid. The parallel hybrid segment is estimated to hold the largest market share by volume during the forecast period. This market is likely to grow due to the increased use of regenerative braking technology. Regenerative braking technology restores the energy to recharge the battery when brakes are applied. Thus, it reduces the requirement for external electric infrastructure. The regenerative braking system is the most commonly used technology in hybrid vehicles. The use of the regenerative braking system and the lesser cost of micro and mild hybrids compared to PHEVs will boost the demand for parallel hybrids.

APAC is estimated to be the fastest-growing market for the hybrid vehicle market.

APAC is estimated to be the fastest-growing region for the hybrid vehicle market, with Japan accounting for the largest market share in 2018. The market growth in the region can be attributed to the increased sales of hybrid vehicles in Japan, China, and South Korea. Also, the Asia Pacific region is home to major players in the hybrid vehicles market, such as Toyota, Honda, Nissan, Kia, BYD, and Hyundai. Toyota has the highest share in hybrid vehicle sales worldwide. Moreover, governments of Asian countries are supporting the growth by providing subsidies. The mass adoption of hybrid vehicle technology by Japan and China will also boost the market.

Market Dynamics

Driver: Increasing emission norms

Growing awareness of the emissions has led the regulatory bodies to implement stringent emission regulations. The rising stringency in emission norms for vehicles is forcing OEMs to manufacture hybrid and electric vehicles. Hybrid vehicles emit fewer greenhouse gases than gasoline and diesel vehicles.

The governments in the US and Europe are concentrating on lowering emission limits to decrease the greenhouse gas effect and are also focusing on improving the fuel economy of vehicles. For instance, the US Department of Transportation has set the Corporate Average Fuel Economy (CAFE) standards for vehicles.

Restraint: Rising demand for BEVs and FCEVs

.

The increasing demand for Battery Electric Vehicles (BEVs) and Fuel Cell Electric Vehicles (FCEVs) will be one of the major challenges for the growth of hybrid vehicles. There are many models and types of BEVs such as hatchbacks, sedans, and SUVs in the passenger car segment. Automotive manufacturers such as BYD (China), Tesla (US), and Volkswagen (Germany) are focusing more on the development of BEVs.

The advantages of FCEVs is a high driving range, fast refueling, noiseless operation, and zero-emission of greenhouse gases and air pollutants. These benefits are positively impacting the demand for FCEVs. Moreover, governments are taking initiatives and promoting fuel cells for transportation, which can further boost the demand for fuel cells in the automotive and transportation sectors. For instance, the government of California launched the Clean Vehicle Rebate Project. The project includes rebate funding for low-income consumers and rebates for the purchase or lease of FCEVs.

Opportunity: Growth in developing markets

Hybrid vehicles offer immense opportunities for growth in the markets of developing countries because of initiatives and support from governments (e.g., incentives in sales and manufacturing, tax rebates, increased focus on deploying hybrid commercial vehicles). The Indian government is providing incentives of approximately USD 446 on the purchase of hybrid and electric vehicles in India. The Brazilian government is encouraging the purchase of hybrid vehicles such as plug-in hybrid, hybrid electric, and CNG hybrid by reducing the tax rate. The Mumbai Metropolitan Region Development Authority (MMRDA), India, has awarded a contract to Tata Motors for supplying 25 Tata Starbus Diesel Series Hybrid Electric Buses.

Challenges: High vehicle cost

The challenge faced by the hybrid vehicle market is high cost. A hybrid vehicle such as a plug-in hybrid vehicle has the battery as its central component. The battery increases the cost of the vehicle, making it costlier than diesel- and gasoline-powered vehicles. The price difference is due to parts such as battery and regenerative brake price. However, there has been a significant decrease in the cost of batteries in the past few years. Also, battery manufacturers are taking initiatives and carrying out R&D operations to decrease the cost of batteries.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017 – 2025 |

|

Base year considered |

2018 |

|

Forecast period |

2020 - 2025 |

|

Forecast units |

Thousand Units |

|

Segments covered |

Electric Powertrain type, Component type, By Propulsion, Degree of Hybridization, Vehicle Type, and Region |

|

Geographies covered |

APAC, Europe, North America, RoW |

|

Companies covered |

Key market players, including, |

The research report categorizes the Hybrid Vehicle Market to forecast the revenues and analyze the trends in each of the following sub-segments:

Hybrid vehicle market, By Electric Powertrain type

- Parallel Hybrid

- Series Hybrid

Hybrid vehicle market, By Component type

- Battery

- Electric Motor

- Transmission

Hybrid vehicle market, By Propulsion

- HEV

- PHEV

- NGV

Hybrid vehicle market, By Degree of Hybridization

- Full Hybrid

- Micro-Hybrid

- Mild Hybrid

Hybrid vehicle market, By Vehicle Type

- Passenger Car

- Commercial Vehicle

Hybrid vehicle market, By Region

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

Europe

- France

- Germany

- Italy

- Netherlands

- Norway

- Sweden

- UK

-

North America

- Canada

- Mexico

- US

- Rest of the World (RoW)

Key Market Players

Toyota (Japan), Honda (Japan), Hyundai (South Korea), Daimler (Germany), and Nissan (Japan)

Critical questions the report answers:

- What are the upcoming trends for the Hybrid Vehicle Market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the Hybrid Vehicle Market

4.2 Market By Electric Powertrain Type, 2018–2025

4.3 Market By Degree of Hybridization, 2018–2025

4.4 Market By Propulsion, 2018–2025

4.5 Market By Component Type, 2018–2025

4.6 Market By Vehicle Type, 2018–2025

4.7 Market, By Region, 2018–2025

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Emission Norms

5.2.1.2 Optimum Fuel Efficiency

5.2.1.3 Continuous Reduction in Battery Price

5.2.2 Restraints

5.2.2.1 Rising Demand for BEVs and FCEVs

5.2.3 Opportunities

5.2.3.1 Government Initiatives Pertaining to Hybrid Vehicles

5.2.3.2 Growth in Developing Markets

5.2.4 Challenges

5.2.4.1 High Vehicle Cost

5.2.4.2 Insufficient Infrastructure and High Development Cost

5.3 Upcoming Hybrid Vehicle Models

5.4 CNG Station Numbers in Key Countries of Europe, 2016

5.5 Natural Gas (NG) Station Numbers in Key Countries, 2018

6 Technology Overview (Page No. - 49)

6.1 Introduction

6.2 Micro Hybrid

6.3 Mild Hybrids

6.4 48 V Li-Ion Battery of Mild Hybrid Technology Roadmap

6.5 Full Hybrids

6.6 Plug-In Hybrids

7 Market, By Electric Powertrain Type (Page No. - 54)

7.1 Introduction

7.2 Parallel Hybrid

7.3 Series Hybrid

8 Market, By Propulsion (Page No. - 59)

8.1 Introduction

8.2 HEV

8.3 PHEV

8.4 NGV

9 Market, By Degree of Hybridization (Page No. - 65)

9.1 Introduction

9.2 Micro Hybrid

9.3 Mild Hybrid

9.4 Full Hybrid Vehicle

10 Market, By Component Type (Page No. - 73)

10.1 Introduction

10.2 Electric Motor

10.2.1 DC/DC Converter

10.2.2 DC/AC Converter

10.3 Transmission

10.4 Battery

11 Market, By Vehicle Type (Page No. - 79)

11.1 Introduction

11.2 Passenger Car

11.3 Commercial Vehicle

12 Market, By Region (Page No. - 85)

12.1 Introduction

12.2 Asia Pacific

12.2.1 China

12.2.2 India

12.2.3 Japan

12.2.4 South Korea

12.3 Europe

12.3.1 France

12.3.2 Germany

12.3.3 Italy

12.3.4 The Netherlands

12.3.5 Norway

12.3.6 Sweden

12.3.7 UK

12.4 North America

12.4.1 Canada

12.4.2 Mexico

12.4.3 US

12.5 RoW

12.5.1 Brazil

12.5.2 Russia

13 Competitive Landscape (Page No. - 107)

13.1 Overview

13.2 Market Ranking Analysis

13.3 Competitive Scenario

13.3.1 New Product Developments

13.3.2 Collaborations/Joint Ventures/Supply Contracts/Partnerships/Agreements

13.3.3 Expansions, 2016–2018

13.3.4 Mergers & Acquisitions, 2017

14 Company Profiles (Page No. - 112)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

14.1 Key Players

14.1.1 Toyota

14.1.2 Ford

14.1.3 Volvo

14.1.4 Continental

14.1.5 ZF

14.1.6 Daimler

14.1.7 Hyundai

14.1.8 Honda

14.1.9 Schaefler

14.1.10 Borgwarner

14.1.11 Delphi Technologies

14.1.12 Allison Transmission

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

14.2 Key Players From Other Regions

14.2.1 North America

14.2.1.1 General Motors

14.2.1.2 Magna International

14.2.1.3 Cummins

14.2.1.4 American Axle & Manufacturing

14.2.2 Europe

14.2.2.1 Eaton

14.2.2.2 Mahle

14.2.2.3 Bosch

14.2.2.4 AVL

14.2.3 Asia Pacific

14.2.3.1 Denso

14.2.3.2 Mitsubishi Electric

14.2.3.3 LG Chemical

14.2.4 Rest of the World (RoW)

14.2.4.1 Yo-Auto

14.2.4.2 Avtovaz

15 Appendix (Page No. - 145)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Introducing RT: Real Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (54 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Heavy-Duty Vehicle Emission Regulation Scenario for Europe

Table 3 Overview of Global Tax Subsidies for Hybrid Vehicles

Table 4 Upcoming Hybrid Vehicle Models

Table 5 Key Functions of Hybrid Vehicles

Table 6 Global Market: By Electric Powertrain Type, 2016–2025 (Thousand Units)

Table 7 Parallel Hybrid: Market By Propulsion, 2016–2025 (Thousand Units)

Table 8 Series Hybrid: Market By Propulsion, 2016–2025 (Thousand Units)

Table 9 Global Market Size, By Propulsion, 2016–2025 ( Thousand Units)

Table 10 HEV: Market By Region, 2016–2025 (Units)

Table 11 PHEV: Market By Region, 2016–2025 (Units)

Table 12 NGV: Market By Region, 2016–2025 (Units)

Table 13 Global Market: By Degree of Hybridization, 2016–2025 (Thousand Units)

Table 14 Micro Hybrid: Market By Region, 2016–2025 (Thousand Units)

Table 15 Micro Hybrid: Market By Vehicle Type, 2016–2025 (Thousand Units)

Table 16 Mild Hybrid: Market By Region, 2016–2025 (Thousand Units)

Table 17 Mild Hybrid: Market By Vehicle Type, 2016–2025 (Thousand Units)

Table 18 Full Hybrid: Market By Region, 2016-2025 (Thousand Units)

Table 19 Full Hybrid: Market By Vehicle Type, 2016–2025 (Thousand Units)

Table 20 Global Market, By Component Type, 2016–2025 (Thousand Units)

Table 21 Electric Motor: Market By Region, 2016–2025 (Units)

Table 22 Electric Motor: Market By Converter Type, 2016–2025 (Units)

Table 23 Transmission: Market By Region, 2016–2025 (Units)

Table 24 Battery: Market By Region, 2016–2025 (Units)

Table 25 Global Market Size, By Vehicle Type, 2016–2025 (Thousand Units)

Table 26 Passenger Car: Market Size By Region, 2016–2025 (Thousand Units)

Table 27 Commercial Vehicle: Market By Region, 2016–2025 (Thousand Units)

Table 28 Global Market, By Region, 2016–2025 (Thousand Units)

Table 29 Asia Pacific: Market By Country, 2016–2025 (Thousand Units)

Table 30 Asia Pacific: Market By Vehicle Type, 2016–2025 (Thousand Units)

Table 31 China: Market By Propulsion Type, 2016–2025 (Units)

Table 32 India: Market By Propulsion Type, 2016–2025 (Units)

Table 33 Japan: Market By Propulsion Type, 2016–2025 (Units)

Table 34 South Korea: Market By Propulsion Type, 2016–2025 (Units)

Table 35 Europe: Market By Country, 2016–2025 (Thousand Units)

Table 36 Europe: Market, By Vehicle Type, 2016–2025 (Thousand Units)

Table 37 France: Market By Propulsion Type, 2016–2025 (Units)

Table 38 Germany: Market By Propulsion Type, 2016–2025 (Units)

Table 39 Italy: Market By Propulsion Type, 2016–2025 (Units)

Table 40 The Netherlands: Market By Propulsion Type, 2016–2025 (Units)

Table 41 Norway: Market By Propulsion Type, 2016–2025 (Units)

Table 42 Sweden: Market By Propulsion Type, 2016–2025 (Units)

Table 43 UK: Market By Propulsion Type, 2016–2025 (Units)

Table 44 North America: Market By Country, 2016–2025 (Thousand Units)

Table 45 North America: Market By Vehicle Type, 2016–2025 (Thousand Units)

Table 46 Canada: Market, By Propulsion Type, 2016–2025 (Units)

Table 47 Mexico: Market By Propulsion Type, 2016–2025 (Units)

Table 48 US: Market By Propulsion Type, 2016–2025 (Units)

Table 49 RoW: Market By Country, 2016–2025 (Thousand Units)

Table 50 RoW: Market By Vehicle Type, 2016–2025 (Thousand Units)

Table 51 Brazil: Market By Propulsion Type, 2016–2025 (Units)

Table 52 Russia: Market By Propulsion Type, 2016–2025 (Units)

Table 53 New Product Developments, 2017–2018

Table 54 Collaborations/Joint Ventures/Supply Contracts/Partnerships/Agreements, 2015–2017

List of Figures (71 Figures)

Figure 1 Global Markets Covered

Figure 2 Market Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market Size Estimation Methodology for the Hybrid Vehicle Market: Bottom-Up Approach

Figure 6 Data Triangulation

Figure 7 Key Countries in the Market: Japan is Estimated to Be the Largest Market By 2025 (Units)

Figure 8 Asia Pacific is Estimated to Be the Fastest Growing Market for Hybrid Vehicle, 2018 vs 2025 (Thousand Units)

Figure 9 Parallel Hybrid is Estimated to Hold the Largest Share of the Market 2018 vs 2025 (Thousand Units)

Figure 10 PC Segment is Estimated to Hold the Largest Share of the Market 2018 vs 2025 (Thousand Units)

Figure 11 Full Hybrid is Estimated to Hold the Largest Share of the Market 2018 vs 2025 (Thousand Units)

Figure 12 Battery and Electric Motor are Estimated to Hold the Largest Share of the Market 2018 vs 2025 (Thousand Units)

Figure 13 HEV is Estimated to Hold the Largest Share of this Market, 2018 vs 2025 (Thousand Units)

Figure 14 Better Fuel Efficiency and Increasing Emission Norms are Expected to Drive the Market

Figure 15 Parallel Hybrid to Hold the Largest Share, By Volume, in Market By Electric Powertrain Type

Figure 16 Full Hybrid to Hold the Largest Share, By Volume, in Market By Degree of Hybridization

Figure 17 HEV to Hold the Largest Share, By Volume, in Market By Propulsion

Figure 18 Battery and Electric Motor to Hold the Largest Share, By Volume, in Market By Component Type

Figure 19 Passenger Car to Hold the Largest Market Share in Market 2018 vs 2025 (Thousand Units)

Figure 20 Asia Pacific to Hold the Largest Share, By Volume, in this Market, By Region

Figure 21 Market Dynamics

Figure 22 Emission Regulation Scenario for Key Countries

Figure 23 Hybrid Fuel Consumption Reduction for Key Hybrid Manufacturers, 2014

Figure 24 Battery Cost (USD/Kwh), 2009–2016

Figure 25 Battery Electric Vehicle Sales, 2012–2017

Figure 26 Timeline of Hybrid Vehicle

Figure 27 Working of Start-Stop System in Micro Hybrid Vehicle

Figure 28 48 v Electrical Architecture

Figure 29 Impact Analysis on 48 V Li-Ion Battery

Figure 30 Working of Hybrid Powertrain

Figure 31 Global Market: By Electric Powertrain Type, 2018 vs 2025 (Thousand Units)

Figure 32 Parallel Hybrid: Market By Propulsion, 2018 vs 2025 (Thousand Units)

Figure 33 Series Hybrid: Market By Propulsion, 2018 vs 2025 (Thousand Units)

Figure 34 Global Market By Propulsion, 2018 vs 2025 (Thousand Units)

Figure 35 HEV: Market By Region, 2018 vs 2025 ( Thousand Units)

Figure 36 PHEV: Market By Region, 2018 vs 2025 (Units)

Figure 37 NGV: Market By Region 2018 vs 2025 (Thousand Units)

Figure 38 Global Market: By Degree of Hybridization, 2018 vs 2025 (Thousand Units)

Figure 39 Micro Hybrid: Market By Region, 2018 vs 2025 (Thousand Units)

Figure 40 Mild Hybrid: Market By Region, 2018 vs 2025 (Thousand Units)

Figure 41 Full Hybrid: Market By Region, 2018 vs 2025 (Thousand Units)

Figure 42 Global Market By Component Type, 2018 vs 2025 (Thousand Units)

Figure 43 Electric Motor: Market By Region, 2018 vs 2025 (Thousand Units)

Figure 44 Transmission: Market By Region, 2018 vs 2025 (Thousand Units)

Figure 45 Battery: Market By Region, 2018 vs 2025 (Thousand Units)

Figure 46 Global Market, By Vehicle Type, 2018 vs 2025 (Thousand Units)

Figure 47 Passenger Car: Market By Region, 2018 vs 2025 (Thousand Units)

Figure 48 Commercial Vehicle: Market By Region, 2018 vs 2025 (Thousand Units)

Figure 49 Market By Region, 2018 and 2025 (Thousand Units)

Figure 50 Asia Pacific: Market 2018 vs 2025 (Thousand Units)

Figure 51 Europe: Market 2018 vs 2025 (Thousand Units)

Figure 52 North America: Market 2018 vs 2025, (Thousand Units)

Figure 53 RoW: Market, 2018 vs 2025 (Thousand Units)

Figure 54 Key Developments By Leading Players in the Market, 2015–2018

Figure 55 Toyota: Company Snapshot (2017)

Figure 56 Toyota: SWOT Analysis

Figure 57 Ford: Company Snapshot (2017)

Figure 58 Ford: SWOT Analysis

Figure 59 Volvo: Company Snapshot (2017)

Figure 60 Volvo: SWOT Analysis

Figure 61 Continental: Company Snapshot (2017)

Figure 62 Continental: SWOT Analysis

Figure 63 ZF: Company Snapshot (2017)

Figure 64 ZF: SWOT Analysis

Figure 65 Daimler: Company Snapshot (2017)

Figure 66 Hyundai: Company Snapshot (2016)

Figure 67 Honda: Company Snapshot (2017)

Figure 68 Schaeffler: Company Snapshot (2017)

Figure 69 Borgwarner, Company Snapshot (2017)

Figure 70 Delphi, Company Snapshot (2017)

Figure 71 Allison Transmission: Company Snapshot (2017)

Growth opportunities and latent adjacency in Hybrid Vehicle Market