Smart Electric Drive Market by Vehicle Type (PC, CV, 2W), EV Type (BEV, PHEV, HEV), Component (Power Electronics, E-Brake Booster, Inverter, Motor, Battery), Application (E-Axle, Wheel Drive), Drive (FWD, RWD, AWD), and Region - Global Forecast to 2026

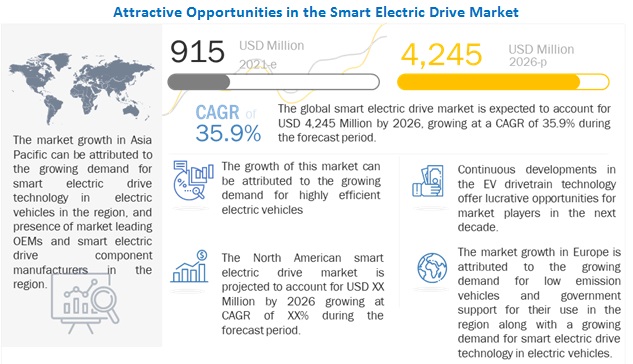

[353 Pages Report] The global smart electric drive market size is projected to grow from USD 915 Million in 2021 to USD 4,245 Million by 2026, at a CAGR of 35.9%. Factors such as shift towards vehicle electrification, adoption of advanced technologies in electric vehicles, government policies supporting electric vehicle adoption and reducing cost of EV batteries will boost the demand for smart electric drive market. The growing concern for larger distance commuting using EV’s will also boost the market.

The COVID-19 pandemic has become a major concern for automotive EV stakeholders. Suspension of vehicle production and supply disruptions have brought the automotive electric vehicle industry to a halt. Lower vehicle sales post the pandemic will be a major concern for automotive EV OEMs for the next few quarters. The smart electric drive market, however, is expected to witness a significant boost in 2022 owing to the adoption of advance integrated components in a vehicle. Before that, lower EV vehicle sales and abrupt stoppage in the development of new technologies will result in slow growth of the market due to pandemic.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on smart electric drive market:

Major component manufacturers such as Nidec Corporation (Japan), Aisin Corporation (Japan), BorgWarner (US), Bosch (Germany) and ZF group (Germany) had announced the suspension of production due to the lowered demand, supply chain bottlenecks, and to protect the safety of their employees in France, Germany, Italy, and Spain during the COVID-19 pandemic. Manufacturers are likely to adjust production to prevent bottlenecks and plan production according to demand from OEMs and tier 1 manufacturers. However, with rise in demand of vehicles post pandemic, manufacturers have adjusted their production planning as per demand from OEMs.

Market Dynamics:

Driver: Lower operating costs of EV’s using smart electric drive technology

According to the US Energy Information Administration (EIA), 101.95 million barrels of gasoline per day was consumed in 2019 around the world. According to Forbes, prices of petrol in the international market has been on a rising trend over the years. The demand for petrol and diesel in the world is high as they non-renewable resources, which may get exhausted in the next few decades. Even though many treaties have been made to control price of petrol in the international market, prices have been on a rise over the years. As most countries import petrol, its usage contributes to lowering the balance of trade of the economy. The limited petroleum reserves and rising prices of the fuel have led automakers to consider alternative fuel sources for their vehicles.

The operating cost of electric vehicle drivetrains is lower than petrol and some other fuel alternatives. Along with environment conservation, this is a major factor for the growing demand for EVs in the market. This will drive the demand for the smart e-drive market in the coming years. The cost of usage of EVs can be as less as USD 0.4-0.6 per kWh as per EDF energy. This is much less compared to the average petrol price used to travel the same distance. This creates a major saving for EV users for daily vehicle use. Home charging can be costlier, many countries such as the US, the UK, Germany, and states offer subsidies for charging at home. This will lead to a faster increase in demand for electric trucks once price of EVs come down comparable to ICE vehicles.

Restraint: Higher cost of smart electric drive systems

The prices of electric vehicles have decreased over the last few years. For instance, Tesla reduced the price of its Model X by USD 3,000 to gain traction in the market. However, new and advanced technologies, for smart e-drive including e-axel, and e-wheel drive are still expensive. Due to their high cost, e-drive systems/modules are offered mostly in moderate-high ranged electric cars. Hence, the penetration of these technologies is limited to these vehicles. The cost of these assemblies is usually 10-15% higher compared to separate parts. The high cost of these components refrains manufacturers from adopting them on a large scale. The additional cost for adjusting the standard drivetrain products for specific EV’s further increases the cost of the electric drive system.

Opportunity: Rising demand for EVs to increase demand for the smart electric drive market

Leading markets for electric vehicles such as China, US, and Germany are investing significantly in Electric vehicles and EV charging infrastructure along with research & development for faster and efficient charging methods, longer ranged EV’s and lower cost batteries. They have also been investing in the development of electric drivetrain technology. Significant investments by automakers are expected to cater to the rising demand for EVs. Countries across North America and Europe along with many Asian countries adopted measures to reduce emissions in the coming decades and replace their vehicle fleets for lower emissions by varying amounts by 2035. This will lead to a very high demand for electric vehicles in the market along with a growing demand for EV’s and related industries including the smart electric drive market.

According to EV Volumes, in 2020, over 3.2 Billion EV’s sold in the global market. OEMs are offering a wide range of vehicles, from small hatchbacks such as Leaf to high-end sedans such as Tesla model 3. The wide range of product offerings has attracted a high number of consumers, resulting in an increased market for electric vehicles. For instance, in July 2021, Volkswagen announced it plans to make half of its vehicle sales EV’s by 2030 and aims to sell 450,000 EV’s globally in 2021. Similarly, Ford has invested USD 22 Billion to electrify its Mustang, F-150 and Transit models as well as developing new EV models. GM also announced on January 2021 plans to go all-electric by 2030 in US and 2035 globally and spent USD 27 billion for speeding up their EV development.

The Renault-Nissan-Mitsubishi alliance has also been developing their EV market. By January 2020, they had sold over 800,000 EV’s with top sellers like Nissan Leaf and Renault Zoe. The three companies will be sharing their EV platform. They announced on June 2021 to develop around 1 million electric cars a year by 2030. In July 2021, Stellantis also announced plans to expand its portfolio of EV’s by 2025 through an investment of USD 35.5 Billion. Further, Volvo Cars have announced to be fully electric by 2030 on March 2021. The demand for smart e-drive market will increase along with the demand for EV’s once the price of EV drivetrain components comes down and starts mass production to increase production volume in the market. Thus by 2026 and beyond, the demand for smart e-drives are expected to grow rapidly in the market.

Challenge: Inadequate charging infrastructure for electric vehicles in developing countries will reduce the potential of the smart electric drive market

To facilitate the widespread acceptance of plug-in hybrid electric vehicles (PHEVs) and all-electric vehicles (EVs), an adequately developed infrastructure of charging stations is required. Barring a few countries such as the US, Germany, the UK, France, and Japan, the development of this infrastructure is in the initial stage across the world. The number of charging stations and charging outlets is negligible due to the high cost associated with building the same. For instance, in Europe, one slow two plug charging station costs approximately USD 2,500 for the hardware alone. Thus, the governments of various countries are offering subsidies and tax exemptions on infrastructure development to reduce the set-up cost and promote the sales of EVs. For instance, the Japanese government started investing in the development of charging stations across the country in association with electric vehicle manufacturers such as Nissan, Mitsubishi, and Honda. Due to this partnership, Japan today has more charging stations (40,000) than fuel stations (34,000). As of March-2021, there are only 1800 charging stations in India. However, the electric mobility revolution in India has recently started to gain some momentum. The government of India recently announced the extension of the FAME II scheme and several states like Maharashtra, Gujarat, Rajasthan and Delhi have announced their own policies for the faster adoption of EVs. In India, the government is actively promoting the use of electric vehicles to meet the 2030 reduction target of vehicle emissions. However, manufacturers are restrained from entering the Indian electric vehicle market due to political instability in the country. Other major concerns include long battery charging time, cost competitiveness, and inadequate infrastructure. Only a very few manufacturers like Mahindra and Mahindra offer station-based outlets. Therefore, the use of electric vehicles is less due to lack of infrastructure development.

This has immensely hampered the growth potential of electric vehicles and their required components and systems in emerging countries. This will lead to the slower growth in demand for smart e-drive market in the world. Many new EV manufactures and some established players will slowly increase their demand for e-drivetrain equipment till they start manufacturing them in-house and will grow at a fast rate once the charging infrastructure has been set up.

E-wheel drive segment is estimated to account for the fastest market during the forecast period

E-wheel drive is a highly integrated electric drive installed in the rear wheels of cars. It combines all components needed for safe driving, acceleration, and deceleration. The components integrated into the drive include a cooling system, brake, controller, electric motor, and power electronics. One of the major benefits of e-wheel drive is enhanced vehicle space (up to 50% according to Green Car Congress) as many components are moved to the wheel. Gem Motors’ e-wheel drive system, for instance, has a 20% more efficient EV drivetrain system than conventional EV drivetrains. Some other top manufacturers of e-wheel drives include Nidec Corporation, Elaphe, Protean, and Schaeffer. With the application of e-wheel drive, a vehicle earlier meant for two people can now seat four people. Also, since the e-wheel drive is installed in the wheel, it delivers direct transmission, thus making driving fast and safe. The Ford Fiesta electric, for instance, is equipped with Schaeffler’s twin e-wheel drive that is installed in the rear wheel rim. E-wheel drive offers emission-free and dynamic driving. As the automotive industry is moving toward zero-emission vehicles and increasing the vehicle space for other applications, the e-wheel drive market is anticipated to witness rapid growth.

Front Wheel Drive is estimated to account for the largest market size during the forecast period

FWD vehicles have the engine, transmission, final drive gears, and differential, all in a single unit. FWD vehicles are usually lighter, on average, than either of their counterparts. Most modern-day sedans, particularly those in the medium and lower price ranges, feature FWD, as FWD cars are usually lighter and have the most weight over the front wheels. This provides a good balance for reliable traction. It also helps with braking. Additionally, superior traction helps them use fuel more efficiently, regardless of the engine size. FWD also has larger space for passengers and cargo. Due to the abovementioned advantages, the FWD segment has the highest market share as compared to the other two, which will ultimately boost the front wheel smart electric drive market for electric and hybrid vehicles.

Passenger Car segment is expected to be the largest market in the forecast period

A passenger car, as defined by the OICA, is a motor vehicle equipped with at least four wheels, comprising of not more than eight seats. The PC segment is the largest vehicle segment and can be categorized by vehicle type, and includes sedans, hatchbacks, station wagons, Sports Utility Vehicles (SUVs), Multi-Utility Vehicles (MUVs), and other car types. Passenger electric vehicles are passenger cars that run on electric power instead of using fuels like petroleum, diesel and others. They use electric motors and EV batteries along with other drivetrain components which power the vehicle’s propulsion system. Electric passenger car is the largest segment in the smart electric drive market in terms of value and is expected to witness significant growth during the forecast period. The demand for passenger cars has increased due to the increase in demand for electric vehicles. Countries such as China have a high demand for electric PCs, with 12% of all vehicle sales being EVs as of H1 2021. Due to the growing stringency of emission norms, European countries are planning to decrease their vehicle emissions by 2035. The availability of a wide range of models, upgraded technology, increasing customer awareness, and availability of subsidies and tax rebates are the major factors driving the market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The smart electric drive market is dominated by global players such as Nidec Corporation (Japan), Aisin Corporation (Japan), BorgWarner (US), Bosch (Germany) and ZF group (Germany). These companies have been developing new products, adopted expansion strategies, and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the high-growth market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2021–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Volume (Thousand Units) and Value (USD Million) |

|

Segments covered |

Vehicle Type, EV Type, Component, Application, Commercial Vehicle Type, 2-Wheeler, Drive Type and Region. |

|

Geographies covered |

North America, Asia Pacific, Europe, and Rest of the World. |

|

Companies Covered |

Nidec Corporation (Japan), Aisin Corporation (Japan), BorgWarner (US), Bosch (Germany) and ZF Group (Germany). |

This research report categorizes the smart electric drive market based on Vehicle Type, EV Type, Component, Application, Commercial Vehicle Type, 2-Wheeler, Drive Type and Region.

Based on Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- 2-Wheelers

Based on EV Type:

- BEV

- HEV

- PHEV

Based on Application:

- E-Axle

- E-Wheel Drive

Based on Component:

- EV Battery

- Electric Motor

- Inverter System

- E-Brake Booster

- Power Electronics

Based on Drive Type:

- Front Wheel Drive

- Rear Wheel Drive

- All Wheel Drive

Based on Commercial Vehicle Type:

- Electric Buses

- Electric Trucks

Based on 2-Wheeler:

- Electric Cycles

- Electric Motorcycles

- Electric Scooters

Based on the region:

-

Asia Pacific (APAC)

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

North America (NA)

- US

- Canada

- Mexico

-

Europe (EU)

- France

- Germany

- Norway

- Spain

- UK

- Rest of Europe

-

Rest of the World (RoW)

- Russia

- Brazil

- Others

Recent Developments

- In September 2021, ZF announced the launch of its eDrive kit during the German IAA 2021 event. It bundles the full e-drivetrain expertise of the company in the drivetrain kit manufactured for easy setup in most conventional vehicles.

- In March 2021, Magna launched its new BEV and PHEV drivetrain. They were test-driven in north Sweden. Its PHEV version reduces emission by 38%. Both its versions offer cloud connectivity, cruise control and eco routing.

- In February 2020, Nidec announced launch of its two-new e-axles developed for 200KW and 50 KW drivetrains. Their e-axle system comprises of a fully integrated traction motor system with electric motor, reduction gearbox and inverter. The Ni200Ex is developed for D and E segment cars which offers much higher output compared to its earlier available Ni150Ex model.

- In August 2019, Continental AG launched a fully integrated electric drivetrain comprising of an electric motor, transmission system and a inverter. The system is manufactured for a total weight less than 80 kg, which is 20% lighter than competitor’s electric drivetrain.

- In January 2019, BorgWarner launched its new range of electric drivetrain through its new iDM e-axle. It is developed for use in all kinds of EV’s.

- In August 2018 , Bosch launched its new electric vehicle drivetrain for use in electric light commercial vehicles. It consists of multiple components like electric motor, power electronics etc.

- In July 2018, Aisin started developing e-axles for a Toyota made EV’s like Mirai, C-HR, IZOA etc. its innovative e-drivetrain products were integrated together for development of its e-axle.

Frequently Asked Questions (FAQ):

Does this report cover passenger and commercial vehicles of smart electric drive market?

Yes, Smart electric drive market report covers market size on various EV vehicle type such as passenger cars, commercial vehiles and two-wheeler.

Who are the winners in the global smart electric drive market?

The smart electric drive market is dominated by global players such as Nidec Corporation (Japan), Aisin Corporation (Japan), BorgWarner (US), Bosch (Germany) and ZF group (Germany). These companies have been developing new products, adopted expansion strategies, and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the high-growth smart electric drive market.

What is the Covid-19 impact on the smart electric drive manufacturers?

Most top OEM’s and component manufacturers suffered in the initial months of Covid-19 due to lockdown. However, this market wasn’t much affected by the pandemic due to the growing demand for EV’s during the pandemic which led to a increase in demand for convenient manufacturing of EVs using smart electric drives like e-axles and the recent e-wheel drive systems.

Which region will have the biggest market for smart electric drives like e-axles and e-wheel drives?

The Asia Pacific region will the the largest market for smart electric drivetrain systems due to the huge volume of demand for e-axles as part of EV’s in the region while North America will be the fastest-growing market for e-wheel drives with a growing demand in the US. Europe will also have a high demand for e-axles as part of EV’s mainly led by countries like Germany, UK and France. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

FIGURE 1 ELECTRIC SCOOTER (MOPED)

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS IN THE SMART ELECTRIC DRIVE MARKET

1.3 MARKET SCOPE

FIGURE 2 MARKETS COVERED

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

1.5 PACKAGE SIZE

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 3 SMART ELECTRIC DRIVE MARKET: RESEARCH DESIGN

FIGURE 4 RESEARCH DESIGN MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.3 PRIMARY PARTICIPANTS

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 7 SMART ELECTRIC DRIVE MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 8 MARKET: TOP-DOWN APPROACH

FIGURE 9 MARKET: RESEARCH DESIGN AND METHODOLOGY

FIGURE 10 RESEARCH APPROACH: MARKET

2.3.3 DEMAND-SIDE APPROACH

FIGURE 11 TOP-DOWN RESEARCH METHODOLOGY APPROACH: COMPANY BASED REVENUE APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 12 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.5.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDE

2.6 ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 13 SMART ELECTRIC DRIVE MARKET: MARKET OVERVIEW

FIGURE 14 MARKET, BY REGION, 2021–2026 (USD MILLION)

FIGURE 15 BEV SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD (2021–2026)

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 16 INCREASING DEMAND FOR SMART DRIVE TECHNOLOGY IN ELECTRIC VEHICLES TO DRIVE THE MARKET

4.2 MARKET GROWTH RATE, BY REGION

FIGURE 17 ASIA PACIFIC PROJECTED TO BE THE LARGEST MARKET

4.3 MARKET, BY COMPONENT

FIGURE 18 EV BATTERIES TO BE THE LARGEST SEGMENT (2021–2026)

4.4 MARKET, BY APPLICATION

FIGURE 19 E-AXLES EXPECTED TO HOLD MAJORITY OF THE MARKET (2021–2026)

4.5 MARKET, BY DRIVE TYPE

FIGURE 20 FWD SEGMENT TO OCCUPY A LARGER MARKET SHARE DURING FORECAST PERIOD (2021–2026)

4.6 MARKET, BY EV TYPE

FIGURE 21 BEV SEGMENT EXPECTED TO LEAD THE MARKET DURING FORECAST PERIOD (2021–2026)

4.7 MARKET, BY VEHICLE TYPE

FIGURE 22 COMMERCIAL VEHICLE SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD (2021–2026)

4.8 MARKET, BY COMMERCIAL VEHICLE TYPE

FIGURE 23 ELECTRIC TRUCK DEMAND IS EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD (2021–2026)

4.9 MARKET, BY 2-WHEELER TYPE

FIGURE 24 ELECTRIC SCOOTERS WILL BE LARGEST AND FASTEST GROWING SEGMENT (2021–2026)

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 SMART ELECTRIC DRIVE MARKET DYNAMICS

TABLE 2 MARKET: IMPACT OF MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Alternate materials & overall weight reduction to open new avenues in electric vehicles technologies

FIGURE 26 SMART ELECTRIC DRIVE GKN’S LOW WEIGHT E-DRIVE MODULE

5.2.1.2 Adoption of advanced technologies in electric vehicles

TABLE 3 E-AXLE DEVELOPMENTS, BY KEY MANUFACTURERS

5.2.1.3 Reducing cost of EV batteries will reduce the price of smart electric drive modules

FIGURE 27 GLOBAL LITHIUM-ION EV BATTERY PRICES (PER KWH)

5.2.1.4 Lower operating costs of EVs will increase demand for smart electric drive modules

TABLE 4 AVERAGE GASOLINE AND DIESEL PRICES OVER THE YEARS (US), (2016-2020)

FIGURE 28 GLOBAL GASOLINE CONSUMPTION TREND, 2011-2020

5.2.2 RESTRAINTS

5.2.2.1 High cost of smart electric drive systems/modules

TABLE 5 GLOBAL AVERAGE SELLING PRICE OF COMPONENTS

5.2.2.2 Maintaining and achieving optimum power-to-weight ratio

TABLE 6 VEHICLE POWER TO COMPONENT WEIGHT RATIO

TABLE 7 POWER OUTPUT TO VEHICLE WEIGHT

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in demand for EVs

FIGURE 29 BEV AND PHEV SALES (THOUSAND UNITS)

5.2.3.2 Government policies promoting sales of electric vehicles

TABLE 8 GOVERNMENT PROGRAMS FOR THE PROMOTION OF ELECTRIC COMMERCIAL VEHICLE SALES

FIGURE 30 EMISSION NORMS AROUND THE WORLD, 2021

FIGURE 31 GOVERNMENT TARGETS FOR EVS

5.2.3.3 Integrated mobility solutions and ride-hailing will increase demand for smart electric drives

FIGURE 32 RIDESHARING MARKET IS ON RISE, 2021 -2026

5.2.4 CHALLENGES

5.2.4.1 Inadequate charging infrastructure for electric vehicles in emerging countries

FIGURE 33 EV CHARGING DEMAND, 2020-2030

5.2.4.2 Developing fail-safe electronic and electrical components

5.3 PORTER’S FIVE FORCES

FIGURE 34 PORTER’S FIVE FORCES: MARKET

TABLE 9 MARKET: IMPACT OF PORTERS 5 FORCES

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 RIVALRY AMONG EXISTING COMPETITORS

5.4MARKET ECOSYSTEM

FIGURE 35 MARKET: ECOSYSTEM ANALYSIS

5.4.1 EV CHARGING PROVIDERS

5.4.2 TIER I SUPPLIERS

5.4.3 EV BATTERY MANUFACTURERS

5.4.4 OEMS

5.4.5 END USERS

TABLE 10 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

5.5 VALUE CHAIN ANALYSIS

FIGURE 36 VALUE CHAIN ANALYSIS OF MARKET

5.6 SMART ELECTRIC DRIVE AVERAGE PRICING ANALYSIS

TABLE 11 SMART ELECTRIC DRIVE: AVERAGE PRICE COMPARISON (USD), 2020

5.7 MACRO INDICATOR ANALYSIS

5.7.1 INTRODUCTION

5.7.1.1 Battery electric vehicle sales as a percentage of total electric vehicle sales

5.7.1.2 GDP (USD billion)

5.7.1.3 GNP per capita, Atlas Method (USD)

5.7.1.4 GDP per capita PPP (USD)

5.7.2 MACRO INDICATORS INFLUENCING THE HYBRID SYSTEM MARKET FOR TOP 3 COUNTRIES

5.7.2.1 Japan

TABLE 12 JAPAN: RISING DEBT-GDP RATIO TO BE THE MOST CRUCIAL INDICATOR GIVEN ITS EXCESSIVELY WEAK PERFORMANCE IN THE RECENT PAST

5.7.2.2 China

TABLE 13 CHINA: DOMESTIC DEMAND EXPECTED TO PLAY A CRUCIAL ROLE OWING TO A HOST OF CHINESE DOMESTIC CARMAKERS

5.7.2.3 US

TABLE 14 US: RISING GNI PER CAPITA EXPECTED TO DRIVE THE SALES OF LUXURY VEHICLES DURING THE FORECAST PERIOD

5.8 CASE STUDY

5.8.1 A PERFORMANCE AND COST OVERVIEW OF SELECTED SOLID-STATE ELECTROLYTES FOR EV BATTERIES

5.8.2 DEVELOPMENT OF COMMERCIAL VEHICLE E-AXLE SYSTEM BASED ON NVH PERFORMANCE OPTIMIZATION

5.9 REGULATORY OVERVIEW

5.9.1 NETHERLANDS

TABLE 15 NETHERLANDS: ELECTRIC VEHICLE INCENTIVES

TABLE 16 NETHERLANDS: ELECTRIC VEHICLE CHARGING STATIONS INCENTIVES

5.9.2 GERMANY

TABLE 17 GERMANY: ELECTRIC VEHICLE INCENTIVES

TABLE 18 GERMANY: ELECTRIC VEHICLE CHARGING STATIONS INCENTIVES

5.9.3 FRANCE

TABLE 19 FRANCE: ELECTRIC VEHICLE INCENTIVES

TABLE 20 FRANCE: ELECTRIC VEHICLE CHARGING STATIONS INCENTIVES

5.9.4 UK

TABLE 21 UK: ELECTRIC VEHICLE INCENTIVES

TABLE 22 UK: ELECTRIC VEHICLE CHARGING STATIONS INCENTIVES

5.9.5 CHINA

TABLE 23 CHINA: ELECTRIC VEHICLE INCENTIVES

TABLE 24 CHINA: ELECTRIC VEHICLE CHARGING STATIONS INCENTIVES

5.9.6 US

TABLE 25 US: ELECTRIC VEHICLE INCENTIVES

TABLE 26 US: ELECTRIC VEHICLE CHARGING STATIONS INCENTIVES

5.10 PATENT ANALYSIS

TABLE 27 IMPORTANT REGISTRATIONS RELATED TO SMART E DRIVE MARKET

5.11 TRENDS AND DISRUPTIONS

FIGURE 37 TRENDS AND DISRUPTIONS IN THE MARKET

5.12 MARKET: COVID-19 IMPACT

5.12.1 IMPACT ON RAW MATERIAL SUPPLY

5.12.2 COVID-19 IMPACT ON AUTOMOTIVE EV INDUSTRY

5.12.3 ANNOUNCEMENTS-OEM AND COMPONENT MANUFACTURER

TABLE 28 ANNOUNCEMENTS

5.12.4 IMPACT ON AUTOMOTIVE PRODUCTION

5.13 MARKET SCENARIO ANALYSIS

FIGURE 38 SMART ELECTRIC DRIVES MARKET– FUTURE TRENDS & SCENARIO, 2021–2026 (USD MILLION)

5.13.1 MOST LIKELY SCENARIO

TABLE 29 MARKET (MOST LIKELY SCENARIO), BY REGION, 2021–2026 (USD MILLION)

5.13.2 OPTIMISTIC SCENARIO

TABLE 30 MARKET (OPTIMISTIC), BY REGION, 2021–2026 (USD MILLION)

5.13.3 PESSIMISTIC SCENARIO

TABLE 31 MARKET (PESSIMISTIC), BY REGION, 2021–2026 (USD MILLION)

6 TECHNOLOGY OVERVIEW (Page No. - 96)

6.1 EVOLUTION

6.1.1 E-DRIVE IN ELECTRIC VEHICLE

FIGURE 39 E-DRIVE: ELECTRIC VEHICLE

6.1.2 E-DRIVE IN HYBRID ELECTRIC VEHICLES – SERIES AND PARALLEL VS. SERIES-PARALLEL COMBINATION

FIGURE 40 E-DRIVE: HYBRID ELECTRIC VEHICLE (SERIES)

FIGURE 41 E-DRIVE: HYBRID ELECTRIC VEHICLE (PARALLEL)

FIGURE 42 E-DRIVE: HYBRID ELECTRIC VEHICLE (SERIES-PARALLEL COMBINATION)

6.2 SPECTRUM OF DRIVE TRAIN ELECTRIFICATION

FIGURE 43 DRIVE TRAIN ELECTRIFICATION

6.3 COMPONENTS OF ELECTRIC DRIVE

6.3.1 ELECTRIC MOTOR

TABLE 32 COMPARISON OF AC AND DC MOTOR

TABLE 33 CHARACTERISTICS COMPARISON OF ELECTRICAL MOTORS

6.3.2 BATTERY

FIGURE 44 ENERGY DENSITY COMPARISON FOR DIFFERENT BATTERY TYPES

6.3.3 MULTISPEED GEARBOX

6.3.4 INVERTER UNIT

6.4 NEW AND UPCOMING TECHNOLOGY

6.4.1 SOLID-STATE BATTERY (SSB)

6.4.2 IOT IN ELECTRIC VEHICLES

7 SMART ELECTRIC DRIVE MARKET, BY APPLICATION (Page No. - 104)

7.1 INTRODUCTION

FIGURE 45 E-AXLE SEGMENT EXPECTED TO DOMINATE THE MARKET, 2021-2026 (USD MILLION)

TABLE 34 MARKET, BY APPLICATION, 2018–2020 (THOUSAND UNITS)

TABLE 35 MARKET, BY APPLICATION, 2021–2026 (THOUSAND UNITS)

TABLE 36 MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 37 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

7.2 OPERATIONAL DATA

TABLE 38 KEY E-AXLE AND SMART ELECTRIC DRIVE MANUFACTURERS

7.2.1 ASSUMPTIONS

TABLE 39 ASSUMPTIONS: BY APPLICATION

7.3 RESEARCH METHODOLOGY

7.4 E-AXLE

TABLE 40 E-AXLE: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 41 E-AXLE: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 42 E-AXLE: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 43 E-AXLE: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.5 E-WHEEL DRIVE

TABLE 44 E-WHEEL DRIVE: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 45 E-WHEEL DRIVE: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 46 E-WHEEL DRIVE: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 47 E-WHEEL DRIVE: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.6 KEY INDUSTRY INSIGHTS

8 SMART ELECTRIC DRIVE MARKET, BY DRIVE TYPE (Page No. - 113)

8.1 INTRODUCTION

FIGURE 46 AWD SEGMENT EXPECTED TO DOMINATE THE MARKET, 2021-2026 (USD MILLION)

TABLE 48 MARKET, BY DRIVE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 49 MARKET, BY DRIVE TYPE, 2021–2026 (THOUSAND UNITS)

8.2 OPERATIONAL DATA

TABLE 50 BEV VEHICLE MODELS AND THEIR DRIVE TYPE

TABLE 51 PHEV VEHICLE MODELS AND THEIR DRIVE TYPE

8.2.1 ASSUMPTIONS

TABLE 52 ASSUMPTIONS: BY DRIVE TYPE

8.3 RESEARCH METHODOLOGY

8.4 FRONT WHEEL DRIVE

TABLE 53 FWD: MARKET, BY REGION, 2018-2020 (THOUSAND UNITS)

TABLE 54 FWD: MARKET, BY REGION, 2021-2026 (THOUSAND UNITS)

8.5 REAR WHEEL DRIVE

TABLE 55 RWD: MARKET, BY REGION, 2018-2020 (THOUSAND UNITS)

TABLE 56 RWD: MARKET, BY REGION, 2021-2026 (THOUSAND UNITS)

8.6 ALL-WHEEL DRIVE

TABLE 57 AWD: MARKET, BY REGION, 2018-2020 (THOUSAND UNITS)

TABLE 58 AWD: MARKET, BY REGION, 2021-2026 (THOUSAND UNITS)

8.7 KEY INDUSTRY INSIGHTS

9 SMART ELECTRIC DRIVE MARKET, BY COMPONENT (Page No. - 125)

9.1 INTRODUCTION

FIGURE 47 ELECTRIC DRIVETRAIN COMPONENTS IN ALL-ELECTRIC DRIVE

FIGURE 48 EV BATTERY SEGMENT EXPECTED TO DOMINATE THE MARKET, 2021-2026 (USD MILLION)

TABLE 59 MARKET, BY COMPONENT, 2018-2020 (THOUSAND UNITS)

TABLE 60 MARKET, BY COMPONENT, 2021-2026 (THOUSAND UNITS)

TABLE 61 MARKET, BY COMPONENT, 2018-2020 (USD MILLION)

TABLE 62 MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

9.2 OPERATIONAL DATA

TABLE 63 POPULAR LI-ION BATTERIES AND THEIR SPECIFICATIONS

TABLE 64 SMART ELECTRIC DRIVETRAIN PROVIDERS

TABLE 65 ELECTRIC MOTOR PROVIDERS

TABLE 66 MOTOR CONTROLLER PROVIDERS

9.2.1 ASSUMPTIONS

TABLE 67 ASSUMPTIONS: BY COMPONENT

9.3 RESEARCH METHODOLOGY

9.4 EV BATTERY

TABLE 68 EV BATTERY: MARKET, BY REGION, 2018-2020 (THOUSAND UNITS)

TABLE 69 EV BATTERY: MARKET, BY REGION, 2021-2026 (THOUSAND UNITS)

TABLE 70 EV BATTERY: MARKET, BY REGION, 2018-2020 (USD MILLION)

TABLE 71 EV BATTERY: MARKET, BY REGION, 2021-2026 (USD MILLION)

9.5 ELECTRIC MOTOR

TABLE 72 ELECTRIC MOTOR: MARKET, BY REGION, 2018-2020 (THOUSAND UNITS)

TABLE 73 ELECTRIC MOTOR: MARKET, BY REGION, 2021-2026 (THOUSAND UNITS)

TABLE 74 ELECTRIC MOTOR: MARKET, BY REGION, 2018-2020 (USD MILLION)

TABLE 75 ELECTRIC MOTOR: MARKET, BY REGION, 2021-2026 (USD MILLION)

9.6 INVERTER SYSTEM

TABLE 76 INVERTER SYSTEM: MARKET, BY REGION, 2018-2020 (THOUSAND UNITS)

TABLE 77 INVERTER SYSTEM: MARKET, BY REGION, 2021-2026 (THOUSAND UNITS)

TABLE 78 INVERTER SYSTEM: MARKET, BY REGION, 2018-2020 (USD MILLION)

TABLE 79 INVERTER SYSTEM: MARKET, BY REGION, 2021-2026 (USD MILLION)

9.7 E-BRAKE BOOSTER

TABLE 80 E-BRAKE BOOSTER: MARKET, BY REGION, 2018-2020 (THOUSAND UNITS)

TABLE 81 E-BRAKE BOOSTER: MARKET, BY REGION, 2021-2026 (THOUSAND UNITS)

TABLE 82 E-BRAKE BOOSTER: MARKET, BY REGION, 2018-2020 (USD MILLION)

TABLE 83 E-BRAKE BOOSTER: MARKET, BY REGION, 2021-2026 (USD MILLION)

9.8 POWER ELECTRONICS

TABLE 84 POWER ELECTRONICS: MARKET, BY REGION, 2018-2020 (THOUSAND UNITS)

TABLE 85 POWER ELECTRONICS: MARKET, BY REGION, 2021-2026 (THOUSAND UNITS)

TABLE 86 POWER ELECTRONICS: MARKET, BY REGION, 2018-2020 (USD MILLION)

TABLE 87 POWER ELECTRONICS: MARKET, BY REGION, 2021-2026 (USD MILLION)

9.9 KEY INDUSTRY INSIGHTS

10 SMART ELECTRIC DRIVE MARKET, BY VEHICLE TYPE (Page No. - 142)

10.1 INTRODUCTION

TABLE 88 MARKET, BY VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 89 MARKET, BY VEHICLE TYPE, 2021–2026 (THOUSAND UNITS)

TABLE 90 MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 91 MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

FIGURE 49 COMMERCIAL VEHICLE SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD (2021–2026)

10.2 OPERATIONAL DATA

TABLE 92 TOP SELLING EVS VEHICLE TYPE AND SUPPLIER DATA FOR SMART ELECTRIC DRIVE MARKET

10.2.1 ASSUMPTIONS

TABLE 93 ASSUMPTIONS: BY VEHICLE TYPE

10.3 RESEARCH METHODOLOGY

10.4 PASSENGER CAR (PC)

10.4.1 ADOPTION OF INTEGRATED UNITS BY OEMS TO DRIVE DEMAND

10.5 COMMERCIAL VEHICLES (CV)

10.5.1 GROWTH OF E-COMMERCE AND LOGISTICS TO DRIVE DEMAND

10.6 2-WHEELERS (2-W)

10.6.1 EASY INSTALLATION & LESS COMPLEX DESIGN TO DRIVE DEMAND

10.7 KEY PRIMARY INSIGHTS

11 SMART ELECTRIC DRIVE MARKET, BY EV TYPE (Page No. - 150)

11.1 INTRODUCTION

TABLE 94 MARKET, BY EV TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 95 MARKET, BY EV TYPE, 2021–2026 (THOUSAND UNITS)

TABLE 96 MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 97 MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

FIGURE 50 BEV SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD (2021–2026)

11.2 OPERATIONAL DATA

TABLE 98 EV MODELS, BY PROPULSION AND SALES

11.2.1 ASSUMPTIONS

TABLE 99 ASSUMPTIONS: BY EV TYPE

11.3 RESEARCH METHODOLOGY

11.4 BATTERY ELECTRIC VEHICLE (BEV)

11.4.1 INCREASE IN ADOPTION OF INTEGRATED DRIVE SYSTEMS BY OEMS TO DRIVE DEMAND

TABLE 100 BEV: SMART ELECTRIC DRIVE MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 101 BEV: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 102 BEV: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 103 BEV: MARKET, BY REGION, 2021–2026 (USD MILLION)

11.5 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

11.5.1 GROWING NEED FOR FLEXIBLE POWERTRAINS TO DRIVE DEMAND

TABLE 104 PHEV: MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 105 PHEV: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 106 PHEV: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 107 PHEV: MARKET, BY REGION, 2021–2026 (USD MILLION)

11.6 HYBRID ELECTRIC VEHICLE (HEV)

11.6.1 USE OF E-AXLES IN HEVS WILL CREATE OPPORTUNITIES FOR SMART ELECTRIC DRIVE TECHNOLOGY

TABLE 108 HEV: SMART ELECTRIC DRIVE MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 109 HEV: MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 110 HEV: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 111 HEV: MARKET, BY REGION, 2021–2026 (USD MILLION)

11.7 KEY INDUSTRY INSIGHTS

12 SMART ELECTRIC DRIVE MARKET, BY COMMERCIAL VEHICLE (Page No. - 161)

12.1 INTRODUCTION

FIGURE 51 E-BUSES EXPECTED TO DOMINATE THE MARKET, 2021-2026 (USD MILLION)

TABLE 112 MARKET, BY COMMERCIAL VEHICLE, 2018-2020 (THOUSAND UNITS)

TABLE 113 MARKET, BY COMMERCIAL VEHICLE, 2021-2026 (THOUSAND UNITS)

TABLE 114 MARKET FOR COMMERCIAL VEHICLE, 2018-2020 (USD MILLION)

TABLE 115 MARKET FOR COMMERCIAL VEHICLE, 2021-2026 (USD MILLION)

12.2 OPERATIONAL DATA

TABLE 116 SMART ELECTRIC DRIVE FOR COMMERCIAL VEHICLES

12.2.1 ASSUMPTIONS

TABLE 117 ASSUMPTIONS: BY COMMERCIAL VEHICLE

12.2.2 RESEARCH METHODOLOGY

12.3 ELECTRIC BUSES

12.3.1 ADOPTION OF ADVANCED INTEGRATED TECHNOLOGIES TO DRIVE DEMAND

TABLE 118 ELECTRIC BUSES: SMART ELECTRIC DRIVE MARKET, BY REGION, 2018-2020 (THOUSAND UNITS)

TABLE 119 ELECTRIC BUSES: MARKET, BY REGION, 2021-2026 (THOUSAND UNITS)

TABLE 120 ELECTRIC BUSES: MARKET, BY REGION, 2018-2020 (USD MILLION)

TABLE 121 ELECTRIC BUSES: MARKET, BY REGION, 2021-2026 (USD MILLION)

12.4 ELECTRIC TRUCKS

12.4.1 INCREASE IN ADOPTION OF INTEGRATED COMPONENTS BY OEMS TO DRIVE DEMAND

TABLE 122 ELECTRIC TRUCKS: MARKET, BY REGION, 2018-2020 (THOUSAND UNITS)

TABLE 123 ELECTRIC TRUCKS: MARKET, BY REGION, 2021-2026 (THOUSAND UNITS)

TABLE 124 ELECTRIC TRUCKS: MARKET, BY REGION, 2018-2020 (USD MILLION)

TABLE 125 ELECTRIC TRUCKS: MARKET, BY REGION, 2021-2026 (USD MILLION)

12.5 KEY INDUSTRY INSIGHTS

13 SMART ELECTRIC DRIVE MARKET, BY ELECTRIC TWO-WHEELER (Page No. - 171)

13.1 INTRODUCTION

FIGURE 52 E-SCOOTERS SEGMENT EXPECTED TO DOMINATE THE MARKET, 2021-2026 (USD MILLION)

TABLE 126 MARKET, BY 2-WHEELER, 2018-2020 (THOUSAND UNITS)

TABLE 127 MARKET, BY 2-WHEELER, 2021-2026 (THOUSAND UNITS)

TABLE 128 MARKET, BY 2-WHEELER, 2018-2020 (USD MILLION)

TABLE 129 MARKET, BY 2-WHEELER, 2021-2026 (USD MILLION)

13.2 OPERATIONAL DATA

TABLE 130 GLOBAL ELECTRIC TWO-WHEELER SALES (THOUSAND UNITS)

13.2.1 ASSUMPTIONS

TABLE 131 ASSUMPTIONS: BY TWO-WHEELER

13.2.2 RESEARCH METHODOLOGY

13.3 ELECTRIC CYCLES

13.3.1 GROWING DEMAND FOR ELECTRIC CYCLES TO DRIVE THE SEGMENT

13.4 ELECTRIC SCOOTERS

13.4.1 INCREASING USE OF SMART ELECTRIC DRIVE TECHNOLOGY TO DRIVE THE SEGMENT

13.5 ELECTRIC MOTORCYCLES

13.5.1 INCREASING USE OF INTEGRATED COMPONENTS AND BATTERY SWAPPING TECHNOLOGY TO DRIVE THE SEGMENT

13.6 KEY INDUSTRY INSIGHTS

14 SMART ELECTRIC DRIVE, E-AXLE MARKET, BY REGION (Page No. - 178)

14.1 INTRODUCTION

14.2 OPERATIONAL DATA

TABLE 132 TOP E-AXLE MANUFACTURERS AND VEHICLES MODELS

14.3 ASIA PACIFIC

TABLE 133 ASIA PACIFIC E-AXLE MANUFACTURERS

14.4 EUROPE

TABLE 134 EUROPE E-AXLE MANUFACTURERS

14.5 NORTH AMERICA

TABLE 135 NORTH AMERICA E-AXLE MANUFACTURERS

14.6 KEY PRIMARY INSIGHTS

15 SMART ELECTRIC DRIVE MARKET, EV COMPONENTS-SUPPLIERS DATA (Page No. - 186)

15.1 REGION-WISE SUPPLIERS DATA

TABLE 136 NORTH AMERICA: SUPPLIERS DATA

TABLE 137 EUROPE: SUPPLIERS DATA

TABLE 138 CHINA: SUPPLIERS DATA

TABLE 139 JAPAN: SUPPLIERS DATA

TABLE 140 REST OF ASIA: SUPPLIERS DATA

16 SMART ELECTRIC DRIVE MARKET, E-AXLE SUPPLY CHAIN (Page No. - 216)

16.1 E-AXLE SUPPLY CHAIN ANALYSIS

FIGURE 53 E-AXLE: SUPPLY CHAIN ANALYSIS

16.2 DISRUPTIONS IN THE E-POWERTRAIN VALUE CHAIN TO CREATE NEW OPPORTUNITIES

FIGURE 54 E-POWERTRAIN LANDSCAPE

16.3 IN-HOUSE VS OUTSOURCING COMPONENTS

16.4 INHOUSE VS OUTSOURCING MANUFACTURING

TABLE 141 INHOUSE VS OUTSOURCING MANUFACTURING OF E-AXLE

16.5 LIST OF KEY COMPONENT SUPPLIERS

TABLE 142 E-AXLE AND E-DRIVETRAIN PROVIDERS

TABLE 143 TRACTION MOTOR AND ELECTRIC MOTOR PROVIDERS

TABLE 144 MOTOR CONTROLLER PROVIDER

17 SMART ELECTRIC DRIVE MARKET, BY REGION (Page No. - 224)

17.1 INTRODUCTION

FIGURE 55 ASIA PACIFIC IS ESTIMATED TO BE THE LARGEST MARKET DURING FORECAST PERIOD (2021–2026)

TABLE 145 MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 146 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 147 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 148 MARKET, BY REGION, 2021–2026 (USD MILLION)

17.2 ASIA PACIFIC

FIGURE 56 ASIA PACIFIC: MARKET SNAPSHOT, 2021-2026

TABLE 149 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 150 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (UNITS)

TABLE 151 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

17.2.1 CHINA

17.2.1.1 Large number of EV manufacturers offering integrated drivetrains to drive the market

TABLE 153 CHINA: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 154 CHINA: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 155 CHINA: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 156 CHINA: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.2.2 INDIA

17.2.2.1 Integration of advanced components in EVs to drive the market

TABLE 157 INDIA: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 158 INDIA: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 159 INDIA: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 160 INDIA: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.2.3 JAPAN

17.2.3.1 Presence of strong local manufacturers to drive the market

TABLE 161 JAPAN: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 162 JAPAN: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 163 JAPAN: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 164 JAPAN: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.2.4 SOUTH KOREA

17.2.4.1 Increased investments in advanced technologies to drive the market

TABLE 165 SOUTH KOREA: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 166 SOUTH KOREA: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 167 SOUTH KOREA: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 168 SOUTH KOREA: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.2.5 REST OF ASIA PACIFIC

TABLE 169 REST OF ASIA PACIFIC: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 170 REST OF ASIA PACIFIC: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 171 REST OF ASIA PACIFIC: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 172 REST OF ASIA PACIFIC: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.3 EUROPE

FIGURE 57 EUROPE: GERMANY WILL BE LEADING THE MARKET DURING 2021-2026

TABLE 173 EUROPE: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 174 EUROPE: MARKET, BY COUNTRY, 2021–2026 (UNITS)

TABLE 175 EUROPE: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 176 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

17.3.1 FRANCE

17.3.1.1 Increasing adoption of integrated electric drives and government incentives to drive the market

TABLE 177 FRANCE: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 178 FRANCE: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 179 FRANCE: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 180 FRANCE: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.3.2 GERMANY

17.3.2.1 Rising sales of EVs using integrated e-axles to drive the market

TABLE 181 GERMANY: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 182 GERMANY: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 183 GERMANY: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 184 GERMANY: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.3.3 NORWAY

17.3.3.1 Strong EV demand and adoption of integrated electric drive technology to drive the market

TABLE 185 NORWAY: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 186 NORWAY: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 187 NORWAY: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 188 NORWAY: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.3.4 UK

17.3.4.1 Outsourcing of smart electric drive technology to drive the market

TABLE 189 UK: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 190 UK: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 191 UK: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 192 UK: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.3.5 SPAIN

17.3.5.1 Increasing investments in EV technologies to drive the market

TABLE 193 SPAIN: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 194 SPAIN: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 195 SPAIN: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 196 SPAIN: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.3.6 REST OF EUROPE

TABLE 197 REST OF EUROPE: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 198 REST OF EUROPE: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 199 REST OF EUROPE: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 200 REST OF EUROPE: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.4 NORTH AMERICA

FIGURE 58 NORTH AMERICA: MARKET SNAPSHOT

TABLE 201 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 202 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (UNITS)

TABLE 203 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 204 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

17.4.1 CANADA

17.4.1.1 Increasing developments in electric vehicle infrastructure to drive the market

TABLE 205 CANADA: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 206 CANADA: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 207 CANADA: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 208 CANADA: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.4.2 US

17.4.2.1 Adoption of in-house manufacturing of integrated drivetrain components to drive the market

TABLE 209 US: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 210 US: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 211 US: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 212 US: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.4.3 MEXICO

17.4.3.1 Rise in EV sales with assembled drivetrain components to drive the market

TABLE 213 MEXICO: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 214 MEXICO: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 215 MEXICO: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 216 MEXICO: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.5 ROW

FIGURE 59 RUSSIA TO BE THE LARGEST MARKET IN ROW

TABLE 217 ROW: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 218 ROW: MARKET, BY COUNTRY, 2021–2026 (UNITS)

TABLE 219 ROW: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 220 ROW: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

17.5.1 RUSSIA

17.5.1.1 EV popularization to drive the market

TABLE 221 RUSSIA: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 222 RUSSIA: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 223 RUSSIA: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 224 RUSSIA: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.5.2 BRAZIL

17.5.2.1 Growing EV demand to drive the market

TABLE 225 BRAZIL: MARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 226 BRAZIL: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 227 BRAZIL: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 228 BRAZIL: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

17.5.3 OTHERS

TABLE 229 OTHERS: SMART ELECTRIC DRIVEMARKET, BY EV TYPE, 2018–2020 (UNITS)

TABLE 230 OTHERS: MARKET, BY EV TYPE, 2021–2026 (UNITS)

TABLE 231 OTHERS: MARKET, BY EV TYPE, 2018–2020 (USD MILLION)

TABLE 232 OTHERS: MARKET, BY EV TYPE, 2021–2026 (USD MILLION)

18 COMPETITIVE LANDSCAPE (Page No. - 268)

18.1 OVERVIEW

18.2 MARKET SHARE ANALYSIS FOR MARKET

TABLE 233 MARKET SHARE ANALYSIS, 2020

FIGURE 60 MARKET SHARE ANALYSIS, 2020

18.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 61 TOP PUBLIC/LISTED PLAYERS DOMINATED MARKET IN LAST FIVE YEARS

18.4 COMPETITIVE SCENARIO

18.4.1 NEW PRODUCT LAUNCHES

TABLE 234 NEW PRODUCT LAUNCHES, 2018–2021

18.4.2 DEALS

TABLE 235 DEALS, 2018–2021

18.4.3 OTHERS

TABLE 236 OTHERS, 2018–2021

18.5 KEY PLAYERS IN MARKET

TABLE 237 COMPANY MATRIX: TOP 5 PLAYERS IN THE MARKET

18.6 COMPANY EVALUATION QUADRANT

18.6.1 STARS

18.6.2 EMERGING LEADERS

18.6.3 PERVASIVE

18.6.4 PARTICIPANTS

FIGURE 62 MARKET: COMPANY EVALUATION QUADRANT, 2021

18.6.5 MARKET: COMPANY FOOTPRINT, 2021

18.6.6 MARKET: APPLICATION FOOTPRINT, 2021

18.6.7 MARKET: REGIONAL FOOTPRINT, 2021

18.7 START-UP/SME EVALUATION QUADRANT

18.7.1 PROGRESSIVE COMPANIES

18.7.2 RESPONSIVE COMPANIES

18.7.3 DYNAMIC COMPANIES

18.7.4 STARTING BLOCKS

FIGURE 63 MARKET: STARTUP/SME EVALUATION QUADRANT, 2021

18.8 RIGHT TO WIN, 2018-2021

TABLE 238 RIGHT TO WIN, 2018-2021

19 COMPANY PROFILES (Page No. - 282)

19.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

19.1.1 NIDEC CORPORATION

TABLE 239 NIDEC CORPORATION: BUSINESS OVERVIEW

FIGURE 64 NIDEC CORPORATION: COMPANY SNAPSHOT

FIGURE 65 NIDEC CORPORATION: SNAPSHOT

TABLE 240 NIDEC CORPORATION: PRODUCTION FOOTPRINT

TABLE 241 NIDEC CORPORATION: PRODUCTS OFFERED

TABLE 242 NIDEC CORPORATION: NEW PRODUCT LAUNCH

TABLE 243 NIDEC CORPORATION: DEALS

TABLE 244 NIDEC CORPORATION: OTHERS

19.1.2 AISIN CORPORATION

TABLE 245 AISIN CORPORATION: BUSINESS OVERVIEW

FIGURE 66 AISIN CORPORATION: COMPANY SNAPSHOT

FIGURE 67 AISIN CORPORATION: SNAPSHOT

FIGURE 68 AISIN CORPORATION: ELECTRIC POWERTRAIN MARKET

TABLE 246 AISIN CORPORATION: PRODUCTS OFFERED

TABLE 247 AISIN CORPORATION: NEW PRODUCT LAUNCH

TABLE 248 AISIN CORPORATION: DEALS

TABLE 249 AISIN CORPORATION: OTHERS

19.1.3 BORGWARNER

TABLE 250 BORGWARNER: BUSINESS OVERVIEW

FIGURE 69 BORGWARNER: COMPANY SNAPSHOT

FIGURE 70 BORGWARNER: SNAPSHOT

TABLE 251 BORGWARNER: PRODUCTS OFFERED

TABLE 252 BORGWARNER: NEW PRODUCT LAUNCH

TABLE 253 BORGWARNER: DEALS

TABLE 254 BORGWARNER: OTHERS

19.1.4 BOSCH

TABLE 255 BOSCH: BUSINESS OVERVIEW

FIGURE 71 BOSCH: COMPANY SNAPSHOT

FIGURE 72 BOSCH: 2020 HIGHLIGHTS

FIGURE 73 BOSCH: SNAPSHOT

FIGURE 74 BOSCH: MAJOR BRANDS

TABLE 256 BOSCH: PRODUCTS OFFERED

TABLE 257 BOSCH: NEW PRODUCT LAUNCH

TABLE 258 BOSCH: DEALS

TABLE 259 BOSCH: OTHERS

19.1.5 ZF GROUP

TABLE 260 ZF GROUP: BUSINESS OVERVIEW

FIGURE 75 ZF GROUP: COMPANY SNAPSHOT

TABLE 261 ZF GROUP: PRODUCTS OFFERED

TABLE 262 ZF GROUP: NEW PRODUCT LAUNCH

TABLE 263 ZF GROUP: DEALS

19.1.6 MAGNA INTERNATIONAL

TABLE 264 MAGNA INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 76 MAGNA INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 77 MAGNA INTERNATIONAL: E-MOBILITY MARKET SCENARIO

FIGURE 78 MAGNA INTERNATIONAL: E-MOBILITY DRIVETRAIN

TABLE 265 MAGNA INTERNATIONAL: PRODUCTS OFFERED

TABLE 266 MAGNA INTERNATIONAL: NEW PRODUCT LAUNCH

TABLE 267 MAGNA INTERNATIONAL: DEALS

19.1.7 CONTINENTAL AG

TABLE 268 CONTINENTAL AG: BUSINESS OVERVIEW

FIGURE 79 CONTINENTAL AG: COMPANY SNAPSHOT

TABLE 269 CONTINENTAL AG: PRODUCTS OFFERED

TABLE 270 CONTINENTAL AG: NEW PRODUCT LAUNCH

TABLE 271 CONTINENTAL AG: DEALS

19.1.8 SIEMENS AG

TABLE 272 SIEMENS: BUSINESS OVERVIEW

FIGURE 80 SIEMENS: COMPANY SNAPSHOT

TABLE 273 SIEMENS: PRODUCTS OFFERED

TABLE 274 SIEMENS: NEW PRODUCT LAUNCH

TABLE 275 SIEMENS: DEALS

19.1.9 GKN (MELROSE)

TABLE 276 GKN: BUSINESS OVERVIEW

FIGURE 81 GKN.: COMPANY SNAPSHOT

FIGURE 82 GKN: SMART ELECTRIC DRIVE OVERVIEW

TABLE 277 GKN: PRODUCTS OFFERED

TABLE 278 GKN: NEW PRODUCT LAUNCH

TABLE 279 GKN: DEALS

19.1.10 MERITOR

TABLE 280 MERITOR: BUSINESS OVERVIEW

FIGURE 83 MERITOR: COMPANY SNAPSHOT

TABLE 281 MERITOR: PRODUCTS OFFERED

TABLE 282 MERITOR: NEW PRODUCT LAUNCH

TABLE 283 MERITOR: DEALS

19.1.11 DANA

TABLE 284 DANA: BUSINESS OVERVIEW

FIGURE 84 DANA: COMPANY SNAPSHOT

TABLE 285 DANA BUSINESS OPERATIONS

TABLE 286 DANA: PRODUCTS OFFERED

TABLE 287 DANA: NEW PRODUCT LAUNCH

TABLE 288 DANA: DEALS

19.1.12 HEXAGON AB

TABLE 289 HEXAGON AB: BUSINESS OVERVIEW

FIGURE 85 HEXAGON AB: COMPANY SNAPSHOT

TABLE 290 HEXAGON AB: PRODUCTS OFFERED

TABLE 291 HEXAGON AB: DEALS

19.1.13 DENSO

TABLE 292 DENSO: BUSINESS OVERVIEW

FIGURE 86 DENSO: COMPANY SNAPSHOT

TABLE 293 DENSO: PRODUCTS OFFERED

TABLE 294 DENSO: NEW PRODUCT LAUNCH

TABLE 295 DENSO: DEALS

19.1.14 HITACHI

TABLE 296 HITACHI: BUSINESS OVERVIEW

FIGURE 87 HITACHI: COMPANY SNAPSHOT

TABLE 297 HITACHI: PRODUCTS OFFERED

TABLE 298 HITACHI: NEW PRODUCT LAUNCH

TABLE 299 HITACHI: DEALS

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

19.2 OTHER PLAYERS

19.2.1 JATCO

TABLE 300 JATCO: BUSINESS OVERVIEW

19.2.2 MEIDENSHA CORPORATION

TABLE 301 MEIDENSHA CORPORATION: BUSINESS OVERVIEW

19.2.3 HYUNDAI MOBIS

TABLE 302 HYUNDAI MOBIS: BUSINESS OVERVIEW

19.2.4 ALLISON TRANSMISSION

TABLE 303 ALLISON TRANSMISSION: BUSINESS OVERVIEW

19.2.5 LG ELECTRONICS

TABLE 304 LG ELECTRONICS: BUSINESS OVERVIEW

19.2.6 JING-JIN ELECTRIC TECHNOLOGIES

TABLE 305 JING-JIN ELECTRIC TECHNOLOGIES: BUSINESS OVERVIEW

19.2.7 SHANGHAI AUTOMOTIVE SMART ELECTRIC DRIVE

TABLE 306 SHANGHAI AUTOMOTIVE SMART ELECTRIC DRIVE: BUSINESS OVERVIEW

19.2.8 HUAYU AUTOMOTIVE ELECTRIC SYSTEM

TABLE 307 HUAYU AUTOMOTIVE ELECTRIC SYSTEM: BUSINESS OVERVIEW

19.2.9 ABB

TABLE 308 ABB: BUSINESS OVERVIEW

19.2.10 INFINEON TECHNOLOGIES

TABLE 309 INFINEON TECHNOLOGIES: BUSINESS OVERVIEW

19.2.11 MAHLE

TABLE 310 MAHLE: BUSINESS OVERVIEW

19.2.12 SMESH E-AXLE

TABLE 311 SMESH E-AXLE: BUSINESS OVERVIEW

20 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 343)

20.1 CHINA TO BE KEY FOCUS AREA FOR SMART ELECTRIC DRIVE MARKET

20.2 TECHNOLOGICAL ADVANCEMENTS TO HELP DEVELOP MARKET FOR SMART ELECTRIC DRIVES

20.3 CONCLUSION

21 APPENDIX (Page No. - 345)

21.1 KEY INSIGHTS OF INDUSTRY EXPERTS

21.2 DISCUSSION GUIDE

21.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

21.4 AVAILABLE CUSTOMIZATIONS

21.5 RELATED REPORTS

21.6 AUTHOR DETAILS

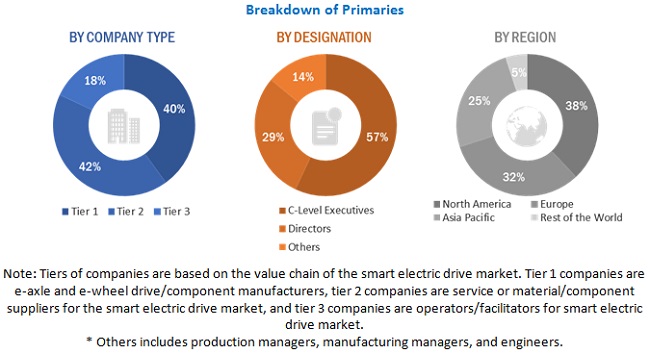

The study involved 4 major activities in estimating the current size of the smart electric drive market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of automobile OEMs, Publications of drivetrain systems, EV component related associations, American Automobile Association (AAA), country-level automotive associations and European Alternative Fuels Observatory (EAFO)], automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Mark lines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global smart electric drive market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the smart electric drive market scenarios through secondary research. Several primary interviews were conducted with market experts from both the demand (country-level government associations, and trade associations, institutes, R&D centers, OEMs/vehicle manufacturers) and supply (component manufacturers) side across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the world. 21% of the experts involved in primary interviews were from the demand side, and 79% were from the supply side of the industry. Primary data was collected through questionnaires, emails, and telephonic interviews. Several primary interviews were conducted from various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in the report.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings delineated in the rest of this report. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the smart electric drive market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s future supply chain and market size, in terms of volume, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze the Smart E-Drive market and forecast (2021–2026) its size in terms of volume (units) and Value (USD Million).

- To provide detailed information regarding the major factors influencing the growth of the smart e-drive market (drivers, restraints, opportunities, and industry challenges)

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment the smart e-drive market and forecast its size, by volume, based on region (Asia Pacific, Europe, North America and Rest of the World)

- To segment the smart e-drive market for commercial vehicles during the forecast period, in terms of volume and value

- To segment and forecast the smart e-drive market size, by value and volume, based on component (EV Battery, Electric Motor, Inverter System, E-Brake Booster, Power Electronics)

- To segment the market for smart e-drive and forecast the market size, by volume, based on application (E-Axle, E-Wheel Drive)

- To segment the market for smart e-drive and forecast the market size, by value and volume, based on vehicle type (Passenger cars, Commercial Vehicles, 2-Wheelers)

- To segment the market for smart e-drive and forecast the market size, by value and volume, based on Commercial vehicle type (Electric Bus, Electric Truck)

- To segment the market for smart e-drive and forecast the market size, by value and volume, based on EV Type (BEV, PHEV, HEV)

- To segment and forecast the smart e-drive market size, by value and volume, based on electric two-wheeler (Electric Cycles, Electric Motorcycles, Electric Scooters)

- To segment and forecast the smart e-drive market size, by volume, based on drive type (Front Wheel Drive, Rear Wheel Drive, All Wheel Drive)

- To showcase technological developments impacting the smart e-drive market.

- To analyze opportunities for stakeholders and the competitive landscape for market leaders.

- To strategically profile key players and comprehensively analyze their market shares and core competencies.

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Smart E-Drive Market, By component at regional level

Company Information

- Profiling of Additional Market Players (Up to 3)

- Additional countries for ME Region (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Electric Drive Market