Hyperspectral Imaging Systems Market Size, Share, Trends & Industry Growth Analysis Report by Offering (Cameras, System Integrator, Service Provider), Technology (Pushbroom, Snapshot, Tunable Filter, Imaging FTIR, Whiskbroom), Wavelength and Region - Global Forecast to 2029

Hyperspectral Imaging Systems Market Size & Growth:

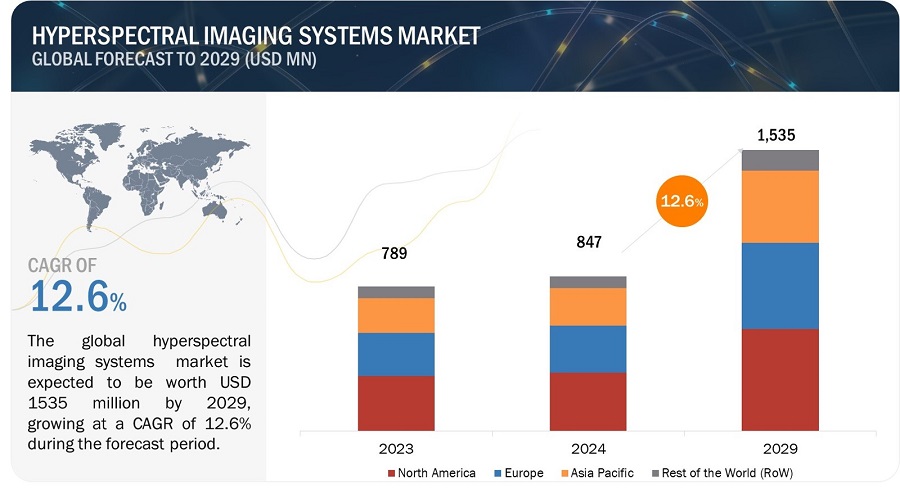

The global hyperspectral imaging systems market size is expected to be valued at USD 847 million in 2024 and is projected to reach USD 1,535 million by 2029 and growing at a CAGR of 12.6% from 2024 to 2029.

The market is experiencing growth driven by emerging industry applications due to superior spectral and spatial details offered by hyperspectral sensors and the development of more affordable, portable, and user-friendly hyperspectral imaging systems.

Hyperspectral Imaging Systems Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Hyperspectral Imaging Systems Market Dynamics

Driver: Emerging applications in industries due to superior spectral and spatial details offered by hyperspectral sensors.

Emerging industry applications benefit from hyperspectral sensors providing superior spatial and spectral details, driving growth in the hyperspectral imaging systems market. These sensors enable precise identification and characterization of materials, improving quality control, resource management, and product development across agriculture, mining, and pharmaceutical sectors. Businesses seek to leverage this advanced technology to gain competitive advantages, enhance decision-making processes, and meet evolving regulatory requirements, thus fueling the demand for hyperspectral imaging systems.

Restraint: Need for specialized expertise

The interpretation and analysis of hyperspectral data require advanced knowledge in remote sensing, image processing, and spectral analysis, which may limit the pool of qualified professionals. Secondly, the complexity of hyperspectral imaging technology necessitates specialized training and skills, leading to higher operational costs for businesses. Additionally, the shortage of experts in this field can hinder the adoption of hyperspectral imaging systems across various industries, slowing market growth.

Opportunity: Growing industry collaboration

Collaborations enable companies to pool resources, expertise, and technologies, leading to the development of more advanced and integrated solutions. This synergy allows for creating tailored products that meet diverse market demands across various sectors, fostering innovation and expanding the adoption of hyperspectral imaging technology. Moreover, strategic partnerships facilitate market expansion, opening up new avenues for growth and establishing stronger footholds in emerging applications and geographic regions.

Challenge: Management and storage of sizeable hyperspectral imagery datasets and high-resolution maps

The sheer volume of data these hyperspectral imaging systems generate requires significant storage capacity and efficient data management solutions. Additionally, processing and analyzing such extensive datasets require advanced computational resources and expertise, which can be costly and time-consuming for businesses. Moreover, ensuring data integrity, security, and accessibility further compounds the challenge, necessitating the development of robust infrastructure and software solutions to address these complexities.

Hyperspectral Imaging Systems Market Ecosystem

Leading players in the market include HORIBA (Japan), Resonon Inc. (US), Bayspec, INC. (US), SPECIM, SPECTRAL IMAGING LTD. (Finland), Malvern Panalytical Ltd (UK) and many more.

Hyperspectral Imaging Systems Market Analysis

Hyperspectral imaging systems market for the camera segment by offering to exhibit the highest CAGR during the forecast period.

Cameras offer precise spectral data, enabling enhanced detection and identification capabilities crucial for applications like agriculture, mineral exploration, and healthcare diagnostics. Moreover, advancements in technology have led to more compact and affordable hyperspectral cameras, making them accessible to a broader range of businesses and driving their adoption for diverse uses, thereby fueling market growth.

Hyperspectral Imaging Systems Market Share

Pushbroom/Line Scan by technology is estimated to account for the largest market share during the forecast period.

The growth of pushbroom/ line scan by technology in the hyperspectral imaging systems market, with the highest market share during the forecast period, can be attributed to rapid growth due to its efficiency and effectiveness in capturing continuous spectral data along a linear path. Unlike other technologies, push broom technology cameras can swiftly cover larger areas with high resolution, making them ideal for applications such as agriculture, environmental monitoring, and infrastructure inspection. Additionally, their streamlined design and reduced complexity result in lower costs and more excellent reliability, further driving their adoption in various industries seeking advanced imaging solutions.

LWIR (Long wave infrared) by wavelength exhibits the highest CAGR in the hyperspectral imaging systems market.

With the increasing emphasis on safety, security, and efficiency, LWIR cameras offer unparalleled capabilities in detecting heat signatures and identifying potential hazards in various industries like surveillance, defense, and automotive. Furthermore, advancements in LWIR technology are driving down costs and enhancing performance, making these cameras more accessible and attractive to a broader range of businesses.

Hyperspectral Imaging Systems Market Trends

Hyperspectral Imaging Systems Market - Regional Analysis

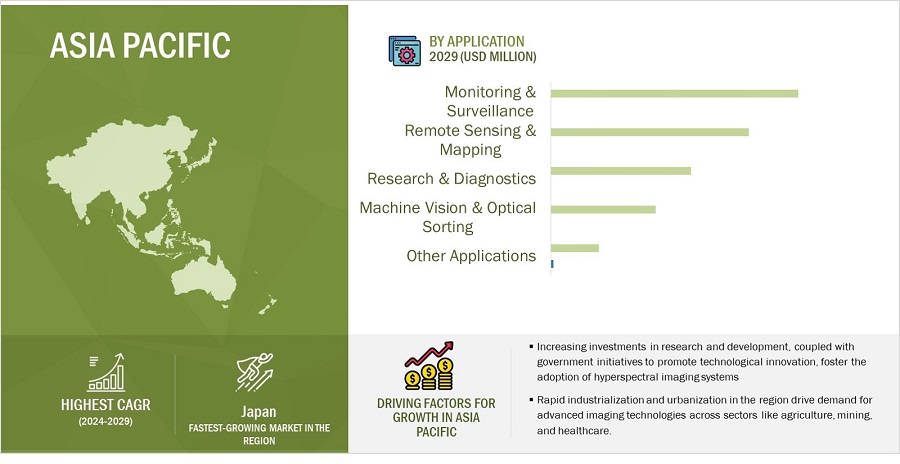

Hyperspectral Imaging Systems market for Asia Pacific region to hold the largest CAGR during the forecast period.

Rapid industrialization and urbanization in the region drive demand for advanced imaging technologies across agriculture, mining, and healthcare sectors. Additionally, increasing investments in research and development and government initiatives to promote technological innovation fosters the adoption of hyperspectral imaging systems. Moreover, the growing awareness of the benefits of hyperspectral imaging for precision agriculture, environmental monitoring, and infrastructure development further fuels market growth in Asia Pacific.

Hyperspectral Imaging Systems Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Hyperspectral Imaging Systems Companies - Key Market Players

The hyperspectral imaging systems companies is dominated by players such as Specim - Hyperspectral imaging cameras and systems (Finland), Corning | Corning.com (US), Welcome to HORIBA (Japan), resonon.com (US), BaySpec (US) and many more.

Hyperspectral Imaging Systems Companies Market Overview

The hyperspectral imaging systems market is rapidly expanding, driven by the technology's ability to capture and analyze a wide spectrum of light for detailed information across various applications. Key sectors such as agriculture, environmental monitoring, and defense are leading the adoption, utilizing hyperspectral imaging for tasks ranging from crop health assessment to surveillance. Technological advancements are making these systems more compact and cost-effective, broadening their accessibility. The market is also benefiting from increased investment in research and development, aimed at enhancing system performance and functionality. As a result, hyperspectral imaging is becoming an indispensable tool in fields requiring precise and comprehensive spectral data analysis.

Hyperspectral Imaging Systems Companies Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 847 million in 2024 |

| Projected Market Size | USD 1,535 million by 2029 |

| Hyperspectral Imaging Systems Market Growth | CAGR of 12.6% |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Offering; By Technology; By Wavelength; By Application and Region. |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the world (RoW) |

|

Companies covered |

The major market players include Corning Incorporated (US), SPECIM, SPECTRAL IMAGING LTD. (Finland), Malvern Panalytical Ltd (UK), HORIBA (Japan), Resonon Inc. (US), Norsk Elektro Optikk (Norway), Telops Inc. (Norway), Headwall Photonics (US), Bayspec, INC. (US), Cubert GmbH (Germany) and many more. |

Hyperspectral Imaging Systems Market Highlights

The study categorizes the hyperspectral imaging systems market based on the following segments:

|

Segment |

Subsegment |

|

By Offering |

|

|

By Technology |

|

|

By Wavelength |

|

|

By Application |

|

|

By Region |

|

Recent Developments in Hyperspectral Imaging Systems Industry

- In January 2024, SPECIM, SPECTRAL IMAGING LTD. (Finland) Announced a new product, Specim FX120. The Specim FX120 is a long-wave infrared hyperspectral camera offering a full spectral range of 7.7 to 12.3 µm. This fast push-broom thermal camera is poised to revolutionize chemical imaging in tough conditions, day or night.

- In October 2023 Corning Incorporated (US) collaborated with Orbital Sidekick (US). Orbital Sidekick is a startup that provides hyperspectral satellite monitoring solutions. The company has launched six satellites, each of which is equipped with a Corning hyperspectral imaging sensor.

- In January 2021, HORIBA France SAS (France) collaborated with GreenTropism SAS (France). The partnership between the two companies will integrate their technologies to create and market intelligent solutions. Customers can access optimized results with automated data interpretation by combining HORIBA's spectroscopic and hyperspectral imaging capabilities with GreenTropism's AI-enhanced data processing methods.

Frequently Asked Questions(FAQs):

What are the major driving factors for the hyperspectral imaging system market?

The use cases of hyperspectral imaging systems for emerging applications in industries due to superior spectral and spatial details offered by hyperspectral sensors are driving market growth. Additionally, developing more affordable, portable, and user-friendly hyperspectral imaging systems is some market drivers.

Which region is expected to hold the highest market share?

North America commands a larger share of the hyperspectral imaging system market. The expanding hyperspectral imaging system sector and industry demands are driving the adoption of hyperspectral imaging system solutions in the North American market. Increasing funding for R&D focused on enhancing the analytical capabilities of hyperspectral imaging technologies is facilitating the growth of hyperspectral imaging system solutions in Asia Pacific region.

Who are the leading players in the global hyperspectral imaging system market?

Companies such as SPECIM, SPECTRAL IMAGING LTD. (fINLAND), Corning Incorporated. (US), HORIBA (Japan), Resonon Inc. (US), Malvern Panalytical Ltd (UK) etc.

What are some of the technological advancements in the market?

The minimization of hyperspectral devices for increased portability and integration into various applications, enabling flexible deployment, are technological advancements in the market. The advancements in the market include the automation of AI and machine learning algorithms to automate data analysis, allowing faster and more accurate interpretation of hyperspectral imagery for actionable insights.

What is the size of the global hyperspectral imaging systems market?

The global hyperspectral imaging systems market is valued at USD 847 million in 2024 and is anticipated to reach USD 1,535 million in 2029 at a CAGR of 12.6% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

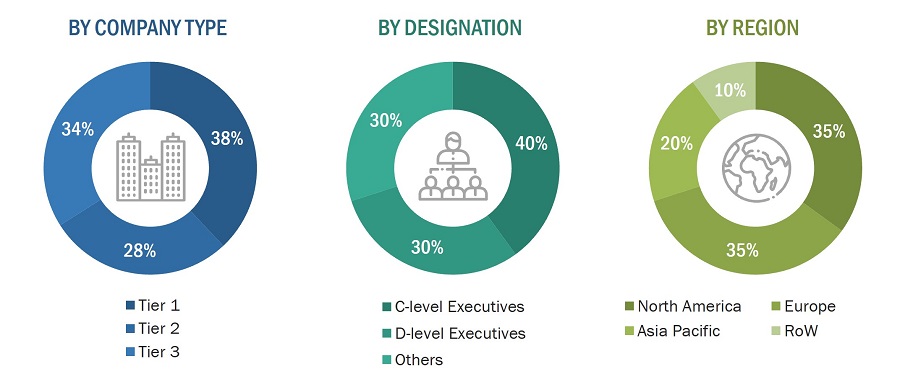

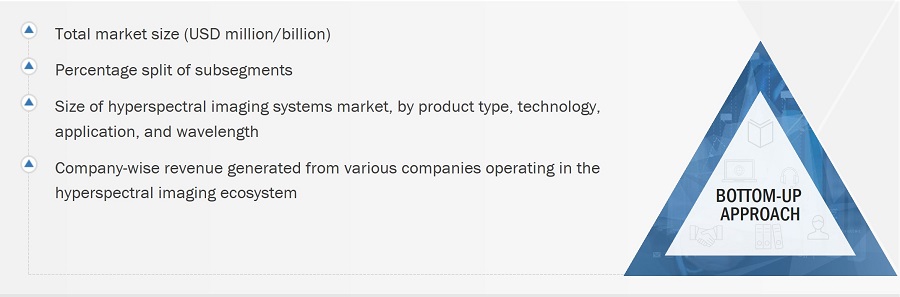

The study involved four major activities in estimating the current size of the hyperspectral imaging systems market. Exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

|

Sources |

Web Link |

|

Company Blogs |

What is hyperspectral Imaging?: A Comprehensive Guide - Specim Spectral Imaging |

|

Industry Journals |

|

|

Environmental Protection Agency |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the hyperspectral imaging systems market through secondary research. Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods, to perform market estimation and forecasting for the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

Bottom-Up Approach

- Identifying various wavelengths using hyperspectral imaging systems

- Analyzing the penetration of each type of wavelength through secondary and primary research

- Analyzing the penetration of hyperspectral imaging systems based on different applications and technologies through secondary and primary research

- Conducting multiple discussion sessions with key opinion leaders to understand the detailed working of hyperspectral imaging systems and their implementation in numerous applications; this helped analyze the break-up of the scope of work carried out by each major company

- Verifying and cross-checking the estimates at every level with key opinion leaders, including CEOs, directors, operation managers, and finally with MarketsandMarkets domain experts

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

- Focusing initially on the top-line investments and expenditures being made in the ecosystem of the hyperspectral imaging systems market; further, splitting the key market areas based on product type, technology, wavelength, application, and region, and listing the key developments.

- Identifying all leading players and applications in the hyperspectral imaging systems market based on region through secondary research and thoroughly verifying them through a brief discussion with industry experts

- Analyzing revenues, product mix, geographic presence, and critical applications served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with the industry experts to validate the information and identify critical growth pockets across all key segments

- Breaking down the total market based on verified splits and critical growth pockets across all segments

Data Triangulation

After arriving at the overall market size from the estimation process explained in the previous section, the total market was split into several segments and subsegments. Where applicable, the data triangulation procedure was employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides, and the market size was validated using top-down and bottom-up approaches.

Market Definition

Hyperspectral imaging systems are utilized to capture specific spectral bands across a continuous spectrum. Hyperspectral imaging systems are advanced imaging technologies that capture and process information across a wide range of the electromagnetic spectrum. Unlike traditional imaging systems, which typically capture images in three spectral bands (red, green, and blue), hyperspectral imaging systems collect spectral data across hundreds or thousands of narrow contiguous bands. These systems consist of hyperspectral cameras along with their accompanying systems. They are widely used in fields such as agriculture, environmental monitoring, mining etc.

Key Stakeholders

- Hyperspectral imaging systems providers

- Original equipment manufacturers (OEMs)

- Research organisations and consulting firms

- Technology standards organisationa

- Raw material suppliers

- Allaince and associations related to hyperspectral imaging technology

- Technology solution providers and design contractors

- Electronics and semiconductor companies

- Technology standards organizations, forums, alliances, and associations

- Analysts and strategic business planners

- Associations, organizations, and alliances related to hyperspectral imaging technology

- Universities and research organizations

- Government bodies

Report Objectives

- To describe and forecast the hyperspectral imaging systems market by offering, technology, wavelength, application, and region.

- To forecast the market size for various segments concerning four key regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges).

- To forecast the size of the hyperspectral cameras deployed in the hyperspectral imaging systems market.

- To provide a detailed overview of the value chain of hyperspectral imaging system ecosystems, along with the average selling price for hyperspectral cameras and other systems

- To strategically profile key players and comprehensively analyze their position in the hyperspectral imaging systems market regarding their ranking and core competencies and detail the competitive landscape for market leaders.

- To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios, tariff analysis, and case studies about the market under study.

- To analyze strategic developments, such as product launches, related developments, acquisitions, expansions, and agreements, in the market

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

- Further breakdown of regions into respective countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hyperspectral Imaging Systems Market