In-Circuit Test Market by Type (Analog, Mixed), Portability (Compact, Benchtop), Application (Consumer Electronics, Aerospace, Defence & Government Services, Medical Equipment, Wireless Communication, Automotive, Energy), Region - Global Forecast to 2028

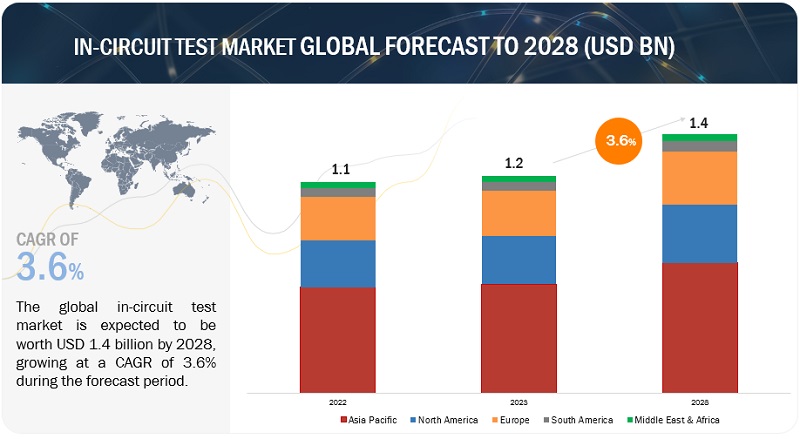

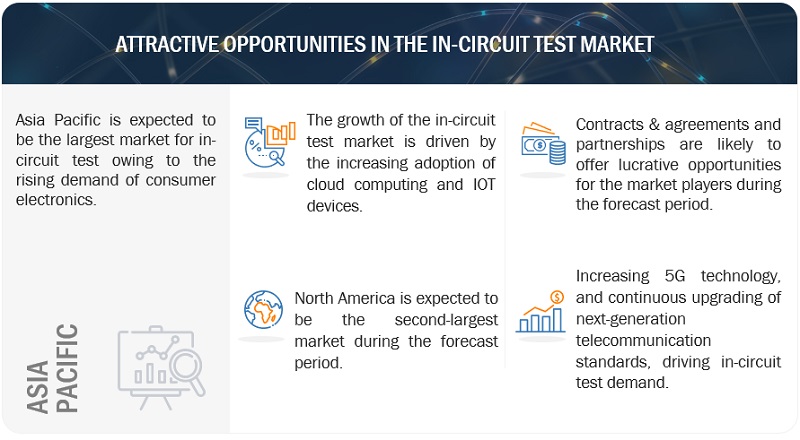

[244 Pages Report] The global In-circuit test market is estimated to grow from USD 1.2 billion in 2023 to USD 1.4 billion by 2028; it is expected to record a CAGR of 3.6% during the forecast period. The growth in in-circuit test demand in recent years is due to the increased investment in wireless communication and automotive projects due to growing consumer electronics industry. The market for in-circuit tests is projected to benefit greatly from the rising usage of smartphones and televisions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

In-circuit Test Market Dynamics

Driver: Growing demand for automotive electronics

Growing demand for automotive electronics is a significant driver of the in-circuit test market. The automotive industry's rapid adoption of advanced electronic systems and components has led to an increased need for robust testing solutions to ensure safety, reliability, and compliance with stringent standards. Modern vehicles are equipped with a wide range of electronic systems, including advanced driver-assistance systems (ADAS), infotainment systems, engine control units (ECUs), and electric vehicle components. The integration of these complex electronic systems requires thorough testing to ensure optimal performance and reliability. In-circuit testing plays a crucial role in identifying faults, defects, and potential failures within these integrated electronic systems. Furthermore, electric vehicles heavily rely on power electronics systems, such as inverters, converters, and motor control units, which require rigorous testing for reliability and performance. In-circuit testing plays a crucial role in ensuring the quality and functionality of these power electronics components. By conducting comprehensive ICT, manufacturers can detect faults, identify weak points, and optimize the performance of EV power electronics systems. As the complexity of EV electronics increases, the need for robust ICT solutions will grow, driving the demand for advanced testing equipment and services.

Restraint: Lack of standardization in connectivity protocols and increasing complexity of PCB designs

With advancements in technology, PCBs have become more intricate, densely packed with components, and feature advanced functionalities. However, these complexities pose significant restraints for in-circuit testing methods. The drive towards smaller and more compact electronic devices has led to increased miniaturization and higher component density on PCBs. Manufacturers are striving to pack more functionality into smaller spaces, resulting in highly complex PCB designs. The miniaturization of components reduced spacing between them, and the introduction of advanced technologies make it challenging to access test points using conventional in-circuit testing methods. This complexity limits the effectiveness of traditional ICT solutions, thereby restraining the growth of the ICT market.

Opportunities: Rising 5G Technology

The implementation of 5G technology involves the integration of complex electronics, including advanced processors, high-frequency components, and multiple communication interfaces. The complexity of these devices, such as 5G smartphones, routers, and base stations, presents challenges in terms of functionality, signal integrity, and power consumption. In-circuit testing plays a critical role in ensuring the proper functioning of these intricate electronics, validating signal integrity, and identifying potential manufacturing defects. The increased complexity of 5G devices provides ample opportunities for the growth of the in-circuit test market. Furthermore, 5G technology operates at higher frequency bands, including millimeter-wave (mmWave) frequencies, which present unique testing challenges. The higher frequencies demand precise signal integrity testing, reduced signal loss, and effective noise suppression techniques. In-circuit testing enables the evaluation of high-frequency signal paths, identifying potential impedance mismatches, signal quality issues, and noise sources. The opportunity for in-circuit testing to validate the performance of high-frequency circuits and ensure compliance with stringent 5G specifications is a key driver for the in-circuit test market.

Challenges: Reducing size of PCB creates difficulty in testing

As printed circuit boards (PCB) size decreases, the available space for placing test points is limited. Test points are critical for making electrical connections to measure and verify signals during in-circuit testing. With reduced PCB real estate, it becomes challenging to allocate sufficient test points for comprehensive testing coverage. This limitation hampers the ability to access critical nodes and perform accurate measurements, leading to potential coverage gaps and reduced test effectiveness. Similarly, shrinking PCB sizes results in tighter component placement and denser routing, making probing more difficult. Limited access to probe tips requires specialized fixtures and fine-pitch probes. Furthermore, the miniaturization of PCBs increases the risk of signal integrity issues, such as crosstalk and impedance mismatches, which can complicate testing and affect measurement accuracy. Thus, probing small-sized components while maintaining signal integrity during in-circuit testing can pose a challenge of in-circuit testing.

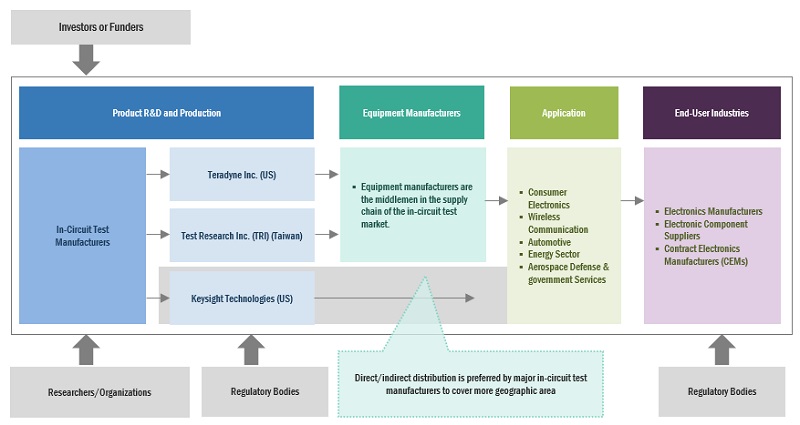

In-circuit test Market Ecosystem

Prominent companies in this market include well-established, financially stable in-circuit test manufacturers. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Teradyne Inc. (US), Test Research Inc. (TRI) (Taiwan), Keysight Technologies (US), Hioki E.E Corporation (Japan) and Kyoritsu Electric Corporation (Japan).

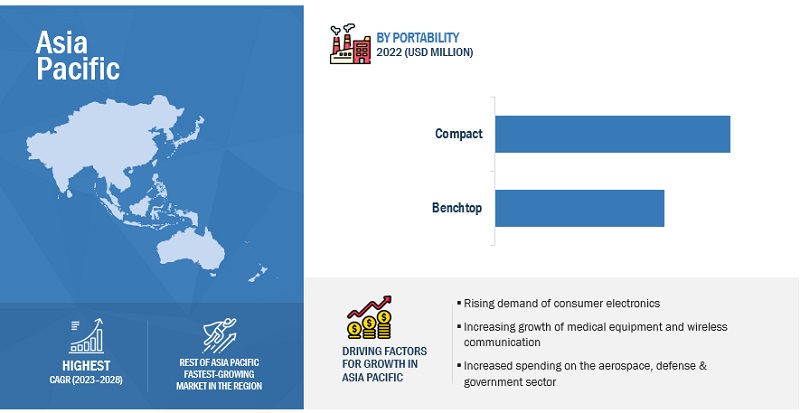

The benchtop, by portability, is expected to be the second largest segment during the forecast period.

This report segments the in-circuit test market based on portability into two types: compact and benchtop. The benchtop segment is expected to be the second largest segment during the forecast period. Because of its mobility, the benchtop demand for in circuit test is likely to be significant. The benchtop automated test equipment with built-in fixturing decreased the uncertainty of repeated findings in bench testing. Its primary in-circuit test sales are attributed to the elimination of hand probing precise measurements and dependable test probe fixturing.

By application, the energy sector is expected to be the fastest growing during the forecast period

This report segments the in-circuit test market based on application into six segments: consumer electronics & appliances, aerospace, defence, and government services, medical equipment manufacturing, automotive, and energy sector. The energy sector is expected to grow at the fastest rate during the forecast period. The increasing investments in the energy sector such as oil & gas, power, utilities, solar inverters, smart meters etc. are expected to drive the market for in-circuit test. The growth of the energy segment can be attributed to the increase in solar inverters and smart inverters spending by countries such as Germany, Italy, Spain, France, and the UK.

"Asia Pacific": The largest in the in-circuit test market"

Asia Pacific is expected to have the largest market share in the in-circuit test market between 2023–2028, followed by Europe and North America. Urbanization and population growth have resulted in the need for vast infrastructure development, which has propelled the electronics demand across the region. As per the Indian Electrical and Electronics Manufacturers’ Association (IEEMA), the electricity generation capacity in India is expected to increase from 200 GW in 2010 to over 800 GW by 2032 to fulfill the increasing demand for power. Thus, there is a need for a huge investment of approximately USD 300 billion in the next 3–4 years in power equipment manufacturing, which will increase the demand for in-circuit testing of these equipment.

Key Market Players

The in-circuit test market is dominated by a few major players that have a wide regional presence. The major players in the in-circuit test market include Teradyne Inc. (US), Test Research Inc. (TRI) (Taiwan), Keysight Technologies (US), Hioki E.E Corporation (Japan), Kyoritsu Electric Corporation (Japan) and SPEA S.p.A. (Italy). Between 2018 and 2022, these companies followed strategies such as contracts, agreements, partnerships, mergers, acquisitions, and expansions to capture a larger share of the in-circuit test market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments covered |

In-circuit test market by type, portability, application, and region. |

|

Geographies covered |

Asia Pacific, North America, Europe, South America, and Middle East & Africa. |

|

Companies covered |

Teradyne Inc. (US), Test Research, Inc. (Taiwan), Keysight Technologies (US), HIOKI E.E. CORPORATION (Japan), Kyoritsu Electric Corporation (Japan), Digitaltest GmbH (Germany), SPEA S.p.A. (Italy), Konrad GmbH (Germany), Testronics (US), S.E.I.C.A. S.p.A. (Italy), Concord Technology Limited (Hong Kong), OKANO ELECTRIC CO., LTD (Japan), Checksum (US), Reinhardt System- und Messelectronic GmbH (Germany), Test Coach Company, LLC (US), Shenzhen PTI Technology Co. Ltd (China), Vital Electronics & Manufacturing Co. (India), Kuttig Electronic (Germany), TeligentEMS (US) |

This research report categorizes the in-circuit test market by type, portability, application, and region.

On the basis of type:

- Analog

- Mixed

On the basis of portability:

- Compact

- Benchtop

On the basis of application:

- Aerospace, Defense, and Government services

- Wireless Communication & Infrastructure

- Consumer Electronics & Appliances

- Medical Equipment Manufacturing

- Automotive

- Energy Sector

On the basis of region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In August 2022, SPEA S.p.A. and JTAG Technologies have entered a technological collaboration to significantly improve the integration of boundary scan options within flying probe and bed-of-nails testing equipment. By incorporating boundary scan capabilities into in-circuit testing, fault coverage of interconnections, logic elements, and in-signal passives will be increased.

- In June 2022, Bosch Automotive Group selected SPEA S.p.A. as its global and exclusive supplier of ICT Automatic Testers for its global manufacturing plants for the third time in a row. Bosch Automotive has picked the SPEA ICT Tester model 3030 as the most effective for its circuit boards.

- In May 2022, Digitaltest incorporates SMH Technologies' FlashRunner 2.0 into their fixtures, In-Circuit and Flying Probe Test Systems. It is especially ideal for programming multi-PCB panels and complex boards because to its flexibility, wide library, and user-friendly software wizard.

- In April 2022, Teradyne, Inc., received a contract from Nations Technologies, an established Chinese microcontroller unit (MCU) and security integrated circuit (IC) chip maker, for the supply of the 7,000th unit of its industry-leading J750 semiconductor test platform.

- In March 2022, MIDEL, Test Research, Inc. (TRI) introduced of the TR8100H SII high-density pin count In-Circuit Tester (ICT) with vacuum fixture for full coverage testing. The TR8100H SII is the latest version of the high-performance board test system designed for low-voltage testing and complex PCBAs.

Frequently Asked Questions (FAQ):

What is the current size of the in-circuit test market?

The current market size of the in-circuit test market is USD 1.1 billion in 2022.

What are the major drivers for the in-circuit test market?

Rising demand of consumer electronics and automotive electronics will be major drivers for the in-circuit test market.

Which is the largest region during the forecasted period in the in-circuit test market?

Asia Pacific is expected to dominate the in-circuit test market between 2023–2028, followed by Europe and North America. The increase in demand of consumer electronics in recent years is driving the region's market.

Which is the largest segment, by type, during the forecasted period in the in-circuit test market?

The analog segment is expected to be the largest market during the forecast period. Increased demand for transformers due to the increasing investments in renewable energy sources and the easy availability of mineral oil are expected to drive the market for the mineral-based in-circuit test segment.

Which is the fastest portability segment during the forecasted period in the in-circuit test market?

The Benchtop segment is expected to be the fastest market during the forecast period. The increasing investment in advancing in-circuit test methods to meet the electronics demand would drive the demand for in-circuit tests used in consumer electronics, automotive and medical equipment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for automotive electronics- Rising demand from consumer electronics industry- Increasing adoption of high-density interconnect (HDI) technology for PCB assemblyRESTRAINTS- High costs associated with testing processes- Lack of standardization in connectivity protocols and increasing complexity of PCB designsOPPORTUNITIES- Rising use of 5G technology- Increasing adoption of cloud computing and IoT devicesCHALLENGES- Testing of high-speed interfaces- Difficulties in testing miniaturized PCBs

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS AND NEW REVENUE POCKETS FOR IN-CIRCUIT TEST PROVIDERS

-

5.4 ECOSYSTEM MAPPINGMARKET MAP

-

5.5 SUPPLY CHAIN ANALYSISRAW MATERIAL/COMPONENT PROVIDERSIN-CIRCUIT TEST EQUIPMENT MANUFACTURERSDISTRIBUTORS AND AFTER-SALES SERVICE PROVIDERSEND USERS

-

5.6 TECHNOLOGY ANALYSISMACHINE LEARNING (ML) TECHNOLOGY USED IN-CIRCUIT TESTINGTEST DATA ANALYTICS AND VISUALIZATION USED IN IN-CIRCUIT TESTINGADVANCED TEST EQUIPMENT AND PROBING TECHNIQUES

-

5.7 PATENT ANALYSIS

-

5.8 TRADE ANALYSISHS CODE 853400- Export scenario- Import scenario

-

5.9 TARIFFS, CODES, AND REGULATIONSTARIFFS APPLICABLE TO PRINTED CIRCUITSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSCODES AND REGULATIONS RELATED TO IN-CIRCUIT TEST MARKET

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.11 CASE STUDY ANALYSISTBG SOLUTIONS DEVELOPED VERSATILE PXI-BASED AUTOMATED TEST SYSTEMDELSERRO ENGINEERING SOLUTIONS HELPED CUSTOMER IDENTIFY DESIGN-RELATED ISSUES TO ENHANCE PRODUCT RELIABILITYELETTRONICA ENHANCED TEST COVERAGE FOR COMPLEX BOARDS WITH XJTAG’S BOUNDARY SCAN SYSTEM

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 ANALOGEASY TO USE AND COVERS BROAD APPLICATION SPECTRUM

-

6.3 MIXEDTESTS CIRCUITS THAT CONTAIN BOTH ANALOG AND DIGITAL COMPONENTS

- 7.1 INTRODUCTION

-

7.2 COMPACTRISING ADOPTION OF AUTOMOTIVE ELECTRONICS AND CONSUMER ELECTRONIC DEVICES TO BOOST DEMAND FOR COMPACT IN-CIRCUIT TEST

-

7.3 BENCHTOPWIDE APPLICATION SCOPE TO FUEL SEGMENTAL GROWTH

- 8.1 INTRODUCTION

-

8.2 CONSUMER ELECTRONICS AND APPLIANCESINCREASING CONSUMER ELECTRONICS SALES IN ASIA PACIFIC AND NORTH AMERICA TO DRIVE MARKET

-

8.3 AEROSPACE, DEFENSE, AND GOVERNMENT SERVICESINCREASED SPENDING ON AEROSPACE, DEFENSE, AND GOVERNMENT SECTORS TO DRIVE DEMAND FOR IN-CIRCUIT TEST EQUIPMENT

-

8.4 MEDICAL EQUIPMENT MANUFACTURINGRISING DEMAND FOR HIGH-DENSITY INTERCONNECT PCBS IN MEDICAL INDUSTRY TO DRIVE MARKET

-

8.5 WIRELESS COMMUNICATIONINCREASING DEMAND FOR WIRELESS TECHNOLOGIES TO DRIVE MARKET

-

8.6 AUTOMOTIVEVEHICLE ELECTRIFICATION AND RIGOROUS QUALITY STANDARDS TO PROPEL DEMAND FOR IN-CIRCUIT TESTING

-

8.7 ENERGYINTEGRATION OF DIGITAL COMMUNICATION SYSTEMS INTO POWER NETWORKS TO ACCELERATE MARKET GROWTH

-

9.1 INTRODUCTIONRECESSION IMPACT: INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTBY TYPEBY PORTABILITYBY APPLICATIONBY COUNTRY- US- Canada- Mexico

-

9.3 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTBY TYPEBY PORTABILITYBY APPLICATIONBY COUNTRY- China- Australia- India- South Korea- Japan- Rest of Asia Pacific

-

9.4 EUROPEEUROPE: RECESSION IMPACTBY TYPEBY PORTABILITYBY APPLICATIONBY COUNTRY- UK- Germany- France- Italy- Russia- Spain- Rest of Europe

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST AND AFRICA: RECESSION IMPACTMIDDLE EAST- Increasing investments in defense sector to drive market- By country- By type- By portability- By applicationAFRICA- Rising investments in communication, infrastructure, and network applications to drive market- By type- By portability- By application

-

9.6 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACTBY TYPEBY PORTABILITYBY APPLICATIONBY COUNTRY- Brazil- Argentina- Chile

- 10.1 OVERVIEW

- 10.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- 10.3 MARKET EVALUATION FRAMEWORK, 2018–2023

- 10.4 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2018–2022

-

10.5 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

-

10.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.1 KEY PLAYERSTERADYNE INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTEST RESEARCH, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKEYSIGHT TECHNOLOGIES- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHIOKI E.E. CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKYORITSU ELECTRIC CORPORATION- Business overview- Products/Services/Solutions offered- MnM viewDIGITALTEST GMBH- Business overview- Products/Services/Solutions offered- Recent developmentsSPEA S.P.A.- Business overview- Products/Services/Solutions offered- Recent developmentsKONRAD GMBH- Business overview- Products/Services/Solutions offered- Recent developmentsTESTRONICS- Business overview- Products/Services/Solutions offeredCONCORD TECHNOLOGY LIMITED- Business overview- Products/Services/Solutions offeredOKANO ELECTRIC CO., LTD- Business overview- Products/Services/Solutions offeredS.E.I.C.A. S.P.A.- Business overview- Products/Services/Solutions offered- Recent developmentsCHECKSUM- Business overview- Products/Services/Solutions offeredREINHARDT SYSTEM- UND MESSELECTRONIC GMBH- Business overview- Products/Services/Solutions offeredACCULOGIC- Business overview- Products/Services/Solutions offered

-

11.2 OTHER PLAYERSTEST COACH COMPANY, LLCSHENZHEN PTI TECHNOLOGY CO. LTD.VITAL ELECTRONICS & MANUFACTURING CO.KUTTIG ELECTRONIC GMBHTELIGENTEMS

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 MARKET: INDUSTRY/COUNTRY ANALYSIS

- TABLE 2 MARKET SNAPSHOT

- TABLE 3 MARKET: ECOSYSTEM ANALYSIS

- TABLE 4 MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2018–2022

- TABLE 5 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 853400, BY COUNTRY, 2019–2021 (USD)

- TABLE 6 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 853400, BY COUNTRY, 2020–2022 (USD)

- TABLE 7 IMPORT TARIFF FOR PRODUCTS COVERED UNDER HS 853400

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MARKET: CODES AND REGULATIONS

- TABLE 15 MARKET: PORTER’S FIVE FORCES ANALYSIS, 2022

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- TABLE 17 KEY BUYING CRITERIA FOR TOP 3 END USERS

- TABLE 18 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 19 MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 20 MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 21 ANALOG: MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 22 ANALOG: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 23 MIXED: MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 24 MIXED: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 25 MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 26 MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 27 COMPACT: MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 28 COMPACT: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 29 BENCHTOP: MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 30 BENCHTOP: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 31 MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 32 MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 33 CONSUMER ELECTRONICS AND APPLIANCES: MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 34 CONSUMER ELECTRONICS AND APPLIANCES: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 35 AEROSPACE, DEFENSE, AND GOVERNMENT SERVICES: MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 36 AEROSPACE, DEFENSE, AND GOVERNMENT SERVICES: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 37 MEDICAL EQUIPMENT MANUFACTURING: MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 38 MEDICAL EQUIPMENT MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 39 WIRELESS COMMUNICATION: MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 40 WIRELESS COMMUNICATION: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 41 AUTOMOTIVE: MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 42 AUTOMOTIVE: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 43 ENERGY: MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 44 ENERGY: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 45 MARKET, BY REGION, 2017–2022 (USD THOUSAND)

- TABLE 46 MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 47 NORTH AMERICA: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 48 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 49 NORTH AMERICA: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 50 NORTH AMERICA: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 51 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 52 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 53 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD THOUSAND)

- TABLE 54 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 55 US: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 56 US: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 57 US: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 58 US: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 59 US: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 60 US: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 61 CANADA: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 62 CANADA: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 63 CANADA: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 64 CANADA: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 65 CANADA: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 66 CANADA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 67 MEXICO: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 68 MEXICO: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 69 MEXICO: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 70 MEXICO: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 71 MEXICO: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 72 MEXICO: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 73 ASIA PACIFIC: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 74 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 75 ASIA PACIFIC: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 76 ASIA PACIFIC: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 77 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 78 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 79 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD THOUSAND)

- TABLE 80 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 81 CHINA: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 82 CHINA: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 83 CHINA: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 84 CHINA: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 85 CHINA: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 86 CHINA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 87 AUSTRALIA: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 88 AUSTRALIA: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 89 AUSTRALIA: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 90 AUSTRALIA: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 91 AUSTRALIA: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 92 AUSTRALIA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 93 INDIA: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 94 INDIA: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 95 INDIA: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 96 INDIA: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 97 INDIA: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 98 INDIA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 99 SOUTH KOREA: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 100 SOUTH KOREA: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 101 SOUTH KOREA: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 102 SOUTH KOREA: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 103 SOUTH KOREA: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 104 SOUTH KOREA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 105 JAPAN: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 106 JAPAN: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 107 JAPAN: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 108 JAPAN: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 109 JAPAN: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 110 JAPAN: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 111 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 112 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 113 REST OF ASIA PACIFIC: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 114 REST OF ASIA PACIFIC: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 115 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 116 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 117 EUROPE: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 118 EUROPE: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 119 EUROPE: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 120 EUROPE: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 121 EUROPE: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 122 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 123 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD THOUSAND)

- TABLE 124 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 125 UK: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 126 UK: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 127 UK: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 128 UK: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 129 UK: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 130 UK: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 131 GERMANY: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 132 GERMANY: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 133 GERMANY: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 134 GERMANY: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 135 GERMANY: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 136 GERMANY: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 137 FRANCE: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 138 FRANCE: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 139 FRANCE: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 140 FRANCE: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 141 FRANCE: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 142 FRANCE: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 143 ITALY: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 144 ITALY: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 145 ITALY: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 146 ITALY: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 147 ITALY: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 148 ITALY: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 149 RUSSIA: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 150 RUSSIA: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 151 RUSSIA: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 152 RUSSIA: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 153 RUSSIA: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 154 RUSSIA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 155 SPAIN: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 156 SPAIN: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 157 SPAIN: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 158 SPAIN: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 159 SPAIN: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 160 SPAIN: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 161 REST OF EUROPE: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 162 REST OF EUROPE: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 163 REST OF EUROPE: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 164 REST OF EUROPE: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 165 REST OF EUROPE: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 166 REST OF EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 167 MIDDLE EAST: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 168 MIDDLE EAST: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 169 MIDDLE EAST: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 170 MIDDLE EAST: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 171 MIDDLE EAST: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 172 MIDDLE EAST: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 173 AFRICA: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 174 AFRICA: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 175 AFRICA: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 176 AFRICA: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 177 AFRICA: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 178 AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 179 SOUTH AMERICA: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 180 SOUTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 181 SOUTH AMERICA: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 182 SOUTH AMERICA: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 183 SOUTH AMERICA: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 184 SOUTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 185 SOUTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD THOUSAND)

- TABLE 186 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 187 BRAZIL: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 188 BRAZIL: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 189 BRAZIL: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 190 BRAZIL: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 191 BRAZIL: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 192 BRAZIL: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 193 ARGENTINA: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 194 ARGENTINA: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 195 ARGENTINA: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 196 ARGENTINA: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 197 ARGENTINA: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 198 ARGENTINA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 199 CHILE: MARKET, BY TYPE, 2017–2022 (USD THOUSAND)

- TABLE 200 CHILE: MARKET, BY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 201 CHILE: MARKET, BY PORTABILITY, 2017–2022 (USD THOUSAND)

- TABLE 202 CHILE: MARKET, BY PORTABILITY, 2023–2028 (USD THOUSAND)

- TABLE 203 CHILE: MARKET, BY APPLICATION, 2017–2022 (USD THOUSAND)

- TABLE 204 CHILE: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 205 MARKET: COMPETITIVE ANALYSIS

- TABLE 206 MARKET EVALUATION FRAMEWORK, 2018–2023

- TABLE 207 MARKET: OTHERS, 2022

- TABLE 208 MARKET: DEALS, 2018–2023

- TABLE 209 COMPANY TYPE FOOTPRINT

- TABLE 210 COMPANY PORTABILITY FOOTPRINT

- TABLE 211 COMPANY END-USER FOOTPRINT

- TABLE 212 COMPANY REGION FOOTPRINT

- TABLE 213 TERADYNE INC.: COMPANY OVERVIEW

- TABLE 214 TERADYNE INC.: PRODUCTS OFFERED

- TABLE 215 TERADYNE INC.: DEALS

- TABLE 216 TEST RESEARCH, INC.: COMPANY OVERVIEW

- TABLE 217 TEST RESEARCH, INC.: PRODUCTS OFFERED

- TABLE 218 TEST RESEARCH, INC.: PRODUCT LAUNCHES

- TABLE 219 TEST RESEARCH, INC.: OTHERS

- TABLE 220 KEYSIGHT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 221 KEYSIGHT TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 222 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 223 KEYSIGHT TECHNOLOGIES: DEALS

- TABLE 224 KEYSIGHT TECHNOLOGIES: OTHERS

- TABLE 225 HIOKI E.E. CORPORATION: COMPANY OVERVIEW

- TABLE 226 HIOKI E.E. CORPORATION: PRODUCTS OFFERED

- TABLE 227 HIOKI E.E. CORPORATION: PRODUCT LAUNCHES

- TABLE 228 HIOKI E.E. CORPORATION: OTHERS

- TABLE 229 KYORITSU ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 230 KYORITSU ELECTRIC CORPORATION: PRODUCTS OFFERED

- TABLE 231 DIGITALTEST GMBH: COMPANY OVERVIEW

- TABLE 232 DIGITALTEST GMBH: PRODUCTS OFFERED

- TABLE 233 DIGITALTEST GMBH: DEALS

- TABLE 234 DIGITALTEST GMBH: OTHERS

- TABLE 235 SPEA S.P.A.: COMPANY OVERVIEW

- TABLE 236 SPEA S.P.A.: PRODUCTS OFFERED

- TABLE 237 SPEA S.P.A.: DEALS

- TABLE 238 SPEA S.P.A.: OTHERS

- TABLE 239 KONRAD GMBH: COMPANY OVERVIEW

- TABLE 240 KONRAD GMBH: PRODUCTS OFFERED

- TABLE 241 KONRAD GMBH: DEALS

- TABLE 242 KONRAD GMBH: OTHERS

- TABLE 243 TESTRONICS: COMPANY OVERVIEW

- TABLE 244 TESTRONICS: PRODUCTS OFFERED

- TABLE 245 CONCORD TECHNOLOGY LIMITED: COMPANY OVERVIEW

- TABLE 246 CONCORD TECHNOLOGY LIMITED: PRODUCTS OFFERED

- TABLE 247 OKANO ELECTRIC CO., LTD: COMPANY OVERVIEW

- TABLE 248 OKANO ELECTRIC CO., LTD: PRODUCTS OFFERED

- TABLE 249 S.E.I.C.A. S.P.A.: COMPANY OVERVIEW

- TABLE 250 S.E.I.C.A. S.P.A.: PRODUCTS OFFERED

- TABLE 251 S.E.I.C.A. S.P.A.: DEALS

- TABLE 252 CHECKSUM: COMPANY OVERVIEW

- TABLE 253 CHECKSUM: PRODUCTS OFFERED

- TABLE 254 REINHARDT SYSTEM- UND MESSELECTRONIC GMBH: COMPANY OVERVIEW

- TABLE 255 REINHARDT SYSTEM- UND MESSELECTRONIC GMBH: PRODUCTS OFFERED

- TABLE 256 ACCULOGIC: COMPANY OVERVIEW

- TABLE 257 ACCULOGIC: PRODUCTS OFFERED

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

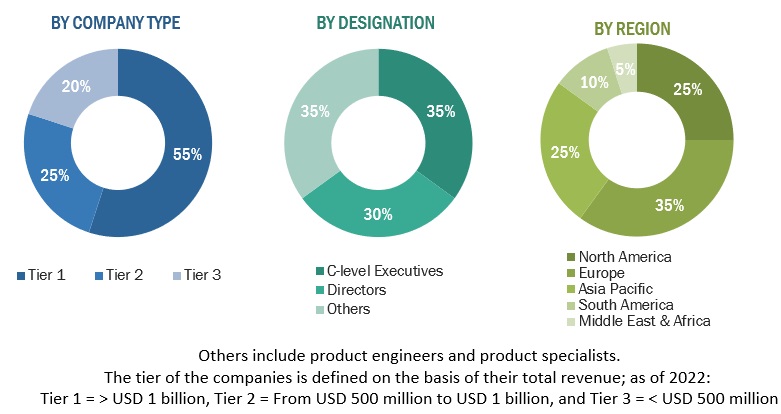

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MAIN METRICS CONSIDERED TO CONSTRUCT AND ASSESS DEMAND FOR IN-CIRCUIT TEST

- FIGURE 7 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF IN-CIRCUIT TEST

- FIGURE 8 MARKET: SUPPLY-SIDE ANALYSIS, 2022

- FIGURE 9 COMPANY REVENUE ANALYSIS, 2022

- FIGURE 10 ANALOG SEGMENT TO ACCOUNT FOR LARGER SIZE OF MARKET, BY TYPE, DURING FORECAST PERIOD

- FIGURE 11 BENCHTOP SEGMENT TO EXHIBIT HIGHER CAGR, BY PORTABILITY, DURING FORECAST PERIOD

- FIGURE 12 CONSUMER ELECTRONICS AND APPLIANCES SEGMENT TO AMASS LARGEST SHARE OF MARKET, BY APPLICATION, DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC DOMINATED MARKET IN 2022

- FIGURE 14 INCREASING INVESTMENTS IN HVDC TRANSMISSION SYSTEMS TO DRIVE MARKET DURING 2023–2028

- FIGURE 15 MARKET TO REGISTER HIGHEST CAGR IN MIDDLE EAST AND AFRICA DURING FORECAST PERIOD

- FIGURE 16 ANALOG SEGMENT DOMINATED MARKET IN 2022

- FIGURE 17 COMPACT SEGMENT ACCOUNTED FOR LARGER SHARE OF MARKET IN 2022

- FIGURE 18 CONSUMER ELECTRONICS AND APPLIANCES SEGMENT DOMINATED MARKET IN 2022

- FIGURE 19 ANALOG AND CHINA DOMINATED ASIA PACIFIC MARKET IN 2022

- FIGURE 20 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 GLOBAL EV SALES VOLUME, 2017–2022

- FIGURE 22 GLOBAL SALES OF SMARTPHONES, TVS, AND PCS, 2018–2021

- FIGURE 23 5G SUBSCRIPTION IN ASIA PACIFIC, 2019–2024

- FIGURE 24 REVENUE SHIFTS FOR MARKET PLAYERS

- FIGURE 25 MARKET MAP

- FIGURE 26 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 EXPORT DATA FOR TOP 5 COUNTRIES, 2020–2022

- FIGURE 28 IMPORT DATA FOR TOP 5 COUNTRIES, 2020–2022 (USD)

- FIGURE 29 MARKET: PORTER’S FIVE FORCES ANALYSIS, 2022

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 32 MARKET, BY TYPE, 2022

- FIGURE 33 MARKET, BY PORTABILITY, 2022

- FIGURE 34 IN-CIRCUIT TEST MARKET, BY APPLICATION, 2022

- FIGURE 35 IN-CIRCUIT TEST MARKET IN MIDDLE EAST & AFRICA MARKET TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 IN-CIRCUIT TEST MARKET SHARE, BY REGION, 2022

- FIGURE 37 NORTH AMERICA: IN-CIRCUIT TEST MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: IN-CIRCUIT TEST MARKET SNAPSHOT

- FIGURE 39 EUROPE: IN-CIRCUIT TEST MARKET SNAPSHOT

- FIGURE 40 SOUTH AMERICA: IN-CIRCUIT TEST MARKET SNAPSHOT

- FIGURE 41 KEY DEVELOPMENTS IN IN-CIRCUIT TEST MARKET, 2018–2023

- FIGURE 42 MARKET SHARE ANALYSIS OF TOP PLAYERS IN IN-CIRCUIT TEST MARKET, 2022

- FIGURE 43 SEGMENTAL REVENUE ANALYSIS, 2018–2022

- FIGURE 44 IN-CIRCUIT TEST MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 45 TERADYNE INC.: COMPANY SNAPSHOT

- FIGURE 46 TEST RESEARCH, INC.: COMPANY SNAPSHOT

- FIGURE 47 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 48 HIOKI E.E. CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 KYORITSU ELECTRIC CORPORATION: COMPANY SNAPSHOT

The study involved major activities in estimating the current size of the in-circuit test market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the in-circuit test market involved the use of extensive secondary sources, directories, and databases, such as Bloomberg, Factiva, IRENA, International Energy Agency, Statista Industry Journal, and Consumer Electronics Association, to collect and identify information useful for a technical, market-oriented, and commercial study of the in-circuit test market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The in-circuit test market comprises several stakeholders, such as in-circuit test manufacturers, technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for in-circuit test in automotive, aerospace, defense & government services, wireless communication & infrastructure, consumer electronics, medical equipment manufacturing and energy sector applications. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the in-circuit test market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share has been determined through primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

In-circuit test Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

In-circuit test (ICT) is a method of electronic component testing that involves checking the electrical integrity and functionality of printed circuit boards (PCBs) or electronic assemblies while they are still assembled. The purpose of ICT is to identify faults or defects in the circuitry, such as open circuits, short circuits, incorrect components, or faulty connections.

The growth of the in-circuit test market during the forecast period can be attributed to the rising demand for PCB and PCB assemblies for the electronic applications across major countries in North America, Europe, Asia Pacific, South America, and Middle East & Africa.

Key Stakeholders

- Assembly, testing, and packaging vendors

- Companies related to the consumer electronics industry

- Companies related to the automotive electronics industry

- Wireless communication and infrastructure companies

- Consulting companies in the energy and power sector

- Government and research organizations

- Investment banks

- Third party testing companies

- In-circuit test equipment manufacturers, dealers, and suppliers

- Medical equipment manufacturing companies

- Organizations, forums, alliances, and associations

- State and national regulatory authorities

- Venture capital firms

Objectives of the Study

- To define, describe, segment, and forecast the in-circuit test market on the basis of type, application, portability, and region.

- To provide a detailed analysis of the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the in-circuit test market with respect to individual growth trends, future expansions, and contribution of each segment to the market

- To analyze the market opportunities for stakeholders and to describe the competitive landscape for market leaders

- To forecast the growth of the in-circuit test market with respect to the major regions (North America, South America, Asia Pacific, Europe, and Middle East & Africa)

- To strategically profile key players and comprehensively analyze their market ranking and core competencies*

- To track and analyze competitive developments such as contracts & agreements, investments & expansions, new product developments, partnerships & collaborations, and mergers & acquisitions in the in-circuit test market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in In-Circuit Test Market