Industrial Analytics Market by Component (Software, Service), Analytics Type (Descriptive, Diagnostic, Predictive, and Prescriptive), Deployment Model, organization size, Industry Vertical, and Region - Global Forecast to 2022

[174 Pages Report] The overall industrial analytics market is expected to grow from USD 11.29 billion in 2017 to USD 25.51 billion by 2022, at a CAGR of 17.7% from 2017 to 2022. Industrial analytics helps business users access the industrial data and perform queries to generate insights. It equips business users with easy-to-use data exploration, data preparation, appropriate analytics, and data visualization tools and techniques. In most of the organizations today, executives, managers, and frontline employees are demanding access to industrial data and analytics tools, to generate insights based on their requirements. Moreover, the volume and variety of industrial data is increasing at a tremendous pace across organizations, as companies are using various data sources, such as sensors, Radio Frequency Identification (RFID), and Global Positioning System (GPS) to collect structured and unstructured industrial data. The base year considered for the study is 2016, and the forecast has been provided for the period between 2017 and 2022.

Market Dynamics

Drivers

- Beginning of the fourth industrial revolution, Industry 4.0

- Advent of IIoT

- Introduction of advanced data analytics techniques

Restraints

- Lack of integration with organization culture

- Complex analytical process

Opportunities

- Smart data-driven organization

- Cost reduction

Challenges

- Lack of appropriate skills

- Data quality and security

dvent of smart sensors, smart meters, and IoT-based technologies in energy and utilities industry drives the global industry analytics market

The energy and utility industry is looking for advanced solutions to get actionable insights. The industry is undergoing major transformation with the advent of smart sensors, smart meters, and IoT-based technologies. The industry generates huge chunks of data from oil wells, utility grids, gas grids, smart grids, and other sensors. Industrial data includes data obtained from RFIDs, sensors, Rich Site Summary (RSS) feeds, smart meters, and smart grids. Industrial analytics can be used in energy and utility firms to implement protective measures for equipment maintenance, real-time customer billing, and provisioning and management of field services.

The following are the major objectives of the study.

- To describe and forecast the global industrial analytics market, in terms of components, analytics types, deployment models, organization sizes, industry verticals, and regions

- To describe and forecast the market size of the 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the industrial analytics ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the industrial analytics market

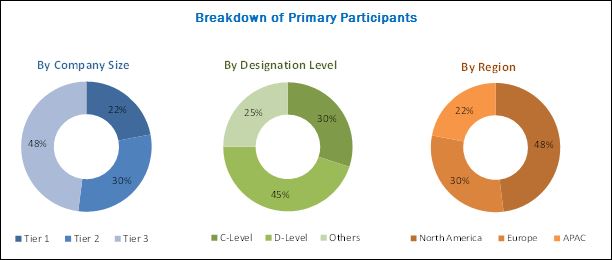

During this research study, major players operating in the industrial analytics market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The industrial analytics ecosystem comprises vendors, such as General Electric (US), IBM (US), Microsoft (US), Oracle (US), PTC (US), SAS Institute (US), SAP (Germany), Cisco (US), HPE (US), Intel (US), Hitachi (Japan), TIBCO (US), AGT International (Switzerland), BRIDGEi2i (India), and Alteryx(US). Other stakeholders of the industrial analytics market include analytics service providers, consulting service providers, IT service providers, resellers, enterprise users, and technology providers. These Industrial Analytics Software Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy. Please visit 360Quadrants to see the vendor listing of Industrial Analytics Software.

Major Market Developments in Industrial Analytics Market

- In February 2017, GE acquired Nurego, a web-based business optimization solution provider. The acquisition empowered the internet applications to be legitimate, considering the cost associated with industrial machines, software services, and cloud/edge services that the applications depend on.

- In June 2016, HPE partnered with General Electric Company in order to combine HPEs cutting-edge Internet of Things (IoT) technologies with GEs industrial expertise and its Predix platform. Both the companies leverage the industrial analytics from the edge to the cloud. Additionally, the partnership would last longer and provide services to manufacturing, oil and gas, automotive, and energy industries.

- In June 2016, IBM collaborated with Cisco to provide a combined solution of IBM Watson Analytics business and Ciscos edge analytics. The solution provided by the companies, leverages businesses to analyze undetected data of businesses, and also help them in making critical decisions in real time.

Key Target Audience for Industrial Analytics Market

- Solution vendors

- Original Equipment Manufacturers (OEMs)

- System integrators

- Advisory firms

- National regulatory authorities

- Venture capitalists

- Private equity groups

- Investment houses

- Equity research firms

Scope of the Industrial Analytics Market research report

By Component

- Software

- Service

By Software

- Operational analytics

- Risk analytics

- Financial analytics

- Marketing analytics

- Customer analytics

- Workforce analytics

By Service

- Managed services

- Professional services

- Consulting services

- Deployment and integration

- Support and maintenance

By Analytics Type

- Descriptive

- Diagnostic

- Predictive

- Prescriptive

By Organization size

- Large enterprises

- Small and medium-sized enterprises

By Deployment Model

- On-premises

- Hosted/on-cloud

By Industry Vertical

- Retail and consumer goods

- Telecommunications and IT

- Transportation and logistics

- Manufacturing

- Energy and utilities

- Others

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Critical questions which the report answers

- What are new application areas which the industrial analytics companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the clients specific requirements. The available customization options are as follows:

Geographic Analysis

- Further breakdown of the North American industrial analytics market

- Further breakdown of the European industrial analytics market

- Further breakdown of the APAC industrial analytics market

- Further breakdown of the MEA industrial analytics market

- Further breakdown of the Latin American industrial analytics market

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The overall industrial analytics market is expected to grow from USD 11.29 Billion in 2017 to USD 25.51 Billion by 2022, at a CAGR of 17.7%. The beginning of the fourth industrial revolution - industry 4.0, advent of Industrial Internet of Things (IIoT), and the introduction of advanced data analytics techniques are the key factors driving the growth of this market.

Industrial analytics is a type of analytics in which business users can access the industrial data and can perform queries to generate insights using the data. It equips business users with easy-to-use data exploration, data preparation, appropriate analytics, and data visualization tools & techniques. It helps companies cut losses, gain industrial insights, and grab new opportunities.

The industrial analytics market is segmented by software and services. The major software comprising industrial analytics include operational analytics, risk analytics, financial analytics, marketing analytics, customer analytics, and workforce analytics. The adoption of customer analytics is expected to increase significantly in the coming years, owing to the increasing need to measure the performance of key metrics such as customer expectation, ROI, and ad-campaign effectiveness across verticals. The services segment is expected to grow at the highest CAGR during the forecast period. Among all the services, consulting services in the professional services segment is projected to witness the highest demand due to the growing need of industrial analytics software solutions across organizations.

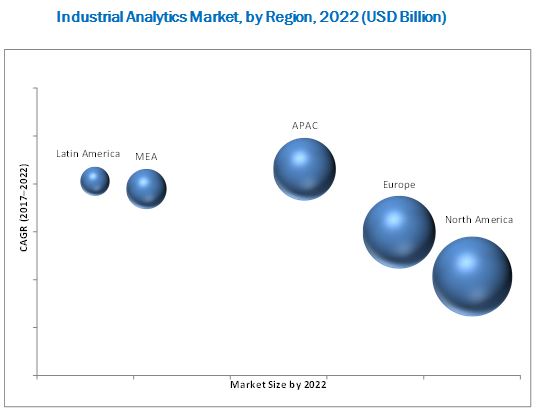

The industrial analytics market in APAC is expected to grow at the highest CAGR during the forecast period. APAC is the fastest-growing market for industrial analytics. The companies operating in the APAC region are likely to benefit from the flexible economic conditions, industrialization- and globalization-motivated policies of the governments, as well as the expanding digitalization, which are expected to have a huge impact on the business community in the region. Players in the IT sector, such as IBM Corporation, have recently formed collaborations with the Government of India to develop smart cities. Such firms are showing good interest in the industrial analytics technology. All these factors combine indicate APAC will hold a significant share of the overall industrial analytics market.

Industrial analytics applications in manufacturing, telecommunications and IT, and energy and utilities drive the growth of data quality tools market

Energy and Utilities

The energy and utility industry is looking for advanced solutions to get actionable insights. The industry is undergoing major transformation with the advent of smart sensors, smart meters, and IoT-based technologies. The industry generates huge chunks of data from oil wells, utility grids, gas grids, smart grids, and other sensors. Industrial data includes data obtained from RFIDs, sensors, Rich Site Summary (RSS) feeds, smart meters, and smart grids. Industrial analytics can be used in energy and utility firms to implement protective measures for equipment maintenance, real-time customer billing, and provisioning and management of field services. It is very important to monitor field assets such as oil fields, equipment, and power generation stations continuously to avoid major operational breakdown.

Transportation and Logistics

Industrial analytics allows decision-makers in transportation and logistics vertical to boost operational and manufacturing efficiency by maximizing route operations, identifying traffic patterns, determining the quality of the workforce, reducing the time for transportation, analyzing accident data to pinpoint attributes responsible for an accident, and providing proactive maintenance. It also eliminates supply chain waste by consolidating shipments and optimizing freight movement.

Telecommunications and IT

The telecommunications vertical adopts industrial analytics to act on dynamic business events in real-time. Telecommunications service providers are using industrial analytics to identify and capitalize on competitive advantages. They analyze their networks every second to find better ways to deliver phones, internet, and TV provisions. Industrial analytics enables companies to perform easy integration of data from disparate sources; get a consolidated view of customers data across the organization; integrate campaign management by automating analytics tasks, optimizing business rules, and systemizing processes; and make collaborative decisions to boost performance. The market growth of the telecommunications vertical is expected to increase rapidly due to the growing demand of data persistence option and voluminous content generated on a daily basis in telecommunication organizations.

Retail and Consumer Goods

The retail and consumer goods industry depends on industrial analytics solutions which enables business users and decision-makers with access to data with data exploration, data integration, appropriate analytics tools, and data visualization technology. It enables them to perform demand analysis and business discovery and gather executive insights in real-time.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for industry analytics?

Lack of integration with organization culture is a major factor restraining the growth of the market. Organizational culture is one of the key factors limiting the adoption of industrial analytics. Organizational culture is built upon decisions based on historical data and business events. Making organizations aware of how they can monetize real-time critical data coming from industrial operations, and derive a sustainable impact from industrial analytics is a major restraint in the adoption of industrial analytics. It is decisive to integrate data management

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Microquadrant Research Methodology

2.3.1 Vendor Inclusion Criteria

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 36)

4.1 Attractive Market Opportunities in the Industrial Analytics Market

4.2 Market Share Across Various Regions

4.3 Market Industry Vertical and Region

4.4 Lifecycle Analysis, By Region

5 Market Overview and Industry Trends (Page No. - 40)

5.1 Market Overview

5.1.1 Introduction

5.1.2 Market Dynamics

5.1.2.1 Drivers

5.1.2.1.1 Beginning of the Fourth Industrial Revolution, Industry 4.0

5.1.2.1.2 Advent of Iiot

5.1.2.1.3 Introduction of Advanced Data Analytics Techniques

5.1.2.2 Restraints

5.1.2.2.1 Lack of Integration With Organization Culture

5.1.2.2.2 Complex Analytical Process

5.1.2.3 Opportunities

5.1.2.3.1 Smart Data-Driven Organization

5.1.2.3.2 Cost Reduction

5.1.2.4 Challenges

5.1.2.4.1 Lack of Appropriate Skills

5.1.2.4.2 Data Quality and Security

5.2 Industry Trends

5.2.1 Introduction

5.2.2 Industrial Analytics Use Cases

5.2.2.1 Introduction

5.2.2.2 Use Case #1

5.2.2.3 Use Case #2

5.2.2.4 Use Case #3

5.2.3 Applications of Industrial Analytics Across Industrial Value Chain

5.2.3.1 Research and Development

5.2.3.2 Manufacturing/Operations

5.2.3.3 Supply Chain/Logistics

5.2.3.4 Marketing/Sales

6 Industrial Analytics Market Analysis, By Component (Page No. - 50)

6.1 Introduction

6.2 Software

6.2.1 Operational Analytics

6.2.2 Risk Analytics

6.2.3 Marketing Analytics

6.2.4 Customer Analytics

6.2.5 Financial Analytics

6.2.6 Workforce Analytics

6.3 Services

6.3.1 Managed Services

6.3.2 Professional Services

6.3.2.1 Consulting Services

6.3.2.2 Support and Maintenance

6.3.2.3 Deployment and Integration

7 Industrial Analytics Market Analysis, By Analytics Type (Page No. - 65)

7.1 Introduction

7.2 Descriptive Analytics

7.3 Diagnostic Analytics

7.4 Predictive Analytics

7.5 Prescriptive Analytics

8 Industrial Analytics Market Analysis, By Deployment Model (Page No. - 70)

8.1 Introduction

8.2 On-Premises

8.3 On-Demand

9 Industrial Analytics Market Analysis, By Organization Size (Page No. - 74)

9.1 Introduction

9.2 Large Enterprises

9.3 Small and Medium-Sized Enterprises

10 Industrial Analytics Market Analysis, By Industry Vertical (Page No. - 78)

10.1 Introduction

10.2 Retail and Consumer Goods

10.3 Telecommunications and It

10.4 Transportation and Logistics

10.5 Manufacturing

10.6 Energy and Utilities

10.7 Others

11 Geographic Analysis (Page No. - 86)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 109)

12.1 Microquadrant Overview

12.1.1 Visionary Leaders

12.1.2 Innovators

12.1.3 Dynamic Differentiators

12.1.4 Emerging Companies

12.2 Competitive Benchmarking

12.2.1 Business Strategy Excellence Adopted By Major Players in the Market

12.2.2 Strength of Product Portfolio Adopted By Major Players in the Market

13 Company Profiles (Page No. - 113)

(Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, Key Relationships, MnM View)*

13.1 General Electric Company

13.2 Hewlett Packard Enterprise

13.3 International Business Machines Corporation

13.4 Microsoft Corporation

13.5 PTC, Inc.

13.6 SAP SE

13.7 SAS Institute, Inc.

13.8 Bridgei2i Analytics Solutions

13.9 Cisco Systems, Inc.

13.10 Intel Corporation

13.11 Oracle Corporation

13.12 Tibco Software, Inc.

13.13 Alteryx, Inc.

13.14 Hitachi, Ltd.

13.15 AGT International GmbH

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, Key Relationships, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 165)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customization

14.6 Related Reports

14.7 Author Details

List of Tables (78 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Industrial Analytics Market Size, By Component, 20152022 (USD Billion)

Table 3 Market Size By Software, 20152022 (USD Billion)

Table 4 Software: Market Size, By Region, 20152022 (USD Million)

Table 5 Operational Analytics Market Size, By Region, 20152022 (USD Million)

Table 6 Risk Analytics Market Size, By Region, 20152022 (USD Million)

Table 7 Marketing Analytics Market Size, By Region, 20152022 (USD Million)

Table 8 Customer Analytics Market Size, By Region, 20152022 (USD Million)

Table 9 Financial Analytics Market Size, By Region, 20152022 (USD Million)

Table 10 Workforce Analytics Market Size, By Region, 20152022 (USD Million)

Table 11 Industrial Analytics Market Size, By Service, 20152022 (USD Billion)

Table 12 Services: Market Size, By Region, 20152022 (USD Million)

Table 13 Managed Services Market Size, By Region, 20152022 (USD Million)

Table 14 Industrial Analytics Market Size, By Professional Service, 20152022 (USD Billion)

Table 15 Professional Services Market Size, By Region, 20152022 (USD Million)

Table 16 Consulting Services Market Size, By Region, 20152022 (USD Million)

Table 17 Support and Maintenance Market Size, By Region, 20152022 (USD Million)

Table 18 Deployment and Integration Market Size, By Region, 20152022 (USD Million)

Table 19 Industrial Analytics Market Size, By Analytics Type, 20152022 (USD Billion)

Table 20 Descriptive Analytics: Market Size By Region, 20152022 (USD Million)

Table 21 Diagnostic Analytics: Market Size By Region, 20152022 (USD Million)

Table 22 Predictive Analytics: Market Size By Region, 20152022 (USD Million)

Table 23 Prescriptive Analytics: Market Size By Region, 20152022 (USD Million)

Table 24 Industrial Analytics Market Size, By Deployment Model, 20152022 (USD Billion)

Table 25 On-Premises: Market Size By Region, 20152022 (USD Million)

Table 26 On-Demand: Market Size By Region, 20152022 (USD Million)

Table 27 Industrial Analytics Market Size, By Organization Size, 20152022 (USD Billion)

Table 28 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 29 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 30 Industrial Analytics Market Size, By Industry Vertical, 20152022 (USD Billion)

Table 31 Retail and Consumer Goods: Market Size, By Region, 20152022 (USD Million)

Table 32 Telecommunications and IT: Market Size, By Region, 20152022 (USD Million)

Table 33 Transportation and Logistics: Market Size, By Region, 20152022 (USD Million)

Table 34 Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 35 Energy and Utilities: Market Size, By Region, 20152022 (USD Million)

Table 36 Others: Market Size, By Region, 20152022 (USD Million)

Table 37 Industrial Analytics Market Size, By Region, 20152022 (USD Billion)

Table 38 North America: Market Size, By Component, 20152022 (USD Million)

Table 39 North America: Market Size, By Software, 20152022 (USD Million)

Table 40 North America: Market Size, By Service, 20152022 (USD Million)

Table 41 North America: Industrial Analytics Market Size, By Professional Service, 20152022 (USD Million)

Table 42 North America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 43 North America: Market Size, By Organization Size, 20152022 (USD Million)

Table 44 North America: Market Size, By Analytics Type, 20152022 (USD Million)

Table 45 North America: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 46 Europe: Industrial Analytics Market Size, By Component, 20152022 (USD Million)

Table 47 Europe: Market Size, By Software, 20152022 (USD Million)

Table 48 Europe: Market Size, By Service, 20152022 (USD Million)

Table 49 Europe: Market Size, By Professional Service, 20152022 (USD Million)

Table 50 Europe: Industrial Analytics Market Size, By Deployment Model, 20152022 (USD Million)

Table 51 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 52 Europe: Market Size, By Analytics Type, 20152022 (USD Million)

Table 53 Europe: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 54 Asia Pacific: Industrial Analytics Market Size, By Component, 20152022 (USD Million)

Table 55 Asia Pacific: Market Size, By Software, 20152022 (USD Million)

Table 56 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 57 Asia Pacific: Industrial Analytics Market Size, By Professional Service, 20152022 (USD Million)

Table 58 Asia Pacific: Market Size, By Deployment Model, 20152022 (USD Million)

Table 59 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 60 Asia Pacific: Market Size, By Analytics Type, 20152022 (USD Million)

Table 61 Asia Pacific: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 62 Middle East and Africa: Industrial Analytics Market Size, By Component, 20152022 (USD Million)

Table 63 Middle East and Africa: Market Size, By Software, 20152022 (USD Million)

Table 64 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 65 Middle East and Africa: Industrial Analytics Market Size, By Professional Service, 20152022 (USD Million)

Table 66 Middle East and Africa: Market Size, By Deployment Model, 20152022 (USD Million)

Table 67 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 68 Middle East and Africa: Market Size, By Analytics Type, 20152022 (USD Million)

Table 69 Middle East and Africa: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 70 Latin America: Industrial Analytics Market Size, By Component, 20152022 (USD Million)

Table 71 Latin America: Market Size By Software, 20152022 (USD Million)

Table 72 Latin America: Market Size By Service, 20152022 (USD Million)

Table 73 Latin America: Industrial Analytics Market Size By Professional Service, 20152022 (USD Million)

Table 74 Latin America: Market Size By Deployment Model, 20152022 (USD Million)

Table 75 Latin America: Market Size By Organization Size, 20152022 (USD Million)

Table 76 Latin America: Market Size By Analytics Type, 20152022 (USD Million)

Table 77 Latin America: Market Size By Industry Vertical, 20152022 (USD Million)

Table 78 Market Ranking for Industrial Analytics Market (2017)

List of Figures (49 Figures)

Figure 1 Industrial Analytics Market Segmentation

Figure 2 Industrial Analytics Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Evaluation Criteria

Figure 8 Industrial Analytics Market: Assumptions

Figure 9 Industrial Analytics Market is Expected to Witness Growth in the Global Market During 20172022

Figure 10 Market Snapshot By Component (2017 vs 2022)

Figure 11 Market Snapshot By Service (20172022)

Figure 12 Market Snapshot By Professional Service (20172022)

Figure 13 Market Snapshot By Software (20172022)

Figure 14 Market Snapshot By Analytics Type (20172022)

Figure 15 Market Snapshot By Deployment Model (20172022)

Figure 16 Market Snapshot By Organization Size (20172022)

Figure 17 Market Snapshot By Industry Vertical (2017 vs 2022)

Figure 18 Increasing Volume and Variety of Industrial Data is the Major Factor Contributing to the Growth of the Industrial Analytics Market

Figure 19 North America is Estimated to Hold the Largest Market Share in 2017

Figure 20 Manufacturing Vertical is Estimated to Have the Largest Market Share in 2017

Figure 21 Asia Pacific is Expected to Enter the Exponential Growth Phase During the Forecast Period

Figure 22 Industrial Analytics Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Global Industry 4.0 Market

Figure 24 Global Industrial Internet of Things Market

Figure 25 Global Advanced Data Analytics Market

Figure 26 Services Segment is Expected to Have A Higher CAGR During the Forecast Period

Figure 27 Customer Analytics Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 29 Consulting Services Segment is Expected to Have the Highest CAGR During the Forecast Period

Figure 30 Predictive Analytics is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 31 On-Demand Deployment Model is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 32 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 33 Energy and Utilities Industry Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 34 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 35 North America is Expected to Have the Largest Market Size in the Industrial Analytics Market During the Forecast Period

Figure 36 North America: Market Snapshot

Figure 37 Asia Pacific: Market Snapshot

Figure 38 Industrial Analytics Market (Global), Competitive Leadership Mapping, 2017

Figure 39 General Electric Company: Company Snapshot

Figure 40 Hewlett Packard Enterprise: Company Snapshot

Figure 41 International Business Machines Corporation: Company Snapshot

Figure 42 Microsoft Corporation: Company Snapshot

Figure 43 PTC, Inc.: Company Snapshot

Figure 44 SAP SE: Company Snapshot

Figure 45 SAS Institute, Inc.: Company Snapshot

Figure 46 Cisco Systems, Inc.: Company Snapshot

Figure 47 Intel Corporation: Company Snapshot

Figure 48 Oracle Corporation: Company Snapshot

Figure 49 Hitachi, Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Industrial Analytics Market

Market estimation and breakdown by industry segments