Prescriptive Analytics Market by Component, Application (Customer Retention and Engagement and Personalized Recommendation), Deployment Mode, Organization Size, Vertical, Capability, and Region (2022 - 2026)

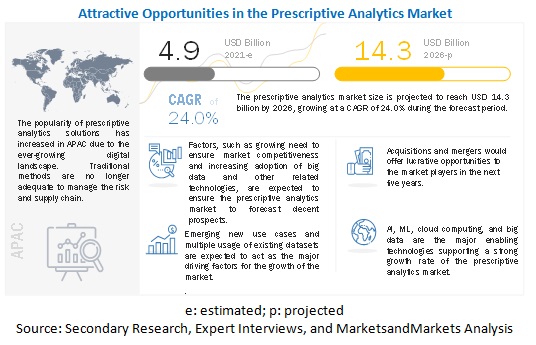

[258 Pages Report] The Prescriptive Analytics Market size to grow from USD 4.9 billion in 2021 to USD 14.3 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 24.0% during the forecast period. Various factors such as increasing spending on marketing and advertising activities by enterprises, changing landscape of customer intelligence to drive the market, and proliferation of customer channels are expected to drive the adoption of prescriptive analytics solutions and services.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

COVID19 has globally changed the dynamics of business operations. Though the COVID19 outbreak has thrown light on weaknesses in business models across verticals, it has offered several opportunities to digitalize and expand their business across regions as the adoption and integration of technologies such as cloud, AI, analytics, IoT, and blockchain has increased in the lockdown period. The retail and manufacturing sectors faced a significant dip in business performance during the first and second quarters of 2020. However, with the availability of vaccines and considerable control achieved over the pandemic, these sectors are expected to witness rising investments throughout the forecast period as prescriptive analytics solutions grow in prominence across different business functions.

Market Dynamics

Driver: Rise in popularity of real-time accessibility of data for efficient business operations

Data-driven decision-making is a must for every organization focusing on its business expansion in the competitive market. Real-time data accessibility helps organizations process and analyze data, which is further used to generate frequent plans for business performance improvements and to achieve a competitive advantage over competitors. Moreover, companies are increasingly leveraging the benefits of business intelligence and analytic tools not just to gather perceptions but also to drive strategic decision= making on a real-time basis. Prescriptive analytics uses technologies, such as ML and artificial intelligence, to recognize and recommend an action or set of actions that can be used to manage future scenarios. The best example of the implementation of prescriptive analytics is Amazon using user data to make recommendations of similar items for the shopper to buy based on the original purchase.

Restraint: Dynamic nature of data

The nature of big data depends on its volume, variety, velocity variability, and veracity, which creates complexities for managing data sets, particularly when large volumes come from varied resources. The surge in data brings a change in the nature of collected data, as the companies are shifting to more data-driven approaches for decision-making. Technology development has increased the capacity for capturing data; and this rise in capacity is likely to create confusion with the availability of data of different types with similar impacts. Organizations are extensively using predictive analytics to meet the challenges in the competitive market. As the data keeps changing with time, with the lack of effective and efficient algorithms for fetching correct data, the dynamic nature of data is expected to restrain the growth of the market.

Opportunity: Overcoming the lacunae of traditional business intelligence tools

The rising volume of data has impacted every industry in the business world. The growth in the volume of data has created complexities, which the conventional BI tools cannot manage. This has driven the necessity for improving analytical tools. Business users today need tools where they can utilize fresh untouched data to respond to operational issues, customer engagement, opportunities, and business threats. Prescriptive analytics is a part of advanced analytics, which has complemented the traditional BI methodologies and has extended organizations to reach real-time decision making. Prescriptive analysis is identified with both descriptive and predictive analysis. While descriptive analysis provides understanding into what has happened and predictive prompts what may happen, prescriptive examination decides the best arrangement, given the known parameters.

The BI traditionally uses constant sets of metrics to measure the historical performance and to guide future business planning, whereas the advanced analytics tools work beyond the traditional BI and focus on dedicated modeling techniques to forecast future actions.

Challenge: Diversity of data models based on business needs

The proliferation of data growth seen in the last few years has been colossal. Thanks to big data, enterprises are collecting the humungous amount of data received from sensors, cameras, web, and other mediums to distinctly engage with their clients, giving them preferential treatment and customized advice. The unstructured data (text, video, image, and sound data), which forms the crust of the data, need different models of advanced analytics to process it. For example, machine-generated data is modeled differently from the data that is generated from web and social media. A machine-generated data can be analyzed using supply chain analytics or operational analytics, while web and social network data can be analyzed using social media analytics. The challenge for statisticians occurs when they need to put different data models for different data sets to come up with a realistic solution. A universal set of rules cannot be modeled against the backdrop of analytics, which can hold true for every instance. Thus, enterprises need to define different business rules for managing different data models and integrated analytics solutions.

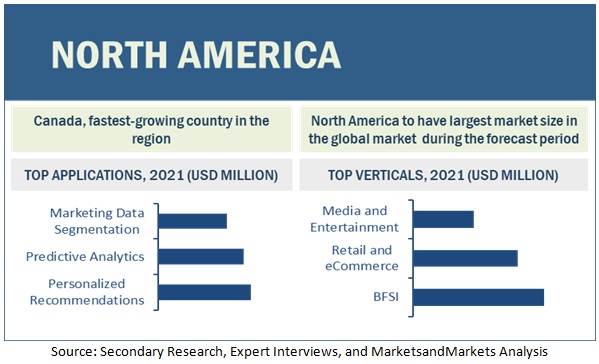

North America to account for largest market size during the forecast period

North America is expected to have the largest market share in the prescriptive analytics market. Key factors favoring the growth of the prescriptive analytics market in North America include the increasing technological advancements in the region. The growing number of prescriptive analytics players across regions is expected to further drive market growth.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The prescriptive analytics vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global prescriptive analytics market include IBM (US), Microsoft (US), Salesforce (US), SAP (Germany), SAS Institute (US), Talend (US), FICO (US), Ayata (US), Altair (US), Alteryx (US), TIBCO (US), Sisense(US) Happiest Minds (India), Zebra (England), Infor (US), RapidMiner (US), Logi Analytics (US), Qlik (US), River Logic (US), Frontline Systems (US), Netformx (US), Mitek Analytics (France), and Panorat.IO (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

20152026 |

|

Base year considered |

2020 |

|

Forecast period |

20212026 |

|

Forecast units |

USD Million |

|

Segments covered |

Component, Deployment Mode, Organization Size, Data Type, Application, Business Function, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

IBM(US), Microsoft(US), Salesforce(US), SAP(Germany), SAS Institute(US), Talend(US), FICO(US), Ayata(US), Altair(US), Alteryx(US), Tibco(US), Sisense(US), Infor(US), Rapidminer(US), Improvado(US), Frontline Systems(US), Zebra(England), River Logic(US), Logi Analytics(US), Happiest Minds(India), Stitch Data(US), Mitek Analytics(US), Netformx(US), and Panorat.io(US). |

This research report categorizes the prescriptive analytics market based on components, type, deployment mode, organization size, application, vertical, and regions.

By Component:

- Software

- Services

- Professional Services

- Managed Services

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large enterprises

- Small and medium-sized enterprises (SMEs)

By Application:

- Risk Management

- Operation Management

- Revenue Management

- Network Management

- Workforce Management

- Supply Chain Management

- Others (Asset Management, Customer Relationship Management)

By Business Function:

- HR

- Sales

- Marketing

- Finance

- Operations

By Data Type:

- Unstructured

- Semi-Structured

- Structured

By Vertical:

- BFSI

- Retail and eCommerce

- Media and Entertainment

- Manufacturing

- Travel and Hospitality

- Energy and Utilities

- Telecom and IT

- Transportaion and Logistics

- Healthcare and Life Sciences

- Government and Defense

- Others (Agriculture, Academics and Research)

By Region:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of APAC

- MEA

- Middle East

- Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In September 2021, Infor launched the next generation of hospitality management solution that puts mobile capabilities for exceptional personalized guest services in the spotlight.

- In August 2021, Sisense launched the latest Sisense Q2 2021 which allows organizations to build extensible insights, explore latest features, explore additional dimensions with Sisense Explanations, and infuse images into pivot tables.

- In May 2021, SAS announced to reinforce the foundation for data and analytics success by incorporating new data management solutions into its cloud native SASViya platform.

- In March 2021, IBM launched its Cloud Satellite which offers cloud services to its clients anywhere. Using this, clients can automate deployment and management of cloud native services for both development and operations, resulting in increasing business agility.

- In November 2020, IBM launched 5G and Edge Computing which helps businesses bringing computation and data storage closer to the source of the data, which further makes it easier to act on the insights generated from the data.

- In August 2020, Talend released the 2020 update of its Talend Data Fabric solution for expanding cloud capabilities to meet the customer needs.

Frequently Asked Questions (FAQ):

What is a prescriptive analytics?

Prescriptive analytics is an approach that analyzes data and provides instant recommendations on optimizing business practices to suit multiple predicted outcomes. It suggests the best possible actions for optimizing the business practices by utilizing similar modeling structures for predicting outcomes and then combining the business rules with ML, AI, and algorithms for simulating various approaches to these numerous outcomes. It is the natural progression from descriptive and predictive analytics procedures. It goes a step further for removing the guesswork out of data analytics. It also helps data scientists and marketers to save time in trying to understand what their data means and what dots can be connected for delivering a highly personalized and propitious user experience to their customers.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, and France in the European region.

Which are key verticals adopting prescriptive analytics solutions and services?

Key verticals adopting prescriptive analytics solutions and services include banking, financial services, and insurance, Retail and eCommerce, media and entertainment, IT and telecom, healthcare, travel and hospitality, and others (automobile, government, and education).

Which are the key drivers supporting the growth of the prescriptive analytics market?

The key drivers supporting the growth of the prescriptive analytics market include Increasing spending on marketing and advertising activities by enterprises, Changing landscape of customer intelligence and Proliferation customer channels.

Who are the key vendors in the prescriptive analytics market?

The key vendors in the global prescriptive analytics market include IBM(US), Microsoft(US), Salesforce(US), SAP(Germany), SAS Institute(US), Talend(US), FICO(US), Ayata(US), Altair(US), Alteryx(US), Tibco(US), Sisense(US) and Infor(US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACTSCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

FIGURE 6 PRESCRIPTIVE ANALYTICS MARKET: MARKET SEGMENTATION

1.6.1 REGIONAL SCOPE

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 20182020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 7 PRESCRIPTIVE ANALYTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

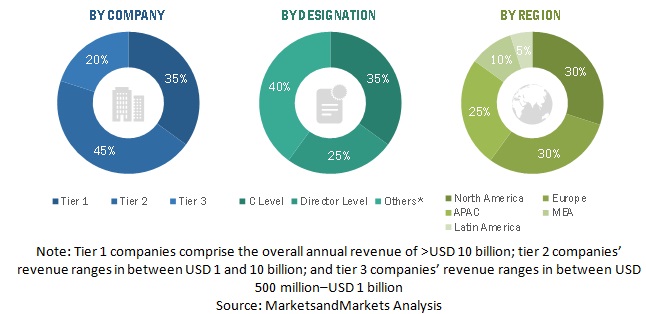

FIGURE 8 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

2.1.2.2 Key insights of industry experts

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 10 PRESCRIPTIVE ANALYTICS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF THE MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF THE PRESCRIPTIVE ANALYTICS MARKET

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGYAPPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/SERVICES OF THE MARKET

FIGURE 14 MARKET SIZE ESTIMATION METHODOLOGYAPPROACH 3, BOTTOM-UP (DEMAND SIDE): PRODUCTS/SOLUTIONS/SERVICES SOLD AND THEIR AVERAGE SELLING PRICE

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 15 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 16 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 52)

TABLE 4 PRESCRIPTIVE ANALYTICS MARKET SIZE AND GROWTH, 20152020 (USD MILLION, Y-O-Y%)

TABLE 5 MARKET SIZE AND GROWTH RATE, 20212026 (USD MILLION, Y-O-Y%)

FIGURE 17 BY COMPONENT, SOFTWARE SEGMENT TO ACHIEVE A LARGER MARKET SIZE IN 2021

FIGURE 18 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE IN 2021

FIGURE 19 SUPPLY CHAIN MANAGEMENT APPLICATION TO DOMINATE THE MARKET IN 2021

FIGURE 20 ON-PREMISES DEPLOYMENT TO LEAD THE MARKET IN 2021

FIGURE 21 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE IN 2021

FIGURE 22 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO ACCOUNT FOR THE LARGEST MARKET SIZE IN 2021

FIGURE 23 NORTH AMERICA TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 24 INCREASING ADOPTION OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING TECHNOLOGIES TO BOOST THE MARKET GROWTH

4.2 PRESCRIPTIVE ANALYTICS MARKET, BY VERTICAL

FIGURE 25 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO LEAD THE MARKET BY 2026

4.3 MARKET, BY REGION

FIGURE 26 NORTH AMERICA TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2020

4.4 MARKET, BY SOLUTION AND VERTICAL

FIGURE 27 RISK MANAGEMENT AND BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENTS TO ACCOUNT FOR THE LARGEST MARKET SHARES IN 2021

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 28 PRESCRIPTIVE ANALYTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Emergence of advanced technologies, such as big data and IoT

5.2.1.2 Rise in popularity of real-time accessibility of data for efficient business operations

5.2.2 RESTRAINTS

5.2.2.1 Complex analytical workflow

5.2.2.2 Dynamic nature of data

5.2.3 OPPORTUNITIES

5.2.3.1 Overcoming the lacunae of traditional business intelligence tools

5.2.3.2 Growing investment in big data infrastructure across geographies

5.2.3.3 Rise in cyber-crimes and need for crime prediction and prevention

5.2.4 CHALLENGES

5.2.4.1 Lack of advanced analytical knowledge among the workforce

5.2.4.2 Diversity of data models based on business needs

5.2.4.3 Reluctance to adopt advanced analytical technology

6 INDUSTRY TRENDS (Page No. - 65)

6.1 INTRODUCTION

6.2 EVOLUTION

FIGURE 29 EVOLUTION OF PRESCRIPTIVE ANALYTICS MARKET

6.3 VALUE CHAIN ANALYSIS

FIGURE 30 MARKET: VALUE CHAIN ANALYSIS

6.4 CASE STUDY ANALYSIS

6.4.1 CASE STUDY 1: A BUILDING PRODUCTS MANUFACTURER SEES USD 5 MILLION IN ANNUAL VALUE WITH RIVER LOGIC

6.4.2 CASE STUDY 2: LOGI REPORT TO IMPROVE MORTGAGE OPERATIONS

6.4.3 CASE STUDY 3: TIBCO'S AGILE TECHNOLOGY ALLOWS CARGOSMART TO FACILITATE CUSTOMERS

6.4.4 CASE STUDY 4: IBM DRIVING INNOVATION IN BULK TANKER TRANSPORTATION WITH ADVANCED ANALYTICS AND OPTIMIZATION

6.4.5 CASE STUDY 5: ALTAIR VISUAL ANALYTICS IS THE CORE ELEMENT IN THE FLEXTRADE SECURITIES TRADING PLATFORM

6.5 PRESCRIPTIVE ANALYTICS USE CASES

6.5.1 INTRODUCTION

6.5.2 TRAVEL AND TRANSPORTATION OPTIMIZATION

6.5.3 OIL PRODUCTION THROUGH FRACKING

6.5.4 IMPROVING THE HEALTHCARE INDUSTRY

6.5.5 GOOGLES SELF-DRIVEN CAR

6.6 PATENT ANALYSIS

6.6.1 METHODOLOGY

6.6.2 DOCUMENT TYPE

TABLE 6 PATENTS FILED, 20182021

6.6.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 31 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2018-2021

6.6.3.1 Top applicants

FIGURE 32 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 20182021

TABLE 7 TOP TEN PATENT OWNERS (US) IN THE PRESCRIPTIVE ANALYTICS MARKET, 2018-2021

6.7 PRICING MODEL ANALYSIS

6.8 TECHNOLOGY ANALYSIS

6.8.1 ARTIFICIAL INTELLIGENCE, MACHINE LEARNING, AND PRESCRIPTIVE ANALYTICS

6.8.2 CLOUD COMPUTING AND PRESCRIPTIVE ANALYTICS

6.8.3 ANALYTICS AND PRESCRIPTIVE ANALYTICS

6.8.4 IOT AND PRESCRIPTIVE ANALYTICS

6.9 PORTERS FIVE FORCES ANALYSIS

FIGURE 33 MARKET: PORTERS FIVE FORCES ANALYSIS

TABLE 8 PRESCRIPTIVE ANALYTICS MARKET: PORTERS FIVE FORCES ANALYSIS

6.9.1 THREAT OF NEW ENTRANTS

6.9.2 THREAT OF SUBSTITUTES

6.9.3 BARGAINING POWER OF SUPPLIERS

6.9.4 BARGAINING POWER OF BUYERS

6.9.5 INTENSITY OF COMPETITIVE RIVALRY

6.10 REGULATORY IMPLICATIONS

6.10.1 GENERAL DATA PROTECTION REGULATION

6.10.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996

6.10.3 BASEL COMMITTEE ON BANKING SUPERVISION 239 COMPLIANCE

6.10.4 SARBANES-OXLEY ACT OF 2002

7 PRESCRIPTIVE ANALYTICS MARKET, BY COMPONENT (Page No. - 80)

7.1 INTRODUCTION

TABLE 9 MARKET SIZE, BY COMPONENT, 20152020 (USD MILLION)

TABLE 10 MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

FIGURE 34 SOFTWARE COMPONENT IS EXPECTED TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

7.2 SOFTWARE

TABLE 11 MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 12 MARKET SIZE, BY REGION, 20212026 (USD MILLION)

7.3 SERVICES

TABLE 13 MARKET SIZE, BY SERVICE, 20152020 (USD MILLION)

TABLE 14 MARKET SIZE, BY SERVICE, 20212026 (USD MILLION)

7.3.1 PROFESSIONAL SERVICES

TABLE 15 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 16 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

7.3.2 MANAGED SERVICES

TABLE 17 MANAGED SERVICES: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 18 MANAGED SERVICES: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

8 PRESCRIPTIVE ANALYTICS MARKET ANALYSIS, BY APPLICATION (Page No. - 86)

8.1 INTRODUCTION

TABLE 19 MARKET SIZE, BY APPLICATION, 20152020 (USD MILLION)

TABLE 20 MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

FIGURE 35 RISK MANAGEMENT APPLICATION IS ESTIMATED TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

8.2 RISK MANAGEMENT

TABLE 21 RISK MANAGEMENT MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 22 RISK MANAGEMENT MARKET SIZE, BY REGION, 20212026 (USD MILLION)

8.3 OPERATIONS MANAGEMENT

TABLE 23 OPERATION MANAGEMENT MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 24 OPERATION MANAGEMENT MARKET SIZE, BY REGION, 20212026 (USD MILLION)

8.4 REVENUE MANAGEMENT

TABLE 25 REVENUE MANAGEMENT MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 26 REVENUE MANAGEMENT MARKET SIZE, BY REGION, 20212026 (USD MILLION)

8.5 NETWORK MANAGEMENT

TABLE 27 NETWORK MANAGEMENT MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 28 NETWORK MANAGEMENT MARKET SIZE, BY REGION, 20212026 (USD MILLION)

8.6 SUPPLY CHAIN MANAGEMENT

TABLE 29 SUPPLY CHAIN MANAGEMENT MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 30 SUPPLY CHAIN MANAGEMENT MARKET SIZE, BY REGION, 20212026 (USD MILLION)

8.7 WORKFORCE MANAGEMENT

TABLE 31 WORKFORCE MANAGEMENT MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 32 WORKFORCE MANAGEMENT MARKET SIZE, BY REGION, 20212026 (USD MILLION)

8.8 OTHER APPLICATIONS

TABLE 33 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 34 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

9 PRESCRIPTIVE ANALYTICS MARKET ANALYSIS, BY BUSINESS FUNCTION (Page No. - 96)

9.1 INTRODUCTION

TABLE 35 MARKET SIZE, BY BUSINESS FUNCTION, 20152020 (USD MILLION)

TABLE 36 MARKET SIZE, BY BUSINESS FUNCTION, 20212026 (USD MILLION)

FIGURE 36 BUSINESS OPERATIONS FUNCTION IS ESTIMATED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

9.2 HUMAN RESOURCES

TABLE 37 HUMAN RESOURCES MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 38 HUMAN RESOURCES MARKET SIZE, BY REGION, 20212026 (USD MILLION)

9.3 SALES

TABLE 39 SALES MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 40 SALES MARKET SIZE, BY REGION, 20212026 (USD MILLION)

9.4 MARKETING

TABLE 41 MARKETING MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 42 MARKETING MARKET SIZE, BY REGION, 20212026 (USD MILLION)

9.5 FINANCE

TABLE 43 FINANCE MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 44 FINANCE MARKET SIZE, BY REGION, 20212026 (USD MILLION)

9.6 OPERATIONS

TABLE 45 OPERATIONS MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 46 OPERATIONS MARKET SIZE, BY REGION, 20212026 (USD MILLION)

10 PRESCRIPTIVE ANALYTICS MARKET ANALYSIS, BY DATA TYPE (Page No. - 105)

10.1 INTRODUCTION

TABLE 47 MARKET SIZE, BY DATA TYPE, 20152020 (USD MILLION)

TABLE 48 MARKET SIZE, BY DATA TYPE, 20212026 (USD MILLION)

FIGURE 37 STRUCTURED DATA TYPE IS ESTIMATED TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

10.2 UNSTRUCTURED DATA

TABLE 49 UNSTRUCTURED DATA TYPE: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 50 UNSTRUCTURED DATA TYPE: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

10.3 SEMI-STRUCTURED DATA

TABLE 51 SEMI-STRUCTURED DATA TYPE: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 52 SEMI-STRUCTURED DATA TYPE: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

10.4 STRUCTURED DATA

TABLE 53 STRUCTURED DATA TYPE: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 54 STRUCTURED DATA TYPE: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

TABLE 55 OTHER VERTICALS: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 56 OTHER VERTICALS: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

11 PRESCRIPTIVE ANALYTICS MARKET, BY ORGANIZATION SIZE (Page No. - 111)

11.1 INTRODUCTION

TABLE 57 MARKET SIZE, BY ORGANIZATION SIZE, 20152020 (USD MILLION)

TABLE 58 MARKET SIZE, BY ORGANIZATION SIZE, 20212026 (USD MILLION)

FIGURE 38 LARGE ENTERPRISE SEGMENT IS ESTIMATED TO HAVE A LARGER MARKET SIZE DURING THE FORECAST PERIOD

11.2 LARGE ENTERPRISES

TABLE 59 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 60 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

11.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 61 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 62 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

12 PRESCRIPTIVE ANALYTICS MARKET, BY DEPLOYMENT MODEL (Page No. - 116)

12.1 INTRODUCTION

TABLE 63 MARKET SIZE, BY DEPLOYMENT MODEL, 20152020 (USD MILLION)

TABLE 64 MARKET SIZE, BY DEPLOYMENT MODEL, 20212026 (USD MILLION)

FIGURE 39 ON-PREMISES DEPLOYMENT MODEL IS ESTIMATED TO HAVE A LARGER MARKET SIZE DURING THE FORECAST PERIOD

12.2 ON-PREMISES

TABLE 65 ON-PREMISES: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 66 ON-PREMISES: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

12.3 CLOUD

TABLE 67 CLOUD: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 68 CLOUD: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

13 PRESCRIPTIVE ANALYTICS MARKET, BY VERTICAL (Page No. - 120)

13.1 INTRODUCTION

13.2 COVID-19 IMPACT

TABLE 69 MARKET SIZE, BY VERTICAL, 20152020 (USD MILLION)

TABLE 70 MARKET SIZE, BY VERTICAL, 20212026 (USD MILLION)

FIGURE 40 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL IS ESTIMATED TO BE THE LARGEST MARKET DURING THE FORECAST PERIOD

13.3 HEALTHCARE AND LIFE SCIENCES

TABLE 71 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 72 HEALTHCARE AND LIFE SCIENCES: SIZE, BY REGION, 20212026 (USD MILLION)

13.4 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 73 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 74 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

13.5 TELECOM AND INFORMATION TECHNOLOGY

TABLE 75 TELECOM AND IT: PRESCRIPTIVE ANALYTICS MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 76 TELECOM AND IT: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

13.6 RETAIL AND ECOMMERCE

TABLE 77 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 78 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

13.7 MEDIA AND ENTERTAINMENT

TABLE 79 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 80 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

13.8 MANUFACTURING

TABLE 81 MANUFACTURING: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 82 MANUFACTURING: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

13.9 ENERGY AND UTILITY

TABLE 83 ENERGY AND UTILITY: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 84 ENERGY AND UTILITY: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

13.10 TRAVEL AND HOSPITALITY

TABLE 85 TRAVEL AND HOSPITALITY: PRESCRIPTIVE ANALYTICS MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 86 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

13.11 TRANSPORTATION AND LOGISTICS

TABLE 87 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 88 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

13.12 GOVERNMENT AND DEFENSE

TABLE 89 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 90 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

13.13 OTHER VERTICALS

TABLE 91 OTHER VERTICALS: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 92 OTHER VERTICALS: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

14 PRESCRIPTIVE ANALYTICS MARKET, BY REGION (Page No. - 137)

14.1 INTRODUCTION

14.2 COVID-19 IMPACT

FIGURE 41 SOUTH KOREA TO HAVE THE HIGHEST CAGR IN THE MARKET DURING THE FORECAST PERIOD

TABLE 93 MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 94 MARKET SIZE, BY REGION, 20212026 (USD MILLION)

FIGURE 42 NORTH AMERICA TO HAVE THE LARGEST MARKET SIZE IN THE PRESCRIPTIVE ANALYTICS MARKET DURING THE FORECAST PERIOD

14.3 NORTH AMERICA

14.3.1 NORTH AMERICA: REGULATIONS

14.3.1.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

14.3.1.2 Gramm-Leach-Bliley Act

14.3.1.3 Health Insurance Portability and Accountability Act (HIPAA) of 1996

14.3.1.4 Federal Information Security Management Act (FISMA)

14.3.1.5 Federal Information Processing Standards (FIPS)

14.3.1.6 California Consumer Privacy Act (CSPA)

FIGURE 43 NORTH AMERICA MARKET SNAPSHOT

TABLE 95 NORTH AMERICA: PRESCRIPTIVE ANALYTICS MARKET SIZE, BY COMPONENT, 20152020 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20152020 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 20152020 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 20212026 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY SERVICE, 20152020 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY SERVICE, 20212026 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY DATA TYPE, 20152020 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY DATA TYPE, 20212026 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20152020 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20212026 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20152020 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20212026 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 20152020 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 20212026 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20152020 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20212026 (USD MILLION)

14.3.2 UNITED STATES

14.3.3 CANADA

14.4 EUROPE

14.4.1 EUROPE: REGULATIONS

14.4.1.1 General Data Protection Regulation (GDPR)

14.4.1.2 European Committee for Standardization (CEN)

14.4.1.3 EUs General Court

TABLE 113 EUROPE: PRESCRIPTIVE ANALYTICS MARKET SIZE, BY COMPONENT, 20152020 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY APPLICATION, 20152020 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 20152020 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 20212026 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY SERVICE, 20152020 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY SERVICE, 20212026 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY DATA TYPE, 20152020 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY DATA TYPE, 20212026 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 20152020 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 20212026 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 20152020 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 20212026 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY VERTICAL, 20152020 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY VERTICAL, 20212026 (USD MILLION)

14.4.2 UNITED KINGDOM

14.4.3 FRANCE

14.4.4 GERMANY

14.4.5 REST OF EUROPE

14.5 ASIA PACIFIC

14.5.1 ASIA PACIFIC: REGULATIONS

14.5.1.1 Personal Data Protection Act (PDPA)

14.5.1.2 International Organization for Standardization (ISO) 27001

FIGURE 44 ASIA PACIFIC AMERICA MARKET SNAPSHOT

TABLE 129 ASIA PACIFIC: PRESCRIPTIVE ANALYTICS MARKET SIZE, BY COMPONENT, 20152020 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20152020 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET SIZE, BY BUSINESS FUNCTION, 20152020 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET SIZE, BY BUSINESS FUNCTION, 20212026 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 20152020 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 20212026 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET SIZE, BY DATA TYPE, 20152020 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY DATA TYPE, 20212026 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 20152020 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 20212026 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 20152020 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 20212026 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20152020 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20212026 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20152020 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20212026 (USD MILLION)

14.5.2 AUSTRALIA

14.5.3 NEW ZEALAND

14.5.4 SOUTH KOREA

14.5.5 CHINA

14.5.6 INDIA

14.5.7 REST OF ASIA-PACIFIC

14.6 MIDDLE EAST AND AFRICA

14.6.1 MIDDLE EAST AND AFRICA: REGULATIONS

14.6.1.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

14.6.1.2 GDPR Applicability in KSA

14.6.1.3 Protection of Personal Information Act (POPIA)

TABLE 147 MIDDLE EAST AND AFRICA: PRESCRIPTIVE ANALYTICS MARKET SIZE, BY COMPONENT, 20152020 (USD MILLION)

TABLE 148 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

TABLE 149 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 20152020 (USD MILLION)

TABLE 150 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

TABLE 151 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 20152020 (USD MILLION)

TABLE 152 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 20212026 (USD MILLION)

TABLE 153 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 20152020 (USD MILLION)

TABLE 154 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 20212026 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DATA TYPE, 20152020 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DATA TYPE, 20212026 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 20152020 (USD MILLION)

TABLE 158 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 20212026 (USD MILLION)

TABLE 159 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20152020 (USD MILLION)

TABLE 160 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20212026 (USD MILLION)

TABLE 161 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 20152020 (USD MILLION)

TABLE 162 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 20212026 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 20152020 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

14.6.2 MIDDLE EAST

14.6.3 AFRICA

14.7 LATIN AMERICA

14.7.1 LATIN AMERICA: REGULATIONS

14.7.1.1 Brazil Data Protection Law

14.7.1.2 Argentina Personal Data Protection Law No. 25.326

TABLE 165 LATIN AMERICA: PRESCRIPTIVE ANALYTICS MARKET SIZE, BY COMPONENT, 20152020 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 20152020 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 20152020 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 20212026 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET SIZE, BY SERVICE, 20152020 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET SIZE, BY SERVICE, 20212026 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET SIZE, BY DATA TYPE, 20152020 (USD MILLION)

TABLE 174 LATIN AMERICA: MARKET SIZE, BY DATA TYPE, 20212026 (USD MILLION)

TABLE 175 LATIN AMERICA: PRESCRIPTIVE ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 20152020 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20212026 (USD MILLION)

TABLE 177 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20152020 (USD MILLION)

TABLE 178 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20212026 (USD MILLION)

TABLE 179 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20152020 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20212026 (USD MILLION)

TABLE 181 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20152020 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20212026 (USD MILLION)

14.7.2 BRAZIL

14.7.3 MEXICO

14.7.4 REST OF LATIN AMERICA

15 COMPETITIVE LANDSCAPE (Page No. - 182)

15.1 OVERVIEW

15.2 KEY PLAYER STRATEGIES

FIGURE 45 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE PRESCRIPTIVE ANALYTICS MARKET

15.3 REVENUE ANALYSIS

FIGURE 46 REVENUE ANALYSIS FOR KEY COMPANIES IN THE PAST FIVE YEARS

15.4 MARKET SHARE ANALYSIS

FIGURE 47 MARKET SHARE ANALYSIS

TABLE 183 MARKET: DEGREE OF COMPETITION

15.5 COMPANY EVALUATION QUADRANT

15.5.1 STARS

15.5.2 EMERGING LEADERS

15.5.3 PERVASIVE PLAYERS

15.5.4 PARTICIPANTS

FIGURE 48 KEY PRESCRIPTIVE ANALYTICS MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2021

15.6 COMPETITIVE BENCHMARKING

TABLE 184 COMPANY SOLUTION FOOTPRINT (TOP THREE)

TABLE 185 COMPANY REGION FOOTPRINT

15.7 STARTUP/SME EVALUATION QUADRANT

15.7.1 PROGRESSIVE COMPANIES

15.7.2 RESPONSIVE COMPANIES

15.7.3 DYNAMIC COMPANIES

15.7.4 STARTING BLOCKS

FIGURE 49 STARTUP/SME PRESCRIPTIVE ANALYTICS MARKET EVALUATION MATRIX, 2021

15.8 COMPETITIVE SCENARIO

15.8.1 PRODUCT LAUNCHES

TABLE 186 PRODUCT LAUNCHES, JULY 2020AUGUST 2021

15.8.2 DEALS

TABLE 187 DEALS, OCTOBER 2020AUGUST 2021

16 COMPANY PROFILES (Page No. - 194)

(Business and financial overview, Solutions offered, Recent developments, & MnM View)*

16.1 KEY PLAYERS

16.1.1 IBM

TABLE 188 IBM: BUSINESS OVERVIEW

FIGURE 50 IBM: FINANCIAL OVERVIEW

TABLE 189 IBM: SOLUTIONS OFFERED

TABLE 190 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 191 IBM: DEALS

16.1.2 MICROSOFT

TABLE 192 MICROSOFT: BUSINESS OVERVIEW

FIGURE 51 MICROSOFT: COMPANY SNAPSHOT

TABLE 193 MICROSOFT: SOLUTIONS OFFERED

TABLE 194 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 195 MICROSOFT: DEALS

16.1.3 SALESFORCE

TABLE 196 SALESFORCE: BUSINESS OVERVIEW

FIGURE 52 SALESFORCE: COMPANY SNAPSHOT

TABLE 197 SALESFORCE: SOLUTIONS OFFERED

TABLE 198 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 199 SALESFORCE: DEALS

16.1.4 SAP

TABLE 200 SAP: BUSINESS OVERVIEW

FIGURE 53 SAP: FINANCIAL OVERVIEW

TABLE 201 SAP: SOLUTIONS OFFERED

TABLE 202 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 203 SAP: DEALS

16.1.5 SAS INSTITUTE

TABLE 204 SAS INSTITUTE: BUSINESS OVERVIEW

FIGURE 54 SAS: FINANCIAL OVERVIEW

TABLE 205 SAS: SOLUTIONS OFFERED

TABLE 206 SAS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 207 SAS: DEALS

16.1.6 TALEND

TABLE 208 TALEND: BUSINESS OVERVIEW

FIGURE 55 TALEND: FINANCIAL OVERVIEW

TABLE 209 TALEND: SOLUTIONS OFFERED

TABLE 210 TALEND: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 211 TALEND: DEALS

16.1.7 FICO

TABLE 212 FICO: BUSINESS OVERVIEW

FIGURE 56 FICO: FINANCIAL OVERVIEW

TABLE 213 FICO: SOLUTIONS OFFERED

TABLE 214 FICO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 215 FICO: DEALS

16.1.8 ALTAIR

TABLE 216 ALTAIR: BUSINESS OVERVIEW

FIGURE 57 ALTAIR: COMPANY SNAPSHOT

TABLE 217 ALTAIR: SOLUTIONS OFFERED

TABLE 218 ALTAIR: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 219 ALTAIR: DEALS

16.1.9 TIBCO

TABLE 220 TIBCO: BUSINESS OVERVIEW

TABLE 221 TIBCO SOFTWARE: SOLUTIONS OFFERED

TABLE 222 TIBCO SOFTWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 223 TIBCO SOFTWARE: DEALS

16.1.10 ALTERYX

TABLE 224 ALTERYX: BUSINESS OVERVIEW

FIGURE 58 ALTERYX: COMPANY SNAPSHOT

TABLE 225 ALTERYX: SOLUTIONS OFFERED

TABLE 226 ALTERYX: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 227 ALTERYX: DEALS

16.1.11 SISENSE

TABLE 228 SISENSE: BUSINESS OVERVIEW

TABLE 229 SISENSE: SOLUTIONS OFFERED

TABLE 230 SISENSE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 231 SISENSE: DEALS

16.1.12 INFOR

TABLE 232 INFOR: BUSINESS OVERVIEW

TABLE 233 INFOR: SOLUTIONS OFFERED

TABLE 234 INFOR: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 235 INFOR: DEALS

16.1.13 RAPIDMINER

16.1.14 IMPROVADO

16.1.15 FRONTLINE SYSTEMS

16.1.16 ZEBRA

16.1.17 RIVER LOGIC

16.1.18 AYATA

16.1.19 LOGI ANALYTICS

16.1.20 HAPPIEST MINDS

16.1.21 STITCH DATA

16.1.22 QLIK

16.1.23 MITEK ANALYTICS

16.1.24 NETFORMX

16.1.25 PANORAT.IO

*Details on Business and financial overview, Solutions offered, Recent developments, & MnM View might not be captured in case of unlisted companies.

17 APPENDIX (Page No. - 237)

17.1 ADJACENT AND RELATED MARKETS

17.1.1 INTRODUCTION

17.2 MOBILE APPS AND WEB ANALYTICS MARKET - GLOBAL FORECAST TO 2025

17.2.1 MARKET DEFINITION

17.2.2 MARKET OVERVIEW

TABLE 236 MOBILE APPS AND WEB ANALYTICS MARKET SIZE AND GROWTH RATE, 20152019 (USD MILLION, Y-O-Y %)

TABLE 237 MOBILE APPS AND WEB ANALYTICS MARKET SIZE AND GROWTH RATE, 20192025 (USD MILLION, Y-O-Y %)

17.2.3 MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT

TABLE 238 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY COMPONENT, 20162019 (USD MILLION)

TABLE 239 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

17.2.4 MOBILE APPS AND WEB ANALYTICS MARKET, BY APPLICATION

TABLE 240 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 241 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY APPLICATION, 20192025 (USD MILLION)

17.2.5 MOBILE APPS AND WEB ANALYTICS MARKET, BY DEPLOYMENT MODE

TABLE 242 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 20162019 (USD MILLION)

TABLE 243 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 20192025 (USD MILLION)

17.2.6 MOBILE APPS AND WEB ANALYTICS MARKET, BY ORGANIZATION SIZE

TABLE 244 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 20162019 (USD MILLION)

TABLE 245 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 20192025 (USD MILLION)

17.2.7 MOBILE APPS AND WEB ANALYTICS MARKET, BY INDUSTRY VERTICAL

TABLE 246 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 20162019 (USD MILLION)

TABLE 247 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 20192025 (USD MILLION)

17.2.8 MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION

TABLE 248 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 249 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY REGION, 20192025 (USD MILLION)

17.2.9 BIG DATA MARKET - GLOBAL FORECAST TO 2025

17.2.9.1 Market definition

17.2.9.2 Market overview

17.2.9.2.1 Big data market, by component

TABLE 250 BIG DATA MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 251 SOLUTIONS: BIG DATA MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 252 BIG DATA MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 253 PROFESSIONAL SERVICES: BIG DATA MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

17.2.9.2.2 Big data market, by deployment mode

TABLE 254 BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 255 CLOUD: BIG DATA MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

17.2.9.2.3 Big data market, by organization size

TABLE 256 BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

17.2.9.2.4 Big data market, by business function

TABLE 257 BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 20182025 (USD MILLION)

17.2.9.2.5 Big data market, by industry vertical

TABLE 258 BIG DATA MARKET SIZE, BY INDUSTRY VERTICAL, 20182025 (USD MILLION)

17.2.9.2.6 Big data market, by region

TABLE 259 BIG DATA MARKET SIZE, BY REGION, 20182025 (USD MILLION)

18 APPENDIX (Page No. - 251)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

18.3 AVAILABLE CUSTOMIZATIONS

18.4 RELATED REPORTS

18.5 AUTHOR DETAILS

The research study for the prescriptive analytics market report involved the use of extensive secondary sources, directories, as well as several journals and magazines to identify and collect information that is useful for this technical and market-oriented study. During the production cycle of the report, in-depth interviews were conducted with various primary respondents, including key opinion leaders, subject-matter experts, high-level executives of various companies offering prescriptive analytics solutions and services, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as, assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from prescriptive analytics solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global prescriptive analytics market and various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players not limited to IBM, Microsoft, Salesforce, SAP, SAS, and Talend in the market were identified through extensive secondary research, and their revenue contribution in the respective regions were determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on prescriptive analytics solutions based on some of the key use cases. These factors for the prescriptive analytics industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the prescriptive analytics market by component (platform and services), professional service, organization size, deployment mode, application, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the prescriptive analytics market

- To analyze the impact of the COVID-19 pandemic on the prescriptive analytics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product analysis- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American prescriptive analytics market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Prescriptive Analytics Market

Analyzing prescriptive analytics market based on components, deployment mode, organization size, and regions