Industrial Counterweights Market by Type (Swing Counterweight, Fixed Counterweight), Material (Steel & Iron, Concrete), Application (Elevators, Cranes, Forklift, Excavators, Lifts, Grinding Wheels), End User, and Region-Global forecast to 2026

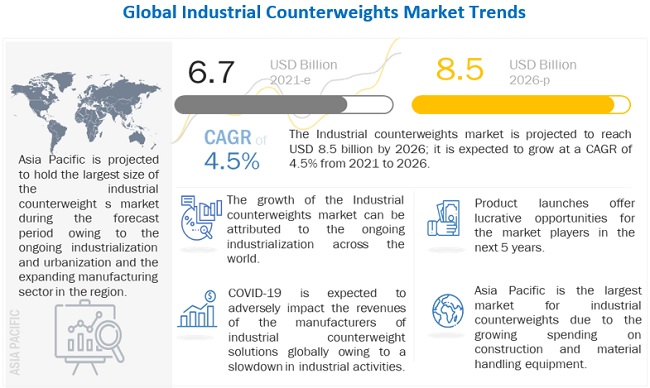

The global industrial counterweights market is expected to grow from an estimated USD 6.7 billion in 2021 to USD 8.5 billion by 2026, at a CAGR of 4.5% during the forecast period. Cast iron, followed by carbon steel, is widely used in manufacturing of industrial counterweights. Increasing demand from construction industry in industrial environment to offer lucrative opportunities for the industrial counterweights market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on industrial counterweights market

COVID-19 has slowed the growth of the industrial counterweights market, as countries were forced to implement lockdowns during the first half of 2020. Strict guidelines were issued by governments and local authorities, and all non-essential operations were halted. This adversely affected the industrial counterweights market owing to the suspension of activities of end-users. The pandemic resulted in a delay in production & supply chain during the second quarter of 2020. Hence, end user industries could not operate at their full capacities.

Industrial Counterweights Market Dynamics

Driver:Increasing demand of cast iron counterweights for off-highway equipment applications

Counterbalancing components are required in the operations of heavy-duty off-highway equipment such as excavators, cranes, wheel loaders, and telehandlers. Counterweights play a vital role in the chassis configuration, confirming the automobile’s ideal performance and increased efficiency. The material choice for the counterweights predetermines their reliability and robustness. Cast iron material offers the best machine-driven properties for the most dependable performance. It is denser, stronger, and harder than other materials. Cast iron requires only paint & coating and its density is three times greater than most of the other materials like concrete. Therefore, these properties and advantages spur the growth of the market.

Restraint: Stringent government regulations restricting the use of lead counterweights

Since lead counterweights are resistant to corrosion, offer high malleability & ductility, and are a poor conductor of electricity, they find extensive utilization in elevators, cranes, bridges, and funfair rides. But the toxic effects of lead have negative environmental and health impacts because of its stability in contaminated sites. Lead emitted into the air can be inhaled or ingested and has a negative impact on the human body. Hence governments are setting lead exposure limits which is restricting the manufacturers to use lead, and consequently shift towards other materials.

Opportunity: Generation of additional demand for material handling equipment by booming retail sector

As the retail sector witnessed unprecedented growth, there has been an increase in the demand for automated storage and retrieval system (ASRS)

in the industry. The advent of start-up companies offering robotic solutions for warehouse automation, rising popularity of automated material handling (AMH) equipment in various industries, and surging labour costs and safety concerns are among the factors driving the growth of the material handling equipment market. The increasing demand for automated material handling equipment in the e-commerce industry is expected to offer lucrative opportunities for the industrial counterweights market during the forecast period.

Challenge: Increasing raw material prices

Metal prices in different countries have increased after iron ore prices in the global market surged to near 10-year highs. The price of steel, aluminum, copper, etc., has gone up and, hence, the cost of counterweights manufacturing has increased. Even though the demand for industrial commodities is rising with the lifting up of lockdown restrictions globally, the supply chains are still not working full-fledged, and transportation issues continue, hence pushing up commodity prices.

Industrial Counterweights Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By type, the fixed counterweights segment is the largest contributor in the industrial counterweights market in 2020.

The fixed counterweight segment is also the fasted growing segment by type. Fixed counterweights find applications in forklifts, tractors, mine shafts, excavators, etc. Fixed counterweights are increasingly adopted across the construction sector due to the high reliability and ease of use offered by them.

The iron & steel segment is expected to be the fastest growing market, by material, during the forecast period.

The iron & steel segment of the industrial counterweights market consists of many types of iron and steel alloys. Iron counterweights are made of cast iron, ductile iron, gray cast iron, etc. Whereas, steel counterweights are made of cast steel, carbon steel, stainless steel, etc. They offer high tensile strength and are widely used in the construction of roads, railways, buildings

By application, the excavator segment is expected to be the fastest growing market in the industrial counterweights market during the forecast period.

Excavators are large off-highway machines used to dig trenches, holes, and foundations. They come in a wide variety of sizes. The smaller ones are called mini or compact excavators. Excavators are widely used at construction sites in applications such as excavation, demolition, heavy lifting, grading, landscaping, mining, dredging, and more.

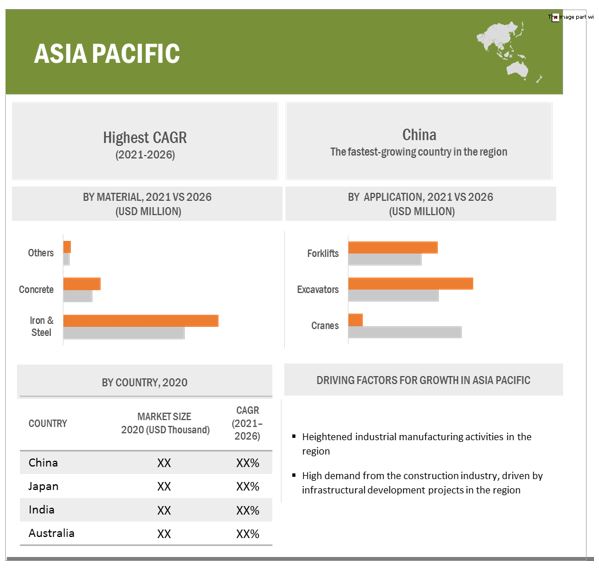

Asia Pacific is expected to account for the largest market size during the forecast period.

Asia Pacific includes countries such as China, Japan, South Korea, Australia, and Rest of APAC. China and Japan, which are among the largest consumers in this region as well as globally, constitute the largest share of the industrial counterweights market. Ongoing industrialization; emerging applications of industrial counterweights such as in water and wastewater treatment; surging number of infrastructural development projects, especially in China and India; are the factors driving the growth of the industrial counterweights market in APAC. The burgeoning demand for high-quality products and the subsequent increase in production rates in this region drive the demand for industrial counterweights in APAC.

Key Market Players

The industrial counterweights market is dominated by a few globally established players such as the key players include FMGC, Farinia Group (France), Sic LAZARO (US), Crescent Foundry (India), Gallizo (Spain), and Mars Metal (Canada).

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Type, Material, Application, and End User |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

FMGC, Farinia Group(France), Sic lazaro US Inc. (US), Crescent Foundry (India), Gallizo(Spain), Mars Metal(Canada), Ultraray Metals (Canada), International Steel & Counterweights (US), Vietnam Cast Iron(Vietnam), Agescan International (Canada), AMAC Alloys (Australia), Max Iron GmbH (Germany), LKAB Minerals (Sweden), Konstanta (Russia), Edgetech Industries (US), Sic Lazaro Industrial (Spain), Shanxi Huaxiang Group Co. Ltd. (China), Tenwinkel GmbH & Co.KG (Germany), Betonfertigteile Ernst Binder GmbH (Germany), Frans Pateer B.V. (Netherlands), Casting Quality (China), Sic Lazaro Polska SP (Poland), Messerschmidt Industriedesign (Germany), Bruckert Beton GmbH (Germany), SO ME FER srl (Italy), VALSUSA SAS (Italy) |

This research report categorizes the industrial counterweights market-based by type, material, application, end-user, and region.

Based on type:

- Swinging Counterweights

- Fixed Counterweights

Based on Material:

- Iron & steel

- Concrete

- Others

Based on Application:

- Elevators

- Cranes

- Forklifts

- Excavators

- Lifts

- Grinding Wheels

- Others

Based on End-User industry:

- Industrial Manufacturing

- Marine

- Construction

- Mining

- Agriculture

- Renewables

- Logistics

Based on the region:

- North America

- Asia Pacific

- South America

- Europe

- Middle East Africa

Recent Developments

- In January 2019, Sic Lazaro acquired Diamond Industries, a metal fabrication firm, to expand its fabrication capabilities, and, thus, the manufacturing of counterweights.

- In February 2019, Crescent Foundry expanded its cast iron castings manufacturing capacity from 1,900 tpm to 8,333 tpm at Kulgachia in the Howrah district of West Bengal, India. The company invested USD 11.6 million in this expansion.

- In October 2019, CMN and Hydroquest, who together in partnership, designed gravity-based ballasts together. Further these companies together collaborated with FMGC (France) to stabilize the tidal turbines.

- In July 2017, Gallizo started its new plant in Poland, which focuses on the manufacture of industrial counterweights for the lift market with an aim to cater to the European counterweights sector.

- In July 2017, Ultraray Metals received a contract to supply 10,000 lbs of marine ballast in the form of 2” x 4” x 12” flat lead bricks for a retrofit of a U.S. Coast Guard vessel.

Frequently Asked Questions (FAQ):

What is the current size of the industrial counterweights market?

The current market size of global industrial counterweights market is estimated to be USD 6.7 billion in 2021.

What is the major drivers for industrial counterweights market?

Increasing demand of industry Increasing demand for cast-iron counterweights for off-highway equipment. Counterbalancing components are required in the operations of heavy-duty off-highway equipment such as excavators, cranes, wheel loaders, and telehandlers. Counterweights play a vital role in the chassis configuration, confirming the automobile’s ideal performance and increased efficiency. The material choice for the counterweights predetermines their reliability and robustness. Cast iron material offers the best machine-driven properties for the most dependable performance. Cast iron is denser, stronger, and harder than other materials. It requires only paint and coating. The density of iron is three times greater than most of the other materials like concrete. Due to this property, it requires less space and volume, thus eliminating the cost for additional material. In case of concrete, to improve the density, some aggregates such as hematite, limonite, magnetite, or metal scraps are added to the concrete mix. This eventually increases the cost; such additional expenses are not required in case of cast iron. Due to the aforementioned features and properties of cast iron, off-highway equipment OEMs are opting for cast iron counterweights.

Which is the fastest-growing region during the forecasted period in industrial counterweights market?

Asia Pacific is the fastest-growing region during the forecasted period. The region is the most populated region in the world and is expected to become the largest industrial counterweights deploying region globally. It comprises many developing countries and requires more increased efficiency of industries for its development. Thus, rise in demand for construction and material handling is likely to drive the growth of market.

Which is the fastest-growing segment, by end-user industry during the forecasted period in industrial counterweights market?

The construction industry, by end-user industry is the fastest-growing segment during the forecasted period. The market for construction industry is projected to grow because the Industrial counterweights help increase efficiency and increase stability of the machines and equipments. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 INDUSTRIAL COUNTERWEIGHTS MARKET, BY MATERIAL: INCLUSIONS AND EXCLUSIONS

1.3.2 MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 REGIONAL SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 1 INDUSTRIAL COUNTERWEIGHTS MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 IMPACT OF COVID-19 ON INDUSTRY

2.4 SCOPE

FIGURE 3 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR INDUSTRIAL COUNTERWEIGHTS

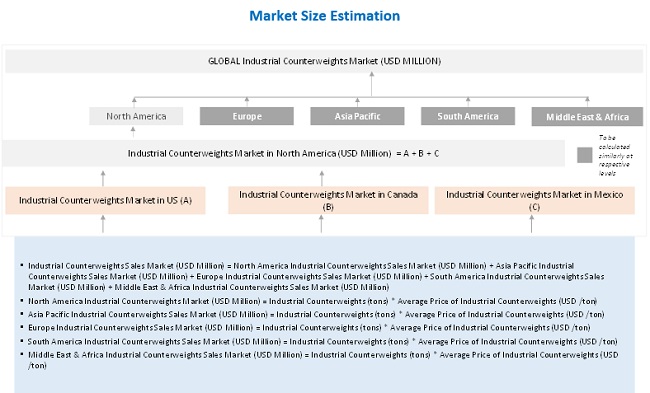

2.5 MARKET SIZE ESTIMATION

2.5.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.5.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5.3 DEMAND-SIDE ANALYSIS

2.5.3.1 Regional analysis

2.5.3.2 Country analysis

2.5.3.3 Assumptions for demand side

2.5.3.4 Calculation for demand side

FIGURE 6 KEY STEPS CONSIDERED FOR ASSESSING DEMAND OF INDUSTRIAL COUNTERWEIGHTS

FIGURE 7 MARKET: DEMAND-SIDE ANALYSIS

2.5.4 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 49)

TABLE 1 SNAPSHOT OF INDUSTRIAL COUNTERWEIGHTS MARKET

FIGURE 8 FIXED COUNTERWEIGHTS TO ACCOUNT FOR LARGER SHARE OF MARKET, BY TYPE, DURING FORECAST PERIOD

FIGURE 9 IRON & STEEL SEGMENT, BY MATERIAL, TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 10 CONSTRUCTION SEGMENT TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF MARKET, BY END USER, DURING FORECAST PERIOD

FIGURE 11 CRANES TO ACCOUNT FOR LARGEST SIZE OF MARKET, BY APPLICATION, DURING FORECAST PERIOD

FIGURE 12 MARKET IN ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING 2021–2026

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN INDUSTRIAL COUNTERWEIGHTS MARKET

FIGURE 13 INCREASING INVESTMENTS IN CONSTRUCTION AND MATERIAL HANDLING EQUIPMENT TO DRIVE MARKET GROWTH DURING 2021–2026

4.2 MARKET, BY REGION

FIGURE 14 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY END USER AND COUNTRY

FIGURE 15 CONSTRUCTION SEGMENT AND CHINA HELD LARGEST SHARES OF MARKET IN APAC IN 2020

4.4 MARKET, BY TYPE

FIGURE 16 FIXED COUNTERWEIGHTS SEGMENT HELD LARGER SHARE OF MARKET IN 2020

4.5 MARKET, BY MATERIAL

FIGURE 17 IRON & STEEL SEGMENT HELD LARGEST SHARE OF MARKET IN 2020

4.6 MARKET, BY END USER

FIGURE 18 CONSTRUCTION SEGMENT HELD LARGEST SHARE OF MARKET IN 2020

4.7 MARKET, BY APPLICATION

FIGURE 19 CRANES SEGMENT HELD LARGEST SHARE OF MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 20 COVID-19 GLOBAL PROPAGATION

FIGURE 21 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 22 RECOVERY ROAD FOR 2020 AND 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 23 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 24 INDUSTRIAL COUNTERWEIGHTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Increasing demand for cast-iron counterweights for off-highway equipment applications

5.5.1.2 Soaring demand for counterweights in material handling operations, majorly in manufacturing and logistics industries

5.5.1.3 Rising demand for heavy machinery from construction sector will propel the demand for counterweights

5.5.2 RESTRAINTS

5.5.2.1 Stringent government regulations restricting use of lead counterweights

5.5.2.2 Varying cost of counterweights by material restricting use of proper counterweights in different applications

5.5.3 OPPORTUNITIES

5.5.3.1 Generation of additional demand for material handling equipment by booming retail sector

FIGURE 25 GLOBAL RETAIL SALES, 2019 (USD BILLION)

5.5.4 CHALLENGES

5.5.4.1 Trimmed demand from end-use industries due to COVID-19

5.5.4.2 Increasing raw material prices

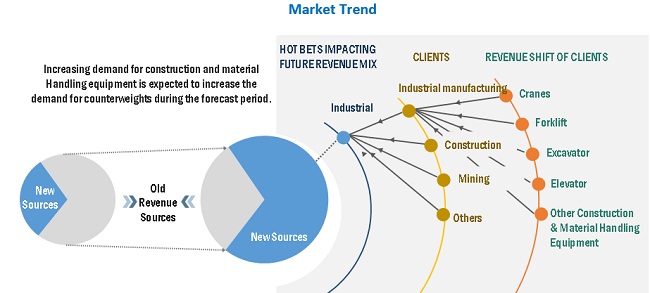

5.6 TRENDS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR INDUSTRIAL COUNTERWEIGHT MANUFACTURERS

FIGURE 26 REVENUE SHIFT FOR INDUSTRIAL COUNTERWEIGHT

5.7 PRICING ANALYSIS

TABLE 2 PRICING ANALYSIS OF INDUSTRIAL COUNTERWEIGHTS

5.8 MARKET MAP

FIGURE 27 MARKET MAP FOR INDUSTRIAL COUNTERWEIGHTS

TABLE 3 INDUSTRIAL COUNTERWEIGHTS: ECOSYSTEM

5.9 VALUE CHAIN ANALYSIS

FIGURE 28 INDUSTRIAL COUNTERWEIGHTS VALUE CHAIN ANALYSIS

5.9.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.9.2 MANUFACTURERS/ASSEMBLERS

5.9.3 DISTRIBUTORS (BUYERS)/END USERS

5.10 TECHNOLOGY ANALYSIS

5.10.1 INDUSTRIAL COUNTERWEIGHTS BASED ON DIFFERENT TECHNOLOGIES

5.11 INDUSTRIAL COUNTERWEIGHTS: CODES AND REGULATIONS

TABLE 4 INDUSTRIAL COUNTERWEIGHTS: CODES AND REGULATIONS

5.12 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 5 INDUSTRIAL COUNTERWEIGHTS: INNOVATIONS AND PATENT REGISTRATIONS

5.13 PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 PORTER’S FIVE FORCES ANALYSIS FOR MARKET

TABLE 6 INDUSTRIAL COUNTERWEIGHTS: PORTER’S FIVE FORCES ANALYSIS

5.13.1 THREAT OF SUBSTITUTES

5.13.2 BARGAINING POWER OF SUPPLIERS

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 THREAT OF NEW ENTRANTS

5.13.5 INTENSITY OF COMPETITIVE RIVALRY

5.14 CASE STUDY ANALYSIS

5.14.1 COUNTERWEIGHT REPLACEMENT IN KOGERPOLDERBRIDGE (NORTHERN HOLLAND PROVINCE)

5.14.2 COUNTERWEIGHT FOR RACING CAR (FORMULA 1)

6 INDUSTRIAL COUNTERWEIGHTS MARKET, BY TYPE (Page No. - 76)

6.1 INTRODUCTION

FIGURE 30 MARKET, BY TYPE, 2020 (%)

FIGURE 31 FIXED MARKET, BY TYPE, 2020 (%)

TABLE 7 MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 8 MARKET, BY FIXED COUNTERWEIGHTS TYPE, 2019–2026 (USD MILLION)

6.2 SWINGING COUNTERWEIGHTS

6.2.1 CONSTRUCTION INDUSTRY DRIVES SWINGING COUNTERWEIGHTS MARKET GROWTH

TABLE 9 SWINGING MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3 FIXED COUNTERWEIGHTS

6.3.1 LOGISTICS, AGRICULTURE, AND MINING INDUSTRIES ACCELERATE FIXED COUNTERWEIGHTS MARKET GROWTH

TABLE 10 FIXED MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 11 FIXED FRAME MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 12 FLOATING FRAME MARKET, BY REGION, 2019–2026 (USD MILLION)

7 INDUSTRIAL COUNTERWEIGHTS MARKET, BY MATERIAL (Page No. - 82)

7.1 INTRODUCTION

FIGURE 32 INDUSTRIAL COUNTERWEIGHTS MARKET, BY MATERIAL, 2020 (%)

TABLE 13 MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

7.2 IRON & STEEL

7.2.1 IRON & STEEL ARE WIDELY USED MATERIALS FOR MANUFACTURING COUNTERWEIGHTS

TABLE 14 MARKET FOR IRON & STEEL, BY REGION, 2019–2026 (USD MILLION)

7.3 CONCRETE

7.3.1 DEMAND FOR CONCRETE COUNTERWEIGHTS IS DRIVEN BY CONSTRUCTION INDUSTRY

TABLE 15 MARKET FOR CONCRETE, BY REGION, 2019–2026 (USD MILLION)

7.4 OTHERS

TABLE 16 MARKET FOR OTHERS, BY REGION, 2019–2026 (USD MILLION)

8 INDUSTRIAL COUNTERWEIGHTS MARKET, BY APPLICATION (Page No. - 87)

8.1 INTRODUCTION

FIGURE 33 MARKET, BY APPLICATION, 2020 (%)

TABLE 17 MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.2 ELEVATORS

8.2.1 COUNTERWEIGHTS MADE UP OF IRON AND STEEL ALLOYS ARE GENERALLY USED FOR APPLICATIONS IN ELEVATORS

TABLE 18 MARKET FOR ELEVATORS, BY REGION, 2019–2026 (USD MILLION)

8.3 CRANES

8.3.1 IN HEIGHTENED DEMAND FOR CRANES IN CONSTRUCTION ACTIVITIES IS FUELING GROWTH OF CRANES SEGMENT

TABLE 19 MARKET FOR CRANES, BY REGION, 2019–2026 (USD MILLION)

8.4 FORKLIFTS

8.4.1 SURGING DEMAND FOR FORKLIFTS IN MANUFACTURING AND WAREHOUSING OPERATIONS IS SUPPORTING GROWTH OF FORKLIFTS SEGMENT

TABLE 20 MARKET FOR FORKLIFTS, BY REGION, 2019–2026 (USD MILLION)

8.5 EXCAVATORS

8.5.1 RISING DEMAND FOR EXCAVATORS IN INFRASTRUCTURE DEVELOPMENT ACTIVITIES IS MOTIVATING GROWTH OF EXCAVATORS SEGMENT

TABLE 21 MARKET FOR EXCAVATOR, BY REGION, 2019–2026 (USD MILLION)

8.6 LIFTS

8.6.1 INTENSIFYING FOCUS ON ENSURING STABILITY IN OPERATIONS IS FUELING DEMAND FOR COUNTERWEIGHTS FOR APPLICATIONS IN LIFTS

TABLE 22 MARKET FOR LIFT, BY REGION, 2019–2026 (USD MILLION)

8.7 GRINDING WHEELS

8.7.1 DEPLOYMENT OF INNOVATIVE GRINDING WHEELS IN AUTOMOTIVE AND AEROSPACE INDUSTRIES IS GENERATING DEMAND FOR COUNTERWEIGHTS

TABLE 23 MARKET FOR GRINDING WHEELS, BY REGION, 2019–2026 (USD MILLION)

8.8 OTHERS

TABLE 24 MARKET FOR OTHERS, BY REGION, 2019–2026 (USD MILLION)

9 INDUSTRIAL COUNTERWEIGHTS MARKET, BY END USER (Page No. - 96)

9.1 INTRODUCTION

FIGURE 34 MARKET, BY END USER, 2020 (%)

TABLE 25 MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9.2 INDUSTRIAL MANUFACTURING

9.2.1 DEMAND FROM AUTOMOTIVE AND OIL & GAS INDUSTRIES DRIVE GROWTH OF INDUSTRIAL MANUFACTURING SEGMENT

TABLE 26 MARKET FOR INDUSTRIAL MANUFACTURING, BY REGION, 2019–2026 (USD MILLION)

9.3 MARINE

9.3.1 GROWTH OF MARINE SEGMENT IS DRIVEN BY ADOPTION OF CRANES IN SHIPPING AND MATERIAL HANDLING INDUSTRIES

TABLE 27 MARKET FOR MARINE, BY REGION, 2019–2026 (USD MILLION)

9.4 CONSTRUCTION

9.4.1 GROWTH OF CONSTRUCTION SEGMENT IS FUELED BY SURGING DEMAND FOR TOWER CRANES IN CONSTRUCTION PROJECTS

TABLE 28 MARKET FOR CONSTRUCTION, BY REGION, 2019–2026 (USD MILLION)

9.5 MINING

9.5.1 ADOPTION OF ROUGH TERRAIN AND ALL-TERRAIN CRANES FOR SURFACE AND SUB-SURFACE MINING ACTIVITIES TO SUPPORT GROWTH OF MINING SEGMENT

TABLE 29 MARKET FOR MINING, BY REGION, 2019–2026 (USD MILLION)

9.6 AGRICULTURE

9.6.1 ADOPTION OF MODERN EQUIPMENT IN AGRICULTURE INDUSTRY CATALYZING GROWTH OF AGRICULTURE SEGMENT

TABLE 30 MARKET FOR AGRICULTURE, BY REGION, 2019–2026 (USD MILLION)

9.7 RENEWABLES

9.7.1 GROWING DEMAND FOR COUNTERWEIGHTS FROM WIND INDUSTRY TO BOOST GROWTH OF RENEWABLES SEGMENT

TABLE 31 MARKET SIZE, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

TABLE 32 MARKET FOR RENEWABLES, BY REGION, 2019–2026 (USD MILLION)

TABLE 33 MARKET FOR WIND TURBINES IN RENEWABLES, BY REGION, 2019–2026 (USD MILLION)

TABLE 34 MARKET FOR OTHERS IN RENEWABLES, BY REGION, 2019–2026 (USD MILLION)

9.8 LOGISTICS

9.8.1 EXPANDING E-COMMERCE INDUSTRY MOTIVATING GROWTH OF LOGISTICS SEGMENT

TABLE 35 MARKET FOR LOGISTICS, BY REGION, 2019–2026 (USD MILLION)

10 REGIONAL ANALYSIS (Page No. - 105)

10.1 INTRODUCTION

FIGURE 35 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

FIGURE 36 MARKET SHARE, BY REGION, 2020 (%)

TABLE 36 GLOBAL MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 37 SNAPSHOT: MARKET IN ASIA PACIFIC

10.2.1 BY TYPE

TABLE 37 MARKET IN ASIA PACIFIC, BY TYPE, 2019–2026 (USD MILLION)

10.2.2 BY FIXED COUNTERWEIGHT TYPE

TABLE 38 MARKET IN ASIA PACIFIC, FIXED COUNTERWEIGHT TYPE, 2019–2026 (USD MILLION)

10.2.3 BY MATERIAL

TABLE 39 MARKET IN ASIA PACIFIC, BY MATERIAL, 2019–2026 (USD MILLION)

10.2.4 BY APPLICATION

TABLE 40 MARKET IN ASIA PACIFIC, BY APPLICATION, 2019–2026 (USD MILLION)

10.2.5 BY END USER

TABLE 41 MARKET IN ASIA PACIFIC, BY END USER, 2019–2026 (USD MILLION)

10.2.6 BY RENEWABLES END USER

TABLE 42 MARKET IN ASIA PACIFIC, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.2.7 BY COUNTRY

TABLE 43 MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

10.2.7.1 CHINA

10.2.7.1.1 China to dominate market in APAC during forecast period

10.2.7.1.2 By end user

TABLE 44 MARKET IN CHINA, BY END USER, 2019–2026 (USD MILLION)

10.2.7.1.3 By renewables end user

TABLE 45 MARKET IN CHINA, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.2.7.2 JAPAN

10.2.7.2.1 Expanding industrial and manufacturing sectors to boost market growth in Japan

10.2.7.2.2 By end user

TABLE 46 MARKET IN JAPAN, BY END USER, 2019–2026 (USD MILLION)

10.2.7.2.3 By renewables end user

TABLE 47 MARKET IN JAPAN, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.2.7.3 INDIA

10.2.7.3.1 Market in India to revolutionize water and wastewater industry

10.2.7.3.2 By end user

TABLE 48 MARKET IN INDIA, BY END USER, 2019–2026 (USD MILLION)

10.2.7.3.3 By renewables end user

TABLE 49 MARKET IN INDIA, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.2.7.4 SOUTH KOREA

10.2.7.4.1 Manufacturing applications fostering market growth in South Korea

10.2.7.4.2 By end user

TABLE 50 INDUSTRIAL COUNTERWEIGHTS MARKET IN SOUTH KOREA, BY END USER, 2019–2026 (USD MILLION)

10.2.7.4.3 By renewables end user

TABLE 51 MARKET IN SOUTH KOREA, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.2.7.5 AUSTRALIA

10.2.7.5.1 Demand from mining industry to substantiate market growth in Australia

10.2.7.5.2 By end user

TABLE 52 MARKET IN AUSTRALIA, BY END USER, 2019–2026 (USD MILLION)

10.2.7.5.3 By renewables end user

TABLE 53 MARKET IN AUSTRALIA, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.2.7.6 REST OF ASIA PACIFIC

10.2.7.6.1 By end user

TABLE 54 MARKET IN REST OF ASIA PACIFIC, BY END USER, 2019–2026 (USD MILLION)

10.2.7.6.2 By renewables end user

TABLE 55 MARKET IN REST OF ASIA PACIFIC, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 38 SNAPSHOT: MARKET IN NORTH AMERICA

10.3.1 BY TYPE

TABLE 56 MARKET IN NORTH AMERICA, BY TYPE, 2019–2026 (USD MILLION)

10.3.2 BY FIXED COUNTERWEIGHT TYPE

TABLE 57 MARKET IN NORTH AMERICA, BY FIXED COUNTERWEIGHT TYPE, 2019–2026 (USD MILLION)

10.3.3 BY MATERIAL

TABLE 58 INDUSTRIAL COUNTERWEIGHTS MARKET IN NORTH AMERICA, BY MATERIAL, 2019–2026 (USD MILLION)

10.3.4 BY APPLICATION

TABLE 59 MARKET IN NORTH AMERICA, BY APPLICATION, 2019–2026 (USD MILLION)

10.3.5 BY END USER

TABLE 60 MARKET IN NORTH AMERICA, BY END USER, 2019–2026 (USD MILLION)

10.3.6 BY RENEWABLES END USER

TABLE 61 MARKET IN NORTH AMERICA, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.3.7 BY COUNTRY

TABLE 62 MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.3.7.1 US

10.3.7.1.1 Industrial automation is fueling demand for counterweights in US

10.3.7.1.2 By end user

TABLE 63 MARKET IN US, BY END USER, 2019–2026 (USD MILLION)

10.3.7.1.3 By renewables end user

TABLE 64 MARKET IN US, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.3.7.2 Canada

10.3.7.2.1 Presence of various End user industries support market growth in Canada

10.3.7.2.2 By end user

TABLE 65 MARKET IN CANADA, BY END USER, 2019–2026 (USD MILLION)

10.3.7.2.3 By renewables end user

TABLE 66 MARKET IN CANADA, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.3.7.3 Mexico

10.3.7.3.1 Government investment warehouse infrastructure development to create opportunities for market growth

10.3.7.3.2 By end user

TABLE 67 MARKET IN MEXICO, BY END USER, 2019–2026 (USD MILLION)

10.3.7.3.3 By renewables end user

TABLE 68 MARKET IN MEXICO, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.3.7.4 Rest of North America

10.3.7.5 By End User Industry

TABLE 69 MARKET IN REST OF NORTH AMERICA, BY END USER INDUSTRY, 2019–2026 (USD)

10.3.7.6 By Renewables End User Industry

TABLE 70 MARKET IN REST OF NORTH AMERICA, BY RENEWABLES END USER INDUSTRY, 2019–2026 (USD)

10.4 EUROPE

10.4.1 BY TYPE

TABLE 71 MARKET IN EUROPE, BY TYPE, 2019–2026 (USD MILLION)

10.4.2 BY FIXED COUNTERWEIGHT TYPE

TABLE 72 MARKET IN EUROPE, BY FIXED COUNTERWEIGHT TYPE, 2019–2026 (USD MILLION)

10.4.3 BY MATERIAL

TABLE 73 MARKET IN EUROPE, BY MATERIAL, 2019–2026 (USD MILLION)

10.4.4 BY APPLICATION

TABLE 74 MARKET IN EUROPE, BY APPLICATION, 2019–2026 (USD MILLION)

10.4.5 BY END USER

TABLE 75 MARKET IN EUROPE, BY END USER, 2019–2026 (USD MILLION)

10.4.6 BY RENEWABLES END USER

TABLE 76 MARKET IN EUROPE, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.4.7 BY COUNTRY

TABLE 77 MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

10.4.7.1 Germany

10.4.7.1.1 Construction industry driving industrial counterweights market growth in Germany

10.4.7.1.2 By end user

TABLE 78 MARKET IN GERMANY, BY END USER, 2019–2026 (USD MILLION)

10.4.7.1.3 By renewables end user

TABLE 79 MARKET IN GERMANY, BY RENWEABLES END USER, 2019–2026 (USD MILLION)

10.4.7.2 UK

10.4.7.2.1 Growing marine sector to drive industrial counterweights market growth in UK

10.4.7.2.2 By end user

TABLE 80 MARKET IN UK, BY END USER, 2019–2026 (USD MILLION)

10.4.7.2.3 By renewables end user

TABLE 81 MARKET IN UK, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.4.7.3 France

10.4.7.3.1 Flourishing automotive industry to contribute to growth of industrial counterweights market in France

10.4.7.3.2 By end user

TABLE 82 MARKET IN FRANCE, BY END USER, 2019–2026 (USD MILLION)

10.4.7.3.3 By renewables end user

TABLE 83 MARKET IN FRANCE, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.4.7.4 SPAIN

10.4.7.4.1 Demand from construction sector driving market growth in Spain

10.4.7.4.2 By end user

TABLE 84 MARKET IN SPAIN, BY END USER, 2019–2026 (USD MILLION)

10.4.7.4.3 By renewables end user

TABLE 85 MARKET IN SPAIN, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.4.7.5 ITALY

10.4.7.5.1 Demand from pharmaceuticals industry is supporting market growth

10.4.7.5.2 By end user

TABLE 86 MARKET IN ITALY, BY END USER, 2019–2026 (USD MILLION)

10.4.7.5.3 By renewables end user

TABLE 87 MARKET IN ITALY, BY RENWEABLES END USER, 2019–2026 (USD MILLION)

10.4.7.6 REST OF EUROPE

10.4.7.6.1 By end user

TABLE 88 MARKET IN REST OF EUROPE, BY END USER, 2019–2026 (USD MILLION)

10.4.7.6.2 By renewables end user

TABLE 89 MARKET IN REST OF EUROPE, BY RENWEABLES END USER, 2019–2026 (USD MILLION)

10.5 SOUTH AMERICA

10.5.1 BY TYPE

TABLE 90 MARKET IN SOUTH AMERICA, BY TYPE, 2019–2026 (USD MILLION)

10.5.2 BY FIXED COUNTERWEIGHT TYPE

TABLE 91 MARKET IN SOUTH AMERICA, BY FIXED COUNTERWEIGHT TYPE, 2019–2026 (USD MILLION)

10.5.3 BY MATERIAL

TABLE 92 MARKET IN SOUTH AMERICA, BY MATERIAL, 2019–2026 (USD MILLION)

10.5.4 BY APPLICATION

TABLE 93 MARKET IN SOUTH AMERICA, BY APPLICATION, 2019–2026 (USD MILLION)

10.5.5 BY END USER

TABLE 94 MARKET IN SOUTH AMERICA, BY END USER, 2019–2026 (USD MILLION)

10.5.6 BY RENEWABLES END USER

TABLE 95 MARKET IN SOUTH AMERICA, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.5.7 BY COUNTRY

TABLE 96 MARKET IN SOUTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.5.7.1 Brazil

10.5.7.1.1 Growing industrial automation to underpin market growth in Brazil

10.5.7.1.2 By end user

TABLE 97 MARKET IN BRAZIL, BY END USER, 2019–2026 (USD MILLION)

10.5.7.1.3 By renewables end user

TABLE 98 MARKET IN BRAZIL, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.5.7.2 Argentina

10.5.7.2.1 Investments in oil and gas industry to fuel demand for industrial counterweights in Argentina

10.5.7.2.2 By end user

TABLE 99 MARKET IN ARGENTINA, BY END USER, 2019–2026 (USD MILLION)

10.5.7.2.3 By renewables end user

TABLE 100 MARKET IN ARGENTINA, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.5.7.3 Rest of South America

10.5.7.3.1 By end user

TABLE 101 MARKET IN REST OF SOUTH AMERICA, BY END USER, 2019–2026 (USD MILLION)

10.5.7.3.2 By renewables end user

TABLE 102 MARKET IN REST OF SOUTH AMERICA, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.5.7.4 CHILE

10.5.7.4.1 Construction and petrochemicals industries substantiate demand for counterweights in Chile

10.5.7.4.2 By end user

TABLE 103 MARKET IN CHILE, BY END USER, 2019–2026 (USD MILLION)

10.5.7.4.3 By renewables end user

TABLE 104 MARKET IN CHILE, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 BY TYPE

TABLE 105 MARKET IN MIDDLE EAST & AFRICA, BY TYPE, 2019–2026 (USD MILLION)

10.6.2 BY FIXED COUNTERWEIGHT TYPE

TABLE 106 MARKET IN MIDDLE EAST & AFRICA, BY FIXED COUNTERWEIGHT TYPE, 2019–2026 (USD MILLION)

10.6.3 BY MATERIAL

TABLE 107 MARKET IN MIDDLE EAST & AFRICA, BY MATERIAL, 2019–2026 (USD MILLION)

10.6.4 BY APPLICATION

TABLE 108 MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION, 2019–2026 (USD MILLION)

10.6.5 BY END USER

TABLE 109 MARKET IN MIDDLE EAST & AFRICA, BY END USER, 2019–2026 (USD MILLION)

10.6.6 BY RENEWABLES END USER

TABLE 110 MARKET IN MIDDLE EAST & AFRICA, BY RENWEABLES END USER, 2019–2026 (USD MILLION)

10.6.7 BY COUNTRY

TABLE 111 MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.6.7.1 Saudi Arabia

10.6.7.1.1 Construction industry supports market growth in Saudi Arabia

10.6.7.1.2 By end user

TABLE 112 MARKET IN SAUDI ARABIA, BY END USER, 2019–2026 (USD MILLION)

10.6.7.1.3 By renewables end user

TABLE 113 MARKET IN SAUDI ARABIA, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.6.7.2 UAE

10.6.7.2.1 Infrastructural development projects boost demand for industrial counterweights in UAE

10.6.7.2.2 By end user

TABLE 114 MARKET IN UAE, BY END USER, 2019–2026 (USD MILLION)

10.6.7.2.3 By renewables end user

TABLE 115 MARKET IN UAE, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.6.7.3 South Africa

10.6.7.3.1 Flourishing mining industry to contribute to growth of industrial counterweights market in South Africa

10.6.7.3.2 By end user

TABLE 116 MARKET IN SOUTH AFRICA, BY END USER, 2019–2026 (USD MILLION)

10.6.7.3.3 By renewables end user

TABLE 117 MARKET IN SOUTH AFRICA, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.6.7.4 IRAN

10.6.7.4.1 Oil & gas and manufacturing sector in Iran to augment counterweight implementation during forecast period

10.6.7.4.2 By end user

TABLE 118 MARKET IN IRAN, BY END USER, 2019–2026 (USD MILLION MILLION)

10.6.7.4.3 By renewables end user

TABLE 119 MARKET IN IRAN, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

10.6.7.5 REST OF MIDDLE EAST & AFRICA

10.6.7.5.1 By end user

TABLE 120 MARKET IN REST OF MIDDLE EAST & AFRICA, BY END USER, 2019–2026 (USD MILLION)

10.6.7.5.2 By renewables end user

TABLE 121 MARKET IN REST OF MIDDLE EAST & AFRICA, BY RENEWABLES END USER, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 158)

11.1 KEY PLAYER STRATEGIES

TABLE 122 OVERVIEW OF TOP MARKET PLAYERS, JANUARY 2017– JULY 2021

11.2 MARKET ANALYSIS OF TOP FIVE PLAYERS

TABLE 123 MARKET: RANK

FIGURE 39 MARKET SHARE ANALYSIS, 2020

11.3 MARKET EVALUATION FRAMEWORK

TABLE 124 MARKET EVALUATION FRAMEWORK

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STAR

11.4.2 EMERGING LEADER

11.4.3 PERVASIVE

11.4.4 PARTICIPANT

FIGURE 40 COMPETITIVE LEADERSHIP MAPPING: INDUSTRIAL COUNTERWEIGHT MARKET, 2019

TABLE 125 COMPANY FOOTPRINT

TABLE 126 COMPANY TYPE FOOTPRINT

TABLE 127 COMPANY MATERIAL FOOTPRINT

TABLE 128 COMPANY APPLICATION FOORPRINT

TABLE 129 COMPANY END USER FOOTPRINT

TABLE 130 COMPANY REGION FOOTPRINT

11.5 COMPETITIVE SCENARIO

TABLE 131 INDUSTRIAL COUNTERWEIGHTS MARKET: PRODUCT LAUNCHES, JANUARY 2017– JULY 2021

TABLE 132 INDUSTRIAL COUNTERWEIGHTS MARKET: DEALS, JANUARY 2017–JULY 2021

TABLE 133 INDUSTRIAL COUNTERWEIGHTS MARKET: OTHER DEVELOPMENTS, JANUARY 2017–JULY 2021

12 COMPANY PROFILES (Page No. - 174)

12.1 INTRODUCTION

(Business overview, Products/solutions/services offered, Recent Developments, SWOT Analysis, MNM view)*

12.2 MAJOR PLAYERS

12.2.1 FMGC, FARINIA GROUP

TABLE 134 FMGC, FARINIA GROUP: COMPANY OVERVIEW

TABLE 135 FMGC, FARINIA GROUP: PRODUCTS/SOLUTIONS OFFERED

TABLE 136 FMGC, FARINIA GROUP: DEALS, JANUARY 2017–JULY 2021

FIGURE 41 FMGC FARINIA GROUP: SWOT ANALYSIS

12.2.2 SIC LAZARO

TABLE 137 SIC LAZARO: COMPANY OVERVIEW

TABLE 138 SIC LAZARO: PRODUCTS/SOLUTIONS OFFERED

TABLE 139 SIC LAZARO: DEALS, JANUARY 2017–JULY 2021

FIGURE 42 SIC LAZARO (US): SWOT ANALYSIS

12.2.3 CRESCENT FOUNDRY

TABLE 140 CRESCENT FOUNDRY: COMPANY OVERVIEW

TABLE 141 CRESCENT FOUNDRY: PRODUCTS/SOLUTIONS OFFERED

TABLE 142 CRESCENT FOUNDRY: OTHERS, JANUARY 2017–JULY 2021

FIGURE 43 CRESCENT FOUNDRY (INDIA): SWOT ANALYSIS

12.2.4 GALLIZO

TABLE 143 GALLIZO: COMPANY OVERVIEW

TABLE 144 GALLIZO: PRODUCTS/SOLUTIONS OFFERED

TABLE 145 GALLIZO: DEALS, JULY 2017–AUGUST 2017

TABLE 146 GALLIZO: OTHER DEVELOPMENTS, JANUARY 2017–JULY 2021

FIGURE 44 GALIZO: SWOT ANALYSIS

12.2.5 MARS METAL

TABLE 147 MARS METAL: COMPANY OVERVIEW

TABLE 148 MARS METAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

FIGURE 45 MARS METAL: SWOT ANALYSIS

12.2.6 ULTRARAY METALS

TABLE 149 ULTRARAY METALS: COMPANY OVERVIEW

TABLE 150 ULTRARAY METALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 151 ULTRARAY METALS: PRODUCT LAUNCHES, JANUARY 2017–JULY 2021

TABLE 152 ULTRARAY METALS: DEALS, JANUARY 2017–JULY 2021

12.2.7 ISC

TABLE 153 ISC: COMPANY OVERVIEW

TABLE 154 ISC: PRODUCT LAUNCHES, JANUARY 2017–JULY 2021

TABLE 155 ISC: OTHER DEVELOPMENTS, JANUARY 2017–JULY 2021

12.2.8 VIETNAM CAST IRON

TABLE 156 VIETNAM CAST IRON: COMPANY OVERVIEW

TABLE 157 VIETNAM CAST IRON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.9 AGESCAN INTERNATIONAL INC.

TABLE 158 AGESCAN INTERNATIONAL INC.: COMPANY OVERVIEW

TABLE 159 AGESCAN INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

12.2.10 AMAC ALLOYS

TABLE 160 AMAC ALLOYS: COMPANY OVERVIEW

TABLE 161 AMAC ALLOYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 162 AMAC ALLOYS: DEALS, FEBRUARY 2017– JANUARY 2017–JULY 2021

12.2.11 MAX IRON

TABLE 163 MAX IRON: COMPANY OVERVIEW

TABLE 164 MAX IRON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 165 MAX IRON: DEALS, JANUARY 2017–JULY 2021

12.2.12 LKAB MINERALS

TABLE 166 LKAB MINERALS: COMPANY OVERVIEW

TABLE 167 LKAB MINERALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.13 KONSTANTA

TABLE 168 KONSTANTA: COMPANY OVERVIEW

TABLE 169 KONSTANTA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.14 EDGETECH INDUSTRIES LLC

TABLE 170 EDGETECH INDUSTRIES LLC: COMPANY OVERVIEW

TABLE 171 EDGETECH INDUSTRIES LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.15 SIC LAZARO INDUSTRIAL

TABLE 172 SIC LAZARO INDUSTRIAL: COMPANY OVERVIEW

TABLE 173 SIC LAZARO INDUSTRIAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.16 SHANXI HUAXIANG GROUP CO. LTD.

TABLE 174 SHANXI HUAXIANG GROUP CO. LTD.: COMPANY OVERVIEW

TABLE 175 SHANXI HUAXIANG GROUP CO LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

12.2.17 TENWINKEL GMBH & CO. KG

TABLE 176 TENWINKEL GMBH & CO. KG: COMPANY OVERVIEW

TABLE 177 TENWINKEL GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.18 BETONFERTIGTEILE ERNST BINDER GMBH

TABLE 178 BETONFERTIGTEILE ERNST BINDER GMBH: COMPANY OVERVIEW

TABLE 179 BETONFERTIGTEILE ERNST BINDER GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.19 FRANS PATEER B.V.

TABLE 180 FRANS PATEER B.V.: COMPANY OVERVIEW

TABLE 181 FRANS PATEER B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.20 CASTING QUALITY

TABLE 182 CASTING QUALITY: COMPANY OVERVIEW

TABLE 183 FRANS PATEER B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.21 SIC LAZARO POLSKA

TABLE 184 SIC LAZARO POLSKA: COMPANY OVERVIEW

TABLE 185 SIC LAZARO POLSKA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.22 MESSERSCHMIDT INDUSTRIEDESIGN

TABLE 186 MESSERSCHMIDT INDUSTRIEDESIGN: COMPANY OVERVIEW

TABLE 187 MESSERSCHMIDT INDUSTRIEDESIGN: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

12.2.23 BRUCKERT BETON GMBH

TABLE 188 BRUCKERT BETON GMBH: COMPANY OVERVIEW

TABLE 189 BRUCKERT BETON GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.24 SO ME FER SRL

TABLE 190 SO ME FER SRL: COMPANY OVERVIEW

12.2.25 VALSUSA SAS

TABLE 191 VALSUSA SAS: COMPANY OVERVIEW

*Details on Business overview, Products/solutions/services offered, Recent Developments, SWOT Analysis, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 214)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

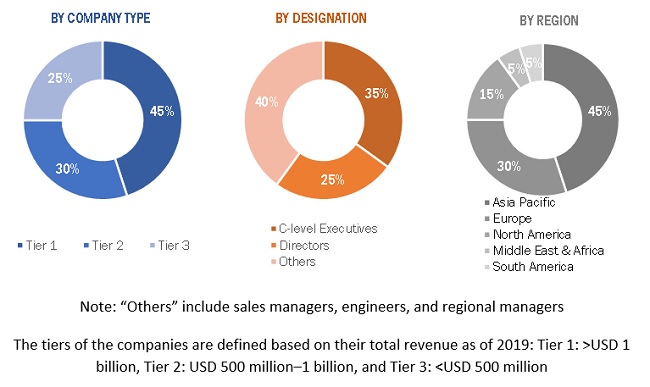

This study involved major activities in estimating the current size of the industrial counterweights market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Country-wise analysis were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global industrial counterweights market. The other secondary sources included press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The industrial counterweights market comprises several stakeholders, such as product manufacturers, service providers, distributors, and end-users in the supply chain. The demand-side of this market is characterized by its industrial end-user industries. Moreover, the demand is also driven by the rising demand of increased efficiency. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the industrial counterweights market ecosystem.

Report Objectives

- To define, describe, and forecast the size of the industrial counterweights market by type, material, application, end user, and region, in terms of value

- To estimate and forecast the global industrial counterweights market for various segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and industry-specific challenges that influence the market growth

- To provide a detailed overview of the industrial counterweights value chain, along with industry trends, use cases, security standards, and Porter’s five forces

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings and core competencies2

- To analyze competitive developments, such as joint ventures, mergers and acquisitions, contracts, and agreements, and new product launches, in the industrial counterweights market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- This report covers the industrial counterweights market size in terms of value.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Counterweights Market