Elevators & Escalators Market

Elevators & Escalators Market by Type (Elevators, Escalators, Moving Walkways), Service (New Installation, Maintenance & Repair), Elevator Technology (Traction, Machine-Room-Less, & Hydraulic), End-use Industry, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The elevators and escalators market is projected to be USD 98.84 billion in 2025, and it is projected to reach USD 113.81 billion by 2030 at a CAGR of 2.86%. An elevator, also known as a lift, serves as a technological solution for vertical transportation, facilitating the movement of individuals or goods between different levels of a building, vessels, or other structures. Operating on the principle of a conveyor transport device, an escalator comprises a motor-driven chain of interconnected steps that ascend or descend on tracks, ensuring that the step treads remain in a horizontal position. A moving walkway is a conveyor belt that transports people horizontally or on a slight incline.

KEY TAKEAWAYS

-

BY TYPEThe elevators and escalators market includes elevator, escalator, and moving walkways. Elevators hold the significant market share as urbanization and more high-rise buildings are increasing the need for elevators. As cities become busier and more people live in urban areas, we need efficient ways to move large groups of people up and down in places like residential towers, office buildings, shopping malls, hospitals, and transit hubs.

-

BY TECHNOLOGYBy service, the market is segmented into new installation, maintenance & repair, and modernization. The new installation sector significantly dominated the market share throughout the forecast period. This surge in demand is closely tied to the increasing construction of high-rise buildings, which encompass a diverse range of structures including modern office complexes, expansive shopping malls, luxurious residential apartments, and sophisticated hotels, all of which reflect robust economic growth.

-

BY END-USE INDUSTRYBy technology, the market covers traction elevator, machine room less traction elevator, and hydraulic. Traction elevator technology is mostly used in modern buildings because it offers a combination of speed, efficiency, and versatility.

-

BY REGIONEnd-use industries include residential, commercial, institutional, infrastructure, and other end-use industries. The commercial segment of the elevators and escalators market is projected to achieve the highest CAGR during the forecast period, emerging as the fastest-growing sector within the industry.

-

COMPETITIVE LANDSCAPENorth America is expected to grow fastest, with a CAGR of 4.32%, driven by large infrastructure projects and modernization.

The elevators and escalators market is expected to witness significant growth in the coming years due to increased construction of high-rise buildings equipped with smart vertical transportation, growing need for reducing energy consumption in buildings, as well as growing aging population to facilitate development.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of elevator and escalator suppliers, which, in turn, impacts the revenues of elevator and escalator manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

§Increased construction of high-rise buildings equipped with smart vertical transportation

-

§Growing need for reducing energy consumption in buildings

Level

-

§Uncertainty and risk regarding global economy

-

§High maintenance cost

Level

-

•Adoption of green building codes and energy-efficient products

-

•Development of innovative technologies

Level

-

•Compliance with standards and regulations

-

•Customer awareness & adoption barriers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased construction of high-rise buildings equipped with smart vertical transportation

Urbanization is increasing fast across the globe, especially in regions like Asia, Africa, and the Middle East. This shift is largely driven by an important migration from rural to urban areas, of the people as they are asking for better opportunities and living conditions. According to the United Nations, the total population on earth is expected to reach 10.3 billion by the mid-2080. This increasing speed of urbanization, combined with an increase in high-rise construction, is expected to significantly boost the demand for elevators and escalators worldwide in the coming decades.

Restraint: High maintenance cost

The high cost of maintenance is one of the main obstacles. Maintaining systems in proper condition requires not only regular inspections but also quick upgrades and replacement of outdated or non-compliant parts. These measures, however, can be costly, particularly when attempting to comply with changing safety standards. There is a hesitant behavior associated with it due to the high maintenance cost. Balancing safety requirements with budget constraints remains an important issue in the industry, making affordability a crucial factor for long-term sustainability and expansion.

Opportunity: Development of innovative technologies

Manufacturers today are working hard to create cutting-edge technologies that help their products stand out and remain competitive. One major focus is on smart elevators, which use advanced hardware and software to innovate how people move within buildings. As urban locations become more complex, innovative elevator solutions play an important role in making these spaces livable and accessible, ensuring people can move swiftly and comfortably even in the tallest buildings

Challenge: Compliance with standards and regulations

Strict safety regulations are a major challenge for companies manufacturing elevators and escalators. Organizations such as the American Society of Mechanical Engineers (ASME), the Elevator and Escalator Safety Trust, and similar foundations set thorough standards to protect everyone who uses these systems. For elevator and escalator makers, keeping up with these ever-evolving safety standards isn’t just a legal duty; it’s also about building trust with the public. Ensuring compliance takes careful monitoring and ongoing staff training, but it’s a critical part of delivering safe, reliable transportation within buildings.

Elevators & Escalators Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Central elevator banks used for patient, staff, and visitor transport across 10 floors at Medanta hospital; feature 40 Mitsubishi Electric elevators for continuous, high-capacity operation in a busy medical facility. | Gearless traction system enabled a 20% reduction in power consumption and delivers quiet, reliable service; spacious car design provides needed ceiling height for hospital applications. |

|

Eighteen Mitsubishi Electric elevators installed in Ruby, Mumbai's tallest office building (40 stories), engineered to meet LEED green building standards; system controls elevator speeds, loads, waiting times, and ensures comfort for high-rise office users. | Destination allocation system improved morning rush hour transport performance by about 15%; efficient operations led to reduced waiting times and lower energy spending, with enhanced security. |

|

Japanese Daisho Group chose exclusive custom elevator solutions in 180 Brisbane buildings: 15 KONE MiniSpace, 4 KONE MonoSpace elevators, linked to a KONE Destination Control System, LED identifiers, E-Link monitoring, and Care Maintenance for premium office functionality. | Achievement of 6 Star Greenstar Office rating, making 180 Brisbane the first building in the city with this top-tier environmental accreditation. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

An ecosystem map visually represents the network of companies operating in a specific market. It depicts all network members, including component manufacturers, elevators and escalators manufacturers, and end users. Each entity in the ecosystem map affects and is affected by the others, and they compete and collaborate to survive.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Elevators and Escalators Market, By Type

Urbanization and more high-rise buildings are increasing the need for elevators. As cities become busier and more people live in urban areas, we need efficient ways to move large groups of people up and down in places like residential towers, office buildings, shopping malls, hospitals, and transit hubs. Governments worldwide are investing in affordable housing, smart city projects, and infrastructure improvements, which also boosts elevator demand in new and renovated buildings.

Elevators and Escalators Market, By Technology

Traction elevator technology is mostly used in modern buildings because it offers a combination of speed, efficiency, and versatility. Traction elevators use ropes and a counterweight system to move the elevator car, which allows for much faster travel between floors, which is especially important in high-rise buildings where long distances need to be covered quickly. Their energy-efficient motors and smart control systems also help in the reduction of energy consumption, making them a more sustainable and cost-effective choice for building owners

Elevators and Escalators Market, By Service

The new installation sector significantly dominated the market share throughout the forecast period. This surge in demand is closely tied to the increasing construction of high-rise buildings, which encompass a diverse range of structures including modern office complexes, expansive shopping malls, luxurious residential apartments, and sophisticated hotels, all of which reflect robust economic growth. Elevators and escalators play a vital role in ensuring efficient vertical and horizontal transportation within these towering edifices, facilitating seamless access to various floors and sections. As the number of newly constructed buildings escalates, the need for efficient elevator and escalator systems also intensifies.

Elevators and Escalators Market, By End-use Industry

The commercial segment of the elevators and escalators market is projected to achieve the highest compound annual growth rate (CAGR) during the forecast period, emerging as the fastest-growing sector within the industry. This commercial category encompasses a diverse range of environments, including modern office buildings, bustling retail centers, expansive airports, luxurious hotels, and vibrant leisure parks. In the coming five years, a significant surge in the construction of hotels, retail outlets, and entertainment venues is expected, driven by increasing urbanization and consumer demand

REGION

Asia Pacific to be the largest region in the global elevators and escalators market during forecast period

The Asia-Pacific (APAC) region is projected to dominate the market for elevators and escalators throughout the forecast period. This growth can be attributed to several factors, including the rapid increase in the global population, which intensifies the demand for infrastructure capable of accommodating urban expansion. Additionally, improving economic conditions in developing nations are fueling investments in construction, particularly for high-rise buildings that necessitate advanced vertical transportation systems such as elevators and escalators.

Elevators & Escalators Market: COMPANY EVALUATION MATRIX

In the elevators and escalators market matrix, Mitsubishi Electric Corporation, (Star), is taking various business expansion initiatives, such as product launches, which could strengthen its operations and increase revenue. Hyundai Elevators Co., Ltd. (Emerging Leader) utilizes IoT, cloud, and AI platforms (like the MIRI smart maintenance system) for real-time diagnostics, predictive maintenance, and tailored service. While Mitsubishi Electric Corporation dominates with scale, Hyundai Elevators Co., Ltd. shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 97.20 BN |

| Market Forecast in 2030 (value) | USD 113.81 BN |

| Growth Rate | CAGR of 2.86% from 2025-2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe, North America, Asia Pacific, the Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Elevators & Escalators Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Middle East & Africa construction hotspots, regulatory frameworks, and distribution partners. |

|

|

RECENT DEVELOPMENTS

- May 2025 : Hyundai Elevator and Samsung C&T signed an MOU to develop third-generation modular elevator technology for skyscrapers up to 500 meters tall. The modular system, over 70% prefabricated, aims to reduce construction time, improve safety, and lead the off-site construction trend.

- November 2024 : Otis Electric, Otis’s subsidiary, launched a new smart elevator designed for both new construction and modernization projects, featuring advanced digital technologies to enhance building mobility and efficiency.

- November 2024 : Hitachi’s Taiwan subsidiary secured its largest-ever order for 147 elevators and escalators to be installed across 13 stations in the second phase of the Taipei MRT Wanda-Zhonghe-Shulin Line, scheduled for completion in 2031.

- August 2024 : Schindler Olayan secured a significant contract to equip The Avenues, which will be the largest commercial mall in the Middle East. This contract includes the installation of 293 units, consisting of 135 elevators, 150 escalators, and 8 moving walkways. All of these units will be cloud-connected, allowing for 24/7 monitoring through Schindler’s ActionBoard.

- May 2024 : KONE acquired Orbitz Elevators’ service business in Australia and all operations in New Zealand, strengthening KONE’s position in the South Pacific with a skilled team and an expanded customer portfolio focused on custom-designed, innovative, and sustainable elevator and escalator solutions for both commercial and residential projects.

Table of Contents

Methodology

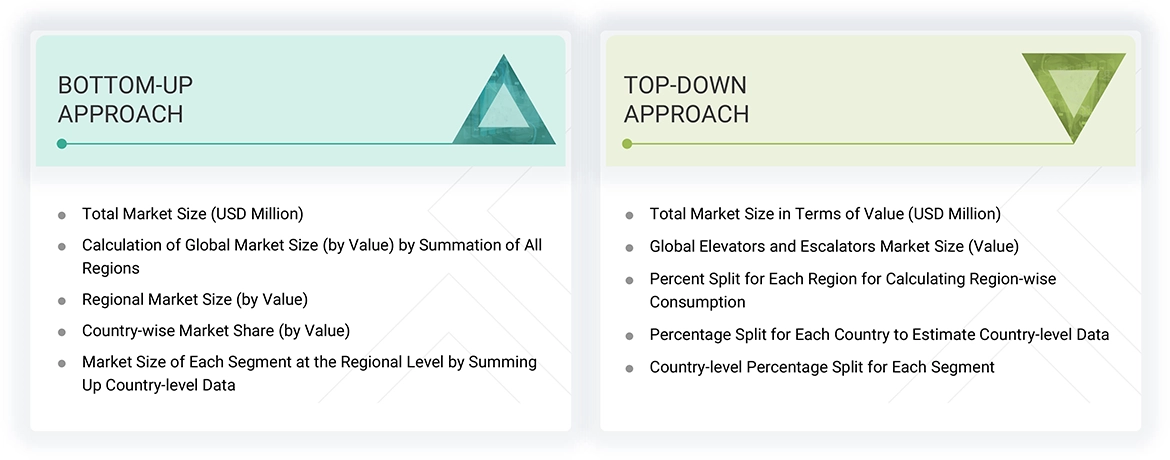

The study involved four major activities to estimate the current size of the global elevators and escalators market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of elevators and escalators through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the elevators and escalators market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the elevators and escalators market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies; trade directories; and databases.

Primary Research

The elevators and escalators market comprises several stakeholders in the supply chain, which include raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the elevators and escalators market. Primary sources from the supply side include associations and institutions involved in the elevators and escalators industry, key opinion leaders, and processing players.

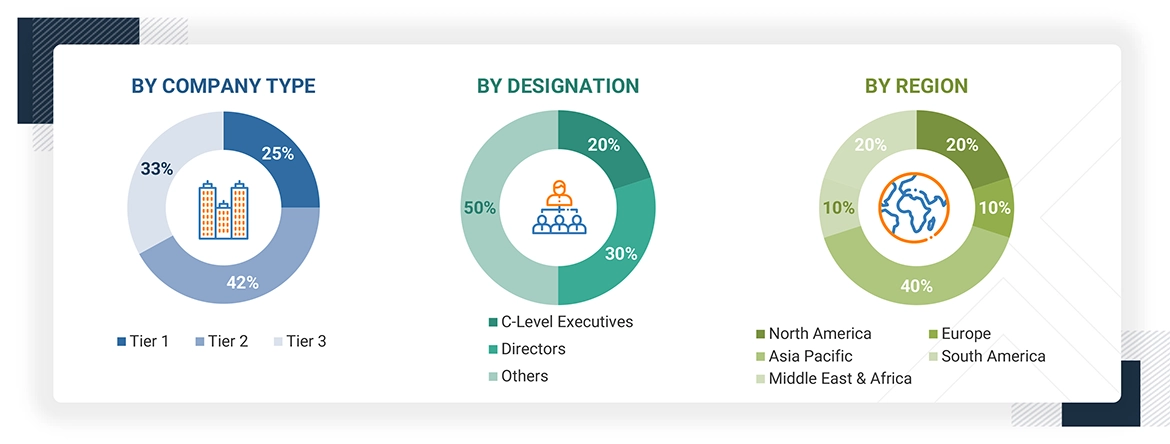

The following is the breakdown of primary respondents:

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 billion; Tier 2: USD 500 million to 1 billion; and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the elevators and escalators market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments of the elevators and escalators market. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

An elevator, also known as a lift, serves as a technological solution for vertical transportation, facilitating the movement of individuals or goods between different levels of a building, vessels, or other structures. Typically powered by electric motors, elevators employ either traction cables or counterweight systems, such as hoists or hydraulic pumps with cylindrical pistons (e.g., jacks). In contrast, an escalator functions as a vertical transportation method utilizing a continuously moving staircase. Operating on the principle of a conveyor transport device, an escalator comprises a motor-driven chain of interconnected steps that ascend or descend on tracks, ensuring that the step treads remain in a horizontal position.

Stakeholders

- Component Manufacturer and Suppliers

- Environmental Associations

- Consulting Companies in the Elevators & Escalators Industry

- Elevators & Escalator Manufacturers

- Traders and Distributors of Elevators & Escalators

- NGOs, Governments, Research Organizations, Investment Banks, Venture Capitalists, and Private Equity Firms

- End-use Industries

Report Objectives

- To define, analyze, and project the size of the elevators and escalators market in terms of value based on type, service, elevator technology, end-use industry, and region

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the market growth

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as product launches, expansions, and acquisitions, in the elevators and escalators market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Key Questions Addressed by the Report

What are the major drivers for the elevators and escalators market?

Increasing construction of high-rise buildings equipped with smart vertical transportation systems, driven by rapid urbanization and the need to reduce energy consumption.

What are the major challenges in the elevators and escalators market?

Adherence to standards and regulations.

What are the restraining factors in the elevators and escalators market?

Uncertainty regarding the global economy and high maintenance costs.

What is the key opportunity in the elevators and escalators market?

Implementation of green building codes, energy-efficient products, and innovative technologies driving demand for smart elevators.

What are the end-use industries where elevator and escalator components are used?

Residential, commercial, institutional, and infrastructure industries.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Elevators & Escalators Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Elevators & Escalators Market