Forklift Market

Forklift Market by Propulsion (Electric, ICE, Fuel Cell), Tonnage Capacity, End-Use Industry, by Class (1, 2, 31, 32, 4/5), Operation, Application, Battery Type (Li-ion, Lead Acid), Lifting Capacity, Tire, Product Type, Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

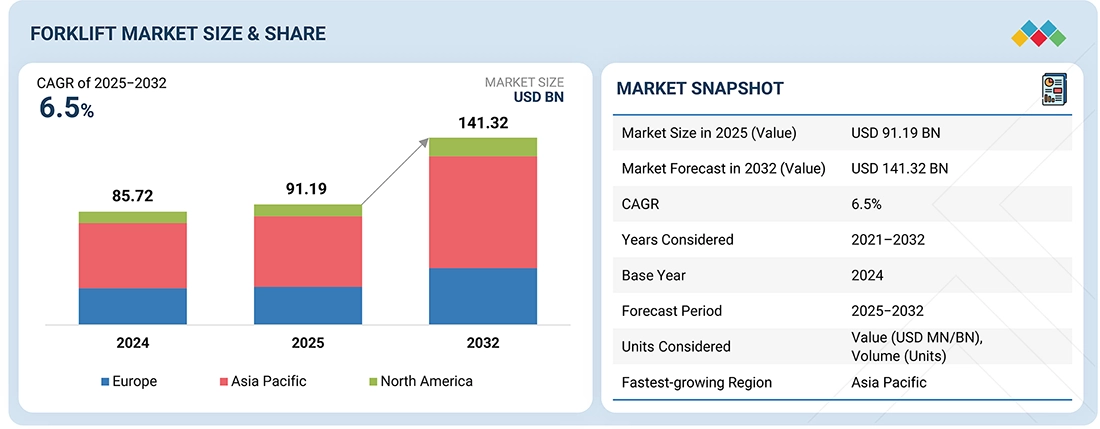

The global forklift market is projected to grow from USD 91.19 billion in 2025 to USD 141.32 billion by 2032 at a compound annual growth rate (CAGR) of 6.5%. The market is experiencing growth due to the rising demand for automated warehouses, the expansion of the e-commerce industry, and the increasing need for sustainable material handling equipment. The forklift market is experiencing rapid growth as e-commerce growth fuels demand for high-density, automated warehouses. This trend is driving strong adoption of narrow-aisle and automated forklift models that enable space optimization and can reduce labour costs by up to 30%. Leading OEMs are accelerating their shift to electric variants, supported by incentives such as the U.S. IRA’s USD 7,500 tax credit, with aftermarket telematics equipment delivering additional ROI via predictive maintenance and fleet analytics. However, supply chain bottlenecks for lithium batteries, more importantly, price volatility, and new emission regulations such as Euro Stage V present key challenges, potentially delaying increased adoption in emerging markets.

KEY TAKEAWAYS

-

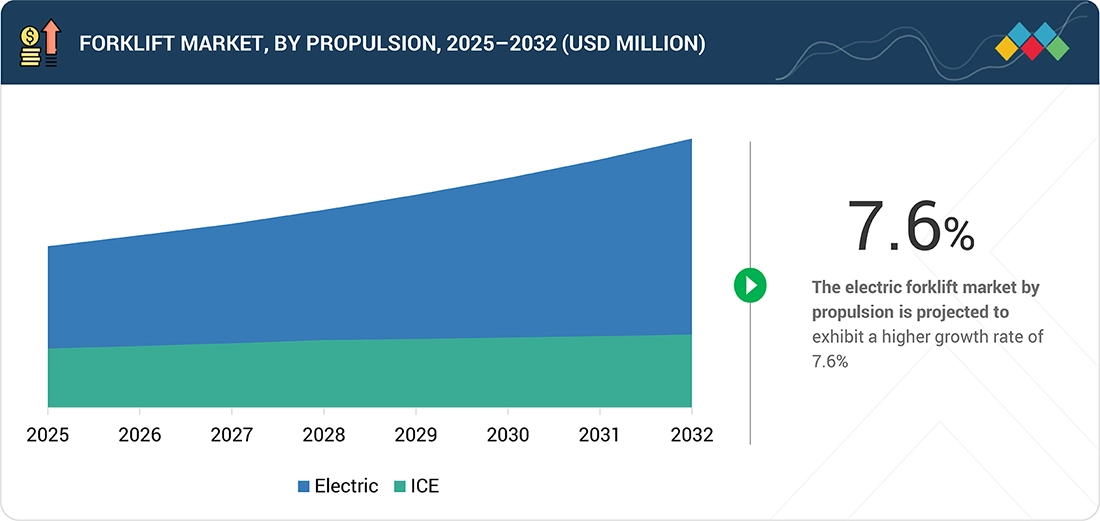

BY PROPULSIONForklifts have been categorized into two segments based on propulsion: electric and internal combustion engine (ICE). Electric forklifts are powered by lithium-ion and lead-acid batteries and are the fastest-growing segment, propelled by zero-emission mandates, government incentives, and their suitability for modern, indoor operations. Asia Pacific leads this shift, fuelled by rapid industrialization, surging e-commerce, and strong policy support from China, Japan, and India.

-

BY TONNAGE CAPACITYForklifts are segmented by tonnage capacity into four categories: below 5 tons, 5–10 tons, 11–36 tons, and above 36 tons. The below-5-ton segment is both the largest and fastest-growing lift-capacity segment due to its versatility in indoor, high-density warehouses and last-mile hubs. Demand accelerates as e-commerce and 3PL operators favor compact trucks that maneuver narrow aisles, pair easily with automation, and offer lower capex and operating costs.

-

BY END USE INDUSTRYThe forklift market, by end-use industry, has been segmented into third-party logistics (3PL), food & beverage, automotive, pulp & paper, metals & heavy machinery, e-commerce, aviation, semiconductors & electronics, chemical, healthcare, and others. The food & beverage industry is projected to hold a significant market share during the forecast period due to the diverse applications of forklifts in this industry. E-commerce is the fastest growing industry during the forecast period due shifting purchasing trends and availability of multiple e-marketplaces.

-

BY CLASSForklifts are categorized under five classes namely Class 1, Class 2, Class 31, Class 32 and Class 4/5. Class 32 is the largest forklift class in this segment due to popular demand in e-commerce and warehouse industry.

-

BY OPERATIONThe forklift market, by operation, has been segmented into manual and autonomous. The manual forklift segment is expected to hold a significant market share during the forecast period due to its affordability and ease of integration. The growth of autonomous forklifts is highest due to advantages such as reduced dependence on labour, increased efficiency, more accuracy, and high return on investments.

-

APPLICATIONThe forklift market, by application, has been segmented into indoor, outdoor, and indoor & outdoor (both) applications. The indoor segment is expected to hold a significant market share during the forecast period due to its application in the fast-moving goods industry. The indoor & outdoor segment is the fastest-growing segment due to its versatility and multiple uses.

-

BY BATTERY TYPEBased on battery type, the global forklift market has been segmented into lithium-ion and lead-acid batteries. The lithium-ion battery type is expected to hold the larger market share during the forecast period. Lithium-ion batteries hold the largest and fastest-growing share in the forklift market because they deliver higher energy density, longer life, rapid charging, and reduced maintenance compared to lead-acid batteries.

-

BY TIRE TYPEThe forklift market, by tire type, has been segmented into cushion and pneumatic tires. Cushion tires is the faster-growing segment because these tires are primarily used for indoor applications, and they are mostly made of smooth and flat surfaces. Pneumatic tires hold the largest market share in the forklift market because they deliver durability and superior performance on outdoor, rough, and uneven terrain.

-

BY PRODUCT TYPEThe forklift market, by product type, has been segmented into warehouse and counterbalance forklifts. The warehouse segment is both the largest and fastest growing due to its lower costs and multiple end uses.

-

REGIONThis study on the forklift market considers four major regions: Asia Pacific, Europe, North America, and the Rest of the World (RoW). Asia Pacific is the largest and fastest-growing segment. The growth of the forklift market in the Asia Pacific region is attributed to rapid industrialization, demand for sustainable warehouse solutions, and cost-efficient material handling solutions.

-

COMPETITIVE LANDSCAPEThe key players in the forklift market include Toyota Industries Corporation (Japan), Kion Group AG (Germany), Jungheinrich AG (Germany), Crown Equipment Corporation (US), and Mitsubishi Logisnext Co Ltd (Japan). These companies have adopted new product development and supply contract strategies to gain traction in the market.

The forklift market is poised for strong growth, supported by the advancement of industrialization in the Asia Pacific region and the rising demand for sustainable material handling technologies. Industries are increasingly adopting recycled electric and autonomous forklifts to balance their performance, low maintenance cost, and their material handling strengths.

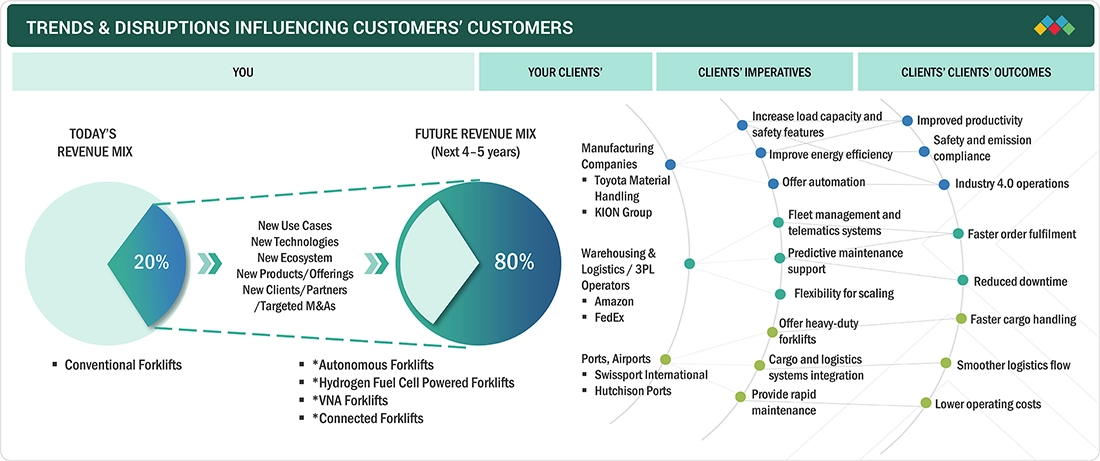

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The forklift market is observing a trend toward electric forklifts, automation, hydrogen fuel cells, and enhanced safety features. Forklifts are increasingly tailored for specific industries, such as cold chain logistics and urban delivery, with modular designs and smart warehousing solutions. Integration of IoT, AI, and other modular systems in the material handling equipment industry is driven by technological innovation and evolving industry demand across various application segments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid growth in e-commerce and warehousing industries

-

Government incentives and regulations pushing electric forklift growth

Level

-

Increase in third-party logistics (3PL) services

-

Increasing demand for stacker cranes

Level

-

Evolution of refurbished and rental forklifts

-

Modular solutions to optimize customer productivity

Level

-

High initial cost of electric forklifts

-

High integration and technology cost of autonomous forklifts

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid growth in e-commerce and warehousing industries

The e-commerce industry is witnessing strong growth due to the increasing number of online shoppers, driven by the widespread adoption of the internet and smartphones. Ease of shopping and a plethora of online marketplaces encourage consumers to shop online, leading to business-to-consumer (B2C) and business-to-business (B2B) e-commerce growth. The Asia Pacific region, particularly countries like China and India, leads the forklift market in both adoption and technological innovation. Overall, the forklift market’s core growth dynamic is the convergence of digital warehousing, automation, and rising demand for high-efficiency, resilient supply chains.

Restraint: Increasing demand for stacker cranes

Stacker cranes are utilized for pallet storage and retrieval in rack systems, offering several operational advantages. They can navigate through narrow aisles, which is not possible with forklifts due to the space required for manoeuvring. Since forklifts and stacker cranes are commonly used for similar tasks, stacker cranes have an added edge as they facilitate the storage and retrieval of goods at greater vertical heights. Hence, they are particularly suitable for warehouses with limited floor space but high vertical clearance, which has become a norm in the warehouse industry due to increased land costs. Additionally, stacker cranes offer enhanced safety because they operate on racks that provide stable support, reducing the risk of tipping.

Opportunity: Evolution of refurbished and rental forklifts

Forklift manufacturers frequently introduce newer forklift models. This updated model attracts customers who upgrade to a modern and advanced material handling solution. While some customers may purchase forklifts for the first time, most prefer to replace their old forklifts with the latest models. As a result, this creates a vast supply of used forklifts in the market. These used forklifts provide a quick return on investment and cost 40 to 60% less than the new models, even though they have shorter life spans, which makes them popular among various customers, like SMEs and new entrepreneurs who cannot afford new forklifts. Overall, the market for rental and refurbished forklifts is growing rapidly as businesses seek flexible, sustainable, and cost-effective solutions to meet the fast-changing demands of e-commerce, warehousing, and logistics.

Challenge: High initial cost of electric forklifts

Electric forklifts offer cost savings and environmental benefits, making them a more realistic choice. Despite this, the high initial cost of electric forklifts, which is almost 20% higher than conventional internal combustion models, poses a significant challenge, especially for small and medium-sized enterprises (SMEs). Although electric forklifts can ultimately provide a greater return on investment due to lower energy and maintenance costs, these benefits take years to realize. As a result, many SMEs find it difficult to switch to electric forklifts, irrespective of the benefits they offer. Therefore, the higher upfront costs of both electric and autonomous electric forklifts are a significant adoption barrier for companies with limited capital.

forklift market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A wide range of forklifts including electric, internal combustion, and automated models for multiple industries like retail, manufacturing, and logistics | Known for reliability, energy efficiency, seamless automation integration, and comprehensive customer support across all forklift types |

|

Manufactures intralogistics and warehouse automation equipment under brands like Linde, OM, and Baoli, covering diesel and electric forklifts across sectors such as manufacturing and e-commerce | Leads in digitalization and automation, offering solutions that reduce downtime and improve operational efficiency with green energy options |

|

Provides electric forklifts tailored for high-performance applications in wholesale, beverage, and manufacturing industries | Wide product range with models offering high load capacities, energy efficiency, durability, and innovative safety features like regenerative braking |

|

Focuses on automated forklifts and lift trucks equipped with advanced automation technologies for warehouse optimization | Combines advanced safety, operability, and energy efficiency with automation solutions to improve productivity and reduce labor shortages |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The major players in the forklift market are Toyota Industries Corporation (Japan), KION Group AG (Germany), Jungheinrich AG (Germany), Crown Equipment Corporation (US), and Mitsubishi Logisnext Co. Ltd. (Japan). They offer the latest technologies, diversified portfolios, and a robust distribution network worldwide.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Forklift Market, By Propulsion Type

ICE forklifts are expected to witness moderate growth during the forecast period. The Asia Pacific region is projected to account for the largest share of the ICE forklift market in terms of value. This is mainly because of the manufacturing sector's need to handle heavy materials. The region has strong manufacturing industries, including heavy metal and automotive, where large, heavy loads need to be handled. ICE forklifts are the viable choice for such operations. Moreover, the high switching cost from ICE to electric forklifts is restraining the incorporation of electric forklifts in this region.

Forklift Market, By Tonnage Capacity

In the tonnage capacity segment, below 5+D2 tons capacity forklifts dominate the market. Asia Pacific is estimated to have the largest market, in terms of value, for forklifts weighing above 36 tons. Kalmar. Toyota Material Handling, Hyster-Yale, and Komatsu are some of the leading players in heavy-duty forklifts. Kalmar DCG 180-330, Kalmar DCG 380-540, Toyota THD3000-24, Toyota THD4500-48, and H36-48XD by Hyster-Yale are some models in this category. However, a limited number of models are available with a load capacity of 36 tons and above.

Forklift Market, By End-Use Industry

The e-commerce and third-party logistics (3PL) end-use industries account for the largest market share. Demand in these industries is mainly driven by rising volumes of e-commerce sales worldwide. The growth of these segments is more pronounced in the Asia Pacific region, where very rapid industrialization and high investments in the warehousing industry are creating more demand for forklifts.

Forklift Market, By Class

By class, the forklift market is dominated by three classes, namely Class 1, Class 2, Class 31, and Class 32, which together constitute electric forklifts. The Asia Pacific region is projected to dominate the Class 4/5 forklift market. This is mainly because of the increasing demand for rough-terrain forklifts for heavy-duty outdoor applications. The growing e-commerce industry in the Asia Pacific region, along with the supporting economic factors, is driving the forklift market in this segment.

REGION

Asia Pacific to be the fastest-growing market for forklifts during the forecast period

The Asia Pacific region is projected to be the fastest-growing forklift market during the forecast period. Increasing e-commerce activities driven by rapid urbanization, infrastructure development, and economic growth are likely to continue to fuel the demand for forklifts in the region. In Asia Pacific, Class 32 forklifts have a major market share as they are predominantly used in warehouses and factories. China is projected to continue dominating the forklift market in this region during the forecast period, and the growth is attributed to the country's robust industrial base and fast-growing e-commerce market.

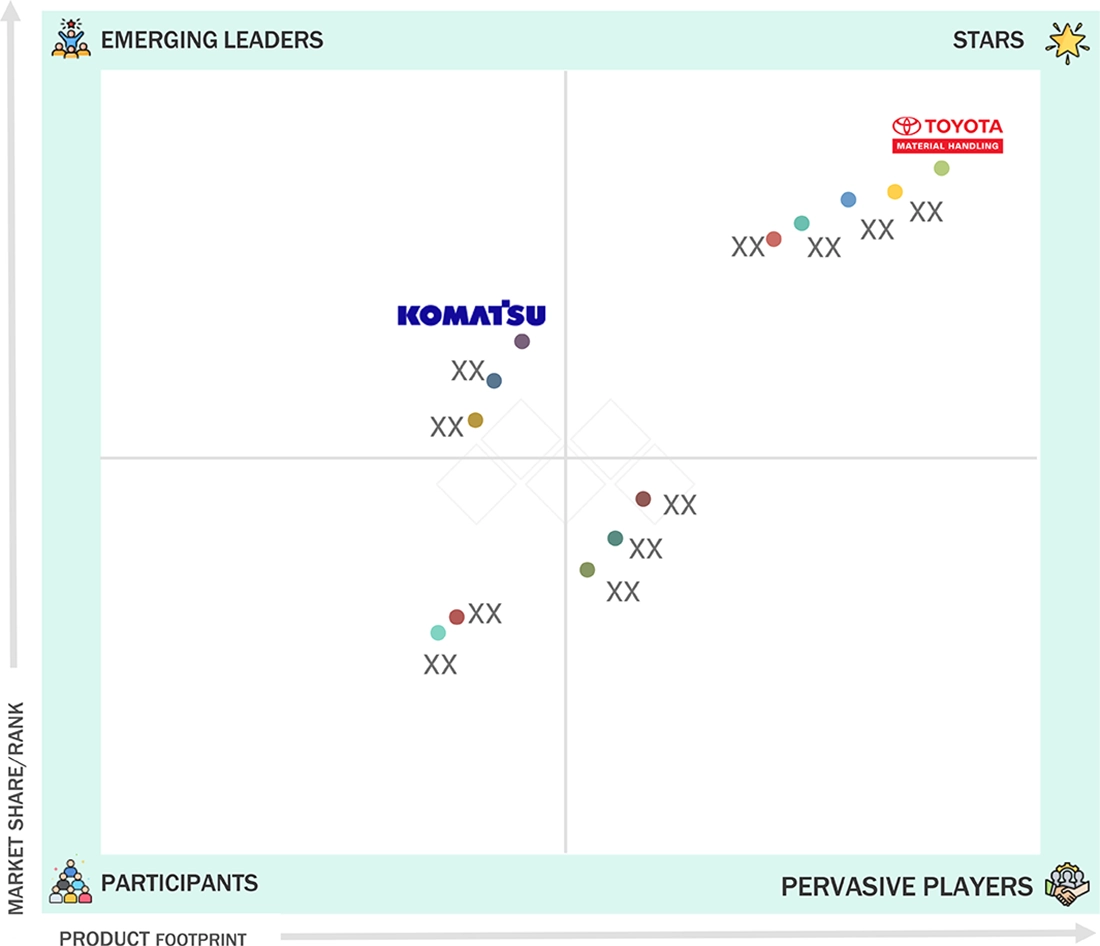

forklift market: COMPANY EVALUATION MATRIX

In the forklift market matrix, Toyota Material Handling Corporation (Star), a Japanese company, leads the market through its high-quality and reliable forklifts with a wide range of product portfolio, which find extensive applications in e-commerce, logistics, and the warehouse industry. Komatsu Ltd (Emerging Leader) is gaining traction with its technological advancements in the forklift market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 91.19 Billion |

| Market Size forecast in 2032 (Value) | USD 141.32 Billion |

| Growth Rate | CAGR of 6.5% from 2025 to 2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Million), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe, North America, Asia Pacific, Rest of the World |

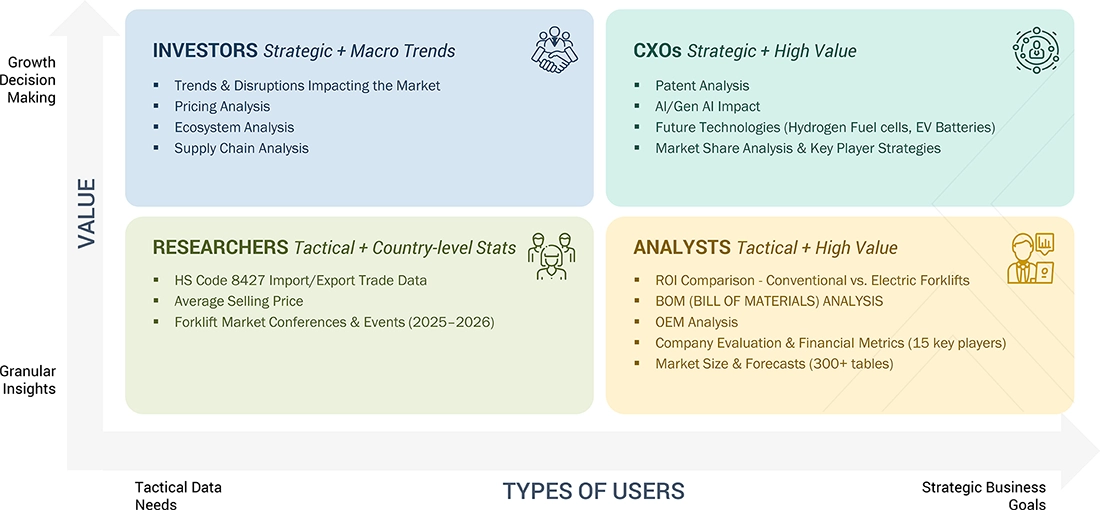

WHAT IS IN IT FOR YOU: forklift market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC and Global Forklift Manufacturer | Detailed company profiles covering financials, product portfolio, and innovations | Identified and profiled 25+ key forklift manufacturers. |

| Forklift Rental and Refurbished Equipment Player | Analysis of rental business models and impact on market growth | Detailed evaluation of rental players and regional rental markets |

RECENT DEVELOPMENTS

- May 2025 : Jungheinrich and Merantix announced a pioneering strategic partnership. The aim of the cooperation is to promote Artificial Intelligence (AI) based applications in the industry.

- January 2025 : KION Group teamed up with NVIDIA and Accenture to develop AI-powered robots and digital twins for smarter warehouses.

- January 2024 : Hyster-Yale Materials Handling announced its partnership with PortxGroup. The partnership puts PortxGroup as the only Hyster-Yale dealer in Thailand, Malaysia, Indonesia, and South Korea’s seaports and terminals.

- June 2024 : Toyota Material Handling Japan (TMHJ), a division of Toyota Industries Corporation and Fujitsu Limited (Fujitsu), announced a joint development of AI Forklift Driving Analysis service which evaluates the safety of forklift driving in the cloud, combining TMHJ's logistics expertise with the AI service Fujitsu Kozuchi on Fujitsu Data Intelligence PaaS.

Table of Contents

Methodology

The research study involved extensive use of secondary sources such as company annual reports/presentations, industry association publications, industrial vehicle magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases to identify and collect information on the forklift market. Primary sources—experts from related industries, including forklift OEMs, battery, and other component suppliers —were interviewed to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements), white papers, certified publications, articles by recognized authors, directories, databases, and industry organizations like the Industrial Truck Association (ITA), Material Handling Industry (MHI), and the International Warehouse Logistics Association (IWLA). The secondary data was collected and analyzed to determine the overall market size, which was further validated through primary research.

Primary Research

Primary interviews have been conducted with market experts from demand (OEM) and supply-side players across four major regions: North America, Europe, Asia Pacific, and the Rest of the World. Approximately 20% of interviews have been conducted from the demand side (end-users such as warehouses, distribution centers, logistics hubs, etc.), while 80% of primary interviews have been conducted from the supply side (OEMs). The primary data was collected through questionnaires, e-mails, and telephone interviews. In the canvassing of primaries, various departments within organizations, such as sales and operations, have been covered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from primary interviews. This, along with the opinions of the in-house subject matter experts, led to the findings described in the remainder of this report.

Note: Company types are based on the supply chain, and the value chain is not considered. Other company types include forklift suppliers (OEMs) and distributors. Other designations include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Market Size Estimation Methodology-Bottom-up approach

The bottom-up approach has been used to estimate and validate the size of the forklift market. In this approach, the country-level sales of forklifts (in units) have been derived from secondary sources and various databases and validated through primary interviews. Further, the country-level penetration of forklifts by class (Class 1, Class 2, Class 3 (Class 31 & Class 32), and Class 4/5) has been derived. The country-level sales of forklifts (in units) have been further multiplied by the penetration of each forklift class type. The forecast has been analyzed based on micro and macro-economic factors such as countries' economic growth and GDP forecast trends, e-commerce industry growth, emission regulations, supply chain and logistics trends, and technological advancements. Through this, the forklift market volume, by class, has been derived for each country. The summation of country-level markets provided the regional-level markets. The further summation of regional-level markets provided the global forklift market in terms of volume (units) by region and class. A similar approach has been followed to analyze the country-level forklift market, by operation.

Market Size Estimation Methodology- Top-down approach

The top-down approach has been followed to determine the market size by application, end-use industry, tire type, propulsion, and tonnage capacity in terms of volume and value for forklifts. The region-wise forklift market volume and value (Asia Pacific, North America, Europe, and the Rest of the World) have been derived from the global forklift market. The percentage share of forklifts by application, end-use industry, tire type, propulsion, and tonnage capacity has been derived from secondary sources and validated through primaries. It has been further multiplied by the region-wise forklift market volume and value. The forecast has been analyzed based on micro and macro-economic factors such as countries' economic growth and GDP forecast trends, e-commerce industry growth, emission regulations, supply chain and logistics trends, and technological advancements. The market volume and value for forklifts by application, end-use industry, tire type, propulsion, and tonnage capacity have been derived through this. The summation of all region-wise markets has been carried out to obtain the total market for forklifts by application, end-use industry, tire type, operation, propulsion, and tonnage capacity in terms of volume (units) and value (USD million).

Forklift Market : Top-Down and Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report. The following figure illustrates the overall market size estimation process employed for this study.

Market Definition

A forklift is an industrial vehicle with an attached, power-operated forked platform that can be raised and lowered to fit underneath cargo to lift or transfer it. Forklifts are used in many industries, including big storage facilities like warehouses. Combustion engines and electric battery-powered forklifts are available in the market. This equipment is widely utilized throughout various sectors for transporting materials and goods.

Stakeholders

- Forklift System Manufacturers and Suppliers

- Forklift Cameras, Controllers, Sensors, and Other Component Suppliers

- Forklift Technology Providers

- Forklift Rental Fleet Owners

- Forklift Dealers and Distributors

- Autonomous Forklift Solution Providers

- Material Handling Associations, Forums, and Alliances

- Government Agencies and Policymakers

- Global Industrial Vehicle and Container Handler Associations

Report Objectives

-

To define, describe, and forecast the forklift market in terms of value and volume based on the following segments:

- By tonnage capacity (below 5 tons, 5–10 tons, 11–36 tons, and above 36 tons)

- By application (indoor, outdoor, and indoor & outdoor)

- By class (Class 1, Class 2, Class 3, and Class 4/5)

- By end-use industry (Third-party logistics (3PL), food & beverage, automotive, pulp & paper, metals and heavy machinery, e-commerce, aviation, semiconductors & electronics, chemicals, healthcare, and others)

- By propulsion (electric, ICE, fuel cells)

- By operation (manual and autonomous)

- By type (warehouse and counterbalance)

- Electric forklift, by battery type (lithium-ion and lead-acid)

- Electric forklift market, by lifting capacity (below 2 tons, 2–5 tons, above 5 tons)

- By tire type (cushion and pneumatic)

- Electric Forklift by Lifting Capacity (Below 2 tons, 2–5 tons, and Above 5 tons)

- By region (Asia Pacific, Europe, North America, and the Rest of the World)

- To provide detailed information about the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market concerning individual growth trends, prospects, and contributions to the total market

- To strategically analyze the competitive landscape, prepare a company evaluation matrix for the players operating in the global market, evaluate the share/rankings based on product footprints of leading market players, and position them on the 2x2 quadrant. Also, analyze the competitive landscape of forklift manufacturers' start-ups/ SMEs, evaluate them based on product footprint, and position them on the 2x2 quadrant

- To strategically analyze the market in terms of value chain, case study analysis, patent analysis, revenue analysis, OEM analysis, total cost of ownership, ecosystem analysis, trends/disruptions impacting buyers, pricing analysis, technology analysis, and regulatory analysis in the forklift market

- To track and analyze competitive developments, such as product launches, deals, and other activities by key industry participants

- To examine the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Profiles of additional market players (up to 5)

FORKLIFT MARKET BY TONNAGE CAPACITY AT COUNTRY LEVEL (For countries covered in the report)

- Below 5 Tons

- 5–10 Tons

- 11–36 Tons

- Above 36 Tons

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Forklift Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Forklift Market

Amey

Nov, 2019

Hello - can you please tell me the extent of the historical data available in this report? Thank you..

Amey

Nov, 2019

I performed a market survey for 38 FLT fleet customers and would like to summarize the gathered data in SWOT presentation. I appreciate if can send me a PowerPoint sample presentation to my personal e.mail .

User

Jul, 2019

Hi. I am interested to understand if you have United States forklift historical data by class for each state and also at each county level. Thank you. .

Atul

Jun, 2019

I would llike to have market information regarding forklift and machinery in general for Central America, The Caribbean, Colombia and Latin America in general. .

Akshit

Jun, 2019

We are Forklift Truck Arm Manufacturer. We have a factory in USA. We want to find the size of the AFTER Market for Forklift Truck in USA..

Atul

Jun, 2019

We are beginning a large-scale marketing effort with a new entrant into the market. This seems like an invaluable source of information, but having not used your services in the past, a sample would be greatly appreciated..