Industrial Filters Market by Type (Liquid and Air Filter Media), End-use Industry (Food & Beverage, Metal & Mining, Chemical, Pharmaceutical, and Power Generation), and Region (APAC, Europe, North America, MEA, and SA) - Global Forecast to 2023

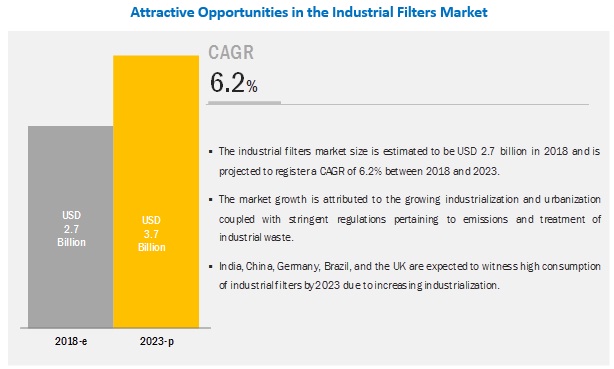

[130 Pages Report] The industrial filters market size is expected to grow from USD 2.7 billion in 2018 to USD 3.7 billion by 2023, at a CAGR of 6.2% during the forecast period. Growing industrialization and urbanization is a major factor driving the industrial filters market. The requirement of a safe working environment in industrial facilities is also driving the demand for industrial filters.

By type, the liquid filter media segment is expected to be the largest segment of the industrial filters market during the forecast period.

The liquid filter media segment is expected to account for the larger market size during the forecast period. On the contrary, air filter media is expected to be the faster-growing segment during the forecast period. Degrading air quality and global warming have forced countries to impose strict air emission regulations on industries to reduce the pollutants released in the air. These stringent regulations are expected to drive the industrial air filters market during the forecast period.

By end-use industry, the market in the food & beverage end-use industry is growing at the fastest rate during the forecast period.

Food & beverage is the largest as well as the fastest-growing end-use industry of industrial filters, where water is required for washing, beverage production, and processing purposes. Filtration in the food & beverage industry is a highly critical process. Increased food safety concerns, the addition of new product lines by various companies, and growing population are expected to boost the demand for industrial filters in this industry.

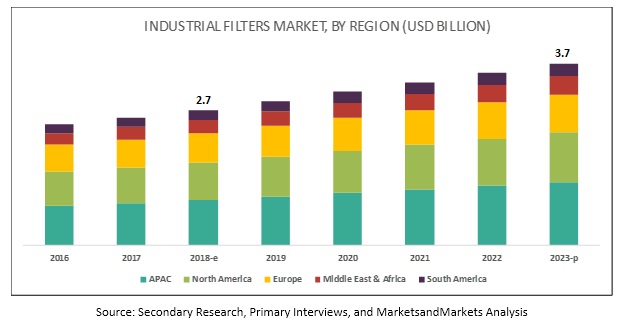

APAC is expected to account for the largest market size during the forecast period

APAC is the major revenue generating region in the global industrial filters market. The region is experiencing growth of various industries owing to the growing population. Growing industrialization and urbanization fuels the growth of the industrial filters market in APAC. Stringent government norms pertaining to emission and treatment of industrial waste in the region are also driving the industrial filters market.

Key Market Players

The key players in the industrial filters market are Valmet Corporation (Finland), Lydall Inc. (US), 3M (US), Ahlstrom-Munksjo (Finland), Clear Edge Filtration Group (US), Nordic Air Filtration (Denmark), Fibertex Nonwoven (Denmark), Sefar AG (Switzerland), Freudenberg Filtration Technologies (Germany), and Sandler AG (Germany). Valmet has a strong portfolio of filter fabrics solutions that are used in several end-use industries such as mineral, mining, chemical, pulp & paper, and food & beverage. Its strong focus on R&D helps in delivering innovative products.

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

|

|

Base year |

2017 |

|

Forecast period |

20182023 |

|

Units considered |

Value (USD Million) |

|

Segments |

Type, End-use Industry, and Region |

|

Regions |

North America, APAC, Europe, the Middle East & Africa, and South America |

|

Companies |

Valmet Corporation (Finland), Lydall Inc. (US), 3M (US), Ahlstrom-Munksjo (Finland), Clear Edge Filtration Group (US), Nordic Air Filtration (Denmark), Fibertex Nonwoven (Denmark), Sefar AG (Switzerland), Freudenberg Filtration Technologies (Germany), and Sandler AG (Germany). |

This research report categorizes the industrial filters market based on type, end-use industry, and region.

On the basis of type, the industrial filters market has been segmented as follows:

- Liquid Filter Media

- Woven Fabrics

- Monofilament

- Multifilament

- Nonwoven Fabrics

- Melt Blown

- Needle Felt

- Mesh

- Woven Fabrics

- Air Filter Media

- Nonwoven Fabrics

- Fiberglass

- Activated Carbon

- Filter Paper

- Metal

- Others

On the basis of end-use industry, the industrial filters market has been segmented as follows:

- Food & Beverage

- Metal & Mining

- Chemical

- Pharmaceutical

- Power Generation

- Others (Textile and Pulp & Paper)

On the basis of region, the industrial filters market has been segmented as follows:

- Europe

- North America

- APAC

- Middle East & Africa

- South America

Recent Developments

- In November 2018, Ahlstrom-Munksjo launched a highly durable air filtration media, Ahlstrom-Munksjo Extia 1000. It will increase the filtration lifetime by more than 40% which will further help customers to extend operational duration before changing the filters.

- In October 2018, Fibertex Nonwoven planned to invest in a nonwovens production line for filter media. This new production line will use various polymers for the production of polyurethane (PU), polyvinylidene fluoride (PVDF), and polyamide (PA) for a wide range of applications.

- In August 2018, Hengst, the parent company of Nordic Air Filtration, acquired DELBAG, a German manufacturer of industrial filters products. This will further strengthen the company's position in the industrial filters segment and will also help the company to offer a wider range of products.

Critical questions the report answers:

- Are there any upcoming hot bets for the industrial filters market?

- How are the market dynamics for different types of industrial filters?

- What are the upcoming opportunities for different types of industrial filters in emerging economies?

- What are the significant trends in end-use industries influencing the industrial filters market?

- Who are the major manufacturers of industrial filters?

- What are the factors governing the industrial filters market in each region?

Frequently Asked Questions (FAQ):

How industrial filters is different from other types of filtration market?

Industrial filters market report covers filter media available in the market as woven fabrics, non woven fabrics, mesh, fiber glass, activated carbon, and filter paper. These material are used to separate pollutants and other harmful substances present in both the liquid and air.

What are some of the novel end-use industries and applications for industrial filters?

These industrial filters are used in industries such as food and beverage (Soft drinks and water), metal and mining (lubricant cleaning, lubricant, and water), chemicals, pharmaceutical, power generation, pulp and paper, and textile.

What are the factors influencing the growth of Industrial filters?

Growing demand for industrial filters is owing to growing industrialization and urbanization, stringent regulations pertaining to emission and treatment of industrial waste, and requirement of safe working environment in industrial facilities.

Who are the major manufacturers?

Major manufactures include, Valmet Corporation (Finland), Lydall Inc. (US), Ahlstrom- Munksjo (Finland), Clear Edge Filtration Group (Us), Nordi Filtration (Denmark), and Sefar AG (Switzerland).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regions Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

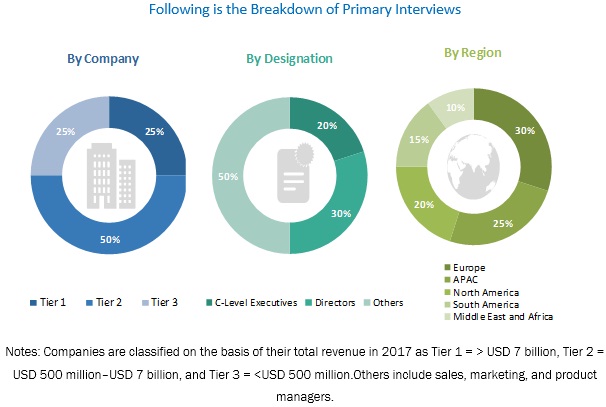

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Limitations

2.5 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Industrial Filters Market

4.2 Liquid Filter Media Market, By Type

4.3 Air Filter Media Market, By Type

4.4 Industrial Filters Market, By End-Use Industry

4.5 Industrial Filters Market, By Region

4.6 APAC Industrial Filters Market, By End-Use Industry and Country

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Industrialization and Urbanization

5.2.1.2 Stringent Regulations Pertaining to Emission and Treatment of Industrial Waste

5.2.1.3 The Requirement of A Safe Working Environment in Industrial Facilities

5.2.2 Restraints

5.2.2.1 Increasing Demand for Renewable Energy Sources

5.2.3 Opportunities

5.2.3.1 The Growing Manufacturing Sector in Southeast Asia

5.3 Porters Five Forces Analysis

5.3.1 Bargaining Power of Buyers

5.3.2 Bargaining Power of Suppliers

5.3.3 Threat of New Entrants

5.3.4 Threat of Substitutes

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

6 Industrial Filters Market, By Type (Page No. - 40)

6.1 Introduction

6.2 Liquid Filter Media

6.2.1 Woven Fabrics

6.2.1.1 Monofilament

6.2.1.1.1 The High Flow Rate and Fewer Chances of Product Contamination are Expected to Drive the Demand for Monofilament Fabrics

6.2.1.2 Multifilament

6.2.1.2.1 Low-Flammability and Low Shrinkage of Multifilament Fabrics are Likely to Drive Its Demand

6.2.2 Nonwoven Fabrics

6.2.2.1 Melt Blown

6.2.2.1.1 The Wide Range of Product Characteristics is Expected to Fuel Its Demand in Several End-Use Industries

6.2.2.2 Needle Felt

6.2.2.2.1 Higher Strength and Less Air Permeability are Increasing the Demand for Needle Felt

6.2.3 Mesh

6.2.3.1 Durability and Corrosion Resistivity of Mesh are Augmenting the Industrial Filters Market

6.3 Air Filter Media

6.3.1 Nonwoven Fabrics

6.3.1.1 Absorbency and Elasticity of Nonwoven Fabrics are Boosting Its Demand

6.3.2 Fiberglass

6.3.2.1 High Strength and Design Flexibility Among Other Properties Ensure the Optimum Performance of Fiberglass

6.3.3 Activated Carbon

6.3.3.1 High Porosity and Large Surface Area of Activated Carbon Make It Suitable for A Wide Range of Industrial Applications

6.3.4 Filter Paper

6.3.4.1 Particle Retention, Volumetric Flow Rate, Compatibility, Porosity, and Wet Strength of Filter Paper are Driving Its Demand

6.3.5 Metal

6.3.5.1 Metal Filter Media Can Be Cleaned and Re-Used, Making It Suitable for Various Applications in the Chemical Processing, Refining, and Pharmaceutical Industries

6.3.6 Others

7 Industrial Filters Market, By End-Use Industry (Page No. - 49)

7.1 Introduction

7.2 Food & Beverage

7.2.1 Stringent Regulations and Norms Related to Food Production are Propelling the Demand for Industrial Filters

7.3 Metal & Mining

7.3.1 Stringent Environmental Regulations Pertaining to Water Consumption are Driving the Market in This End-Use Industry Segment

7.4 Chemical

7.4.1 Growing Chemical Industry is One of the Major Drivers for the Market

7.5 Pharmaceutical

7.5.1 Increased Need for Air and Water Filtration is A Governing Factor for the Market

7.6 Power Generation

7.6.1 Meeting Environmental Regulations, Coupled With Maintaining the Performance of Equipment is Critical to the Growth of This Segment

7.7 Others

8 Industrial Filters Market, By Region (Page No. - 57)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.1.1 Growing Population and Increasing Industrialization are Driving the Industrial Filters Market

8.2.2 India

8.2.2.1 Rapid Growth in the Industrial Sector is Propelling the Industrial Filters Market

8.2.3 Japan

8.2.3.1 Growth in the Food & Beverage and Pharmaceutical Industries is Boosting the Market

8.2.4 Australia

8.2.4.1 Increased Demand From Metal & Mining and Food & Beverage Industries is Fueling the Market

8.2.5 Rest of APAC

8.3 North America

8.3.1 US

8.3.1.1 Large Industrial Base and Stringent Environmental Regulations are Expected to Favor the Growth of the Industrial Filters Market

8.3.2 Canada

8.3.2.1 Demand From the Chemical and Metal & Mining Industries is Driving the Market

8.3.3 Mexico

8.3.3.1 Growing Population and Urbanization in Mexico are Contributing to the Increase in Demand for Industrial Filters

8.4 Europe

8.4.1 Germany

8.4.1.1 The Presence of A Large Industrial Base is Leading to Market Growth

8.4.2 UK

8.4.2.1 The Growth of the Food & Beverage and Mining Industries is Augmenting the Industrial Filters Market

8.4.3 France

8.4.3.1 The Food & Beverage and Metal & Mining Industries are the Key Drivers for the Market

8.4.4 Russia

8.4.4.1 There is A Huge Demand for Industrial Filters From the Countrys Metal & Mining Industry

8.4.5 Spain

8.4.5.1 Rising Environmental Concerns, Along With Favorable Government Regulations for Industrialization are Influencing the Industrial Filters Market

8.4.6 Italy

8.4.6.1 Rapid Industrialization is Generating A Positive Impact on the Market

8.4.7 Rest of Europe

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.1.1 Growing Industrialization and Water Scarcity are Supporting the Demand for Industrial Filters

8.5.2 UAE

8.5.2.1 The Growth of the Chemical and Mining Industries is Spurring the UAE Market

8.5.3 Qatar

8.5.3.1 The Large Production of Chemicals, Oil, and Gas in the Country is Leading to the Industrial Filters Market Growth

8.5.4 South Africa

8.5.4.1 Growing Population and Foreign Investments to Boost Industrialization are Affecting the Market Positively

8.5.5 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.1.1 Strong Industrial Base in the Country is Impacting the Industrial Filters Market

8.6.2 Chile

8.6.2.1 The Growth of the Metal & Mining Industry is Expected to Drive the Industrial Filters Market

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 92)

9.1 Introduction

9.2 Competitive Leadership Mapping, 2018

9.2.1 Terminology/Nomenclature

9.2.1.1 Visionary Leaders

9.2.1.2 Innovators

9.2.1.3 Dynamic Differentiators

9.2.1.4 Emerging Companies

9.2.2 Strength of Product Portfolio

9.2.3 Business Strategy Excellence

9.3 Ranking of Key Players

9.3.1 Valmet Corporation

9.3.2 Lydall Inc.

9.3.3 Ahlstrom-Munksjo

9.3.4 Sefar AG

9.3.5 Clear Edge Filtration Group

9.4 Competitive Scenario

9.4.1 Investment & Expansion

9.4.2 Acquisition

9.4.3 New Product Launch

10 Company Profiles (Page No. - 101)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Valmet Corporation

10.2 Lydall Inc.

10.3 3M

10.4 Ahlstrom-Munksjo

10.5 Clear Edge Filtration Group

10.6 Nordic Air Filtration

10.7 Fibertex Nonwoven

10.8 Sefar AG

10.9 Freudenberg Filtration Technologies

10.10 Sandler AG

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

10.11 Other Companies

10.11.1 Andritz Group

10.11.2 American Fabric Filter

10.11.3 Apc Filtration

10.11.4 Hollingsworth & Vose

10.11.5 Schweitzer-Mauduit International, Inc

10.11.6 Kimberly-Clark Corporation

10.11.7 Norafin Industries

10.11.8 Eagle Nonwovens Inc.

10.11.9 Mann+Hummel

10.11.10 Johns Manville Corporation

10.11.11 Irema Ireland

11 Appendix (Page No. - 123)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (68 Tables)

Table 1 Trends and Forecast of GDP Per Capita, By Country, 20162020 (USD)

Table 2 Industrial Filters Market Size, By Type, 20162023 (USD Million)

Table 3 Liquid Filter Media Market Size, By Type, 20162023 (USD Million)

Table 4 Air Filter Media Market Size, By Type, 20162023 (USD Million)

Table 5 Industrial Filters Market Size, By End-Use Industry, 20162023 (USD Million)

Table 6 Market Size in Food & Beverage, By Region, 20162023 (USD Million)

Table 7 Industrial Filters Market Size in Metal & Mining, By Region, 20162023 (USD Million)

Table 8 Market Size in Chemical, By Region, 20162023 (USD Million)

Table 9 Industrial Filters Market Size in Pharmaceutical, By Region, 20162023 (USD Million)

Table 10 Market Size in Power Generation, By Region, 20162023 (USD Million)

Table 11 Industrial Filters Market Size in Other End-Use Industries, By Region, 20162023 (USD Million)

Table 12 Market Size, By Region, 20162023 (USD Million)

Table 13 APAC: Industrial Filters Market Size, By Country, 20162023 (USD Million)

Table 14 APAC: Market Size, By Type, 20162023 (USD Million)

Table 15 APAC: Liquid Filter Media Market Size, By Type, 20162023 (USD Million)

Table 16 APAC: Air Filter Media Market Size, By Type, 20162023 (USD Million)

Table 17 APAC: Industrial Filters Market Size, By End-Use Industry, 20162023 (USD Million)

Table 18 China: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 19 India: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 20 Japan: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 21 Australia: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 22 Rest of APAC: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 23 North America: Industrial Filters Market Size, By Country, 20162023 (USD Million)

Table 24 North America: Market Size, By Type, 20162023 (USD Million)

Table 25 North America: Liquid Filter Media Market Size, By Type, 20162023 (USD Million)

Table 26 North America: Air Filter Media Market Size, By Type, 20162023 (USD Million)

Table 27 North America: Industrial Filters Market Size, By End-Use Industry, 20162023 (USD Million)

Table 28 North America: Market Size in Food & Beverage, By Country, 20162023 (USD Million)

Table 29 North America: Market Size in Metal & Mining, By Country, 20162023 (USD Million)

Table 30 North America: Market Size in Chemical, By Country, 20162023 (USD Million)

Table 31 North America: Market Size in Pharmaceutical, By Country, 20162023 (USD Million)

Table 32 North America: Market Size in Power Generation, By Country, 20162023 (USD Million)

Table 33 US: Industrial Filters Market Size, By End-Use Industry, 20162023 (USD Million)

Table 34 Canada: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 35 Mexico: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 36 Europe: Industrial Filters Market Size, By Country, 20162023 (USD Million)

Table 37 Europe: Market Size, By Type, 20162023 (USD Million)

Table 38 Europe: Liquid Filter Media Market Size, By Type, 20162023 (USD Million)

Table 39 Europe: Air Filter Media Market Size, By Type, 20162023 (USD Million)

Table 40 Europe: Industrial Filters Market Size, By End-Use Industry, 20162023 (USD Million)

Table 41 Germany: Industrial Filters Market Size, By End-Use Industry, 20162023 (USD Million)

Table 42 UK: Industrial Filters Market Size, By End-Use Industry, 20162023 (USD Million)

Table 43 France: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 44 Russia: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 45 Spain: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 46 Italy: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 47 Rest of Europe: Industrial Filters Market Size, By End-Use Industry, 20162023 (USD Million)

Table 48 Middle East & Africa: Industrial Filters Market Size, By Country, 20162023 (USD Million)

Table 49 Middle East & Africa: Market Size, By Type, 20162023 (USD Million)

Table 50 Middle East & Africa: Liquid Filter Media Market Size, By Type, 20162023 (USD Million)

Table 51 Middle East & Africa: Air Filter Media Market Size, By Type, 20162023 (USD Million)

Table 52 Middle East & Africa: Industrial Filters Market Size, By End-Use Industry, 20162023 (USD Million)

Table 53 Saudi Arabia: Industrial Filters Market Size, By End-Use Industry, 20162023 (USD Million)

Table 54 UAE: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 55 Qatar: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 56 South Africa: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 57 Rest of Middle East & Africa: Industrial Filters Market Size, By End-Use Industry, 20162023 (USD Million)

Table 58 South America: Industrial Filters Market Size, By Country, 20162023 (USD Million)

Table 59 South America: Market Size, By Type, 20162023 (USD Million)

Table 60 South America: Liquid Filter Media Market Size, By Type, 20162023 (USD Million)

Table 61 South America: Air Filter Media Market Size, By Type, 20162023 (USD Million)

Table 62 South America: Industrial Filters Market Size, By End-Use Industry, 20162023 (USD Million)

Table 63 Brazil: Market Size, By End-Use Industry, 20162023 (USD Million)

Table 64 Chile: Industrial Filters Market Size, By End-Use Industry, 20162023 (USD Million)

Table 65 Rest of South America: Industrial Filters Market Size, By End-Use Industry, 20162023 (USD Million)

Table 66 Investment & Expansion, 20132018

Table 67 Acquisition, 20132018

Table 68 New Product Launch, 20132018

List of Figures (41 Figures)

Figure 1 Market Segmentation

Figure 2 Industrial Filters Market: Research Design

Figure 3 Industrial Filters Market: Bottom-Up Approach

Figure 4 Industrial Filters Market: Top-Down Approach

Figure 5 Industrial Filters Market: Data Triangulation

Figure 6 Liquid Filter Media Accounted for A Larger Market Share in 2017

Figure 7 Food & Beverage End-Use Industry Led the Industrial Filters Market in 2017

Figure 8 APAC to Register the Highest CAGR in the Industrial Filters Market

Figure 9 Growing Industrialization in the Emerging Economies to Drive the Industrial Filters Market

Figure 10 Woven Fabrics Segment to Dominate the Liquid Filter Media Market

Figure 11 Nonwoven Fabrics Segment to Be the Fastest-Growing Type of Air Filter Media

Figure 12 Food & Beverage to Be the Largest End-Use Industry of Industrial Filters

Figure 13 India to Register the Highest CAGR in the Industrial Filters Market

Figure 14 Food & Beverage End-Use Industry and China Accounted for the Largest Market Share in 2017

Figure 15 Drivers, Restraints, Opportunities, and Challenges: Industrial Filters Market

Figure 16 Release of Air Pollutants and Gross Value Added (GVA) for Industry, 20102016

Figure 17 Natural Gas Production, Worldwide, 2015

Figure 18 Southeast Asia GDP Growth Rate, 20142018

Figure 19 Low Bargaining Power of Suppliers Owing to A Large Number of Raw Material Suppliers in the Market

Figure 20 Air Filter Media to Register A Higher CAGR in the Industrial Filters Market

Figure 21 Woven Fabrics to Be the Largest Type of Liquid Filter Media

Figure 22 Nonwoven Fabrics to Be the Largest Type of Air Filter Media

Figure 23 Food & Beverage to Be the Leading End-Use Industry of Industrial Filters

Figure 24 APAC to Be the Largest Industrial Filters Market

Figure 25 India to Grow at the Fastest Rate During the Forecast Period

Figure 26 APAC: Industrial Filters Market Snapshot

Figure 27 North America: Industrial Filters Market Snapshot

Figure 28 Europe: Industrial Filters Market Snapshot

Figure 29 Companies Adopted Investment & Expansion as the Key Growth Strategy Between 2013 and 2018

Figure 30 Industrial Filters Market: Competitive Leadership Mapping, 2018

Figure 31 Valmet Corporation Led the Market in 2017

Figure 32 Valmet Corporation: Company Snapshot

Figure 33 Valmet Corporation: SWOT Analysis

Figure 34 Lydall Inc.: Company Snapshot

Figure 35 Lydall Inc.: SWOT Analysis

Figure 36 3M: Company Snapshot

Figure 37 3M: SWOT Analysis

Figure 38 Ahlstrom-Munksjo: Company Snapshot

Figure 39 Ahlstrom-Munksjo: SWOT Analysis

Figure 40 Clear Edge Filtration Group: SWOT Analysis

Figure 41 Fibertex Nonwoven: Company Snapshot

The study involves four major activities in estimating the current market size of industrial filters. Exhaustive secondary research was carried out to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, and databases.

Primary Research

The industrial filters market comprises several stakeholders, such as raw material suppliers, distributors of industrial filters, liquid and air filtration associations, filtration equipment manufacturers, and regulatory organizations in the supply chain. The demand side of this market consists of food & beverage, chemical, pharmaceutical, power generation, pulp & paper, textile, and metal & mining industries; whereas the supply side consists of industrial filters manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the industrial filters market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. Data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study:

- To analyze and forecast the industrial filters market size, in terms of value

- To provide detailed information about the key factors (drivers, restraints, and opportunities) influencing the market growth

- To define, describe, and forecast the market size by type and end-use industry

- To forecast the market size with respect to five regions, namely, Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as acquisition, new product launch, investment & expansion, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

Micromarkets are defined as subsegments of the industrial filters market included in the report.

Core competencies of the companies are determined in terms of their key developments and strategies adopted to sustain their position in the market.

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies along with the market data. The following customization options are available for this report:

Product Analysis

- A product matrix that provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of Rest of APAC industrial filters market

Company Information:

- Detailed analysis and profiles of additional market players.

Growth opportunities and latent adjacency in Industrial Filters Market