String Wound Filter Materials Market by Yarn Type (PP and Cotton), Core Materials (PP and Stainless Steel), End-Use Industry (Water & Wastewater Treatment, Chemical & Petrochemical, and Food & Beverage), and Region - Global Forecast to 2027

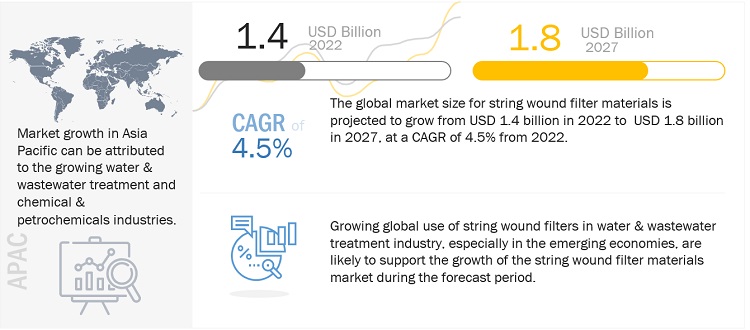

The market for String wound filter materials is approximated to be USD 1.4 billion in 2022, and it is projected to reach 1.8 billion by 2027 at a CAGR of 4.5%. String-wound filters, also known as depth filters. String wound filters use two layers of filtration to keep out unwanted particles. The first layer captures particles the same size or larger than the micron rating, while the inner layer captures smaller particles that pass through the first layer. This improved filtration comes at the expense of surface area, which means that depth filters must be cleaned/changed more frequently. The string wound filter uses fibres to remove rust, dirt, and other sediments from water. String materials include polypropylene, glass fiber, cotton, and others. It is wrapped around a centre core made of stainless steel or polypropylene. Due to its high dirt holding capacity and rugged construction, string wound filters are very popular in various end use industrie like water & wastewater treatment, chemical & petrochemicals and food & beverages

To know about the assumptions considered for the study, Request for Free Sample Report

String wound filter materials Market Dynamics

Driver: Increasing demand from end-use industries and government initiatives for stringent water treatment norms.

String wound filter cartridges are roll shaped and have high dirt holding capacity. String wound filters provide higher microorganism resistance, provide consistent performance, and are thus highly preferred by water & wastewater treatment industries. Owing to these properties and benefits of string wound filters over other filters, the demand of string wound filters is increasing in several end-use industries such as water & wastewater treatment and food & beverages. Governments all over the world are implementing policies to replace the inadequate water resources with alternative water supply interventions such as the reuse of wastewater. Reuse of treated wastewater has emerged as an economical and environmentally sustainable alternative. In regions such as Australia, California, US, etc. certain amount of wastewater reuse is mandatory as per the law.

Restraint: Problems related to media migration and chemical leaching affecting usability of string wound filters

Despite being low cost and the advantages that they offer, string wound filter cartridges also have specific operational difficulties such as media migration and chemical leaching which hampers their performance. String wound filters contain approximately 1% (weight basis) chemicals including resin binders, lubricants, antistatic, and release agents, which start leaching out when they are put into operation. They mix with the filtrate and reduce the efficiency of the filtration process.

Opportunities: Large-scale and growing demand for glass fiber string wound filters from chemical & petrochemical industry

The chemical & petrochemical industry is the largest consumer of string wound filters using glass fiber filters due to their compatibility with various chemicals and petrochemicals. Glass fiber string wound filters are relatively expensive and are preferred only for specific applications such as for high temperatures above 140 0C. The growing demand for chemicals and petrochemicals is encouraging manufacturers to set up new facilities or expand their existing facilities. This expansion of chemical and petrochemical industries may create opportunity for string wound filter materials.

Challenges: Availability of alternative filter media

String wound filters are a type of cartridge filter preferred for their high dirt-holding capacities and economical construction. However, there are different types of cartridge filters and other filtration technologies that compete with string wound filters. These include pleated filters, membrane filters, and melt blown filters. For instance, pleated filters are ideal for filtering fluids where particle sizes are less than 1µm. With technological advancements, these filters are expected to exhibit enhanced performance, which may result in increased competitiveness between the different filter media.

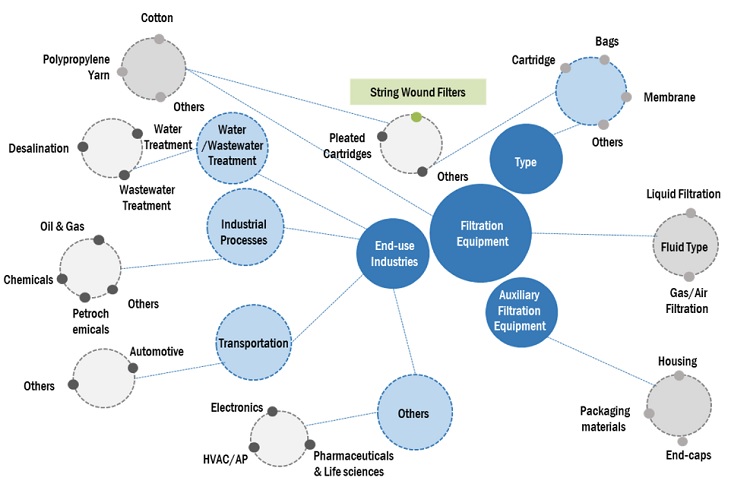

Ecosystem Diagram

By End Use Industry, food & beverage industry accounted for the highest CAGR during the forecast period

Demand for string wound filter materials market to be driven by increasing investment in food & beverage industry across the world especially in asia pacific region. Water & wastewater treatment, chemical & pertrochemical and food and beverage industries are the major end user of string wound filters. String wound filters are widely used in filtration of food ingredients and fluids in food & beverage industry. Food & beverage industry uses string wound filters made with FDA approved materials in their filtration process.

By Yarn Type, Polypropylene yarn accounted for the highest CAGR during the forecast period

Polypropylene yarn accounted for the highest CAGR during forecast period and also holds largest share in string wound filter materials yarn type and is followed by cotton yarn. The gowing demand from water & wastewater treatment industry especially in the coastal region for desalination process is helping the growth of polypropelene yarn type string wound filters.

By Core Material, Polypropylene accounted for the highest CAGR during the forecast period

Polypropylene core material accounted for the highest CAGR in the string wound filters during the forecast period. Polypropylene construction of central core offers excellent filtration and good thermal stability. Central core of string wound filters are designed and made with polypropylene for high strength and high flow rates applications where stainless steel or any ather core materials cannot be used.

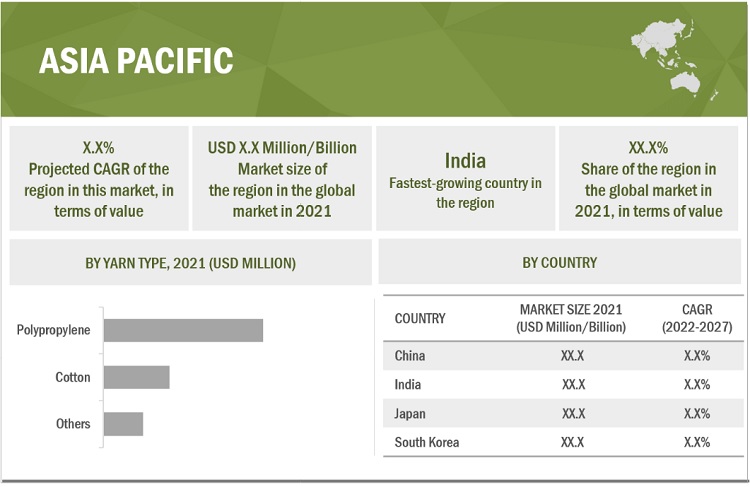

Asia Pacific is projected to account for the highest CAGR in the string wound filter materials market during the forecast period

The major string wound filter materials markets in Asia Pacific are China,Indai, Japan and South Korea. The water & wastewater treatment industry is the largest consumer of string wound filters in the region. The degradation of ecological environment due to its rapid social and economic growth and water pollution are the major challenges faced by the high growth countries like China and India. Due to this Asia Pacific has the largest and growing wastewater treatment market globally. India in Asia Pacific region accounted for highest CAGR in the string wound filter materials market, followed by China, South Korea and Japan, during the forecast period.

Key Market Players

String wound filter materials market comprises key manufacturers such as Schweitzer-Mauduit International, Inc. (SWM) (US), Coats Group Plc (UK), William Barnet and Son, LLC (US), Micronics Engineered Filtration Group, Inc. (US), MMP Filtration Pvt. Ltd. (India), East Asia Textile Technology Ltd. (China), STRADOM S.A (Poland) and United Filters International (US). Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the String wound filter materials market.

Scope of the report:

|

Report Metric |

Details |

|

Years Considered |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Unit considered |

Value (USD Million/USD Billion) and Volume (Tons) |

|

Segments |

By Yarn Type, By Core Material Type, By End Use Sector, and Region |

|

Regions |

North America, Europe, Asia Pacific, Rest of the World. |

|

Companies |

The major players are Schweitzer-Mauduit International, Inc. (SWM) (US), Coats Group Plc (UK), William Barnet and Son, LLC (US), Micronics Engineered Filtration Group, Inc. (US), MMP Filtration Pvt. Ltd. (India), East Asia Textile Technology Ltd. (China), STRADOM S.A (Poland) and United Filters International (US).and others are covered in the string wound filter materials market. |

This research report categorizes the global string wound filter materials market on the basis of Yarn Type, Core Material, End-Use, and Region.

String Wound Filter Materials Market, By Yarn Type

- Polypropylene Yarn

- Cotton Yarn

- Others

String Wound Filter Materials Market, By Core Material

- Polypropylene

- Stainless Steel

- Others

String Wound Filter Materials Market Market, By End Use

- Water & wastewater treatment

- chemical & petrochemicals

- Food & beverages

- Others

String Wound Filter Materials Market, By Region

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (ROW)

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In February 2022, Micronics Engineered Filtration Group, has acquired National Filter Media (NFM) and FilterFab. The acquisition of National Filter Media significantly expands Micronics’ portfolio of engineered filtration solutions.

- November 2021, Nitto Boseki Co., Ltd. starts operation of the new special glass factory in Taiwan with floor area approximately 20,000?. The main product produced at this plant is NE-glass yarn.

- In May 2021, Hyosung signed an MOU with the Busan Metropolitan Government and Netspa to recycle transparent PET bottles and produce the nylon fiber Mipan Regen Ocean from waste fishing nets.

- In April 2021, Schweitzer-Mauduit International, Inc. acquired Scapa Group Ltd, a UK-based innovation, design, and manufacturing solutions provider.

- In August 2020, Coats, the world’s leading industrial thread company, is partnering with HeiQ, a Swiss technology company, to incorporate HeiQ Viroblock technology into its engineered yarns.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the string wound filter materials market?

The string wound filter materials market is expected to witness significant growth in the future due to the increasing demand in emerging applications in the water & wastewater treatment industry. The growing desalination industry and replacement market for string wound filter cartridges are driving the string wound filter materials market.

What are the major challenges in the string wound filter materials market?

The major challenge in the string wound filter materials market is the availability of alternative filter media.

What are the restraining factors in the string wound filter materials market?

The major restraining factor faced by the string wound filter materials market are the problems related to media migration and chemical leaching, affecting usability of string wound filters

What is the key opportunity in the string wound filter materials market?

Large-scale & growing demand for glass fiber string wound filters from chemical & petrochemical industry and high growth in emerging economies such as Southeast Asian (SEA) countries presents a significant market opportunity for string wound filter materials manufacturers.

What are the end-use industries where string wound filter materials are used?

The string wound filter materials are majorly used in water & wastewater treatment, chemical & petrochemicals and food & beverages .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand from end-use industries and government initiatives for stringent water treatment norms- Growing desalination industry- Preference for string wound filters due to high dirt-holding capacity and low cost- Replacement market for string wound filter cartridgesRESTRAINTS- Problems related to media migration and chemical leaching affecting usability of string wound filtersOPPORTUNITIES- Growing demand for glass fiber string wound filters from chemical & petrochemical industry- High growth in emerging economies such as Southeast Asian (SEA) countriesCHALLENGES- Availability of alternative filter media

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRYTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTES

-

5.4 FACTORS AFFECTING SELECTION OF STRING WOUND FILTERSMATERIAL PARAMETERSDIMENSIONAL AND PERFORMANCE PARAMETERS

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 COST STRUCTURE AND PRICING ANALYSISCOST STRUCTUREPRICING ANALYSIS

-

5.7 CUSTOMER BUYING BEHAVIOR (NEEDS AND EXPECTATIONS, DECISION-MAKING PROCESS)PROCUREMENT VARIATION- New plant expansion- Repair and maintenance activities

-

5.8 YC AND YCC SHIFTCLIENT’S HOT BETSCLIENT’S CLIENTS IMPERATIVES

-

5.9 ECOSYSTEM MAPPING

- 5.10 CASE STUDY ANALYSIS

- 6.1 INTRODUCTION

- 6.2 POLYPROPYLENE

- 6.3 COTTON

- 6.4 OTHER YARN TYPES

- 7.1 INTRODUCTION

- 7.2 POLYPROPYLENE

- 7.3 STAINLESS STEEL

- 7.4 OTHERS

- 8.1 INTRODUCTION

- 8.2 WATER & WASTEWATER TREATMENT

- 8.3 FOOD & BEVERAGE

- 8.4 CHEMICAL & PETROCHEMICAL

- 8.5 OTHERS

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICCHINA- Presence of large-scale chemical & petrochemical manufacturing baseINDIA- Steady growth in chemical & petrochemical sector to increase demandJAPAN- Demand for string wound filter materials to be low during forecast periodSOUTH KOREA- Steady chemical & petrochemical industry to drive demandREST OF ASIA PACIFIC

-

9.3 NORTH AMERICAUS- Steady growth in water & wastewater treatment industry to drive marketCANADA- Population growth and growing water treatment infrastructure to boost demandMEXICO- Investments in wastewater treatment industry to increase demand

-

9.4 EUROPEGERMANYFRANCE- Uncertain end-use industry growth to hamper market growthUK- Sluggish demand for string wound filter materials to affect market growthITALY- Increased demand in water & wastewater treatment industry to drive marketREST OF EUROPE

-

9.5 REST OF THE WORLD (ROW)SAUDI ARABIA- Steady growth of chemical & petrochemical industry to drive demandBRAZIL- Demand for string wound filter materials to grow slowSOUTH AFRICA- Water & wastewater treatment industry to lead demand for string wound filter materialsREST OF MEA & SA

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES

-

10.3 COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSPARTICIPANTSEMERGING LEADERS

-

10.4 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSJOHNS MANVILLE- Business overview- Products/Solutions/Services offered- MnM viewCHINA JUSHI CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewCOATS GROUP PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNIPPON ELECTRIC GLASS CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsNITTO BOSEKI CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsTAIWAN GLASS INDUSTRY CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsMMP FILTRATION PVT. LTD.- Business overview- Products/Solutions/Services offered- MnM viewMICRONICS ENGINEERED FILTRATION GROUP, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewSCHWEITZER-MAUDUIT INTERNATIONAL, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsCHONGQING POLYCOMP INTERNATIONAL CORP.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewUNITED FILTERS INTERNATIONAL- Business overview- Products/Solutions/Services offered- MnM viewTORAY INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHYOSUNG CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsEAST ASIA TEXTILE TECHNOLOGY LTD.- Business overview- Products/Solutions/Services offeredWILLIAM BARNET & SON, LLC- Business overview- Products/Solutions/Services offeredSAINT-GOBAIN VETROTEX- Business overview- Products/Solutions/Services offered

-

11.2 OTHER PLAYERSAGY HOLDING CORP.TAISHAN FIBERGLASS INC. (CTG)GOPANI PRODUCT SYSTEMSFEATURE-TECHONGTEK FILTRATION CO., LTD.SHANGHAI MELKO FILTRATION CO., LTD.STRADOM S.A.AJR FILTRATIONSHELCO FILTERSCOLEMAN FILTER COMPANY, LLCTRINITY FILTRATION TECHNOLOGIES PVT. LTD.CLEANFLOW FILTERSVALIN CORPORATIONEATONOWENS CORNINGRELIANCE INDUSTRIES LTD.

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

-

12.3 INDUSTRIAL FILTRATION MARKETMARKET DEFINITIONMARKET OVERVIEWINDUSTRIAL FILTRATION MARKET, BY TYPEINDUSTRIAL FILTRATION MARKET, BY PRODUCTINDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA

-

12.4 MEMBRANE FILTRATION MARKETMARKET DEFINITIONMARKET OVERVIEWMEMBRANE FILTRATION MARKET, BY APPLICATIONMEMBRANE FILTRATION MARKET, BY MEMBRANE MATERIAL

- 12.5 MACROECONOMIC OVERVIEW

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 SELECTION CRITERIA FOR DIFFERENT TYPES OF CARTRIDGE FILTERS

- TABLE 2 COMPARISON OF DIFFERENT STRING WOUND FILTER TYPES

- TABLE 3 CHEMICAL COMPATIBILITY OF DIFFERENT STRING WOUND FILTER MATERIALS

- TABLE 4 STRING WOUND FILTER MATERIALS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 COST STRUCTURE: STRING WOUND FILTER MATERIALS MARKET

- TABLE 6 DIFFERENT YARN MATERIALS USED IN STRING WOUND FILTERS AND THEIR COMPATIBILITIES WITH FILTERED MATERIALS

- TABLE 7 STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 8 STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 9 POLYPROPYLENE YARN MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 10 POLYPROPYLENE YARN MARKET SIZE, BY REGION, 2020–2027 (TON)

- TABLE 11 COTTON YARN MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 12 COTTON YARN MARKET SIZE, BY REGION, 2020–2027 (TON)

- TABLE 13 OTHER YARN MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 14 OTHER YARN MARKET SIZE, BY REGION, 2020–2027 (TON)

- TABLE 15 STRING WOUND FILTER MATERIALS MARKET SIZE, BY CORE MATERIAL, 2020–2027 (MILLION UNITS)

- TABLE 16 STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 17 STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 18 STRING WOUND FILTER MATERIALS MARKET SIZE IN WATER & WASTEWATER TREATMENT, BY REGION, 2020–2027 (USD MILLION)

- TABLE 19 STRING WOUND FILTER MATERIALS MARKET SIZE IN WATER & WASTEWATER TREATMENT, BY REGION, 2020–2027 (TON)

- TABLE 20 STRING WOUND FILTER MATERIALS MARKET SIZE IN FOOD & BEVERAGE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 21 STRING WOUND FILTER MATERIALS MARKET SIZE IN FOOD & BEVERAGE, BY REGION, 2020–2027 (TON)

- TABLE 22 STRING WOUND FILTER MATERIALS MARKET SIZE IN CHEMICAL & PETROCHEMICAL, BY REGION, 2020–2027 (USD MILLION)

- TABLE 23 STRING WOUND FILTER MATERIALS MARKET SIZE IN CHEMICAL & PETROCHEMICAL, BY REGION, 2020–2027 (TON)

- TABLE 24 FILTER MATERIALS AND COMPATIBILITY WITH CHEMICALS

- TABLE 25 STRING WOUND FILTER MATERIALS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 26 STRING WOUND FILTER MATERIALS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2027 (TON)

- TABLE 27 STRING WOUND FILTER MATERIALS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 28 STRING WOUND FILTER MATERIALS MARKET SIZE, BY REGION, 2020–2027 (TON)

- TABLE 29 ASIA PACIFIC: STRING WOUND FILTER MATERIALS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 30 ASIA PACIFIC: STRING WOUND FILTER MATERIALS MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

- TABLE 31 ASIA PACIFIC: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 32 ASIA PACIFIC: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 33 ASIA PACIFIC: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 34 ASIA PACIFIC: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 35 CHINA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 36 CHINA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 37 CHINA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 38 CHINA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 39 INDIA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 40 INDIA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 41 INDIA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 42 INDIA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 43 JAPAN: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 44 JAPAN: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 45 JAPAN: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 46 JAPAN: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 47 SOUTH KOREA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 48 SOUTH KOREA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 49 SOUTH KOREA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 50 SOUTH KOREA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 51 REST OF ASIA PACIFIC: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 52 REST OF ASIA PACIFIC: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 53 REST OF ASIA PACIFIC: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 54 REST OF ASIA PACIFIC: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 55 NORTH AMERICA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

- TABLE 57 NORTH AMERICA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 58 NORTH AMERICA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 59 NORTH AMERICA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 60 NORTH AMERICA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 61 US: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 62 US: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 63 US: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 64 US: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 65 CANADA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 66 CANADA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 67 CANADA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 68 CANADA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 69 MEXICO: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 70 MEXICO: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 71 MEXICO: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 72 MEXICO: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 73 EUROPE: STRING WOUND FILTER MATERIALS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 74 EUROPE: STRING WOUND FILTER MATERIALS MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

- TABLE 75 EUROPE: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 76 EUROPE: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 77 EUROPE: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 78 EUROPE: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 79 GERMANY: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 80 GERMANY: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 81 GERMANY: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 82 GERMANY: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 83 FRANCE: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 84 FRANCE: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 85 FRANCE: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 86 FRANCE: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 87 UK: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 88 UK: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 89 UK: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 90 UK: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 91 ITALY: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 92 ITALY: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 93 ITALY: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 94 ITALY: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 95 REST OF EUROPE: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 96 REST OF EUROPE: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 97 REST OF EUROPE: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 98 REST OF EUROPE: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 99 ROW: STRING WOUND FILTER MATERIALS MARKET SIZE, BY KEY COUNTRIES, 2020–2027 (USD MILLION)

- TABLE 100 ROW: STRING WOUND FILTER MATERIALS MARKET SIZE, BY KEY COUNTRIES, 2020–2027 (TON)

- TABLE 101 ROW: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 102 ROW: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 103 ROW: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 104 ROW: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 105 SAUDI ARABIA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 106 SAUDI ARABIA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 107 SAUDI ARABIA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 108 SAUDI ARABIA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 109 BRAZIL: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 110 BRAZIL: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 111 BRAZIL: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 112 BRAZIL: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 113 SOUTH AFRICA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 114 SOUTH AFRICA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 115 SOUTH AFRICA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 116 SOUTH AFRICA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 117 REST OF MEA & SA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (USD MILLION)

- TABLE 118 REST OF MEA & SA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY YARN TYPE, 2020–2027 (TON)

- TABLE 119 REST OF MEA & SA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 120 REST OF MEA & SA: STRING WOUND FILTER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

- TABLE 121 STRING WOUND FILTER MATERIALS MARKET: DEGREE OF COMPETITION

- TABLE 122 STRATEGIC POSITIONING OF KEY PLAYERS

- TABLE 123 STRING WOUND FILTER MATERIALS MARKET: PRODUCT LAUNCHES, 2018 TO 2022

- TABLE 124 STRING WOUND FILTER MATERIALS MARKET: DEALS, 2018 TO 2022

- TABLE 125 STRING WOUND FILTER MATERIALS MARKET: EXPANSIONS, 2018 TO 2022

- TABLE 126 JOHNS MANVILLE: COMPANY OVERVIEW

- TABLE 127 CHINA JUSHI CO., LTD.: COMPANY OVERVIEW

- TABLE 128 CHINA JUSHI CO., LTD.: PRODUCT LAUNCHES

- TABLE 129 COATS GROUP PLC: COMPANY OVERVIEW

- TABLE 130 COATS GROUP PLC: DEALS

- TABLE 131 COATS GROUP PLC: OTHERS

- TABLE 132 NIPPON ELECTRIC GLASS CO., LTD.: COMPANY OVERVIEW

- TABLE 133 NIPPON ELECTRIC GLASS CO., LTD.: OTHERS

- TABLE 134 NITTO BOSEKI CO., LTD.: COMPANY OVERVIEW

- TABLE 135 NITTO BOSEKI CO., LTD.: OTHERS

- TABLE 136 TAIWAN GLASS INDUSTRY CORPORATION: COMPANY OVERVIEW

- TABLE 137 TAIWAN GLASS INDUSTRY CORPORATION: DEALS

- TABLE 138 TAIWAN GLASS INDUSTRY CORPORATION: OTHERS

- TABLE 139 MMP FILTRATION PVT. LTD.: COMPANY OVERVIEW

- TABLE 140 MICRONICS ENGINEERED FILTRATION GROUP, INC.: COMPANY OVERVIEW

- TABLE 141 MICRONICS ENGINEERED FILTRATION GROUP, INC: PRODUCT LAUNCHES

- TABLE 142 MICRONICS ENGINEERED FILTRATION GROUP, INC.: DEALS

- TABLE 143 MICRONICS ENGINEERED FILTRATION GROUP, INC.: OTHERS

- TABLE 144 SCHWEITZER-MAUDUIT INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 145 SCHWEITZER-MAUDUIT INTERNATIONAL, INC.: DEALS

- TABLE 146 CHONGQING POLYCOMP INTERNATIONAL CORP.: COMPANY OVERVIEW

- TABLE 147 CHONGQING POLYCOMP INTERNATIONAL CORP.: OTHERS

- TABLE 148 UNITED FILTERS INTERNATIONAL: COMPANY OVERVIEW

- TABLE 149 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 150 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 151 TORAY INDUSTRIES, INC.: OTHERS

- TABLE 152 HYOSUNG CORPORATION: COMPANY OVERVIEW

- TABLE 153 HYOSUNG CORPORATION: DEALS

- TABLE 154 HYOSUNG CORPORATION: OTHERS

- TABLE 155 EAST ASIA TEXTILE TECHNOLOGY LTD.: COMPANY OVERVIEW

- TABLE 156 WILLIAM BARNET & SON, LLC: COMPANY OVERVIEW

- TABLE 157 SAINT-GOBAIN VETROTEX: COMPANY OVERVIEW

- TABLE 158 INDUSTRIAL FILTRATION MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

- TABLE 159 INDUSTRIAL FILTRATION MARKET SIZE, BY PRODUCT, 2018–2025 (USD MILLION)

- TABLE 160 DEPTH FILTER: INDUSTRIAL FILTRATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

- TABLE 161 CARTRIDGE FILTER: INDUSTRIAL FILTRATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

- TABLE 162 INDUSTRIAL FILTRATION MARKET SIZE, BY FILTER MEDIA, 2018–2025 (USD MILLION)

- TABLE 163 MEMBRANE FILTRATION MARKET SIZE, BY APPLICATION, 2017–2025 (USD MILLION)

- TABLE 164 MEMBRANE FILTRATION MARKET SIZE FOR WATER & WASTEWATER, BY REGION, 2017–2025 (USD MILLION)

- TABLE 165 MEMBRANE FILTRATION MARKET SIZE FOR FOOD & BEVERAGE, BY REGION, 2017–2025 (USD MILLION)

- TABLE 166 WATER & WASTEWATER: MEMBRANE FILTRATION MARKET SIZE, BY MEMBRANE MATERIAL, 2017–2025 (USD MILLION)

- TABLE 167 WORLD GDP GROWTH PROJECTION, 2019–2026 (USD BILLION)

- TABLE 168 INDUSTRIAL PRODUCTION INDEX, BY COUNTRY

- FIGURE 1 STRING WOUND FILTER MATERIALS: MARKET SEGMENTATION

- FIGURE 2 STRING WOUND FILTER MATERIALS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: STRING WOUND FILTER MATERIAL PRODUCTION

- FIGURE 4 MARKET SIZE ESTIMATION: BASED ON SHARE OF NONWOVEN MATERIALS IN STRING WOUND FILTER MATERIALS MARKET

- FIGURE 5 STRING WOUND FILTER MATERIALS MARKET: DATA TRIANGULATION

- FIGURE 6 POLYPROPYLENE YARN TYPE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 7 WATER & WASTEWATER TREATMENT SEGMENT DOMINATED MARKET IN 2021

- FIGURE 8 ASIA PACIFIC WAS LARGEST STRING WOUND FILTER MATERIALS MARKET IN 2021

- FIGURE 9 HIGH DEMAND FROM END-USE INDUSTRIES TO DRIVE MARKET BETWEEN 2022 AND 2027

- FIGURE 10 POLYPROPYLENE SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES

- FIGURE 11 INDIA TO GROW AT FASTEST RATES

- FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 13 PORTER’S FIVE FORCES ANALYSIS: STRING WOUND FILTER MATERIALS MARKET

- FIGURE 14 COST BREAKUP: STRING WOUND FILTER MATERIALS MARKET

- FIGURE 15 POLYPROPYLENE SEGMENT TO SUSTAIN ITS DOMINANCE DURING FORECAST PERIOD

- FIGURE 16 POLYPROPYLENE TO REMAIN DOMINANT CORE MATERIAL SEGMENT

- FIGURE 17 WATER & WASTEWATER TREATMENT SEGMENT TO THE LEAD MARKET

- FIGURE 18 INDIA TO BE FASTEST-GROWING STRING WOUND FILTER MATERIALS MARKET DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC: STRING WOUND FILTER MATERIALS MARKET SNAPSHOT

- FIGURE 20 NORTH AMERICA: STRING WOUND FILTER MATERIALS MARKET SNAPSHOT

- FIGURE 21 EUROPE: STRING WOUND FILTER MATERIALS MARKET SNAPSHOT

- FIGURE 22 MARKET SHARE OF KEY PLAYERS

- FIGURE 23 COMPANY EVALUATION MATRIX, 2021

- FIGURE 24 JOHNS MANVILLE: COMPANY SNAPSHOT

- FIGURE 25 CHINA JUSHI CO., LTD.: COMPANY SNAPSHOT

- FIGURE 26 COATS GROUP PLC: COMPANY SNAPSHOT

- FIGURE 27 NIPPON ELECTRIC GLASS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 28 NITTO BOSEKI CO., LTD.: COMPANY SNAPSHOT

- FIGURE 29 TAIWAN GLASS INDUSTRY CORPORATION: COMPANY SNAPSHOT

- FIGURE 30 SCHWEITZER-MAUDUIT INTERNATIONAL, INC.: COMPANY SNAPSHOT

- FIGURE 31 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 32 HYOSUNG CORPORATION: COMPANY SNAPSHOT

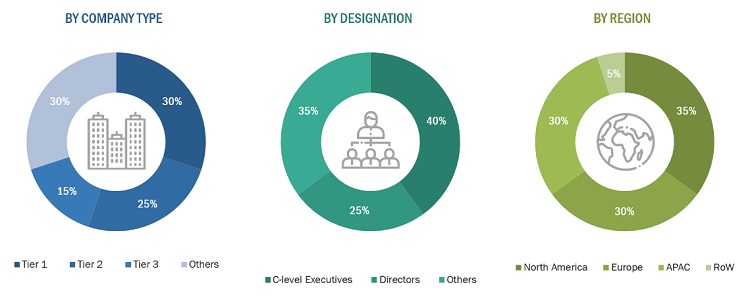

This research involved using extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect valuable information for a technical and market-oriented study of the string wound filter materials market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of this industry's value chain. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies, white papers, and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The string wound filter materials market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, and CXOs of companies in the string wound filter materials market. Primary sources from the supply side include associations and institutions involved in the string wound filter materials industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global string wound filter materials market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage share split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global string wound filter cartridge materials market, in terms of value and volume.

- To provide detailed information regarding key factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To analyze the market segmentation and forecast the market size based on yarn type, end-use industry, and core material.

- To analyze and forecast market segments, including the impact of upcoming recession, with respect to four regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), along with their major countries.

- To strategically analyze growth trends, prospects, and contribution of segments to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape.

- To strategically profile leading players and comprehensively analyze their key developments, such as product launches, expansions, mergers & acquisitions, and partnerships, in the string wound filter cartridge materials marke

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies.

The following customization options are available for the report:

Product Analysis:

Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the NA string wound filter materials market

- Further breakdown of the Rest of Europe's string wound filter materials market

Company Information:

Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in String Wound Filter Materials Market