Industrial Plugs and Sockets Market by Type, End User (Heavy Industries, Oil & Gas, Chemicals & Pharmaceuticals, Power Generation), Current (up to 32 A, 32 to 125 A, Above 125 A), Protection (Dustproof & Splash Proof, Waterproof, Explosion Proof), and Region - Global Forecast to 2025

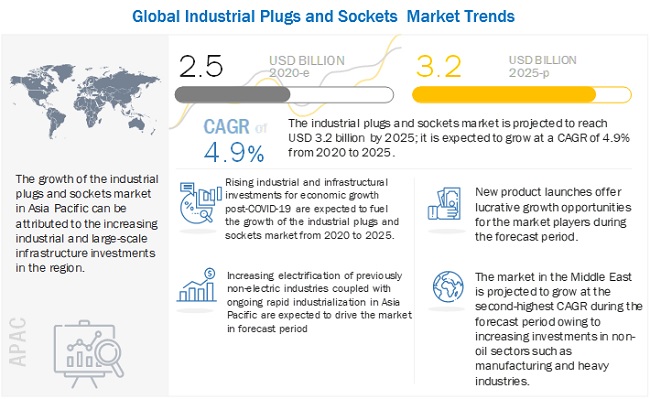

[260 Pages Report] The global industrial plugs and sockets market size is projected to grow from USD 2.5 billion in 2020 to USD 3.2 billion by 2025; it is expected to grow at a CAGR of 4.9% from 2020 to 2025. The key factors driving the growth of the industrial plugs and sockets industry include rapid industrialization in Asia Pacific and increased investments in infrastructure development projects to contribute to the global economy post-COVID-19.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Industrial Plugs and Sockets Market

The most significant near-term impact on industrial plugs and sockets will be felt through supply chains. Industry executives are anticipating delivery and construction slowdowns, either because nations have shuttered industries to slow the spread of coronavirus or because the workers have tested positive. Many components and parts for manufacturing industrial plugs and sockets come from China, the US, and some parts of Europe. Manufacturing disruptions in China and the US could significantly fall in the industrial plugs and sockets market over the next one or two years.

Due to the COVID-19 pandemic, local currencies of many countries have depreciated. There is a misalignment of supply and demand, leading to financial losses for components/parts manufacturers. Key components used in manufacturing industrial plugs and sockets are procured typically in US dollars, which results in increased component cost.

Industrial Plugs and Sockets Market Dynamics

Driver: Increasing electrification of different industries to drive demand for industrial plugs and sockets

Industries are energy-intensive and require large amounts of fuel and electricity for operating mechanical drives; boilers; furnaces; heating, ventilation, air-conditioning (HVAC) systems; etc. Traditionally, applications such as IC engines, fossil fuel-based boilers, furnaces, etc. used non-electric sources of energy. As a part of the transition to a low carbon future and ensure their reliable operations, industries are increasingly carrying out their electrification. This trend is prominent in developed regions such as Europe and North America, wherein governments of different countries are actively pursuing carbon-neutral goals. Even in other regions, industries have started carrying out their electrification to ensure economic savings, resulting in increased investments. Through electrification, companies can reduce their energy and overhead costs while meeting sustainability goals simultaneously.

Restraints: Slowdown in the economic growth of key countries in Asia Pacific to impact the growth of industrial plugs and sockets market

Asia Pacific is one of the key markets for industrial plugs and sockets. The region is home to the two fastest-growing countries globally. These countries' growth is driven by the rapid industrialization and the strong industrial progress taking place there. However, over the last few years, this growth has been flatlined or gone down owing to various factors. China has been mainly benefited from thriving domestic demand for its goods and large-volume exports. The declining domestic consumption and the ongoing trade war with the US and other nations have reduced exports from the country in recent years. China's economy grew at a double-digit rate at the start of the decade, but this growth has slowed down and stabilized in the last few years. In India, economic growth is driven mainly by the domestic demand for manufactured goods with little exports. The decline in domestic demand for the manufactured goods has adversely impacted the development of the industrial plugs and sockets market, thereby acting as a long-term restraint.

Opportunities: Growing investments in non-oil sectors of the Middle East present new opportunities for industrial plugs and sockets

The Middle East, which is witnessing increased oil and gas investments, is shifting focus toward diversifying its investments. For years, investments in this region were in the oil and gas sector; however, in recent years, the countries have realized the requirement to diversify their investments and strengthen their non-oil and gas sector. Revenues from the oil and gas sector make up the lions share of the region's GDP. Globally, all countries are trying to reduce their dependence on fossil fuels that can be a huge threat to the future revenues of the Middle East countries. Realizing this, a number of countries in the Middle East are trying to diversify their revenue streams.

Challenges: Presence of gray market for industrial plugs and sockets

Local manufacturers develop low-cost counterfeit industrial plugs and sockets, which imitate the original ones. These counterfeit industrial plugs and sockets are exact copies of the high-end products offered by the leading players. Though these counterfeit products are cost-effective, they are prone to accidents such as short circuits, leading to fires, shocks, or explosions. The market for industrial plugs and sockets has grown significantly over the years and is a major challenge for global players. This market's growth leads to the lowered income of companies, loss of brand names, and reduced skilled workforce owing to low income. The gray market for electrical products has also affected the sales of products offered by the leading players.

To know about the assumptions considered for the study, download the pdf brochure

By type, the industrial sockets segment is the largest contributor in the industrial plugs and sockets market during the forecast period.

The industrial sockets segment is expected to lead the industrial plugs and sockets market from 2020 to 2025. Typically, industrial sockets and plugs are used in equal numbers. However, multiple sockets are installed to easily connect to fixed electrical main circuits, thereby allowing operators to connect and access electrical power units easily. The price of industrial sockets is higher than plugs. These factors are expected to drive the growth of the market's industrial sockets segment from 2020 to 2025.

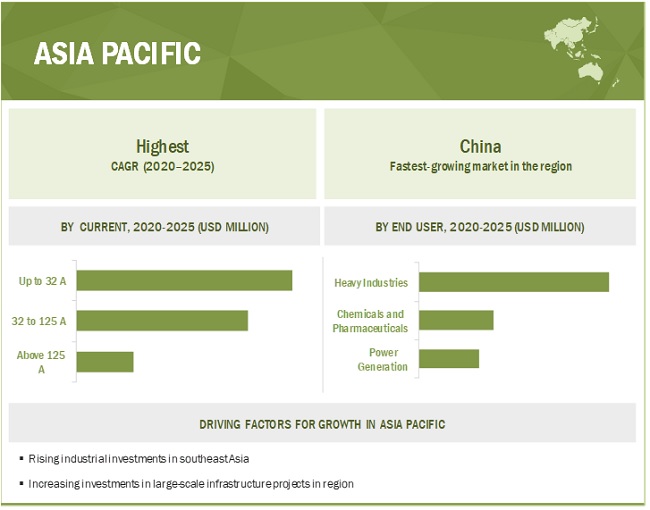

By end user, heavy industries are expected to be the largest contributor in the industrial plugs and sockets market during the forecast period.

The heavy industries segment is estimated to account for the largest size of the industrial plugs and sockets market in 2020, and this trend is expected to continue during the forecast period. Industrial plugs and sockets are extensively used in heavy industries for safe, reliable, and easy connection and disconnection of equipment irrespective of the environmental conditions. The heavy industries sector's growth is mainly driven by the increasing infrastructure investments in key markets such as China and India, along with the increased industrial investments in Southeast Asian markets.

The waterproof industrial plugs and sockets segment is expected to be the largest contributor during the forecast period by protection.

The waterproof industrial plugs and sockets segment is expected to lead the industrial plugs and sockets market from 2020 to 2025. Waterproof industrial plugs and sockets can operate in conditions where they have to be submerged in water or are near constant water jets. The increased demand for waterproof industrial plugs and sockets from construction, food and beverages, marine, offshore oil and gas, and chemicals and pharmaceutical industries is expected to drive this segment of the market.

Asia Pacific is expected to account for the largest market size during the forecast period.

Asia Pacific is expected to be the largest industrial plugs and sockets market during the forecast period. Asia Pacific comprises China, India, Japan, South Korea, Australia, and the Rest of Asia Pacific. Asia Pacific is estimated to be the largest market for industrial plugs and sockets during the forecast period. The growth of the market in this region is mainly driven by the increasing industrial and large-scale infrastructure investments during the forecast period. Rising demand for safe, secure, and reliable connected and disconnected equipment for use in a diverse range of environments, increased investments in the construction sector, and sustained industrial investments in the key markets offer high-growth opportunities for the industrial plugs and sockets market in Asia Pacific.

Key Market Players

The key players in the industrial plugs and sockets market include Amphenol Corporation (US), ABB (Switzerland), Emerson Electric (US), Schneider Electric (France), and Legrand SA (France).

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

20182025 |

|

Base year considered |

2019 |

|

Forecast period |

20202025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By type, end user, protection, current, and region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East, South America, and Africa |

|

Companies covered |

Amphenol Corporation (US), ABB (Switzerland), Emerson Electric (US), Schneider Electric (France), Legrand (France), Marechal Electric Group (France), Mennekes (Germany), Palazolli Group (Italy), SCAME Group (Italy), Eaton (Ireland), and others |

This research report categorizes the industrial plugs and sockets market based on type, end-user, protection, current, and region.

Based on type:

- Industrial Plugs

- Industrial Sockets

Based on end-user:

- Heavy Industries

- Oil and Gas

- Chemicals and Pharmaceuticals

- Power Generation

- Others ( Agriculture, military, and sports and entertainment)

Based on protection:

- Dustproof and Splash Proof

- Waterproof

- Explosion Proof

Based on the current:

- Up to 32 A

- 32 to 125 A

- Above 125 A

Based on the region:

- Asia Pacific

- North America

- Europe

- Middle East

- South America

- Africa

Recent Developments

- In July 2019, Amphenol launched a new Ecomate family of connectors of IP65-69k rating. These products are for indoor or outdoor industrial applications. These products have a current rating of 5-300 A

- In July 2019, Emerson enhanced Appleton 200 A Powertite series of pin and sleeve plugs, receptacles, and connectors. Through this update, the product will now be assembled faster due to reduced complexity.

- In April 2019, Marechal launched its new EVO40 series disconnector of 40 A current rating and watertight (IP66/IP67) protection. The product offers safe isolation of any low electrical circuit. The product follows the IEC 60204-1 standard.

- In November 2018, Emerson Electric opened a new facility and first industrial solutions center in South Korea. Emerson made a USD 25 million investment in this new facility that will support customers of its automation solutions business division under which the company provides industrial plugs and sockets.

Frequently Asked Questions (FAQ):

What is the current size of the industrial plugs and sockets market?

The global industrial plugs and sockets market current size is estimated to be USD 2.5 billion in 2020.

What are the major drivers for the industrial plugs and sockets market?

Increasing electrification of different industries, ongoing rapid industrialization in Asia Pacific, and rising economic nationalism and investments in local manufacturing is expected to drive demand for industrial plugs and sockets

What is the COVID-19 impact on Industrial Plugs and Sockets Market?

The most significant near-term impact on industrial plugs and sockets will be felt through supply chains. Industry executives are anticipating delivery and construction slowdowns, either because nations have shuttered industries to slow the spread of coronavirus or because the workers have tested positive.

Which is the fastest-growing region during the forecasted period in the industrial plugs and sockets market?

Asia Pacific is the fastest-growing region during the forecasted period due to increasing investments in large infrastructure projects and increasing industrial investments.

Which is the fastest-growing segment, by the end-user during the forecasted period in the industrial plugs and sockets market?

The heavy industries are the fastest growing segment by the end-user during the forecasted period due to increased investments in infrastructure projects to spur the economic growth post-COVID-19 pandemic. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INDUSTRIAL PLUGS AND SOCKETS MARKET: INCLUSIONS AND EXCLUSIONS

TABLE 1 INDUSTRIAL PLUGS AND SOCKETS MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

TABLE 2 INDUSTRIAL PLUGS AND SOCKETS MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

TABLE 3 INDUSTRIAL PLUGS AND SOCKETS MARKET, BY CURRENT: INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 1 INDUSTRIAL PLUGS AND SOCKETS MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 key industry insights

2.2.2.2 Breakdown of primaries

2.3 SCOPE

FIGURE 3 MAIN PARAMETERS CONSIDERED FOR ASSESSING GLOBAL DEMAND FOR INDUSTRIAL PLUGS AND SOCKETS

2.4 MARKET SIZE ESTIMATION

2.4.1 DEMAND-SIDE ANALYSIS

FIGURE 4 INDUSTRIAL PLUGS AND SOCKETS MARKET: REGION-/COUNTRY-WISE ANALYSIS

2.4.1.1 Calculations

2.4.1.2 Assumptions

2.4.2 SUPPLY-SIDE ANALYSIS

FIGURE 5 INDUSTRIAL PLUGS AND SOCKETS MARKET: SUPPLY-SIDE ANALYSIS

2.4.2.1 Calculations

FIGURE 6 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF INDUSTRIAL PLUGS AND SOCKETS

2.4.2.2 Assumptions

FIGURE 7 COMPANY REVENUE ANALYSIS, 2019

2.4.3 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 53)

3.1 SCENARIO ANALYSIS

FIGURE 8 SCENARIO ANALYSIS: INDUSTRIAL PLUGS AND SOCKETS MARKET, 20182025

3.1.1 OPTIMISTIC SCENARIO

3.1.2 REALISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

TABLE 4 INDUSTRIAL PLUGS AND SOCKETS MARKET SNAPSHOT

FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF INDUSTRIAL PLUGS AND SOCKETS MARKET IN TERMS OF VALUE IN 2019

FIGURE 10 INDUSTRIAL SOCKETS SEGMENT TO ACCOUNT FOR LARGE SIZE OF INDUSTRIAL PLUGS AND SOCKETS MARKET IN TERMS OF VALUE FROM 2020 TO 2025

FIGURE 11 WATERPROOF SEGMENT TO LEAD INDUSTRIAL PLUGS AND SOCKETS MARKET IN TERMS OF VALUE FROM 2020 TO 2025

FIGURE 12 HEAVY INDUSTRIES SEGMENT TO ACCOUNT FOR LARGEST SIZE OF INDUSTRIAL PLUGS AND SOCKETS MARKET IN TERMS OF VALUE FROM 2020 TO 2025

FIGURE 13 UP TO 32 A SEGMENT TO LEAD INDUSTRIAL PLUGS AND SOCKETS MARKET IN TERMS OF VALUE FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 ATTRACTIVE OPPORTUNITIES IN INDUSTRIAL PLUGS AND SOCKETS MARKET

FIGURE 14 INCREASING INVESTMENTS IN INFRASTRUCTURE DEVELOPMENT PROJECTS TO DRIVE GROWTH OF INDUSTRIAL PLUGS AND SOCKETS MARKET FROM 2020 TO 2025

4.2 INDUSTRIAL PLUGS AND SOCKETS MARKET, BY REGION

FIGURE 15 INDUSTRIAL PLUGS AND SOCKETS MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

4.3 INDUSTRIAL PLUGS AND SOCKETS MARKET IN ASIA PACIFIC, BY END USER AND COUNTRY

FIGURE 16 HEAVY INDUSTRIES SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES OF INDUSTRIAL PLUGS AND SOCKETS MARKET IN ASIA PACIFIC IN 2019

4.4 INDUSTRIAL PLUGS AND SOCKETS MARKET, BY TYPE

FIGURE 17 INDUSTRIAL PLUGS SEGMENT OF INDUSTRIAL PLUGS AND SOCKETS MARKET TO GROW AT HIGH CAGR FROM 2020 TO 2025

4.5 INDUSTRIAL PLUGS AND SOCKETS MARKET, BY PROTECTION

FIGURE 18 WATERPROOF SEGMENT TO HOLD LARGEST SHARE OF INDUSTRIAL PLUGS AND SOCKETS MARKET IN 2025

4.6 INDUSTRIAL PLUGS AND SOCKETS MARKET, BY CURRENT

FIGURE 19 UP TO 32 A SEGMENT TO ACCOUNT FOR LARGEST SIZE OF INDUSTRIAL PLUGS AND SOCKETS MARKET IN 2025

4.7 INDUSTRIAL PLUGS AND SOCKETS MARKET, BY END USER

FIGURE 20 HEAVY INDUSTRIES SEGMENT TO HOLD LARGEST SHARE OF INDUSTRIAL PLUGS AND SOCKETS MARKET IN 2025

5 MARKET OVERVIEW (Page No. - 65)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 21 COVID-19 GLOBAL PROPAGATION

FIGURE 22 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 GLOBAL ROAD TO RECOVERY FROM COVID-19

FIGURE 23 GLOBAL RECOVERY ROAD FROM COVID-19 FROM 2020 TO 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 24 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 25 INDUSTRIAL PLUGS AND SOCKETS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Increasing electrification of different industries to drive demand for industrial plugs and sockets

FIGURE 26 INDUSTRY-WISE ELECTRIFICATION TRENDS, 20202050 (%)

5.5.1.2 Ongoing rapid industrialization in Asia Pacific and rising economic nationalism and investments in local manufacturing

5.5.2 RESTRAINTS

5.5.2.1 Slowdown in economic growth of key countries in Asia Pacific to impact growth of industrial plugs and sockets market

FIGURE 27 ANNUAL GDP GROWTH RATE, 20112019 (%)

5.5.3 OPPORTUNITIES

5.5.3.1 Growing investments in non-oil sectors of Middle East present new opportunities for industrial plugs and sockets

5.5.3.2 Ongoing industrial growth in Africa

5.5.4 CHALLENGES

5.5.4.1 Presence of gray market for industrial plugs and sockets

5.5.4.2 Impact of COVID-19 on industrial plugs and sockets market

5.6 TRENDS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS

FIGURE 28 REVENUE SHIFT FOR INDUSTRIAL PLUGS AND SOCKETS

5.7 AVERAGE SELLING PRICES TREND

FIGURE 29 AVERAGE SELLING PRICE OF INDUSTRIAL PLUGS AND SOCKETS

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 30 INDUSTRIAL PLUGS AND SOCKETS SUPPLY CHAIN ANALYSIS

5.8.1 RAW MATERIALS SUPPLIERS

5.8.2 MANUFACTURING

5.8.3 DISTRIBUTION (BUYERS)

5.8.4 END USERS

5.9 TECHNOLOGY ANALYSIS

5.10 INDUSTRIAL PLUGS AND SOCKETS: CODES AND REGULATIONS

5.11 CASE STUDY ANALYSIS

5.11.1 USE OF INDUSTRIAL PLUGS AND SOCKETS IN INDUSTRIAL APPLICATIONS

6 INDUSTRIAL PLUGS AND SOCKETS MARKET, BY TYPE (Page No. - 78)

6.1 INTRODUCTION

FIGURE 31 INDUSTRIAL SOCKETS SEGMENT ACCOUNTED FOR LARGE SHARE OF INDUSTRIAL PLUGS AND SOCKETS MARKET IN 2019 IN TERMS OF VALUE

TABLE 5 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 6 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

TABLE 7 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (THOUSAND UNITS)

TABLE 8 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (THOUSAND UNITS)

6.2 INDUSTRIAL PLUGS

6.2.1 EASE OF CONNECTION AND DISCONNECTION TO DRIVE GLOBAL DEMAND FOR INDUSTRIAL PLUGS

TABLE 9 INDUSTRIAL PLUGS: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20172019 (USD MILLION)

TABLE 10 INDUSTRIAL PLUGS: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

6.3 INDUSTRIAL SOCKETS

6.3.1 SAFE AND QUICK ACCESS TO FIXED MAIN POWER SUPPLY OFFERED BY INDUSTRIAL SOCKETS LEAD TO THEIR ADOPTION IN INSTALLATIONS

TABLE 11 INDUSTRIAL SOCKETS: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20172019 (USD MILLION)

TABLE 12 INDUSTRIAL SOCKETS: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7 INDUSTRIAL PLUGS AND SOCKETS MARKET, BY END USER (Page No. - 84)

7.1 INTRODUCTION

FIGURE 32 HEAVY INDUSTRIES SEGMENT HELD LARGEST SHARE OF INDUSTRIAL PLUGS AND SOCKETS MARKET IN 2019 IN TERMS OF VALUE

TABLE 13 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 14 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

TABLE 15 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (THOUSAND UNITS)

TABLE 16 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (THOUSAND UNITS)

7.2 HEAVY INDUSTRIES

7.2.1 INCREASING ADOPTION OF INDUSTRIAL PLUGS AND SOCKETS IN HEAVY INDUSTRIES TO CATER TO THEIR DIVERSE SET OF REQUIREMENTS

TABLE 17 HEAVY INDUSTRIES: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20172019 (USD MILLION)

TABLE 18 HEAVY INDUSTRIES: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.3 CHEMICALS AND PHARMACEUTICALS

7.3.1 SURGING USE OF APPROPRIATELY RATED INDUSTRIAL PLUGS AND SOCKETS IN CHEMICALS AND PHARMACEUTICALS INDUSTRY TO PROPEL MARKET GROWTH

TABLE 19 CHEMICALS AND PHARMACEUTICALS: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20172019 (USD MILLION)

TABLE 20 CHEMICALS AND PHARMACEUTICALS: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.4 POWER GENERATION

7.4.1 ONGOING ELECTRIFICATION OF TRADITIONALLY NON-ELECTRIC SECTORS TO FUEL DEMAND FOR INDUSTRIAL PLUGS AND SOCKETS FROM POWER GENERATION INDUSTRY

TABLE 21 POWER GENERATION: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20172019 (USD MILLION)

TABLE 22 POWER GENERATION: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.5 OIL AND GAS

7.5.1 RISING DEPLOYMENT OF SAFE AND EASY TO USE INDUSTRIAL PLUGS AND SOCKETS IN OIL AND GAS INDUSTRY

TABLE 23 OIL AND GAS: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20172019 (USD MILLION)

TABLE 24 OIL AND GAS: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.6 OTHERS

TABLE 25 OTHERS: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20172019 (USD MILLION)

TABLE 26 OTHERS: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

8 INDUSTRIAL PLUGS AND SOCKETS MARKET, BY CURRENT (Page No. - 95)

8.1 INTRODUCTION

FIGURE 33 UP TO 32 A SEGMENT HELD LARGEST SHARE OF INDUSTRIAL PLUGS AND SOCKETS MARKET IN 2019 IN TERMS OF VALUE

TABLE 27 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20172019 (USD MILLION)

TABLE 28 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20202025 (USD MILLION)

TABLE 29 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20172019 (THOUSAND UNITS)

TABLE 30 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20202025 (THOUSAND UNITS)

8.2 UP TO 32 A

8.2.1 SUSTAINING INDUSTRIAL SECTOR INVESTMENTS IN ASIA PACIFIC TO DRIVE DEMAND FOR UP TO 32 A INDUSTRIAL PLUGS AND SOCKETS

TABLE 31 UP TO 32 A: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20172019 (USD MILLION)

TABLE 32 UP TO 32 A: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

8.3 32 TO 125 A

8.3.1 GROWING ADOPTION OF 32 TO 125 A INDUSTRIAL PLUGS AND SOCKETS IN ONGOING INFRASTRUCTURE DEVELOPMENT AND INDUSTRIAL PROJECTS

TABLE 33 32 TO 125 A: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20172019 (USD MILLION)

TABLE 34 32 TO 125 A: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

8.4 ABOVE 125 A

8.4.1 RISING USE OF ABOVE 125 A INDUSTRIAL PLUGS AND SOCKETS IN HEAVY-DUTY APPLICATIONS

TABLE 35 ABOVE 125 A: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20172019 (USD MILLION)

TABLE 36 ABOVE 125 A: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9 INDUSTRIAL PLUGS AND SOCKETS MARKET, BY PROTECTION (Page No. - 102)

9.1 INTRODUCTION

FIGURE 34 WATERPROOF SEGMENT HELD LARGEST SHARE OF INDUSTRIAL PLUGS AND SOCKETS MARKET IN 2019 IN TERMS OF VALUE

TABLE 37 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20172019 (USD MILLION)

TABLE 38 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20202025 (USD MILLION)

TABLE 39 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20172019 (THOUSAND UNITS)

TABLE 40 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20202025 (THOUSAND UNITS)

9.2 DUSTPROOF AND SPLASH PROOF

9.2.1 SUSTAINED INDUSTRIAL SECTOR INVESTMENTS IN ASIA PACIFIC TO DRIVE DEMAND FOR DUSTPROOF AND SPLASH-PROOF INDUSTRIAL PLUGS AND SOCKETS

TABLE 41 DUSTPROOF AND SPLASH PROOF: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20172019 (USD MILLION)

TABLE 42 DUSTPROOF AND SPLASH PROOF: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9.3 WATERPROOF

9.3.1 INCREASED DEMAND FOR SAFE AND RELIABLE WATERPROOF INDUSTRIAL PLUGS AND SOCKETS FOR USE IN CHALLENGING ENVIRONMENTS

TABLE 43 WATERPROOF: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20172019 (USD MILLION)

TABLE 44 WATERPROOF: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9.4 EXPLOSION PROOF

9.4.1 SURGED ADOPTION OF EXPLOSION-PROOF INDUSTRIAL PLUGS AND SOCKETS IN CHEMICALS AND PHARMACEUTICALS INDUSTRY

TABLE 45 EXPLOSION PROOF: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20172019 (USD MILLION)

TABLE 46 EXPLOSION PROOF: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

10 INDUSTRIAL PLUGS AND SOCKETS MARKET, BY REGION (Page No. - 110)

10.1 INTRODUCTION

FIGURE 35 INDUSTRIAL PLUGS AND SOCKETS MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 36 INDUSTRIAL PLUGS AND SOCKETS MARKET SHARE (VALUE), BY REGION, 2019 (%)

TABLE 47 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20172019 (USD MILLION)

TABLE 48 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

TABLE 49 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20172019 (THOUSAND UNITS)

TABLE 50 INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY REGION, 20202025 (THOUSAND UNITS)

10.2 ASIA PACIFIC

10.2.1 IMPACT OF COVID-19 ON INDUSTRIAL PLUGS AND SOCKETS MARKET IN ASIA PACIFIC

FIGURE 37 SNAPSHOT: INDUSTRIAL PLUGS AND SOCKETS MARKET IN ASIA PACIFIC

10.2.2 BY TYPE

TABLE 51 ASIA PACIFIC: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 52 ASIA PACIFIC: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.2.3 BY CURRENT

TABLE 53 ASIA PACIFIC: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20172019 (USD MILLION)

TABLE 54 ASIA PACIFIC: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20202025 (USD MILLION)

10.2.4 BY PROTECTION

TABLE 55 ASIA PACIFIC: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20172019 (USD MILLION)

TABLE 56 ASIA PACIFIC: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20202025 (USD MILLION)

10.2.5 BY END USER

TABLE 57 ASIA PACIFIC: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 58 ASIA PACIFIC: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.2.6 BY COUNTRY

TABLE 59 ASIA PACIFIC: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY COUNTRY, 20172019 (USD MILLION)

TABLE 60 ASIA PACIFIC: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.2.6.1 China

10.2.6.1.1 Sustaining FDIs and planned investments in construction sector to drive market growth in China

10.2.6.1.2 List of top end users of industrial plugs and sockets in China

10.2.6.1.3 By type

TABLE 61 CHINA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 62 CHINA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.2.6.1.4 By end user

TABLE 63 CHINA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 64 CHINA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.2.6.2 India

10.2.6.2.1 Surging infrastructure investments as part of national infrastructure plan in India to fuel market growth

10.2.6.2.2 List of top end users of industrial plugs and sockets in India

10.2.6.2.3 By type

TABLE 65 INDIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 66 INDIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.2.6.2.4 By end user

TABLE 67 INDIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 68 INDIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.2.6.3 Australia

10.2.6.3.1 Increasing investments in mining and manufacturing sector of Australia to drive market growth

10.2.6.3.2 List of top end users of industrial plugs and sockets in Australia

10.2.6.3.3 By type

TABLE 69 AUSTRALIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 70 AUSTRALIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.2.6.3.4 By end user

TABLE 71 AUSTRALIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 72 AUSTRALIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.2.6.4 Japan

10.2.6.4.1 Increasing FDIs accelerate market growth in Japan

10.2.6.4.2 List of top end users of industrial plugs and sockets in Japan

10.2.6.4.3 By type

TABLE 73 JAPAN: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 74 JAPAN: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.2.6.4.4 By end user

TABLE 75 JAPAN: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 76 JAPAN: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.2.6.5 South Korea

10.2.6.5.1 Flourishing shipbuilding, steel, and automotive industries to fuel market growth in South Korea

10.2.6.5.2 List of top end users of industrial plugs and sockets in South Korea

10.2.6.5.3 By type

TABLE 77 SOUTH KOREA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 78 SOUTH KOREA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.2.6.5.4 By end user

TABLE 79 SOUTH KOREA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 80 SOUTH KOREA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.2.6.6 Rest of Asia Pacific

10.2.6.6.1 List of top end users of industrial plugs and sockets in Rest of Asia Pacific

10.2.6.6.2 By type

TABLE 81 REST OF ASIA PACIFIC: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 82 REST OF ASIA PACIFIC: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.2.6.6.3 By end user

TABLE 83 REST OF ASIA PACIFIC: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 84 REST OF ASIA PACIFIC: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.3 NORTH AMERICA

10.3.1 IMPACT OF COVID-19 ON INDUSTRIAL PLUGS AND SOCKETS MARKET IN NORTH AMERICA

FIGURE 38 SNAPSHOT: INDUSTRIAL PLUGS AND SOCKETS MARKET IN NORTH AMERICA

10.3.2 BY TYPE

TABLE 85 NORTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 86 NORTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.3.3 BY CURRENT

TABLE 87 NORTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20172019 (USD MILLION)

TABLE 88 NORTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20202025 (USD MILLION)

10.3.4 BY PROTECTION

TABLE 89 NORTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20172019 (USD MILLION)

TABLE 90 NORTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20202025 (USD MILLION)

10.3.5 BY END USER

TABLE 91 NORTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 92 NORTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.3.6 BY COUNTRY

TABLE 93 NORTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY COUNTRY, 20172019 (USD MILLION)

TABLE 94 NORTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.3.6.1 US

10.3.6.1.1 Surging construction sector investments to fuel market growth in US

10.3.6.1.2 List of top end users of industrial plugs and sockets in US

10.3.6.1.3 By type

TABLE 95 US: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 96 US: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.3.6.1.4 By end user

TABLE 97 US: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 98 US: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.3.6.2 Canada

10.3.6.2.1 Increasing number of planned infrastructure investments in Canada to contribute to market growth

10.3.6.2.2 List of top end users of industrial plugs and sockets in Canada

10.3.6.2.3 By type

TABLE 99 CANADA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 100 CANADA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.3.6.2.4 By end user

TABLE 101 CANADA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 102 CANADA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.3.6.3 Mexico

10.3.6.3.1 Ongoing industrialization in Mexico to boost growth of market

10.3.6.3.2 List of top end users of industrial plugs and sockets in Mexico

10.3.6.3.3 By type

TABLE 103 MEXICO: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 104 MEXICO: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.3.6.3.4 By end user

TABLE 105 MEXICO: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 106 MEXICO: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.4 EUROPE

10.4.1 IMPACT OF COVID-19 ON INDUSTRIAL PLUGS AND SOCKETS MARKET IN EUROPE

10.4.2 BY TYPE

TABLE 107 EUROPE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 108 EUROPE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.4.3 BY CURRENT

TABLE 109 EUROPE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20172019 (USD MILLION)

TABLE 110 EUROPE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20202025 (USD MILLION)

10.4.4 BY PROTECTION

TABLE 111 EUROPE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20172019 (USD MILLION)

TABLE 112 EUROPE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20202025 (USD MILLION)

10.4.5 BY END USER

TABLE 113 EUROPE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 114 EUROPE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.4.6 BY COUNTRY

TABLE 115 EUROPE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY COUNTRY, 20172019 (USD MILLION)

TABLE 116 EUROPE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.4.6.1 Germany

10.4.6.1.1 Flourishing construction industry, along with stable machinery and steel sectors in Germany contribute to market growth

10.4.6.1.2 List of top end users of industrial plugs and sockets in Germany

10.4.6.1.3 By type

TABLE 117 GERMANY: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 118 GERMANY: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.4.6.1.4 By end user

TABLE 119 GERMANY: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 120 GERMANY: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.4.6.2 Russia

10.4.6.2.1 Increasing investments in oil and gas and transport sectors in Russia to contribute to market growth

10.4.6.2.2 List of top end users of industrial plugs and sockets in Russia

10.4.6.2.3 By type

TABLE 121 RUSSIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 122 RUSSIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.4.6.2.4 By end user

TABLE 123 RUSSIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 124 RUSSIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20182025 (USD MILLION)

10.4.6.3 UK

10.4.6.3.1 Surging number of new infrastructure development projects in UK to drive market growth

10.4.6.3.2 List of top end users of industrial plugs and sockets in UK

10.4.6.3.3 By type

TABLE 125 UK: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 126 UK: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.4.6.3.4 By end user

TABLE 127 UK: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 128 UK: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.4.6.4 Italy

10.4.6.4.1 Rising FDIs in manufacturing sector of Italy to fuel market growth

10.4.6.4.2 List of top end users of industrial plugs and sockets in Italy

10.4.6.4.3 By type

TABLE 129 ITALY: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 130 ITALY: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.4.6.4.4 By end user

TABLE 131 ITALY: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 132 ITALY: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.4.6.5 Rest of Europe

10.4.6.5.1 List of top end users of industrial plugs and sockets in Rest of Europe

10.4.6.5.2 By type

TABLE 133 REST OF EUROPE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 134 REST OF EUROPE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.4.6.5.3 By end user

TABLE 135 REST OF EUROPE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 136 REST OF EUROPE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.5 MIDDLE EAST

10.5.1 IMPACT OF COVID-19 ON INDUSTRIAL PLUGS AND SOCKETS MARKET IN MIDDLE EAST

10.5.2 BY TYPE

TABLE 137 MIDDLE EAST: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 138 MIDDLE EAST: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.5.3 BY CURRENT

TABLE 139 MIDDLE EAST: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20172019 (USD MILLION)

TABLE 140 MIDDLE EAST: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20202025 (USD MILLION)

10.5.4 BY PROTECTION

TABLE 141 MIDDLE EAST: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20172019 (USD MILLION)

TABLE 142 MIDDLE EAST: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20202025 (USD MILLION)

10.5.5 BY END USER

TABLE 143 MIDDLE EAST: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 144 MIDDLE EAST: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.5.6 BY COUNTRY

TABLE 145 MIDDLE EAST: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY COUNTRY, 20172019 (USD MILLION)

TABLE 146 MIDDLE EAST: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.5.6.1 Iran

10.5.6.1.1 Shifting focus of Iran toward non-oil sectors and signing of key strategic partnership deal with China to drive market growth

10.5.6.1.2 List of top end users of industrial plugs and sockets in Iran

10.5.6.1.3 By type

TABLE 147 IRAN: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 148 IRAN: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.5.6.1.4 By end user

TABLE 149 IRAN: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 150 IRAN: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.5.6.2 Saudi Arabia

10.5.6.2.1 Surging investments in non-oil sectors of Saudi Arabia to lead to market growth

10.5.6.2.2 List of top end users of industrial plugs and sockets in Saudi Arabia

10.5.6.2.3 By type

TABLE 151 SAUDI ARABIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 152 SAUDI ARABIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.5.6.2.4 By end user

TABLE 153 SAUDI ARABIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 154 SAUDI ARABIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.5.6.3 UAE

10.5.6.3.1 Increasing FDIs in oil and gas and non-oil sectors to contribute to market growth in UAE

10.5.6.3.2 List of top end users of industrial plugs and sockets in UAE

10.5.6.3.3 By type

TABLE 155 UAE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 156 UAE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.5.6.3.4 By end user

TABLE 157 UAE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 158 UAE: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.5.6.4 Qatar

10.5.6.4.1 Ongoing infrastructure development projects in Qatar to hold FIFA World Cup-2022 to drive market growth

10.5.6.4.2 List of top end users of industrial plugs and sockets in Qatar

10.5.6.4.3 By type

TABLE 159 QATAR: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 160 QATAR: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.5.6.4.4 By end user

TABLE 161 QATAR: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 162 QATAR: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.5.6.5 Rest of Middle East

10.5.6.5.1 List of top end users of industrial plugs and sockets in Rest of Middle East

10.5.6.5.2 By type

TABLE 163 REST OF MIDDLE EAST: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 164 REST OF MIDDLE EAST: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.5.6.5.3 By end user

TABLE 165 REST OF MIDDLE EAST: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 166 REST OF MIDDLE EAST: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.6 SOUTH AMERICA

10.6.1 IMPACT OF COVID-19 ON INDUSTRIAL PLUGS AND SOCKETS MARKET IN SOUTH AMERICA

10.6.2 BY TYPE

TABLE 167 SOUTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 168 SOUTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.6.3 BY CURRENT

TABLE 169 SOUTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20172019 (USD MILLION)

TABLE 170 SOUTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20202025 (USD MILLION)

10.6.4 BY PROTECTION

TABLE 171 SOUTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20172019 (USD MILLION)

TABLE 172 SOUTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20202025 (USD MILLION)

10.6.5 BY END USER

TABLE 173 SOUTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 174 SOUTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.6.6 BY COUNTRY

TABLE 175 SOUTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY COUNTRY, 20172019 (USD MILLION)

TABLE 176 SOUTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.6.6.1 Brazil

10.6.6.1.1 Surging investments in key industrial sectors to drive market growth in Brazil

10.6.6.1.2 List of top end users of industrial plugs and sockets in Brazil

10.6.6.1.3 By type

TABLE 177 BRAZIL: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 178 BRAZIL: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.6.6.1.4 By end user

TABLE 179 BRAZIL: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 180 BRAZIL: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.6.6.2 Argentina

10.6.6.2.1 Increasing infrastructure investments to offset economic damages induced by COVID-19 in Argentina

10.6.6.2.2 List of top end users of industrial plugs and sockets in Argentina

10.6.6.2.3 By type

TABLE 181 ARGENTINA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 182 ARGENTINA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.6.6.2.4 By end user

TABLE 183 ARGENTINA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 184 ARGENTINA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.6.6.3 Venezuela

10.6.6.3.1 Ongoing economic recovery measures and changes in policies to fuel long-term market growth in Venezuela

10.6.6.3.2 List of top end users of industrial plugs and sockets in Venezuela

10.6.6.3.3 By type

TABLE 185 VENEZUELA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 186 VENEZUELA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.6.6.3.4 By end user

TABLE 187 VENEZUELA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 188 VENEZUELA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.6.6.4 Rest of South America

10.6.6.4.1 List of top end users of industrial plugs and sockets in Rest of South America

10.6.6.4.2 By type

TABLE 189 REST OF SOUTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 190 REST OF SOUTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.6.6.4.3 By end user

TABLE 191 REST OF SOUTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 192 REST OF SOUTH AMERICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.7 AFRICA

10.7.1 IMPACT OF COVID-19 ON INDUSTRIAL PLUGS AND SOCKETS MARKET IN AFRICA

TABLE 193 AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 194 AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.7.3 BY CURRENT

TABLE 195 AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20172019 (USD MILLION)

TABLE 196 AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY CURRENT, 20202025 (USD MILLION)

10.7.4 BY PROTECTION

TABLE 197 AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20172019 (USD MILLION)

TABLE 198 AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY PROTECTION, 20202025 (USD MILLION)

10.7.5 BY END USER

TABLE 199 AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 200 AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.7.6 BY COUNTRY

TABLE 201 AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY COUNTRY, 20172019 (USD MILLION)

TABLE 202 AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.7.6.1 South Africa

10.7.6.1.1 Surging large-scale infrastructure investments post-COVID-19 to fuel market growth in South Africa

10.7.6.1.2 List of top end users of industrial plugs and sockets in South Africa

10.7.6.1.3 By type

TABLE 203 SOUTH AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 204 SOUTH AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.7.6.1.4 By end user

TABLE 205 SOUTH AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 206 SOUTH AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.7.6.2 Egypt

10.7.6.2.1 Ongoing sustained industrial production growth in Egypt to contribute to demand for industrial plugs and sockets

10.7.6.2.2 List of top end users of industrial plugs and sockets in Egypt

10.7.6.2.3 By type

TABLE 207 EGYPT: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 208 EGYPT: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.7.6.2.4 By end user

TABLE 209 EGYPT: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 210 EGYPT: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.7.6.3 Nigeria

10.7.6.3.1 Flourishing food and beverages and oil and gas sectors to drive market growth in Nigeria

10.7.6.3.2 List of top end users of industrial plugs and sockets in Nigeria

10.7.6.3.3 By type

TABLE 211 NIGERIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 212 NIGERIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.7.6.3.4 By end user

TABLE 213 NIGERIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 214 NIGERIA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

10.7.6.4 Rest of Africa

10.7.6.4.1 List of top end users of industrial plugs and sockets in Rest of Africa

10.7.6.4.2 By type

TABLE 215 REST OF AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20172019 (USD MILLION)

TABLE 216 REST OF AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY TYPE, 20202025 (USD MILLION)

10.7.6.4.3 By end user

TABLE 217 REST OF AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20172019 (USD MILLION)

TABLE 218 REST OF AFRICA: INDUSTRIAL PLUGS AND SOCKETS MARKET SIZE, BY END USER, 20202025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 207)

11.1 KEY PLAYERS STRATEGIES

TABLE 219 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, 20172020

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 39 MARKET EVALUATION FRAMEWORK

11.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

FIGURE 40 INDUSTRIAL PLUGS AND SOCKETS MARKET SHARE ANALYSIS IN 2019

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STAR

11.4.2 EMERGING LEADER

11.4.3 PERVASIVE

11.4.4 EMERGING COMPANY

FIGURE 41 COMPETITIVE LEADERSHIP MAPPING (GLOBAL) INDUSTRIAL PLUGS AND SOCKETS MARKET, 2019

11.5 COMPETITIVE SCENARIO

11.5.1 NEW PRODUCT LAUNCHES

11.5.2 MERGERS AND ACQUISITIONS

11.5.3 INVESTMENTS/EXPANSION

11.5.4 CONTRACTS AND AGREEMENTS

12 COMPANY PROFILES (Page No. - 215)

(Business and financial overview, Products offered, Recent Developments, SWOT Analysis, MNM view)*

12.1 AMPHENOL CORPORATION

FIGURE 42 AMPHENOL CORPORATION: COMPANY SNAPSHOT

12.2 ABB

FIGURE 43 ABB: COMPANY SNAPSHOT

12.3 EMERSON ELECTRIC

FIGURE 44 EMERSON ELECTRIC: COMPANY SNAPSHOT

12.4 SCHNEIDER ELECTRIC

FIGURE 45 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

12.5 LEGRAND

FIGURE 46 LEGRAND: COMPANY SNAPSHOT

12.6 MARECHAL ELECTRIC GROUP

12.7 MENNEKES

12.8 PALAZZOLI GROUP

12.9 SCAME GROUP

12.10 EATON

FIGURE 47 EATON: COMPANY SNAPSHOT

12.11 HUBBELL

FIGURE 48 HUBBELL: COMPANY SNAPSHOT

12.12 R. STAHL

FIGURE 49 R. STAHL: COMPANY SNAPSHOT

12.13 WALTHER-WERKE

12.14 ILME

12.15 RAUSCHER & STOECKLIN

12.16 BALS ELEKTROTECHNIK

12.17 PC ELECTRIC

12.18 GEWISS

12.19 LEVITON

12.20 C&S ELECTRIC

12.21 WEG

12.22 NEPTUNE

*Details on Business and financial overview, Products offered, Recent Developments, SWOT Analysis, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 253)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

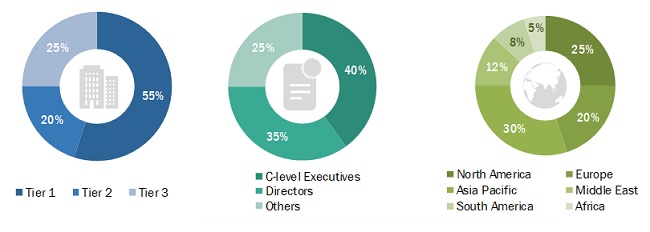

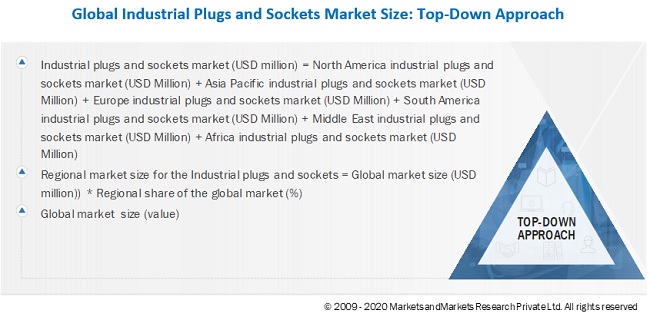

This study involved four major activities in estimating the current size of the industrial plugs and sockets market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global industrial plugs and sockets market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The industrial plugs and sockets market comprises several stakeholders, such as end-product manufacturers, service providers, and end-users in the supply chain. This market's demand-side is characterized by its end-users, such as utilities/asset owners, industrial owners, automotive and electronic industrial owners, and others. The supply-side is characterized by industrial plugs and sockets manufacturers and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global industrial plugs and sockets market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The industry and market's key players have been identified through extensive secondary research, and their market share in the respective regions has been determined through both primary and secondary research.

- In terms of value, the industrys supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define and describe the global industrial plugs and sockets market by type, end user, current, protection, and region.

- To provide detailed information about the major factors influencing the market (drivers, restraints, opportunities, and industry-specific challenges).

- To strategically analyze the global industrial plugs and sockets market with respect to individual growth trends, future expansions, and each segment's contribution to the market.

- The impact of the COVID-19 pandemic on the industrial plugs and sockets market has been analyzed to estimate the market size.

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders.

- To forecast the growth of the global industrial plugs and sockets market with respect to the main regions (Asia Pacific, North America, Europe, Middle East, South America, and Africa).

- To profile and rank key players and comprehensively analyze their market share.

- To analyze competitive developments such as contracts & agreements, product launches, and mergers & acquisitions in the industrial plugs and sockets market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Industrial Plugs and Sockets Market